Financial Analysis: Enron's Internal Control, Ethics, and Policy

VerifiedAdded on 2020/07/23

|10

|2486

|243

Report

AI Summary

This report provides a detailed analysis of the Enron case study, examining the internal control procedures, violations, and unethical behaviors that led to the company's downfall. It discusses the significance of internal controls in ensuring accurate financial reporting and identifies specific control failures within Enron, such as fiduciary failures, high-risk accounting practices, and conflicts of interest. The report assesses the causes of unethical behavior, including the use of special purpose entities to hide liabilities and the manipulation of financial statements. It also proposes solutions for improving internal control processes, such as strengthening the independence of external auditors and implementing stricter policies against fraudulent activities. Finally, the report offers recommendations to the Board of Directors regarding policy improvements, emphasizing the importance of internal audits, external audits, and enhanced ethical oversight to prevent future scandals and maintain stakeholder trust. The report concludes that effective internal controls and ethical conduct are crucial for financial stability and corporate integrity.

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................3

Discussing the internal control procedure in the context of Enron case study......................3

Identifying the control that is being violated.........................................................................3

Proposing a solution for internal control process that is violated..........................................5

Assessing and explaining the causes of unethical behavior in relation to the case situation.6

Providing recommendations to the Board of Directors regarding policy improvement........7

CONCLUSION..........................................................................................................................8

REFERENCES...........................................................................................................................9

BIBLIOGRAPHY....................................................................................................................10

INTRODUCTION......................................................................................................................3

Discussing the internal control procedure in the context of Enron case study......................3

Identifying the control that is being violated.........................................................................3

Proposing a solution for internal control process that is violated..........................................5

Assessing and explaining the causes of unethical behavior in relation to the case situation.6

Providing recommendations to the Board of Directors regarding policy improvement........7

CONCLUSION..........................................................................................................................8

REFERENCES...........................................................................................................................9

BIBLIOGRAPHY....................................................................................................................10

INTRODUCTION

In the recent times, every business unit places high level of emphasis on accounting

with the motive to present fair view of financial position and performance. This in turn helps

both managers as well as investors in making suitable decision regarding investment. This

project report is based on the case situation of Enron which was one of the leading energy

providers of US. It attained leading position in the field of electricity, natural gas,

communications, pulp and paper. Company creatively and systematically planned accounting

fraud that is considered as an ‘Enron Scandal’. In this, report will provide deeper insight

about the aspect of internal control violation and unethical behavior performed by Enron.

Further, it will also shed light on the policies that BOD should employ for making

improvement in the position and performance.

Discussing the internal control procedure in the context of Enron case study

Internal control process is highly significant and required for reflecting the accurate

view of financials. For controlling financial loopholes, system of auditing practiced by the

Enron. On the basis of cited case situation, focus of the company in regards to internal control

reduced along with expansion. However, due to some discrepancies or mistakes done by the

management organization faced issues. Case study of Enron clearly presents that

management of the company stopped applying an existing internal control system. Further,

business unit also failed to introduce effectual new control system (Bhasin, 2016). In addition

to this, in some cases firm undertook old system without making evaluation of reliability and

usability. Manager of Enron also relied on new system but avoided the main aspects in

relation to checking their accuracy and timeliness. Through assessment, it has been identified

that Enron assigned or allocated roles and responsibilities without defining reporting lines.

Thus, it can be said that due to some specific issues pertaining to internal control issues such

as accounting scandal faced by Enron.

Identifying the control that is being violated

By doing investigation, it has been identified that there are several reasons due to

which internal control is violated such as:

Fiduciary failure: Case study of Enron presents that Board of Directors failed to

offer protection to the shareholders. The main reasons behind this, BOD allows Enron

to undertake high risk accounting practices. Along with this, due to the inappropriate

In the recent times, every business unit places high level of emphasis on accounting

with the motive to present fair view of financial position and performance. This in turn helps

both managers as well as investors in making suitable decision regarding investment. This

project report is based on the case situation of Enron which was one of the leading energy

providers of US. It attained leading position in the field of electricity, natural gas,

communications, pulp and paper. Company creatively and systematically planned accounting

fraud that is considered as an ‘Enron Scandal’. In this, report will provide deeper insight

about the aspect of internal control violation and unethical behavior performed by Enron.

Further, it will also shed light on the policies that BOD should employ for making

improvement in the position and performance.

Discussing the internal control procedure in the context of Enron case study

Internal control process is highly significant and required for reflecting the accurate

view of financials. For controlling financial loopholes, system of auditing practiced by the

Enron. On the basis of cited case situation, focus of the company in regards to internal control

reduced along with expansion. However, due to some discrepancies or mistakes done by the

management organization faced issues. Case study of Enron clearly presents that

management of the company stopped applying an existing internal control system. Further,

business unit also failed to introduce effectual new control system (Bhasin, 2016). In addition

to this, in some cases firm undertook old system without making evaluation of reliability and

usability. Manager of Enron also relied on new system but avoided the main aspects in

relation to checking their accuracy and timeliness. Through assessment, it has been identified

that Enron assigned or allocated roles and responsibilities without defining reporting lines.

Thus, it can be said that due to some specific issues pertaining to internal control issues such

as accounting scandal faced by Enron.

Identifying the control that is being violated

By doing investigation, it has been identified that there are several reasons due to

which internal control is violated such as:

Fiduciary failure: Case study of Enron presents that Board of Directors failed to

offer protection to the shareholders. The main reasons behind this, BOD allows Enron

to undertake high risk accounting practices. Along with this, due to the inappropriate

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

conflict of interest transaction business organization failed to contribute in the

category of seventh largest public company in US.

High risk accounting: BOD also permitted Enron to undertake riskier accounting

practices. For example: Company’s BOD allowed and encouraged Enron to

manipulate the level of debt through the means of special purpose or business entities.

In order to hide the losses and reflect higher margin firm manipulated the financial

records. Along with this, debt level is also not reflected by the firm in balance sheet

that is considered as higher risky accounting (Enron the use and abuse of special

purpose entities in corporate structures, 2017). Moreover, the main objectives behind

such aspect are to attract more investors and maintaining the faith of existing

stakeholders.

Inappropriate conflicts of interest: Investigation report shows that Board exercised

inadequate oversight pertaining to LJM transaction and failed to protect Enron

shareholders from unfair dealing. Along with this, irrespective of the aspect of clear

interest of conflicts BOD of Enron was given approval in relation to establishing and

operating LJM private equity funds.

Excessive compensation: At the time of accounting scandal, high level of

compensation was approved by the executives of Enron (Lin, 2013). During this time,

business unit failed to assess and monitor the cumulative cash drain or halt abuse that

was done by the chairman & CEO.

Lack of independence: Due to the financial ties take place between the company and

some BOD they failed to give high level of independence to the auditors.

Extensive undisclosed off: With the aim to present the financial condition better BOD

of Enron allowed in relation to conducting billions of dollars in off-the-books activity.

Thus, to fulfill such objective firm failed to present or disclose adequate liabilities

which in turn contributed in Enron collapse.

category of seventh largest public company in US.

High risk accounting: BOD also permitted Enron to undertake riskier accounting

practices. For example: Company’s BOD allowed and encouraged Enron to

manipulate the level of debt through the means of special purpose or business entities.

In order to hide the losses and reflect higher margin firm manipulated the financial

records. Along with this, debt level is also not reflected by the firm in balance sheet

that is considered as higher risky accounting (Enron the use and abuse of special

purpose entities in corporate structures, 2017). Moreover, the main objectives behind

such aspect are to attract more investors and maintaining the faith of existing

stakeholders.

Inappropriate conflicts of interest: Investigation report shows that Board exercised

inadequate oversight pertaining to LJM transaction and failed to protect Enron

shareholders from unfair dealing. Along with this, irrespective of the aspect of clear

interest of conflicts BOD of Enron was given approval in relation to establishing and

operating LJM private equity funds.

Excessive compensation: At the time of accounting scandal, high level of

compensation was approved by the executives of Enron (Lin, 2013). During this time,

business unit failed to assess and monitor the cumulative cash drain or halt abuse that

was done by the chairman & CEO.

Lack of independence: Due to the financial ties take place between the company and

some BOD they failed to give high level of independence to the auditors.

Extensive undisclosed off: With the aim to present the financial condition better BOD

of Enron allowed in relation to conducting billions of dollars in off-the-books activity.

Thus, to fulfill such objective firm failed to present or disclose adequate liabilities

which in turn contributed in Enron collapse.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

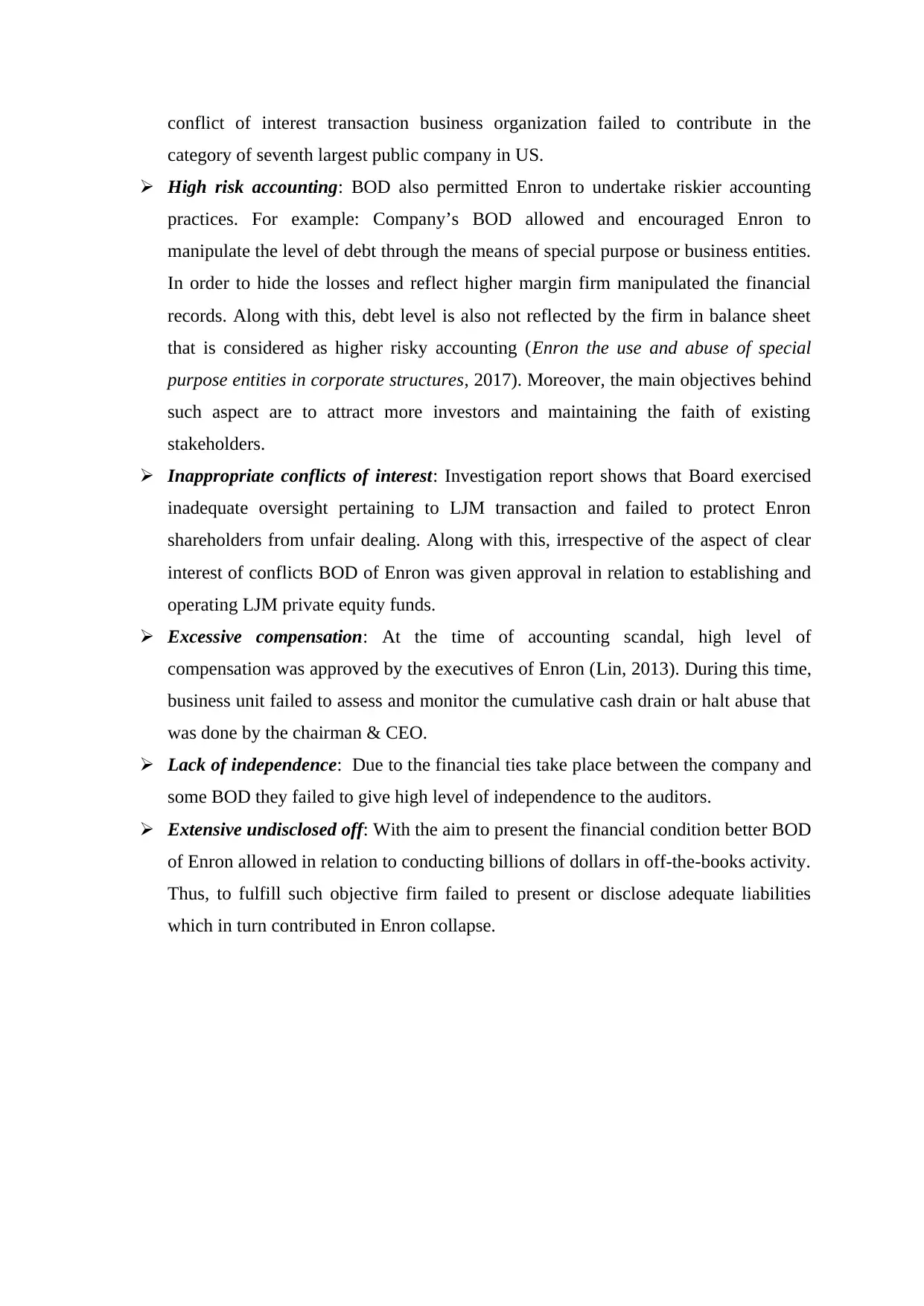

(Source: Management controls: the organizational fraud triangle of leadership, culture and

control in Enron, 2017)

Proposing a solution for internal control process that is violated

In the business unit, team of higher management makes more focus on applying the

policies that ensures high level of reliability of accounting system. Moreover, without having

appropriate records manager is not in position to take suitable decision regarding financial

aspects. Hence, as per the assessed violation following recommendations have been made:

It is suggested to the BOD of Enron to apply the specific solution on which majority

of the members of board give their consensus. Hence, Enron should make focus on

developing the strategies that presents ethical responses and assists it in attaining the

leading position.

Besides this, Enron should streamline the process of accounting which in turn helps in

avoiding the misleading results. Moreover, company can build and maintain the trust

of shareholders if it will present the fair view of monetary aspects.

BOD of Enron should take decision in relation to giving compensation and other

financial aspects after making assessment of the current condition or position (Enron

the use and abuse of special purpose entities in corporate structure, 2017). Moreover,

in the case of excessive offering monetary position and performance of firm is

affected negatively.

Further, it is recommended to Enron to provide external auditors with the high level

of independence. As per US GAAP and standardized accounting rules firm should

give proper independence to the auditors in relation to investigating the accounting

control in Enron, 2017)

Proposing a solution for internal control process that is violated

In the business unit, team of higher management makes more focus on applying the

policies that ensures high level of reliability of accounting system. Moreover, without having

appropriate records manager is not in position to take suitable decision regarding financial

aspects. Hence, as per the assessed violation following recommendations have been made:

It is suggested to the BOD of Enron to apply the specific solution on which majority

of the members of board give their consensus. Hence, Enron should make focus on

developing the strategies that presents ethical responses and assists it in attaining the

leading position.

Besides this, Enron should streamline the process of accounting which in turn helps in

avoiding the misleading results. Moreover, company can build and maintain the trust

of shareholders if it will present the fair view of monetary aspects.

BOD of Enron should take decision in relation to giving compensation and other

financial aspects after making assessment of the current condition or position (Enron

the use and abuse of special purpose entities in corporate structure, 2017). Moreover,

in the case of excessive offering monetary position and performance of firm is

affected negatively.

Further, it is recommended to Enron to provide external auditors with the high level

of independence. As per US GAAP and standardized accounting rules firm should

give proper independence to the auditors in relation to investigating the accounting

records. By doing this, Enron would become able to detect and rectify the errors that

prevailed in the financial accounts and reports.

For revitalizing the brand image it is vital for the firm to strengthen the internal

control system. In this regard, business unit needs to make focus on the application or

adoption of IAS and IFRS while determining the amount of assets and liabilities.

Moreover, overestimation of assets and underestimation of liabilities is not good

because it ruins image of firm.

Hence, by undertaking and applying all the above depicted measures Enron can improve

the internal control system in a prominent way. All such identified measures will assist firm

in getting the desired level of outcome or success.

Assessing and explaining the causes of unethical behavior in relation to the case situation

From assessment, it has been identified that Enron used wide range of deceptive

and fraudulent activities with the aim to hide undesired aspects in reporting. In addition to

this, Special Purpose Entities (SPE) was created by the firm to hide liabilities from the

financial statements. This is considered as an unethical behavior because it is the

accountability of the company to present fair view of monetary performance in front of

stakeholders. For instance: As per the case study, real debt and financial position is not

presented by Enron to the shareholders (Enron: Corporate Failure, Market Success, 2017).

This activity of firm is highly unethical because company owe responsibility towards the

shareholders in relation to giving appropriate information about the financial performance.

Company has obligation to present the fair information regarding revenue, profit, expenses,

assets and liabilities.

Usually, investors prefer to invest money in the company that has high assets and

fewer liabilities. Moreover, shareholders feel secure when company maintains higher assets

and fewer liabilities. By keeping such aspect in mind Enron manipulated the amount of

liabilities. Thus, it is one of the main aspects due to which unethical activities performed by

the executives of Enron. Such undesirable activity negatively influenced the brand image

and market share of Enron to a great extent. Along with this, business unit presented high

level of sales revenue and profit margin as compared to the actual one. Hence, misleading

financial statements are presented by the organization which is recognized as unethical

behavior (Enron: Corporate Failure, Market Success, 2017). Enron has highlighted higher

amount of profit with the aim to build and faith among the investors. Besides this, with the

prevailed in the financial accounts and reports.

For revitalizing the brand image it is vital for the firm to strengthen the internal

control system. In this regard, business unit needs to make focus on the application or

adoption of IAS and IFRS while determining the amount of assets and liabilities.

Moreover, overestimation of assets and underestimation of liabilities is not good

because it ruins image of firm.

Hence, by undertaking and applying all the above depicted measures Enron can improve

the internal control system in a prominent way. All such identified measures will assist firm

in getting the desired level of outcome or success.

Assessing and explaining the causes of unethical behavior in relation to the case situation

From assessment, it has been identified that Enron used wide range of deceptive

and fraudulent activities with the aim to hide undesired aspects in reporting. In addition to

this, Special Purpose Entities (SPE) was created by the firm to hide liabilities from the

financial statements. This is considered as an unethical behavior because it is the

accountability of the company to present fair view of monetary performance in front of

stakeholders. For instance: As per the case study, real debt and financial position is not

presented by Enron to the shareholders (Enron: Corporate Failure, Market Success, 2017).

This activity of firm is highly unethical because company owe responsibility towards the

shareholders in relation to giving appropriate information about the financial performance.

Company has obligation to present the fair information regarding revenue, profit, expenses,

assets and liabilities.

Usually, investors prefer to invest money in the company that has high assets and

fewer liabilities. Moreover, shareholders feel secure when company maintains higher assets

and fewer liabilities. By keeping such aspect in mind Enron manipulated the amount of

liabilities. Thus, it is one of the main aspects due to which unethical activities performed by

the executives of Enron. Such undesirable activity negatively influenced the brand image

and market share of Enron to a great extent. Along with this, business unit presented high

level of sales revenue and profit margin as compared to the actual one. Hence, misleading

financial statements are presented by the organization which is recognized as unethical

behavior (Enron: Corporate Failure, Market Success, 2017). Enron has highlighted higher

amount of profit with the aim to build and faith among the investors. Besides this, with the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

motive to attract large number of investors company performed such kind of unethical

practices.

In addition to this, due to the concerned accounting scandal of Enron several

individuals lost their jobs. Apart from this, some of the personnel lost pension, whereas

money of the shareholders also gone away. This aspect shows that activities of CEO are

highly unethical and they had not given any justification for the same. Along with this,

members of the board also ignored feedbacks that provided by the whistleblowers. It exhibits

that Board team became morally blind and failed to comply with the obligation pertaining to

ethical awareness as well as strategic responsiveness. By taking into account all such aspects

it can be presented that Enron accounting scandal includes several unethical practices.

Providing recommendations to the Board of Directors regarding policy improvement

From assessment, it has been found that business unit performed unethical practices

regarding accounting and other financial aspects. According to the case scenario, Enron

presented higher profit margin while firm is actually losing money. Such activity negatively

influenced the brand image of Enron as well as stock price. In order to improve the current

position and performance of firm it is highly required for the Board of Directors to undertake

strategic actions such as:

For avoiding the level of fraudulent activities Board of Directors should lay emphasis

on conducting internal audit on a periodical basis such as quarterly. By doing this,

higher management team of Enron can easily find the fraud related activities that

takes place within the organization. Thus, by taking corrective measure or action

within the suitable time frame business unit would become able to restrict such kind

of activities.

Along with this, by conducting external audit Enron can avoid the level of biasness to

a great extent. Moreover, auditors present their views after evaluating each and every

figure in against to the vouchers. In the case of external audit, auditors present

financial statements after doing in-depth investigation of each element included in the

record (Financial Fraud - Importance of an Internal Control System, 2017). Thus, by

presenting the audited statements Enron would become able to develop faith among

the stakeholders such as investors, suppliers, other institutions etc. The rationale

behind this, stakeholders have high level of trust on the audited statements rather than

others.

practices.

In addition to this, due to the concerned accounting scandal of Enron several

individuals lost their jobs. Apart from this, some of the personnel lost pension, whereas

money of the shareholders also gone away. This aspect shows that activities of CEO are

highly unethical and they had not given any justification for the same. Along with this,

members of the board also ignored feedbacks that provided by the whistleblowers. It exhibits

that Board team became morally blind and failed to comply with the obligation pertaining to

ethical awareness as well as strategic responsiveness. By taking into account all such aspects

it can be presented that Enron accounting scandal includes several unethical practices.

Providing recommendations to the Board of Directors regarding policy improvement

From assessment, it has been found that business unit performed unethical practices

regarding accounting and other financial aspects. According to the case scenario, Enron

presented higher profit margin while firm is actually losing money. Such activity negatively

influenced the brand image of Enron as well as stock price. In order to improve the current

position and performance of firm it is highly required for the Board of Directors to undertake

strategic actions such as:

For avoiding the level of fraudulent activities Board of Directors should lay emphasis

on conducting internal audit on a periodical basis such as quarterly. By doing this,

higher management team of Enron can easily find the fraud related activities that

takes place within the organization. Thus, by taking corrective measure or action

within the suitable time frame business unit would become able to restrict such kind

of activities.

Along with this, by conducting external audit Enron can avoid the level of biasness to

a great extent. Moreover, auditors present their views after evaluating each and every

figure in against to the vouchers. In the case of external audit, auditors present

financial statements after doing in-depth investigation of each element included in the

record (Financial Fraud - Importance of an Internal Control System, 2017). Thus, by

presenting the audited statements Enron would become able to develop faith among

the stakeholders such as investors, suppliers, other institutions etc. The rationale

behind this, stakeholders have high level of trust on the audited statements rather than

others.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It is also recommended to the Board of Directors to frame and introduce highly strict

policies in against to the person who perform fraudulent activities. Moreover, punitive

activities create fear factor among the personnel. Thus, by indulging such policies

within the firm fraudulent activities can be restricted to the significant level.

Further, it is advised to the BOD of Enron to enhance judgment integrity and

capability in relation to analyzing moral results. Management also needs to make

focus on strengthening the feedback system. By doing this, firm can undertake timely

action in against to unethical practices and thereby would become able to build

distinct image in the mind of stakeholders.

CONCLUSION

From the above report, it has been concluded that due to the less effectual internal

control system accounting scandal faced by Enron. Besides this, it can be inferred that higher

management team of the firm should make focus on investigate the causes of fraud. By doing

this, Enron can undertake suitable action for improvement. It can be seen in the report that

unethical practices performed by the business organization include representation of high

margin and hiding bank loan. Along with this, it has been articulated that BOD of Enron

should focus on the system of internal and external auditing. Hence, by adopting such

measures business unit can detect fraud and would become able to present financial

statements in a fair manner.

policies in against to the person who perform fraudulent activities. Moreover, punitive

activities create fear factor among the personnel. Thus, by indulging such policies

within the firm fraudulent activities can be restricted to the significant level.

Further, it is advised to the BOD of Enron to enhance judgment integrity and

capability in relation to analyzing moral results. Management also needs to make

focus on strengthening the feedback system. By doing this, firm can undertake timely

action in against to unethical practices and thereby would become able to build

distinct image in the mind of stakeholders.

CONCLUSION

From the above report, it has been concluded that due to the less effectual internal

control system accounting scandal faced by Enron. Besides this, it can be inferred that higher

management team of the firm should make focus on investigate the causes of fraud. By doing

this, Enron can undertake suitable action for improvement. It can be seen in the report that

unethical practices performed by the business organization include representation of high

margin and hiding bank loan. Along with this, it has been articulated that BOD of Enron

should focus on the system of internal and external auditing. Hence, by adopting such

measures business unit can detect fraud and would become able to present financial

statements in a fair manner.

REFERENCES

Books and Journals

Bhasin, M. L., 2016. Debacle of Satyam Computers Limited: A Case Study of

Enron. Wulfenia Journal KLAGENFURT. 23(3). pp.124-162.

Lin, S.K., 2013. Resisting Corporate Corruption: Cases in Practical Ethics From Enron

Through The Financial Crisis, By Stephen V. Arbogast, Wiley-Scrivener, 2013; 552

Pages. Price US $75.00, ISBN 978-1-118-20855-7. Administrative Sciences. 3(2). pp.6-8.

Online

Enron the use and abuse of special purpose entities in corporate structures. 2017. [Online].

Available through: < http://scholarship.law.duke.edu/cgi/viewcontent.cgi?

article=2308&context=faculty_scholarship >. [Accessed on 27th August 2017].

Enron: Corporate Failure, Market Success. 2017. [pdf]. Available through:

<http://www.isda.org/whatsnew/pdf/EnronFinal4121.pdf>. [Accessed on 27th August

2017].

Financial Fraud - Importance of an Internal Control System. 2017. [Online]. Available

through: <

http://www.theseus.fi/bitstream/handle/10024/49666/Saarni_Jenna.pdf;jsessionid=722453

8C559D1305C087A50FCA532F48?sequence=1>. [Accessed on 27th August 2017].

Management controls: the organizational fraud triangle of leadership, culture and control in

Enron. 2017. [Online]. Available through:

<https://iveybusinessjournal.com/publication/management-controls-the-organizational-

fraud-triangle-of-leadership-culture-and-control-in-enron/>. [Accessed on 27th August

2017].

Books and Journals

Bhasin, M. L., 2016. Debacle of Satyam Computers Limited: A Case Study of

Enron. Wulfenia Journal KLAGENFURT. 23(3). pp.124-162.

Lin, S.K., 2013. Resisting Corporate Corruption: Cases in Practical Ethics From Enron

Through The Financial Crisis, By Stephen V. Arbogast, Wiley-Scrivener, 2013; 552

Pages. Price US $75.00, ISBN 978-1-118-20855-7. Administrative Sciences. 3(2). pp.6-8.

Online

Enron the use and abuse of special purpose entities in corporate structures. 2017. [Online].

Available through: < http://scholarship.law.duke.edu/cgi/viewcontent.cgi?

article=2308&context=faculty_scholarship >. [Accessed on 27th August 2017].

Enron: Corporate Failure, Market Success. 2017. [pdf]. Available through:

<http://www.isda.org/whatsnew/pdf/EnronFinal4121.pdf>. [Accessed on 27th August

2017].

Financial Fraud - Importance of an Internal Control System. 2017. [Online]. Available

through: <

http://www.theseus.fi/bitstream/handle/10024/49666/Saarni_Jenna.pdf;jsessionid=722453

8C559D1305C087A50FCA532F48?sequence=1>. [Accessed on 27th August 2017].

Management controls: the organizational fraud triangle of leadership, culture and control in

Enron. 2017. [Online]. Available through:

<https://iveybusinessjournal.com/publication/management-controls-the-organizational-

fraud-triangle-of-leadership-culture-and-control-in-enron/>. [Accessed on 27th August

2017].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BIBLIOGRAPHY

https://iveybusinessjournal.com/publication/management-controls-the-organizational-fraud-

triangle-of-leadership-culture-and-control-in-enron/

http://www.isda.org/whatsnew/pdf/EnronFinal4121.pdf

http://scholarship.law.duke.edu/cgi/viewcontent.cgi?

article=2308&context=faculty_scholarship

http://www.theseus.fi/bitstream/handle/10024/49666/

Saarni_Jenna.pdf;jsessionid=7224538C559D1305C087A50FCA532F48?sequence=1

https://iveybusinessjournal.com/publication/management-controls-the-organizational-fraud-

triangle-of-leadership-culture-and-control-in-enron/

http://www.isda.org/whatsnew/pdf/EnronFinal4121.pdf

http://scholarship.law.duke.edu/cgi/viewcontent.cgi?

article=2308&context=faculty_scholarship

http://www.theseus.fi/bitstream/handle/10024/49666/

Saarni_Jenna.pdf;jsessionid=7224538C559D1305C087A50FCA532F48?sequence=1

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.