Kedison Plc: Financial Statement & Ratio Analysis Performance

VerifiedAdded on 2023/06/15

|10

|2096

|168

Report

AI Summary

This report provides a comprehensive financial analysis, beginning with the preparation of a profit and loss statement and statement of financial position for Kedison Plc, emphasizing the double-entry system's role in balancing the financial position. It then calculates and interprets key financial ratios for Chocco Plc for the years 2020 and 2019, commenting on the company's profitability, liquidity, leverage, efficiency, and market performance, with recommendations for improvement. The analysis covers metrics like ROCE, ROE, EPS, net profit margin, asset turnover, stock holding days, debtors collection period, current ratio, gearing ratio, and investor cover ratio, offering a thorough assessment of Chocco Plc's financial health and strategic areas for development. Desklib is a platform which provides all the necessary AI based study tools for students.

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

Question 1........................................................................................................................................3

(a) Preparation of profit and loss statement and statement of financial position........................3

(b) Reason behind balanced statement of financial position.......................................................5

Question 2........................................................................................................................................6

(a) Calculation of ratios for Chocco Plc for the year 2020 and 2019.........................................6

(b) Comment on the financial performance and position of Chocoo Plc....................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................3

Question 1........................................................................................................................................3

(a) Preparation of profit and loss statement and statement of financial position........................3

(b) Reason behind balanced statement of financial position.......................................................5

Question 2........................................................................................................................................6

(a) Calculation of ratios for Chocco Plc for the year 2020 and 2019.........................................6

(b) Comment on the financial performance and position of Chocoo Plc....................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Accounting fundamentals is the basic accounting concepts, principles etc. which helps

the company in preparing and analysing the financial report (Dewi, Azam and Yusoff, 2019).

This report will discuss two questions. In first question, the report will calculate the income

statement and balance sheet along with the discussion of concept of double entry system. Lastly,

in the second question, the report will calculate the financial ratio along with the comment on the

performance of business.

Question 1

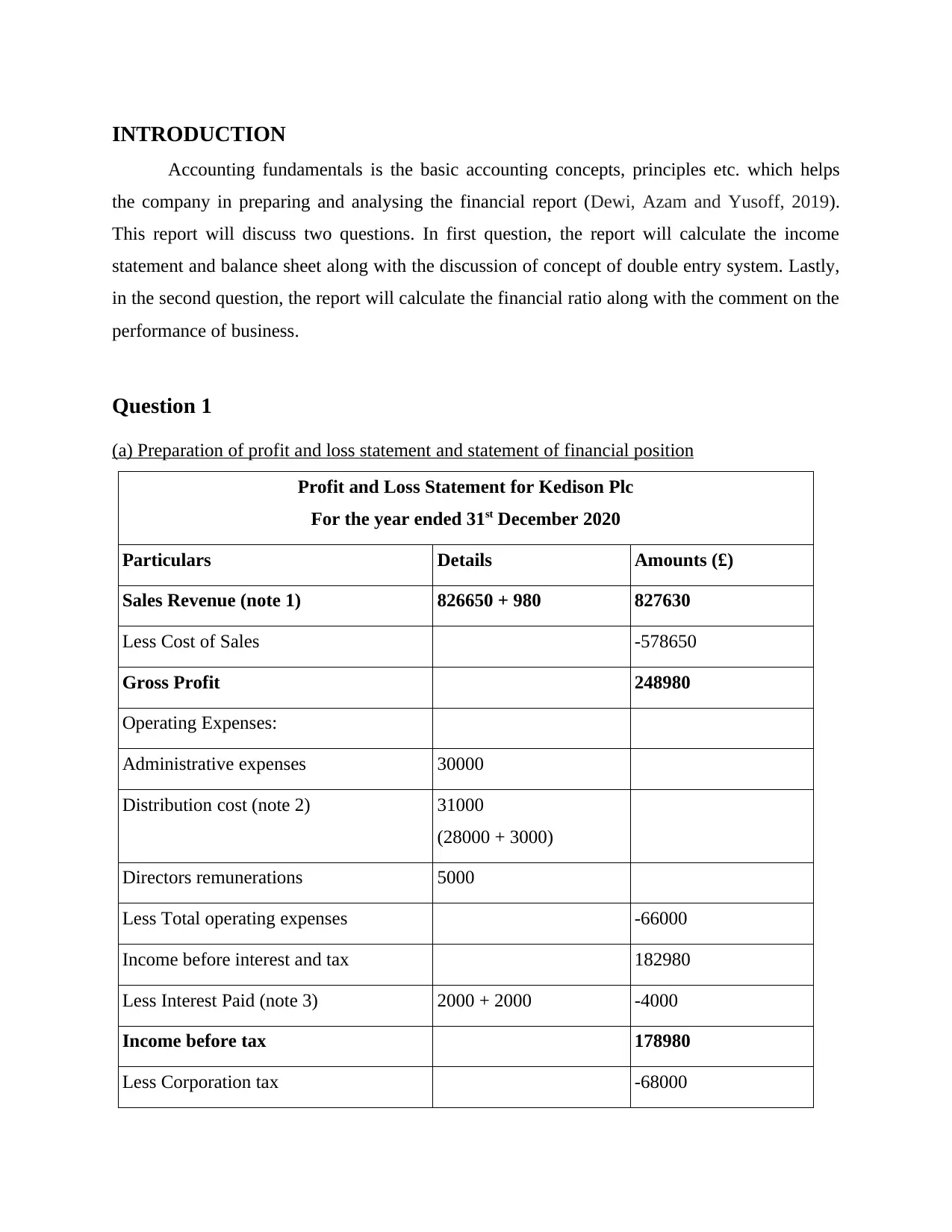

(a) Preparation of profit and loss statement and statement of financial position

Profit and Loss Statement for Kedison Plc

For the year ended 31st December 2020

Particulars Details Amounts (£)

Sales Revenue (note 1) 826650 + 980 827630

Less Cost of Sales -578650

Gross Profit 248980

Operating Expenses:

Administrative expenses 30000

Distribution cost (note 2) 31000

(28000 + 3000)

Directors remunerations 5000

Less Total operating expenses -66000

Income before interest and tax 182980

Less Interest Paid (note 3) 2000 + 2000 -4000

Income before tax 178980

Less Corporation tax -68000

Accounting fundamentals is the basic accounting concepts, principles etc. which helps

the company in preparing and analysing the financial report (Dewi, Azam and Yusoff, 2019).

This report will discuss two questions. In first question, the report will calculate the income

statement and balance sheet along with the discussion of concept of double entry system. Lastly,

in the second question, the report will calculate the financial ratio along with the comment on the

performance of business.

Question 1

(a) Preparation of profit and loss statement and statement of financial position

Profit and Loss Statement for Kedison Plc

For the year ended 31st December 2020

Particulars Details Amounts (£)

Sales Revenue (note 1) 826650 + 980 827630

Less Cost of Sales -578650

Gross Profit 248980

Operating Expenses:

Administrative expenses 30000

Distribution cost (note 2) 31000

(28000 + 3000)

Directors remunerations 5000

Less Total operating expenses -66000

Income before interest and tax 182980

Less Interest Paid (note 3) 2000 + 2000 -4000

Income before tax 178980

Less Corporation tax -68000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Net Income transfer to retained

earnings

110980

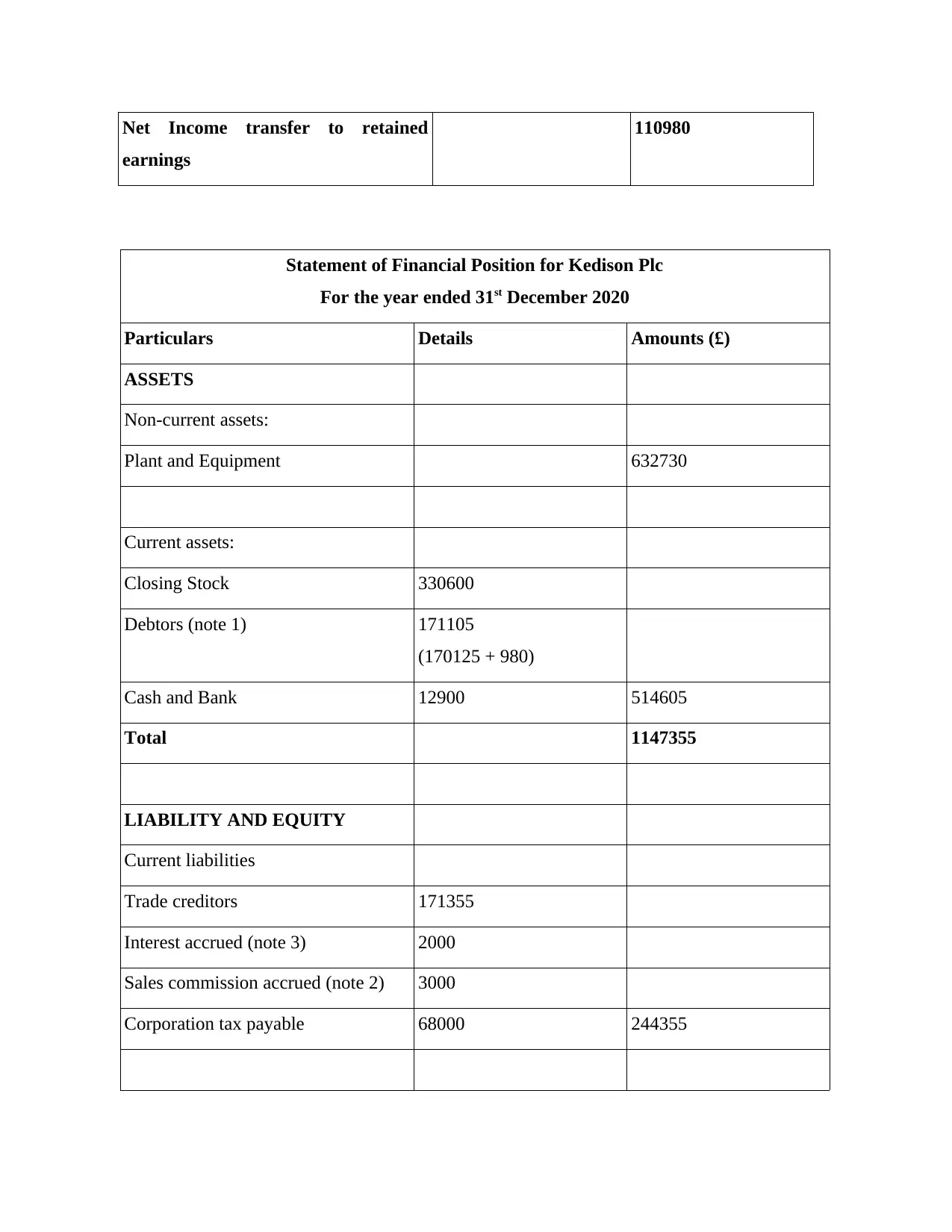

Statement of Financial Position for Kedison Plc

For the year ended 31st December 2020

Particulars Details Amounts (£)

ASSETS

Non-current assets:

Plant and Equipment 632730

Current assets:

Closing Stock 330600

Debtors (note 1) 171105

(170125 + 980)

Cash and Bank 12900 514605

Total 1147355

LIABILITY AND EQUITY

Current liabilities

Trade creditors 171355

Interest accrued (note 3) 2000

Sales commission accrued (note 2) 3000

Corporation tax payable 68000 244355

earnings

110980

Statement of Financial Position for Kedison Plc

For the year ended 31st December 2020

Particulars Details Amounts (£)

ASSETS

Non-current assets:

Plant and Equipment 632730

Current assets:

Closing Stock 330600

Debtors (note 1) 171105

(170125 + 980)

Cash and Bank 12900 514605

Total 1147355

LIABILITY AND EQUITY

Current liabilities

Trade creditors 171355

Interest accrued (note 3) 2000

Sales commission accrued (note 2) 3000

Corporation tax payable 68000 244355

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

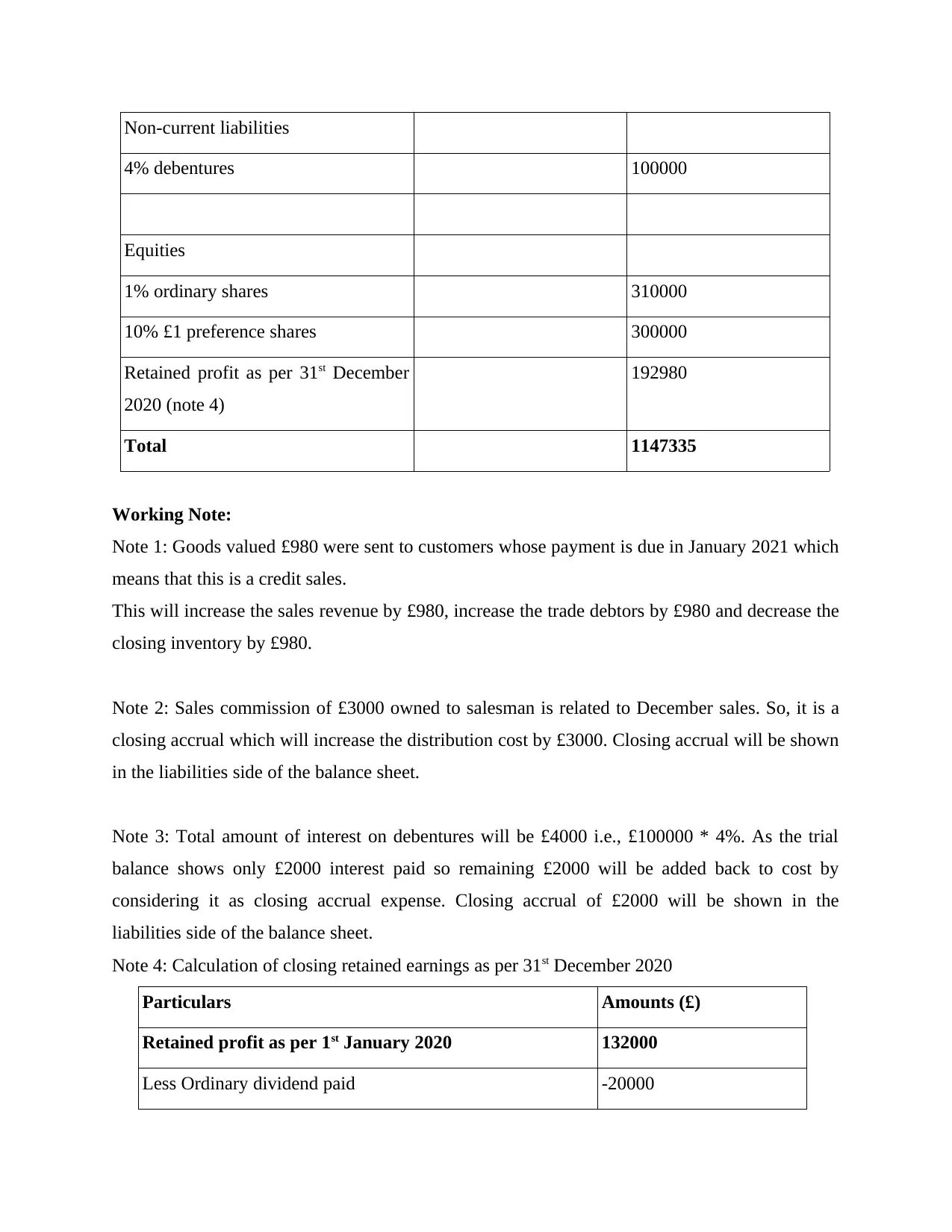

Non-current liabilities

4% debentures 100000

Equities

1% ordinary shares 310000

10% £1 preference shares 300000

Retained profit as per 31st December

2020 (note 4)

192980

Total 1147335

Working Note:

Note 1: Goods valued £980 were sent to customers whose payment is due in January 2021 which

means that this is a credit sales.

This will increase the sales revenue by £980, increase the trade debtors by £980 and decrease the

closing inventory by £980.

Note 2: Sales commission of £3000 owned to salesman is related to December sales. So, it is a

closing accrual which will increase the distribution cost by £3000. Closing accrual will be shown

in the liabilities side of the balance sheet.

Note 3: Total amount of interest on debentures will be £4000 i.e., £100000 * 4%. As the trial

balance shows only £2000 interest paid so remaining £2000 will be added back to cost by

considering it as closing accrual expense. Closing accrual of £2000 will be shown in the

liabilities side of the balance sheet.

Note 4: Calculation of closing retained earnings as per 31st December 2020

Particulars Amounts (£)

Retained profit as per 1st January 2020 132000

Less Ordinary dividend paid -20000

4% debentures 100000

Equities

1% ordinary shares 310000

10% £1 preference shares 300000

Retained profit as per 31st December

2020 (note 4)

192980

Total 1147335

Working Note:

Note 1: Goods valued £980 were sent to customers whose payment is due in January 2021 which

means that this is a credit sales.

This will increase the sales revenue by £980, increase the trade debtors by £980 and decrease the

closing inventory by £980.

Note 2: Sales commission of £3000 owned to salesman is related to December sales. So, it is a

closing accrual which will increase the distribution cost by £3000. Closing accrual will be shown

in the liabilities side of the balance sheet.

Note 3: Total amount of interest on debentures will be £4000 i.e., £100000 * 4%. As the trial

balance shows only £2000 interest paid so remaining £2000 will be added back to cost by

considering it as closing accrual expense. Closing accrual of £2000 will be shown in the

liabilities side of the balance sheet.

Note 4: Calculation of closing retained earnings as per 31st December 2020

Particulars Amounts (£)

Retained profit as per 1st January 2020 132000

Less Ordinary dividend paid -20000

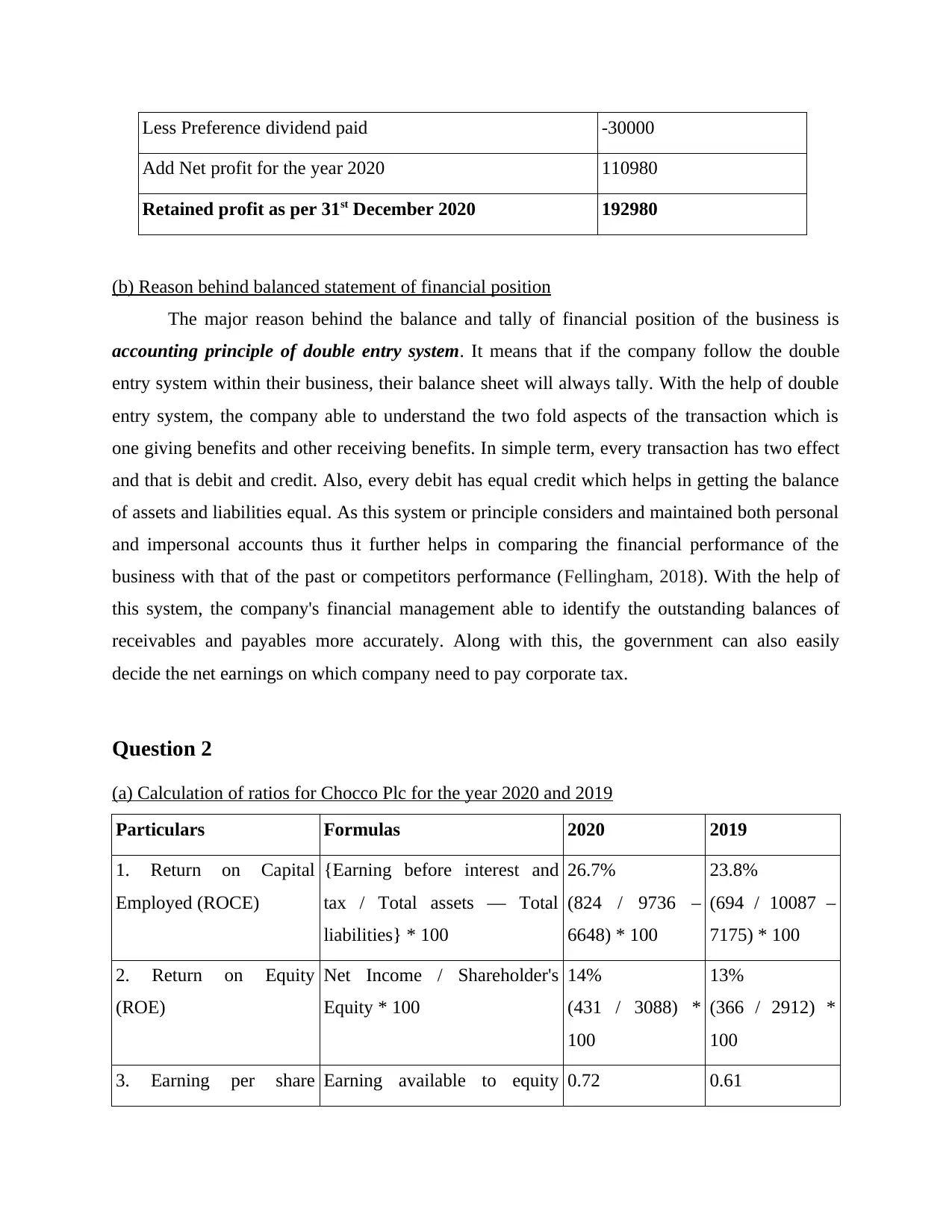

Less Preference dividend paid -30000

Add Net profit for the year 2020 110980

Retained profit as per 31st December 2020 192980

(b) Reason behind balanced statement of financial position

The major reason behind the balance and tally of financial position of the business is

accounting principle of double entry system. It means that if the company follow the double

entry system within their business, their balance sheet will always tally. With the help of double

entry system, the company able to understand the two fold aspects of the transaction which is

one giving benefits and other receiving benefits. In simple term, every transaction has two effect

and that is debit and credit. Also, every debit has equal credit which helps in getting the balance

of assets and liabilities equal. As this system or principle considers and maintained both personal

and impersonal accounts thus it further helps in comparing the financial performance of the

business with that of the past or competitors performance (Fellingham, 2018). With the help of

this system, the company's financial management able to identify the outstanding balances of

receivables and payables more accurately. Along with this, the government can also easily

decide the net earnings on which company need to pay corporate tax.

Question 2

(a) Calculation of ratios for Chocco Plc for the year 2020 and 2019

Particulars Formulas 2020 2019

1. Return on Capital

Employed (ROCE)

{Earning before interest and

tax / Total assets — Total

liabilities} * 100

26.7%

(824 / 9736 –

6648) * 100

23.8%

(694 / 10087 –

7175) * 100

2. Return on Equity

(ROE)

Net Income / Shareholder's

Equity * 100

14%

(431 / 3088) *

100

13%

(366 / 2912) *

100

3. Earning per share Earning available to equity 0.72 0.61

Add Net profit for the year 2020 110980

Retained profit as per 31st December 2020 192980

(b) Reason behind balanced statement of financial position

The major reason behind the balance and tally of financial position of the business is

accounting principle of double entry system. It means that if the company follow the double

entry system within their business, their balance sheet will always tally. With the help of double

entry system, the company able to understand the two fold aspects of the transaction which is

one giving benefits and other receiving benefits. In simple term, every transaction has two effect

and that is debit and credit. Also, every debit has equal credit which helps in getting the balance

of assets and liabilities equal. As this system or principle considers and maintained both personal

and impersonal accounts thus it further helps in comparing the financial performance of the

business with that of the past or competitors performance (Fellingham, 2018). With the help of

this system, the company's financial management able to identify the outstanding balances of

receivables and payables more accurately. Along with this, the government can also easily

decide the net earnings on which company need to pay corporate tax.

Question 2

(a) Calculation of ratios for Chocco Plc for the year 2020 and 2019

Particulars Formulas 2020 2019

1. Return on Capital

Employed (ROCE)

{Earning before interest and

tax / Total assets — Total

liabilities} * 100

26.7%

(824 / 9736 –

6648) * 100

23.8%

(694 / 10087 –

7175) * 100

2. Return on Equity

(ROE)

Net Income / Shareholder's

Equity * 100

14%

(431 / 3088) *

100

13%

(366 / 2912) *

100

3. Earning per share Earning available to equity 0.72 0.61

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

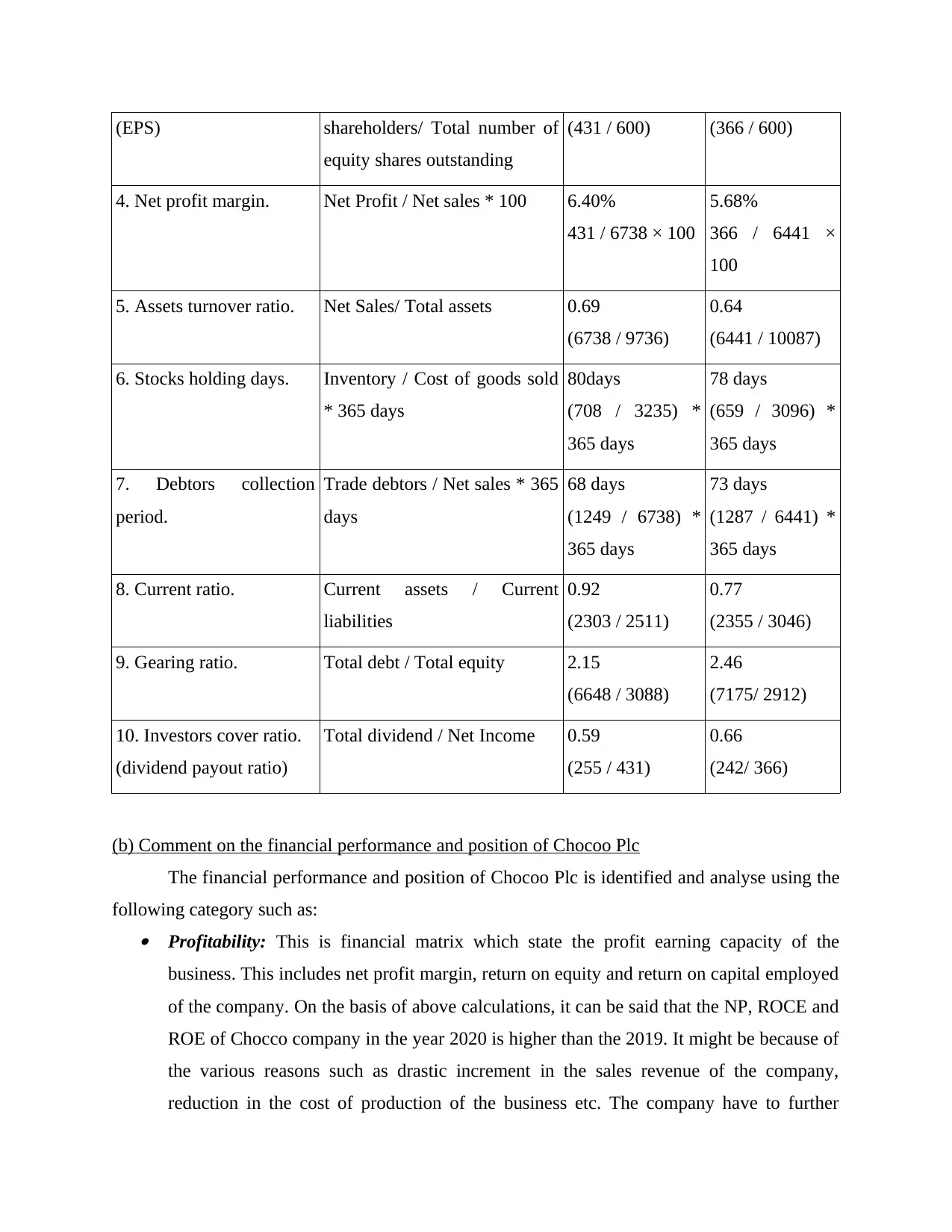

(EPS) shareholders/ Total number of

equity shares outstanding

(431 / 600) (366 / 600)

4. Net profit margin. Net Profit / Net sales * 100 6.40%

431 / 6738 × 100

5.68%

366 / 6441 ×

100

5. Assets turnover ratio. Net Sales/ Total assets 0.69

(6738 / 9736)

0.64

(6441 / 10087)

6. Stocks holding days. Inventory / Cost of goods sold

* 365 days

80days

(708 / 3235) *

365 days

78 days

(659 / 3096) *

365 days

7. Debtors collection

period.

Trade debtors / Net sales * 365

days

68 days

(1249 / 6738) *

365 days

73 days

(1287 / 6441) *

365 days

8. Current ratio. Current assets / Current

liabilities

0.92

(2303 / 2511)

0.77

(2355 / 3046)

9. Gearing ratio. Total debt / Total equity 2.15

(6648 / 3088)

2.46

(7175/ 2912)

10. Investors cover ratio.

(dividend payout ratio)

Total dividend / Net Income 0.59

(255 / 431)

0.66

(242/ 366)

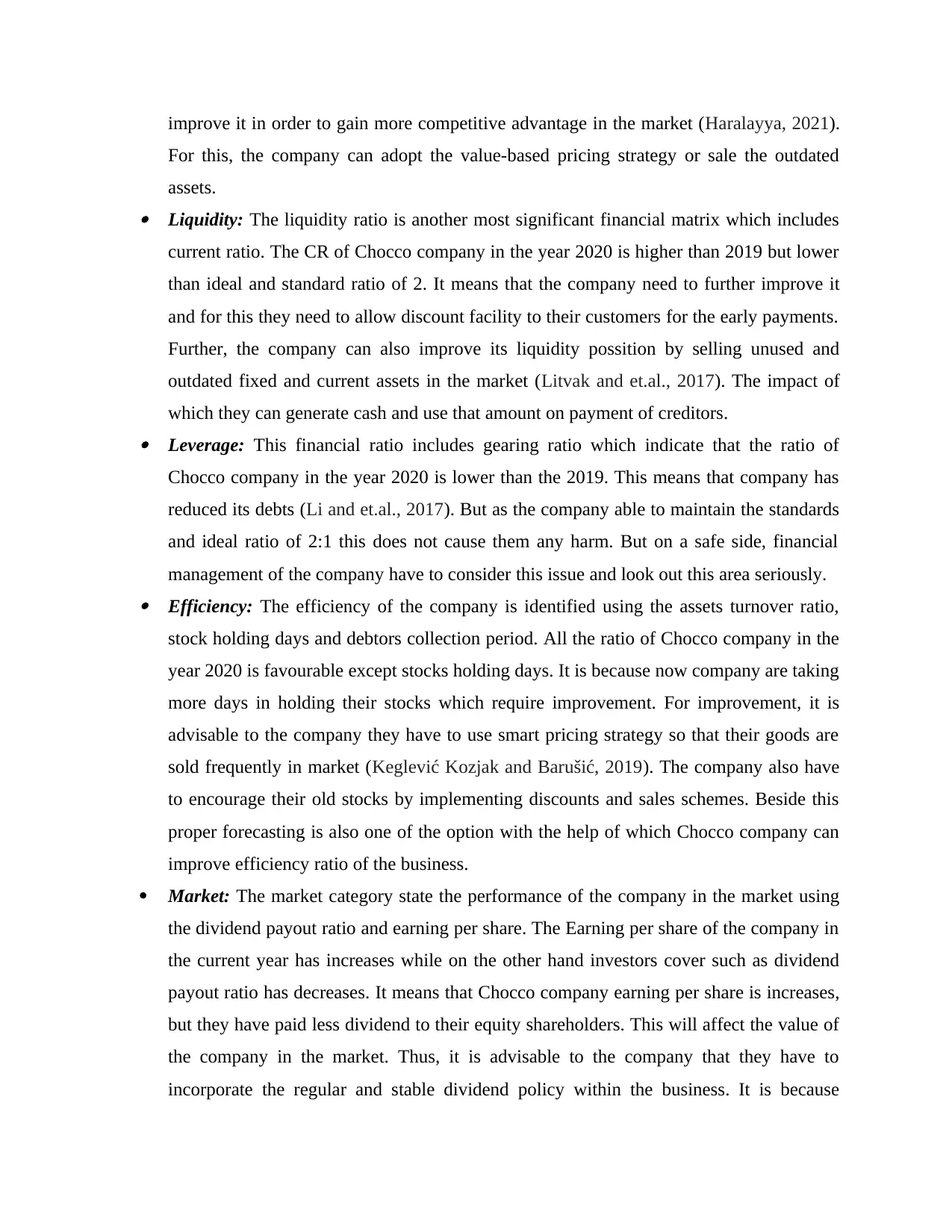

(b) Comment on the financial performance and position of Chocoo Plc

The financial performance and position of Chocoo Plc is identified and analyse using the

following category such as: Profitability: This is financial matrix which state the profit earning capacity of the

business. This includes net profit margin, return on equity and return on capital employed

of the company. On the basis of above calculations, it can be said that the NP, ROCE and

ROE of Chocco company in the year 2020 is higher than the 2019. It might be because of

the various reasons such as drastic increment in the sales revenue of the company,

reduction in the cost of production of the business etc. The company have to further

equity shares outstanding

(431 / 600) (366 / 600)

4. Net profit margin. Net Profit / Net sales * 100 6.40%

431 / 6738 × 100

5.68%

366 / 6441 ×

100

5. Assets turnover ratio. Net Sales/ Total assets 0.69

(6738 / 9736)

0.64

(6441 / 10087)

6. Stocks holding days. Inventory / Cost of goods sold

* 365 days

80days

(708 / 3235) *

365 days

78 days

(659 / 3096) *

365 days

7. Debtors collection

period.

Trade debtors / Net sales * 365

days

68 days

(1249 / 6738) *

365 days

73 days

(1287 / 6441) *

365 days

8. Current ratio. Current assets / Current

liabilities

0.92

(2303 / 2511)

0.77

(2355 / 3046)

9. Gearing ratio. Total debt / Total equity 2.15

(6648 / 3088)

2.46

(7175/ 2912)

10. Investors cover ratio.

(dividend payout ratio)

Total dividend / Net Income 0.59

(255 / 431)

0.66

(242/ 366)

(b) Comment on the financial performance and position of Chocoo Plc

The financial performance and position of Chocoo Plc is identified and analyse using the

following category such as: Profitability: This is financial matrix which state the profit earning capacity of the

business. This includes net profit margin, return on equity and return on capital employed

of the company. On the basis of above calculations, it can be said that the NP, ROCE and

ROE of Chocco company in the year 2020 is higher than the 2019. It might be because of

the various reasons such as drastic increment in the sales revenue of the company,

reduction in the cost of production of the business etc. The company have to further

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

improve it in order to gain more competitive advantage in the market (Haralayya, 2021).

For this, the company can adopt the value-based pricing strategy or sale the outdated

assets. Liquidity: The liquidity ratio is another most significant financial matrix which includes

current ratio. The CR of Chocco company in the year 2020 is higher than 2019 but lower

than ideal and standard ratio of 2. It means that the company need to further improve it

and for this they need to allow discount facility to their customers for the early payments.

Further, the company can also improve its liquidity possition by selling unused and

outdated fixed and current assets in the market (Litvak and et.al., 2017). The impact of

which they can generate cash and use that amount on payment of creditors. Leverage: This financial ratio includes gearing ratio which indicate that the ratio of

Chocco company in the year 2020 is lower than the 2019. This means that company has

reduced its debts (Li and et.al., 2017). But as the company able to maintain the standards

and ideal ratio of 2:1 this does not cause them any harm. But on a safe side, financial

management of the company have to consider this issue and look out this area seriously. Efficiency: The efficiency of the company is identified using the assets turnover ratio,

stock holding days and debtors collection period. All the ratio of Chocco company in the

year 2020 is favourable except stocks holding days. It is because now company are taking

more days in holding their stocks which require improvement. For improvement, it is

advisable to the company they have to use smart pricing strategy so that their goods are

sold frequently in market (Keglević Kozjak and Barušić, 2019). The company also have

to encourage their old stocks by implementing discounts and sales schemes. Beside this

proper forecasting is also one of the option with the help of which Chocco company can

improve efficiency ratio of the business.

Market: The market category state the performance of the company in the market using

the dividend payout ratio and earning per share. The Earning per share of the company in

the current year has increases while on the other hand investors cover such as dividend

payout ratio has decreases. It means that Chocco company earning per share is increases,

but they have paid less dividend to their equity shareholders. This will affect the value of

the company in the market. Thus, it is advisable to the company that they have to

incorporate the regular and stable dividend policy within the business. It is because

For this, the company can adopt the value-based pricing strategy or sale the outdated

assets. Liquidity: The liquidity ratio is another most significant financial matrix which includes

current ratio. The CR of Chocco company in the year 2020 is higher than 2019 but lower

than ideal and standard ratio of 2. It means that the company need to further improve it

and for this they need to allow discount facility to their customers for the early payments.

Further, the company can also improve its liquidity possition by selling unused and

outdated fixed and current assets in the market (Litvak and et.al., 2017). The impact of

which they can generate cash and use that amount on payment of creditors. Leverage: This financial ratio includes gearing ratio which indicate that the ratio of

Chocco company in the year 2020 is lower than the 2019. This means that company has

reduced its debts (Li and et.al., 2017). But as the company able to maintain the standards

and ideal ratio of 2:1 this does not cause them any harm. But on a safe side, financial

management of the company have to consider this issue and look out this area seriously. Efficiency: The efficiency of the company is identified using the assets turnover ratio,

stock holding days and debtors collection period. All the ratio of Chocco company in the

year 2020 is favourable except stocks holding days. It is because now company are taking

more days in holding their stocks which require improvement. For improvement, it is

advisable to the company they have to use smart pricing strategy so that their goods are

sold frequently in market (Keglević Kozjak and Barušić, 2019). The company also have

to encourage their old stocks by implementing discounts and sales schemes. Beside this

proper forecasting is also one of the option with the help of which Chocco company can

improve efficiency ratio of the business.

Market: The market category state the performance of the company in the market using

the dividend payout ratio and earning per share. The Earning per share of the company in

the current year has increases while on the other hand investors cover such as dividend

payout ratio has decreases. It means that Chocco company earning per share is increases,

but they have paid less dividend to their equity shareholders. This will affect the value of

the company in the market. Thus, it is advisable to the company that they have to

incorporate the regular and stable dividend policy within the business. It is because

higher dividend will satisfy the equity shareholders of the business and also further

increase the capital of company (Rahmawati, Danial and Sunarya, 2018).

CONCLUSION

The report has concluded the two most important calculations such as income statement,

financial position and ratio calculations. Further, the report has also comment on the

performance of the business using the ratio calculation of Chocco Plc. Lastly, the report has also

discussed the double entry principle of accounting which helps in the tally of balance sheet.

increase the capital of company (Rahmawati, Danial and Sunarya, 2018).

CONCLUSION

The report has concluded the two most important calculations such as income statement,

financial position and ratio calculations. Further, the report has also comment on the

performance of the business using the ratio calculation of Chocco Plc. Lastly, the report has also

discussed the double entry principle of accounting which helps in the tally of balance sheet.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Dewi, N., Azam, S. and Yusoff, S., 2019. Factors influencing the information quality of local

government financial statement and financial accountability. Management Science

Letters. 9(9). pp.1373-1384.

Fellingham, J., 2018. The Double Entry System of Accounting. Accounting, Economics, and

Law: A Convivium. 8(1).

Haralayya, B., 2021. Ratio Analysis at NSSK, Bidar. Iconic Research And Engineering

Journals. 4(12). pp.170-182.

Litvak, I. and et.al., 2017. In-situ 13 C/12 C ratio analysis in water carbonates using FTIR. Agil.

Technol. Appl. Note, Environ, pp.1-6.

Li, B. and et.al., 2017, October. Signal noise ratio analysis and on-orbit performance estimation

of a solar occultation Fourier transform spectrometer. In AOPC 2017: Space Optics and

Earth Imaging and Space Navigation (Vol. 10463, p. 104631A). International Society for

Optics and Photonics.

Keglević Kozjak, S. and Barušić, D., 2019. FINANCIAL RATIO ANALYSIS OF SELECTED

PROMOTION COMPANIES. CroDiM: International Journal of Marketing Science. 2(1).

pp.59-71.

Rahmawati, F., Danial, R. D. M. and Sunarya, E., 2018. Activity Ratio Analysis for Measuring

Company Effectiveness PT. Martina Berto Tbk Jakarta. Jurnal Apresiasi Ekonomi. 6(3).

pp.183-189.

Books and Journals

Dewi, N., Azam, S. and Yusoff, S., 2019. Factors influencing the information quality of local

government financial statement and financial accountability. Management Science

Letters. 9(9). pp.1373-1384.

Fellingham, J., 2018. The Double Entry System of Accounting. Accounting, Economics, and

Law: A Convivium. 8(1).

Haralayya, B., 2021. Ratio Analysis at NSSK, Bidar. Iconic Research And Engineering

Journals. 4(12). pp.170-182.

Litvak, I. and et.al., 2017. In-situ 13 C/12 C ratio analysis in water carbonates using FTIR. Agil.

Technol. Appl. Note, Environ, pp.1-6.

Li, B. and et.al., 2017, October. Signal noise ratio analysis and on-orbit performance estimation

of a solar occultation Fourier transform spectrometer. In AOPC 2017: Space Optics and

Earth Imaging and Space Navigation (Vol. 10463, p. 104631A). International Society for

Optics and Photonics.

Keglević Kozjak, S. and Barušić, D., 2019. FINANCIAL RATIO ANALYSIS OF SELECTED

PROMOTION COMPANIES. CroDiM: International Journal of Marketing Science. 2(1).

pp.59-71.

Rahmawati, F., Danial, R. D. M. and Sunarya, E., 2018. Activity Ratio Analysis for Measuring

Company Effectiveness PT. Martina Berto Tbk Jakarta. Jurnal Apresiasi Ekonomi. 6(3).

pp.183-189.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.