Accounting 101 Assignment: Inventory, Sales, and Controls

VerifiedAdded on 2023/03/17

|27

|3113

|38

Homework Assignment

AI Summary

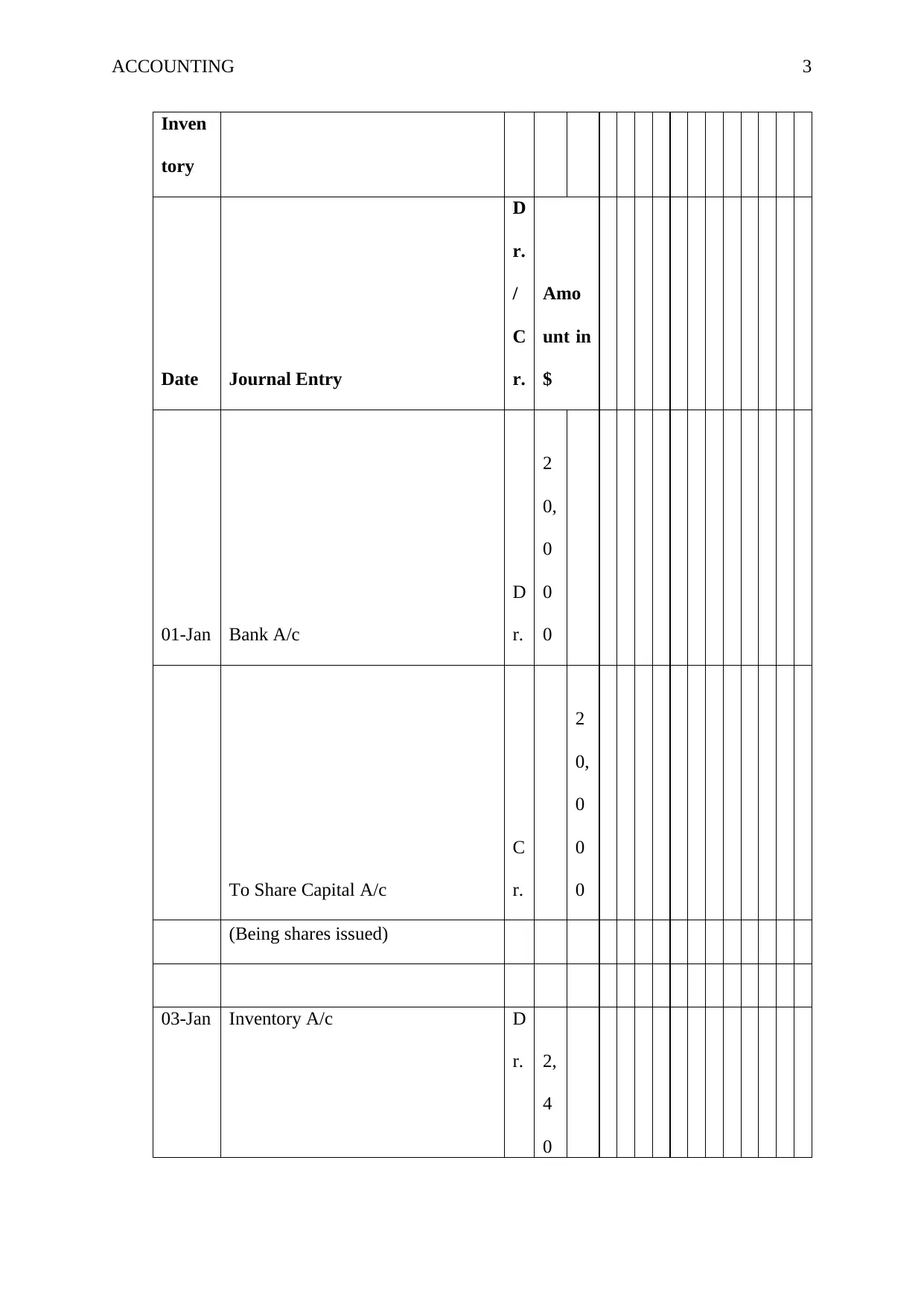

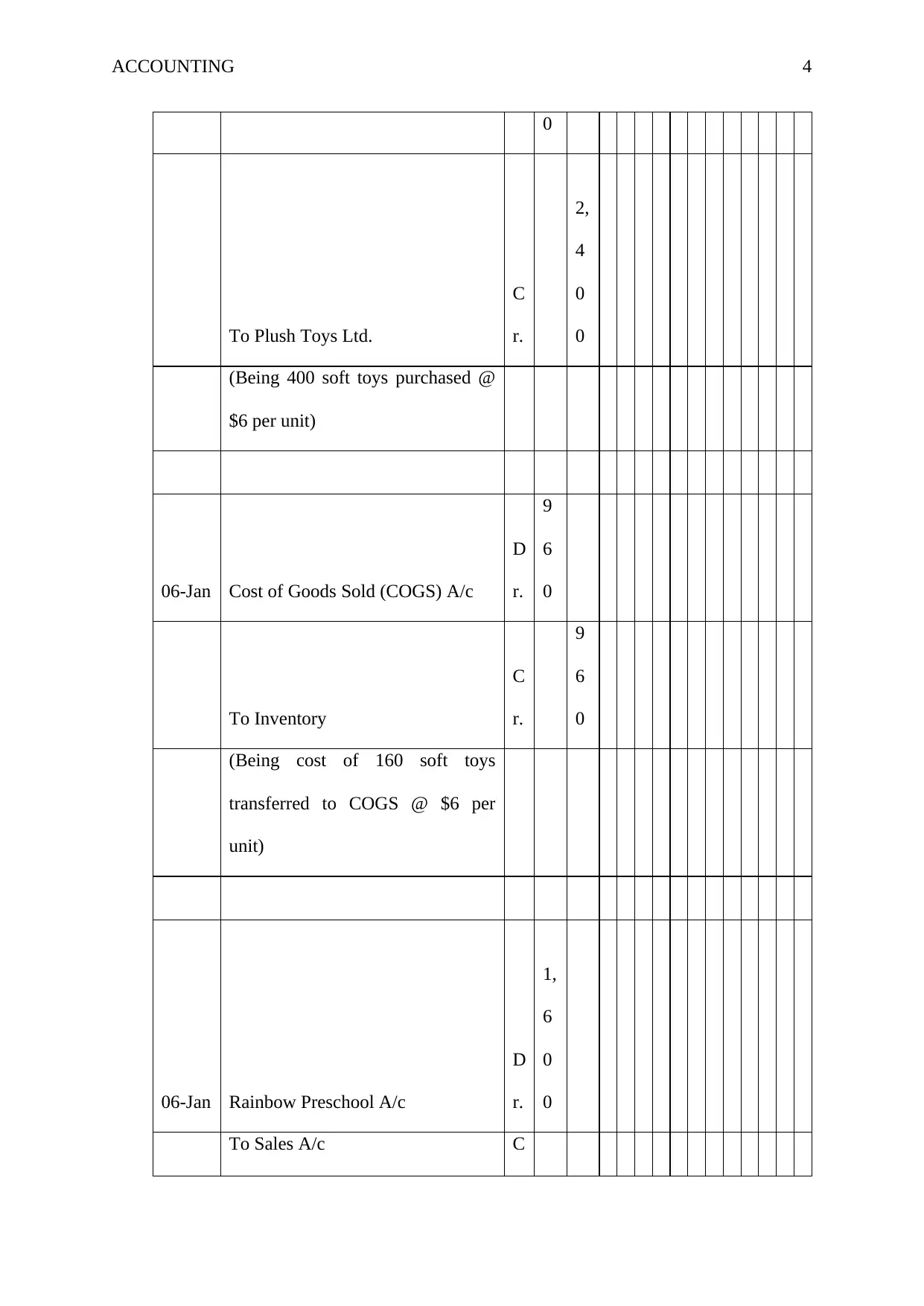

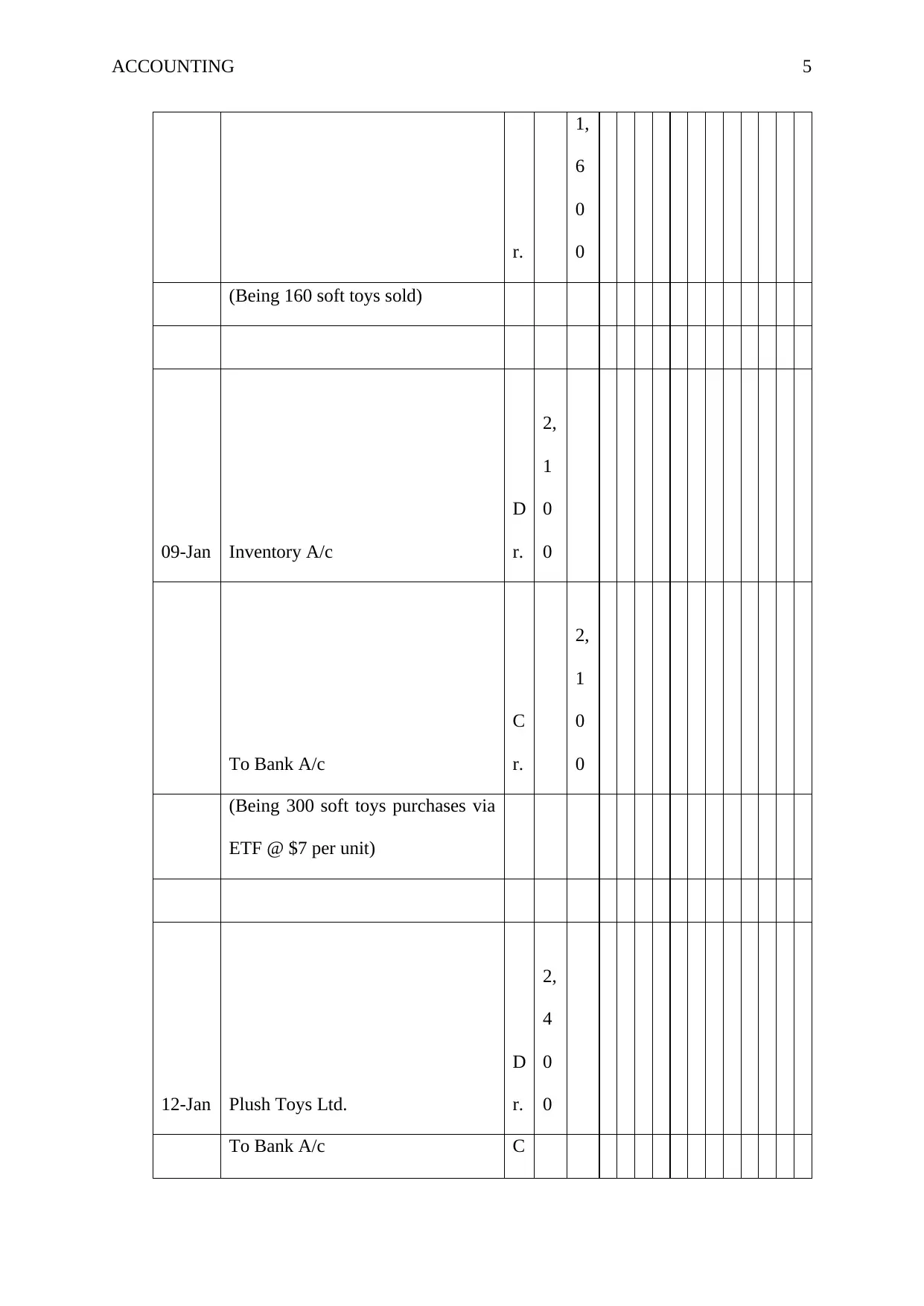

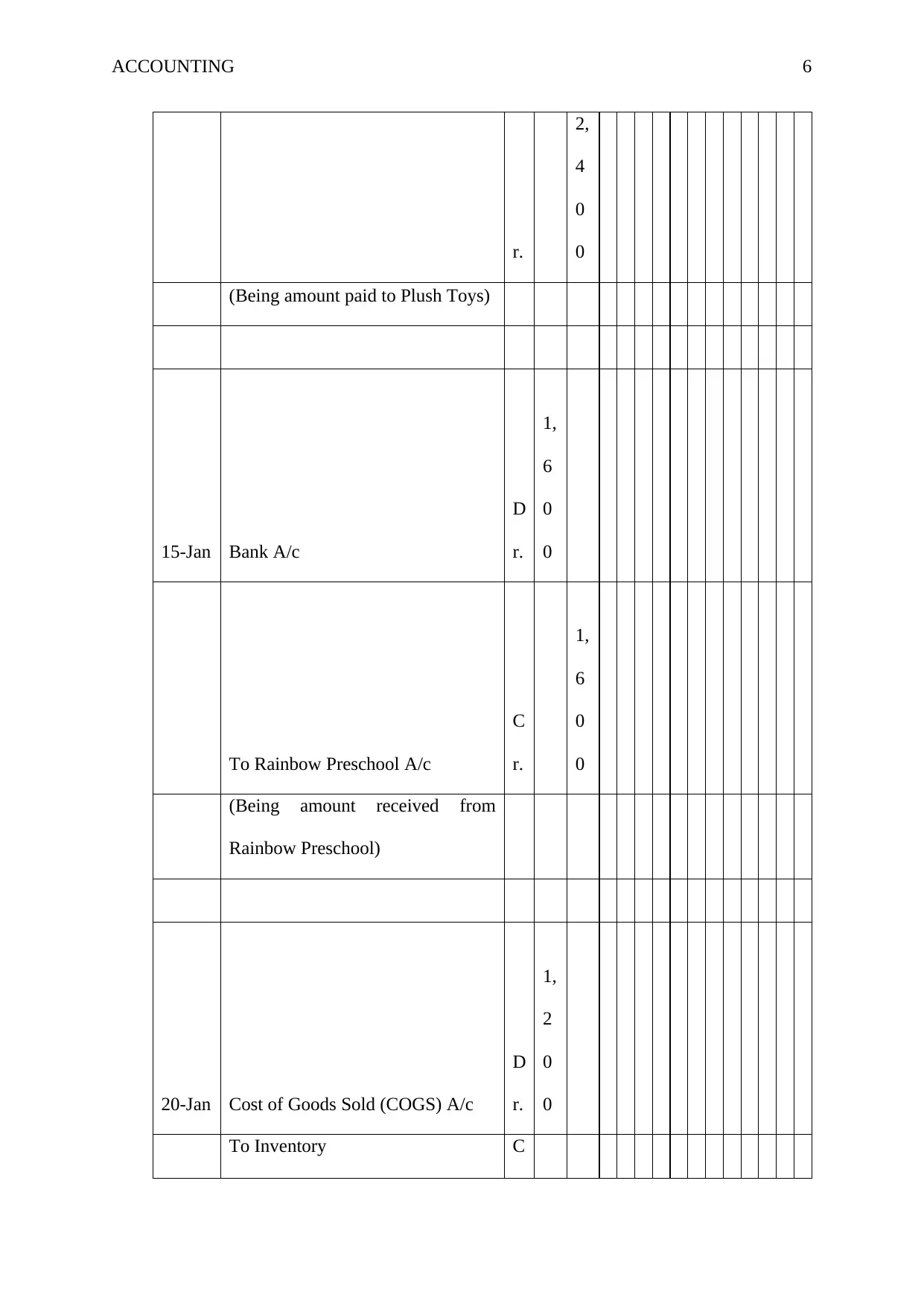

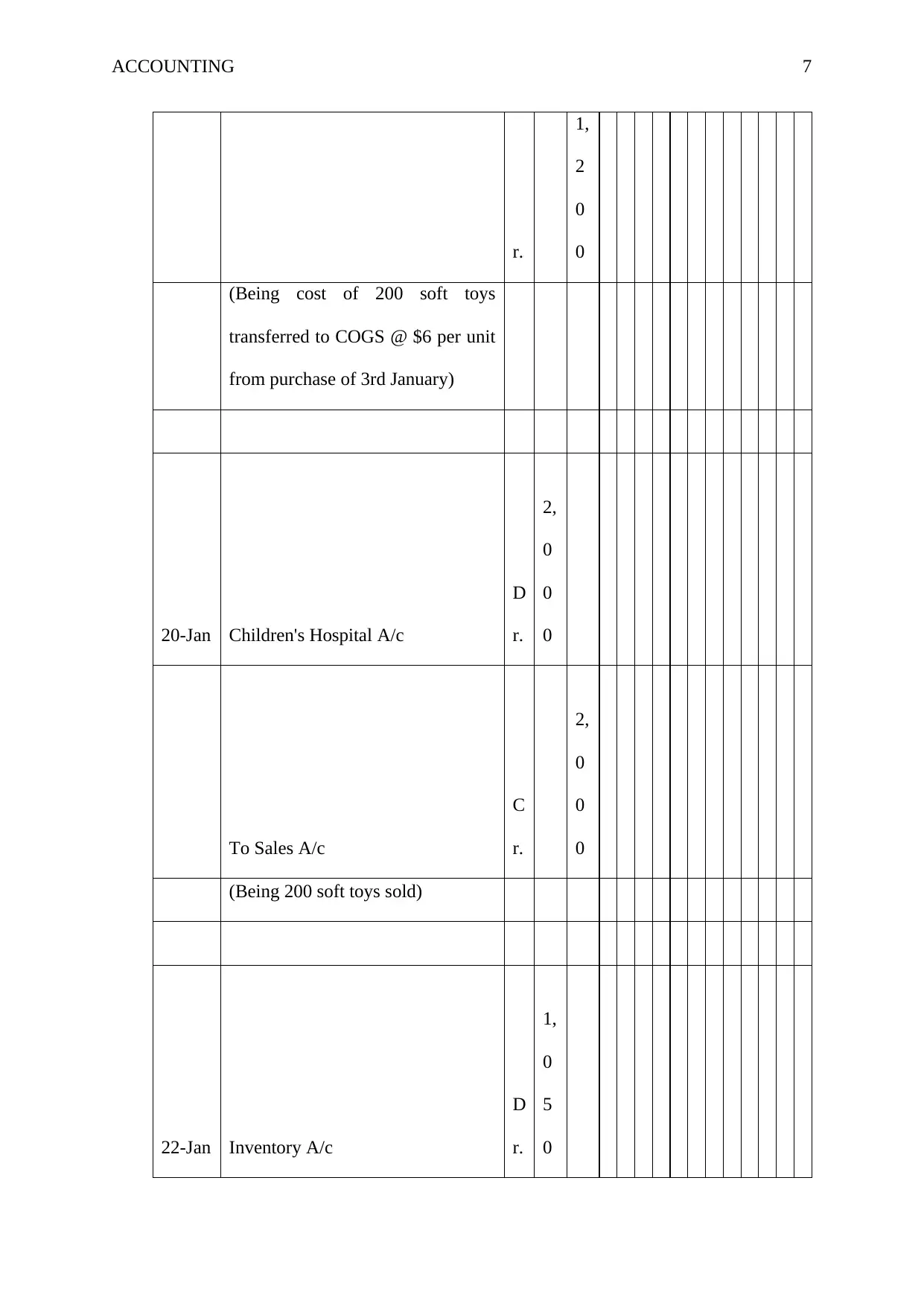

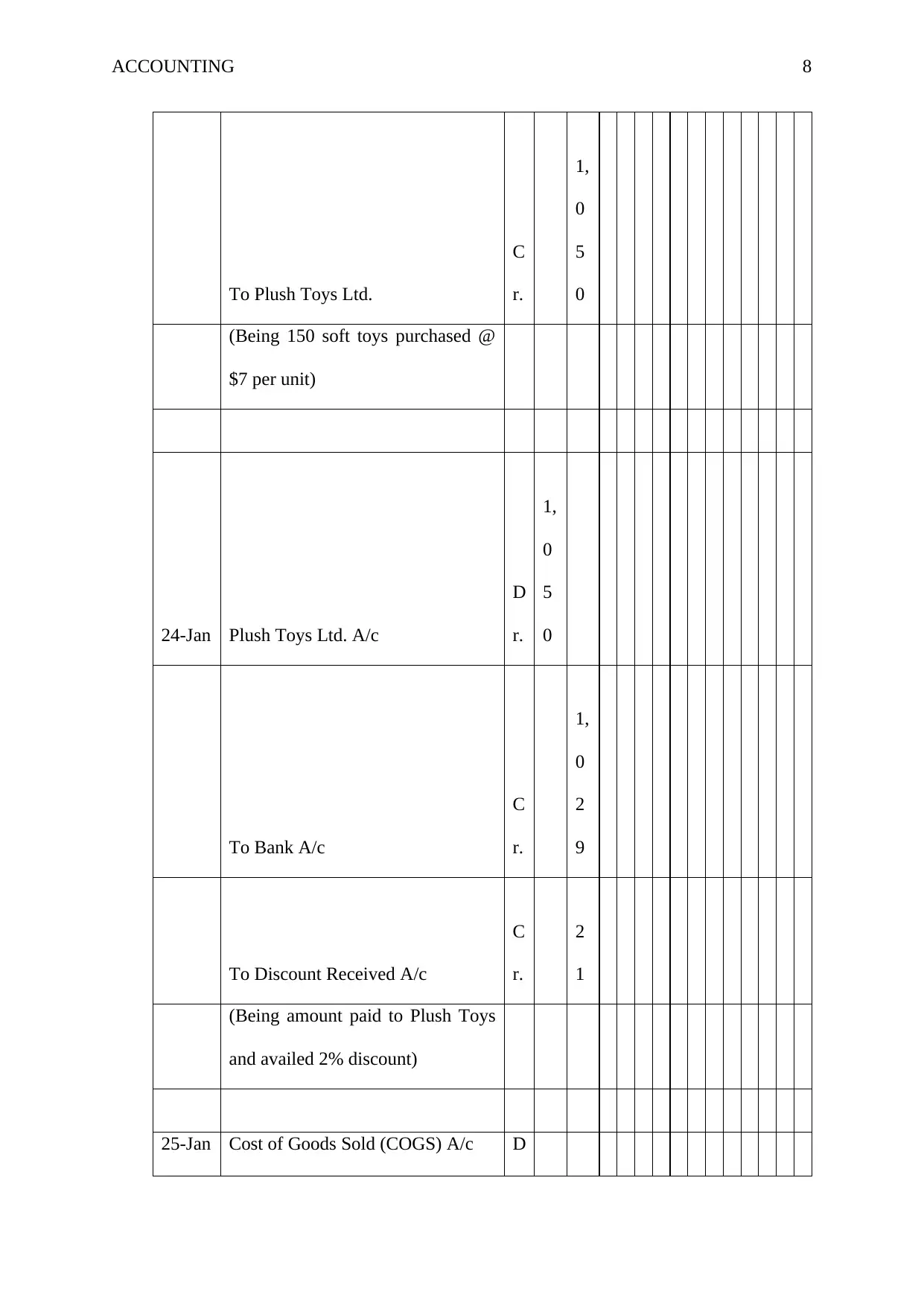

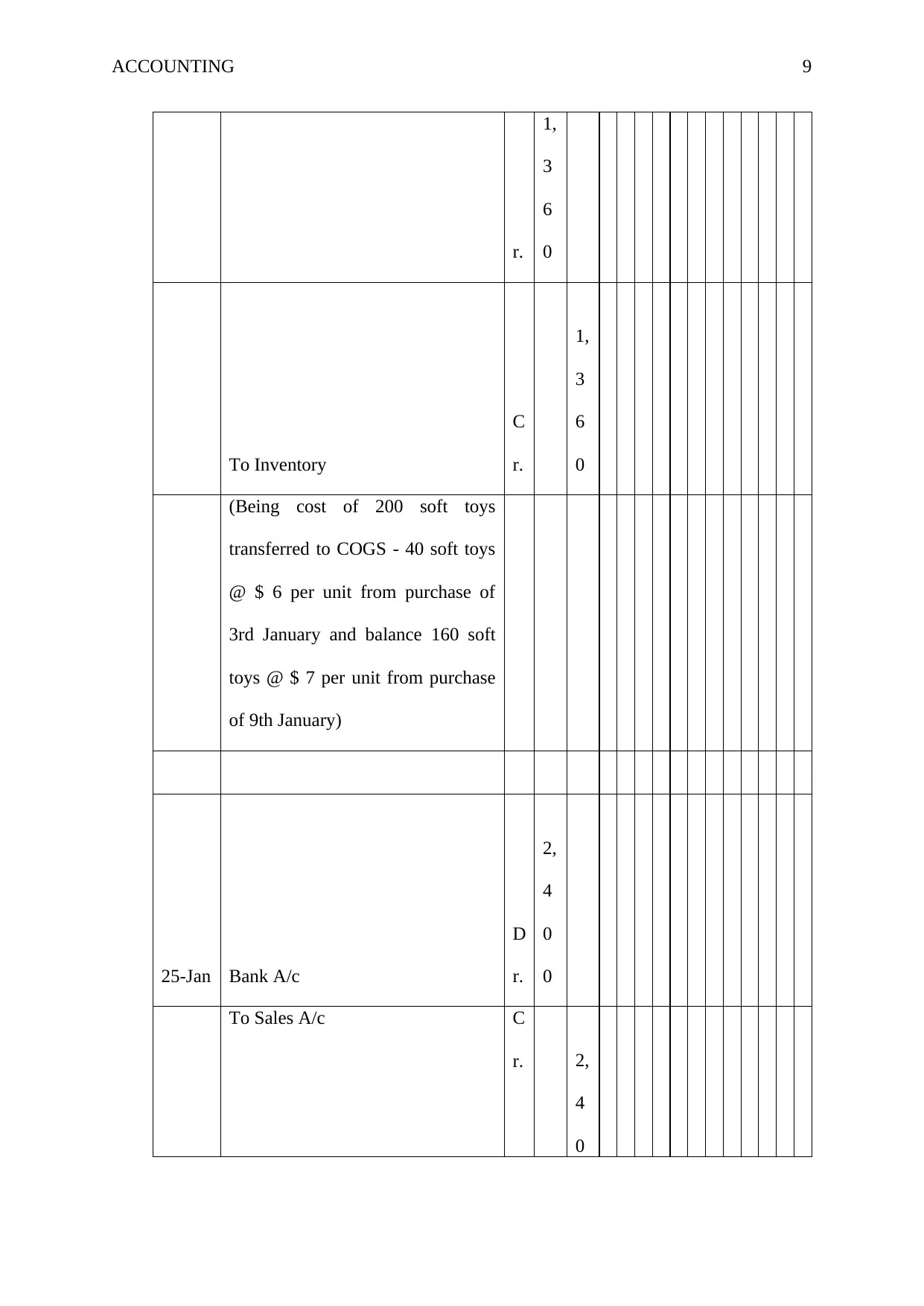

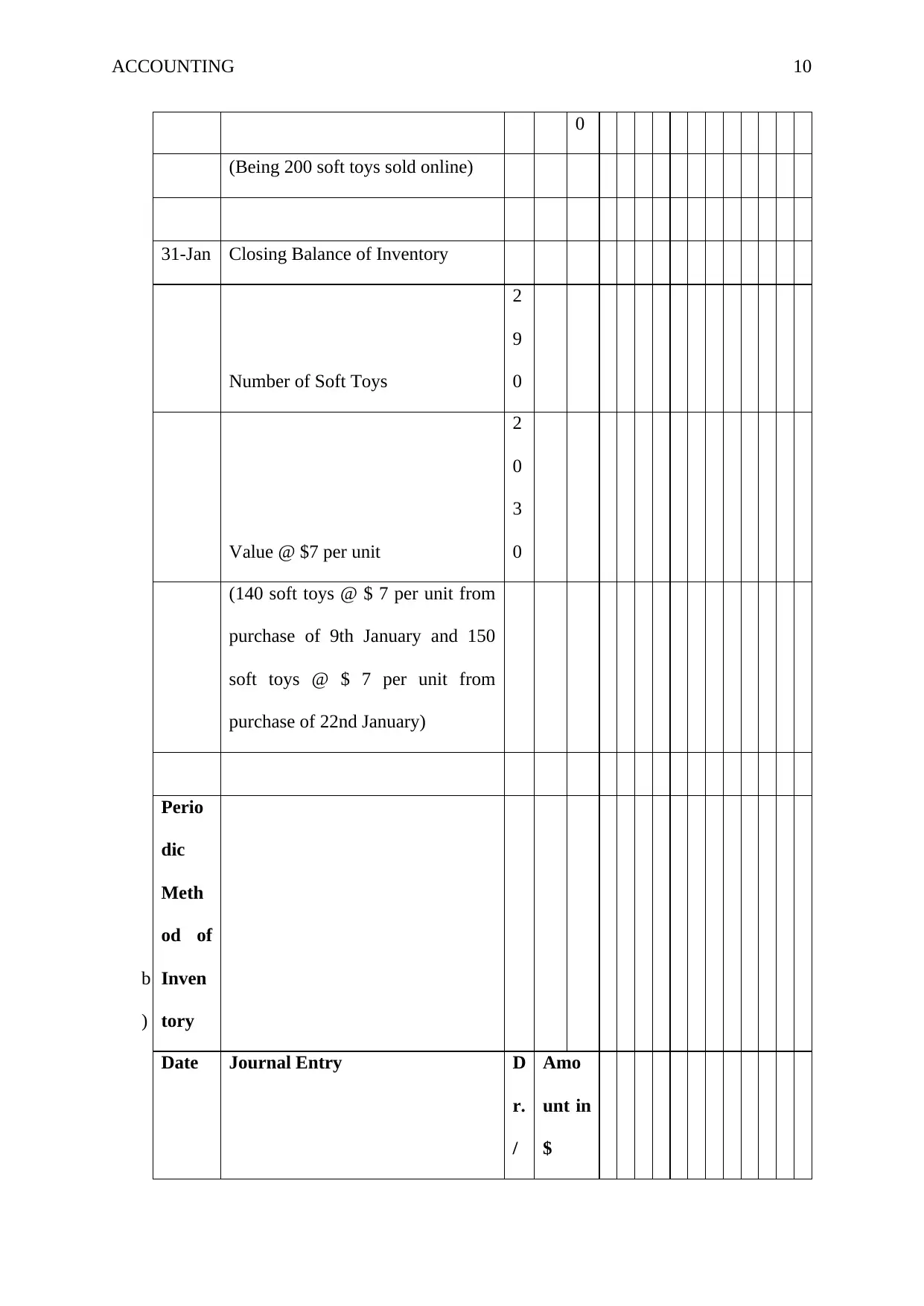

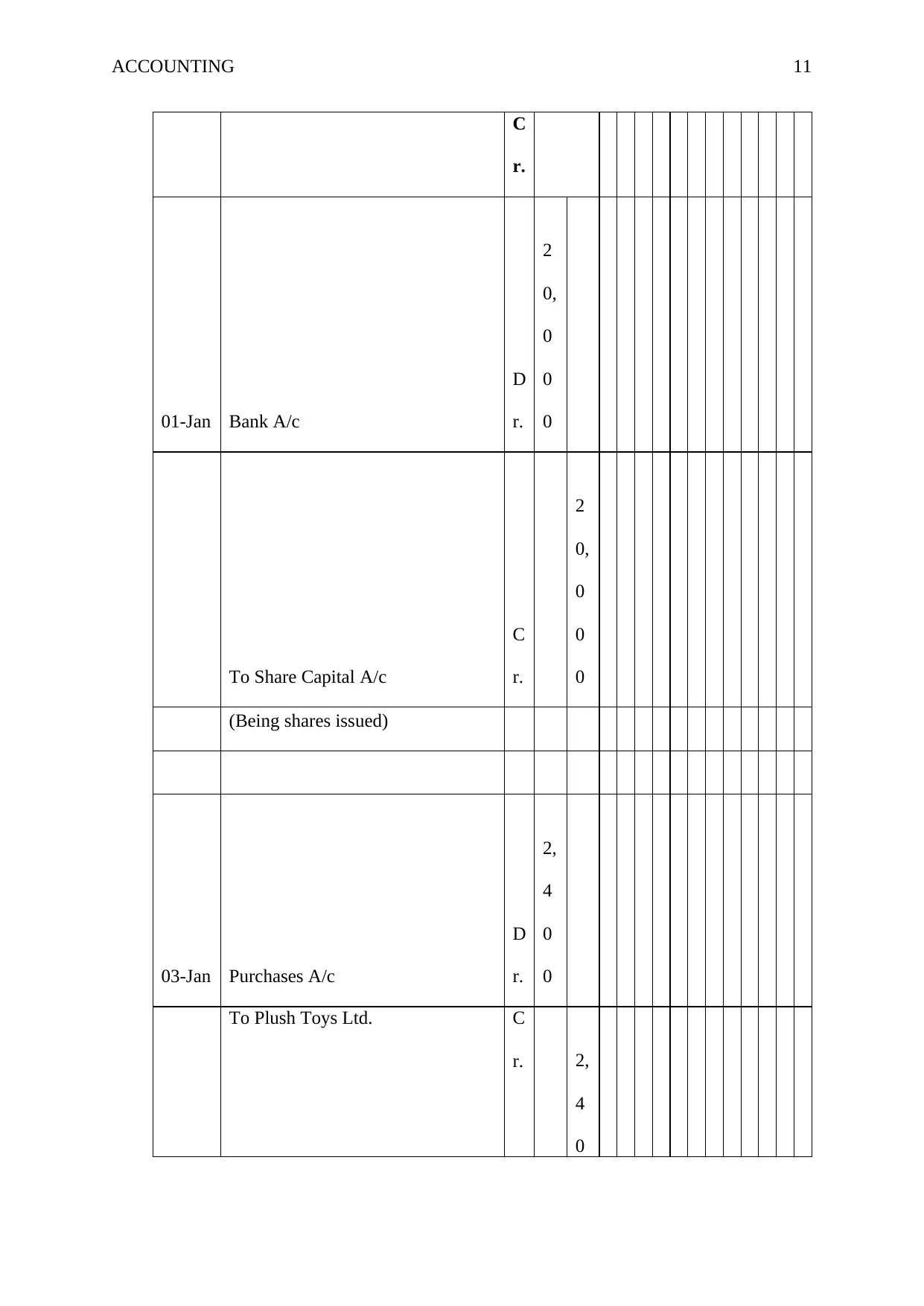

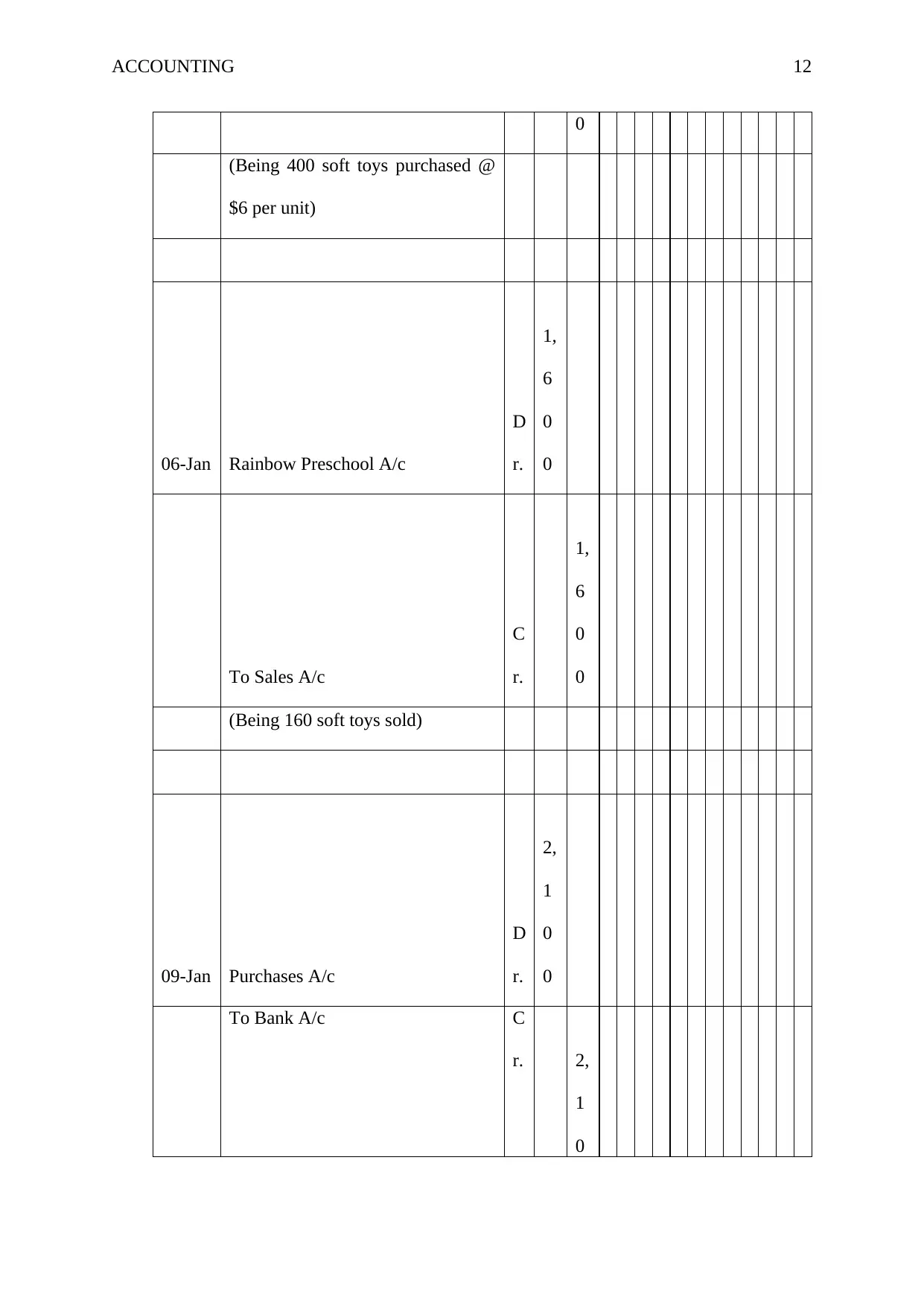

This accounting assignment solution covers inventory valuation methods, journal entries, and internal controls. The assignment begins with a scenario involving a retail business, Spottie Ltd, and its transactions during January 2018, including share issuance, inventory purchases, sales, and payments. The solution demonstrates the application of both perpetual and periodic inventory systems, along with the First-In, First-Out (FIFO) method. Journal entries for each transaction are provided. The assignment also discusses the benefits of using cloud-based accounting software, such as Xero, highlighting automation, efficient cash flow management, and accessibility. Finally, the solution explains the importance of internal controls in preventing fraud and ensuring the accuracy of financial statements, illustrating the concept with a case study. This document provides a comprehensive guide to understanding and solving accounting problems related to inventory, sales, and internal controls.

1 out of 27

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)