Accounting for Decision Makers (ACC 1701) Lecture 1: An Introduction

VerifiedAdded on 2021/08/30

|52

|5950

|101

Presentation

AI Summary

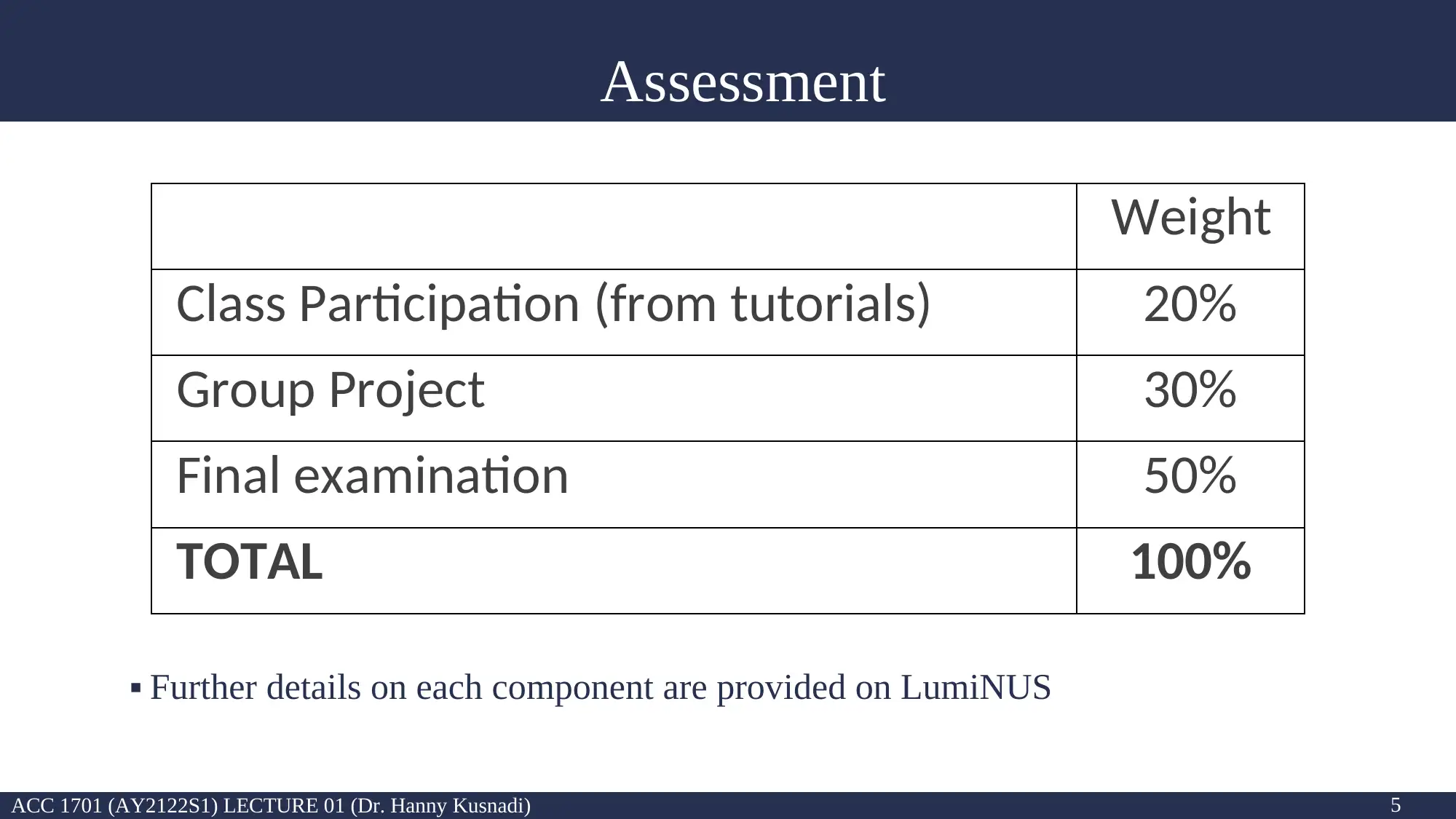

This document presents the lecture notes for the first lecture of ACC 1701, "Accounting for Decision Makers," taught by Dr. Hanny Kusnadi at the National University of Singapore (NUS). The lecture introduces the course, administrative details, and the importance of accounting in the business world. It covers topics such as the need for accounting, users of accounting information (both internal and external), the accounting system, different types of business entities (sole proprietorship, partnership, and corporation), financial accounting standards (IFRS and Singapore FRS), the IASB conceptual framework, qualitative characteristics of accounting information (relevance, faithful representation, comparability, verifiability, timeliness, and understandability), and the importance of ethical conduct in accounting. The lecture emphasizes the role of financial statements in providing reliable information for decision-making and highlights the impact of accounting scandals driven by poor ethics. The lecture also outlines the assessment components, tips for succeeding in the class, Zoom lecture etiquette, and procedures to follow when technology fails. The lecture uses examples like Andy's AI Company and Amazon's financial data to illustrate key concepts. It also introduces the use of PollEv for interactive activities and provides an overview of Chapters 1 and 2, focusing on accounting in business and financial statements.

1 out of 52

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)