Unit 5 Accounting Principles: Standards, Ethics, and Regulations

VerifiedAdded on 2023/06/08

|14

|2569

|276

Report

AI Summary

This report provides an overview of accounting principles, standards, financial statements, and ethics, focusing on the role and purpose of accounting functions within an organization, specifically Brainlabs. It evaluates the main branches of accounting, including cost, management, auditing, and tax accounting, and discusses the role of technology in accounting systems. The report also addresses ethical issues, regulations, and compliance, highlighting potential conflicts of interest and the impact of unethical practices. Furthermore, it examines the significance of cash budgets in financial planning and control, emphasizing the importance of accurate financial reporting for organizational success. The document is available on Desklib, where students can find additional resources and solved assignments.

Learner Name ID

Programme Name Pearson BTEC

Higher National

Diploma in Business

Unit Number and Title Unit 5 – Accounting

Principles

Credit Value 15 Unit Level 4

Cohort Jan 22

Title

Part 1 Accounting

Principles.

Standards, Financial

Statements and

1

Programme Name Pearson BTEC

Higher National

Diploma in Business

Unit Number and Title Unit 5 – Accounting

Principles

Credit Value 15 Unit Level 4

Cohort Jan 22

Title

Part 1 Accounting

Principles.

Standards, Financial

Statements and

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Content

Assessment Part 1

1.0 Introduction 3

2.0 An examination of purpose of an accounting function within

an organization 3-4

3.0 A critical evaluation of the accounting function 5-6

4.0 Explanation of main branches of accounting 6-7

5.0 Accounting systems and the role of technology 7-8

6.0 Issues of ethics, regulations and compliance 8-9

7.0 CASH BUDGET 9-10

8.0 Conclusions 10

References 10-11

2

Assessment Part 1

1.0 Introduction 3

2.0 An examination of purpose of an accounting function within

an organization 3-4

3.0 A critical evaluation of the accounting function 5-6

4.0 Explanation of main branches of accounting 6-7

5.0 Accounting systems and the role of technology 7-8

6.0 Issues of ethics, regulations and compliance 8-9

7.0 CASH BUDGET 9-10

8.0 Conclusions 10

References 10-11

2

Part 1

1.0 Introduction

Write an Introduction to Management Accounting and the

principles of Management Accounting

In this report of accounting principles it discuss about the

standards which basically include the normal rules and regulation that

needed to be implemented and give instruction to the accountant at the

time of maintaining and transacting the financial documents. The main

goal and objective of accounting principles is to support the stability and

equalization of financial statement. Which assists the creditors, lenders

who give loan facility to the borrower and the investor who invest money

in potential organization(Abdulkareem, 2019). The group of systematic

accounting principles which has been given by the financial accounting

standards board (FASB). The company which is chosen form this report

is Brainlabs it is the information controlled marketing agency, which

mainly assist the firm to organize the marketing test- control through the

help of monitor, customer relationship officer and inquiry of London,

United Kingdom. In this case it basically include the importance of

accounting section and financial report and find how the budget strategy

and anticipation helps to predict future results and measure of

correctives to achieve the long term objectives of the organization.

2.0 An examination of purpose of an accounting function within

an organization

3

1.0 Introduction

Write an Introduction to Management Accounting and the

principles of Management Accounting

In this report of accounting principles it discuss about the

standards which basically include the normal rules and regulation that

needed to be implemented and give instruction to the accountant at the

time of maintaining and transacting the financial documents. The main

goal and objective of accounting principles is to support the stability and

equalization of financial statement. Which assists the creditors, lenders

who give loan facility to the borrower and the investor who invest money

in potential organization(Abdulkareem, 2019). The group of systematic

accounting principles which has been given by the financial accounting

standards board (FASB). The company which is chosen form this report

is Brainlabs it is the information controlled marketing agency, which

mainly assist the firm to organize the marketing test- control through the

help of monitor, customer relationship officer and inquiry of London,

United Kingdom. In this case it basically include the importance of

accounting section and financial report and find how the budget strategy

and anticipation helps to predict future results and measure of

correctives to achieve the long term objectives of the organization.

2.0 An examination of purpose of an accounting function within

an organization

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This accounting method is basically utilized for recording the

transactions of company, it operates and understanding the financial

information(Al Homsi, Sori and Asadov, 2020). The function of accounting is

similar to the big machine in which the organization give information

along with the raw materials and note whole firms transaction,

assessment activity, taxes and many more. It also explain about the

actual picture of financial situation of the business. In includes some few

points which are involved in accounting, the first part is maintaining the

books it is also known as accounting cycle. It is the process which is

measured to accept in data transactions because of same and relevant

financial documents. In bigger and shorter organizations, profit or non-

profit, private and public these kind of firms are induced by numbers.

Sales revenue, generating payrolls and maintaining inventory these all

are tracing and the capable leader know how to handle the commands of

those numbers it is very important but with no real purpose of accounting

it is nearly not possible. Firms choosing a good complete role of

accounting it needed to carry individual aspect of accounting after the

debit and credit.

The main goal for the accounting function is to keep the daily financial

proceedings. It also keep and confirm ll the types of monetary

information which involves projected expenses, capital

expenditures,donations, cash flows, utilities and salaries. It should

require to trace in every month.

There are some functions of accounting and its main objective in context

of firms Brainlabs which are as given below:

Keeping financial statements: It maintain a better and correct note

of day to day financial transactions of the firm Brainlabs (Altinay,

2020). This is UK based firm purchases, sales, trade receivables

4

transactions of company, it operates and understanding the financial

information(Al Homsi, Sori and Asadov, 2020). The function of accounting is

similar to the big machine in which the organization give information

along with the raw materials and note whole firms transaction,

assessment activity, taxes and many more. It also explain about the

actual picture of financial situation of the business. In includes some few

points which are involved in accounting, the first part is maintaining the

books it is also known as accounting cycle. It is the process which is

measured to accept in data transactions because of same and relevant

financial documents. In bigger and shorter organizations, profit or non-

profit, private and public these kind of firms are induced by numbers.

Sales revenue, generating payrolls and maintaining inventory these all

are tracing and the capable leader know how to handle the commands of

those numbers it is very important but with no real purpose of accounting

it is nearly not possible. Firms choosing a good complete role of

accounting it needed to carry individual aspect of accounting after the

debit and credit.

The main goal for the accounting function is to keep the daily financial

proceedings. It also keep and confirm ll the types of monetary

information which involves projected expenses, capital

expenditures,donations, cash flows, utilities and salaries. It should

require to trace in every month.

There are some functions of accounting and its main objective in context

of firms Brainlabs which are as given below:

Keeping financial statements: It maintain a better and correct note

of day to day financial transactions of the firm Brainlabs (Altinay,

2020). This is UK based firm purchases, sales, trade receivables

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and trade payable also the borrowings which helps the firm

accounting.

Near control of financial transaction: This organization function of

accounting is helpful for the accountant to get a complete relation

with payments in order of Brainlabs company and the trade

receivable earned by the company to ensure that its get the sales

revenue and left profits.

To make the financial documents: It mainly create the individual

types of financial documents in which whole accounting is needed.

The accounting function involve prepare monthly data, annually

and quarterly financial reports which are related to the assets of

Brainlabs company, the profit and losses of internal and external

stakeholders and its borrowings(Amel-Zadeh, Meeks and Meeks, 2020).

To make payable of bills: This function of accounting mainly helps

to confirming the accounts and to make ensure that bills are

adequately paid off and setting the payments dates or paying the

bills for the company. In which they have a duties to pay high for

the retailers and providers on a same date.

3.0 A critical evaluation of the accounting function

The purpose of accounting includes analyzing, reporting, recording

and measuring the financial activities of the company. This

objective of accounting mainly assist in creating to forecast the

budget, profit and loss and the balance sheet(Christianson and et.al.,

2021). It helps in reducing the expense, maximizing incomes and

analyze the upcoming expenditures.

Evaluating the accounting function which are as discussed below:

5

accounting.

Near control of financial transaction: This organization function of

accounting is helpful for the accountant to get a complete relation

with payments in order of Brainlabs company and the trade

receivable earned by the company to ensure that its get the sales

revenue and left profits.

To make the financial documents: It mainly create the individual

types of financial documents in which whole accounting is needed.

The accounting function involve prepare monthly data, annually

and quarterly financial reports which are related to the assets of

Brainlabs company, the profit and losses of internal and external

stakeholders and its borrowings(Amel-Zadeh, Meeks and Meeks, 2020).

To make payable of bills: This function of accounting mainly helps

to confirming the accounts and to make ensure that bills are

adequately paid off and setting the payments dates or paying the

bills for the company. In which they have a duties to pay high for

the retailers and providers on a same date.

3.0 A critical evaluation of the accounting function

The purpose of accounting includes analyzing, reporting, recording

and measuring the financial activities of the company. This

objective of accounting mainly assist in creating to forecast the

budget, profit and loss and the balance sheet(Christianson and et.al.,

2021). It helps in reducing the expense, maximizing incomes and

analyze the upcoming expenditures.

Evaluating the accounting function which are as discussed below:

5

Management of financial information: The organizational

function of accounting is basically helps to handle the day to

day financial activities in an appropriate manner. The daily

transaction includes sales, purchases, trade receivables and

payable.

Trade payable: This accounting function basically helps in

managing the payments date and payments of

vendor(Irsyadillah and Bayou, 2021). It also provide an assistance

for making the management salary and benefits of

employees on time.

Creating financial information: This accounting function

involve in creating the statements which includes profit/ loss

and balance sheet of the organization. It also helps in

maintaining the organizations past financial data and making

it achievable for operational task and the process of audit.

Analyzing the performance: This business of accounting

function is help financially in tracking the financial activities

also measure the financial performance of the organization.

It provide suggestions for increasing the productivity an

reducing the wastage of resources.

4.0 Explanation of main branches of accounting

The main branches of Accounting are as Follows-

Cost Accounting- It Includes evaluating and analyzing the cost

which the organization have occurred in offering of goods and

services to their customer called Cost Accounting. The main

objective of cost accounting is to control and manage the cost of

6

function of accounting is basically helps to handle the day to

day financial activities in an appropriate manner. The daily

transaction includes sales, purchases, trade receivables and

payable.

Trade payable: This accounting function basically helps in

managing the payments date and payments of

vendor(Irsyadillah and Bayou, 2021). It also provide an assistance

for making the management salary and benefits of

employees on time.

Creating financial information: This accounting function

involve in creating the statements which includes profit/ loss

and balance sheet of the organization. It also helps in

maintaining the organizations past financial data and making

it achievable for operational task and the process of audit.

Analyzing the performance: This business of accounting

function is help financially in tracking the financial activities

also measure the financial performance of the organization.

It provide suggestions for increasing the productivity an

reducing the wastage of resources.

4.0 Explanation of main branches of accounting

The main branches of Accounting are as Follows-

Cost Accounting- It Includes evaluating and analyzing the cost

which the organization have occurred in offering of goods and

services to their customer called Cost Accounting. The main

objective of cost accounting is to control and manage the cost of

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the business so that the organisation can increase their profit

margin.

Management Accounting- It helps the organization to provide

information to the management so that the manager of

organization can control Administration of the business. It also

helps the manager to take important decisions of the business.

Auditing- It is also a branch accounting where an outsider certified

public accountant have been appoint known as auditor to inspect

the books of account of the organization to see that the Account

are accurate or not and the money which they invest are invested

at right place or not(Sanada and Tokuga, 2019). If any type of fraud have

been detected by the Auditor then it is a responsibility of auditor to

tell about the fraud to the board of directors of the company.

Tax Accounting- It is a next main branch of Accounting this

accounting which is done by the accounts department of the

organization to know their tax liability and also helps in minimizing

the tax of the company. The main function of Tax Accounting are

preparing various tax returns and dealing with their legal

implications.

5.0 Accounting systems and the role of technology

Accounting system consist accounting process with integrated

procedure and controls. It helps the organization to record the business

transactions in a proper manner by the help of which the businesses can

make there decisions easily. To make a better accounting system

technology plays a major role. The role of technology in accounting

system are as follows-

7

margin.

Management Accounting- It helps the organization to provide

information to the management so that the manager of

organization can control Administration of the business. It also

helps the manager to take important decisions of the business.

Auditing- It is also a branch accounting where an outsider certified

public accountant have been appoint known as auditor to inspect

the books of account of the organization to see that the Account

are accurate or not and the money which they invest are invested

at right place or not(Sanada and Tokuga, 2019). If any type of fraud have

been detected by the Auditor then it is a responsibility of auditor to

tell about the fraud to the board of directors of the company.

Tax Accounting- It is a next main branch of Accounting this

accounting which is done by the accounts department of the

organization to know their tax liability and also helps in minimizing

the tax of the company. The main function of Tax Accounting are

preparing various tax returns and dealing with their legal

implications.

5.0 Accounting systems and the role of technology

Accounting system consist accounting process with integrated

procedure and controls. It helps the organization to record the business

transactions in a proper manner by the help of which the businesses can

make there decisions easily. To make a better accounting system

technology plays a major role. The role of technology in accounting

system are as follows-

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accessibility of Accounting Data- By the help of technology the licensed

users can easily access the their accounting data any time any where

without any difficulty which also saves the time of the organization.

Accurate Data- By the help of technology the accuracy of data is also

improved through which the companies can get their financial position in

the market.

Better Decision Making- The next major role of technology is that it helps

in better decision making because the financial document which they

use are accurate and verified so that the companies can get their target

easily.

Automated Data Entry- There are many accounting software like tally

erp.9, SAP, Busy etc. which are used by the companies to get their

financial position and by the help of these software the companies can

get many information and calculations easily like invoicing, payments

and payroll services etc.

6.0 Issues of ethics, regulations and compliance

It can be define as finding out of comparison between the right and

wrong. It means that the company or organization have to do their

work with honesty which means without any bad intention. If any

firm or company doing their operation ethically then, their

operations will run smoothly and efficiently (Tsuji, 2020). The firm

Brainlabs also do their work ethically until they can good profit for

themselves, but when the firm start facing losses they start their

operation unethically. Some unethical works done by the Brainlabs

are as follows-

Influence or change the Figures- The brain lab firm start changing

their figure in the accounts by putting pressure on the accounts

8

users can easily access the their accounting data any time any where

without any difficulty which also saves the time of the organization.

Accurate Data- By the help of technology the accuracy of data is also

improved through which the companies can get their financial position in

the market.

Better Decision Making- The next major role of technology is that it helps

in better decision making because the financial document which they

use are accurate and verified so that the companies can get their target

easily.

Automated Data Entry- There are many accounting software like tally

erp.9, SAP, Busy etc. which are used by the companies to get their

financial position and by the help of these software the companies can

get many information and calculations easily like invoicing, payments

and payroll services etc.

6.0 Issues of ethics, regulations and compliance

It can be define as finding out of comparison between the right and

wrong. It means that the company or organization have to do their

work with honesty which means without any bad intention. If any

firm or company doing their operation ethically then, their

operations will run smoothly and efficiently (Tsuji, 2020). The firm

Brainlabs also do their work ethically until they can good profit for

themselves, but when the firm start facing losses they start their

operation unethically. Some unethical works done by the Brainlabs

are as follows-

Influence or change the Figures- The brain lab firm start changing

their figure in the accounts by putting pressure on the accounts

8

department so that they can show the profit to the investors attract

them towards there firm.

Conflict of interest- There is a conflict of interest raise between the

investors and the firm after the completion of auditing because the

investors find out that the organization have change their figures to

attract them which bring issues in the firm and it can also lead to

shutdown of their business.

Lack of productivity- Due to wrong accounting information the

productivity of the firm also get affected because the Branlab firm

is not able to find out the right strategies which can help them to

get their position back in the market.

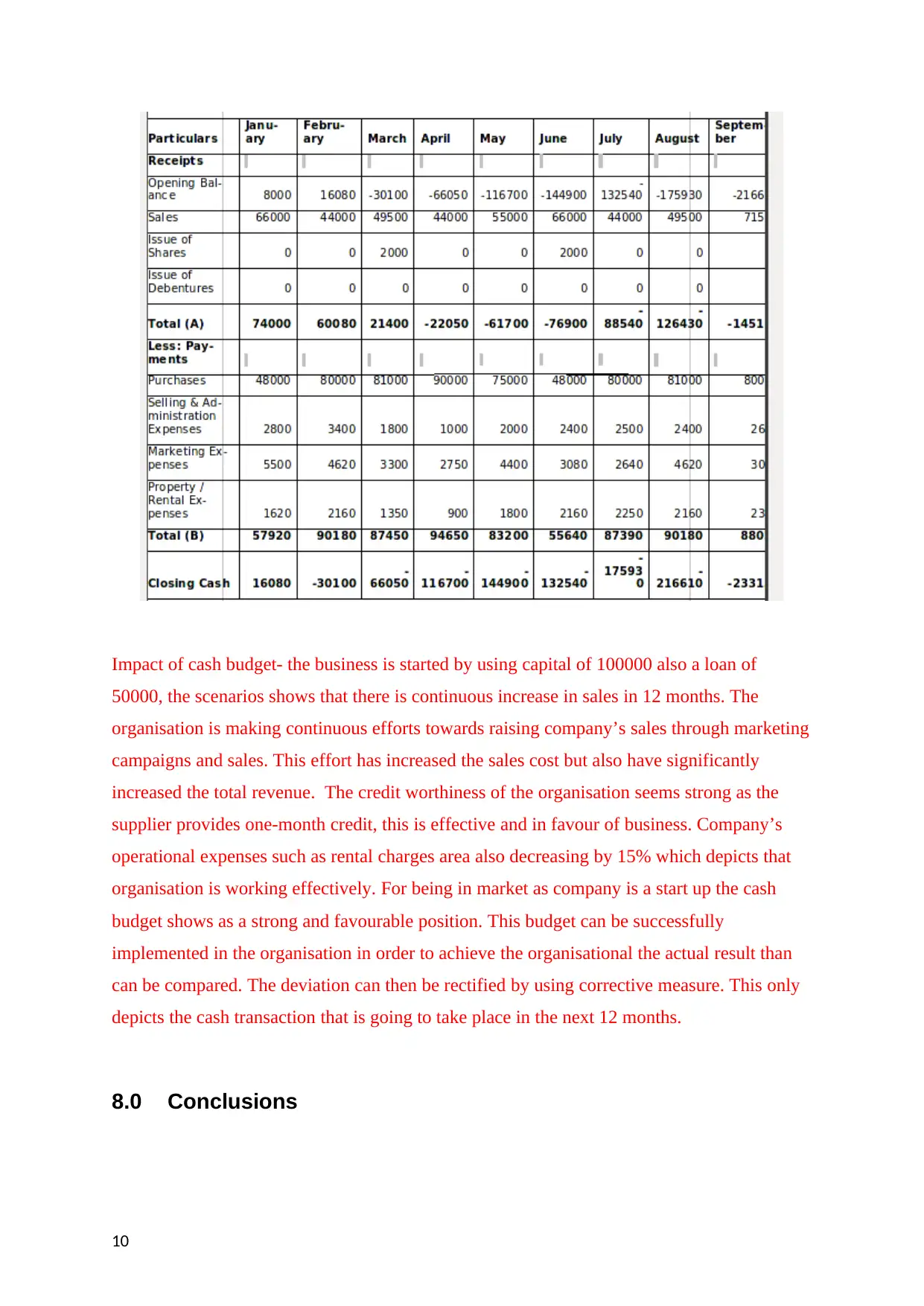

7.0 CASH BUDGET

This financial document of the firm shows all the cash related

transactions. In this report firm keeping all the money based

incomes and expenditures and it also how that how well a

company maintain its cash transactions. It also involve three

significant components of the statement like operating, investing

and financing activity.

9

them towards there firm.

Conflict of interest- There is a conflict of interest raise between the

investors and the firm after the completion of auditing because the

investors find out that the organization have change their figures to

attract them which bring issues in the firm and it can also lead to

shutdown of their business.

Lack of productivity- Due to wrong accounting information the

productivity of the firm also get affected because the Branlab firm

is not able to find out the right strategies which can help them to

get their position back in the market.

7.0 CASH BUDGET

This financial document of the firm shows all the cash related

transactions. In this report firm keeping all the money based

incomes and expenditures and it also how that how well a

company maintain its cash transactions. It also involve three

significant components of the statement like operating, investing

and financing activity.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Impact of cash budget- the business is started by using capital of 100000 also a loan of

50000, the scenarios shows that there is continuous increase in sales in 12 months. The

organisation is making continuous efforts towards raising company’s sales through marketing

campaigns and sales. This effort has increased the sales cost but also have significantly

increased the total revenue. The credit worthiness of the organisation seems strong as the

supplier provides one-month credit, this is effective and in favour of business. Company’s

operational expenses such as rental charges area also decreasing by 15% which depicts that

organisation is working effectively. For being in market as company is a start up the cash

budget shows as a strong and favourable position. This budget can be successfully

implemented in the organisation in order to achieve the organisational the actual result than

can be compared. The deviation can then be rectified by using corrective measure. This only

depicts the cash transaction that is going to take place in the next 12 months.

8.0 Conclusions

10

50000, the scenarios shows that there is continuous increase in sales in 12 months. The

organisation is making continuous efforts towards raising company’s sales through marketing

campaigns and sales. This effort has increased the sales cost but also have significantly

increased the total revenue. The credit worthiness of the organisation seems strong as the

supplier provides one-month credit, this is effective and in favour of business. Company’s

operational expenses such as rental charges area also decreasing by 15% which depicts that

organisation is working effectively. For being in market as company is a start up the cash

budget shows as a strong and favourable position. This budget can be successfully

implemented in the organisation in order to achieve the organisational the actual result than

can be compared. The deviation can then be rectified by using corrective measure. This only

depicts the cash transaction that is going to take place in the next 12 months.

8.0 Conclusions

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As it is concluded from the above report that the standards of

accounting play a very significant role in a firm and it give lead to

maximize the profitable situation and development of the

organization. The departments of accounting maintain the

documents of all financial tasks and transfer them in financial

reports. There are some multiple components which influence the

daily assessment of the firm and the effect can be directly based

upon the components. This report utilize some various corrective

analysis and the activity recommended to the firm Brainlabs which

assist in accomplishing the upcoming future objectives. An

estimated cash of one year is ready with the assistance of historic

information to analyze the futuristic results of the organization.

References

Abdulkareem, M.D., 2019. Impact of Ethical Codes on Professional Accounting Practices in

Nigeria: Professional Accountants Perceptions (Doctoral dissertation, Kwara State

University (Nigeria)).

Al Homsi, M., Sori, Z.M. and Asadov, A., 2020. Accounting for musharakah mutanaqisah

home financing. CONTEMPORARY ISSUES IN FINANCIAL REPORTING OF

ISLAMIC FINANCIAL INSTITUTIONS (Penerbit UMK).

Altinay, A.T., 2020. Institutional Convergence in European Union Member States: The

Evoluation of the International Accounting and Auditing Standarts. In Handbook of

Research on Social and Economic Development in the European Union (pp. 288-

308). IGI Global.

Amel-Zadeh, A., Meeks, G. and Meeks, J.G., 2020. An outline of issues in accounting for

M&A 1. In Accounting for M&A (pp. 13-41). Routledge.

Christianson, M.S., and et.al., 2021. Financial fluency: demystifying accounting and business

planning for the reproductive medicine specialist. Fertility and sterility. 115(1).

pp.7-16.

Irsyadillah, I. and Bayou, M.S.M., 2021. An institutional perspective on the selection and use

of accounting textbooks: the case of universities in Indonesia. Meditari Accountancy

Research.

Sanada, M. and Tokuga, Y., 2019. Accounting Regulation in Japan: Evolution and

Development from 2001 to 2015. Routledge.

11

accounting play a very significant role in a firm and it give lead to

maximize the profitable situation and development of the

organization. The departments of accounting maintain the

documents of all financial tasks and transfer them in financial

reports. There are some multiple components which influence the

daily assessment of the firm and the effect can be directly based

upon the components. This report utilize some various corrective

analysis and the activity recommended to the firm Brainlabs which

assist in accomplishing the upcoming future objectives. An

estimated cash of one year is ready with the assistance of historic

information to analyze the futuristic results of the organization.

References

Abdulkareem, M.D., 2019. Impact of Ethical Codes on Professional Accounting Practices in

Nigeria: Professional Accountants Perceptions (Doctoral dissertation, Kwara State

University (Nigeria)).

Al Homsi, M., Sori, Z.M. and Asadov, A., 2020. Accounting for musharakah mutanaqisah

home financing. CONTEMPORARY ISSUES IN FINANCIAL REPORTING OF

ISLAMIC FINANCIAL INSTITUTIONS (Penerbit UMK).

Altinay, A.T., 2020. Institutional Convergence in European Union Member States: The

Evoluation of the International Accounting and Auditing Standarts. In Handbook of

Research on Social and Economic Development in the European Union (pp. 288-

308). IGI Global.

Amel-Zadeh, A., Meeks, G. and Meeks, J.G., 2020. An outline of issues in accounting for

M&A 1. In Accounting for M&A (pp. 13-41). Routledge.

Christianson, M.S., and et.al., 2021. Financial fluency: demystifying accounting and business

planning for the reproductive medicine specialist. Fertility and sterility. 115(1).

pp.7-16.

Irsyadillah, I. and Bayou, M.S.M., 2021. An institutional perspective on the selection and use

of accounting textbooks: the case of universities in Indonesia. Meditari Accountancy

Research.

Sanada, M. and Tokuga, Y., 2019. Accounting Regulation in Japan: Evolution and

Development from 2001 to 2015. Routledge.

11

Tsuji, M., 2020. The social psychology of Cryptocurrency: Do accounting standard-setters

understand the users?. International Journal of Systems and Service-Oriented

Engineering (IJSSOE). 10(2). pp.1-12.

Table of Content

Assessment Part 2

Section B:

Detailed letter to client p

Financial Statements p

i] Profit & Loss Account p

ii] Balance Sheet p

Ratio Analysis p

Conclusion p

Recommendations p

References p

12

understand the users?. International Journal of Systems and Service-Oriented

Engineering (IJSSOE). 10(2). pp.1-12.

Table of Content

Assessment Part 2

Section B:

Detailed letter to client p

Financial Statements p

i] Profit & Loss Account p

ii] Balance Sheet p

Ratio Analysis p

Conclusion p

Recommendations p

References p

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.