Wesfarmers Limited Financial Analysis

VerifiedAdded on 2020/04/01

|26

|1455

|46

AI Summary

This assignment analyzes the financial performance of Australian retail giant Wesfarmers Limited. It examines key financial ratios such as Return on Equity, Earnings per Share, and Working Capital Ratio. The analysis also delves into risk management practices, corporate governance adherence (to ASX Corporate Governance), and provides recommendations for potential investment based on the company's financial stability and profit trends.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING SYSTEMS AND PROCESSES

Accounting Systems and Processes

Name of the Student:

Name of the University:

Author Note:

Accounting Systems and Processes

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2ACCOUNTING SYSTEMS AND PROCESSES

Table of Contents

Question 1........................................................................................................................................4

Naming cells in spreadsheets...........................................................................................................4

Question 2........................................................................................................................................4

Negative numbers............................................................................................................................4

Question 3........................................................................................................................................5

Spreadsheet of data and report areas...............................................................................................5

Question 4........................................................................................................................................6

IF Functions.....................................................................................................................................6

Question 5........................................................................................................................................7

Periodic inventory systems..............................................................................................................7

Question 6........................................................................................................................................7

Worksheet and financial reports......................................................................................................7

Question 7......................................................................................................................................14

Question 8......................................................................................................................................18

Bank reconciliation........................................................................................................................18

Question 9......................................................................................................................................20

Accounts receivable.......................................................................................................................20

Question 10....................................................................................................................................21

Table of Contents

Question 1........................................................................................................................................4

Naming cells in spreadsheets...........................................................................................................4

Question 2........................................................................................................................................4

Negative numbers............................................................................................................................4

Question 3........................................................................................................................................5

Spreadsheet of data and report areas...............................................................................................5

Question 4........................................................................................................................................6

IF Functions.....................................................................................................................................6

Question 5........................................................................................................................................7

Periodic inventory systems..............................................................................................................7

Question 6........................................................................................................................................7

Worksheet and financial reports......................................................................................................7

Question 7......................................................................................................................................14

Question 8......................................................................................................................................18

Bank reconciliation........................................................................................................................18

Question 9......................................................................................................................................20

Accounts receivable.......................................................................................................................20

Question 10....................................................................................................................................21

3ACCOUNTING SYSTEMS AND PROCESSES

Question 11....................................................................................................................................22

Question 12....................................................................................................................................22

Dishonor of a note receivable........................................................................................................22

Question 13....................................................................................................................................23

Reference List................................................................................................................................26

Question 11....................................................................................................................................22

Question 12....................................................................................................................................22

Dishonor of a note receivable........................................................................................................22

Question 13....................................................................................................................................23

Reference List................................................................................................................................26

4ACCOUNTING SYSTEMS AND PROCESSES

Question 1

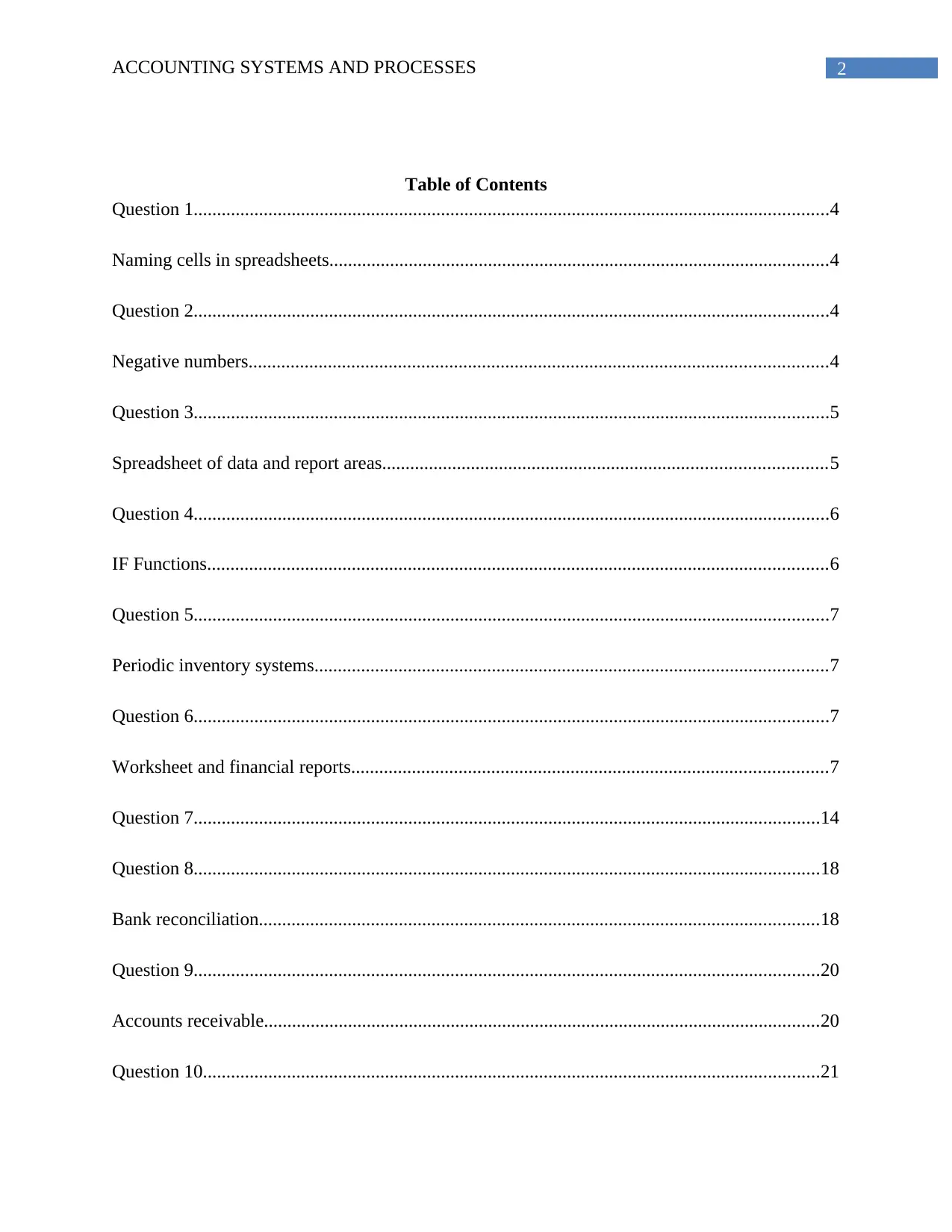

Naming cells in spreadsheets

In a spreadsheet, it is important to name each cells with a name to avoid any confusion.

Naming each of the cell make it easy to understand and correlate with the statement that is

required to solve any case calculations.

Calculation of Gross Profit:-

Particulars Amount

Sales Revenue $17000

Less: Cost of Goods Sold $2000

GROSS PROFIT $15000

Question 2

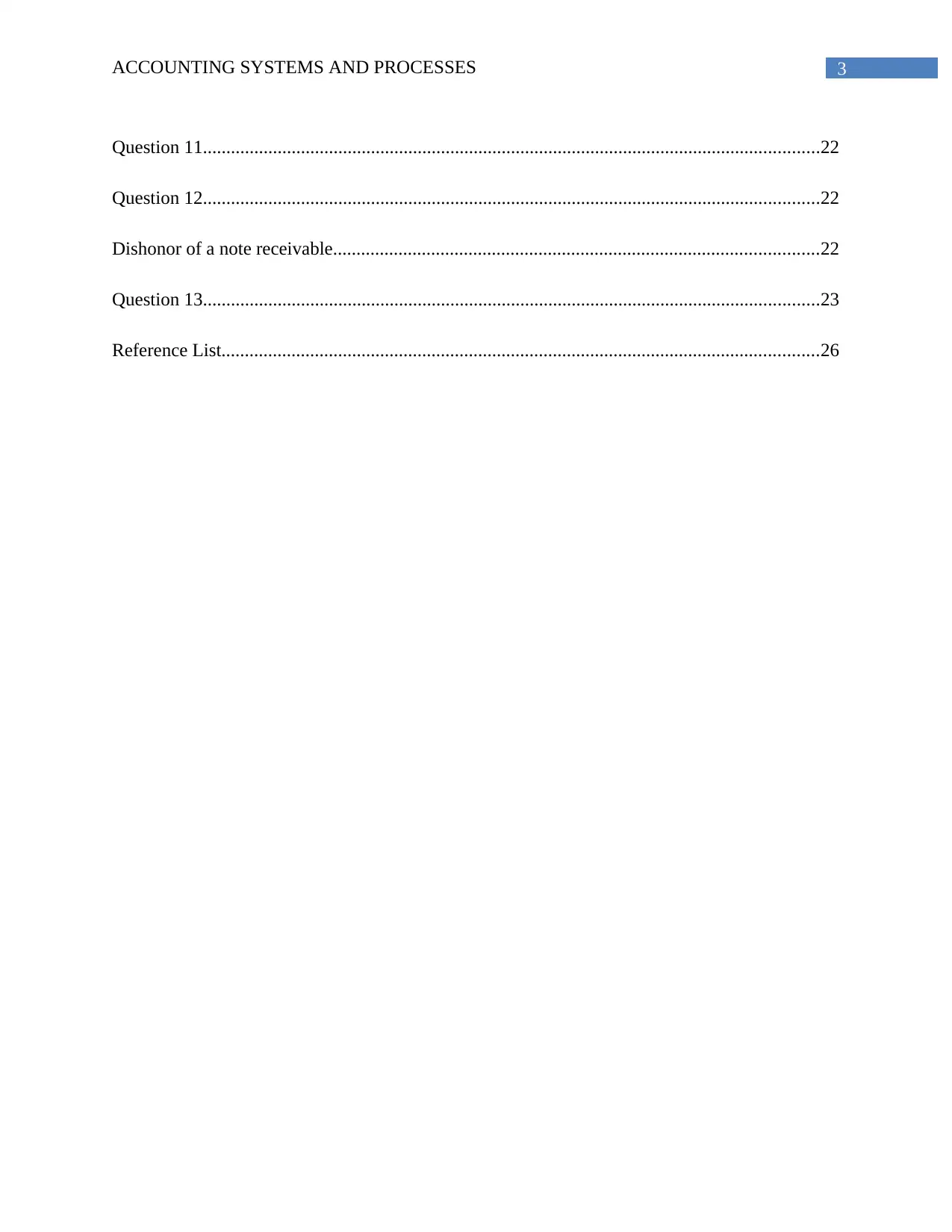

Negative numbers

In spreadsheet, negative numbers are presented by either brackets with minus sign or with

a red color.

Question 1

Naming cells in spreadsheets

In a spreadsheet, it is important to name each cells with a name to avoid any confusion.

Naming each of the cell make it easy to understand and correlate with the statement that is

required to solve any case calculations.

Calculation of Gross Profit:-

Particulars Amount

Sales Revenue $17000

Less: Cost of Goods Sold $2000

GROSS PROFIT $15000

Question 2

Negative numbers

In spreadsheet, negative numbers are presented by either brackets with minus sign or with

a red color.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5ACCOUNTING SYSTEMS AND PROCESSES

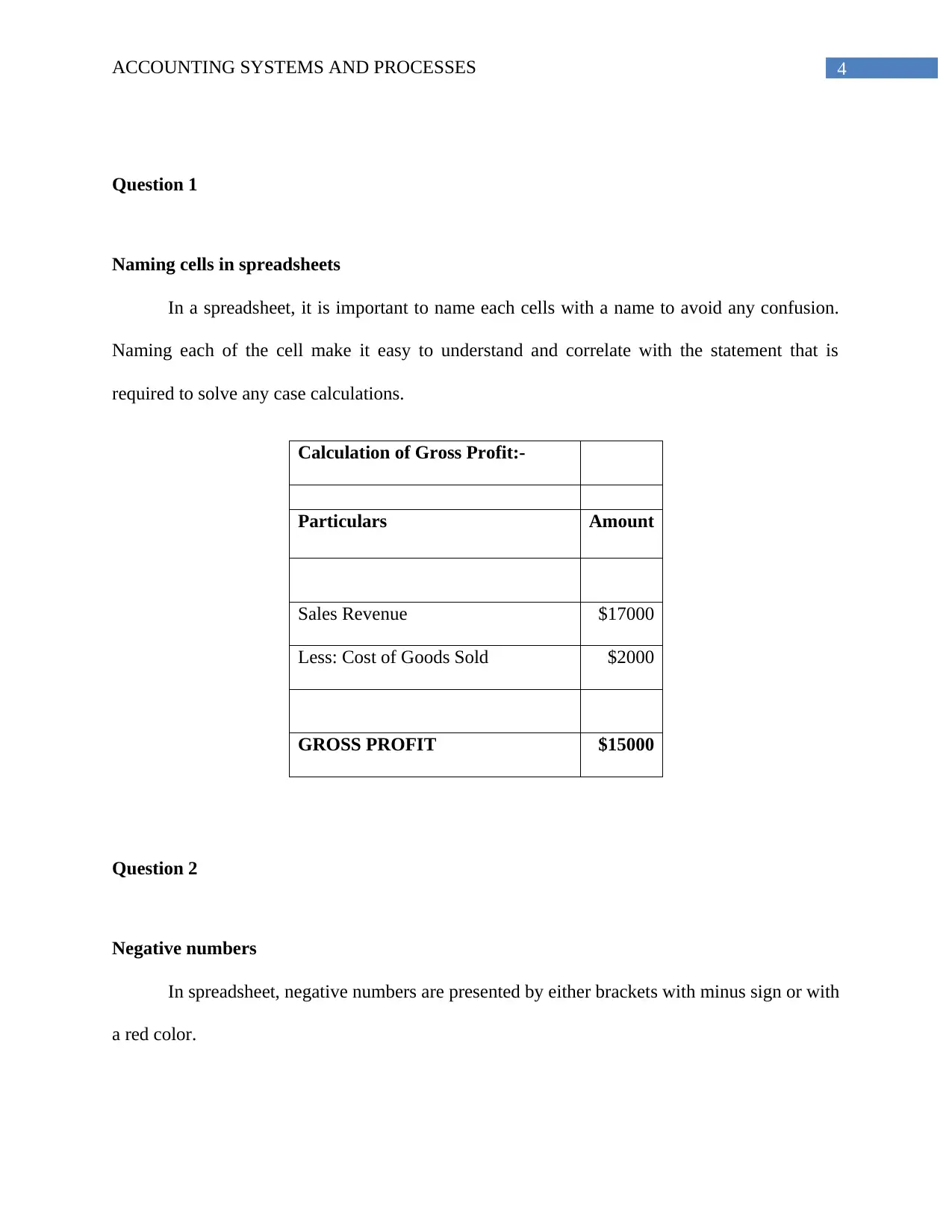

Question 3

Spreadsheet of data and report areas

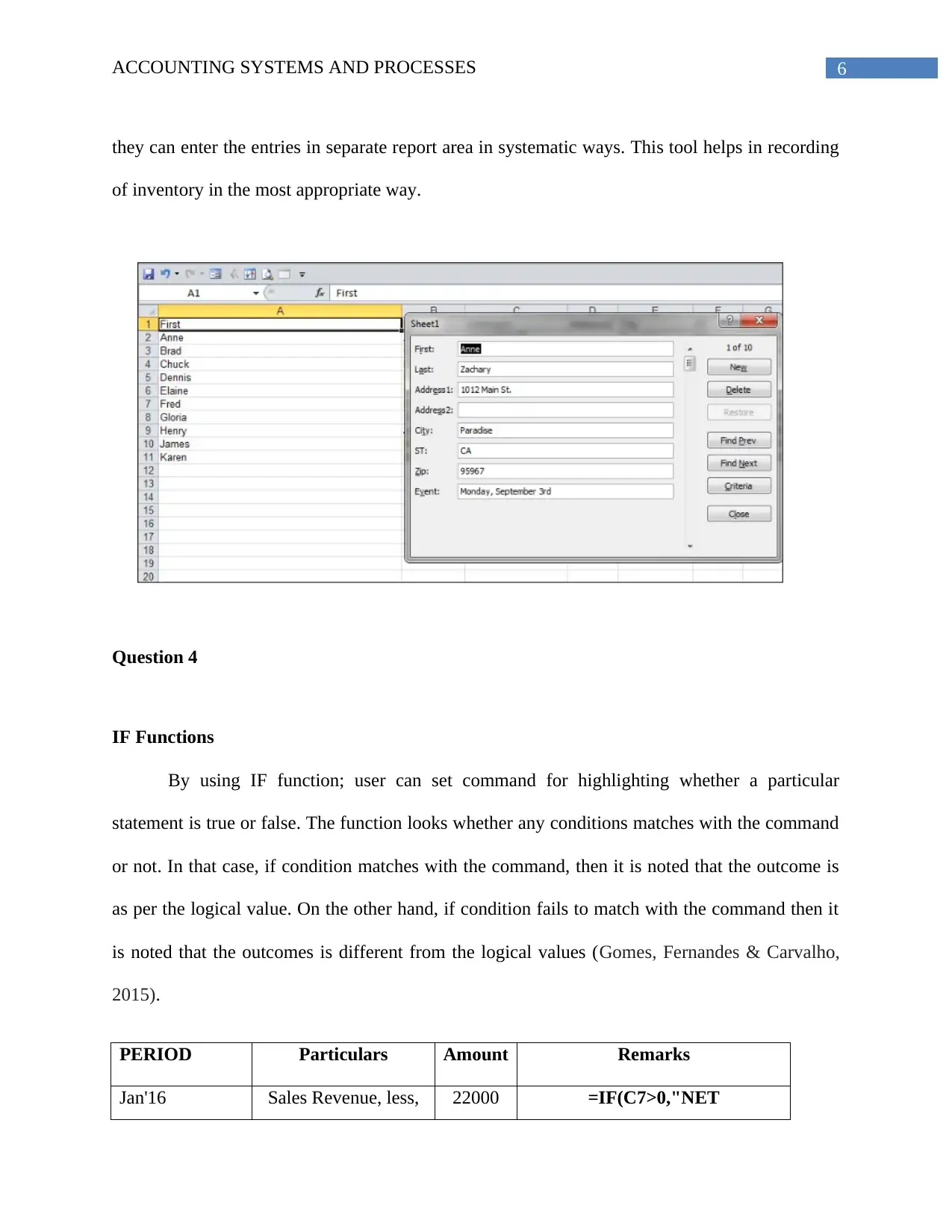

An accountant make use of spreadsheets with completely separate data entry area as well

as separate report area in order to reduce any type of error present at the time of analyzing

financial study. The spreadsheet design is treated as one of the important mechanisms where it is

sure to achieve success in short-term and long-term basis. Using spreadsheets by accountants

will help them in getting access to flexible results and further it become easy to analyze, enhance

and optimize performance level in any of the business organization. Use of spreadsheet can even

give rise to risk as it even generate incorrect information that automatically lead to poor

decision-making activities. To that, accountants should make an effort to reduce the level of risk

as far as possible by following required design and get involved in developmental practices.

Therefore, spreadsheets are a significant tool that makes works easier for the accounts where

Question 3

Spreadsheet of data and report areas

An accountant make use of spreadsheets with completely separate data entry area as well

as separate report area in order to reduce any type of error present at the time of analyzing

financial study. The spreadsheet design is treated as one of the important mechanisms where it is

sure to achieve success in short-term and long-term basis. Using spreadsheets by accountants

will help them in getting access to flexible results and further it become easy to analyze, enhance

and optimize performance level in any of the business organization. Use of spreadsheet can even

give rise to risk as it even generate incorrect information that automatically lead to poor

decision-making activities. To that, accountants should make an effort to reduce the level of risk

as far as possible by following required design and get involved in developmental practices.

Therefore, spreadsheets are a significant tool that makes works easier for the accounts where

6ACCOUNTING SYSTEMS AND PROCESSES

they can enter the entries in separate report area in systematic ways. This tool helps in recording

of inventory in the most appropriate way.

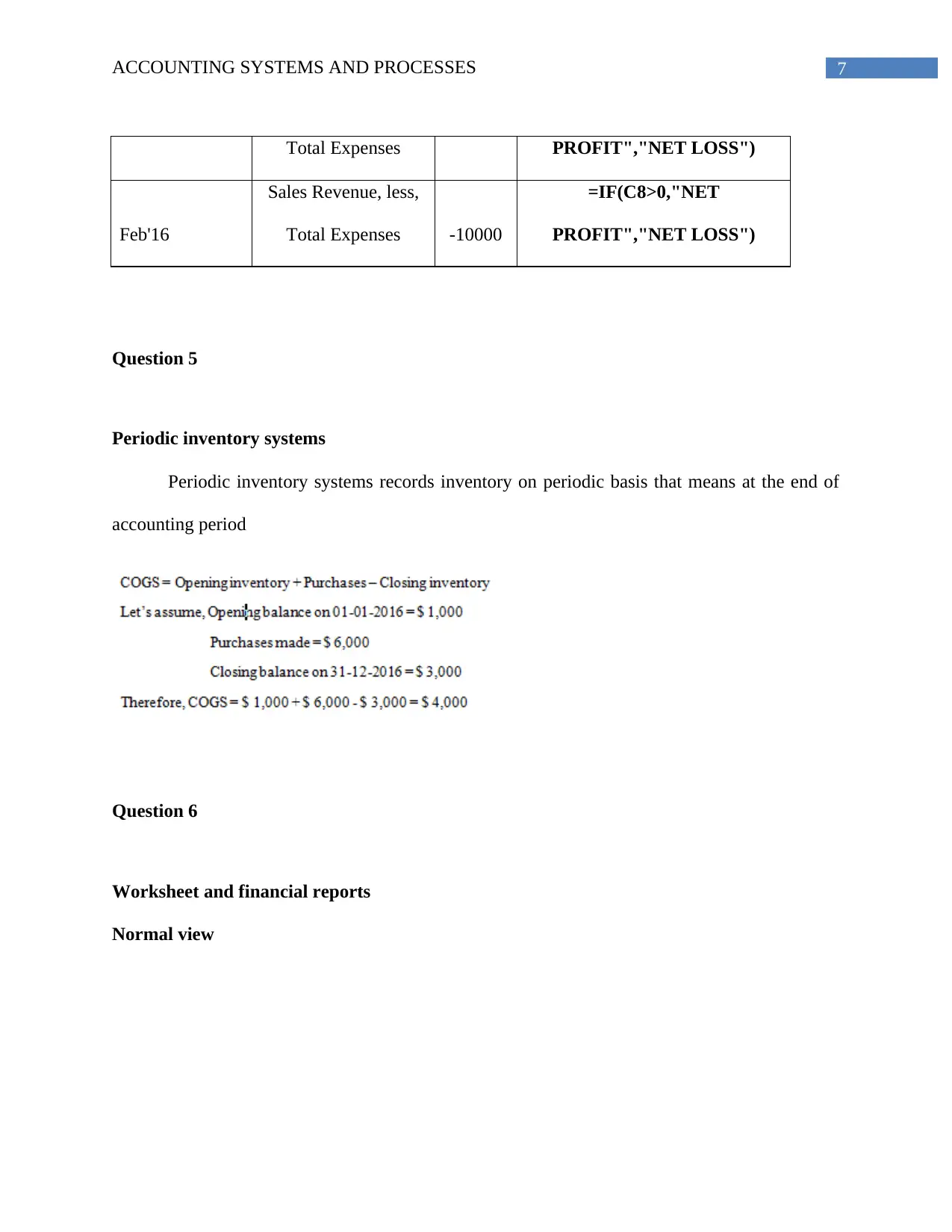

Question 4

IF Functions

By using IF function; user can set command for highlighting whether a particular

statement is true or false. The function looks whether any conditions matches with the command

or not. In that case, if condition matches with the command, then it is noted that the outcome is

as per the logical value. On the other hand, if condition fails to match with the command then it

is noted that the outcomes is different from the logical values (Gomes, Fernandes & Carvalho,

2015).

PERIOD Particulars Amount Remarks

Jan'16 Sales Revenue, less, 22000 =IF(C7>0,"NET

they can enter the entries in separate report area in systematic ways. This tool helps in recording

of inventory in the most appropriate way.

Question 4

IF Functions

By using IF function; user can set command for highlighting whether a particular

statement is true or false. The function looks whether any conditions matches with the command

or not. In that case, if condition matches with the command, then it is noted that the outcome is

as per the logical value. On the other hand, if condition fails to match with the command then it

is noted that the outcomes is different from the logical values (Gomes, Fernandes & Carvalho,

2015).

PERIOD Particulars Amount Remarks

Jan'16 Sales Revenue, less, 22000 =IF(C7>0,"NET

7ACCOUNTING SYSTEMS AND PROCESSES

Total Expenses PROFIT","NET LOSS")

Feb'16

Sales Revenue, less,

Total Expenses -10000

=IF(C8>0,"NET

PROFIT","NET LOSS")

Question 5

Periodic inventory systems

Periodic inventory systems records inventory on periodic basis that means at the end of

accounting period

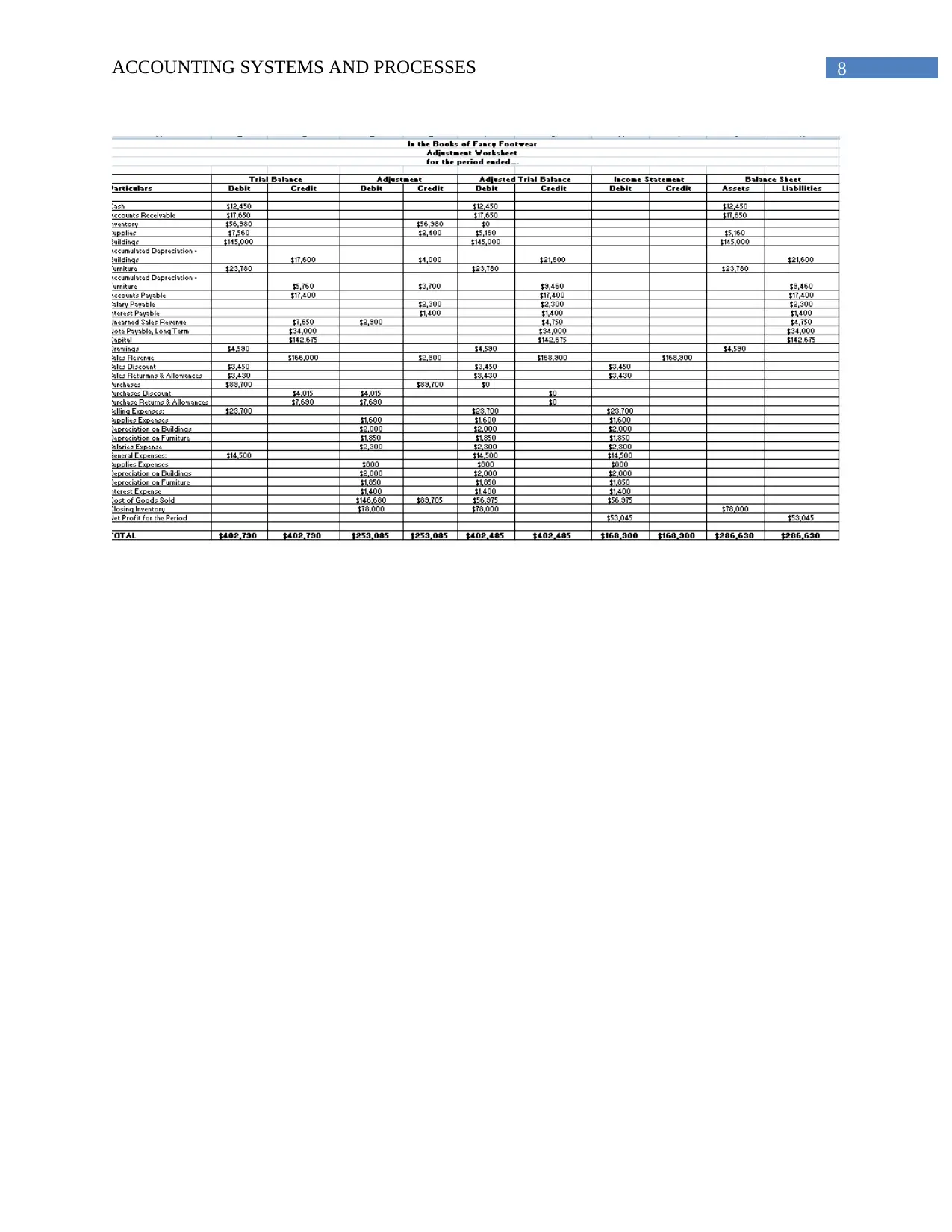

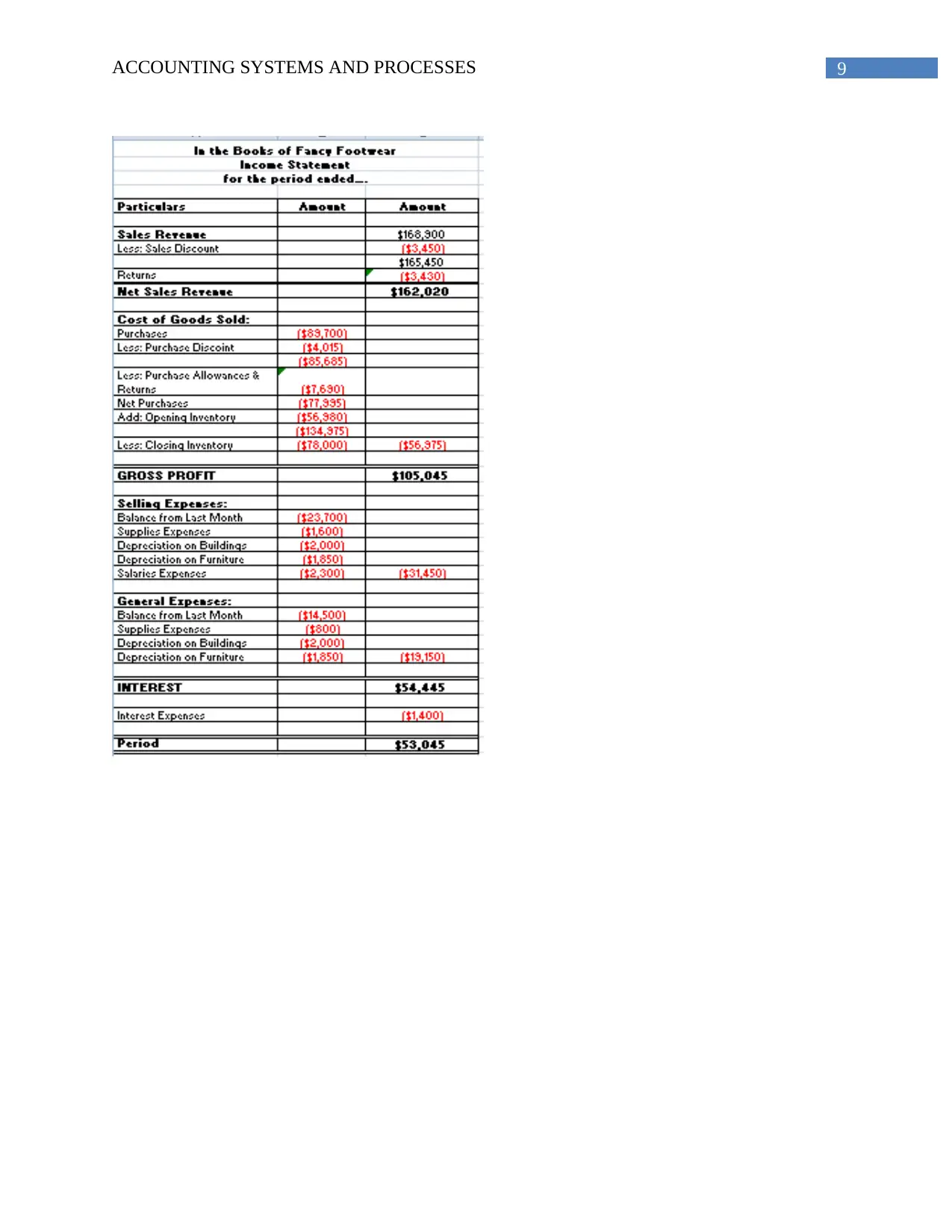

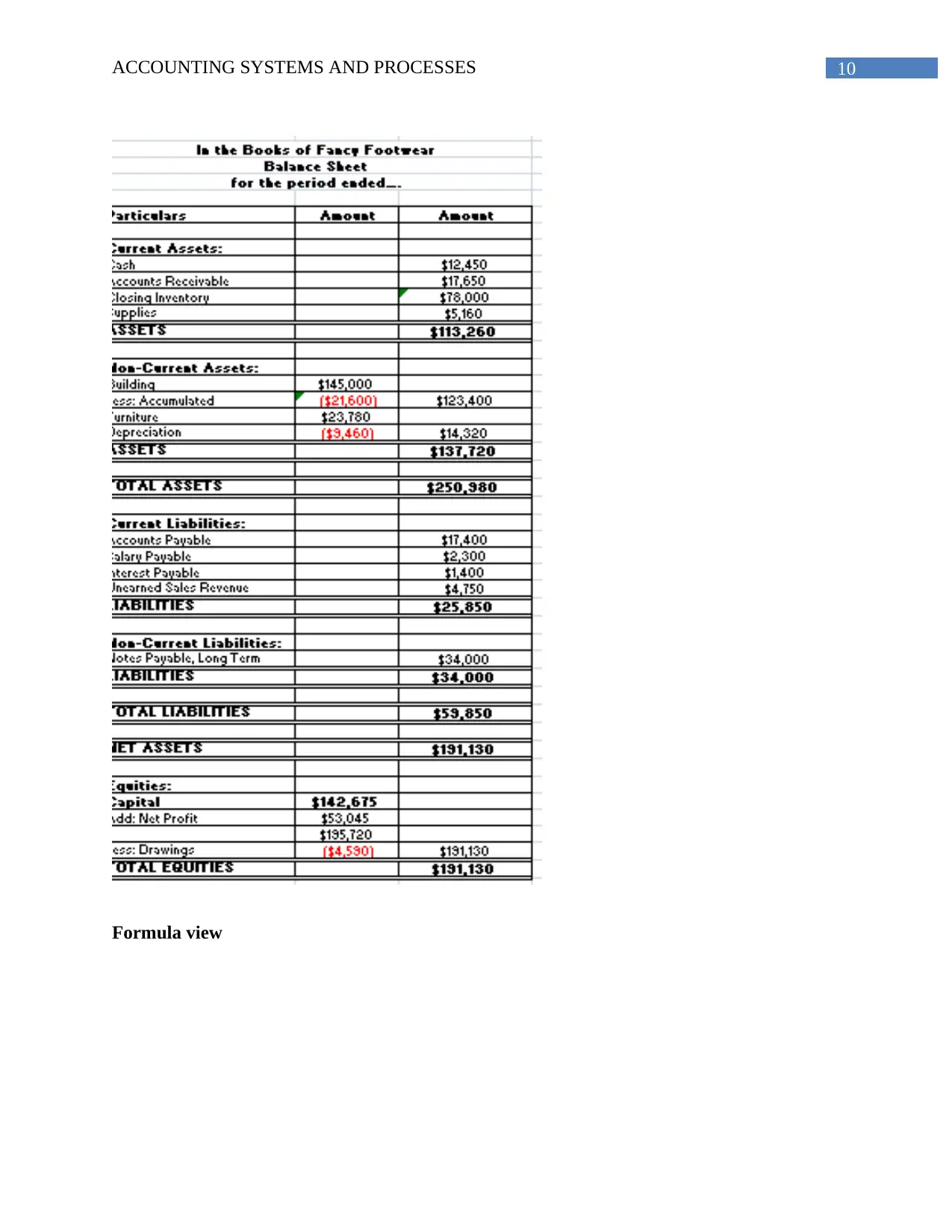

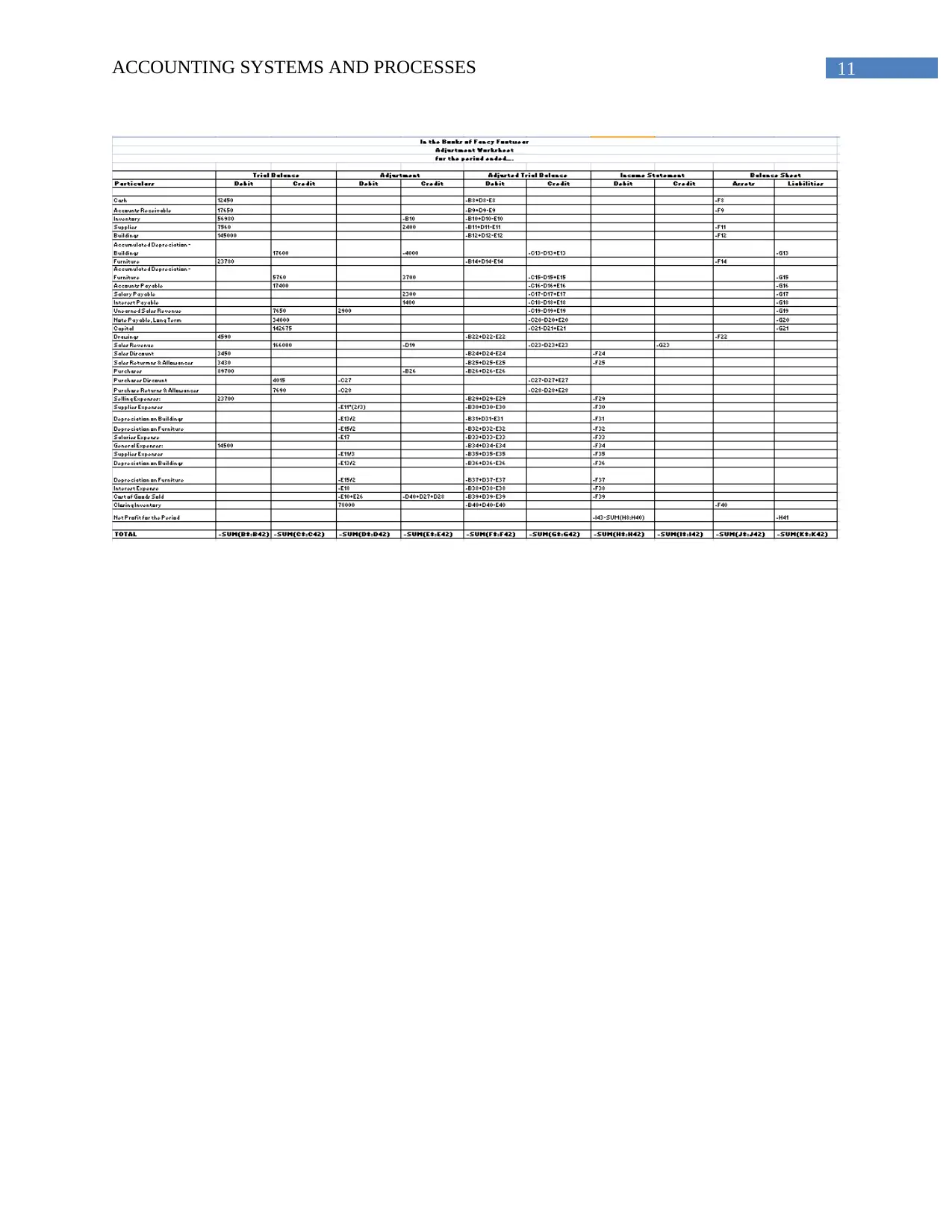

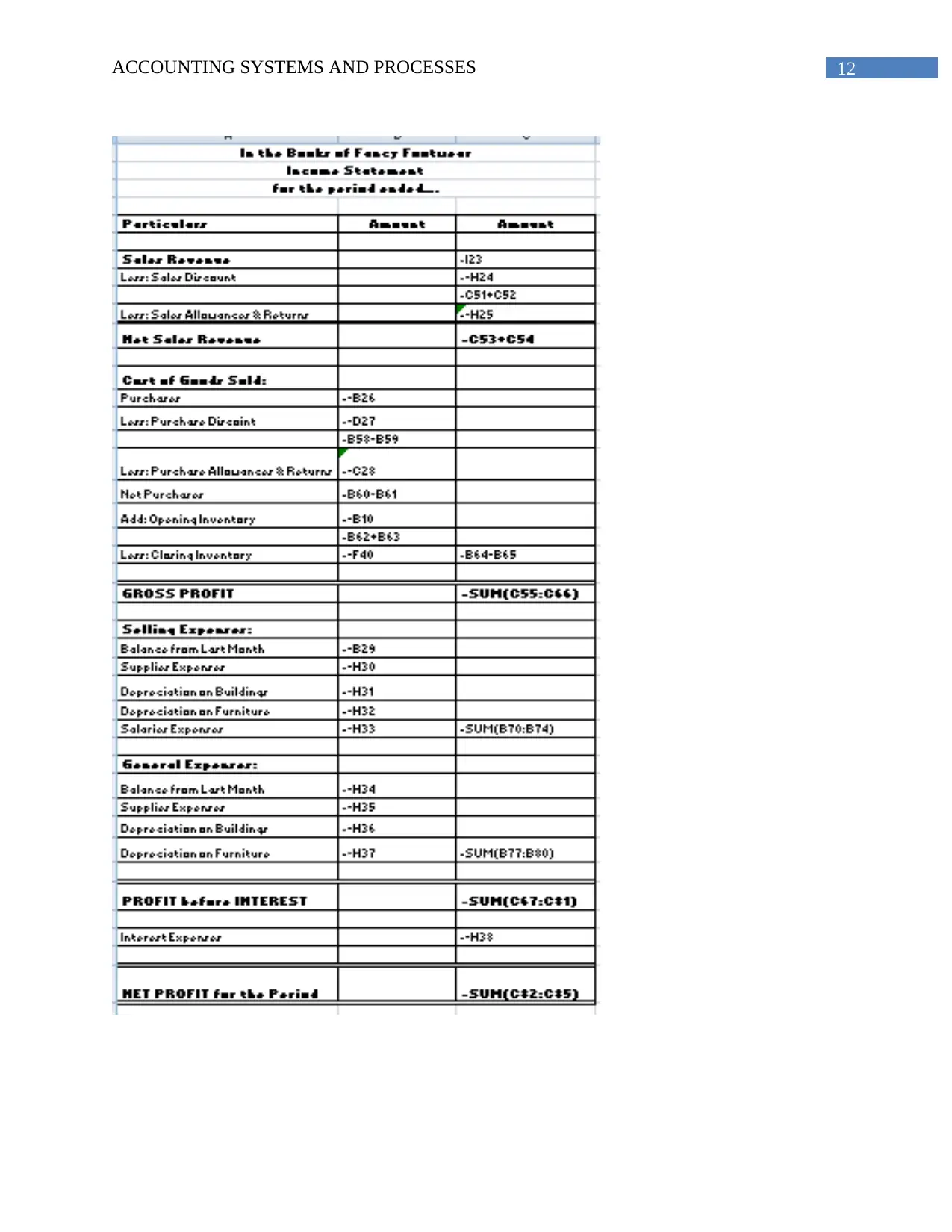

Question 6

Worksheet and financial reports

Normal view

Total Expenses PROFIT","NET LOSS")

Feb'16

Sales Revenue, less,

Total Expenses -10000

=IF(C8>0,"NET

PROFIT","NET LOSS")

Question 5

Periodic inventory systems

Periodic inventory systems records inventory on periodic basis that means at the end of

accounting period

Question 6

Worksheet and financial reports

Normal view

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8ACCOUNTING SYSTEMS AND PROCESSES

9ACCOUNTING SYSTEMS AND PROCESSES

10ACCOUNTING SYSTEMS AND PROCESSES

Formula view

Formula view

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11ACCOUNTING SYSTEMS AND PROCESSES

12ACCOUNTING SYSTEMS AND PROCESSES

13ACCOUNTING SYSTEMS AND PROCESSES

Particulars Amount Amount

Current Assets:

Cash =J8

Accounts Receivable =J9

Closing Inventory =F40

Supplies =J11

TOTAL CURRENT ASSETS =SUM(C95:C98)

Non-Current Assets:

Building =J12

Less: Accumulated Depreciation =-K13 =B102+B103

Furniture =J14

Less: Accumulated Depreciation =-K15 =B104+B105

TOTAL NON-CURRENT ASSETS =SUM(C103:C105)

TOTAL ASSETS =C99+C106

Current Liabilities:

Accounts Payable =K16

Salary Payable =K17

Interest Payable =K18

Unearned Sales Revenue =K19

TOTAL CURRENT LIABILITIES =SUM(C111:C114)

Non-Current Liabilities:

Notes Payable, Long Term =K20

TOTAL NON-CURRENT LIABILITIES =SUM(C116:C118)

TOTAL LIABILITIES =C119+C115

NET ASSETS =C108-C121

Equities:

Capital =K21

Add: Net Profit =K41

=B126+B127

Less: Drawings =-J22 =B128+B129

TOTAL EQUITIES =SUM(C125:C129)

for the period ended….

In the Books of Fancy Footwear

Balance Sheet

Particulars Amount Amount

Current Assets:

Cash =J8

Accounts Receivable =J9

Closing Inventory =F40

Supplies =J11

TOTAL CURRENT ASSETS =SUM(C95:C98)

Non-Current Assets:

Building =J12

Less: Accumulated Depreciation =-K13 =B102+B103

Furniture =J14

Less: Accumulated Depreciation =-K15 =B104+B105

TOTAL NON-CURRENT ASSETS =SUM(C103:C105)

TOTAL ASSETS =C99+C106

Current Liabilities:

Accounts Payable =K16

Salary Payable =K17

Interest Payable =K18

Unearned Sales Revenue =K19

TOTAL CURRENT LIABILITIES =SUM(C111:C114)

Non-Current Liabilities:

Notes Payable, Long Term =K20

TOTAL NON-CURRENT LIABILITIES =SUM(C116:C118)

TOTAL LIABILITIES =C119+C115

NET ASSETS =C108-C121

Equities:

Capital =K21

Add: Net Profit =K41

=B126+B127

Less: Drawings =-J22 =B128+B129

TOTAL EQUITIES =SUM(C125:C129)

for the period ended….

In the Books of Fancy Footwear

Balance Sheet

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14ACCOUNTING SYSTEMS AND PROCESSES

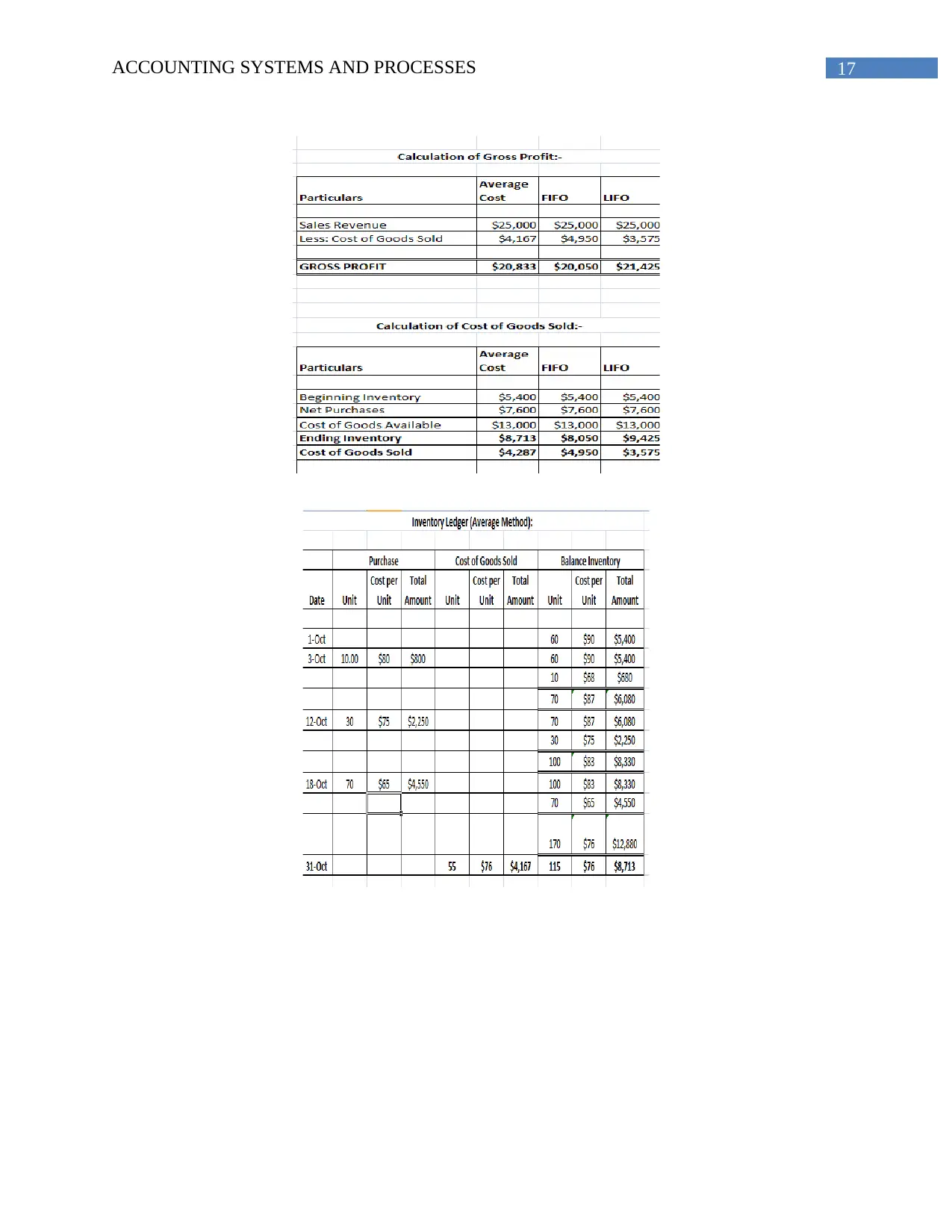

Question 7

Original data

Normal view

Particulars

Average

Cost FIFO LIFO

Beginning Inventory $3,420 $3,420 $3,420

Net Purchases $7,790 $7,790 $7,790

Cost of Goods Available $11,210 $11,210 $11,210

Ending Inventory $7,583 $8,075 $7,250

Cost of Goods Sold $3,627 $3,135 $3,960

Calculation of Gross Profit:-

Particulars

Average

Cost FIFO LIFO

Sales Revenue $25,000 $25,000 $25,000

Less: Cost of Goods Sold $3,627 $3,135 $3,960

GROSS PROFIT $21,373 $21,865 $21,040

Calculation of Gross Profit:-

Formula view

Question 7

Original data

Normal view

Particulars

Average

Cost FIFO LIFO

Beginning Inventory $3,420 $3,420 $3,420

Net Purchases $7,790 $7,790 $7,790

Cost of Goods Available $11,210 $11,210 $11,210

Ending Inventory $7,583 $8,075 $7,250

Cost of Goods Sold $3,627 $3,135 $3,960

Calculation of Gross Profit:-

Particulars

Average

Cost FIFO LIFO

Sales Revenue $25,000 $25,000 $25,000

Less: Cost of Goods Sold $3,627 $3,135 $3,960

GROSS PROFIT $21,373 $21,865 $21,040

Calculation of Gross Profit:-

Formula view

15ACCOUNTING SYSTEMS AND PROCESSES

Particulars Average Cost FIFO LIFO

Sales Revenue 25000 =B6 =C6

Less: Cost of Goods Sold 3627 3135 3960

GROSS PROFIT =B6-B7 =C6-C7 =D6-D7

Particulars Average Cost FIFO LIFO

Beginning Inventory 3420 3420 3420

Net Purchases 7790 7790 7790

Cost of Goods Available =B17+B18 =C17+C18 =D17+D18

Ending Inventory 7583 8075 7250

Cost of Goods Sold =B19-B20 =C19-C20 =D19-D20

Calculation of Gross Profit:-

Calculation of Gross Profit:-

Workings

Date Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount

1-Oct 60 $57 $3,420

3-Oct 10.00 $65 $650 60 $57 $3,420

10 $65 $650

70 $58 $4,070

12-Oct 30 $70 $2,100 70 $58 $4,070

30 $70 $2,100

100 $62 $6,170

18-Oct 70 $72 $5,040 100 $62 $6,170

70 $72 $5,040

170 $66 $11,210

31-Oct 55 $66 $3,627 115 $66 $7,583

Inventory Ledger (Average Method):

Purchase Cost of Goods Sold Balance Inventory

Particulars Average Cost FIFO LIFO

Sales Revenue 25000 =B6 =C6

Less: Cost of Goods Sold 3627 3135 3960

GROSS PROFIT =B6-B7 =C6-C7 =D6-D7

Particulars Average Cost FIFO LIFO

Beginning Inventory 3420 3420 3420

Net Purchases 7790 7790 7790

Cost of Goods Available =B17+B18 =C17+C18 =D17+D18

Ending Inventory 7583 8075 7250

Cost of Goods Sold =B19-B20 =C19-C20 =D19-D20

Calculation of Gross Profit:-

Calculation of Gross Profit:-

Workings

Date Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount

1-Oct 60 $57 $3,420

3-Oct 10.00 $65 $650 60 $57 $3,420

10 $65 $650

70 $58 $4,070

12-Oct 30 $70 $2,100 70 $58 $4,070

30 $70 $2,100

100 $62 $6,170

18-Oct 70 $72 $5,040 100 $62 $6,170

70 $72 $5,040

170 $66 $11,210

31-Oct 55 $66 $3,627 115 $66 $7,583

Inventory Ledger (Average Method):

Purchase Cost of Goods Sold Balance Inventory

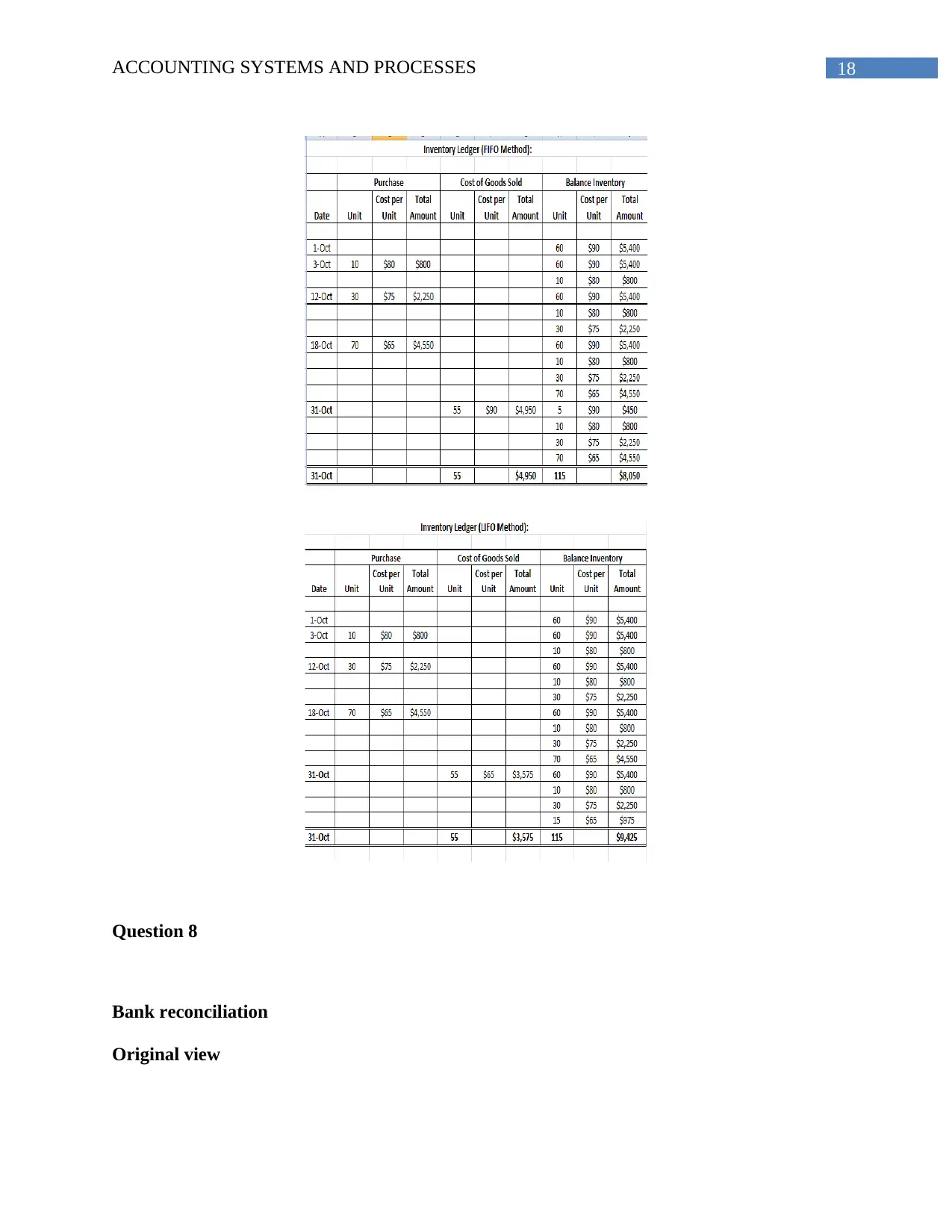

16ACCOUNTING SYSTEMS AND PROCESSES

Date Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount

1-Oct 60 $57 $3,420

3-Oct 10 $65 $650 60 $57 $3,420

10 $65 $650

12-Oct 30 $70 $2,100 60 $57 $3,420

10 $65 $650

30 $70 $2,100

18-Oct 70 $72 $5,040 60 $57 $3,420

10 $65 $650

30 $70 $2,100

70 $72 $5,040

31-Oct 55 $57 $3,135 5 $57 $285

10 $65 $650

30 $70 $2,100

70 $72 $5,040

31-Oct 55 $3,135 115 $8,075

Inventory Ledger (FIFO Method):

Purchase Cost of Goods Sold Balance Inventory

Date Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount

1-Oct 60 $57 $3,420

3-Oct 10 $65 $650 60 $57 $3,420

10 $65 $650

12-Oct 30 $70 $2,100 60 $57 $3,420

10 $65 $650

30 $70 $2,100

18-Oct 70 $72 $5,040 60 $57 $3,420

10 $65 $650

30 $70 $2,100

70 $72 $5,040

31-Oct 55 $72 $3,960 60 $57 $3,420

10 $65 $650

30 $70 $2,100

15 $72 $1,080

31-Oct 55 $3,960 115 $7,250

Inventory Ledger (LIFO Method):

Purchase Cost of Goods Sold Balance Inventory

Revised

Date Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount

1-Oct 60 $57 $3,420

3-Oct 10 $65 $650 60 $57 $3,420

10 $65 $650

12-Oct 30 $70 $2,100 60 $57 $3,420

10 $65 $650

30 $70 $2,100

18-Oct 70 $72 $5,040 60 $57 $3,420

10 $65 $650

30 $70 $2,100

70 $72 $5,040

31-Oct 55 $57 $3,135 5 $57 $285

10 $65 $650

30 $70 $2,100

70 $72 $5,040

31-Oct 55 $3,135 115 $8,075

Inventory Ledger (FIFO Method):

Purchase Cost of Goods Sold Balance Inventory

Date Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount Unit

Cost per

Unit

Total

Amount

1-Oct 60 $57 $3,420

3-Oct 10 $65 $650 60 $57 $3,420

10 $65 $650

12-Oct 30 $70 $2,100 60 $57 $3,420

10 $65 $650

30 $70 $2,100

18-Oct 70 $72 $5,040 60 $57 $3,420

10 $65 $650

30 $70 $2,100

70 $72 $5,040

31-Oct 55 $72 $3,960 60 $57 $3,420

10 $65 $650

30 $70 $2,100

15 $72 $1,080

31-Oct 55 $3,960 115 $7,250

Inventory Ledger (LIFO Method):

Purchase Cost of Goods Sold Balance Inventory

Revised

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17ACCOUNTING SYSTEMS AND PROCESSES

18ACCOUNTING SYSTEMS AND PROCESSES

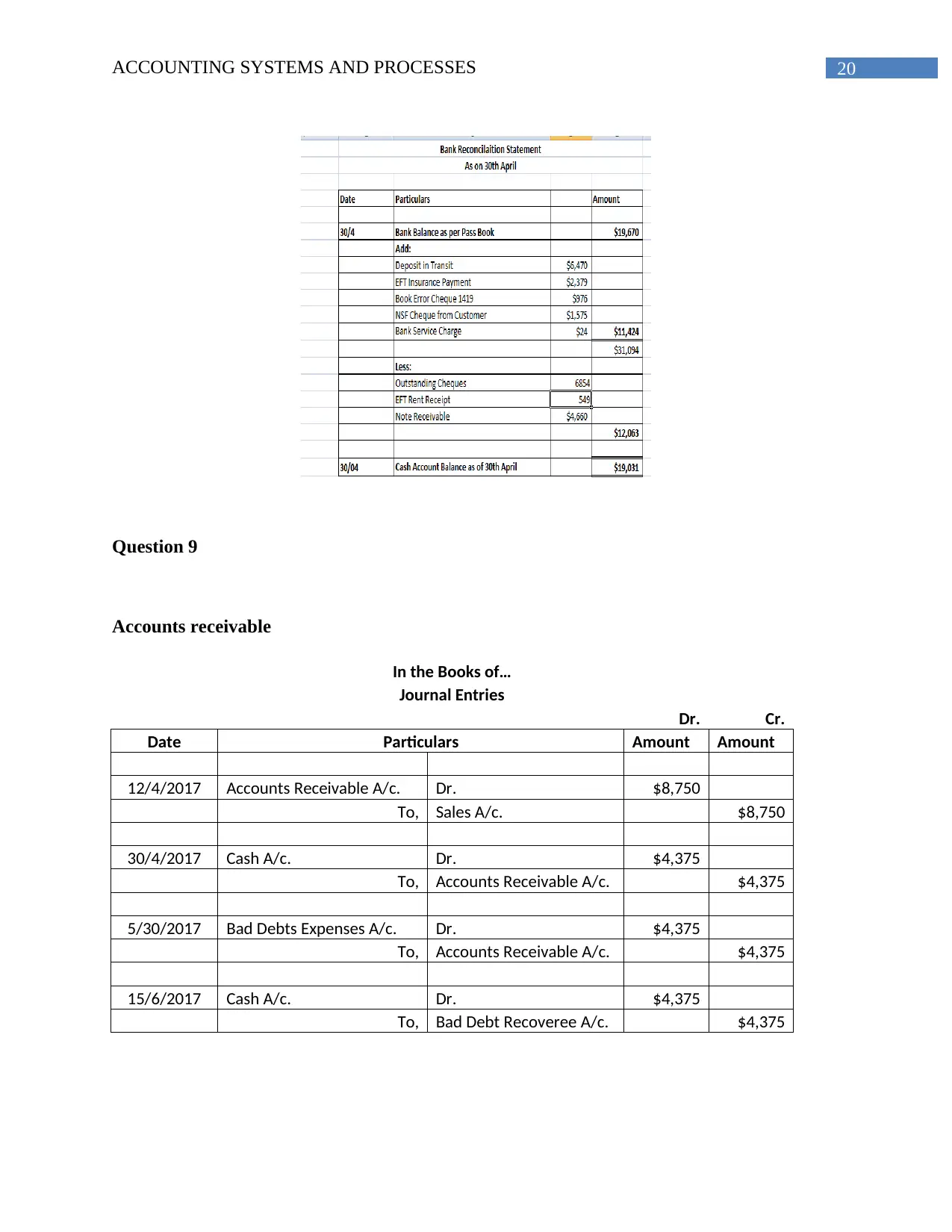

Question 8

Bank reconciliation

Original view

Question 8

Bank reconciliation

Original view

19ACCOUNTING SYSTEMS AND PROCESSES

Normal view

Date Particulars Amount

30/4 Bank Balance as per Pass Book $19,670

Add:

Deposit in Transit $1,543

EFT Insurance Payment $300

Book Error Cheque 1419 $340

NSF Cheque from Customer $1,700

Bank Service Charge $40 $3,923

$23,593

Less:

Outstanding Cheques 2462

EFT Rent Receipt 600

Note Receivable $1,500

$4,562

30/04 Cash Account Balance as of 30th April $19,031

Bank Reconcilaition Statement

As on 30th April

Formula view

Date Particulars Amount

30/4 Bank Balance as per Pass Book 19670

Add:

Deposit in Transit 1543

EFT Insurance Payment 300

Book Error Cheque 1419 340

NSF Cheque from Customer 1700

Bank Service Charge 40 =SUM(D8:D12)

=E6+E12

Less:

Outstanding Cheques =1532+700+230

EFT Rent Receipt 600

Note Receivable 1500

=SUM(D15:D18)

30/04 =IF(E20>0,"Cash Account Balance as of 30th April","Bank Overdraft Balance as of 30th April") =E13-E18

Bank Reconcilaition Statement

As on 30th April

Revised

Normal view

Date Particulars Amount

30/4 Bank Balance as per Pass Book $19,670

Add:

Deposit in Transit $1,543

EFT Insurance Payment $300

Book Error Cheque 1419 $340

NSF Cheque from Customer $1,700

Bank Service Charge $40 $3,923

$23,593

Less:

Outstanding Cheques 2462

EFT Rent Receipt 600

Note Receivable $1,500

$4,562

30/04 Cash Account Balance as of 30th April $19,031

Bank Reconcilaition Statement

As on 30th April

Formula view

Date Particulars Amount

30/4 Bank Balance as per Pass Book 19670

Add:

Deposit in Transit 1543

EFT Insurance Payment 300

Book Error Cheque 1419 340

NSF Cheque from Customer 1700

Bank Service Charge 40 =SUM(D8:D12)

=E6+E12

Less:

Outstanding Cheques =1532+700+230

EFT Rent Receipt 600

Note Receivable 1500

=SUM(D15:D18)

30/04 =IF(E20>0,"Cash Account Balance as of 30th April","Bank Overdraft Balance as of 30th April") =E13-E18

Bank Reconcilaition Statement

As on 30th April

Revised

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

20ACCOUNTING SYSTEMS AND PROCESSES

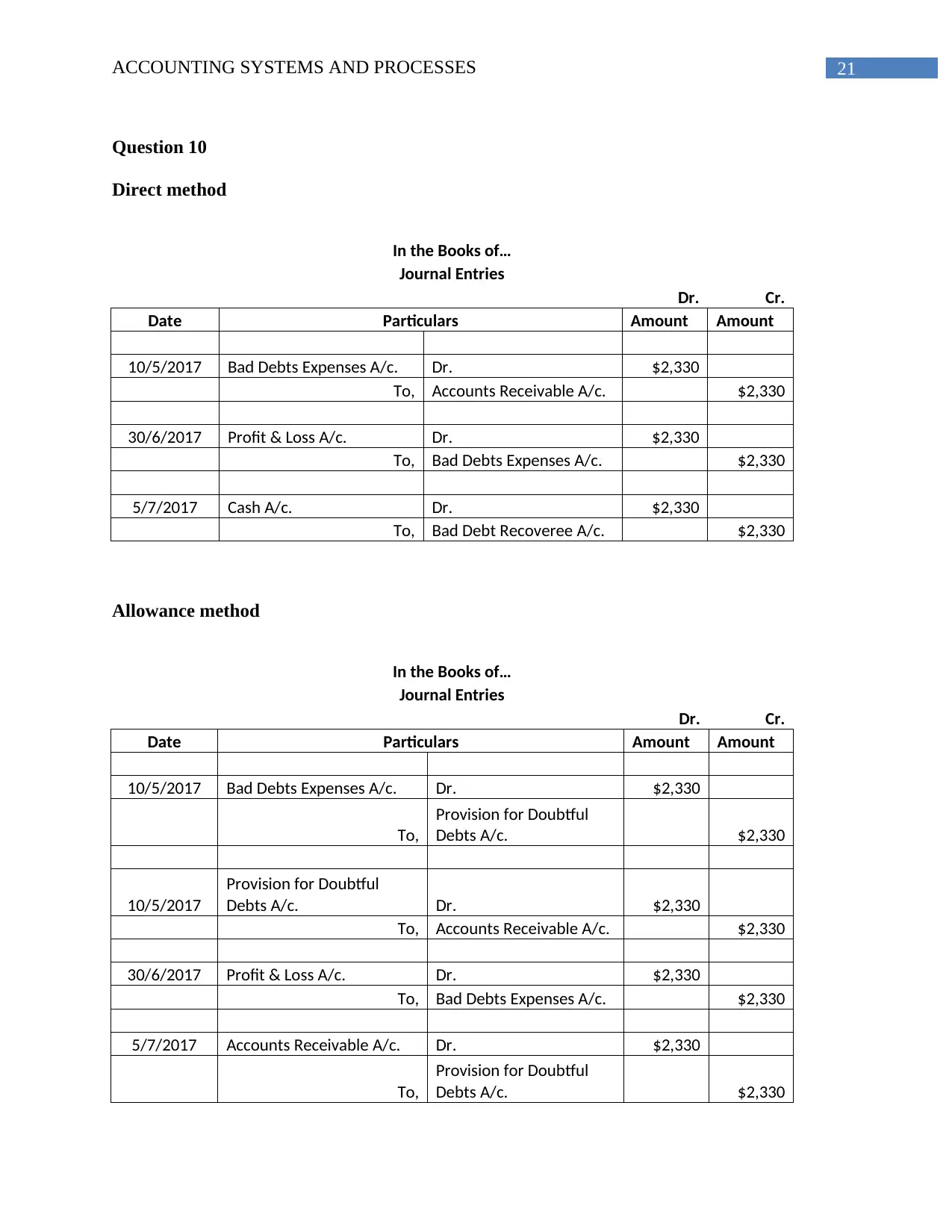

Question 9

Accounts receivable

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

12/4/2017 Accounts Receivable A/c. Dr. $8,750

To, Sales A/c. $8,750

30/4/2017 Cash A/c. Dr. $4,375

To, Accounts Receivable A/c. $4,375

5/30/2017 Bad Debts Expenses A/c. Dr. $4,375

To, Accounts Receivable A/c. $4,375

15/6/2017 Cash A/c. Dr. $4,375

To, Bad Debt Recoveree A/c. $4,375

Question 9

Accounts receivable

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

12/4/2017 Accounts Receivable A/c. Dr. $8,750

To, Sales A/c. $8,750

30/4/2017 Cash A/c. Dr. $4,375

To, Accounts Receivable A/c. $4,375

5/30/2017 Bad Debts Expenses A/c. Dr. $4,375

To, Accounts Receivable A/c. $4,375

15/6/2017 Cash A/c. Dr. $4,375

To, Bad Debt Recoveree A/c. $4,375

21ACCOUNTING SYSTEMS AND PROCESSES

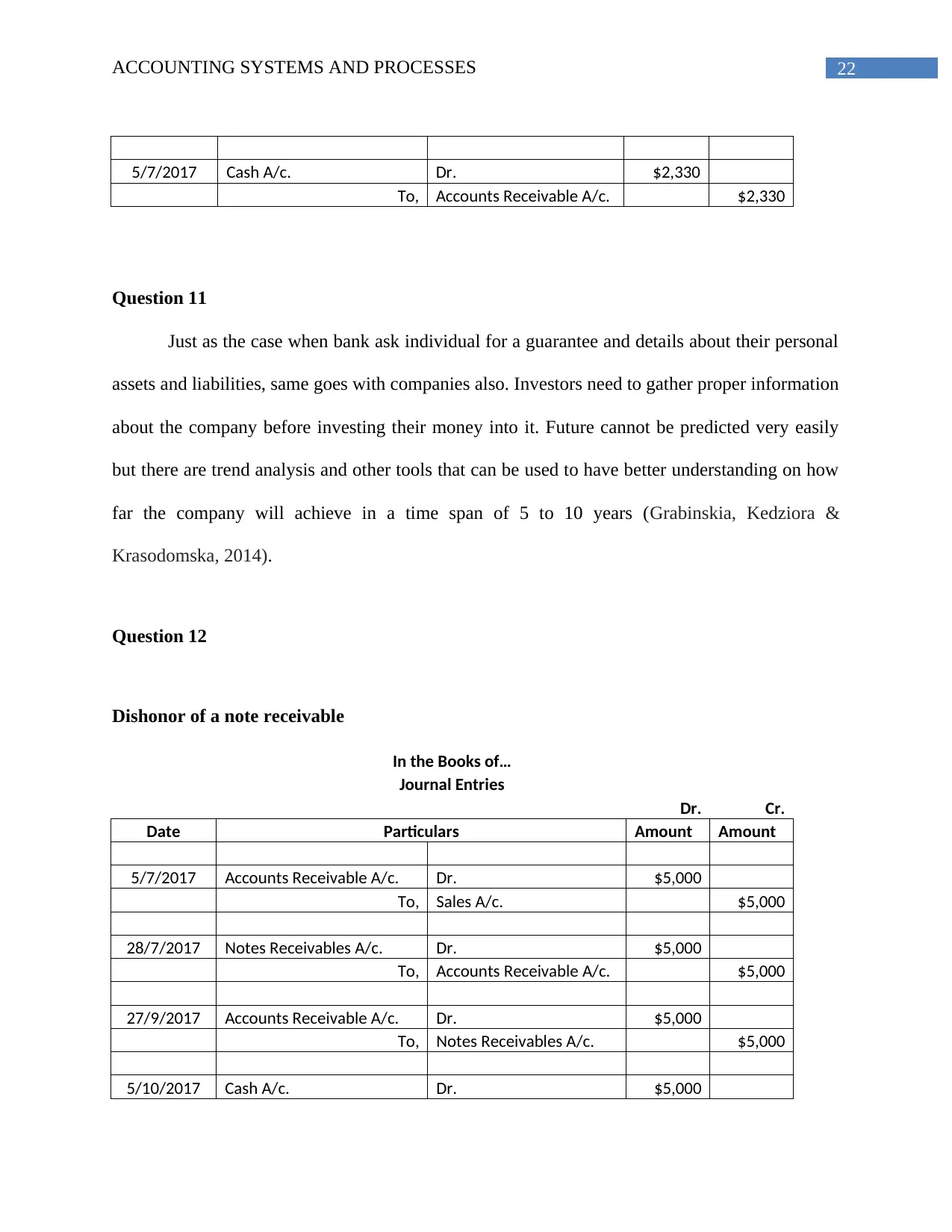

Question 10

Direct method

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

10/5/2017 Bad Debts Expenses A/c. Dr. $2,330

To, Accounts Receivable A/c. $2,330

30/6/2017 Profit & Loss A/c. Dr. $2,330

To, Bad Debts Expenses A/c. $2,330

5/7/2017 Cash A/c. Dr. $2,330

To, Bad Debt Recoveree A/c. $2,330

Allowance method

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

10/5/2017 Bad Debts Expenses A/c. Dr. $2,330

To,

Provision for Doubtful

Debts A/c. $2,330

10/5/2017

Provision for Doubtful

Debts A/c. Dr. $2,330

To, Accounts Receivable A/c. $2,330

30/6/2017 Profit & Loss A/c. Dr. $2,330

To, Bad Debts Expenses A/c. $2,330

5/7/2017 Accounts Receivable A/c. Dr. $2,330

To,

Provision for Doubtful

Debts A/c. $2,330

Question 10

Direct method

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

10/5/2017 Bad Debts Expenses A/c. Dr. $2,330

To, Accounts Receivable A/c. $2,330

30/6/2017 Profit & Loss A/c. Dr. $2,330

To, Bad Debts Expenses A/c. $2,330

5/7/2017 Cash A/c. Dr. $2,330

To, Bad Debt Recoveree A/c. $2,330

Allowance method

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

10/5/2017 Bad Debts Expenses A/c. Dr. $2,330

To,

Provision for Doubtful

Debts A/c. $2,330

10/5/2017

Provision for Doubtful

Debts A/c. Dr. $2,330

To, Accounts Receivable A/c. $2,330

30/6/2017 Profit & Loss A/c. Dr. $2,330

To, Bad Debts Expenses A/c. $2,330

5/7/2017 Accounts Receivable A/c. Dr. $2,330

To,

Provision for Doubtful

Debts A/c. $2,330

22ACCOUNTING SYSTEMS AND PROCESSES

5/7/2017 Cash A/c. Dr. $2,330

To, Accounts Receivable A/c. $2,330

Question 11

Just as the case when bank ask individual for a guarantee and details about their personal

assets and liabilities, same goes with companies also. Investors need to gather proper information

about the company before investing their money into it. Future cannot be predicted very easily

but there are trend analysis and other tools that can be used to have better understanding on how

far the company will achieve in a time span of 5 to 10 years (Grabinskia, Kedziora &

Krasodomska, 2014).

Question 12

Dishonor of a note receivable

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

5/7/2017 Accounts Receivable A/c. Dr. $5,000

To, Sales A/c. $5,000

28/7/2017 Notes Receivables A/c. Dr. $5,000

To, Accounts Receivable A/c. $5,000

27/9/2017 Accounts Receivable A/c. Dr. $5,000

To, Notes Receivables A/c. $5,000

5/10/2017 Cash A/c. Dr. $5,000

5/7/2017 Cash A/c. Dr. $2,330

To, Accounts Receivable A/c. $2,330

Question 11

Just as the case when bank ask individual for a guarantee and details about their personal

assets and liabilities, same goes with companies also. Investors need to gather proper information

about the company before investing their money into it. Future cannot be predicted very easily

but there are trend analysis and other tools that can be used to have better understanding on how

far the company will achieve in a time span of 5 to 10 years (Grabinskia, Kedziora &

Krasodomska, 2014).

Question 12

Dishonor of a note receivable

In the Books of…

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

5/7/2017 Accounts Receivable A/c. Dr. $5,000

To, Sales A/c. $5,000

28/7/2017 Notes Receivables A/c. Dr. $5,000

To, Accounts Receivable A/c. $5,000

27/9/2017 Accounts Receivable A/c. Dr. $5,000

To, Notes Receivables A/c. $5,000

5/10/2017 Cash A/c. Dr. $5,000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

23ACCOUNTING SYSTEMS AND PROCESSES

To, Accounts Receivable A/c. $5,000

Question 13

The discussion will be on Australian retail giant named as Wesfarmers Limited that

operates in diversified areas such as retail, office improvements, home improvements and

energy.

Profits generated by the companies are often attributing to their parent member and same

us the case with Wesfarmers Limited. It is found that the company gets engaged in using foreign

currency for their operation purpose that amounts $15 million and shows several cash hedging

activities and hedge reserve as well. Further, it is even found out that the company undergoes a

loss of around $78 million. The company is required to pay dividend money of $2600 on time.

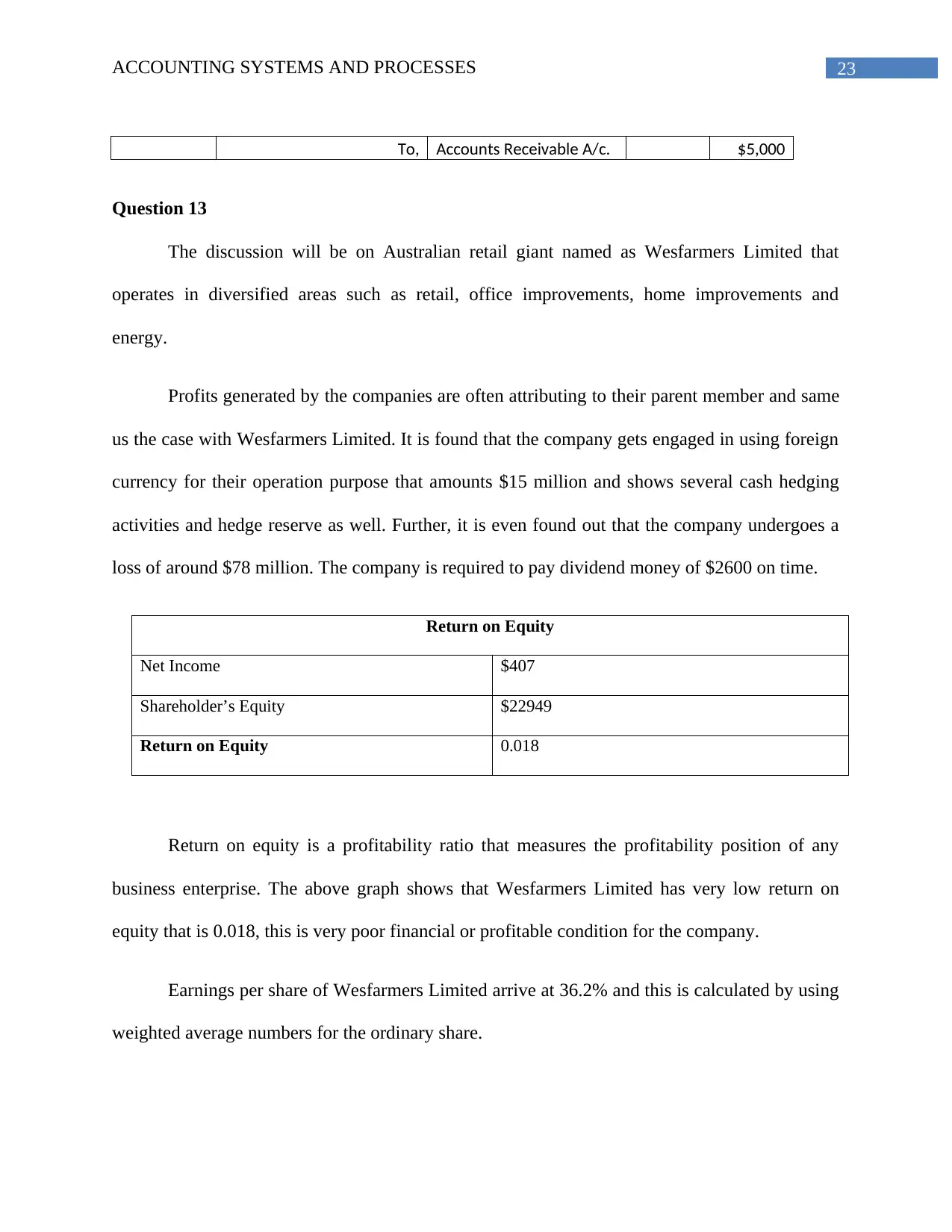

Return on Equity

Net Income $407

Shareholder’s Equity $22949

Return on Equity 0.018

Return on equity is a profitability ratio that measures the profitability position of any

business enterprise. The above graph shows that Wesfarmers Limited has very low return on

equity that is 0.018, this is very poor financial or profitable condition for the company.

Earnings per share of Wesfarmers Limited arrive at 36.2% and this is calculated by using

weighted average numbers for the ordinary share.

To, Accounts Receivable A/c. $5,000

Question 13

The discussion will be on Australian retail giant named as Wesfarmers Limited that

operates in diversified areas such as retail, office improvements, home improvements and

energy.

Profits generated by the companies are often attributing to their parent member and same

us the case with Wesfarmers Limited. It is found that the company gets engaged in using foreign

currency for their operation purpose that amounts $15 million and shows several cash hedging

activities and hedge reserve as well. Further, it is even found out that the company undergoes a

loss of around $78 million. The company is required to pay dividend money of $2600 on time.

Return on Equity

Net Income $407

Shareholder’s Equity $22949

Return on Equity 0.018

Return on equity is a profitability ratio that measures the profitability position of any

business enterprise. The above graph shows that Wesfarmers Limited has very low return on

equity that is 0.018, this is very poor financial or profitable condition for the company.

Earnings per share of Wesfarmers Limited arrive at 36.2% and this is calculated by using

weighted average numbers for the ordinary share.

24ACCOUNTING SYSTEMS AND PROCESSES

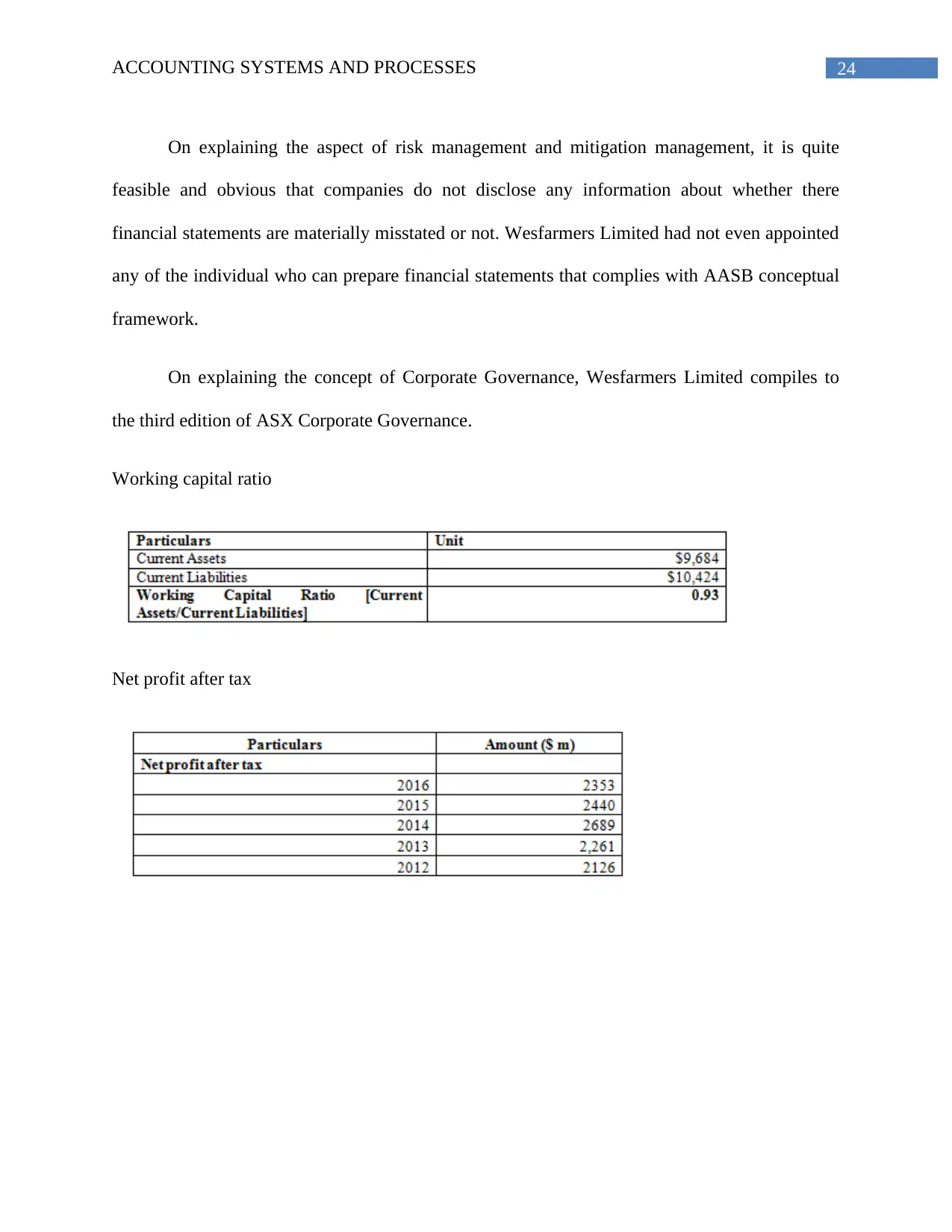

On explaining the aspect of risk management and mitigation management, it is quite

feasible and obvious that companies do not disclose any information about whether there

financial statements are materially misstated or not. Wesfarmers Limited had not even appointed

any of the individual who can prepare financial statements that complies with AASB conceptual

framework.

On explaining the concept of Corporate Governance, Wesfarmers Limited compiles to

the third edition of ASX Corporate Governance.

Working capital ratio

Net profit after tax

On explaining the aspect of risk management and mitigation management, it is quite

feasible and obvious that companies do not disclose any information about whether there

financial statements are materially misstated or not. Wesfarmers Limited had not even appointed

any of the individual who can prepare financial statements that complies with AASB conceptual

framework.

On explaining the concept of Corporate Governance, Wesfarmers Limited compiles to

the third edition of ASX Corporate Governance.

Working capital ratio

Net profit after tax

25ACCOUNTING SYSTEMS AND PROCESSES

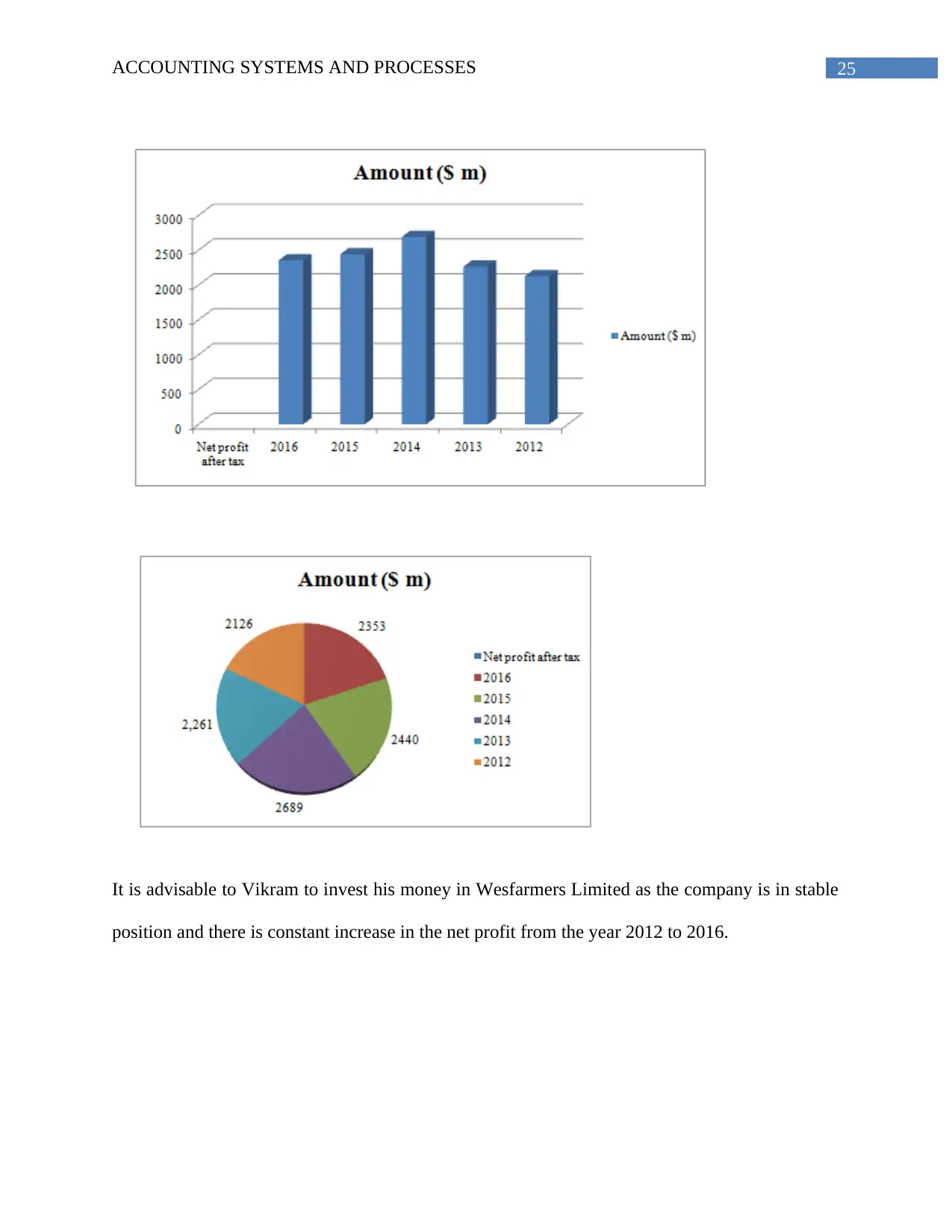

It is advisable to Vikram to invest his money in Wesfarmers Limited as the company is in stable

position and there is constant increase in the net profit from the year 2012 to 2016.

It is advisable to Vikram to invest his money in Wesfarmers Limited as the company is in stable

position and there is constant increase in the net profit from the year 2012 to 2016.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

26ACCOUNTING SYSTEMS AND PROCESSES

Reference List

Gomes, P. S., Fernandes, M. J., & Carvalho, J. B. D. C. (2015). The international harmonization

process of public sector accounting in Portugal: the perspective of different

stakeholders. International Journal of Public Administration, 38(4), 268-281.

Grabinskia, K., Kedziora, M., & Krasodomska, J. (2014). The Polish accounting system and

IFRS implementation process in the view of empirical research. Accounting and

Management Information Systems, 13(2), 281.

Reference List

Gomes, P. S., Fernandes, M. J., & Carvalho, J. B. D. C. (2015). The international harmonization

process of public sector accounting in Portugal: the perspective of different

stakeholders. International Journal of Public Administration, 38(4), 268-281.

Grabinskia, K., Kedziora, M., & Krasodomska, J. (2014). The Polish accounting system and

IFRS implementation process in the view of empirical research. Accounting and

Management Information Systems, 13(2), 281.

1 out of 26

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.