Accounting Fundamentals: Ledger, Trial Balance, Statements

VerifiedAdded on 2023/01/17

|21

|3340

|62

Homework Assignment

AI Summary

This accounting assignment provides a comprehensive overview of accounting fundamentals. It begins with an introduction to key concepts and then delves into practical applications through several tasks. Task 1 covers journal entries, ledger accounts, trial balance, and the preparation of financial statements, including the income statement and balance sheet. Tasks 2, 3, and 4 present detailed ledger accounts, trial balances, and financial statements for different entities (Pendo, Mafuta, and Ricardo), demonstrating the application of accounting principles in various scenarios. Task 5 focuses on capital expenditure. The assignment concludes with a discussion of the concepts covered and references used, providing a solid foundation in financial accounting principles. This assignment is ideal for students seeking to understand how to prepare financial statements and analyze financial positions.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

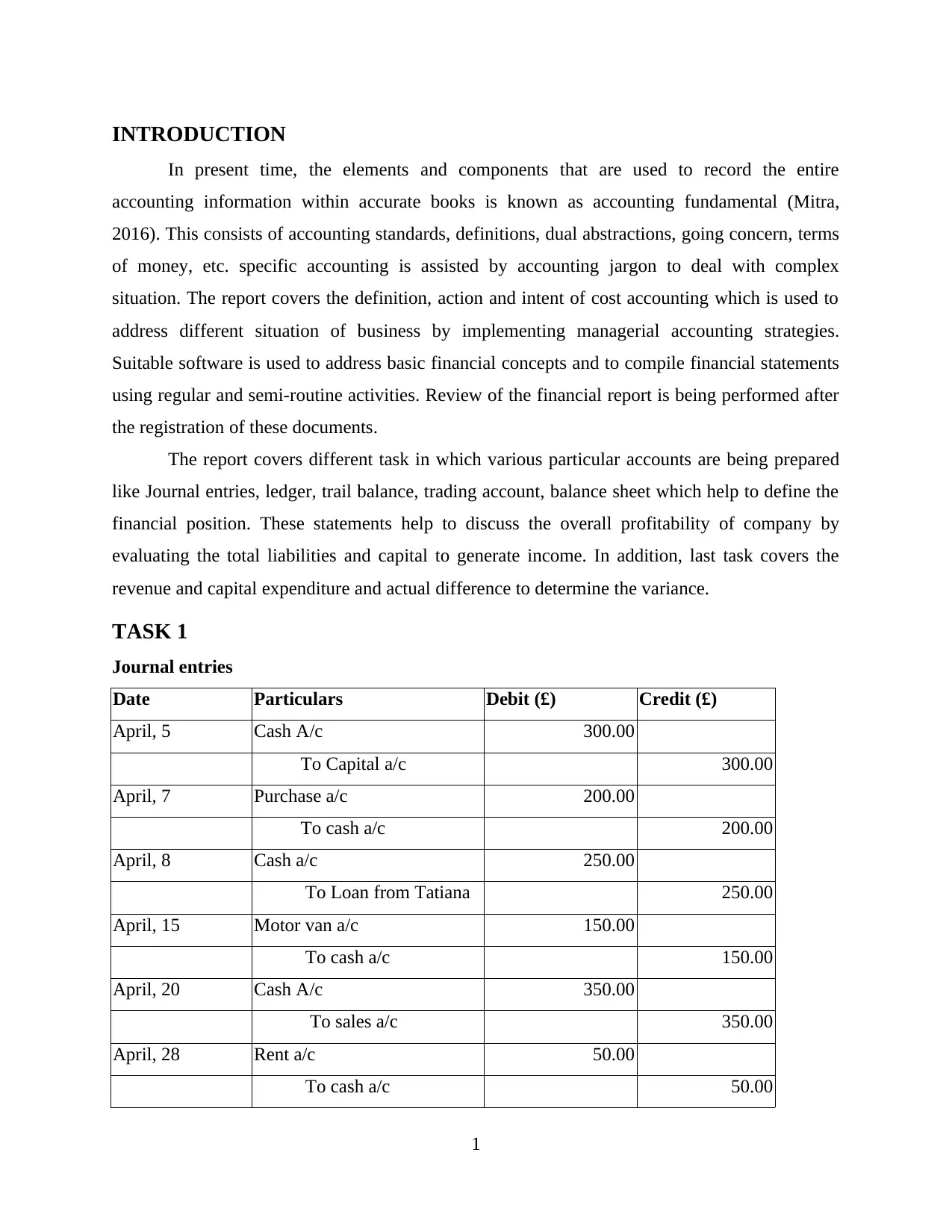

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

(a) Ledger accounts.....................................................................................................................1

(b) Trial Balance.........................................................................................................................3

(c) Final Statements of maxim....................................................................................................3

TASK 2............................................................................................................................................4

(a) Ledgers accounts of Pendo....................................................................................................4

(b) Trial balance of Pendo...........................................................................................................5

(c) Income statement of Pendo....................................................................................................6

TASK 3............................................................................................................................................6

(a) Ledger accounts of Mafuta....................................................................................................6

(b) Trial balance of Mafuta.........................................................................................................8

TASK 4............................................................................................................................................9

(a) Ledger accounts of Ricardo...................................................................................................9

(b) Trial balance of Ricardo......................................................................................................11

TASK 5..........................................................................................................................................12

CONCLUSION .............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

(a) Ledger accounts.....................................................................................................................1

(b) Trial Balance.........................................................................................................................3

(c) Final Statements of maxim....................................................................................................3

TASK 2............................................................................................................................................4

(a) Ledgers accounts of Pendo....................................................................................................4

(b) Trial balance of Pendo...........................................................................................................5

(c) Income statement of Pendo....................................................................................................6

TASK 3............................................................................................................................................6

(a) Ledger accounts of Mafuta....................................................................................................6

(b) Trial balance of Mafuta.........................................................................................................8

TASK 4............................................................................................................................................9

(a) Ledger accounts of Ricardo...................................................................................................9

(b) Trial balance of Ricardo......................................................................................................11

TASK 5..........................................................................................................................................12

CONCLUSION .............................................................................................................................14

REFERENCES .............................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In present time, the elements and components that are used to record the entire

accounting information within accurate books is known as accounting fundamental (Mitra,

2016). This consists of accounting standards, definitions, dual abstractions, going concern, terms

of money, etc. specific accounting is assisted by accounting jargon to deal with complex

situation. The report covers the definition, action and intent of cost accounting which is used to

address different situation of business by implementing managerial accounting strategies.

Suitable software is used to address basic financial concepts and to compile financial statements

using regular and semi-routine activities. Review of the financial report is being performed after

the registration of these documents.

The report covers different task in which various particular accounts are being prepared

like Journal entries, ledger, trail balance, trading account, balance sheet which help to define the

financial position. These statements help to discuss the overall profitability of company by

evaluating the total liabilities and capital to generate income. In addition, last task covers the

revenue and capital expenditure and actual difference to determine the variance.

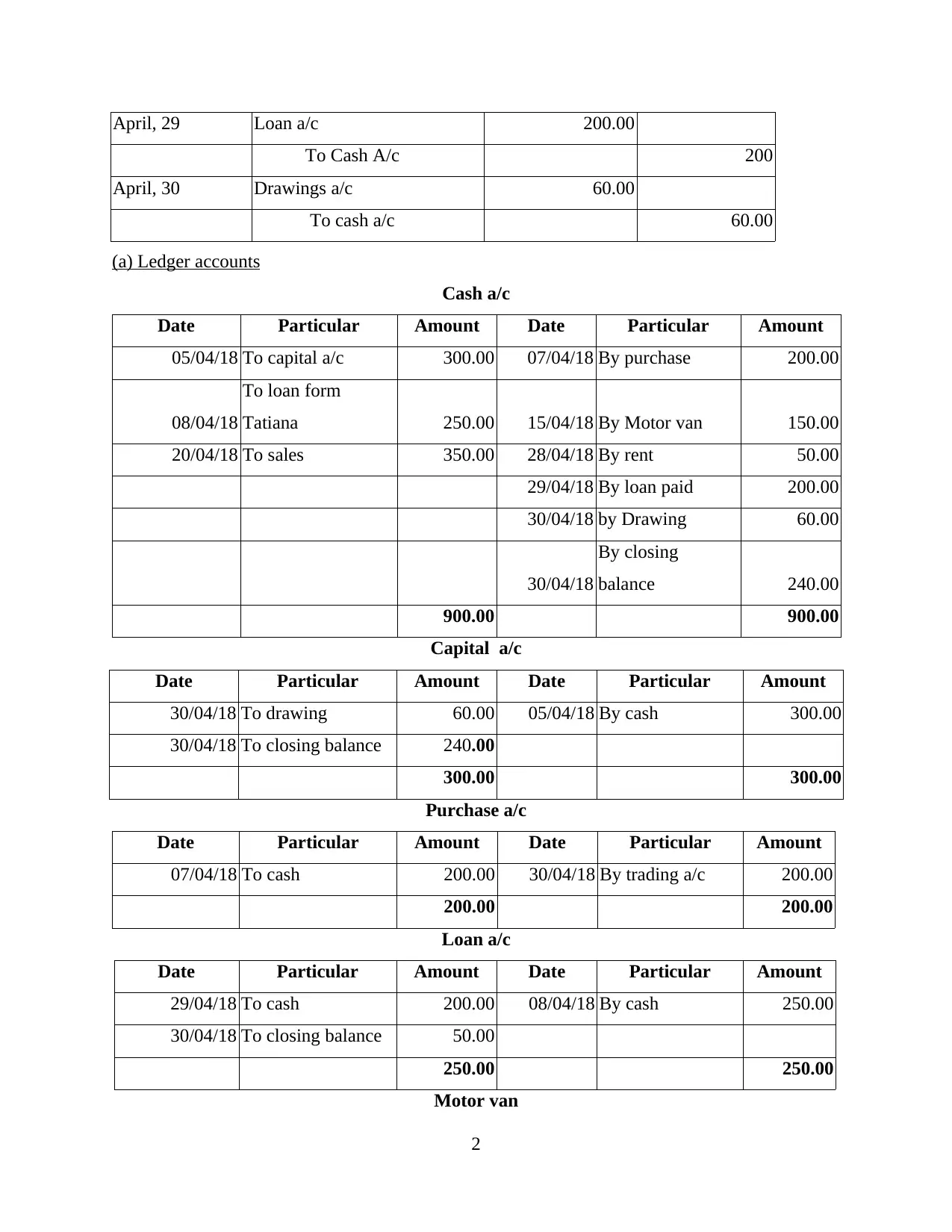

TASK 1

Journal entries

Date Particulars Debit (£) Credit (£)

April, 5 Cash A/c 300.00

To Capital a/c 300.00

April, 7 Purchase a/c 200.00

To cash a/c 200.00

April, 8 Cash a/c 250.00

To Loan from Tatiana 250.00

April, 15 Motor van a/c 150.00

To cash a/c 150.00

April, 20 Cash A/c 350.00

To sales a/c 350.00

April, 28 Rent a/c 50.00

To cash a/c 50.00

1

In present time, the elements and components that are used to record the entire

accounting information within accurate books is known as accounting fundamental (Mitra,

2016). This consists of accounting standards, definitions, dual abstractions, going concern, terms

of money, etc. specific accounting is assisted by accounting jargon to deal with complex

situation. The report covers the definition, action and intent of cost accounting which is used to

address different situation of business by implementing managerial accounting strategies.

Suitable software is used to address basic financial concepts and to compile financial statements

using regular and semi-routine activities. Review of the financial report is being performed after

the registration of these documents.

The report covers different task in which various particular accounts are being prepared

like Journal entries, ledger, trail balance, trading account, balance sheet which help to define the

financial position. These statements help to discuss the overall profitability of company by

evaluating the total liabilities and capital to generate income. In addition, last task covers the

revenue and capital expenditure and actual difference to determine the variance.

TASK 1

Journal entries

Date Particulars Debit (£) Credit (£)

April, 5 Cash A/c 300.00

To Capital a/c 300.00

April, 7 Purchase a/c 200.00

To cash a/c 200.00

April, 8 Cash a/c 250.00

To Loan from Tatiana 250.00

April, 15 Motor van a/c 150.00

To cash a/c 150.00

April, 20 Cash A/c 350.00

To sales a/c 350.00

April, 28 Rent a/c 50.00

To cash a/c 50.00

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

April, 29 Loan a/c 200.00

To Cash A/c 200

April, 30 Drawings a/c 60.00

To cash a/c 60.00

(a) Ledger accounts

Cash a/c

Date Particular Amount Date Particular Amount

05/04/18 To capital a/c 300.00 07/04/18 By purchase 200.00

08/04/18

To loan form

Tatiana 250.00 15/04/18 By Motor van 150.00

20/04/18 To sales 350.00 28/04/18 By rent 50.00

29/04/18 By loan paid 200.00

30/04/18 by Drawing 60.00

30/04/18

By closing

balance 240.00

900.00 900.00

Capital a/c

Date Particular Amount Date Particular Amount

30/04/18 To drawing 60.00 05/04/18 By cash 300.00

30/04/18 To closing balance 240.00

300.00 300.00

Purchase a/c

Date Particular Amount Date Particular Amount

07/04/18 To cash 200.00 30/04/18 By trading a/c 200.00

200.00 200.00

Loan a/c

Date Particular Amount Date Particular Amount

29/04/18 To cash 200.00 08/04/18 By cash 250.00

30/04/18 To closing balance 50.00

250.00 250.00

Motor van

2

To Cash A/c 200

April, 30 Drawings a/c 60.00

To cash a/c 60.00

(a) Ledger accounts

Cash a/c

Date Particular Amount Date Particular Amount

05/04/18 To capital a/c 300.00 07/04/18 By purchase 200.00

08/04/18

To loan form

Tatiana 250.00 15/04/18 By Motor van 150.00

20/04/18 To sales 350.00 28/04/18 By rent 50.00

29/04/18 By loan paid 200.00

30/04/18 by Drawing 60.00

30/04/18

By closing

balance 240.00

900.00 900.00

Capital a/c

Date Particular Amount Date Particular Amount

30/04/18 To drawing 60.00 05/04/18 By cash 300.00

30/04/18 To closing balance 240.00

300.00 300.00

Purchase a/c

Date Particular Amount Date Particular Amount

07/04/18 To cash 200.00 30/04/18 By trading a/c 200.00

200.00 200.00

Loan a/c

Date Particular Amount Date Particular Amount

29/04/18 To cash 200.00 08/04/18 By cash 250.00

30/04/18 To closing balance 50.00

250.00 250.00

Motor van

2

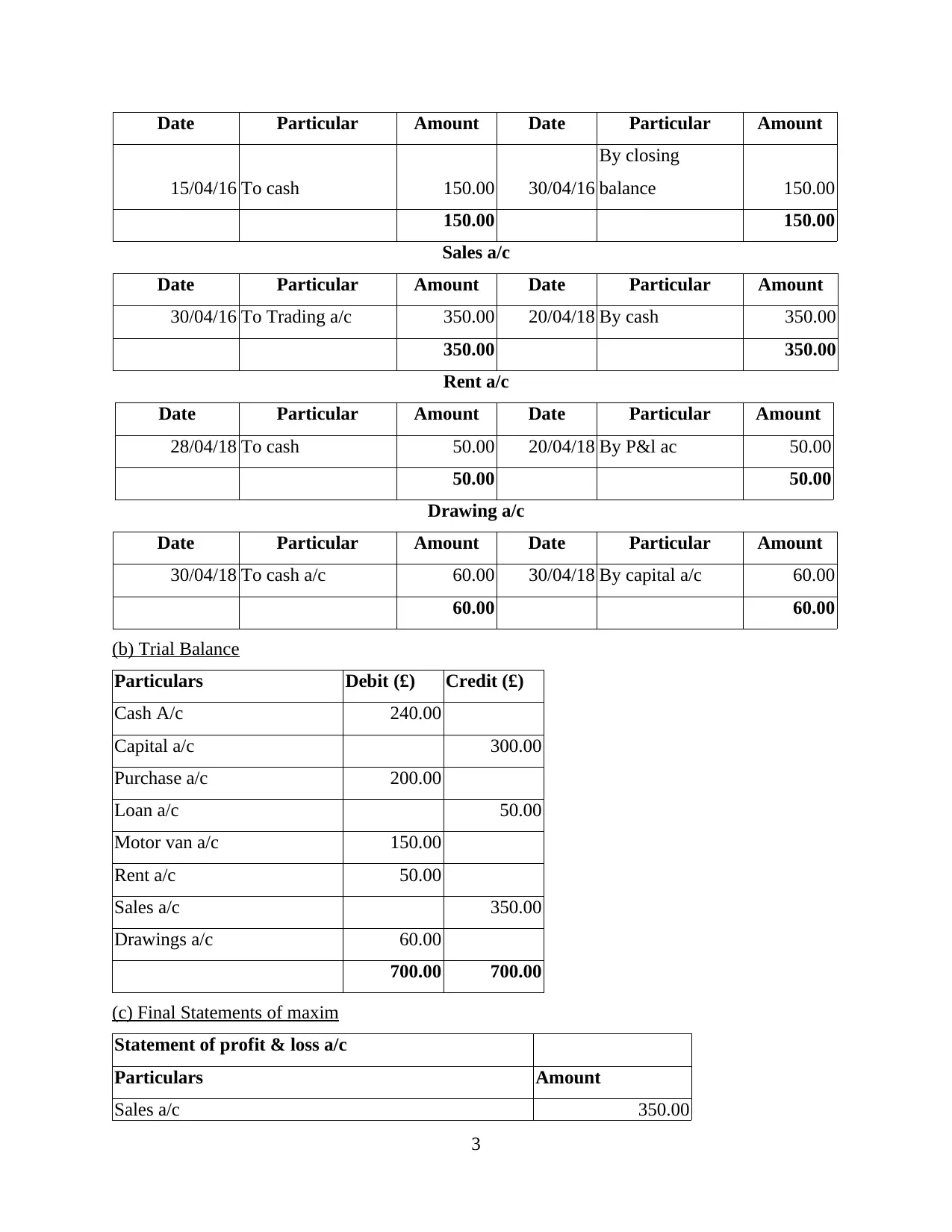

Date Particular Amount Date Particular Amount

15/04/16 To cash 150.00 30/04/16

By closing

balance 150.00

150.00 150.00

Sales a/c

Date Particular Amount Date Particular Amount

30/04/16 To Trading a/c 350.00 20/04/18 By cash 350.00

350.00 350.00

Rent a/c

Date Particular Amount Date Particular Amount

28/04/18 To cash 50.00 20/04/18 By P&l ac 50.00

50.00 50.00

Drawing a/c

Date Particular Amount Date Particular Amount

30/04/18 To cash a/c 60.00 30/04/18 By capital a/c 60.00

60.00 60.00

(b) Trial Balance

Particulars Debit (£) Credit (£)

Cash A/c 240.00

Capital a/c 300.00

Purchase a/c 200.00

Loan a/c 50.00

Motor van a/c 150.00

Rent a/c 50.00

Sales a/c 350.00

Drawings a/c 60.00

700.00 700.00

(c) Final Statements of maxim

Statement of profit & loss a/c

Particulars Amount

Sales a/c 350.00

3

15/04/16 To cash 150.00 30/04/16

By closing

balance 150.00

150.00 150.00

Sales a/c

Date Particular Amount Date Particular Amount

30/04/16 To Trading a/c 350.00 20/04/18 By cash 350.00

350.00 350.00

Rent a/c

Date Particular Amount Date Particular Amount

28/04/18 To cash 50.00 20/04/18 By P&l ac 50.00

50.00 50.00

Drawing a/c

Date Particular Amount Date Particular Amount

30/04/18 To cash a/c 60.00 30/04/18 By capital a/c 60.00

60.00 60.00

(b) Trial Balance

Particulars Debit (£) Credit (£)

Cash A/c 240.00

Capital a/c 300.00

Purchase a/c 200.00

Loan a/c 50.00

Motor van a/c 150.00

Rent a/c 50.00

Sales a/c 350.00

Drawings a/c 60.00

700.00 700.00

(c) Final Statements of maxim

Statement of profit & loss a/c

Particulars Amount

Sales a/c 350.00

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

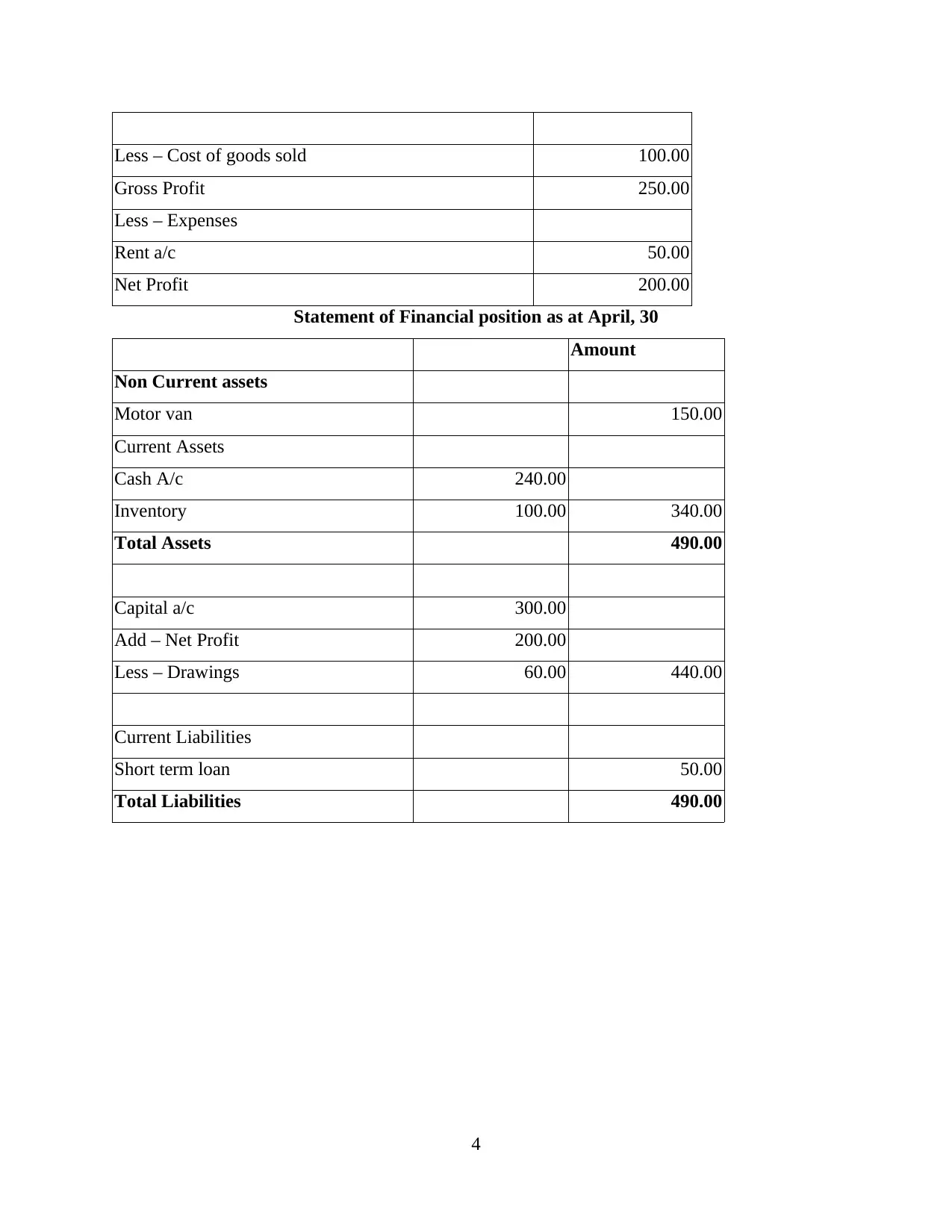

Less – Cost of goods sold 100.00

Gross Profit 250.00

Less – Expenses

Rent a/c 50.00

Net Profit 200.00

Statement of Financial position as at April, 30

Amount

Non Current assets

Motor van 150.00

Current Assets

Cash A/c 240.00

Inventory 100.00 340.00

Total Assets 490.00

Capital a/c 300.00

Add – Net Profit 200.00

Less – Drawings 60.00 440.00

Current Liabilities

Short term loan 50.00

Total Liabilities 490.00

4

Gross Profit 250.00

Less – Expenses

Rent a/c 50.00

Net Profit 200.00

Statement of Financial position as at April, 30

Amount

Non Current assets

Motor van 150.00

Current Assets

Cash A/c 240.00

Inventory 100.00 340.00

Total Assets 490.00

Capital a/c 300.00

Add – Net Profit 200.00

Less – Drawings 60.00 440.00

Current Liabilities

Short term loan 50.00

Total Liabilities 490.00

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

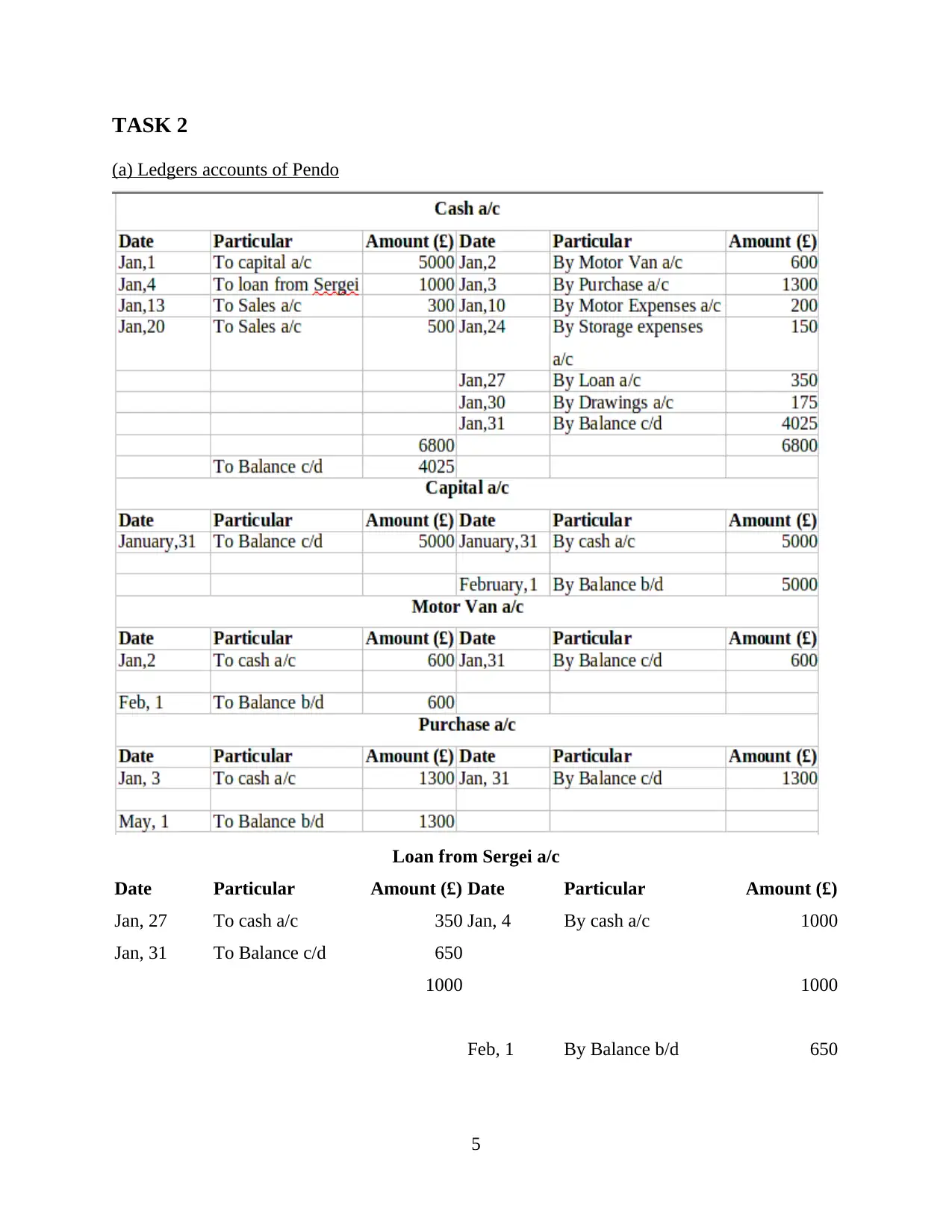

TASK 2

(a) Ledgers accounts of Pendo

Loan from Sergei a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 27 To cash a/c 350 Jan, 4 By cash a/c 1000

Jan, 31 To Balance c/d 650

1000 1000

Feb, 1 By Balance b/d 650

5

(a) Ledgers accounts of Pendo

Loan from Sergei a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 27 To cash a/c 350 Jan, 4 By cash a/c 1000

Jan, 31 To Balance c/d 650

1000 1000

Feb, 1 By Balance b/d 650

5

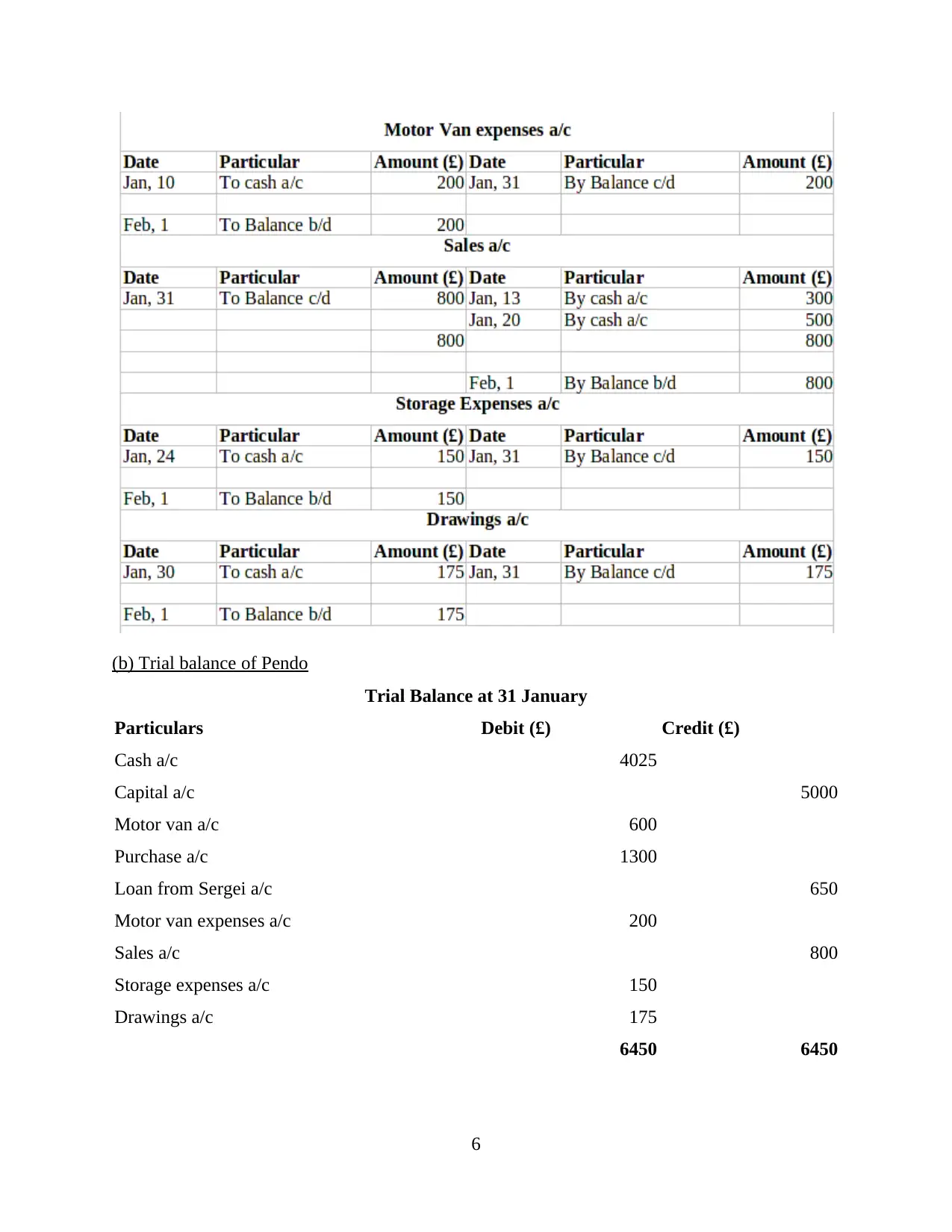

(b) Trial balance of Pendo

Trial Balance at 31 January

Particulars Debit (£) Credit (£)

Cash a/c 4025

Capital a/c 5000

Motor van a/c 600

Purchase a/c 1300

Loan from Sergei a/c 650

Motor van expenses a/c 200

Sales a/c 800

Storage expenses a/c 150

Drawings a/c 175

6450 6450

6

Trial Balance at 31 January

Particulars Debit (£) Credit (£)

Cash a/c 4025

Capital a/c 5000

Motor van a/c 600

Purchase a/c 1300

Loan from Sergei a/c 650

Motor van expenses a/c 200

Sales a/c 800

Storage expenses a/c 150

Drawings a/c 175

6450 6450

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

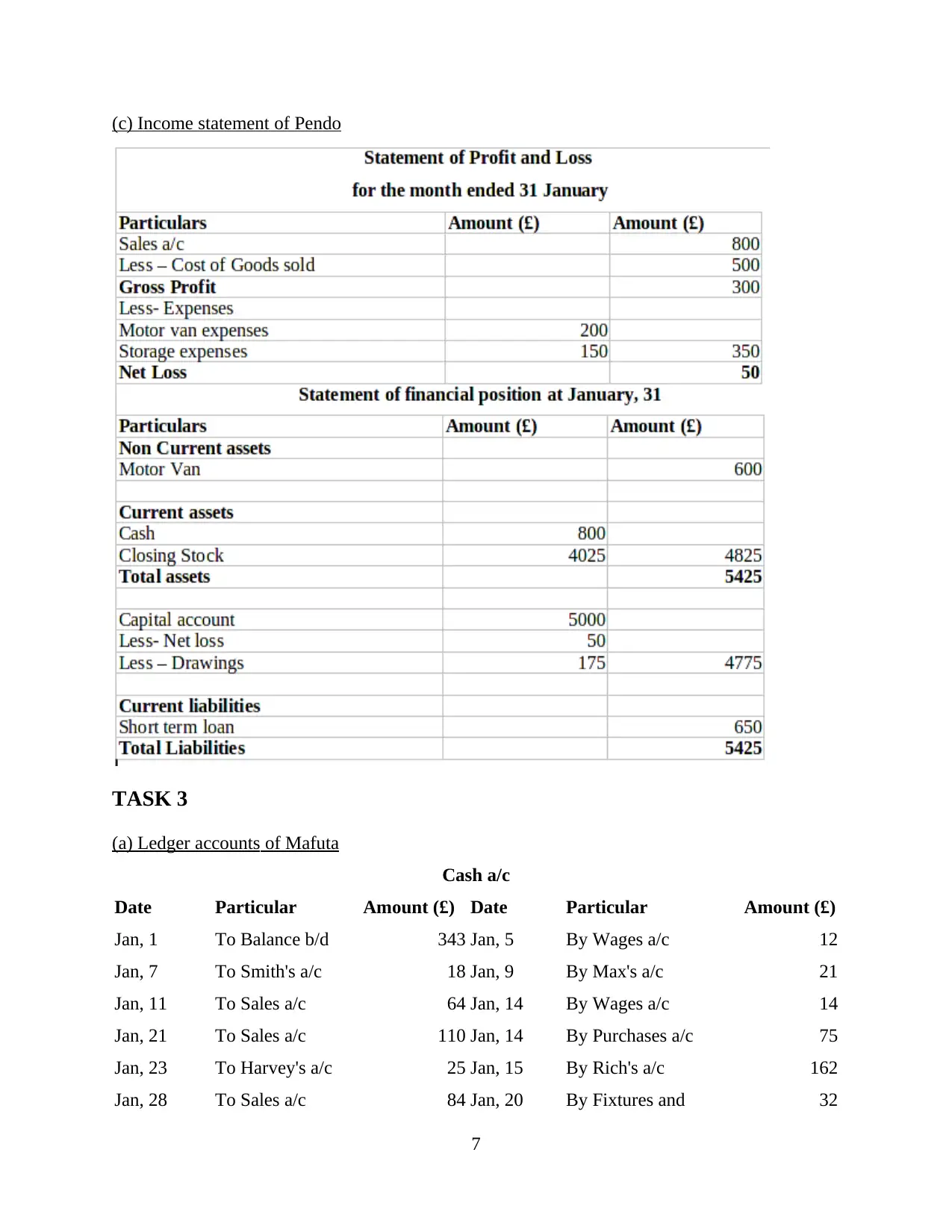

(c) Income statement of Pendo

TASK 3

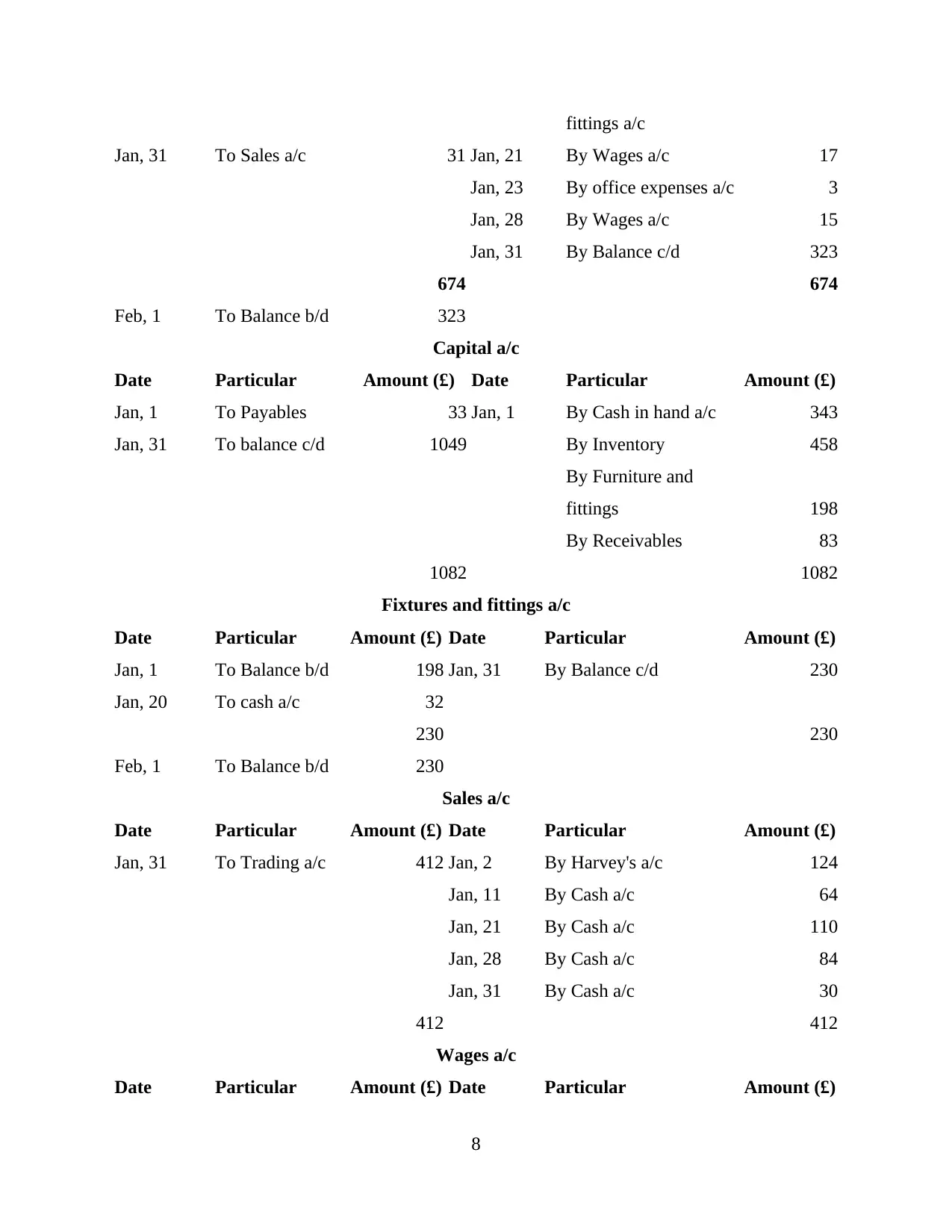

(a) Ledger accounts of Mafuta

Cash a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 343 Jan, 5 By Wages a/c 12

Jan, 7 To Smith's a/c 18 Jan, 9 By Max's a/c 21

Jan, 11 To Sales a/c 64 Jan, 14 By Wages a/c 14

Jan, 21 To Sales a/c 110 Jan, 14 By Purchases a/c 75

Jan, 23 To Harvey's a/c 25 Jan, 15 By Rich's a/c 162

Jan, 28 To Sales a/c 84 Jan, 20 By Fixtures and 32

7

TASK 3

(a) Ledger accounts of Mafuta

Cash a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 343 Jan, 5 By Wages a/c 12

Jan, 7 To Smith's a/c 18 Jan, 9 By Max's a/c 21

Jan, 11 To Sales a/c 64 Jan, 14 By Wages a/c 14

Jan, 21 To Sales a/c 110 Jan, 14 By Purchases a/c 75

Jan, 23 To Harvey's a/c 25 Jan, 15 By Rich's a/c 162

Jan, 28 To Sales a/c 84 Jan, 20 By Fixtures and 32

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

fittings a/c

Jan, 31 To Sales a/c 31 Jan, 21 By Wages a/c 17

Jan, 23 By office expenses a/c 3

Jan, 28 By Wages a/c 15

Jan, 31 By Balance c/d 323

674 674

Feb, 1 To Balance b/d 323

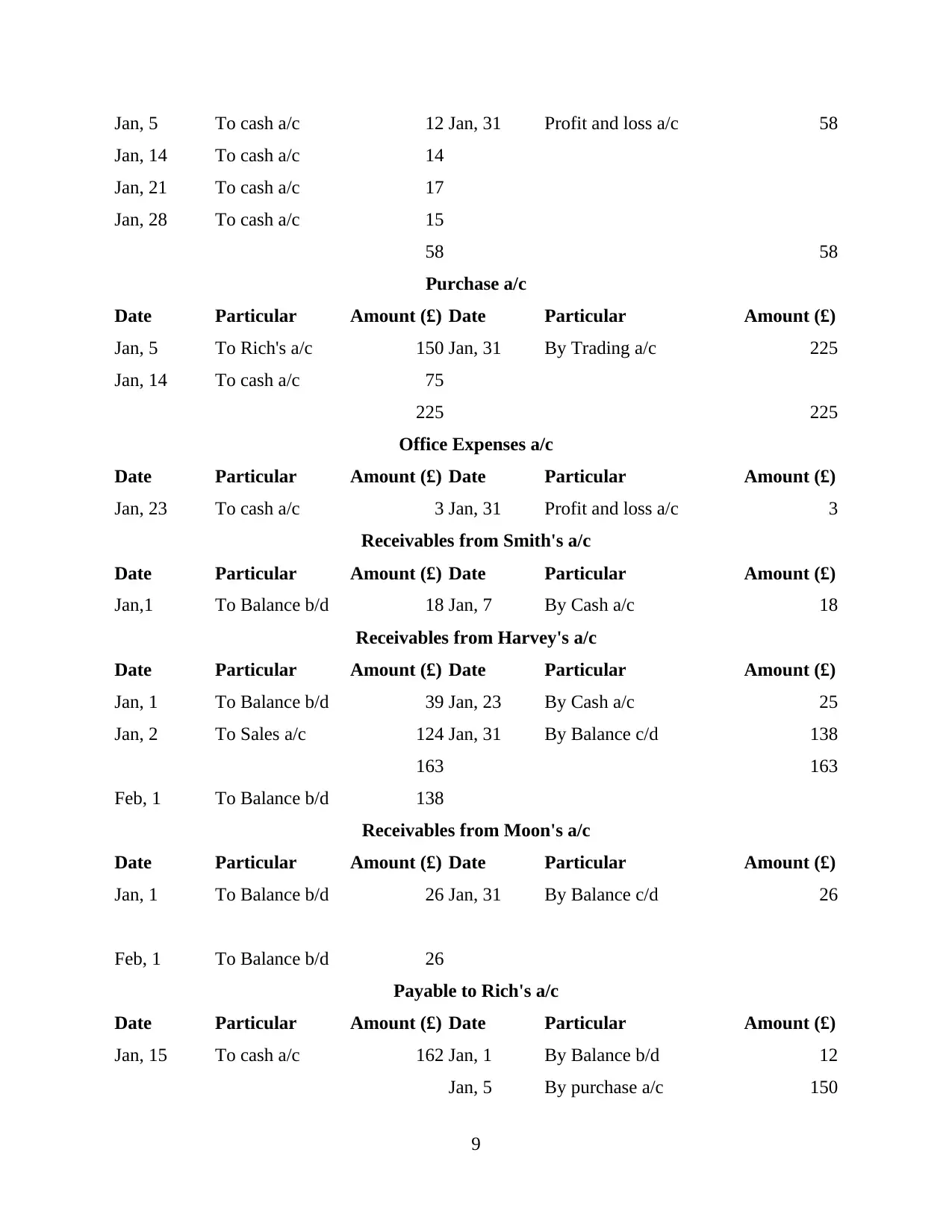

Capital a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Payables 33 Jan, 1 By Cash in hand a/c 343

Jan, 31 To balance c/d 1049 By Inventory 458

By Furniture and

fittings 198

By Receivables 83

1082 1082

Fixtures and fittings a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 198 Jan, 31 By Balance c/d 230

Jan, 20 To cash a/c 32

230 230

Feb, 1 To Balance b/d 230

Sales a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 31 To Trading a/c 412 Jan, 2 By Harvey's a/c 124

Jan, 11 By Cash a/c 64

Jan, 21 By Cash a/c 110

Jan, 28 By Cash a/c 84

Jan, 31 By Cash a/c 30

412 412

Wages a/c

Date Particular Amount (£) Date Particular Amount (£)

8

Jan, 31 To Sales a/c 31 Jan, 21 By Wages a/c 17

Jan, 23 By office expenses a/c 3

Jan, 28 By Wages a/c 15

Jan, 31 By Balance c/d 323

674 674

Feb, 1 To Balance b/d 323

Capital a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Payables 33 Jan, 1 By Cash in hand a/c 343

Jan, 31 To balance c/d 1049 By Inventory 458

By Furniture and

fittings 198

By Receivables 83

1082 1082

Fixtures and fittings a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 198 Jan, 31 By Balance c/d 230

Jan, 20 To cash a/c 32

230 230

Feb, 1 To Balance b/d 230

Sales a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 31 To Trading a/c 412 Jan, 2 By Harvey's a/c 124

Jan, 11 By Cash a/c 64

Jan, 21 By Cash a/c 110

Jan, 28 By Cash a/c 84

Jan, 31 By Cash a/c 30

412 412

Wages a/c

Date Particular Amount (£) Date Particular Amount (£)

8

Jan, 5 To cash a/c 12 Jan, 31 Profit and loss a/c 58

Jan, 14 To cash a/c 14

Jan, 21 To cash a/c 17

Jan, 28 To cash a/c 15

58 58

Purchase a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 5 To Rich's a/c 150 Jan, 31 By Trading a/c 225

Jan, 14 To cash a/c 75

225 225

Office Expenses a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 23 To cash a/c 3 Jan, 31 Profit and loss a/c 3

Receivables from Smith's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan,1 To Balance b/d 18 Jan, 7 By Cash a/c 18

Receivables from Harvey's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 39 Jan, 23 By Cash a/c 25

Jan, 2 To Sales a/c 124 Jan, 31 By Balance c/d 138

163 163

Feb, 1 To Balance b/d 138

Receivables from Moon's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 26 Jan, 31 By Balance c/d 26

Feb, 1 To Balance b/d 26

Payable to Rich's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 15 To cash a/c 162 Jan, 1 By Balance b/d 12

Jan, 5 By purchase a/c 150

9

Jan, 14 To cash a/c 14

Jan, 21 To cash a/c 17

Jan, 28 To cash a/c 15

58 58

Purchase a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 5 To Rich's a/c 150 Jan, 31 By Trading a/c 225

Jan, 14 To cash a/c 75

225 225

Office Expenses a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 23 To cash a/c 3 Jan, 31 Profit and loss a/c 3

Receivables from Smith's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan,1 To Balance b/d 18 Jan, 7 By Cash a/c 18

Receivables from Harvey's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 39 Jan, 23 By Cash a/c 25

Jan, 2 To Sales a/c 124 Jan, 31 By Balance c/d 138

163 163

Feb, 1 To Balance b/d 138

Receivables from Moon's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 1 To Balance b/d 26 Jan, 31 By Balance c/d 26

Feb, 1 To Balance b/d 26

Payable to Rich's a/c

Date Particular Amount (£) Date Particular Amount (£)

Jan, 15 To cash a/c 162 Jan, 1 By Balance b/d 12

Jan, 5 By purchase a/c 150

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.