Detailed Accounting System Report for Spottie Ltd - Semester 2

VerifiedAdded on 2023/03/23

|22

|3239

|59

Report

AI Summary

This report provides a comprehensive analysis of accounting systems for Spottie Ltd, covering various aspects of financial management and control. It begins with an examination of inventory management systems, comparing perpetual and periodic methods, and recommending the weighted average method within a perpetual system. The report then transitions to computerized accounting information systems, focusing on the Xero cloud-based system, detailing its advantages and disadvantages, and assessing its suitability for adoption. Further, the document addresses employee fraud, highlighting the importance of internal controls and cash management. It also includes a bank reconciliation exercise and an analysis of property, plant, and equipment (PPE) transactions. Journal entries, memorandums, and letters are used to present findings and recommendations, offering a holistic view of Spottie Ltd's accounting practices and potential improvements.

Running head: ACCOUNTING SYSTEM

Accounting System

Name of the Student:

Name of the University:

Author’s Note:

Accounting System

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING SYSTEM

Table of Contents

Answer to question 1:......................................................................................................................2

Sub part (i): Memo:.....................................................................................................................2

Sub part (ii): Journal:...................................................................................................................5

Answer to question 2: Report:.........................................................................................................9

Introduction:................................................................................................................................9

Computerized Accounting Information System:.........................................................................9

Xero Cloud based accounting information system:...................................................................10

Advantages of Xero Cloud based accounting information system:...........................................10

Disadvantages of Xero Accounting information system:..........................................................11

Adoption of the Xero Accounting information system:............................................................11

Conclusion:................................................................................................................................12

Answer to question 3: Letter:........................................................................................................13

Answer to question 4: Bank Reconciliation:.................................................................................15

Sub part (i):................................................................................................................................15

Sub part (ii):...............................................................................................................................15

Sub part (iii):..............................................................................................................................17

Answer to question 5: PPE transactions:.......................................................................................18

References and bibliography:........................................................................................................20

Table of Contents

Answer to question 1:......................................................................................................................2

Sub part (i): Memo:.....................................................................................................................2

Sub part (ii): Journal:...................................................................................................................5

Answer to question 2: Report:.........................................................................................................9

Introduction:................................................................................................................................9

Computerized Accounting Information System:.........................................................................9

Xero Cloud based accounting information system:...................................................................10

Advantages of Xero Cloud based accounting information system:...........................................10

Disadvantages of Xero Accounting information system:..........................................................11

Adoption of the Xero Accounting information system:............................................................11

Conclusion:................................................................................................................................12

Answer to question 3: Letter:........................................................................................................13

Answer to question 4: Bank Reconciliation:.................................................................................15

Sub part (i):................................................................................................................................15

Sub part (ii):...............................................................................................................................15

Sub part (iii):..............................................................................................................................17

Answer to question 5: PPE transactions:.......................................................................................18

References and bibliography:........................................................................................................20

2ACCOUNTING SYSTEM

Answer to question 1:

Sub part (i): Memo:

MEMORANDUM

Date: 14 May 2019

To: Directors, Spottie Ltd

From: [Name, Designation]

Subject: Inventory System

Introduction:

This memorandum is prepared to analyze and understand different types of inventory

control system and inventory valuation methods. There are various inventory management

systems, which can be used in a business organization, to control the flow of inventory as well as

to make the valuation of cost of goods sold and ending inventory. In the following parts of this

memorandum, some of such inventory management systems have been described briefly.

Perpetual Inventory System:

There are various types of inventory which can be successfully applied in a business

organization to control the flow of inventory. Perpetual inventory system is a type of inventory

management system, under which, all the purchases and issues of inventory are recorded

periodically as and when such purchase or sales transaction occurs. In this system, purchases are

recorded at actual costs and issues are recorded on cost based on certain valuation techniques.

There are various valuation methods, which are followed in perpetual inventory system, such as

Answer to question 1:

Sub part (i): Memo:

MEMORANDUM

Date: 14 May 2019

To: Directors, Spottie Ltd

From: [Name, Designation]

Subject: Inventory System

Introduction:

This memorandum is prepared to analyze and understand different types of inventory

control system and inventory valuation methods. There are various inventory management

systems, which can be used in a business organization, to control the flow of inventory as well as

to make the valuation of cost of goods sold and ending inventory. In the following parts of this

memorandum, some of such inventory management systems have been described briefly.

Perpetual Inventory System:

There are various types of inventory which can be successfully applied in a business

organization to control the flow of inventory. Perpetual inventory system is a type of inventory

management system, under which, all the purchases and issues of inventory are recorded

periodically as and when such purchase or sales transaction occurs. In this system, purchases are

recorded at actual costs and issues are recorded on cost based on certain valuation techniques.

There are various valuation methods, which are followed in perpetual inventory system, such as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING SYSTEM

FIFO method, LIFO method, Simple average method and weighted average method of inventory

valuation. In this system with every sales transaction, a separate entry is passed to record to cost

of goods sold. At the end of the period the value of closing inventory is automatically determined

by the store ledger balance. Some of such inventory valuation methods have been described

below.

First-in-firs-out method:

First In First Out (FIFO) is a method of inventory recording and inventory valuation in

which, all the purchases of inventory are recorded as and when the purchases are made and

issues are recorded on the basis of prices of earliest received materials. In this system the cost of

goods sold is measured taking the prices of materials received in the earlier stage and the closing

inventory is valued at the recent market price. In the inflationary period this system is suitable

and can give a reasonable and logical result.

Weighted Average method:

Weighted average method is one more type of inventory valuation technique, in which

the purchases are recorded at actual costs but the issues are recorded at the weighted average

price of the materials. To ascertain the issue price or the cost of goods sold, the amount of last

held materials is divided by the quantity of materials to get the issue price. In this system, both

the cost of goods sold and the ending inventory is valued at weighted average price and is

suitable for every type of business.

Periodic Inventory System:

FIFO method, LIFO method, Simple average method and weighted average method of inventory

valuation. In this system with every sales transaction, a separate entry is passed to record to cost

of goods sold. At the end of the period the value of closing inventory is automatically determined

by the store ledger balance. Some of such inventory valuation methods have been described

below.

First-in-firs-out method:

First In First Out (FIFO) is a method of inventory recording and inventory valuation in

which, all the purchases of inventory are recorded as and when the purchases are made and

issues are recorded on the basis of prices of earliest received materials. In this system the cost of

goods sold is measured taking the prices of materials received in the earlier stage and the closing

inventory is valued at the recent market price. In the inflationary period this system is suitable

and can give a reasonable and logical result.

Weighted Average method:

Weighted average method is one more type of inventory valuation technique, in which

the purchases are recorded at actual costs but the issues are recorded at the weighted average

price of the materials. To ascertain the issue price or the cost of goods sold, the amount of last

held materials is divided by the quantity of materials to get the issue price. In this system, both

the cost of goods sold and the ending inventory is valued at weighted average price and is

suitable for every type of business.

Periodic Inventory System:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING SYSTEM

In contrast of the perpetual inventory system, periodic inventory system is one more type

of inventory control and management system. In this system, the purchases are recorded as and

when the purchase transaction is made but the issues are not recorded properly as and when such

issues take place. At the end of the period the closing inventory is valued by physical stock

taking and considering the current market price of the inventory. Then the cost of goods sold is

determined by the difference between the cost of goods available and the cost of ending

inventory. Here, the cost of goods available is equal to the summation of beginning inventory

and the cost of purchase. This is a traditional system which is less rational and effective in real

time business practice.

Conclusion:

From the above discussion, it can be concluded that, inventory is a resource for the

business which needs to be well managed for an optimum and efficient utilization of business

resources. To achieve such objective there are various inventory management concepts and tools

which can be applied in a business. The perpetual and weighted average method of inventory

valuation is more efficient and effective for business and hence, it can be recommended for the

company to adopt the weighted average method of perpetual inventory system.

In contrast of the perpetual inventory system, periodic inventory system is one more type

of inventory control and management system. In this system, the purchases are recorded as and

when the purchase transaction is made but the issues are not recorded properly as and when such

issues take place. At the end of the period the closing inventory is valued by physical stock

taking and considering the current market price of the inventory. Then the cost of goods sold is

determined by the difference between the cost of goods available and the cost of ending

inventory. Here, the cost of goods available is equal to the summation of beginning inventory

and the cost of purchase. This is a traditional system which is less rational and effective in real

time business practice.

Conclusion:

From the above discussion, it can be concluded that, inventory is a resource for the

business which needs to be well managed for an optimum and efficient utilization of business

resources. To achieve such objective there are various inventory management concepts and tools

which can be applied in a business. The perpetual and weighted average method of inventory

valuation is more efficient and effective for business and hence, it can be recommended for the

company to adopt the weighted average method of perpetual inventory system.

5ACCOUNTING SYSTEM

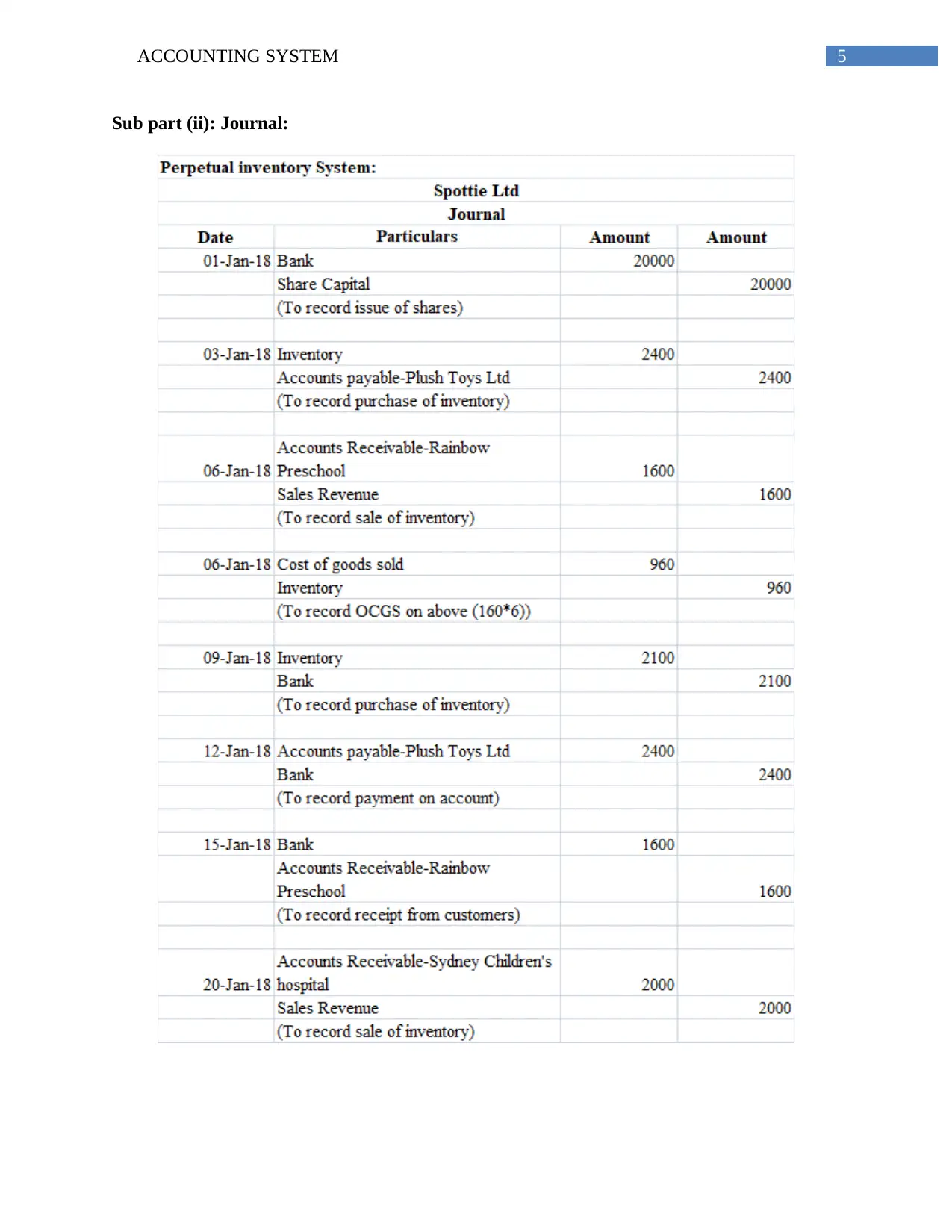

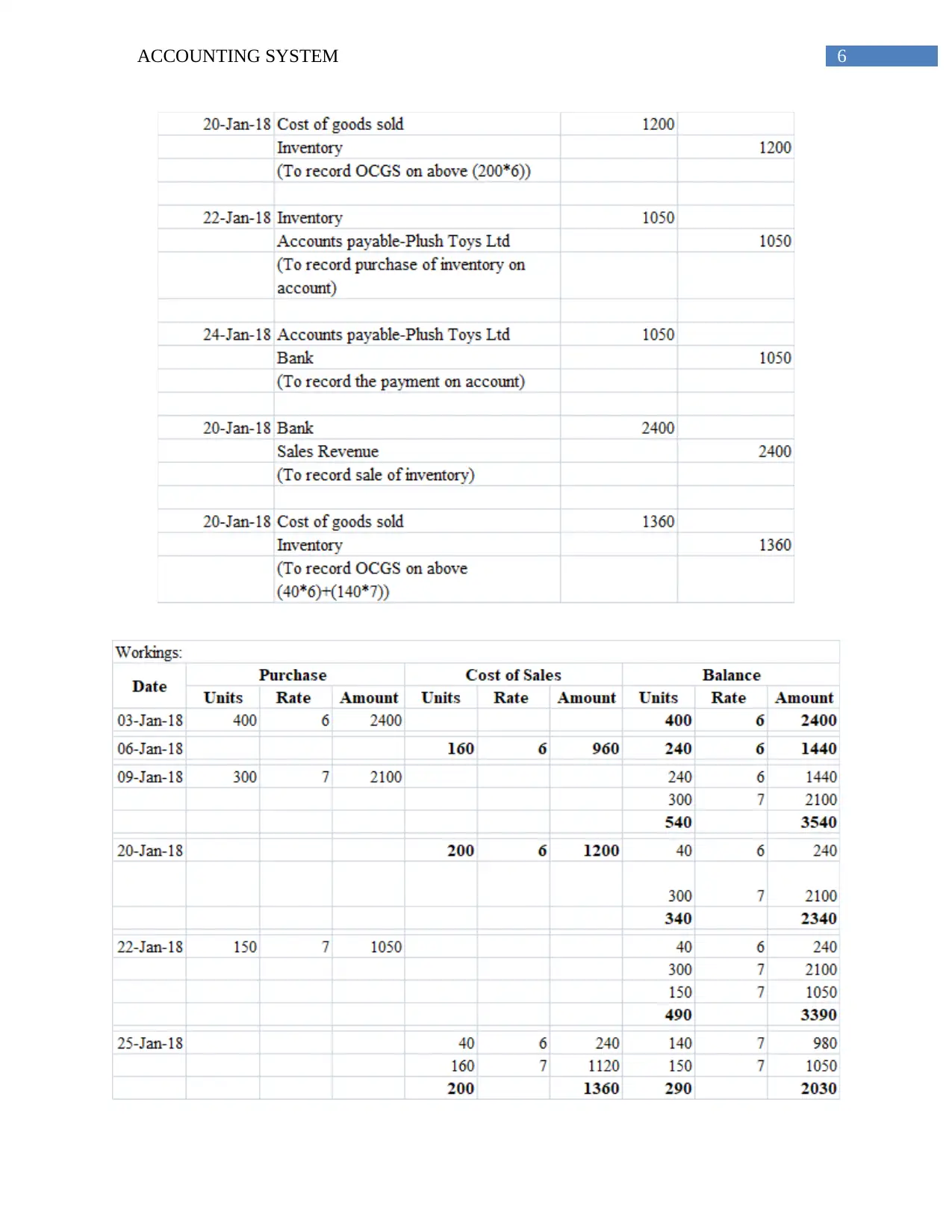

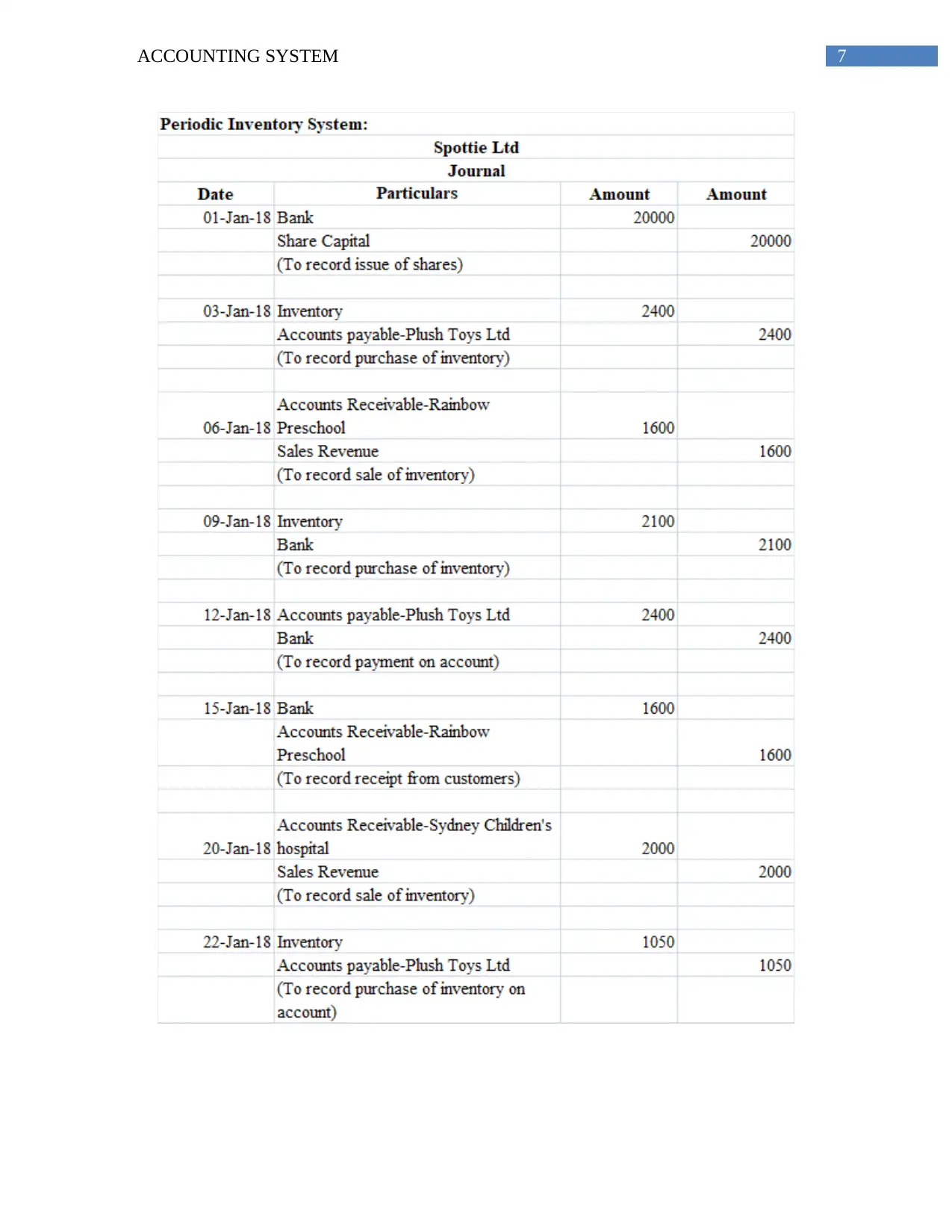

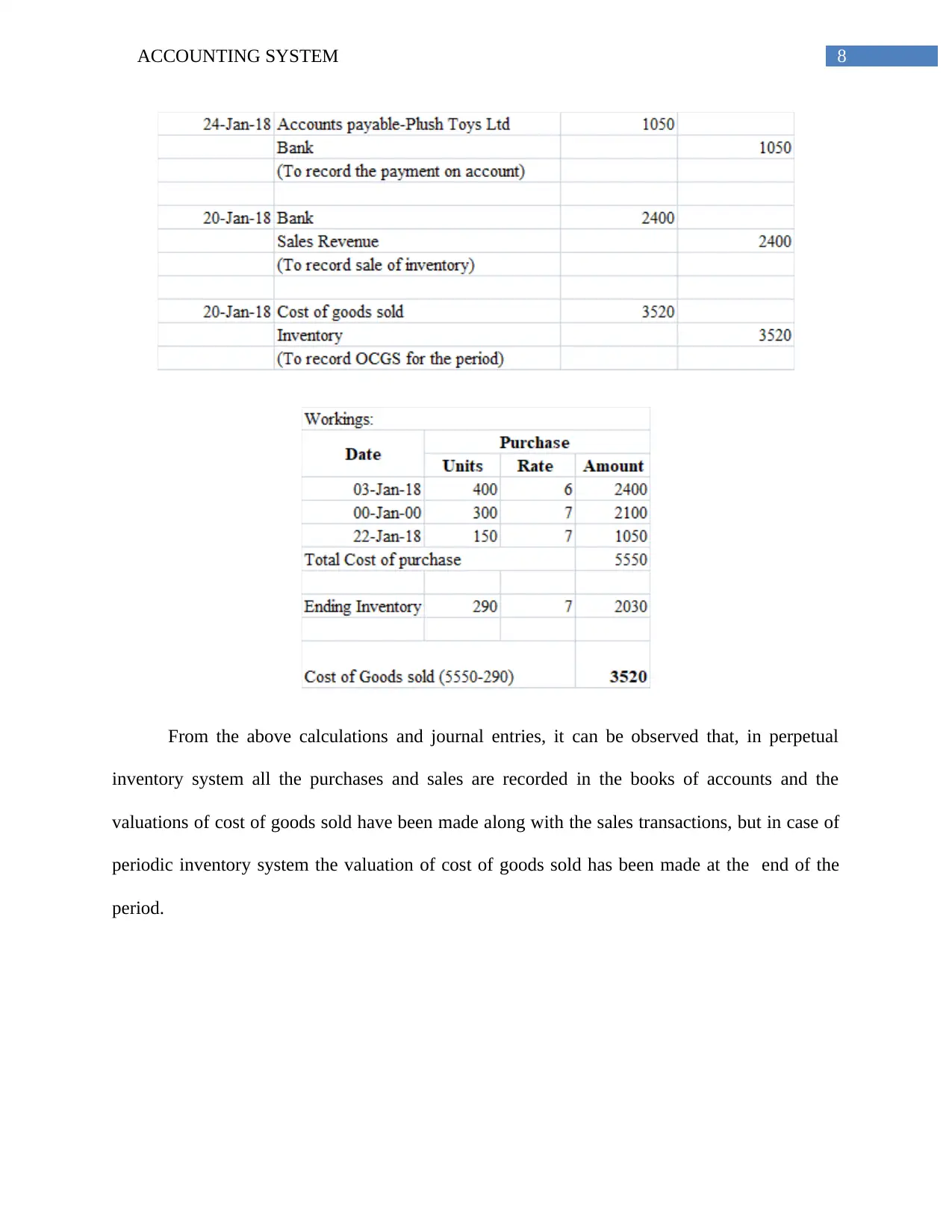

Sub part (ii): Journal:

Sub part (ii): Journal:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING SYSTEM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING SYSTEM

8ACCOUNTING SYSTEM

From the above calculations and journal entries, it can be observed that, in perpetual

inventory system all the purchases and sales are recorded in the books of accounts and the

valuations of cost of goods sold have been made along with the sales transactions, but in case of

periodic inventory system the valuation of cost of goods sold has been made at the end of the

period.

From the above calculations and journal entries, it can be observed that, in perpetual

inventory system all the purchases and sales are recorded in the books of accounts and the

valuations of cost of goods sold have been made along with the sales transactions, but in case of

periodic inventory system the valuation of cost of goods sold has been made at the end of the

period.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING SYSTEM

Answer to question 2: Report:

Introduction:

Accounting is the process of recording business transactions, summarizing them and

preparing meaningful information and reports after processing them. When the volume of

businesses were small and the transactions were a very and simple, it was possible for a single

individual to manage all the accounting and reporting activities of an organization. To ride off

this situation, various accounting information systems have developed which can help and

individual to record numerous transactions and process them simultaneously. There are various

fully automated and semi automated accounting software and accounting information systems

available in the market which can be used in real time business situations to record business

transaction and to process them. Some important desktop accounting software are, MAYOB,

Sage 50, Tally, SAP and so on. There are some cloud based accounting systems also, which can

be accessed through the internet and can be worked in from anywhere. A good example of such a

cloud based accounting systems is the Xero cloud based accounting information syste (Belfo &

Trigo 2013).

Computerized Accounting Information System:

With the revolution in the business world and advancement in the technologies the

accounting system has also been computerized for more accurate and efficient management and

processing of accounting information. Various computerized systems and computer aids have

been used to manage the accounting and recording processes of business transactions of any

business organizations. Various customized as well as readymade accounting software packages

are available in the market which can be used for this purpose. Some of such important desktop

Answer to question 2: Report:

Introduction:

Accounting is the process of recording business transactions, summarizing them and

preparing meaningful information and reports after processing them. When the volume of

businesses were small and the transactions were a very and simple, it was possible for a single

individual to manage all the accounting and reporting activities of an organization. To ride off

this situation, various accounting information systems have developed which can help and

individual to record numerous transactions and process them simultaneously. There are various

fully automated and semi automated accounting software and accounting information systems

available in the market which can be used in real time business situations to record business

transaction and to process them. Some important desktop accounting software are, MAYOB,

Sage 50, Tally, SAP and so on. There are some cloud based accounting systems also, which can

be accessed through the internet and can be worked in from anywhere. A good example of such a

cloud based accounting systems is the Xero cloud based accounting information syste (Belfo &

Trigo 2013).

Computerized Accounting Information System:

With the revolution in the business world and advancement in the technologies the

accounting system has also been computerized for more accurate and efficient management and

processing of accounting information. Various computerized systems and computer aids have

been used to manage the accounting and recording processes of business transactions of any

business organizations. Various customized as well as readymade accounting software packages

are available in the market which can be used for this purpose. Some of such important desktop

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING SYSTEM

accounting packages are, MAYOB, SAP and Recon. Some cloud based computerized accounting

systems are XERO, Sage 50 cloud based information system and so on. The Xero cloud based

accounting system has become very popular and has been used widely all over the globe. In the

following paragraphs of this report, some of such importance, advantage and disadvantages of

the Xero cloud based accounting system have been described briefly (Belfo & Trigo 2013).

Xero Cloud based accounting information system:

Xero is a cloud based accounting information system, which is totally cloud based and

can be accessed and operated from anywhere using internet. To use the system, an annual

subscription needs to be purchased and the company needs to be registered with the Xero system.

All the details of the company needs to entered into the system before starting the work. It is a

totally automated accounting information system. The only thing an individual needs to do, is

just to enter the invoices and bills, the rest of the processing of accounting information is done

automatically by the system. It records all the subsidiary books by itself and can generate

meaningful information for the use of the managers and information users. it is having various

advantages for which it is gaining importance day by day, some of such advantages of the system

have been outlined as follows (Hossack 2015).

Advantages of Xero Cloud based accounting information system:

The Xero cloud based accounting system processes the financial data and produces the desired

and meaningful reports based on the given criteria. The important feature of the system is its

accessibility from the anywhere in the world. The software can be accessed from anywhere using

the internet and can be worked into it sitting anywhere. Its popularity is because of its simplicity

accounting packages are, MAYOB, SAP and Recon. Some cloud based computerized accounting

systems are XERO, Sage 50 cloud based information system and so on. The Xero cloud based

accounting system has become very popular and has been used widely all over the globe. In the

following paragraphs of this report, some of such importance, advantage and disadvantages of

the Xero cloud based accounting system have been described briefly (Belfo & Trigo 2013).

Xero Cloud based accounting information system:

Xero is a cloud based accounting information system, which is totally cloud based and

can be accessed and operated from anywhere using internet. To use the system, an annual

subscription needs to be purchased and the company needs to be registered with the Xero system.

All the details of the company needs to entered into the system before starting the work. It is a

totally automated accounting information system. The only thing an individual needs to do, is

just to enter the invoices and bills, the rest of the processing of accounting information is done

automatically by the system. It records all the subsidiary books by itself and can generate

meaningful information for the use of the managers and information users. it is having various

advantages for which it is gaining importance day by day, some of such advantages of the system

have been outlined as follows (Hossack 2015).

Advantages of Xero Cloud based accounting information system:

The Xero cloud based accounting system processes the financial data and produces the desired

and meaningful reports based on the given criteria. The important feature of the system is its

accessibility from the anywhere in the world. The software can be accessed from anywhere using

the internet and can be worked into it sitting anywhere. Its popularity is because of its simplicity

11ACCOUNTING SYSTEM

and efficiency. It is very much simple and easy to record transactions in the system; the rest part

of processing the information is done by itself automatically. Its user interface is also very simple

and easy. Its advanced feature is its information generating capacityion. It shows all the

important figures and facts in the dashboard of the system with some graphs. It also shows the

pending invoices for receipt and pending bills to be paid in the dashboard. Another more

important feature of the system is the inventory control system. It records all the inventory

related transactions and tracks the inventory with every inputs and outputs in the inventory.

Therefore, it is very user friendly easy and efficient in performing all the accounting and

reporting financial transactions (Hossack 2015).

Disadvantages of Xero Accounting information system:

Xero is a fully automated cloud based accounting information system. It can be accessed

through the internet and can be used from anywhere in the world. it is very much easy to operate

and to record transactions. Only the invoices for sales and bills for purchases are needed to be

entered. Various other automated calculation features includes, the calculations and accounting

for fixed assets and depreciation, interest calculations, debtors and creditors management and so

on. It also presents data and reports in a meaningful and systematic way and formats. It can

present information in graphical forms also. It shows all the key parameters and figures of

accounting in the dashboard of the system. Having all those usefulness and efficiencies it is

becoming more popular now a days (Brandas, Megan & Didraga 2015).

Adoption of the Xero Accounting information system:

After knowing the importance and advantages of Xero, now the disadvantages or shor

coming of the system must be analyzed. Xero is a complete cloud based system. All the

transactions are recorded using internet and all the data are stored in the cloud. If any alteration is

and efficiency. It is very much simple and easy to record transactions in the system; the rest part

of processing the information is done by itself automatically. Its user interface is also very simple

and easy. Its advanced feature is its information generating capacityion. It shows all the

important figures and facts in the dashboard of the system with some graphs. It also shows the

pending invoices for receipt and pending bills to be paid in the dashboard. Another more

important feature of the system is the inventory control system. It records all the inventory

related transactions and tracks the inventory with every inputs and outputs in the inventory.

Therefore, it is very user friendly easy and efficient in performing all the accounting and

reporting financial transactions (Hossack 2015).

Disadvantages of Xero Accounting information system:

Xero is a fully automated cloud based accounting information system. It can be accessed

through the internet and can be used from anywhere in the world. it is very much easy to operate

and to record transactions. Only the invoices for sales and bills for purchases are needed to be

entered. Various other automated calculation features includes, the calculations and accounting

for fixed assets and depreciation, interest calculations, debtors and creditors management and so

on. It also presents data and reports in a meaningful and systematic way and formats. It can

present information in graphical forms also. It shows all the key parameters and figures of

accounting in the dashboard of the system. Having all those usefulness and efficiencies it is

becoming more popular now a days (Brandas, Megan & Didraga 2015).

Adoption of the Xero Accounting information system:

After knowing the importance and advantages of Xero, now the disadvantages or shor

coming of the system must be analyzed. Xero is a complete cloud based system. All the

transactions are recorded using internet and all the data are stored in the cloud. If any alteration is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.