Comprehensive Analysis of Accounting Principles and Practices

VerifiedAdded on 2023/06/08

|17

|5276

|320

Report

AI Summary

This report provides a comprehensive analysis of accounting principles, including the purpose and scope of accounting in complex environments, its role in decision-making, and its ability to meet stakeholder needs. It explores the main branches of accounting, basic accounting concepts, and threats to business enterprises related to regulation, compliance, and ethics. The report includes the construction of a schedule of expected cash collections and disbursements, a cash budget, and a flexible budget. Furthermore, it prepares financial statements, computes liquidity, profitability, and investment ratios, and offers recommendations on the company's liquidity position and overall performance. The analysis is aimed at providing a thorough understanding of the company's financial standing and future prospects.

Unit 5 Accounting

Principles

Principles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..................................................................................................................................................3

PART 1....................................................................................................................................................................3

1.Examine the purpose and scope of accounting in complex operating environments....................................3

2. Critical evaluation of the accounting function in informing decision making and meeting stakeholder and

societal needs and expectations.........................................................................................................................4

3. The main branches of accounting and job skill-sets and competencies:.......................................................5

4. Basic accounting concepts:............................................................................................................................6

5. Threats to business enterprises are a topic of regulation, compliance, and ethics........................................7

A. Construct a schedule of expected cash collections for the quarter..............................................................8

B. Construct a schedule of anticipated cash disbursements for merchandise inventory purchases for the

quarter.................................................................................................................................................................8

C. Construct a cash budget for July, August, September and Q1 (first quarter). Show in the financing

section any borrowing that will be required in any month................................................................................9

D. Pros and Cons of budgetary control, budgets and budgeting.......................................................................9

E. Construct a Flexible Budget........................................................................................................................11

PART 2..................................................................................................................................................................12

Prepare income statement and balance sheet...................................................................................................12

1. Compute the liquidity, profitability and investment ratios..........................................................................13

2. Recommendation on the liquidity position of the company with the help of ratios and also consider

whether the firm is able to take bank overdraft or not ....................................................................................14

3. Analyse overall performance of the company and provide recommendations on the basis of analysis ....14

CONCLUSION ....................................................................................................................................................15

REFERENCES......................................................................................................................................................16

INTRODUCTION ..................................................................................................................................................3

PART 1....................................................................................................................................................................3

1.Examine the purpose and scope of accounting in complex operating environments....................................3

2. Critical evaluation of the accounting function in informing decision making and meeting stakeholder and

societal needs and expectations.........................................................................................................................4

3. The main branches of accounting and job skill-sets and competencies:.......................................................5

4. Basic accounting concepts:............................................................................................................................6

5. Threats to business enterprises are a topic of regulation, compliance, and ethics........................................7

A. Construct a schedule of expected cash collections for the quarter..............................................................8

B. Construct a schedule of anticipated cash disbursements for merchandise inventory purchases for the

quarter.................................................................................................................................................................8

C. Construct a cash budget for July, August, September and Q1 (first quarter). Show in the financing

section any borrowing that will be required in any month................................................................................9

D. Pros and Cons of budgetary control, budgets and budgeting.......................................................................9

E. Construct a Flexible Budget........................................................................................................................11

PART 2..................................................................................................................................................................12

Prepare income statement and balance sheet...................................................................................................12

1. Compute the liquidity, profitability and investment ratios..........................................................................13

2. Recommendation on the liquidity position of the company with the help of ratios and also consider

whether the firm is able to take bank overdraft or not ....................................................................................14

3. Analyse overall performance of the company and provide recommendations on the basis of analysis ....14

CONCLUSION ....................................................................................................................................................15

REFERENCES......................................................................................................................................................16

INTRODUCTION

Accounting principles refers to the rules and regulations which can be followed by the companies or

organisations while analysing financial information. These principle make it simple to analyse financial

information by using various methodology and terms (Appelbaum and Nehmer, 2020). This report includes

purpose of accounting and its function which take part in smooth running of business operations. Further, it

explain the main branches, concepts and ethics of accounting. Financial statements are constructed with the

help of given data which includes Cash collection for the quarter, cash disbursements for quarter and also

provide explantation of budget and budgetary control. Another part of report include financial statements like

balance-sheet, income statement and ratios. Financial ratios are helpful to provide recommendation on the

liquidity position of the company. A conclusion and recommendation is constructed to analyse the overall

financial position of the company.

PART 1

1.Examine the purpose and scope of accounting in complex operating environments

Accounting contains a process of recording, reporting and analysing the financial information related

to the business called accounting. The process of accounting functions are as follows-

Recording- This step is initial step for the accounting function. In this step all the financial

transactions related to the business operations like sales, purchase, payment, receipts, incomes, losses, gains,

and many more transaction are written down in a proper manner.

Reporting- In this step all the monetary transactions of business are recorded in summarising manner.

In the reporting the financial position of the business in the particular accounting year can be explained by the

help of graphs, charts and diagrams. The information included in the report should be prepared in a systematic

way so that it can understandable for both insider and outsider (Bakhash, 2019).

Analysing- The next step after reporting is analysing. In this step the organisation analyse the

performance of the business in a particular accounting year and make the decisions for the future according

the financial position of the business.

The purposes and scope of accounting function are given below

To Keep the records- The very first purpose of accounting is to keep the records for the business so

that they can analyse the performance of the business in a particular accounting year. Due to this the

organisations can improve their performance and increase the sales and profitably.

To Facilitate decision making- After analysing accounting records the management of the

organisation can make the decisions related to the business. So that they can expand their business operations

in future and improve the efficiency of the business organisation.

Accounting principles refers to the rules and regulations which can be followed by the companies or

organisations while analysing financial information. These principle make it simple to analyse financial

information by using various methodology and terms (Appelbaum and Nehmer, 2020). This report includes

purpose of accounting and its function which take part in smooth running of business operations. Further, it

explain the main branches, concepts and ethics of accounting. Financial statements are constructed with the

help of given data which includes Cash collection for the quarter, cash disbursements for quarter and also

provide explantation of budget and budgetary control. Another part of report include financial statements like

balance-sheet, income statement and ratios. Financial ratios are helpful to provide recommendation on the

liquidity position of the company. A conclusion and recommendation is constructed to analyse the overall

financial position of the company.

PART 1

1.Examine the purpose and scope of accounting in complex operating environments

Accounting contains a process of recording, reporting and analysing the financial information related

to the business called accounting. The process of accounting functions are as follows-

Recording- This step is initial step for the accounting function. In this step all the financial

transactions related to the business operations like sales, purchase, payment, receipts, incomes, losses, gains,

and many more transaction are written down in a proper manner.

Reporting- In this step all the monetary transactions of business are recorded in summarising manner.

In the reporting the financial position of the business in the particular accounting year can be explained by the

help of graphs, charts and diagrams. The information included in the report should be prepared in a systematic

way so that it can understandable for both insider and outsider (Bakhash, 2019).

Analysing- The next step after reporting is analysing. In this step the organisation analyse the

performance of the business in a particular accounting year and make the decisions for the future according

the financial position of the business.

The purposes and scope of accounting function are given below

To Keep the records- The very first purpose of accounting is to keep the records for the business so

that they can analyse the performance of the business in a particular accounting year. Due to this the

organisations can improve their performance and increase the sales and profitably.

To Facilitate decision making- After analysing accounting records the management of the

organisation can make the decisions related to the business. So that they can expand their business operations

in future and improve the efficiency of the business organisation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To Provide information to the investors- The next important purpose of accounting is that

it helps in providing the financial information to the investors so that they can invest their money

at the right place .

To Meets legal requirements- Accounting function provide all the financial data of the

business which helps them to find out the tax liability of the business. Due to this the

organisations can pay their tax on time and meet all the legal requirements. If the organisation

did not pay the taxes then it will consider as a legal offence and the owner of the organisation

can get into a prison of that activity. So that why this purpose is consider as a main purpose for

the organisation (Barabash and et.al., 2020).

2. Critical evaluation of the accounting function in informing decision making and meeting

stakeholder and societal needs and expectations

Accounting is very important of the organisation by the help of this function the

organisation can evaluate the financial position, goodwill and opportunities to earn the profit in

future for the firm. This function is not only good for the organisation it is also beneficial for the

society, investors and the competitors. The analysis and evaluation of the financial position of

the company can be done by the help of the financial statements of the business. The financial

statements include profit and loss account, balance sheet, cash flow, and notes to account. The

critical evaluation of the accounting helps in informing decision making and meeting stakeholder

and societal needs and expectations. The two types of accounting functions are given given

below.

Financial reporting- This function of accounting is mainly determined on providing the

information to the outside users like government and other authorities. But this financial

reporting function can also be used for internal organisation by help of making strategies for

increasing the sales and profitability of the organisations. This financial report contains the

information related to the operations of organisation like P&L statement, balance-sheet, cash

flow statement, accounts payable, notes to account and accounts receivable. These financial

reports helps the investors to evaluate the financial positions of the business so that they can

decide whether they have to invest in the business or not. It helps them to invest their money so

that they can earn some profit (Brink and et.al., 2020).

Management Reporting- This reporting function of accounting is more useful for the

organisation as compare to financial reporting. The management reporting function helps the

it helps in providing the financial information to the investors so that they can invest their money

at the right place .

To Meets legal requirements- Accounting function provide all the financial data of the

business which helps them to find out the tax liability of the business. Due to this the

organisations can pay their tax on time and meet all the legal requirements. If the organisation

did not pay the taxes then it will consider as a legal offence and the owner of the organisation

can get into a prison of that activity. So that why this purpose is consider as a main purpose for

the organisation (Barabash and et.al., 2020).

2. Critical evaluation of the accounting function in informing decision making and meeting

stakeholder and societal needs and expectations

Accounting is very important of the organisation by the help of this function the

organisation can evaluate the financial position, goodwill and opportunities to earn the profit in

future for the firm. This function is not only good for the organisation it is also beneficial for the

society, investors and the competitors. The analysis and evaluation of the financial position of

the company can be done by the help of the financial statements of the business. The financial

statements include profit and loss account, balance sheet, cash flow, and notes to account. The

critical evaluation of the accounting helps in informing decision making and meeting stakeholder

and societal needs and expectations. The two types of accounting functions are given given

below.

Financial reporting- This function of accounting is mainly determined on providing the

information to the outside users like government and other authorities. But this financial

reporting function can also be used for internal organisation by help of making strategies for

increasing the sales and profitability of the organisations. This financial report contains the

information related to the operations of organisation like P&L statement, balance-sheet, cash

flow statement, accounts payable, notes to account and accounts receivable. These financial

reports helps the investors to evaluate the financial positions of the business so that they can

decide whether they have to invest in the business or not. It helps them to invest their money so

that they can earn some profit (Brink and et.al., 2020).

Management Reporting- This reporting function of accounting is more useful for the

organisation as compare to financial reporting. The management reporting function helps the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organisation to evaluate or analyse each and every department of the business organisation. The

management report is only prepared for the organisations because it contains some confidential

information which any organisations do not provide to the external users. In management report

all the information related to the business like strengths and weaknesses are included (Sorokin

and et.al., 2019). It is important to keep in mind while making the management report is that the

information which are stated in the management report must be relevant and important for the

business because it helps in decision making of the organisations.

3. The main branches of accounting and job skill-sets and competencies:

Management Accounting- It is a activity of placing, designing, quantifying, evaluating,

recommending, and communicating of the data that helps in performing of the organizational

goals. In management accounting the manager of the organizations uses the provisions of the

accounting information for better understanding the position of the business so that they can

manage and control the organization effectively and efficiently. It is mainly focus on the future

action. Management does not follow any rules and regulation while financial accounting is

totally based on the GAAPs. Management accounting helps the organisation to perform the

management functions of the organisation like planning, directing, controlling, organising. The

objective of management accounting is uses of information, planning and policy formation,

reporting, coordinating operations and many more (El-Helaly, Ntim, and Al-Gazzar, 2020).

Taxation- The next branch of accounting is taxation or it can be called as tax accounting.

It helps the organisation in identifying and minimising the tax liability of businesses so that they

can increase their profitability. The tax accounting is directed by the Internal Revenue code

which includes rules and regulation which every organisation and individual have to follow

while composing their tax return. The tax liability of every business is determined according to

the incomes of the organisation. Tax accounting is done by the organisation for tracking the flow

of funds include inflow and outflow which are related to the organisation. There various types of

tax accounting which are tax accounting for sole proprietor, tax accounting for the companies

and last tax accounting for the those companies which are exempted from tax (Hermano and

Martín-Cruz, 2019).

Auditing- The branch of accounting is auditing. Auditing refers to the examine or survey

of the financial records which are prepared by the accounts department of organisation. The

management report is only prepared for the organisations because it contains some confidential

information which any organisations do not provide to the external users. In management report

all the information related to the business like strengths and weaknesses are included (Sorokin

and et.al., 2019). It is important to keep in mind while making the management report is that the

information which are stated in the management report must be relevant and important for the

business because it helps in decision making of the organisations.

3. The main branches of accounting and job skill-sets and competencies:

Management Accounting- It is a activity of placing, designing, quantifying, evaluating,

recommending, and communicating of the data that helps in performing of the organizational

goals. In management accounting the manager of the organizations uses the provisions of the

accounting information for better understanding the position of the business so that they can

manage and control the organization effectively and efficiently. It is mainly focus on the future

action. Management does not follow any rules and regulation while financial accounting is

totally based on the GAAPs. Management accounting helps the organisation to perform the

management functions of the organisation like planning, directing, controlling, organising. The

objective of management accounting is uses of information, planning and policy formation,

reporting, coordinating operations and many more (El-Helaly, Ntim, and Al-Gazzar, 2020).

Taxation- The next branch of accounting is taxation or it can be called as tax accounting.

It helps the organisation in identifying and minimising the tax liability of businesses so that they

can increase their profitability. The tax accounting is directed by the Internal Revenue code

which includes rules and regulation which every organisation and individual have to follow

while composing their tax return. The tax liability of every business is determined according to

the incomes of the organisation. Tax accounting is done by the organisation for tracking the flow

of funds include inflow and outflow which are related to the organisation. There various types of

tax accounting which are tax accounting for sole proprietor, tax accounting for the companies

and last tax accounting for the those companies which are exempted from tax (Hermano and

Martín-Cruz, 2019).

Auditing- The branch of accounting is auditing. Auditing refers to the examine or survey

of the financial records which are prepared by the accounts department of organisation. The

main purpose of auditing is to identify the frauds and errors which have been done in the

organisations. There are different types of auditing which are as follows-

Internal audit- Internal audit refers to that audit in which the auditing of the financial records are

done by the employees of the organisation. It is voluntary function for the organisation its not

compulsory (Kuznetsov and et.al., 2019).

External Audit- The external audit of the organisation is done by the auditor. The

company appoints an auditor to audit the accounting record of the businesses so that they can

find the errors and frauds in the organisation.

4. Basic accounting concepts:

Separate Entity Concept- This concept says that the organisation and owner of the

organisation are two different individuals. It can be understand by the help of the balance-sheet

in which the capital which is brought the owner into the business is considered as a liability for

the business and recorded on liabilities side of the balance-sheet. The owners can charge interest

on the capital which they bought in the organisation (Srinivasan and Ramani, 2019). If any

amount withdraw by the owners from the business then it will consider as a drawing and the

business can charge some amount of interest on it.

Going concern concept- Every business owner start their with a goal that their business

will run for their lifetime. The operations of the business will not discontinued due to any reason.

The business organisations will run their operations smoothly and efficiently in future.

Matching concepts- This concept states that the income and expenditure of the organisation

must be match with each other for the same accounting period. It means that all the revenue

which the organisation have earn in a particular accounting year must be matched with the

expenditures which they have incur in that particular accounting period (Lessambo, 2018).

Accounting software which are widely in use are as follows-

Quick books accounting- It is one of the major popular accounting software in the

accounting market. The first version of this software was launched in 1998 for simplifying the

accounting process. According to the sources this Quick book hold almost 85% of the retail

market.

5. Threats to business enterprises are a topic of regulation, compliance, and ethics.

Business ethics encompass a broad range of topics that are covered by an association's

moral guidelines. Developing behavior based on sincerity and trust are significant moral

organisations. There are different types of auditing which are as follows-

Internal audit- Internal audit refers to that audit in which the auditing of the financial records are

done by the employees of the organisation. It is voluntary function for the organisation its not

compulsory (Kuznetsov and et.al., 2019).

External Audit- The external audit of the organisation is done by the auditor. The

company appoints an auditor to audit the accounting record of the businesses so that they can

find the errors and frauds in the organisation.

4. Basic accounting concepts:

Separate Entity Concept- This concept says that the organisation and owner of the

organisation are two different individuals. It can be understand by the help of the balance-sheet

in which the capital which is brought the owner into the business is considered as a liability for

the business and recorded on liabilities side of the balance-sheet. The owners can charge interest

on the capital which they bought in the organisation (Srinivasan and Ramani, 2019). If any

amount withdraw by the owners from the business then it will consider as a drawing and the

business can charge some amount of interest on it.

Going concern concept- Every business owner start their with a goal that their business

will run for their lifetime. The operations of the business will not discontinued due to any reason.

The business organisations will run their operations smoothly and efficiently in future.

Matching concepts- This concept states that the income and expenditure of the organisation

must be match with each other for the same accounting period. It means that all the revenue

which the organisation have earn in a particular accounting year must be matched with the

expenditures which they have incur in that particular accounting period (Lessambo, 2018).

Accounting software which are widely in use are as follows-

Quick books accounting- It is one of the major popular accounting software in the

accounting market. The first version of this software was launched in 1998 for simplifying the

accounting process. According to the sources this Quick book hold almost 85% of the retail

market.

5. Threats to business enterprises are a topic of regulation, compliance, and ethics.

Business ethics encompass a broad range of topics that are covered by an association's

moral guidelines. Developing behavior based on sincerity and trust are significant moral

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

challenges in business, but more complex issues include embracing diversity, making decisions

with compassion, and upholding consistency and administration that adheres to the institution's

fundamental standards. Administrative consistency is the acceptance of laws, rules, orders, and

specifics pertinent to an association's business procedures. Infractions of administrative law

frequently result in legal justifications, including government sanctions. Compliance with

regulations refers to a company's observance of policies, procedures, guidelines, and

prerequisites that are pertinent to its operational tasks. Administrative consistency violations

frequently result in the imposition of justifiable penalties like fines from the government

(MacManus, 2019).

IRFS Objective: Organizations must maintain and publish their records in accordance

with IFRS guidelines. The goal of the global financial disclosing standards, which were

developed to lay out a common accounting language, is to provide financially sound and reliable

expressions across various endeavors and nations. For IFRS budget reports, a clear and

appropriate claim of conformity with IFRS should be kept in mind. According to the Companies

Act, financial reports must make reference to IFRS as adopted by the EU. According to moral

standards, bookkeepers should uphold the rules and regulations that govern their training

grounds and wards. Business associates and others should logically assume that you should

refrain from engaging in any actions that will diminish the reputation of your line of work.

Mission OF IAS: A collection of legally limiting principles serves as an illustration of

the high standards expected of those operating in the public space. The fundamental principles

that govern the Civil Service are outlined in the Civil Service Code, along with the example that

all government employees are expected to take in relation to these standards (Malakhova and

et.al., 2022). The International Accounting Standards (IAS) Regulation's goal is to coordinate the

financial information provided by European Union-based protection guarantee organizations

(EU). Universally applicable accounting concepts promote openness, responsibility, and

sufficiency in any financial market. This increases capital contribution and equips investors and

other market participants to make fully informed financial decisions regarding the opportunities

and dangers associated with ventures.

A. Construct a schedule of expected cash collections for the quarter.

Schedule of Expected

Cash Collection

July August September

with compassion, and upholding consistency and administration that adheres to the institution's

fundamental standards. Administrative consistency is the acceptance of laws, rules, orders, and

specifics pertinent to an association's business procedures. Infractions of administrative law

frequently result in legal justifications, including government sanctions. Compliance with

regulations refers to a company's observance of policies, procedures, guidelines, and

prerequisites that are pertinent to its operational tasks. Administrative consistency violations

frequently result in the imposition of justifiable penalties like fines from the government

(MacManus, 2019).

IRFS Objective: Organizations must maintain and publish their records in accordance

with IFRS guidelines. The goal of the global financial disclosing standards, which were

developed to lay out a common accounting language, is to provide financially sound and reliable

expressions across various endeavors and nations. For IFRS budget reports, a clear and

appropriate claim of conformity with IFRS should be kept in mind. According to the Companies

Act, financial reports must make reference to IFRS as adopted by the EU. According to moral

standards, bookkeepers should uphold the rules and regulations that govern their training

grounds and wards. Business associates and others should logically assume that you should

refrain from engaging in any actions that will diminish the reputation of your line of work.

Mission OF IAS: A collection of legally limiting principles serves as an illustration of

the high standards expected of those operating in the public space. The fundamental principles

that govern the Civil Service are outlined in the Civil Service Code, along with the example that

all government employees are expected to take in relation to these standards (Malakhova and

et.al., 2022). The International Accounting Standards (IAS) Regulation's goal is to coordinate the

financial information provided by European Union-based protection guarantee organizations

(EU). Universally applicable accounting concepts promote openness, responsibility, and

sufficiency in any financial market. This increases capital contribution and equips investors and

other market participants to make fully informed financial decisions regarding the opportunities

and dangers associated with ventures.

A. Construct a schedule of expected cash collections for the quarter.

Schedule of Expected

Cash Collection

July August September

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

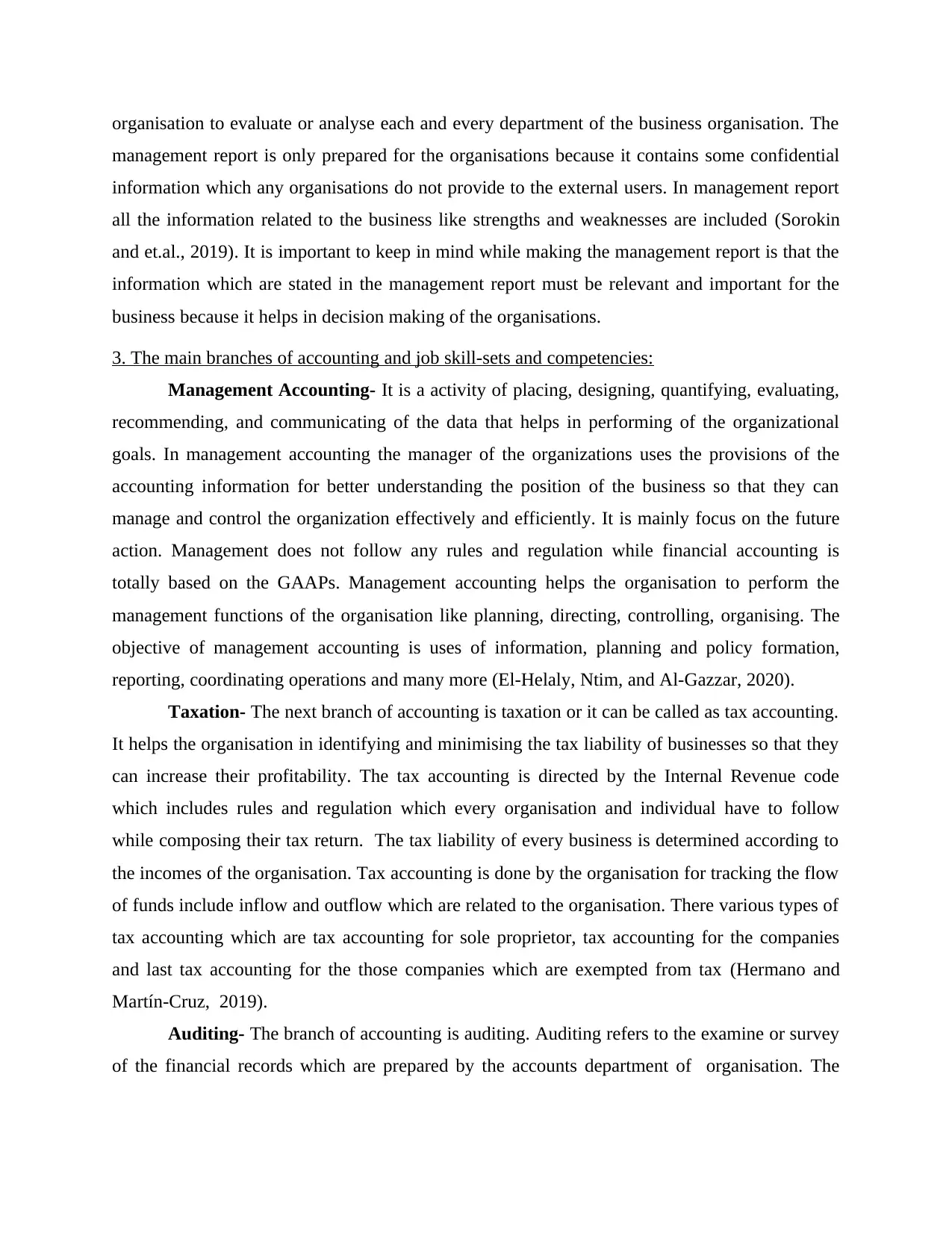

From account

receivable

July

Cash sales from July 40000

Credit sale receivable 4000

August

Cash sales from

August 50000

Credit sale receivable 1200

July creditor payment 32000

September

Cash sales from

September 60000

Credit receivable 6000

July creditor payment 2000

August creditor

payment 40000

Total cash collected 44000 83200 108000

B. Construct a schedule of anticipated cash disbursements for merchandise inventory purchases

for the quarter.

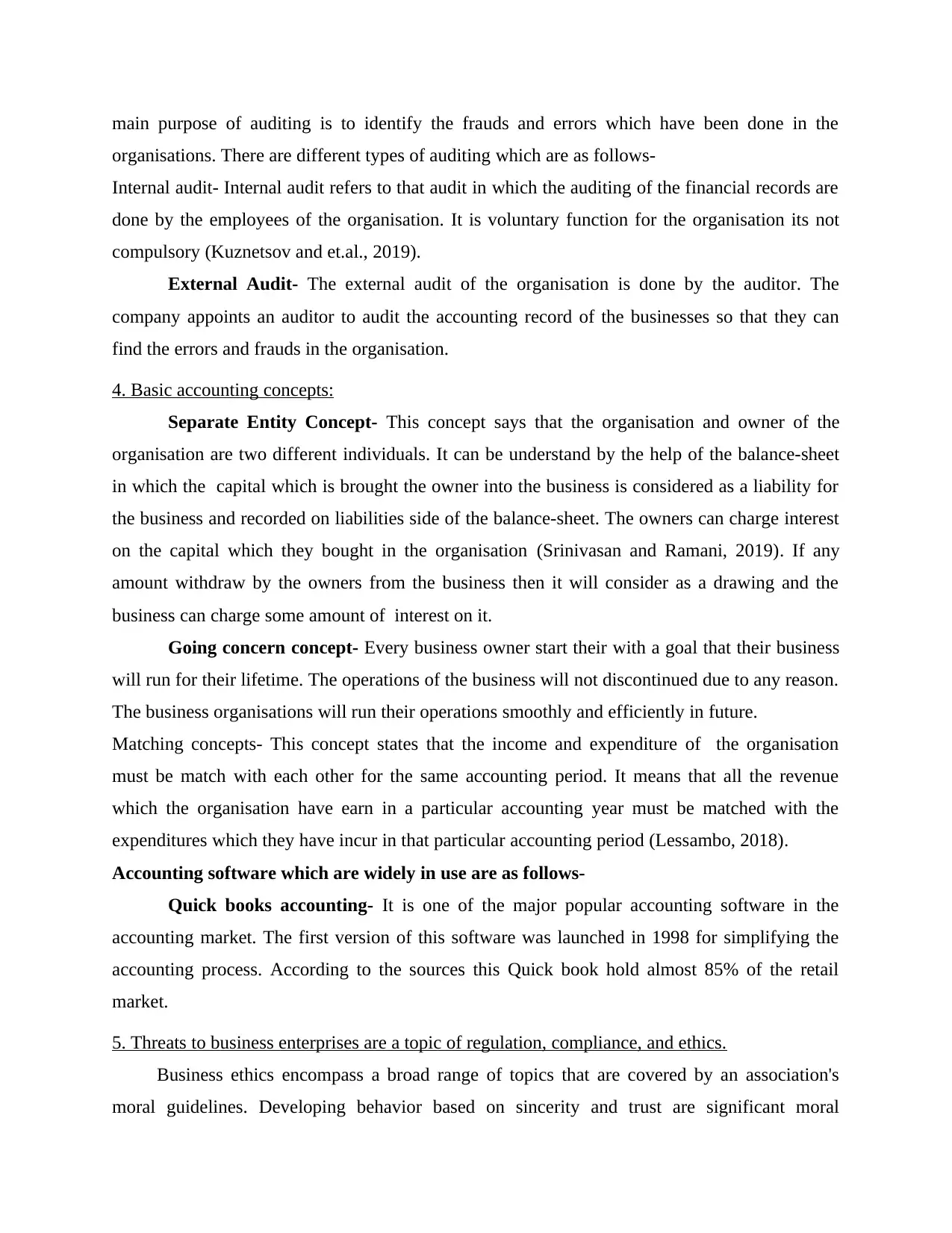

Schedule for cash

disbursement from

July to September

July August September

Total purchases 20000 22000 24200

cash purchases 4000 4400 4840

Trade payable 10000 16000 17600

selling and ad

expenses 12000 12600 13230

Equipment costing 0 0 25000

Dividend payable 0 0 9000

Total cash

disbursement 46000 55000 93870

C. Construct a cash budget for July, August, September and Q1 (first quarter). Show in the

financing section any borrowing that will be required in any month.

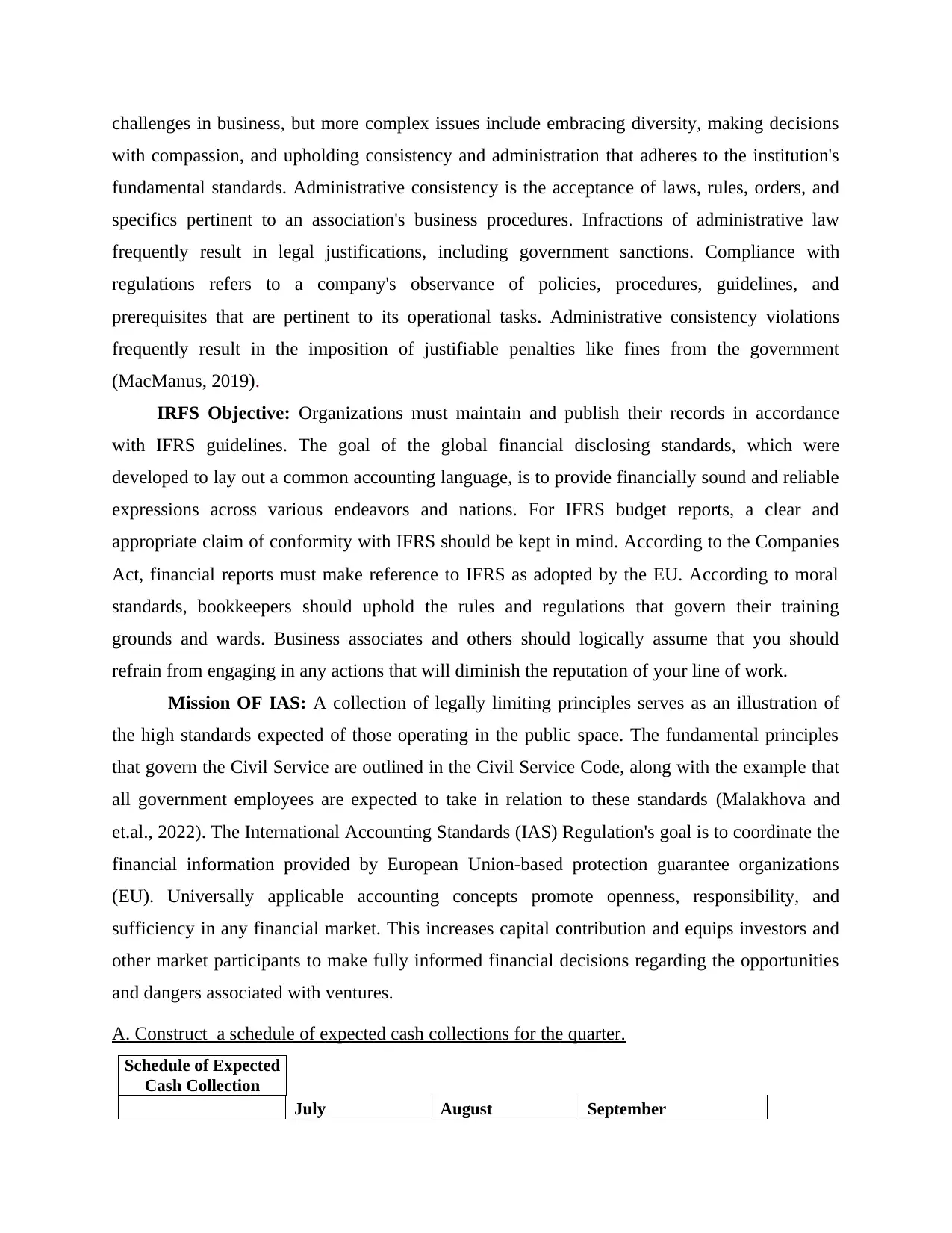

Cash Budget

Particular July August September

Opening balance 90000 198000 248200

Receipt

receivable

July

Cash sales from July 40000

Credit sale receivable 4000

August

Cash sales from

August 50000

Credit sale receivable 1200

July creditor payment 32000

September

Cash sales from

September 60000

Credit receivable 6000

July creditor payment 2000

August creditor

payment 40000

Total cash collected 44000 83200 108000

B. Construct a schedule of anticipated cash disbursements for merchandise inventory purchases

for the quarter.

Schedule for cash

disbursement from

July to September

July August September

Total purchases 20000 22000 24200

cash purchases 4000 4400 4840

Trade payable 10000 16000 17600

selling and ad

expenses 12000 12600 13230

Equipment costing 0 0 25000

Dividend payable 0 0 9000

Total cash

disbursement 46000 55000 93870

C. Construct a cash budget for July, August, September and Q1 (first quarter). Show in the

financing section any borrowing that will be required in any month.

Cash Budget

Particular July August September

Opening balance 90000 198000 248200

Receipt

Cash sales 40000 50000 60000

Credit sale receivable 4000 1200 6000

Receivables of previous months 32000 42000

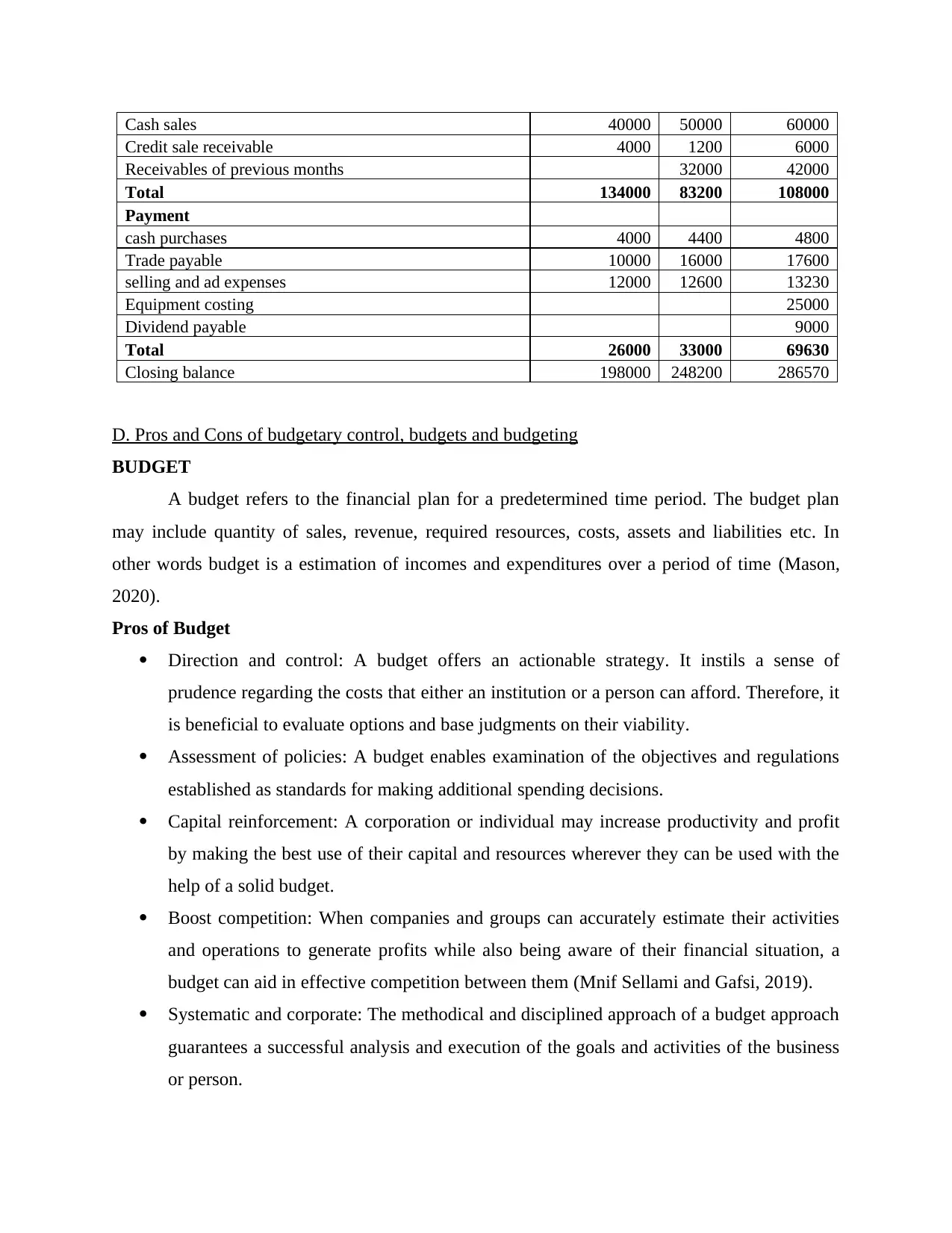

Total 134000 83200 108000

Payment

cash purchases 4000 4400 4800

Trade payable 10000 16000 17600

selling and ad expenses 12000 12600 13230

Equipment costing 25000

Dividend payable 9000

Total 26000 33000 69630

Closing balance 198000 248200 286570

D. Pros and Cons of budgetary control, budgets and budgeting

BUDGET

A budget refers to the financial plan for a predetermined time period. The budget plan

may include quantity of sales, revenue, required resources, costs, assets and liabilities etc. In

other words budget is a estimation of incomes and expenditures over a period of time (Mason,

2020).

Pros of Budget

Direction and control: A budget offers an actionable strategy. It instils a sense of

prudence regarding the costs that either an institution or a person can afford. Therefore, it

is beneficial to evaluate options and base judgments on their viability.

Assessment of policies: A budget enables examination of the objectives and regulations

established as standards for making additional spending decisions.

Capital reinforcement: A corporation or individual may increase productivity and profit

by making the best use of their capital and resources wherever they can be used with the

help of a solid budget.

Boost competition: When companies and groups can accurately estimate their activities

and operations to generate profits while also being aware of their financial situation, a

budget can aid in effective competition between them (Mnif Sellami and Gafsi, 2019).

Systematic and corporate: The methodical and disciplined approach of a budget approach

guarantees a successful analysis and execution of the goals and activities of the business

or person.

Credit sale receivable 4000 1200 6000

Receivables of previous months 32000 42000

Total 134000 83200 108000

Payment

cash purchases 4000 4400 4800

Trade payable 10000 16000 17600

selling and ad expenses 12000 12600 13230

Equipment costing 25000

Dividend payable 9000

Total 26000 33000 69630

Closing balance 198000 248200 286570

D. Pros and Cons of budgetary control, budgets and budgeting

BUDGET

A budget refers to the financial plan for a predetermined time period. The budget plan

may include quantity of sales, revenue, required resources, costs, assets and liabilities etc. In

other words budget is a estimation of incomes and expenditures over a period of time (Mason,

2020).

Pros of Budget

Direction and control: A budget offers an actionable strategy. It instils a sense of

prudence regarding the costs that either an institution or a person can afford. Therefore, it

is beneficial to evaluate options and base judgments on their viability.

Assessment of policies: A budget enables examination of the objectives and regulations

established as standards for making additional spending decisions.

Capital reinforcement: A corporation or individual may increase productivity and profit

by making the best use of their capital and resources wherever they can be used with the

help of a solid budget.

Boost competition: When companies and groups can accurately estimate their activities

and operations to generate profits while also being aware of their financial situation, a

budget can aid in effective competition between them (Mnif Sellami and Gafsi, 2019).

Systematic and corporate: The methodical and disciplined approach of a budget approach

guarantees a successful analysis and execution of the goals and activities of the business

or person.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Formative: A budget establishes guidelines to be followed so that resources and money

are used effectively, preventing any of them from being squandered.

Cons of budget

Unfaithful and unrealistic: Assumptions and conclusions form the basis of a budget. The

whole forecast across the budget plan will be impacted by any changes to the business

strategy or execution. As a result, the outcomes of a financial plan are never certain and

occasionally unreliable (Mnif and Gafsi, 2020).

Inflexible: A budget is created based on certain institutional regulations or personal goals

that influence decision-making. The budget, however, cannot be changed if there is a

need to assess the financial situation in light of market fluctuations.

Fund oriented: The interests and needs of the people are not supported by the budget.

While the requirements of the people are more qualitative in nature, it is more profit-

oriented, which is more quantitative..

Time-consuming: The method of creating a budget Or creating a budget takes a lot of

time. Before committing to any investment or spending toward a certain aim, it must take

into account all relevant factors pertaining to a company or a person.

Conflicts: Failure of a proposed budget can lead to numerous internal conflicts and rifts,

which finally manifest themselves in the organization's ineffective management.

BUDGETARY CONTROL

It refers to the financial process for controlling incomes and expenditures of a certain

period of time. In this process, manager regularly compare the actual income and expenditure to

the budgeted income and expenditures to measure the deficiencies. It also help firm to measure

the requirement of needful actions to overcome from the deficiencies (Pfiffner, 2019).

Pros of Budgetary Control

It states the objectives, plans and policies of the company. When there is no

predetermined goal and aim then the contribution and efforts will be wasted in the

success of budget.

It determines the targets for every department and they are forced to to their job

according to their target. It plays important role in managing activities of every

department and reduces the possibilities of conflicts.

are used effectively, preventing any of them from being squandered.

Cons of budget

Unfaithful and unrealistic: Assumptions and conclusions form the basis of a budget. The

whole forecast across the budget plan will be impacted by any changes to the business

strategy or execution. As a result, the outcomes of a financial plan are never certain and

occasionally unreliable (Mnif and Gafsi, 2020).

Inflexible: A budget is created based on certain institutional regulations or personal goals

that influence decision-making. The budget, however, cannot be changed if there is a

need to assess the financial situation in light of market fluctuations.

Fund oriented: The interests and needs of the people are not supported by the budget.

While the requirements of the people are more qualitative in nature, it is more profit-

oriented, which is more quantitative..

Time-consuming: The method of creating a budget Or creating a budget takes a lot of

time. Before committing to any investment or spending toward a certain aim, it must take

into account all relevant factors pertaining to a company or a person.

Conflicts: Failure of a proposed budget can lead to numerous internal conflicts and rifts,

which finally manifest themselves in the organization's ineffective management.

BUDGETARY CONTROL

It refers to the financial process for controlling incomes and expenditures of a certain

period of time. In this process, manager regularly compare the actual income and expenditure to

the budgeted income and expenditures to measure the deficiencies. It also help firm to measure

the requirement of needful actions to overcome from the deficiencies (Pfiffner, 2019).

Pros of Budgetary Control

It states the objectives, plans and policies of the company. When there is no

predetermined goal and aim then the contribution and efforts will be wasted in the

success of budget.

It determines the targets for every department and they are forced to to their job

according to their target. It plays important role in managing activities of every

department and reduces the possibilities of conflicts.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It states the better co-ordination among the employees and departments and also helps the

management to find out the deviations and the reasons behind them.

It helps in minimising the production cost by reducing the wastage of resources and also

help in order to proper utilization of the resources (Sabel, 2019).

Budgetary control facilitates centralized control with decentralized activity. Everting is

predetermine and preplanned will help in smooth functioning of business operations.

It increases efficiency of the employees in order to provide predetermined path also

motivate them for cost consciousness.

Cons of budgetary Control

It is very difficult to cover all future conditions and uncertainties while preparing a plan.

Budgets are mainly based on the future assumptions which may or may not be accurate.

Management of budget is a time consuming process and it take various analysis such as

market conditions, past performance of the company and others and it is very costly

process to perform all these analysis and operations (Sari and et.al., 2018).

Budgetary control is a management process. It cannot replace management in decision

making because it is not a secondary option for management.

The success of budget is mainly depended on the support of the top level management. If

there is a gap of support from senior level management, then the budget will be failed.

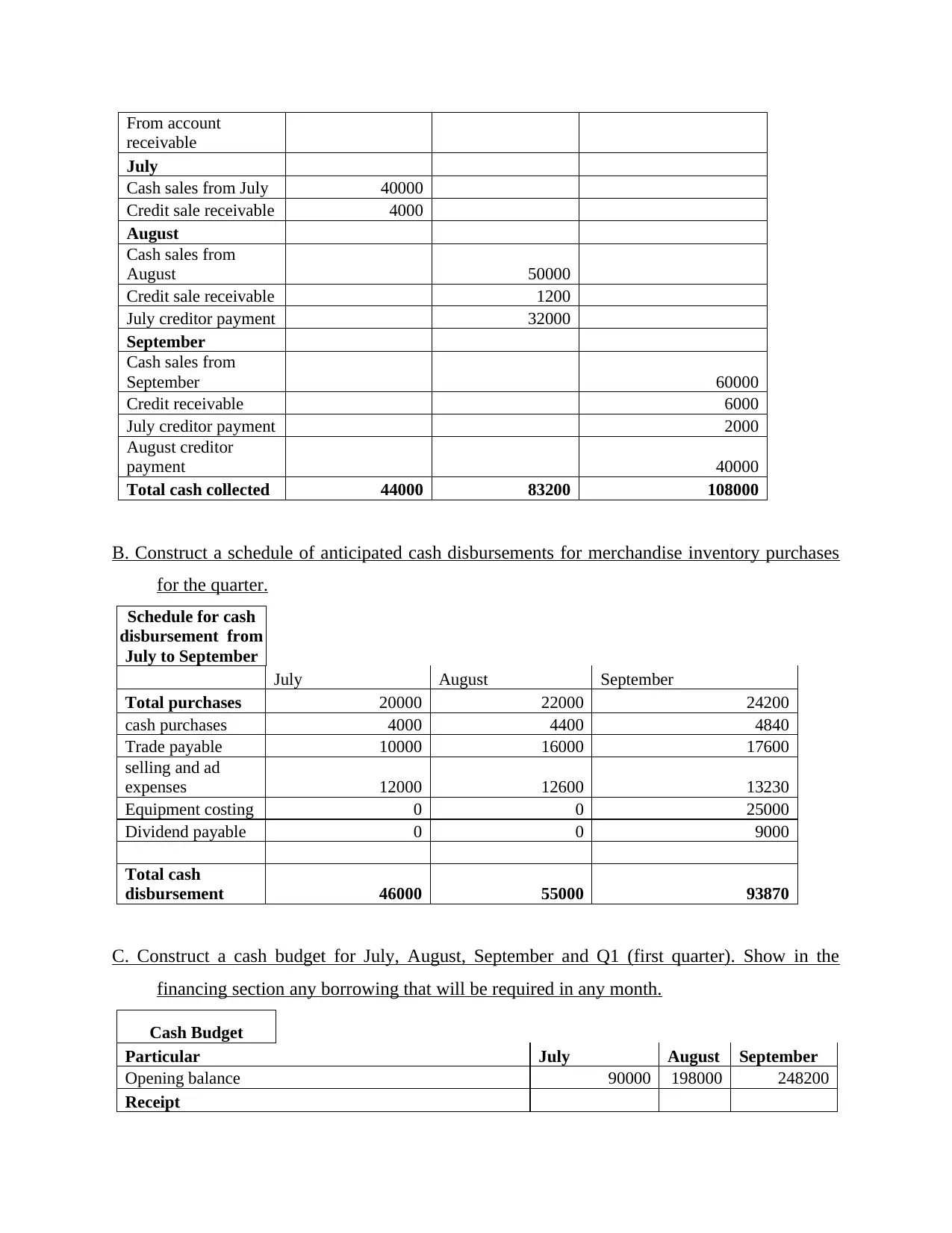

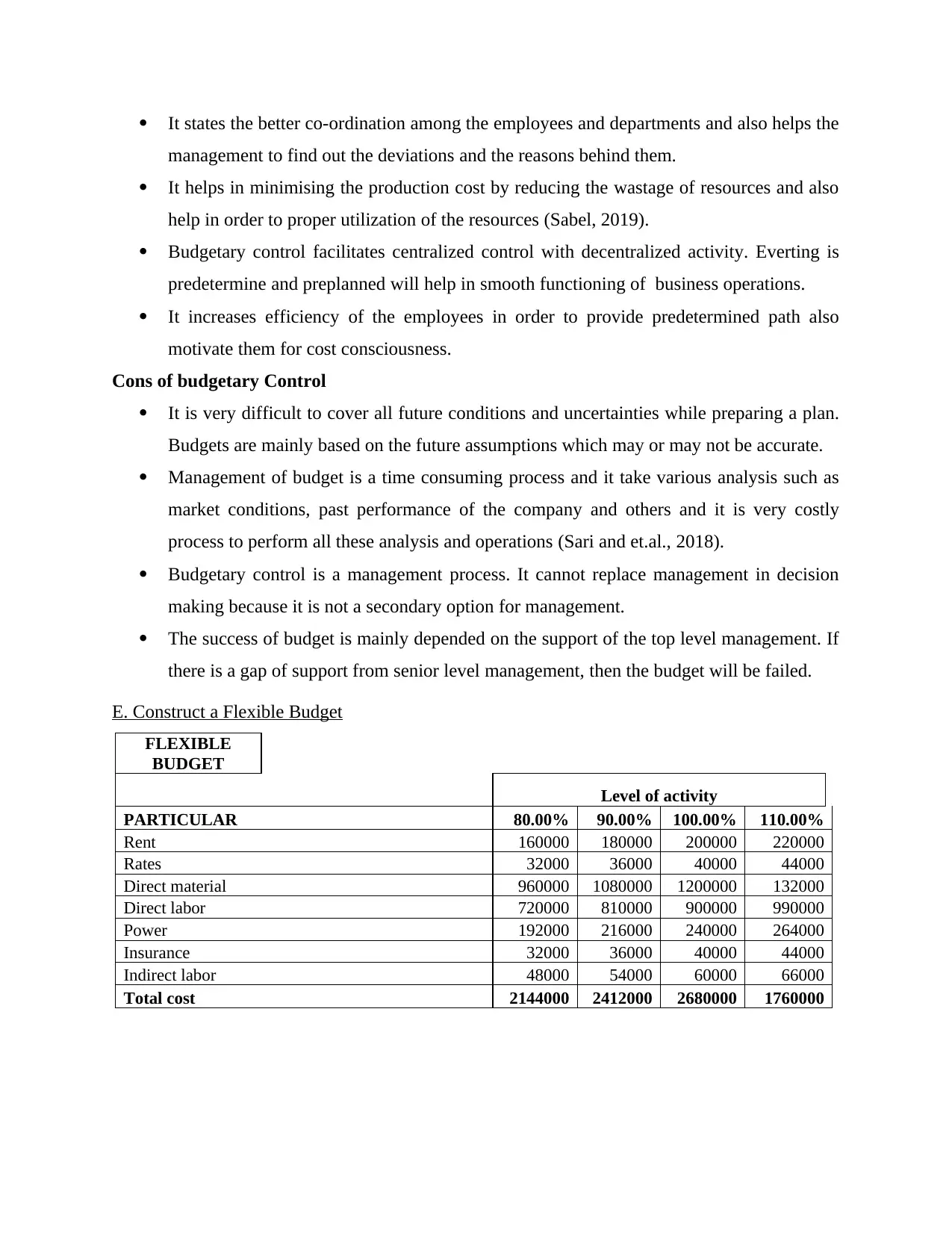

E. Construct a Flexible Budget

FLEXIBLE

BUDGET

Level of activity

PARTICULAR 80.00% 90.00% 100.00% 110.00%

Rent 160000 180000 200000 220000

Rates 32000 36000 40000 44000

Direct material 960000 1080000 1200000 132000

Direct labor 720000 810000 900000 990000

Power 192000 216000 240000 264000

Insurance 32000 36000 40000 44000

Indirect labor 48000 54000 60000 66000

Total cost 2144000 2412000 2680000 1760000

management to find out the deviations and the reasons behind them.

It helps in minimising the production cost by reducing the wastage of resources and also

help in order to proper utilization of the resources (Sabel, 2019).

Budgetary control facilitates centralized control with decentralized activity. Everting is

predetermine and preplanned will help in smooth functioning of business operations.

It increases efficiency of the employees in order to provide predetermined path also

motivate them for cost consciousness.

Cons of budgetary Control

It is very difficult to cover all future conditions and uncertainties while preparing a plan.

Budgets are mainly based on the future assumptions which may or may not be accurate.

Management of budget is a time consuming process and it take various analysis such as

market conditions, past performance of the company and others and it is very costly

process to perform all these analysis and operations (Sari and et.al., 2018).

Budgetary control is a management process. It cannot replace management in decision

making because it is not a secondary option for management.

The success of budget is mainly depended on the support of the top level management. If

there is a gap of support from senior level management, then the budget will be failed.

E. Construct a Flexible Budget

FLEXIBLE

BUDGET

Level of activity

PARTICULAR 80.00% 90.00% 100.00% 110.00%

Rent 160000 180000 200000 220000

Rates 32000 36000 40000 44000

Direct material 960000 1080000 1200000 132000

Direct labor 720000 810000 900000 990000

Power 192000 216000 240000 264000

Insurance 32000 36000 40000 44000

Indirect labor 48000 54000 60000 66000

Total cost 2144000 2412000 2680000 1760000

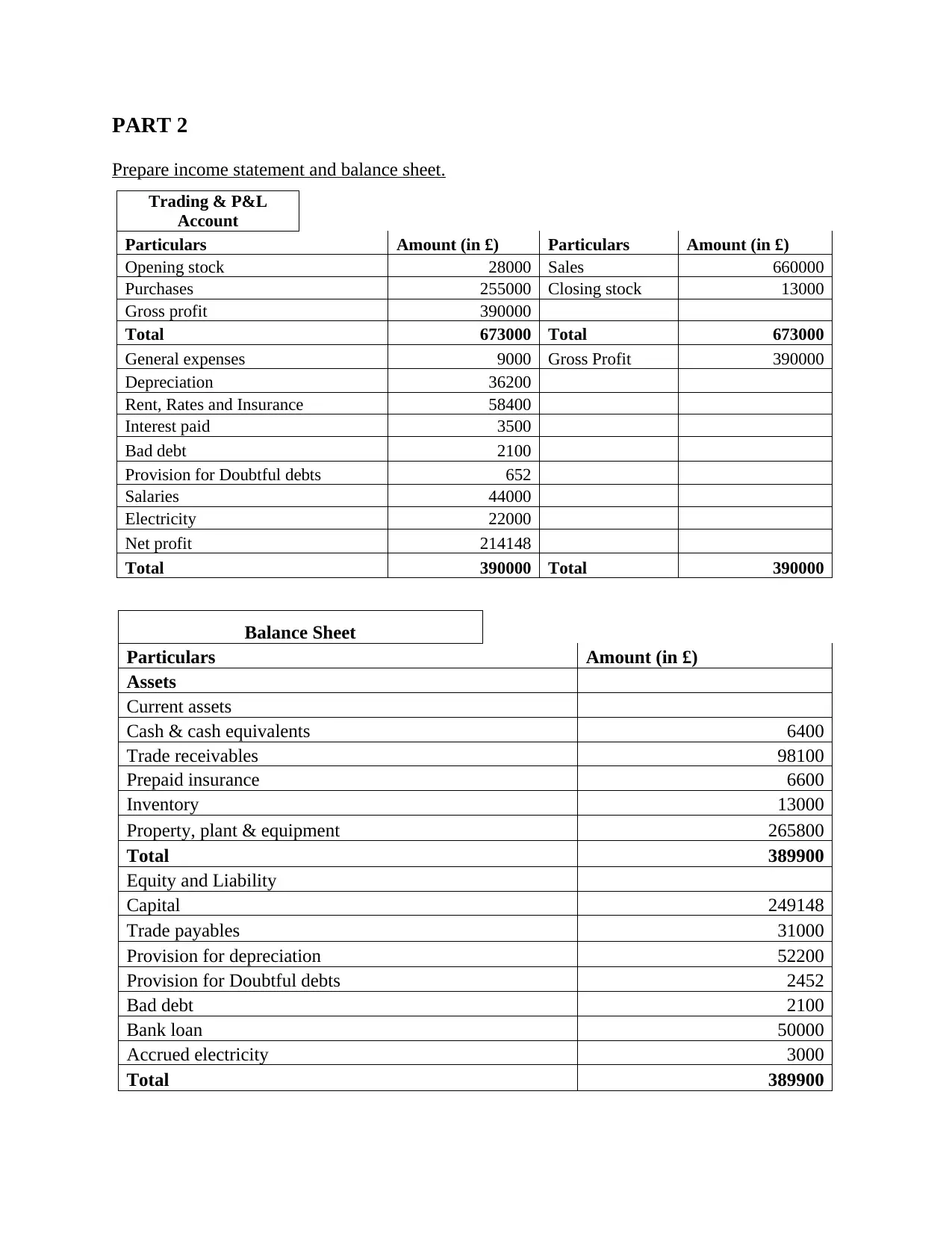

PART 2

Prepare income statement and balance sheet.

Trading & P&L

Account

Particulars Amount (in £) Particulars Amount (in £)

Opening stock 28000 Sales 660000

Purchases 255000 Closing stock 13000

Gross profit 390000

Total 673000 Total 673000

General expenses 9000 Gross Profit 390000

Depreciation 36200

Rent, Rates and Insurance 58400

Interest paid 3500

Bad debt 2100

Provision for Doubtful debts 652

Salaries 44000

Electricity 22000

Net profit 214148

Total 390000 Total 390000

Balance Sheet

Particulars Amount (in £)

Assets

Current assets

Cash & cash equivalents 6400

Trade receivables 98100

Prepaid insurance 6600

Inventory 13000

Property, plant & equipment 265800

Total 389900

Equity and Liability

Capital 249148

Trade payables 31000

Provision for depreciation 52200

Provision for Doubtful debts 2452

Bad debt 2100

Bank loan 50000

Accrued electricity 3000

Total 389900

Prepare income statement and balance sheet.

Trading & P&L

Account

Particulars Amount (in £) Particulars Amount (in £)

Opening stock 28000 Sales 660000

Purchases 255000 Closing stock 13000

Gross profit 390000

Total 673000 Total 673000

General expenses 9000 Gross Profit 390000

Depreciation 36200

Rent, Rates and Insurance 58400

Interest paid 3500

Bad debt 2100

Provision for Doubtful debts 652

Salaries 44000

Electricity 22000

Net profit 214148

Total 390000 Total 390000

Balance Sheet

Particulars Amount (in £)

Assets

Current assets

Cash & cash equivalents 6400

Trade receivables 98100

Prepaid insurance 6600

Inventory 13000

Property, plant & equipment 265800

Total 389900

Equity and Liability

Capital 249148

Trade payables 31000

Provision for depreciation 52200

Provision for Doubtful debts 2452

Bad debt 2100

Bank loan 50000

Accrued electricity 3000

Total 389900

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17