Financial Statement Analysis: Accounting Fundamentals Report for 2019

VerifiedAdded on 2023/01/09

|14

|3756

|76

Report

AI Summary

This report provides a detailed analysis of accounting fundamentals, including the preparation and interpretation of financial statements. It begins with the presentation of an income statement and a statement of financial position for Wales plc, demonstrating the application of accounting principles. The report then delves into a comprehensive ratio analysis for Jerry plc, comparing financial performance for 2018 and 2019. It calculates and interprets key ratios such as Return on Capital Employed (ROCE), Return on Equity (ROE), Earnings per Share (EPS), Gross Profit Margin, Asset Turnover Ratio, Stock Holding Period, Debtors Collection Period, Current Ratio, and Gearing Ratio. The analysis reveals trends, strengths, and weaknesses in Jerry plc's financial health. Furthermore, the report discusses the different user groups of company accounts, explaining their interests in the financial information provided, and evaluates the advantages, disadvantages, and limitations of a highly regulated financial reporting regime from the perspectives of both users and preparers of financial statements.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

QUESTION 1..................................................................................................................................1

Income Statement of the Wales plc for the year ended 31st December 2019..............................1

Statement of the financial position of Wales plc for the year ended 31st December 2019..........1

QUESTION 2..................................................................................................................................2

a) Calculation of Ratios for Jerry plc for year 2019 and 2018....................................................2

b) Situation revealed by ratio analysis.........................................................................................4

QUESTION 3..................................................................................................................................7

a) Different user groups of the company accounts and discussing why the user groups are

interested in information provided in the financial statements....................................................7

b) Discuss advantages and disadvantages of the highly regulated financial reporting regime.

From the perspective of users and preparer of financial statements............................................9

c) Limitations of the financial statements..................................................................................10

REFERENCES..............................................................................................................................11

TABLE OF CONTENTS................................................................................................................2

QUESTION 1..................................................................................................................................1

Income Statement of the Wales plc for the year ended 31st December 2019..............................1

Statement of the financial position of Wales plc for the year ended 31st December 2019..........1

QUESTION 2..................................................................................................................................2

a) Calculation of Ratios for Jerry plc for year 2019 and 2018....................................................2

b) Situation revealed by ratio analysis.........................................................................................4

QUESTION 3..................................................................................................................................7

a) Different user groups of the company accounts and discussing why the user groups are

interested in information provided in the financial statements....................................................7

b) Discuss advantages and disadvantages of the highly regulated financial reporting regime.

From the perspective of users and preparer of financial statements............................................9

c) Limitations of the financial statements..................................................................................10

REFERENCES..............................................................................................................................11

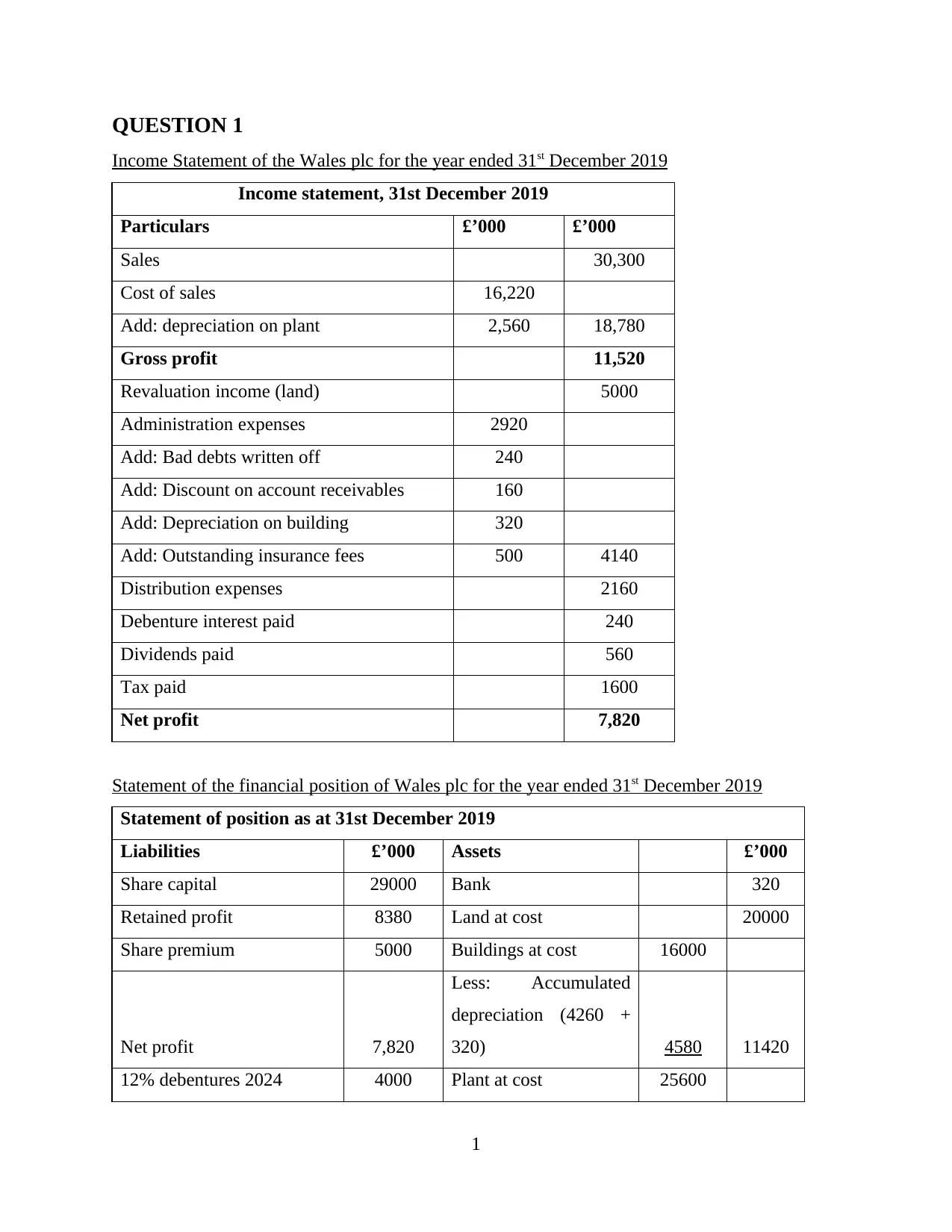

QUESTION 1

Income Statement of the Wales plc for the year ended 31st December 2019

Income statement, 31st December 2019

Particulars £’000 £’000

Sales 30,300

Cost of sales 16,220

Add: depreciation on plant 2,560 18,780

Gross profit 11,520

Revaluation income (land) 5000

Administration expenses 2920

Add: Bad debts written off 240

Add: Discount on account receivables 160

Add: Depreciation on building 320

Add: Outstanding insurance fees 500 4140

Distribution expenses 2160

Debenture interest paid 240

Dividends paid 560

Tax paid 1600

Net profit 7,820

Statement of the financial position of Wales plc for the year ended 31st December 2019

Statement of position as at 31st December 2019

Liabilities £’000 Assets £’000

Share capital 29000 Bank 320

Retained profit 8380 Land at cost 20000

Share premium 5000 Buildings at cost 16000

Net profit 7,820

Less: Accumulated

depreciation (4260 +

320) 4580 11420

12% debentures 2024 4000 Plant at cost 25600

1

Income Statement of the Wales plc for the year ended 31st December 2019

Income statement, 31st December 2019

Particulars £’000 £’000

Sales 30,300

Cost of sales 16,220

Add: depreciation on plant 2,560 18,780

Gross profit 11,520

Revaluation income (land) 5000

Administration expenses 2920

Add: Bad debts written off 240

Add: Discount on account receivables 160

Add: Depreciation on building 320

Add: Outstanding insurance fees 500 4140

Distribution expenses 2160

Debenture interest paid 240

Dividends paid 560

Tax paid 1600

Net profit 7,820

Statement of the financial position of Wales plc for the year ended 31st December 2019

Statement of position as at 31st December 2019

Liabilities £’000 Assets £’000

Share capital 29000 Bank 320

Retained profit 8380 Land at cost 20000

Share premium 5000 Buildings at cost 16000

Net profit 7,820

Less: Accumulated

depreciation (4260 +

320) 4580 11420

12% debentures 2024 4000 Plant at cost 25600

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Outstanding insurance fees 500

Less: Accumulated

depreciation (4960 +

2560) 7520 18080

Trade payables 4480

Trade receivables

(8240-240- 160) 7840

Income tax liability 1600 Inventory 3120

Total liabilities 60780 Total assets 60780

Workings

Working note

Building cost 16000

Depreciation (2% * 16000) 320

Plant cost 25600

Depreciation (10% * 25600) 2560

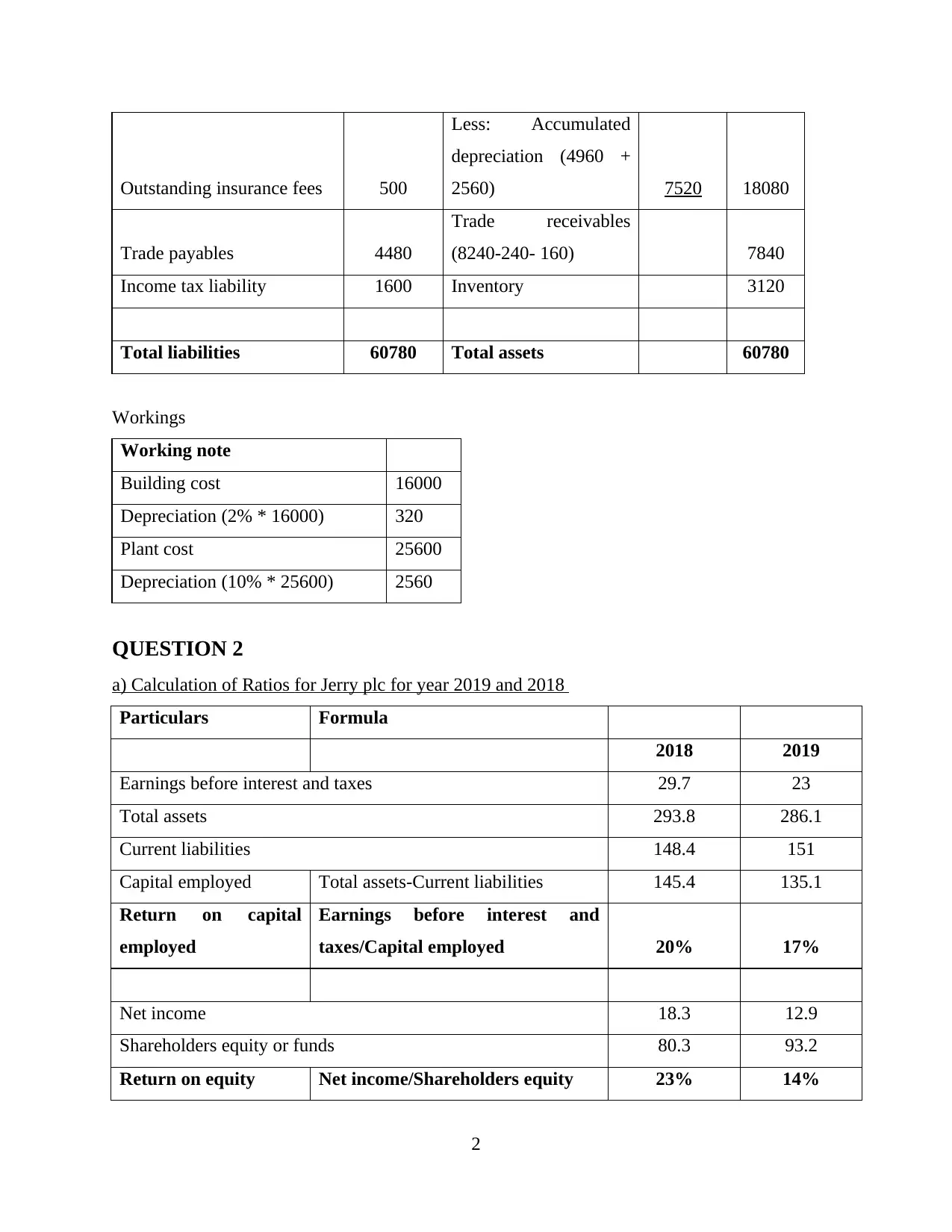

QUESTION 2

a) Calculation of Ratios for Jerry plc for year 2019 and 2018

Particulars Formula

2018 2019

Earnings before interest and taxes 29.7 23

Total assets 293.8 286.1

Current liabilities 148.4 151

Capital employed Total assets-Current liabilities 145.4 135.1

Return on capital

employed

Earnings before interest and

taxes/Capital employed 20% 17%

Net income 18.3 12.9

Shareholders equity or funds 80.3 93.2

Return on equity Net income/Shareholders equity 23% 14%

2

Less: Accumulated

depreciation (4960 +

2560) 7520 18080

Trade payables 4480

Trade receivables

(8240-240- 160) 7840

Income tax liability 1600 Inventory 3120

Total liabilities 60780 Total assets 60780

Workings

Working note

Building cost 16000

Depreciation (2% * 16000) 320

Plant cost 25600

Depreciation (10% * 25600) 2560

QUESTION 2

a) Calculation of Ratios for Jerry plc for year 2019 and 2018

Particulars Formula

2018 2019

Earnings before interest and taxes 29.7 23

Total assets 293.8 286.1

Current liabilities 148.4 151

Capital employed Total assets-Current liabilities 145.4 135.1

Return on capital

employed

Earnings before interest and

taxes/Capital employed 20% 17%

Net income 18.3 12.9

Shareholders equity or funds 80.3 93.2

Return on equity Net income/Shareholders equity 23% 14%

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

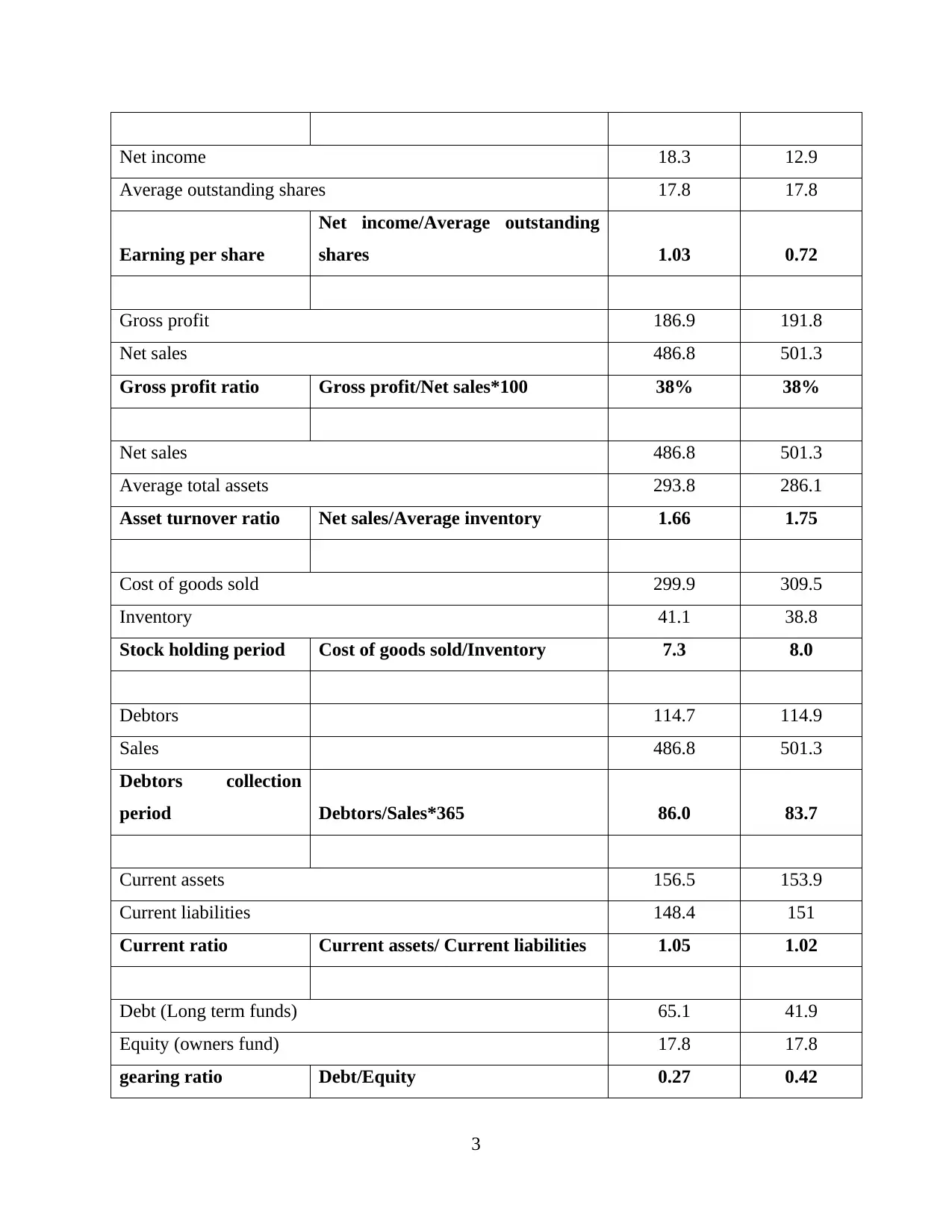

Net income 18.3 12.9

Average outstanding shares 17.8 17.8

Earning per share

Net income/Average outstanding

shares 1.03 0.72

Gross profit 186.9 191.8

Net sales 486.8 501.3

Gross profit ratio Gross profit/Net sales*100 38% 38%

Net sales 486.8 501.3

Average total assets 293.8 286.1

Asset turnover ratio Net sales/Average inventory 1.66 1.75

Cost of goods sold 299.9 309.5

Inventory 41.1 38.8

Stock holding period Cost of goods sold/Inventory 7.3 8.0

Debtors 114.7 114.9

Sales 486.8 501.3

Debtors collection

period Debtors/Sales*365 86.0 83.7

Current assets 156.5 153.9

Current liabilities 148.4 151

Current ratio Current assets/ Current liabilities 1.05 1.02

Debt (Long term funds) 65.1 41.9

Equity (owners fund) 17.8 17.8

gearing ratio Debt/Equity 0.27 0.42

3

Average outstanding shares 17.8 17.8

Earning per share

Net income/Average outstanding

shares 1.03 0.72

Gross profit 186.9 191.8

Net sales 486.8 501.3

Gross profit ratio Gross profit/Net sales*100 38% 38%

Net sales 486.8 501.3

Average total assets 293.8 286.1

Asset turnover ratio Net sales/Average inventory 1.66 1.75

Cost of goods sold 299.9 309.5

Inventory 41.1 38.8

Stock holding period Cost of goods sold/Inventory 7.3 8.0

Debtors 114.7 114.9

Sales 486.8 501.3

Debtors collection

period Debtors/Sales*365 86.0 83.7

Current assets 156.5 153.9

Current liabilities 148.4 151

Current ratio Current assets/ Current liabilities 1.05 1.02

Debt (Long term funds) 65.1 41.9

Equity (owners fund) 17.8 17.8

gearing ratio Debt/Equity 0.27 0.42

3

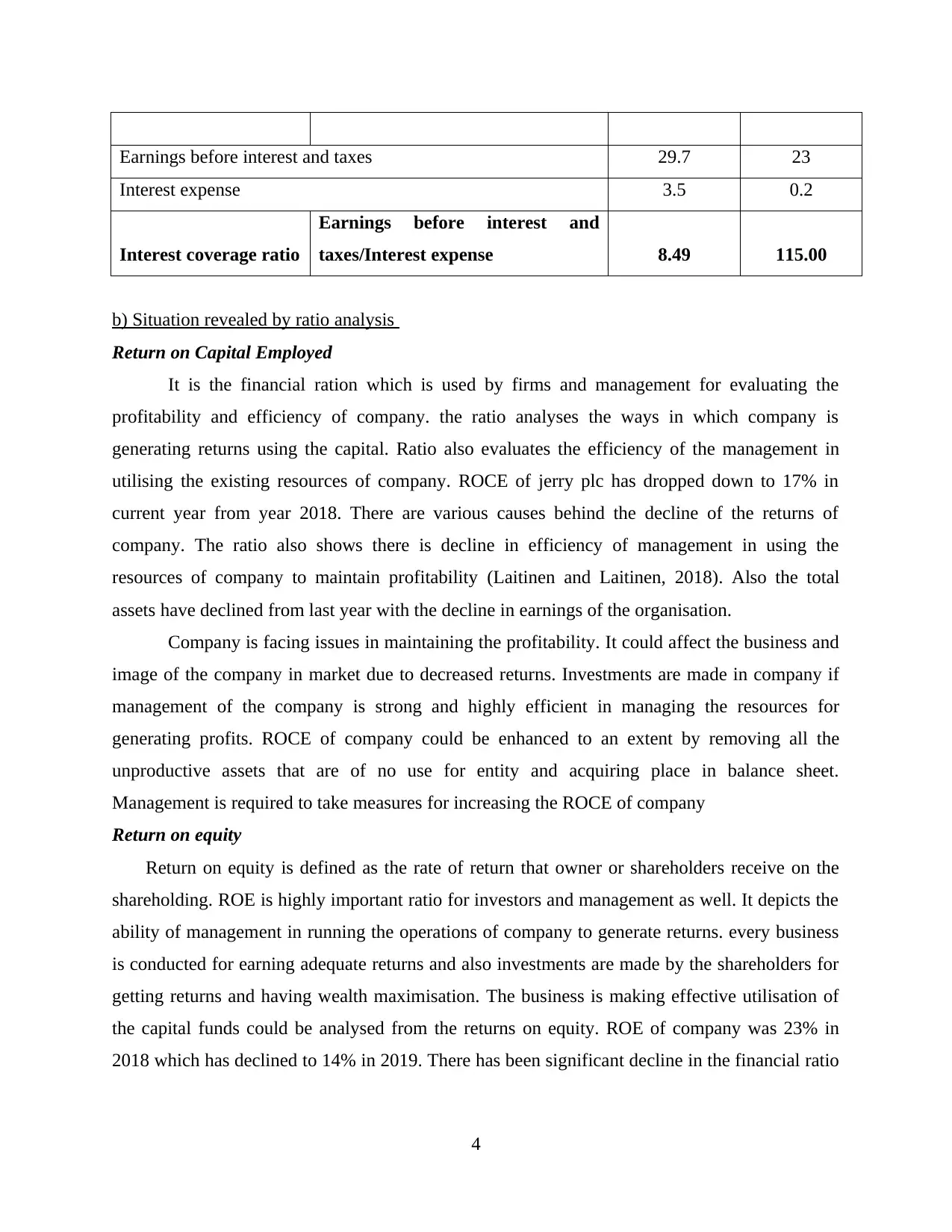

Earnings before interest and taxes 29.7 23

Interest expense 3.5 0.2

Interest coverage ratio

Earnings before interest and

taxes/Interest expense 8.49 115.00

b) Situation revealed by ratio analysis

Return on Capital Employed

It is the financial ration which is used by firms and management for evaluating the

profitability and efficiency of company. the ratio analyses the ways in which company is

generating returns using the capital. Ratio also evaluates the efficiency of the management in

utilising the existing resources of company. ROCE of jerry plc has dropped down to 17% in

current year from year 2018. There are various causes behind the decline of the returns of

company. The ratio also shows there is decline in efficiency of management in using the

resources of company to maintain profitability (Laitinen and Laitinen, 2018). Also the total

assets have declined from last year with the decline in earnings of the organisation.

Company is facing issues in maintaining the profitability. It could affect the business and

image of the company in market due to decreased returns. Investments are made in company if

management of the company is strong and highly efficient in managing the resources for

generating profits. ROCE of company could be enhanced to an extent by removing all the

unproductive assets that are of no use for entity and acquiring place in balance sheet.

Management is required to take measures for increasing the ROCE of company

Return on equity

Return on equity is defined as the rate of return that owner or shareholders receive on the

shareholding. ROE is highly important ratio for investors and management as well. It depicts the

ability of management in running the operations of company to generate returns. every business

is conducted for earning adequate returns and also investments are made by the shareholders for

getting returns and having wealth maximisation. The business is making effective utilisation of

the capital funds could be analysed from the returns on equity. ROE of company was 23% in

2018 which has declined to 14% in 2019. There has been significant decline in the financial ratio

4

Interest expense 3.5 0.2

Interest coverage ratio

Earnings before interest and

taxes/Interest expense 8.49 115.00

b) Situation revealed by ratio analysis

Return on Capital Employed

It is the financial ration which is used by firms and management for evaluating the

profitability and efficiency of company. the ratio analyses the ways in which company is

generating returns using the capital. Ratio also evaluates the efficiency of the management in

utilising the existing resources of company. ROCE of jerry plc has dropped down to 17% in

current year from year 2018. There are various causes behind the decline of the returns of

company. The ratio also shows there is decline in efficiency of management in using the

resources of company to maintain profitability (Laitinen and Laitinen, 2018). Also the total

assets have declined from last year with the decline in earnings of the organisation.

Company is facing issues in maintaining the profitability. It could affect the business and

image of the company in market due to decreased returns. Investments are made in company if

management of the company is strong and highly efficient in managing the resources for

generating profits. ROCE of company could be enhanced to an extent by removing all the

unproductive assets that are of no use for entity and acquiring place in balance sheet.

Management is required to take measures for increasing the ROCE of company

Return on equity

Return on equity is defined as the rate of return that owner or shareholders receive on the

shareholding. ROE is highly important ratio for investors and management as well. It depicts the

ability of management in running the operations of company to generate returns. every business

is conducted for earning adequate returns and also investments are made by the shareholders for

getting returns and having wealth maximisation. The business is making effective utilisation of

the capital funds could be analysed from the returns on equity. ROE of company was 23% in

2018 which has declined to 14% in 2019. There has been significant decline in the financial ratio

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

from last year. in current year company has raised new equity funds where the profits have

declined from last year which has caused the ratio to fall with significant change.

It is highly important for the company to raise the return over equity for maintaining the

market image. Falling returns is cause of concern and management is required to pay attention to

stop the falling returns by framing strategies and taking measures to increase the profitability of

company (Husain and Sunardi, 2020). If investors are not getting requires returns on their

investment they may withdraw their holding causing the prices of the shares to fall further

decreasing the market cap of company.

Earning per share

Earning per share is the investor ratio used for assessing the earnings over each share of

the company. Earnings per share are derived by dividing the net income available with the

company after meeting all the expenses and cost of running company. In year 2018 EPS of

company was 1.03 where in 2019 EPS was 0.72. EPS of company has declined from last year

due to decrease in the profits. It could be analysed that the company has not issued any shares in

the year however the profits have declined significantly from last year. The decline shows that

management has to become active and increase its efforts for increasing the returns and profits

for achieving the desired goals and business. Companies having lower EPS are generally not

considered by investors as good investments as they are not capable of providing the returns over

their investments (Laitinen, 2017). High earnings are essential for the business for the growth

and progress in the market from the current and existing levels.

Gross profit margins

It is the profitability ratio which is used for assessing management efficiency in managing

the costs and production activities. Gross profit is the amount left with company after meeting all

the costs and expenses related to the production activities. A company must have higher gross

profit so that it could meet the further operational cost of operating the business efficiently. Over

the two years gross profit margin of company has remained at 38%. The gross profit margin of

company is adequate but should be increased further by applying more effective cost efficient

strategies that enables management to decrease cost of products. Revenues of company have

raised and the cost has also increased in the same proportion. This shows there was only increase

in variable costs in the production of goods. Company is required to establish promotional

5

declined from last year which has caused the ratio to fall with significant change.

It is highly important for the company to raise the return over equity for maintaining the

market image. Falling returns is cause of concern and management is required to pay attention to

stop the falling returns by framing strategies and taking measures to increase the profitability of

company (Husain and Sunardi, 2020). If investors are not getting requires returns on their

investment they may withdraw their holding causing the prices of the shares to fall further

decreasing the market cap of company.

Earning per share

Earning per share is the investor ratio used for assessing the earnings over each share of

the company. Earnings per share are derived by dividing the net income available with the

company after meeting all the expenses and cost of running company. In year 2018 EPS of

company was 1.03 where in 2019 EPS was 0.72. EPS of company has declined from last year

due to decrease in the profits. It could be analysed that the company has not issued any shares in

the year however the profits have declined significantly from last year. The decline shows that

management has to become active and increase its efforts for increasing the returns and profits

for achieving the desired goals and business. Companies having lower EPS are generally not

considered by investors as good investments as they are not capable of providing the returns over

their investments (Laitinen, 2017). High earnings are essential for the business for the growth

and progress in the market from the current and existing levels.

Gross profit margins

It is the profitability ratio which is used for assessing management efficiency in managing

the costs and production activities. Gross profit is the amount left with company after meeting all

the costs and expenses related to the production activities. A company must have higher gross

profit so that it could meet the further operational cost of operating the business efficiently. Over

the two years gross profit margin of company has remained at 38%. The gross profit margin of

company is adequate but should be increased further by applying more effective cost efficient

strategies that enables management to decrease cost of products. Revenues of company have

raised and the cost has also increased in the same proportion. This shows there was only increase

in variable costs in the production of goods. Company is required to establish promotional

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

strategies for increasing the revenues and profits and at the same time maintaining effective

control over cost of operation.

Asset Turnover Ratio

It is ratio used by the users of financial statements for evaluating the ability of company

in generating sales over the assets of company. It reflects the effectiveness of management in

utilising the existing resources and assets of company to generate sales. Company with lower

asset turnover ratio is considered having inefficient management which is not making effective

use of the resources of the entity (Selvam, Dhamotharan and Sankarkumar, 2020). Asset

turnover of company is 1.75 which has increased from 1.66 in last year. The ratio is adequate and

shows that the management of company is efficient and generates sales up to 1.75 times of the

assets. Higher the ratio better is for the company as company will be able to generate more

revenues with the existing assets. Investors are interested in knowing the ratio of the firm as they

require analysing the management of company in which they are proposing to invest funds.

Funds are not invested in companies with weak management as they may not be able to make

effective use of the resources made available to them.

Stock holding period

Stock holding period is also known as inventory turnover ratio. It reflects the average

time that entity is taking to turn the inventory in sales includes inventory in work in progress.

The ratio suggest for low stock holding period ensuring that inventory is held for shorter period

of time. Management must effectively turn the inventory into sales for the business. It shows that

the management of the company is highly efficient in moving the inventory of the business. Jerry

plc is having stock holding period of 8 which was 7.3 in 2018 there has been upward movement

in the ratio (Martins, 2017). It could be analysed from the above ratio that stock holding period

of company is shorter however management is required to decrease it further for becoming more

efficient and generating faster cash for the company. Faster movement enhances the operating

cycle of the business.

Debtors Collection Period

It reflects the time that company takes in collecting the dues from its customers. A

company must have shorter collection period for having adequate cash flow in the company. The

collection period of company is 84 days in 2019 which was 86 days in year 2018. It has

decreased the debtor days from last year. However it is required to further reduce the collection

6

control over cost of operation.

Asset Turnover Ratio

It is ratio used by the users of financial statements for evaluating the ability of company

in generating sales over the assets of company. It reflects the effectiveness of management in

utilising the existing resources and assets of company to generate sales. Company with lower

asset turnover ratio is considered having inefficient management which is not making effective

use of the resources of the entity (Selvam, Dhamotharan and Sankarkumar, 2020). Asset

turnover of company is 1.75 which has increased from 1.66 in last year. The ratio is adequate and

shows that the management of company is efficient and generates sales up to 1.75 times of the

assets. Higher the ratio better is for the company as company will be able to generate more

revenues with the existing assets. Investors are interested in knowing the ratio of the firm as they

require analysing the management of company in which they are proposing to invest funds.

Funds are not invested in companies with weak management as they may not be able to make

effective use of the resources made available to them.

Stock holding period

Stock holding period is also known as inventory turnover ratio. It reflects the average

time that entity is taking to turn the inventory in sales includes inventory in work in progress.

The ratio suggest for low stock holding period ensuring that inventory is held for shorter period

of time. Management must effectively turn the inventory into sales for the business. It shows that

the management of the company is highly efficient in moving the inventory of the business. Jerry

plc is having stock holding period of 8 which was 7.3 in 2018 there has been upward movement

in the ratio (Martins, 2017). It could be analysed from the above ratio that stock holding period

of company is shorter however management is required to decrease it further for becoming more

efficient and generating faster cash for the company. Faster movement enhances the operating

cycle of the business.

Debtors Collection Period

It reflects the time that company takes in collecting the dues from its customers. A

company must have shorter collection period for having adequate cash flow in the company. The

collection period of company is 84 days in 2019 which was 86 days in year 2018. It has

decreased the debtor days from last year. However it is required to further reduce the collection

6

period as the credit given by company is high and is affecting the cash operating cycle

(Buvaneswari, Pushpalatha and Sandesh, 2017). Higher credit periods are generally granted for

increasing the revenues and customer base but this affects the cash cycle and causes higher

demand of money which is then borrowed from the external sources at interests.

Current Ratio

The financial ratio is used for assessing the liquidity of company. Current ratio measures

the ability of company to meet the short term obligations with the available current assets. Every

company must have enough current assets so that it could meet the its obligations and run the

operations successfully. Current ratio of company last year was 1.05 in 2018 where in current

year it is 1.02. Current ratio of company is not strong and states that short term obligations are

equal to the current assets. Managers are required to make liquidity position strong by managing

the current assets and obligations adequately. Lower ratio could reflect negative image to the

creditors of the entity.

Gearing Ratio

The gearing ratio is an important financial ratio which is used by the analysts and

management for evaluating the debt and equity ratio in overall capital of the company. It assesses

the capital structure of the entity. It is also used for assessing the financial risk of the enterprise.

Debt equity ratio of Jerry plc is 0.42 where last year it was 0.27. There has been upward

movement in the ratio that shows company has increased the debt. It will increase the financial

risk associated with the business (Coulon, 2020). Raising debt higher than this will make the

company highly risky. Currently it is having adequate capital structure with minimum cost of

capital as benefits from debt capital are availed from the government. Cost of equity is higher

than debt but the risk involved in equity is very low as company is not under obligation to pay

dividend every year.

Interest Coverage Ratio

It measures the ability of company in making payments for interest expenses. it evaluates

how many times it could pay interest from the existing profits of the business. Interest coverage

ratio of the firm should be higher. The company is having interest coverage ratio of 115 that has

increased significantly from 8.49 last year. The ability to pay interest has increased as interest

expenses of the entity have declined significantly as compared with previous year.

7

(Buvaneswari, Pushpalatha and Sandesh, 2017). Higher credit periods are generally granted for

increasing the revenues and customer base but this affects the cash cycle and causes higher

demand of money which is then borrowed from the external sources at interests.

Current Ratio

The financial ratio is used for assessing the liquidity of company. Current ratio measures

the ability of company to meet the short term obligations with the available current assets. Every

company must have enough current assets so that it could meet the its obligations and run the

operations successfully. Current ratio of company last year was 1.05 in 2018 where in current

year it is 1.02. Current ratio of company is not strong and states that short term obligations are

equal to the current assets. Managers are required to make liquidity position strong by managing

the current assets and obligations adequately. Lower ratio could reflect negative image to the

creditors of the entity.

Gearing Ratio

The gearing ratio is an important financial ratio which is used by the analysts and

management for evaluating the debt and equity ratio in overall capital of the company. It assesses

the capital structure of the entity. It is also used for assessing the financial risk of the enterprise.

Debt equity ratio of Jerry plc is 0.42 where last year it was 0.27. There has been upward

movement in the ratio that shows company has increased the debt. It will increase the financial

risk associated with the business (Coulon, 2020). Raising debt higher than this will make the

company highly risky. Currently it is having adequate capital structure with minimum cost of

capital as benefits from debt capital are availed from the government. Cost of equity is higher

than debt but the risk involved in equity is very low as company is not under obligation to pay

dividend every year.

Interest Coverage Ratio

It measures the ability of company in making payments for interest expenses. it evaluates

how many times it could pay interest from the existing profits of the business. Interest coverage

ratio of the firm should be higher. The company is having interest coverage ratio of 115 that has

increased significantly from 8.49 last year. The ability to pay interest has increased as interest

expenses of the entity have declined significantly as compared with previous year.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

QUESTION 3

a) Different user groups of the company accounts and discussing why the user groups are

interested in information provided in the financial statements

Objective of the accounting is to provide the information to the users to make important

financial decisions. There are different users of the financial information provided by the

company who uses the information according to their needs and interest in the company. The

different user groups of financial information include owners, management, suppliers,

employees, lenders, customers, government and general public.

Owners

Owners are the people who provide capital and funds to the organisation. They have the

curiosity in identifying and ensuring that the business is being conducted over sound lines or not.

They are interested in knowing that their capital is employed effectively and increasing the value

of the business (Andjelic and Vesic, 2017). Using the financial statements owners assess the

performance of the business in a given time period and ensure that the strategies are framed for

increasing the returns from business.

Management

Management is highly interested in identifying position of firm. Merits and demerits of

business activity are identified from financial performance of the business during the year.

management assess whether the strategies employed have enabled the company to generate

profitable returns or not. Financial statements are the overall report of the business that is

assessed by the management for framing strategies for improving profitability performance of

the business.

Creditors

Creditors are the people who have dues from the company. They include people who

have supplied goods on credit, lenders of the money and bankers. Suppliers and other parties are

interested in assessing the financial soundness of the business before granting credit. Prosperity

and progress of firm to which the credits are granted are watched extensively by the creditors

from point of security and granting further credit. Liquidity is assessed by the creditors using

financial statements of the business.

Employees

8

a) Different user groups of the company accounts and discussing why the user groups are

interested in information provided in the financial statements

Objective of the accounting is to provide the information to the users to make important

financial decisions. There are different users of the financial information provided by the

company who uses the information according to their needs and interest in the company. The

different user groups of financial information include owners, management, suppliers,

employees, lenders, customers, government and general public.

Owners

Owners are the people who provide capital and funds to the organisation. They have the

curiosity in identifying and ensuring that the business is being conducted over sound lines or not.

They are interested in knowing that their capital is employed effectively and increasing the value

of the business (Andjelic and Vesic, 2017). Using the financial statements owners assess the

performance of the business in a given time period and ensure that the strategies are framed for

increasing the returns from business.

Management

Management is highly interested in identifying position of firm. Merits and demerits of

business activity are identified from financial performance of the business during the year.

management assess whether the strategies employed have enabled the company to generate

profitable returns or not. Financial statements are the overall report of the business that is

assessed by the management for framing strategies for improving profitability performance of

the business.

Creditors

Creditors are the people who have dues from the company. They include people who

have supplied goods on credit, lenders of the money and bankers. Suppliers and other parties are

interested in assessing the financial soundness of the business before granting credit. Prosperity

and progress of firm to which the credits are granted are watched extensively by the creditors

from point of security and granting further credit. Liquidity is assessed by the creditors using

financial statements of the business.

Employees

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Employees are the internal users of the financial statements that are concerned with the

performance and profitability of the firm. Employees are concerned with becoming part of the

organisation that is growing fast and is becoming profitable. The profitability and growth of the

company is essential for getting regular income and increase in wages. Financial statements also

reflect the productivity and efficiency of the employees in achieving the goals and objectives.

Investors

Prospective investors proposing to invest money in the firm assess the prosperity and

progress of the company before making investments. They assess the returns provided by the

company over the period of time (Dimitriou, 2020). Financial statements are used for assessing

the performance of the company. It enables the investors to identify profitability, efficiency of

the management, liquidity and capital structure of the company.

Government

Every company is required to furnish the financial statements of the company with

respective statutory authorities. Government keep close observation on companies that are

performing well and are yielding adequate profits. Governments are concerned in financial for

assessing profitability and wealth of company for purpose of the taxation.

b) Discuss advantages and disadvantages of the highly regulated financial reporting regime.

From the perspective of users and preparer of financial statements.

Financial reporting is defined as the communication of the financial statements and other

financial information from business to third parties that includes creditors, customers,

shareholders, government and public. It is reporting of the accounting information of the

company with users or group of users. Financial reporting is the total communication that

involves issuer company, creditors and investors as the primary users and other external users

such as auditors and analysts. Objective of the financial statements and financial reporting is to

enable the investment decision making for external users and management accountability for

internal users.

Advantages of the financial reporting

There are different advantages of the financial reporting framework.

Financial reporting enables the users of the financial information in effective decision

making. Users assess the trends and performance of the company from the financial statements.

Liquidity and profitability of the firm could be assessed adequately by the firm using tools such

9

performance and profitability of the firm. Employees are concerned with becoming part of the

organisation that is growing fast and is becoming profitable. The profitability and growth of the

company is essential for getting regular income and increase in wages. Financial statements also

reflect the productivity and efficiency of the employees in achieving the goals and objectives.

Investors

Prospective investors proposing to invest money in the firm assess the prosperity and

progress of the company before making investments. They assess the returns provided by the

company over the period of time (Dimitriou, 2020). Financial statements are used for assessing

the performance of the company. It enables the investors to identify profitability, efficiency of

the management, liquidity and capital structure of the company.

Government

Every company is required to furnish the financial statements of the company with

respective statutory authorities. Government keep close observation on companies that are

performing well and are yielding adequate profits. Governments are concerned in financial for

assessing profitability and wealth of company for purpose of the taxation.

b) Discuss advantages and disadvantages of the highly regulated financial reporting regime.

From the perspective of users and preparer of financial statements.

Financial reporting is defined as the communication of the financial statements and other

financial information from business to third parties that includes creditors, customers,

shareholders, government and public. It is reporting of the accounting information of the

company with users or group of users. Financial reporting is the total communication that

involves issuer company, creditors and investors as the primary users and other external users

such as auditors and analysts. Objective of the financial statements and financial reporting is to

enable the investment decision making for external users and management accountability for

internal users.

Advantages of the financial reporting

There are different advantages of the financial reporting framework.

Financial reporting enables the users of the financial information in effective decision

making. Users assess the trends and performance of the company from the financial statements.

Liquidity and profitability of the firm could be assessed adequately by the firm using tools such

9

as ratio analysis before the investments are made in the company. Various critical decisions

regarding the business such as financial obligations against its assets, capital structure of the

enterprise to assess financial risk involved in the company.

Financial reporting enables the company to present the progress and position of company

over the years. Business requires funds for keeping is operations running without interruptions

for which funds are borrowed from the banks and financial institutions. Banks and other

authorities grant funds after reviewing the financial performance and position of the entity from

the financial statements.

Disadvantages

Financial reporting is not only affected by environment but also environment of financial

reporting taking place but also by limitations and characteristics of kind of the information which

is provided by the financial statements. Information is financial information which is based over

approximations of financial effects on the individual business entity of the transactions that have

already occurred (Sabri and Aw, 2019). The financial reporting requires the business to disclose

all the policies and framework adopted for the business reflecting the actual position of the

company.

c) Limitations of the financial statements

Limitations refer to the factors that user are required to be aware before relying over the

financial statements for decision making. Limitations of the financial statements are:

Dependence over historical cost

Business transactions are recorded initially over their cost. It is concerned while reviewing

balance sheet and value of the assets and the liabilities changes over time. Companies make

alterations in the marketable securities for matching the changes of marketable securities which

makes the statement misleading.

Inflationary effects

Inflation rate is higher relatively and amounts associated with the assets & liabilities in

balance sheet appears inordinately lower as they are not adjusted for the inflations and is mainly

applicable to the long term assets.

Intangible assets are not recorded

Many of the intangible assets of company are not recorded as the assets. Instead

expenditures made for creating intangible assets are recognised as assets immediately. Policy

10

regarding the business such as financial obligations against its assets, capital structure of the

enterprise to assess financial risk involved in the company.

Financial reporting enables the company to present the progress and position of company

over the years. Business requires funds for keeping is operations running without interruptions

for which funds are borrowed from the banks and financial institutions. Banks and other

authorities grant funds after reviewing the financial performance and position of the entity from

the financial statements.

Disadvantages

Financial reporting is not only affected by environment but also environment of financial

reporting taking place but also by limitations and characteristics of kind of the information which

is provided by the financial statements. Information is financial information which is based over

approximations of financial effects on the individual business entity of the transactions that have

already occurred (Sabri and Aw, 2019). The financial reporting requires the business to disclose

all the policies and framework adopted for the business reflecting the actual position of the

company.

c) Limitations of the financial statements

Limitations refer to the factors that user are required to be aware before relying over the

financial statements for decision making. Limitations of the financial statements are:

Dependence over historical cost

Business transactions are recorded initially over their cost. It is concerned while reviewing

balance sheet and value of the assets and the liabilities changes over time. Companies make

alterations in the marketable securities for matching the changes of marketable securities which

makes the statement misleading.

Inflationary effects

Inflation rate is higher relatively and amounts associated with the assets & liabilities in

balance sheet appears inordinately lower as they are not adjusted for the inflations and is mainly

applicable to the long term assets.

Intangible assets are not recorded

Many of the intangible assets of company are not recorded as the assets. Instead

expenditures made for creating intangible assets are recognised as assets immediately. Policy

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.