HA1020 Accounting Principles and Practices: Final Assessment T2 2021

VerifiedAdded on 2023/06/17

|14

|4835

|363

Homework Assignment

AI Summary

This document provides detailed solutions to the HA1020 Accounting Principles and Practices final assessment. It covers various aspects of accounting principles, including depreciation methods (straight-line, reducing balance, and units-of-production), the relationship between liabilities and expenses, and accrual accounting adjustments. The assessment also includes preparing adjusting entries, calculating total revenue after adjustments, and explaining the rationale behind accrual accounting adjustments. The solutions demonstrate the application of accounting principles in practical scenarios, offering insights into financial statement preparation and analysis. Desklib offers a wide range of solved assignments for students.

HA1020

ACCOUNTING PRINCIPLES AND PRACTICES

FINAL ASSESSMENT

Assessment Weight: 50 total marks

Instructions:

All questions must be answered by using the answer boxes

provided in this paper.

Completed answers must be submitted to Blackboard by the

published due date and time.

Submission instructions are at the end of this paper.

Purpose:

This assessment consists of six (6) questions and is designed to assess your

level of knowledge of the key topics covered in this unit

HA1020 Final Assessment T2 2021

ACCOUNTING PRINCIPLES AND PRACTICES

FINAL ASSESSMENT

Assessment Weight: 50 total marks

Instructions:

All questions must be answered by using the answer boxes

provided in this paper.

Completed answers must be submitted to Blackboard by the

published due date and time.

Submission instructions are at the end of this paper.

Purpose:

This assessment consists of six (6) questions and is designed to assess your

level of knowledge of the key topics covered in this unit

HA1020 Final Assessment T2 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

(7 marks)

Miss Nancy started a lawn moving business in Gold Coast, Queensland,

Australia. For this purpose, she purchased a group of new lawn mowers for $20

000. The accountant of Miss Nancy told her that she must have to decide the

useful life and residual value of these new lawn mowers. After an initial

consultation with the stakeholders, she decided that the mowers to last five years

and have negligible resale value at that point. The business plan projects cutting

5000 lawns over five years. The yearly projection is as follows:

1st Year: 500 lawns,

2nd Year: 1 000 lawns,

3rd Year: 1 200 lawns,

4th Year: 1 800 lawns, and

5th Year: 500 lawns.

Required:

1. Calculate the accumulated depreciation balance at the end of the second

year using each of the following depreciation bases: (a) straight-line [1.5

Marks]; (b) reducing balance (25 per cent rate) [2 Marks]; and (c) units-of-

production [1.5 Marks].

2. Based on your calculations, which depreciation basis would produce the

highest retained profits at the end of the second year? (2 Marks)

ANSWER: ** Answer box will enlarge as you type

1)

a) Straight line method of depreciation

20000 / 5

= 4000

Accumulated depreciation: 8000 (4000 * 2)

b) Residual balance method

40000 / 5000 * 1500

= 12000

2)

Residual balance method of depreciation accounting support the highest level of

product margin to the business venture. As the residual method of depreciation

work on the concept that assume that the depreciation will not be fixed for all the

financial years. It will keep on changing and fluctuating on the basis of the level of

use deliver of the asset. The concept of depreciation indicate the fact that this is a

value of the property that is consumed during the respective time period. The

value denoted as the proportion of asset that is consumed in context the overall

capability of the respective asset. Depreciation is a concept involve that in context

to the fixed asset the entire asset or property do not get fully consumed in one

particular financial year (Rinta-Kahila and et.al., 2018). It takes plenty of years for

the property to get fully demolished or consumed based on its expected life or

time period of the property. In accounting term depreciation is a mandatory

requirement which needed to fulfil by the venture. This is a non cash expenditure

HA1020 Final Assessment T2 2021

(7 marks)

Miss Nancy started a lawn moving business in Gold Coast, Queensland,

Australia. For this purpose, she purchased a group of new lawn mowers for $20

000. The accountant of Miss Nancy told her that she must have to decide the

useful life and residual value of these new lawn mowers. After an initial

consultation with the stakeholders, she decided that the mowers to last five years

and have negligible resale value at that point. The business plan projects cutting

5000 lawns over five years. The yearly projection is as follows:

1st Year: 500 lawns,

2nd Year: 1 000 lawns,

3rd Year: 1 200 lawns,

4th Year: 1 800 lawns, and

5th Year: 500 lawns.

Required:

1. Calculate the accumulated depreciation balance at the end of the second

year using each of the following depreciation bases: (a) straight-line [1.5

Marks]; (b) reducing balance (25 per cent rate) [2 Marks]; and (c) units-of-

production [1.5 Marks].

2. Based on your calculations, which depreciation basis would produce the

highest retained profits at the end of the second year? (2 Marks)

ANSWER: ** Answer box will enlarge as you type

1)

a) Straight line method of depreciation

20000 / 5

= 4000

Accumulated depreciation: 8000 (4000 * 2)

b) Residual balance method

40000 / 5000 * 1500

= 12000

2)

Residual balance method of depreciation accounting support the highest level of

product margin to the business venture. As the residual method of depreciation

work on the concept that assume that the depreciation will not be fixed for all the

financial years. It will keep on changing and fluctuating on the basis of the level of

use deliver of the asset. The concept of depreciation indicate the fact that this is a

value of the property that is consumed during the respective time period. The

value denoted as the proportion of asset that is consumed in context the overall

capability of the respective asset. Depreciation is a concept involve that in context

to the fixed asset the entire asset or property do not get fully consumed in one

particular financial year (Rinta-Kahila and et.al., 2018). It takes plenty of years for

the property to get fully demolished or consumed based on its expected life or

time period of the property. In accounting term depreciation is a mandatory

requirement which needed to fulfil by the venture. This is a non cash expenditure

HA1020 Final Assessment T2 2021

associated with the organisation. The expense do not get to bear by the business

entity in liquidity format but have to charge in against of the profitability of the

respective financial year. The residual balance method is a concept involve in

depreciation accounting that motivate the organisation to record only the value of

depreciation that can denote the overall use of the property or asset during the

respective financial year. This is a proportion of property that is consumed by the

organisation in the one year of time frame. In general situation the rate is fixed for

the depreciation. The difference between residual method and straight line

technique is that in case of the straight line method of depreciation the value

remain same throughout the life of the property.

In the current situation the depreciation for two financial years are calculated with

straight line method denote the value as 8000 and on the other hand the value

with the weighted average method is 12000. This clearly indicate with the fact that

straight line method of depreciation accounting demonstrate the value to be the

minimum in nature. In case of the residual method technique of depreciation

accounting the respective value goes to 12000 of two financial years. This clearly

indicate the fact that in context to the firm profitability and revenue the straight line

method or technique of monitoring depreciation is the most favourable one in

comparison to other residual method technique of depreciation valuation (Cugova

and Cug, 2020). This method allows the business unit to sustain a burden of

depreciation in all the year of useful life in the same proportion. Whereas, the

residual method technique allow the consumption of depreciation on the basis of

the particular use of the asset during the respective time period. The role of the

depreciation is very significant in the business accounting as this involve

analysing the need of the asset in term of utilising the property. In case the

organisation utilises the straight-line method of depreciation than the maximum

amount of retained profit will be consumed by the organisation. On the other hand

in case the business entity utilise the residual method of depreciation accounting

than the less profit will be generated in against to utilise the asset for the whole

year. The difference in both the method is such that straight line technique allow

the venture to sustain a same burden over all the financial year involve in the

useful life of the asset. In context to the residual method technique the asset that

is already utilised will not be involved in the further valuation of the depreciation

against the asset or property. Hence the straight line technique involve less value

of depreciation in comparison to the residual method of depreciation accounting.

Question 2 (7 marks)

We have discussed the accounting for liabilities in Week 10 and 11. Based on this

discussion, please explain the relationship between liabilities and expenses.

Provide five examples where they both increase at the same time (4 Marks). Why

are some liabilities interest-bearing and others are not (3 Marks). [Words Limit:

Up to 100 Words]

ANSWER:

Liabilities are the mandatory requirements which needed to meet by the business

venture. This is an obligation that the business venture needed to bear. The

liability is mandatory need and requirements require to mitigate by the

organisation in against to deliver the business operations. On the other hand

expenses are the one that is against operating various functional responsibilities

HA1020 Final Assessment T2 2021

entity in liquidity format but have to charge in against of the profitability of the

respective financial year. The residual balance method is a concept involve in

depreciation accounting that motivate the organisation to record only the value of

depreciation that can denote the overall use of the property or asset during the

respective financial year. This is a proportion of property that is consumed by the

organisation in the one year of time frame. In general situation the rate is fixed for

the depreciation. The difference between residual method and straight line

technique is that in case of the straight line method of depreciation the value

remain same throughout the life of the property.

In the current situation the depreciation for two financial years are calculated with

straight line method denote the value as 8000 and on the other hand the value

with the weighted average method is 12000. This clearly indicate with the fact that

straight line method of depreciation accounting demonstrate the value to be the

minimum in nature. In case of the residual method technique of depreciation

accounting the respective value goes to 12000 of two financial years. This clearly

indicate the fact that in context to the firm profitability and revenue the straight line

method or technique of monitoring depreciation is the most favourable one in

comparison to other residual method technique of depreciation valuation (Cugova

and Cug, 2020). This method allows the business unit to sustain a burden of

depreciation in all the year of useful life in the same proportion. Whereas, the

residual method technique allow the consumption of depreciation on the basis of

the particular use of the asset during the respective time period. The role of the

depreciation is very significant in the business accounting as this involve

analysing the need of the asset in term of utilising the property. In case the

organisation utilises the straight-line method of depreciation than the maximum

amount of retained profit will be consumed by the organisation. On the other hand

in case the business entity utilise the residual method of depreciation accounting

than the less profit will be generated in against to utilise the asset for the whole

year. The difference in both the method is such that straight line technique allow

the venture to sustain a same burden over all the financial year involve in the

useful life of the asset. In context to the residual method technique the asset that

is already utilised will not be involved in the further valuation of the depreciation

against the asset or property. Hence the straight line technique involve less value

of depreciation in comparison to the residual method of depreciation accounting.

Question 2 (7 marks)

We have discussed the accounting for liabilities in Week 10 and 11. Based on this

discussion, please explain the relationship between liabilities and expenses.

Provide five examples where they both increase at the same time (4 Marks). Why

are some liabilities interest-bearing and others are not (3 Marks). [Words Limit:

Up to 100 Words]

ANSWER:

Liabilities are the mandatory requirements which needed to meet by the business

venture. This is an obligation that the business venture needed to bear. The

liability is mandatory need and requirements require to mitigate by the

organisation in against to deliver the business operations. On the other hand

expenses are the one that is against operating various functional responsibilities

HA1020 Final Assessment T2 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

by the organisation. This is about to operate the business functions. For example

if thee operations or sales of company is increased than the expenses of

operations will increase and also the result of this liability of taxation will further be

increased. The another example is when instalment of loan is not paid and also

the interest is not paid. In such a case the liability of loan get increase and also

the expense of interest get to increase (Pozdnyakov, Zoryana and Tetiana, 2020).

The one more example is such that in case of depreciation is charge against to

the residual value method. Then the expense of depreciation and the liability both

get increased. One more situation is when the causalities arise at the work place

this cause to increased expense and the liability. All these are the core examples

of the respective practices.

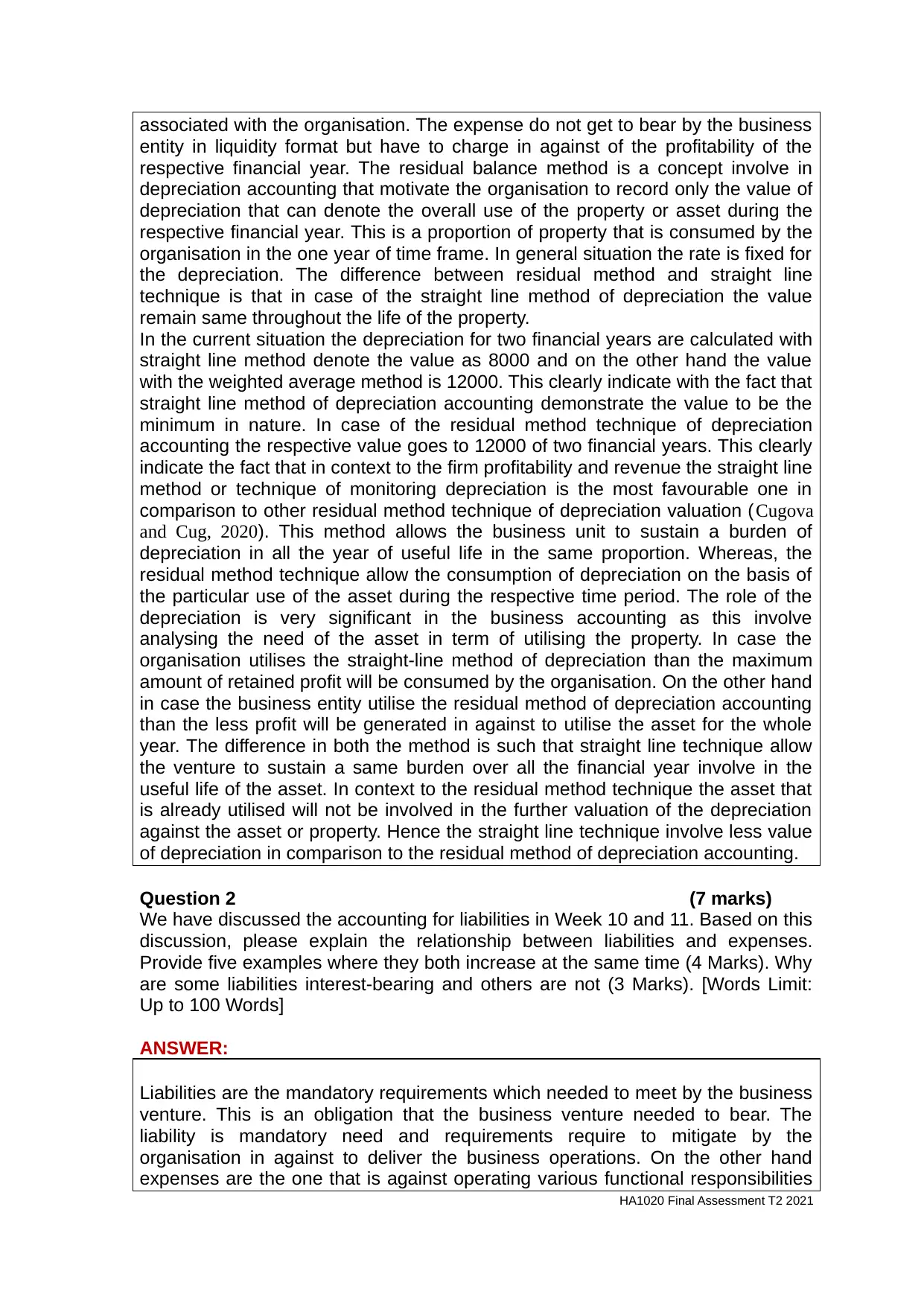

Question 3 (11 marks)

The accountant of ABC Limited has prepared the following unadjusted trial balance of

ABC Limited on 30th June 2021.

Yellow Limited

TRIAL BALANCE

AS AT 30th JUNE 2021

Accounts Debit ($) Credit ($)

Cash at bank 13 985

Account receivables 26 200

Prepaid insurance 3 900

Office Supplies 4 680

Office equipment 14 100

Accumulated depreciation - equipment 2 850

Accounts payable 315

Salary payable

Unearned service revenue 1 230

Loan payable 10 500

Capital 33 300

Drawings 60 000

Service revenue 159 270

Salary expenses 66 000

Depreciation expenses - equipment

Miscellaneous expenses 18 600

TOTAL 207 465 207 465

The following additional information is available at the end of June for

adjustments:

Mr Emmanuel is working as the inventory clerk. He performs the physical

count of the office supplies on 30th June 2021. This physical count reveals

that the unused office supplies of $550 are on hand.

The rate of depreciation for the office equipment is 15% per annum and

ABC Limited used the straight-line method of depreciation.

Of the $1230 unearned service revenue, $300 is still unearned

HA1020 Final Assessment T2 2021

if thee operations or sales of company is increased than the expenses of

operations will increase and also the result of this liability of taxation will further be

increased. The another example is when instalment of loan is not paid and also

the interest is not paid. In such a case the liability of loan get increase and also

the expense of interest get to increase (Pozdnyakov, Zoryana and Tetiana, 2020).

The one more example is such that in case of depreciation is charge against to

the residual value method. Then the expense of depreciation and the liability both

get increased. One more situation is when the causalities arise at the work place

this cause to increased expense and the liability. All these are the core examples

of the respective practices.

Question 3 (11 marks)

The accountant of ABC Limited has prepared the following unadjusted trial balance of

ABC Limited on 30th June 2021.

Yellow Limited

TRIAL BALANCE

AS AT 30th JUNE 2021

Accounts Debit ($) Credit ($)

Cash at bank 13 985

Account receivables 26 200

Prepaid insurance 3 900

Office Supplies 4 680

Office equipment 14 100

Accumulated depreciation - equipment 2 850

Accounts payable 315

Salary payable

Unearned service revenue 1 230

Loan payable 10 500

Capital 33 300

Drawings 60 000

Service revenue 159 270

Salary expenses 66 000

Depreciation expenses - equipment

Miscellaneous expenses 18 600

TOTAL 207 465 207 465

The following additional information is available at the end of June for

adjustments:

Mr Emmanuel is working as the inventory clerk. He performs the physical

count of the office supplies on 30th June 2021. This physical count reveals

that the unused office supplies of $550 are on hand.

The rate of depreciation for the office equipment is 15% per annum and

ABC Limited used the straight-line method of depreciation.

Of the $1230 unearned service revenue, $300 is still unearned

HA1020 Final Assessment T2 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

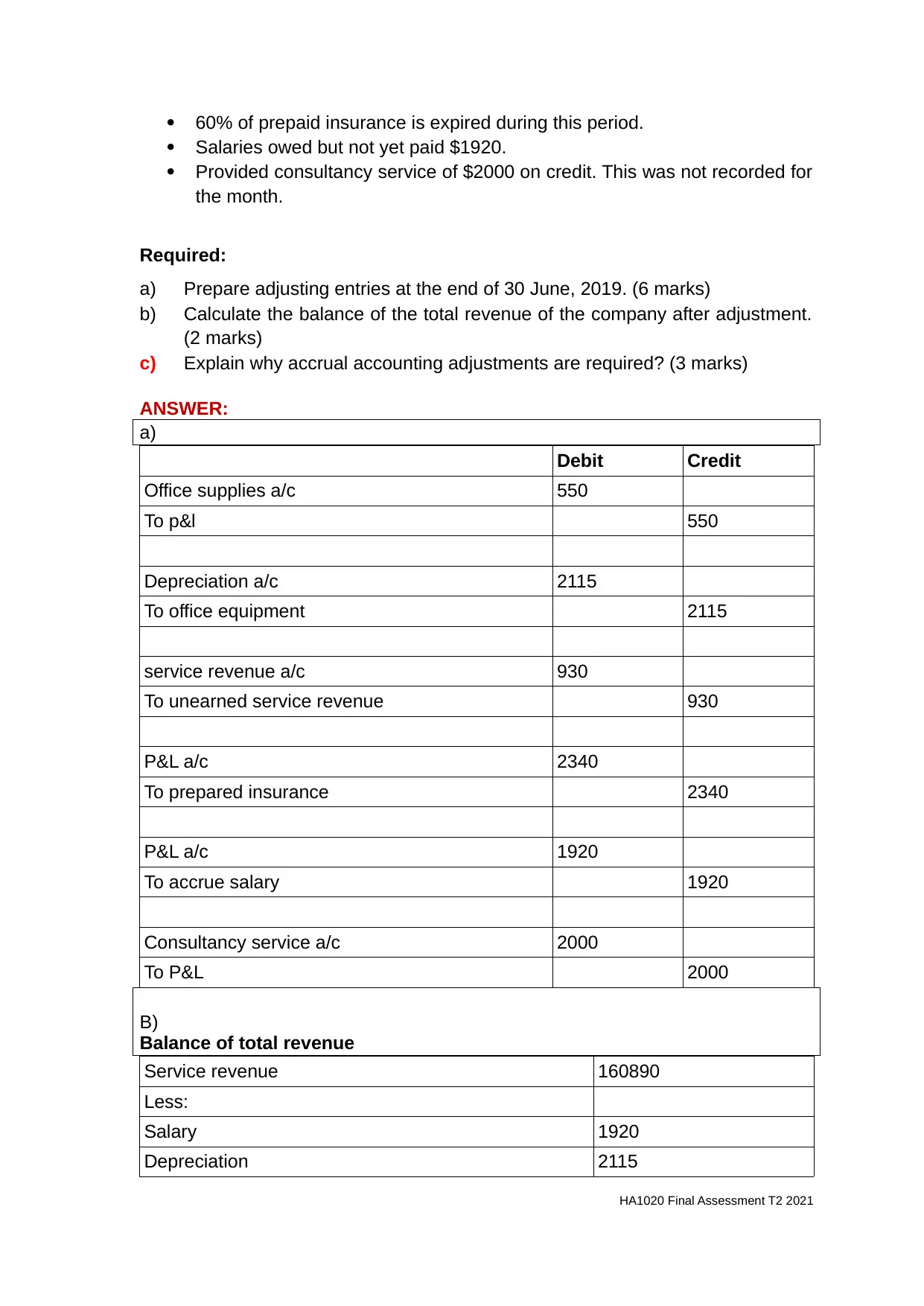

60% of prepaid insurance is expired during this period.

Salaries owed but not yet paid $1920.

Provided consultancy service of $2000 on credit. This was not recorded for

the month.

Required:

a) Prepare adjusting entries at the end of 30 June, 2019. (6 marks)

b) Calculate the balance of the total revenue of the company after adjustment.

(2 marks)

c) Explain why accrual accounting adjustments are required? (3 marks)

ANSWER:

a)

Debit Credit

Office supplies a/c 550

To p&l 550

Depreciation a/c 2115

To office equipment 2115

service revenue a/c 930

To unearned service revenue 930

P&L a/c 2340

To prepared insurance 2340

P&L a/c 1920

To accrue salary 1920

Consultancy service a/c 2000

To P&L 2000

B)

Balance of total revenue

Service revenue 160890

Less:

Salary 1920

Depreciation 2115

HA1020 Final Assessment T2 2021

Salaries owed but not yet paid $1920.

Provided consultancy service of $2000 on credit. This was not recorded for

the month.

Required:

a) Prepare adjusting entries at the end of 30 June, 2019. (6 marks)

b) Calculate the balance of the total revenue of the company after adjustment.

(2 marks)

c) Explain why accrual accounting adjustments are required? (3 marks)

ANSWER:

a)

Debit Credit

Office supplies a/c 550

To p&l 550

Depreciation a/c 2115

To office equipment 2115

service revenue a/c 930

To unearned service revenue 930

P&L a/c 2340

To prepared insurance 2340

P&L a/c 1920

To accrue salary 1920

Consultancy service a/c 2000

To P&L 2000

B)

Balance of total revenue

Service revenue 160890

Less:

Salary 1920

Depreciation 2115

HA1020 Final Assessment T2 2021

Miscellaneous expense 18600

Insurance 2340

Profit 135915

c)

The accrual technique or method of accounting demonstrate the fact that this

technique involve reporting the business transactions at the time of event actually

incurred. This method of accounting allow the reporting of the financial

transactions over the time period at which the event is actually happened

irrespective of the fact that whether any cash outflow or inflow arises in against of

delivering the whole transaction (Changwony and Paterson, 2019). The accounting

adjustments are the one that is coordinated with the use of accrual method of

accounting. IN case of the cash based accounting the transaction is only

recorded at the time cash inflow or outflow is actually witnessed against the

delivery of respective transaction. The accrual nature of accounting do not give

major emphasis of the time actually cash inflow or outflow is recorded

(Mulawarman and Kamayanti, 2018). This is a accounting technique when the cash

nature of accounting is reporting,. Any transaction that could entertain cash or

liquidity resource will only get to report in the books of accounts. All such

transactions do not involve cash will not include in the books of accounts. The

role of actual nature of accounting is such that it allow the organisational record

the transactions in accounting books at the time the event actually happened but

not on the time the cash is either received or paid in against to deal with the

event. This method or technique is more realistic in nature that create more

favourable atmosphere to utilise the respective method or technique.

In accounting term ths role of the business accounting is to report the event in the

books of accounts with the use of monetary value of the event or activity. The

focus of the accounting is to record in books so that financial implication of the

transactions can be monitored by the organisation. Accrual based transaction

deal with the fact that the reporting of the transactions or accounting event is

done at the time the activity actually perform but not on the time the cash is

received or paid against the event is happened. This technique is more

professional and feasible in nature as this is not relevant to record the transaction

in accounting books only the time cash is either received or paid by the venture

(Vania, Nugraha and Nugroho, 2018). AS the business transactions are majorly

based on the feature which do not allow the stakeholder to immediately deal with

the cash. The practice of cash based accounting is against to the normal

implication of the general principle of accounting. In the practical situation of

business this method is very important and essential to deliver the final objective

of the accounting. As the technique is capable to present the actual financial

position of the organisation in accounting book of records. This technique played

a basic role in implementing the key role in formulating or meting up the basic

conclusion of the accounting and the role of the accounting.

Question 4 (11 marks)

HARDA Limited is a retailer of office stationery and art supplies. The internal

auditor of the business is concerned about the inventory management of the

HA1020 Final Assessment T2 2021

Insurance 2340

Profit 135915

c)

The accrual technique or method of accounting demonstrate the fact that this

technique involve reporting the business transactions at the time of event actually

incurred. This method of accounting allow the reporting of the financial

transactions over the time period at which the event is actually happened

irrespective of the fact that whether any cash outflow or inflow arises in against of

delivering the whole transaction (Changwony and Paterson, 2019). The accounting

adjustments are the one that is coordinated with the use of accrual method of

accounting. IN case of the cash based accounting the transaction is only

recorded at the time cash inflow or outflow is actually witnessed against the

delivery of respective transaction. The accrual nature of accounting do not give

major emphasis of the time actually cash inflow or outflow is recorded

(Mulawarman and Kamayanti, 2018). This is a accounting technique when the cash

nature of accounting is reporting,. Any transaction that could entertain cash or

liquidity resource will only get to report in the books of accounts. All such

transactions do not involve cash will not include in the books of accounts. The

role of actual nature of accounting is such that it allow the organisational record

the transactions in accounting books at the time the event actually happened but

not on the time the cash is either received or paid in against to deal with the

event. This method or technique is more realistic in nature that create more

favourable atmosphere to utilise the respective method or technique.

In accounting term ths role of the business accounting is to report the event in the

books of accounts with the use of monetary value of the event or activity. The

focus of the accounting is to record in books so that financial implication of the

transactions can be monitored by the organisation. Accrual based transaction

deal with the fact that the reporting of the transactions or accounting event is

done at the time the activity actually perform but not on the time the cash is

received or paid against the event is happened. This technique is more

professional and feasible in nature as this is not relevant to record the transaction

in accounting books only the time cash is either received or paid by the venture

(Vania, Nugraha and Nugroho, 2018). AS the business transactions are majorly

based on the feature which do not allow the stakeholder to immediately deal with

the cash. The practice of cash based accounting is against to the normal

implication of the general principle of accounting. In the practical situation of

business this method is very important and essential to deliver the final objective

of the accounting. As the technique is capable to present the actual financial

position of the organisation in accounting book of records. This technique played

a basic role in implementing the key role in formulating or meting up the basic

conclusion of the accounting and the role of the accounting.

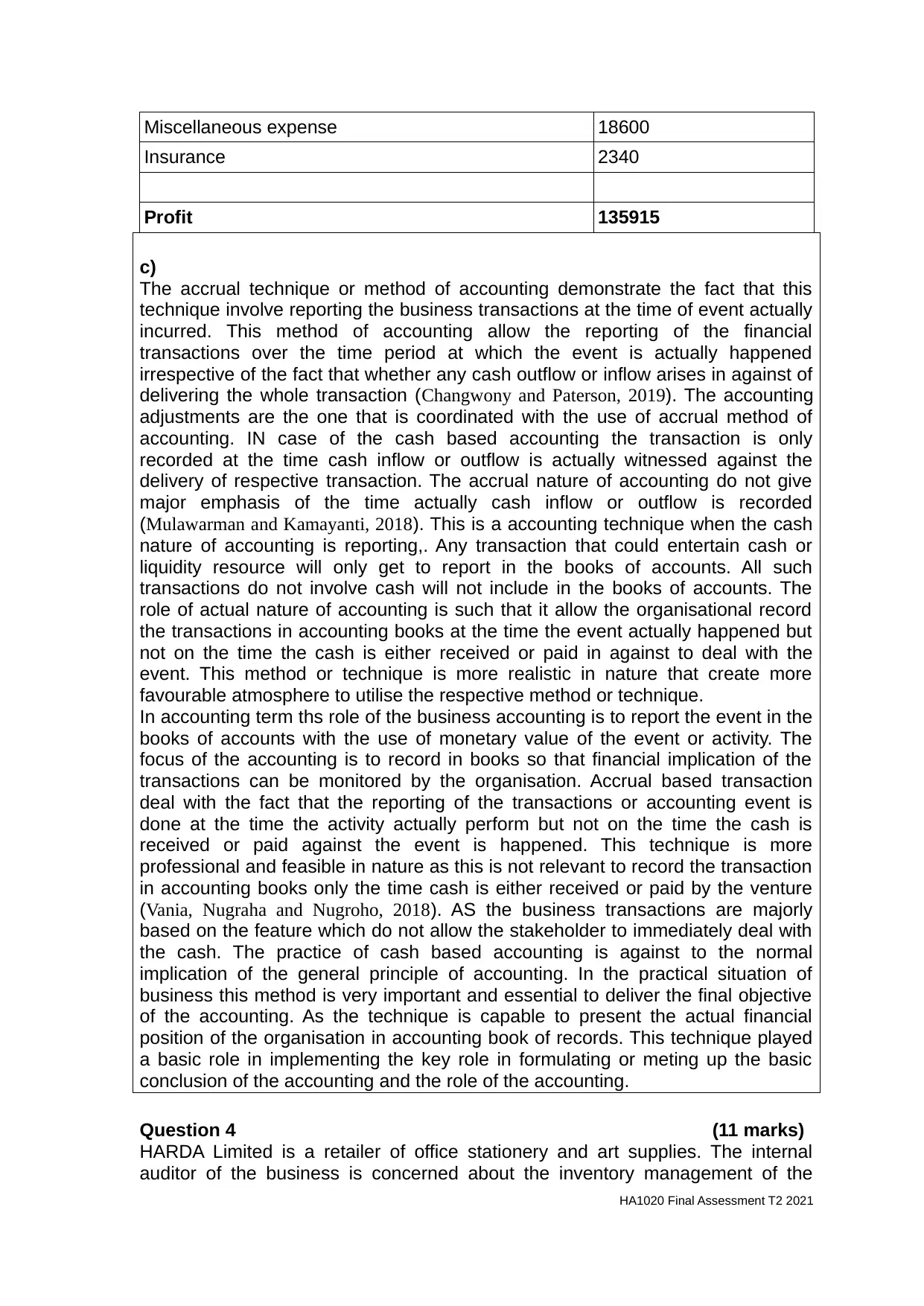

Question 4 (11 marks)

HARDA Limited is a retailer of office stationery and art supplies. The internal

auditor of the business is concerned about the inventory management of the

HA1020 Final Assessment T2 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

speciality pen (a product with the highest level of sale). The following information

is extracted from the records of HARDA Limited. The company uses the

perpetual inventory system to record the inventory of its products. Its monthly

reporting date is 30 October.

Date Purchased Sold Balance

1/10 600 @ 5.00

6/10 400 @ 5.20

15/10 800 @ 10

20/10 600@4.75

25/10 400@12

30/10 100 (Sales Return from 25/10 Sales)

Total 1000 1100

Required:

a) Complete the inventory stock record below for the speciality pen of HARDA

Limited. All transactions occurred in the month of October. Ignore GST. (7

marks)

b) Calculate the Cost of Sales (COS) for 30 October, assuming the FIFO

Method. (2 mark)

c) Calculate the Ending Inventory on 30 October, assuming the FIFO

Method. (2 mark)

(Note: please write your answers in by completing the table, as provided

below.)

Date Purchases Cost of Goods Sold

Unit

s

Unit

cost

Total

$

Unit

s

Unit

cost

Total

$

Units Unit

cost

Total

$

1/10 600 5 3000

6/10 400 5.20 2080 600 5 3000

400 5.20 2080

15/10 800 10 8000 200 5.20 1040

20/10 600 4.75 2850 200 5.20 1040

HA1020 Final Assessment T2 2021

is extracted from the records of HARDA Limited. The company uses the

perpetual inventory system to record the inventory of its products. Its monthly

reporting date is 30 October.

Date Purchased Sold Balance

1/10 600 @ 5.00

6/10 400 @ 5.20

15/10 800 @ 10

20/10 600@4.75

25/10 400@12

30/10 100 (Sales Return from 25/10 Sales)

Total 1000 1100

Required:

a) Complete the inventory stock record below for the speciality pen of HARDA

Limited. All transactions occurred in the month of October. Ignore GST. (7

marks)

b) Calculate the Cost of Sales (COS) for 30 October, assuming the FIFO

Method. (2 mark)

c) Calculate the Ending Inventory on 30 October, assuming the FIFO

Method. (2 mark)

(Note: please write your answers in by completing the table, as provided

below.)

Date Purchases Cost of Goods Sold

Unit

s

Unit

cost

Total

$

Unit

s

Unit

cost

Total

$

Units Unit

cost

Total

$

1/10 600 5 3000

6/10 400 5.20 2080 600 5 3000

400 5.20 2080

15/10 800 10 8000 200 5.20 1040

20/10 600 4.75 2850 200 5.20 1040

HA1020 Final Assessment T2 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

600 4.75 2850

25/10 400 12 4800 400 4.75 1900

30/10 -100 12 -1200 500 4.75 2375

ANSWER:

Calculation of Cost of Goods Sold assuming First in First Out Method

The cost of goods sold indicate the goods which is sold to the customers and any closing

inventory and sales return are not included in it. On the basis of above stock card, the

COGS for 30th October is as follows:

COGS = 800* 10 + 400* 12 – 100* 12

= 8000 + 4800 – 1200 = 11600

Calculation of Ending Inventory assuming FIFO method

The closing stock is a stock cost which remain in the business which means do not sold in

the market to the customers. The closing stock is recorded at cost or realizable value

whichever is lower. On the base of above stock card, the ending inventory are as follows:

Ending Stock = 500 * 4.75 = 2375

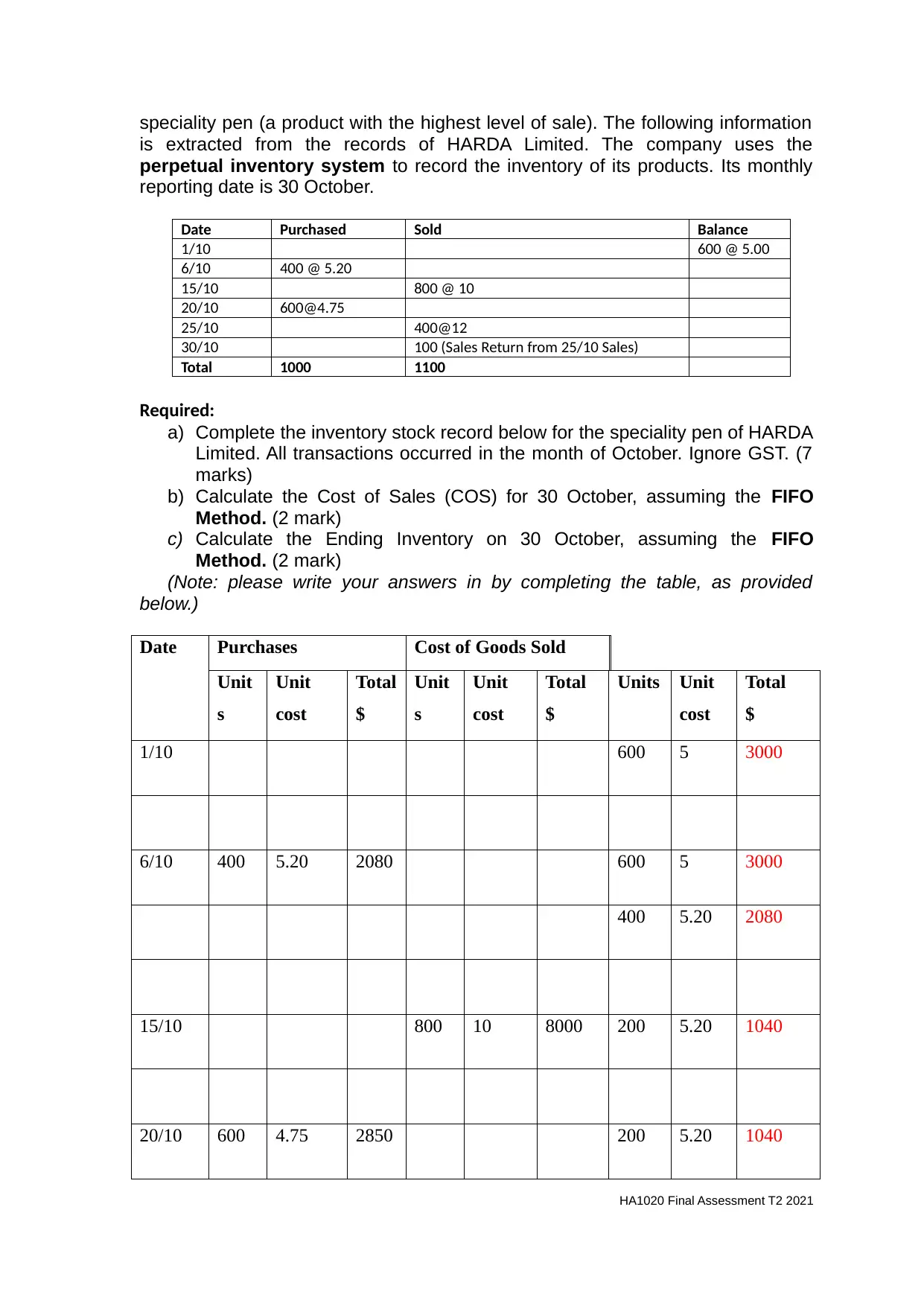

Question 5 (7 marks)

The accountant of Paul Shop Fitter Private Limited has provided the following

data on the Assets, Liabilities, Equity, Income and Expense amounts as at 30th

June 2021.

$ $

Equipment 221,800 Supplies 84,200

Prepaid Insurance 24,000 Cash in Bank 88,400

Accounts receivable 182,800 Accounts payable 101,100

Capital ? Bank loan 30,000

Service income 1,158,000 Salary expense 483,000

Advertising expense 15,000 Supplies expense 142,500

HA1020 Final Assessment T2 2021

25/10 400 12 4800 400 4.75 1900

30/10 -100 12 -1200 500 4.75 2375

ANSWER:

Calculation of Cost of Goods Sold assuming First in First Out Method

The cost of goods sold indicate the goods which is sold to the customers and any closing

inventory and sales return are not included in it. On the basis of above stock card, the

COGS for 30th October is as follows:

COGS = 800* 10 + 400* 12 – 100* 12

= 8000 + 4800 – 1200 = 11600

Calculation of Ending Inventory assuming FIFO method

The closing stock is a stock cost which remain in the business which means do not sold in

the market to the customers. The closing stock is recorded at cost or realizable value

whichever is lower. On the base of above stock card, the ending inventory are as follows:

Ending Stock = 500 * 4.75 = 2375

Question 5 (7 marks)

The accountant of Paul Shop Fitter Private Limited has provided the following

data on the Assets, Liabilities, Equity, Income and Expense amounts as at 30th

June 2021.

$ $

Equipment 221,800 Supplies 84,200

Prepaid Insurance 24,000 Cash in Bank 88,400

Accounts receivable 182,800 Accounts payable 101,100

Capital ? Bank loan 30,000

Service income 1,158,000 Salary expense 483,000

Advertising expense 15,000 Supplies expense 142,500

HA1020 Final Assessment T2 2021

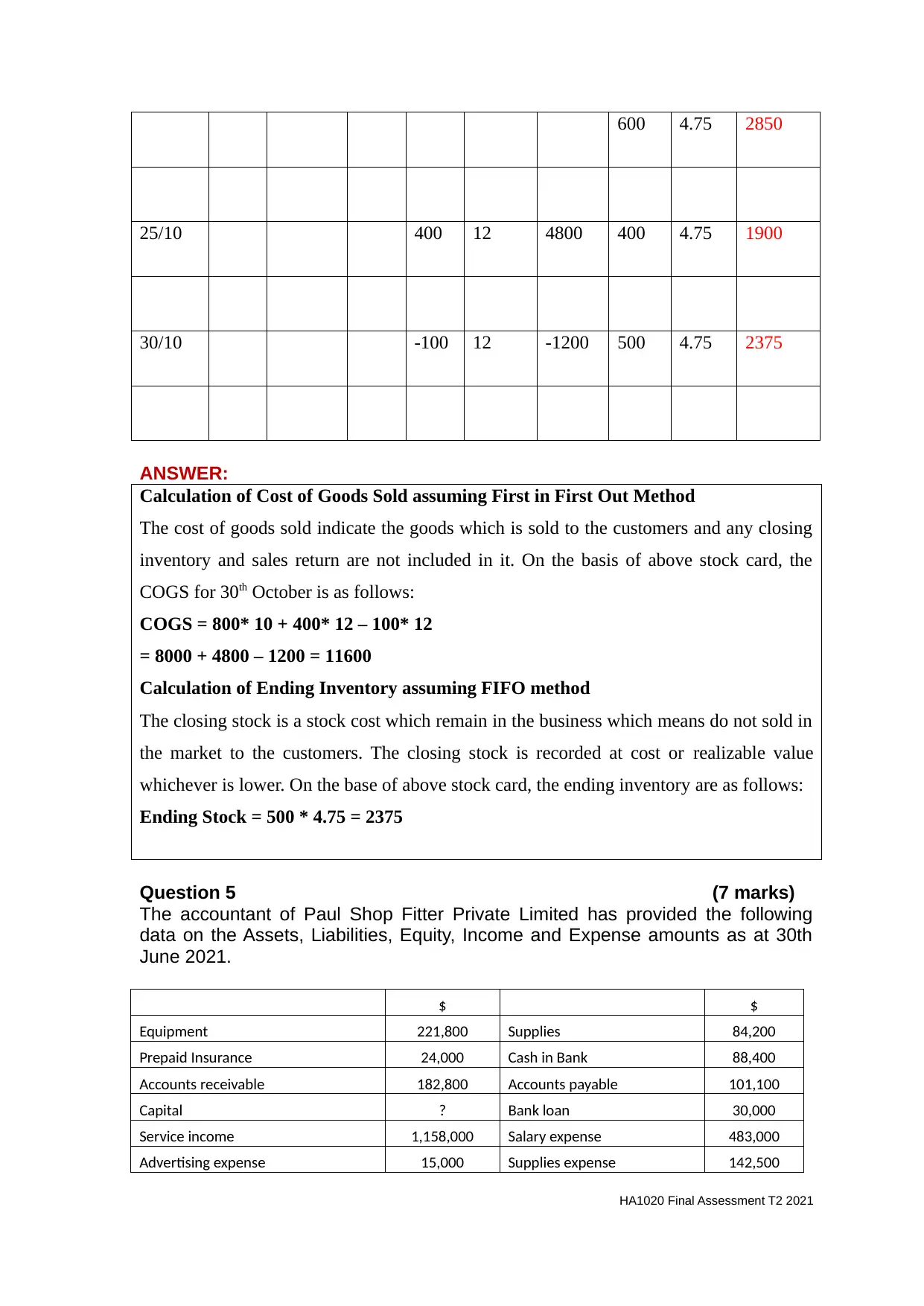

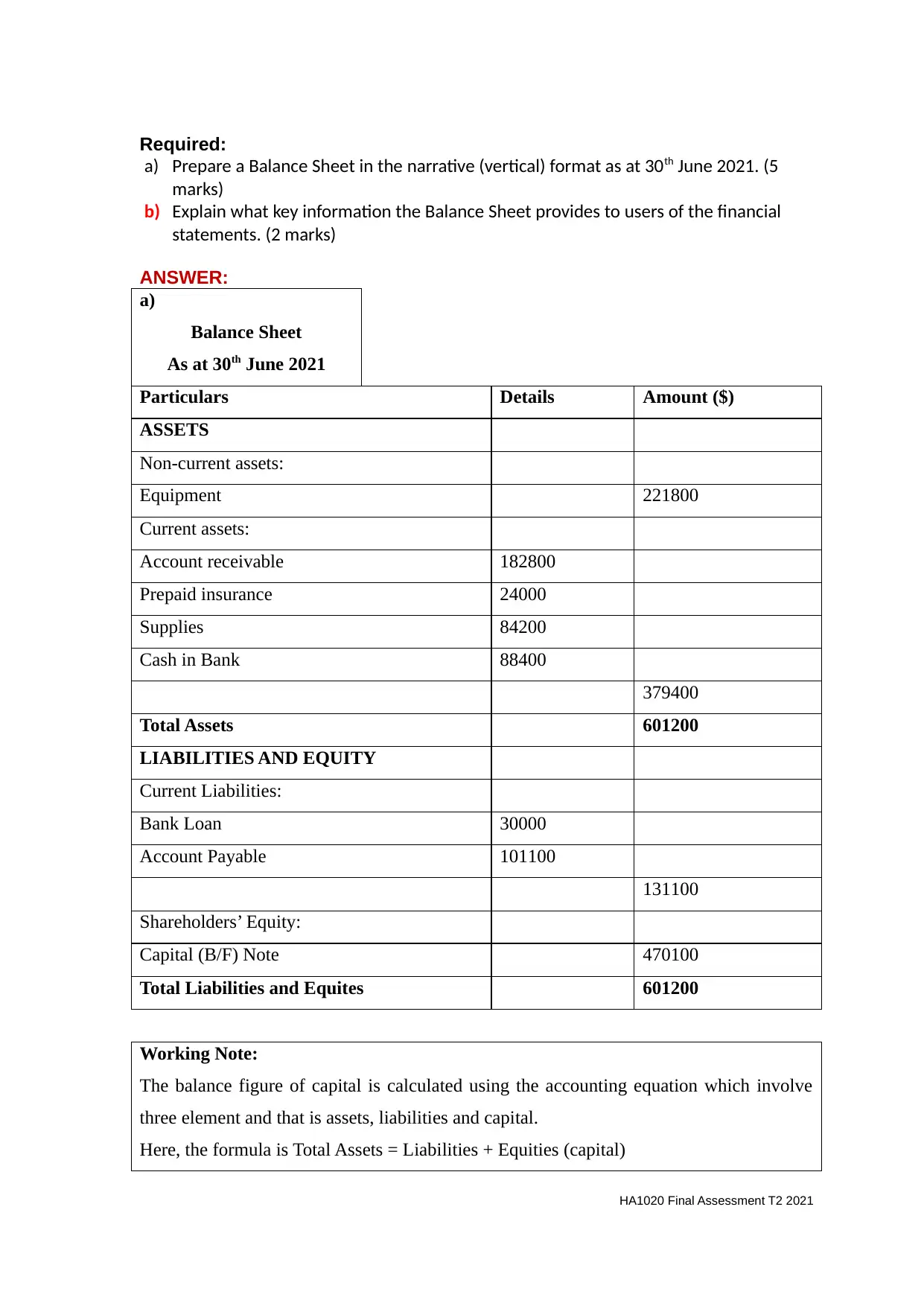

Required:

a) Prepare a Balance Sheet in the narrative (vertical) format as at 30th June 2021. (5

marks)

b) Explain what key information the Balance Sheet provides to users of the financial

statements. (2 marks)

ANSWER:

a)

Balance Sheet

As at 30th June 2021

Particulars Details Amount ($)

ASSETS

Non-current assets:

Equipment 221800

Current assets:

Account receivable 182800

Prepaid insurance 24000

Supplies 84200

Cash in Bank 88400

379400

Total Assets 601200

LIABILITIES AND EQUITY

Current Liabilities:

Bank Loan 30000

Account Payable 101100

131100

Shareholders’ Equity:

Capital (B/F) Note 470100

Total Liabilities and Equites 601200

Working Note:

The balance figure of capital is calculated using the accounting equation which involve

three element and that is assets, liabilities and capital.

Here, the formula is Total Assets = Liabilities + Equities (capital)

HA1020 Final Assessment T2 2021

a) Prepare a Balance Sheet in the narrative (vertical) format as at 30th June 2021. (5

marks)

b) Explain what key information the Balance Sheet provides to users of the financial

statements. (2 marks)

ANSWER:

a)

Balance Sheet

As at 30th June 2021

Particulars Details Amount ($)

ASSETS

Non-current assets:

Equipment 221800

Current assets:

Account receivable 182800

Prepaid insurance 24000

Supplies 84200

Cash in Bank 88400

379400

Total Assets 601200

LIABILITIES AND EQUITY

Current Liabilities:

Bank Loan 30000

Account Payable 101100

131100

Shareholders’ Equity:

Capital (B/F) Note 470100

Total Liabilities and Equites 601200

Working Note:

The balance figure of capital is calculated using the accounting equation which involve

three element and that is assets, liabilities and capital.

Here, the formula is Total Assets = Liabilities + Equities (capital)

HA1020 Final Assessment T2 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

b)

The key information provided by company’s balance sheet to the users of financial

statement are as follows:

Management of the company:

The balance sheet (BS) states the operational and financial management of the

company along with its debt issuances, dividend, capital expenditures etc. This helps the

users to identify that whether the company able to generate enough cash flows for their

smooth functioning of business or not. The management of the company generally

required the key information such as debt funding status, liquidity situation assessment,

trade receivable status, investment made in assets etc. This information is available in the

balance sheet of the company (Ševkušić, 2018). The working capital cycle of the

company is also measure through the financial position statement information. On this

basis, the company can adopt appropriate steps and strategy to improve this operating

cycle. Not only that, the user such as management also need to analyse the availability of

funds for the future expansion. The information related to availability of funds is shown in

the Cash and Bank balance item of current assets of balance sheet. That’s why it is stated

that BS has the large purpose for the management of the company because of the key

information it provided to the company. Along with that this also helpful for identifying

the investors of the company that the balance sheet is manipulated by the company or not

in order to show more profit and positive liquidity performance. This problem is identified

using BS.

Potential Investors of the company:

The key information such as earning available for equity shareholders, equity

shares, debts funds etc. of the balance sheet and other financial statement are use by the

investors of the company. They use this information to identify and analyse the financial

soundness of the company (Kausar and Lennox, 2017). For this, the uses the information

and data such as trends of the previous years and on that basis analyse whether investing

in such a company is profitable for them or not. Not only that, they also able to

understand the future potential growth of the company. The balance sheet specifies the

change in shareholders equity from one year to second year which further state that

whether company has issued more shares or buyback it for changing their capital

HA1020 Final Assessment T2 2021

The key information provided by company’s balance sheet to the users of financial

statement are as follows:

Management of the company:

The balance sheet (BS) states the operational and financial management of the

company along with its debt issuances, dividend, capital expenditures etc. This helps the

users to identify that whether the company able to generate enough cash flows for their

smooth functioning of business or not. The management of the company generally

required the key information such as debt funding status, liquidity situation assessment,

trade receivable status, investment made in assets etc. This information is available in the

balance sheet of the company (Ševkušić, 2018). The working capital cycle of the

company is also measure through the financial position statement information. On this

basis, the company can adopt appropriate steps and strategy to improve this operating

cycle. Not only that, the user such as management also need to analyse the availability of

funds for the future expansion. The information related to availability of funds is shown in

the Cash and Bank balance item of current assets of balance sheet. That’s why it is stated

that BS has the large purpose for the management of the company because of the key

information it provided to the company. Along with that this also helpful for identifying

the investors of the company that the balance sheet is manipulated by the company or not

in order to show more profit and positive liquidity performance. This problem is identified

using BS.

Potential Investors of the company:

The key information such as earning available for equity shareholders, equity

shares, debts funds etc. of the balance sheet and other financial statement are use by the

investors of the company. They use this information to identify and analyse the financial

soundness of the company (Kausar and Lennox, 2017). For this, the uses the information

and data such as trends of the previous years and on that basis analyse whether investing

in such a company is profitable for them or not. Not only that, they also able to

understand the future potential growth of the company. The balance sheet specifies the

change in shareholders equity from one year to second year which further state that

whether company has issued more shares or buyback it for changing their capital

HA1020 Final Assessment T2 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

structure. Along with that the information of the BS also helps the investor in their

decision-making regarding the acquisition of business and became their partnership for

expansion purpose.

Banks/financial institutions:

Balance sheet serves very critical purpose of making the decision for the Banks regarding

whether to lend money to the company or not. The balance sheet of the company states

the credit policy of the company which defines whether they pay their payment or due on

time or not (Kuzmenko and Shalimova, 2018). Not only that, on the basis of balance sheet

the company need to understand the sources of finance which indicate low cost of

acquisition. The current asset and current liability information available on the BS helps

the banks to analyse the ability of the company to repay its debts. Basically, the loans

provided by the banks to the company are fixed repayment in the form interest and

principal amount at maturity date. That’s why the users have to use the BS to know about

the capability of the company and deicide whether they are able to sustain and achieve

competitive advantage in the national and international market or not.

Potential Customers:

The potential customers or customers information is gathered by the users of

financial statement from the company’s balance sheet only. The BS state the debtors or

customers in current assets section from which the payment is due to the company. If this

data increases over the period of time despite increase in sales, then it means that

company have poor credit policy. The customers of the business can be individual or

company with whom they never want to destroy their relationship. The payment of

current liabilities only possible when the company receive their payment from customers

on time. The information about company’s loyal customer is also gathered from the

balance sheet. That’s why the company will do their own business analysis in which they

include company’s existing debt, current liquidity situation and other funds availability

(Mardani and Fallah, 2018). In order to improve the debtor’s payment of the company, it

is recommended that they have to provide discount facility to those customers who make

earlier payment. This helps the company to receive payment on time from the debtors and

improve the business efficiency. It is because the low and non-availability of cash will

stop the operational cycle of the business. The balance sheet is basically a statement

HA1020 Final Assessment T2 2021

decision-making regarding the acquisition of business and became their partnership for

expansion purpose.

Banks/financial institutions:

Balance sheet serves very critical purpose of making the decision for the Banks regarding

whether to lend money to the company or not. The balance sheet of the company states

the credit policy of the company which defines whether they pay their payment or due on

time or not (Kuzmenko and Shalimova, 2018). Not only that, on the basis of balance sheet

the company need to understand the sources of finance which indicate low cost of

acquisition. The current asset and current liability information available on the BS helps

the banks to analyse the ability of the company to repay its debts. Basically, the loans

provided by the banks to the company are fixed repayment in the form interest and

principal amount at maturity date. That’s why the users have to use the BS to know about

the capability of the company and deicide whether they are able to sustain and achieve

competitive advantage in the national and international market or not.

Potential Customers:

The potential customers or customers information is gathered by the users of

financial statement from the company’s balance sheet only. The BS state the debtors or

customers in current assets section from which the payment is due to the company. If this

data increases over the period of time despite increase in sales, then it means that

company have poor credit policy. The customers of the business can be individual or

company with whom they never want to destroy their relationship. The payment of

current liabilities only possible when the company receive their payment from customers

on time. The information about company’s loyal customer is also gathered from the

balance sheet. That’s why the company will do their own business analysis in which they

include company’s existing debt, current liquidity situation and other funds availability

(Mardani and Fallah, 2018). In order to improve the debtor’s payment of the company, it

is recommended that they have to provide discount facility to those customers who make

earlier payment. This helps the company to receive payment on time from the debtors and

improve the business efficiency. It is because the low and non-availability of cash will

stop the operational cycle of the business. The balance sheet is basically a statement

HA1020 Final Assessment T2 2021

which described the assets, liabilities and shareholders equities of the company in a

particular date. On this basis, the various internal and external user take appropriate and

profitable decisions.

Raw material supplier/Creditors:

The raw material suppliers of the company are the one who provide then stocks for

converting them into finished products. The creditors supply the goods to the company on

both cash and credit basis. This creditor shown in balance sheet indicate that this much

amount yet due be paid by the supplier. The creditors will change over the period of time

but in case if creditors increase with the unchanged and slight change in purchase than it

means that the credit worthiness of the company is very poor (Omondi, 2021). This need

to be improved by the company otherwise creditors will not supply goods to the company

on credit basis. In order to improve it the company can either give payment on time or can

pay interest on late payment. The creditors are the users of company’s financial statement

which get affected by this information available in the balance sheet. Thus, in order to

improve it they have to adopt the above mentioned two solutions.

Government Agencies/ Banking and stock market regulators:

The information about business ethics and financial position of the company are

also gathered from the statement of financial position. This state whether the company are

able to pay its bank loan or other financial institution along with the fixed payment to

debts on time or not. Along with that the banker can also use the information for analysing

credit worthiness of the company because bankers always do business with the public

deposits (De Boer, 2021). In case, if they do not get their payment back various of public

deposits get vanished which lastly affect the large public only. The public invest their

money in bank by keeping trust which bank cannot harm and destroy. The stock regulator

keeps their eye on businesses to know whether all information is disclosed by the

company in their balance sheet or not. It is because management in order to improve their

business performance do window dressing which means manipulation of accounts and

statements.

Question 6 (7 marks)

HA1020 Final Assessment T2 2021

particular date. On this basis, the various internal and external user take appropriate and

profitable decisions.

Raw material supplier/Creditors:

The raw material suppliers of the company are the one who provide then stocks for

converting them into finished products. The creditors supply the goods to the company on

both cash and credit basis. This creditor shown in balance sheet indicate that this much

amount yet due be paid by the supplier. The creditors will change over the period of time

but in case if creditors increase with the unchanged and slight change in purchase than it

means that the credit worthiness of the company is very poor (Omondi, 2021). This need

to be improved by the company otherwise creditors will not supply goods to the company

on credit basis. In order to improve it the company can either give payment on time or can

pay interest on late payment. The creditors are the users of company’s financial statement

which get affected by this information available in the balance sheet. Thus, in order to

improve it they have to adopt the above mentioned two solutions.

Government Agencies/ Banking and stock market regulators:

The information about business ethics and financial position of the company are

also gathered from the statement of financial position. This state whether the company are

able to pay its bank loan or other financial institution along with the fixed payment to

debts on time or not. Along with that the banker can also use the information for analysing

credit worthiness of the company because bankers always do business with the public

deposits (De Boer, 2021). In case, if they do not get their payment back various of public

deposits get vanished which lastly affect the large public only. The public invest their

money in bank by keeping trust which bank cannot harm and destroy. The stock regulator

keeps their eye on businesses to know whether all information is disclosed by the

company in their balance sheet or not. It is because management in order to improve their

business performance do window dressing which means manipulation of accounts and

statements.

Question 6 (7 marks)

HA1020 Final Assessment T2 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.