Comparison of Capital and Revenue Expenditures

VerifiedAdded on 2020/10/05

|23

|4693

|56

AI Summary

This assignment provides an analysis of capital and revenue expenditures, highlighting their distinct characteristics. Capital expenditures involve significant investments for fixed assets, while revenue expenditures are recurring costs related to normal business activities. The study concludes that these expenses have different impacts on profit and loss accounts, with capital expenditures having a more substantial effect. The assignment also emphasizes the importance of understanding accounting concepts in preparing financial statements.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

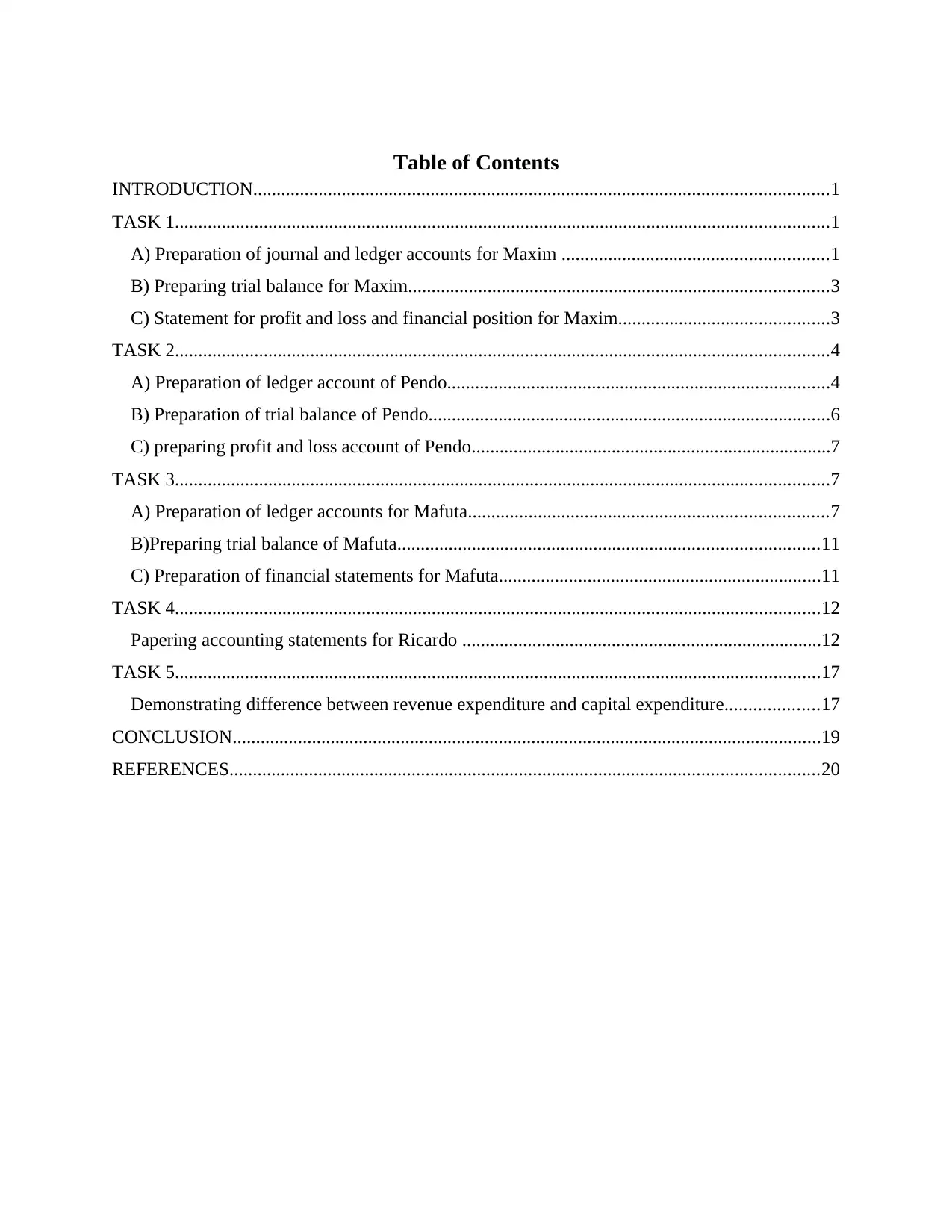

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A) Preparation of journal and ledger accounts for Maxim .........................................................1

B) Preparing trial balance for Maxim..........................................................................................3

C) Statement for profit and loss and financial position for Maxim.............................................3

TASK 2............................................................................................................................................4

A) Preparation of ledger account of Pendo..................................................................................4

B) Preparation of trial balance of Pendo......................................................................................6

C) preparing profit and loss account of Pendo.............................................................................7

TASK 3............................................................................................................................................7

A) Preparation of ledger accounts for Mafuta.............................................................................7

B)Preparing trial balance of Mafuta..........................................................................................11

C) Preparation of financial statements for Mafuta.....................................................................11

TASK 4..........................................................................................................................................12

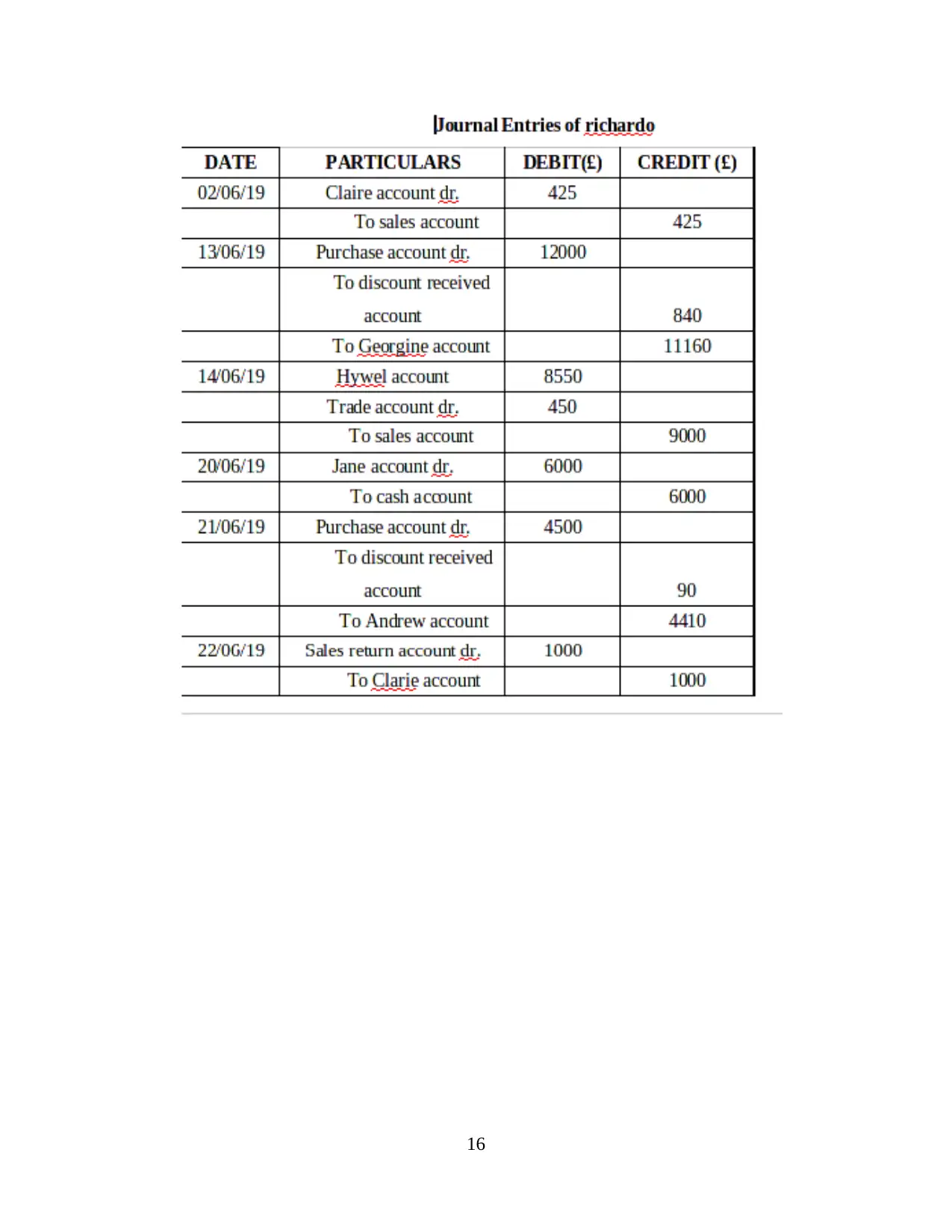

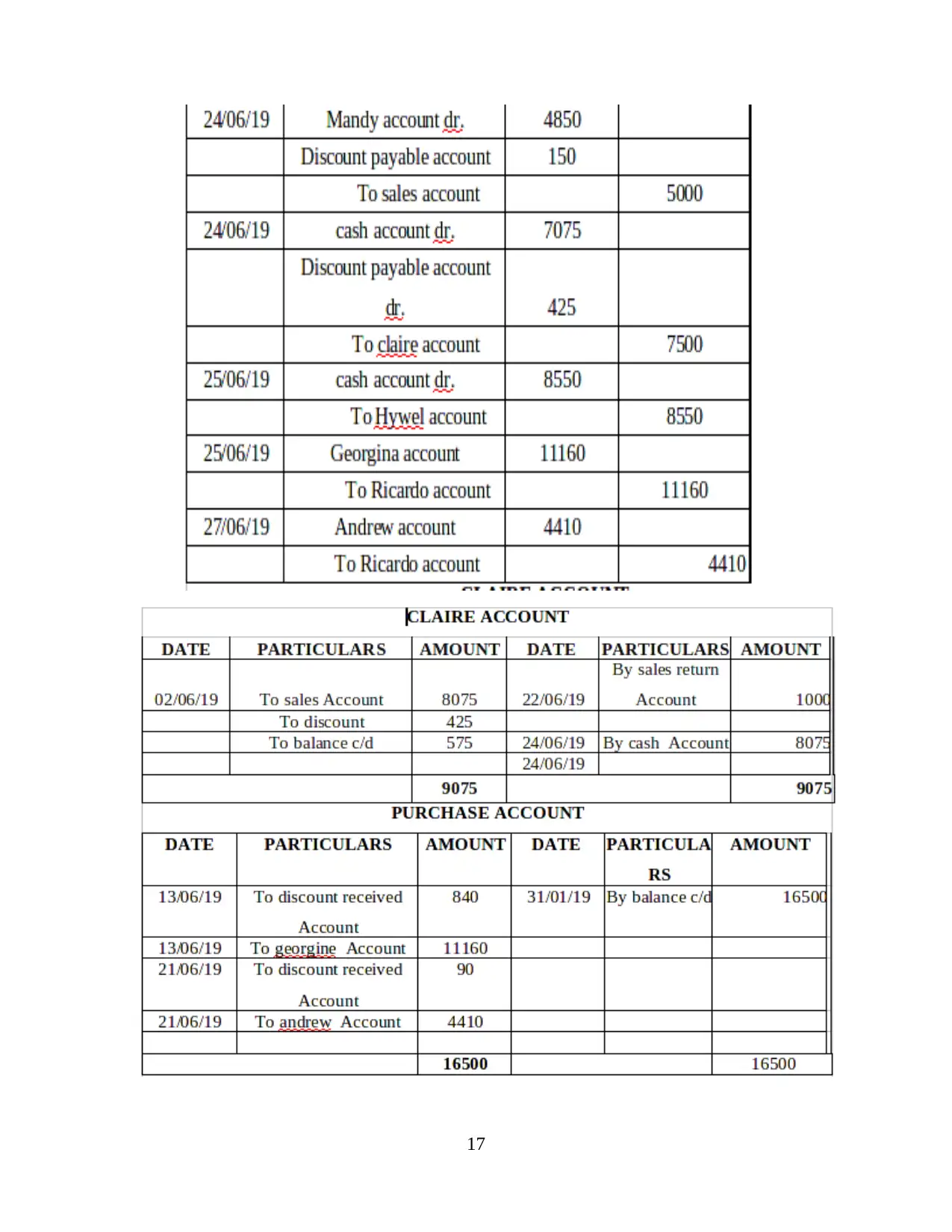

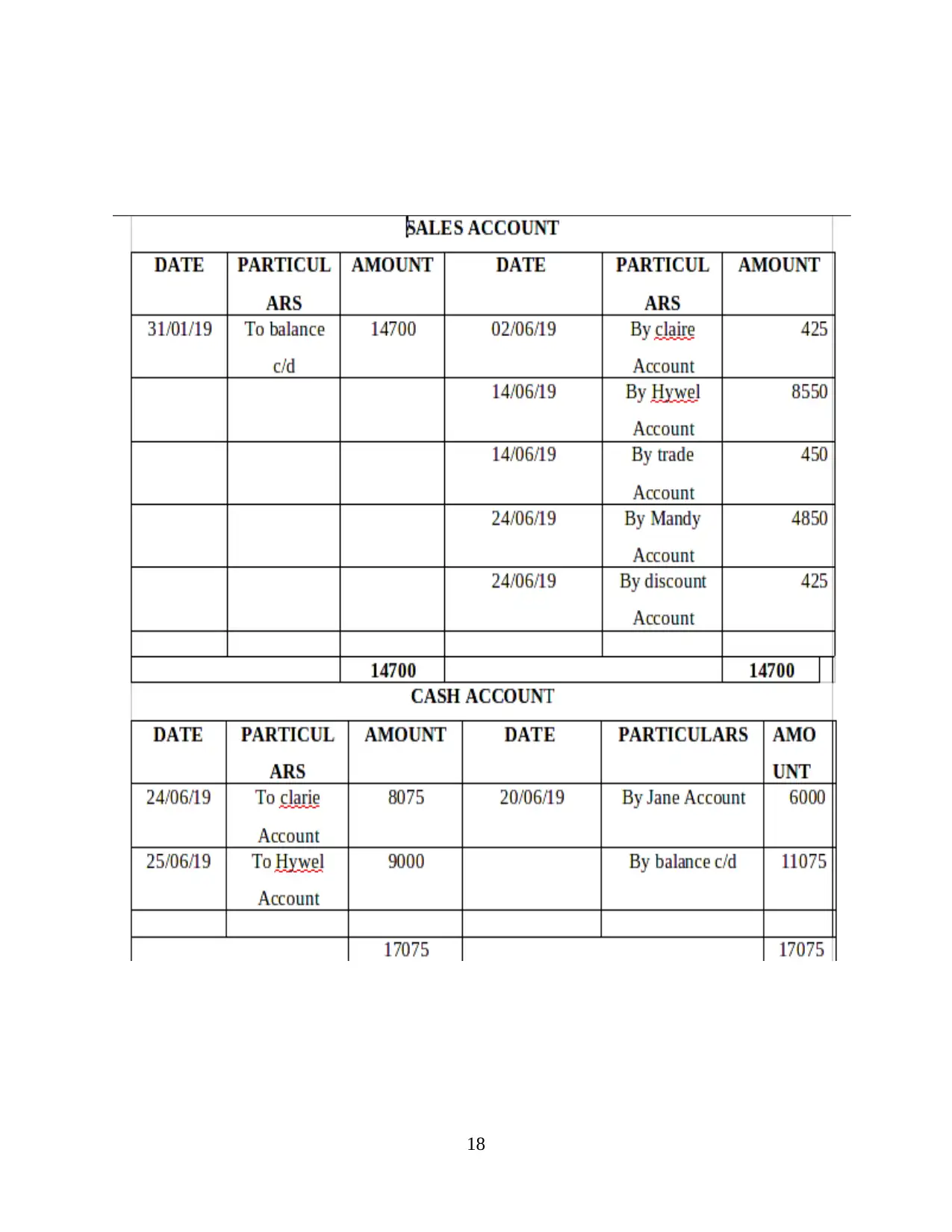

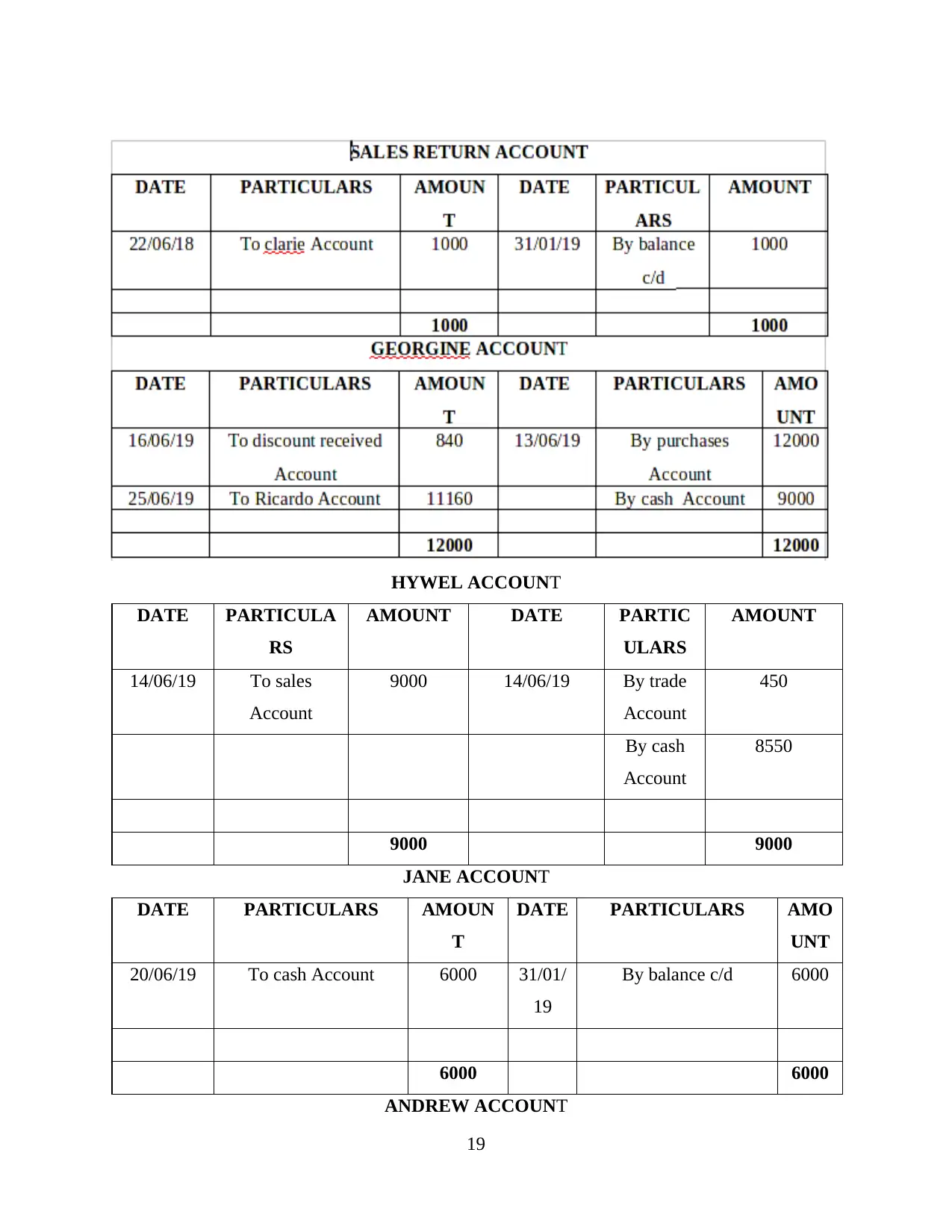

Papering accounting statements for Ricardo .............................................................................12

TASK 5..........................................................................................................................................17

Demonstrating difference between revenue expenditure and capital expenditure....................17

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A) Preparation of journal and ledger accounts for Maxim .........................................................1

B) Preparing trial balance for Maxim..........................................................................................3

C) Statement for profit and loss and financial position for Maxim.............................................3

TASK 2............................................................................................................................................4

A) Preparation of ledger account of Pendo..................................................................................4

B) Preparation of trial balance of Pendo......................................................................................6

C) preparing profit and loss account of Pendo.............................................................................7

TASK 3............................................................................................................................................7

A) Preparation of ledger accounts for Mafuta.............................................................................7

B)Preparing trial balance of Mafuta..........................................................................................11

C) Preparation of financial statements for Mafuta.....................................................................11

TASK 4..........................................................................................................................................12

Papering accounting statements for Ricardo .............................................................................12

TASK 5..........................................................................................................................................17

Demonstrating difference between revenue expenditure and capital expenditure....................17

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION

Fundamental accounting is a set of concepts that are needed to be taken into account at

the time of preparing financial statements and recording each of the monitory transaction made

by the company (Schaltegger and Burritt, 2017). Present study represents preparation of journal

and ledger accounts of different business organisations. Preparation of balance sheet, statement

of profit and loss account of various business organisations is shown in the study. Furthermore, it

also shows a brief description about difference between revenue expenditures and capital

expenditure in context to international accounting standards.

TASK 1

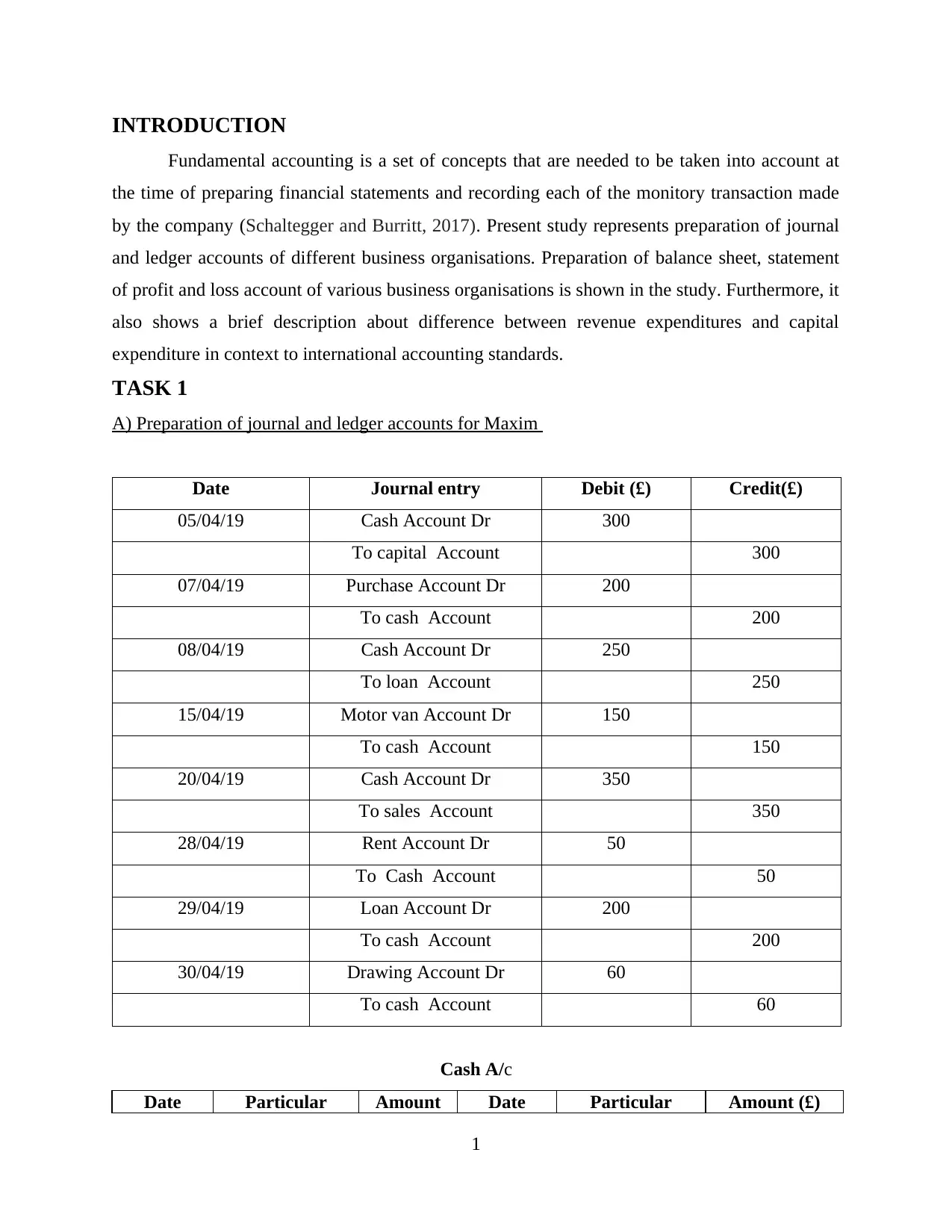

A) Preparation of journal and ledger accounts for Maxim

Date Journal entry Debit (£) Credit(£)

05/04/19 Cash Account Dr 300

To capital Account 300

07/04/19 Purchase Account Dr 200

To cash Account 200

08/04/19 Cash Account Dr 250

To loan Account 250

15/04/19 Motor van Account Dr 150

To cash Account 150

20/04/19 Cash Account Dr 350

To sales Account 350

28/04/19 Rent Account Dr 50

To Cash Account 50

29/04/19 Loan Account Dr 200

To cash Account 200

30/04/19 Drawing Account Dr 60

To cash Account 60

Cash A/c

Date Particular Amount Date Particular Amount (£)

1

Fundamental accounting is a set of concepts that are needed to be taken into account at

the time of preparing financial statements and recording each of the monitory transaction made

by the company (Schaltegger and Burritt, 2017). Present study represents preparation of journal

and ledger accounts of different business organisations. Preparation of balance sheet, statement

of profit and loss account of various business organisations is shown in the study. Furthermore, it

also shows a brief description about difference between revenue expenditures and capital

expenditure in context to international accounting standards.

TASK 1

A) Preparation of journal and ledger accounts for Maxim

Date Journal entry Debit (£) Credit(£)

05/04/19 Cash Account Dr 300

To capital Account 300

07/04/19 Purchase Account Dr 200

To cash Account 200

08/04/19 Cash Account Dr 250

To loan Account 250

15/04/19 Motor van Account Dr 150

To cash Account 150

20/04/19 Cash Account Dr 350

To sales Account 350

28/04/19 Rent Account Dr 50

To Cash Account 50

29/04/19 Loan Account Dr 200

To cash Account 200

30/04/19 Drawing Account Dr 60

To cash Account 60

Cash A/c

Date Particular Amount Date Particular Amount (£)

1

(£)

05/04/19 To capital

Account

300 07/04/19 By purchase

Account

200

08/04/19 To loan Account 250 15/04/19 By Motor van

Account

150

20/04/19 To sales

Account

350 28/04/19 By rent Account 50

29/04/19 By loan Account 200

30/04/19 By Drawing

Account

60

30/04/19 By balance c/d 240

900 900

Loan A/c

Date Particular Amount

(£)

Date Particular Amount (£)

29/04/19 To cash Account 200 08/04/19 By cash Account 250

30/04/19 To balance c/d 50

250 250

Drawing A/c

Date Particular Amount

(£)

Date Particular Amount (£)

30/04/19 To cash Account 60 30/04/19 By balance c/d 60

60 60

Purchase A/c

Date Particular Amount

(£)

Date Particular Amount (£)

07/04/19 To cash Account 200 30/04/19 By balance c/d 200

2

05/04/19 To capital

Account

300 07/04/19 By purchase

Account

200

08/04/19 To loan Account 250 15/04/19 By Motor van

Account

150

20/04/19 To sales

Account

350 28/04/19 By rent Account 50

29/04/19 By loan Account 200

30/04/19 By Drawing

Account

60

30/04/19 By balance c/d 240

900 900

Loan A/c

Date Particular Amount

(£)

Date Particular Amount (£)

29/04/19 To cash Account 200 08/04/19 By cash Account 250

30/04/19 To balance c/d 50

250 250

Drawing A/c

Date Particular Amount

(£)

Date Particular Amount (£)

30/04/19 To cash Account 60 30/04/19 By balance c/d 60

60 60

Purchase A/c

Date Particular Amount

(£)

Date Particular Amount (£)

07/04/19 To cash Account 200 30/04/19 By balance c/d 200

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

200 200

Capital A/c

Date Particular Amount

(£)

Date Particular Amount (£)

30/04/19 To balance c/d 300 05/04/19 By cash account 300

300 300

Rent A/c

Date Particular Amount

(£)

Date Particular Amount (£)

28/04/18 To cash account 50 30/04/18 By balance c/d 50

50 50

Motor van A/c

Date Particular Amount

(£)

Date Particular Amount (£)

15/04/19 To cash Account 150 30/04/19 By balance c/d 150

150 150

Sales A/c

Date Particular Amount (£) Date Particular Amount (£)

30/04/19 To balance c/d 350 20/04/19 By cash 350

350 350

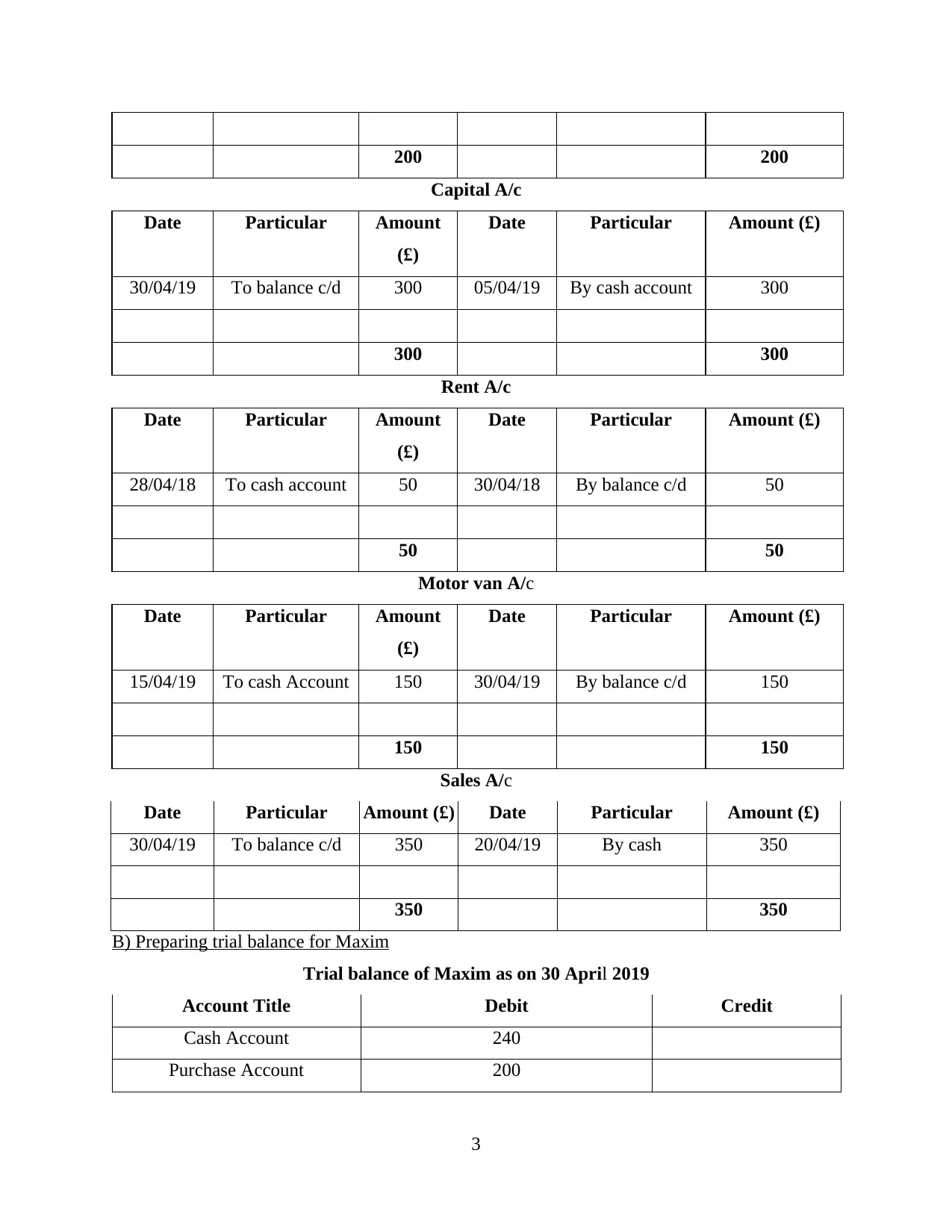

B) Preparing trial balance for Maxim

Trial balance of Maxim as on 30 April 2019

Account Title Debit Credit

Cash Account 240

Purchase Account 200

3

Capital A/c

Date Particular Amount

(£)

Date Particular Amount (£)

30/04/19 To balance c/d 300 05/04/19 By cash account 300

300 300

Rent A/c

Date Particular Amount

(£)

Date Particular Amount (£)

28/04/18 To cash account 50 30/04/18 By balance c/d 50

50 50

Motor van A/c

Date Particular Amount

(£)

Date Particular Amount (£)

15/04/19 To cash Account 150 30/04/19 By balance c/d 150

150 150

Sales A/c

Date Particular Amount (£) Date Particular Amount (£)

30/04/19 To balance c/d 350 20/04/19 By cash 350

350 350

B) Preparing trial balance for Maxim

Trial balance of Maxim as on 30 April 2019

Account Title Debit Credit

Cash Account 240

Purchase Account 200

3

Loan Account 50

Motor van Account 150

Capital Account 300

Sales Account 350

Drawing Account 60

rent Account 50

Total 700 700

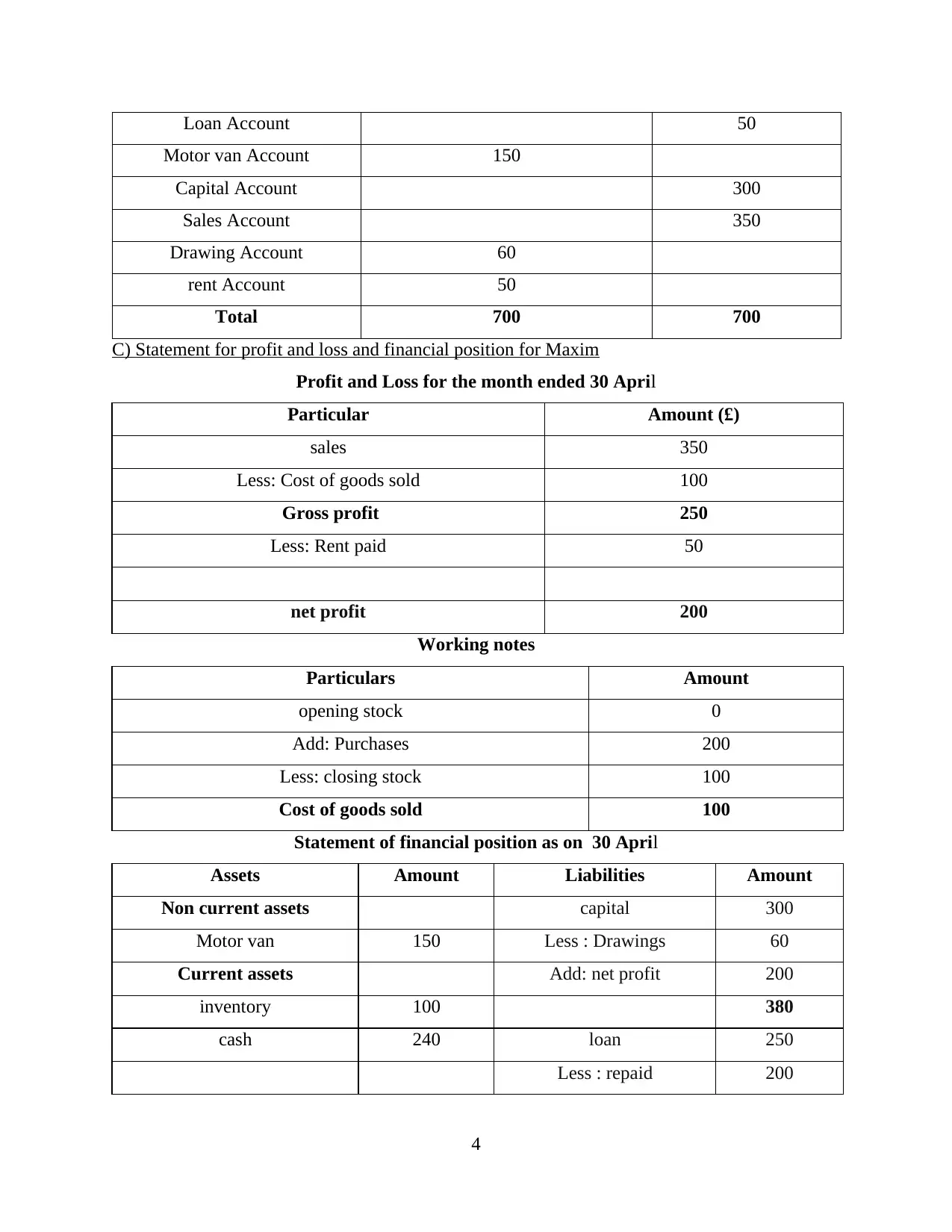

C) Statement for profit and loss and financial position for Maxim

Profit and Loss for the month ended 30 April

Particular Amount (£)

sales 350

Less: Cost of goods sold 100

Gross profit 250

Less: Rent paid 50

net profit 200

Working notes

Particulars Amount

opening stock 0

Add: Purchases 200

Less: closing stock 100

Cost of goods sold 100

Statement of financial position as on 30 April

Assets Amount Liabilities Amount

Non current assets capital 300

Motor van 150 Less : Drawings 60

Current assets Add: net profit 200

inventory 100 380

cash 240 loan 250

Less : repaid 200

4

Motor van Account 150

Capital Account 300

Sales Account 350

Drawing Account 60

rent Account 50

Total 700 700

C) Statement for profit and loss and financial position for Maxim

Profit and Loss for the month ended 30 April

Particular Amount (£)

sales 350

Less: Cost of goods sold 100

Gross profit 250

Less: Rent paid 50

net profit 200

Working notes

Particulars Amount

opening stock 0

Add: Purchases 200

Less: closing stock 100

Cost of goods sold 100

Statement of financial position as on 30 April

Assets Amount Liabilities Amount

Non current assets capital 300

Motor van 150 Less : Drawings 60

Current assets Add: net profit 200

inventory 100 380

cash 240 loan 250

Less : repaid 200

4

50

Total 490 Total 490

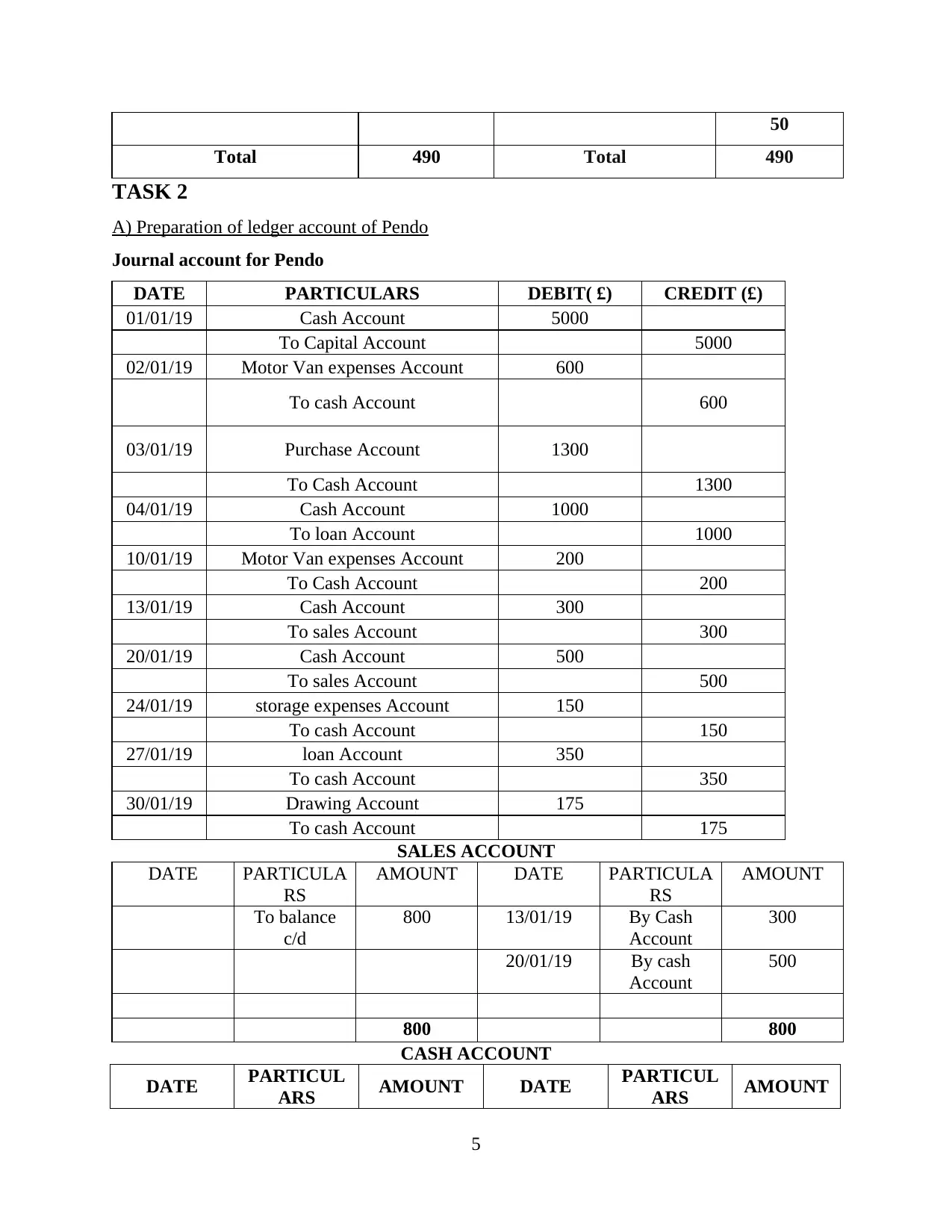

TASK 2

A) Preparation of ledger account of Pendo

Journal account for Pendo

DATE PARTICULARS DEBIT( £) CREDIT (£)

01/01/19 Cash Account 5000

To Capital Account 5000

02/01/19 Motor Van expenses Account 600

To cash Account 600

03/01/19 Purchase Account 1300

To Cash Account 1300

04/01/19 Cash Account 1000

To loan Account 1000

10/01/19 Motor Van expenses Account 200

To Cash Account 200

13/01/19 Cash Account 300

To sales Account 300

20/01/19 Cash Account 500

To sales Account 500

24/01/19 storage expenses Account 150

To cash Account 150

27/01/19 loan Account 350

To cash Account 350

30/01/19 Drawing Account 175

To cash Account 175

SALES ACCOUNT

DATE PARTICULA

RS

AMOUNT DATE PARTICULA

RS

AMOUNT

To balance

c/d

800 13/01/19 By Cash

Account

300

20/01/19 By cash

Account

500

800 800

CASH ACCOUNT

DATE PARTICUL

ARS AMOUNT DATE PARTICUL

ARS AMOUNT

5

Total 490 Total 490

TASK 2

A) Preparation of ledger account of Pendo

Journal account for Pendo

DATE PARTICULARS DEBIT( £) CREDIT (£)

01/01/19 Cash Account 5000

To Capital Account 5000

02/01/19 Motor Van expenses Account 600

To cash Account 600

03/01/19 Purchase Account 1300

To Cash Account 1300

04/01/19 Cash Account 1000

To loan Account 1000

10/01/19 Motor Van expenses Account 200

To Cash Account 200

13/01/19 Cash Account 300

To sales Account 300

20/01/19 Cash Account 500

To sales Account 500

24/01/19 storage expenses Account 150

To cash Account 150

27/01/19 loan Account 350

To cash Account 350

30/01/19 Drawing Account 175

To cash Account 175

SALES ACCOUNT

DATE PARTICULA

RS

AMOUNT DATE PARTICULA

RS

AMOUNT

To balance

c/d

800 13/01/19 By Cash

Account

300

20/01/19 By cash

Account

500

800 800

CASH ACCOUNT

DATE PARTICUL

ARS AMOUNT DATE PARTICUL

ARS AMOUNT

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

01/01/19 To capital

Account 5000 02/01/19 By Motor

Van Account 600

04/01/19 To Sergei

Account 1000 03/01/19 By purchases

Account 1300

13/01/19 To Sales

Account 300 10/01/19

By Motor

Van expenses

Account

200

20/01/19 To sales

Account 500 24/01/19

By Storage

expenses

Account

150

27/01/19 By loan

Account 350

30/01/19 By Drawings

Account 175

31/01/19 By Balance

c/d 4025

6800 6800

PURCHASE ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

03/01/19 To Cash 1300 31/01/1

9

By balance c/d 1300

1300 1300

MOTOR VAN

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

02/01/19 To Cash 600 31//01/

19

By balance c/d 800

10/01/19 To storage

expenses

account

200

800 800

EXPENSES ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

31/01/

19

By balance c/d 150

24/01/19 To Cash 150

150 150

CAPITAL ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

01/01/19 To Cash 5000 31/01/1

9

By balance c/d 5000

6

Account 5000 02/01/19 By Motor

Van Account 600

04/01/19 To Sergei

Account 1000 03/01/19 By purchases

Account 1300

13/01/19 To Sales

Account 300 10/01/19

By Motor

Van expenses

Account

200

20/01/19 To sales

Account 500 24/01/19

By Storage

expenses

Account

150

27/01/19 By loan

Account 350

30/01/19 By Drawings

Account 175

31/01/19 By Balance

c/d 4025

6800 6800

PURCHASE ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

03/01/19 To Cash 1300 31/01/1

9

By balance c/d 1300

1300 1300

MOTOR VAN

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

02/01/19 To Cash 600 31//01/

19

By balance c/d 800

10/01/19 To storage

expenses

account

200

800 800

EXPENSES ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

31/01/

19

By balance c/d 150

24/01/19 To Cash 150

150 150

CAPITAL ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

01/01/19 To Cash 5000 31/01/1

9

By balance c/d 5000

6

5000 5000

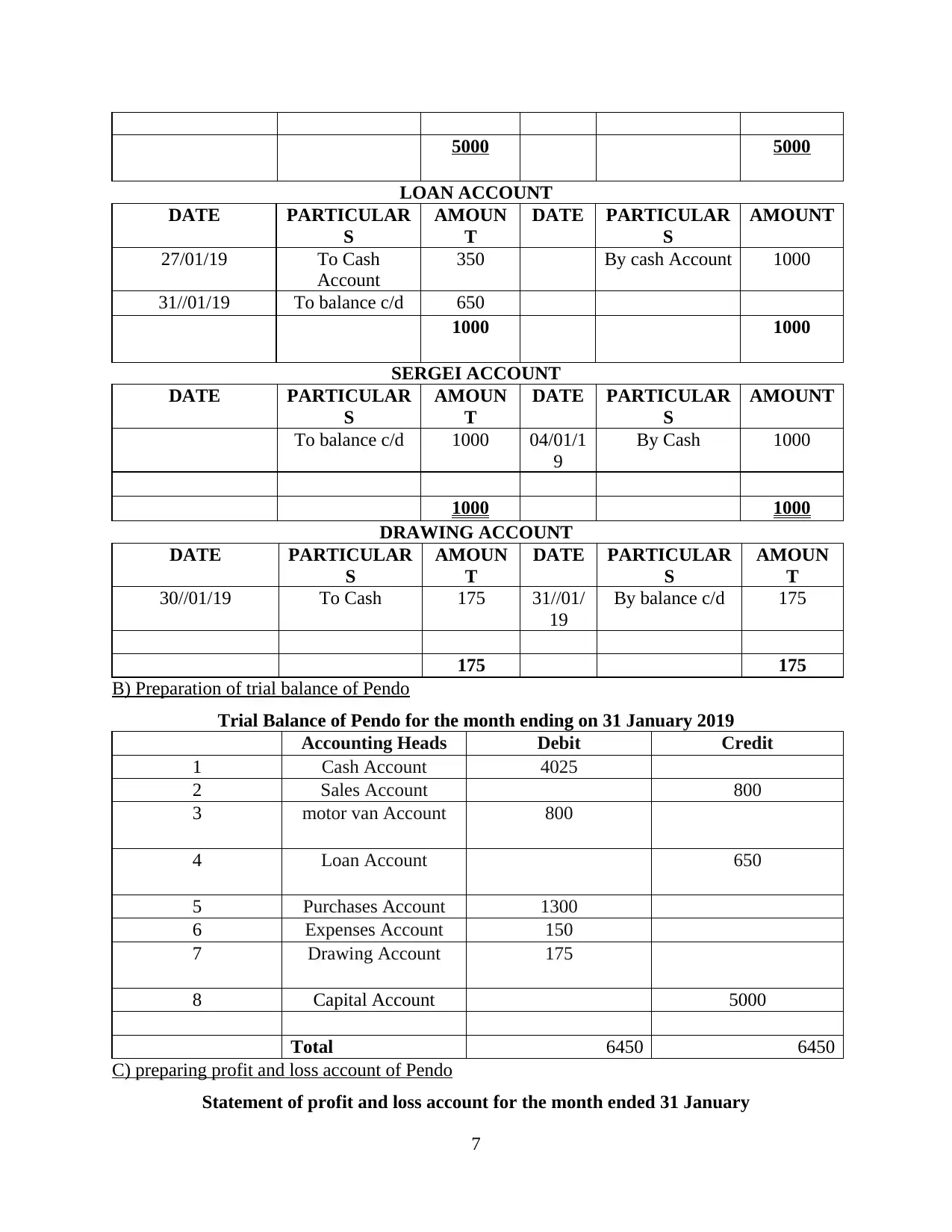

LOAN ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

27/01/19 To Cash

Account

350 By cash Account 1000

31//01/19 To balance c/d 650

1000 1000

SERGEI ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

To balance c/d 1000 04/01/1

9

By Cash 1000

1000 1000

DRAWING ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUN

T

30//01/19 To Cash 175 31//01/

19

By balance c/d 175

175 175

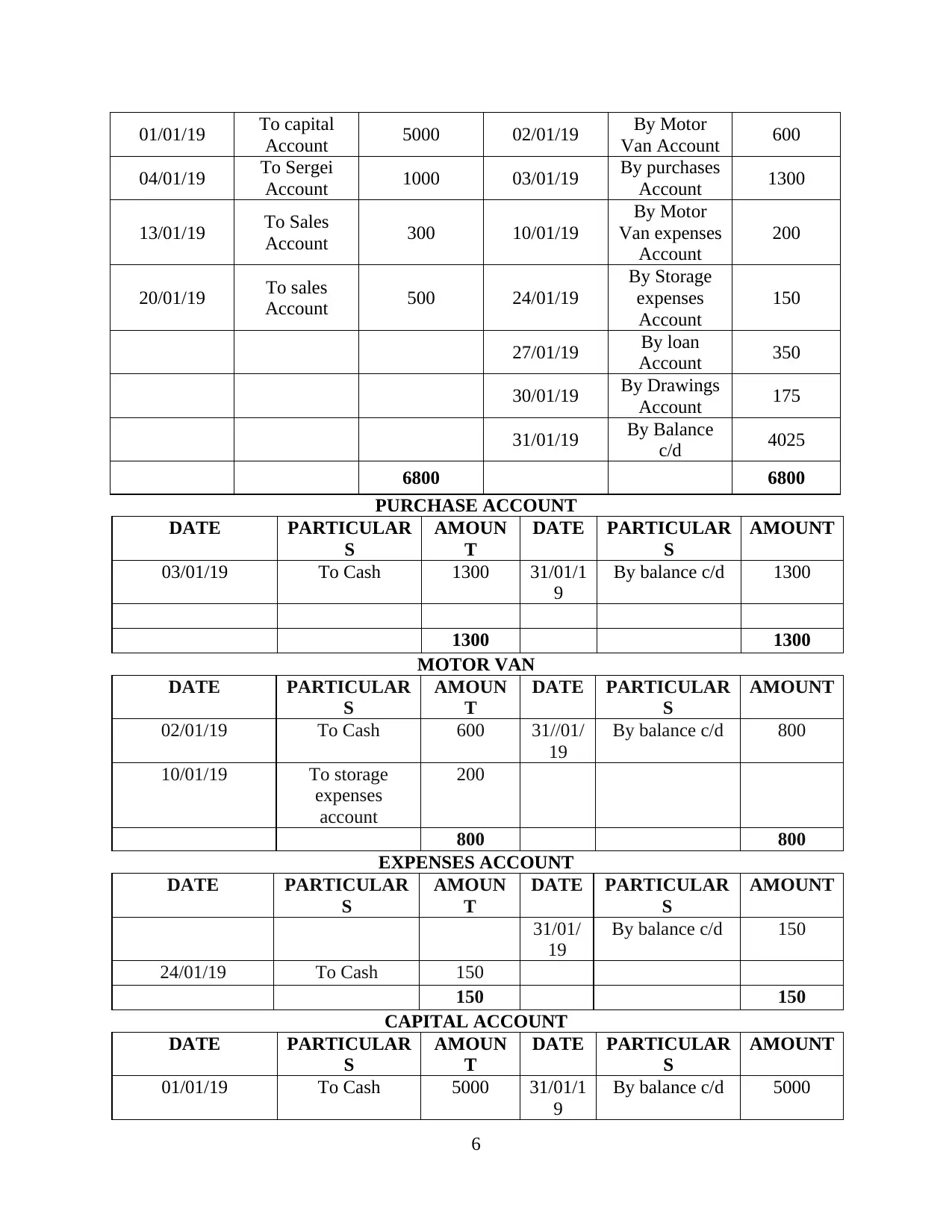

B) Preparation of trial balance of Pendo

Trial Balance of Pendo for the month ending on 31 January 2019

Accounting Heads Debit Credit

1 Cash Account 4025

2 Sales Account 800

3 motor van Account 800

4 Loan Account 650

5 Purchases Account 1300

6 Expenses Account 150

7 Drawing Account 175

8 Capital Account 5000

Total 6450 6450

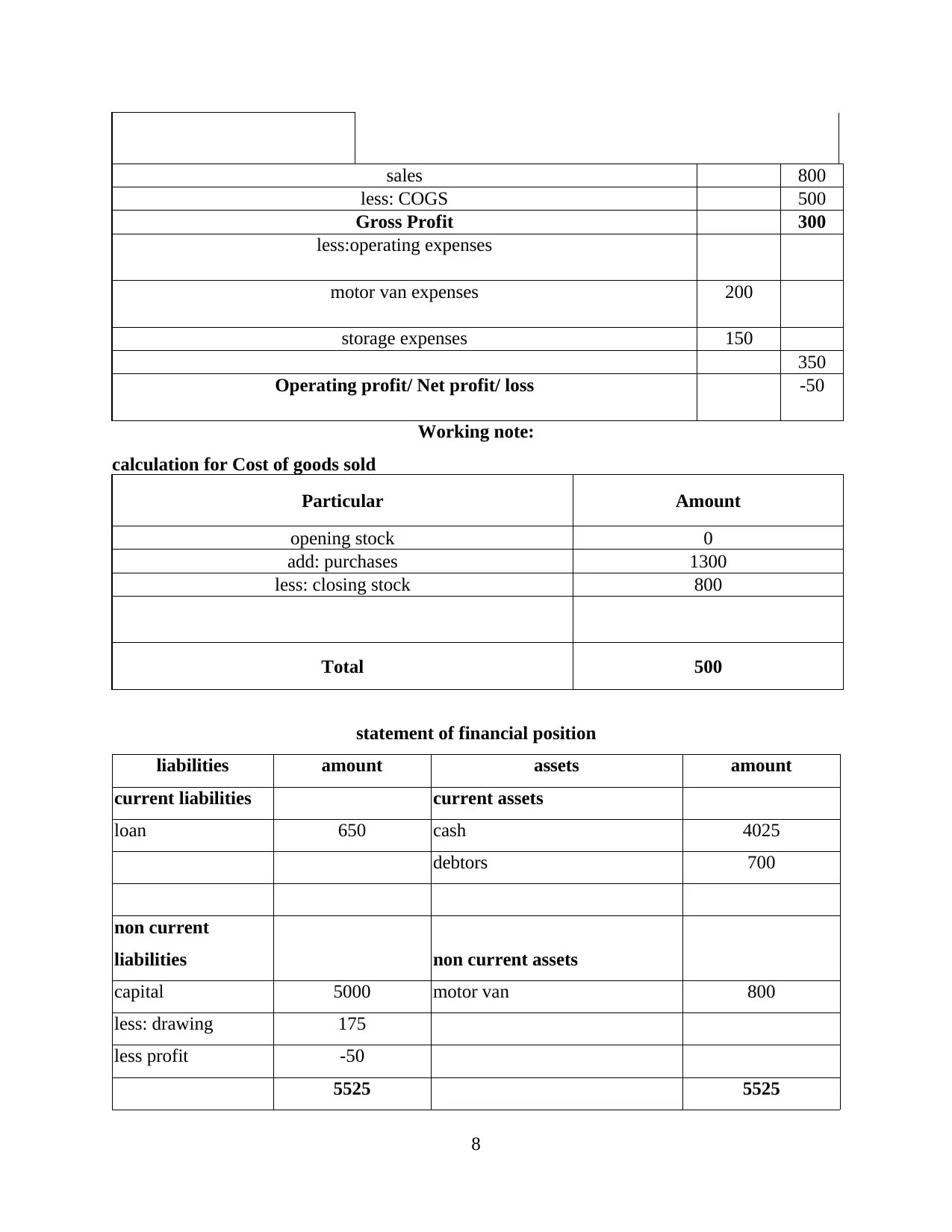

C) preparing profit and loss account of Pendo

Statement of profit and loss account for the month ended 31 January

7

LOAN ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

27/01/19 To Cash

Account

350 By cash Account 1000

31//01/19 To balance c/d 650

1000 1000

SERGEI ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUNT

To balance c/d 1000 04/01/1

9

By Cash 1000

1000 1000

DRAWING ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULAR

S

AMOUN

T

30//01/19 To Cash 175 31//01/

19

By balance c/d 175

175 175

B) Preparation of trial balance of Pendo

Trial Balance of Pendo for the month ending on 31 January 2019

Accounting Heads Debit Credit

1 Cash Account 4025

2 Sales Account 800

3 motor van Account 800

4 Loan Account 650

5 Purchases Account 1300

6 Expenses Account 150

7 Drawing Account 175

8 Capital Account 5000

Total 6450 6450

C) preparing profit and loss account of Pendo

Statement of profit and loss account for the month ended 31 January

7

sales 800

less: COGS 500

Gross Profit 300

less:operating expenses

motor van expenses 200

storage expenses 150

350

Operating profit/ Net profit/ loss -50

Working note:

calculation for Cost of goods sold

Particular Amount

opening stock 0

add: purchases 1300

less: closing stock 800

Total 500

statement of financial position

liabilities amount assets amount

current liabilities current assets

loan 650 cash 4025

debtors 700

non current

liabilities non current assets

capital 5000 motor van 800

less: drawing 175

less profit -50

5525 5525

8

less: COGS 500

Gross Profit 300

less:operating expenses

motor van expenses 200

storage expenses 150

350

Operating profit/ Net profit/ loss -50

Working note:

calculation for Cost of goods sold

Particular Amount

opening stock 0

add: purchases 1300

less: closing stock 800

Total 500

statement of financial position

liabilities amount assets amount

current liabilities current assets

loan 650 cash 4025

debtors 700

non current

liabilities non current assets

capital 5000 motor van 800

less: drawing 175

less profit -50

5525 5525

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

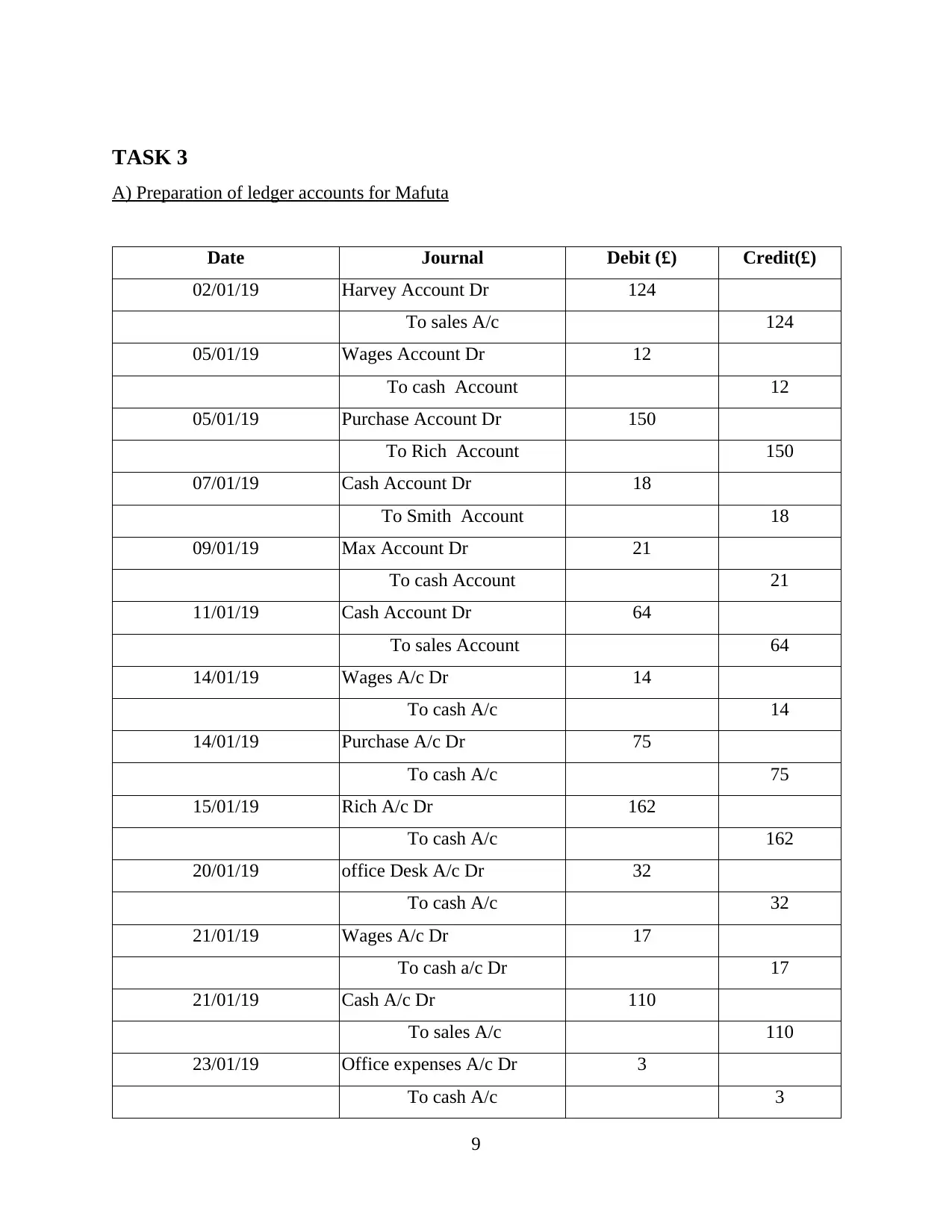

TASK 3

A) Preparation of ledger accounts for Mafuta

Date Journal Debit (£) Credit(£)

02/01/19 Harvey Account Dr 124

To sales A/c 124

05/01/19 Wages Account Dr 12

To cash Account 12

05/01/19 Purchase Account Dr 150

To Rich Account 150

07/01/19 Cash Account Dr 18

To Smith Account 18

09/01/19 Max Account Dr 21

To cash Account 21

11/01/19 Cash Account Dr 64

To sales Account 64

14/01/19 Wages A/c Dr 14

To cash A/c 14

14/01/19 Purchase A/c Dr 75

To cash A/c 75

15/01/19 Rich A/c Dr 162

To cash A/c 162

20/01/19 office Desk A/c Dr 32

To cash A/c 32

21/01/19 Wages A/c Dr 17

To cash a/c Dr 17

21/01/19 Cash A/c Dr 110

To sales A/c 110

23/01/19 Office expenses A/c Dr 3

To cash A/c 3

9

A) Preparation of ledger accounts for Mafuta

Date Journal Debit (£) Credit(£)

02/01/19 Harvey Account Dr 124

To sales A/c 124

05/01/19 Wages Account Dr 12

To cash Account 12

05/01/19 Purchase Account Dr 150

To Rich Account 150

07/01/19 Cash Account Dr 18

To Smith Account 18

09/01/19 Max Account Dr 21

To cash Account 21

11/01/19 Cash Account Dr 64

To sales Account 64

14/01/19 Wages A/c Dr 14

To cash A/c 14

14/01/19 Purchase A/c Dr 75

To cash A/c 75

15/01/19 Rich A/c Dr 162

To cash A/c 162

20/01/19 office Desk A/c Dr 32

To cash A/c 32

21/01/19 Wages A/c Dr 17

To cash a/c Dr 17

21/01/19 Cash A/c Dr 110

To sales A/c 110

23/01/19 Office expenses A/c Dr 3

To cash A/c 3

9

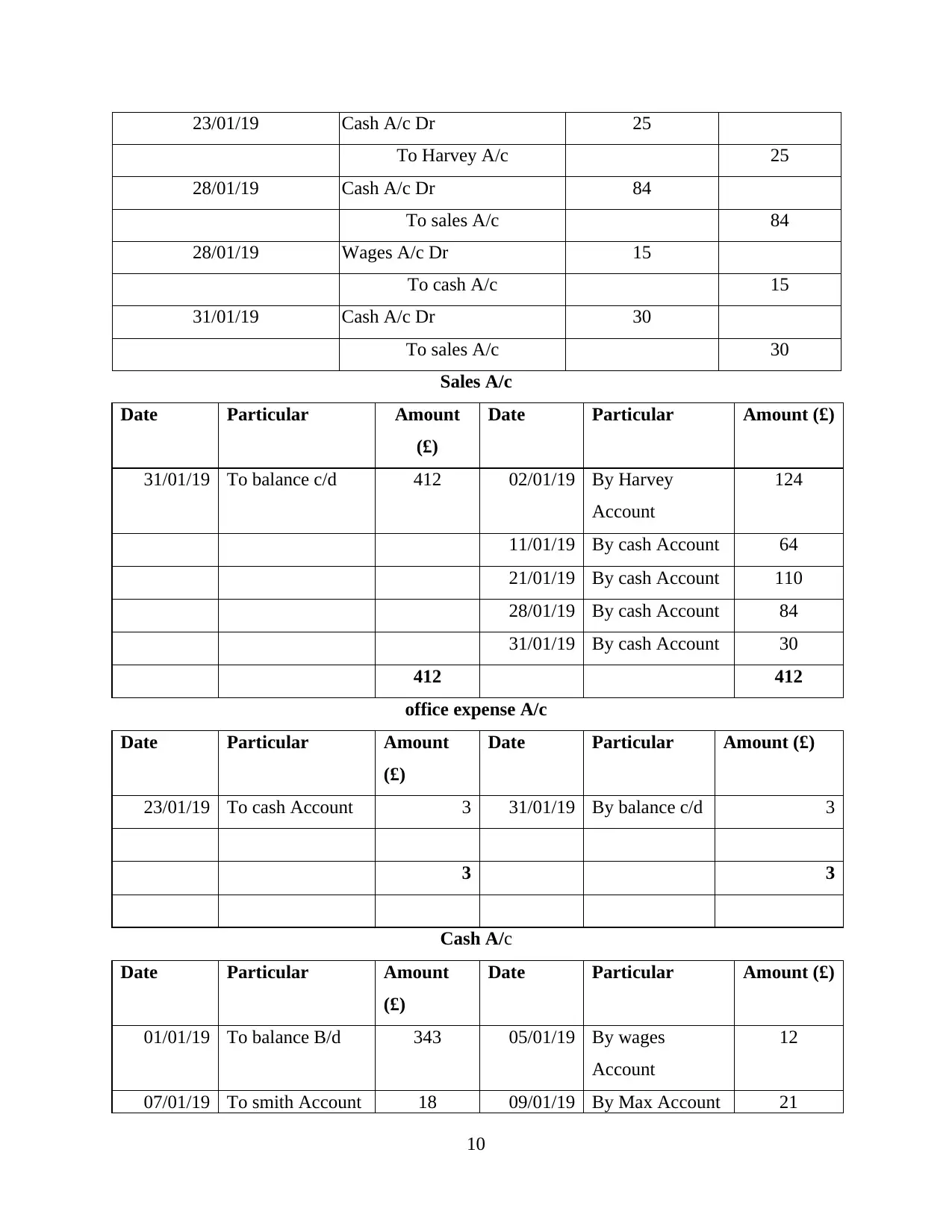

23/01/19 Cash A/c Dr 25

To Harvey A/c 25

28/01/19 Cash A/c Dr 84

To sales A/c 84

28/01/19 Wages A/c Dr 15

To cash A/c 15

31/01/19 Cash A/c Dr 30

To sales A/c 30

Sales A/c

Date Particular Amount

(£)

Date Particular Amount (£)

31/01/19 To balance c/d 412 02/01/19 By Harvey

Account

124

11/01/19 By cash Account 64

21/01/19 By cash Account 110

28/01/19 By cash Account 84

31/01/19 By cash Account 30

412 412

office expense A/c

Date Particular Amount

(£)

Date Particular Amount (£)

23/01/19 To cash Account 3 31/01/19 By balance c/d 3

3 3

Cash A/c

Date Particular Amount

(£)

Date Particular Amount (£)

01/01/19 To balance B/d 343 05/01/19 By wages

Account

12

07/01/19 To smith Account 18 09/01/19 By Max Account 21

10

To Harvey A/c 25

28/01/19 Cash A/c Dr 84

To sales A/c 84

28/01/19 Wages A/c Dr 15

To cash A/c 15

31/01/19 Cash A/c Dr 30

To sales A/c 30

Sales A/c

Date Particular Amount

(£)

Date Particular Amount (£)

31/01/19 To balance c/d 412 02/01/19 By Harvey

Account

124

11/01/19 By cash Account 64

21/01/19 By cash Account 110

28/01/19 By cash Account 84

31/01/19 By cash Account 30

412 412

office expense A/c

Date Particular Amount

(£)

Date Particular Amount (£)

23/01/19 To cash Account 3 31/01/19 By balance c/d 3

3 3

Cash A/c

Date Particular Amount

(£)

Date Particular Amount (£)

01/01/19 To balance B/d 343 05/01/19 By wages

Account

12

07/01/19 To smith Account 18 09/01/19 By Max Account 21

10

11/01/19 To sales Account 64 14/01/19 By wages

Account

14

21/01/19 To sales Account 110 15/01/19 By Rich Account 162

23/01/19 To Harvey

Account

25 20/01/19 By office desk

Account

32

28/01/19 To sales Account 84 21/01/19 By wages

Account

17

31/01/19 To sales Account 30 23/01/19 By office

expense Account

3

28/01/19 By wages

Account

15

14/01/19 By purchase

Account

75

31/01/19 By balance c/d 323

674 674

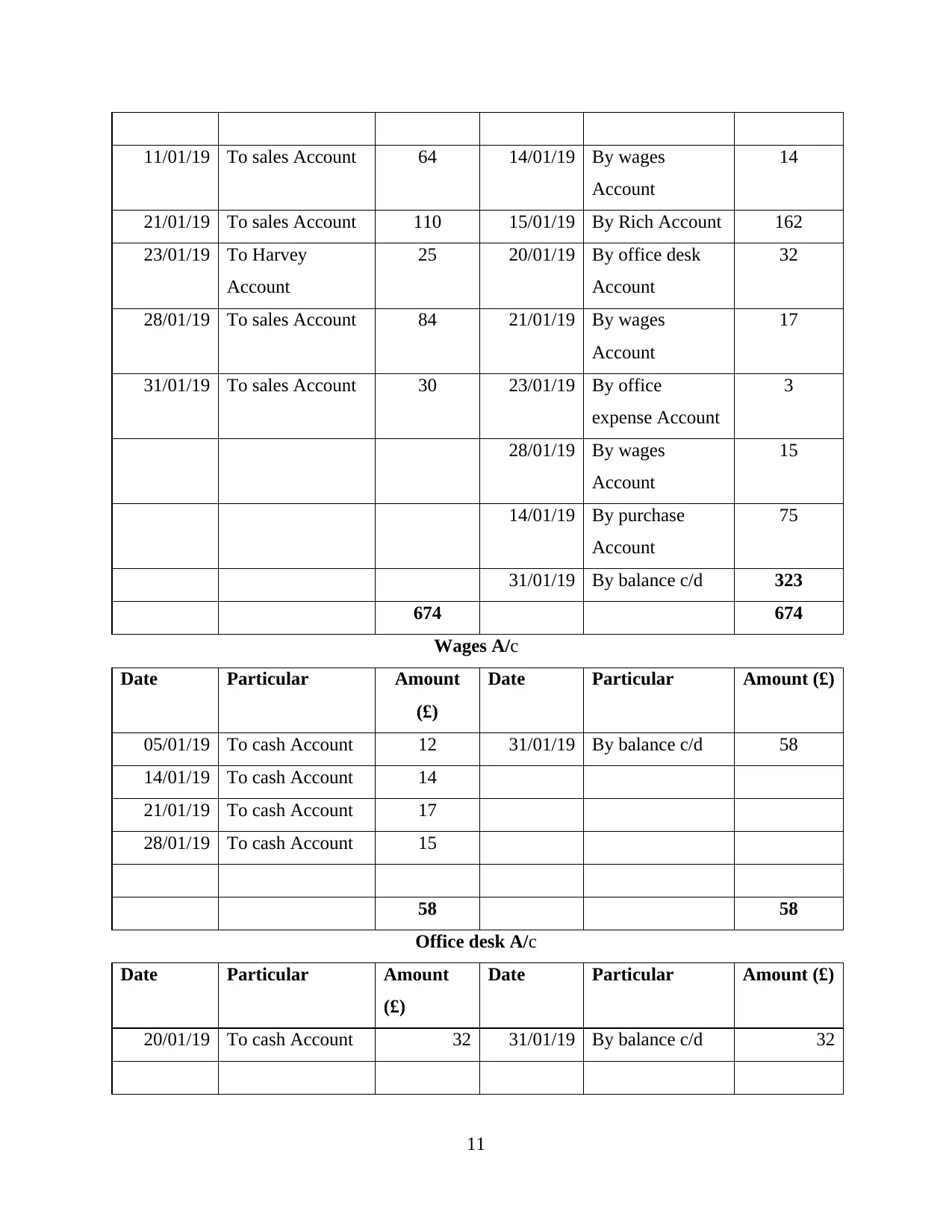

Wages A/c

Date Particular Amount

(£)

Date Particular Amount (£)

05/01/19 To cash Account 12 31/01/19 By balance c/d 58

14/01/19 To cash Account 14

21/01/19 To cash Account 17

28/01/19 To cash Account 15

58 58

Office desk A/c

Date Particular Amount

(£)

Date Particular Amount (£)

20/01/19 To cash Account 32 31/01/19 By balance c/d 32

11

Account

14

21/01/19 To sales Account 110 15/01/19 By Rich Account 162

23/01/19 To Harvey

Account

25 20/01/19 By office desk

Account

32

28/01/19 To sales Account 84 21/01/19 By wages

Account

17

31/01/19 To sales Account 30 23/01/19 By office

expense Account

3

28/01/19 By wages

Account

15

14/01/19 By purchase

Account

75

31/01/19 By balance c/d 323

674 674

Wages A/c

Date Particular Amount

(£)

Date Particular Amount (£)

05/01/19 To cash Account 12 31/01/19 By balance c/d 58

14/01/19 To cash Account 14

21/01/19 To cash Account 17

28/01/19 To cash Account 15

58 58

Office desk A/c

Date Particular Amount

(£)

Date Particular Amount (£)

20/01/19 To cash Account 32 31/01/19 By balance c/d 32

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

32 32

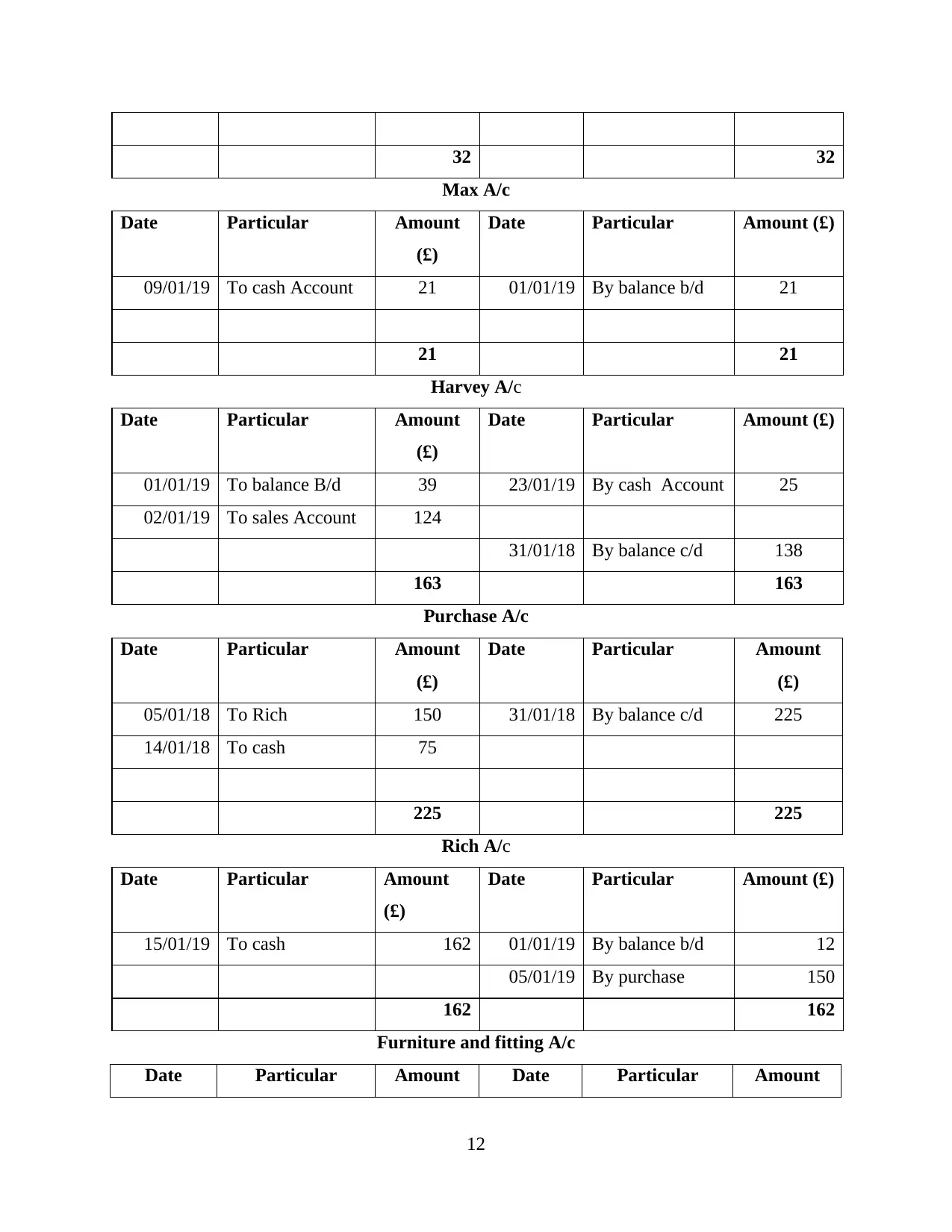

Max A/c

Date Particular Amount

(£)

Date Particular Amount (£)

09/01/19 To cash Account 21 01/01/19 By balance b/d 21

21 21

Harvey A/c

Date Particular Amount

(£)

Date Particular Amount (£)

01/01/19 To balance B/d 39 23/01/19 By cash Account 25

02/01/19 To sales Account 124

31/01/18 By balance c/d 138

163 163

Purchase A/c

Date Particular Amount

(£)

Date Particular Amount

(£)

05/01/18 To Rich 150 31/01/18 By balance c/d 225

14/01/18 To cash 75

225 225

Rich A/c

Date Particular Amount

(£)

Date Particular Amount (£)

15/01/19 To cash 162 01/01/19 By balance b/d 12

05/01/19 By purchase 150

162 162

Furniture and fitting A/c

Date Particular Amount Date Particular Amount

12

Max A/c

Date Particular Amount

(£)

Date Particular Amount (£)

09/01/19 To cash Account 21 01/01/19 By balance b/d 21

21 21

Harvey A/c

Date Particular Amount

(£)

Date Particular Amount (£)

01/01/19 To balance B/d 39 23/01/19 By cash Account 25

02/01/19 To sales Account 124

31/01/18 By balance c/d 138

163 163

Purchase A/c

Date Particular Amount

(£)

Date Particular Amount

(£)

05/01/18 To Rich 150 31/01/18 By balance c/d 225

14/01/18 To cash 75

225 225

Rich A/c

Date Particular Amount

(£)

Date Particular Amount (£)

15/01/19 To cash 162 01/01/19 By balance b/d 12

05/01/19 By purchase 150

162 162

Furniture and fitting A/c

Date Particular Amount Date Particular Amount

12

(£) (£)

01/01/19 To balance b/d 198 31/01/19 By balance c/d 198

198 198

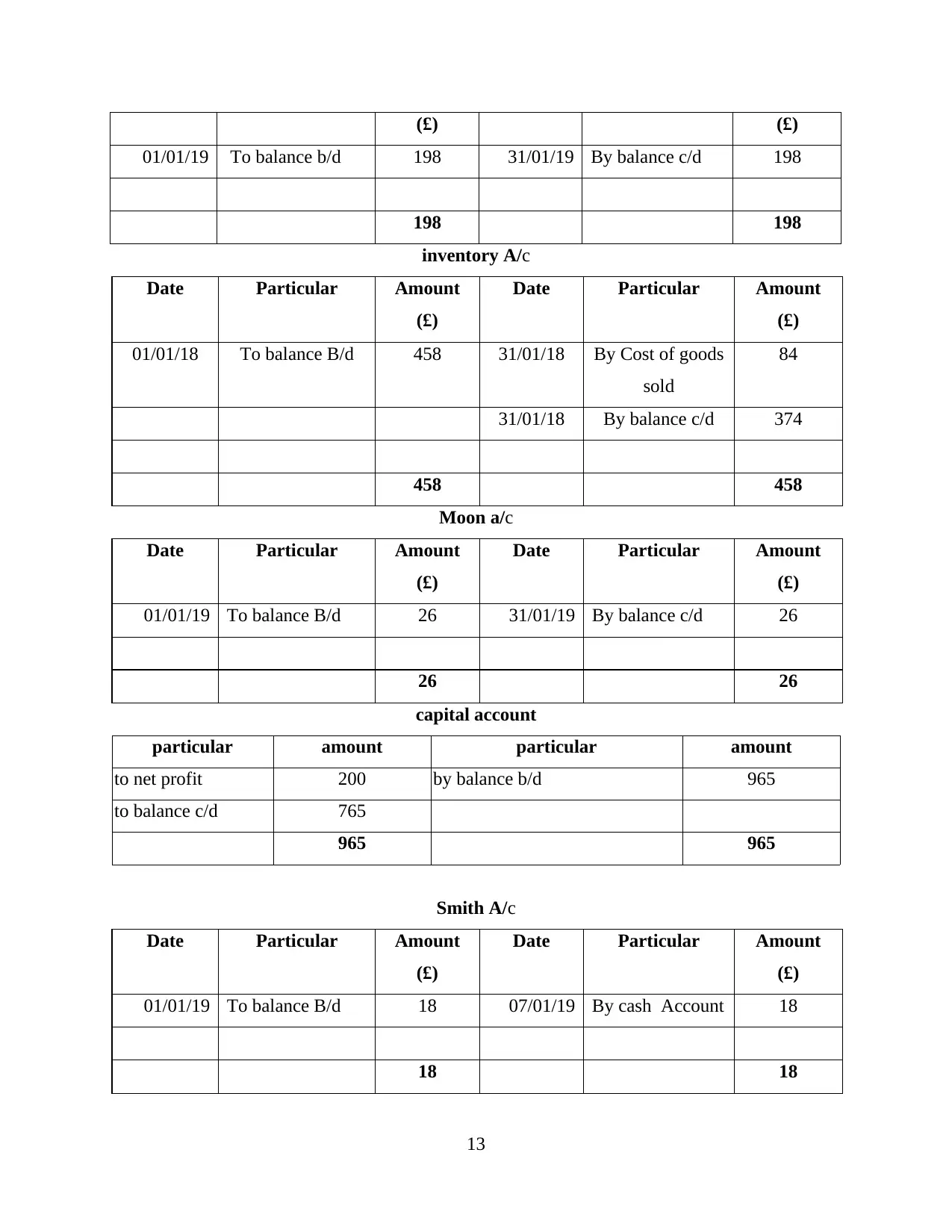

inventory A/c

Date Particular Amount

(£)

Date Particular Amount

(£)

01/01/18 To balance B/d 458 31/01/18 By Cost of goods

sold

84

31/01/18 By balance c/d 374

458 458

Moon a/c

Date Particular Amount

(£)

Date Particular Amount

(£)

01/01/19 To balance B/d 26 31/01/19 By balance c/d 26

26 26

capital account

particular amount particular amount

to net profit 200 by balance b/d 965

to balance c/d 765

965 965

Smith A/c

Date Particular Amount

(£)

Date Particular Amount

(£)

01/01/19 To balance B/d 18 07/01/19 By cash Account 18

18 18

13

01/01/19 To balance b/d 198 31/01/19 By balance c/d 198

198 198

inventory A/c

Date Particular Amount

(£)

Date Particular Amount

(£)

01/01/18 To balance B/d 458 31/01/18 By Cost of goods

sold

84

31/01/18 By balance c/d 374

458 458

Moon a/c

Date Particular Amount

(£)

Date Particular Amount

(£)

01/01/19 To balance B/d 26 31/01/19 By balance c/d 26

26 26

capital account

particular amount particular amount

to net profit 200 by balance b/d 965

to balance c/d 765

965 965

Smith A/c

Date Particular Amount

(£)

Date Particular Amount

(£)

01/01/19 To balance B/d 18 07/01/19 By cash Account 18

18 18

13

B)Preparing trial balance of Mafuta

Trial balance for the month ending on 31 January

Account Title Debit credit

Cash Account 323

sales Account 412

wages Account 58

Office expense Account 3

Office desk Account 32

Harvey Account 138

Purchase Account 225

Inventory Account 374

furniture and fittings Account 198

Moon Account 26

Suspense account (B/F) 765

Total 1377 1377

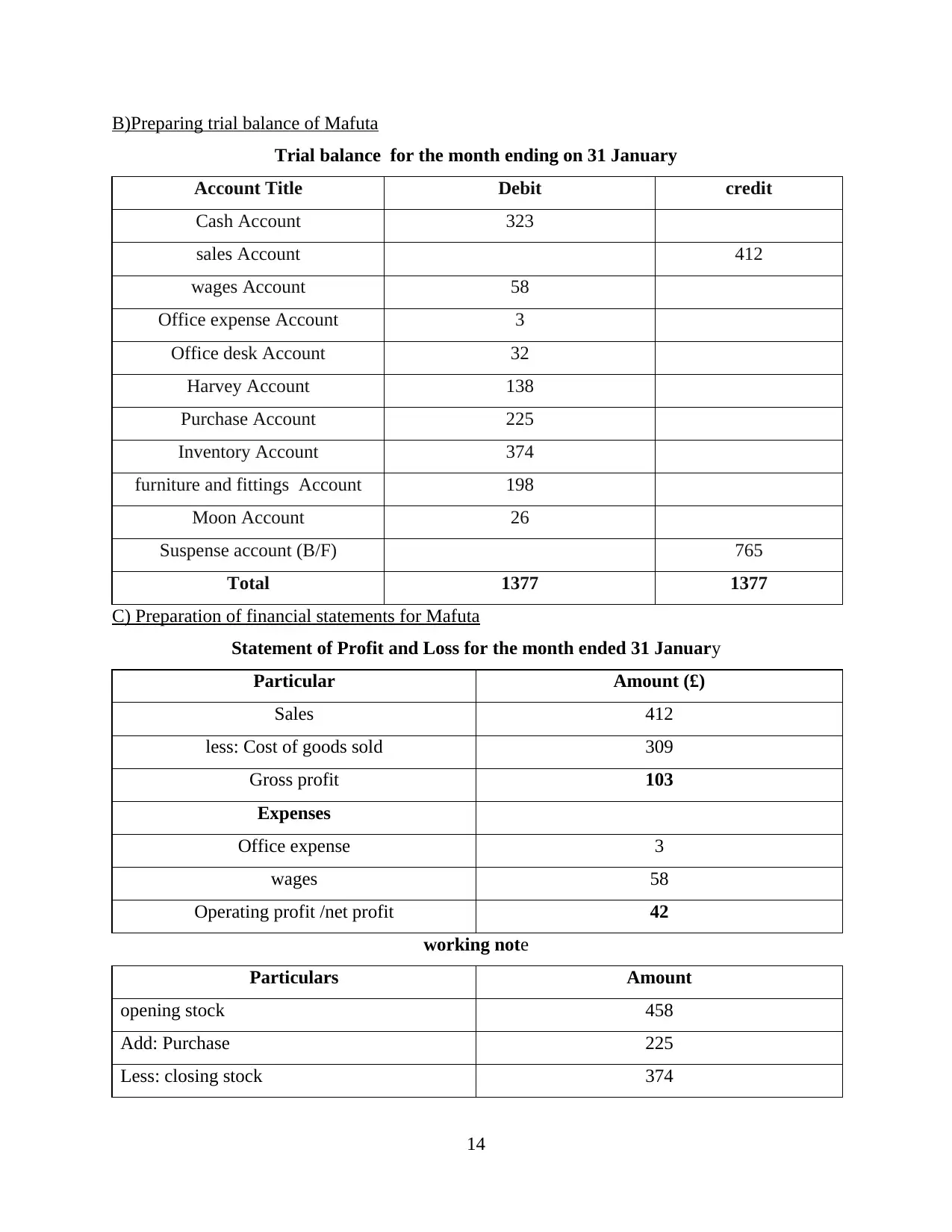

C) Preparation of financial statements for Mafuta

Statement of Profit and Loss for the month ended 31 January

Particular Amount (£)

Sales 412

less: Cost of goods sold 309

Gross profit 103

Expenses

Office expense 3

wages 58

Operating profit /net profit 42

working note

Particulars Amount

opening stock 458

Add: Purchase 225

Less: closing stock 374

14

Trial balance for the month ending on 31 January

Account Title Debit credit

Cash Account 323

sales Account 412

wages Account 58

Office expense Account 3

Office desk Account 32

Harvey Account 138

Purchase Account 225

Inventory Account 374

furniture and fittings Account 198

Moon Account 26

Suspense account (B/F) 765

Total 1377 1377

C) Preparation of financial statements for Mafuta

Statement of Profit and Loss for the month ended 31 January

Particular Amount (£)

Sales 412

less: Cost of goods sold 309

Gross profit 103

Expenses

Office expense 3

wages 58

Operating profit /net profit 42

working note

Particulars Amount

opening stock 458

Add: Purchase 225

Less: closing stock 374

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Cost of goods sold 309

Statement of financial position as on 31 January

Assets Amount Liabilities Amount

Non current assets capital 965

furniture and fittings 198 Add: Net profit 42

Office desk 32 bank O/d 84

current assets

cash 323

Inventory 374

Sundry debtors

Harvey 138

Moon 26

1091 1091

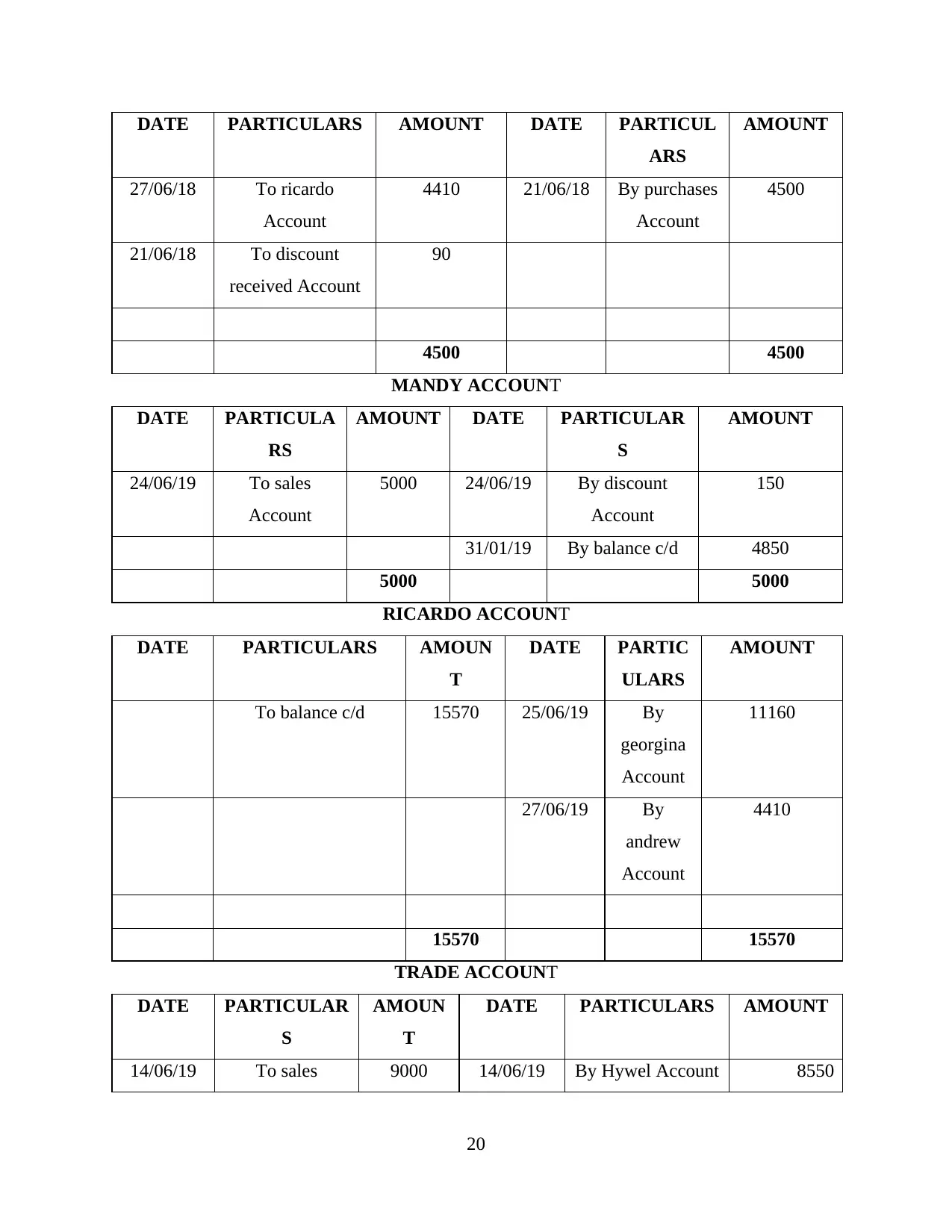

TASK 4

Papering accounting statements for Ricardo

15

Statement of financial position as on 31 January

Assets Amount Liabilities Amount

Non current assets capital 965

furniture and fittings 198 Add: Net profit 42

Office desk 32 bank O/d 84

current assets

cash 323

Inventory 374

Sundry debtors

Harvey 138

Moon 26

1091 1091

TASK 4

Papering accounting statements for Ricardo

15

16

17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

18

HYWEL ACCOUNT

DATE PARTICULA

RS

AMOUNT DATE PARTIC

ULARS

AMOUNT

14/06/19 To sales

Account

9000 14/06/19 By trade

Account

450

By cash

Account

8550

9000 9000

JANE ACCOUNT

DATE PARTICULARS AMOUN

T

DATE PARTICULARS AMO

UNT

20/06/19 To cash Account 6000 31/01/

19

By balance c/d 6000

6000 6000

ANDREW ACCOUNT

19

DATE PARTICULA

RS

AMOUNT DATE PARTIC

ULARS

AMOUNT

14/06/19 To sales

Account

9000 14/06/19 By trade

Account

450

By cash

Account

8550

9000 9000

JANE ACCOUNT

DATE PARTICULARS AMOUN

T

DATE PARTICULARS AMO

UNT

20/06/19 To cash Account 6000 31/01/

19

By balance c/d 6000

6000 6000

ANDREW ACCOUNT

19

DATE PARTICULARS AMOUNT DATE PARTICUL

ARS

AMOUNT

27/06/18 To ricardo

Account

4410 21/06/18 By purchases

Account

4500

21/06/18 To discount

received Account

90

4500 4500

MANDY ACCOUNT

DATE PARTICULA

RS

AMOUNT DATE PARTICULAR

S

AMOUNT

24/06/19 To sales

Account

5000 24/06/19 By discount

Account

150

31/01/19 By balance c/d 4850

5000 5000

RICARDO ACCOUNT

DATE PARTICULARS AMOUN

T

DATE PARTIC

ULARS

AMOUNT

To balance c/d 15570 25/06/19 By

georgina

Account

11160

27/06/19 By

andrew

Account

4410

15570 15570

TRADE ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULARS AMOUNT

14/06/19 To sales 9000 14/06/19 By Hywel Account 8550

20

ARS

AMOUNT

27/06/18 To ricardo

Account

4410 21/06/18 By purchases

Account

4500

21/06/18 To discount

received Account

90

4500 4500

MANDY ACCOUNT

DATE PARTICULA

RS

AMOUNT DATE PARTICULAR

S

AMOUNT

24/06/19 To sales

Account

5000 24/06/19 By discount

Account

150

31/01/19 By balance c/d 4850

5000 5000

RICARDO ACCOUNT

DATE PARTICULARS AMOUN

T

DATE PARTIC

ULARS

AMOUNT

To balance c/d 15570 25/06/19 By

georgina

Account

11160

27/06/19 By

andrew

Account

4410

15570 15570

TRADE ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULARS AMOUNT

14/06/19 To sales 9000 14/06/19 By Hywel Account 8550

20

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Account

By balance c/d 450

9000 9000

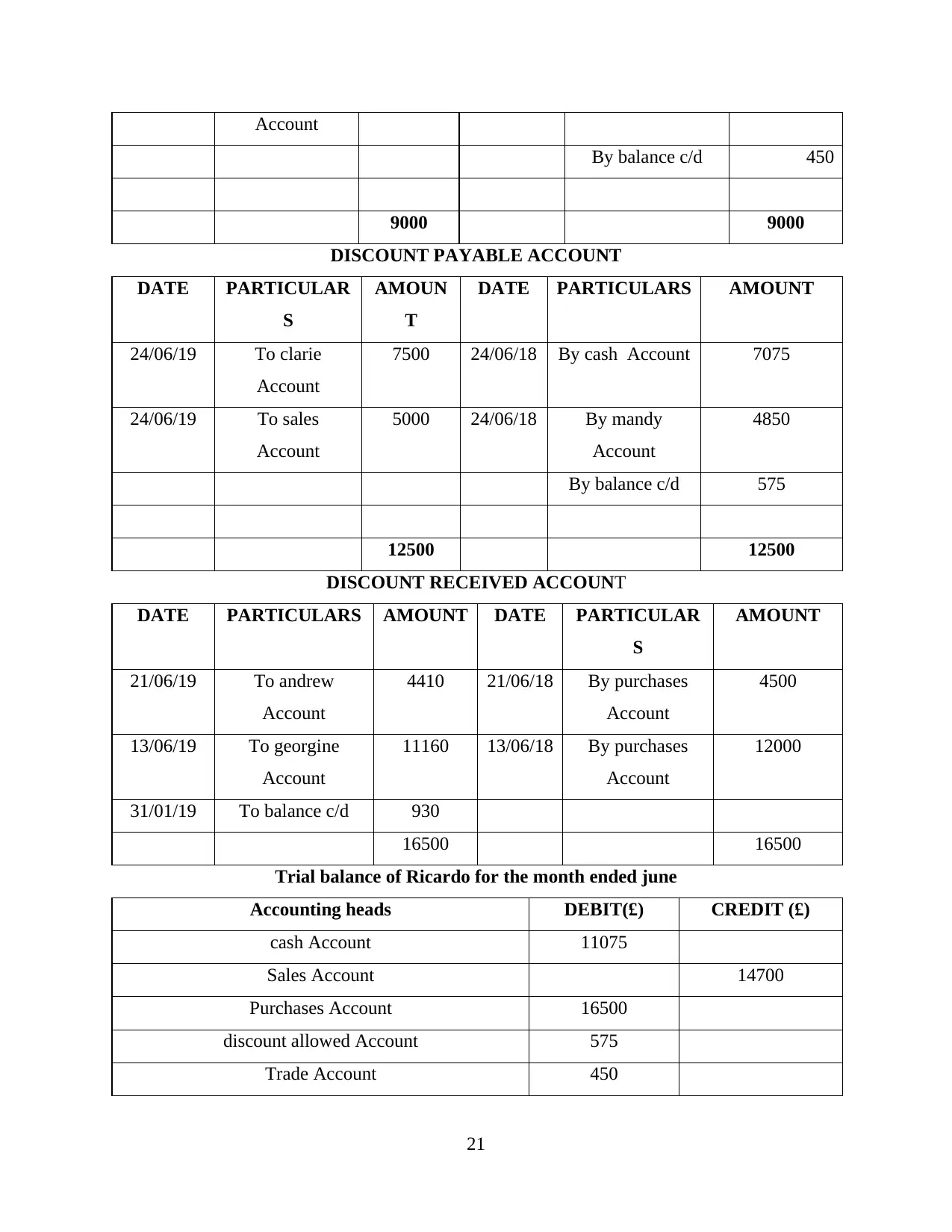

DISCOUNT PAYABLE ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULARS AMOUNT

24/06/19 To clarie

Account

7500 24/06/18 By cash Account 7075

24/06/19 To sales

Account

5000 24/06/18 By mandy

Account

4850

By balance c/d 575

12500 12500

DISCOUNT RECEIVED ACCOUNT

DATE PARTICULARS AMOUNT DATE PARTICULAR

S

AMOUNT

21/06/19 To andrew

Account

4410 21/06/18 By purchases

Account

4500

13/06/19 To georgine

Account

11160 13/06/18 By purchases

Account

12000

31/01/19 To balance c/d 930

16500 16500

Trial balance of Ricardo for the month ended june

Accounting heads DEBIT(£) CREDIT (£)

cash Account 11075

Sales Account 14700

Purchases Account 16500

discount allowed Account 575

Trade Account 450

21

By balance c/d 450

9000 9000

DISCOUNT PAYABLE ACCOUNT

DATE PARTICULAR

S

AMOUN

T

DATE PARTICULARS AMOUNT

24/06/19 To clarie

Account

7500 24/06/18 By cash Account 7075

24/06/19 To sales

Account

5000 24/06/18 By mandy

Account

4850

By balance c/d 575

12500 12500

DISCOUNT RECEIVED ACCOUNT

DATE PARTICULARS AMOUNT DATE PARTICULAR

S

AMOUNT

21/06/19 To andrew

Account

4410 21/06/18 By purchases

Account

4500

13/06/19 To georgine

Account

11160 13/06/18 By purchases

Account

12000

31/01/19 To balance c/d 930

16500 16500

Trial balance of Ricardo for the month ended june

Accounting heads DEBIT(£) CREDIT (£)

cash Account 11075

Sales Account 14700

Purchases Account 16500

discount allowed Account 575

Trade Account 450

21

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.