Accounting Fundamentals: Financial Reporting, Analysis, and Ratios

VerifiedAdded on 2023/01/06

|17

|3044

|36

Homework Assignment

AI Summary

This assignment comprehensively addresses key accounting principles, starting with journal entries, ledgers, and an updated trial balance. It progresses to the preparation of financial statements, including profit and loss statements and balance sheets, for two different businesses. The assignment fur...

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

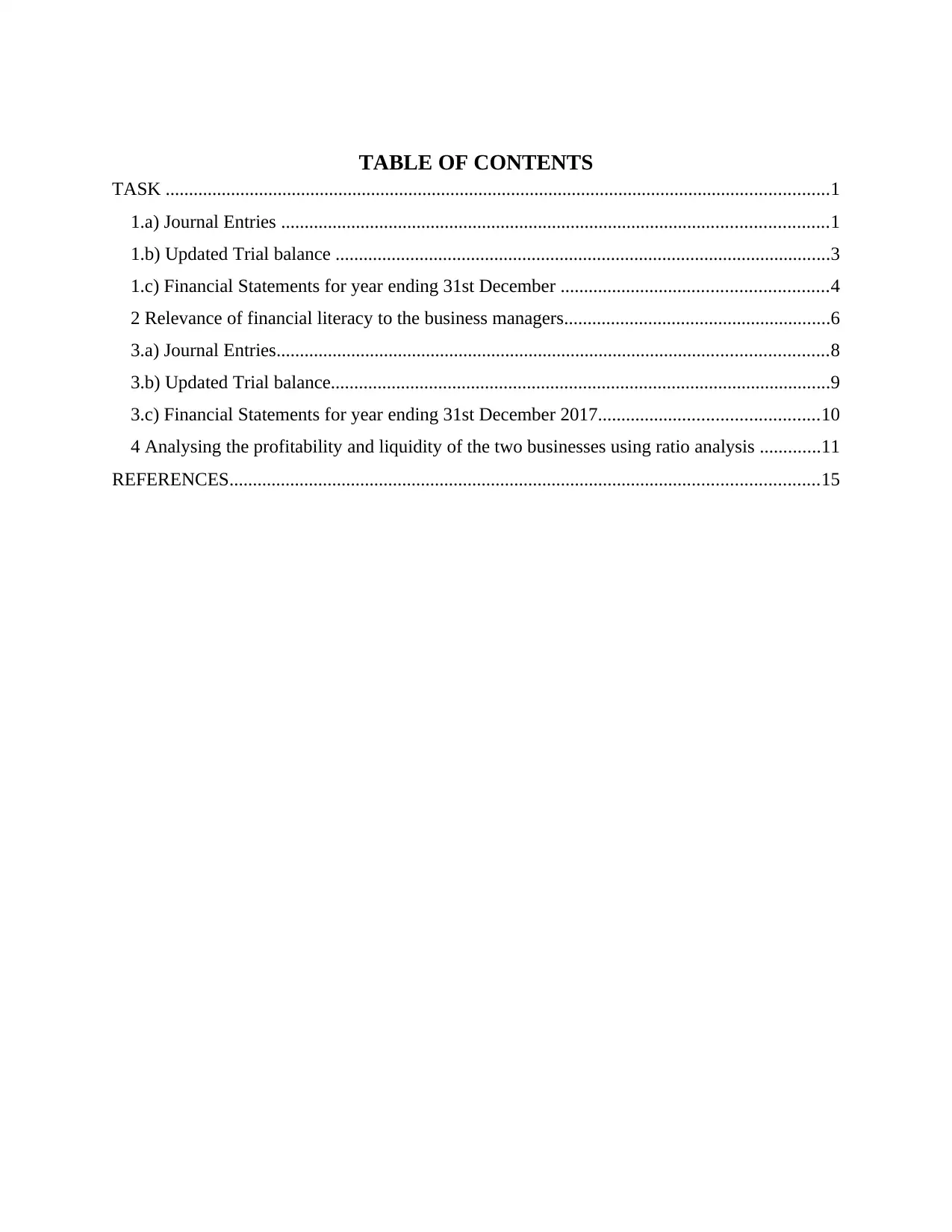

TABLE OF CONTENTS

TASK ..............................................................................................................................................1

1.a) Journal Entries .....................................................................................................................1

1.b) Updated Trial balance ..........................................................................................................3

1.c) Financial Statements for year ending 31st December .........................................................4

2 Relevance of financial literacy to the business managers.........................................................6

3.a) Journal Entries......................................................................................................................8

3.b) Updated Trial balance...........................................................................................................9

3.c) Financial Statements for year ending 31st December 2017...............................................10

4 Analysing the profitability and liquidity of the two businesses using ratio analysis .............11

REFERENCES..............................................................................................................................15

TASK ..............................................................................................................................................1

1.a) Journal Entries .....................................................................................................................1

1.b) Updated Trial balance ..........................................................................................................3

1.c) Financial Statements for year ending 31st December .........................................................4

2 Relevance of financial literacy to the business managers.........................................................6

3.a) Journal Entries......................................................................................................................8

3.b) Updated Trial balance...........................................................................................................9

3.c) Financial Statements for year ending 31st December 2017...............................................10

4 Analysing the profitability and liquidity of the two businesses using ratio analysis .............11

REFERENCES..............................................................................................................................15

TASK

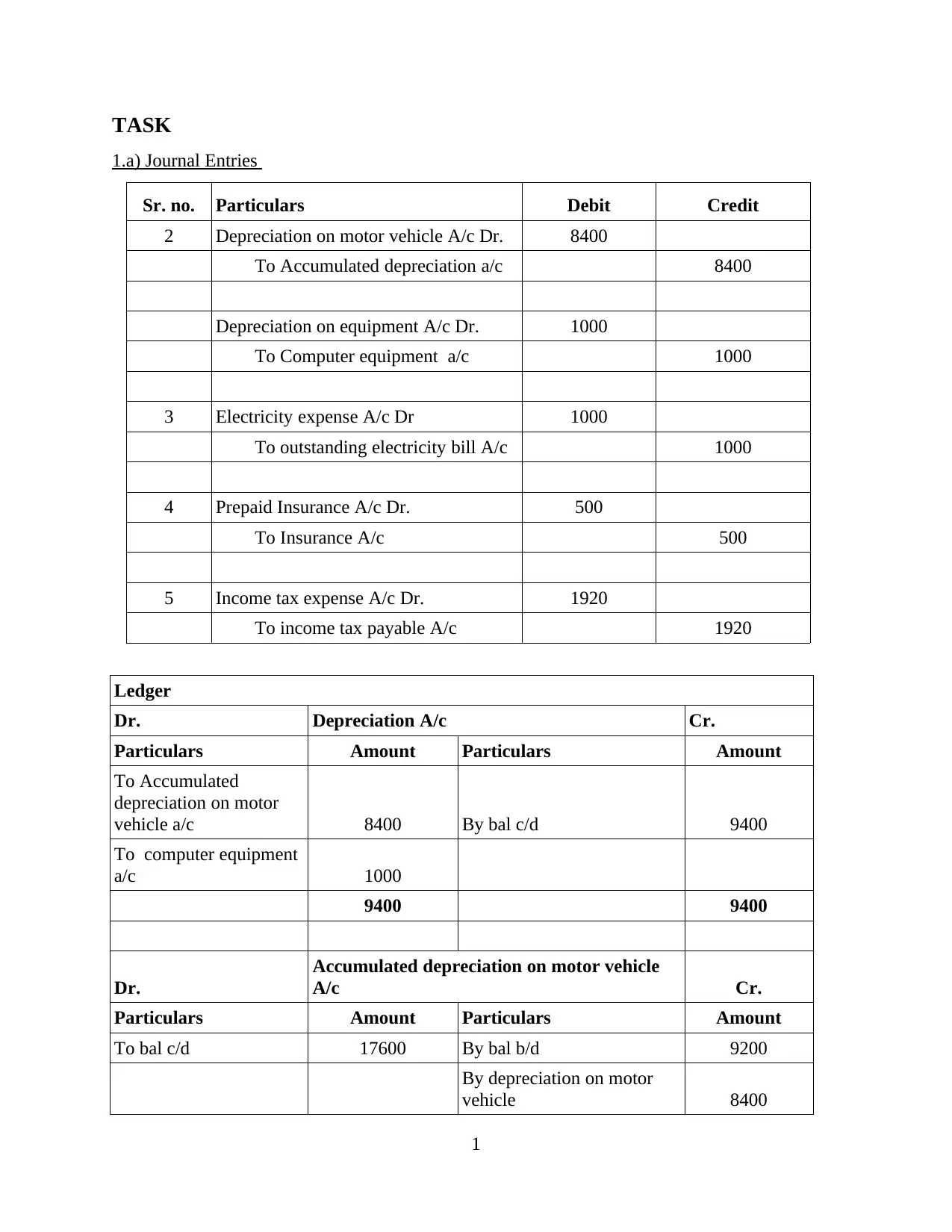

1.a) Journal Entries

Sr. no. Particulars Debit Credit

2 Depreciation on motor vehicle A/c Dr. 8400

To Accumulated depreciation a/c 8400

Depreciation on equipment A/c Dr. 1000

To Computer equipment a/c 1000

3 Electricity expense A/c Dr 1000

To outstanding electricity bill A/c 1000

4 Prepaid Insurance A/c Dr. 500

To Insurance A/c 500

5 Income tax expense A/c Dr. 1920

To income tax payable A/c 1920

Ledger

Dr. Depreciation A/c Cr.

Particulars Amount Particulars Amount

To Accumulated

depreciation on motor

vehicle a/c 8400 By bal c/d 9400

To computer equipment

a/c 1000

9400 9400

Dr.

Accumulated depreciation on motor vehicle

A/c Cr.

Particulars Amount Particulars Amount

To bal c/d 17600 By bal b/d 9200

By depreciation on motor

vehicle 8400

1

1.a) Journal Entries

Sr. no. Particulars Debit Credit

2 Depreciation on motor vehicle A/c Dr. 8400

To Accumulated depreciation a/c 8400

Depreciation on equipment A/c Dr. 1000

To Computer equipment a/c 1000

3 Electricity expense A/c Dr 1000

To outstanding electricity bill A/c 1000

4 Prepaid Insurance A/c Dr. 500

To Insurance A/c 500

5 Income tax expense A/c Dr. 1920

To income tax payable A/c 1920

Ledger

Dr. Depreciation A/c Cr.

Particulars Amount Particulars Amount

To Accumulated

depreciation on motor

vehicle a/c 8400 By bal c/d 9400

To computer equipment

a/c 1000

9400 9400

Dr.

Accumulated depreciation on motor vehicle

A/c Cr.

Particulars Amount Particulars Amount

To bal c/d 17600 By bal b/d 9200

By depreciation on motor

vehicle 8400

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

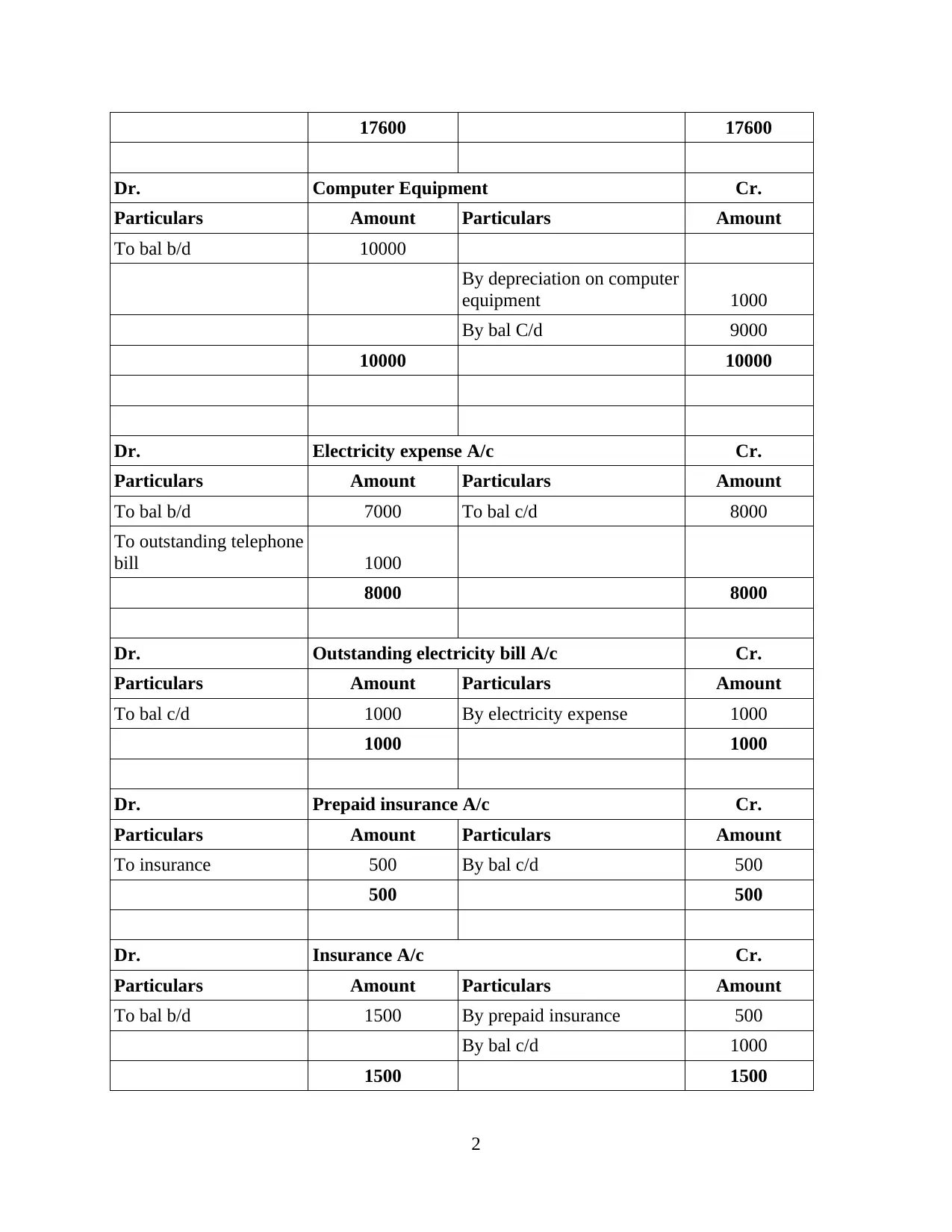

17600 17600

Dr. Computer Equipment Cr.

Particulars Amount Particulars Amount

To bal b/d 10000

By depreciation on computer

equipment 1000

By bal C/d 9000

10000 10000

Dr. Electricity expense A/c Cr.

Particulars Amount Particulars Amount

To bal b/d 7000 To bal c/d 8000

To outstanding telephone

bill 1000

8000 8000

Dr. Outstanding electricity bill A/c Cr.

Particulars Amount Particulars Amount

To bal c/d 1000 By electricity expense 1000

1000 1000

Dr. Prepaid insurance A/c Cr.

Particulars Amount Particulars Amount

To insurance 500 By bal c/d 500

500 500

Dr. Insurance A/c Cr.

Particulars Amount Particulars Amount

To bal b/d 1500 By prepaid insurance 500

By bal c/d 1000

1500 1500

2

Dr. Computer Equipment Cr.

Particulars Amount Particulars Amount

To bal b/d 10000

By depreciation on computer

equipment 1000

By bal C/d 9000

10000 10000

Dr. Electricity expense A/c Cr.

Particulars Amount Particulars Amount

To bal b/d 7000 To bal c/d 8000

To outstanding telephone

bill 1000

8000 8000

Dr. Outstanding electricity bill A/c Cr.

Particulars Amount Particulars Amount

To bal c/d 1000 By electricity expense 1000

1000 1000

Dr. Prepaid insurance A/c Cr.

Particulars Amount Particulars Amount

To insurance 500 By bal c/d 500

500 500

Dr. Insurance A/c Cr.

Particulars Amount Particulars Amount

To bal b/d 1500 By prepaid insurance 500

By bal c/d 1000

1500 1500

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dr. Income tax expense A/c Cr.

Particulars Amount Particulars Amount

To income tax payable 1920 By bal c/d 1920

1920 1920

Dr. Income tax payable A/c Cr.

Particulars Amount Particulars Amount

To bal c/d 1920 By income tax expense 1920

1920 1920

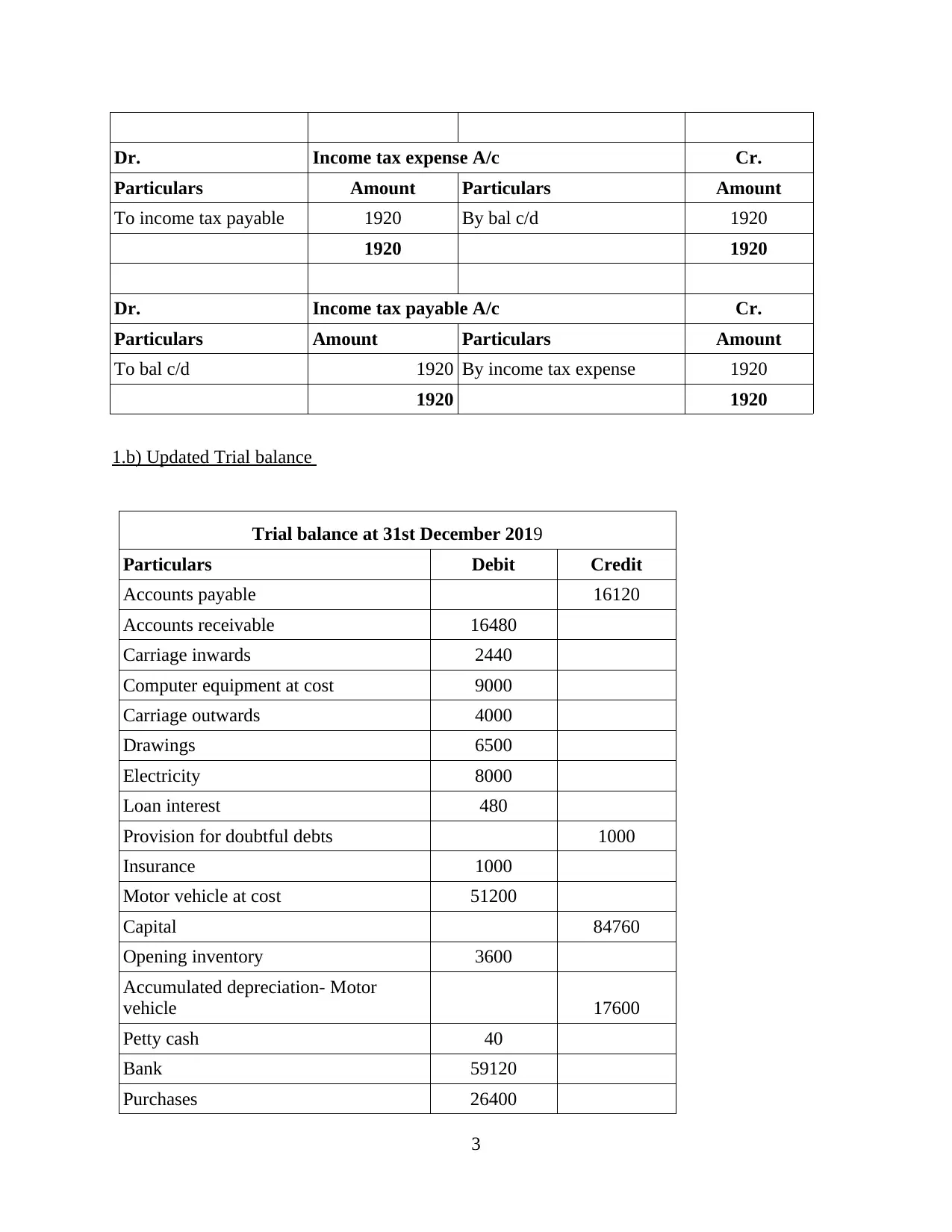

1.b) Updated Trial balance

Trial balance at 31st December 2019

Particulars Debit Credit

Accounts payable 16120

Accounts receivable 16480

Carriage inwards 2440

Computer equipment at cost 9000

Carriage outwards 4000

Drawings 6500

Electricity 8000

Loan interest 480

Provision for doubtful debts 1000

Insurance 1000

Motor vehicle at cost 51200

Capital 84760

Opening inventory 3600

Accumulated depreciation- Motor

vehicle 17600

Petty cash 40

Bank 59120

Purchases 26400

3

Particulars Amount Particulars Amount

To income tax payable 1920 By bal c/d 1920

1920 1920

Dr. Income tax payable A/c Cr.

Particulars Amount Particulars Amount

To bal c/d 1920 By income tax expense 1920

1920 1920

1.b) Updated Trial balance

Trial balance at 31st December 2019

Particulars Debit Credit

Accounts payable 16120

Accounts receivable 16480

Carriage inwards 2440

Computer equipment at cost 9000

Carriage outwards 4000

Drawings 6500

Electricity 8000

Loan interest 480

Provision for doubtful debts 1000

Insurance 1000

Motor vehicle at cost 51200

Capital 84760

Opening inventory 3600

Accumulated depreciation- Motor

vehicle 17600

Petty cash 40

Bank 59120

Purchases 26400

3

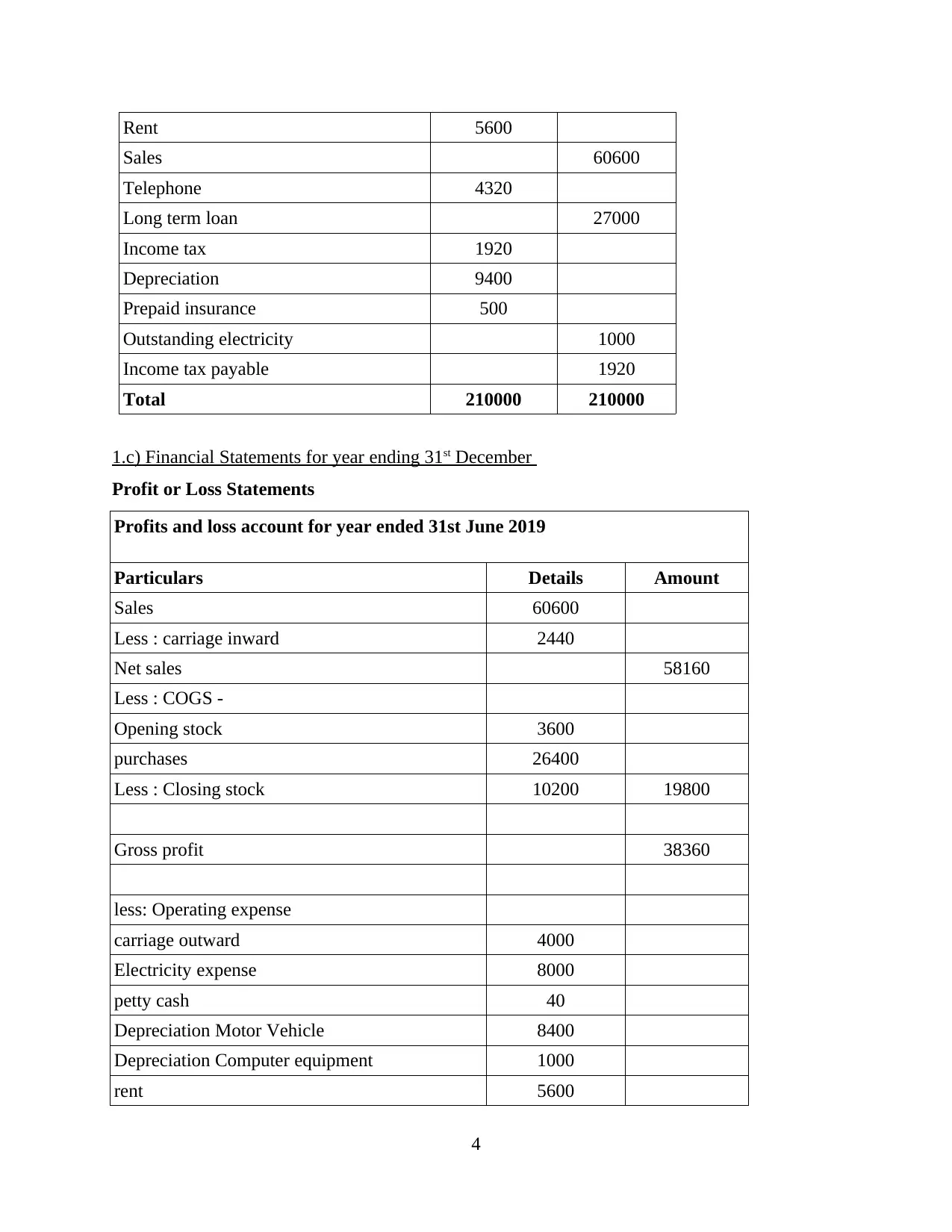

Rent 5600

Sales 60600

Telephone 4320

Long term loan 27000

Income tax 1920

Depreciation 9400

Prepaid insurance 500

Outstanding electricity 1000

Income tax payable 1920

Total 210000 210000

1.c) Financial Statements for year ending 31st December

Profit or Loss Statements

Profits and loss account for year ended 31st June 2019

Particulars Details Amount

Sales 60600

Less : carriage inward 2440

Net sales 58160

Less : COGS -

Opening stock 3600

purchases 26400

Less : Closing stock 10200 19800

Gross profit 38360

less: Operating expense

carriage outward 4000

Electricity expense 8000

petty cash 40

Depreciation Motor Vehicle 8400

Depreciation Computer equipment 1000

rent 5600

4

Sales 60600

Telephone 4320

Long term loan 27000

Income tax 1920

Depreciation 9400

Prepaid insurance 500

Outstanding electricity 1000

Income tax payable 1920

Total 210000 210000

1.c) Financial Statements for year ending 31st December

Profit or Loss Statements

Profits and loss account for year ended 31st June 2019

Particulars Details Amount

Sales 60600

Less : carriage inward 2440

Net sales 58160

Less : COGS -

Opening stock 3600

purchases 26400

Less : Closing stock 10200 19800

Gross profit 38360

less: Operating expense

carriage outward 4000

Electricity expense 8000

petty cash 40

Depreciation Motor Vehicle 8400

Depreciation Computer equipment 1000

rent 5600

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

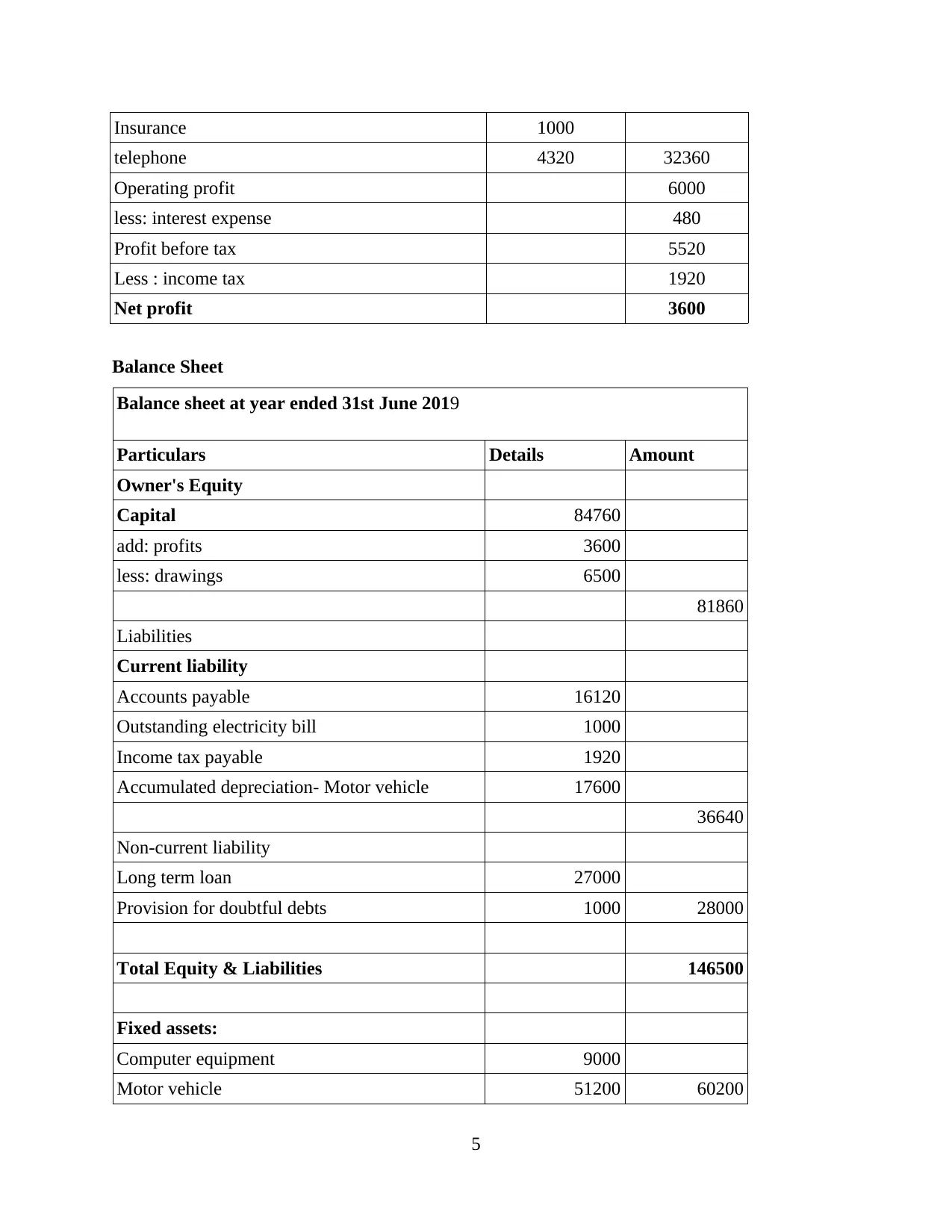

Insurance 1000

telephone 4320 32360

Operating profit 6000

less: interest expense 480

Profit before tax 5520

Less : income tax 1920

Net profit 3600

Balance Sheet

Balance sheet at year ended 31st June 2019

Particulars Details Amount

Owner's Equity

Capital 84760

add: profits 3600

less: drawings 6500

81860

Liabilities

Current liability

Accounts payable 16120

Outstanding electricity bill 1000

Income tax payable 1920

Accumulated depreciation- Motor vehicle 17600

36640

Non-current liability

Long term loan 27000

Provision for doubtful debts 1000 28000

Total Equity & Liabilities 146500

Fixed assets:

Computer equipment 9000

Motor vehicle 51200 60200

5

telephone 4320 32360

Operating profit 6000

less: interest expense 480

Profit before tax 5520

Less : income tax 1920

Net profit 3600

Balance Sheet

Balance sheet at year ended 31st June 2019

Particulars Details Amount

Owner's Equity

Capital 84760

add: profits 3600

less: drawings 6500

81860

Liabilities

Current liability

Accounts payable 16120

Outstanding electricity bill 1000

Income tax payable 1920

Accumulated depreciation- Motor vehicle 17600

36640

Non-current liability

Long term loan 27000

Provision for doubtful debts 1000 28000

Total Equity & Liabilities 146500

Fixed assets:

Computer equipment 9000

Motor vehicle 51200 60200

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

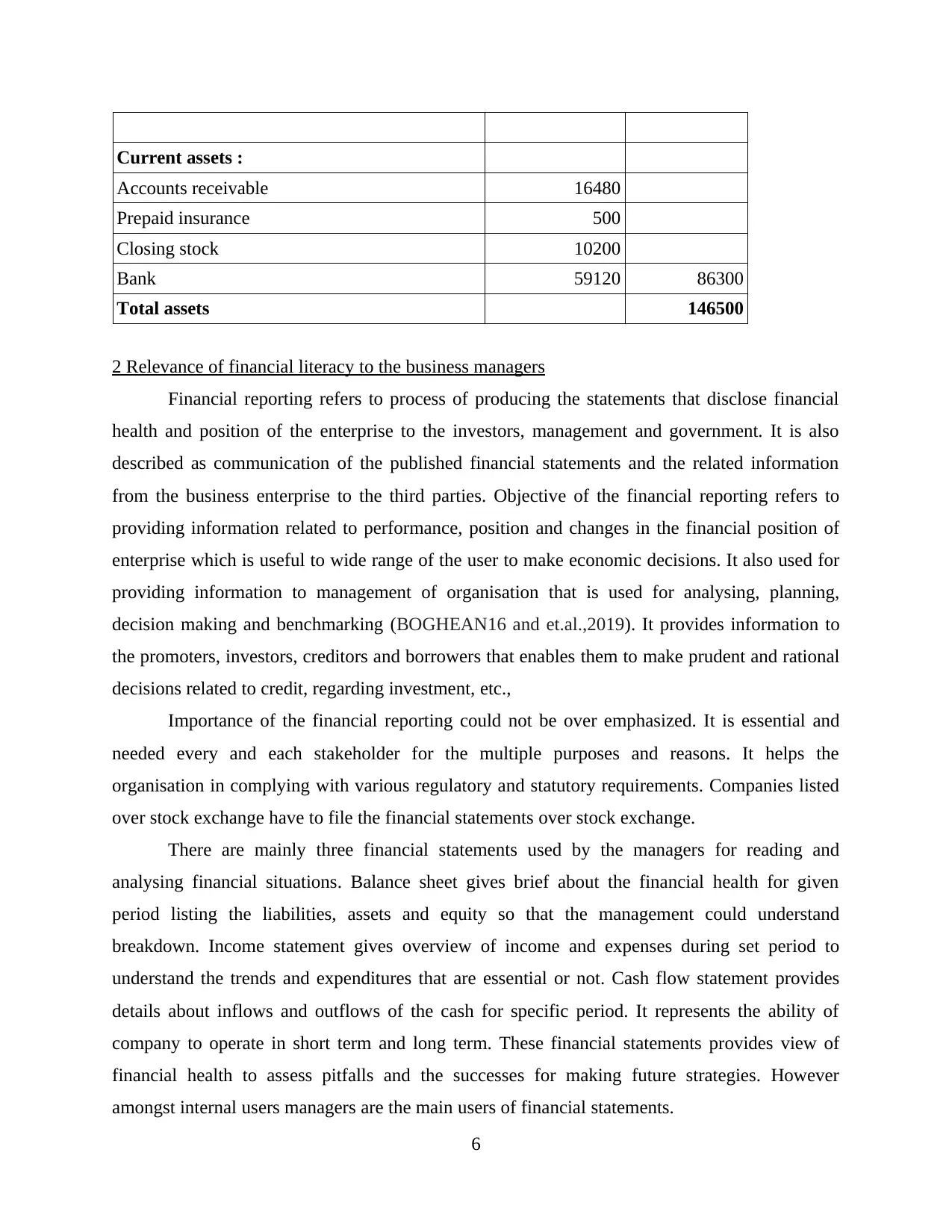

Current assets :

Accounts receivable 16480

Prepaid insurance 500

Closing stock 10200

Bank 59120 86300

Total assets 146500

2 Relevance of financial literacy to the business managers

Financial reporting refers to process of producing the statements that disclose financial

health and position of the enterprise to the investors, management and government. It is also

described as communication of the published financial statements and the related information

from the business enterprise to the third parties. Objective of the financial reporting refers to

providing information related to performance, position and changes in the financial position of

enterprise which is useful to wide range of the user to make economic decisions. It also used for

providing information to management of organisation that is used for analysing, planning,

decision making and benchmarking (BOGHEAN16 and et.al.,2019). It provides information to

the promoters, investors, creditors and borrowers that enables them to make prudent and rational

decisions related to credit, regarding investment, etc.,

Importance of the financial reporting could not be over emphasized. It is essential and

needed every and each stakeholder for the multiple purposes and reasons. It helps the

organisation in complying with various regulatory and statutory requirements. Companies listed

over stock exchange have to file the financial statements over stock exchange.

There are mainly three financial statements used by the managers for reading and

analysing financial situations. Balance sheet gives brief about the financial health for given

period listing the liabilities, assets and equity so that the management could understand

breakdown. Income statement gives overview of income and expenses during set period to

understand the trends and expenditures that are essential or not. Cash flow statement provides

details about inflows and outflows of the cash for specific period. It represents the ability of

company to operate in short term and long term. These financial statements provides view of

financial health to assess pitfalls and the successes for making future strategies. However

amongst internal users managers are the main users of financial statements.

6

Accounts receivable 16480

Prepaid insurance 500

Closing stock 10200

Bank 59120 86300

Total assets 146500

2 Relevance of financial literacy to the business managers

Financial reporting refers to process of producing the statements that disclose financial

health and position of the enterprise to the investors, management and government. It is also

described as communication of the published financial statements and the related information

from the business enterprise to the third parties. Objective of the financial reporting refers to

providing information related to performance, position and changes in the financial position of

enterprise which is useful to wide range of the user to make economic decisions. It also used for

providing information to management of organisation that is used for analysing, planning,

decision making and benchmarking (BOGHEAN16 and et.al.,2019). It provides information to

the promoters, investors, creditors and borrowers that enables them to make prudent and rational

decisions related to credit, regarding investment, etc.,

Importance of the financial reporting could not be over emphasized. It is essential and

needed every and each stakeholder for the multiple purposes and reasons. It helps the

organisation in complying with various regulatory and statutory requirements. Companies listed

over stock exchange have to file the financial statements over stock exchange.

There are mainly three financial statements used by the managers for reading and

analysing financial situations. Balance sheet gives brief about the financial health for given

period listing the liabilities, assets and equity so that the management could understand

breakdown. Income statement gives overview of income and expenses during set period to

understand the trends and expenditures that are essential or not. Cash flow statement provides

details about inflows and outflows of the cash for specific period. It represents the ability of

company to operate in short term and long term. These financial statements provides view of

financial health to assess pitfalls and the successes for making future strategies. However

amongst internal users managers are the main users of financial statements.

6

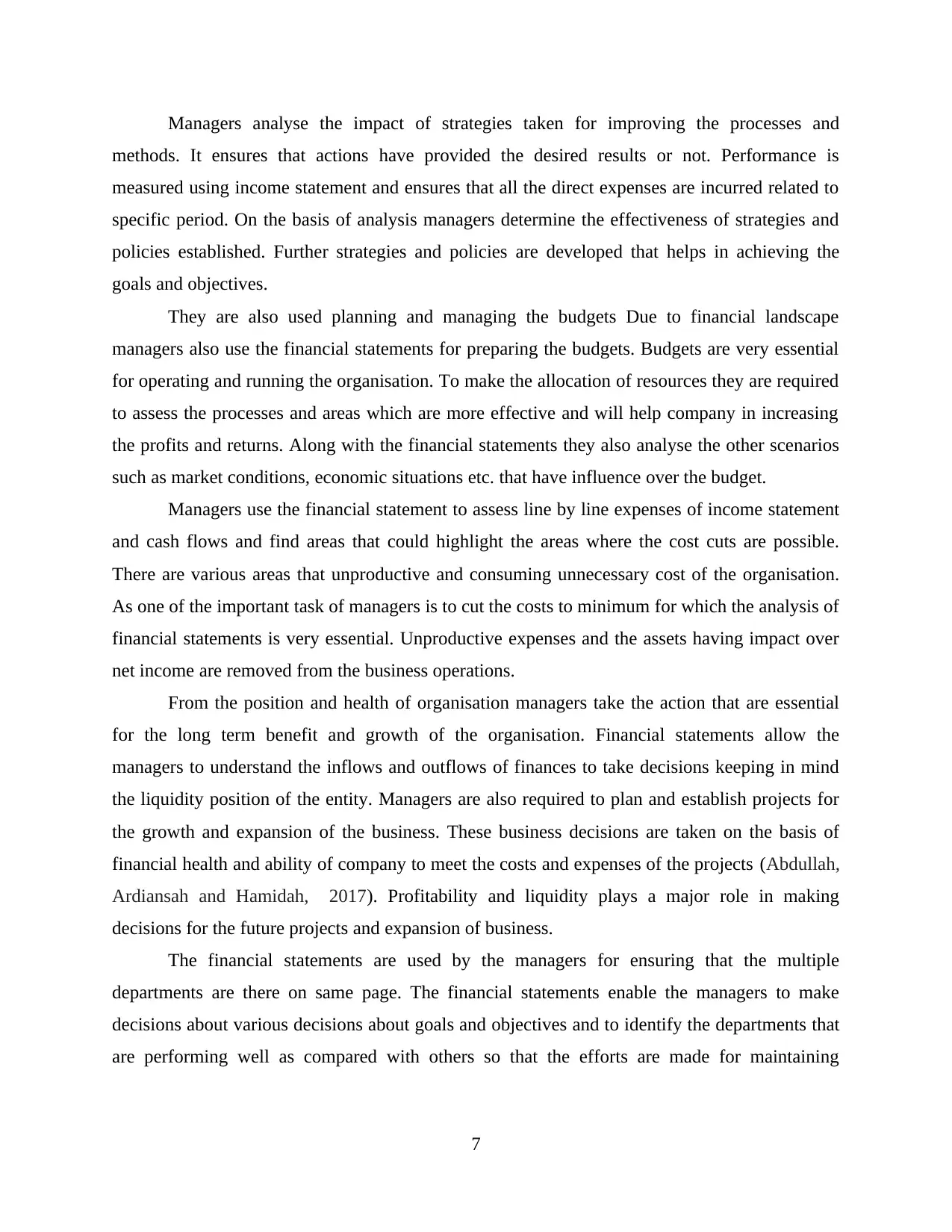

Managers analyse the impact of strategies taken for improving the processes and

methods. It ensures that actions have provided the desired results or not. Performance is

measured using income statement and ensures that all the direct expenses are incurred related to

specific period. On the basis of analysis managers determine the effectiveness of strategies and

policies established. Further strategies and policies are developed that helps in achieving the

goals and objectives.

They are also used planning and managing the budgets Due to financial landscape

managers also use the financial statements for preparing the budgets. Budgets are very essential

for operating and running the organisation. To make the allocation of resources they are required

to assess the processes and areas which are more effective and will help company in increasing

the profits and returns. Along with the financial statements they also analyse the other scenarios

such as market conditions, economic situations etc. that have influence over the budget.

Managers use the financial statement to assess line by line expenses of income statement

and cash flows and find areas that could highlight the areas where the cost cuts are possible.

There are various areas that unproductive and consuming unnecessary cost of the organisation.

As one of the important task of managers is to cut the costs to minimum for which the analysis of

financial statements is very essential. Unproductive expenses and the assets having impact over

net income are removed from the business operations.

From the position and health of organisation managers take the action that are essential

for the long term benefit and growth of the organisation. Financial statements allow the

managers to understand the inflows and outflows of finances to take decisions keeping in mind

the liquidity position of the entity. Managers are also required to plan and establish projects for

the growth and expansion of the business. These business decisions are taken on the basis of

financial health and ability of company to meet the costs and expenses of the projects (Abdullah,

Ardiansah and Hamidah, 2017). Profitability and liquidity plays a major role in making

decisions for the future projects and expansion of business.

The financial statements are used by the managers for ensuring that the multiple

departments are there on same page. The financial statements enable the managers to make

decisions about various decisions about goals and objectives and to identify the departments that

are performing well as compared with others so that the efforts are made for maintaining

7

methods. It ensures that actions have provided the desired results or not. Performance is

measured using income statement and ensures that all the direct expenses are incurred related to

specific period. On the basis of analysis managers determine the effectiveness of strategies and

policies established. Further strategies and policies are developed that helps in achieving the

goals and objectives.

They are also used planning and managing the budgets Due to financial landscape

managers also use the financial statements for preparing the budgets. Budgets are very essential

for operating and running the organisation. To make the allocation of resources they are required

to assess the processes and areas which are more effective and will help company in increasing

the profits and returns. Along with the financial statements they also analyse the other scenarios

such as market conditions, economic situations etc. that have influence over the budget.

Managers use the financial statement to assess line by line expenses of income statement

and cash flows and find areas that could highlight the areas where the cost cuts are possible.

There are various areas that unproductive and consuming unnecessary cost of the organisation.

As one of the important task of managers is to cut the costs to minimum for which the analysis of

financial statements is very essential. Unproductive expenses and the assets having impact over

net income are removed from the business operations.

From the position and health of organisation managers take the action that are essential

for the long term benefit and growth of the organisation. Financial statements allow the

managers to understand the inflows and outflows of finances to take decisions keeping in mind

the liquidity position of the entity. Managers are also required to plan and establish projects for

the growth and expansion of the business. These business decisions are taken on the basis of

financial health and ability of company to meet the costs and expenses of the projects (Abdullah,

Ardiansah and Hamidah, 2017). Profitability and liquidity plays a major role in making

decisions for the future projects and expansion of business.

The financial statements are used by the managers for ensuring that the multiple

departments are there on same page. The financial statements enable the managers to make

decisions about various decisions about goals and objectives and to identify the departments that

are performing well as compared with others so that the efforts are made for maintaining

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

sustainability and new frameworks for increasing the productivity of other departments are also

made.

The financial information is also used as an effective tool for motivating and engaging

the team. Growing performance and profitability could encourage the employees to perform

more better. Employees become more productive when they become part of organisation that is

performing well and growing constantly with increased market expansion.

Managers have great need of financial statements. It enable the managers to meet all the

statutory and regulatory requirements of the company. Managers makes sure the financial

information as essential and required by the authorities have been provided by the company. Non

compliance could affect the image of company significantly. Financial statements are audited by

the auditors to ensure that all the financial information to be reported to the outside parties.

Managers ensure that the accounting information provided provides true and fair view of the

financial position of the company.

Financial information are said to be the backbone in financial planning, benchmarking,

analysis and for decision making. Managers ensure that the decisions taken are most beneficial

for the growth and expansion of business. Using the financial statements managers analyse the

capital structure of the firm to assess the sources of funds which will prove to be most beneficial.

They ensure that the capital structure of company have lowest cost of capital (Mabula and

Dongping, 2019). Financial risks of the company are reduced to the extent possible as it

represents high risks and influence the decision of investors. Managers cannot steps and actions

for the business without analysing the financial statements of the business.

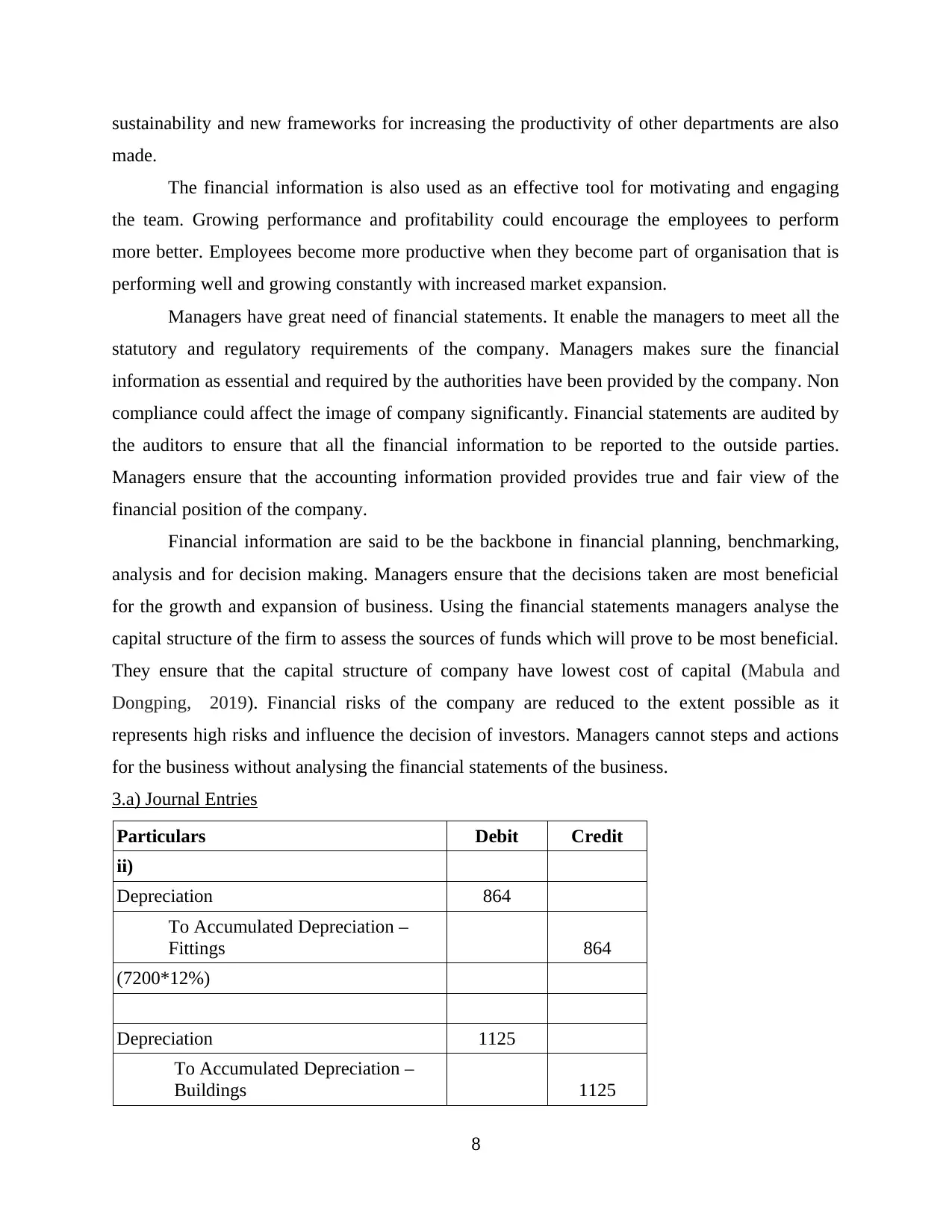

3.a) Journal Entries

Particulars Debit Credit

ii)

Depreciation 864

To Accumulated Depreciation –

Fittings 864

(7200*12%)

Depreciation 1125

To Accumulated Depreciation –

Buildings 1125

8

made.

The financial information is also used as an effective tool for motivating and engaging

the team. Growing performance and profitability could encourage the employees to perform

more better. Employees become more productive when they become part of organisation that is

performing well and growing constantly with increased market expansion.

Managers have great need of financial statements. It enable the managers to meet all the

statutory and regulatory requirements of the company. Managers makes sure the financial

information as essential and required by the authorities have been provided by the company. Non

compliance could affect the image of company significantly. Financial statements are audited by

the auditors to ensure that all the financial information to be reported to the outside parties.

Managers ensure that the accounting information provided provides true and fair view of the

financial position of the company.

Financial information are said to be the backbone in financial planning, benchmarking,

analysis and for decision making. Managers ensure that the decisions taken are most beneficial

for the growth and expansion of business. Using the financial statements managers analyse the

capital structure of the firm to assess the sources of funds which will prove to be most beneficial.

They ensure that the capital structure of company have lowest cost of capital (Mabula and

Dongping, 2019). Financial risks of the company are reduced to the extent possible as it

represents high risks and influence the decision of investors. Managers cannot steps and actions

for the business without analysing the financial statements of the business.

3.a) Journal Entries

Particulars Debit Credit

ii)

Depreciation 864

To Accumulated Depreciation –

Fittings 864

(7200*12%)

Depreciation 1125

To Accumulated Depreciation –

Buildings 1125

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

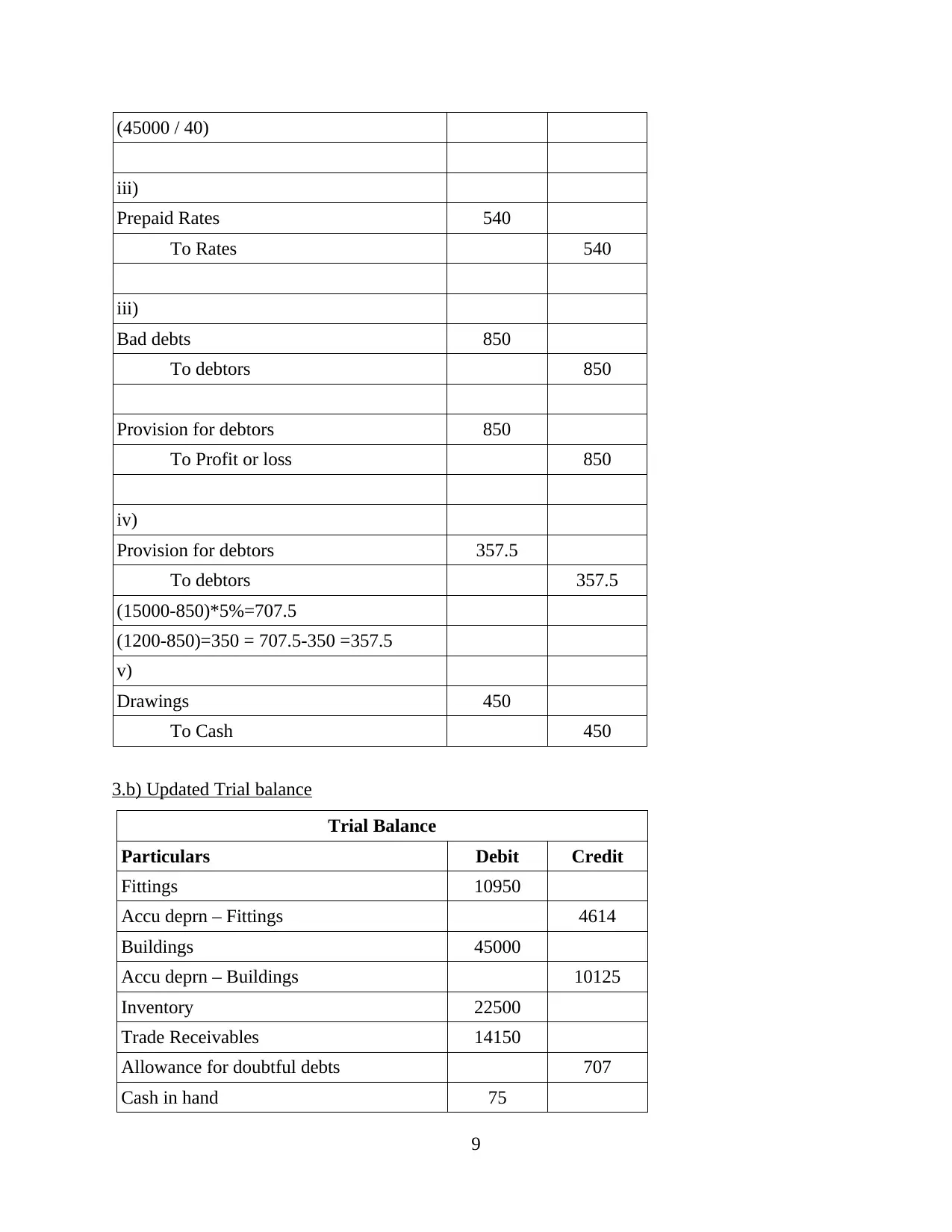

(45000 / 40)

iii)

Prepaid Rates 540

To Rates 540

iii)

Bad debts 850

To debtors 850

Provision for debtors 850

To Profit or loss 850

iv)

Provision for debtors 357.5

To debtors 357.5

(15000-850)*5%=707.5

(1200-850)=350 = 707.5-350 =357.5

v)

Drawings 450

To Cash 450

3.b) Updated Trial balance

Trial Balance

Particulars Debit Credit

Fittings 10950

Accu deprn – Fittings 4614

Buildings 45000

Accu deprn – Buildings 10125

Inventory 22500

Trade Receivables 14150

Allowance for doubtful debts 707

Cash in hand 75

9

iii)

Prepaid Rates 540

To Rates 540

iii)

Bad debts 850

To debtors 850

Provision for debtors 850

To Profit or loss 850

iv)

Provision for debtors 357.5

To debtors 357.5

(15000-850)*5%=707.5

(1200-850)=350 = 707.5-350 =357.5

v)

Drawings 450

To Cash 450

3.b) Updated Trial balance

Trial Balance

Particulars Debit Credit

Fittings 10950

Accu deprn – Fittings 4614

Buildings 45000

Accu deprn – Buildings 10125

Inventory 22500

Trade Receivables 14150

Allowance for doubtful debts 707

Cash in hand 75

9

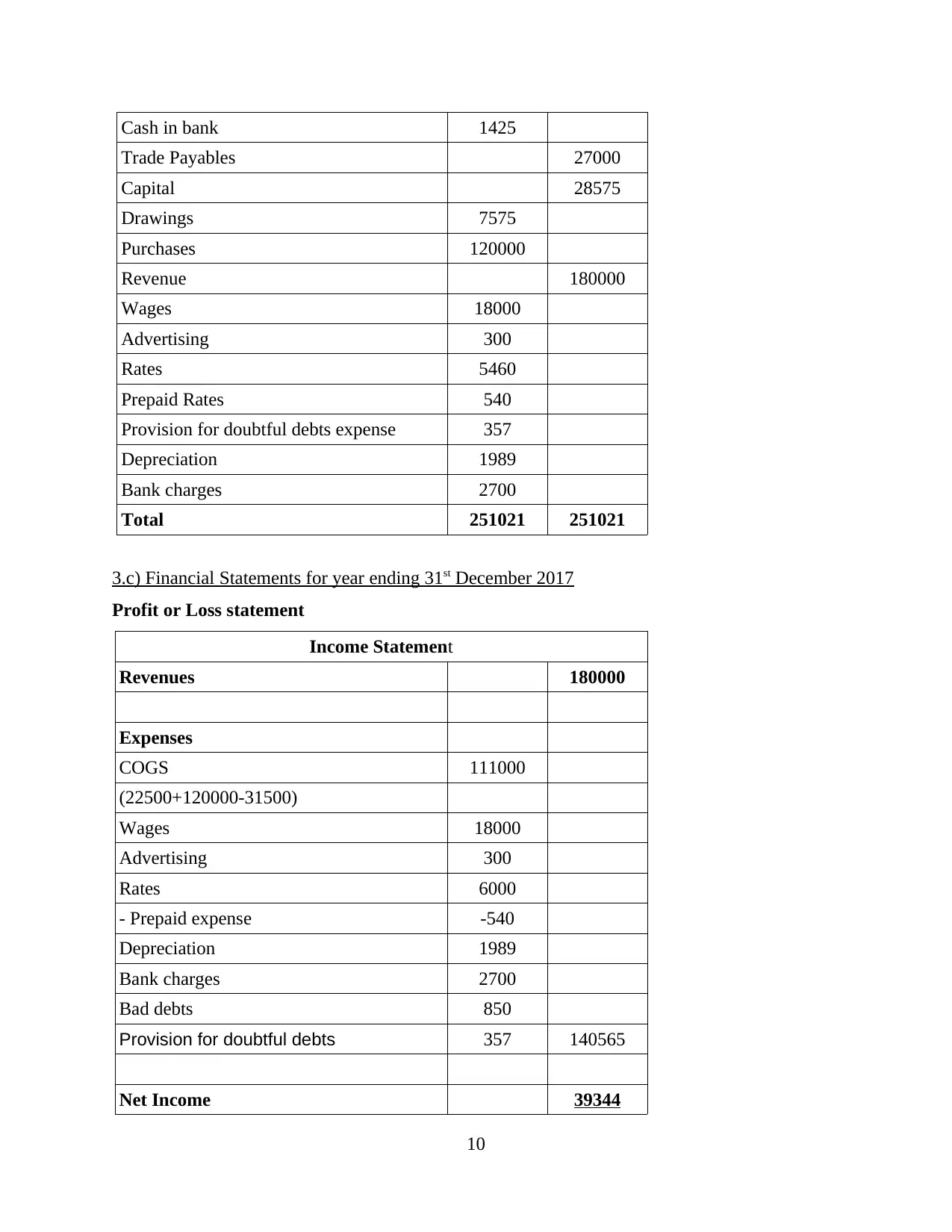

Cash in bank 1425

Trade Payables 27000

Capital 28575

Drawings 7575

Purchases 120000

Revenue 180000

Wages 18000

Advertising 300

Rates 5460

Prepaid Rates 540

Provision for doubtful debts expense 357

Depreciation 1989

Bank charges 2700

Total 251021 251021

3.c) Financial Statements for year ending 31st December 2017

Profit or Loss statement

Income Statement

Revenues 180000

Expenses

COGS 111000

(22500+120000-31500)

Wages 18000

Advertising 300

Rates 6000

- Prepaid expense -540

Depreciation 1989

Bank charges 2700

Bad debts 850

Provision for doubtful debts 357 140565

Net Income 39344

10

Trade Payables 27000

Capital 28575

Drawings 7575

Purchases 120000

Revenue 180000

Wages 18000

Advertising 300

Rates 5460

Prepaid Rates 540

Provision for doubtful debts expense 357

Depreciation 1989

Bank charges 2700

Total 251021 251021

3.c) Financial Statements for year ending 31st December 2017

Profit or Loss statement

Income Statement

Revenues 180000

Expenses

COGS 111000

(22500+120000-31500)

Wages 18000

Advertising 300

Rates 6000

- Prepaid expense -540

Depreciation 1989

Bank charges 2700

Bad debts 850

Provision for doubtful debts 357 140565

Net Income 39344

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

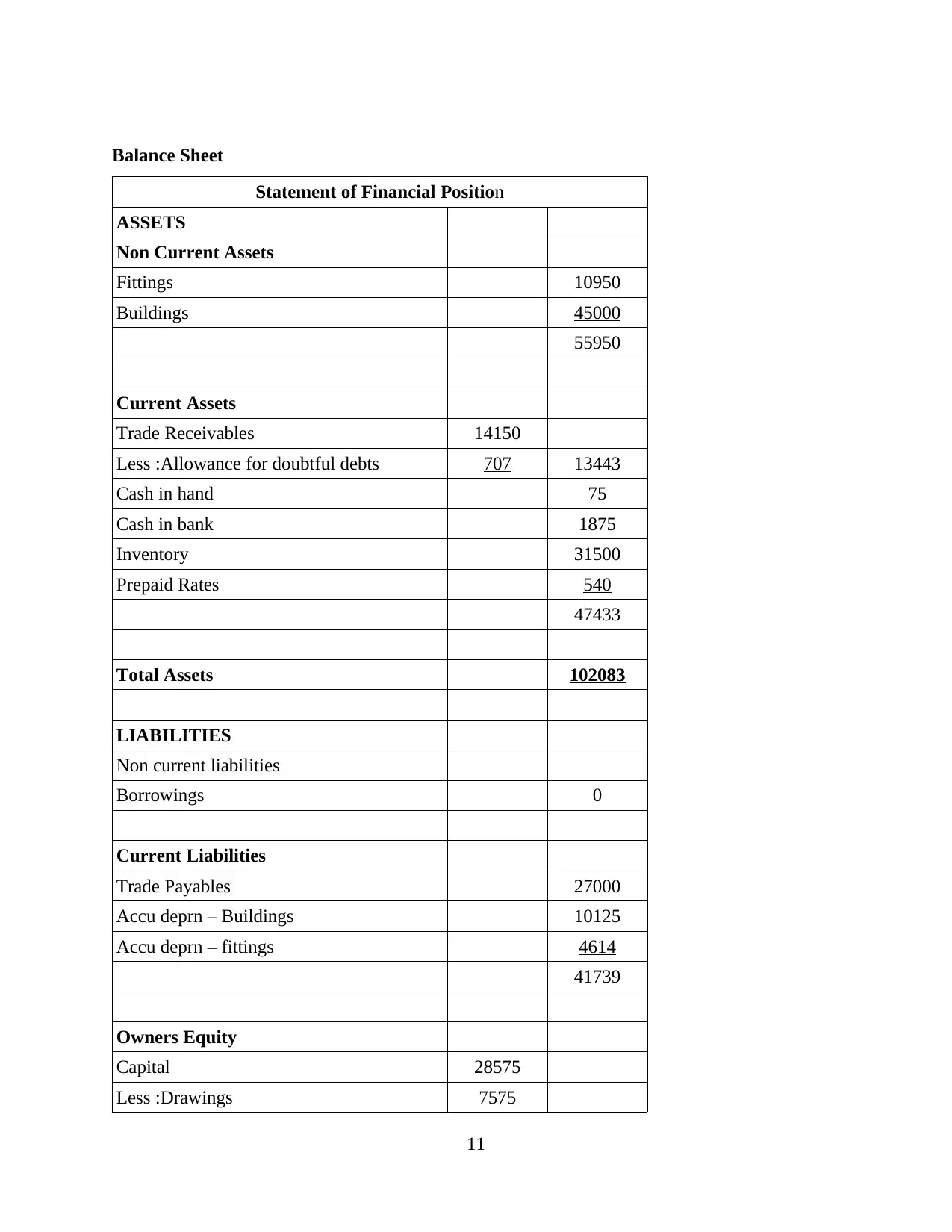

Balance Sheet

Statement of Financial Position

ASSETS

Non Current Assets

Fittings 10950

Buildings 45000

55950

Current Assets

Trade Receivables 14150

Less :Allowance for doubtful debts 707 13443

Cash in hand 75

Cash in bank 1875

Inventory 31500

Prepaid Rates 540

47433

Total Assets 102083

LIABILITIES

Non current liabilities

Borrowings 0

Current Liabilities

Trade Payables 27000

Accu deprn – Buildings 10125

Accu deprn – fittings 4614

41739

Owners Equity

Capital 28575

Less :Drawings 7575

11

Statement of Financial Position

ASSETS

Non Current Assets

Fittings 10950

Buildings 45000

55950

Current Assets

Trade Receivables 14150

Less :Allowance for doubtful debts 707 13443

Cash in hand 75

Cash in bank 1875

Inventory 31500

Prepaid Rates 540

47433

Total Assets 102083

LIABILITIES

Non current liabilities

Borrowings 0

Current Liabilities

Trade Payables 27000

Accu deprn – Buildings 10125

Accu deprn – fittings 4614

41739

Owners Equity

Capital 28575

Less :Drawings 7575

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Add : Profits 39344 60344

Total Equity and Liabilities 102083

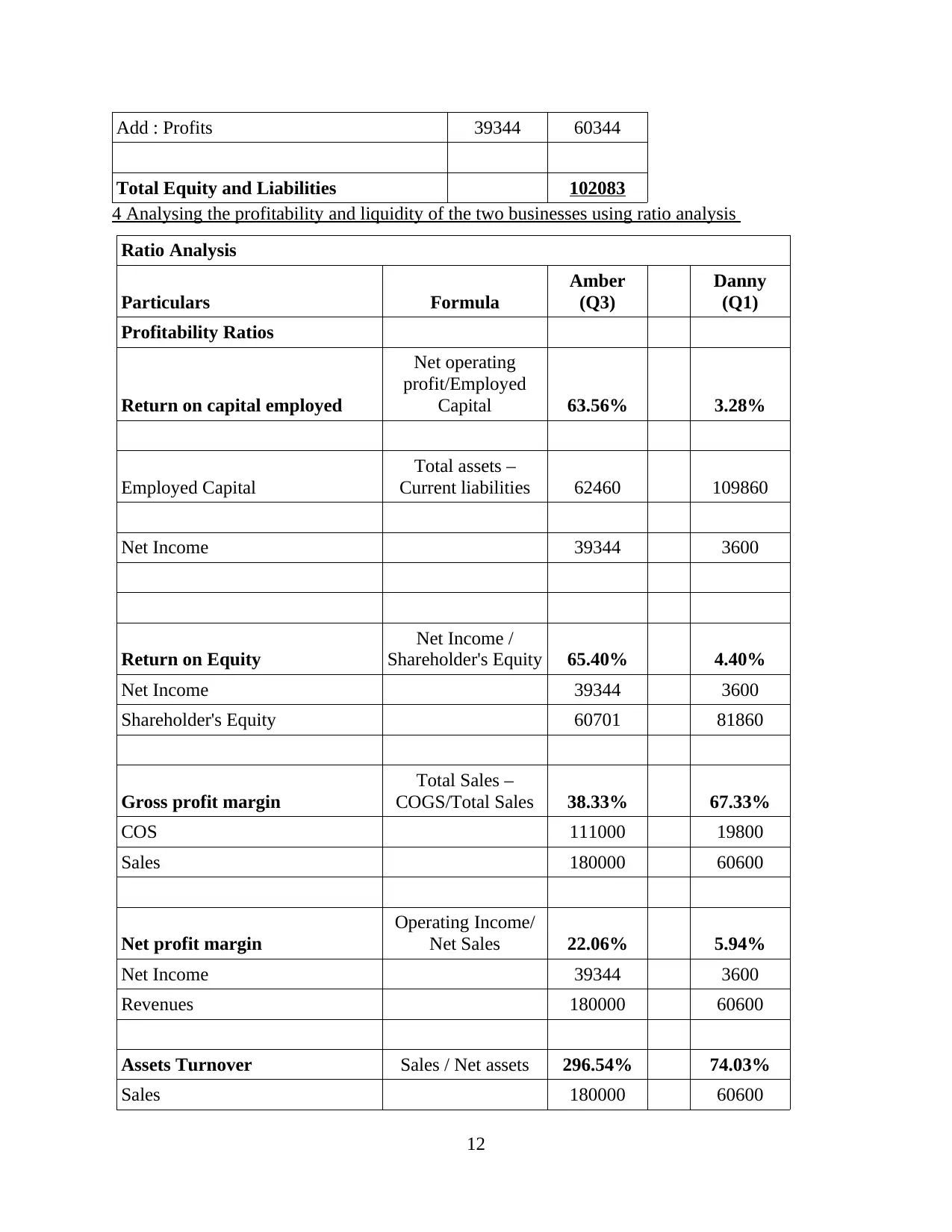

4 Analysing the profitability and liquidity of the two businesses using ratio analysis

Ratio Analysis

Particulars Formula

Amber

(Q3)

Danny

(Q1)

Profitability Ratios

Return on capital employed

Net operating

profit/Employed

Capital 63.56% 3.28%

Employed Capital

Total assets –

Current liabilities 62460 109860

Net Income 39344 3600

Return on Equity

Net Income /

Shareholder's Equity 65.40% 4.40%

Net Income 39344 3600

Shareholder's Equity 60701 81860

Gross profit margin

Total Sales –

COGS/Total Sales 38.33% 67.33%

COS 111000 19800

Sales 180000 60600

Net profit margin

Operating Income/

Net Sales 22.06% 5.94%

Net Income 39344 3600

Revenues 180000 60600

Assets Turnover Sales / Net assets 296.54% 74.03%

Sales 180000 60600

12

Total Equity and Liabilities 102083

4 Analysing the profitability and liquidity of the two businesses using ratio analysis

Ratio Analysis

Particulars Formula

Amber

(Q3)

Danny

(Q1)

Profitability Ratios

Return on capital employed

Net operating

profit/Employed

Capital 63.56% 3.28%

Employed Capital

Total assets –

Current liabilities 62460 109860

Net Income 39344 3600

Return on Equity

Net Income /

Shareholder's Equity 65.40% 4.40%

Net Income 39344 3600

Shareholder's Equity 60701 81860

Gross profit margin

Total Sales –

COGS/Total Sales 38.33% 67.33%

COS 111000 19800

Sales 180000 60600

Net profit margin

Operating Income/

Net Sales 22.06% 5.94%

Net Income 39344 3600

Revenues 180000 60600

Assets Turnover Sales / Net assets 296.54% 74.03%

Sales 180000 60600

12

Net assets 60701 81860

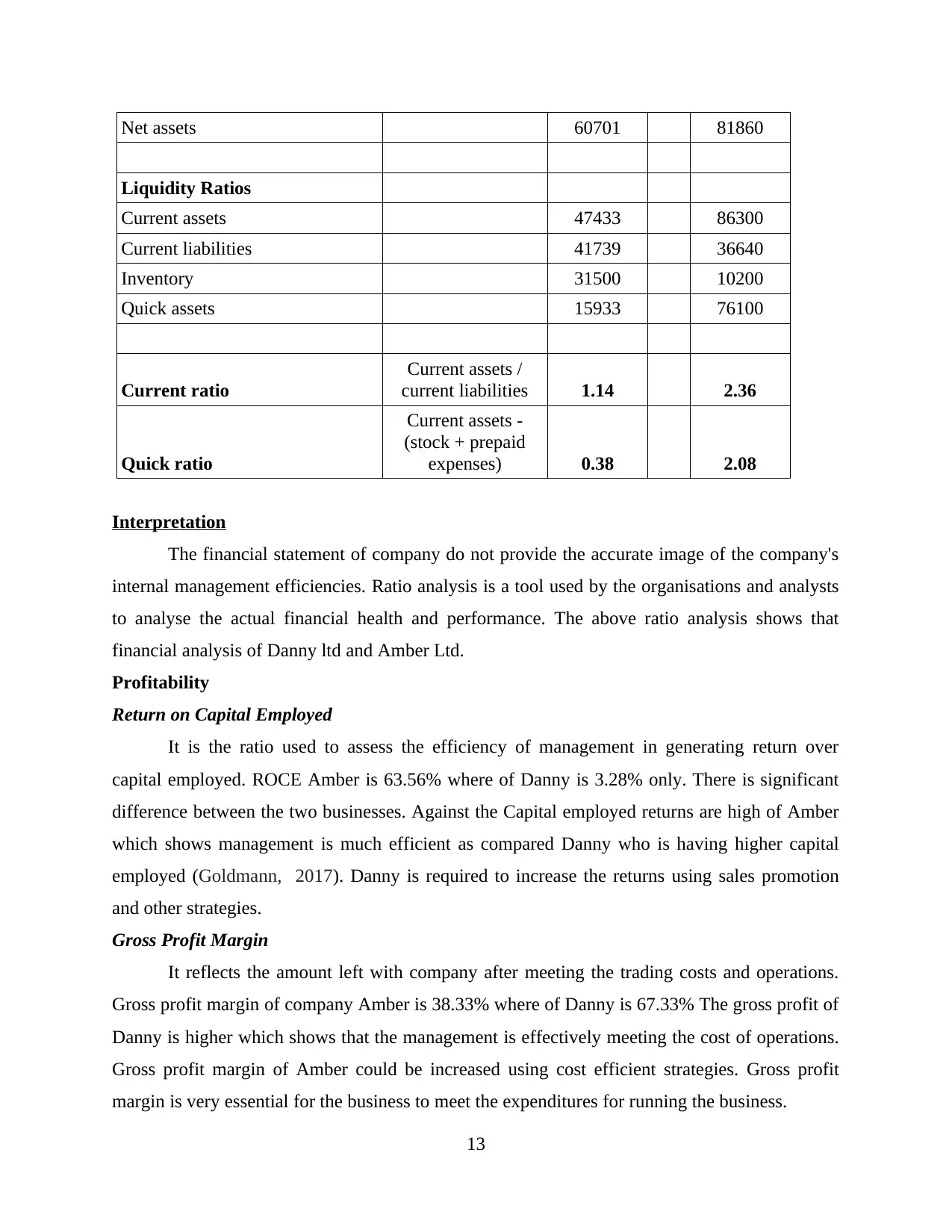

Liquidity Ratios

Current assets 47433 86300

Current liabilities 41739 36640

Inventory 31500 10200

Quick assets 15933 76100

Current ratio

Current assets /

current liabilities 1.14 2.36

Quick ratio

Current assets -

(stock + prepaid

expenses) 0.38 2.08

Interpretation

The financial statement of company do not provide the accurate image of the company's

internal management efficiencies. Ratio analysis is a tool used by the organisations and analysts

to analyse the actual financial health and performance. The above ratio analysis shows that

financial analysis of Danny ltd and Amber Ltd.

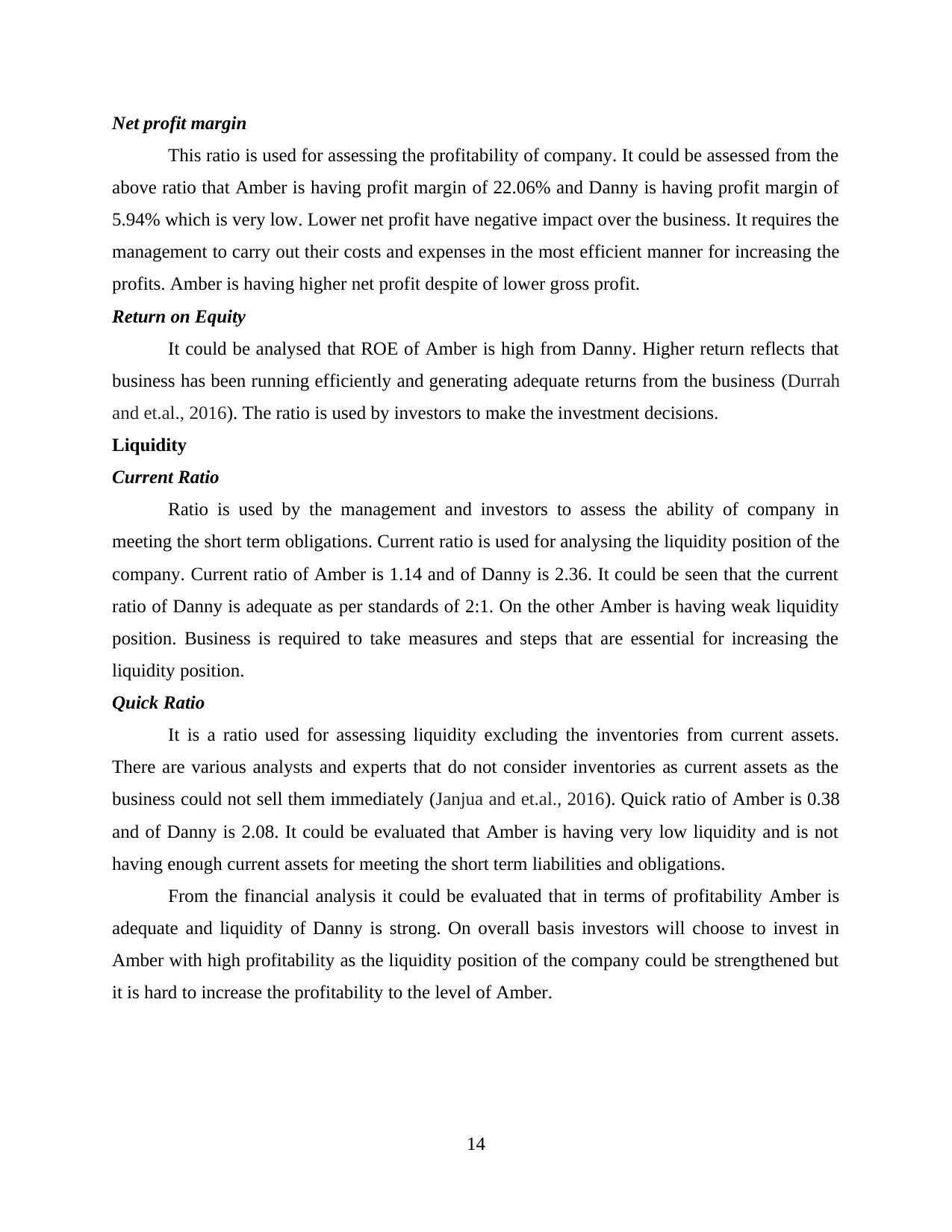

Profitability

Return on Capital Employed

It is the ratio used to assess the efficiency of management in generating return over

capital employed. ROCE Amber is 63.56% where of Danny is 3.28% only. There is significant

difference between the two businesses. Against the Capital employed returns are high of Amber

which shows management is much efficient as compared Danny who is having higher capital

employed (Goldmann, 2017). Danny is required to increase the returns using sales promotion

and other strategies.

Gross Profit Margin

It reflects the amount left with company after meeting the trading costs and operations.

Gross profit margin of company Amber is 38.33% where of Danny is 67.33% The gross profit of

Danny is higher which shows that the management is effectively meeting the cost of operations.

Gross profit margin of Amber could be increased using cost efficient strategies. Gross profit

margin is very essential for the business to meet the expenditures for running the business.

13

Liquidity Ratios

Current assets 47433 86300

Current liabilities 41739 36640

Inventory 31500 10200

Quick assets 15933 76100

Current ratio

Current assets /

current liabilities 1.14 2.36

Quick ratio

Current assets -

(stock + prepaid

expenses) 0.38 2.08

Interpretation

The financial statement of company do not provide the accurate image of the company's

internal management efficiencies. Ratio analysis is a tool used by the organisations and analysts

to analyse the actual financial health and performance. The above ratio analysis shows that

financial analysis of Danny ltd and Amber Ltd.

Profitability

Return on Capital Employed

It is the ratio used to assess the efficiency of management in generating return over

capital employed. ROCE Amber is 63.56% where of Danny is 3.28% only. There is significant

difference between the two businesses. Against the Capital employed returns are high of Amber

which shows management is much efficient as compared Danny who is having higher capital

employed (Goldmann, 2017). Danny is required to increase the returns using sales promotion

and other strategies.

Gross Profit Margin

It reflects the amount left with company after meeting the trading costs and operations.

Gross profit margin of company Amber is 38.33% where of Danny is 67.33% The gross profit of

Danny is higher which shows that the management is effectively meeting the cost of operations.

Gross profit margin of Amber could be increased using cost efficient strategies. Gross profit

margin is very essential for the business to meet the expenditures for running the business.

13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Net profit margin

This ratio is used for assessing the profitability of company. It could be assessed from the

above ratio that Amber is having profit margin of 22.06% and Danny is having profit margin of

5.94% which is very low. Lower net profit have negative impact over the business. It requires the

management to carry out their costs and expenses in the most efficient manner for increasing the

profits. Amber is having higher net profit despite of lower gross profit.

Return on Equity

It could be analysed that ROE of Amber is high from Danny. Higher return reflects that

business has been running efficiently and generating adequate returns from the business (Durrah

and et.al., 2016). The ratio is used by investors to make the investment decisions.

Liquidity

Current Ratio

Ratio is used by the management and investors to assess the ability of company in

meeting the short term obligations. Current ratio is used for analysing the liquidity position of the

company. Current ratio of Amber is 1.14 and of Danny is 2.36. It could be seen that the current

ratio of Danny is adequate as per standards of 2:1. On the other Amber is having weak liquidity

position. Business is required to take measures and steps that are essential for increasing the

liquidity position.

Quick Ratio

It is a ratio used for assessing liquidity excluding the inventories from current assets.

There are various analysts and experts that do not consider inventories as current assets as the

business could not sell them immediately (Janjua and et.al., 2016). Quick ratio of Amber is 0.38

and of Danny is 2.08. It could be evaluated that Amber is having very low liquidity and is not

having enough current assets for meeting the short term liabilities and obligations.

From the financial analysis it could be evaluated that in terms of profitability Amber is

adequate and liquidity of Danny is strong. On overall basis investors will choose to invest in

Amber with high profitability as the liquidity position of the company could be strengthened but

it is hard to increase the profitability to the level of Amber.

14

This ratio is used for assessing the profitability of company. It could be assessed from the

above ratio that Amber is having profit margin of 22.06% and Danny is having profit margin of

5.94% which is very low. Lower net profit have negative impact over the business. It requires the

management to carry out their costs and expenses in the most efficient manner for increasing the

profits. Amber is having higher net profit despite of lower gross profit.

Return on Equity

It could be analysed that ROE of Amber is high from Danny. Higher return reflects that

business has been running efficiently and generating adequate returns from the business (Durrah

and et.al., 2016). The ratio is used by investors to make the investment decisions.

Liquidity

Current Ratio

Ratio is used by the management and investors to assess the ability of company in

meeting the short term obligations. Current ratio is used for analysing the liquidity position of the

company. Current ratio of Amber is 1.14 and of Danny is 2.36. It could be seen that the current

ratio of Danny is adequate as per standards of 2:1. On the other Amber is having weak liquidity

position. Business is required to take measures and steps that are essential for increasing the

liquidity position.

Quick Ratio

It is a ratio used for assessing liquidity excluding the inventories from current assets.

There are various analysts and experts that do not consider inventories as current assets as the

business could not sell them immediately (Janjua and et.al., 2016). Quick ratio of Amber is 0.38

and of Danny is 2.08. It could be evaluated that Amber is having very low liquidity and is not

having enough current assets for meeting the short term liabilities and obligations.

From the financial analysis it could be evaluated that in terms of profitability Amber is

adequate and liquidity of Danny is strong. On overall basis investors will choose to invest in

Amber with high profitability as the liquidity position of the company could be strengthened but

it is hard to increase the profitability to the level of Amber.

14

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

BOGHEAN16, F., and et.al., 2019. THE ROLE OF ACCOUNTING IN DECISION MAKING

BY MANAGERS–EMPIRICAL RESEARCH REGARDING THE USE OF FINANCIAL

ACCOUNTING INFORMATION.

Abdullah, M.D.F., Ardiansah, M.N. and Hamidah, N., 2017. The Effect of Company Size,

Company Age, Public Ownership and Audit Quality on Internet Financial

Reporting. Sriwijaya international journal of dynamic economics and business. 1(2).

pp.153-166.

Mabula, J.B. and Dongping, H., 2019. SME managers' financial literacy on firm practices in

Tanzania. International Journal of Knowledge Engineering and Data Mining. 6(4).

pp.376-394.

Goldmann, K., 2017. Financial liquidity and profitability management in practice of polish

business. In Financial Environment and Business Development (pp. 103-112). Springer,

Cham.

Durrah, O., and et.al., 2016. Exploring the relationship between liquidity ratios and indicators of

financial performance: An analytical study on food industrial companies listed in Amman

Bursa. International Journal of Economics and Financial Issues. 6(2).

Janjua, A.R., and et.al., 2016. Influence of Liquidity on Profitability of Cement Sector:

Indication from Firms Listed in Pakistan Stock Exchange. Business Management

Dynamics. 6(5). p.1.

15

Books and Journals

BOGHEAN16, F., and et.al., 2019. THE ROLE OF ACCOUNTING IN DECISION MAKING

BY MANAGERS–EMPIRICAL RESEARCH REGARDING THE USE OF FINANCIAL

ACCOUNTING INFORMATION.

Abdullah, M.D.F., Ardiansah, M.N. and Hamidah, N., 2017. The Effect of Company Size,

Company Age, Public Ownership and Audit Quality on Internet Financial

Reporting. Sriwijaya international journal of dynamic economics and business. 1(2).

pp.153-166.

Mabula, J.B. and Dongping, H., 2019. SME managers' financial literacy on firm practices in

Tanzania. International Journal of Knowledge Engineering and Data Mining. 6(4).

pp.376-394.

Goldmann, K., 2017. Financial liquidity and profitability management in practice of polish

business. In Financial Environment and Business Development (pp. 103-112). Springer,

Cham.

Durrah, O., and et.al., 2016. Exploring the relationship between liquidity ratios and indicators of

financial performance: An analytical study on food industrial companies listed in Amman

Bursa. International Journal of Economics and Financial Issues. 6(2).

Janjua, A.R., and et.al., 2016. Influence of Liquidity on Profitability of Cement Sector:

Indication from Firms Listed in Pakistan Stock Exchange. Business Management

Dynamics. 6(5). p.1.

15

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.