Accounting Principles: Comprehensive Financial Statement Analysis

VerifiedAdded on 2023/06/12

|12

|1512

|94

Practical Assignment

AI Summary

This assignment provides a detailed solution to an accounting problem, starting with journal entries for various business transactions, including salaries, sales, and purchases. It then compiles these entries into a general ledger, followed by an adjusted trial balance to ensure accuracy. The assignment culminates in the preparation of key financial statements: an income statement, a retained earnings statement, and a balance sheet, offering a comprehensive view of the company's financial performance and position. Desklib provides this and many other solved assignments and past papers to help students excel.

Running head: ACCOUNTING PRINCIPLE

Accounting Principle

Name of the Student:

Name of the University:

Author’s Note:

Accounting Principle

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING PRINCIPLE

Table of Contents

Journal Entries:................................................................................................................................2

General Ledger:...............................................................................................................................3

Adjusted Trial Balance:...................................................................................................................7

Income Statement:...........................................................................................................................7

Retained Earnings Statement:..........................................................................................................8

Balance Sheet:.................................................................................................................................8

Bibliography:.................................................................................................................................10

Table of Contents

Journal Entries:................................................................................................................................2

General Ledger:...............................................................................................................................3

Adjusted Trial Balance:...................................................................................................................7

Income Statement:...........................................................................................................................7

Retained Earnings Statement:..........................................................................................................8

Balance Sheet:.................................................................................................................................8

Bibliography:.................................................................................................................................10

2ACCOUNTING PRINCIPLE

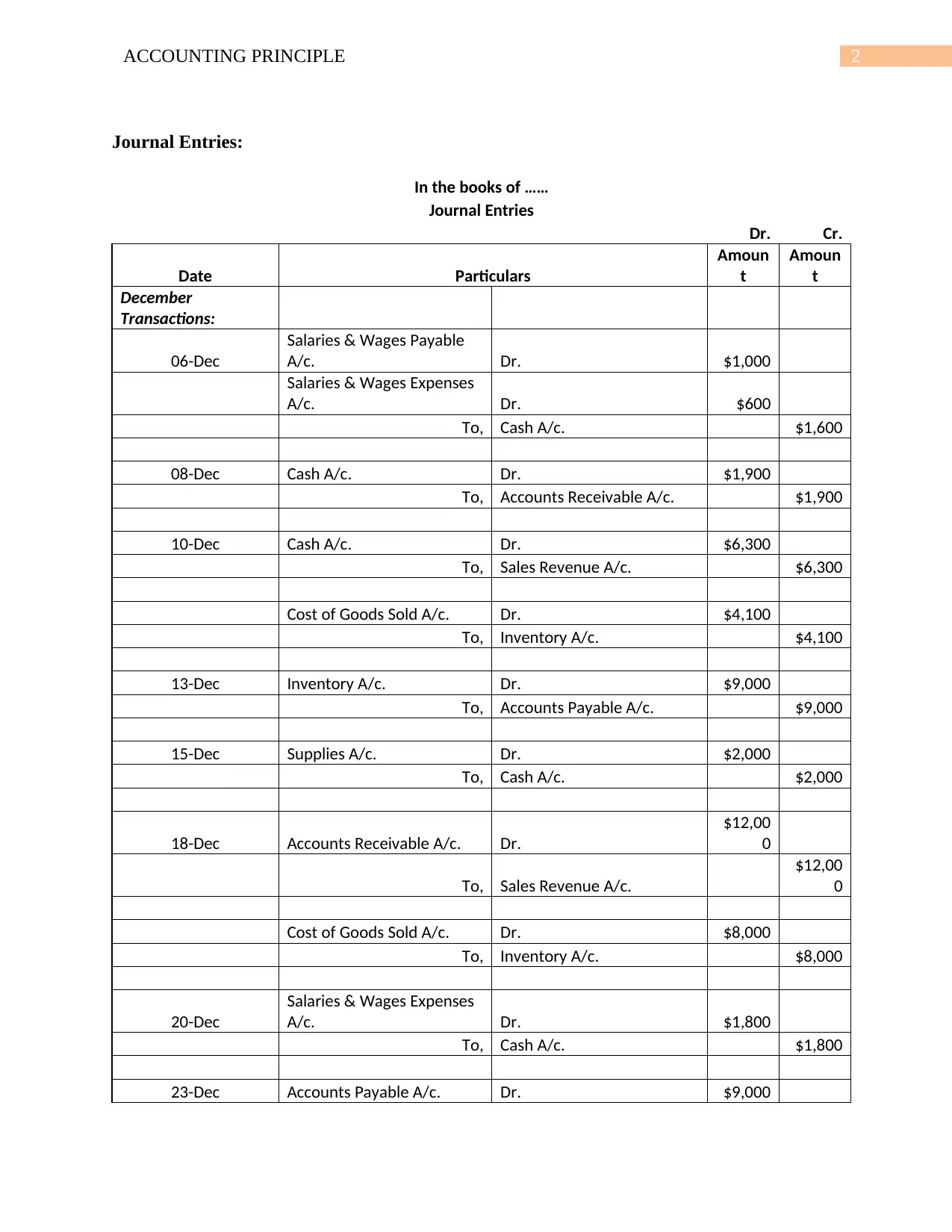

Journal Entries:

In the books of ……

Journal Entries

Dr. Cr.

Date Particulars

Amoun

t

Amoun

t

December

Transactions:

06-Dec

Salaries & Wages Payable

A/c. Dr. $1,000

Salaries & Wages Expenses

A/c. Dr. $600

To, Cash A/c. $1,600

08-Dec Cash A/c. Dr. $1,900

To, Accounts Receivable A/c. $1,900

10-Dec Cash A/c. Dr. $6,300

To, Sales Revenue A/c. $6,300

Cost of Goods Sold A/c. Dr. $4,100

To, Inventory A/c. $4,100

13-Dec Inventory A/c. Dr. $9,000

To, Accounts Payable A/c. $9,000

15-Dec Supplies A/c. Dr. $2,000

To, Cash A/c. $2,000

18-Dec Accounts Receivable A/c. Dr.

$12,00

0

To, Sales Revenue A/c.

$12,00

0

Cost of Goods Sold A/c. Dr. $8,000

To, Inventory A/c. $8,000

20-Dec

Salaries & Wages Expenses

A/c. Dr. $1,800

To, Cash A/c. $1,800

23-Dec Accounts Payable A/c. Dr. $9,000

Journal Entries:

In the books of ……

Journal Entries

Dr. Cr.

Date Particulars

Amoun

t

Amoun

t

December

Transactions:

06-Dec

Salaries & Wages Payable

A/c. Dr. $1,000

Salaries & Wages Expenses

A/c. Dr. $600

To, Cash A/c. $1,600

08-Dec Cash A/c. Dr. $1,900

To, Accounts Receivable A/c. $1,900

10-Dec Cash A/c. Dr. $6,300

To, Sales Revenue A/c. $6,300

Cost of Goods Sold A/c. Dr. $4,100

To, Inventory A/c. $4,100

13-Dec Inventory A/c. Dr. $9,000

To, Accounts Payable A/c. $9,000

15-Dec Supplies A/c. Dr. $2,000

To, Cash A/c. $2,000

18-Dec Accounts Receivable A/c. Dr.

$12,00

0

To, Sales Revenue A/c.

$12,00

0

Cost of Goods Sold A/c. Dr. $8,000

To, Inventory A/c. $8,000

20-Dec

Salaries & Wages Expenses

A/c. Dr. $1,800

To, Cash A/c. $1,800

23-Dec Accounts Payable A/c. Dr. $9,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING PRINCIPLE

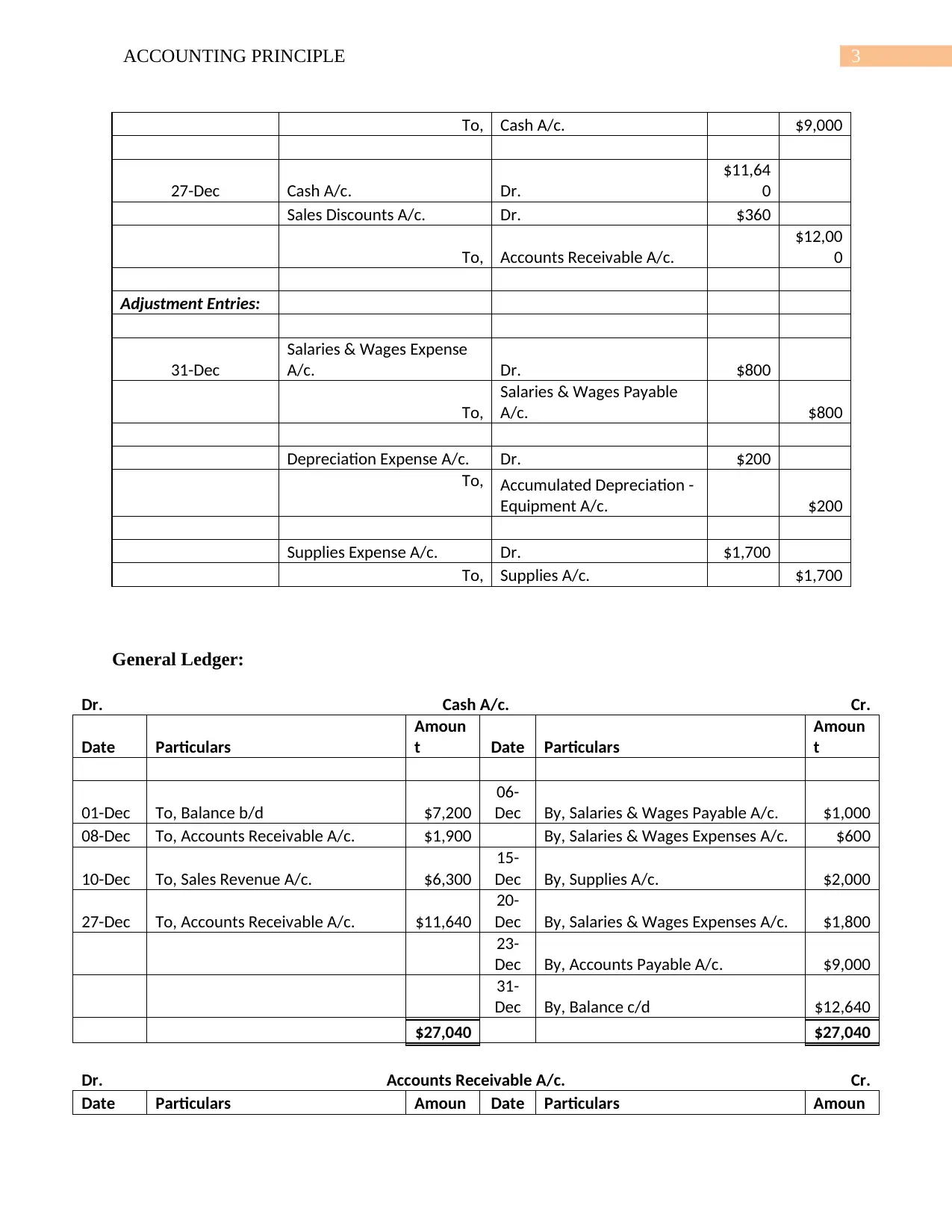

To, Cash A/c. $9,000

27-Dec Cash A/c. Dr.

$11,64

0

Sales Discounts A/c. Dr. $360

To, Accounts Receivable A/c.

$12,00

0

Adjustment Entries:

31-Dec

Salaries & Wages Expense

A/c. Dr. $800

To,

Salaries & Wages Payable

A/c. $800

Depreciation Expense A/c. Dr. $200

To, Accumulated Depreciation -

Equipment A/c. $200

Supplies Expense A/c. Dr. $1,700

To, Supplies A/c. $1,700

General Ledger:

Dr. Cash A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $7,200

06-

Dec By, Salaries & Wages Payable A/c. $1,000

08-Dec To, Accounts Receivable A/c. $1,900 By, Salaries & Wages Expenses A/c. $600

10-Dec To, Sales Revenue A/c. $6,300

15-

Dec By, Supplies A/c. $2,000

27-Dec To, Accounts Receivable A/c. $11,640

20-

Dec By, Salaries & Wages Expenses A/c. $1,800

23-

Dec By, Accounts Payable A/c. $9,000

31-

Dec By, Balance c/d $12,640

$27,040 $27,040

Dr. Accounts Receivable A/c. Cr.

Date Particulars Amoun Date Particulars Amoun

To, Cash A/c. $9,000

27-Dec Cash A/c. Dr.

$11,64

0

Sales Discounts A/c. Dr. $360

To, Accounts Receivable A/c.

$12,00

0

Adjustment Entries:

31-Dec

Salaries & Wages Expense

A/c. Dr. $800

To,

Salaries & Wages Payable

A/c. $800

Depreciation Expense A/c. Dr. $200

To, Accumulated Depreciation -

Equipment A/c. $200

Supplies Expense A/c. Dr. $1,700

To, Supplies A/c. $1,700

General Ledger:

Dr. Cash A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $7,200

06-

Dec By, Salaries & Wages Payable A/c. $1,000

08-Dec To, Accounts Receivable A/c. $1,900 By, Salaries & Wages Expenses A/c. $600

10-Dec To, Sales Revenue A/c. $6,300

15-

Dec By, Supplies A/c. $2,000

27-Dec To, Accounts Receivable A/c. $11,640

20-

Dec By, Salaries & Wages Expenses A/c. $1,800

23-

Dec By, Accounts Payable A/c. $9,000

31-

Dec By, Balance c/d $12,640

$27,040 $27,040

Dr. Accounts Receivable A/c. Cr.

Date Particulars Amoun Date Particulars Amoun

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING PRINCIPLE

t t

01-Dec To, Balance b/d $4,600

08-

Dec By, Cash A/c. $1,900

18-Dec To, Sales Revenue A/c. $12,000

27-

Dec By, Cash A/c. $11,640

By, Sales Discounts A/c. $360

31-

Dec By, Balance c/d $2,700

$16,600 $16,600

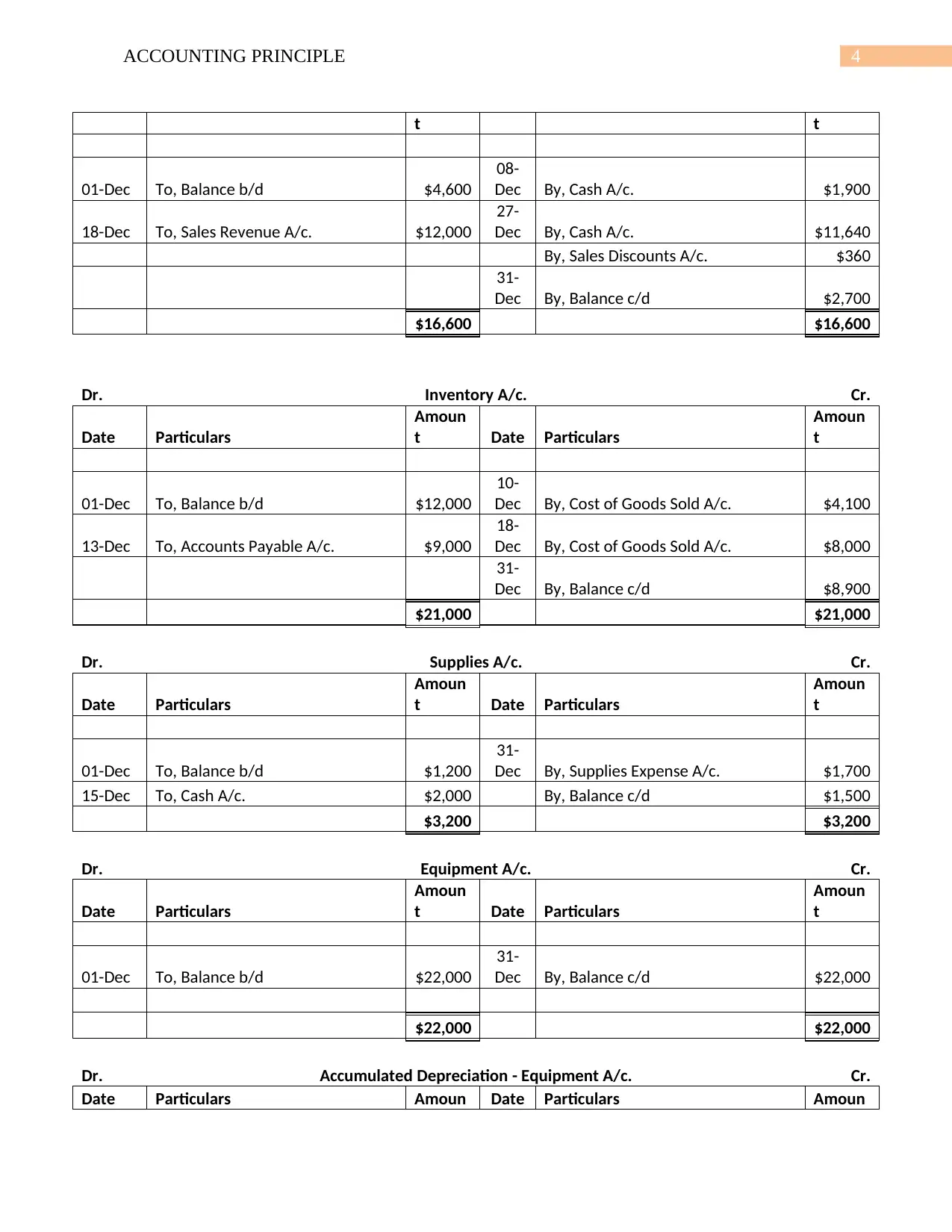

Dr. Inventory A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $12,000

10-

Dec By, Cost of Goods Sold A/c. $4,100

13-Dec To, Accounts Payable A/c. $9,000

18-

Dec By, Cost of Goods Sold A/c. $8,000

31-

Dec By, Balance c/d $8,900

$21,000 $21,000

Dr. Supplies A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $1,200

31-

Dec By, Supplies Expense A/c. $1,700

15-Dec To, Cash A/c. $2,000 By, Balance c/d $1,500

$3,200 $3,200

Dr. Equipment A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $22,000

31-

Dec By, Balance c/d $22,000

$22,000 $22,000

Dr. Accumulated Depreciation - Equipment A/c. Cr.

Date Particulars Amoun Date Particulars Amoun

t t

01-Dec To, Balance b/d $4,600

08-

Dec By, Cash A/c. $1,900

18-Dec To, Sales Revenue A/c. $12,000

27-

Dec By, Cash A/c. $11,640

By, Sales Discounts A/c. $360

31-

Dec By, Balance c/d $2,700

$16,600 $16,600

Dr. Inventory A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $12,000

10-

Dec By, Cost of Goods Sold A/c. $4,100

13-Dec To, Accounts Payable A/c. $9,000

18-

Dec By, Cost of Goods Sold A/c. $8,000

31-

Dec By, Balance c/d $8,900

$21,000 $21,000

Dr. Supplies A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $1,200

31-

Dec By, Supplies Expense A/c. $1,700

15-Dec To, Cash A/c. $2,000 By, Balance c/d $1,500

$3,200 $3,200

Dr. Equipment A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

01-Dec To, Balance b/d $22,000

31-

Dec By, Balance c/d $22,000

$22,000 $22,000

Dr. Accumulated Depreciation - Equipment A/c. Cr.

Date Particulars Amoun Date Particulars Amoun

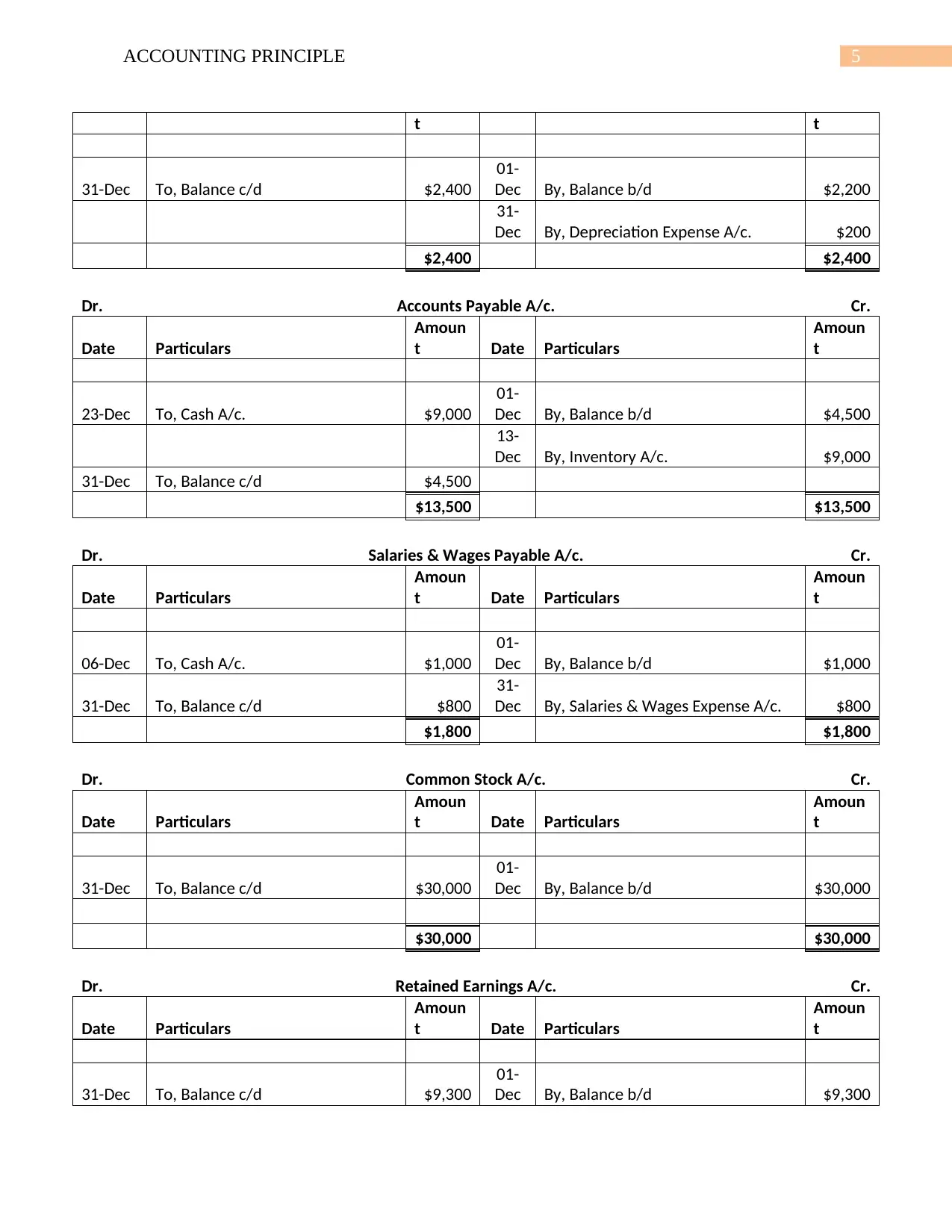

5ACCOUNTING PRINCIPLE

t t

31-Dec To, Balance c/d $2,400

01-

Dec By, Balance b/d $2,200

31-

Dec By, Depreciation Expense A/c. $200

$2,400 $2,400

Dr. Accounts Payable A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

23-Dec To, Cash A/c. $9,000

01-

Dec By, Balance b/d $4,500

13-

Dec By, Inventory A/c. $9,000

31-Dec To, Balance c/d $4,500

$13,500 $13,500

Dr. Salaries & Wages Payable A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

06-Dec To, Cash A/c. $1,000

01-

Dec By, Balance b/d $1,000

31-Dec To, Balance c/d $800

31-

Dec By, Salaries & Wages Expense A/c. $800

$1,800 $1,800

Dr. Common Stock A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Balance c/d $30,000

01-

Dec By, Balance b/d $30,000

$30,000 $30,000

Dr. Retained Earnings A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Balance c/d $9,300

01-

Dec By, Balance b/d $9,300

t t

31-Dec To, Balance c/d $2,400

01-

Dec By, Balance b/d $2,200

31-

Dec By, Depreciation Expense A/c. $200

$2,400 $2,400

Dr. Accounts Payable A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

23-Dec To, Cash A/c. $9,000

01-

Dec By, Balance b/d $4,500

13-

Dec By, Inventory A/c. $9,000

31-Dec To, Balance c/d $4,500

$13,500 $13,500

Dr. Salaries & Wages Payable A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

06-Dec To, Cash A/c. $1,000

01-

Dec By, Balance b/d $1,000

31-Dec To, Balance c/d $800

31-

Dec By, Salaries & Wages Expense A/c. $800

$1,800 $1,800

Dr. Common Stock A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Balance c/d $30,000

01-

Dec By, Balance b/d $30,000

$30,000 $30,000

Dr. Retained Earnings A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Balance c/d $9,300

01-

Dec By, Balance b/d $9,300

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

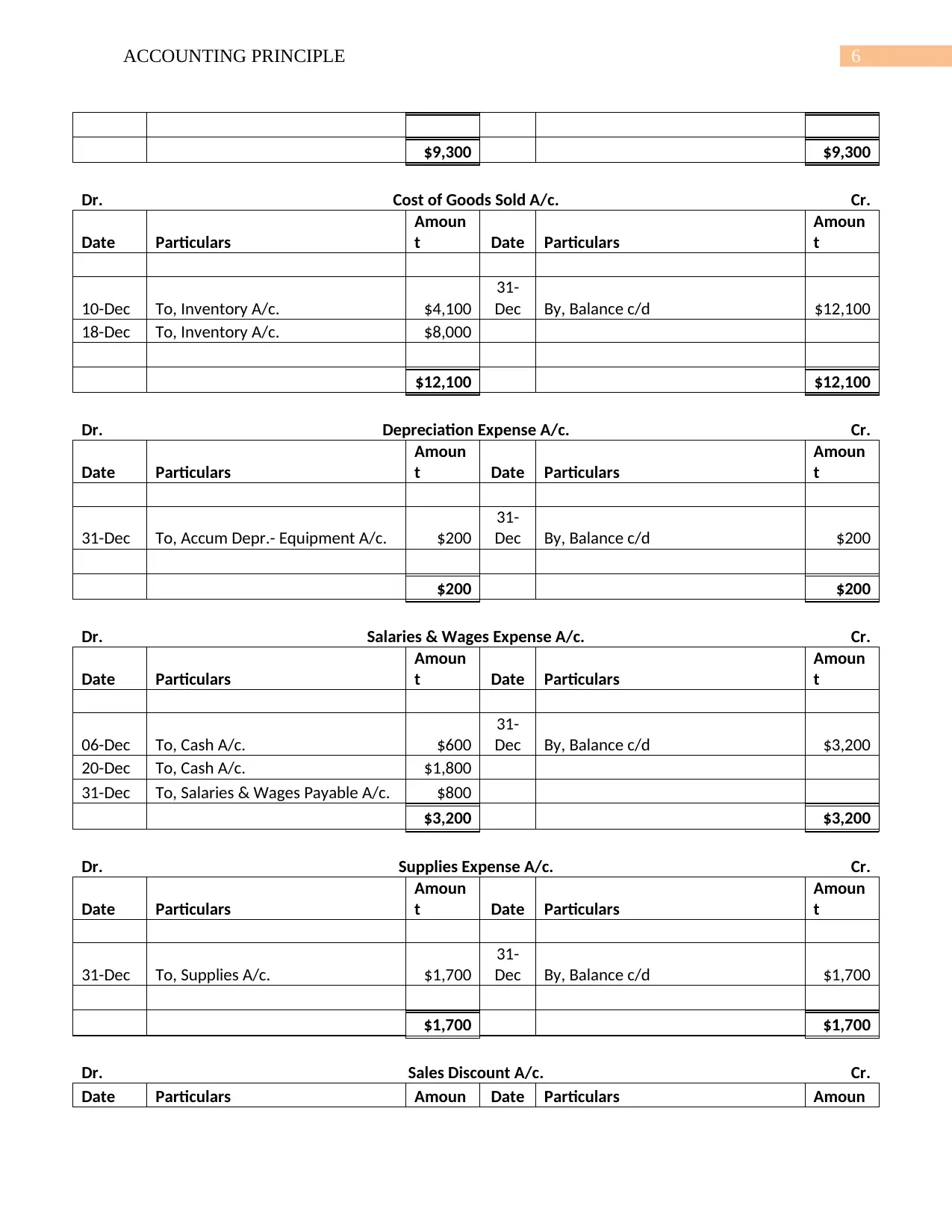

6ACCOUNTING PRINCIPLE

$9,300 $9,300

Dr. Cost of Goods Sold A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

10-Dec To, Inventory A/c. $4,100

31-

Dec By, Balance c/d $12,100

18-Dec To, Inventory A/c. $8,000

$12,100 $12,100

Dr. Depreciation Expense A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Accum Depr.- Equipment A/c. $200

31-

Dec By, Balance c/d $200

$200 $200

Dr. Salaries & Wages Expense A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

06-Dec To, Cash A/c. $600

31-

Dec By, Balance c/d $3,200

20-Dec To, Cash A/c. $1,800

31-Dec To, Salaries & Wages Payable A/c. $800

$3,200 $3,200

Dr. Supplies Expense A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Supplies A/c. $1,700

31-

Dec By, Balance c/d $1,700

$1,700 $1,700

Dr. Sales Discount A/c. Cr.

Date Particulars Amoun Date Particulars Amoun

$9,300 $9,300

Dr. Cost of Goods Sold A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

10-Dec To, Inventory A/c. $4,100

31-

Dec By, Balance c/d $12,100

18-Dec To, Inventory A/c. $8,000

$12,100 $12,100

Dr. Depreciation Expense A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Accum Depr.- Equipment A/c. $200

31-

Dec By, Balance c/d $200

$200 $200

Dr. Salaries & Wages Expense A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

06-Dec To, Cash A/c. $600

31-

Dec By, Balance c/d $3,200

20-Dec To, Cash A/c. $1,800

31-Dec To, Salaries & Wages Payable A/c. $800

$3,200 $3,200

Dr. Supplies Expense A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Supplies A/c. $1,700

31-

Dec By, Balance c/d $1,700

$1,700 $1,700

Dr. Sales Discount A/c. Cr.

Date Particulars Amoun Date Particulars Amoun

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

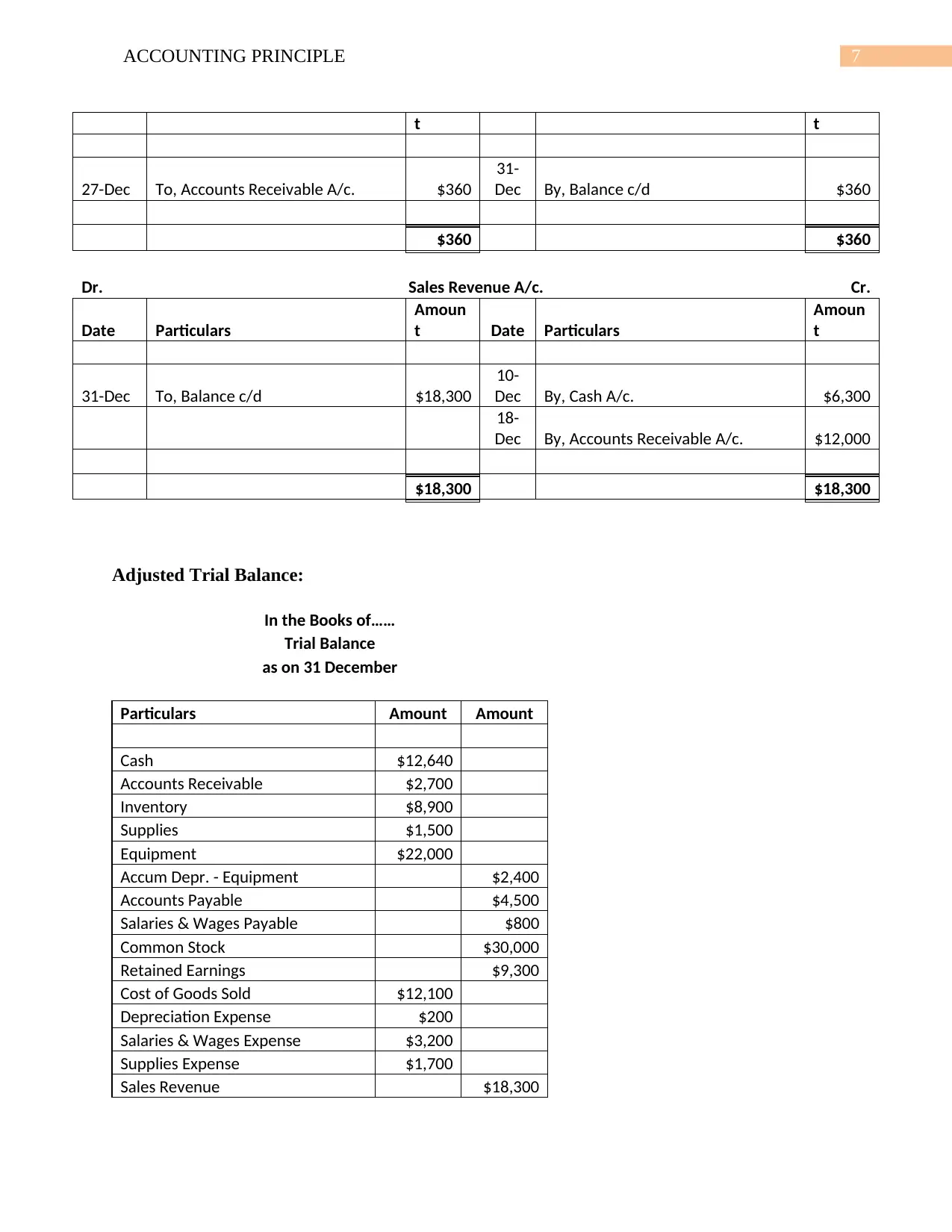

7ACCOUNTING PRINCIPLE

t t

27-Dec To, Accounts Receivable A/c. $360

31-

Dec By, Balance c/d $360

$360 $360

Dr. Sales Revenue A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Balance c/d $18,300

10-

Dec By, Cash A/c. $6,300

18-

Dec By, Accounts Receivable A/c. $12,000

$18,300 $18,300

Adjusted Trial Balance:

In the Books of……

Trial Balance

as on 31 December

Particulars Amount Amount

Cash $12,640

Accounts Receivable $2,700

Inventory $8,900

Supplies $1,500

Equipment $22,000

Accum Depr. - Equipment $2,400

Accounts Payable $4,500

Salaries & Wages Payable $800

Common Stock $30,000

Retained Earnings $9,300

Cost of Goods Sold $12,100

Depreciation Expense $200

Salaries & Wages Expense $3,200

Supplies Expense $1,700

Sales Revenue $18,300

t t

27-Dec To, Accounts Receivable A/c. $360

31-

Dec By, Balance c/d $360

$360 $360

Dr. Sales Revenue A/c. Cr.

Date Particulars

Amoun

t Date Particulars

Amoun

t

31-Dec To, Balance c/d $18,300

10-

Dec By, Cash A/c. $6,300

18-

Dec By, Accounts Receivable A/c. $12,000

$18,300 $18,300

Adjusted Trial Balance:

In the Books of……

Trial Balance

as on 31 December

Particulars Amount Amount

Cash $12,640

Accounts Receivable $2,700

Inventory $8,900

Supplies $1,500

Equipment $22,000

Accum Depr. - Equipment $2,400

Accounts Payable $4,500

Salaries & Wages Payable $800

Common Stock $30,000

Retained Earnings $9,300

Cost of Goods Sold $12,100

Depreciation Expense $200

Salaries & Wages Expense $3,200

Supplies Expense $1,700

Sales Revenue $18,300

8ACCOUNTING PRINCIPLE

Sales Discount $360

TOTAL $65,300 $65,300

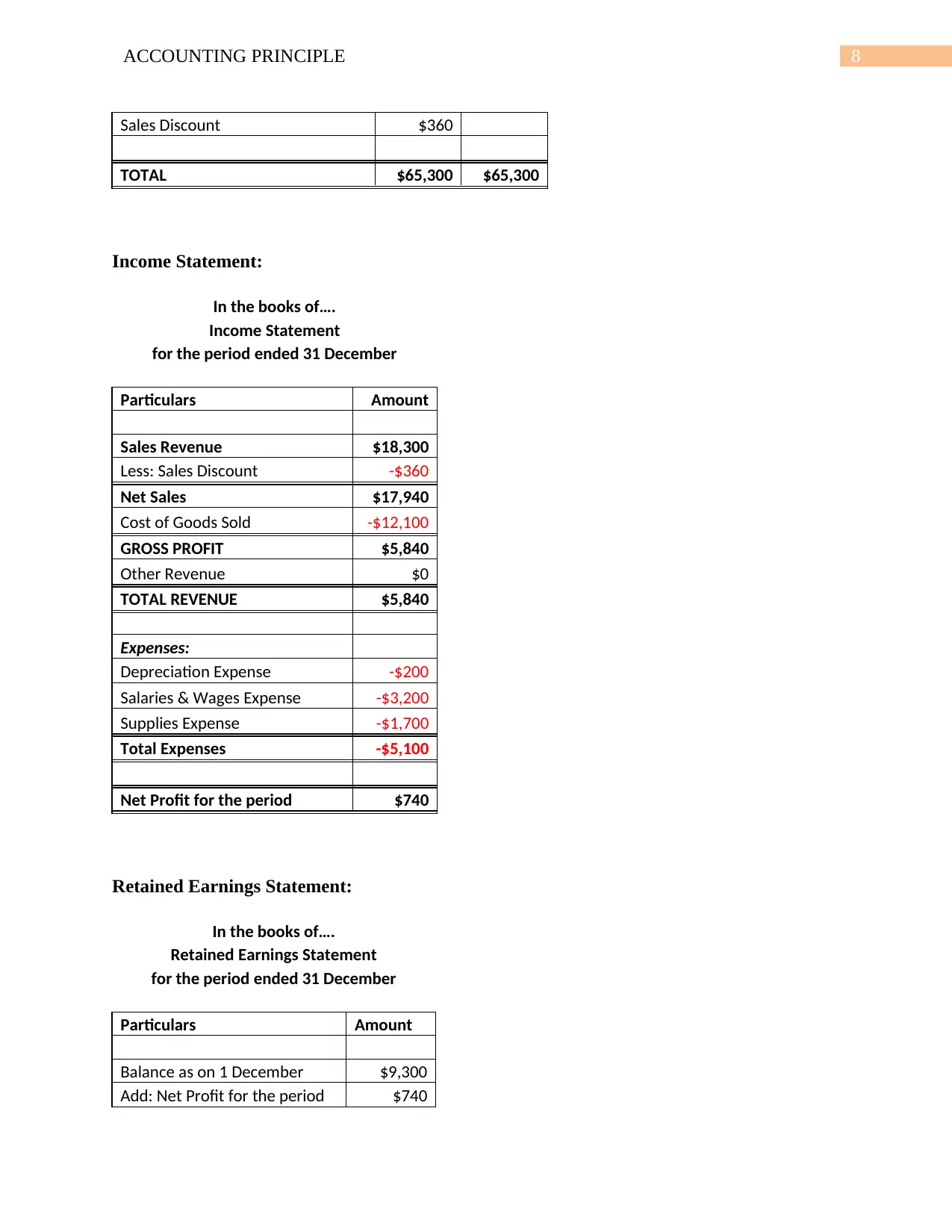

Income Statement:

In the books of….

Income Statement

for the period ended 31 December

Particulars Amount

Sales Revenue $18,300

Less: Sales Discount -$360

Net Sales $17,940

Cost of Goods Sold -$12,100

GROSS PROFIT $5,840

Other Revenue $0

TOTAL REVENUE $5,840

Expenses:

Depreciation Expense -$200

Salaries & Wages Expense -$3,200

Supplies Expense -$1,700

Total Expenses -$5,100

Net Profit for the period $740

Retained Earnings Statement:

In the books of….

Retained Earnings Statement

for the period ended 31 December

Particulars Amount

Balance as on 1 December $9,300

Add: Net Profit for the period $740

Sales Discount $360

TOTAL $65,300 $65,300

Income Statement:

In the books of….

Income Statement

for the period ended 31 December

Particulars Amount

Sales Revenue $18,300

Less: Sales Discount -$360

Net Sales $17,940

Cost of Goods Sold -$12,100

GROSS PROFIT $5,840

Other Revenue $0

TOTAL REVENUE $5,840

Expenses:

Depreciation Expense -$200

Salaries & Wages Expense -$3,200

Supplies Expense -$1,700

Total Expenses -$5,100

Net Profit for the period $740

Retained Earnings Statement:

In the books of….

Retained Earnings Statement

for the period ended 31 December

Particulars Amount

Balance as on 1 December $9,300

Add: Net Profit for the period $740

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING PRINCIPLE

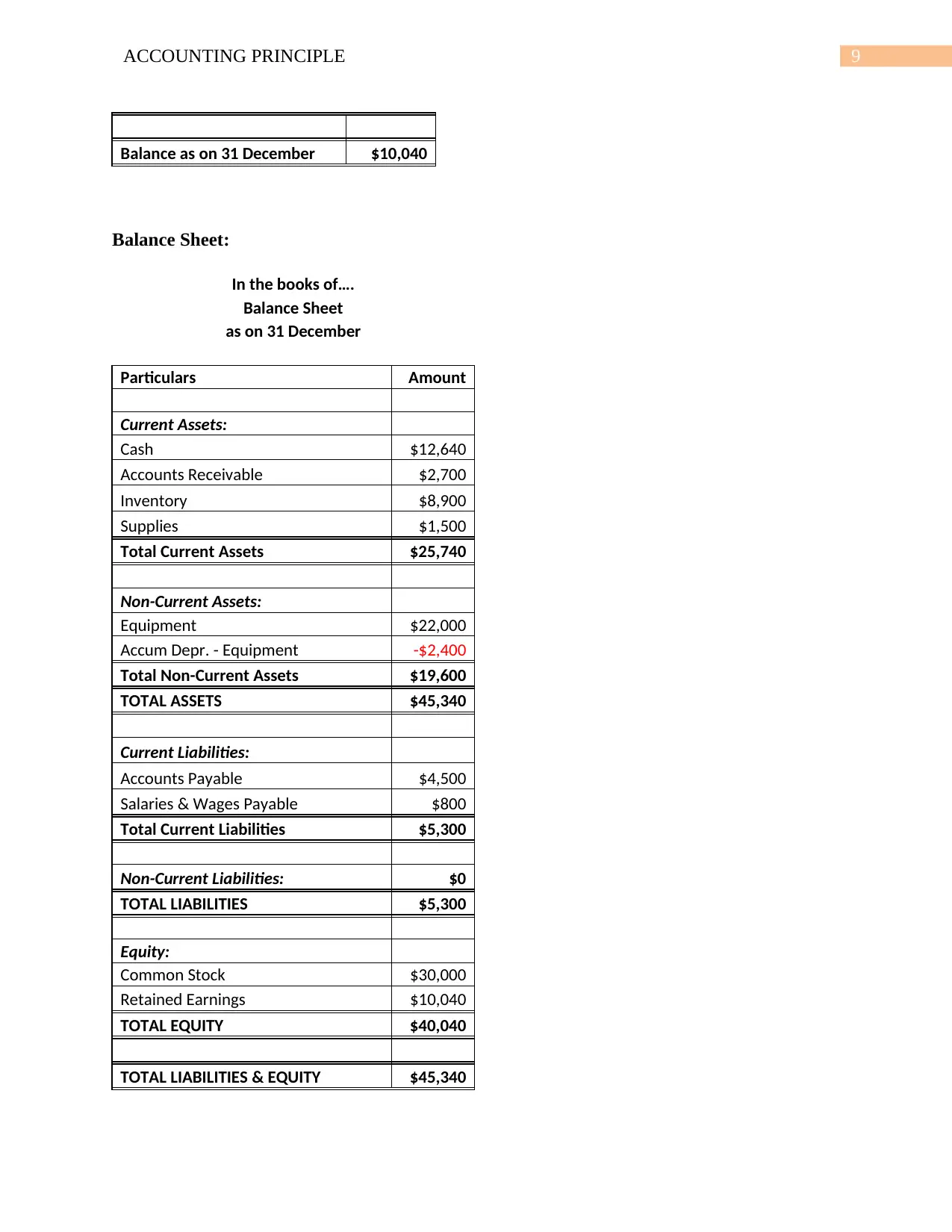

Balance as on 31 December $10,040

Balance Sheet:

In the books of….

Balance Sheet

as on 31 December

Particulars Amount

Current Assets:

Cash $12,640

Accounts Receivable $2,700

Inventory $8,900

Supplies $1,500

Total Current Assets $25,740

Non-Current Assets:

Equipment $22,000

Accum Depr. - Equipment -$2,400

Total Non-Current Assets $19,600

TOTAL ASSETS $45,340

Current Liabilities:

Accounts Payable $4,500

Salaries & Wages Payable $800

Total Current Liabilities $5,300

Non-Current Liabilities: $0

TOTAL LIABILITIES $5,300

Equity:

Common Stock $30,000

Retained Earnings $10,040

TOTAL EQUITY $40,040

TOTAL LIABILITIES & EQUITY $45,340

Balance as on 31 December $10,040

Balance Sheet:

In the books of….

Balance Sheet

as on 31 December

Particulars Amount

Current Assets:

Cash $12,640

Accounts Receivable $2,700

Inventory $8,900

Supplies $1,500

Total Current Assets $25,740

Non-Current Assets:

Equipment $22,000

Accum Depr. - Equipment -$2,400

Total Non-Current Assets $19,600

TOTAL ASSETS $45,340

Current Liabilities:

Accounts Payable $4,500

Salaries & Wages Payable $800

Total Current Liabilities $5,300

Non-Current Liabilities: $0

TOTAL LIABILITIES $5,300

Equity:

Common Stock $30,000

Retained Earnings $10,040

TOTAL EQUITY $40,040

TOTAL LIABILITIES & EQUITY $45,340

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING PRINCIPLE

11ACCOUNTING PRINCIPLE

Bibliography:

Scott, W.R., 2015. Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall

Williams, J., 2014. Financial accounting. McGraw-Hill Higher Education

Bibliography:

Scott, W.R., 2015. Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall

Williams, J., 2014. Financial accounting. McGraw-Hill Higher Education

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.