University Accounting Fundamentals Assignment Solution - Finance

VerifiedAdded on 2023/01/10

|17

|3038

|46

Homework Assignment

AI Summary

This document presents a comprehensive solution to an accounting fundamentals assignment, covering key concepts such as journal entries, trial balance, and financial statement preparation. The solution includes detailed explanations and calculations for depreciation, prepaid expenses, and bad debts. It also features a profit and loss account, balance sheet, and analysis of the importance of the final report to various stakeholders, including shareholders, financial institutions, managers, and others. Additionally, the assignment delves into the comparison and contrasting of liquidity and profitability, providing a clear understanding of these crucial financial metrics. The solution is designed to provide students with a thorough understanding of accounting principles and their practical application in financial analysis.

Accounting Fundamentals

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

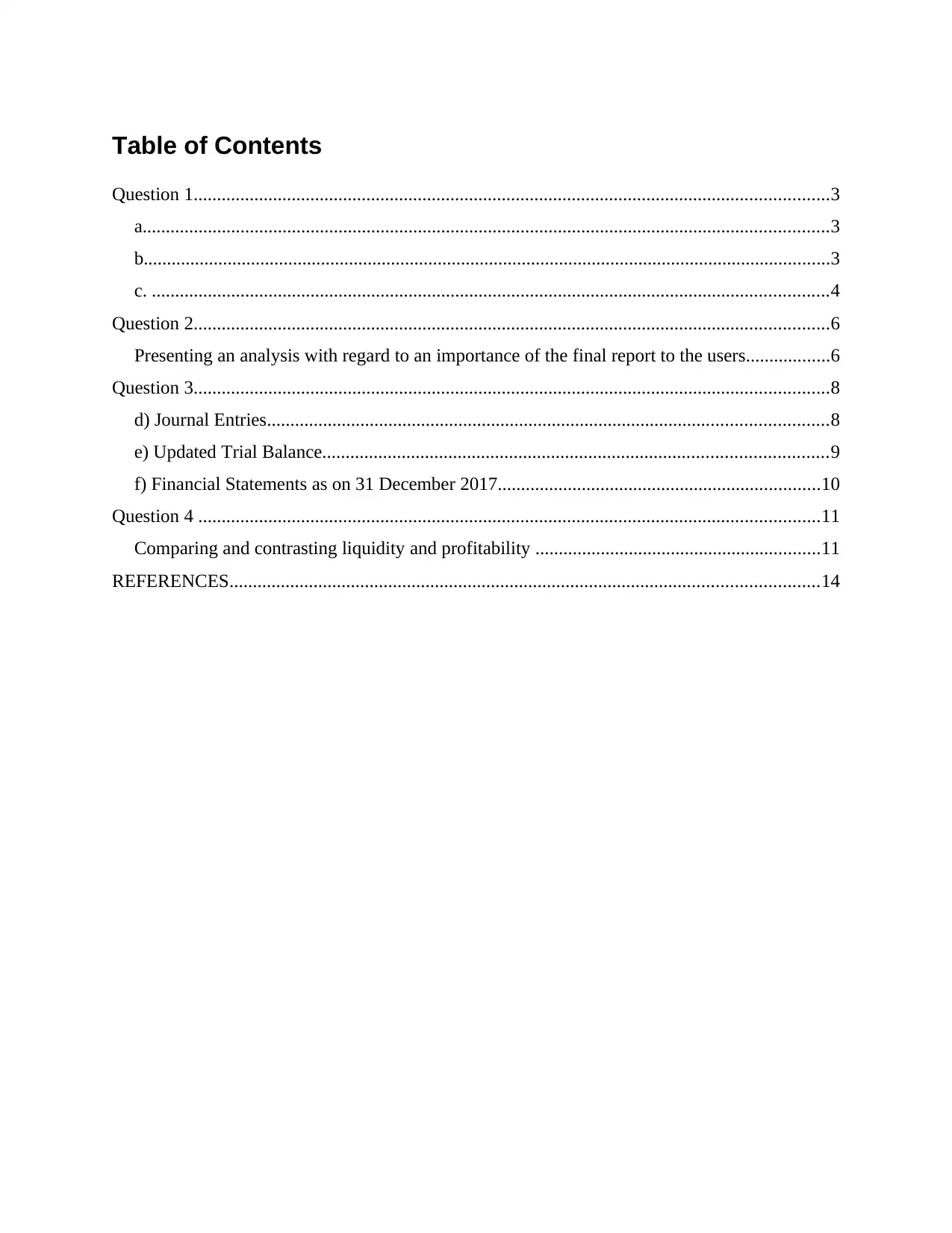

Table of Contents

Question 1........................................................................................................................................3

a...................................................................................................................................................3

b...................................................................................................................................................3

c. .................................................................................................................................................4

Question 2........................................................................................................................................6

Presenting an analysis with regard to an importance of the final report to the users..................6

Question 3........................................................................................................................................8

d) Journal Entries........................................................................................................................8

e) Updated Trial Balance............................................................................................................9

f) Financial Statements as on 31 December 2017.....................................................................10

Question 4 .....................................................................................................................................11

Comparing and contrasting liquidity and profitability .............................................................11

REFERENCES..............................................................................................................................14

Question 1........................................................................................................................................3

a...................................................................................................................................................3

b...................................................................................................................................................3

c. .................................................................................................................................................4

Question 2........................................................................................................................................6

Presenting an analysis with regard to an importance of the final report to the users..................6

Question 3........................................................................................................................................8

d) Journal Entries........................................................................................................................8

e) Updated Trial Balance............................................................................................................9

f) Financial Statements as on 31 December 2017.....................................................................10

Question 4 .....................................................................................................................................11

Comparing and contrasting liquidity and profitability .............................................................11

REFERENCES..............................................................................................................................14

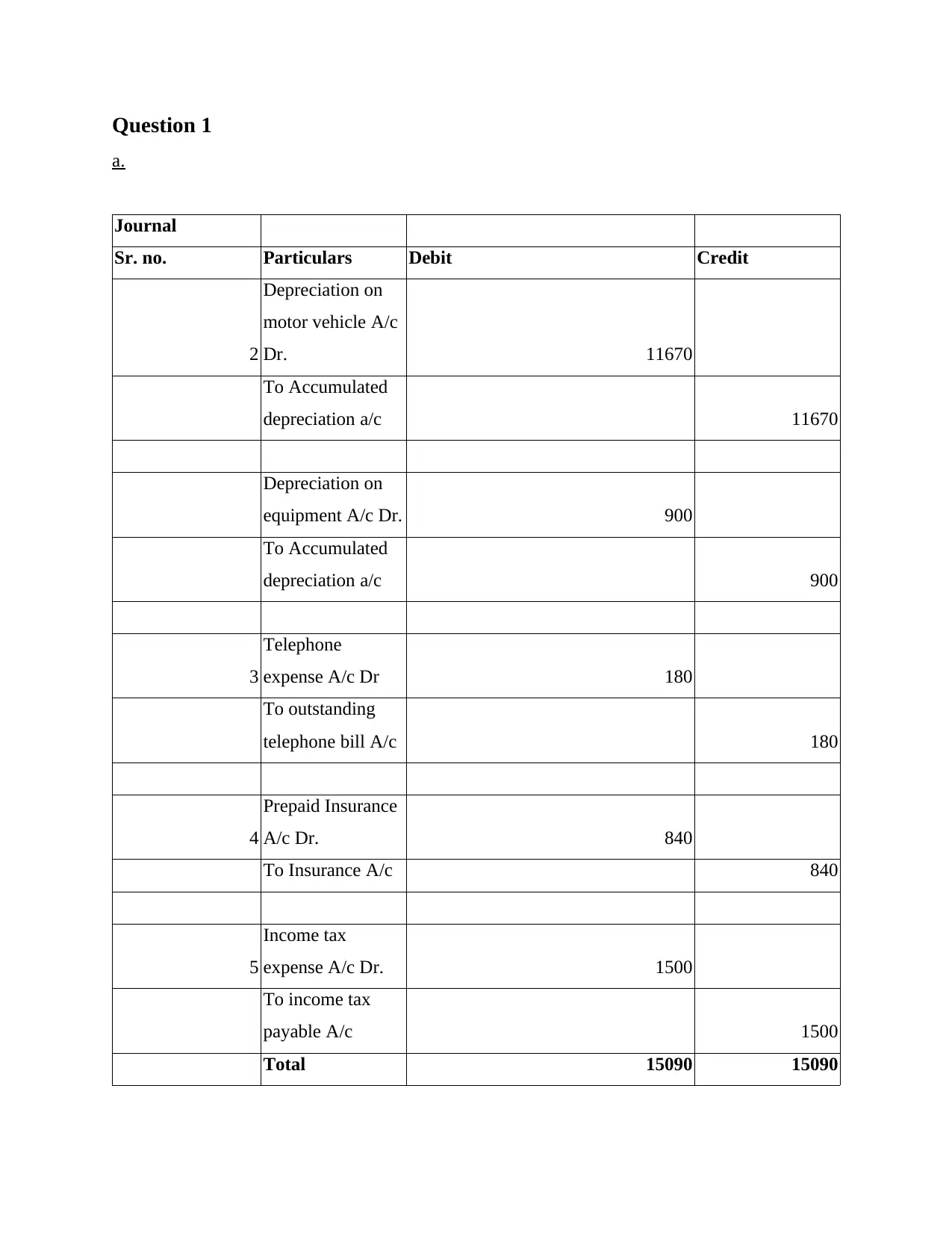

Question 1

a.

Journal

Sr. no. Particulars Debit Credit

2

Depreciation on

motor vehicle A/c

Dr. 11670

To Accumulated

depreciation a/c 11670

Depreciation on

equipment A/c Dr. 900

To Accumulated

depreciation a/c 900

3

Telephone

expense A/c Dr 180

To outstanding

telephone bill A/c 180

4

Prepaid Insurance

A/c Dr. 840

To Insurance A/c 840

5

Income tax

expense A/c Dr. 1500

To income tax

payable A/c 1500

Total 15090 15090

a.

Journal

Sr. no. Particulars Debit Credit

2

Depreciation on

motor vehicle A/c

Dr. 11670

To Accumulated

depreciation a/c 11670

Depreciation on

equipment A/c Dr. 900

To Accumulated

depreciation a/c 900

3

Telephone

expense A/c Dr 180

To outstanding

telephone bill A/c 180

4

Prepaid Insurance

A/c Dr. 840

To Insurance A/c 840

5

Income tax

expense A/c Dr. 1500

To income tax

payable A/c 1500

Total 15090 15090

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

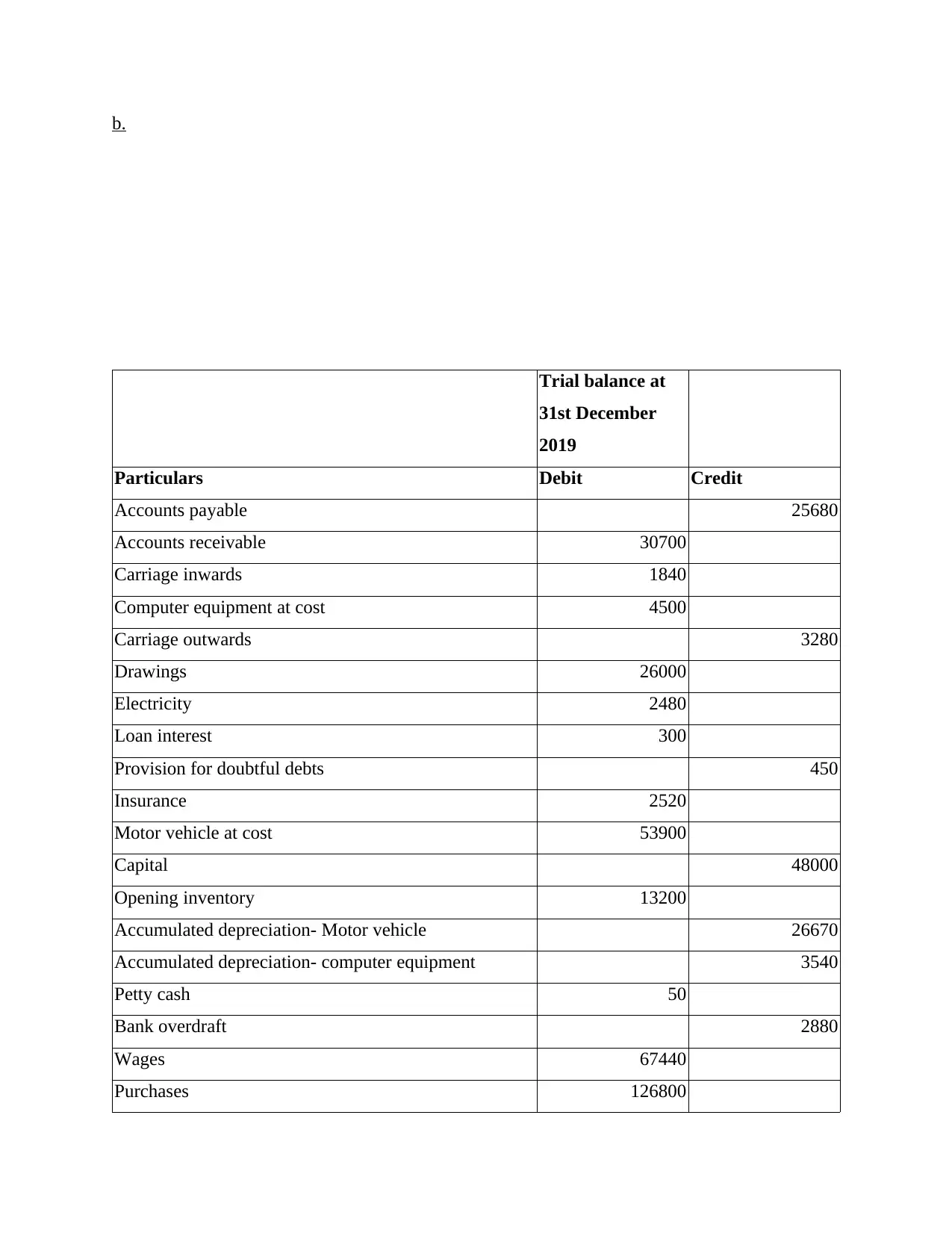

b.

Trial balance at

31st December

2019

Particulars Debit Credit

Accounts payable 25680

Accounts receivable 30700

Carriage inwards 1840

Computer equipment at cost 4500

Carriage outwards 3280

Drawings 26000

Electricity 2480

Loan interest 300

Provision for doubtful debts 450

Insurance 2520

Motor vehicle at cost 53900

Capital 48000

Opening inventory 13200

Accumulated depreciation- Motor vehicle 26670

Accumulated depreciation- computer equipment 3540

Petty cash 50

Bank overdraft 2880

Wages 67440

Purchases 126800

Trial balance at

31st December

2019

Particulars Debit Credit

Accounts payable 25680

Accounts receivable 30700

Carriage inwards 1840

Computer equipment at cost 4500

Carriage outwards 3280

Drawings 26000

Electricity 2480

Loan interest 300

Provision for doubtful debts 450

Insurance 2520

Motor vehicle at cost 53900

Capital 48000

Opening inventory 13200

Accumulated depreciation- Motor vehicle 26670

Accumulated depreciation- computer equipment 3540

Petty cash 50

Bank overdraft 2880

Wages 67440

Purchases 126800

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Rent 23760

Sales 256400

Telephone 1620

Long term loan 8000

Closing stock 14400

Income tax 1500

Prepaid insurance 840

Outstanding telephone 180

Income tax payable 1500

Total 376580 376580

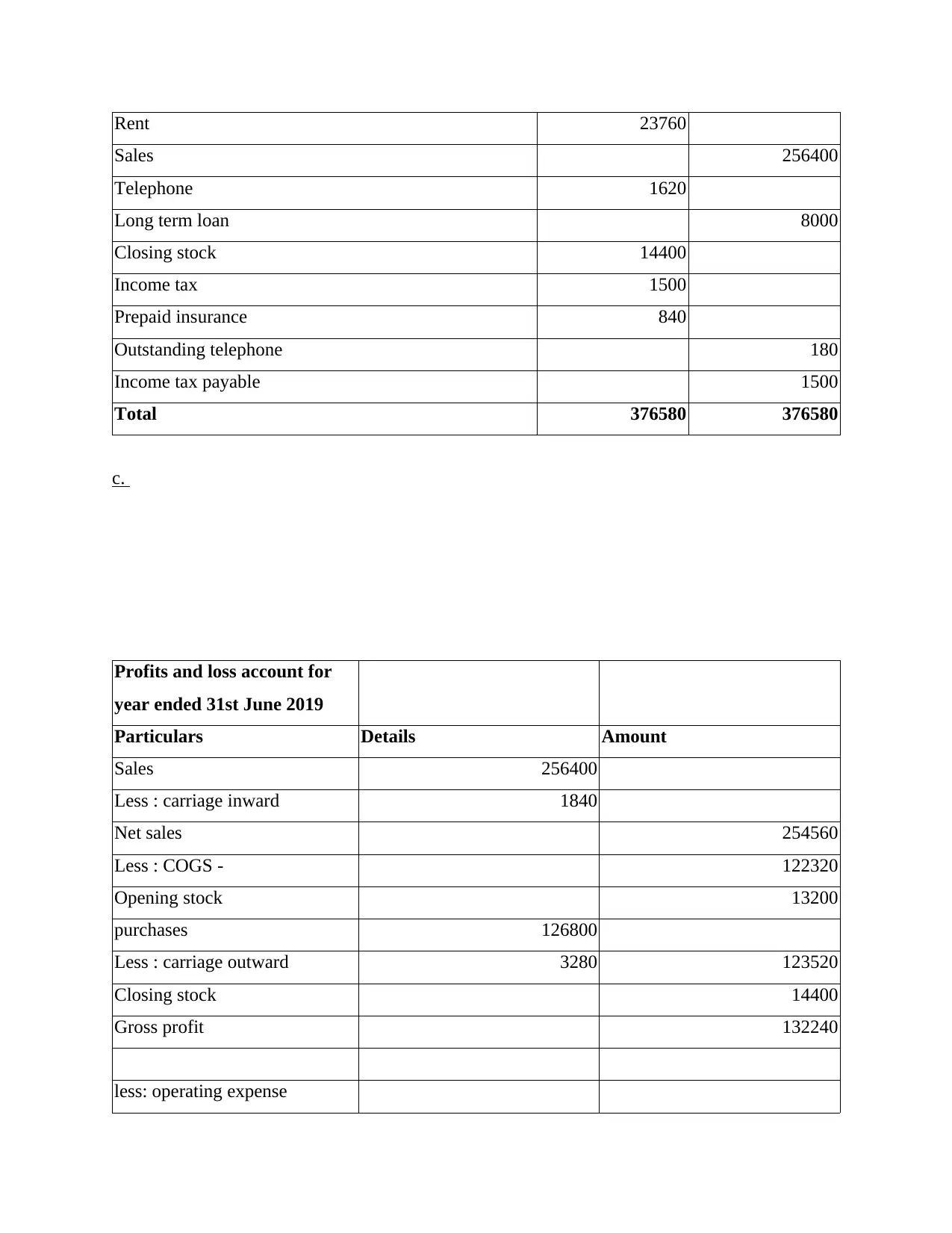

c.

Profits and loss account for

year ended 31st June 2019

Particulars Details Amount

Sales 256400

Less : carriage inward 1840

Net sales 254560

Less : COGS - 122320

Opening stock 13200

purchases 126800

Less : carriage outward 3280 123520

Closing stock 14400

Gross profit 132240

less: operating expense

Sales 256400

Telephone 1620

Long term loan 8000

Closing stock 14400

Income tax 1500

Prepaid insurance 840

Outstanding telephone 180

Income tax payable 1500

Total 376580 376580

c.

Profits and loss account for

year ended 31st June 2019

Particulars Details Amount

Sales 256400

Less : carriage inward 1840

Net sales 254560

Less : COGS - 122320

Opening stock 13200

purchases 126800

Less : carriage outward 3280 123520

Closing stock 14400

Gross profit 132240

less: operating expense

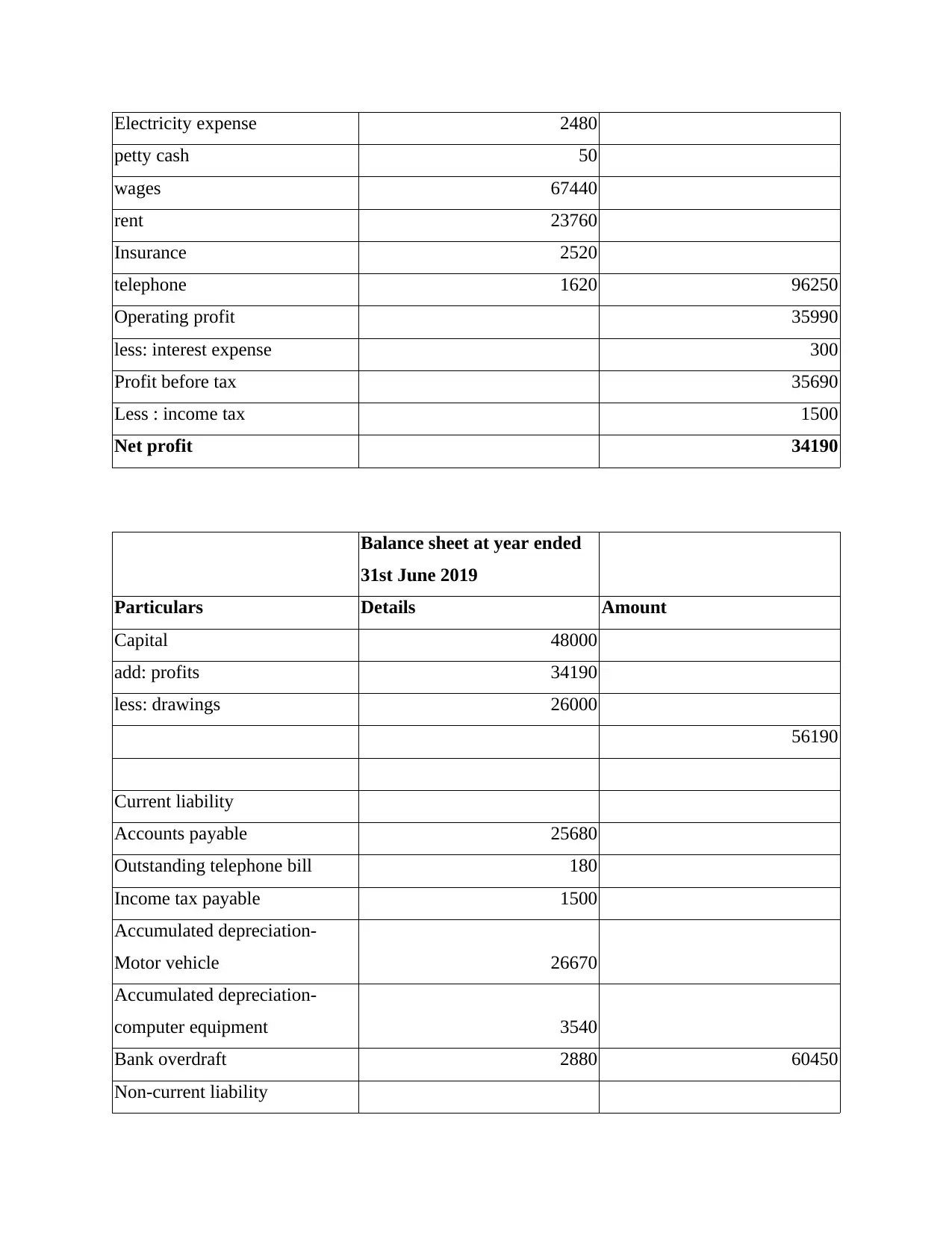

Electricity expense 2480

petty cash 50

wages 67440

rent 23760

Insurance 2520

telephone 1620 96250

Operating profit 35990

less: interest expense 300

Profit before tax 35690

Less : income tax 1500

Net profit 34190

Balance sheet at year ended

31st June 2019

Particulars Details Amount

Capital 48000

add: profits 34190

less: drawings 26000

56190

Current liability

Accounts payable 25680

Outstanding telephone bill 180

Income tax payable 1500

Accumulated depreciation-

Motor vehicle 26670

Accumulated depreciation-

computer equipment 3540

Bank overdraft 2880 60450

Non-current liability

petty cash 50

wages 67440

rent 23760

Insurance 2520

telephone 1620 96250

Operating profit 35990

less: interest expense 300

Profit before tax 35690

Less : income tax 1500

Net profit 34190

Balance sheet at year ended

31st June 2019

Particulars Details Amount

Capital 48000

add: profits 34190

less: drawings 26000

56190

Current liability

Accounts payable 25680

Outstanding telephone bill 180

Income tax payable 1500

Accumulated depreciation-

Motor vehicle 26670

Accumulated depreciation-

computer equipment 3540

Bank overdraft 2880 60450

Non-current liability

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

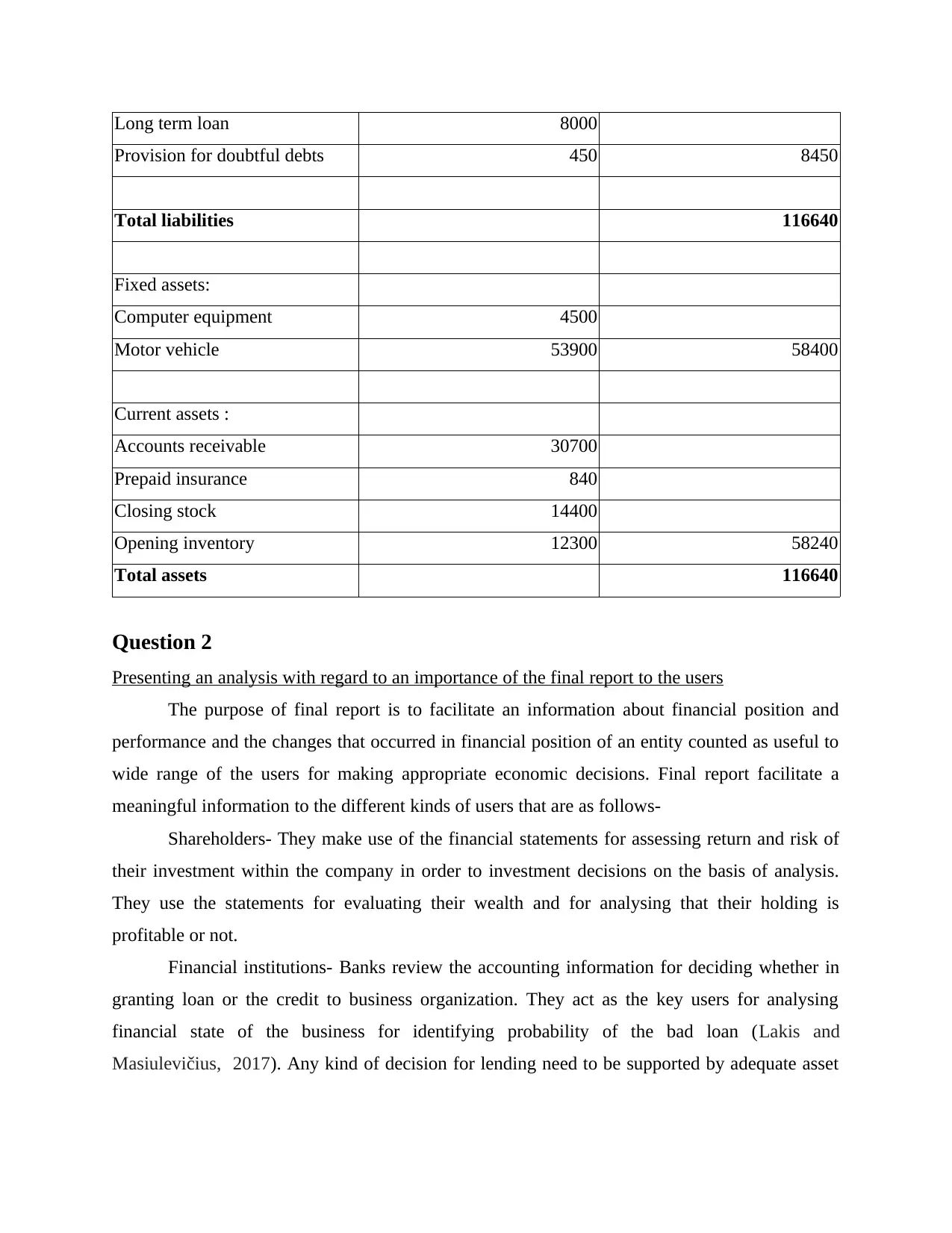

Long term loan 8000

Provision for doubtful debts 450 8450

Total liabilities 116640

Fixed assets:

Computer equipment 4500

Motor vehicle 53900 58400

Current assets :

Accounts receivable 30700

Prepaid insurance 840

Closing stock 14400

Opening inventory 12300 58240

Total assets 116640

Question 2

Presenting an analysis with regard to an importance of the final report to the users

The purpose of final report is to facilitate an information about financial position and

performance and the changes that occurred in financial position of an entity counted as useful to

wide range of the users for making appropriate economic decisions. Final report facilitate a

meaningful information to the different kinds of users that are as follows-

Shareholders- They make use of the financial statements for assessing return and risk of

their investment within the company in order to investment decisions on the basis of analysis.

They use the statements for evaluating their wealth and for analysing that their holding is

profitable or not.

Financial institutions- Banks review the accounting information for deciding whether in

granting loan or the credit to business organization. They act as the key users for analysing

financial state of the business for identifying probability of the bad loan (Lakis and

Masiulevičius, 2017). Any kind of decision for lending need to be supported by adequate asset

Provision for doubtful debts 450 8450

Total liabilities 116640

Fixed assets:

Computer equipment 4500

Motor vehicle 53900 58400

Current assets :

Accounts receivable 30700

Prepaid insurance 840

Closing stock 14400

Opening inventory 12300 58240

Total assets 116640

Question 2

Presenting an analysis with regard to an importance of the final report to the users

The purpose of final report is to facilitate an information about financial position and

performance and the changes that occurred in financial position of an entity counted as useful to

wide range of the users for making appropriate economic decisions. Final report facilitate a

meaningful information to the different kinds of users that are as follows-

Shareholders- They make use of the financial statements for assessing return and risk of

their investment within the company in order to investment decisions on the basis of analysis.

They use the statements for evaluating their wealth and for analysing that their holding is

profitable or not.

Financial institutions- Banks review the accounting information for deciding whether in

granting loan or the credit to business organization. They act as the key users for analysing

financial state of the business for identifying probability of the bad loan (Lakis and

Masiulevičius, 2017). Any kind of decision for lending need to be supported by adequate asset

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

base and the liquidity. This reporting helps the banking institution in anticipating an ability of

borrower in paying back the loaned funds and the related interest charges.

Managers- They need the financial information for managing routine affairs of the

corporation by analysing their financial performance & health so that they could be able to take

operational decisions in appropriate manner. They require such information for understanding

the liquidity, profitability and the cash flows of an entity for each and every month so that it

could make the financing & operational decisions regarding business.

Prospective investors- They are the main parties who need financial informations for

tracking the performance of their investment. They act as the owners of business and needs

accounting related data for deciding whether to invest or withdraw the investment made by them.

With the use of financial information an investor could assess the viability of the project and

might predict the future dividends on the basis of the profits disclosed or reported in the

statement. Furthermore, it also enables in determining the risk attached with an investment that

may gauged from final reports. For example- fluctuating profits reflects higher risk and

therefore, it provides as the basis for an investment decisions of the potential investors.

Suppliers- they need the information for analysing credit worthiness of the business and

in ascertaining whether to supply the goods on the credit terms or not. They require to know if

they would be repaid on time and that the credit terms are been set as per analysis of customer's

financial state. Thus, they would be requiring the statement for the purpose of deciding whether

it is safe for extending the credit to the firm or not.

Employees- They use the final report for computing the profitability of the company and

its conditions on the future remuneration and the security of job. An entity might elect for

facilitating its financial information to the employees with detailed explanation of the

information that a document contains. This could be used for increasing level of the employee

involvement and in understanding the business.

Customers- When the customer selects the supplier for major contracts, it needs to review

their final report initially for judging or measuring financial capability of the supplier for

remaining within the business for long enough in providing proper goods and services mandated

in a contract. This helps them to investigate whether the supplier is having adequate resources for

ensuring steady supply of the goods in the future. This specially vital or important where

consumers is more of dependent on the supplier for specialized element.

borrower in paying back the loaned funds and the related interest charges.

Managers- They need the financial information for managing routine affairs of the

corporation by analysing their financial performance & health so that they could be able to take

operational decisions in appropriate manner. They require such information for understanding

the liquidity, profitability and the cash flows of an entity for each and every month so that it

could make the financing & operational decisions regarding business.

Prospective investors- They are the main parties who need financial informations for

tracking the performance of their investment. They act as the owners of business and needs

accounting related data for deciding whether to invest or withdraw the investment made by them.

With the use of financial information an investor could assess the viability of the project and

might predict the future dividends on the basis of the profits disclosed or reported in the

statement. Furthermore, it also enables in determining the risk attached with an investment that

may gauged from final reports. For example- fluctuating profits reflects higher risk and

therefore, it provides as the basis for an investment decisions of the potential investors.

Suppliers- they need the information for analysing credit worthiness of the business and

in ascertaining whether to supply the goods on the credit terms or not. They require to know if

they would be repaid on time and that the credit terms are been set as per analysis of customer's

financial state. Thus, they would be requiring the statement for the purpose of deciding whether

it is safe for extending the credit to the firm or not.

Employees- They use the final report for computing the profitability of the company and

its conditions on the future remuneration and the security of job. An entity might elect for

facilitating its financial information to the employees with detailed explanation of the

information that a document contains. This could be used for increasing level of the employee

involvement and in understanding the business.

Customers- When the customer selects the supplier for major contracts, it needs to review

their final report initially for judging or measuring financial capability of the supplier for

remaining within the business for long enough in providing proper goods and services mandated

in a contract. This helps them to investigate whether the supplier is having adequate resources for

ensuring steady supply of the goods in the future. This specially vital or important where

consumers is more of dependent on the supplier for specialized element.

Public- They might have seen as interested in effects of the firm on an economy, local

community and an environment. They are the major users of company's financial information

because they are interested in knowing the performance of the firm in overall industry so that

they could buy the products of best performing entity and could determine the firm which is

leading in the market.

Competitors- They compare their financial health or performance with the rival company

for learning and developing the strategies in improving their competitiveness. This could help the

competitors in achieving the competitive edge or advantage against their respective rivalry

organizations. An entity that are competing against the business would attempt for gaining access

to its final report for the purpose of evaluating its financial condition. Knowledge that they gain

can change their competitive measures or the strategies.

Government- It is an external party who requires the accounting information for

identifying that the firm is working in compliance with all the rules and regulations and is paying

adequate taxable amount within the time frame or not. Through the use of final report they could

determine accuracy hos the tax that is declared in tax returns. They also keep a track on the

economic progress through an assessment of the final report of the business from different

segment of an economy.

Investment analyst- External analysts desires to see the final report for the purpose of

deciding whether they must recommend the security of an organization to their respective clients.

Rating agencies- This kind of rating agency would require a review of final report for the

purpose of giving credit rating to company as the whole or to their securities.

Unions- They need final report for evaluating an ability of the business in paying a

benefit and the compensation to union members to whom they represent.

Thus, these are the external and internal users who show a keen interest in the financial

information of the company in making the best possible decisions (Voss, 2019). Financial

reporting plays a crucial role for the stakeholders in calculating the performance of company. It

helps the management in communicating the previous success and the future business

expectation. It enables the business in making suitable decisions and helps in indicating the

tendencies & trends by showing the way in which an entity is gathering money and the rate at

which the creditors are been paid.

community and an environment. They are the major users of company's financial information

because they are interested in knowing the performance of the firm in overall industry so that

they could buy the products of best performing entity and could determine the firm which is

leading in the market.

Competitors- They compare their financial health or performance with the rival company

for learning and developing the strategies in improving their competitiveness. This could help the

competitors in achieving the competitive edge or advantage against their respective rivalry

organizations. An entity that are competing against the business would attempt for gaining access

to its final report for the purpose of evaluating its financial condition. Knowledge that they gain

can change their competitive measures or the strategies.

Government- It is an external party who requires the accounting information for

identifying that the firm is working in compliance with all the rules and regulations and is paying

adequate taxable amount within the time frame or not. Through the use of final report they could

determine accuracy hos the tax that is declared in tax returns. They also keep a track on the

economic progress through an assessment of the final report of the business from different

segment of an economy.

Investment analyst- External analysts desires to see the final report for the purpose of

deciding whether they must recommend the security of an organization to their respective clients.

Rating agencies- This kind of rating agency would require a review of final report for the

purpose of giving credit rating to company as the whole or to their securities.

Unions- They need final report for evaluating an ability of the business in paying a

benefit and the compensation to union members to whom they represent.

Thus, these are the external and internal users who show a keen interest in the financial

information of the company in making the best possible decisions (Voss, 2019). Financial

reporting plays a crucial role for the stakeholders in calculating the performance of company. It

helps the management in communicating the previous success and the future business

expectation. It enables the business in making suitable decisions and helps in indicating the

tendencies & trends by showing the way in which an entity is gathering money and the rate at

which the creditors are been paid.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

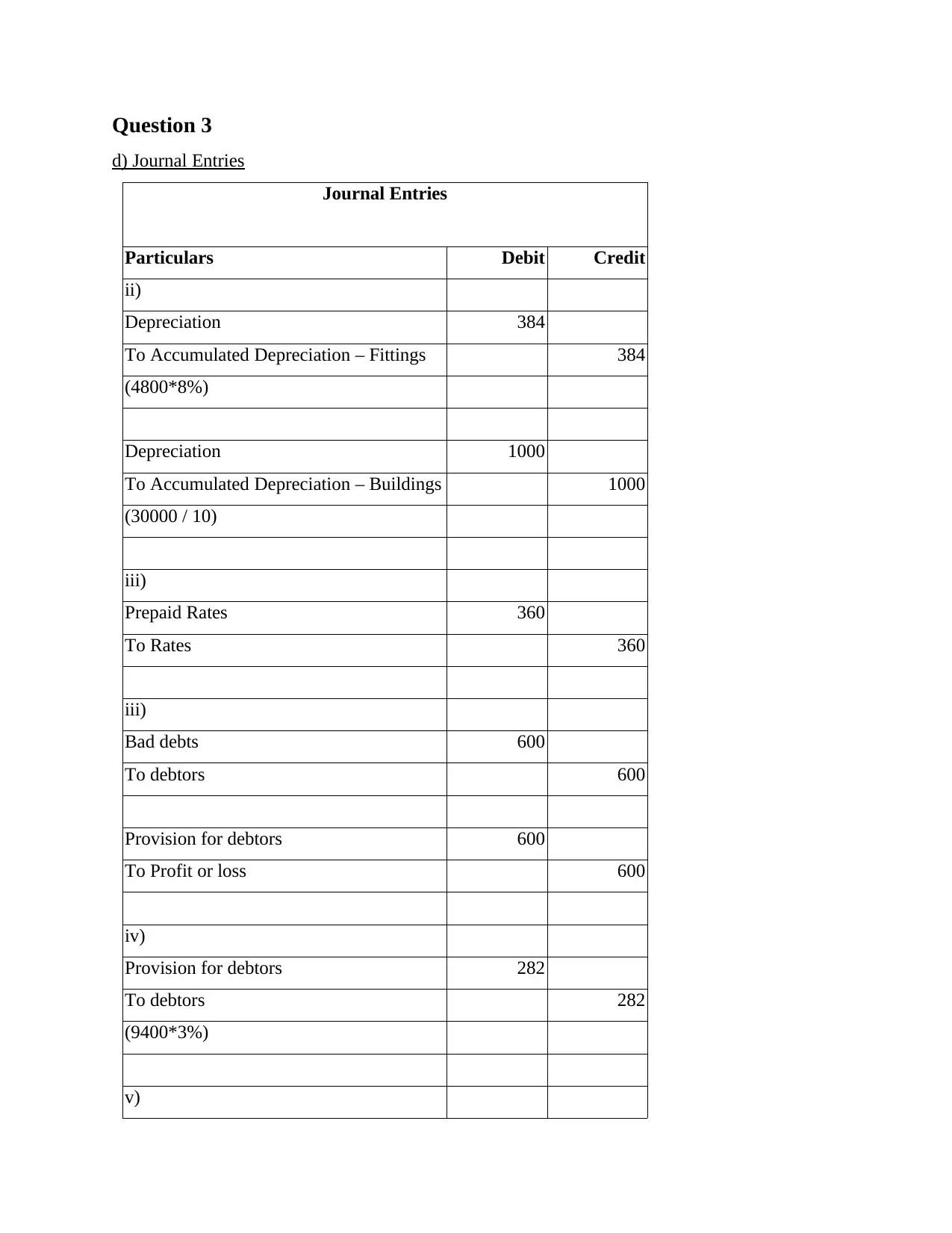

Question 3

d) Journal Entries

Journal Entries

Particulars Debit Credit

ii)

Depreciation 384

To Accumulated Depreciation – Fittings 384

(4800*8%)

Depreciation 1000

To Accumulated Depreciation – Buildings 1000

(30000 / 10)

iii)

Prepaid Rates 360

To Rates 360

iii)

Bad debts 600

To debtors 600

Provision for debtors 600

To Profit or loss 600

iv)

Provision for debtors 282

To debtors 282

(9400*3%)

v)

d) Journal Entries

Journal Entries

Particulars Debit Credit

ii)

Depreciation 384

To Accumulated Depreciation – Fittings 384

(4800*8%)

Depreciation 1000

To Accumulated Depreciation – Buildings 1000

(30000 / 10)

iii)

Prepaid Rates 360

To Rates 360

iii)

Bad debts 600

To debtors 600

Provision for debtors 600

To Profit or loss 600

iv)

Provision for debtors 282

To debtors 282

(9400*3%)

v)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Drawings 250

To Cash 250

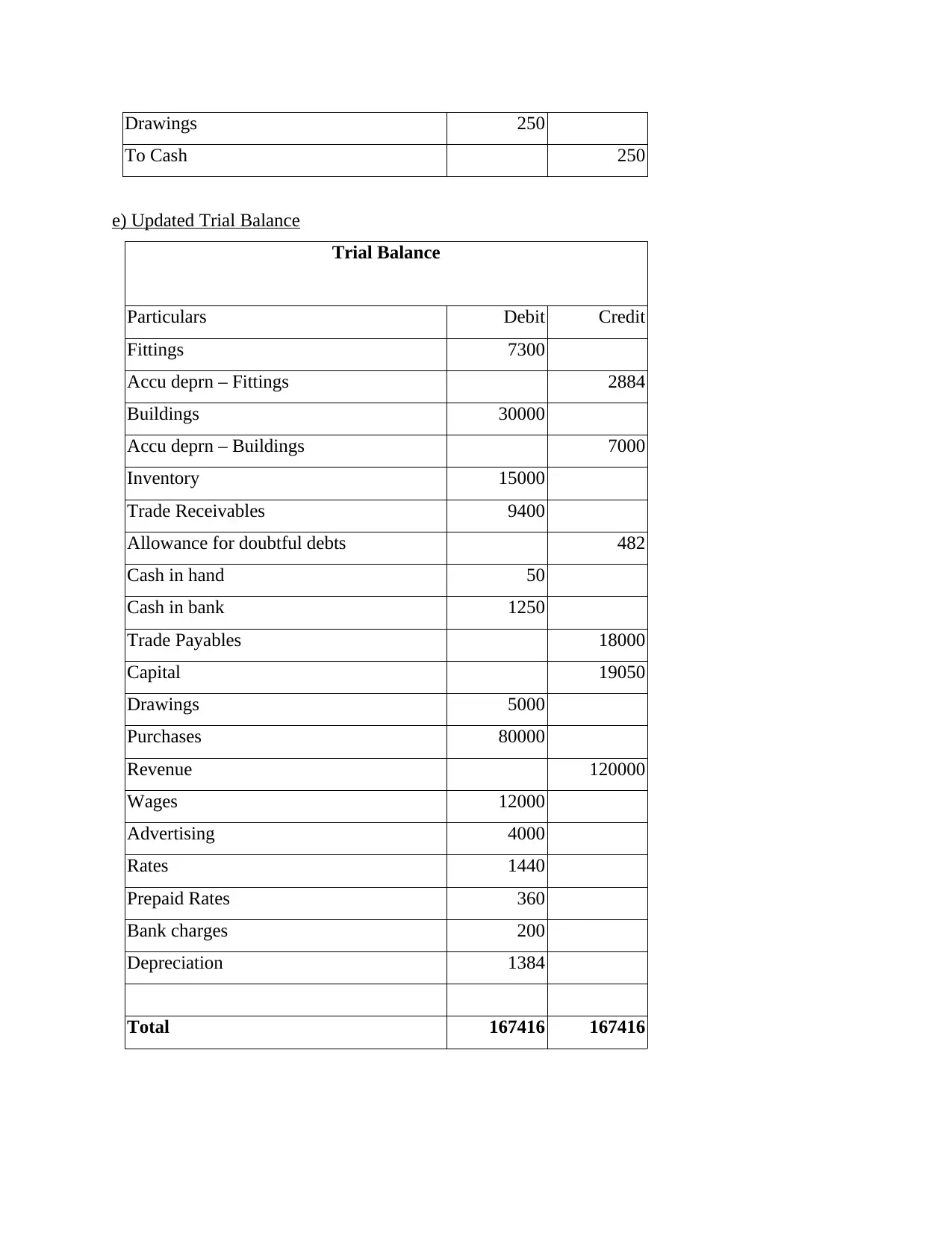

e) Updated Trial Balance

Trial Balance

Particulars Debit Credit

Fittings 7300

Accu deprn – Fittings 2884

Buildings 30000

Accu deprn – Buildings 7000

Inventory 15000

Trade Receivables 9400

Allowance for doubtful debts 482

Cash in hand 50

Cash in bank 1250

Trade Payables 18000

Capital 19050

Drawings 5000

Purchases 80000

Revenue 120000

Wages 12000

Advertising 4000

Rates 1440

Prepaid Rates 360

Bank charges 200

Depreciation 1384

Total 167416 167416

To Cash 250

e) Updated Trial Balance

Trial Balance

Particulars Debit Credit

Fittings 7300

Accu deprn – Fittings 2884

Buildings 30000

Accu deprn – Buildings 7000

Inventory 15000

Trade Receivables 9400

Allowance for doubtful debts 482

Cash in hand 50

Cash in bank 1250

Trade Payables 18000

Capital 19050

Drawings 5000

Purchases 80000

Revenue 120000

Wages 12000

Advertising 4000

Rates 1440

Prepaid Rates 360

Bank charges 200

Depreciation 1384

Total 167416 167416

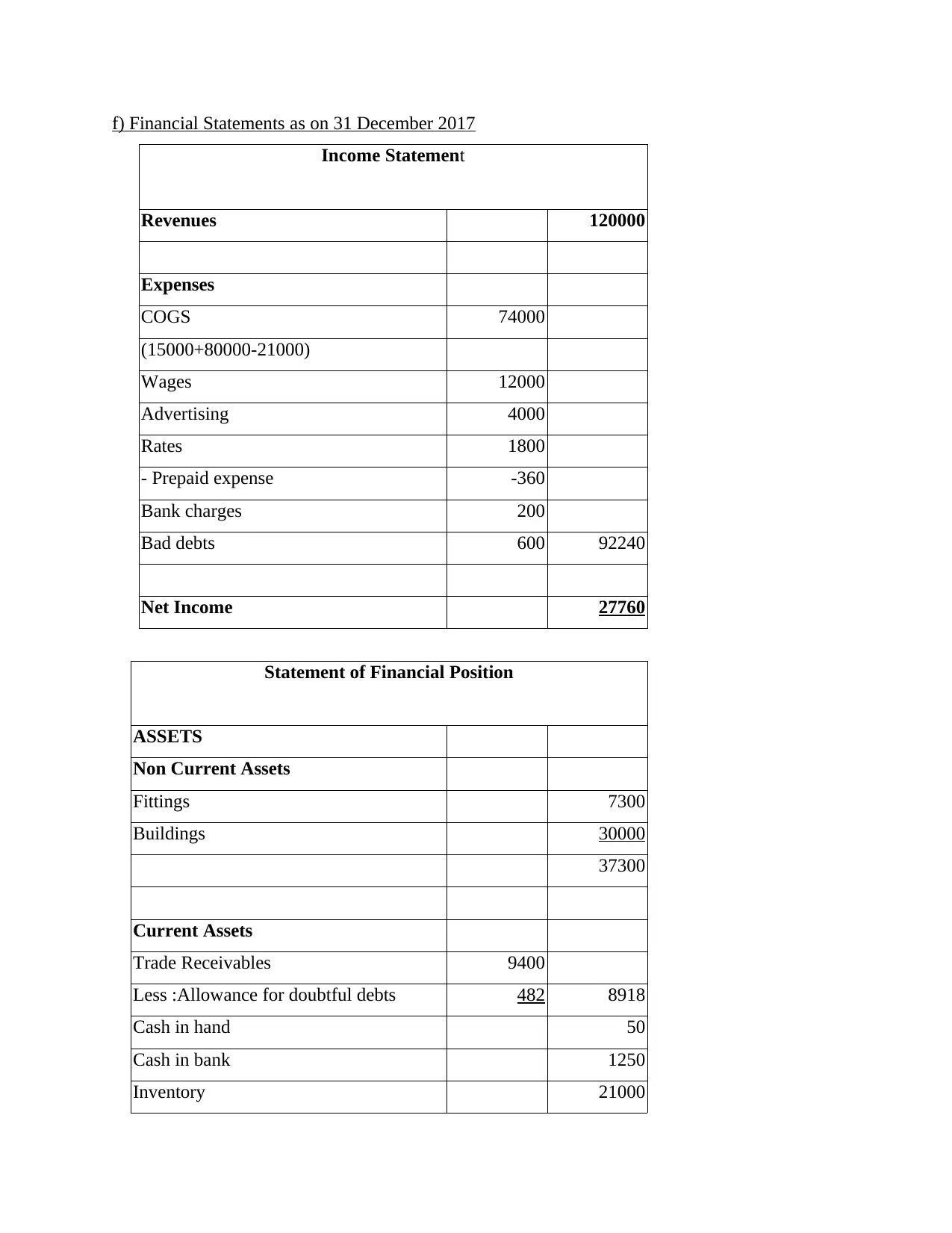

f) Financial Statements as on 31 December 2017

Income Statement

Revenues 120000

Expenses

COGS 74000

(15000+80000-21000)

Wages 12000

Advertising 4000

Rates 1800

- Prepaid expense -360

Bank charges 200

Bad debts 600 92240

Net Income 27760

Statement of Financial Position

ASSETS

Non Current Assets

Fittings 7300

Buildings 30000

37300

Current Assets

Trade Receivables 9400

Less :Allowance for doubtful debts 482 8918

Cash in hand 50

Cash in bank 1250

Inventory 21000

Income Statement

Revenues 120000

Expenses

COGS 74000

(15000+80000-21000)

Wages 12000

Advertising 4000

Rates 1800

- Prepaid expense -360

Bank charges 200

Bad debts 600 92240

Net Income 27760

Statement of Financial Position

ASSETS

Non Current Assets

Fittings 7300

Buildings 30000

37300

Current Assets

Trade Receivables 9400

Less :Allowance for doubtful debts 482 8918

Cash in hand 50

Cash in bank 1250

Inventory 21000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.