Accounting Fundamentals Assessment 1: Financial Analysis Report

VerifiedAdded on 2023/01/07

|14

|3911

|76

Report

AI Summary

This report provides a comprehensive analysis of accounting fundamentals, focusing on the financial performance of Wales Plc and Jerry Plc. The report begins with the preparation of financial statements, including the income statement and balance sheet for Wales Plc, detailing revenue, expense...

Accounting Fundamentals Assessment 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

Question 1........................................................................................................................................1

1. Prepare Income Statement of Wales Plc and Statement of financial position for the year end

31st December, 2019....................................................................................................................1

Question 2........................................................................................................................................3

1. Calculate the following ratios of Jerry Plc..............................................................................3

2. Discuss the organizational situation on the basis of calculated ratios.....................................7

Question 3........................................................................................................................................7

1. Identify three different user groups of company accounts......................................................7

2. Discuss the advantages and disadvantages of a highly regulated financial reporting regime. 9

3. Discuss the limitations of financial statements......................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

MAIN BODY..................................................................................................................................1

Question 1........................................................................................................................................1

1. Prepare Income Statement of Wales Plc and Statement of financial position for the year end

31st December, 2019....................................................................................................................1

Question 2........................................................................................................................................3

1. Calculate the following ratios of Jerry Plc..............................................................................3

2. Discuss the organizational situation on the basis of calculated ratios.....................................7

Question 3........................................................................................................................................7

1. Identify three different user groups of company accounts......................................................7

2. Discuss the advantages and disadvantages of a highly regulated financial reporting regime. 9

3. Discuss the limitations of financial statements......................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

Accounting fundamental principles are among the essential accounting aspects which all

companies need to concentrate on so that organizational effectiveness can be sustained (Burger

and Curtis, 2017). The accounting professionals may use financial reports such as income

statement, cash flow and balance sheet when planning to assess the potential business situation.

They can all assist in analyzing the actual business position and predicting it for the long term.

It's also really crucial for the companies' managers to truly make adequate and proper changes in

almost all of the accounting records so that the actual position of organization can be ascertained.

This report is focused on analysis of various accounting aspects which all agencies need to

concentrate on. This assessment covers a wide variety such as developing financial statements by

making the necessary changes, estimating ratios to determine the exact market situation etc. In

addition, this report further includes different users of financial statement and the benefit and

downside of tightly controlled financial reporting system and drawback of final accounts.

MAIN BODY

Question 1

1. Prepare Income Statement of Wales Plc and Statement of financial position for the year end

31st December, 2019

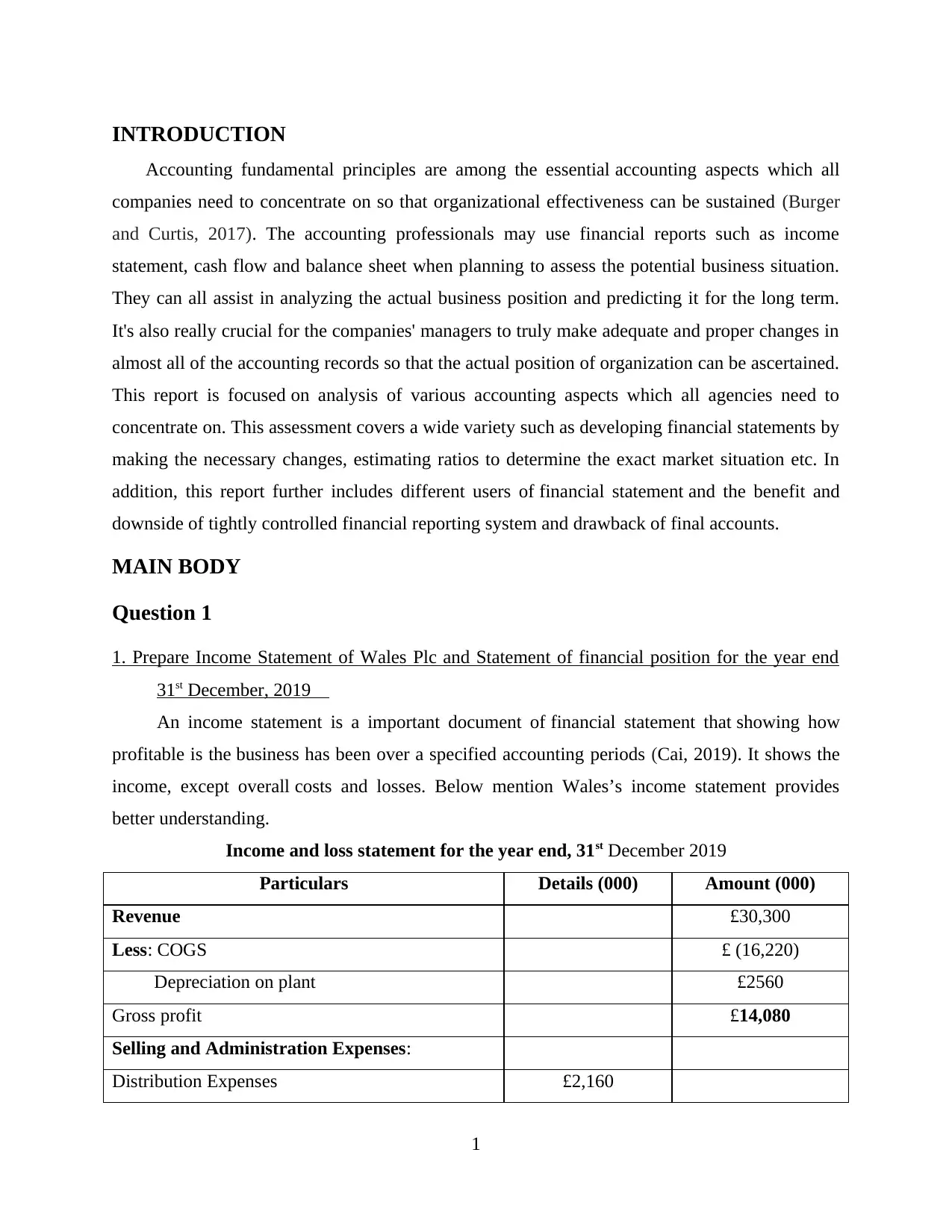

An income statement is a important document of financial statement that showing how

profitable is the business has been over a specified accounting periods (Cai, 2019). It shows the

income, except overall costs and losses. Below mention Wales’s income statement provides

better understanding.

Income and loss statement for the year end, 31st December 2019

Particulars Details (000) Amount (000)

Revenue £30,300

Less: COGS £ (16,220)

Depreciation on plant £2560

Gross profit £14,080

Selling and Administration Expenses:

Distribution Expenses £2,160

1

Accounting fundamental principles are among the essential accounting aspects which all

companies need to concentrate on so that organizational effectiveness can be sustained (Burger

and Curtis, 2017). The accounting professionals may use financial reports such as income

statement, cash flow and balance sheet when planning to assess the potential business situation.

They can all assist in analyzing the actual business position and predicting it for the long term.

It's also really crucial for the companies' managers to truly make adequate and proper changes in

almost all of the accounting records so that the actual position of organization can be ascertained.

This report is focused on analysis of various accounting aspects which all agencies need to

concentrate on. This assessment covers a wide variety such as developing financial statements by

making the necessary changes, estimating ratios to determine the exact market situation etc. In

addition, this report further includes different users of financial statement and the benefit and

downside of tightly controlled financial reporting system and drawback of final accounts.

MAIN BODY

Question 1

1. Prepare Income Statement of Wales Plc and Statement of financial position for the year end

31st December, 2019

An income statement is a important document of financial statement that showing how

profitable is the business has been over a specified accounting periods (Cai, 2019). It shows the

income, except overall costs and losses. Below mention Wales’s income statement provides

better understanding.

Income and loss statement for the year end, 31st December 2019

Particulars Details (000) Amount (000)

Revenue £30,300

Less: COGS £ (16,220)

Depreciation on plant £2560

Gross profit £14,080

Selling and Administration Expenses:

Distribution Expenses £2,160

1

You're viewing a preview

Unlock full access by subscribing today!

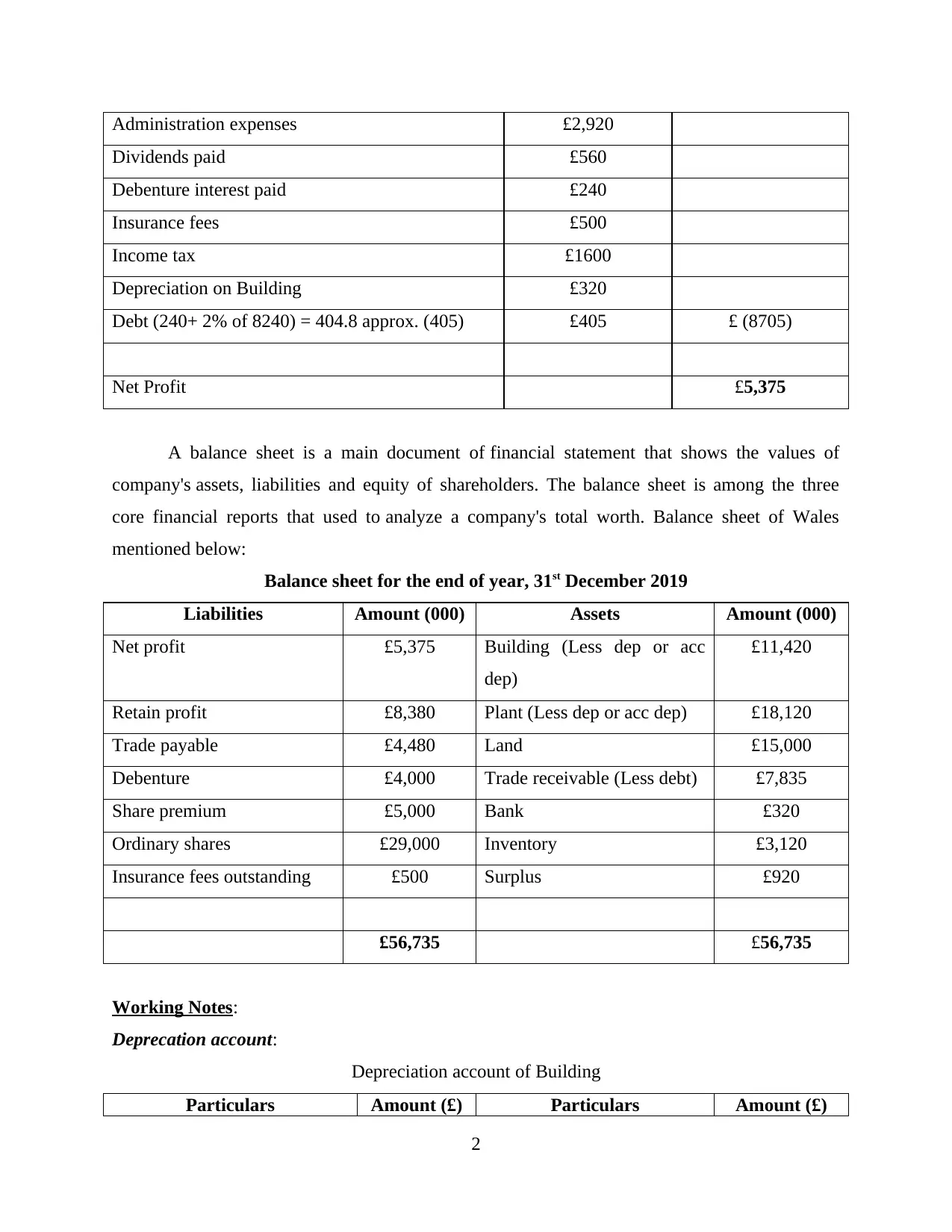

Administration expenses £2,920

Dividends paid £560

Debenture interest paid £240

Insurance fees £500

Income tax £1600

Depreciation on Building £320

Debt (240+ 2% of 8240) = 404.8 approx. (405) £405 £ (8705)

Net Profit £5,375

A balance sheet is a main document of financial statement that shows the values of

company's assets, liabilities and equity of shareholders. The balance sheet is among the three

core financial reports that used to analyze a company's total worth. Balance sheet of Wales

mentioned below:

Balance sheet for the end of year, 31st December 2019

Liabilities Amount (000) Assets Amount (000)

Net profit £5,375 Building (Less dep or acc

dep)

£11,420

Retain profit £8,380 Plant (Less dep or acc dep) £18,120

Trade payable £4,480 Land £15,000

Debenture £4,000 Trade receivable (Less debt) £7,835

Share premium £5,000 Bank £320

Ordinary shares £29,000 Inventory £3,120

Insurance fees outstanding £500 Surplus £920

£56,735 £56,735

Working Notes:

Deprecation account:

Depreciation account of Building

Particulars Amount (£) Particulars Amount (£)

2

Dividends paid £560

Debenture interest paid £240

Insurance fees £500

Income tax £1600

Depreciation on Building £320

Debt (240+ 2% of 8240) = 404.8 approx. (405) £405 £ (8705)

Net Profit £5,375

A balance sheet is a main document of financial statement that shows the values of

company's assets, liabilities and equity of shareholders. The balance sheet is among the three

core financial reports that used to analyze a company's total worth. Balance sheet of Wales

mentioned below:

Balance sheet for the end of year, 31st December 2019

Liabilities Amount (000) Assets Amount (000)

Net profit £5,375 Building (Less dep or acc

dep)

£11,420

Retain profit £8,380 Plant (Less dep or acc dep) £18,120

Trade payable £4,480 Land £15,000

Debenture £4,000 Trade receivable (Less debt) £7,835

Share premium £5,000 Bank £320

Ordinary shares £29,000 Inventory £3,120

Insurance fees outstanding £500 Surplus £920

£56,735 £56,735

Working Notes:

Deprecation account:

Depreciation account of Building

Particulars Amount (£) Particulars Amount (£)

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

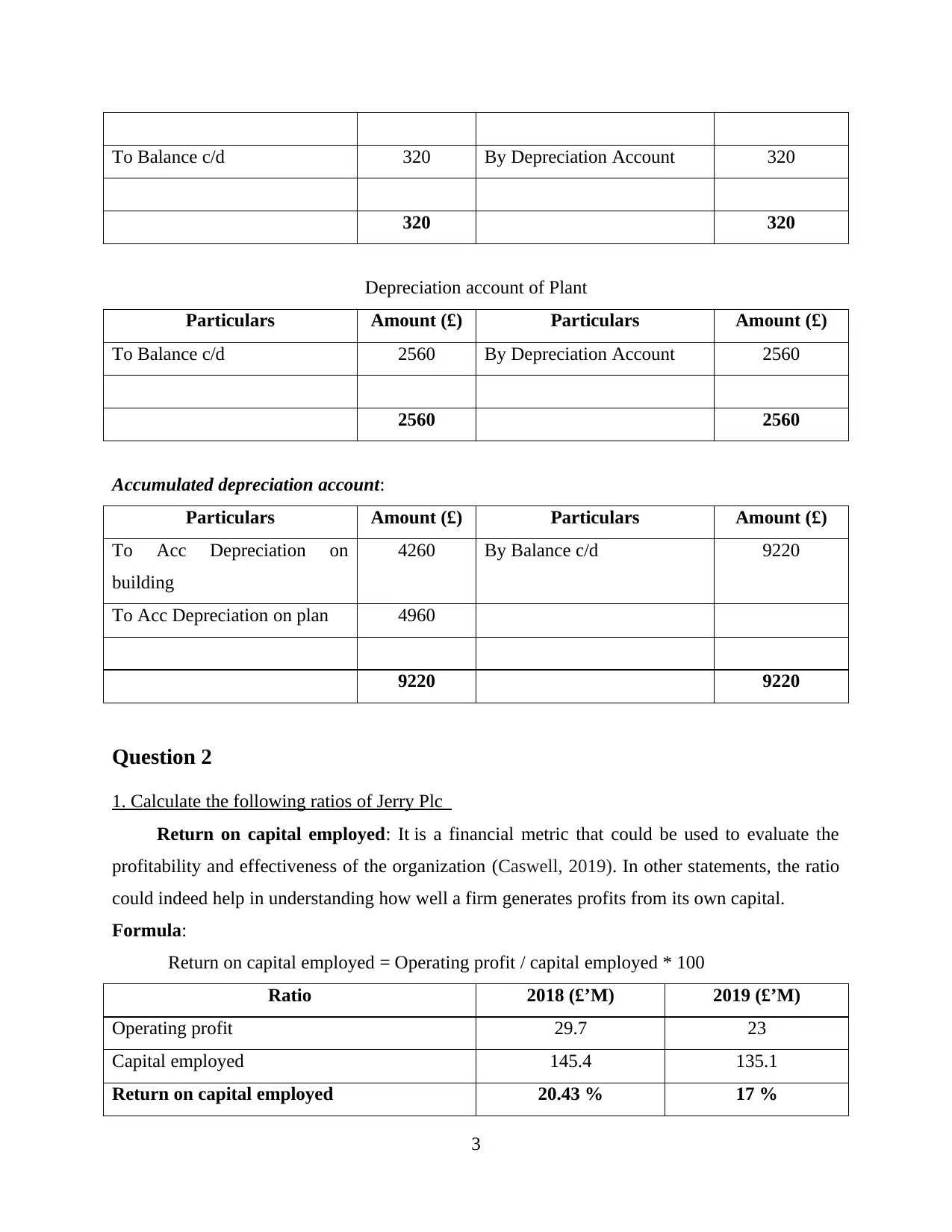

To Balance c/d 320 By Depreciation Account 320

320 320

Depreciation account of Plant

Particulars Amount (£) Particulars Amount (£)

To Balance c/d 2560 By Depreciation Account 2560

2560 2560

Accumulated depreciation account:

Particulars Amount (£) Particulars Amount (£)

To Acc Depreciation on

building

4260 By Balance c/d 9220

To Acc Depreciation on plan 4960

9220 9220

Question 2

1. Calculate the following ratios of Jerry Plc

Return on capital employed: It is a financial metric that could be used to evaluate the

profitability and effectiveness of the organization (Caswell, 2019). In other statements, the ratio

could indeed help in understanding how well a firm generates profits from its own capital.

Formula:

Return on capital employed = Operating profit / capital employed * 100

Ratio 2018 (£’M) 2019 (£’M)

Operating profit 29.7 23

Capital employed 145.4 135.1

Return on capital employed 20.43 % 17 %

3

320 320

Depreciation account of Plant

Particulars Amount (£) Particulars Amount (£)

To Balance c/d 2560 By Depreciation Account 2560

2560 2560

Accumulated depreciation account:

Particulars Amount (£) Particulars Amount (£)

To Acc Depreciation on

building

4260 By Balance c/d 9220

To Acc Depreciation on plan 4960

9220 9220

Question 2

1. Calculate the following ratios of Jerry Plc

Return on capital employed: It is a financial metric that could be used to evaluate the

profitability and effectiveness of the organization (Caswell, 2019). In other statements, the ratio

could indeed help in understanding how well a firm generates profits from its own capital.

Formula:

Return on capital employed = Operating profit / capital employed * 100

Ratio 2018 (£’M) 2019 (£’M)

Operating profit 29.7 23

Capital employed 145.4 135.1

Return on capital employed 20.43 % 17 %

3

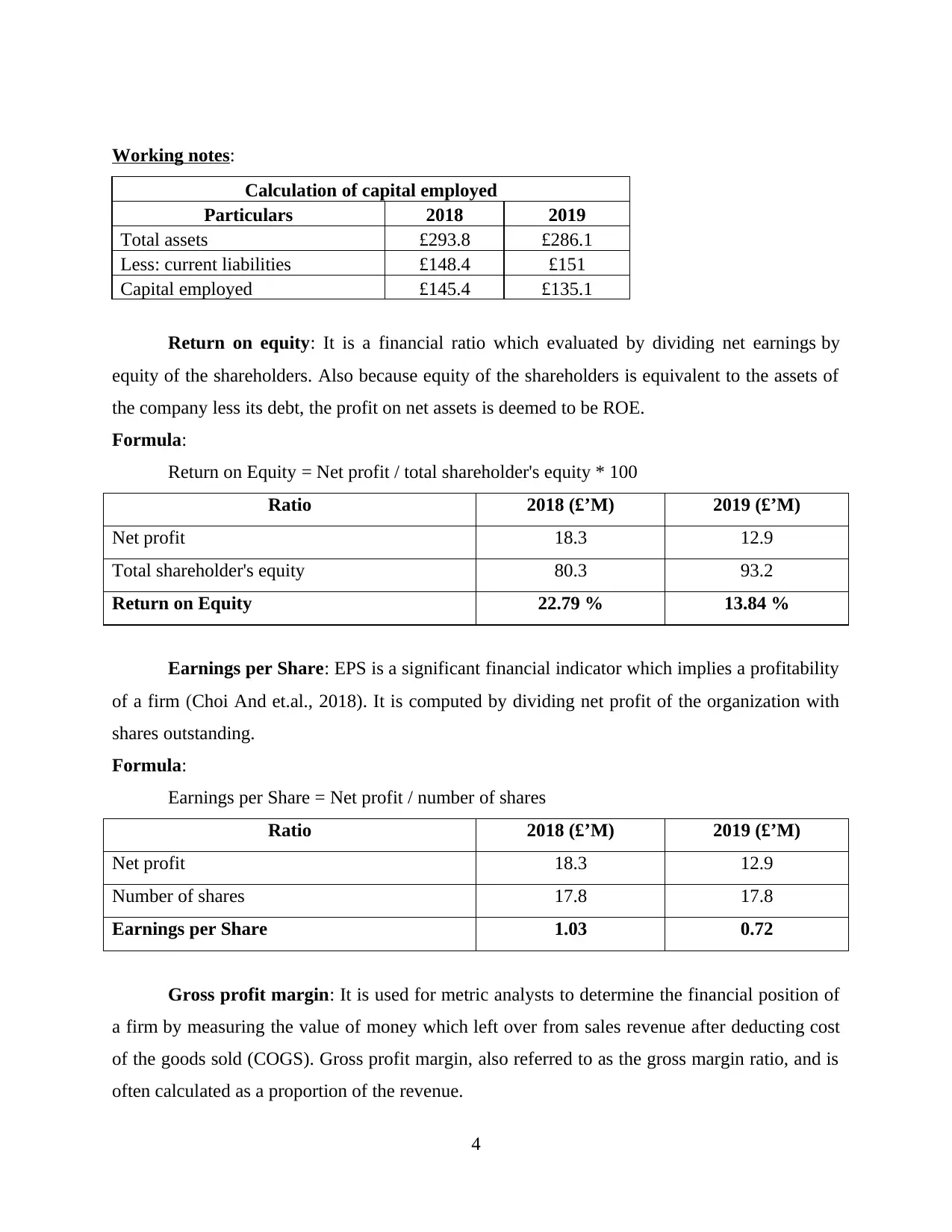

Working notes:

Calculation of capital employed

Particulars 2018 2019

Total assets £293.8 £286.1

Less: current liabilities £148.4 £151

Capital employed £145.4 £135.1

Return on equity: It is a financial ratio which evaluated by dividing net earnings by

equity of the shareholders. Also because equity of the shareholders is equivalent to the assets of

the company less its debt, the profit on net assets is deemed to be ROE.

Formula:

Return on Equity = Net profit / total shareholder's equity * 100

Ratio 2018 (£’M) 2019 (£’M)

Net profit 18.3 12.9

Total shareholder's equity 80.3 93.2

Return on Equity 22.79 % 13.84 %

Earnings per Share: EPS is a significant financial indicator which implies a profitability

of a firm (Choi And et.al., 2018). It is computed by dividing net profit of the organization with

shares outstanding.

Formula:

Earnings per Share = Net profit / number of shares

Ratio 2018 (£’M) 2019 (£’M)

Net profit 18.3 12.9

Number of shares 17.8 17.8

Earnings per Share 1.03 0.72

Gross profit margin: It is used for metric analysts to determine the financial position of

a firm by measuring the value of money which left over from sales revenue after deducting cost

of the goods sold (COGS). Gross profit margin, also referred to as the gross margin ratio, and is

often calculated as a proportion of the revenue.

4

Calculation of capital employed

Particulars 2018 2019

Total assets £293.8 £286.1

Less: current liabilities £148.4 £151

Capital employed £145.4 £135.1

Return on equity: It is a financial ratio which evaluated by dividing net earnings by

equity of the shareholders. Also because equity of the shareholders is equivalent to the assets of

the company less its debt, the profit on net assets is deemed to be ROE.

Formula:

Return on Equity = Net profit / total shareholder's equity * 100

Ratio 2018 (£’M) 2019 (£’M)

Net profit 18.3 12.9

Total shareholder's equity 80.3 93.2

Return on Equity 22.79 % 13.84 %

Earnings per Share: EPS is a significant financial indicator which implies a profitability

of a firm (Choi And et.al., 2018). It is computed by dividing net profit of the organization with

shares outstanding.

Formula:

Earnings per Share = Net profit / number of shares

Ratio 2018 (£’M) 2019 (£’M)

Net profit 18.3 12.9

Number of shares 17.8 17.8

Earnings per Share 1.03 0.72

Gross profit margin: It is used for metric analysts to determine the financial position of

a firm by measuring the value of money which left over from sales revenue after deducting cost

of the goods sold (COGS). Gross profit margin, also referred to as the gross margin ratio, and is

often calculated as a proportion of the revenue.

4

You're viewing a preview

Unlock full access by subscribing today!

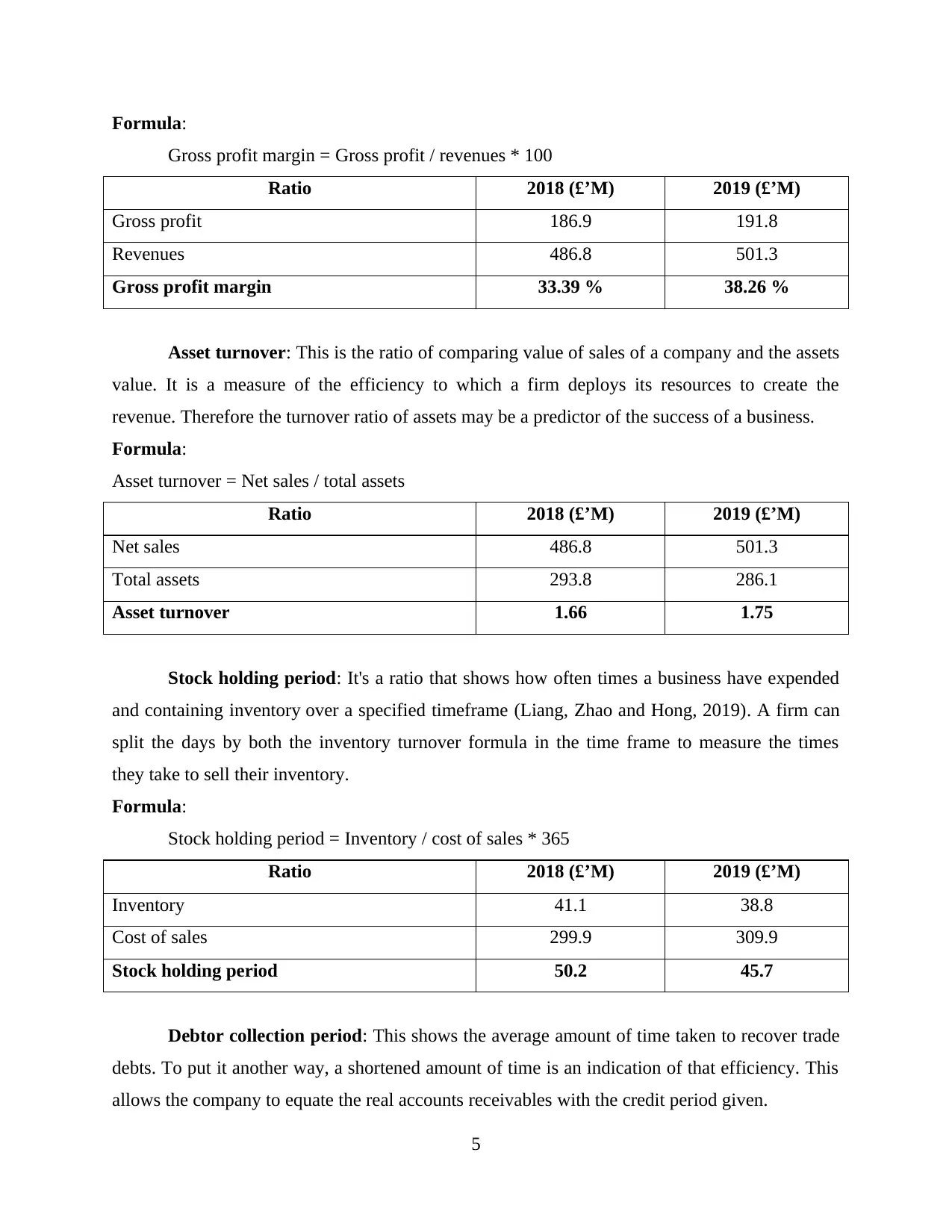

Formula:

Gross profit margin = Gross profit / revenues * 100

Ratio 2018 (£’M) 2019 (£’M)

Gross profit 186.9 191.8

Revenues 486.8 501.3

Gross profit margin 33.39 % 38.26 %

Asset turnover: This is the ratio of comparing value of sales of a company and the assets

value. It is a measure of the efficiency to which a firm deploys its resources to create the

revenue. Therefore the turnover ratio of assets may be a predictor of the success of a business.

Formula:

Asset turnover = Net sales / total assets

Ratio 2018 (£’M) 2019 (£’M)

Net sales 486.8 501.3

Total assets 293.8 286.1

Asset turnover 1.66 1.75

Stock holding period: It's a ratio that shows how often times a business have expended

and containing inventory over a specified timeframe (Liang, Zhao and Hong, 2019). A firm can

split the days by both the inventory turnover formula in the time frame to measure the times

they take to sell their inventory.

Formula:

Stock holding period = Inventory / cost of sales * 365

Ratio 2018 (£’M) 2019 (£’M)

Inventory 41.1 38.8

Cost of sales 299.9 309.9

Stock holding period 50.2 45.7

Debtor collection period: This shows the average amount of time taken to recover trade

debts. To put it another way, a shortened amount of time is an indication of that efficiency. This

allows the company to equate the real accounts receivables with the credit period given.

5

Gross profit margin = Gross profit / revenues * 100

Ratio 2018 (£’M) 2019 (£’M)

Gross profit 186.9 191.8

Revenues 486.8 501.3

Gross profit margin 33.39 % 38.26 %

Asset turnover: This is the ratio of comparing value of sales of a company and the assets

value. It is a measure of the efficiency to which a firm deploys its resources to create the

revenue. Therefore the turnover ratio of assets may be a predictor of the success of a business.

Formula:

Asset turnover = Net sales / total assets

Ratio 2018 (£’M) 2019 (£’M)

Net sales 486.8 501.3

Total assets 293.8 286.1

Asset turnover 1.66 1.75

Stock holding period: It's a ratio that shows how often times a business have expended

and containing inventory over a specified timeframe (Liang, Zhao and Hong, 2019). A firm can

split the days by both the inventory turnover formula in the time frame to measure the times

they take to sell their inventory.

Formula:

Stock holding period = Inventory / cost of sales * 365

Ratio 2018 (£’M) 2019 (£’M)

Inventory 41.1 38.8

Cost of sales 299.9 309.9

Stock holding period 50.2 45.7

Debtor collection period: This shows the average amount of time taken to recover trade

debts. To put it another way, a shortened amount of time is an indication of that efficiency. This

allows the company to equate the real accounts receivables with the credit period given.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

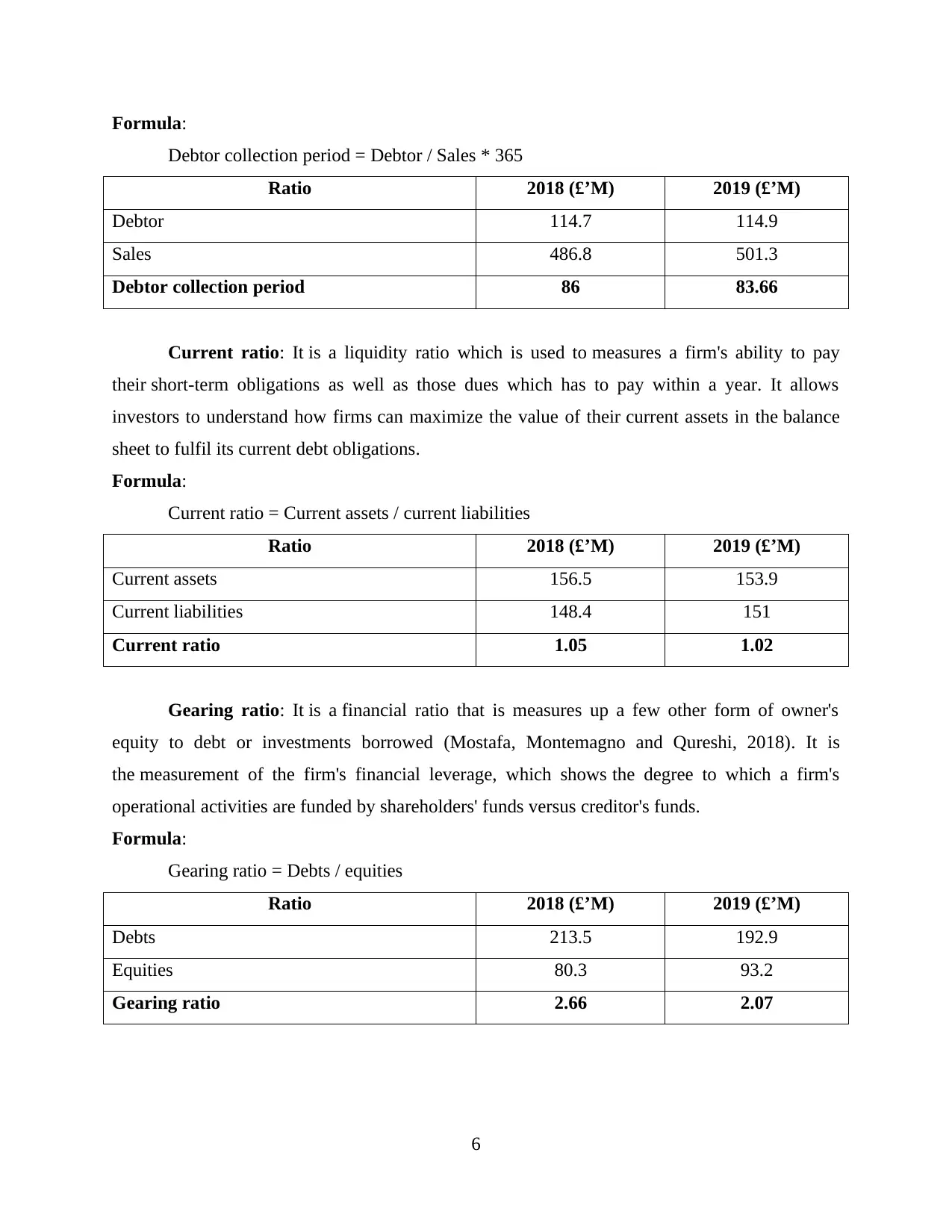

Formula:

Debtor collection period = Debtor / Sales * 365

Ratio 2018 (£’M) 2019 (£’M)

Debtor 114.7 114.9

Sales 486.8 501.3

Debtor collection period 86 83.66

Current ratio: It is a liquidity ratio which is used to measures a firm's ability to pay

their short-term obligations as well as those dues which has to pay within a year. It allows

investors to understand how firms can maximize the value of their current assets in the balance

sheet to fulfil its current debt obligations.

Formula:

Current ratio = Current assets / current liabilities

Ratio 2018 (£’M) 2019 (£’M)

Current assets 156.5 153.9

Current liabilities 148.4 151

Current ratio 1.05 1.02

Gearing ratio: It is a financial ratio that is measures up a few other form of owner's

equity to debt or investments borrowed (Mostafa, Montemagno and Qureshi, 2018). It is

the measurement of the firm's financial leverage, which shows the degree to which a firm's

operational activities are funded by shareholders' funds versus creditor's funds.

Formula:

Gearing ratio = Debts / equities

Ratio 2018 (£’M) 2019 (£’M)

Debts 213.5 192.9

Equities 80.3 93.2

Gearing ratio 2.66 2.07

6

Debtor collection period = Debtor / Sales * 365

Ratio 2018 (£’M) 2019 (£’M)

Debtor 114.7 114.9

Sales 486.8 501.3

Debtor collection period 86 83.66

Current ratio: It is a liquidity ratio which is used to measures a firm's ability to pay

their short-term obligations as well as those dues which has to pay within a year. It allows

investors to understand how firms can maximize the value of their current assets in the balance

sheet to fulfil its current debt obligations.

Formula:

Current ratio = Current assets / current liabilities

Ratio 2018 (£’M) 2019 (£’M)

Current assets 156.5 153.9

Current liabilities 148.4 151

Current ratio 1.05 1.02

Gearing ratio: It is a financial ratio that is measures up a few other form of owner's

equity to debt or investments borrowed (Mostafa, Montemagno and Qureshi, 2018). It is

the measurement of the firm's financial leverage, which shows the degree to which a firm's

operational activities are funded by shareholders' funds versus creditor's funds.

Formula:

Gearing ratio = Debts / equities

Ratio 2018 (£’M) 2019 (£’M)

Debts 213.5 192.9

Equities 80.3 93.2

Gearing ratio 2.66 2.07

6

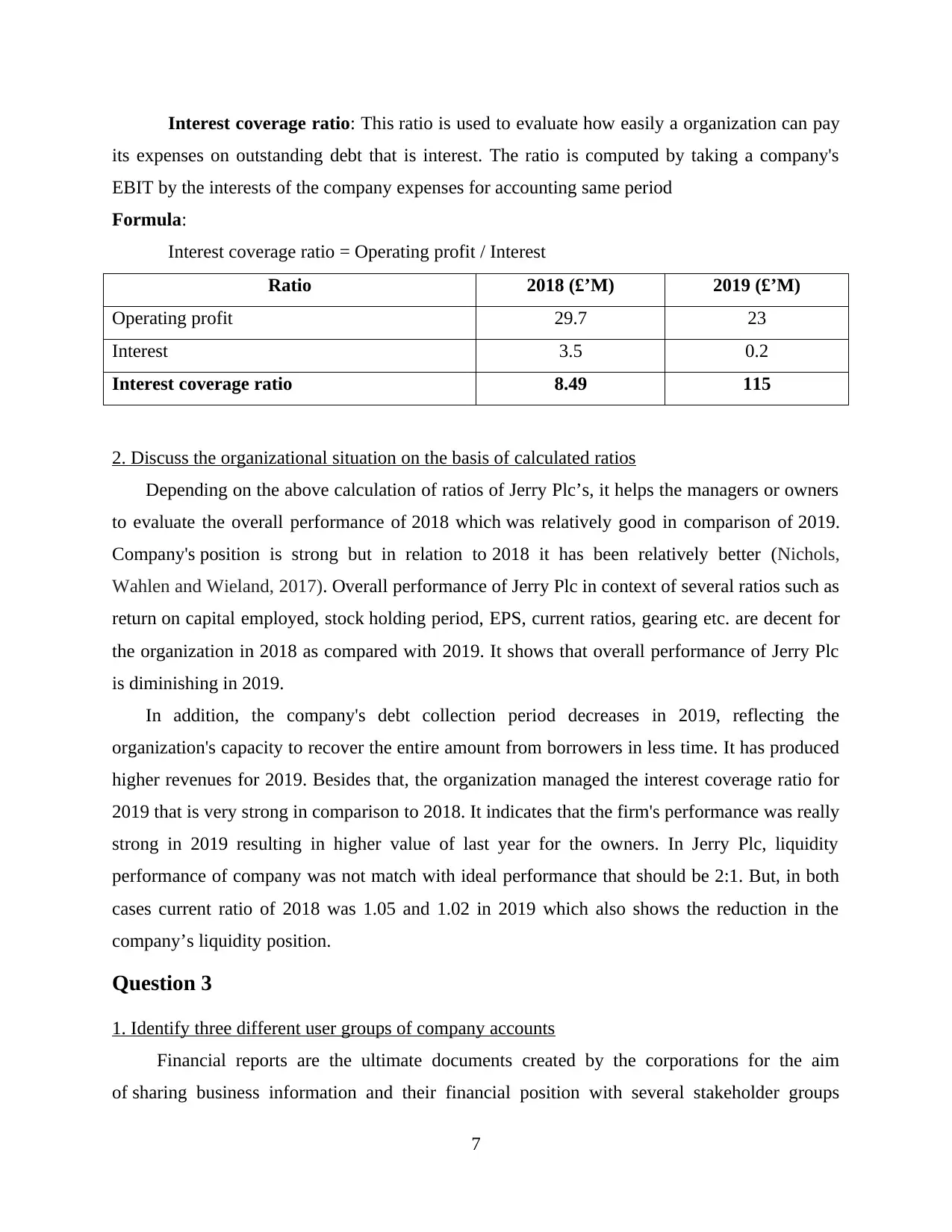

Interest coverage ratio: This ratio is used to evaluate how easily a organization can pay

its expenses on outstanding debt that is interest. The ratio is computed by taking a company's

EBIT by the interests of the company expenses for accounting same period

Formula:

Interest coverage ratio = Operating profit / Interest

Ratio 2018 (£’M) 2019 (£’M)

Operating profit 29.7 23

Interest 3.5 0.2

Interest coverage ratio 8.49 115

2. Discuss the organizational situation on the basis of calculated ratios

Depending on the above calculation of ratios of Jerry Plc’s, it helps the managers or owners

to evaluate the overall performance of 2018 which was relatively good in comparison of 2019.

Company's position is strong but in relation to 2018 it has been relatively better (Nichols,

Wahlen and Wieland, 2017). Overall performance of Jerry Plc in context of several ratios such as

return on capital employed, stock holding period, EPS, current ratios, gearing etc. are decent for

the organization in 2018 as compared with 2019. It shows that overall performance of Jerry Plc

is diminishing in 2019.

In addition, the company's debt collection period decreases in 2019, reflecting the

organization's capacity to recover the entire amount from borrowers in less time. It has produced

higher revenues for 2019. Besides that, the organization managed the interest coverage ratio for

2019 that is very strong in comparison to 2018. It indicates that the firm's performance was really

strong in 2019 resulting in higher value of last year for the owners. In Jerry Plc, liquidity

performance of company was not match with ideal performance that should be 2:1. But, in both

cases current ratio of 2018 was 1.05 and 1.02 in 2019 which also shows the reduction in the

company’s liquidity position.

Question 3

1. Identify three different user groups of company accounts

Financial reports are the ultimate documents created by the corporations for the aim

of sharing business information and their financial position with several stakeholder groups

7

its expenses on outstanding debt that is interest. The ratio is computed by taking a company's

EBIT by the interests of the company expenses for accounting same period

Formula:

Interest coverage ratio = Operating profit / Interest

Ratio 2018 (£’M) 2019 (£’M)

Operating profit 29.7 23

Interest 3.5 0.2

Interest coverage ratio 8.49 115

2. Discuss the organizational situation on the basis of calculated ratios

Depending on the above calculation of ratios of Jerry Plc’s, it helps the managers or owners

to evaluate the overall performance of 2018 which was relatively good in comparison of 2019.

Company's position is strong but in relation to 2018 it has been relatively better (Nichols,

Wahlen and Wieland, 2017). Overall performance of Jerry Plc in context of several ratios such as

return on capital employed, stock holding period, EPS, current ratios, gearing etc. are decent for

the organization in 2018 as compared with 2019. It shows that overall performance of Jerry Plc

is diminishing in 2019.

In addition, the company's debt collection period decreases in 2019, reflecting the

organization's capacity to recover the entire amount from borrowers in less time. It has produced

higher revenues for 2019. Besides that, the organization managed the interest coverage ratio for

2019 that is very strong in comparison to 2018. It indicates that the firm's performance was really

strong in 2019 resulting in higher value of last year for the owners. In Jerry Plc, liquidity

performance of company was not match with ideal performance that should be 2:1. But, in both

cases current ratio of 2018 was 1.05 and 1.02 in 2019 which also shows the reduction in the

company’s liquidity position.

Question 3

1. Identify three different user groups of company accounts

Financial reports are the ultimate documents created by the corporations for the aim

of sharing business information and their financial position with several stakeholder groups

7

You're viewing a preview

Unlock full access by subscribing today!

which use the shaped by various reasons (Patel, 2018). It's indeed vital that all companies ensure

they seem to be willing to share specific information with stakeholders while they benefit the

firm to grow. There are some major type of financial reports which produced by the

organizations such as profit & loss account (Income and loss statement), balance sheet (Financial

position) and cash flow analysis. The overall financial position of the company could be

measured with the help of making financial reports so that management able to formulate their

future strategy accordingly. There are many specific categories of users who really are involved

in the use of financial statement in details. It describes three main categories from every one of

them discussed below:

Internal users: All the end account users who are directly connected to the company are

referred to as internal participants or stakeholders. They utilize financial report to assess the

firm's results, so they can shape multiple decisions which helps in maximising overall earnings

of stakeholders. Internal users of financial statement are staff members, owner, board

members, managers etc. These people are interested in company's financial statement such as

profit & loss account, balance sheet, cash or fund flow statement etc. for several reasons which

help in making strategic decisions. Employees required such information to ensure that, they are

working in financially stable organization or not because of their job security. Managers are

largely responsible for developing and implementing appropriate plans so they can improve

company efficiency. It is one of the key reasons why internal stakeholders required such

financial information from different financial statements.

External users: Those individuals who are regarded as external parties who shows interest

in financial information of the company (Schroeder, Clark and Cathey, 2019). Organizations use

the account report to determine the company's operations position which further helps in making

effective decisions. External stakeholders are ranking institution, current and potential investors,

government agency, customers etc. These people are interested in financial statement for

different reasons. Creditors are using such financial reports to evaluate company's reputation

and examine business capacity to return products from their investments. In fact, govt agencies

use the company's final statements to ensure whether the companies pay the correct tax or not,

and that the enterprise is performing in an acceptable manner or not. Using financial statement,

consumers evaluate whether they buy goods from a financially stable company or not.

8

they seem to be willing to share specific information with stakeholders while they benefit the

firm to grow. There are some major type of financial reports which produced by the

organizations such as profit & loss account (Income and loss statement), balance sheet (Financial

position) and cash flow analysis. The overall financial position of the company could be

measured with the help of making financial reports so that management able to formulate their

future strategy accordingly. There are many specific categories of users who really are involved

in the use of financial statement in details. It describes three main categories from every one of

them discussed below:

Internal users: All the end account users who are directly connected to the company are

referred to as internal participants or stakeholders. They utilize financial report to assess the

firm's results, so they can shape multiple decisions which helps in maximising overall earnings

of stakeholders. Internal users of financial statement are staff members, owner, board

members, managers etc. These people are interested in company's financial statement such as

profit & loss account, balance sheet, cash or fund flow statement etc. for several reasons which

help in making strategic decisions. Employees required such information to ensure that, they are

working in financially stable organization or not because of their job security. Managers are

largely responsible for developing and implementing appropriate plans so they can improve

company efficiency. It is one of the key reasons why internal stakeholders required such

financial information from different financial statements.

External users: Those individuals who are regarded as external parties who shows interest

in financial information of the company (Schroeder, Clark and Cathey, 2019). Organizations use

the account report to determine the company's operations position which further helps in making

effective decisions. External stakeholders are ranking institution, current and potential investors,

government agency, customers etc. These people are interested in financial statement for

different reasons. Creditors are using such financial reports to evaluate company's reputation

and examine business capacity to return products from their investments. In fact, govt agencies

use the company's final statements to ensure whether the companies pay the correct tax or not,

and that the enterprise is performing in an acceptable manner or not. Using financial statement,

consumers evaluate whether they buy goods from a financially stable company or not.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Board member: They are among the key users of financial statements as they are strongly

involved in corporate results and they also focused on company's development by making

effective decision. Both owners, executives, CEOs etc. are member of this group. These people

are interested in financial information since it is the responsibility of board members to manage

the property of business and they need to analyze the actual position of firm for such reasons.

From the overall analysis it has been analysed that above discussed users of financial

statement are interested in company’s financial performance which allow them to understand that

company is profit making organization or not (Smith, 2019). In addition, it helps in attracting

potential inventors to invent in their company after evaluating financial health of organization.

Internal, external stakeholders required such information to make strategic decisions as per

convince or their individual reasons.

2. Discuss the advantages and disadvantages of a highly regulated financial reporting regime

Strictly regulated financial statement regime is highly useful for all companies as well as

end users of financial statement as reliable reports which include business trisections with the aid

of it. It has different advantages and disadvantages for both consumers and the provider and all

of each other could be discussed below:

Advantages:

Heavily regulated financial reporting strategies are accompanied by auditors, those who

able to attract ever more stockholders because of final accounts are transparent and

accurate.

If the corporation practices a tightly structured financial reporting system, that would be

helpful to customers such as investors and creditors (Tkhagapso, 2019). It will help them

to decide whether or not that organization able to reimburse their balance in time.

Disadvantage:

The laws and regulations enforced by a strictly controlled financial reporting regime are

very rigid, and it should be possible that standard setters make a slight error

unintentionally; it may have a negative effect on the business market reputation.

Another drawback for the users regarding strict regulations for financial reporting system

is that they may find it impossible to interpret the final accounting details because of

specific regulations.

9

involved in corporate results and they also focused on company's development by making

effective decision. Both owners, executives, CEOs etc. are member of this group. These people

are interested in financial information since it is the responsibility of board members to manage

the property of business and they need to analyze the actual position of firm for such reasons.

From the overall analysis it has been analysed that above discussed users of financial

statement are interested in company’s financial performance which allow them to understand that

company is profit making organization or not (Smith, 2019). In addition, it helps in attracting

potential inventors to invent in their company after evaluating financial health of organization.

Internal, external stakeholders required such information to make strategic decisions as per

convince or their individual reasons.

2. Discuss the advantages and disadvantages of a highly regulated financial reporting regime

Strictly regulated financial statement regime is highly useful for all companies as well as

end users of financial statement as reliable reports which include business trisections with the aid

of it. It has different advantages and disadvantages for both consumers and the provider and all

of each other could be discussed below:

Advantages:

Heavily regulated financial reporting strategies are accompanied by auditors, those who

able to attract ever more stockholders because of final accounts are transparent and

accurate.

If the corporation practices a tightly structured financial reporting system, that would be

helpful to customers such as investors and creditors (Tkhagapso, 2019). It will help them

to decide whether or not that organization able to reimburse their balance in time.

Disadvantage:

The laws and regulations enforced by a strictly controlled financial reporting regime are

very rigid, and it should be possible that standard setters make a slight error

unintentionally; it may have a negative effect on the business market reputation.

Another drawback for the users regarding strict regulations for financial reporting system

is that they may find it impossible to interpret the final accounting details because of

specific regulations.

9

3. Discuss the limitations of financial statements

There are several limitations of financial statements which are essential to understand and

make it in their mind before making any strategic decision in context of organizations:

Based on historical cost: Financial reports do not show the firm's current value because it

s based on historic cost concept. First they record transactions at their expense. Over time the

valuation of assets and liabilities varies (Ward and Calabrese, 2018). Often organization adjust

things like securities and try to match the changes with their market prices, but other products,

such as fixed assets, don't change. The balance sheet could indeed be misrepresentative if they

show a large percentage of the amount that is based on actual costs.

Based on personal judgement: The asset value is contained the claim that is dependent

on the expectations of the person dealing with it. The process of depreciation, amortization of

properties etc. are based on the judgment of accountant.

Inflationary effects: If the inflation scenario the rate is fairly high, the amount of balance

sheet which shoes in the categories of assets and liabilities would look disproportionately weak,

because business cannot adapt these to inflation. This is especially important for long-term

resources such as fixed assets.

Judgement regarding several accounting policies: As business produce a balance

sheet based on the principle of going concern, whereby asset valuation doesn't really reflect true

assets or asset replacement cost. And, they know the numbers that are transmitting by financial

statements isn't right. This also relies on the management’s decision on the accounting

procedures that have been implemented.

Not always comparable across companies: If a corporation wants to match firm's

results with other firms, their financial reports weren't always identical, even though different

businesses follow different accounting methods.

False figures: A company's management team can affect out the results. This situation

occurs whenever there is undue pressure to encourage conversation results, for example

whenever a bonus plan just calls for salaries and bonuses if the level of sales grows (Wright,

2017). One could suspect the existence of this problem whenever the results rise sharply to a

high level in comparison to industry norm.

Lack of non financial factors: The financial reports take into account only financial or

monetary factors and they do not resolve non-financial concerns, such as the ecological

10

There are several limitations of financial statements which are essential to understand and

make it in their mind before making any strategic decision in context of organizations:

Based on historical cost: Financial reports do not show the firm's current value because it

s based on historic cost concept. First they record transactions at their expense. Over time the

valuation of assets and liabilities varies (Ward and Calabrese, 2018). Often organization adjust

things like securities and try to match the changes with their market prices, but other products,

such as fixed assets, don't change. The balance sheet could indeed be misrepresentative if they

show a large percentage of the amount that is based on actual costs.

Based on personal judgement: The asset value is contained the claim that is dependent

on the expectations of the person dealing with it. The process of depreciation, amortization of

properties etc. are based on the judgment of accountant.

Inflationary effects: If the inflation scenario the rate is fairly high, the amount of balance

sheet which shoes in the categories of assets and liabilities would look disproportionately weak,

because business cannot adapt these to inflation. This is especially important for long-term

resources such as fixed assets.

Judgement regarding several accounting policies: As business produce a balance

sheet based on the principle of going concern, whereby asset valuation doesn't really reflect true

assets or asset replacement cost. And, they know the numbers that are transmitting by financial

statements isn't right. This also relies on the management’s decision on the accounting

procedures that have been implemented.

Not always comparable across companies: If a corporation wants to match firm's

results with other firms, their financial reports weren't always identical, even though different

businesses follow different accounting methods.

False figures: A company's management team can affect out the results. This situation

occurs whenever there is undue pressure to encourage conversation results, for example

whenever a bonus plan just calls for salaries and bonuses if the level of sales grows (Wright,

2017). One could suspect the existence of this problem whenever the results rise sharply to a

high level in comparison to industry norm.

Lack of non financial factors: The financial reports take into account only financial or

monetary factors and they do not resolve non-financial concerns, such as the ecological

10

You're viewing a preview

Unlock full access by subscribing today!

responsiveness of a firm's operations, or how well it appears to work with both the surrounding

area. A organization reporting better financial performance might be an inability in other areas

including the reputation of the firm, the devotion of its employees, etc.

CONCLUSION

On the basis of above analysis it has been evaluate that fundamental accounting is the

method of reporting financial activities in a company's account. This accounting method involves

the collection, updating and monitoring overall information which are used for regulatory

purpose, law enforcement and tax collecting authorities of such operations. This plays an

important role in effectively operating a company, as it helps organizations to measure revenue

and expenses, ensuring compliance by regulators. It gives interactive financial reports that could

be used to build strategic decisions for investors, administrators and public sector. This study

revealed that various key articles are essential for managers to plan for successful tactics. The

income statement allows determining the total costs and profitability of the firm. Financial

position also shows the company's financial health and helps investors to make their decisions

regarding finances. Moreover, ratio analysis lets the Jerry Plc determine the success of their

business in terms of competitiveness, productivity, quality etc. Stakeholders are interested in the

company's financial statement and these are classified into internal, external stakeholders or

board members who made their decisions on the basis of published financial reports.

Further stakeholders made decisions whether they have to make their decision in respect of

organization or not. There are also several benefits or drawbacks which have been critical to

assess financial statements before making any business strategy.

11

area. A organization reporting better financial performance might be an inability in other areas

including the reputation of the firm, the devotion of its employees, etc.

CONCLUSION

On the basis of above analysis it has been evaluate that fundamental accounting is the

method of reporting financial activities in a company's account. This accounting method involves

the collection, updating and monitoring overall information which are used for regulatory

purpose, law enforcement and tax collecting authorities of such operations. This plays an

important role in effectively operating a company, as it helps organizations to measure revenue

and expenses, ensuring compliance by regulators. It gives interactive financial reports that could

be used to build strategic decisions for investors, administrators and public sector. This study

revealed that various key articles are essential for managers to plan for successful tactics. The

income statement allows determining the total costs and profitability of the firm. Financial

position also shows the company's financial health and helps investors to make their decisions

regarding finances. Moreover, ratio analysis lets the Jerry Plc determine the success of their

business in terms of competitiveness, productivity, quality etc. Stakeholders are interested in the

company's financial statement and these are classified into internal, external stakeholders or

board members who made their decisions on the basis of published financial reports.

Further stakeholders made decisions whether they have to make their decision in respect of

organization or not. There are also several benefits or drawbacks which have been critical to

assess financial statements before making any business strategy.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books & Journals

Burger, M. and Curtis, A., 2017. Aggregate margin debt and the divergence of price from

accounting fundamentals. Contemporary Accounting Research. 34(3). pp.1418-1445.

Cai, C. W., 2019. Triple‐entry accounting with blockchain: How far have we come?. Accounting

& Finance.

Caswell, S., 2019. An Analysis of Financial Accounting Fundamentals Through Case Studies.

Choi, K. B. And et.al., 2018. Amplification ratio analysis of a bridge-type mechanical

amplification mechanism based on a fully compliant model. Mechanism and Machine

Theory. 121. pp.355-372.

Liang, W., Zhao, G. and Hong, C., 2019. Selecting the optimal mining method with extended

multi-objective optimization by ratio analysis plus the full multiplicative form

(MULTIMOORA) approach. Neural Computing and Applications. 31(10). pp.5871-5886.

Mostafa, K. G., Montemagno, C. and Qureshi, A. J., 2018. Strength to cost ratio analysis of

FDM Nylon 12 3D Printed Parts. Procedia Manufacturing. 26. pp.753-762.

Nichols, D. C., Wahlen, J. M. and Wieland, M. M., 2017. Pricing and Mispricing of Accounting

Fundamentals in the Time‐Series and in the Cross Section. Contemporary Accounting

Research. 34(3). pp.1378-1417.

Patel, K., 2018. Explaining value vs. growth investing through accounting

fundamentals. Financial Analysts Journal. 74(4). pp.31-32.

Schroeder, R. G., Clark, M. W. and Cathey, J. M., 2019. Financial accounting theory and

analysis: text and cases. John Wiley & Sons.

Smith, M., 2019. Research methods in accounting. SAGE Publications Limited.

Tkhagapso, R., 2019, October. Transformation of Fundamental Accounting Principles in the

Context of a Company Insolvency from the Perspective of the Digital Economy. In The

2018 International Conference on Digital Science (pp. 75-85). Springer, Cham.

Ward, D. M. and Calabrese, T., 2018. Accounting fundamentals for health care management.

Jones & Bartlett Learning.

Wright, C. J., 2017. Fundamentals of oil & gas accounting. PennWell Books.

12

Books & Journals

Burger, M. and Curtis, A., 2017. Aggregate margin debt and the divergence of price from

accounting fundamentals. Contemporary Accounting Research. 34(3). pp.1418-1445.

Cai, C. W., 2019. Triple‐entry accounting with blockchain: How far have we come?. Accounting

& Finance.

Caswell, S., 2019. An Analysis of Financial Accounting Fundamentals Through Case Studies.

Choi, K. B. And et.al., 2018. Amplification ratio analysis of a bridge-type mechanical

amplification mechanism based on a fully compliant model. Mechanism and Machine

Theory. 121. pp.355-372.

Liang, W., Zhao, G. and Hong, C., 2019. Selecting the optimal mining method with extended

multi-objective optimization by ratio analysis plus the full multiplicative form

(MULTIMOORA) approach. Neural Computing and Applications. 31(10). pp.5871-5886.

Mostafa, K. G., Montemagno, C. and Qureshi, A. J., 2018. Strength to cost ratio analysis of

FDM Nylon 12 3D Printed Parts. Procedia Manufacturing. 26. pp.753-762.

Nichols, D. C., Wahlen, J. M. and Wieland, M. M., 2017. Pricing and Mispricing of Accounting

Fundamentals in the Time‐Series and in the Cross Section. Contemporary Accounting

Research. 34(3). pp.1378-1417.

Patel, K., 2018. Explaining value vs. growth investing through accounting

fundamentals. Financial Analysts Journal. 74(4). pp.31-32.

Schroeder, R. G., Clark, M. W. and Cathey, J. M., 2019. Financial accounting theory and

analysis: text and cases. John Wiley & Sons.

Smith, M., 2019. Research methods in accounting. SAGE Publications Limited.

Tkhagapso, R., 2019, October. Transformation of Fundamental Accounting Principles in the

Context of a Company Insolvency from the Perspective of the Digital Economy. In The

2018 International Conference on Digital Science (pp. 75-85). Springer, Cham.

Ward, D. M. and Calabrese, T., 2018. Accounting fundamentals for health care management.

Jones & Bartlett Learning.

Wright, C. J., 2017. Fundamentals of oil & gas accounting. PennWell Books.

12

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.