Report on Accounting Fundamentals: Analyzing Wales and Sweet Plc

VerifiedAdded on 2023/06/13

|12

|2334

|170

Report

AI Summary

This report provides a comprehensive analysis of accounting fundamentals, focusing on the financial performance and position of Wales Plc and Sweet Plc. It includes the preparation of an income statement and statement of financial position for Wales Plc, along with an explanation of why the statement of financial position balances. Additionally, the report calculates and interprets various financial ratios for Sweet Plc for the years 2021 and 2020, offering insights into the company's profitability, liquidity, and efficiency. The analysis covers key metrics such as Return on Capital Employed (ROCE), Return on Equity (ROE), Earnings Per Share (EPS), Net Profit Margin, Asset Turnover, Stock Holding Days, Debtors Collection Period, Current Ratio, Gearing Ratio, and Interest Cover, providing a thorough assessment of Sweet Plc's financial health and performance trends.

ACCOUNTING

FUNDAMENTALS

1

FUNDAMENTALS

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

Question 1........................................................................................................................................3

(a) Preparation of income statement and statement of financial position of Wales Plc..............3

(b) Reason of balance statement of financial position.................................................................5

Question 2........................................................................................................................................5

(a) Calculation of following ratios for Sweet Plc for 2021 and 2020..........................................5

(b) Comment on the financial performance and position of Sweet plc.......................................7

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

2

INTRODUCTION...........................................................................................................................3

Question 1........................................................................................................................................3

(a) Preparation of income statement and statement of financial position of Wales Plc..............3

(b) Reason of balance statement of financial position.................................................................5

Question 2........................................................................................................................................5

(a) Calculation of following ratios for Sweet Plc for 2021 and 2020..........................................5

(b) Comment on the financial performance and position of Sweet plc.......................................7

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

2

INTRODUCTION

Accounting is a process of recording financial transaction related to business. Also,

accounting is a process of measurement, processing and communication of financial as well as

non-financial information for the users decision-making purpose. The report will prepare income

statement and financial position statement of Wales plc along with reason of statement of

financial position balance. Lastly, the report will compute the financial ratios along with

interpretation on performance of Sweet plc.

Question 1

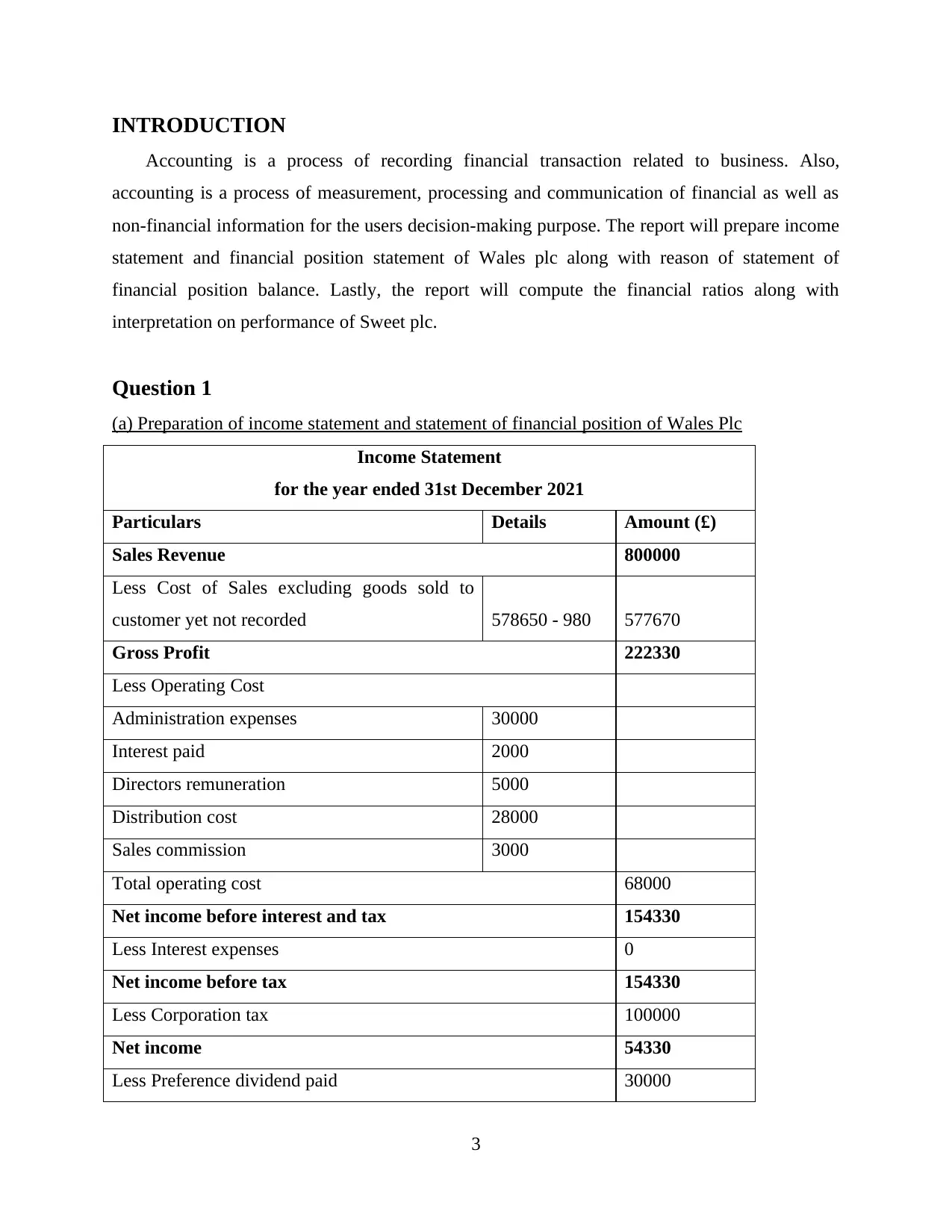

(a) Preparation of income statement and statement of financial position of Wales Plc

Income Statement

for the year ended 31st December 2021

Particulars Details Amount (£)

Sales Revenue 800000

Less Cost of Sales excluding goods sold to

customer yet not recorded 578650 - 980 577670

Gross Profit 222330

Less Operating Cost

Administration expenses 30000

Interest paid 2000

Directors remuneration 5000

Distribution cost 28000

Sales commission 3000

Total operating cost 68000

Net income before interest and tax 154330

Less Interest expenses 0

Net income before tax 154330

Less Corporation tax 100000

Net income 54330

Less Preference dividend paid 30000

3

Accounting is a process of recording financial transaction related to business. Also,

accounting is a process of measurement, processing and communication of financial as well as

non-financial information for the users decision-making purpose. The report will prepare income

statement and financial position statement of Wales plc along with reason of statement of

financial position balance. Lastly, the report will compute the financial ratios along with

interpretation on performance of Sweet plc.

Question 1

(a) Preparation of income statement and statement of financial position of Wales Plc

Income Statement

for the year ended 31st December 2021

Particulars Details Amount (£)

Sales Revenue 800000

Less Cost of Sales excluding goods sold to

customer yet not recorded 578650 - 980 577670

Gross Profit 222330

Less Operating Cost

Administration expenses 30000

Interest paid 2000

Directors remuneration 5000

Distribution cost 28000

Sales commission 3000

Total operating cost 68000

Net income before interest and tax 154330

Less Interest expenses 0

Net income before tax 154330

Less Corporation tax 100000

Net income 54330

Less Preference dividend paid 30000

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

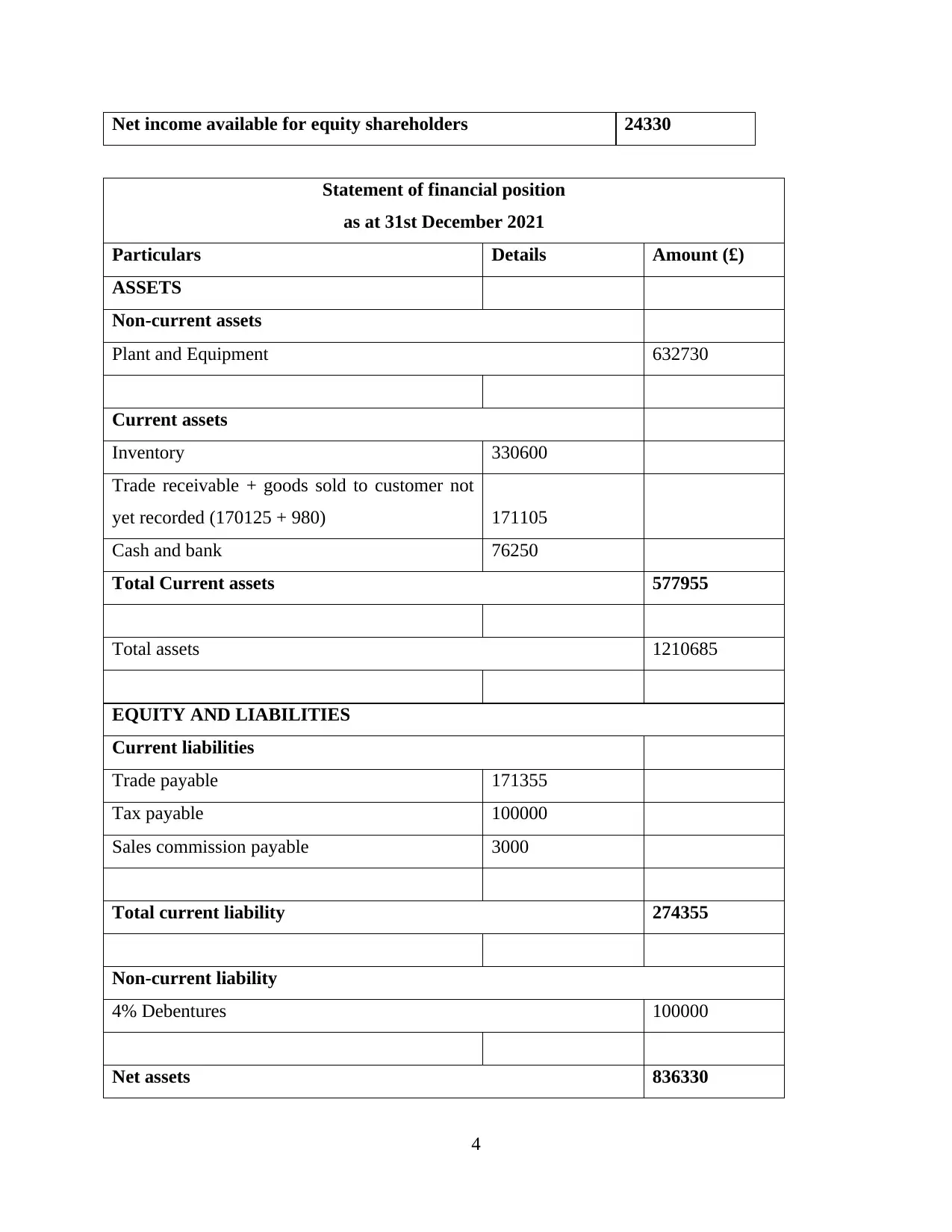

Net income available for equity shareholders 24330

Statement of financial position

as at 31st December 2021

Particulars Details Amount (£)

ASSETS

Non-current assets

Plant and Equipment 632730

Current assets

Inventory 330600

Trade receivable + goods sold to customer not

yet recorded (170125 + 980) 171105

Cash and bank 76250

Total Current assets 577955

Total assets 1210685

EQUITY AND LIABILITIES

Current liabilities

Trade payable 171355

Tax payable 100000

Sales commission payable 3000

Total current liability 274355

Non-current liability

4% Debentures 100000

Net assets 836330

4

Statement of financial position

as at 31st December 2021

Particulars Details Amount (£)

ASSETS

Non-current assets

Plant and Equipment 632730

Current assets

Inventory 330600

Trade receivable + goods sold to customer not

yet recorded (170125 + 980) 171105

Cash and bank 76250

Total Current assets 577955

Total assets 1210685

EQUITY AND LIABILITIES

Current liabilities

Trade payable 171355

Tax payable 100000

Sales commission payable 3000

Total current liability 274355

Non-current liability

4% Debentures 100000

Net assets 836330

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

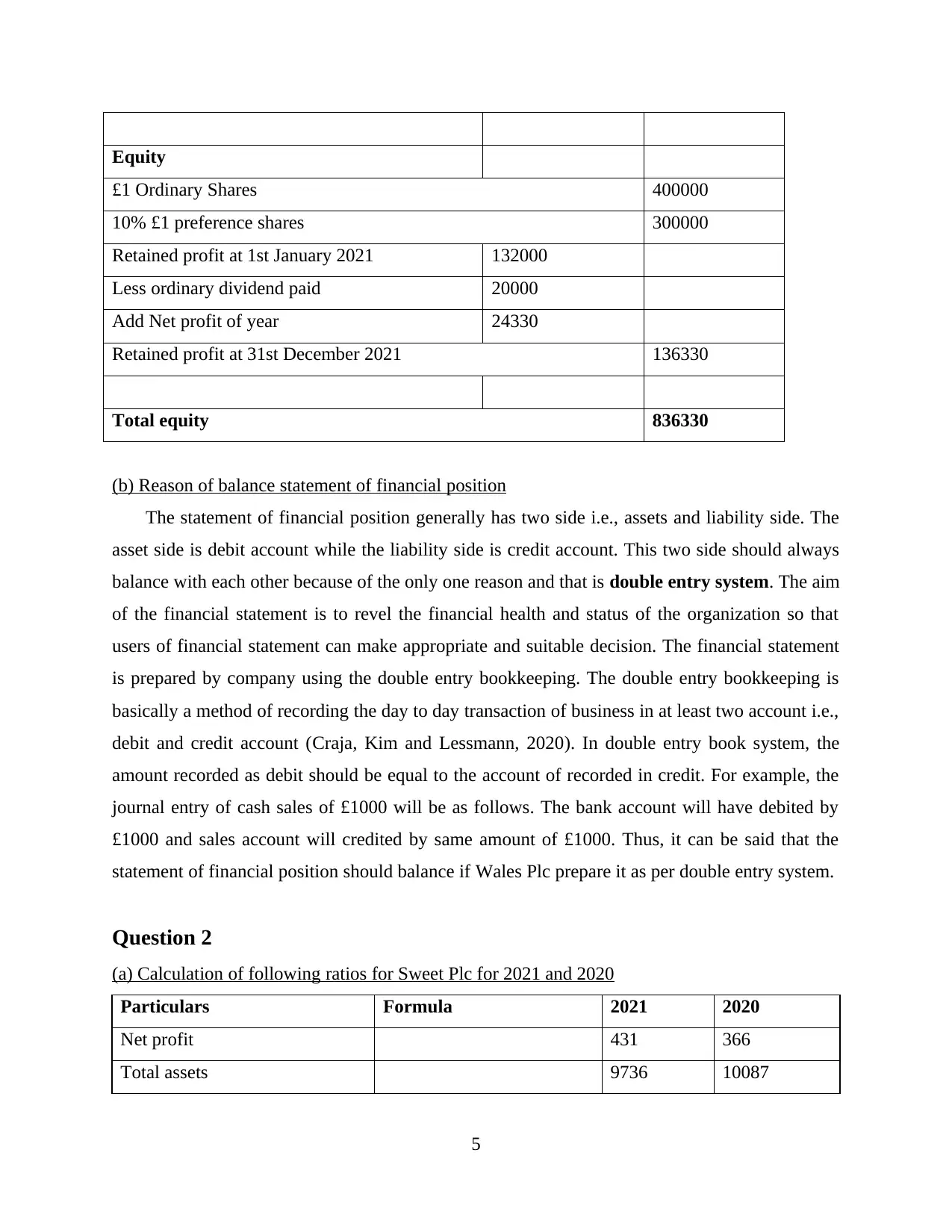

Equity

£1 Ordinary Shares 400000

10% £1 preference shares 300000

Retained profit at 1st January 2021 132000

Less ordinary dividend paid 20000

Add Net profit of year 24330

Retained profit at 31st December 2021 136330

Total equity 836330

(b) Reason of balance statement of financial position

The statement of financial position generally has two side i.e., assets and liability side. The

asset side is debit account while the liability side is credit account. This two side should always

balance with each other because of the only one reason and that is double entry system. The aim

of the financial statement is to revel the financial health and status of the organization so that

users of financial statement can make appropriate and suitable decision. The financial statement

is prepared by company using the double entry bookkeeping. The double entry bookkeeping is

basically a method of recording the day to day transaction of business in at least two account i.e.,

debit and credit account (Craja, Kim and Lessmann, 2020). In double entry book system, the

amount recorded as debit should be equal to the account of recorded in credit. For example, the

journal entry of cash sales of £1000 will be as follows. The bank account will have debited by

£1000 and sales account will credited by same amount of £1000. Thus, it can be said that the

statement of financial position should balance if Wales Plc prepare it as per double entry system.

Question 2

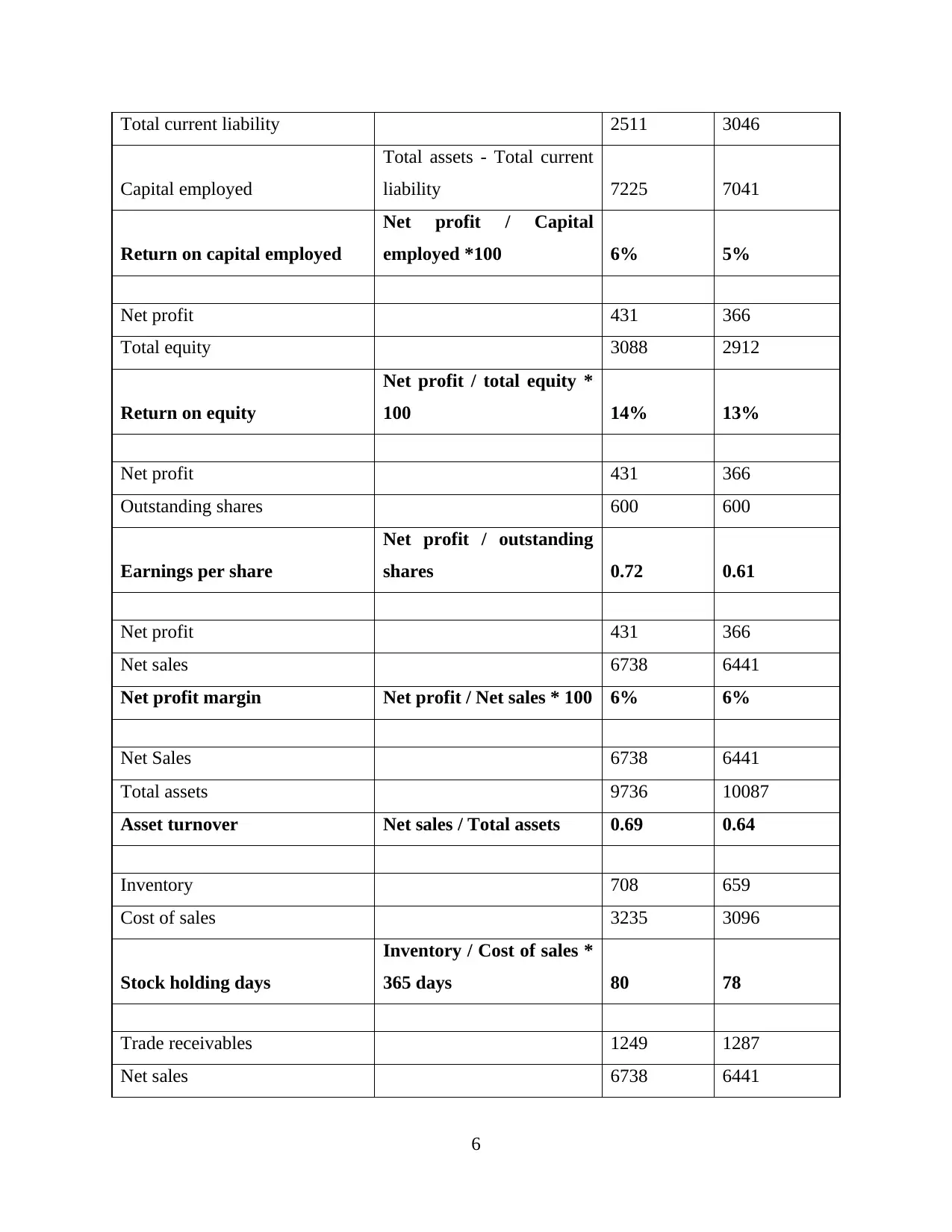

(a) Calculation of following ratios for Sweet Plc for 2021 and 2020

Particulars Formula 2021 2020

Net profit 431 366

Total assets 9736 10087

5

£1 Ordinary Shares 400000

10% £1 preference shares 300000

Retained profit at 1st January 2021 132000

Less ordinary dividend paid 20000

Add Net profit of year 24330

Retained profit at 31st December 2021 136330

Total equity 836330

(b) Reason of balance statement of financial position

The statement of financial position generally has two side i.e., assets and liability side. The

asset side is debit account while the liability side is credit account. This two side should always

balance with each other because of the only one reason and that is double entry system. The aim

of the financial statement is to revel the financial health and status of the organization so that

users of financial statement can make appropriate and suitable decision. The financial statement

is prepared by company using the double entry bookkeeping. The double entry bookkeeping is

basically a method of recording the day to day transaction of business in at least two account i.e.,

debit and credit account (Craja, Kim and Lessmann, 2020). In double entry book system, the

amount recorded as debit should be equal to the account of recorded in credit. For example, the

journal entry of cash sales of £1000 will be as follows. The bank account will have debited by

£1000 and sales account will credited by same amount of £1000. Thus, it can be said that the

statement of financial position should balance if Wales Plc prepare it as per double entry system.

Question 2

(a) Calculation of following ratios for Sweet Plc for 2021 and 2020

Particulars Formula 2021 2020

Net profit 431 366

Total assets 9736 10087

5

Total current liability 2511 3046

Capital employed

Total assets - Total current

liability 7225 7041

Return on capital employed

Net profit / Capital

employed *100 6% 5%

Net profit 431 366

Total equity 3088 2912

Return on equity

Net profit / total equity *

100 14% 13%

Net profit 431 366

Outstanding shares 600 600

Earnings per share

Net profit / outstanding

shares 0.72 0.61

Net profit 431 366

Net sales 6738 6441

Net profit margin Net profit / Net sales * 100 6% 6%

Net Sales 6738 6441

Total assets 9736 10087

Asset turnover Net sales / Total assets 0.69 0.64

Inventory 708 659

Cost of sales 3235 3096

Stock holding days

Inventory / Cost of sales *

365 days 80 78

Trade receivables 1249 1287

Net sales 6738 6441

6

Capital employed

Total assets - Total current

liability 7225 7041

Return on capital employed

Net profit / Capital

employed *100 6% 5%

Net profit 431 366

Total equity 3088 2912

Return on equity

Net profit / total equity *

100 14% 13%

Net profit 431 366

Outstanding shares 600 600

Earnings per share

Net profit / outstanding

shares 0.72 0.61

Net profit 431 366

Net sales 6738 6441

Net profit margin Net profit / Net sales * 100 6% 6%

Net Sales 6738 6441

Total assets 9736 10087

Asset turnover Net sales / Total assets 0.69 0.64

Inventory 708 659

Cost of sales 3235 3096

Stock holding days

Inventory / Cost of sales *

365 days 80 78

Trade receivables 1249 1287

Net sales 6738 6441

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

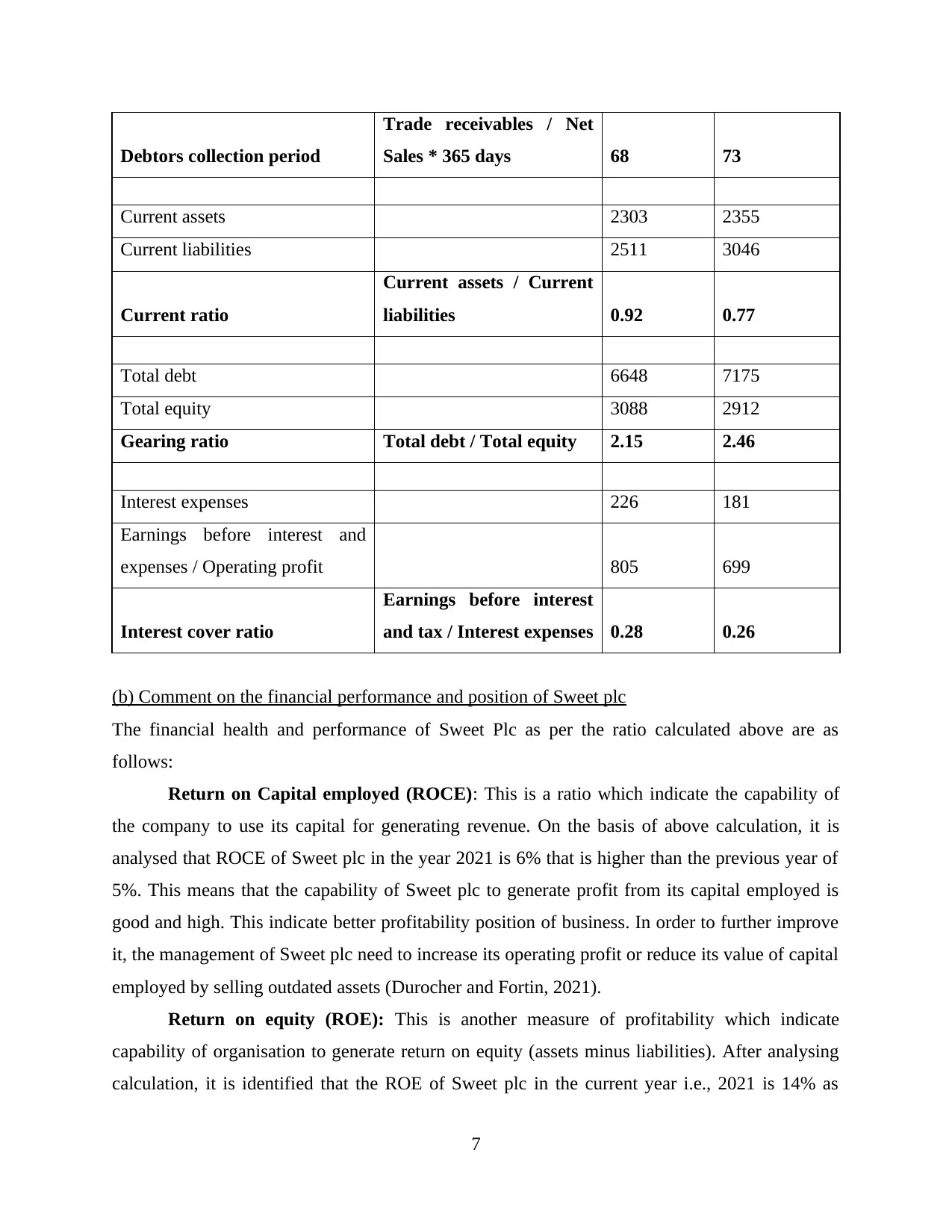

Debtors collection period

Trade receivables / Net

Sales * 365 days 68 73

Current assets 2303 2355

Current liabilities 2511 3046

Current ratio

Current assets / Current

liabilities 0.92 0.77

Total debt 6648 7175

Total equity 3088 2912

Gearing ratio Total debt / Total equity 2.15 2.46

Interest expenses 226 181

Earnings before interest and

expenses / Operating profit 805 699

Interest cover ratio

Earnings before interest

and tax / Interest expenses 0.28 0.26

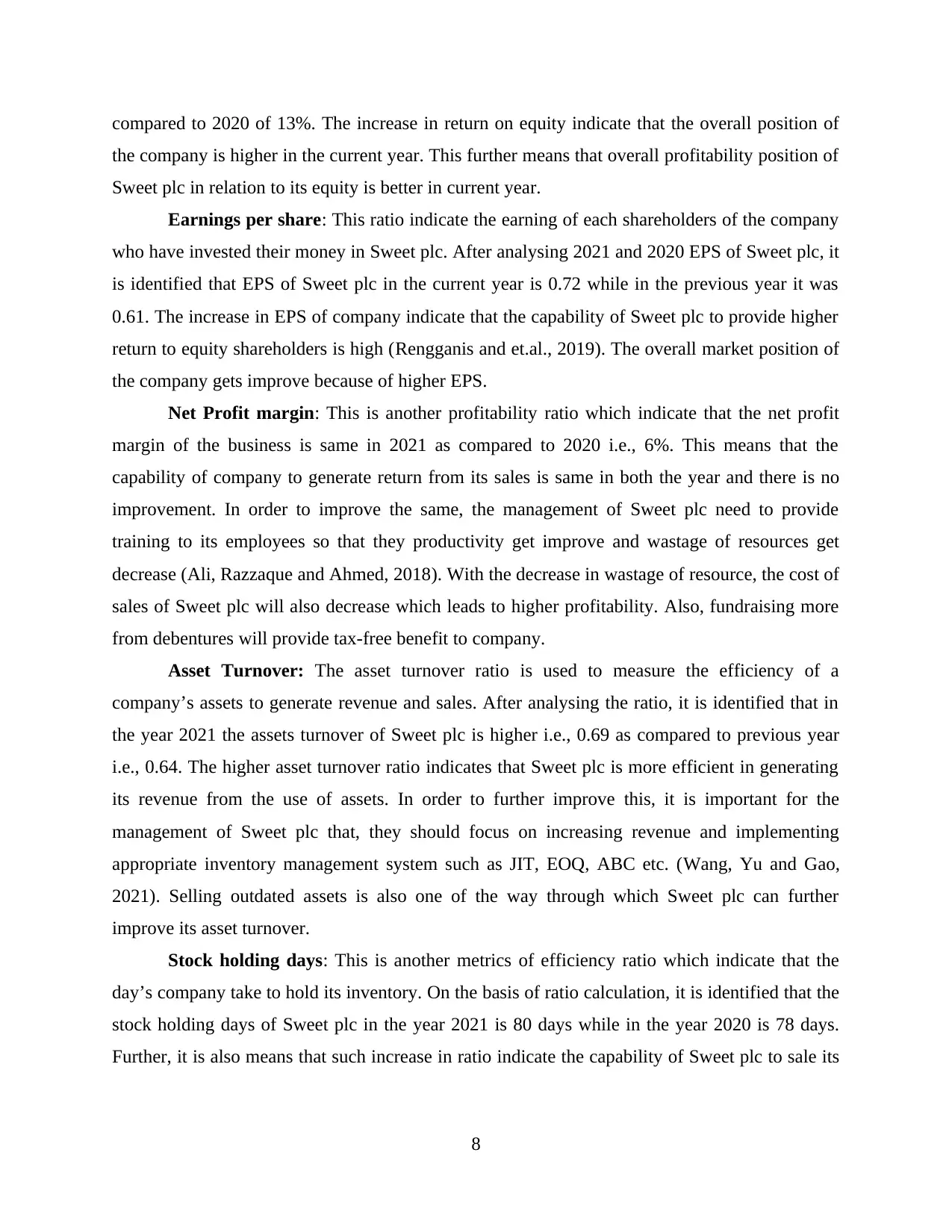

(b) Comment on the financial performance and position of Sweet plc

The financial health and performance of Sweet Plc as per the ratio calculated above are as

follows:

Return on Capital employed (ROCE): This is a ratio which indicate the capability of

the company to use its capital for generating revenue. On the basis of above calculation, it is

analysed that ROCE of Sweet plc in the year 2021 is 6% that is higher than the previous year of

5%. This means that the capability of Sweet plc to generate profit from its capital employed is

good and high. This indicate better profitability position of business. In order to further improve

it, the management of Sweet plc need to increase its operating profit or reduce its value of capital

employed by selling outdated assets (Durocher and Fortin, 2021).

Return on equity (ROE): This is another measure of profitability which indicate

capability of organisation to generate return on equity (assets minus liabilities). After analysing

calculation, it is identified that the ROE of Sweet plc in the current year i.e., 2021 is 14% as

7

Trade receivables / Net

Sales * 365 days 68 73

Current assets 2303 2355

Current liabilities 2511 3046

Current ratio

Current assets / Current

liabilities 0.92 0.77

Total debt 6648 7175

Total equity 3088 2912

Gearing ratio Total debt / Total equity 2.15 2.46

Interest expenses 226 181

Earnings before interest and

expenses / Operating profit 805 699

Interest cover ratio

Earnings before interest

and tax / Interest expenses 0.28 0.26

(b) Comment on the financial performance and position of Sweet plc

The financial health and performance of Sweet Plc as per the ratio calculated above are as

follows:

Return on Capital employed (ROCE): This is a ratio which indicate the capability of

the company to use its capital for generating revenue. On the basis of above calculation, it is

analysed that ROCE of Sweet plc in the year 2021 is 6% that is higher than the previous year of

5%. This means that the capability of Sweet plc to generate profit from its capital employed is

good and high. This indicate better profitability position of business. In order to further improve

it, the management of Sweet plc need to increase its operating profit or reduce its value of capital

employed by selling outdated assets (Durocher and Fortin, 2021).

Return on equity (ROE): This is another measure of profitability which indicate

capability of organisation to generate return on equity (assets minus liabilities). After analysing

calculation, it is identified that the ROE of Sweet plc in the current year i.e., 2021 is 14% as

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

compared to 2020 of 13%. The increase in return on equity indicate that the overall position of

the company is higher in the current year. This further means that overall profitability position of

Sweet plc in relation to its equity is better in current year.

Earnings per share: This ratio indicate the earning of each shareholders of the company

who have invested their money in Sweet plc. After analysing 2021 and 2020 EPS of Sweet plc, it

is identified that EPS of Sweet plc in the current year is 0.72 while in the previous year it was

0.61. The increase in EPS of company indicate that the capability of Sweet plc to provide higher

return to equity shareholders is high (Rengganis and et.al., 2019). The overall market position of

the company gets improve because of higher EPS.

Net Profit margin: This is another profitability ratio which indicate that the net profit

margin of the business is same in 2021 as compared to 2020 i.e., 6%. This means that the

capability of company to generate return from its sales is same in both the year and there is no

improvement. In order to improve the same, the management of Sweet plc need to provide

training to its employees so that they productivity get improve and wastage of resources get

decrease (Ali, Razzaque and Ahmed, 2018). With the decrease in wastage of resource, the cost of

sales of Sweet plc will also decrease which leads to higher profitability. Also, fundraising more

from debentures will provide tax-free benefit to company.

Asset Turnover: The asset turnover ratio is used to measure the efficiency of a

company’s assets to generate revenue and sales. After analysing the ratio, it is identified that in

the year 2021 the assets turnover of Sweet plc is higher i.e., 0.69 as compared to previous year

i.e., 0.64. The higher asset turnover ratio indicates that Sweet plc is more efficient in generating

its revenue from the use of assets. In order to further improve this, it is important for the

management of Sweet plc that, they should focus on increasing revenue and implementing

appropriate inventory management system such as JIT, EOQ, ABC etc. (Wang, Yu and Gao,

2021). Selling outdated assets is also one of the way through which Sweet plc can further

improve its asset turnover.

Stock holding days: This is another metrics of efficiency ratio which indicate that the

day’s company take to hold its inventory. On the basis of ratio calculation, it is identified that the

stock holding days of Sweet plc in the year 2021 is 80 days while in the year 2020 is 78 days.

Further, it is also means that such increase in ratio indicate the capability of Sweet plc to sale its

8

the company is higher in the current year. This further means that overall profitability position of

Sweet plc in relation to its equity is better in current year.

Earnings per share: This ratio indicate the earning of each shareholders of the company

who have invested their money in Sweet plc. After analysing 2021 and 2020 EPS of Sweet plc, it

is identified that EPS of Sweet plc in the current year is 0.72 while in the previous year it was

0.61. The increase in EPS of company indicate that the capability of Sweet plc to provide higher

return to equity shareholders is high (Rengganis and et.al., 2019). The overall market position of

the company gets improve because of higher EPS.

Net Profit margin: This is another profitability ratio which indicate that the net profit

margin of the business is same in 2021 as compared to 2020 i.e., 6%. This means that the

capability of company to generate return from its sales is same in both the year and there is no

improvement. In order to improve the same, the management of Sweet plc need to provide

training to its employees so that they productivity get improve and wastage of resources get

decrease (Ali, Razzaque and Ahmed, 2018). With the decrease in wastage of resource, the cost of

sales of Sweet plc will also decrease which leads to higher profitability. Also, fundraising more

from debentures will provide tax-free benefit to company.

Asset Turnover: The asset turnover ratio is used to measure the efficiency of a

company’s assets to generate revenue and sales. After analysing the ratio, it is identified that in

the year 2021 the assets turnover of Sweet plc is higher i.e., 0.69 as compared to previous year

i.e., 0.64. The higher asset turnover ratio indicates that Sweet plc is more efficient in generating

its revenue from the use of assets. In order to further improve this, it is important for the

management of Sweet plc that, they should focus on increasing revenue and implementing

appropriate inventory management system such as JIT, EOQ, ABC etc. (Wang, Yu and Gao,

2021). Selling outdated assets is also one of the way through which Sweet plc can further

improve its asset turnover.

Stock holding days: This is another metrics of efficiency ratio which indicate that the

day’s company take to hold its inventory. On the basis of ratio calculation, it is identified that the

stock holding days of Sweet plc in the year 2021 is 80 days while in the year 2020 is 78 days.

Further, it is also means that such increase in ratio indicate the capability of Sweet plc to sale its

8

inventory or stocks in market is poor (Easton and et.al., 2018). In order to improve the same, the

company need to adopt the marketing strategy such as discount on high amount purchase etc.

Debtors collection period: The debtor collection period of Sweet plc in the year 2021 is

lower than the previous year i.e., 2021 68 days and 2020 73 days. This indicate that the

capability of company to collect payment from its debtors on time is poor. In order to improve

so, the company need to offer early payment discounts to its customers (Setyawati and Amelia,

2018).

Current ratio: The current ratio indicates the liquidity position of company. On the basis

of calculation, it is identified that the current ratio of Sweet plc in the year 2021 is 0.92 while in

the year 2020 was 0.77. This increase in ratio indicate that the overall liquidity position or

performance of Sweet plc is good in the current year as compared to previous year. The ability of

company to pay of its current obligation is good, the impact of which the credit worthiness of

organization gets improve more year by year (IŞILDAK, 2019).

Gearing ratio: The gearing ratio of Sweet plc in the year 2021 is 2.15 and in the year

2020 it was 2.46. This means the ratio has increased in current year as compared to previous

year. It further means that ratio between debt financing and equity financing of Sweet plc has

decreased in current year which is good. Because the gearing ratio of company in year 2020 is

quite higher than the ideal ratio of 2. If the company will not reduce it that the chance of

overburden of funds will vanish financial health of business.

Interest cover: The interest cover of Sweet plc in 2021 is 0.28 while in 2020 it was 0.26.

This increase in interest cover is poor for the company financial performance. It is because the

company are paying higher portion of interest of its operating profit (IŞILDAK, 2019). In order

to reduce the same, company need to acquire the funds from the lower interest bank loan and

other financing option.

CONCLUSION

After summing up the above information, it is concluded that the overall financial

performance of Sweet plc in the current year as compared to previous year was better and high.

The report has also prepared the income statement and financial position of Wales plc. Lastly;

the report has also indicated why statement of financial position balance.

9

company need to adopt the marketing strategy such as discount on high amount purchase etc.

Debtors collection period: The debtor collection period of Sweet plc in the year 2021 is

lower than the previous year i.e., 2021 68 days and 2020 73 days. This indicate that the

capability of company to collect payment from its debtors on time is poor. In order to improve

so, the company need to offer early payment discounts to its customers (Setyawati and Amelia,

2018).

Current ratio: The current ratio indicates the liquidity position of company. On the basis

of calculation, it is identified that the current ratio of Sweet plc in the year 2021 is 0.92 while in

the year 2020 was 0.77. This increase in ratio indicate that the overall liquidity position or

performance of Sweet plc is good in the current year as compared to previous year. The ability of

company to pay of its current obligation is good, the impact of which the credit worthiness of

organization gets improve more year by year (IŞILDAK, 2019).

Gearing ratio: The gearing ratio of Sweet plc in the year 2021 is 2.15 and in the year

2020 it was 2.46. This means the ratio has increased in current year as compared to previous

year. It further means that ratio between debt financing and equity financing of Sweet plc has

decreased in current year which is good. Because the gearing ratio of company in year 2020 is

quite higher than the ideal ratio of 2. If the company will not reduce it that the chance of

overburden of funds will vanish financial health of business.

Interest cover: The interest cover of Sweet plc in 2021 is 0.28 while in 2020 it was 0.26.

This increase in interest cover is poor for the company financial performance. It is because the

company are paying higher portion of interest of its operating profit (IŞILDAK, 2019). In order

to reduce the same, company need to acquire the funds from the lower interest bank loan and

other financing option.

CONCLUSION

After summing up the above information, it is concluded that the overall financial

performance of Sweet plc in the current year as compared to previous year was better and high.

The report has also prepared the income statement and financial position of Wales plc. Lastly;

the report has also indicated why statement of financial position balance.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journals

Craja, P., Kim, A. and Lessmann, S., 2020. Deep learning for detecting financial statement

fraud. Decision Support Systems. 139. p.113421.

Durocher, S. and Fortin, A., 2021. Financial statement users’ institutional logic. Journal of

Accounting and Public Policy. 40(2). p.106819.

Rengganis, R. M. Y. D. and et.al., 2019. The fraud diamond: element in detecting financial

statement of fraud. International research journal of management, IT and social

sciences. 6(3). pp.1-10.

Ali, M. J., Razzaque, R. M. and Ahmed, K., 2018. Real earnings management and financial

statement fraud: evidence from Malaysia. International Journal of Accounting &

Information Management.

Wang, Y., Yu, M. and Gao, S., 2021. Gender diversity and financial statement fraud. Journal of

Accounting and Public Policy, p.106903.

Easton, P. D. and et.al., 2018. Financial statement analysis & valuation. Boston, MA:

Cambridge Business Publishers.

Setyawati, I. and Amelia, R., 2018. The role of current ratio, operating cash flow and inflation

rate in predicting financial distress: Indonesia Stock Exchange. JDM (Jurnal Dinamika

Manajemen). 9(2). pp.140-148.

IŞILDAK, M. S., 2019. Investigation of the Effect of Financial Ratios on Market Value/Book

Value Ratio by Panel Data Analysis: Application in BİST Registered Weaving, Garment

and Leather Sector. Ekonomik Yaklasim. 30(111). pp.71-100.

11

Books and journals

Craja, P., Kim, A. and Lessmann, S., 2020. Deep learning for detecting financial statement

fraud. Decision Support Systems. 139. p.113421.

Durocher, S. and Fortin, A., 2021. Financial statement users’ institutional logic. Journal of

Accounting and Public Policy. 40(2). p.106819.

Rengganis, R. M. Y. D. and et.al., 2019. The fraud diamond: element in detecting financial

statement of fraud. International research journal of management, IT and social

sciences. 6(3). pp.1-10.

Ali, M. J., Razzaque, R. M. and Ahmed, K., 2018. Real earnings management and financial

statement fraud: evidence from Malaysia. International Journal of Accounting &

Information Management.

Wang, Y., Yu, M. and Gao, S., 2021. Gender diversity and financial statement fraud. Journal of

Accounting and Public Policy, p.106903.

Easton, P. D. and et.al., 2018. Financial statement analysis & valuation. Boston, MA:

Cambridge Business Publishers.

Setyawati, I. and Amelia, R., 2018. The role of current ratio, operating cash flow and inflation

rate in predicting financial distress: Indonesia Stock Exchange. JDM (Jurnal Dinamika

Manajemen). 9(2). pp.140-148.

IŞILDAK, M. S., 2019. Investigation of the Effect of Financial Ratios on Market Value/Book

Value Ratio by Panel Data Analysis: Application in BİST Registered Weaving, Garment

and Leather Sector. Ekonomik Yaklasim. 30(111). pp.71-100.

11

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.