Accounting Principles: Financial Statements, Ethics, and Analysis

VerifiedAdded on 2023/06/10

Principles

Paraphrase This Document

INTRODUCTION...........................................................................................................................3

Section1............................................................................................................................................3

Explain the objective and scope of accounting principles in complex operating situation....3

Describe how the accounting function are helpful in decision making and to satisfy the

stakeholders and societal needs..............................................................................................4

Describe the branches of accounting and job role of the individual......................................5

Ethical issues that take place in an organization are as follows:............................................7

Section 2...........................................................................................................................................8

Present financial statement and Cash budget using Excel and also interpret the ratios.........8

C. How Digital software is used preparing financial statements..........................................10

Identification of the problem and solution in the Cash Budget as well as impact led by the

same on the organisation......................................................................................................12

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

In this report it discusses about the accounting significance and range in the composite

functioning of environment and work job ability needed in every accounting branch (Alexander

and Fasiello, 2021). They also include some explanations on how accounting assists the team of

shareholders to create advised decisions. Also, it contains the communication of accounting

approach and connection of innovative technology in present day accounting. It also describes

the ethics related problems, ruling and adherence in what size the reason to threat the firm. It

stays with the composition of budgetary cash flow for 1 year and influence to the definite

situation. The financial report includes income statement and the balance sheet of the firm

village wide catering business. However, it carries the justification of this financial document

which truly based upon the liquidity, profitability, solvency and efficiency with the help of the

calculation of some financial ratios.

Section1

Explain the objective and scope of accounting principles in complex operating situation

Every organization need accounting function to run and expand its business operations.

Accounting include several types of activities that are collecting, recording, summarising,

characterising and examining. It is all based on company day to day transactions of income and

expenditures (Paolone, 2020). The recorded data from accounting is also shows a accurate and

proper framework and these collected data are always present in the form of qualitative and

quantitative method. There are several function of accounting which are as follows:

To keep a record of each and every transaction: Accounting play a major role in every

sector for recording a transaction history of a specific period of time. Due to this business

is helpful in analysing the correct financial position of the company at the end of the year.

It is also helpful at the time of comparing the two or more years’ performance of the

company.

Helpful in decision making: After analysing the recorded data company is helpful in

taking the right decision for future forecasting or planning. Future decision making

includes what types of practice are useful to maintain the company efficiency. The

business organization also prepare the budget of every department for controlling the

expenditure and increasing the profits.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

market and these share are collected by the potential stakeholders. These stakeholder

refers as outsider of the business but they are connected from this business directly.

Stakeholders include investors, shareholders, employees, customers and providers

(Raхimova, 2020). All these are wanted to know the financial condition of the company

and it is possible only because of accounting.

Fulfil the legal necessity: The books of accounts always shows the right value of assets

and liabilities at the end of the financial or accounting year. It is directly control by the

accounts department of the business. It is also helpful in analysing whether the

organization are accurately and legally fulfilling the requirement of the business or not.

Describe how the accounting function are helpful in decision making and to satisfy the

stakeholders and societal needs

The department of accounting is always play a huge role in entire organization because

its main focus in the organization is to record the daily transaction. It is also focus on cost cutting

for generating the more profits in a business organization. The books of accounting include

journal, ledger, cash flow statement and income and statement (Sarathchandra and Munasinghe,

2018). It further help the organization and shareholders to collects the useful and valuable

information. The various different aspects are as follows:

After observing and interpretating of the financial reports, the company is helpful in

taking the right decision on behalf of the company success and expansion. It is implement

by the company through eliminating unnecessary business activities and perform the task

which are necessary for the company growth and development.

After preparing the financial, business get suggestion about what type of product or

services are useful for the company and what are not by maintaining the company cost. It

provide the idea of making the forecast budget for the business which contain what type

of practices are useful for the organization to perform the task effectively and efficiently.

The main motive of the business is to increase more and more profit of the company and

it is taken place only when the transactions are recorded by accounts department

accurately. If the organization is not recorded its transaction accurately then it effects the

company profit or sometimes it resulted the loss in a particular period of time.

Paraphrase This Document

the below report how accounting helps the shareholders and society are explained:

The shareholders and investors of the company generally uses the financial statement to

analyse the company financial position and profit at the end of the financial year. The

Investors invest the money in the company shares that why they observe the financial

statement of the organization. The investor or shareholder only invest on the business

which are profit making and high goodwill (Scepanovic, 2019). After analysing the

report, the investor takes a decision of investing in a particular project or business.

The analyses of the accounting are only done by the accountants or company CA after the

order of the company manager and founder. The manager is used this data for controlling

and motivating the employee and the owners used for analysing the company profit and

standard.

Every company have creditors and suppliers which asses the monetary transaction of the

business to analyse the loan amount is occurring and how much time period is taken by

the company to repay its short term debts (Siddiqui and Ahmed, 2020). The creditors are

only give goods and services to company when the company pay them its credits on

timely basis.

It can be saying that without accounting the business organization is failed because it is

the only way to analyse the company cost and income and the company credit and debts.

The investors or business are both depended on the company accounting records.

Describe the branches of accounting and job role of the individual.

The financial accounting is defined as the art of recording, classifying, interpreting and

summarizing the various statements of the organization which occurs on the daily basis in order

to conduct business operations (VASILE and CROITORU, 2021). This is the way which helps

the business enterprises in order to analyses the business transactions and financial statements in

the effective way.

• Job skills and competencies- it is very important for an individual to know about the

fiscal accounting in order to read and record the transactions. It is very important for the

organization to be aware how to prepare reports. It is very essential to have a good knowledge

of the various accounting software in order to analyses the recorded data. This impact in the

decision making for the company.

accounting in order to perform the various functions effectively. There are various key elements

for the managers to perform such as monitor and control over the flow of money within the

business enterprise. This helps the organization to eliminate the risk of the overflow of cash

within the organization. It is important to stop the unnecessary the use of the resources to

manage the functions effectively and efficiently.

Cost Accounting: this accounting measures the cost of the production, owners and managers of

the company. It considers the factor of production which suggests the cost that is linked with the

project.

Accounting professional needs to have accountability, flexibility, good communication,

simplicity and so on.

Auditing: This helps in analyzing and ascertaining he financial records of the origination. It is

prepared in the standard format which includes information of the company such as tax

liabilities, etc. The internal auditor of the company is not authorized to do such audits of the

company.

This accounting focuses on the critical thinking, empathy, curiosity, business ethics and

knowledge of taxations. Standard policies show that the auditor should not be biased with the

decision of a company.

Detailed accounting system and the role of technology in modern- day accounting

The system of accounting is the technique which is mainly utilize to maintain the track record of

the financial task that are executed in a company business. In already include in the company

business to maintain the track record of their buying, selling, sales revenue, income and receipts,

assets and debts, etc. it also able to create the statistical information that assists the company and

outsider clients to create illuminated decisions. The approach of accounting handles

expenditures, funding and invoices (Bęczkowska, 2019). The under included parts provide an

justification on how the technology function take a main part in present situation:

Cloud-based approach: The internet get the important necessity in the present time period

and the company should understand to create overall utilization . It also include some

various business of accounting that are utilizing cloud-based approach to elaborate their

information. Due to which the firms can approach its information anytime by a easy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

safety security and proved to be mainly advantageous for the firms.

Better executed customer proceedings: Coming digitally is not really helpful for the

company along with their customer. The customer and accountant they both try to save

its time period and accomplish on-site for the consulting . These both of the clients

analyse, edit and approach the actual time information in the similar point of time by

utilizing meetings and video conferencing.

Mobile Accounting: Today generation massively using mobile phones and there are wide

verity of the mobile applications that are used in accounting and they fulfil all needs of

accounting like creation of bills, sending important information with the privacy.

Specialized accounting software: There are many software are formed in the market that

they can done accounting process in very less time with proper accuracy. These software

can make accounting very easy and they also reduce the cost of firms (Bini and Bellucci,

2020).

Ethical issues that take place in an organization are as follows:

Discrimination: This is a situation when an employee treated different from the other

employee and it is a major problem in any organisation. All employee and workers have

equal rights and they have to treated in equal manner. It is illegal to create discrimination

among the employees on the basis of their cast, religion , age, gender etc. This may lead

to the mental harassment of any worker and can lead to the negative consequences.

Unethical Accounting Practices: Accounting is presented on the basis of accounting

standards and it is necessary to follow them. Some companies not using these standards

or regulations in order to prepare fake reports to attract investors or to present more

profitable position of the company. Company influence accountant to prepare fake

reports it is a illegal to prepare fake reports. It will damage the image of the company. In

some situation, the business leaks the financial information to the third of other institution

and it shall not do so until and unless very necessary and higher authorities have asked

for it (Boolaky, Mirosea and Singh, 2018).

Abuse of Leadership Authority: There are some top level managers or employees, they

uses their power in the inappropriate manner. This may lead a firm to conflicts and create

misunderstanding among the manager and sub ordinates.

Paraphrase This Document

employees also misuses the information by selling it to its competitors or other parties.

This may take company to bad situations or it can suffer from losses.

Section 2

Present financial statement and Cash budget using Excel and also interpret the ratios.

Financial statements are the statements that shows an organization's financial condition in

a particular financial year. These are the written reports that helps the organization in decision

making process and in forecasting the future plans by analysing the past performance. These

statements are used by the analysts, investors, and financial planners. With the help of these

statements an organizations can analyse the financial health of the company.

Types of Financial Statements

Balance Sheet

Income Statements

Cash Flow Statements

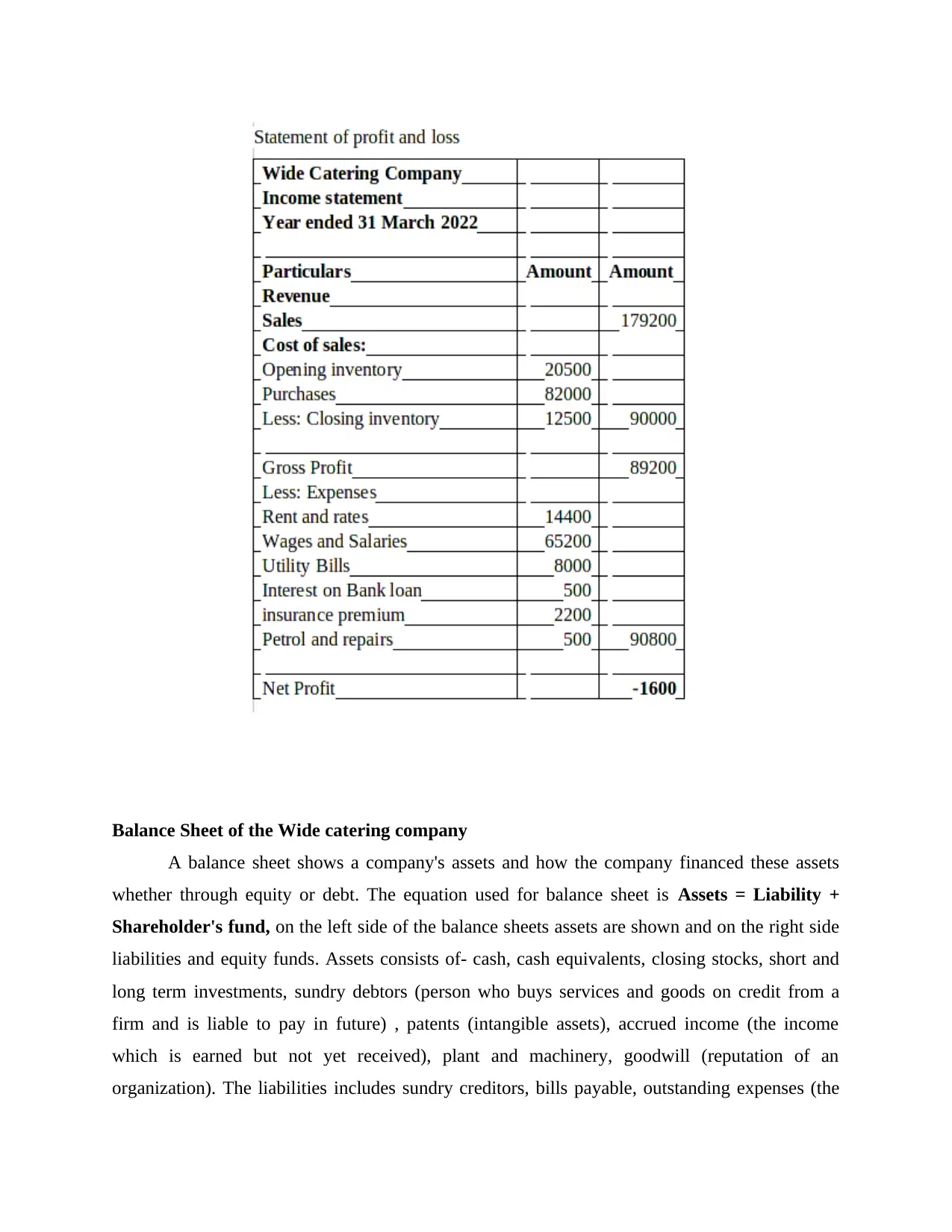

Statement of profit and loss

It is also known as Profit and Loss account, the statement which shows the revenue and

expenses or profit and loss of an organisation in an accounting period. It provides the

information to the lenders, investors that whether the company is in profit or loss during the

financial year. The equation is used to find out the net income is Net Income = Revenue –

Expenses. The income side of statements consists of operating revenue (income from services

charges, commission received) and non-operating revenue (sale of assets, interest received). The

expenditure section includes cost of goods sold, advertisement expenses, depreciation or

amortization. It is also called earning statement, revenue statement, financial performance

statement. It helps the creditors and investors in finalizing the capability of the organization of

generating profit or income in future. Income statement help in calculating accounting ratios

such as earning per share, price-earnings ratio.

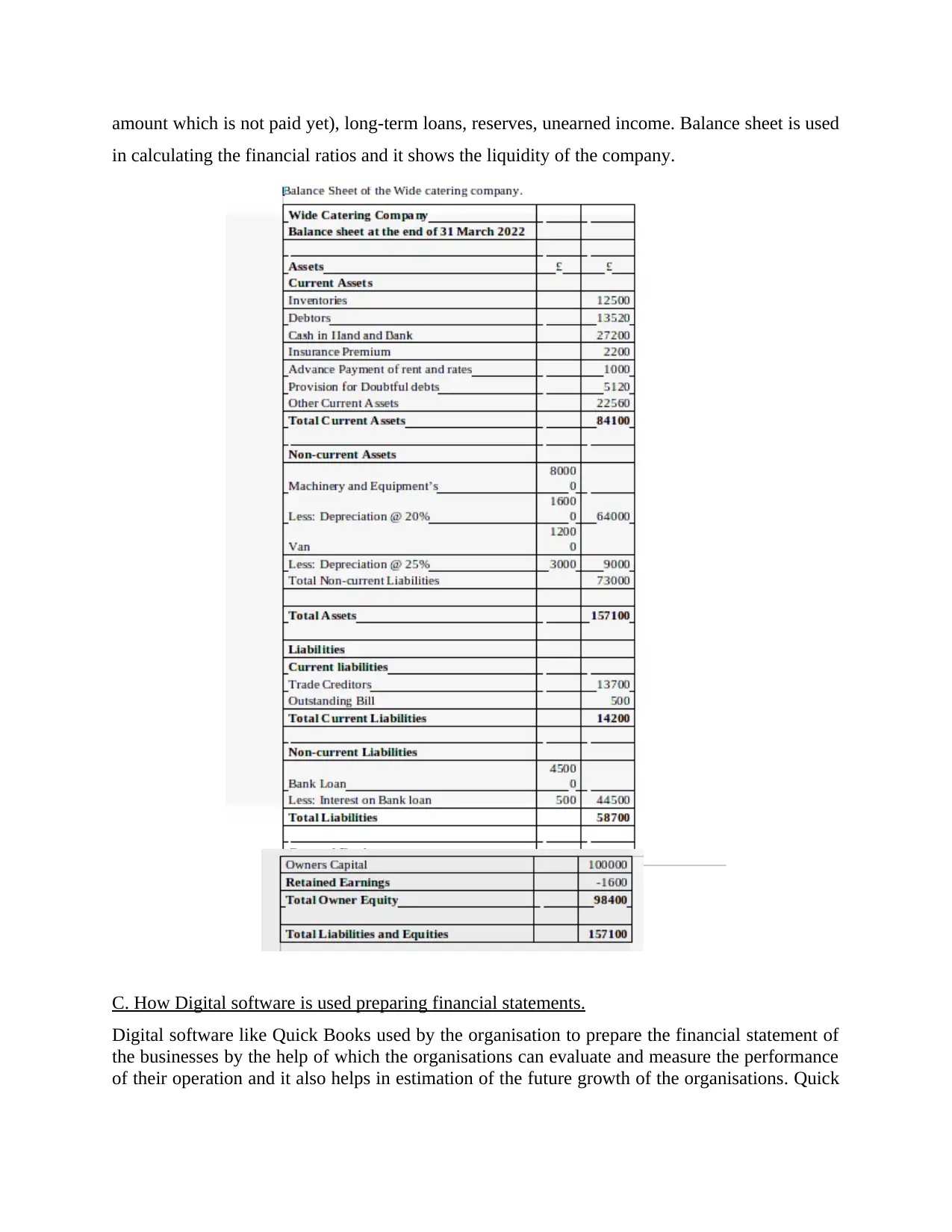

A balance sheet shows a company's assets and how the company financed these assets

whether through equity or debt. The equation used for balance sheet is Assets = Liability +

Shareholder's fund, on the left side of the balance sheets assets are shown and on the right side

liabilities and equity funds. Assets consists of- cash, cash equivalents, closing stocks, short and

long term investments, sundry debtors (person who buys services and goods on credit from a

firm and is liable to pay in future) , patents (intangible assets), accrued income (the income

which is earned but not yet received), plant and machinery, goodwill (reputation of an

organization). The liabilities includes sundry creditors, bills payable, outstanding expenses (the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

in calculating the financial ratios and it shows the liquidity of the company.

C. How Digital software is used preparing financial statements.

Digital software like Quick Books used by the organisation to prepare the financial statement of

the businesses by the help of which the organisations can evaluate and measure the performance

of their operation and it also helps in estimation of the future growth of the organisations. Quick

Paraphrase This Document

statements.

Profit and loss statement of Quick books: All the transactions related to Incomes and

expenditures which are recorded by the organisations through digital software like quick

books, then the software prepare profit and loss statement automatically and done all the

calculation by itself and reduce the burden of organisations. The accounts department just

have to record their business transaction accurately. Profit and loss account include

transactions related to income and expenditure only.

Balance sheet of quick books: Quick books also help in preparing the balance sheet of the

organisations. Balance sheet contains all Assets and Liabilities of the business which help

the organisation to determine their financial position. It also includes the Owner's Equity

which show on the liabilities side of the balance-sheet. It is a statement not an account.

Cash flow statement of quick books: Cash flow statements shows the inflow and outflow of

cash in the organisation, it helps the organisation to evaluate the profit which they earn by

investing their cash in other activities. It requires many calculations to prepare but quick books

make it easy by calculating all by itself and reduce the wastage of time of the organisation.

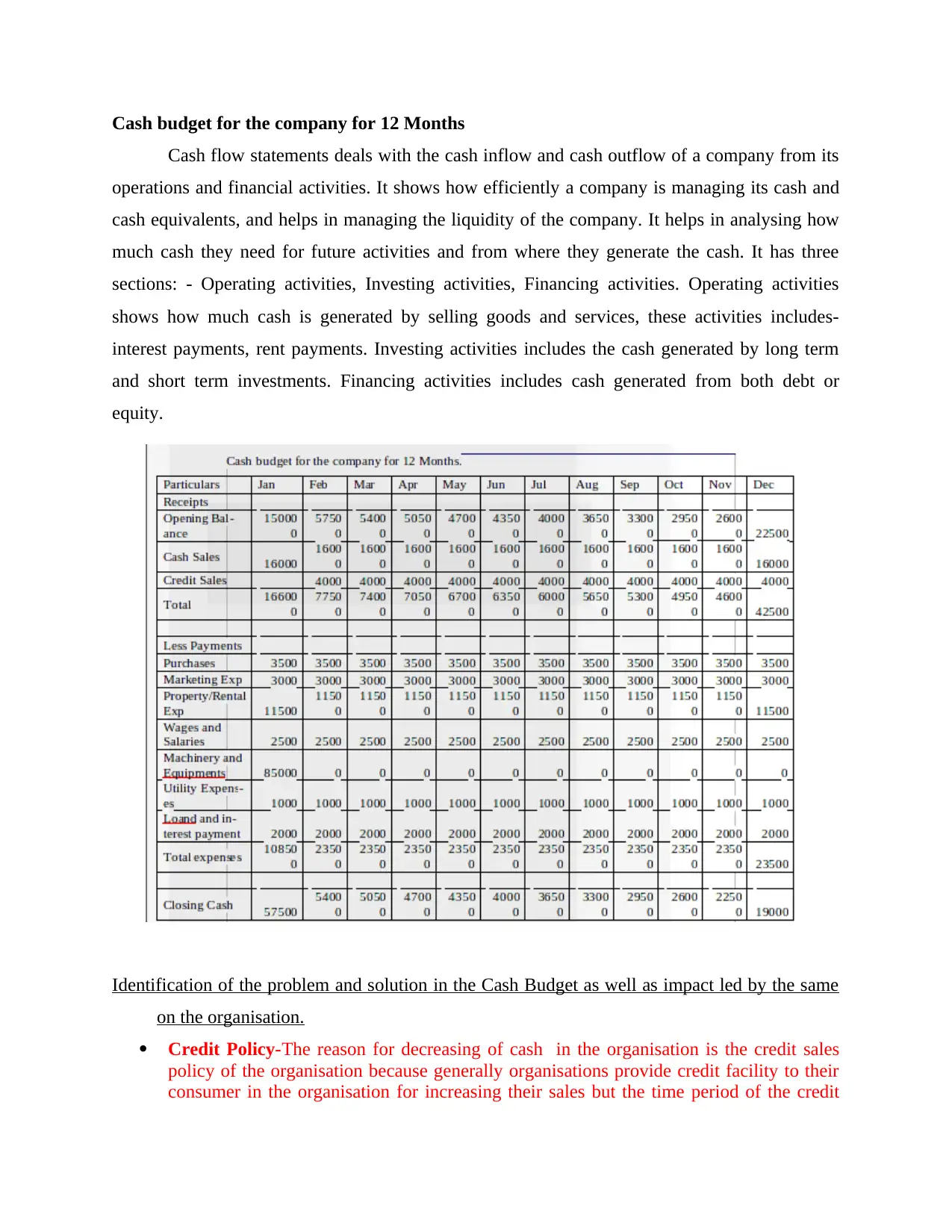

Cash flow statements deals with the cash inflow and cash outflow of a company from its

operations and financial activities. It shows how efficiently a company is managing its cash and

cash equivalents, and helps in managing the liquidity of the company. It helps in analysing how

much cash they need for future activities and from where they generate the cash. It has three

sections: - Operating activities, Investing activities, Financing activities. Operating activities

shows how much cash is generated by selling goods and services, these activities includes-

interest payments, rent payments. Investing activities includes the cash generated by long term

and short term investments. Financing activities includes cash generated from both debt or

equity.

Identification of the problem and solution in the Cash Budget as well as impact led by the same

on the organisation.

Credit Policy-The reason for decreasing of cash in the organisation is the credit sales

policy of the organisation because generally organisations provide credit facility to their

consumer in the organisation for increasing their sales but the time period of the credit

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

money to the organisation after one month but the expenses of presiding month is paid

by the organisation in the current month which leads to decrease in cash in the

organisation. So to tackle these kinds of situations companies have to reduce the time

period of credit sale given to the consumer.

Expenditure on Fixed Assets- The next reason for increasing and decreasing of cash is

expenditure which is incurred on fixed Assets of the organisations because Fixed assets

are one time investment and contain huge amount of money and organisations pay that

money at one time which leads to decreasing in cash of the businesses so to rectify the

situation the organisation have to prepare a proper plan and divide in amount in small

parts and pay that money in the instalment at the end of each month which leads to

reduction in the burden of cash in the organisation. And increase the cash of the

organisation.

Organisations are not able to generate revenue and struggling in maintaining of their

position in the market, to bring back the position again then, the organisations have to reduce

their costs and increase the efficiency of the business which leads to increasing in profit margin

of the organisations.

Ratio Analysis:

Ratio Analysis is the systematic way to understand the financial statements so that the

strong and weak point of a organisation or its past and current performance can be find out. Ratio

can be figured out by comparing of two related items so ratio can also be defined as a relative

figure which shows the relation between the two related items.

Liquidity ratio:

Liquidity ratio determine the short term position of the company or any firm. Liquidity

ratios consist of two ratios that are current ratio and quick ratio (Costa Oliveira and Rodrigues,

2018).

Current ratio:

Current ratio refers to the comparison of current assets with current liabilities and it

measure short-term solvency position of the company.

Paraphrase This Document

term liabilities but current assets of company continuously increasing which is a good sign for

the company. Company can easily meet their short term obligations (Coucom, 2018) (Dichev

and Zhao, 2021).

Quick ratio: this ratio also measures the short term performance of the company but it gives more

accurate results as compare to current ratio by excluding company stock form current assets.

Interpretation: There is a decline in the ratio because current liabilities are increase more

as compare to the current assets. Company has to decrease their current liabilities in order to

sustain in the market.

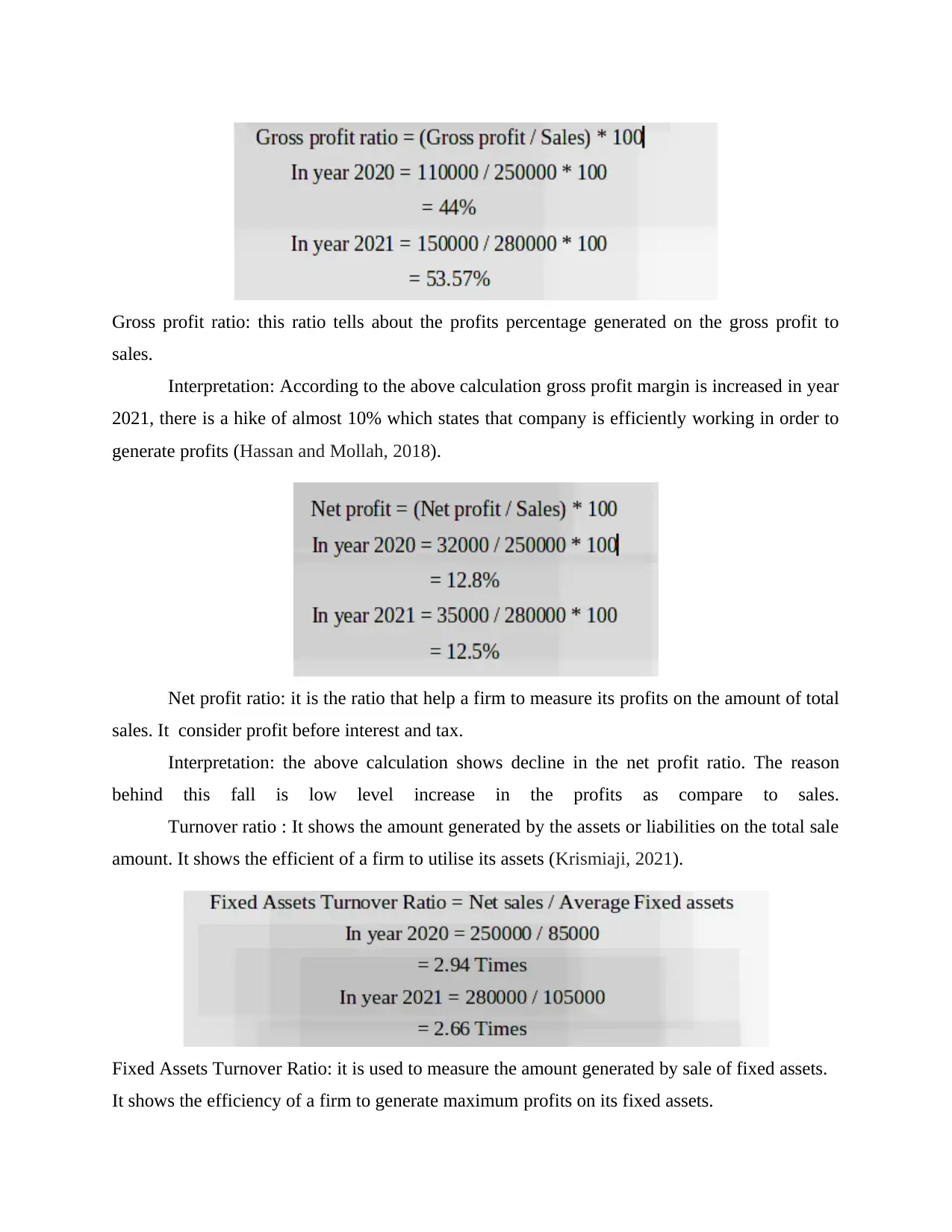

Profitability ratio: this ratio help a firm to measure its profit percentage on its revenues.

sales.

Interpretation: According to the above calculation gross profit margin is increased in year

2021, there is a hike of almost 10% which states that company is efficiently working in order to

generate profits (Hassan and Mollah, 2018).

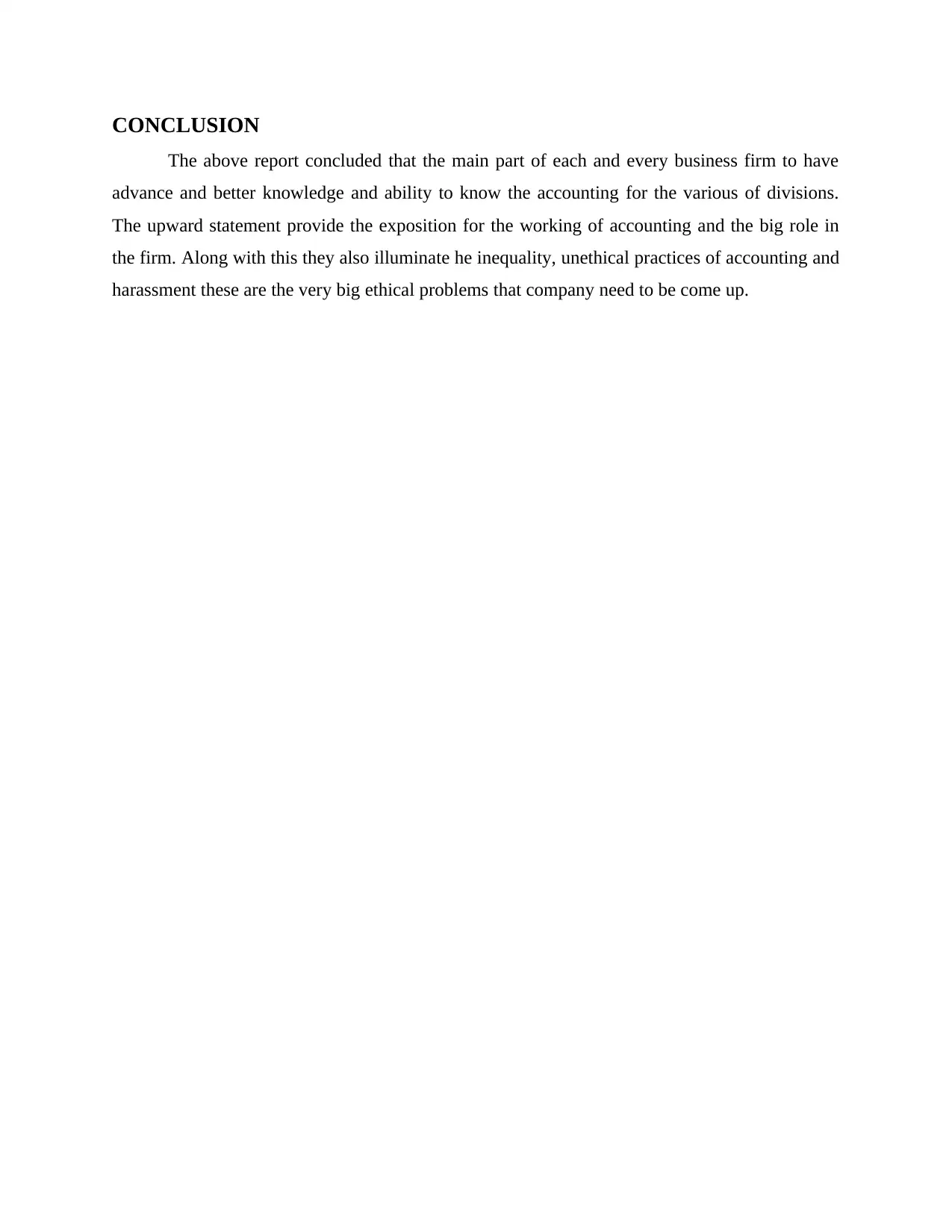

Net profit ratio: it is the ratio that help a firm to measure its profits on the amount of total

sales. It consider profit before interest and tax.

Interpretation: the above calculation shows decline in the net profit ratio. The reason

behind this fall is low level increase in the profits as compare to sales.

Turnover ratio : It shows the amount generated by the assets or liabilities on the total sale

amount. It shows the efficient of a firm to utilise its assets (Krismiaji, 2021).

Fixed Assets Turnover Ratio: it is used to measure the amount generated by sale of fixed assets.

It shows the efficiency of a firm to generate maximum profits on its fixed assets.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

generate profits in year 2021 as compare to previous year.

Inventory Turnover Ratio: it shows the capability of the firm to convert its stock into sale.

It shows how much times a company sale its available stocks.

Interpretation: there is a decline in the ratio of inventory turnover, the reason behind this

fall is increase in average inventory. This shows company is less efficient in selling their assets

as compare to year 2020.

Solvency ratio: This ratio help in measuring the long term solvency position of the firm.

This also tells that company is able to meet its future uncertainties or not(Maama and Appiah,

2019).

Debt Equity Ratio: It shows the capability of the firm to meet its long term debts by

shareholders fund if any problem arise (Maulana, Rohman and Prabowo, 2022).

Interpretation: the ideal ratio of debt equity ratio is 2:1. according to the calculations

company is not able to manage its debts and equity. Both the year has low debt equity ratio as

compare to previous year. Company is more risky to invest in the eyes of investors.

Paraphrase This Document

The above report concluded that the main part of each and every business firm to have

advance and better knowledge and ability to know the accounting for the various of divisions.

The upward statement provide the exposition for the working of accounting and the big role in

the firm. Along with this they also illuminate he inequality, unethical practices of accounting and

harassment these are the very big ethical problems that company need to be come up.

Books and Journals

Alexander, D. and Fasiello, R., 2021. Prudence and directive 34–reality and rhetoric in

accounting regulation. Accounting in Europe, 18(1), pp.26-42.

Bęczkowska, D.M., 2019. Cost accounting in public universities in poland and their information

needs in this field–results of own survey research. In EDULEARN19 Proceedings 11th

International Conference on Education and New Learning Technologies: Palma, Spain.

1-3 July, 2019 (pp. 1014-1022). IATED Academy.

Bini, L. and Bellucci, M., 2020. Accounting for Sustainability. In Integrated Sustainability

Reporting (pp. 9-51). Springer, Cham.

Boolaky, P.K., Mirosea, N. and Singh, K., 2018. On the regulatory changes in government

accounting development in Indonesia: A chronology from colonisation and post-

colonisation era. Journal of Accounting in Emerging Economies.

Costa Oliveira, H. and Rodrigues, L.L., 2018, June. Contemporary bureaucracy through

management accounting. In XVIIIth International Conference ASEPUC.

Coucom, C., 2018. Cambridge IGCSE® and O Level Accounting Workbook. Cambridge

University Press.

Dichev, I.D. and Zhao, J., 2021. Comparing GAAP With NIPA Earnings. Journal of Accounting,

Auditing & Finance, 36(3), pp.517-539.

Hassan, A. and Mollah, S., 2018. Just and Balanced: The Importance of Accounting in Islamic

Finance. In Islamic Finance (pp. 275-283). Palgrave Macmillan, Cham.

Krismiaji, K., 2021. Audit Quality Characteristics and Accounting Conservatism: Empirical

Study in Indonesian Company. ATESTASI: Jurnal Ilmiah Akuntansi, 4(2), pp.132-141.

Maama, H. and Appiah, K.O., 2019. Green accounting practices: lesson from an emerging

economy. Qualitative Research in Financial Markets.

Maulana, B.H., Rohman, A. and Prabowo, T., 2022. DOING QUALITATIVE RESEARCH OF

PHENOMENOLOGY IN ACCOUNTING. Academy of Accounting and Financial

Studies Journal, 26, pp.1-7.

Paolone, F., 2020. The Value Relevance of Accounting Information and Cash Flows: A Review

of Prior Studies and Models. Accounting, Cash Flow and Value Relevance, pp.37-52.

Raхimova, G.M., 2020. PROBLEMS OF ACCOUNTING AND AUDIT OF FIXED

ASSETS. Theoretical & Applied Science, (5), pp.726-729.

Sarathchandra, P.K.K. and Munasinghe, M.A.T.K., 2018. Relationship between Board

Characteristics and Earnings Management Evidence from Sri Lankan Listed

Companies. 4th International Conference for Accounting Researchers and Educators,

Department of Accountancy, Faculty of Commerce and Management Studies,

University of Kelaniya, Sri Lanka.

Scepanovic, M., 2019. Accounting for leases: the analysis of the shift from IAS 17 to IFRS 16.

Siddiqui, D.A. and Ahmed, P., 2020. Truthfulness in Accounting: Analysis of Earning

Manipulation in Pakistani Firms. Available at SSRN 3681332.

VASILE, E. and CROITORU, I., 2021. THE ROLE OF JUDICIAL ACCOUNTING

EXPERTISE ON ACCOUNTING INFORMATION. Internal Auditing & Risk

Management, 16(4).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.