Comprehensive Accounting: Journal Entries and Financial Analysis

VerifiedAdded on 2023/06/12

|12

|1901

|411

Homework Assignment

AI Summary

This accounting assignment solution includes journal entries, income statement preparation, and balance sheet presentation. It covers topics such as bad debt expenses, accounts receivable management, and different depreciation methods for assets like trucks. The assignment also compares perpetual and periodic inventory systems, detailing the journal entries and income statement variations for each method, including scenarios with damaged or lost inventory. The solution provides a comprehensive overview of financial accounting principles and their practical application.

Running head: ACCOUNTING

Accounting

Name of the Student:

Name of the University:

Author’s Note:

Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING

Table of Contents

Question 4:.......................................................................................................................................2

Requirement B.............................................................................................................................2

Question 5........................................................................................................................................5

Requirement A.............................................................................................................................5

Requirement B – Journal Entries.................................................................................................6

Journal Entries.............................................................................................................................7

Question 6........................................................................................................................................8

Requirement A.............................................................................................................................8

Reference list:................................................................................................................................11

ACCOUNTING

Table of Contents

Question 4:.......................................................................................................................................2

Requirement B.............................................................................................................................2

Question 5........................................................................................................................................5

Requirement A.............................................................................................................................5

Requirement B – Journal Entries.................................................................................................6

Journal Entries.............................................................................................................................7

Question 6........................................................................................................................................8

Requirement A.............................................................................................................................8

Reference list:................................................................................................................................11

2

ACCOUNTING

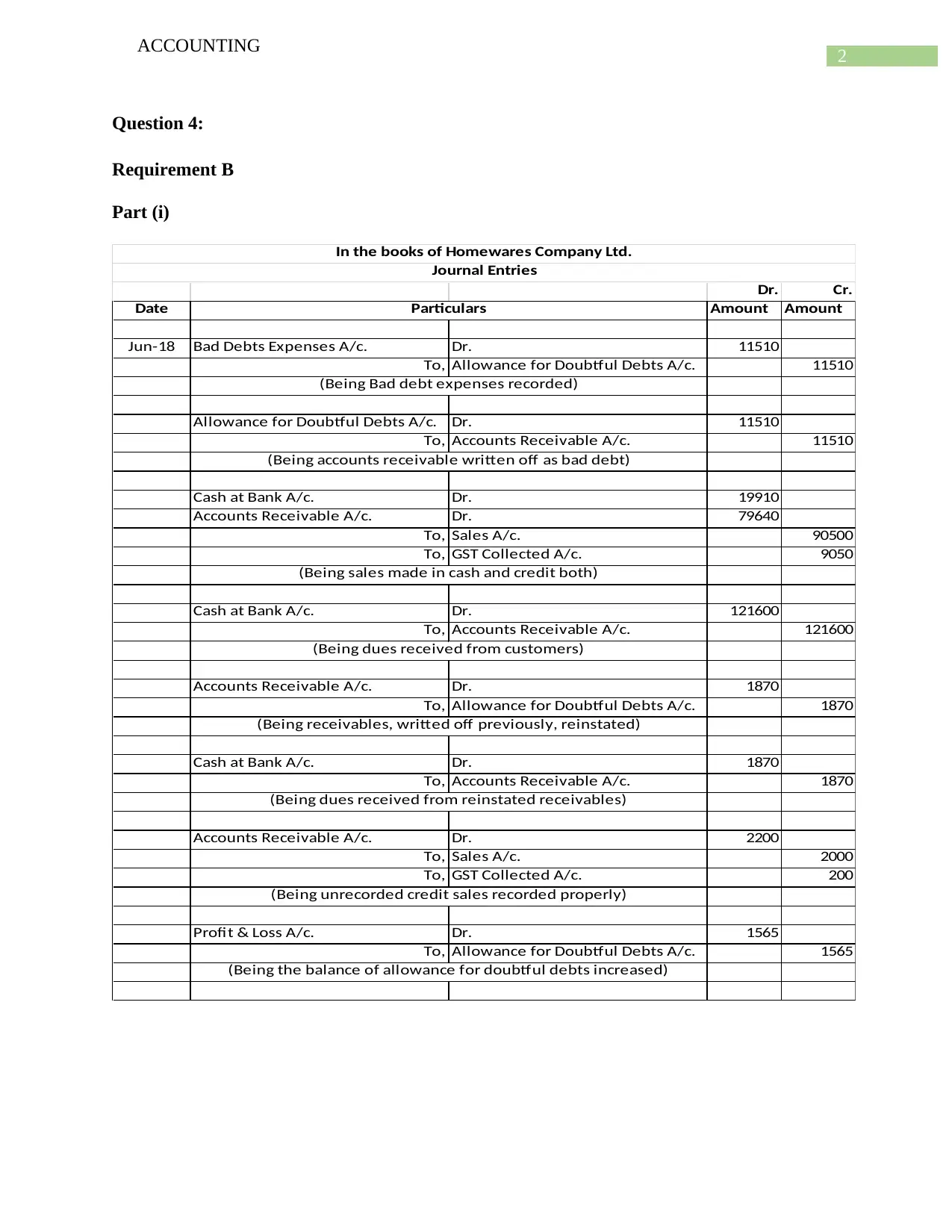

Question 4:

Requirement B

Part (i)

Dr. Cr.

Date Amount Amount

Jun-18 Bad Debts Expenses A/c. Dr. 11510

To, Allowance for Doubtful Debts A/c. 11510

Allowance for Doubtful Debts A/c. Dr. 11510

To, Accounts Receivable A/c. 11510

Cash at Bank A/c. Dr. 19910

Accounts Receivable A/c. Dr. 79640

To, Sales A/c. 90500

To, GST Collected A/c. 9050

Cash at Bank A/c. Dr. 121600

To, Accounts Receivable A/c. 121600

Accounts Receivable A/c. Dr. 1870

To, Allowance for Doubtful Debts A/c. 1870

Cash at Bank A/c. Dr. 1870

To, Accounts Receivable A/c. 1870

Accounts Receivable A/c. Dr. 2200

To, Sales A/c. 2000

To, GST Collected A/c. 200

Profit & Loss A/c. Dr. 1565

To, Allowance for Doubtful Debts A/c. 1565

Journal Entries

(Being the balance of allowance for doubtful debts increased)

Particulars

(Being Bad debt expenses recorded)

(Being accounts receivable written off as bad debt)

(Being sales made in cash and credit both)

(Being dues received from customers)

(Being receivables, writted off previously, reinstated)

(Being dues received from reinstated receivables)

(Being unrecorded credit sales recorded properly)

In the books of Homewares Company Ltd.

ACCOUNTING

Question 4:

Requirement B

Part (i)

Dr. Cr.

Date Amount Amount

Jun-18 Bad Debts Expenses A/c. Dr. 11510

To, Allowance for Doubtful Debts A/c. 11510

Allowance for Doubtful Debts A/c. Dr. 11510

To, Accounts Receivable A/c. 11510

Cash at Bank A/c. Dr. 19910

Accounts Receivable A/c. Dr. 79640

To, Sales A/c. 90500

To, GST Collected A/c. 9050

Cash at Bank A/c. Dr. 121600

To, Accounts Receivable A/c. 121600

Accounts Receivable A/c. Dr. 1870

To, Allowance for Doubtful Debts A/c. 1870

Cash at Bank A/c. Dr. 1870

To, Accounts Receivable A/c. 1870

Accounts Receivable A/c. Dr. 2200

To, Sales A/c. 2000

To, GST Collected A/c. 200

Profit & Loss A/c. Dr. 1565

To, Allowance for Doubtful Debts A/c. 1565

Journal Entries

(Being the balance of allowance for doubtful debts increased)

Particulars

(Being Bad debt expenses recorded)

(Being accounts receivable written off as bad debt)

(Being sales made in cash and credit both)

(Being dues received from customers)

(Being receivables, writted off previously, reinstated)

(Being dues received from reinstated receivables)

(Being unrecorded credit sales recorded properly)

In the books of Homewares Company Ltd.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING

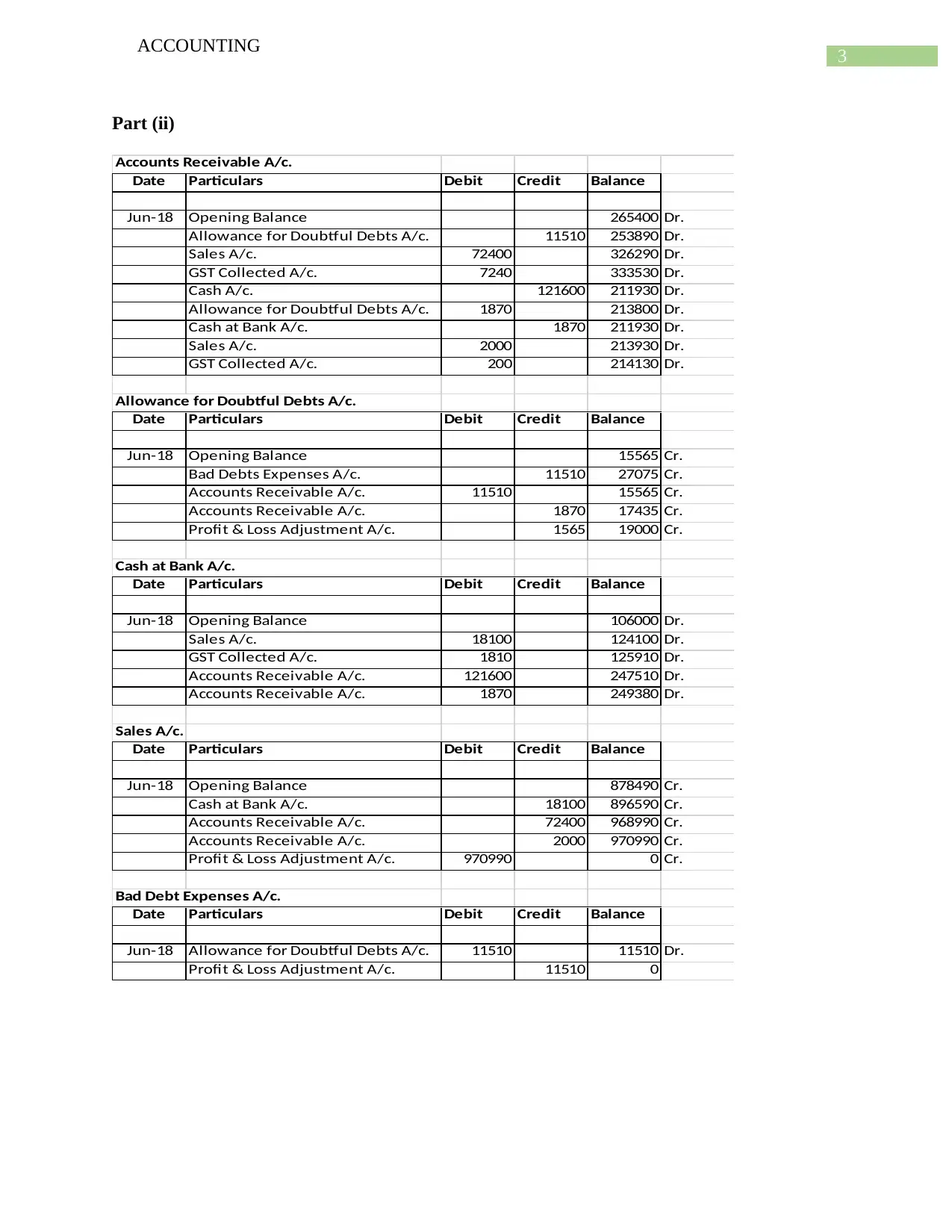

Part (ii)

Accounts Receivable A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 265400 Dr.

Allowance for Doubtful Debts A/c. 11510 253890 Dr.

Sales A/c. 72400 326290 Dr.

GST Collected A/c. 7240 333530 Dr.

Cash A/c. 121600 211930 Dr.

Allowance for Doubtful Debts A/c. 1870 213800 Dr.

Cash at Bank A/c. 1870 211930 Dr.

Sales A/c. 2000 213930 Dr.

GST Collected A/c. 200 214130 Dr.

Allowance for Doubtful Debts A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 15565 Cr.

Bad Debts Expenses A/c. 11510 27075 Cr.

Accounts Receivable A/c. 11510 15565 Cr.

Accounts Receivable A/c. 1870 17435 Cr.

Profit & Loss Adjustment A/c. 1565 19000 Cr.

Cash at Bank A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 106000 Dr.

Sales A/c. 18100 124100 Dr.

GST Collected A/c. 1810 125910 Dr.

Accounts Receivable A/c. 121600 247510 Dr.

Accounts Receivable A/c. 1870 249380 Dr.

Sales A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 878490 Cr.

Cash at Bank A/c. 18100 896590 Cr.

Accounts Receivable A/c. 72400 968990 Cr.

Accounts Receivable A/c. 2000 970990 Cr.

Profit & Loss Adjustment A/c. 970990 0 Cr.

Bad Debt Expenses A/c.

Date Particulars Debit Credit Balance

Jun-18 Allowance for Doubtful Debts A/c. 11510 11510 Dr.

Profit & Loss Adjustment A/c. 11510 0

ACCOUNTING

Part (ii)

Accounts Receivable A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 265400 Dr.

Allowance for Doubtful Debts A/c. 11510 253890 Dr.

Sales A/c. 72400 326290 Dr.

GST Collected A/c. 7240 333530 Dr.

Cash A/c. 121600 211930 Dr.

Allowance for Doubtful Debts A/c. 1870 213800 Dr.

Cash at Bank A/c. 1870 211930 Dr.

Sales A/c. 2000 213930 Dr.

GST Collected A/c. 200 214130 Dr.

Allowance for Doubtful Debts A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 15565 Cr.

Bad Debts Expenses A/c. 11510 27075 Cr.

Accounts Receivable A/c. 11510 15565 Cr.

Accounts Receivable A/c. 1870 17435 Cr.

Profit & Loss Adjustment A/c. 1565 19000 Cr.

Cash at Bank A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 106000 Dr.

Sales A/c. 18100 124100 Dr.

GST Collected A/c. 1810 125910 Dr.

Accounts Receivable A/c. 121600 247510 Dr.

Accounts Receivable A/c. 1870 249380 Dr.

Sales A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 878490 Cr.

Cash at Bank A/c. 18100 896590 Cr.

Accounts Receivable A/c. 72400 968990 Cr.

Accounts Receivable A/c. 2000 970990 Cr.

Profit & Loss Adjustment A/c. 970990 0 Cr.

Bad Debt Expenses A/c.

Date Particulars Debit Credit Balance

Jun-18 Allowance for Doubtful Debts A/c. 11510 11510 Dr.

Profit & Loss Adjustment A/c. 11510 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING

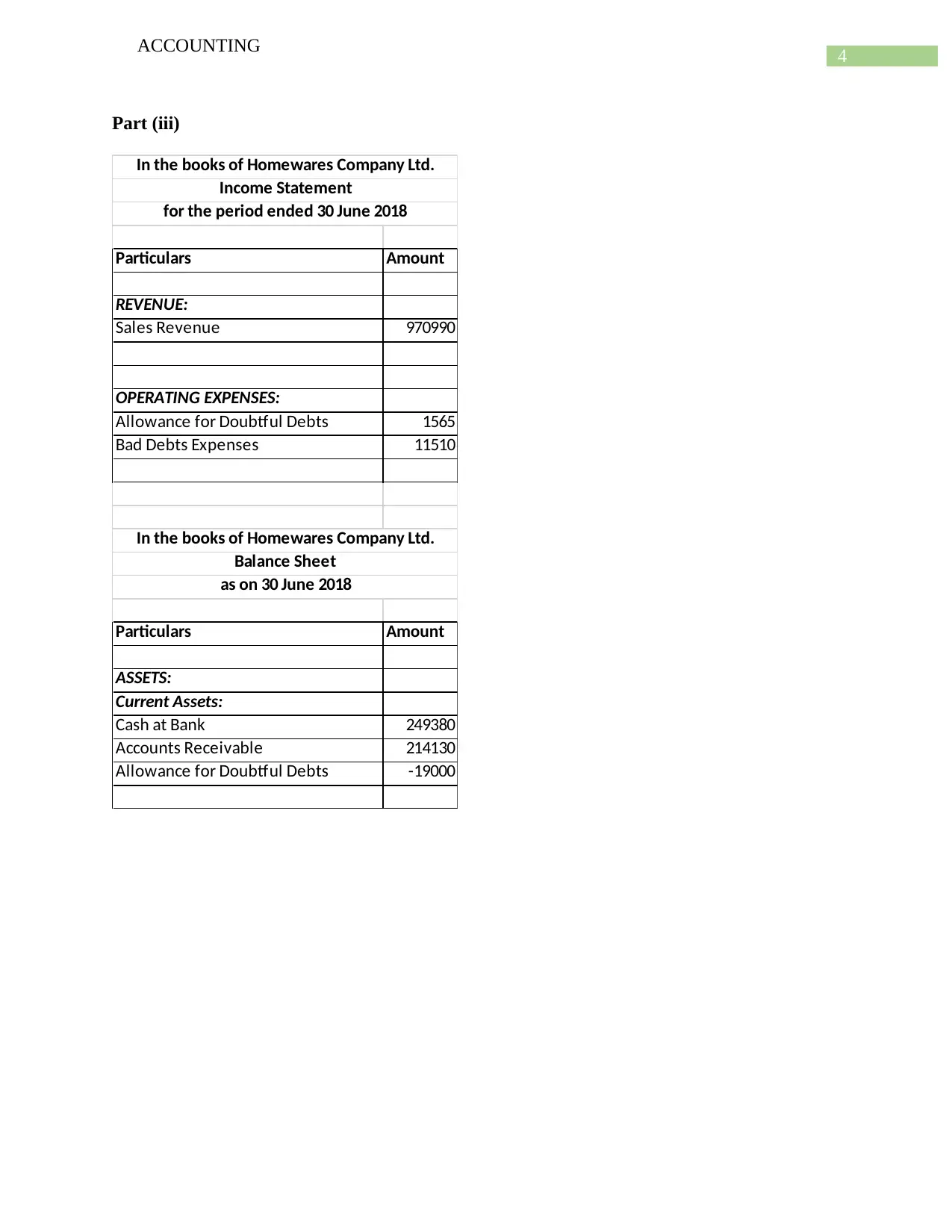

Part (iii)

Particulars Amount

REVENUE:

Sales Revenue 970990

OPERATING EXPENSES:

Allowance for Doubtful Debts 1565

Bad Debts Expenses 11510

Particulars Amount

ASSETS:

Current Assets:

Cash at Bank 249380

Accounts Receivable 214130

Allowance for Doubtful Debts -19000

In the books of Homewares Company Ltd.

Income Statement

for the period ended 30 June 2018

In the books of Homewares Company Ltd.

Balance Sheet

as on 30 June 2018

ACCOUNTING

Part (iii)

Particulars Amount

REVENUE:

Sales Revenue 970990

OPERATING EXPENSES:

Allowance for Doubtful Debts 1565

Bad Debts Expenses 11510

Particulars Amount

ASSETS:

Current Assets:

Cash at Bank 249380

Accounts Receivable 214130

Allowance for Doubtful Debts -19000

In the books of Homewares Company Ltd.

Income Statement

for the period ended 30 June 2018

In the books of Homewares Company Ltd.

Balance Sheet

as on 30 June 2018

5

ACCOUNTING

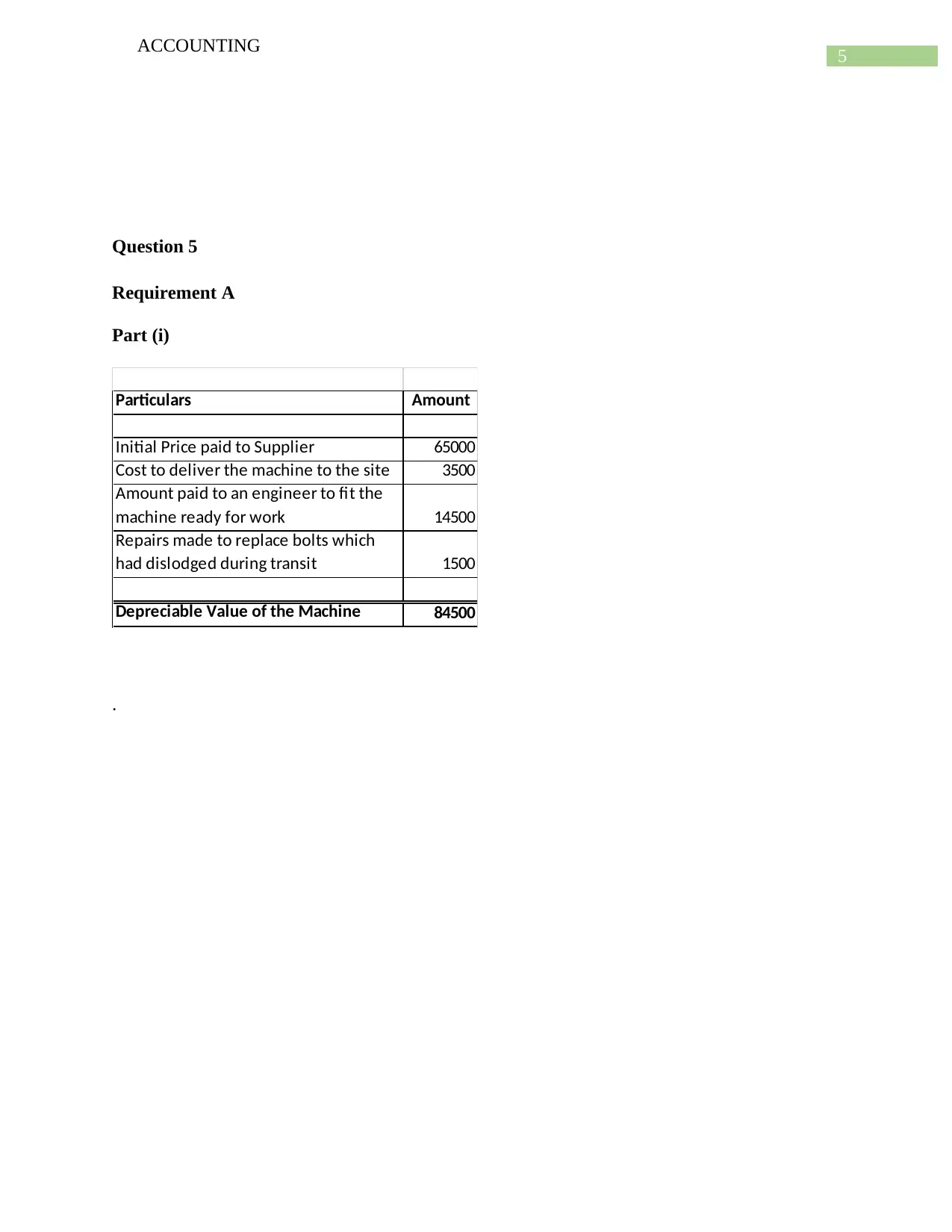

Question 5

Requirement A

Part (i)

Particulars Amount

Initial Price paid to Supplier 65000

Cost to deliver the machine to the site 3500

Amount paid to an engineer to fit the

machine ready for work 14500

Repairs made to replace bolts which

had dislodged during transit 1500

Depreciable Value of the Machine 84500

.

ACCOUNTING

Question 5

Requirement A

Part (i)

Particulars Amount

Initial Price paid to Supplier 65000

Cost to deliver the machine to the site 3500

Amount paid to an engineer to fit the

machine ready for work 14500

Repairs made to replace bolts which

had dislodged during transit 1500

Depreciable Value of the Machine 84500

.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING

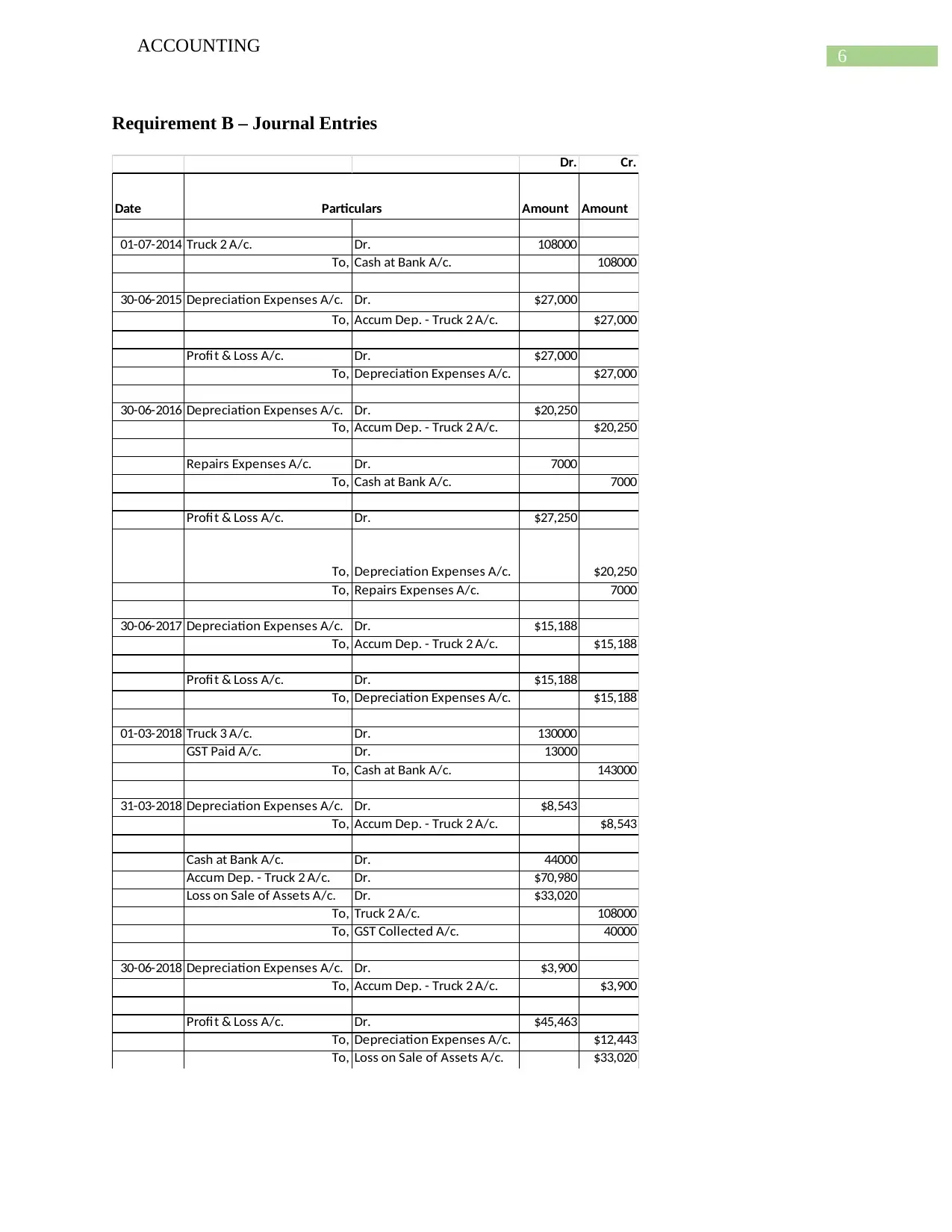

Requirement B – Journal Entries

Dr. Cr.

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $27,000

To, Accum Dep. - Truck 2 A/c. $27,000

Profit & Loss A/c. Dr. $27,000

To, Depreciation Expenses A/c. $27,000

30-06-2016 Depreciation Expenses A/c. Dr. $20,250

To, Accum Dep. - Truck 2 A/c. $20,250

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $27,250

To, Depreciation Expenses A/c. $20,250

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $15,188

To, Accum Dep. - Truck 2 A/c. $15,188

Profit & Loss A/c. Dr. $15,188

To, Depreciation Expenses A/c. $15,188

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $8,543

To, Accum Dep. - Truck 2 A/c. $8,543

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $70,980

Loss on Sale of Assets A/c. Dr. $33,020

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $45,463

To, Depreciation Expenses A/c. $12,443

To, Loss on Sale of Assets A/c. $33,020

Particulars

ACCOUNTING

Requirement B – Journal Entries

Dr. Cr.

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $27,000

To, Accum Dep. - Truck 2 A/c. $27,000

Profit & Loss A/c. Dr. $27,000

To, Depreciation Expenses A/c. $27,000

30-06-2016 Depreciation Expenses A/c. Dr. $20,250

To, Accum Dep. - Truck 2 A/c. $20,250

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $27,250

To, Depreciation Expenses A/c. $20,250

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $15,188

To, Accum Dep. - Truck 2 A/c. $15,188

Profit & Loss A/c. Dr. $15,188

To, Depreciation Expenses A/c. $15,188

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $8,543

To, Accum Dep. - Truck 2 A/c. $8,543

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $70,980

Loss on Sale of Assets A/c. Dr. $33,020

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $45,463

To, Depreciation Expenses A/c. $12,443

To, Loss on Sale of Assets A/c. $33,020

Particulars

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING

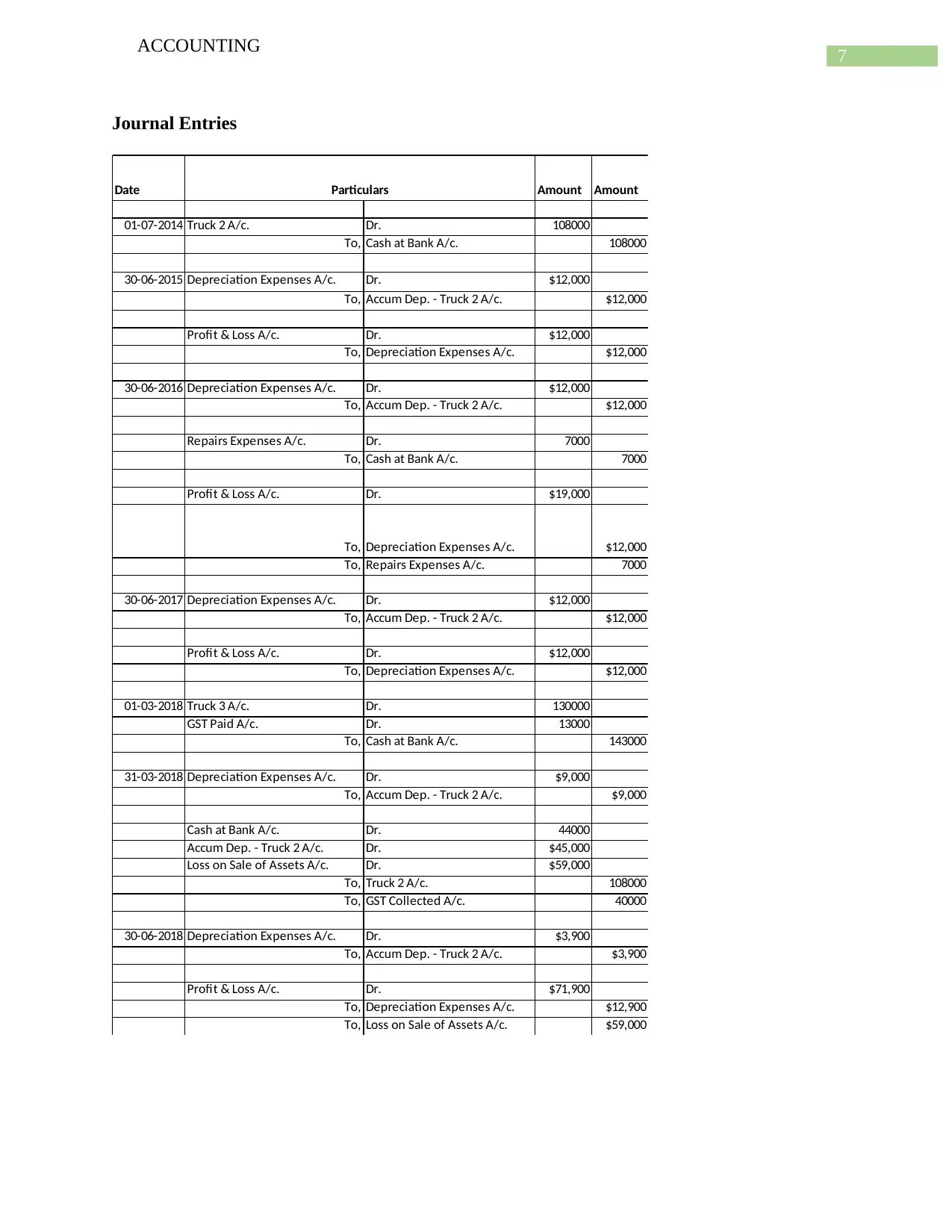

Journal Entries

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

30-06-2016 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $19,000

To, Depreciation Expenses A/c. $12,000

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $9,000

To, Accum Dep. - Truck 2 A/c. $9,000

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $45,000

Loss on Sale of Assets A/c. Dr. $59,000

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $71,900

To, Depreciation Expenses A/c. $12,900

To, Loss on Sale of Assets A/c. $59,000

Particulars

ACCOUNTING

Journal Entries

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

30-06-2016 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $19,000

To, Depreciation Expenses A/c. $12,000

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $9,000

To, Accum Dep. - Truck 2 A/c. $9,000

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $45,000

Loss on Sale of Assets A/c. Dr. $59,000

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $71,900

To, Depreciation Expenses A/c. $12,900

To, Loss on Sale of Assets A/c. $59,000

Particulars

8

ACCOUNTING

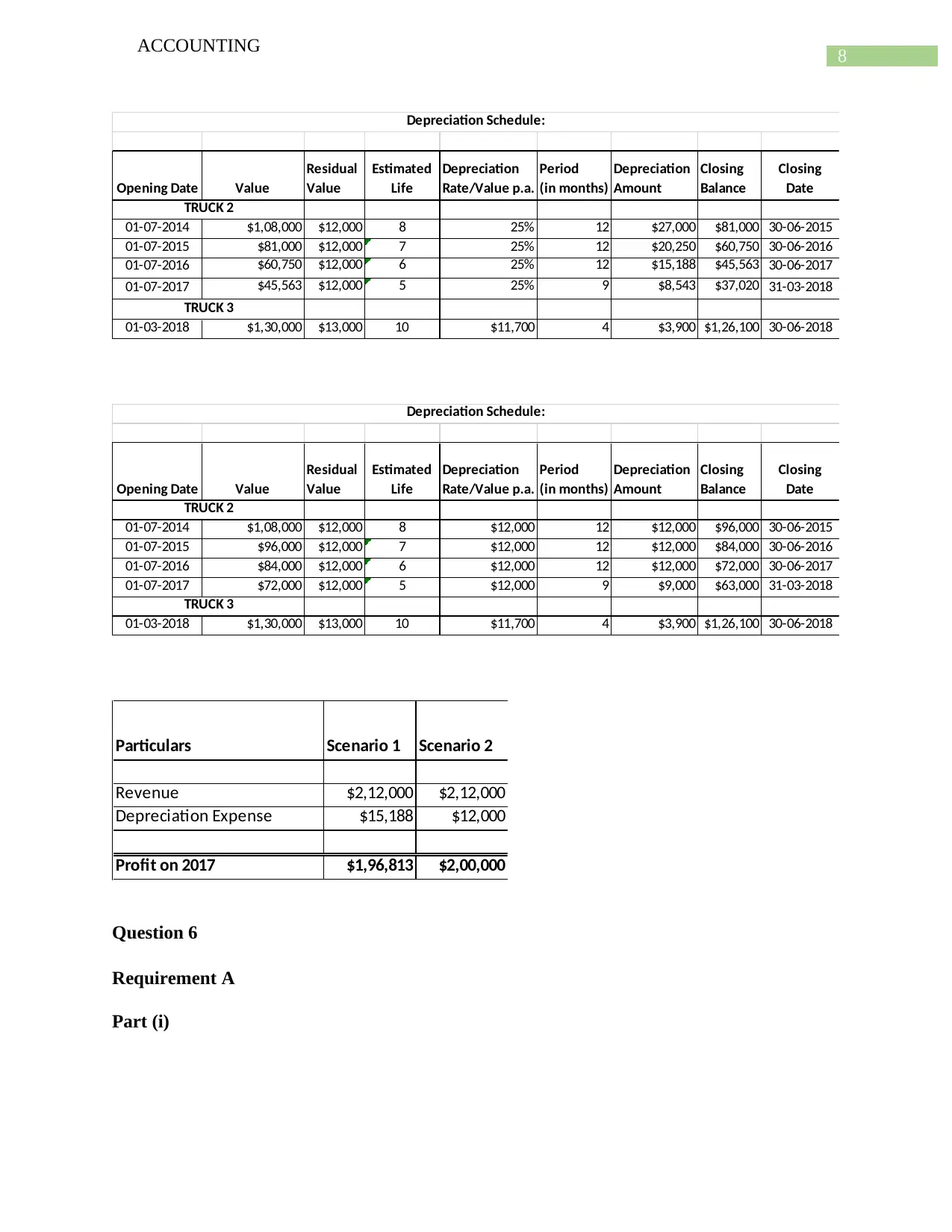

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 25% 12 $27,000 $81,000 30-06-2015

01-07-2015 $81,000 $12,000 7 25% 12 $20,250 $60,750 30-06-2016

01-07-2016 $60,750 $12,000 6 25% 12 $15,188 $45,563 30-06-2017

01-07-2017 $45,563 $12,000 5 25% 9 $8,543 $37,020 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 $12,000 12 $12,000 $96,000 30-06-2015

01-07-2015 $96,000 $12,000 7 $12,000 12 $12,000 $84,000 30-06-2016

01-07-2016 $84,000 $12,000 6 $12,000 12 $12,000 $72,000 30-06-2017

01-07-2017 $72,000 $12,000 5 $12,000 9 $9,000 $63,000 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Particulars Scenario 1 Scenario 2

Revenue $2,12,000 $2,12,000

Depreciation Expense $15,188 $12,000

Profit on 2017 $1,96,813 $2,00,000

Question 6

Requirement A

Part (i)

ACCOUNTING

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 25% 12 $27,000 $81,000 30-06-2015

01-07-2015 $81,000 $12,000 7 25% 12 $20,250 $60,750 30-06-2016

01-07-2016 $60,750 $12,000 6 25% 12 $15,188 $45,563 30-06-2017

01-07-2017 $45,563 $12,000 5 25% 9 $8,543 $37,020 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 $12,000 12 $12,000 $96,000 30-06-2015

01-07-2015 $96,000 $12,000 7 $12,000 12 $12,000 $84,000 30-06-2016

01-07-2016 $84,000 $12,000 6 $12,000 12 $12,000 $72,000 30-06-2017

01-07-2017 $72,000 $12,000 5 $12,000 9 $9,000 $63,000 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Particulars Scenario 1 Scenario 2

Revenue $2,12,000 $2,12,000

Depreciation Expense $15,188 $12,000

Profit on 2017 $1,96,813 $2,00,000

Question 6

Requirement A

Part (i)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ACCOUNTING

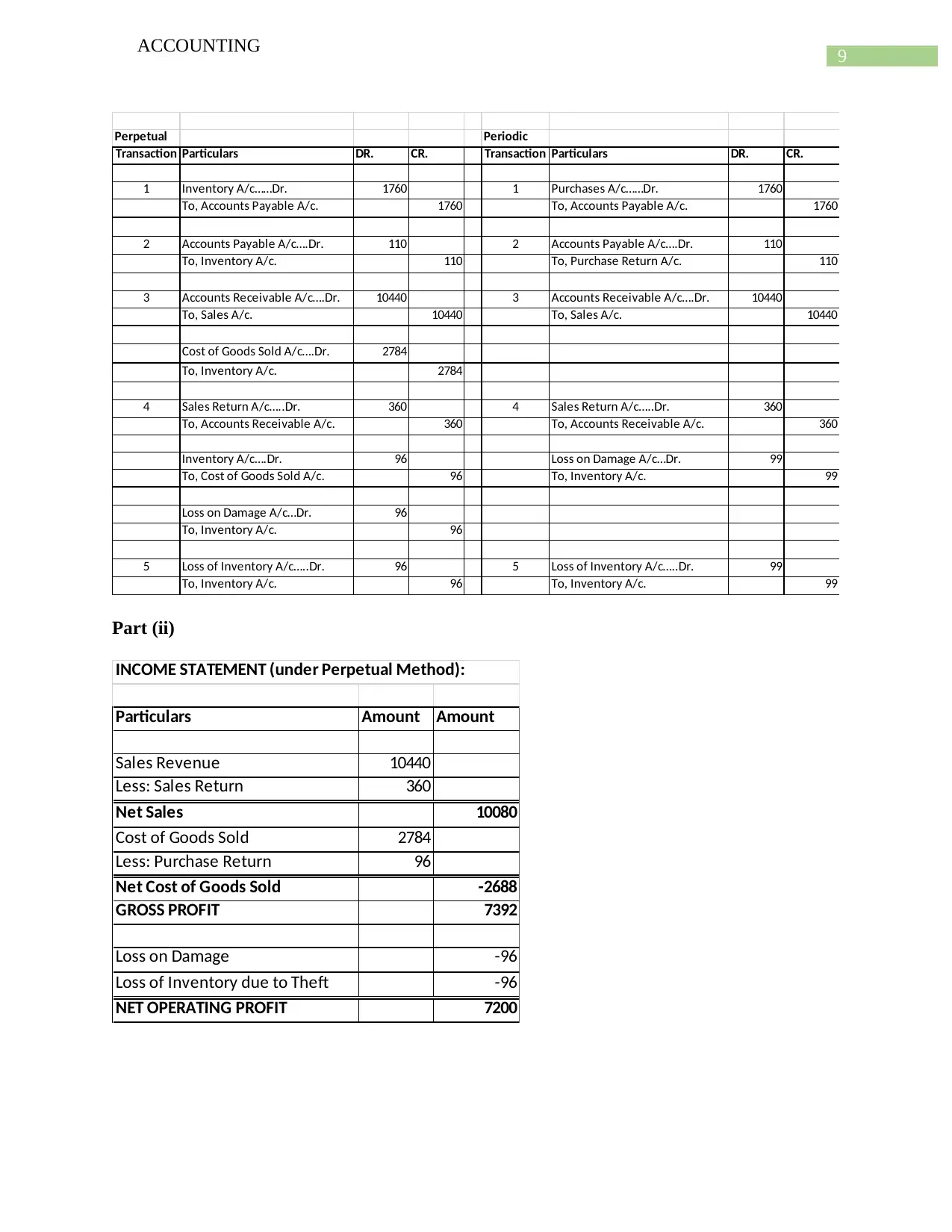

Perpetual Periodic

Transaction Particulars DR. CR. Transaction Particulars DR. CR.

1 Inventory A/c……Dr. 1760 1 Purchases A/c……Dr. 1760

To, Accounts Payable A/c. 1760 To, Accounts Payable A/c. 1760

2 Accounts Payable A/c….Dr. 110 2 Accounts Payable A/c….Dr. 110

To, Inventory A/c. 110 To, Purchase Return A/c. 110

3 Accounts Receivable A/c….Dr. 10440 3 Accounts Receivable A/c….Dr. 10440

To, Sales A/c. 10440 To, Sales A/c. 10440

Cost of Goods Sold A/c….Dr. 2784

To, Inventory A/c. 2784

4 Sales Return A/c…..Dr. 360 4 Sales Return A/c…..Dr. 360

To, Accounts Receivable A/c. 360 To, Accounts Receivable A/c. 360

Inventory A/c….Dr. 96 Loss on Damage A/c…Dr. 99

To, Cost of Goods Sold A/c. 96 To, Inventory A/c. 99

Loss on Damage A/c…Dr. 96

To, Inventory A/c. 96

5 Loss of Inventory A/c…..Dr. 96 5 Loss of Inventory A/c…..Dr. 99

To, Inventory A/c. 96 To, Inventory A/c. 99

Part (ii)

INCOME STATEMENT (under Perpetual Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Cost of Goods Sold 2784

Less: Purchase Return 96

Net Cost of Goods Sold -2688

GROSS PROFIT 7392

Loss on Damage -96

Loss of Inventory due to Theft -96

NET OPERATING PROFIT 7200

ACCOUNTING

Perpetual Periodic

Transaction Particulars DR. CR. Transaction Particulars DR. CR.

1 Inventory A/c……Dr. 1760 1 Purchases A/c……Dr. 1760

To, Accounts Payable A/c. 1760 To, Accounts Payable A/c. 1760

2 Accounts Payable A/c….Dr. 110 2 Accounts Payable A/c….Dr. 110

To, Inventory A/c. 110 To, Purchase Return A/c. 110

3 Accounts Receivable A/c….Dr. 10440 3 Accounts Receivable A/c….Dr. 10440

To, Sales A/c. 10440 To, Sales A/c. 10440

Cost of Goods Sold A/c….Dr. 2784

To, Inventory A/c. 2784

4 Sales Return A/c…..Dr. 360 4 Sales Return A/c…..Dr. 360

To, Accounts Receivable A/c. 360 To, Accounts Receivable A/c. 360

Inventory A/c….Dr. 96 Loss on Damage A/c…Dr. 99

To, Cost of Goods Sold A/c. 96 To, Inventory A/c. 99

Loss on Damage A/c…Dr. 96

To, Inventory A/c. 96

5 Loss of Inventory A/c…..Dr. 96 5 Loss of Inventory A/c…..Dr. 99

To, Inventory A/c. 96 To, Inventory A/c. 99

Part (ii)

INCOME STATEMENT (under Perpetual Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Cost of Goods Sold 2784

Less: Purchase Return 96

Net Cost of Goods Sold -2688

GROSS PROFIT 7392

Loss on Damage -96

Loss of Inventory due to Theft -96

NET OPERATING PROFIT 7200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ACCOUNTING

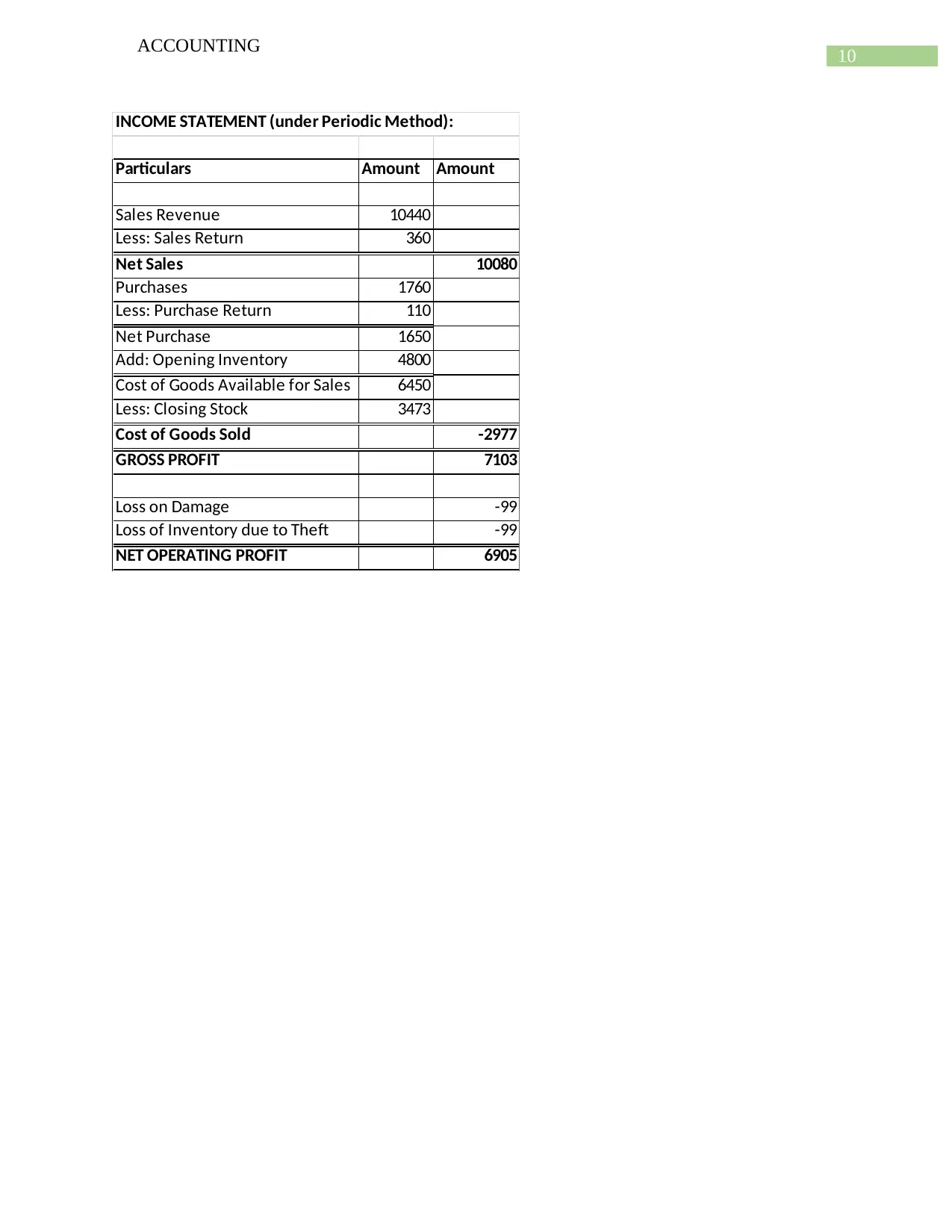

INCOME STATEMENT (under Periodic Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Purchases 1760

Less: Purchase Return 110

Net Purchase 1650

Add: Opening Inventory 4800

Cost of Goods Available for Sales 6450

Less: Closing Stock 3473

Cost of Goods Sold -2977

GROSS PROFIT 7103

Loss on Damage -99

Loss of Inventory due to Theft -99

NET OPERATING PROFIT 6905

ACCOUNTING

INCOME STATEMENT (under Periodic Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Purchases 1760

Less: Purchase Return 110

Net Purchase 1650

Add: Opening Inventory 4800

Cost of Goods Available for Sales 6450

Less: Closing Stock 3473

Cost of Goods Sold -2977

GROSS PROFIT 7103

Loss on Damage -99

Loss of Inventory due to Theft -99

NET OPERATING PROFIT 6905

11

ACCOUNTING

Reference list:

Hoyle, J.B., Schaefer, T. and Doupnik, T., 2015. Advanced accounting. McGraw Hill.

Scott, W.R., 2015. Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

Williams, J., 2014. Financial accounting. McGraw-Hill Higher Education.

ACCOUNTING

Reference list:

Hoyle, J.B., Schaefer, T. and Doupnik, T., 2015. Advanced accounting. McGraw Hill.

Scott, W.R., 2015. Financial accounting theory (Vol. 2, No. 0, p. 0). Prentice Hall.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

Williams, J., 2014. Financial accounting. McGraw-Hill Higher Education.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.