Accounting System and Process Assignment for Spottie Ltd Analysis

VerifiedAdded on 2022/12/30

|22

|2814

|1

Homework Assignment

AI Summary

This document presents a detailed solution to an accounting assignment focused on accounting systems and processes. It begins with an analysis of inventory control systems, comparing perpetual and periodic methods, and includes journal entries and memos. The assignment then shifts to computerized accounting information systems, specifically examining Xero, a cloud-based accounting software, discussing its benefits, demerits, and implementation. A letter concerning internal controls and cash misappropriation is provided, followed by a bank reconciliation and a discussion of PPE (Property, Plant, and Equipment) transactions. The solution provides a thorough overview of accounting principles and practical applications, offering valuable insights into financial management and control.

Running head: ACCOUNTING SYSTEM AND PROCESS

Accounting System and Process

Name of the Student:

Name of the University:

Author’s Note:

Accounting System and Process

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING SYSTEM AND PROCESS

Table of Contents

Answer to question 1:......................................................................................................................2

Sub part (i): Memo:.....................................................................................................................2

Sub part (ii): Journal:...................................................................................................................5

Answer to question 2: Report:.........................................................................................................9

Introduction:................................................................................................................................9

CAIS (Computerized accounting information system):..............................................................9

Xero Cloud based Accounting information system:..................................................................10

Benefits of cloud based accounting software Xero:..................................................................11

Demerits of Xero:......................................................................................................................11

Implementation of Xero accounting information system:.........................................................11

Conclusion:................................................................................................................................12

Answer to question 3: Letter:........................................................................................................13

Answer to question 4: Bank Reconciliation:.................................................................................15

Sub part (i):................................................................................................................................15

Sub part (ii):...............................................................................................................................15

Sub part (iii):..............................................................................................................................17

Answer to question: 5 PPE transactions:.......................................................................................18

References and bibliography:........................................................................................................20

Table of Contents

Answer to question 1:......................................................................................................................2

Sub part (i): Memo:.....................................................................................................................2

Sub part (ii): Journal:...................................................................................................................5

Answer to question 2: Report:.........................................................................................................9

Introduction:................................................................................................................................9

CAIS (Computerized accounting information system):..............................................................9

Xero Cloud based Accounting information system:..................................................................10

Benefits of cloud based accounting software Xero:..................................................................11

Demerits of Xero:......................................................................................................................11

Implementation of Xero accounting information system:.........................................................11

Conclusion:................................................................................................................................12

Answer to question 3: Letter:........................................................................................................13

Answer to question 4: Bank Reconciliation:.................................................................................15

Sub part (i):................................................................................................................................15

Sub part (ii):...............................................................................................................................15

Sub part (iii):..............................................................................................................................17

Answer to question: 5 PPE transactions:.......................................................................................18

References and bibliography:........................................................................................................20

2ACCOUNTING SYSTEM AND PROCESS

Answer to question 1:

Sub part (i): Memo:

MEMORANDUM

Date: 14 May 2019

To: Directors, Spottie Ltd

From: [Name, Designation]

Subject: Inventory System

Introduction:

This memo is prepared to explain and describe various inventor control system that can

be used in an organization. Inventory system is the process of record keeping and inventory

control system in which the inventory related transactions are recorded and valuations are done

at the end of certain period of time. In the following paragraphs various inventory systems has

been described briefly.

Perpetual Inventory System:

Perpetual inventory system is defined as the process of recording purchase and sales on

inventory continuously throughout the year. Purchases are recorded as and when a purchase

transaction occurs and sales are also recorded as and when the sales are made. With every sales

transaction an additional entry is made to record the cost of goods sold. The valuation of

inventory is done on the basis of either FIOF, LIFO, or Weighted average method or any other

Answer to question 1:

Sub part (i): Memo:

MEMORANDUM

Date: 14 May 2019

To: Directors, Spottie Ltd

From: [Name, Designation]

Subject: Inventory System

Introduction:

This memo is prepared to explain and describe various inventor control system that can

be used in an organization. Inventory system is the process of record keeping and inventory

control system in which the inventory related transactions are recorded and valuations are done

at the end of certain period of time. In the following paragraphs various inventory systems has

been described briefly.

Perpetual Inventory System:

Perpetual inventory system is defined as the process of recording purchase and sales on

inventory continuously throughout the year. Purchases are recorded as and when a purchase

transaction occurs and sales are also recorded as and when the sales are made. With every sales

transaction an additional entry is made to record the cost of goods sold. The valuation of

inventory is done on the basis of either FIOF, LIFO, or Weighted average method or any other

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING SYSTEM AND PROCESS

valuation method. The FIFO and Weighted average method of perpetual inventory system has

been described briefly in the following paragraph.

First-in-firs-out method:

First-in-first-out (FIFO) method of inventory valuation is a system recording inventory in

the inventory ledger, where, the oldest inventories are issued first and the most recent inventories

are kept in stock. In this method, the cost of goods sold is measured on the basis or oldest unit

price of materials and the cost of ending inventory is measured by the price of recent materials.

This is a traditional method of perpetual inventory system.

Weighted Average method:

This is one more type of method of inventory recording and valuation. In this method

purchases and sales are recorded every day as and when such transactions occurs. The only

difference is in valuation of cost of goods sold and the valuation on ending inventory. Under the

weighted average method of inventory system, the cost of goods sold is determined using the

weighted average method. To ascertain the cost of goods sold, the last remaining total cost of

inventory is divided by the last remaining total quantity of inventory.

Periodic Inventory System:

This is a traditional system of recording inventory and measuring the cost of goods sold

and ending inventory. In this system purchase of materials are recorded in the books as cost of

purchase and the sales are recorded in the books of accounts at usual sales price. No entry is

made at the time of sales to record the cost of goods sold. At the end of the period, a single entry

is made to record the cost of goods sold. In this method, the quantity balance of ending inventory

valuation method. The FIFO and Weighted average method of perpetual inventory system has

been described briefly in the following paragraph.

First-in-firs-out method:

First-in-first-out (FIFO) method of inventory valuation is a system recording inventory in

the inventory ledger, where, the oldest inventories are issued first and the most recent inventories

are kept in stock. In this method, the cost of goods sold is measured on the basis or oldest unit

price of materials and the cost of ending inventory is measured by the price of recent materials.

This is a traditional method of perpetual inventory system.

Weighted Average method:

This is one more type of method of inventory recording and valuation. In this method

purchases and sales are recorded every day as and when such transactions occurs. The only

difference is in valuation of cost of goods sold and the valuation on ending inventory. Under the

weighted average method of inventory system, the cost of goods sold is determined using the

weighted average method. To ascertain the cost of goods sold, the last remaining total cost of

inventory is divided by the last remaining total quantity of inventory.

Periodic Inventory System:

This is a traditional system of recording inventory and measuring the cost of goods sold

and ending inventory. In this system purchase of materials are recorded in the books as cost of

purchase and the sales are recorded in the books of accounts at usual sales price. No entry is

made at the time of sales to record the cost of goods sold. At the end of the period, a single entry

is made to record the cost of goods sold. In this method, the quantity balance of ending inventory

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING SYSTEM AND PROCESS

is determined by a physical stocktaking. When the physical quantity is determined the value of

ending inventory is calculated considering the recent market price of the materials. The cost of

goods sold is determined for the whole period at the end of the period considering the cost of

beginning inventory, cost of purchase and cost of ending invneotyr.

Conclusion:

From the above discussion and analysis, it can be concluded that, there are various

traditional and modern inventory recording and controlling system. Perpetual systems are more

effective and efficient, but periodic inventory system is less rational and logical. Because of its

usefulness and effectiveness, the perpetual inventory system is more suitable for business having

huge price fluctuation in materials.

is determined by a physical stocktaking. When the physical quantity is determined the value of

ending inventory is calculated considering the recent market price of the materials. The cost of

goods sold is determined for the whole period at the end of the period considering the cost of

beginning inventory, cost of purchase and cost of ending invneotyr.

Conclusion:

From the above discussion and analysis, it can be concluded that, there are various

traditional and modern inventory recording and controlling system. Perpetual systems are more

effective and efficient, but periodic inventory system is less rational and logical. Because of its

usefulness and effectiveness, the perpetual inventory system is more suitable for business having

huge price fluctuation in materials.

5ACCOUNTING SYSTEM AND PROCESS

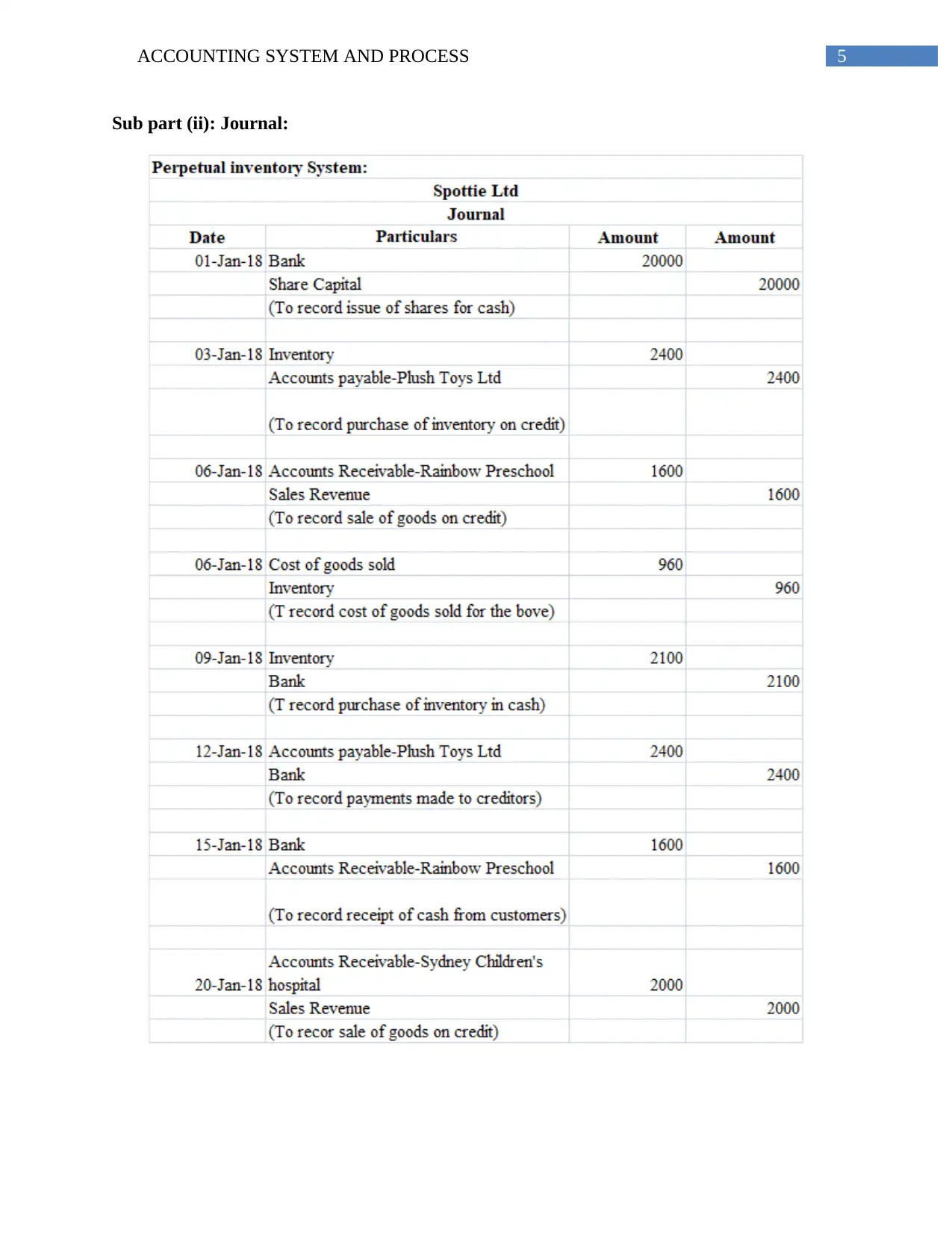

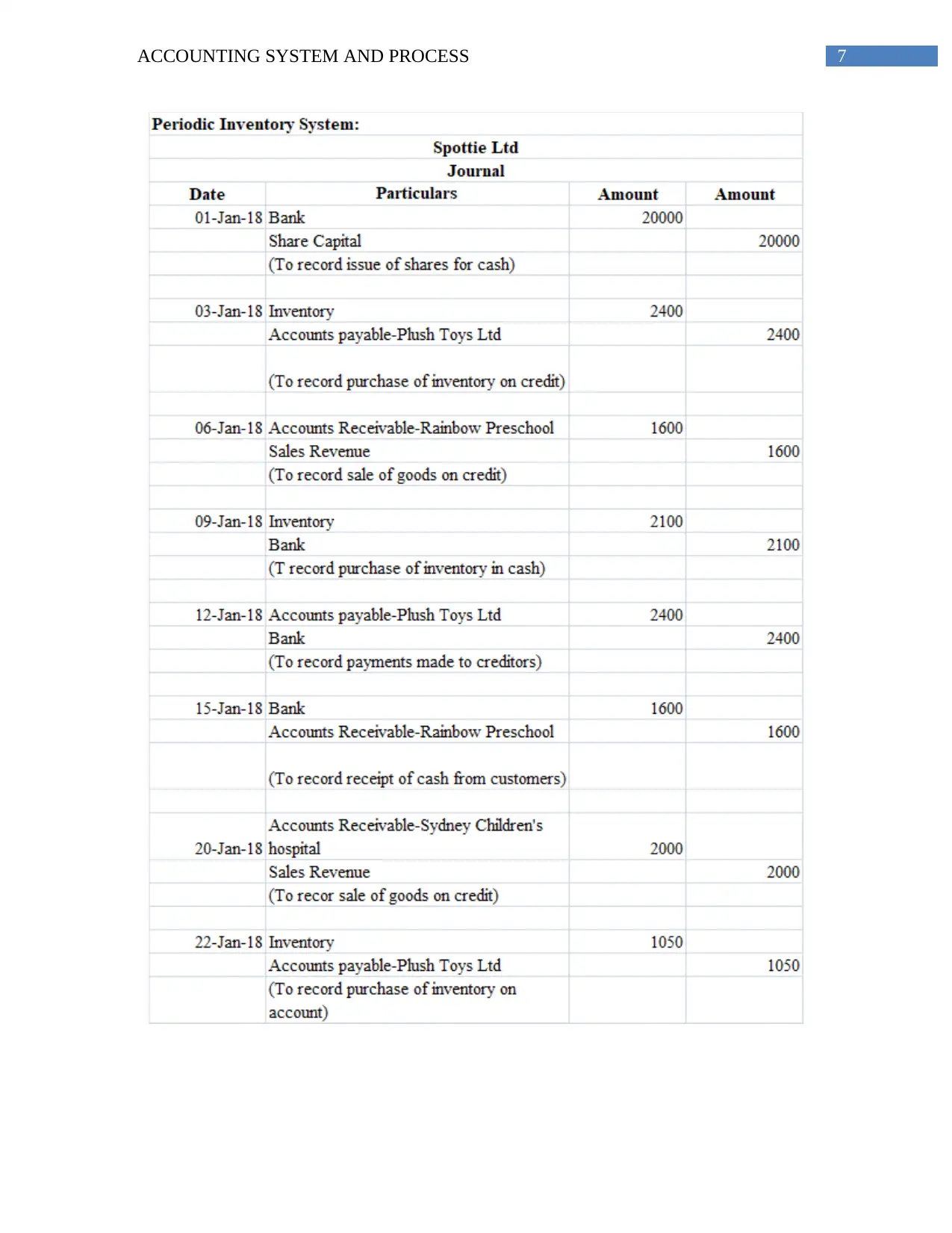

Sub part (ii): Journal:

Sub part (ii): Journal:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING SYSTEM AND PROCESS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING SYSTEM AND PROCESS

8ACCOUNTING SYSTEM AND PROCESS

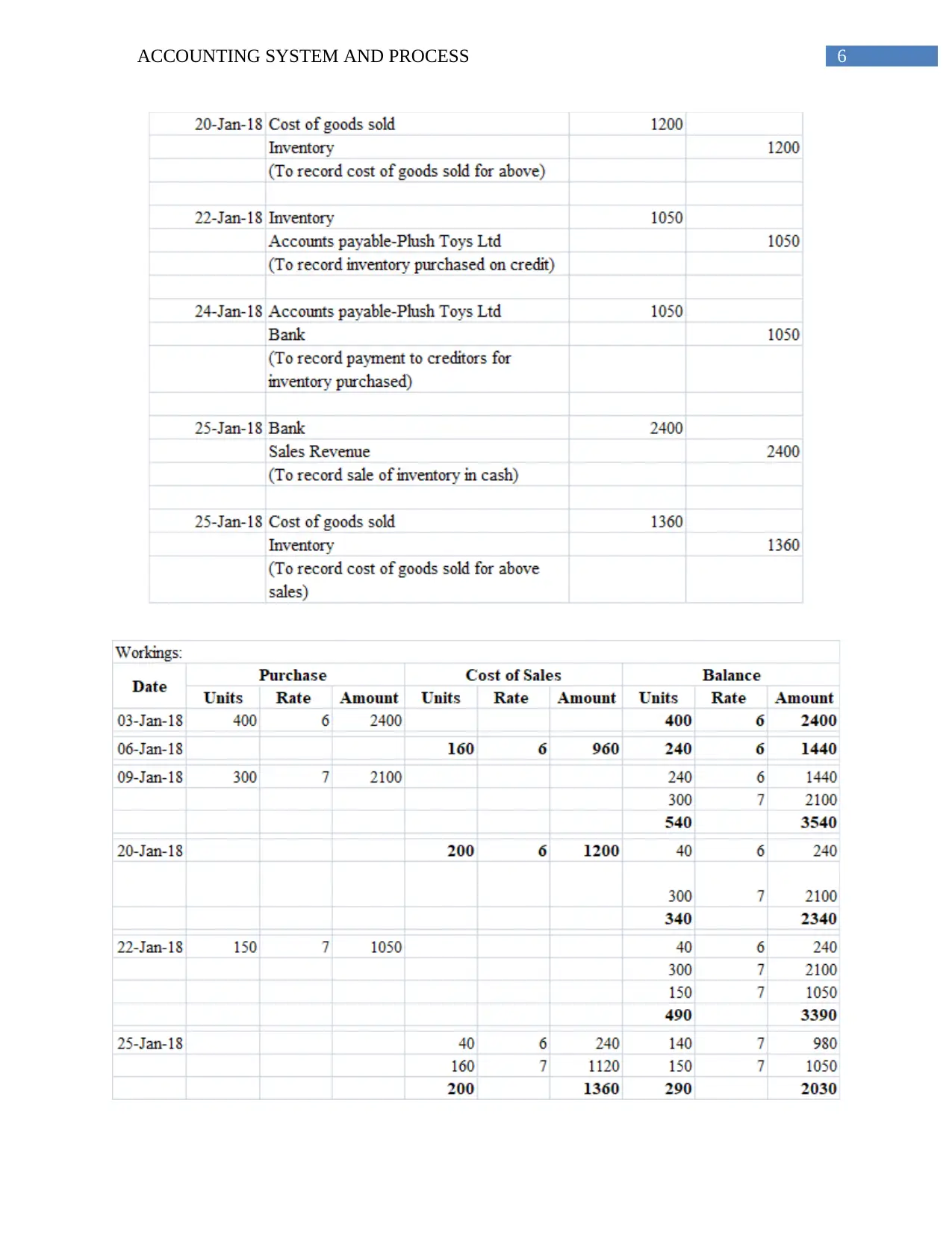

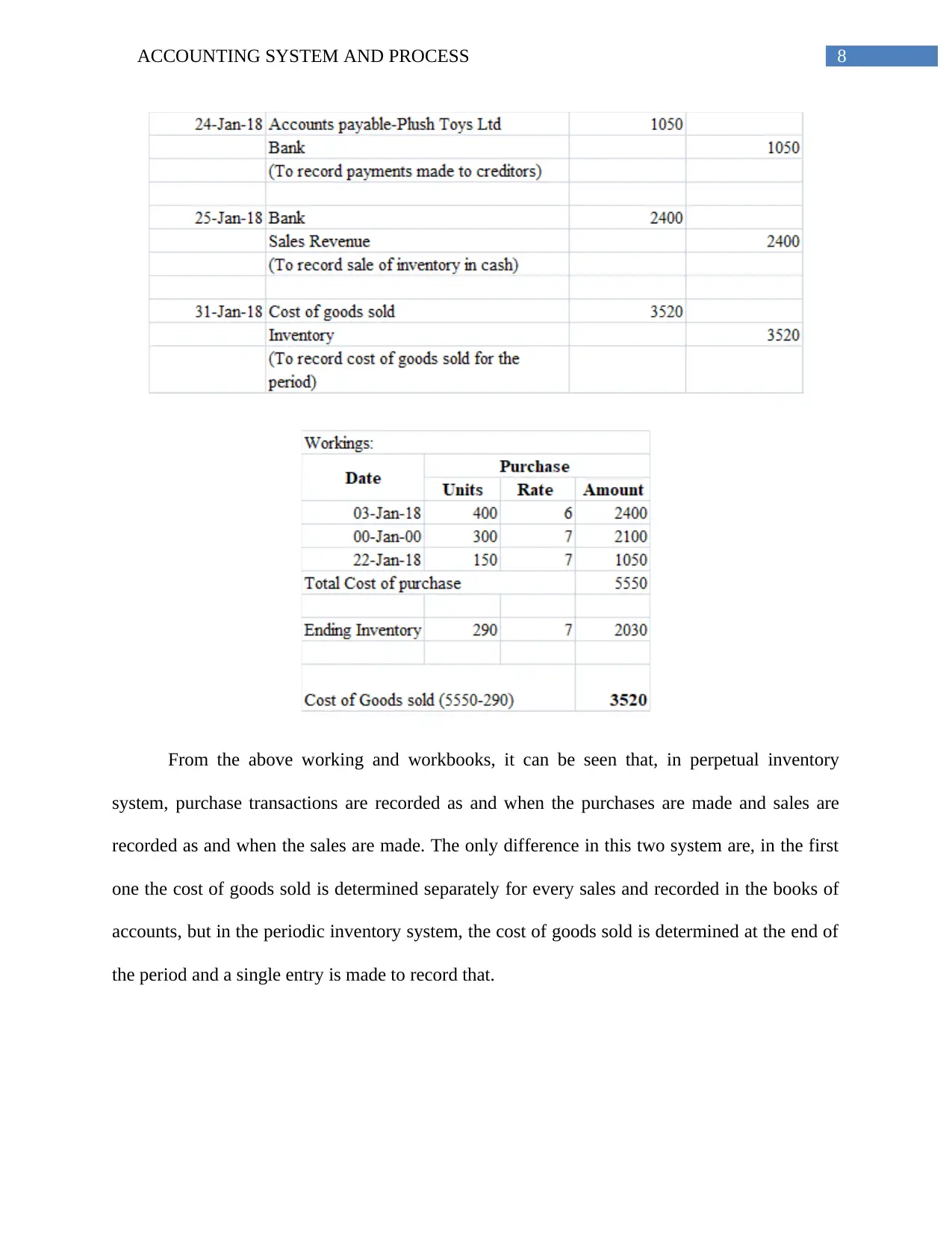

From the above working and workbooks, it can be seen that, in perpetual inventory

system, purchase transactions are recorded as and when the purchases are made and sales are

recorded as and when the sales are made. The only difference in this two system are, in the first

one the cost of goods sold is determined separately for every sales and recorded in the books of

accounts, but in the periodic inventory system, the cost of goods sold is determined at the end of

the period and a single entry is made to record that.

From the above working and workbooks, it can be seen that, in perpetual inventory

system, purchase transactions are recorded as and when the purchases are made and sales are

recorded as and when the sales are made. The only difference in this two system are, in the first

one the cost of goods sold is determined separately for every sales and recorded in the books of

accounts, but in the periodic inventory system, the cost of goods sold is determined at the end of

the period and a single entry is made to record that.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING SYSTEM AND PROCESS

Answer to question 2: Report:

Introduction:

The report is prepared to demonstrate the importance and usefulness of the automated

accounting system to the organizations. Accounting is the process by which the financial records

and the associated transactions is summarized, recorded and classified in a meaningful manner

by the accountants of organization that assist in the process of making decision. In the earlier

days, there was less complexities in the business transactions and the size of business was small

for which the job of the accountants was easy and it was easy for the accountant to carry out the

process of recording all the business and financial transactions. However, with the increase in the

competitive environment and complexities of business, the accountants started facing difficulties

in performing their work in an appropriate and proficient manner. With the advancement of

technology, the work of accountants became easier resulting from the development of accounting

information system.

CAIS (Computerized accounting information system):

The reporting requirement concerning the disclosure of financial and accounting

information has become essential and important due to the evolution and the advancement of

business. There has been the development of several automated accounting system in order to

compete in an increased pressure imposed by the competition prevailing in the industry. The

business organization can implement various accounting software systems as there are varieties

of accounting software packages available in the market. Such software provides great assistance

to the business in recording their financial transactions and daily operations. An organization can

see that in the market, there are availability of desktop accounting software packages which

Answer to question 2: Report:

Introduction:

The report is prepared to demonstrate the importance and usefulness of the automated

accounting system to the organizations. Accounting is the process by which the financial records

and the associated transactions is summarized, recorded and classified in a meaningful manner

by the accountants of organization that assist in the process of making decision. In the earlier

days, there was less complexities in the business transactions and the size of business was small

for which the job of the accountants was easy and it was easy for the accountant to carry out the

process of recording all the business and financial transactions. However, with the increase in the

competitive environment and complexities of business, the accountants started facing difficulties

in performing their work in an appropriate and proficient manner. With the advancement of

technology, the work of accountants became easier resulting from the development of accounting

information system.

CAIS (Computerized accounting information system):

The reporting requirement concerning the disclosure of financial and accounting

information has become essential and important due to the evolution and the advancement of

business. There has been the development of several automated accounting system in order to

compete in an increased pressure imposed by the competition prevailing in the industry. The

business organization can implement various accounting software systems as there are varieties

of accounting software packages available in the market. Such software provides great assistance

to the business in recording their financial transactions and daily operations. An organization can

see that in the market, there are availability of desktop accounting software packages which

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING SYSTEM AND PROCESS

provides assistance in recording the day to day operating and accounting activities of the

business. In addition to this, for the purpose of recording the accenting and the financial

transactions of the business, there are accounting packages available in the market based on the

internet system. Another name of the internet based accounting system is the cloud based system

of accounting. Some of the renowned desktop system of accounting is MYOB, SAP and Recon.

Xero is one of the cloud based accounting software with some of the other software named as

Sage cloud based accounting package and Quick books accounting system (Patel, 2015). The

paragraph depicted below demonstrates the application of the software and the merits and

demerits of the cloud based accounting software named Xero.

Xero Cloud based Accounting information system:

Xero is one of the cloud based accounting software package that can run using the

internet and the organization using the system would be able to perform the application online as

well. The software package can be accessed using the password and the user id and the

accountants have ease in recording the accounting transactions using the software. For using the

accounting software, it is required by the organization to subscribe for the software and the

company should be registered to the software by making or paying the subscription fee. The

accounting software Xero can be used by the accountants in different stage. In the first stage, the

activities sand the details of the activities of the companies relating to the transaction are fetched

into the software. The opening balance of the liabilities, assets, expenses and income should be

imported in the software. Since this particular accounting software is completely automated, it is

required by the accountant to fetch the data in the forms of claim of bill expenses, invoices and

the transactions. The subsequent effects to the respective ledger would be given automatically

provides assistance in recording the day to day operating and accounting activities of the

business. In addition to this, for the purpose of recording the accenting and the financial

transactions of the business, there are accounting packages available in the market based on the

internet system. Another name of the internet based accounting system is the cloud based system

of accounting. Some of the renowned desktop system of accounting is MYOB, SAP and Recon.

Xero is one of the cloud based accounting software with some of the other software named as

Sage cloud based accounting package and Quick books accounting system (Patel, 2015). The

paragraph depicted below demonstrates the application of the software and the merits and

demerits of the cloud based accounting software named Xero.

Xero Cloud based Accounting information system:

Xero is one of the cloud based accounting software package that can run using the

internet and the organization using the system would be able to perform the application online as

well. The software package can be accessed using the password and the user id and the

accountants have ease in recording the accounting transactions using the software. For using the

accounting software, it is required by the organization to subscribe for the software and the

company should be registered to the software by making or paying the subscription fee. The

accounting software Xero can be used by the accountants in different stage. In the first stage, the

activities sand the details of the activities of the companies relating to the transaction are fetched

into the software. The opening balance of the liabilities, assets, expenses and income should be

imported in the software. Since this particular accounting software is completely automated, it is

required by the accountant to fetch the data in the forms of claim of bill expenses, invoices and

the transactions. The subsequent effects to the respective ledger would be given automatically

11ACCOUNTING SYSTEM AND PROCESS

and thereby producing the report quickly. This particular accounting software has become

popular because of its efficiency and ease to use.

Benefits of cloud based accounting software Xero:

One of the biggest advantages that contribute to the popularity is the efficiency and the

use of use of the software by the accountant along with its capability of producing the reports

instantly. Another advantage is that the software can be accessed online and therefore,

accountants responsible for handling the software can use it irrespective of anywhere in the

world. The accountants find ease to enter the invoices and bills claiming the expenses directly

into the system for generating the report and subsequent impacts are done automatically

(Susanto, 2016). The information product offered by the software is one of the important features

that make the control system efficient and effective.

Demerits of Xero:

Since Xero is a cloud based accounting software, the data sought for producing the report

are entered and refreshed onto the cloud and accordingly the transactions are entered. Therefore,

it can be inferred that data security is the important detrimental factor in using this particular

software. It is certainly possible in the weak security; the other parties can steal the data from the

cloud. Furthermore, in the event of losing the password and hacking of the account, accountant

can get access to the data without stretching (Mirzaey et al., 2017). This also presents the case of

security issue as the data lost can be easily gained which makes it possible for any other user to

access and might result in occurrence of fraud.

and thereby producing the report quickly. This particular accounting software has become

popular because of its efficiency and ease to use.

Benefits of cloud based accounting software Xero:

One of the biggest advantages that contribute to the popularity is the efficiency and the

use of use of the software by the accountant along with its capability of producing the reports

instantly. Another advantage is that the software can be accessed online and therefore,

accountants responsible for handling the software can use it irrespective of anywhere in the

world. The accountants find ease to enter the invoices and bills claiming the expenses directly

into the system for generating the report and subsequent impacts are done automatically

(Susanto, 2016). The information product offered by the software is one of the important features

that make the control system efficient and effective.

Demerits of Xero:

Since Xero is a cloud based accounting software, the data sought for producing the report

are entered and refreshed onto the cloud and accordingly the transactions are entered. Therefore,

it can be inferred that data security is the important detrimental factor in using this particular

software. It is certainly possible in the weak security; the other parties can steal the data from the

cloud. Furthermore, in the event of losing the password and hacking of the account, accountant

can get access to the data without stretching (Mirzaey et al., 2017). This also presents the case of

security issue as the data lost can be easily gained which makes it possible for any other user to

access and might result in occurrence of fraud.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.