Accounting Systems and Processes: Finance Homework Solution

VerifiedAdded on 2020/04/01

|25

|1311

|33

Homework Assignment

AI Summary

This document presents a comprehensive solution to an accounting systems and processes assignment. It addresses various aspects of accounting, starting with naming cells in spreadsheets and their benefits for formula maintenance. The solution explores displaying negative numbers, designing spreadsheets for error minimization, and using the IF function for conditional statements. It also covers the periodic inventory system, including calculations for cost of goods sold. The assignment further delves into financial statement analysis, including direct write-off and allowance methods for bad debts, and evaluating an organization's financial position using receivables. The final section provides an analysis of Wesfarmers' financial performance, discussing dividends, return on equity, earnings per share, working capital ratio, and net profit tax, culminating in an investment recommendation for an individual. The document includes formula views, normal views, and workings for clarity.

Running head: ACCOUNTING SYSTEMS AND PROCESSES

Accounting systems and Processes

Name of the Student:

Name of the University:

Author Note:

Accounting systems and Processes

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

ACCOUNTING SYSTEMS AND PROCESSES

Table of Contents

Question 1........................................................................................................................................3

Question 2........................................................................................................................................3

Question 3........................................................................................................................................4

Question 4........................................................................................................................................5

Question 5........................................................................................................................................6

Question 6:.......................................................................................................................................7

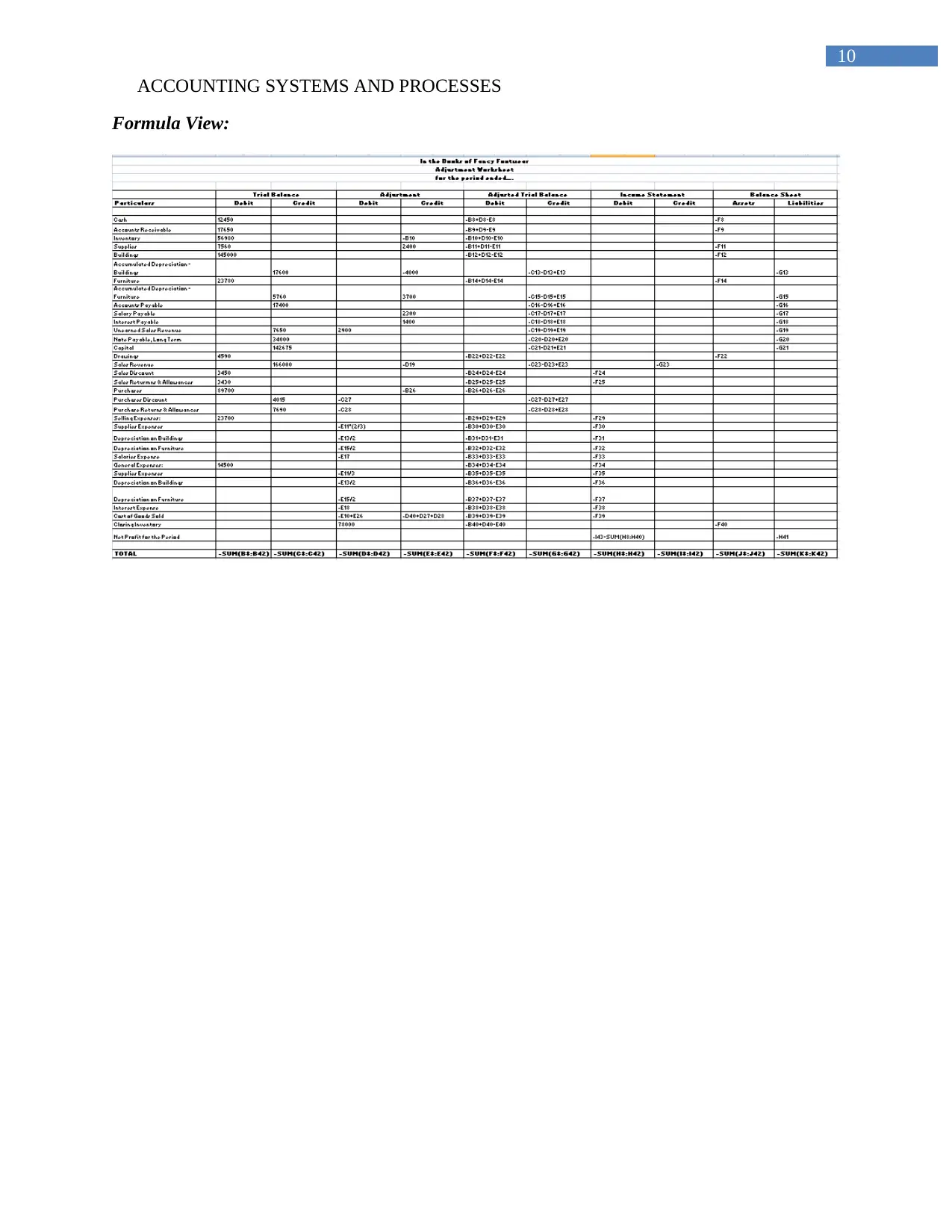

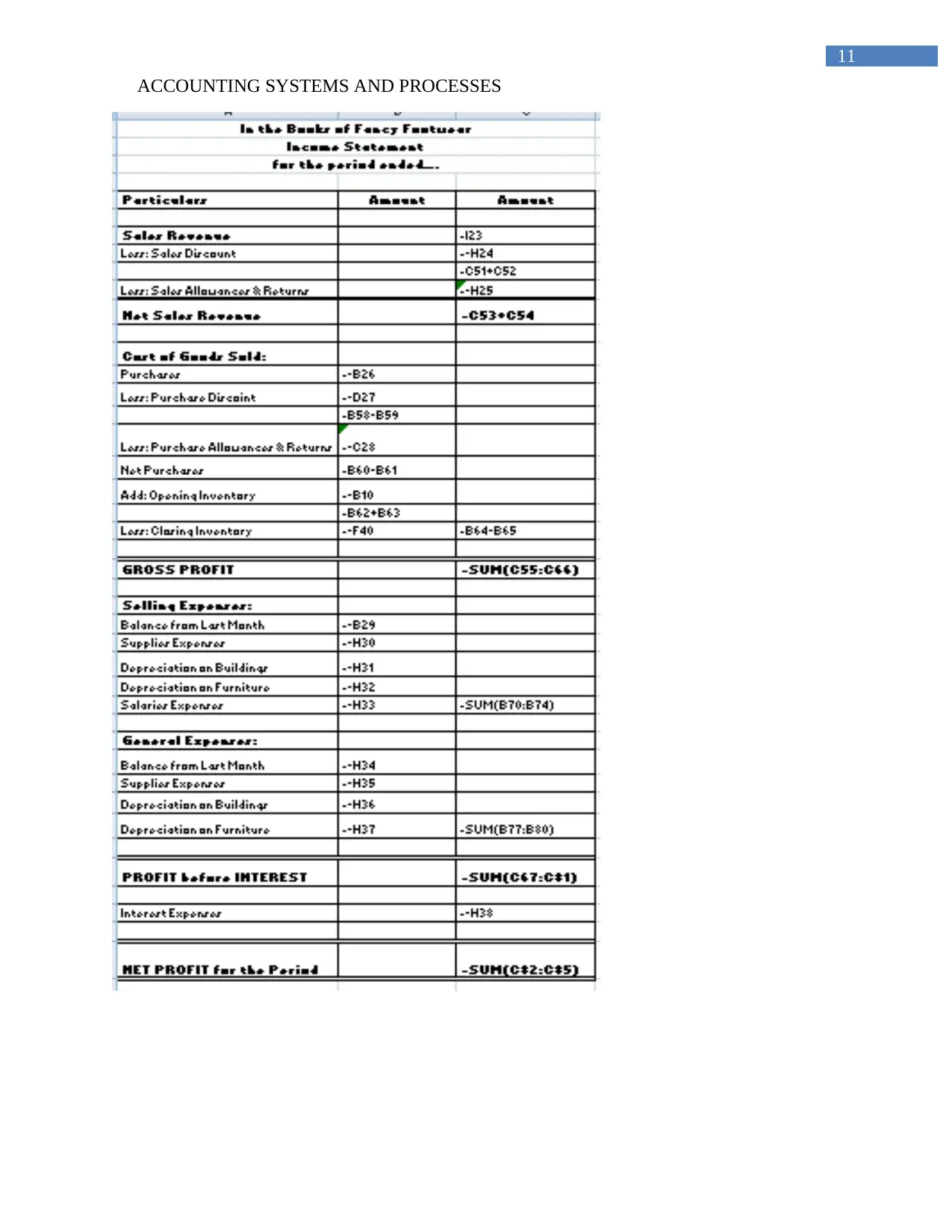

Formula View:...............................................................................................................................10

Question 7......................................................................................................................................13

Question 8......................................................................................................................................18

Question 9:.....................................................................................................................................19

Question 10....................................................................................................................................20

Question 11....................................................................................................................................21

Question 12....................................................................................................................................21

Question 13....................................................................................................................................21

References:....................................................................................................................................25

ACCOUNTING SYSTEMS AND PROCESSES

Table of Contents

Question 1........................................................................................................................................3

Question 2........................................................................................................................................3

Question 3........................................................................................................................................4

Question 4........................................................................................................................................5

Question 5........................................................................................................................................6

Question 6:.......................................................................................................................................7

Formula View:...............................................................................................................................10

Question 7......................................................................................................................................13

Question 8......................................................................................................................................18

Question 9:.....................................................................................................................................19

Question 10....................................................................................................................................20

Question 11....................................................................................................................................21

Question 12....................................................................................................................................21

Question 13....................................................................................................................................21

References:....................................................................................................................................25

3

ACCOUNTING SYSTEMS AND PROCESSES

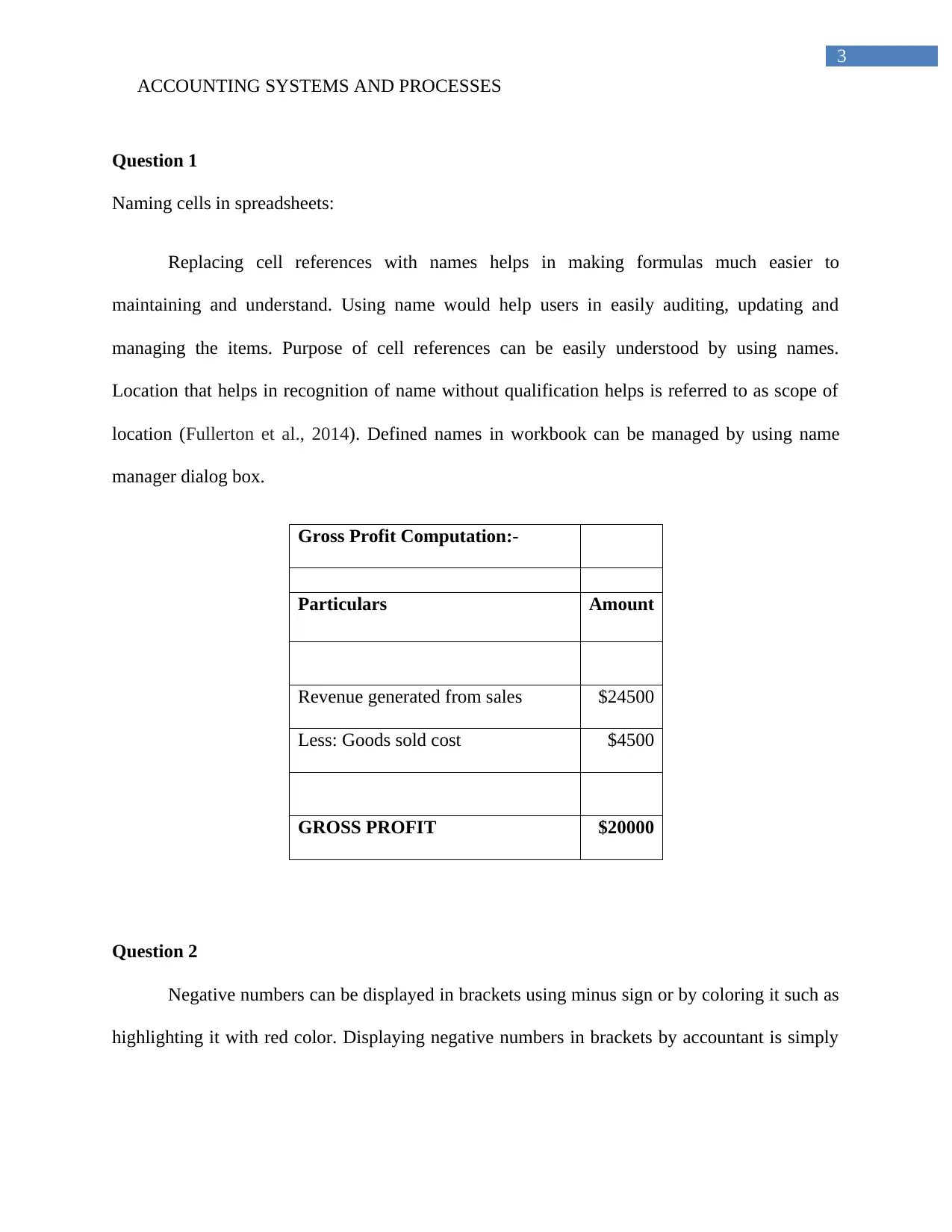

Question 1

Naming cells in spreadsheets:

Replacing cell references with names helps in making formulas much easier to

maintaining and understand. Using name would help users in easily auditing, updating and

managing the items. Purpose of cell references can be easily understood by using names.

Location that helps in recognition of name without qualification helps is referred to as scope of

location (Fullerton et al., 2014). Defined names in workbook can be managed by using name

manager dialog box.

Gross Profit Computation:-

Particulars Amount

Revenue generated from sales $24500

Less: Goods sold cost $4500

GROSS PROFIT $20000

Question 2

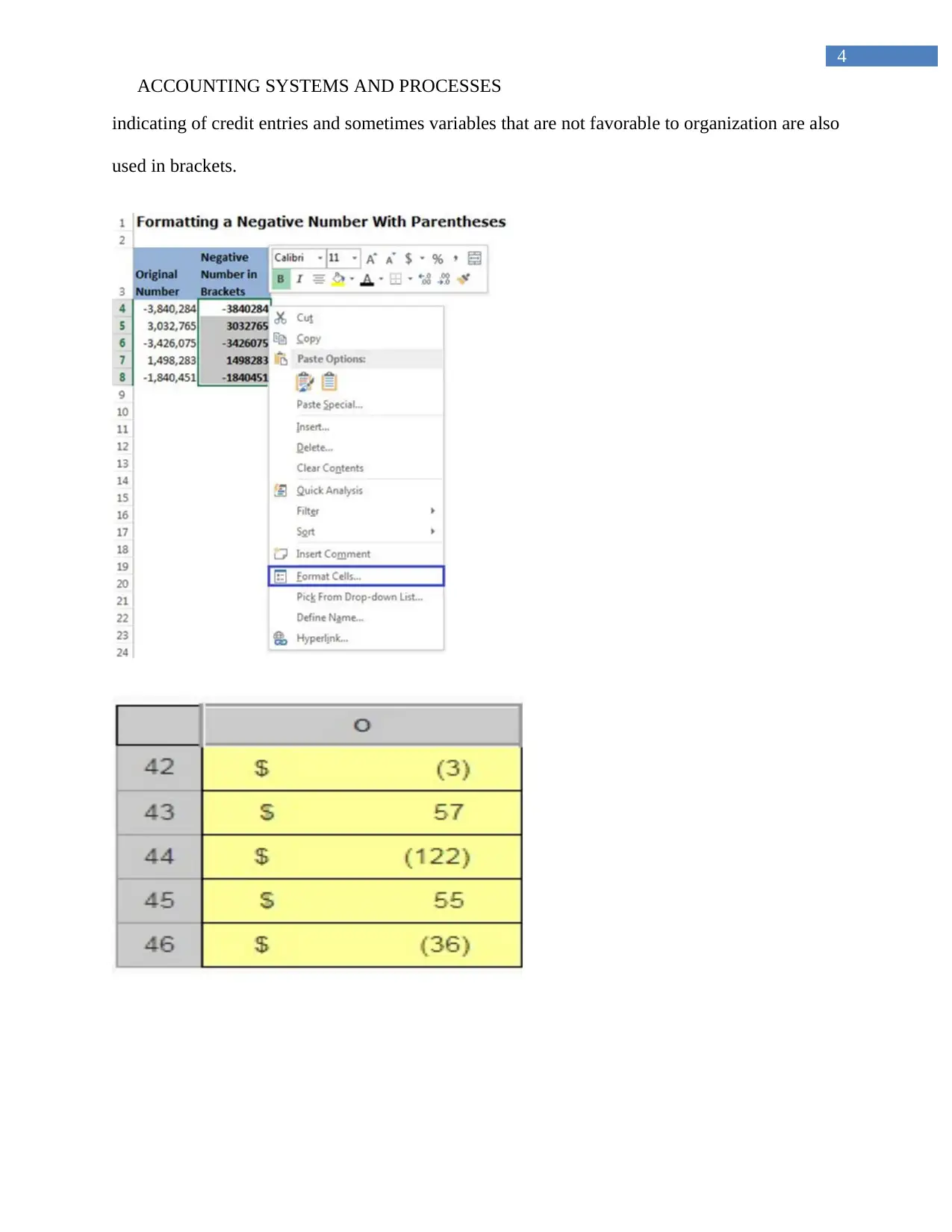

Negative numbers can be displayed in brackets using minus sign or by coloring it such as

highlighting it with red color. Displaying negative numbers in brackets by accountant is simply

ACCOUNTING SYSTEMS AND PROCESSES

Question 1

Naming cells in spreadsheets:

Replacing cell references with names helps in making formulas much easier to

maintaining and understand. Using name would help users in easily auditing, updating and

managing the items. Purpose of cell references can be easily understood by using names.

Location that helps in recognition of name without qualification helps is referred to as scope of

location (Fullerton et al., 2014). Defined names in workbook can be managed by using name

manager dialog box.

Gross Profit Computation:-

Particulars Amount

Revenue generated from sales $24500

Less: Goods sold cost $4500

GROSS PROFIT $20000

Question 2

Negative numbers can be displayed in brackets using minus sign or by coloring it such as

highlighting it with red color. Displaying negative numbers in brackets by accountant is simply

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

ACCOUNTING SYSTEMS AND PROCESSES

indicating of credit entries and sometimes variables that are not favorable to organization are also

used in brackets.

ACCOUNTING SYSTEMS AND PROCESSES

indicating of credit entries and sometimes variables that are not favorable to organization are also

used in brackets.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

ACCOUNTING SYSTEMS AND PROCESSES

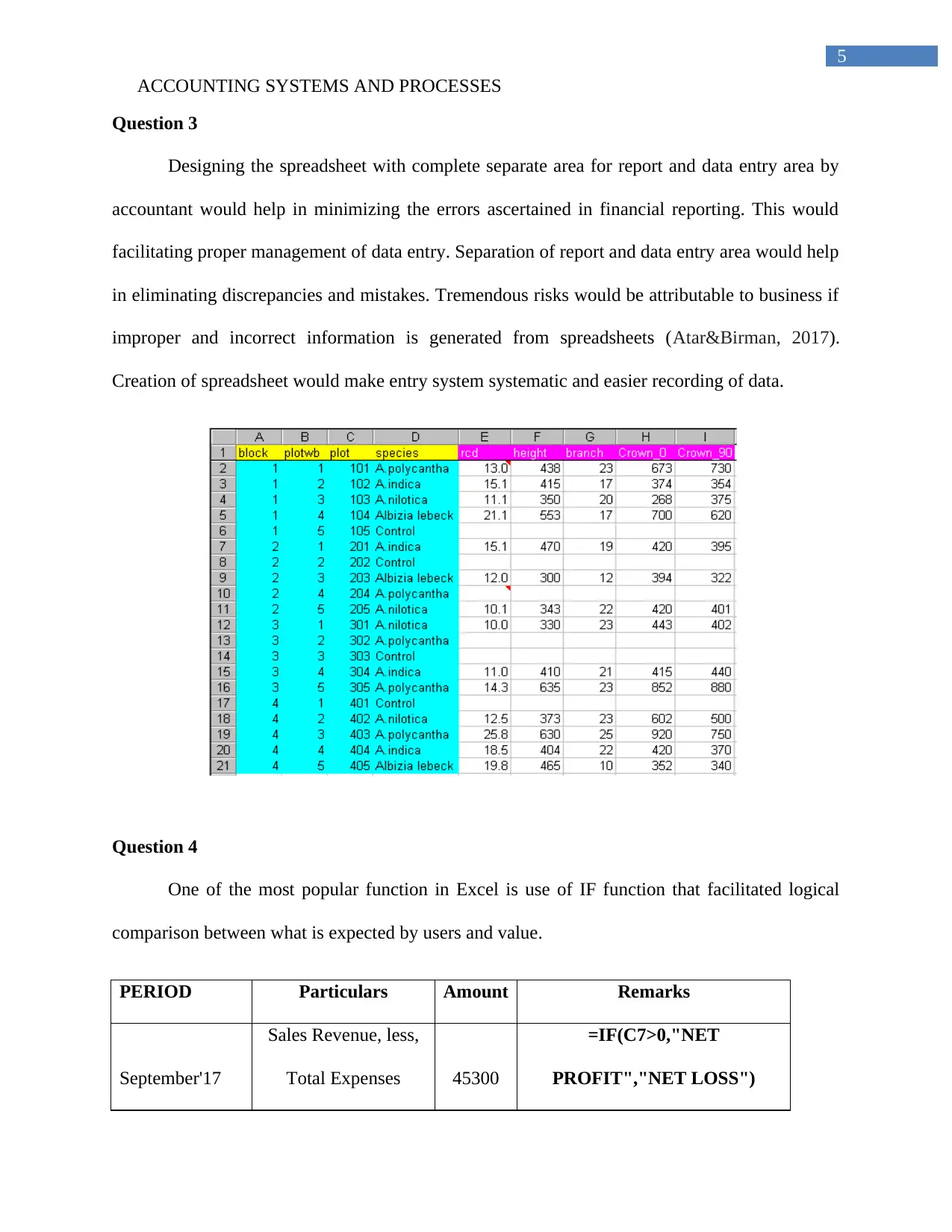

Question 3

Designing the spreadsheet with complete separate area for report and data entry area by

accountant would help in minimizing the errors ascertained in financial reporting. This would

facilitating proper management of data entry. Separation of report and data entry area would help

in eliminating discrepancies and mistakes. Tremendous risks would be attributable to business if

improper and incorrect information is generated from spreadsheets (Atar&Birman, 2017).

Creation of spreadsheet would make entry system systematic and easier recording of data.

Question 4

One of the most popular function in Excel is use of IF function that facilitated logical

comparison between what is expected by users and value.

PERIOD Particulars Amount Remarks

September'17

Sales Revenue, less,

Total Expenses 45300

=IF(C7>0,"NET

PROFIT","NET LOSS")

ACCOUNTING SYSTEMS AND PROCESSES

Question 3

Designing the spreadsheet with complete separate area for report and data entry area by

accountant would help in minimizing the errors ascertained in financial reporting. This would

facilitating proper management of data entry. Separation of report and data entry area would help

in eliminating discrepancies and mistakes. Tremendous risks would be attributable to business if

improper and incorrect information is generated from spreadsheets (Atar&Birman, 2017).

Creation of spreadsheet would make entry system systematic and easier recording of data.

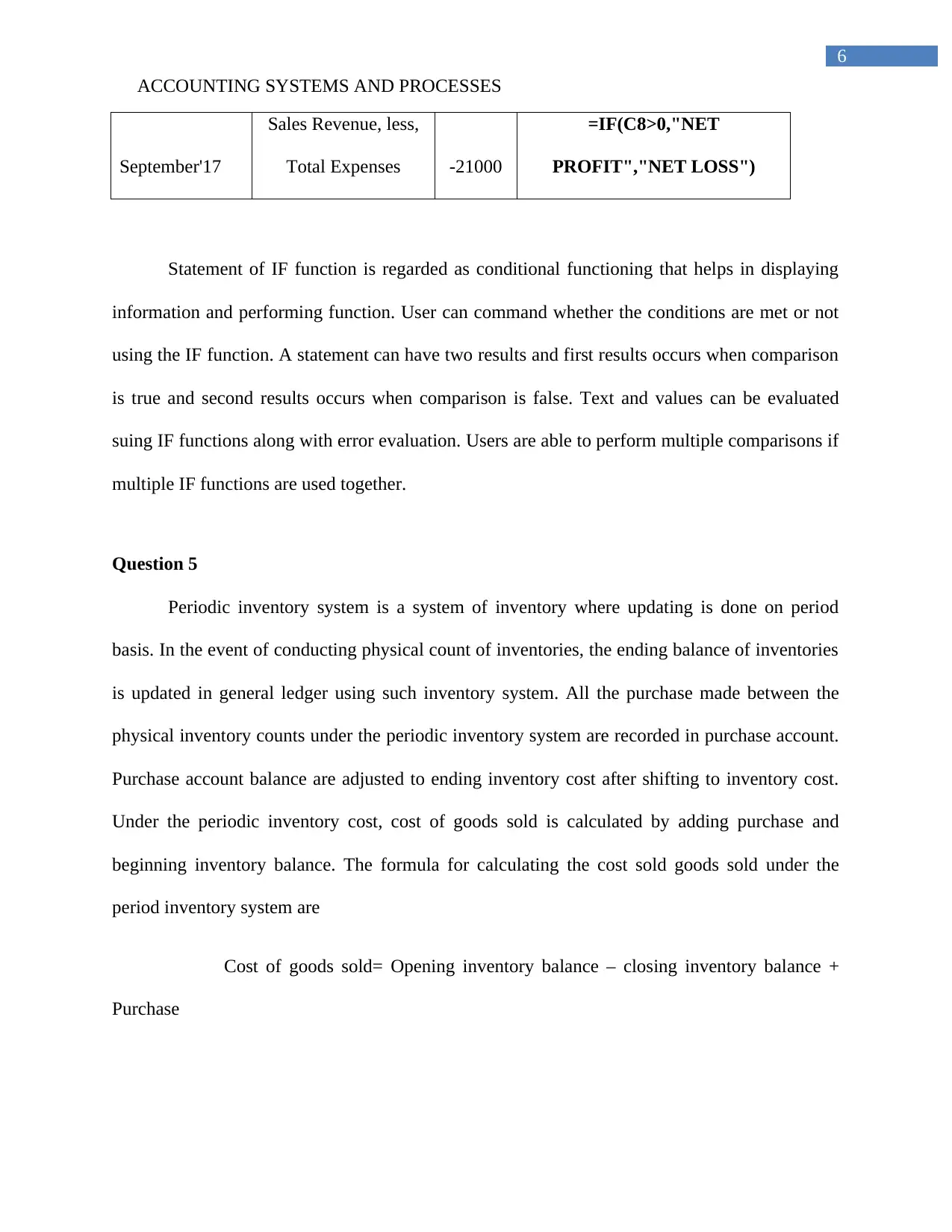

Question 4

One of the most popular function in Excel is use of IF function that facilitated logical

comparison between what is expected by users and value.

PERIOD Particulars Amount Remarks

September'17

Sales Revenue, less,

Total Expenses 45300

=IF(C7>0,"NET

PROFIT","NET LOSS")

6

ACCOUNTING SYSTEMS AND PROCESSES

September'17

Sales Revenue, less,

Total Expenses -21000

=IF(C8>0,"NET

PROFIT","NET LOSS")

Statement of IF function is regarded as conditional functioning that helps in displaying

information and performing function. User can command whether the conditions are met or not

using the IF function. A statement can have two results and first results occurs when comparison

is true and second results occurs when comparison is false. Text and values can be evaluated

suing IF functions along with error evaluation. Users are able to perform multiple comparisons if

multiple IF functions are used together.

Question 5

Periodic inventory system is a system of inventory where updating is done on period

basis. In the event of conducting physical count of inventories, the ending balance of inventories

is updated in general ledger using such inventory system. All the purchase made between the

physical inventory counts under the periodic inventory system are recorded in purchase account.

Purchase account balance are adjusted to ending inventory cost after shifting to inventory cost.

Under the periodic inventory cost, cost of goods sold is calculated by adding purchase and

beginning inventory balance. The formula for calculating the cost sold goods sold under the

period inventory system are

Cost of goods sold= Opening inventory balance – closing inventory balance +

Purchase

ACCOUNTING SYSTEMS AND PROCESSES

September'17

Sales Revenue, less,

Total Expenses -21000

=IF(C8>0,"NET

PROFIT","NET LOSS")

Statement of IF function is regarded as conditional functioning that helps in displaying

information and performing function. User can command whether the conditions are met or not

using the IF function. A statement can have two results and first results occurs when comparison

is true and second results occurs when comparison is false. Text and values can be evaluated

suing IF functions along with error evaluation. Users are able to perform multiple comparisons if

multiple IF functions are used together.

Question 5

Periodic inventory system is a system of inventory where updating is done on period

basis. In the event of conducting physical count of inventories, the ending balance of inventories

is updated in general ledger using such inventory system. All the purchase made between the

physical inventory counts under the periodic inventory system are recorded in purchase account.

Purchase account balance are adjusted to ending inventory cost after shifting to inventory cost.

Under the periodic inventory cost, cost of goods sold is calculated by adding purchase and

beginning inventory balance. The formula for calculating the cost sold goods sold under the

period inventory system are

Cost of goods sold= Opening inventory balance – closing inventory balance +

Purchase

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

ACCOUNTING SYSTEMS AND PROCESSES

For instance, ABC Corporation has an opening balance of $ 98000 and physical

inventory count at ending period is recorded at $ 70000 and has made a purchase of $ 120000.

Opening balance= $ 98000

Purchase= $ 120000

Closing balance= $ 70000

COGS= ($ 98000 + $ 120000 - $ 70000) = $ 148000

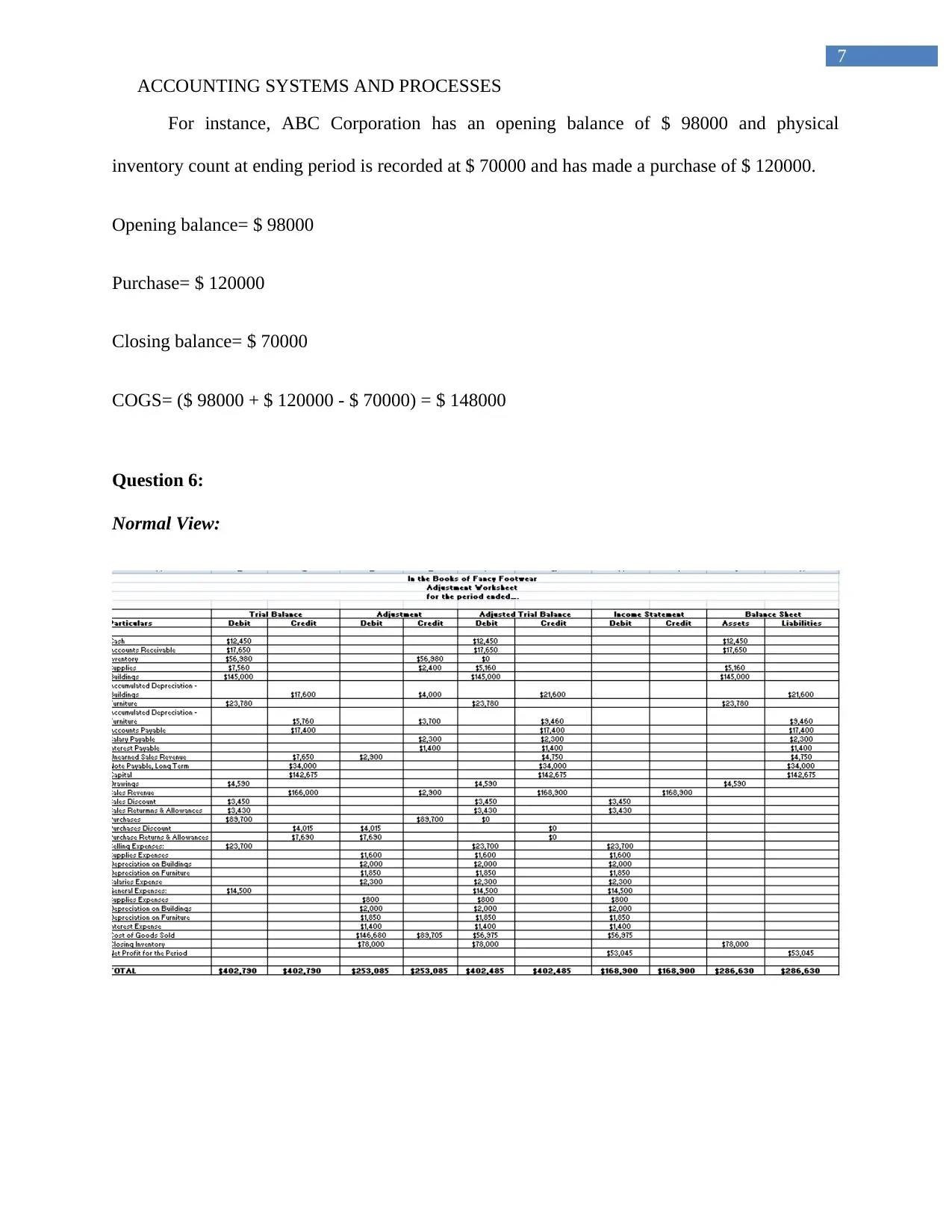

Question 6:

Normal View:

ACCOUNTING SYSTEMS AND PROCESSES

For instance, ABC Corporation has an opening balance of $ 98000 and physical

inventory count at ending period is recorded at $ 70000 and has made a purchase of $ 120000.

Opening balance= $ 98000

Purchase= $ 120000

Closing balance= $ 70000

COGS= ($ 98000 + $ 120000 - $ 70000) = $ 148000

Question 6:

Normal View:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

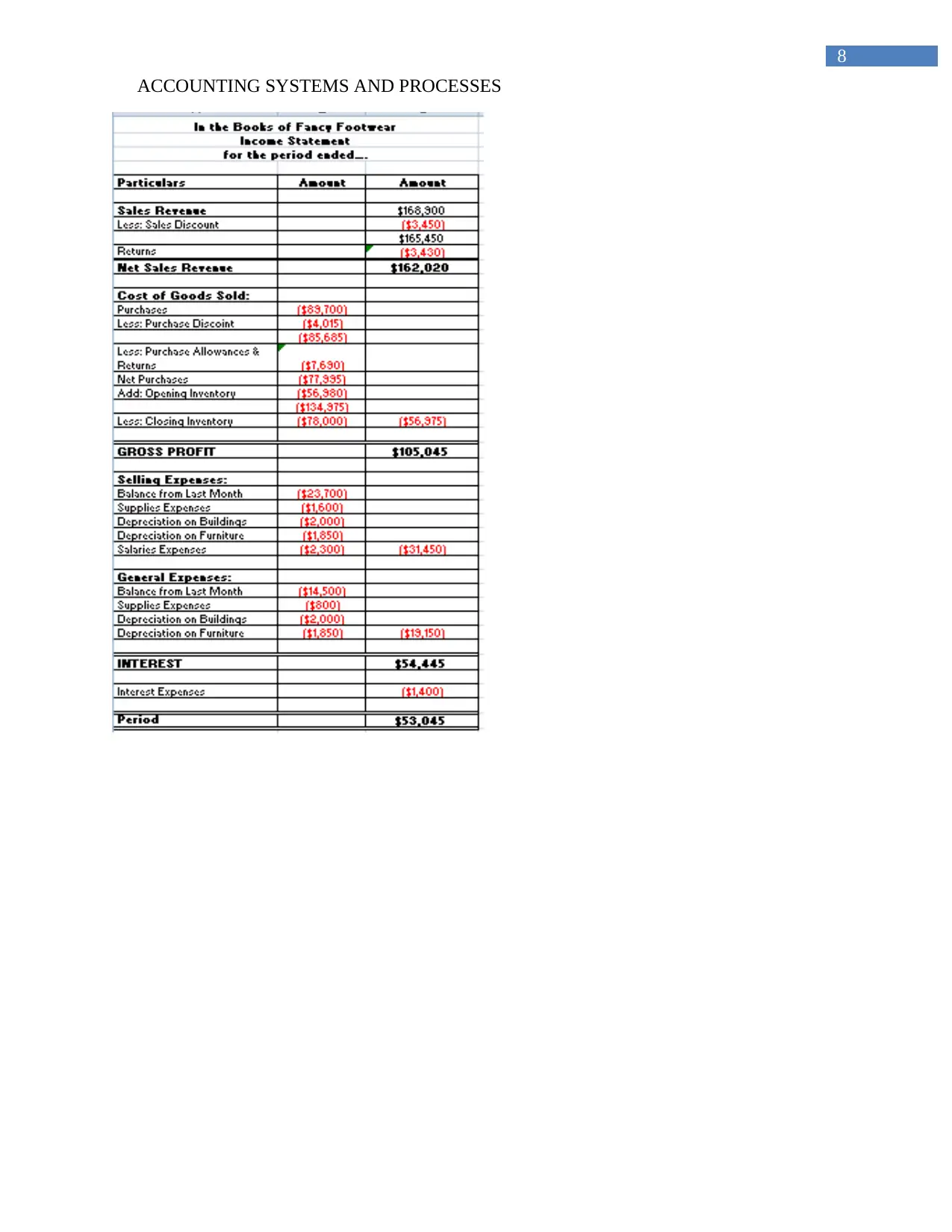

8

ACCOUNTING SYSTEMS AND PROCESSES

ACCOUNTING SYSTEMS AND PROCESSES

9

ACCOUNTING SYSTEMS AND PROCESSES

ACCOUNTING SYSTEMS AND PROCESSES

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

ACCOUNTING SYSTEMS AND PROCESSES

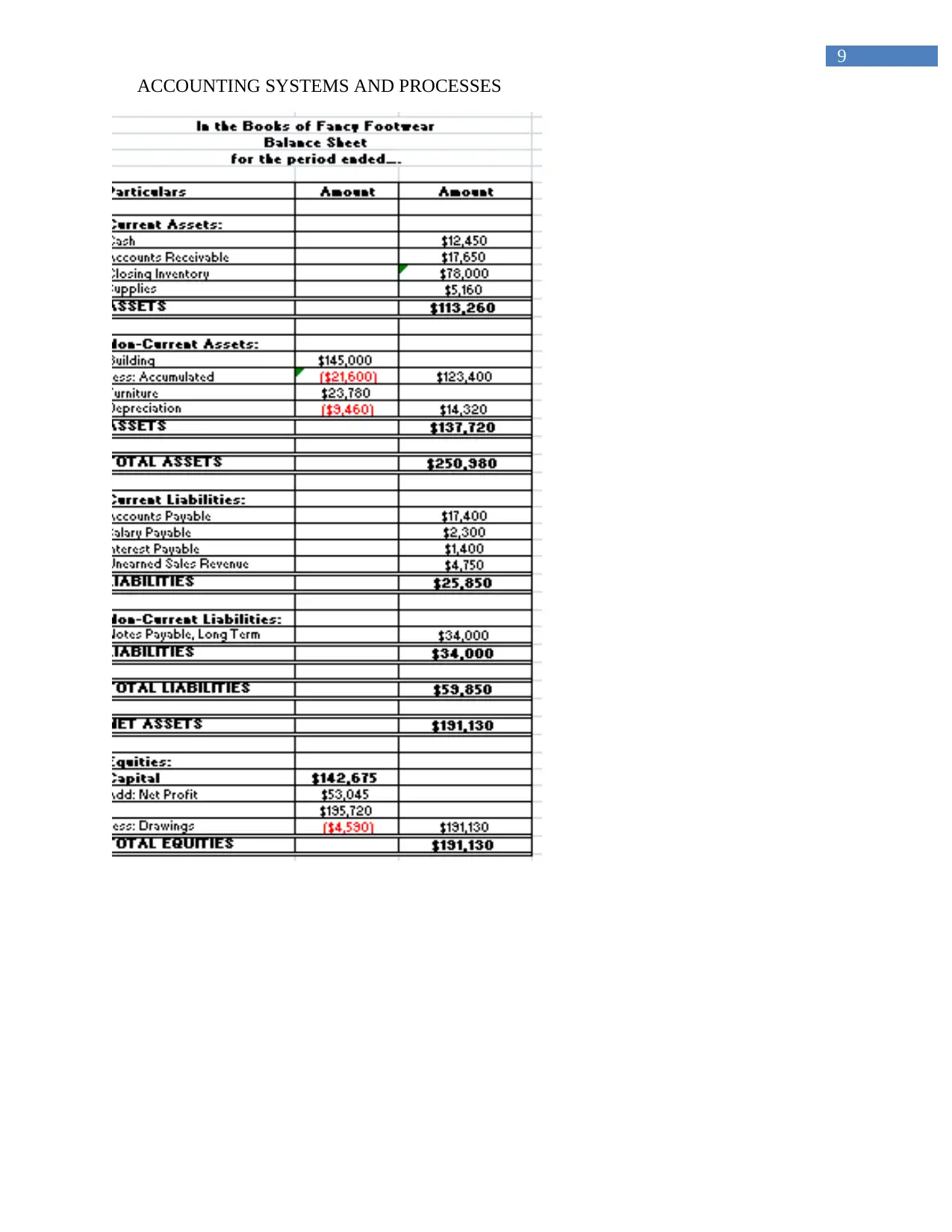

Formula View:

ACCOUNTING SYSTEMS AND PROCESSES

Formula View:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

ACCOUNTING SYSTEMS AND PROCESSES

ACCOUNTING SYSTEMS AND PROCESSES

12

ACCOUNTING SYSTEMS AND PROCESSES

Particulars Amount Amount

Current Assets:

Cash =J8

Accounts Receivable =J9

Closing Inventory =F40

Supplies =J11

TOTAL CURRENT ASSETS =SUM(C95:C98)

Non-Current Assets:

Building =J12

Less: Accumulated Depreciation =-K13 =B102+B103

Furniture =J14

Less: Accumulated Depreciation =-K15 =B104+B105

TOTAL NON-CURRENT ASSETS =SUM(C103:C105)

TOTAL ASSETS =C99+C106

Current Liabilities:

Accounts Payable =K16

Salary Payable =K17

Interest Payable =K18

Unearned Sales Revenue =K19

TOTAL CURRENT LIABILITIES =SUM(C111:C114)

Non-Current Liabilities:

Notes Payable, Long Term =K20

TOTAL NON-CURRENT LIABILITIES =SUM(C116:C118)

TOTAL LIABILITIES =C119+C115

NET ASSETS =C108-C121

Equities:

Capital =K21

Add: Net Profit =K41

=B126+B127

Less: Drawings =-J22 =B128+B129

TOTAL EQUITIES =SUM(C125:C129)

for the period ended….

In the Books of Fancy Footwear

Balance Sheet

ACCOUNTING SYSTEMS AND PROCESSES

Particulars Amount Amount

Current Assets:

Cash =J8

Accounts Receivable =J9

Closing Inventory =F40

Supplies =J11

TOTAL CURRENT ASSETS =SUM(C95:C98)

Non-Current Assets:

Building =J12

Less: Accumulated Depreciation =-K13 =B102+B103

Furniture =J14

Less: Accumulated Depreciation =-K15 =B104+B105

TOTAL NON-CURRENT ASSETS =SUM(C103:C105)

TOTAL ASSETS =C99+C106

Current Liabilities:

Accounts Payable =K16

Salary Payable =K17

Interest Payable =K18

Unearned Sales Revenue =K19

TOTAL CURRENT LIABILITIES =SUM(C111:C114)

Non-Current Liabilities:

Notes Payable, Long Term =K20

TOTAL NON-CURRENT LIABILITIES =SUM(C116:C118)

TOTAL LIABILITIES =C119+C115

NET ASSETS =C108-C121

Equities:

Capital =K21

Add: Net Profit =K41

=B126+B127

Less: Drawings =-J22 =B128+B129

TOTAL EQUITIES =SUM(C125:C129)

for the period ended….

In the Books of Fancy Footwear

Balance Sheet

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.