ACC00718: Accounting Information Systems Procedures and Checks Report

VerifiedAdded on 2023/03/17

|7

|1683

|28

Report

AI Summary

This report analyzes two scenarios related to accounting information systems and fraud. Scenario A focuses on a public company overpaying a promotions company due to inflated response numbers. The report identifies five procedures and checks, including inspection, external confirmation, recalculation, analytical procedures, and existence testing, to mitigate such risks. Scenario B examines an American company's Australian subsidiary, where high freight and travel expenses raised concerns. The report highlights internal controls like segregation of duties, documentation, updated internal control programs, regular inspections, and monitoring controls to prevent fraud. Additionally, the report identifies audit procedures that could have alerted the auditor to the fraud, such as inspection, documentation, completeness testing, occurrence testing, and breach of duties and obligations. The report also includes a list of relevant references.

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

ACCOUNTING INFORMATION SYSTEMS AND PROCESSES

By (Name)

Course Name

Name of the Professor

Student’s Name

Date

ACCOUNTING INFORMATION SYSTEMS AND PROCESSES

By (Name)

Course Name

Name of the Professor

Student’s Name

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

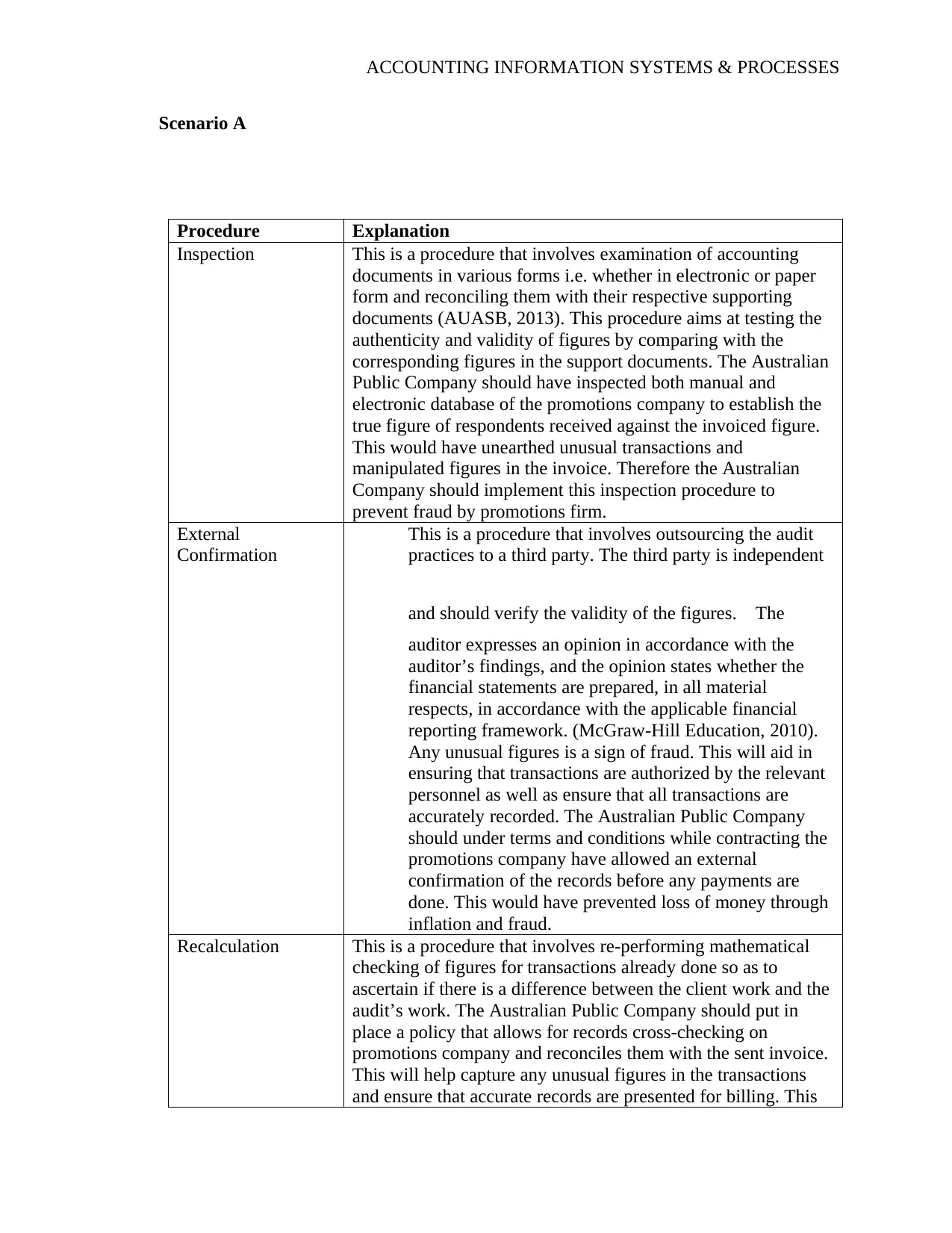

Scenario A

Procedure Explanation

Inspection This is a procedure that involves examination of accounting

documents in various forms i.e. whether in electronic or paper

form and reconciling them with their respective supporting

documents (AUASB, 2013). This procedure aims at testing the

authenticity and validity of figures by comparing with the

corresponding figures in the support documents. The Australian

Public Company should have inspected both manual and

electronic database of the promotions company to establish the

true figure of respondents received against the invoiced figure.

This would have unearthed unusual transactions and

manipulated figures in the invoice. Therefore the Australian

Company should implement this inspection procedure to

prevent fraud by promotions firm.

External

Confirmation

This is a procedure that involves outsourcing the audit

practices to a third party. The third party is independent

and should verify the validity of the figures. The

auditor expresses an opinion in accordance with the

auditor’s findings, and the opinion states whether the

financial statements are prepared, in all material

respects, in accordance with the applicable financial

reporting framework. (McGraw-Hill Education, 2010).

Any unusual figures is a sign of fraud. This will aid in

ensuring that transactions are authorized by the relevant

personnel as well as ensure that all transactions are

accurately recorded. The Australian Public Company

should under terms and conditions while contracting the

promotions company have allowed an external

confirmation of the records before any payments are

done. This would have prevented loss of money through

inflation and fraud.

Recalculation This is a procedure that involves re-performing mathematical

checking of figures for transactions already done so as to

ascertain if there is a difference between the client work and the

audit’s work. The Australian Public Company should put in

place a policy that allows for records cross-checking on

promotions company and reconciles them with the sent invoice.

This will help capture any unusual figures in the transactions

and ensure that accurate records are presented for billing. This

Scenario A

Procedure Explanation

Inspection This is a procedure that involves examination of accounting

documents in various forms i.e. whether in electronic or paper

form and reconciling them with their respective supporting

documents (AUASB, 2013). This procedure aims at testing the

authenticity and validity of figures by comparing with the

corresponding figures in the support documents. The Australian

Public Company should have inspected both manual and

electronic database of the promotions company to establish the

true figure of respondents received against the invoiced figure.

This would have unearthed unusual transactions and

manipulated figures in the invoice. Therefore the Australian

Company should implement this inspection procedure to

prevent fraud by promotions firm.

External

Confirmation

This is a procedure that involves outsourcing the audit

practices to a third party. The third party is independent

and should verify the validity of the figures. The

auditor expresses an opinion in accordance with the

auditor’s findings, and the opinion states whether the

financial statements are prepared, in all material

respects, in accordance with the applicable financial

reporting framework. (McGraw-Hill Education, 2010).

Any unusual figures is a sign of fraud. This will aid in

ensuring that transactions are authorized by the relevant

personnel as well as ensure that all transactions are

accurately recorded. The Australian Public Company

should under terms and conditions while contracting the

promotions company have allowed an external

confirmation of the records before any payments are

done. This would have prevented loss of money through

inflation and fraud.

Recalculation This is a procedure that involves re-performing mathematical

checking of figures for transactions already done so as to

ascertain if there is a difference between the client work and the

audit’s work. The Australian Public Company should put in

place a policy that allows for records cross-checking on

promotions company and reconciles them with the sent invoice.

This will help capture any unusual figures in the transactions

and ensure that accurate records are presented for billing. This

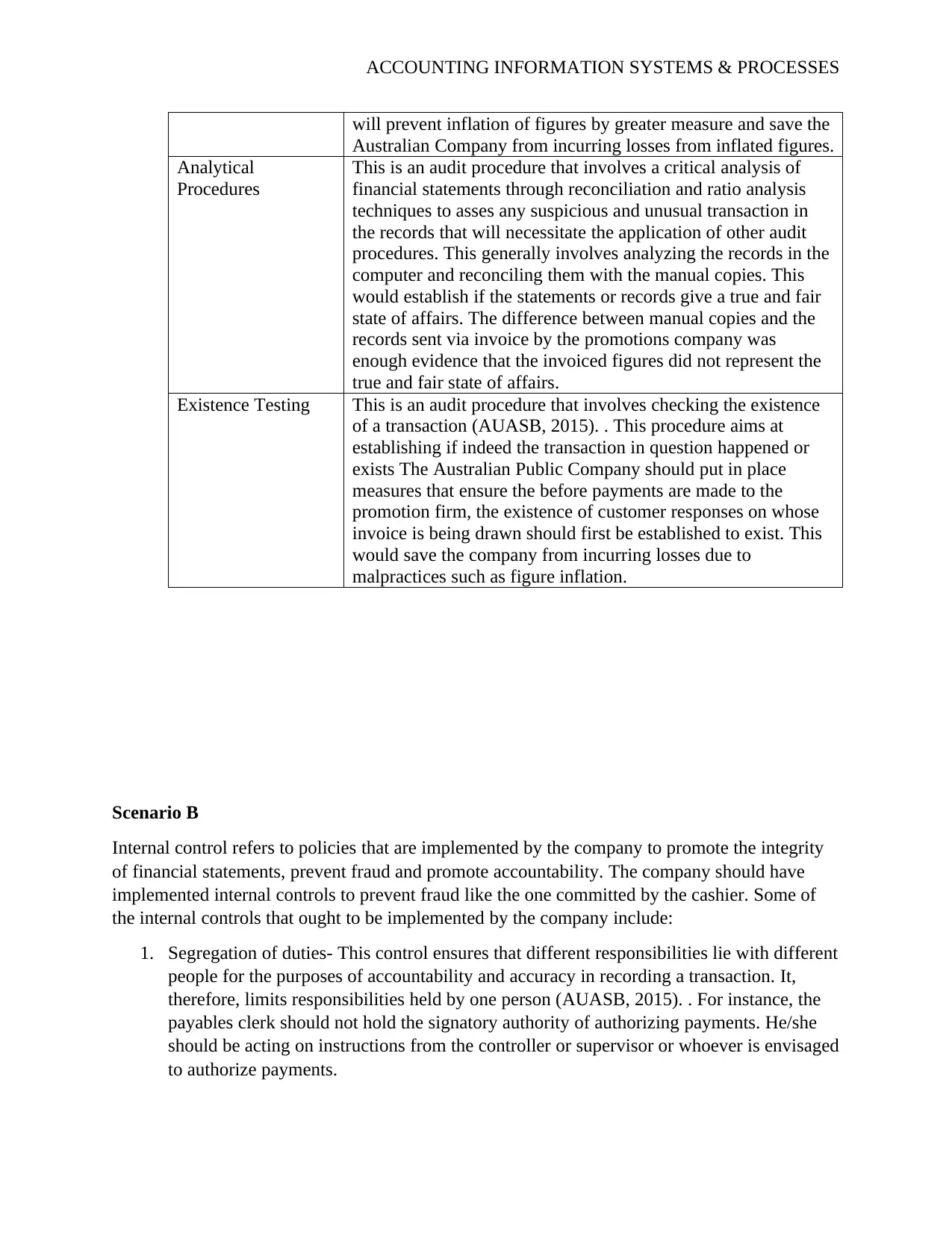

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

will prevent inflation of figures by greater measure and save the

Australian Company from incurring losses from inflated figures.

Analytical

Procedures

This is an audit procedure that involves a critical analysis of

financial statements through reconciliation and ratio analysis

techniques to asses any suspicious and unusual transaction in

the records that will necessitate the application of other audit

procedures. This generally involves analyzing the records in the

computer and reconciling them with the manual copies. This

would establish if the statements or records give a true and fair

state of affairs. The difference between manual copies and the

records sent via invoice by the promotions company was

enough evidence that the invoiced figures did not represent the

true and fair state of affairs.

Existence Testing This is an audit procedure that involves checking the existence

of a transaction (AUASB, 2015). . This procedure aims at

establishing if indeed the transaction in question happened or

exists The Australian Public Company should put in place

measures that ensure the before payments are made to the

promotion firm, the existence of customer responses on whose

invoice is being drawn should first be established to exist. This

would save the company from incurring losses due to

malpractices such as figure inflation.

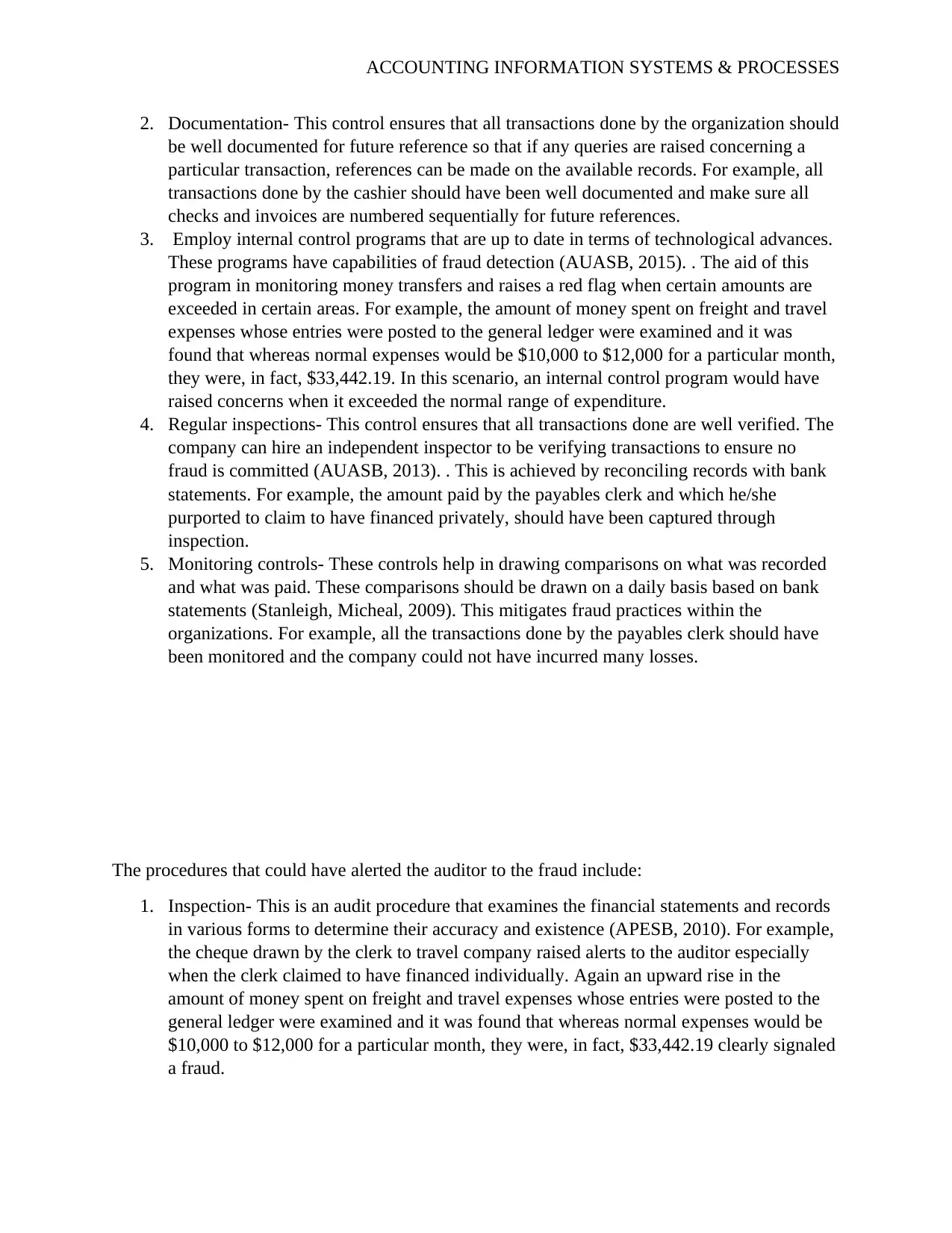

Scenario B

Internal control refers to policies that are implemented by the company to promote the integrity

of financial statements, prevent fraud and promote accountability. The company should have

implemented internal controls to prevent fraud like the one committed by the cashier. Some of

the internal controls that ought to be implemented by the company include:

1. Segregation of duties- This control ensures that different responsibilities lie with different

people for the purposes of accountability and accuracy in recording a transaction. It,

therefore, limits responsibilities held by one person (AUASB, 2015). . For instance, the

payables clerk should not hold the signatory authority of authorizing payments. He/she

should be acting on instructions from the controller or supervisor or whoever is envisaged

to authorize payments.

will prevent inflation of figures by greater measure and save the

Australian Company from incurring losses from inflated figures.

Analytical

Procedures

This is an audit procedure that involves a critical analysis of

financial statements through reconciliation and ratio analysis

techniques to asses any suspicious and unusual transaction in

the records that will necessitate the application of other audit

procedures. This generally involves analyzing the records in the

computer and reconciling them with the manual copies. This

would establish if the statements or records give a true and fair

state of affairs. The difference between manual copies and the

records sent via invoice by the promotions company was

enough evidence that the invoiced figures did not represent the

true and fair state of affairs.

Existence Testing This is an audit procedure that involves checking the existence

of a transaction (AUASB, 2015). . This procedure aims at

establishing if indeed the transaction in question happened or

exists The Australian Public Company should put in place

measures that ensure the before payments are made to the

promotion firm, the existence of customer responses on whose

invoice is being drawn should first be established to exist. This

would save the company from incurring losses due to

malpractices such as figure inflation.

Scenario B

Internal control refers to policies that are implemented by the company to promote the integrity

of financial statements, prevent fraud and promote accountability. The company should have

implemented internal controls to prevent fraud like the one committed by the cashier. Some of

the internal controls that ought to be implemented by the company include:

1. Segregation of duties- This control ensures that different responsibilities lie with different

people for the purposes of accountability and accuracy in recording a transaction. It,

therefore, limits responsibilities held by one person (AUASB, 2015). . For instance, the

payables clerk should not hold the signatory authority of authorizing payments. He/she

should be acting on instructions from the controller or supervisor or whoever is envisaged

to authorize payments.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

2. Documentation- This control ensures that all transactions done by the organization should

be well documented for future reference so that if any queries are raised concerning a

particular transaction, references can be made on the available records. For example, all

transactions done by the cashier should have been well documented and make sure all

checks and invoices are numbered sequentially for future references.

3. Employ internal control programs that are up to date in terms of technological advances.

These programs have capabilities of fraud detection (AUASB, 2015). . The aid of this

program in monitoring money transfers and raises a red flag when certain amounts are

exceeded in certain areas. For example, the amount of money spent on freight and travel

expenses whose entries were posted to the general ledger were examined and it was

found that whereas normal expenses would be $10,000 to $12,000 for a particular month,

they were, in fact, $33,442.19. In this scenario, an internal control program would have

raised concerns when it exceeded the normal range of expenditure.

4. Regular inspections- This control ensures that all transactions done are well verified. The

company can hire an independent inspector to be verifying transactions to ensure no

fraud is committed (AUASB, 2013). . This is achieved by reconciling records with bank

statements. For example, the amount paid by the payables clerk and which he/she

purported to claim to have financed privately, should have been captured through

inspection.

5. Monitoring controls- These controls help in drawing comparisons on what was recorded

and what was paid. These comparisons should be drawn on a daily basis based on bank

statements (Stanleigh, Micheal, 2009). This mitigates fraud practices within the

organizations. For example, all the transactions done by the payables clerk should have

been monitored and the company could not have incurred many losses.

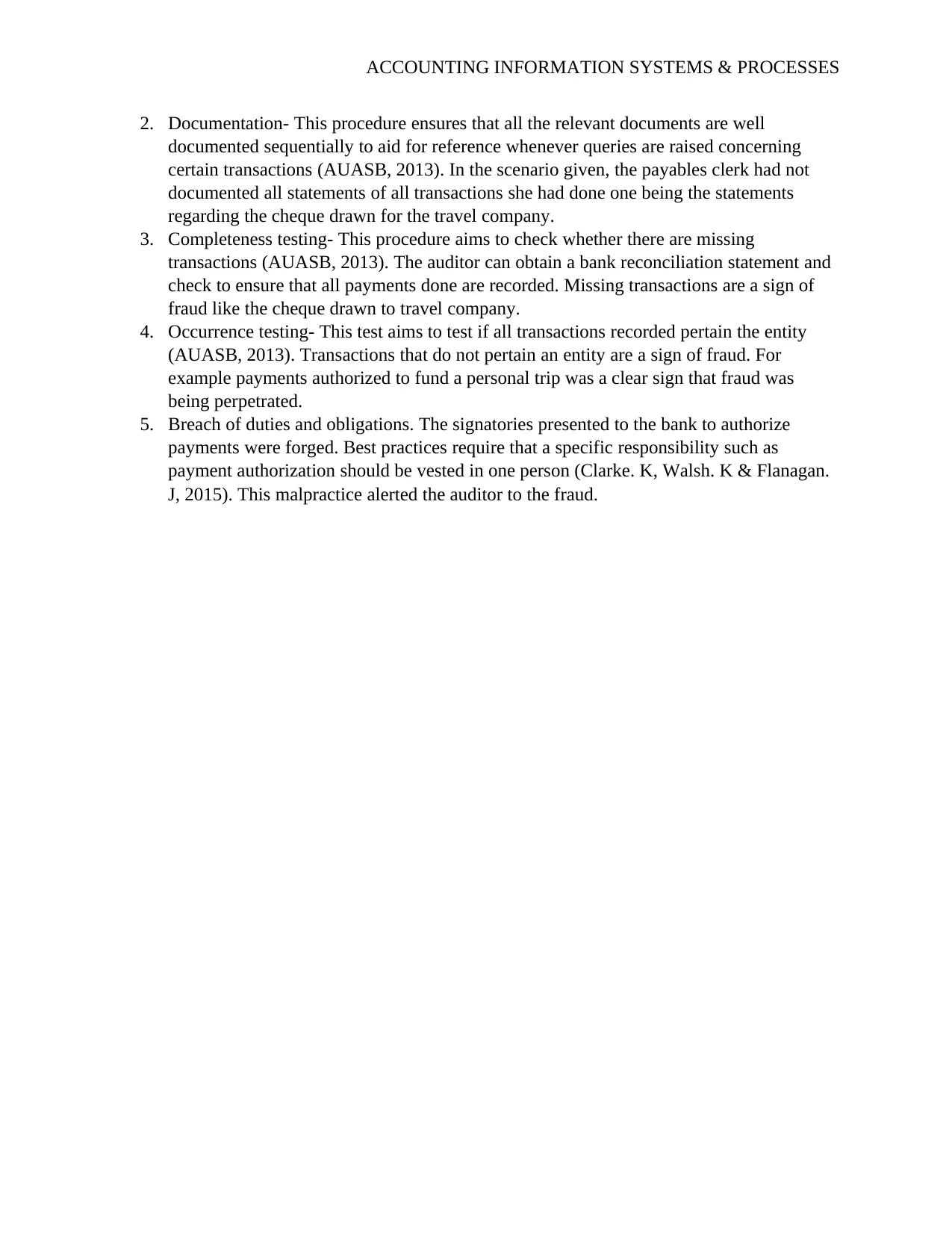

The procedures that could have alerted the auditor to the fraud include:

1. Inspection- This is an audit procedure that examines the financial statements and records

in various forms to determine their accuracy and existence (APESB, 2010). For example,

the cheque drawn by the clerk to travel company raised alerts to the auditor especially

when the clerk claimed to have financed individually. Again an upward rise in the

amount of money spent on freight and travel expenses whose entries were posted to the

general ledger were examined and it was found that whereas normal expenses would be

$10,000 to $12,000 for a particular month, they were, in fact, $33,442.19 clearly signaled

a fraud.

2. Documentation- This control ensures that all transactions done by the organization should

be well documented for future reference so that if any queries are raised concerning a

particular transaction, references can be made on the available records. For example, all

transactions done by the cashier should have been well documented and make sure all

checks and invoices are numbered sequentially for future references.

3. Employ internal control programs that are up to date in terms of technological advances.

These programs have capabilities of fraud detection (AUASB, 2015). . The aid of this

program in monitoring money transfers and raises a red flag when certain amounts are

exceeded in certain areas. For example, the amount of money spent on freight and travel

expenses whose entries were posted to the general ledger were examined and it was

found that whereas normal expenses would be $10,000 to $12,000 for a particular month,

they were, in fact, $33,442.19. In this scenario, an internal control program would have

raised concerns when it exceeded the normal range of expenditure.

4. Regular inspections- This control ensures that all transactions done are well verified. The

company can hire an independent inspector to be verifying transactions to ensure no

fraud is committed (AUASB, 2013). . This is achieved by reconciling records with bank

statements. For example, the amount paid by the payables clerk and which he/she

purported to claim to have financed privately, should have been captured through

inspection.

5. Monitoring controls- These controls help in drawing comparisons on what was recorded

and what was paid. These comparisons should be drawn on a daily basis based on bank

statements (Stanleigh, Micheal, 2009). This mitigates fraud practices within the

organizations. For example, all the transactions done by the payables clerk should have

been monitored and the company could not have incurred many losses.

The procedures that could have alerted the auditor to the fraud include:

1. Inspection- This is an audit procedure that examines the financial statements and records

in various forms to determine their accuracy and existence (APESB, 2010). For example,

the cheque drawn by the clerk to travel company raised alerts to the auditor especially

when the clerk claimed to have financed individually. Again an upward rise in the

amount of money spent on freight and travel expenses whose entries were posted to the

general ledger were examined and it was found that whereas normal expenses would be

$10,000 to $12,000 for a particular month, they were, in fact, $33,442.19 clearly signaled

a fraud.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

2. Documentation- This procedure ensures that all the relevant documents are well

documented sequentially to aid for reference whenever queries are raised concerning

certain transactions (AUASB, 2013). In the scenario given, the payables clerk had not

documented all statements of all transactions she had done one being the statements

regarding the cheque drawn for the travel company.

3. Completeness testing- This procedure aims to check whether there are missing

transactions (AUASB, 2013). The auditor can obtain a bank reconciliation statement and

check to ensure that all payments done are recorded. Missing transactions are a sign of

fraud like the cheque drawn to travel company.

4. Occurrence testing- This test aims to test if all transactions recorded pertain the entity

(AUASB, 2013). Transactions that do not pertain an entity are a sign of fraud. For

example payments authorized to fund a personal trip was a clear sign that fraud was

being perpetrated.

5. Breach of duties and obligations. The signatories presented to the bank to authorize

payments were forged. Best practices require that a specific responsibility such as

payment authorization should be vested in one person (Clarke. K, Walsh. K & Flanagan.

J, 2015). This malpractice alerted the auditor to the fraud.

2. Documentation- This procedure ensures that all the relevant documents are well

documented sequentially to aid for reference whenever queries are raised concerning

certain transactions (AUASB, 2013). In the scenario given, the payables clerk had not

documented all statements of all transactions she had done one being the statements

regarding the cheque drawn for the travel company.

3. Completeness testing- This procedure aims to check whether there are missing

transactions (AUASB, 2013). The auditor can obtain a bank reconciliation statement and

check to ensure that all payments done are recorded. Missing transactions are a sign of

fraud like the cheque drawn to travel company.

4. Occurrence testing- This test aims to test if all transactions recorded pertain the entity

(AUASB, 2013). Transactions that do not pertain an entity are a sign of fraud. For

example payments authorized to fund a personal trip was a clear sign that fraud was

being perpetrated.

5. Breach of duties and obligations. The signatories presented to the bank to authorize

payments were forged. Best practices require that a specific responsibility such as

payment authorization should be vested in one person (Clarke. K, Walsh. K & Flanagan.

J, 2015). This malpractice alerted the auditor to the fraud.

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

References

Accounting Professional & Ethical Standards Board Limited (“APESB”) (2010). APES

110 Code of Ethics for Professional Accountants.

AUASB. (2013). Auditing Standard ASA 102 Compliance with Ethical Requirements

when Performing Audits, Review, and Other Assurance Engagements.

AUASB. (2015). Auditing Standard ASA 200 Overall Objectives of the Independent

Auditor and the Conduct of an Audit in Accordance with Australian Auditing Standards.

Clarke. K, Walsh. K & Flanagan. J (2015). "How prevalent are post-completion audits in

Australia. Accounting, Accountability & Performance". Accounting, Accountability &

Performance.

Clarke. K, Walsh. K & Flanagan. J (2015). "How prevalent are post-completion audits in

Australia. Accounting, Accountability & Performance". Accounting, Accountability &

Performance.

Gay, G. and Simnett, R. (2015). Auditing and assurance services in Australia. 6th ed.

Melbourne: McGraw-Hill Education (Australia) Pty Ltd.

Stanleigh, Micheal (2009). "UNDERTAKING A SUCCESSFUL PROJECT

AUDIT" (PDF). PROJECT SMART. Retrieved 18 May 2016

References

Accounting Professional & Ethical Standards Board Limited (“APESB”) (2010). APES

110 Code of Ethics for Professional Accountants.

AUASB. (2013). Auditing Standard ASA 102 Compliance with Ethical Requirements

when Performing Audits, Review, and Other Assurance Engagements.

AUASB. (2015). Auditing Standard ASA 200 Overall Objectives of the Independent

Auditor and the Conduct of an Audit in Accordance with Australian Auditing Standards.

Clarke. K, Walsh. K & Flanagan. J (2015). "How prevalent are post-completion audits in

Australia. Accounting, Accountability & Performance". Accounting, Accountability &

Performance.

Clarke. K, Walsh. K & Flanagan. J (2015). "How prevalent are post-completion audits in

Australia. Accounting, Accountability & Performance". Accounting, Accountability &

Performance.

Gay, G. and Simnett, R. (2015). Auditing and assurance services in Australia. 6th ed.

Melbourne: McGraw-Hill Education (Australia) Pty Ltd.

Stanleigh, Micheal (2009). "UNDERTAKING A SUCCESSFUL PROJECT

AUDIT" (PDF). PROJECT SMART. Retrieved 18 May 2016

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING INFORMATION SYSTEMS & PROCESSES

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.