Accounting for Managers: Analyzing Nimbin's Financial Statements 2016

VerifiedAdded on 2020/07/23

|11

|2013

|30

Report

AI Summary

This report provides a comprehensive analysis of Nimbin Pty Ltd's financial performance in 2016, focusing on profitability, liquidity, and solvency. It employs ratio analysis to evaluate the company's financial health, comparing its performance to industry averages. The report examines key financial metrics, including return on assets, return on equity, profit margins, earnings per share, and various turnover ratios. Furthermore, it assesses the role of a chef as an asset and explores how accounting information supports decision-making for various entities, such as HR managers, factory managers, and AFL clubs. The report also details the impact of business transactions on financial statements, including the effects of purchasing equipment, providing services, paying liabilities, and collecting receivables. The conclusion highlights the importance of accounting in providing insights for sound economic decisions.

ACCOUNTING FOR MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

A) Analyzing financial performance of Nimbin....................................................................1

b. Commenting on the profitability, liquidity and solvency aspect of Nimbin pertaining to

2016........................................................................................................................................6

QUESTION 2...................................................................................................................................6

a. Assessing whether chef is an asset for the restaurant in monetary terms...........................6

b. Assessing the extent to which accounting information helps other entities in decision

making....................................................................................................................................6

c. Indicating the effect of business transactions on financial statements...............................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

A) Analyzing financial performance of Nimbin....................................................................1

b. Commenting on the profitability, liquidity and solvency aspect of Nimbin pertaining to

2016........................................................................................................................................6

QUESTION 2...................................................................................................................................6

a. Assessing whether chef is an asset for the restaurant in monetary terms...........................6

b. Assessing the extent to which accounting information helps other entities in decision

making....................................................................................................................................6

c. Indicating the effect of business transactions on financial statements...............................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

In the business unit, manager conducts ratio analysis with the motive to get information

about the financial position and performance. In this, report will shed light on the profitability,

liquidity and solvency aspect of Nimbin. Besides this, it will provide deeper insight about the

manner in which business transactions affect financial statements.

QUESTION 1

A) Analyzing financial performance of Nimbin

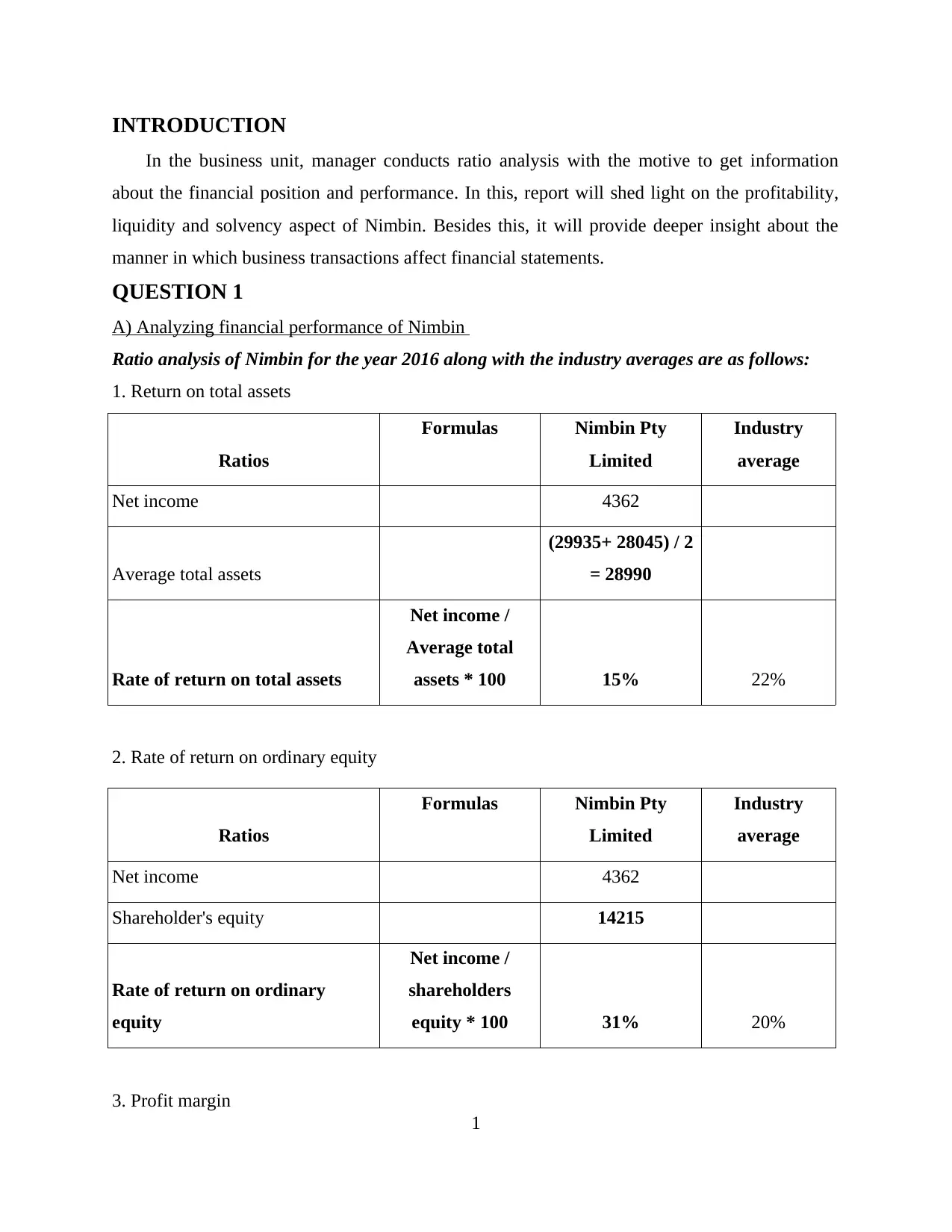

Ratio analysis of Nimbin for the year 2016 along with the industry averages are as follows:

1. Return on total assets

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net income 4362

Average total assets

(29935+ 28045) / 2

= 28990

Rate of return on total assets

Net income /

Average total

assets * 100 15% 22%

2. Rate of return on ordinary equity

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net income 4362

Shareholder's equity 14215

Rate of return on ordinary

equity

Net income /

shareholders

equity * 100 31% 20%

3. Profit margin

1

In the business unit, manager conducts ratio analysis with the motive to get information

about the financial position and performance. In this, report will shed light on the profitability,

liquidity and solvency aspect of Nimbin. Besides this, it will provide deeper insight about the

manner in which business transactions affect financial statements.

QUESTION 1

A) Analyzing financial performance of Nimbin

Ratio analysis of Nimbin for the year 2016 along with the industry averages are as follows:

1. Return on total assets

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net income 4362

Average total assets

(29935+ 28045) / 2

= 28990

Rate of return on total assets

Net income /

Average total

assets * 100 15% 22%

2. Rate of return on ordinary equity

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net income 4362

Shareholder's equity 14215

Rate of return on ordinary

equity

Net income /

shareholders

equity * 100 31% 20%

3. Profit margin

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Gross profit 19900

Net profit 4362

Net sales 55000

GP margin

Gross profit / net

sales * 100

36%

NP margin

Net profit / net

sales *100

8%

4%

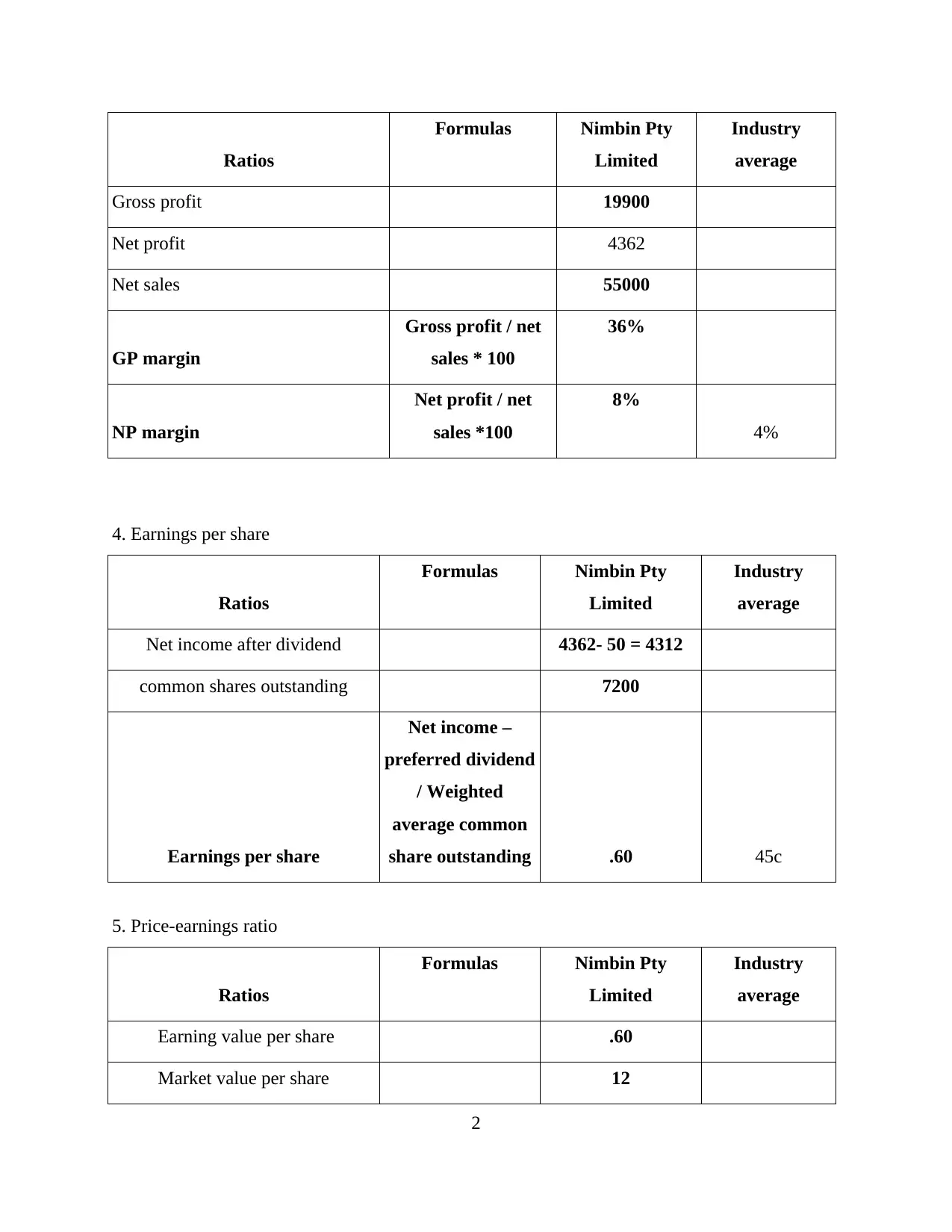

4. Earnings per share

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net income after dividend 4362- 50 = 4312

common shares outstanding 7200

Earnings per share

Net income –

preferred dividend

/ Weighted

average common

share outstanding .60 45c

5. Price-earnings ratio

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Earning value per share .60

Market value per share 12

2

Formulas Nimbin Pty

Limited

Industry

average

Gross profit 19900

Net profit 4362

Net sales 55000

GP margin

Gross profit / net

sales * 100

36%

NP margin

Net profit / net

sales *100

8%

4%

4. Earnings per share

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net income after dividend 4362- 50 = 4312

common shares outstanding 7200

Earnings per share

Net income –

preferred dividend

/ Weighted

average common

share outstanding .60 45c

5. Price-earnings ratio

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Earning value per share .60

Market value per share 12

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

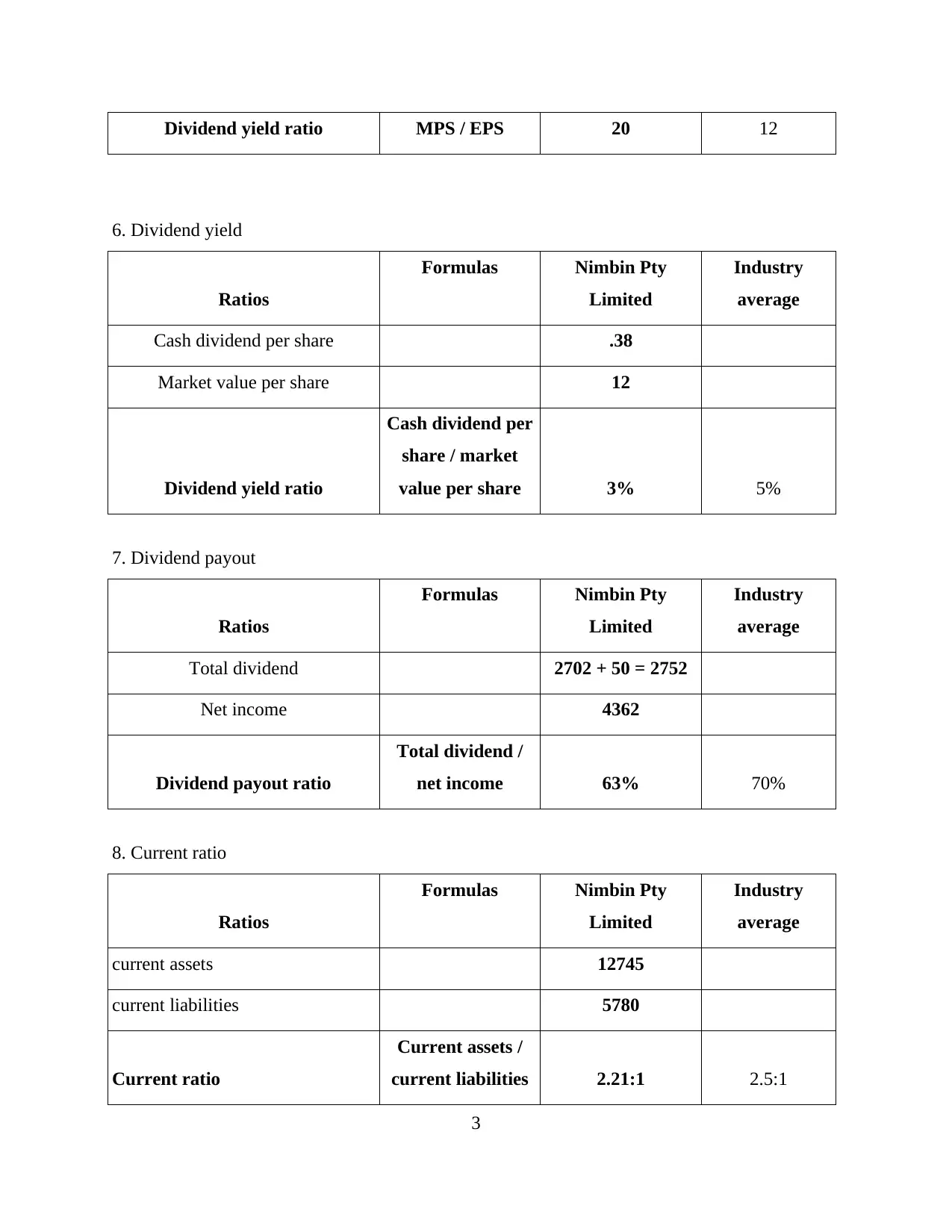

Dividend yield ratio MPS / EPS 20 12

6. Dividend yield

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Cash dividend per share .38

Market value per share 12

Dividend yield ratio

Cash dividend per

share / market

value per share 3% 5%

7. Dividend payout

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Total dividend 2702 + 50 = 2752

Net income 4362

Dividend payout ratio

Total dividend /

net income 63% 70%

8. Current ratio

Ratios

Formulas Nimbin Pty

Limited

Industry

average

current assets 12745

current liabilities 5780

Current ratio

Current assets /

current liabilities 2.21:1 2.5:1

3

6. Dividend yield

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Cash dividend per share .38

Market value per share 12

Dividend yield ratio

Cash dividend per

share / market

value per share 3% 5%

7. Dividend payout

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Total dividend 2702 + 50 = 2752

Net income 4362

Dividend payout ratio

Total dividend /

net income 63% 70%

8. Current ratio

Ratios

Formulas Nimbin Pty

Limited

Industry

average

current assets 12745

current liabilities 5780

Current ratio

Current assets /

current liabilities 2.21:1 2.5:1

3

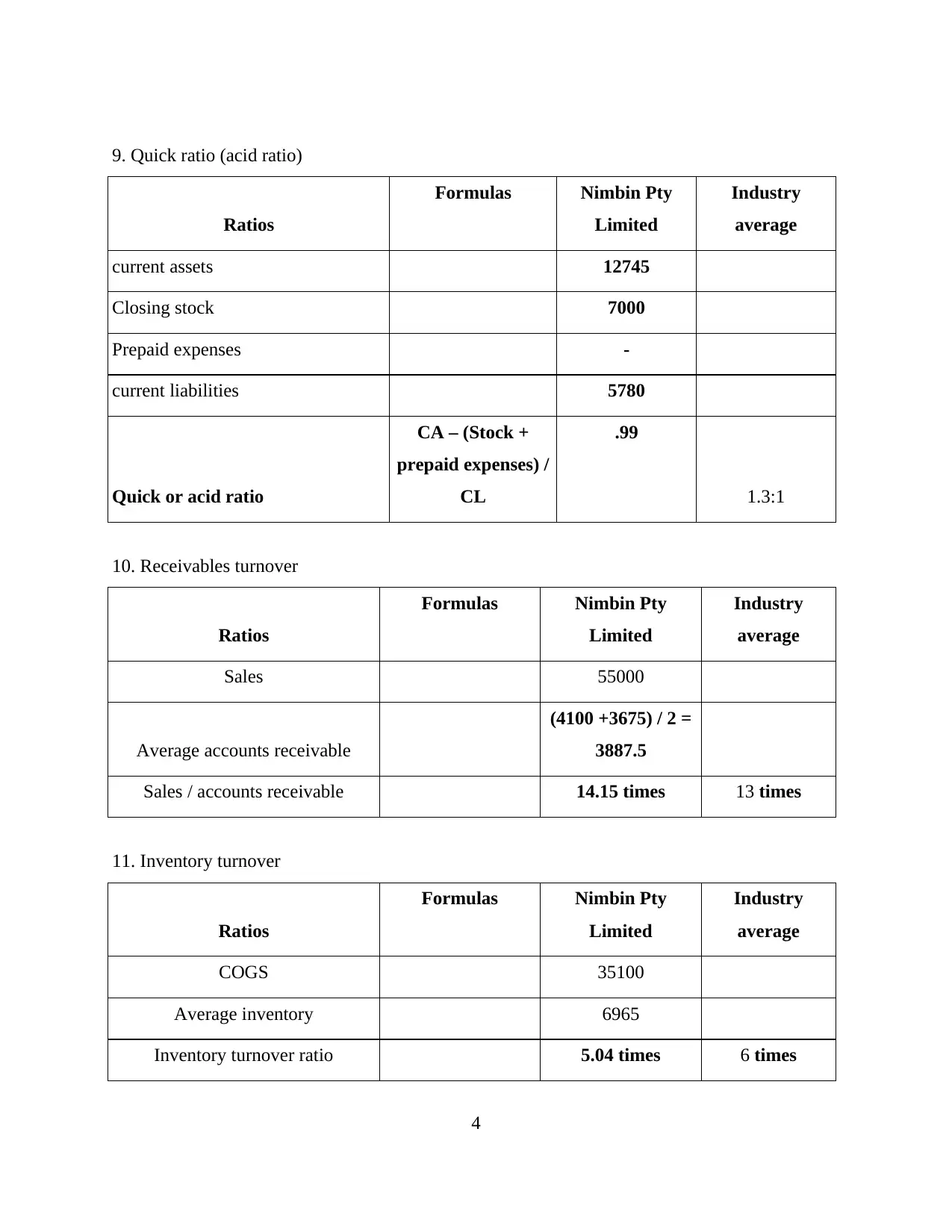

9. Quick ratio (acid ratio)

Ratios

Formulas Nimbin Pty

Limited

Industry

average

current assets 12745

Closing stock 7000

Prepaid expenses -

current liabilities 5780

Quick or acid ratio

CA – (Stock +

prepaid expenses) /

CL

.99

1.3:1

10. Receivables turnover

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Sales 55000

Average accounts receivable

(4100 +3675) / 2 =

3887.5

Sales / accounts receivable 14.15 times 13 times

11. Inventory turnover

Ratios

Formulas Nimbin Pty

Limited

Industry

average

COGS 35100

Average inventory 6965

Inventory turnover ratio 5.04 times 6 times

4

Ratios

Formulas Nimbin Pty

Limited

Industry

average

current assets 12745

Closing stock 7000

Prepaid expenses -

current liabilities 5780

Quick or acid ratio

CA – (Stock +

prepaid expenses) /

CL

.99

1.3:1

10. Receivables turnover

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Sales 55000

Average accounts receivable

(4100 +3675) / 2 =

3887.5

Sales / accounts receivable 14.15 times 13 times

11. Inventory turnover

Ratios

Formulas Nimbin Pty

Limited

Industry

average

COGS 35100

Average inventory 6965

Inventory turnover ratio 5.04 times 6 times

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

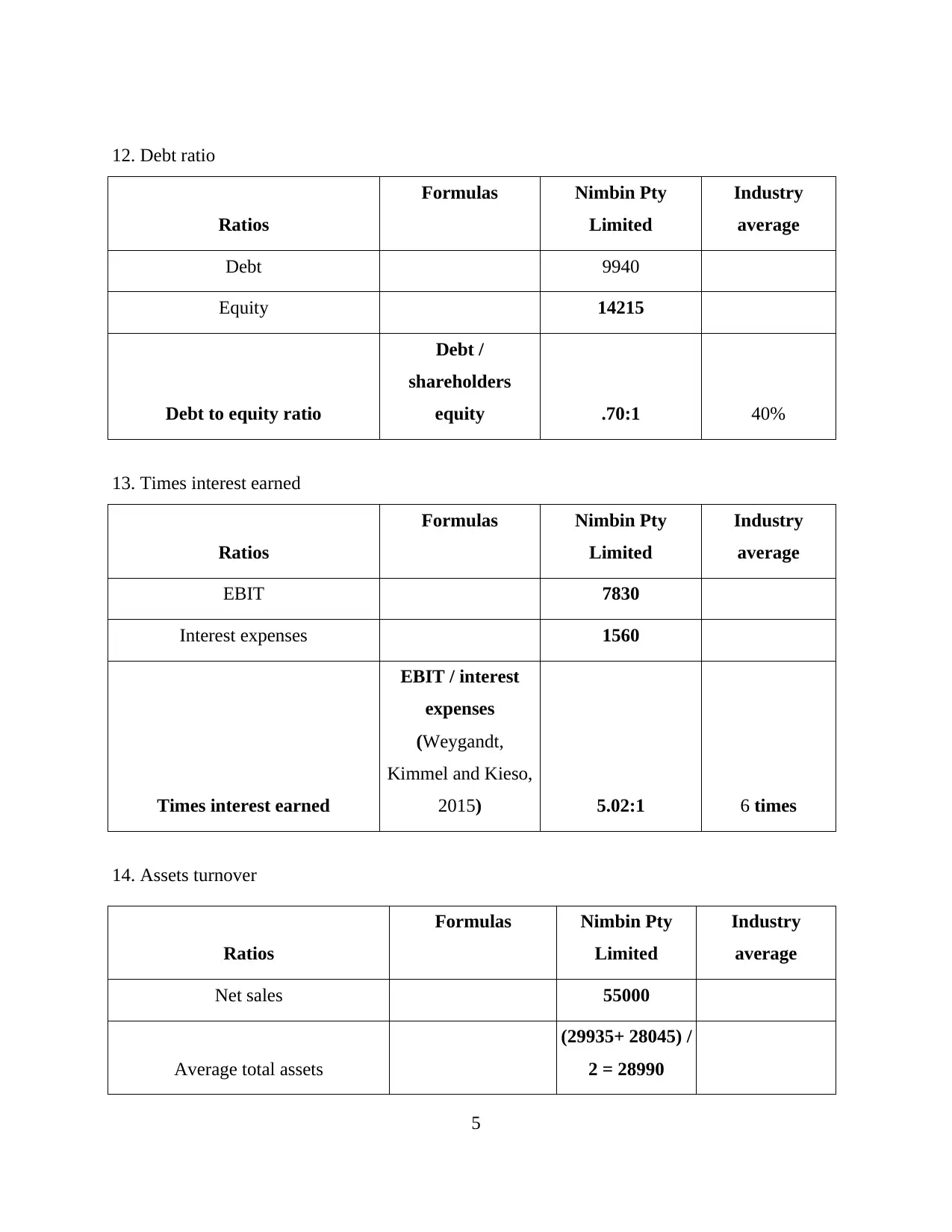

12. Debt ratio

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Debt 9940

Equity 14215

Debt to equity ratio

Debt /

shareholders

equity .70:1 40%

13. Times interest earned

Ratios

Formulas Nimbin Pty

Limited

Industry

average

EBIT 7830

Interest expenses 1560

Times interest earned

EBIT / interest

expenses

(Weygandt,

Kimmel and Kieso,

2015) 5.02:1 6 times

14. Assets turnover

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net sales 55000

Average total assets

(29935+ 28045) /

2 = 28990

5

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Debt 9940

Equity 14215

Debt to equity ratio

Debt /

shareholders

equity .70:1 40%

13. Times interest earned

Ratios

Formulas Nimbin Pty

Limited

Industry

average

EBIT 7830

Interest expenses 1560

Times interest earned

EBIT / interest

expenses

(Weygandt,

Kimmel and Kieso,

2015) 5.02:1 6 times

14. Assets turnover

Ratios

Formulas Nimbin Pty

Limited

Industry

average

Net sales 55000

Average total assets

(29935+ 28045) /

2 = 28990

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

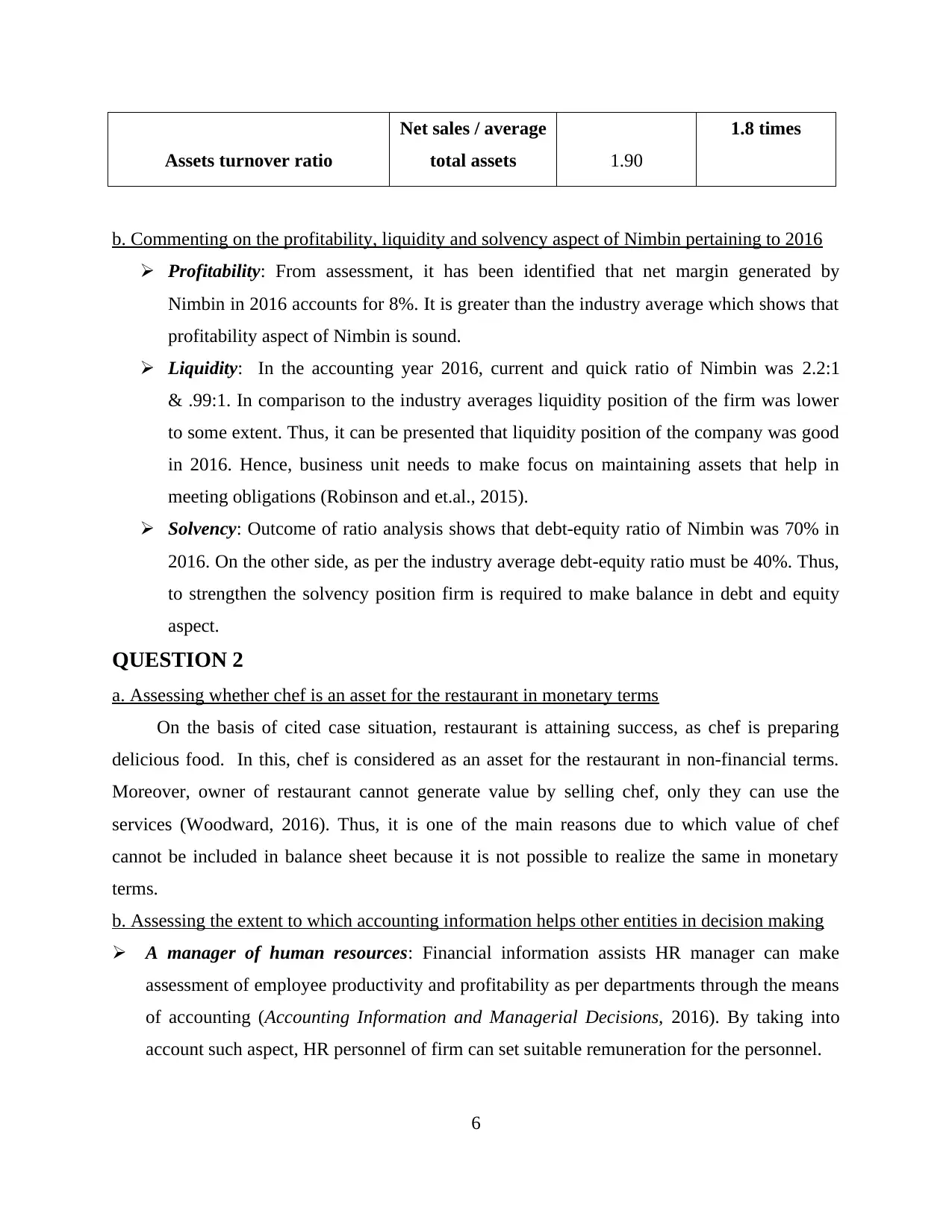

Assets turnover ratio

Net sales / average

total assets 1.90

1.8 times

b. Commenting on the profitability, liquidity and solvency aspect of Nimbin pertaining to 2016

Profitability: From assessment, it has been identified that net margin generated by

Nimbin in 2016 accounts for 8%. It is greater than the industry average which shows that

profitability aspect of Nimbin is sound.

Liquidity: In the accounting year 2016, current and quick ratio of Nimbin was 2.2:1

& .99:1. In comparison to the industry averages liquidity position of the firm was lower

to some extent. Thus, it can be presented that liquidity position of the company was good

in 2016. Hence, business unit needs to make focus on maintaining assets that help in

meeting obligations (Robinson and et.al., 2015).

Solvency: Outcome of ratio analysis shows that debt-equity ratio of Nimbin was 70% in

2016. On the other side, as per the industry average debt-equity ratio must be 40%. Thus,

to strengthen the solvency position firm is required to make balance in debt and equity

aspect.

QUESTION 2

a. Assessing whether chef is an asset for the restaurant in monetary terms

On the basis of cited case situation, restaurant is attaining success, as chef is preparing

delicious food. In this, chef is considered as an asset for the restaurant in non-financial terms.

Moreover, owner of restaurant cannot generate value by selling chef, only they can use the

services (Woodward, 2016). Thus, it is one of the main reasons due to which value of chef

cannot be included in balance sheet because it is not possible to realize the same in monetary

terms.

b. Assessing the extent to which accounting information helps other entities in decision making

A manager of human resources: Financial information assists HR manager can make

assessment of employee productivity and profitability as per departments through the means

of accounting (Accounting Information and Managerial Decisions, 2016). By taking into

account such aspect, HR personnel of firm can set suitable remuneration for the personnel.

6

Net sales / average

total assets 1.90

1.8 times

b. Commenting on the profitability, liquidity and solvency aspect of Nimbin pertaining to 2016

Profitability: From assessment, it has been identified that net margin generated by

Nimbin in 2016 accounts for 8%. It is greater than the industry average which shows that

profitability aspect of Nimbin is sound.

Liquidity: In the accounting year 2016, current and quick ratio of Nimbin was 2.2:1

& .99:1. In comparison to the industry averages liquidity position of the firm was lower

to some extent. Thus, it can be presented that liquidity position of the company was good

in 2016. Hence, business unit needs to make focus on maintaining assets that help in

meeting obligations (Robinson and et.al., 2015).

Solvency: Outcome of ratio analysis shows that debt-equity ratio of Nimbin was 70% in

2016. On the other side, as per the industry average debt-equity ratio must be 40%. Thus,

to strengthen the solvency position firm is required to make balance in debt and equity

aspect.

QUESTION 2

a. Assessing whether chef is an asset for the restaurant in monetary terms

On the basis of cited case situation, restaurant is attaining success, as chef is preparing

delicious food. In this, chef is considered as an asset for the restaurant in non-financial terms.

Moreover, owner of restaurant cannot generate value by selling chef, only they can use the

services (Woodward, 2016). Thus, it is one of the main reasons due to which value of chef

cannot be included in balance sheet because it is not possible to realize the same in monetary

terms.

b. Assessing the extent to which accounting information helps other entities in decision making

A manager of human resources: Financial information assists HR manager can make

assessment of employee productivity and profitability as per departments through the means

of accounting (Accounting Information and Managerial Decisions, 2016). By taking into

account such aspect, HR personnel of firm can set suitable remuneration for the personnel.

6

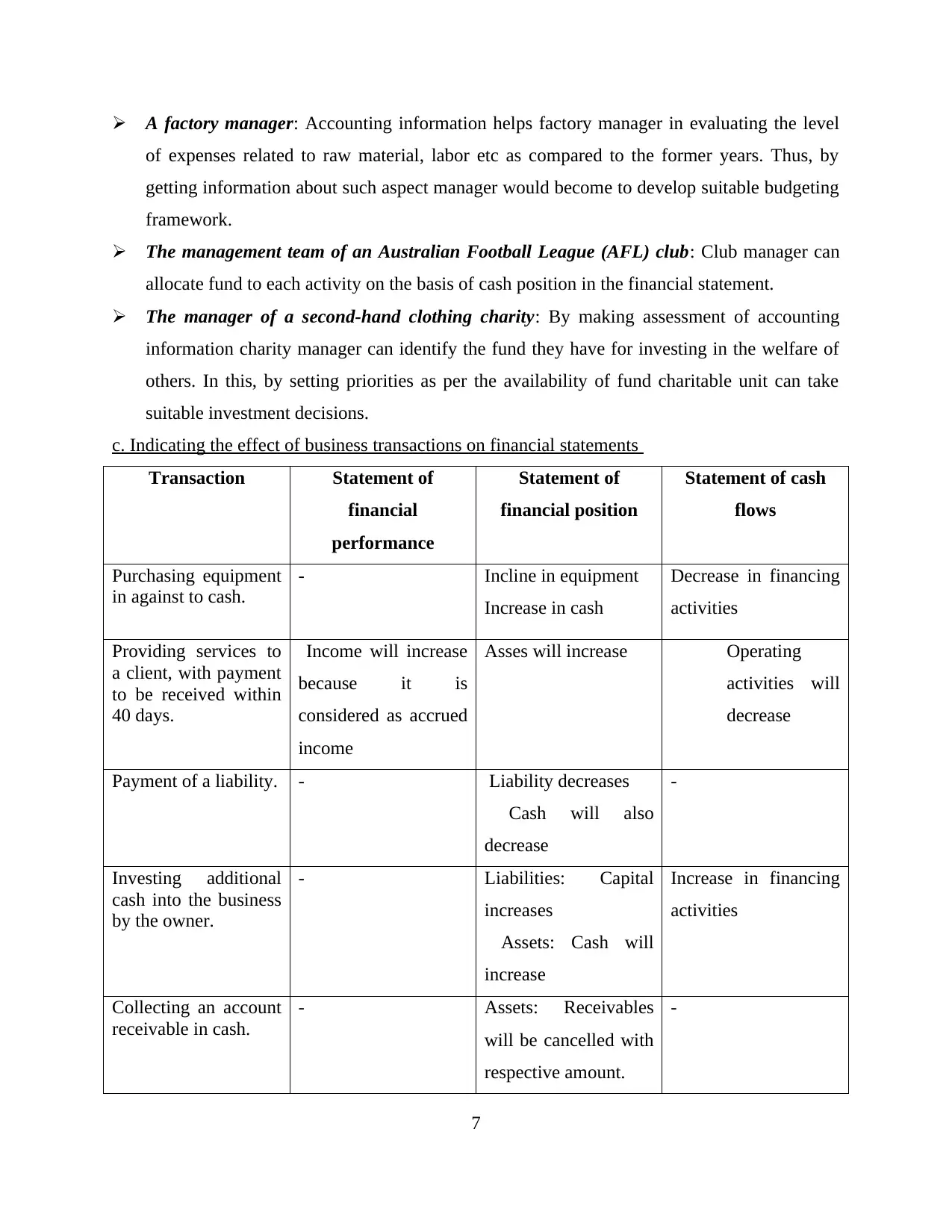

A factory manager: Accounting information helps factory manager in evaluating the level

of expenses related to raw material, labor etc as compared to the former years. Thus, by

getting information about such aspect manager would become to develop suitable budgeting

framework.

The management team of an Australian Football League (AFL) club: Club manager can

allocate fund to each activity on the basis of cash position in the financial statement.

The manager of a second-hand clothing charity: By making assessment of accounting

information charity manager can identify the fund they have for investing in the welfare of

others. In this, by setting priorities as per the availability of fund charitable unit can take

suitable investment decisions.

c. Indicating the effect of business transactions on financial statements

Transaction Statement of

financial

performance

Statement of

financial position

Statement of cash

flows

Purchasing equipment

in against to cash.

- Incline in equipment

Increase in cash

Decrease in financing

activities

Providing services to

a client, with payment

to be received within

40 days.

Income will increase

because it is

considered as accrued

income

Asses will increase Operating

activities will

decrease

Payment of a liability. - Liability decreases

Cash will also

decrease

-

Investing additional

cash into the business

by the owner.

- Liabilities: Capital

increases

Assets: Cash will

increase

Increase in financing

activities

Collecting an account

receivable in cash.

- Assets: Receivables

will be cancelled with

respective amount.

-

7

of expenses related to raw material, labor etc as compared to the former years. Thus, by

getting information about such aspect manager would become to develop suitable budgeting

framework.

The management team of an Australian Football League (AFL) club: Club manager can

allocate fund to each activity on the basis of cash position in the financial statement.

The manager of a second-hand clothing charity: By making assessment of accounting

information charity manager can identify the fund they have for investing in the welfare of

others. In this, by setting priorities as per the availability of fund charitable unit can take

suitable investment decisions.

c. Indicating the effect of business transactions on financial statements

Transaction Statement of

financial

performance

Statement of

financial position

Statement of cash

flows

Purchasing equipment

in against to cash.

- Incline in equipment

Increase in cash

Decrease in financing

activities

Providing services to

a client, with payment

to be received within

40 days.

Income will increase

because it is

considered as accrued

income

Asses will increase Operating

activities will

decrease

Payment of a liability. - Liability decreases

Cash will also

decrease

-

Investing additional

cash into the business

by the owner.

- Liabilities: Capital

increases

Assets: Cash will

increase

Increase in financing

activities

Collecting an account

receivable in cash.

- Assets: Receivables

will be cancelled with

respective amount.

-

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

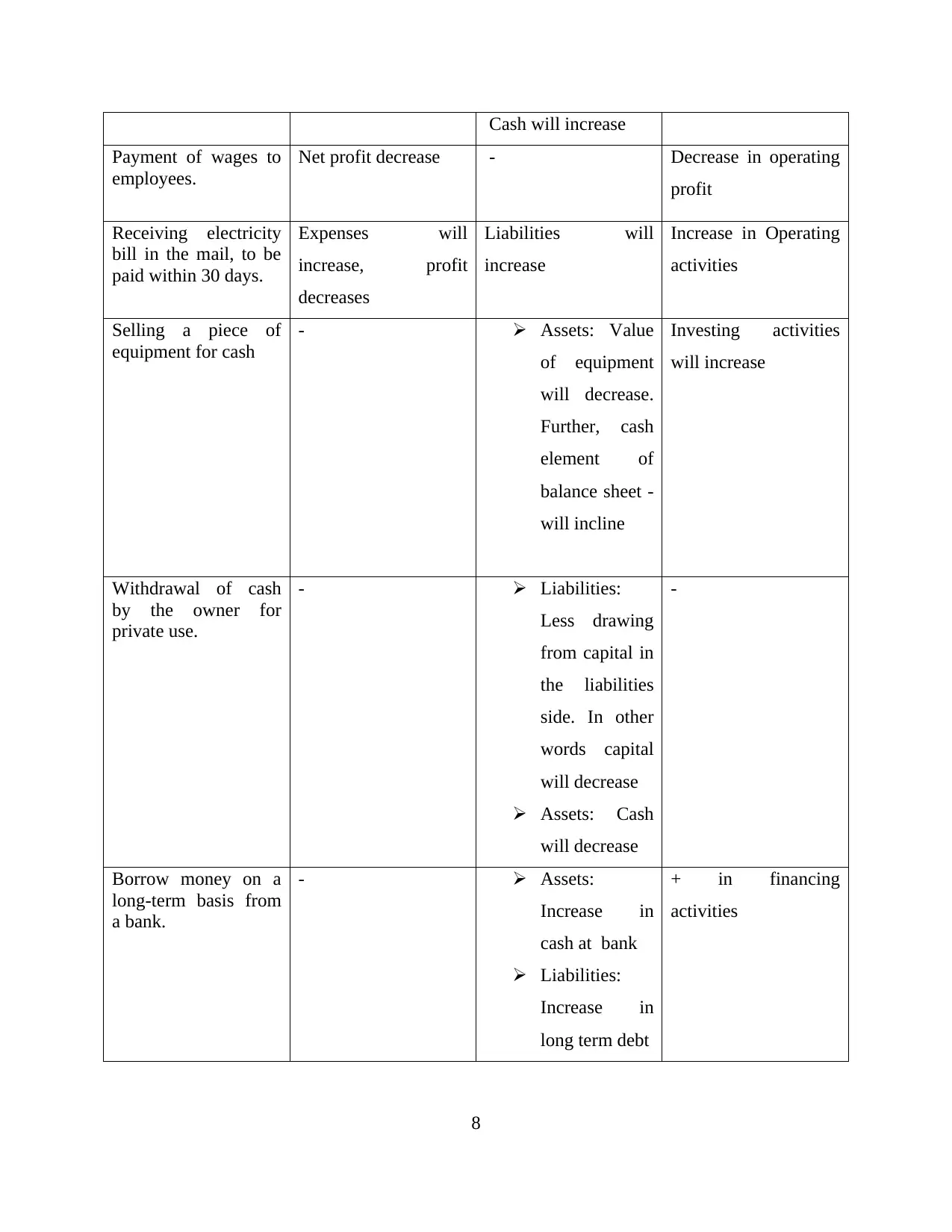

Cash will increase

Payment of wages to

employees.

Net profit decrease - Decrease in operating

profit

Receiving electricity

bill in the mail, to be

paid within 30 days.

Expenses will

increase, profit

decreases

Liabilities will

increase

Increase in Operating

activities

Selling a piece of

equipment for cash

- Assets: Value

of equipment

will decrease.

Further, cash

element of

balance sheet -

will incline

Investing activities

will increase

Withdrawal of cash

by the owner for

private use.

- Liabilities:

Less drawing

from capital in

the liabilities

side. In other

words capital

will decrease

Assets: Cash

will decrease

-

Borrow money on a

long-term basis from

a bank.

- Assets:

Increase in

cash at bank

Liabilities:

Increase in

long term debt

+ in financing

activities

8

Payment of wages to

employees.

Net profit decrease - Decrease in operating

profit

Receiving electricity

bill in the mail, to be

paid within 30 days.

Expenses will

increase, profit

decreases

Liabilities will

increase

Increase in Operating

activities

Selling a piece of

equipment for cash

- Assets: Value

of equipment

will decrease.

Further, cash

element of

balance sheet -

will incline

Investing activities

will increase

Withdrawal of cash

by the owner for

private use.

- Liabilities:

Less drawing

from capital in

the liabilities

side. In other

words capital

will decrease

Assets: Cash

will decrease

-

Borrow money on a

long-term basis from

a bank.

- Assets:

Increase in

cash at bank

Liabilities:

Increase in

long term debt

+ in financing

activities

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the above report, it has been concluded that profitability and liquidity position of

Nimbin was good during the year of 2016. Besides this, it can be inferred that accounting

provides high level of assistance to the entities in making appropriate economic decisions.

9

From the above report, it has been concluded that profitability and liquidity position of

Nimbin was good during the year of 2016. Besides this, it can be inferred that accounting

provides high level of assistance to the entities in making appropriate economic decisions.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.