Accounting Report: Financial Statements, Costing Methods, and Analysis

VerifiedAdded on 2023/01/18

|23

|3349

|99

Report

AI Summary

This accounting report offers a detailed examination of business transactions, including the preparation of financial statements for Jennifer Ltd and See-it-now Ltd, a travel agency. It contrasts financial and management accounting, covering journal entries, ledger accounts, trial balances, income statements, and balance sheets. The report computes product costs and net profits using marginal and absorption costing methods, analyzing their differences. Furthermore, it explores high-quality financial information principles, emphasizing relevance, reliability, understandability, comparability, consistency, neutrality, and materiality to ensure accurate and reliable financial reporting. The report also discusses the features of high-quality financial information to both the company's management.

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Abstract

The report will present a detailed analysis of the business transaction by preparing the

financial statements and will throw a purview regarding the contrast in between the financial and

management accounting. It will also include computation of products cost and net profits by

applying the marginal and absorption costing method.

The report will present a detailed analysis of the business transaction by preparing the

financial statements and will throw a purview regarding the contrast in between the financial and

management accounting. It will also include computation of products cost and net profits by

applying the marginal and absorption costing method.

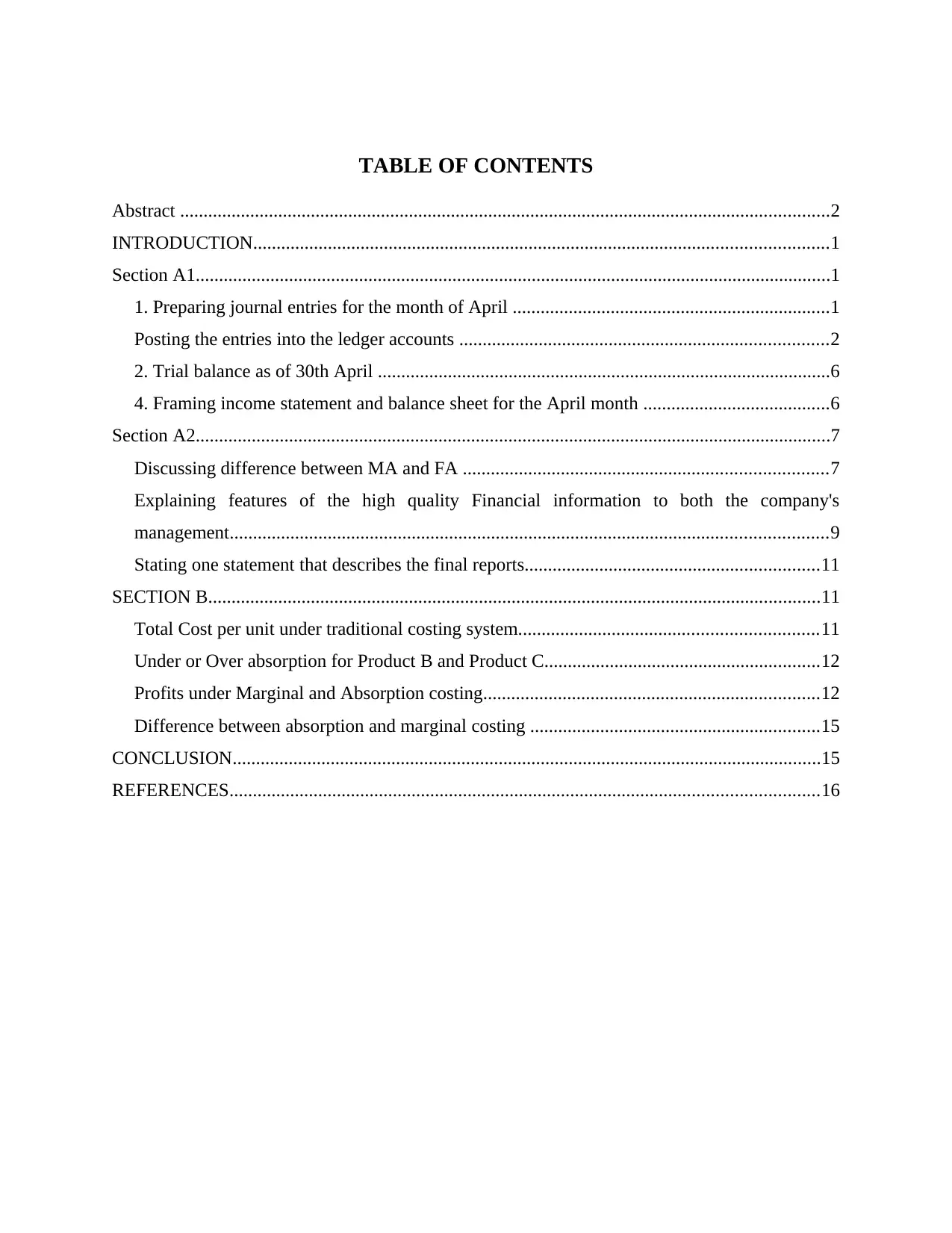

TABLE OF CONTENTS

Abstract ...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

Section A1........................................................................................................................................1

1. Preparing journal entries for the month of April ....................................................................1

Posting the entries into the ledger accounts ...............................................................................2

2. Trial balance as of 30th April .................................................................................................6

4. Framing income statement and balance sheet for the April month ........................................6

Section A2........................................................................................................................................7

Discussing difference between MA and FA ..............................................................................7

Explaining features of the high quality Financial information to both the company's

management................................................................................................................................9

Stating one statement that describes the final reports...............................................................11

SECTION B...................................................................................................................................11

Total Cost per unit under traditional costing system................................................................11

Under or Over absorption for Product B and Product C...........................................................12

Profits under Marginal and Absorption costing........................................................................12

Difference between absorption and marginal costing ..............................................................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

Abstract ...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

Section A1........................................................................................................................................1

1. Preparing journal entries for the month of April ....................................................................1

Posting the entries into the ledger accounts ...............................................................................2

2. Trial balance as of 30th April .................................................................................................6

4. Framing income statement and balance sheet for the April month ........................................6

Section A2........................................................................................................................................7

Discussing difference between MA and FA ..............................................................................7

Explaining features of the high quality Financial information to both the company's

management................................................................................................................................9

Stating one statement that describes the final reports...............................................................11

SECTION B...................................................................................................................................11

Total Cost per unit under traditional costing system................................................................11

Under or Over absorption for Product B and Product C...........................................................12

Profits under Marginal and Absorption costing........................................................................12

Difference between absorption and marginal costing ..............................................................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Accounting refers to the practice of entering or recording the financial transactions that

are pertaining to the business. It is the process that involves interpreting, assessing and reporting

the business transactions to the oversight agencies, tax collection enterprises and the regulators.

The present report focuses on Jennifer Ltd and See-it-now Ltd, operates its business as a travel

agency and started its business from the month of April. Furthermore, the report throw a deeper

insights towards framing final reports through analysing the business transactions. Moreover, it

also includes high quality financial principles that the firm needs to follow for making reliable

reporting.

Section A1

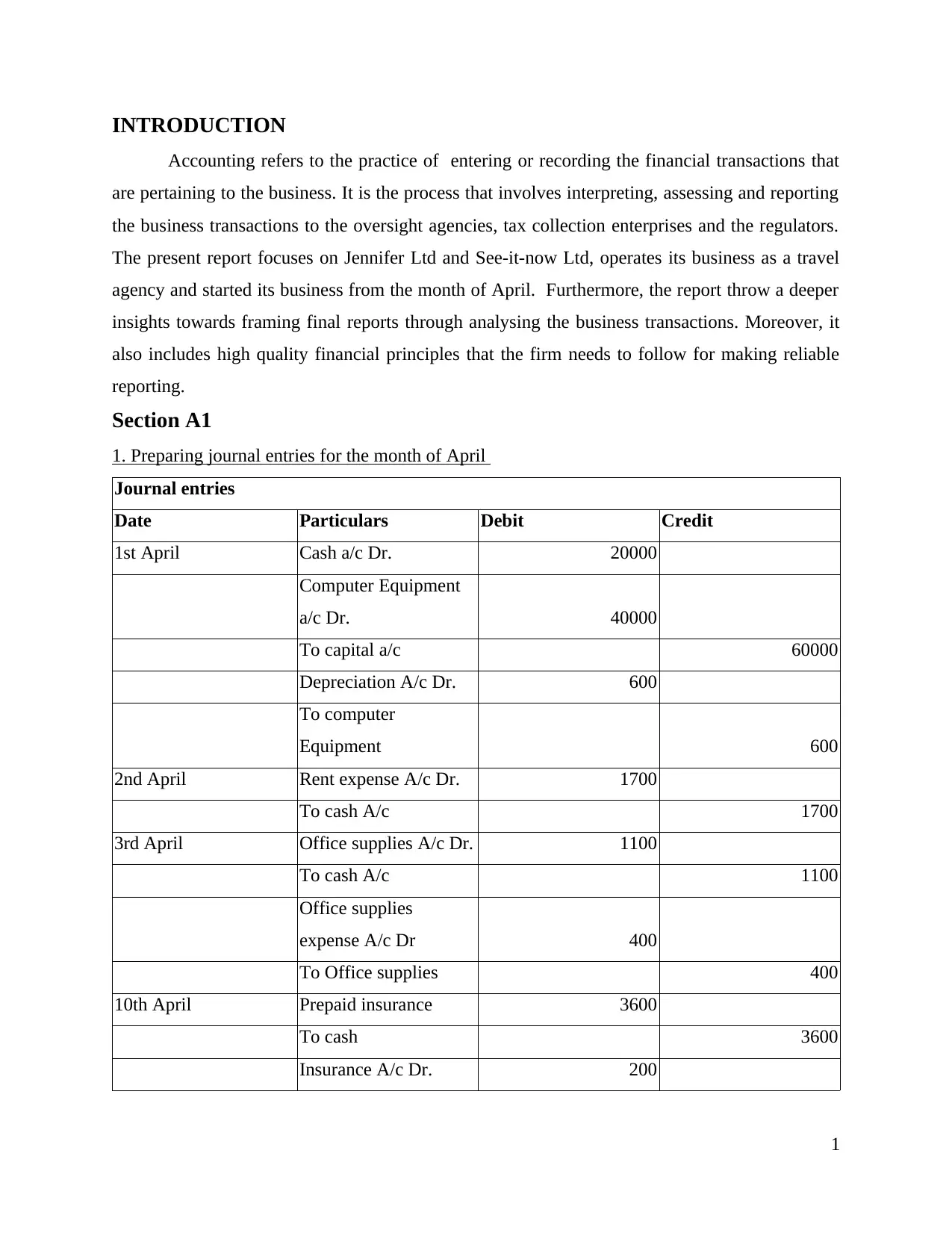

1. Preparing journal entries for the month of April

Journal entries

Date Particulars Debit Credit

1st April Cash a/c Dr. 20000

Computer Equipment

a/c Dr. 40000

To capital a/c 60000

Depreciation A/c Dr. 600

To computer

Equipment 600

2nd April Rent expense A/c Dr. 1700

To cash A/c 1700

3rd April Office supplies A/c Dr. 1100

To cash A/c 1100

Office supplies

expense A/c Dr 400

To Office supplies 400

10th April Prepaid insurance 3600

To cash 3600

Insurance A/c Dr. 200

1

Accounting refers to the practice of entering or recording the financial transactions that

are pertaining to the business. It is the process that involves interpreting, assessing and reporting

the business transactions to the oversight agencies, tax collection enterprises and the regulators.

The present report focuses on Jennifer Ltd and See-it-now Ltd, operates its business as a travel

agency and started its business from the month of April. Furthermore, the report throw a deeper

insights towards framing final reports through analysing the business transactions. Moreover, it

also includes high quality financial principles that the firm needs to follow for making reliable

reporting.

Section A1

1. Preparing journal entries for the month of April

Journal entries

Date Particulars Debit Credit

1st April Cash a/c Dr. 20000

Computer Equipment

a/c Dr. 40000

To capital a/c 60000

Depreciation A/c Dr. 600

To computer

Equipment 600

2nd April Rent expense A/c Dr. 1700

To cash A/c 1700

3rd April Office supplies A/c Dr. 1100

To cash A/c 1100

Office supplies

expense A/c Dr 400

To Office supplies 400

10th April Prepaid insurance 3600

To cash 3600

Insurance A/c Dr. 200

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To prepaid Insurance 200

24th April Cash a/c Dr. 7900

Accrued commission

A/c Dr. 1650

To commission

received 9550

28th April

Salaries expense A/c

Dr. 2120

To cash A/c 1800

To outstanding salary 320

29th April Repair expense 250

To cash 250

30th April

Telephone bill expense

A/c Dr. 650

To cash 650

30th April Drawing A/c Dr. 1500

To cash A/c 1500

81670 81670

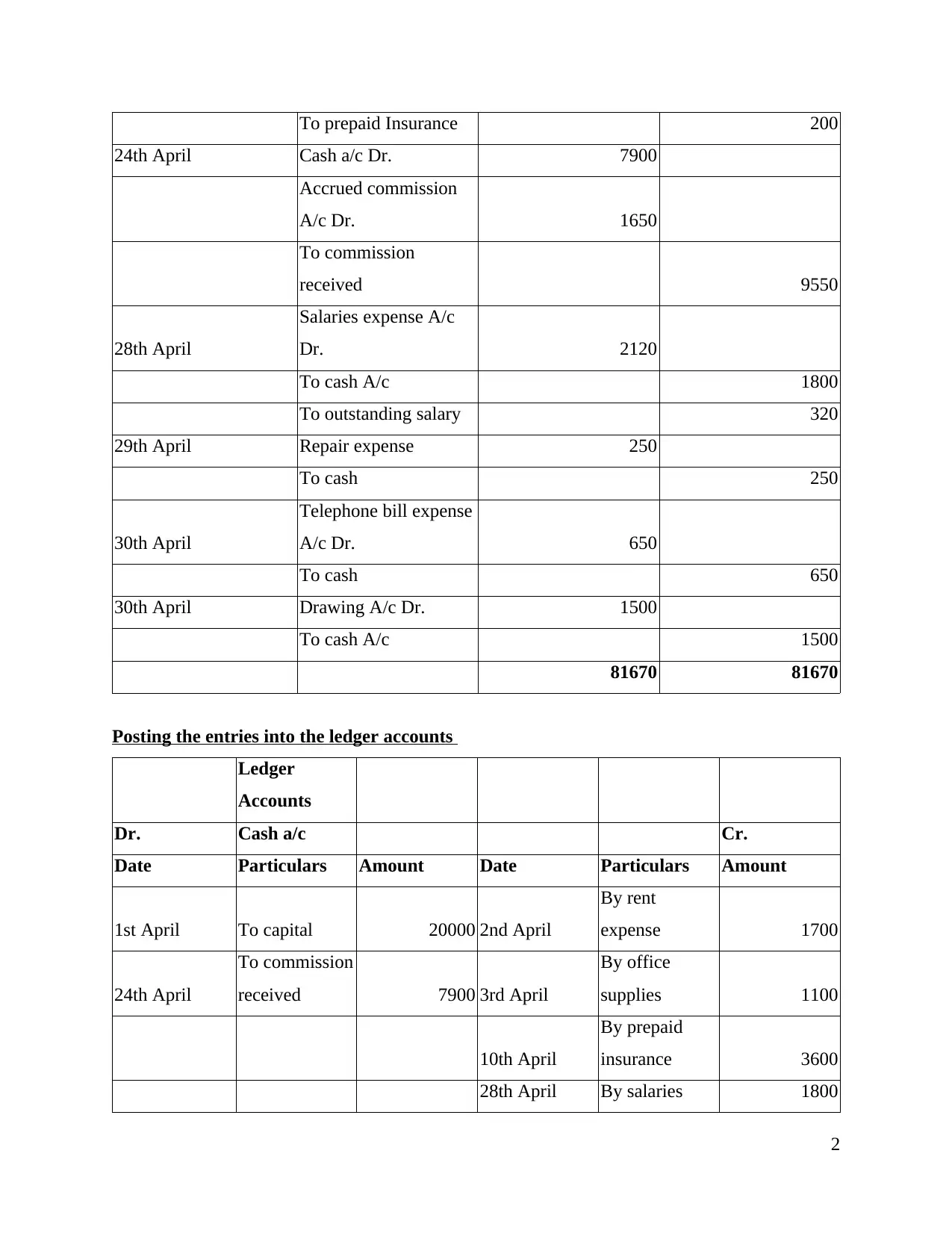

Posting the entries into the ledger accounts

Ledger

Accounts

Dr. Cash a/c Cr.

Date Particulars Amount Date Particulars Amount

1st April To capital 20000 2nd April

By rent

expense 1700

24th April

To commission

received 7900 3rd April

By office

supplies 1100

10th April

By prepaid

insurance 3600

28th April By salaries 1800

2

24th April Cash a/c Dr. 7900

Accrued commission

A/c Dr. 1650

To commission

received 9550

28th April

Salaries expense A/c

Dr. 2120

To cash A/c 1800

To outstanding salary 320

29th April Repair expense 250

To cash 250

30th April

Telephone bill expense

A/c Dr. 650

To cash 650

30th April Drawing A/c Dr. 1500

To cash A/c 1500

81670 81670

Posting the entries into the ledger accounts

Ledger

Accounts

Dr. Cash a/c Cr.

Date Particulars Amount Date Particulars Amount

1st April To capital 20000 2nd April

By rent

expense 1700

24th April

To commission

received 7900 3rd April

By office

supplies 1100

10th April

By prepaid

insurance 3600

28th April By salaries 1800

2

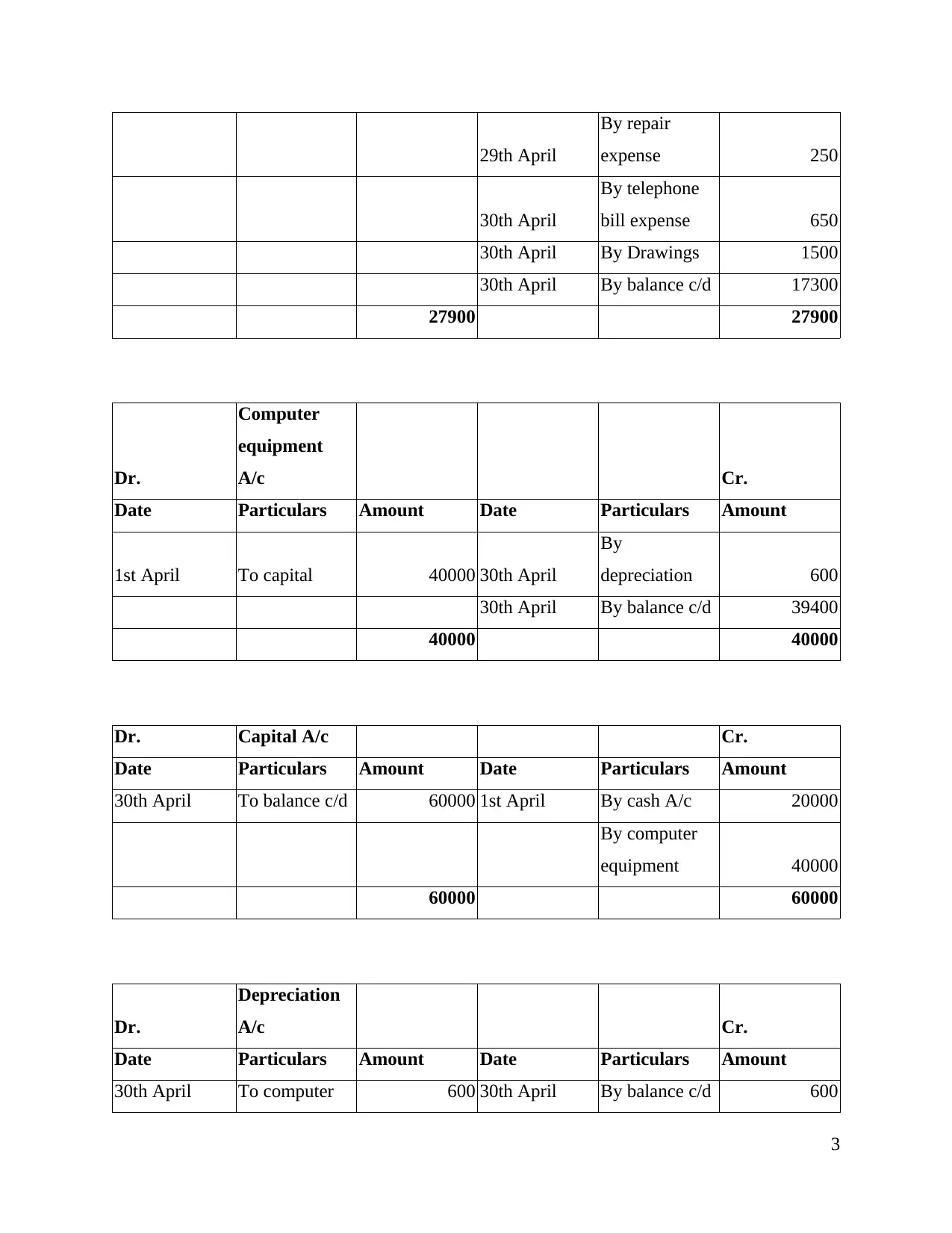

29th April

By repair

expense 250

30th April

By telephone

bill expense 650

30th April By Drawings 1500

30th April By balance c/d 17300

27900 27900

Dr.

Computer

equipment

A/c Cr.

Date Particulars Amount Date Particulars Amount

1st April To capital 40000 30th April

By

depreciation 600

30th April By balance c/d 39400

40000 40000

Dr. Capital A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To balance c/d 60000 1st April By cash A/c 20000

By computer

equipment 40000

60000 60000

Dr.

Depreciation

A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To computer 600 30th April By balance c/d 600

3

By repair

expense 250

30th April

By telephone

bill expense 650

30th April By Drawings 1500

30th April By balance c/d 17300

27900 27900

Dr.

Computer

equipment

A/c Cr.

Date Particulars Amount Date Particulars Amount

1st April To capital 40000 30th April

By

depreciation 600

30th April By balance c/d 39400

40000 40000

Dr. Capital A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To balance c/d 60000 1st April By cash A/c 20000

By computer

equipment 40000

60000 60000

Dr.

Depreciation

A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To computer 600 30th April By balance c/d 600

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Equipment

600 600

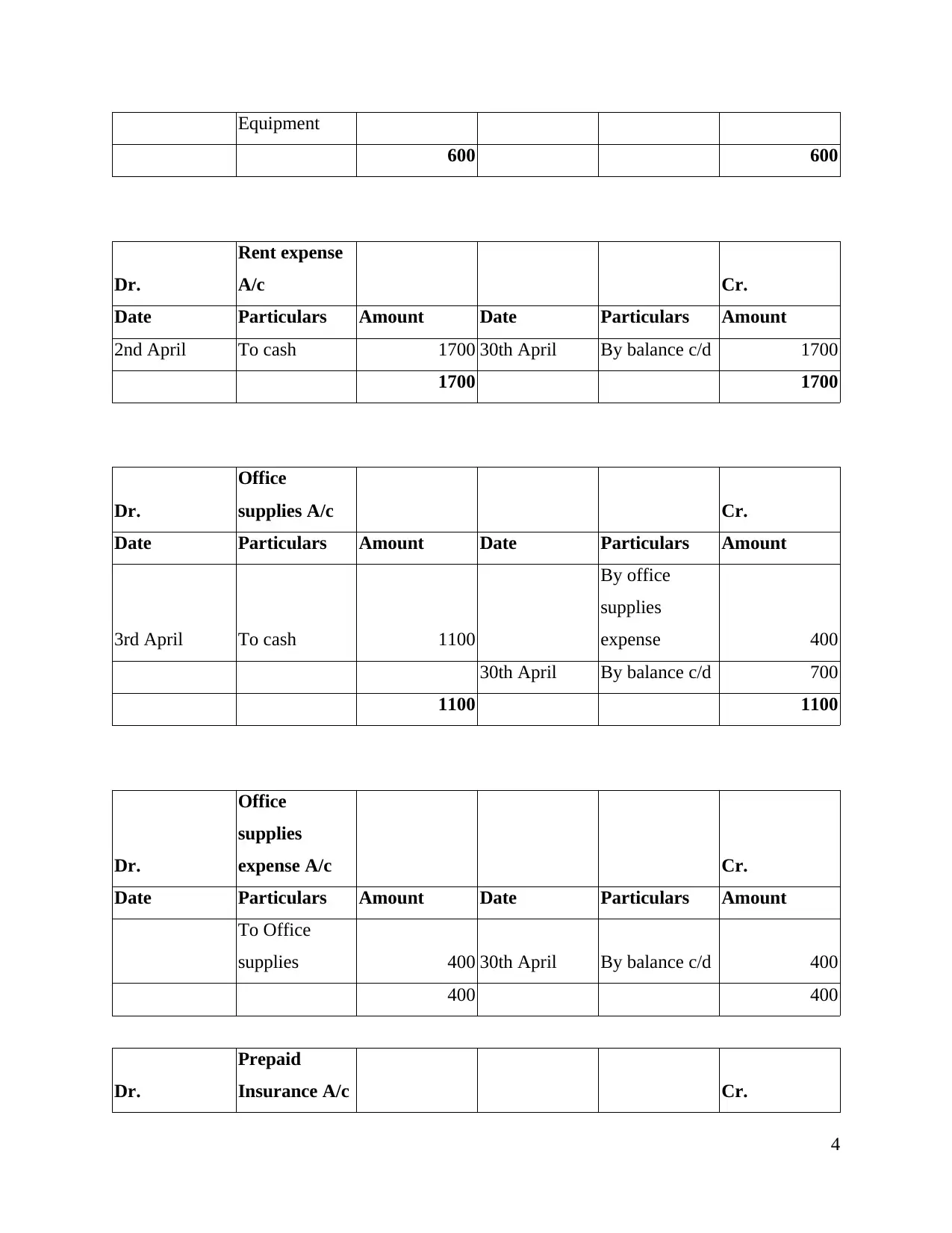

Dr.

Rent expense

A/c Cr.

Date Particulars Amount Date Particulars Amount

2nd April To cash 1700 30th April By balance c/d 1700

1700 1700

Dr.

Office

supplies A/c Cr.

Date Particulars Amount Date Particulars Amount

3rd April To cash 1100

By office

supplies

expense 400

30th April By balance c/d 700

1100 1100

Dr.

Office

supplies

expense A/c Cr.

Date Particulars Amount Date Particulars Amount

To Office

supplies 400 30th April By balance c/d 400

400 400

Dr.

Prepaid

Insurance A/c Cr.

4

600 600

Dr.

Rent expense

A/c Cr.

Date Particulars Amount Date Particulars Amount

2nd April To cash 1700 30th April By balance c/d 1700

1700 1700

Dr.

Office

supplies A/c Cr.

Date Particulars Amount Date Particulars Amount

3rd April To cash 1100

By office

supplies

expense 400

30th April By balance c/d 700

1100 1100

Dr.

Office

supplies

expense A/c Cr.

Date Particulars Amount Date Particulars Amount

To Office

supplies 400 30th April By balance c/d 400

400 400

Dr.

Prepaid

Insurance A/c Cr.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

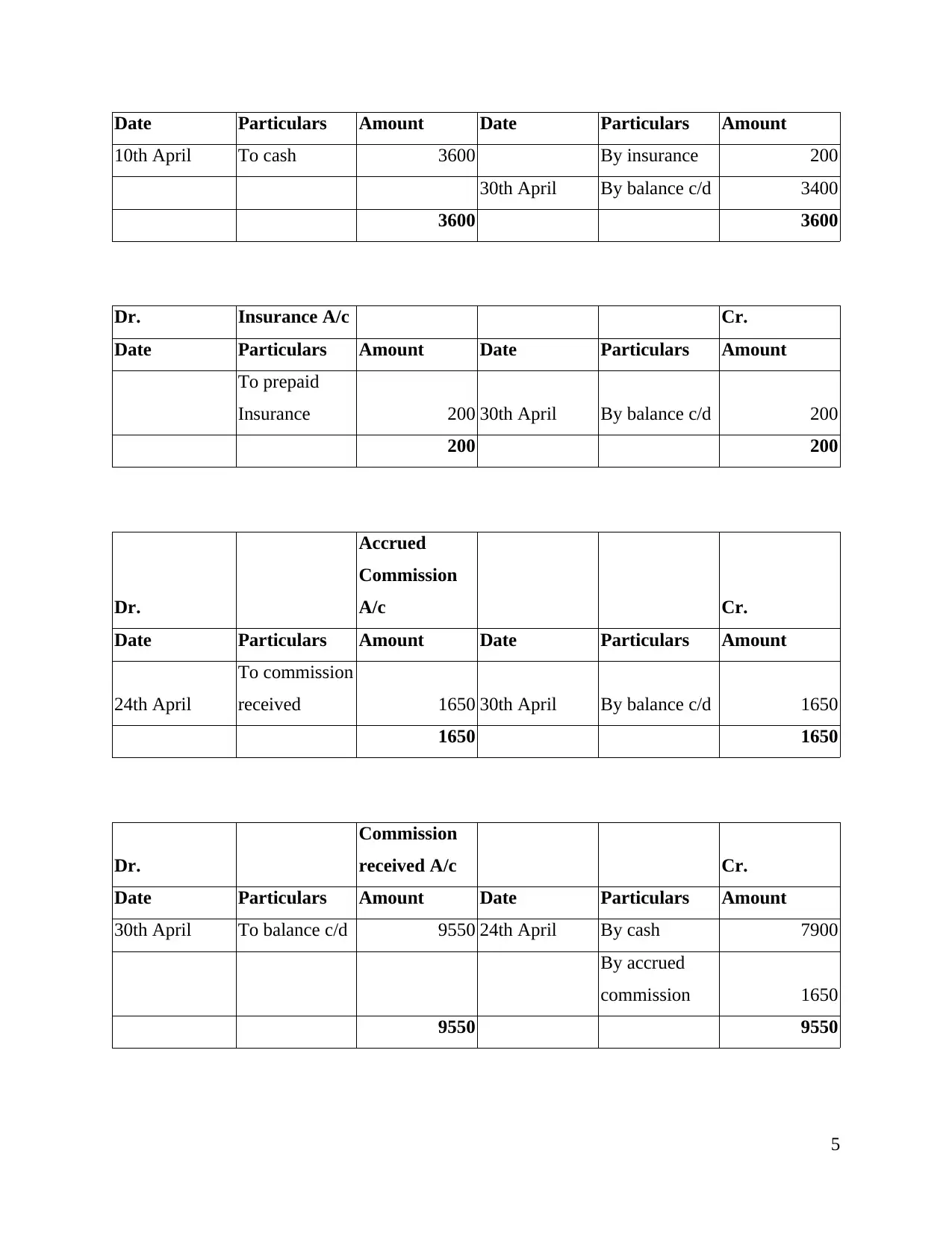

Date Particulars Amount Date Particulars Amount

10th April To cash 3600 By insurance 200

30th April By balance c/d 3400

3600 3600

Dr. Insurance A/c Cr.

Date Particulars Amount Date Particulars Amount

To prepaid

Insurance 200 30th April By balance c/d 200

200 200

Dr.

Accrued

Commission

A/c Cr.

Date Particulars Amount Date Particulars Amount

24th April

To commission

received 1650 30th April By balance c/d 1650

1650 1650

Dr.

Commission

received A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To balance c/d 9550 24th April By cash 7900

By accrued

commission 1650

9550 9550

5

10th April To cash 3600 By insurance 200

30th April By balance c/d 3400

3600 3600

Dr. Insurance A/c Cr.

Date Particulars Amount Date Particulars Amount

To prepaid

Insurance 200 30th April By balance c/d 200

200 200

Dr.

Accrued

Commission

A/c Cr.

Date Particulars Amount Date Particulars Amount

24th April

To commission

received 1650 30th April By balance c/d 1650

1650 1650

Dr.

Commission

received A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To balance c/d 9550 24th April By cash 7900

By accrued

commission 1650

9550 9550

5

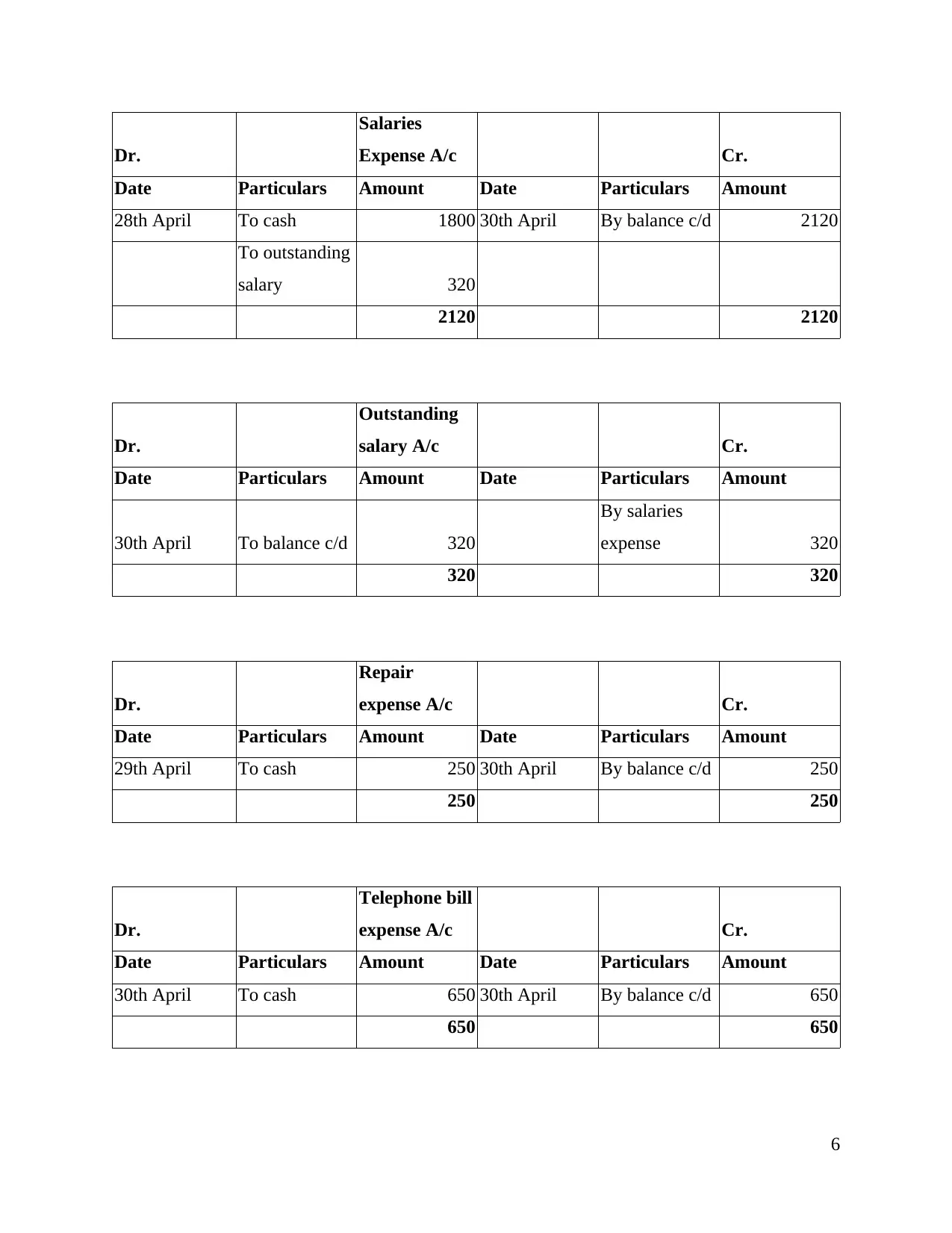

Dr.

Salaries

Expense A/c Cr.

Date Particulars Amount Date Particulars Amount

28th April To cash 1800 30th April By balance c/d 2120

To outstanding

salary 320

2120 2120

Dr.

Outstanding

salary A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To balance c/d 320

By salaries

expense 320

320 320

Dr.

Repair

expense A/c Cr.

Date Particulars Amount Date Particulars Amount

29th April To cash 250 30th April By balance c/d 250

250 250

Dr.

Telephone bill

expense A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To cash 650 30th April By balance c/d 650

650 650

6

Salaries

Expense A/c Cr.

Date Particulars Amount Date Particulars Amount

28th April To cash 1800 30th April By balance c/d 2120

To outstanding

salary 320

2120 2120

Dr.

Outstanding

salary A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To balance c/d 320

By salaries

expense 320

320 320

Dr.

Repair

expense A/c Cr.

Date Particulars Amount Date Particulars Amount

29th April To cash 250 30th April By balance c/d 250

250 250

Dr.

Telephone bill

expense A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To cash 650 30th April By balance c/d 650

650 650

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

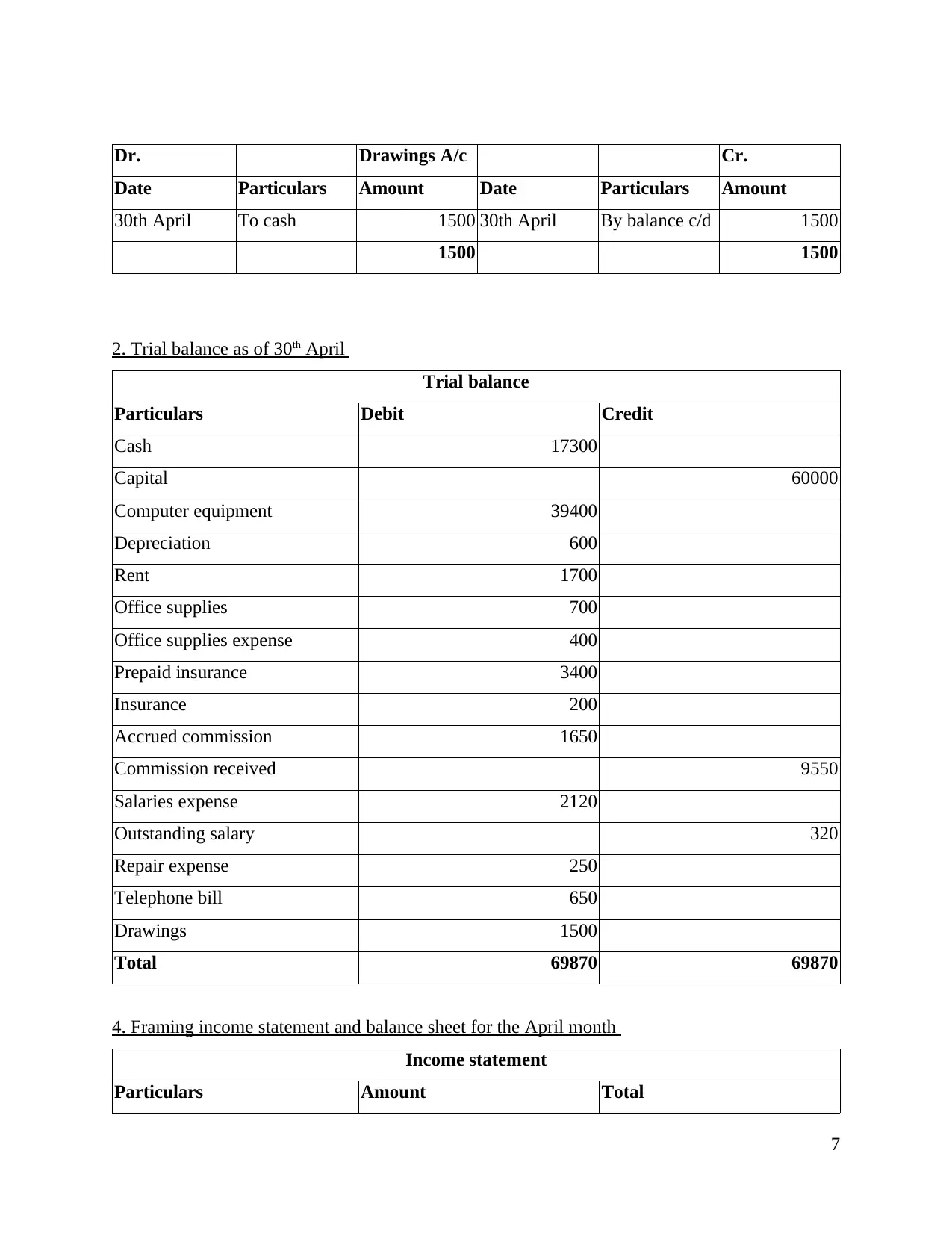

Dr. Drawings A/c Cr.

Date Particulars Amount Date Particulars Amount

30th April To cash 1500 30th April By balance c/d 1500

1500 1500

2. Trial balance as of 30th April

Trial balance

Particulars Debit Credit

Cash 17300

Capital 60000

Computer equipment 39400

Depreciation 600

Rent 1700

Office supplies 700

Office supplies expense 400

Prepaid insurance 3400

Insurance 200

Accrued commission 1650

Commission received 9550

Salaries expense 2120

Outstanding salary 320

Repair expense 250

Telephone bill 650

Drawings 1500

Total 69870 69870

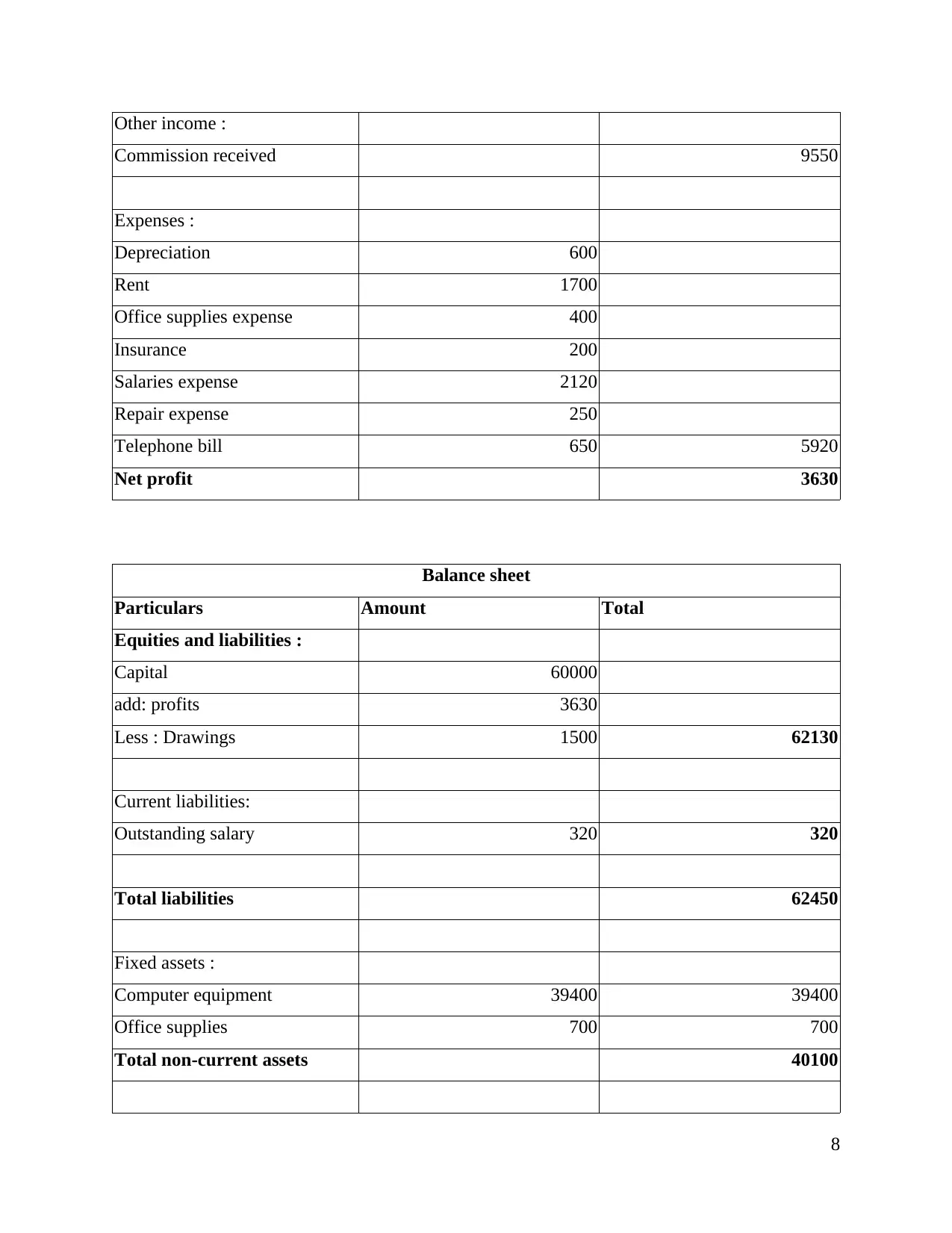

4. Framing income statement and balance sheet for the April month

Income statement

Particulars Amount Total

7

Date Particulars Amount Date Particulars Amount

30th April To cash 1500 30th April By balance c/d 1500

1500 1500

2. Trial balance as of 30th April

Trial balance

Particulars Debit Credit

Cash 17300

Capital 60000

Computer equipment 39400

Depreciation 600

Rent 1700

Office supplies 700

Office supplies expense 400

Prepaid insurance 3400

Insurance 200

Accrued commission 1650

Commission received 9550

Salaries expense 2120

Outstanding salary 320

Repair expense 250

Telephone bill 650

Drawings 1500

Total 69870 69870

4. Framing income statement and balance sheet for the April month

Income statement

Particulars Amount Total

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Other income :

Commission received 9550

Expenses :

Depreciation 600

Rent 1700

Office supplies expense 400

Insurance 200

Salaries expense 2120

Repair expense 250

Telephone bill 650 5920

Net profit 3630

Balance sheet

Particulars Amount Total

Equities and liabilities :

Capital 60000

add: profits 3630

Less : Drawings 1500 62130

Current liabilities:

Outstanding salary 320 320

Total liabilities 62450

Fixed assets :

Computer equipment 39400 39400

Office supplies 700 700

Total non-current assets 40100

8

Commission received 9550

Expenses :

Depreciation 600

Rent 1700

Office supplies expense 400

Insurance 200

Salaries expense 2120

Repair expense 250

Telephone bill 650 5920

Net profit 3630

Balance sheet

Particulars Amount Total

Equities and liabilities :

Capital 60000

add: profits 3630

Less : Drawings 1500 62130

Current liabilities:

Outstanding salary 320 320

Total liabilities 62450

Fixed assets :

Computer equipment 39400 39400

Office supplies 700 700

Total non-current assets 40100

8

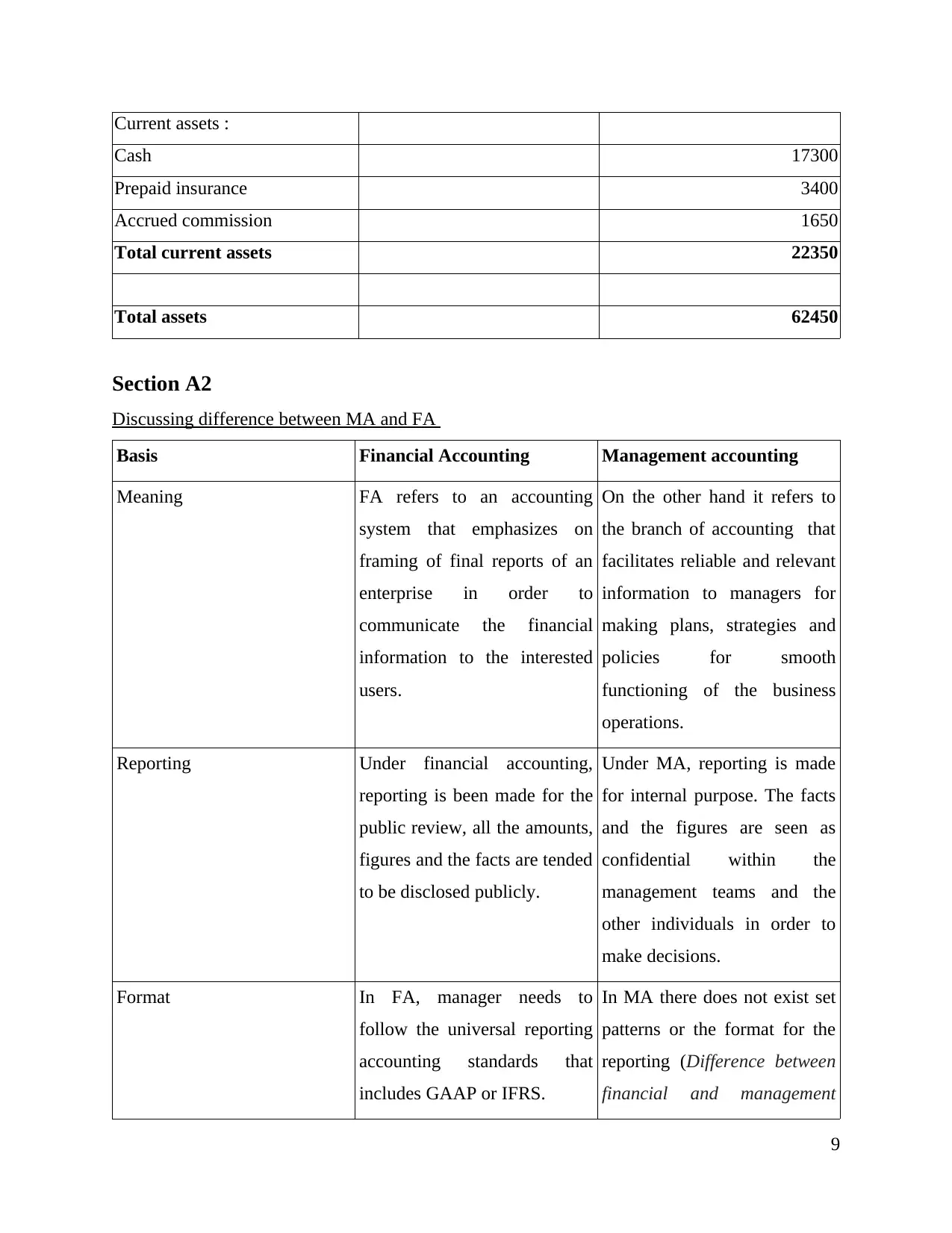

Current assets :

Cash 17300

Prepaid insurance 3400

Accrued commission 1650

Total current assets 22350

Total assets 62450

Section A2

Discussing difference between MA and FA

Basis Financial Accounting Management accounting

Meaning FA refers to an accounting

system that emphasizes on

framing of final reports of an

enterprise in order to

communicate the financial

information to the interested

users.

On the other hand it refers to

the branch of accounting that

facilitates reliable and relevant

information to managers for

making plans, strategies and

policies for smooth

functioning of the business

operations.

Reporting Under financial accounting,

reporting is been made for the

public review, all the amounts,

figures and the facts are tended

to be disclosed publicly.

Under MA, reporting is made

for internal purpose. The facts

and the figures are seen as

confidential within the

management teams and the

other individuals in order to

make decisions.

Format In FA, manager needs to

follow the universal reporting

accounting standards that

includes GAAP or IFRS.

In MA there does not exist set

patterns or the format for the

reporting (Difference between

financial and management

9

Cash 17300

Prepaid insurance 3400

Accrued commission 1650

Total current assets 22350

Total assets 62450

Section A2

Discussing difference between MA and FA

Basis Financial Accounting Management accounting

Meaning FA refers to an accounting

system that emphasizes on

framing of final reports of an

enterprise in order to

communicate the financial

information to the interested

users.

On the other hand it refers to

the branch of accounting that

facilitates reliable and relevant

information to managers for

making plans, strategies and

policies for smooth

functioning of the business

operations.

Reporting Under financial accounting,

reporting is been made for the

public review, all the amounts,

figures and the facts are tended

to be disclosed publicly.

Under MA, reporting is made

for internal purpose. The facts

and the figures are seen as

confidential within the

management teams and the

other individuals in order to

make decisions.

Format In FA, manager needs to

follow the universal reporting

accounting standards that

includes GAAP or IFRS.

In MA there does not exist set

patterns or the format for the

reporting (Difference between

financial and management

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.