Comprehensive Financial Analysis: Eccles plc and Chocco plc

VerifiedAdded on 2023/01/05

|9

|1992

|90

Report

AI Summary

This report offers a detailed analysis of accounting fundamentals, focusing on the preparation and interpretation of financial statements. The first part of the report presents the Income Statement and Statement of Financial Position for Eccles plc, including a discussion on why the statement of financial position balances. The second part delves into a ratio analysis of Chocco plc for 2019 and 2018, covering liquidity, profitability, efficiency, leverage, and market value ratios. The report includes a schedule of ratios and a comprehensive interpretation of Chocco plc's financial performance and position based on the calculated ratios. The analysis provides insights into the company's strengths and weaknesses, guiding potential strategies for improvement. The report concludes with a list of relevant references from academic journals and books.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

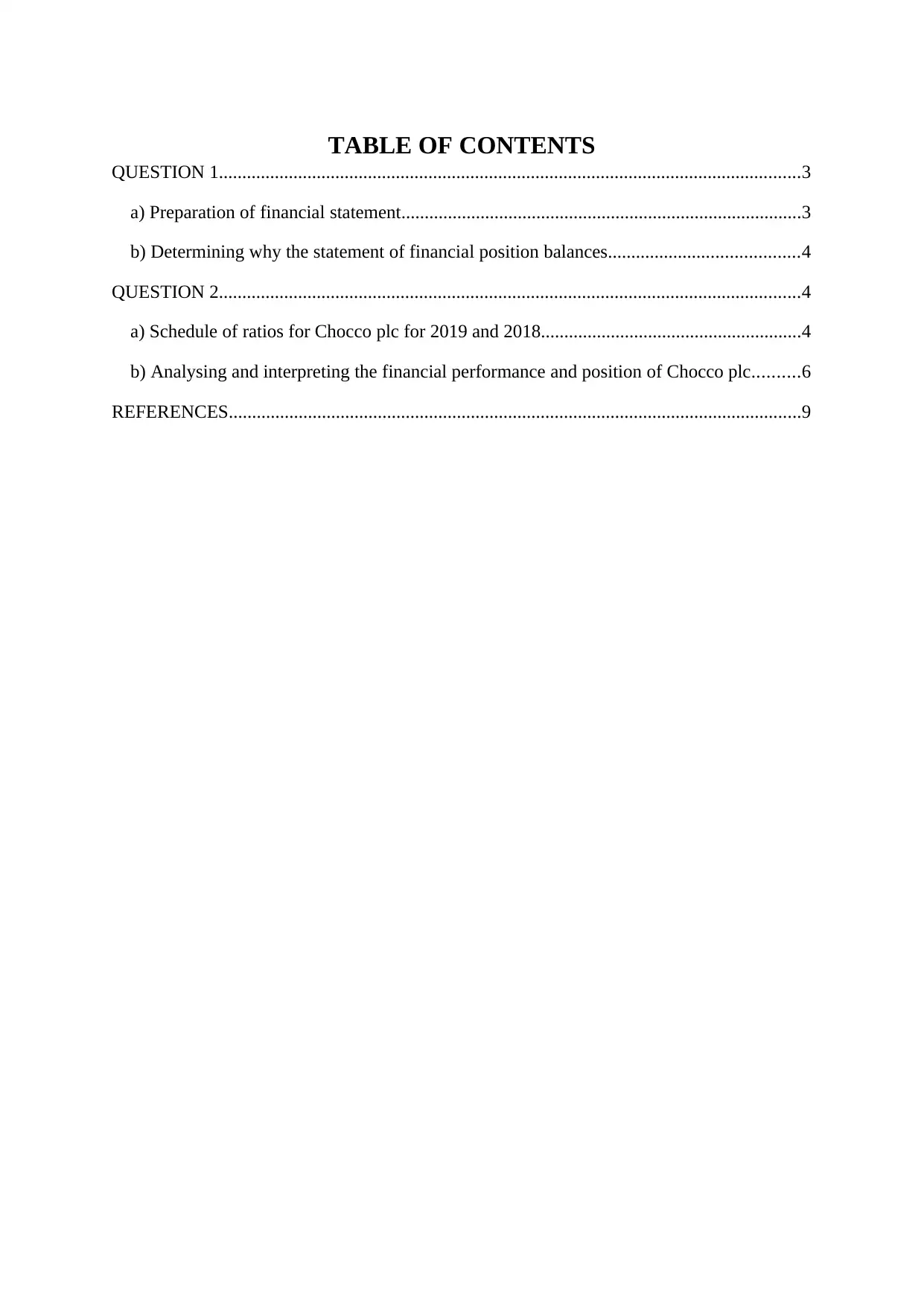

TABLE OF CONTENTS

QUESTION 1.............................................................................................................................3

a) Preparation of financial statement......................................................................................3

b) Determining why the statement of financial position balances.........................................4

QUESTION 2.............................................................................................................................4

a) Schedule of ratios for Chocco plc for 2019 and 2018........................................................4

b) Analysing and interpreting the financial performance and position of Chocco plc..........6

REFERENCES...........................................................................................................................9

QUESTION 1.............................................................................................................................3

a) Preparation of financial statement......................................................................................3

b) Determining why the statement of financial position balances.........................................4

QUESTION 2.............................................................................................................................4

a) Schedule of ratios for Chocco plc for 2019 and 2018........................................................4

b) Analysing and interpreting the financial performance and position of Chocco plc..........6

REFERENCES...........................................................................................................................9

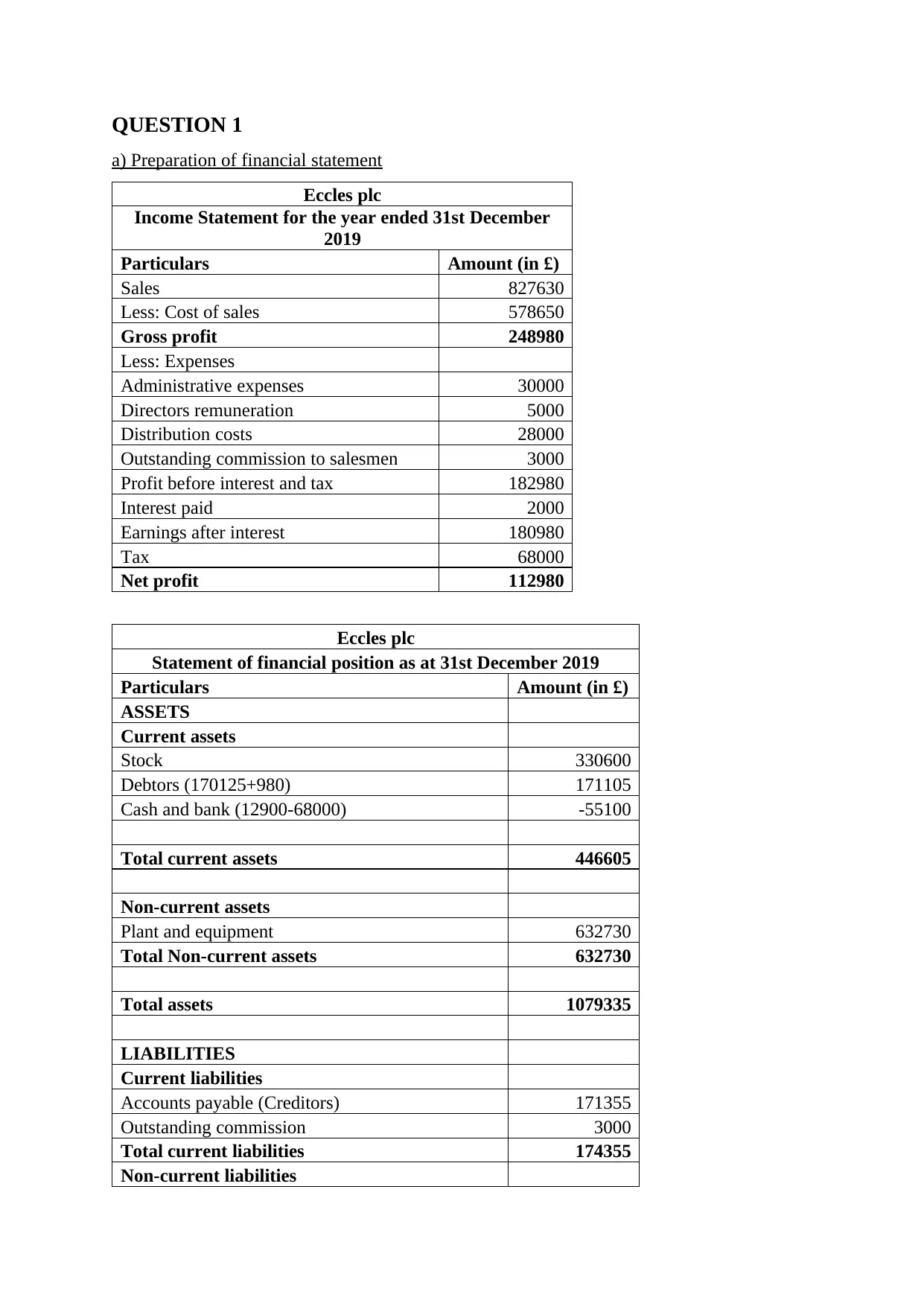

QUESTION 1

a) Preparation of financial statement

Eccles plc

Income Statement for the year ended 31st December

2019

Particulars Amount (in £)

Sales 827630

Less: Cost of sales 578650

Gross profit 248980

Less: Expenses

Administrative expenses 30000

Directors remuneration 5000

Distribution costs 28000

Outstanding commission to salesmen 3000

Profit before interest and tax 182980

Interest paid 2000

Earnings after interest 180980

Tax 68000

Net profit 112980

Eccles plc

Statement of financial position as at 31st December 2019

Particulars Amount (in £)

ASSETS

Current assets

Stock 330600

Debtors (170125+980) 171105

Cash and bank (12900-68000) -55100

Total current assets 446605

Non-current assets

Plant and equipment 632730

Total Non-current assets 632730

Total assets 1079335

LIABILITIES

Current liabilities

Accounts payable (Creditors) 171355

Outstanding commission 3000

Total current liabilities 174355

Non-current liabilities

a) Preparation of financial statement

Eccles plc

Income Statement for the year ended 31st December

2019

Particulars Amount (in £)

Sales 827630

Less: Cost of sales 578650

Gross profit 248980

Less: Expenses

Administrative expenses 30000

Directors remuneration 5000

Distribution costs 28000

Outstanding commission to salesmen 3000

Profit before interest and tax 182980

Interest paid 2000

Earnings after interest 180980

Tax 68000

Net profit 112980

Eccles plc

Statement of financial position as at 31st December 2019

Particulars Amount (in £)

ASSETS

Current assets

Stock 330600

Debtors (170125+980) 171105

Cash and bank (12900-68000) -55100

Total current assets 446605

Non-current assets

Plant and equipment 632730

Total Non-current assets 632730

Total assets 1079335

LIABILITIES

Current liabilities

Accounts payable (Creditors) 171355

Outstanding commission 3000

Total current liabilities 174355

Non-current liabilities

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

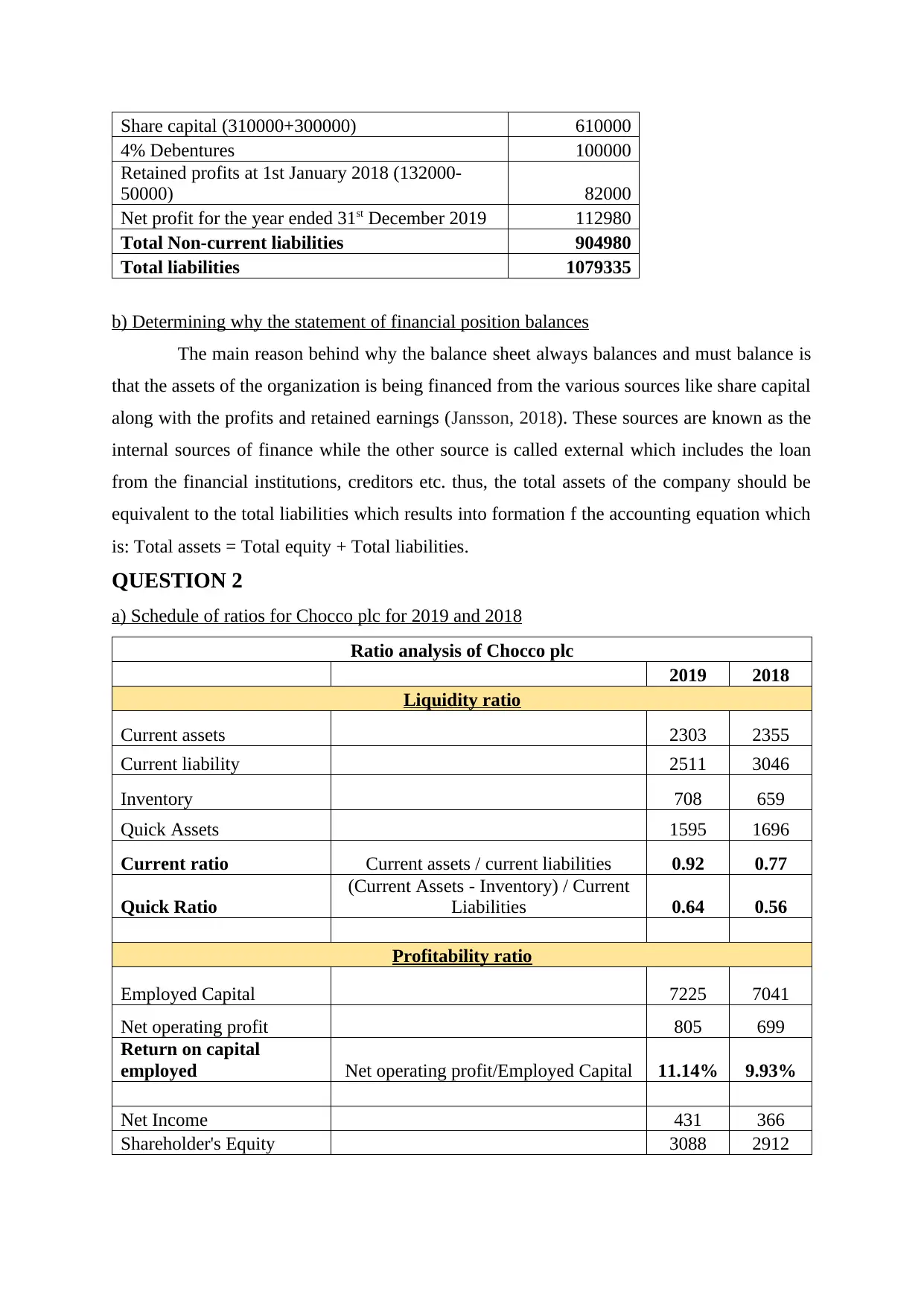

Share capital (310000+300000) 610000

4% Debentures 100000

Retained profits at 1st January 2018 (132000-

50000) 82000

Net profit for the year ended 31st December 2019 112980

Total Non-current liabilities 904980

Total liabilities 1079335

b) Determining why the statement of financial position balances

The main reason behind why the balance sheet always balances and must balance is

that the assets of the organization is being financed from the various sources like share capital

along with the profits and retained earnings (Jansson, 2018). These sources are known as the

internal sources of finance while the other source is called external which includes the loan

from the financial institutions, creditors etc. thus, the total assets of the company should be

equivalent to the total liabilities which results into formation f the accounting equation which

is: Total assets = Total equity + Total liabilities.

QUESTION 2

a) Schedule of ratios for Chocco plc for 2019 and 2018

Ratio analysis of Chocco plc

2019 2018

Liquidity ratio

Current assets 2303 2355

Current liability 2511 3046

Inventory 708 659

Quick Assets 1595 1696

Current ratio Current assets / current liabilities 0.92 0.77

Quick Ratio

(Current Assets - Inventory) / Current

Liabilities 0.64 0.56

Profitability ratio

Employed Capital 7225 7041

Net operating profit 805 699

Return on capital

employed Net operating profit/Employed Capital 11.14% 9.93%

Net Income 431 366

Shareholder's Equity 3088 2912

4% Debentures 100000

Retained profits at 1st January 2018 (132000-

50000) 82000

Net profit for the year ended 31st December 2019 112980

Total Non-current liabilities 904980

Total liabilities 1079335

b) Determining why the statement of financial position balances

The main reason behind why the balance sheet always balances and must balance is

that the assets of the organization is being financed from the various sources like share capital

along with the profits and retained earnings (Jansson, 2018). These sources are known as the

internal sources of finance while the other source is called external which includes the loan

from the financial institutions, creditors etc. thus, the total assets of the company should be

equivalent to the total liabilities which results into formation f the accounting equation which

is: Total assets = Total equity + Total liabilities.

QUESTION 2

a) Schedule of ratios for Chocco plc for 2019 and 2018

Ratio analysis of Chocco plc

2019 2018

Liquidity ratio

Current assets 2303 2355

Current liability 2511 3046

Inventory 708 659

Quick Assets 1595 1696

Current ratio Current assets / current liabilities 0.92 0.77

Quick Ratio

(Current Assets - Inventory) / Current

Liabilities 0.64 0.56

Profitability ratio

Employed Capital 7225 7041

Net operating profit 805 699

Return on capital

employed Net operating profit/Employed Capital 11.14% 9.93%

Net Income 431 366

Shareholder's Equity 3088 2912

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

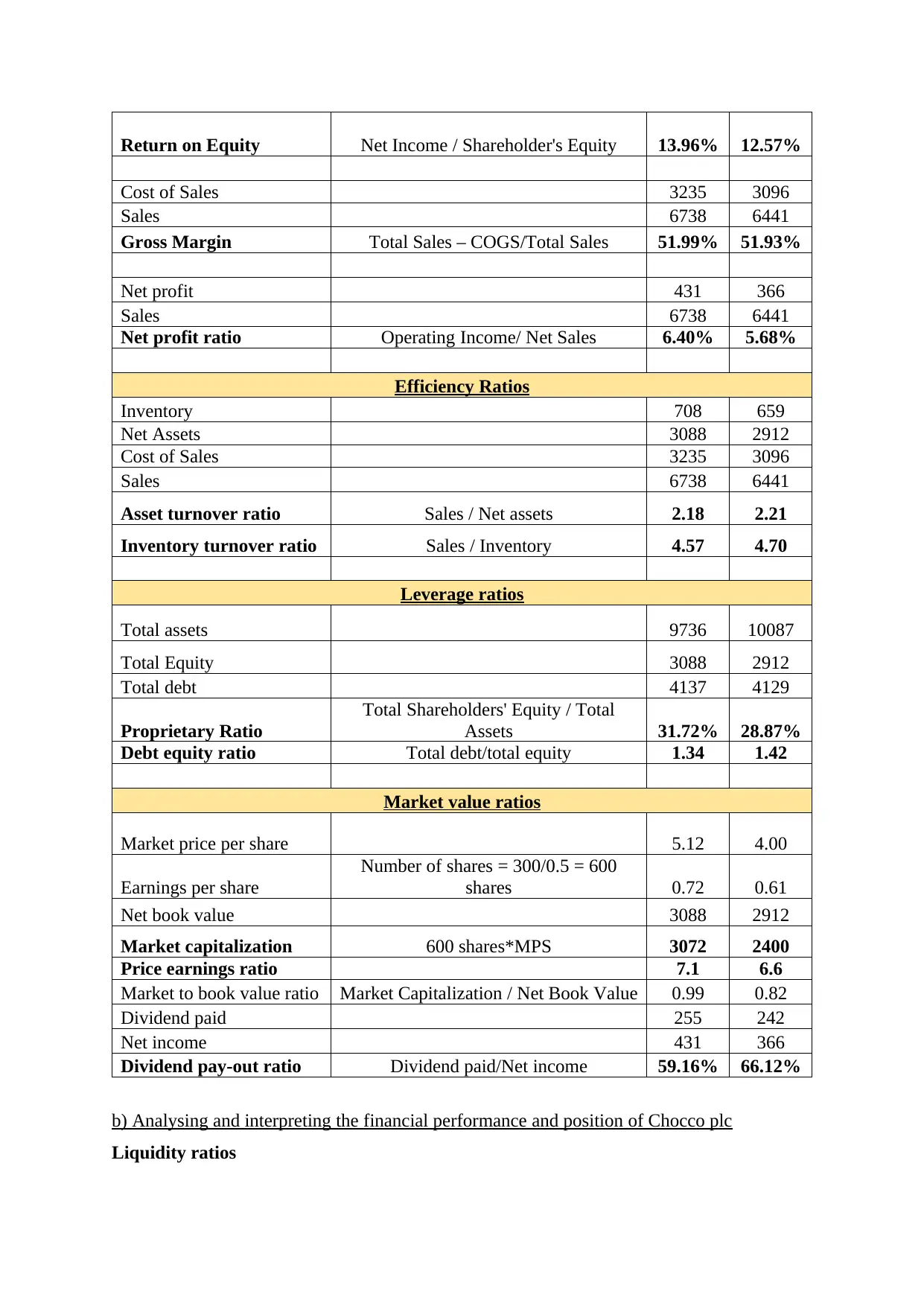

Return on Equity Net Income / Shareholder's Equity 13.96% 12.57%

Cost of Sales 3235 3096

Sales 6738 6441

Gross Margin Total Sales – COGS/Total Sales 51.99% 51.93%

Net profit 431 366

Sales 6738 6441

Net profit ratio Operating Income/ Net Sales 6.40% 5.68%

Efficiency Ratios

Inventory 708 659

Net Assets 3088 2912

Cost of Sales 3235 3096

Sales 6738 6441

Asset turnover ratio Sales / Net assets 2.18 2.21

Inventory turnover ratio Sales / Inventory 4.57 4.70

Leverage ratios

Total assets 9736 10087

Total Equity 3088 2912

Total debt 4137 4129

Proprietary Ratio

Total Shareholders' Equity / Total

Assets 31.72% 28.87%

Debt equity ratio Total debt/total equity 1.34 1.42

Market value ratios

Market price per share 5.12 4.00

Earnings per share

Number of shares = 300/0.5 = 600

shares 0.72 0.61

Net book value 3088 2912

Market capitalization 600 shares*MPS 3072 2400

Price earnings ratio 7.1 6.6

Market to book value ratio Market Capitalization / Net Book Value 0.99 0.82

Dividend paid 255 242

Net income 431 366

Dividend pay-out ratio Dividend paid/Net income 59.16% 66.12%

b) Analysing and interpreting the financial performance and position of Chocco plc

Liquidity ratios

Cost of Sales 3235 3096

Sales 6738 6441

Gross Margin Total Sales – COGS/Total Sales 51.99% 51.93%

Net profit 431 366

Sales 6738 6441

Net profit ratio Operating Income/ Net Sales 6.40% 5.68%

Efficiency Ratios

Inventory 708 659

Net Assets 3088 2912

Cost of Sales 3235 3096

Sales 6738 6441

Asset turnover ratio Sales / Net assets 2.18 2.21

Inventory turnover ratio Sales / Inventory 4.57 4.70

Leverage ratios

Total assets 9736 10087

Total Equity 3088 2912

Total debt 4137 4129

Proprietary Ratio

Total Shareholders' Equity / Total

Assets 31.72% 28.87%

Debt equity ratio Total debt/total equity 1.34 1.42

Market value ratios

Market price per share 5.12 4.00

Earnings per share

Number of shares = 300/0.5 = 600

shares 0.72 0.61

Net book value 3088 2912

Market capitalization 600 shares*MPS 3072 2400

Price earnings ratio 7.1 6.6

Market to book value ratio Market Capitalization / Net Book Value 0.99 0.82

Dividend paid 255 242

Net income 431 366

Dividend pay-out ratio Dividend paid/Net income 59.16% 66.12%

b) Analysing and interpreting the financial performance and position of Chocco plc

Liquidity ratios

Current ratio

The current ratio of the company has increased in comparison to the previous year

which the ratio is still low and the company requires to take actions for the purpose of

increasing the current assets or reducing its current liabilities.

Quick Ratio

Through this ratio, it can be interpreted that the company has made an investment into

its stocks which ahs resulted into blocking of the cash (Mas' ud and Srengga, 2017). Thus, it

becomes a point of concern for the company as this might result into insufficient amount of

funds for carrying out the daily business activities.

Profitability ratios

Return on capital employed

This ratio of the company rose to 11.14% in the year 2019 which is positive sign of

growth. It depicts that the Chocco plc has effectively made use of its capital employed in

creating desired income. Therefore, more such efforts should be made for ensuring that in

future the percentage increases.

Return on Equity

The ROE has shown an increase in trend and from the investors point of view, this is

very sound and it highlights the efficiency and the effectiveness of the organization in terms

of effectively utilizing the funds provided by the investors along with providing attractive and

higher return on it.

Gross Profit Margin

This ratio has remained consistent and there is no such change which is mainly of no

variation in the sales and the cost of sales. It is important to improve it further through the

way of increasing the sales revenue and reducing eth cost of sales associated with it.

Net Profit ratio

The net profit margin of Chocco plc has increased to 6.40% which shows that the

entity has been working sound in respect to further increasing its profits. The company has

effectively exercised control over its expenditure which has resulted into increase in net

profit.

Efficiency ratios

Asset turnover ratio

This ratio of the company has reduced which means that the company is not able to optimum

utilize its assets in generating higher revenue. Thus, it is crucial for the entity t implement

strategy for ensuring effective use of its assets which will result into positive outcome.

The current ratio of the company has increased in comparison to the previous year

which the ratio is still low and the company requires to take actions for the purpose of

increasing the current assets or reducing its current liabilities.

Quick Ratio

Through this ratio, it can be interpreted that the company has made an investment into

its stocks which ahs resulted into blocking of the cash (Mas' ud and Srengga, 2017). Thus, it

becomes a point of concern for the company as this might result into insufficient amount of

funds for carrying out the daily business activities.

Profitability ratios

Return on capital employed

This ratio of the company rose to 11.14% in the year 2019 which is positive sign of

growth. It depicts that the Chocco plc has effectively made use of its capital employed in

creating desired income. Therefore, more such efforts should be made for ensuring that in

future the percentage increases.

Return on Equity

The ROE has shown an increase in trend and from the investors point of view, this is

very sound and it highlights the efficiency and the effectiveness of the organization in terms

of effectively utilizing the funds provided by the investors along with providing attractive and

higher return on it.

Gross Profit Margin

This ratio has remained consistent and there is no such change which is mainly of no

variation in the sales and the cost of sales. It is important to improve it further through the

way of increasing the sales revenue and reducing eth cost of sales associated with it.

Net Profit ratio

The net profit margin of Chocco plc has increased to 6.40% which shows that the

entity has been working sound in respect to further increasing its profits. The company has

effectively exercised control over its expenditure which has resulted into increase in net

profit.

Efficiency ratios

Asset turnover ratio

This ratio of the company has reduced which means that the company is not able to optimum

utilize its assets in generating higher revenue. Thus, it is crucial for the entity t implement

strategy for ensuring effective use of its assets which will result into positive outcome.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory turnover ratio

The ITR of the organization has declined which implies that the organization is

confronting issue in regard to selling its products (Valaskova and et.al., 2018). It is attractive

to have higher proportion and if there should arise an occurrence of lower proportion it

portrays that the organization overspend through the method of buying an excessive amount

of load of merchandise and is squandering its assets by warehousing the non-saleable

inventory things. This features that organization isn't effective in rapidly selling its inventory.

Leverage ratios

Proprietary Ratio

This proportion has indicated an upward pattern which is ideal for the organization as

it features that the company is utilizing the equity assets rather than obligation in the

business. The rate has expanded and is in this manner having extra space for the taking the

obligation if there is any requirement of it (Kristanti and Herwany, 2017). Alongside that,

there is a decrease in the total assets of the organization and an expansion in the equity funds

which has come about into high ratio.

Debt equity ratio

This ratio helps in deciding the creation of the obligation and equity in the capital

structure of an organization. It is attractive to have the proportion of 1 however in the event

of Chocco plc the proportion is 1.34 which has diminished in contrast with the earlier year

yet isn't extremely low. This portrays that the substance is having more obligation when

contrasted with its value which cause risk for the business entity consequently, measures are

needed to be embraced which will help in accomplishing the ideal proportion.

Market value ratios

Price earnings ratio

The PER of Chocco plc has indicated an expansion in pattern which features the

developing stocks of the organization. Alongside it, the proportion is high which portrays the

more grounded and positive future presentation of the element and alongside it, the desires of

the investors with respect to the future income will likewise increment and will pay more

(Rashid, 2018). Be that as it may, then again, it is critical to investigate the opposite side too,

which is, growing stocks are higher unpredictable which applies tremendous tension on the

entity to invest in more amounts of energy to legitimize with the higher valuation.

Market to book value ratio

This proportion is the budgetary measurements which is used to assess the current

estimation of the current share worth of an organization as opposed to its book esteem. The

The ITR of the organization has declined which implies that the organization is

confronting issue in regard to selling its products (Valaskova and et.al., 2018). It is attractive

to have higher proportion and if there should arise an occurrence of lower proportion it

portrays that the organization overspend through the method of buying an excessive amount

of load of merchandise and is squandering its assets by warehousing the non-saleable

inventory things. This features that organization isn't effective in rapidly selling its inventory.

Leverage ratios

Proprietary Ratio

This proportion has indicated an upward pattern which is ideal for the organization as

it features that the company is utilizing the equity assets rather than obligation in the

business. The rate has expanded and is in this manner having extra space for the taking the

obligation if there is any requirement of it (Kristanti and Herwany, 2017). Alongside that,

there is a decrease in the total assets of the organization and an expansion in the equity funds

which has come about into high ratio.

Debt equity ratio

This ratio helps in deciding the creation of the obligation and equity in the capital

structure of an organization. It is attractive to have the proportion of 1 however in the event

of Chocco plc the proportion is 1.34 which has diminished in contrast with the earlier year

yet isn't extremely low. This portrays that the substance is having more obligation when

contrasted with its value which cause risk for the business entity consequently, measures are

needed to be embraced which will help in accomplishing the ideal proportion.

Market value ratios

Price earnings ratio

The PER of Chocco plc has indicated an expansion in pattern which features the

developing stocks of the organization. Alongside it, the proportion is high which portrays the

more grounded and positive future presentation of the element and alongside it, the desires of

the investors with respect to the future income will likewise increment and will pay more

(Rashid, 2018). Be that as it may, then again, it is critical to investigate the opposite side too,

which is, growing stocks are higher unpredictable which applies tremendous tension on the

entity to invest in more amounts of energy to legitimize with the higher valuation.

Market to book value ratio

This proportion is the budgetary measurements which is used to assess the current

estimation of the current share worth of an organization as opposed to its book esteem. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

proportion has ascended to 0.99 from 0.82 in 2018. The proportion lower than 1 show that the

share of the organization is underestimated which is considered as the awful speculation

which could imply that there is something missing with the organization and furthermore

portrays that the organization will be paying considerably more than what will be left after

bankrupt (Doorasamy, 2016). The proportion greater than 1 alludes to the overvaluation of

the stock passing on that the association is performing admirably. The 0.99 is roughly 1, in

this manner, Chocco plc should execute the techniques which will help in accomplishing the

proportion of more than 1. Thusly, the stock estimation of the organization is acceptable.

Dividend pay-out ratio

The DPR of the organization has declined in regard to its earlier year which features

that the organization is reinvesting its acquiring into the activities which results into

additional extension of the business (Zarei, Yazdifar and Ghaleno, 2020). Through this,

organization will have the option to achieve high development goals which will thus result

into acquiring significant level of capital additions for the speculators. In this way, Chocco

plc is in the situation to draw in more speculators who are more enthusiastic about procuring

higher expected benefits from a critical rise in the share price of the organization and least

interest in the pay produced through profit.

share of the organization is underestimated which is considered as the awful speculation

which could imply that there is something missing with the organization and furthermore

portrays that the organization will be paying considerably more than what will be left after

bankrupt (Doorasamy, 2016). The proportion greater than 1 alludes to the overvaluation of

the stock passing on that the association is performing admirably. The 0.99 is roughly 1, in

this manner, Chocco plc should execute the techniques which will help in accomplishing the

proportion of more than 1. Thusly, the stock estimation of the organization is acceptable.

Dividend pay-out ratio

The DPR of the organization has declined in regard to its earlier year which features

that the organization is reinvesting its acquiring into the activities which results into

additional extension of the business (Zarei, Yazdifar and Ghaleno, 2020). Through this,

organization will have the option to achieve high development goals which will thus result

into acquiring significant level of capital additions for the speculators. In this way, Chocco

plc is in the situation to draw in more speculators who are more enthusiastic about procuring

higher expected benefits from a critical rise in the share price of the organization and least

interest in the pay produced through profit.

REFERENCES

Books and Journals

Doorasamy, M., 2016. Using DuPont analysis to assess the financial performance of the top 3

JSE listed companies in the food industry. Investment management and financial

innovations, (13, Iss. 2), pp.29-44.

Jansson, C., 2018. Financial resilience: the role of financial balance, profitability, and

ownership. In The Resilience Framework (pp. 111-131). Springer, Singapore.

Kristanti, F. T. and Herwany, A., 2017. Corporate governance, financial ratios, political risk

and financial distress: A survival analysis. Accounting and Finance Review (AFR)

Vol. 2(2).

Mas' ud, I. and Srengga, R.M., 2017. Financial Ratio Analysis To Predict Financial Distress

Conditions Manufacturing Companies Listed In Indonesia Stock Exchange,(Online),

Vol. 10. No. 2.

Rashid, C. A., 2018. Efficiency of Financial Ratios Analysis for Evaluating Companies’

Liquidity. International Journal of Social Sciences & Educational Studies. 4(4),

p.110.

Valaskova, K., and et.al., 2018. Financial risk measurement and prediction modelling for

sustainable development of business entities using regression

analysis. Sustainability. 10(7). p.2144.

Zarei, H., Yazdifar, H. and Ghaleno, M. D., 2020. Predicting auditors' opinions using

financial ratios and non-financial metrics: evidence from Iran. Journal of

Accounting in Emerging Economies.

Books and Journals

Doorasamy, M., 2016. Using DuPont analysis to assess the financial performance of the top 3

JSE listed companies in the food industry. Investment management and financial

innovations, (13, Iss. 2), pp.29-44.

Jansson, C., 2018. Financial resilience: the role of financial balance, profitability, and

ownership. In The Resilience Framework (pp. 111-131). Springer, Singapore.

Kristanti, F. T. and Herwany, A., 2017. Corporate governance, financial ratios, political risk

and financial distress: A survival analysis. Accounting and Finance Review (AFR)

Vol. 2(2).

Mas' ud, I. and Srengga, R.M., 2017. Financial Ratio Analysis To Predict Financial Distress

Conditions Manufacturing Companies Listed In Indonesia Stock Exchange,(Online),

Vol. 10. No. 2.

Rashid, C. A., 2018. Efficiency of Financial Ratios Analysis for Evaluating Companies’

Liquidity. International Journal of Social Sciences & Educational Studies. 4(4),

p.110.

Valaskova, K., and et.al., 2018. Financial risk measurement and prediction modelling for

sustainable development of business entities using regression

analysis. Sustainability. 10(7). p.2144.

Zarei, H., Yazdifar, H. and Ghaleno, M. D., 2020. Predicting auditors' opinions using

financial ratios and non-financial metrics: evidence from Iran. Journal of

Accounting in Emerging Economies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.