Accounting - Open book exam: Case studies and ratio analysis

VerifiedAdded on 2023/06/08

|14

|2833

|500

AI Summary

This article covers case studies and ratio analysis for Accounting - Open book exam. It includes preparation of accounting equation, profit & loss account, balance sheet, computation of ratios, identification of financial strengths & weaknesses, and allocation of manufacturing overheads.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Accounting - Open book

exam

exam

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Case study 1...............................................................................................................................3

1. Preparation of Accounting equation at July 2022..............................................................3

2. Preparation of Profit & loss account for July 2022............................................................5

3. Balance Sheet as at 31st July 2022......................................................................................5

Case Study 2...............................................................................................................................6

2. Identification of financial strengths & weaknesses of Marigold.......................................7

3. Use of ratios for the potential purchase of Marigold by Primrose.....................................8

Case Study 3...............................................................................................................................9

1. Determination of profit cost and gross margin under current method of allocating

manufacturing overheads.......................................................................................................9

2. Allocation of manufacturing overheads under activity based costing method................10

3. Impact of activity - based costing on product profitability..............................................11

Case Study 4.............................................................................................................................12

1. Profit & Loss forecast for the five months to 31st October..............................................12

2. Cash budget for the five months to 31st October..............................................................12

3. Commenting on the resultsand identification of issues and recommendation to address

the same 13

REFERENCES.........................................................................................................................14

Case study 1...............................................................................................................................3

1. Preparation of Accounting equation at July 2022..............................................................3

2. Preparation of Profit & loss account for July 2022............................................................5

3. Balance Sheet as at 31st July 2022......................................................................................5

Case Study 2...............................................................................................................................6

2. Identification of financial strengths & weaknesses of Marigold.......................................7

3. Use of ratios for the potential purchase of Marigold by Primrose.....................................8

Case Study 3...............................................................................................................................9

1. Determination of profit cost and gross margin under current method of allocating

manufacturing overheads.......................................................................................................9

2. Allocation of manufacturing overheads under activity based costing method................10

3. Impact of activity - based costing on product profitability..............................................11

Case Study 4.............................................................................................................................12

1. Profit & Loss forecast for the five months to 31st October..............................................12

2. Cash budget for the five months to 31st October..............................................................12

3. Commenting on the resultsand identification of issues and recommendation to address

the same 13

REFERENCES.........................................................................................................................14

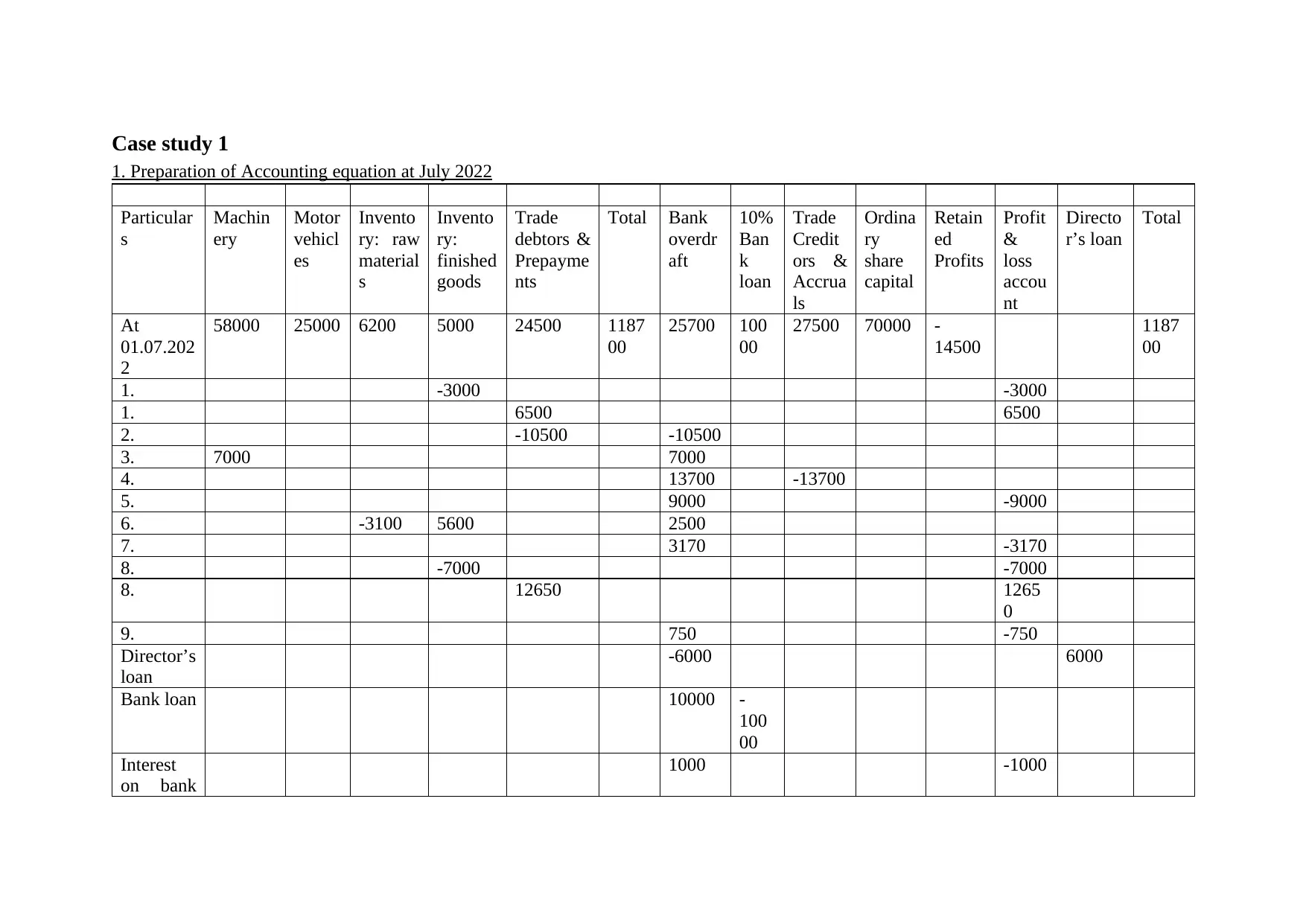

Case study 1

1. Preparation of Accounting equation at July 2022

Particular

s

Machin

ery

Motor

vehicl

es

Invento

ry: raw

material

s

Invento

ry:

finished

goods

Trade

debtors &

Prepayme

nts

Total Bank

overdr

aft

10%

Ban

k

loan

Trade

Credit

ors &

Accrua

ls

Ordina

ry

share

capital

Retain

ed

Profits

Profit

&

loss

accou

nt

Directo

r’s loan

Total

At

01.07.202

2

58000 25000 6200 5000 24500 1187

00

25700 100

00

27500 70000 -

14500

1187

00

1. -3000 -3000

1. 6500 6500

2. -10500 -10500

3. 7000 7000

4. 13700 -13700

5. 9000 -9000

6. -3100 5600 2500

7. 3170 -3170

8. -7000 -7000

8. 12650 1265

0

9. 750 -750

Director’s

loan

-6000 6000

Bank loan 10000 -

100

00

Interest

on bank

1000 -1000

1. Preparation of Accounting equation at July 2022

Particular

s

Machin

ery

Motor

vehicl

es

Invento

ry: raw

material

s

Invento

ry:

finished

goods

Trade

debtors &

Prepayme

nts

Total Bank

overdr

aft

10%

Ban

k

loan

Trade

Credit

ors &

Accrua

ls

Ordina

ry

share

capital

Retain

ed

Profits

Profit

&

loss

accou

nt

Directo

r’s loan

Total

At

01.07.202

2

58000 25000 6200 5000 24500 1187

00

25700 100

00

27500 70000 -

14500

1187

00

1. -3000 -3000

1. 6500 6500

2. -10500 -10500

3. 7000 7000

4. 13700 -13700

5. 9000 -9000

6. -3100 5600 2500

7. 3170 -3170

8. -7000 -7000

8. 12650 1265

0

9. 750 -750

Director’s

loan

-6000 6000

Bank loan 10000 -

100

00

Interest

on bank

1000 -1000

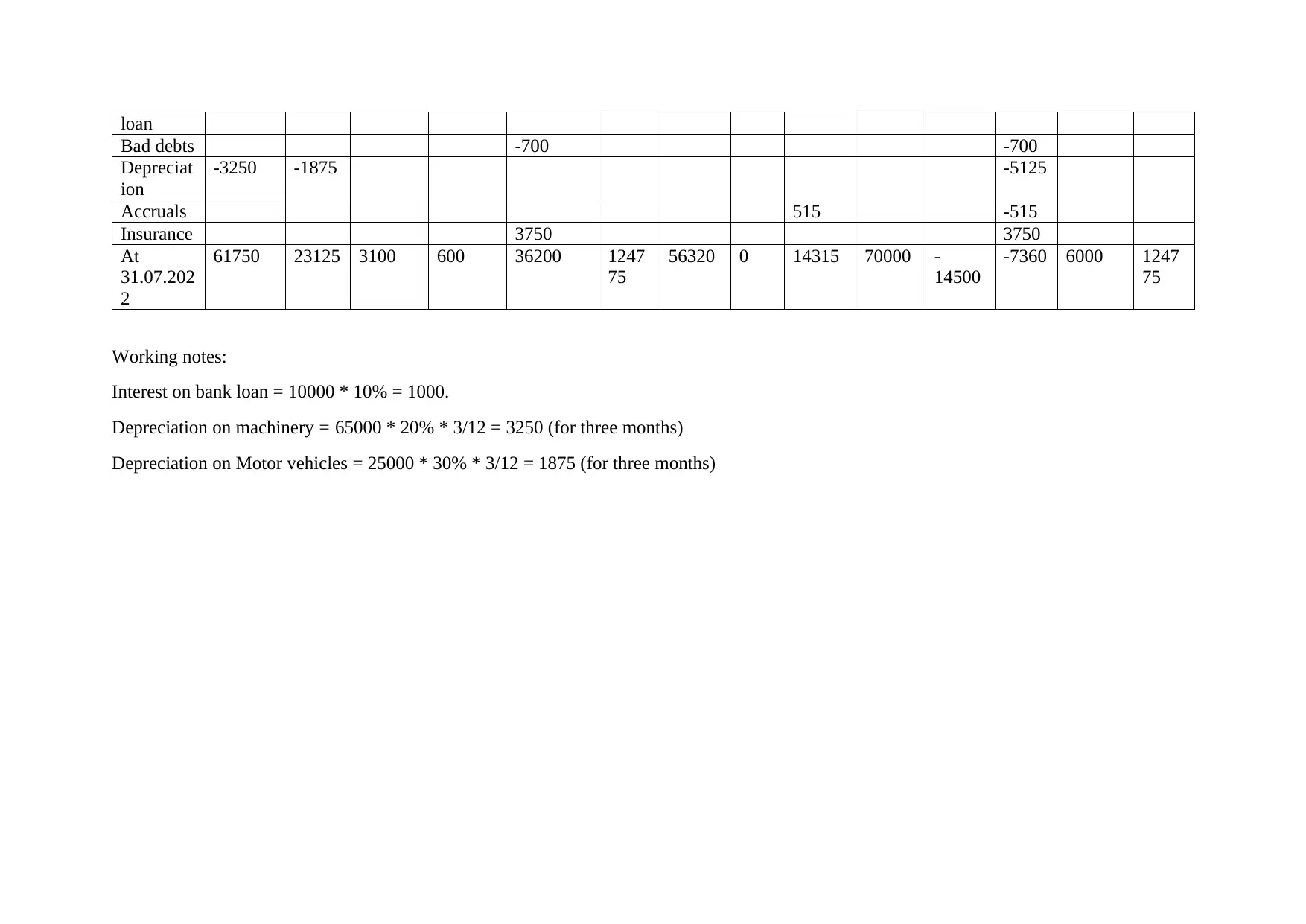

loan

Bad debts -700 -700

Depreciat

ion

-3250 -1875 -5125

Accruals 515 -515

Insurance 3750 3750

At

31.07.202

2

61750 23125 3100 600 36200 1247

75

56320 0 14315 70000 -

14500

-7360 6000 1247

75

Working notes:

Interest on bank loan = 10000 * 10% = 1000.

Depreciation on machinery = 65000 * 20% * 3/12 = 3250 (for three months)

Depreciation on Motor vehicles = 25000 * 30% * 3/12 = 1875 (for three months)

Bad debts -700 -700

Depreciat

ion

-3250 -1875 -5125

Accruals 515 -515

Insurance 3750 3750

At

31.07.202

2

61750 23125 3100 600 36200 1247

75

56320 0 14315 70000 -

14500

-7360 6000 1247

75

Working notes:

Interest on bank loan = 10000 * 10% = 1000.

Depreciation on machinery = 65000 * 20% * 3/12 = 3250 (for three months)

Depreciation on Motor vehicles = 25000 * 30% * 3/12 = 1875 (for three months)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

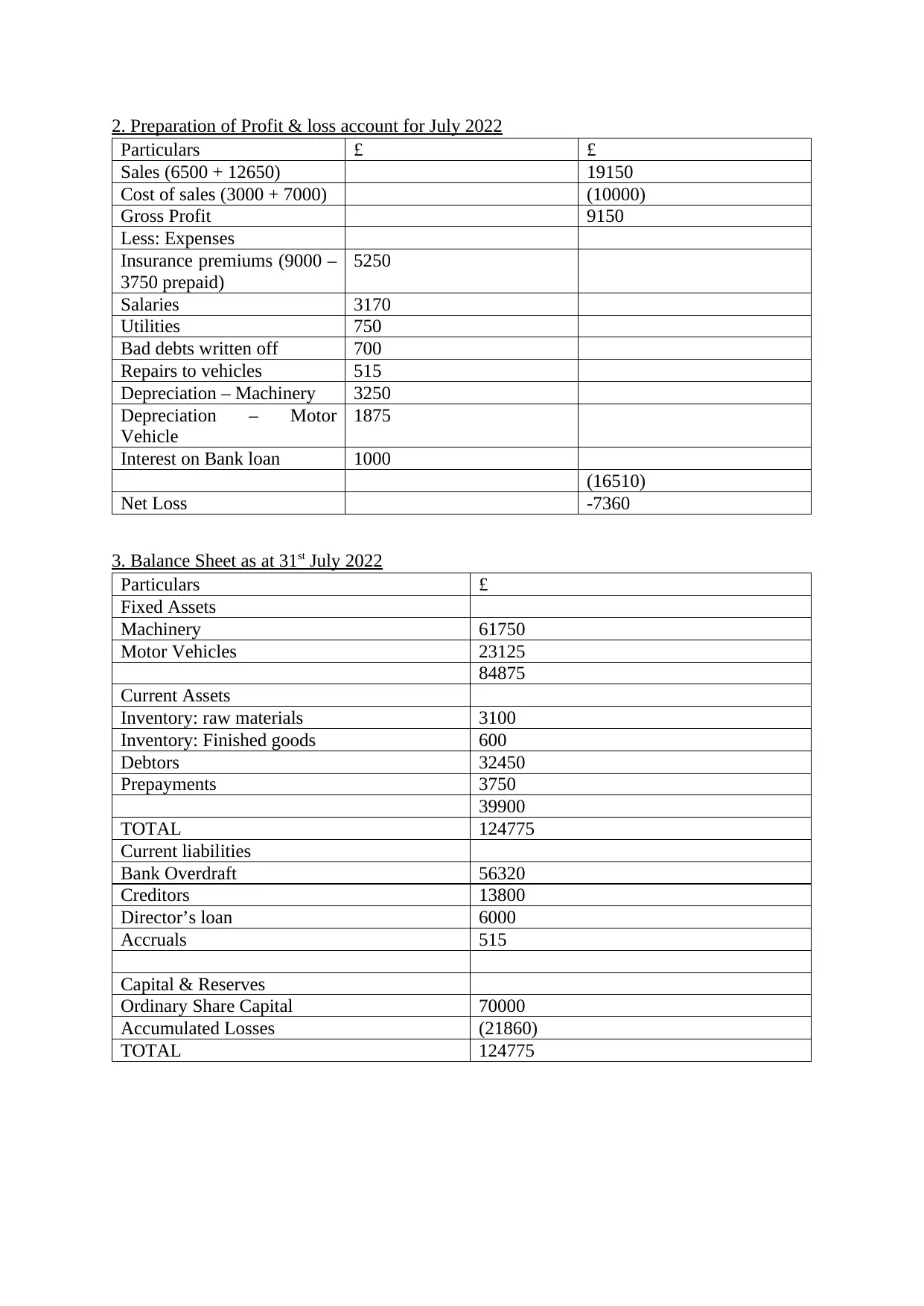

2. Preparation of Profit & loss account for July 2022

Particulars £ £

Sales (6500 + 12650) 19150

Cost of sales (3000 + 7000) (10000)

Gross Profit 9150

Less: Expenses

Insurance premiums (9000 –

3750 prepaid)

5250

Salaries 3170

Utilities 750

Bad debts written off 700

Repairs to vehicles 515

Depreciation – Machinery 3250

Depreciation – Motor

Vehicle

1875

Interest on Bank loan 1000

(16510)

Net Loss -7360

3. Balance Sheet as at 31st July 2022

Particulars £

Fixed Assets

Machinery 61750

Motor Vehicles 23125

84875

Current Assets

Inventory: raw materials 3100

Inventory: Finished goods 600

Debtors 32450

Prepayments 3750

39900

TOTAL 124775

Current liabilities

Bank Overdraft 56320

Creditors 13800

Director’s loan 6000

Accruals 515

Capital & Reserves

Ordinary Share Capital 70000

Accumulated Losses (21860)

TOTAL 124775

Particulars £ £

Sales (6500 + 12650) 19150

Cost of sales (3000 + 7000) (10000)

Gross Profit 9150

Less: Expenses

Insurance premiums (9000 –

3750 prepaid)

5250

Salaries 3170

Utilities 750

Bad debts written off 700

Repairs to vehicles 515

Depreciation – Machinery 3250

Depreciation – Motor

Vehicle

1875

Interest on Bank loan 1000

(16510)

Net Loss -7360

3. Balance Sheet as at 31st July 2022

Particulars £

Fixed Assets

Machinery 61750

Motor Vehicles 23125

84875

Current Assets

Inventory: raw materials 3100

Inventory: Finished goods 600

Debtors 32450

Prepayments 3750

39900

TOTAL 124775

Current liabilities

Bank Overdraft 56320

Creditors 13800

Director’s loan 6000

Accruals 515

Capital & Reserves

Ordinary Share Capital 70000

Accumulated Losses (21860)

TOTAL 124775

Case Study 2

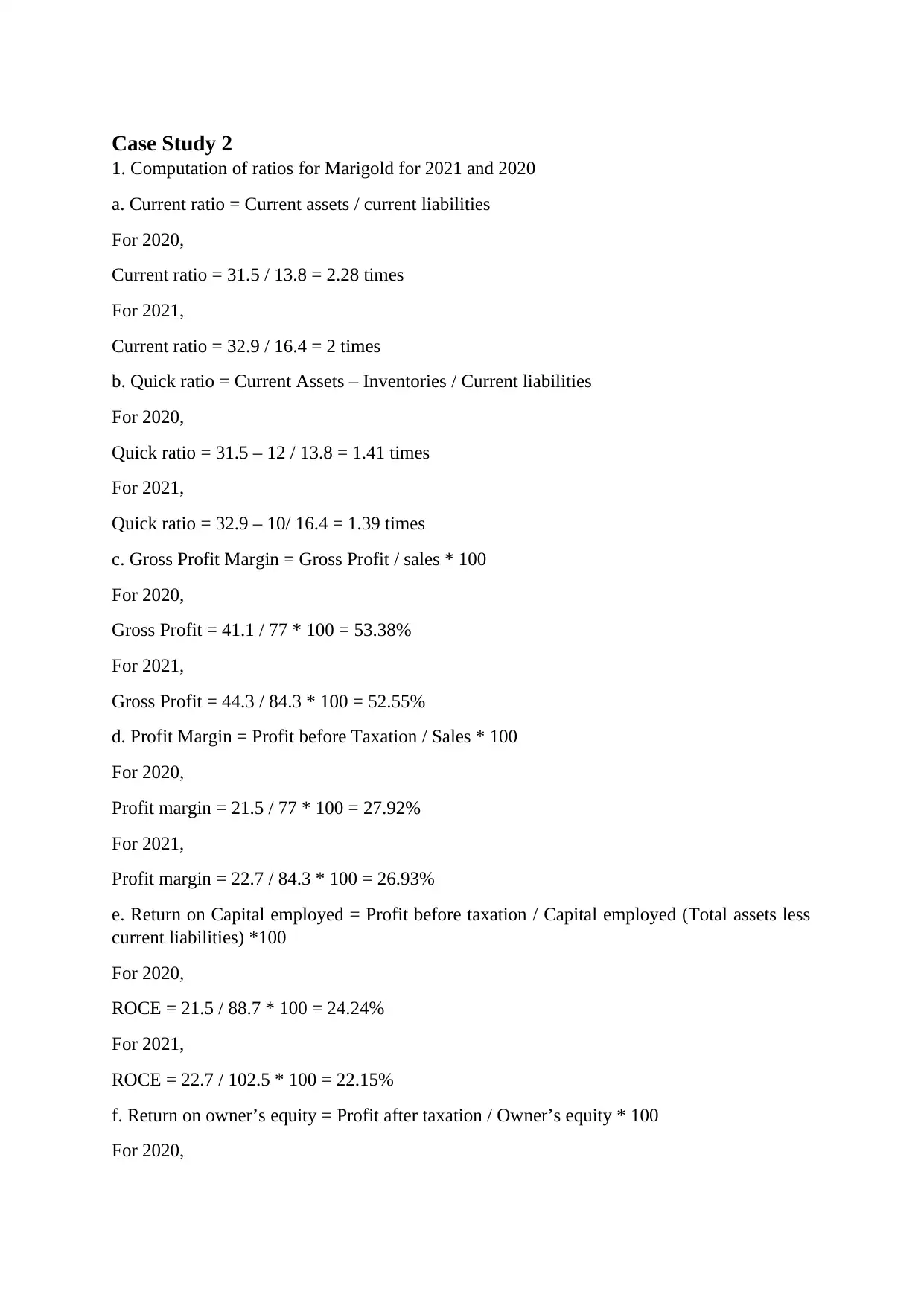

1. Computation of ratios for Marigold for 2021 and 2020

a. Current ratio = Current assets / current liabilities

For 2020,

Current ratio = 31.5 / 13.8 = 2.28 times

For 2021,

Current ratio = 32.9 / 16.4 = 2 times

b. Quick ratio = Current Assets – Inventories / Current liabilities

For 2020,

Quick ratio = 31.5 – 12 / 13.8 = 1.41 times

For 2021,

Quick ratio = 32.9 – 10/ 16.4 = 1.39 times

c. Gross Profit Margin = Gross Profit / sales * 100

For 2020,

Gross Profit = 41.1 / 77 * 100 = 53.38%

For 2021,

Gross Profit = 44.3 / 84.3 * 100 = 52.55%

d. Profit Margin = Profit before Taxation / Sales * 100

For 2020,

Profit margin = 21.5 / 77 * 100 = 27.92%

For 2021,

Profit margin = 22.7 / 84.3 * 100 = 26.93%

e. Return on Capital employed = Profit before taxation / Capital employed (Total assets less

current liabilities) *100

For 2020,

ROCE = 21.5 / 88.7 * 100 = 24.24%

For 2021,

ROCE = 22.7 / 102.5 * 100 = 22.15%

f. Return on owner’s equity = Profit after taxation / Owner’s equity * 100

For 2020,

1. Computation of ratios for Marigold for 2021 and 2020

a. Current ratio = Current assets / current liabilities

For 2020,

Current ratio = 31.5 / 13.8 = 2.28 times

For 2021,

Current ratio = 32.9 / 16.4 = 2 times

b. Quick ratio = Current Assets – Inventories / Current liabilities

For 2020,

Quick ratio = 31.5 – 12 / 13.8 = 1.41 times

For 2021,

Quick ratio = 32.9 – 10/ 16.4 = 1.39 times

c. Gross Profit Margin = Gross Profit / sales * 100

For 2020,

Gross Profit = 41.1 / 77 * 100 = 53.38%

For 2021,

Gross Profit = 44.3 / 84.3 * 100 = 52.55%

d. Profit Margin = Profit before Taxation / Sales * 100

For 2020,

Profit margin = 21.5 / 77 * 100 = 27.92%

For 2021,

Profit margin = 22.7 / 84.3 * 100 = 26.93%

e. Return on Capital employed = Profit before taxation / Capital employed (Total assets less

current liabilities) *100

For 2020,

ROCE = 21.5 / 88.7 * 100 = 24.24%

For 2021,

ROCE = 22.7 / 102.5 * 100 = 22.15%

f. Return on owner’s equity = Profit after taxation / Owner’s equity * 100

For 2020,

ROE = 17.5 / 69 * 100 = 25.36%

For 2021,

ROE = 19.5 / 82.8 * 100 = 23.55%

g. Fixed to Current assets ratio = Fixed assets / current assets

For 2020,

FCAR = 71 / 31.5 = 2.25

For 2021,

FCAR = 86 / 32.9 = 2.61

h. Average Collection Period = Debtors / Sales per day

For 2020,

ACP = 16.5 / [77 / 365] = 78 days

For 2021,

ACP = 21.1 / [84.3 / 365] = 91 days

i. Times Interest Earned = Profit before interest / Interest

For 2020,

Times Interest earned = 23.7 / 2.2 = 10.77 times

For 2021,

Times interest earned = 25 / 2.3 = 10.87 times

j. Dividend Cover = Profit after taxation / Dividend

For 2020,

Dividend cover = 17.5 / 1.8 = 9.72 times

For 2021,

Dividend Cover = 19.5 / 5.7 = 3.42 times

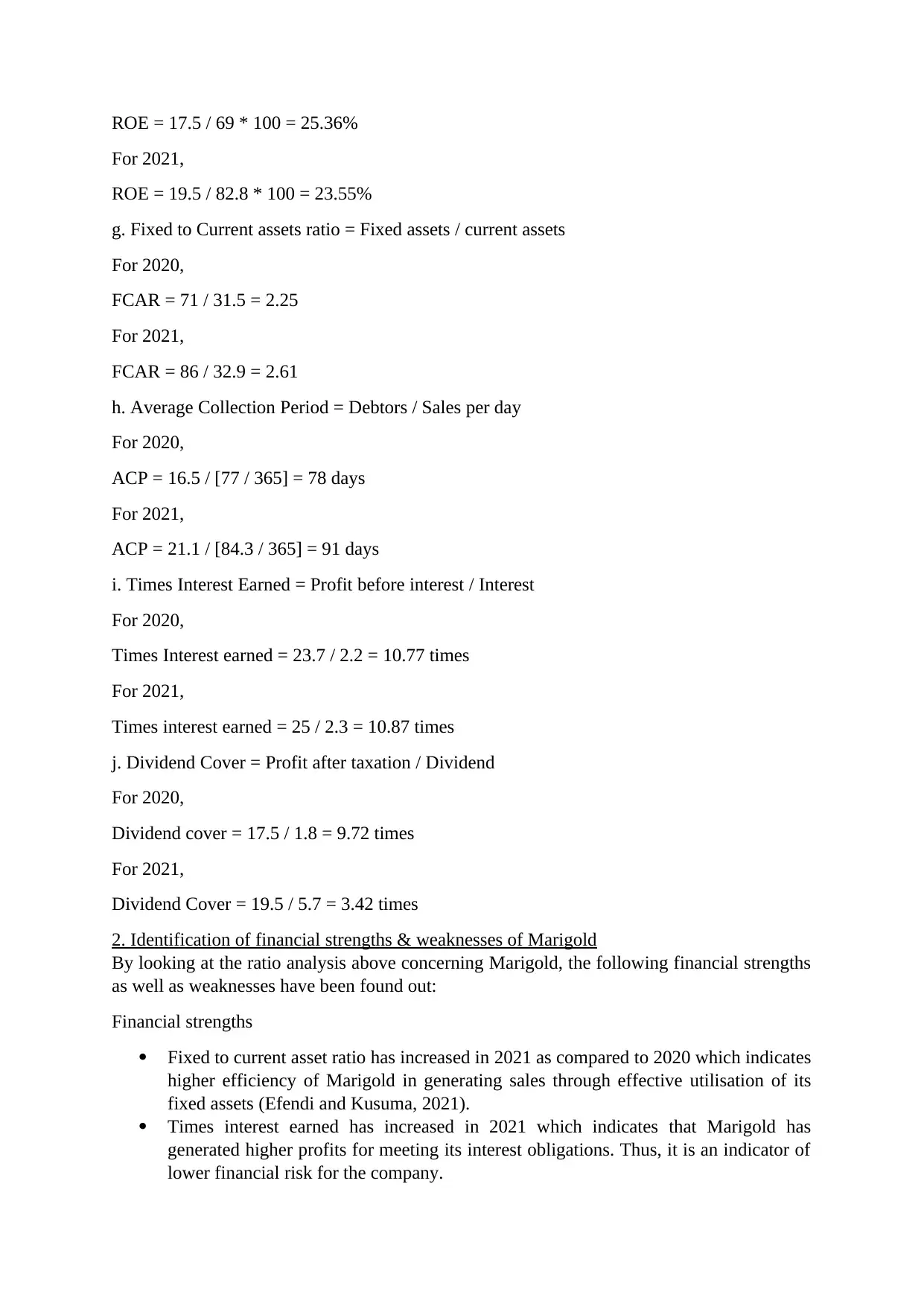

2. Identification of financial strengths & weaknesses of Marigold

By looking at the ratio analysis above concerning Marigold, the following financial strengths

as well as weaknesses have been found out:

Financial strengths

Fixed to current asset ratio has increased in 2021 as compared to 2020 which indicates

higher efficiency of Marigold in generating sales through effective utilisation of its

fixed assets (Efendi and Kusuma, 2021).

Times interest earned has increased in 2021 which indicates that Marigold has

generated higher profits for meeting its interest obligations. Thus, it is an indicator of

lower financial risk for the company.

For 2021,

ROE = 19.5 / 82.8 * 100 = 23.55%

g. Fixed to Current assets ratio = Fixed assets / current assets

For 2020,

FCAR = 71 / 31.5 = 2.25

For 2021,

FCAR = 86 / 32.9 = 2.61

h. Average Collection Period = Debtors / Sales per day

For 2020,

ACP = 16.5 / [77 / 365] = 78 days

For 2021,

ACP = 21.1 / [84.3 / 365] = 91 days

i. Times Interest Earned = Profit before interest / Interest

For 2020,

Times Interest earned = 23.7 / 2.2 = 10.77 times

For 2021,

Times interest earned = 25 / 2.3 = 10.87 times

j. Dividend Cover = Profit after taxation / Dividend

For 2020,

Dividend cover = 17.5 / 1.8 = 9.72 times

For 2021,

Dividend Cover = 19.5 / 5.7 = 3.42 times

2. Identification of financial strengths & weaknesses of Marigold

By looking at the ratio analysis above concerning Marigold, the following financial strengths

as well as weaknesses have been found out:

Financial strengths

Fixed to current asset ratio has increased in 2021 as compared to 2020 which indicates

higher efficiency of Marigold in generating sales through effective utilisation of its

fixed assets (Efendi and Kusuma, 2021).

Times interest earned has increased in 2021 which indicates that Marigold has

generated higher profits for meeting its interest obligations. Thus, it is an indicator of

lower financial risk for the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial weaknesses

The liquidity position of Marigold has deteriorated in 2021 as compared to 2020

because both current as well as the quick ratio which are the indicators of its liquidity

has reduced.

Further, the profitability of Marigold has also reduced in 2021 as against 2020 as can

be seen through gross profit margin and profit margin which have reduced. This has

occurred because of greater increase in expenses as compared to sales (Ballou,

Heitger and Stoel, 2018).

Both return on capital employed and return on owner’s equity have reduced in 2021

as compared to 2020 which indicates that the shareholders are getting less returns in

current year as against previous year. Lower ROCE means the efficiency of business

has reduced in utilising the available assets for generating profits. Also, lower ROE is

the indicator of Marigold’s inefficiency in 2021 to generate higher or equivalent

returns on its shareholder’s equity.

Average collection period associated with the recovery of outstanding dues from

accounts receivables has increased in 2021 which indicates Marigold’s inefficiency in

collecting dues from its debtors or having poor credit policies in place.

Dividend coverage ratio has reduced significantly in 2021 due to the higher

declaration and payment made towards dividend to shareholders.

3. Use of ratios for the potential purchase of Marigold by Primrose

By using the above ratios, the following points for the consideration have been identified in

the context of potential purchase of Marigold by Primrose.

The dividend pay - out ratio has got more than the twice that is, from 1.8 million to

5.7 million in 2021 which is quite an unusual signal for the buyer as Primrose would

face difficulty in meeting higher expectation of Marigold’s shareholders. Also,

Primrose would be expected to generate higher profits for the payment of higher

dividends always.

Also, Marigold is having long collection period which is the indicator of poor credit

management & control within Marigold. It is also an indicator of inappropriate credit

policies in place. Long collection period has resulted in poor liquidity position of the

business.

Increase (Purba and Nurlinda, 2018) in fixed assets from 2020 to 2021 indicates

further increase in capital expenditure as a fruitful option.

Both gross profit and net profit margins have reduced with a simultaneous rise in

sales. This indicates that Marigold has captured greater market share at the cost of

lower selling price.

Higher times interest earned is the indicator of lower financial risk for the Primrose.

The liquidity position of Marigold has deteriorated in 2021 as compared to 2020

because both current as well as the quick ratio which are the indicators of its liquidity

has reduced.

Further, the profitability of Marigold has also reduced in 2021 as against 2020 as can

be seen through gross profit margin and profit margin which have reduced. This has

occurred because of greater increase in expenses as compared to sales (Ballou,

Heitger and Stoel, 2018).

Both return on capital employed and return on owner’s equity have reduced in 2021

as compared to 2020 which indicates that the shareholders are getting less returns in

current year as against previous year. Lower ROCE means the efficiency of business

has reduced in utilising the available assets for generating profits. Also, lower ROE is

the indicator of Marigold’s inefficiency in 2021 to generate higher or equivalent

returns on its shareholder’s equity.

Average collection period associated with the recovery of outstanding dues from

accounts receivables has increased in 2021 which indicates Marigold’s inefficiency in

collecting dues from its debtors or having poor credit policies in place.

Dividend coverage ratio has reduced significantly in 2021 due to the higher

declaration and payment made towards dividend to shareholders.

3. Use of ratios for the potential purchase of Marigold by Primrose

By using the above ratios, the following points for the consideration have been identified in

the context of potential purchase of Marigold by Primrose.

The dividend pay - out ratio has got more than the twice that is, from 1.8 million to

5.7 million in 2021 which is quite an unusual signal for the buyer as Primrose would

face difficulty in meeting higher expectation of Marigold’s shareholders. Also,

Primrose would be expected to generate higher profits for the payment of higher

dividends always.

Also, Marigold is having long collection period which is the indicator of poor credit

management & control within Marigold. It is also an indicator of inappropriate credit

policies in place. Long collection period has resulted in poor liquidity position of the

business.

Increase (Purba and Nurlinda, 2018) in fixed assets from 2020 to 2021 indicates

further increase in capital expenditure as a fruitful option.

Both gross profit and net profit margins have reduced with a simultaneous rise in

sales. This indicates that Marigold has captured greater market share at the cost of

lower selling price.

Higher times interest earned is the indicator of lower financial risk for the Primrose.

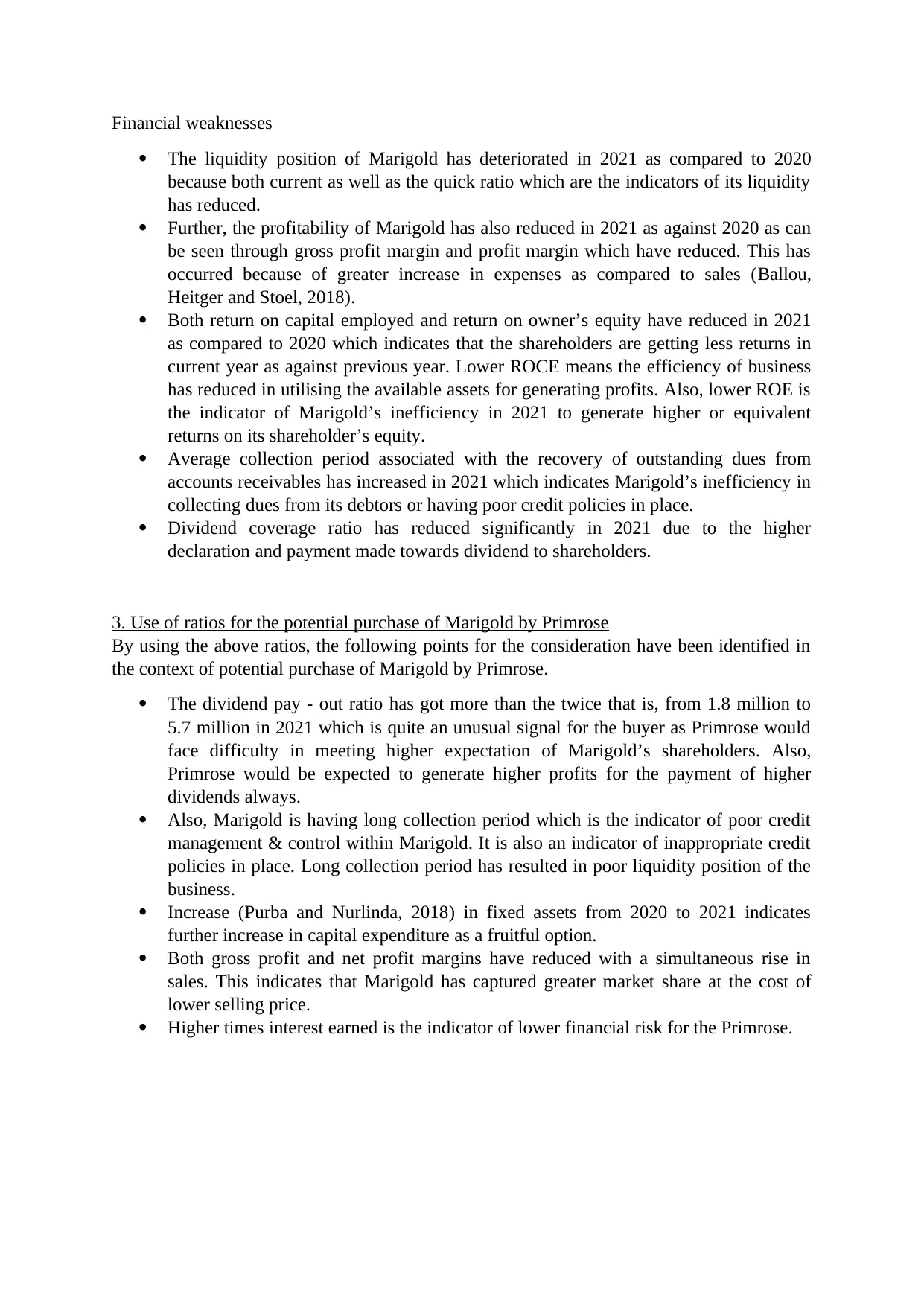

Case Study 3

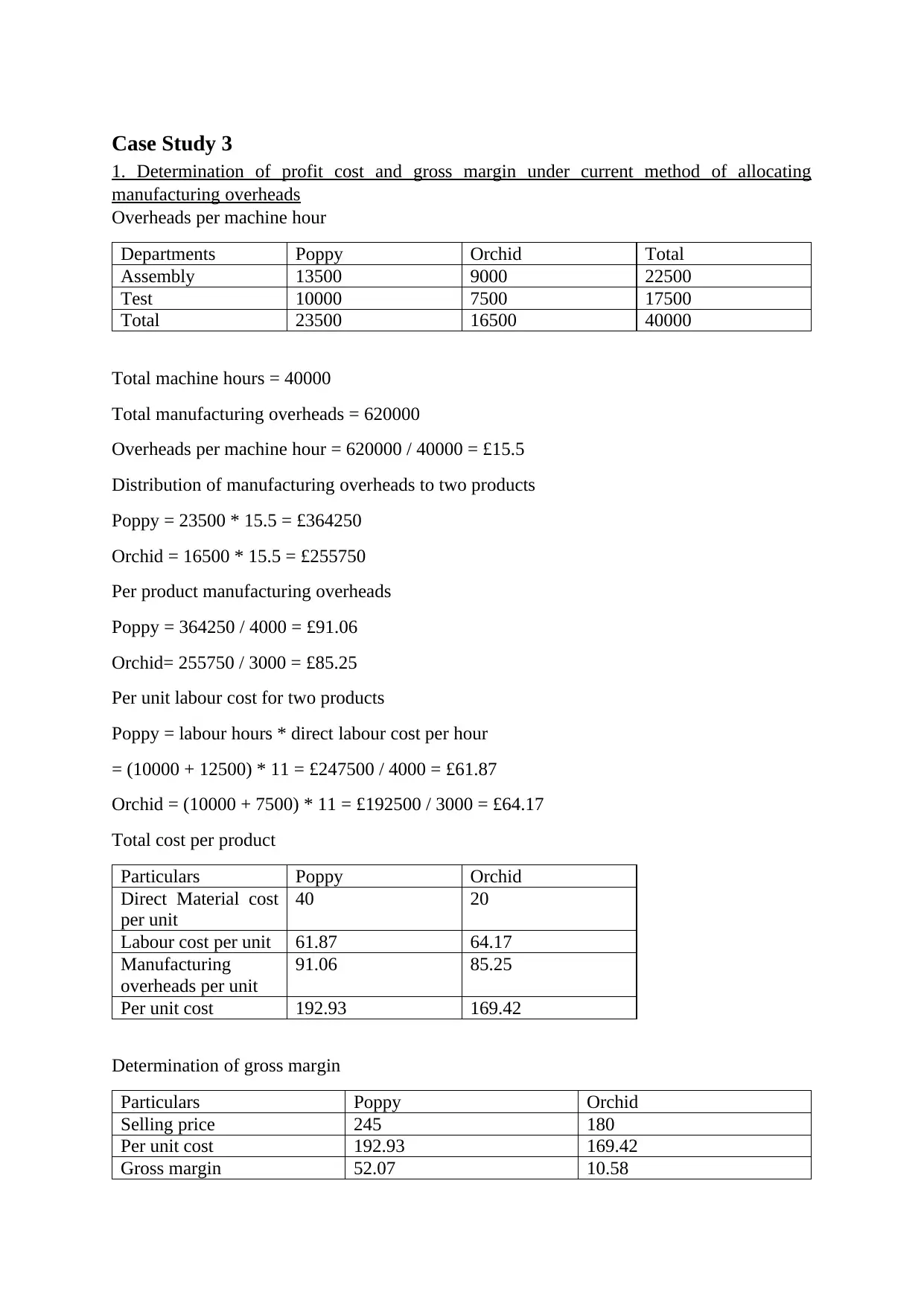

1. Determination of profit cost and gross margin under current method of allocating

manufacturing overheads

Overheads per machine hour

Departments Poppy Orchid Total

Assembly 13500 9000 22500

Test 10000 7500 17500

Total 23500 16500 40000

Total machine hours = 40000

Total manufacturing overheads = 620000

Overheads per machine hour = 620000 / 40000 = £15.5

Distribution of manufacturing overheads to two products

Poppy = 23500 * 15.5 = £364250

Orchid = 16500 * 15.5 = £255750

Per product manufacturing overheads

Poppy = 364250 / 4000 = £91.06

Orchid= 255750 / 3000 = £85.25

Per unit labour cost for two products

Poppy = labour hours * direct labour cost per hour

= (10000 + 12500) * 11 = £247500 / 4000 = £61.87

Orchid = (10000 + 7500) * 11 = £192500 / 3000 = £64.17

Total cost per product

Particulars Poppy Orchid

Direct Material cost

per unit

40 20

Labour cost per unit 61.87 64.17

Manufacturing

overheads per unit

91.06 85.25

Per unit cost 192.93 169.42

Determination of gross margin

Particulars Poppy Orchid

Selling price 245 180

Per unit cost 192.93 169.42

Gross margin 52.07 10.58

1. Determination of profit cost and gross margin under current method of allocating

manufacturing overheads

Overheads per machine hour

Departments Poppy Orchid Total

Assembly 13500 9000 22500

Test 10000 7500 17500

Total 23500 16500 40000

Total machine hours = 40000

Total manufacturing overheads = 620000

Overheads per machine hour = 620000 / 40000 = £15.5

Distribution of manufacturing overheads to two products

Poppy = 23500 * 15.5 = £364250

Orchid = 16500 * 15.5 = £255750

Per product manufacturing overheads

Poppy = 364250 / 4000 = £91.06

Orchid= 255750 / 3000 = £85.25

Per unit labour cost for two products

Poppy = labour hours * direct labour cost per hour

= (10000 + 12500) * 11 = £247500 / 4000 = £61.87

Orchid = (10000 + 7500) * 11 = £192500 / 3000 = £64.17

Total cost per product

Particulars Poppy Orchid

Direct Material cost

per unit

40 20

Labour cost per unit 61.87 64.17

Manufacturing

overheads per unit

91.06 85.25

Per unit cost 192.93 169.42

Determination of gross margin

Particulars Poppy Orchid

Selling price 245 180

Per unit cost 192.93 169.42

Gross margin 52.07 10.58

Gross margin (%) 21.25% 5.88%

2. Allocation of manufacturing overheads under activity based costing method

Total overheads relevant to different cost pools

Direct labour hours 40000 + 115000 = 155000

Machine hours 80000 + 50000 = 130000

Set up hours 335000

Activity analysis

Activity Poppy Orchid Total

Direct labour hours 22500 17500 40000

Machine hours 23500 16500 40000

Set up hours (2:1) * 1000 500 1500

500 set ups for each product, however poppy took twice as long as orchid during set

up.

Manufacturing overheads per activity

Cost drivers Cost Activity Manufacturing

overheads per

activity

Direct labour hours 155000 40000 3.875

Machine hours 130000 40000 3.25

Set up hours 335000 1500 223.33

Allocation of these overheads to two products based on identified cost pools

Poppy Orchid Total

Particulars Activity Cost Activity Cost Activity Cost

Direct

labour

hours

22500 87188 17500 67812 40000 155000

Machine

hours

23500 76375 16500 53625 40000 130000

Set up

hours

1000 223330 500 111670 1500 335000

Total

overhead

costs

386893 233107 620000

Units

produced

4000 3000

Overhead

costs per

unit

96.72 77.70

Determination of gross margin per unit under activity - based costing method

2. Allocation of manufacturing overheads under activity based costing method

Total overheads relevant to different cost pools

Direct labour hours 40000 + 115000 = 155000

Machine hours 80000 + 50000 = 130000

Set up hours 335000

Activity analysis

Activity Poppy Orchid Total

Direct labour hours 22500 17500 40000

Machine hours 23500 16500 40000

Set up hours (2:1) * 1000 500 1500

500 set ups for each product, however poppy took twice as long as orchid during set

up.

Manufacturing overheads per activity

Cost drivers Cost Activity Manufacturing

overheads per

activity

Direct labour hours 155000 40000 3.875

Machine hours 130000 40000 3.25

Set up hours 335000 1500 223.33

Allocation of these overheads to two products based on identified cost pools

Poppy Orchid Total

Particulars Activity Cost Activity Cost Activity Cost

Direct

labour

hours

22500 87188 17500 67812 40000 155000

Machine

hours

23500 76375 16500 53625 40000 130000

Set up

hours

1000 223330 500 111670 1500 335000

Total

overhead

costs

386893 233107 620000

Units

produced

4000 3000

Overhead

costs per

unit

96.72 77.70

Determination of gross margin per unit under activity - based costing method

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Particulars Poppy Orchid

Selling price (a) 245 180

Less:

Direct material cost 40 20

Labour cost per unit (same

as above)

61.87 64.17

Manufacturing overhead per

unit

96.72 77.70

Total cost (b) 198.59 161.87

Gross margin (a - b) 46.41 18.13

Gross margin (%) 18.94% 10.07%

3. Impact of activity - based costing on product profitability

Products ABC Current costing

Poppy 18.94% 21.25%

Orchid 10.07% 5.88%

Through the above table, it can be clearly seen than Poppy is found to be profitable in case of

both the costing techniques. However, poppy’s profitability margin has reduced in activity -

based costing method while the profit margin of Orchid has increased. This has happened

because of more accurate allocation of overhead costs under ABC costing method whereas in

case of current costing method where allocation of overheads is done on machine hours, the

product that is consuming more of machine hours get unreasonably more proportion of

manufacturing overheads (Fleischman and McLean, 2020). This led to reduction in their

profit margin. Therefore, ABC method by depicting current cost & profit structure for each

product assists in making decisions pertaining to production & pricing. Therefore, under

ABC method, the profitability of Poppy has reduced while the profitability of Orchid has

increased.

Selling price (a) 245 180

Less:

Direct material cost 40 20

Labour cost per unit (same

as above)

61.87 64.17

Manufacturing overhead per

unit

96.72 77.70

Total cost (b) 198.59 161.87

Gross margin (a - b) 46.41 18.13

Gross margin (%) 18.94% 10.07%

3. Impact of activity - based costing on product profitability

Products ABC Current costing

Poppy 18.94% 21.25%

Orchid 10.07% 5.88%

Through the above table, it can be clearly seen than Poppy is found to be profitable in case of

both the costing techniques. However, poppy’s profitability margin has reduced in activity -

based costing method while the profit margin of Orchid has increased. This has happened

because of more accurate allocation of overhead costs under ABC costing method whereas in

case of current costing method where allocation of overheads is done on machine hours, the

product that is consuming more of machine hours get unreasonably more proportion of

manufacturing overheads (Fleischman and McLean, 2020). This led to reduction in their

profit margin. Therefore, ABC method by depicting current cost & profit structure for each

product assists in making decisions pertaining to production & pricing. Therefore, under

ABC method, the profitability of Poppy has reduced while the profitability of Orchid has

increased.

Case Study 4

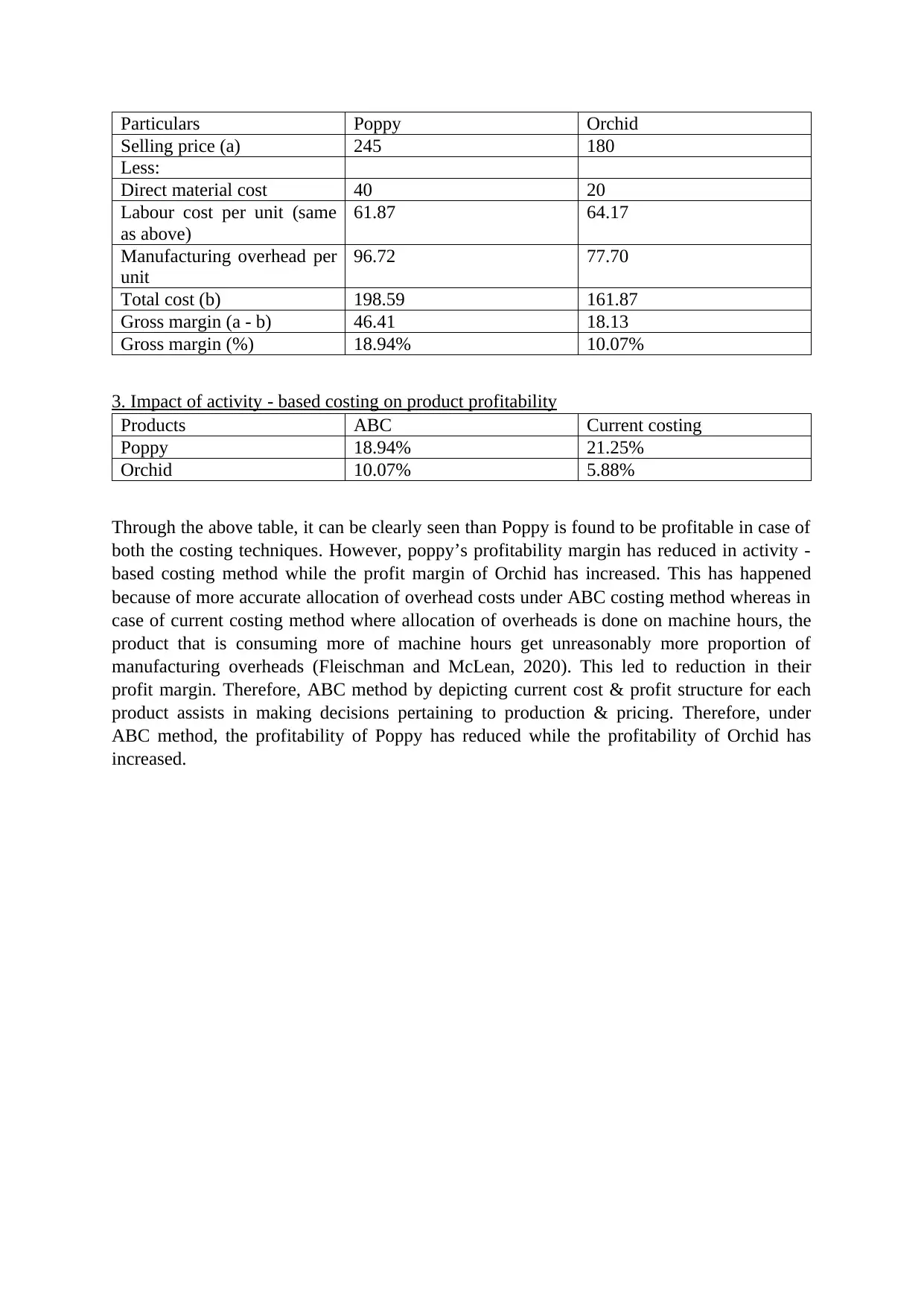

1. Profit & Loss forecast for the five months to 31st October

Particulars €

Sales 2140000 [400000 + 240000 + 200000

+ 600000 + 700000]

Purchases (1219000) [175000 + 144000 + 120000

+ 360000 + 420000]

Direct labour cost (226750) [44250 * 3 + 47000 * 2]

Salaries (70500) 14100 * 5

Marketing cost (42450) [6660 * 5 + 9150]

Depreciation (66250) [13250 *5]

Administrative staff salaries (66750) [13350 * 5]

Overheads (215000) [43000 * 5]

Profit for the period 233300

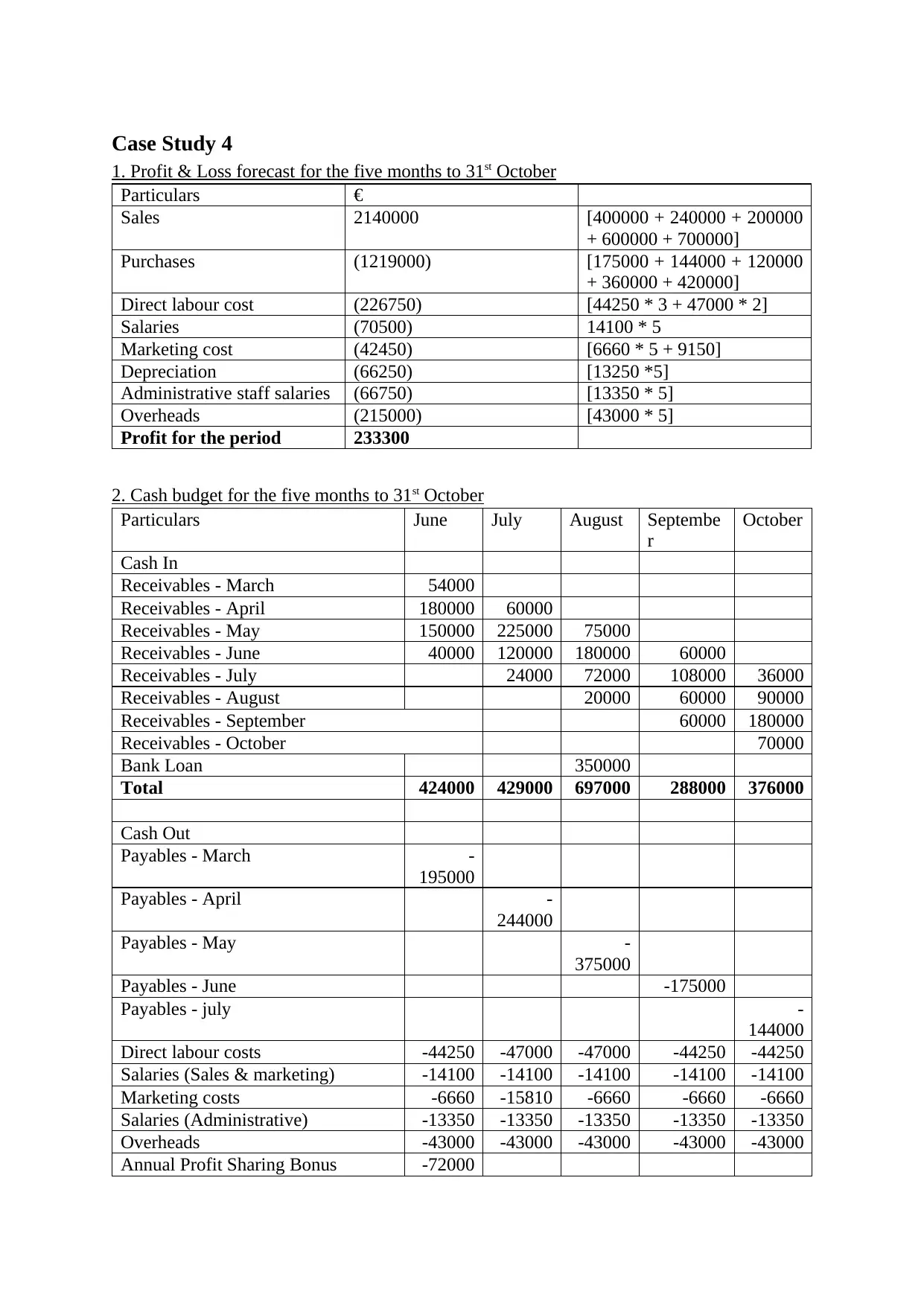

2. Cash budget for the five months to 31st October

Particulars June July August Septembe

r

October

Cash In

Receivables - March 54000

Receivables - April 180000 60000

Receivables - May 150000 225000 75000

Receivables - June 40000 120000 180000 60000

Receivables - July 24000 72000 108000 36000

Receivables - August 20000 60000 90000

Receivables - September 60000 180000

Receivables - October 70000

Bank Loan 350000

Total 424000 429000 697000 288000 376000

Cash Out

Payables - March -

195000

Payables - April -

244000

Payables - May -

375000

Payables - June -175000

Payables - july -

144000

Direct labour costs -44250 -47000 -47000 -44250 -44250

Salaries (Sales & marketing) -14100 -14100 -14100 -14100 -14100

Marketing costs -6660 -15810 -6660 -6660 -6660

Salaries (Administrative) -13350 -13350 -13350 -13350 -13350

Overheads -43000 -43000 -43000 -43000 -43000

Annual Profit Sharing Bonus -72000

1. Profit & Loss forecast for the five months to 31st October

Particulars €

Sales 2140000 [400000 + 240000 + 200000

+ 600000 + 700000]

Purchases (1219000) [175000 + 144000 + 120000

+ 360000 + 420000]

Direct labour cost (226750) [44250 * 3 + 47000 * 2]

Salaries (70500) 14100 * 5

Marketing cost (42450) [6660 * 5 + 9150]

Depreciation (66250) [13250 *5]

Administrative staff salaries (66750) [13350 * 5]

Overheads (215000) [43000 * 5]

Profit for the period 233300

2. Cash budget for the five months to 31st October

Particulars June July August Septembe

r

October

Cash In

Receivables - March 54000

Receivables - April 180000 60000

Receivables - May 150000 225000 75000

Receivables - June 40000 120000 180000 60000

Receivables - July 24000 72000 108000 36000

Receivables - August 20000 60000 90000

Receivables - September 60000 180000

Receivables - October 70000

Bank Loan 350000

Total 424000 429000 697000 288000 376000

Cash Out

Payables - March -

195000

Payables - April -

244000

Payables - May -

375000

Payables - June -175000

Payables - july -

144000

Direct labour costs -44250 -47000 -47000 -44250 -44250

Salaries (Sales & marketing) -14100 -14100 -14100 -14100 -14100

Marketing costs -6660 -15810 -6660 -6660 -6660

Salaries (Administrative) -13350 -13350 -13350 -13350 -13350

Overheads -43000 -43000 -43000 -43000 -43000

Annual Profit Sharing Bonus -72000

Scheme

Corporate tax liability -

134000

Equipment -24000 -

108000

-108000

Other Equipment -40000

Total -

388360

-

535260

-

607110

-444360 -

265360

Net Cash 35640 -

106260

89890 -156360 110640

Opening position 15000 50640 -55620 34270 -

122090

Closing cash balance 50640 -55620 34270 -122090 -11450

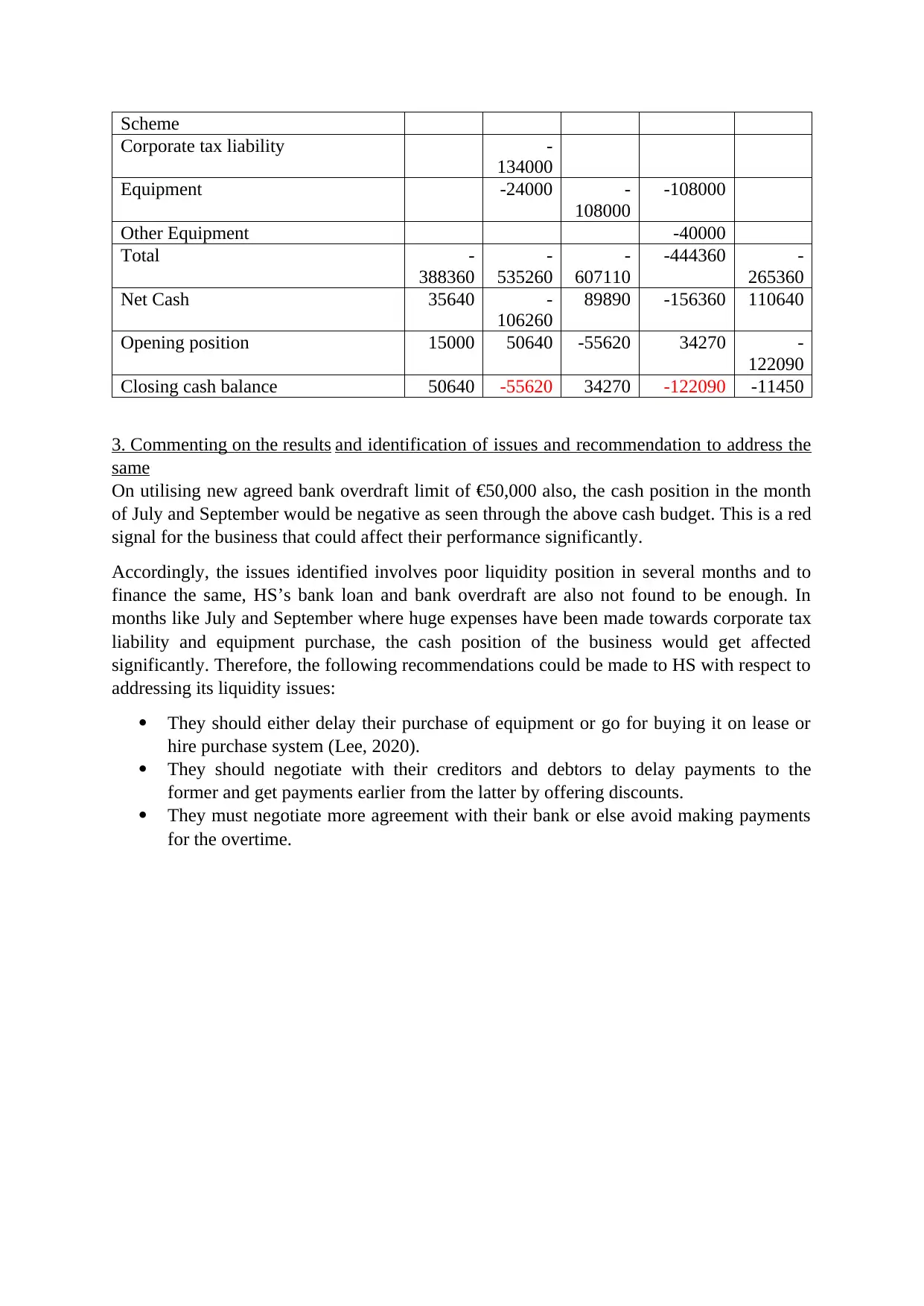

3. Commenting on the results and identification of issues and recommendation to address the

same

On utilising new agreed bank overdraft limit of €50,000 also, the cash position in the month

of July and September would be negative as seen through the above cash budget. This is a red

signal for the business that could affect their performance significantly.

Accordingly, the issues identified involves poor liquidity position in several months and to

finance the same, HS’s bank loan and bank overdraft are also not found to be enough. In

months like July and September where huge expenses have been made towards corporate tax

liability and equipment purchase, the cash position of the business would get affected

significantly. Therefore, the following recommendations could be made to HS with respect to

addressing its liquidity issues:

They should either delay their purchase of equipment or go for buying it on lease or

hire purchase system (Lee, 2020).

They should negotiate with their creditors and debtors to delay payments to the

former and get payments earlier from the latter by offering discounts.

They must negotiate more agreement with their bank or else avoid making payments

for the overtime.

Corporate tax liability -

134000

Equipment -24000 -

108000

-108000

Other Equipment -40000

Total -

388360

-

535260

-

607110

-444360 -

265360

Net Cash 35640 -

106260

89890 -156360 110640

Opening position 15000 50640 -55620 34270 -

122090

Closing cash balance 50640 -55620 34270 -122090 -11450

3. Commenting on the results and identification of issues and recommendation to address the

same

On utilising new agreed bank overdraft limit of €50,000 also, the cash position in the month

of July and September would be negative as seen through the above cash budget. This is a red

signal for the business that could affect their performance significantly.

Accordingly, the issues identified involves poor liquidity position in several months and to

finance the same, HS’s bank loan and bank overdraft are also not found to be enough. In

months like July and September where huge expenses have been made towards corporate tax

liability and equipment purchase, the cash position of the business would get affected

significantly. Therefore, the following recommendations could be made to HS with respect to

addressing its liquidity issues:

They should either delay their purchase of equipment or go for buying it on lease or

hire purchase system (Lee, 2020).

They should negotiate with their creditors and debtors to delay payments to the

former and get payments earlier from the latter by offering discounts.

They must negotiate more agreement with their bank or else avoid making payments

for the overtime.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Ballou, B., Heitger, D.L. and Stoel, D., 2018. Data-driven decision-making and its impact on

accounting undergraduate curriculum. Journal of Accounting Education. 44. pp.14-

24.

Efendi, D. and Kusuma, E.A., 2021. The role of the management accounting system and

decision-making style on managerial performance. Jurnal Keuangan dan

Perbankan. 25(1). pp.144-161.

Fleischman, R. and McLean, T., 2020. Management accounting: Theory and practice. In The

Routledge companion to accounting history (pp. 214-251). Routledge.

Lee, T. A., 2020. Financial accounting theory. In The Routledge companion to accounting

history (pp. 159-184). Routledge.

Purba, R. B. and Nurlinda, S.T., 2018. Perspectives of accounting theory. Journal of

Economics, Business, & Accountancy Ventura. 21(1). pp.137-141.

Ballou, B., Heitger, D.L. and Stoel, D., 2018. Data-driven decision-making and its impact on

accounting undergraduate curriculum. Journal of Accounting Education. 44. pp.14-

24.

Efendi, D. and Kusuma, E.A., 2021. The role of the management accounting system and

decision-making style on managerial performance. Jurnal Keuangan dan

Perbankan. 25(1). pp.144-161.

Fleischman, R. and McLean, T., 2020. Management accounting: Theory and practice. In The

Routledge companion to accounting history (pp. 214-251). Routledge.

Lee, T. A., 2020. Financial accounting theory. In The Routledge companion to accounting

history (pp. 159-184). Routledge.

Purba, R. B. and Nurlinda, S.T., 2018. Perspectives of accounting theory. Journal of

Economics, Business, & Accountancy Ventura. 21(1). pp.137-141.

1 out of 14

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.