Accounting Theory Analysis: Issues for Bharti Airtel Company Report

VerifiedAdded on 2023/04/21

|10

|1882

|445

Report

AI Summary

This report provides a comprehensive analysis of accounting theory as applied to Bharti Airtel, a leading telecommunications company. It begins by discussing the company's background and the significant financial issues it faces, particularly its high debt levels. The report identifies key accounting issues, including regulatory and political uncertainties, economic uncertainties, and challenges related to network quality and customer lifecycle management. It examines the application of relevant accounting standards, such as Indian Accounting Standards (Ind AS), and explores related accounting theories, like management's responsibility for financial statements and internal financial controls. The report then critically analyzes the issues in detail, focusing on risks associated with internal control gaps, regulatory taxation, increasing costs, and economic uncertainties. It discusses accounting requirements, including compliance with the Companies Act, 2013, and SEBI regulations. The report also explores how accounting theories can be applied to address these problems and suggests changes and improvements for enhancing reporting accounting practices and disclosures to mitigate identified risks. Overall, the report offers insights into the financial challenges faced by Bharti Airtel and the application of accounting theory to address these challenges.

Running head: ACCOUNTING THEORY

Accounting Theory

Name of the Student

Name of the University

Author’s Note

Accounting Theory

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING THEORY

2ACCOUNTING THEORY

Table of Contents

Introduction..........................................................................................................................3

Discussion of issues associated to the company..............................................................3

Discussion of the background of the company................................................................3

Accounting issues present in the company......................................................................3

Application of relevant accounting standards..................................................................3

Relevant Theories............................................................................................................4

Critical Analysis..................................................................................................................4

Details of the issues in accounting...................................................................................4

Discussion of accounting requirement in detail...............................................................5

Discussion of the theory appropriate to the case firm and the accounting problems......5

Discussion of the main theme of the theory....................................................................6

Changes/suggestions for improving the reporting accounting practices and disclosures6

Conclusion...........................................................................................................................7

References............................................................................................................................8

Table of Contents

Introduction..........................................................................................................................3

Discussion of issues associated to the company..............................................................3

Discussion of the background of the company................................................................3

Accounting issues present in the company......................................................................3

Application of relevant accounting standards..................................................................3

Relevant Theories............................................................................................................4

Critical Analysis..................................................................................................................4

Details of the issues in accounting...................................................................................4

Discussion of accounting requirement in detail...............................................................5

Discussion of the theory appropriate to the case firm and the accounting problems......5

Discussion of the main theme of the theory....................................................................6

Changes/suggestions for improving the reporting accounting practices and disclosures6

Conclusion...........................................................................................................................7

References............................................................................................................................8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING THEORY

Introduction

Discussion of issues associated to the company

On November 28 2018, the Economic Times reported that Bharti Airtel bears net

consolidated debt of 1,14,557 crore out of which the borrowings pertaining to the Indian

Operators was seen as 80,000 crores. Therefore, as per the recent report it can be seen that the

company is suffering major problems associated to increased debt ratio (Kumar 2018).

Discussion of the background of the company

Bharti Airtel Limited is recognised as leading globally established telecommunications

organization operating in 16 countries across Asia and Africa. The company is headquartered in

New Delhi, India and ranked among the top 3 services providers of mobile telecommunications

services. The product and service offerings of the company are seen in form of services such as

2G, 3G and 4G wireless facilities (Airtel 2019).

Accounting issues present in the company

The main form of the accounting issues present in the company can be considered with

regulatory and political uncertainties. Some of the other accounting issues can be seen with

economic uncertainties, poor quality of network, information technology and redundancies

including disaster recoveries. The inadequacy in the quality of the customer lifecycle is also seen

to pose potential issues in accounting. The inadequate quality of the customer lifecycle

management needs to also depicted redundancies and disaster recoveries (Airtel 2019).

Application of relevant accounting standards

The board of directors of the company is depicted to implement “Section 134(5) of the

Companies Act,2013, as per the standalone financial statements for providing a true and fair

view of the position of the financial performance of the company. The relevant accounting

Introduction

Discussion of issues associated to the company

On November 28 2018, the Economic Times reported that Bharti Airtel bears net

consolidated debt of 1,14,557 crore out of which the borrowings pertaining to the Indian

Operators was seen as 80,000 crores. Therefore, as per the recent report it can be seen that the

company is suffering major problems associated to increased debt ratio (Kumar 2018).

Discussion of the background of the company

Bharti Airtel Limited is recognised as leading globally established telecommunications

organization operating in 16 countries across Asia and Africa. The company is headquartered in

New Delhi, India and ranked among the top 3 services providers of mobile telecommunications

services. The product and service offerings of the company are seen in form of services such as

2G, 3G and 4G wireless facilities (Airtel 2019).

Accounting issues present in the company

The main form of the accounting issues present in the company can be considered with

regulatory and political uncertainties. Some of the other accounting issues can be seen with

economic uncertainties, poor quality of network, information technology and redundancies

including disaster recoveries. The inadequacy in the quality of the customer lifecycle is also seen

to pose potential issues in accounting. The inadequate quality of the customer lifecycle

management needs to also depicted redundancies and disaster recoveries (Airtel 2019).

Application of relevant accounting standards

The board of directors of the company is depicted to implement “Section 134(5) of the

Companies Act,2013, as per the standalone financial statements for providing a true and fair

view of the position of the financial performance of the company. The relevant accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING THEORY

standard followed by the company is seen in accordance with “Indian Accounting Standards

(Ind AS)”, which is prescribed as per “section 133 of the Companies Act,2013. These rules are

read with “Indian Accounting Standards) Rules, 2015” which are amended with the accounting

principles accepted in India (Bhasin 2015).

Relevant Theories

The important theories are considered as per Management’s Responsibility for the

Standalone Financial Statements, regulatory requirement and responsibility of the management

for internal financial controls (Narayanaswamy 2017).

Critical Analysis

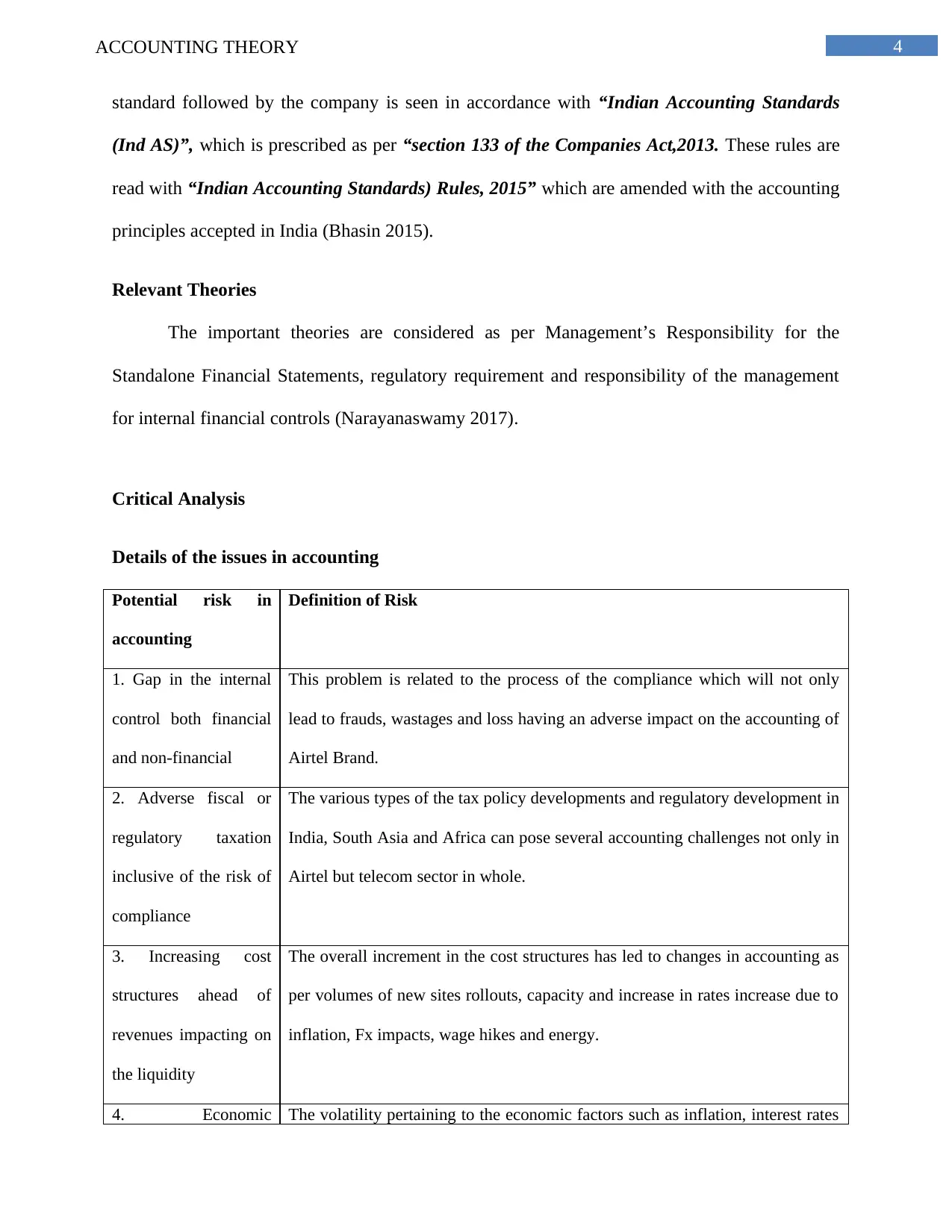

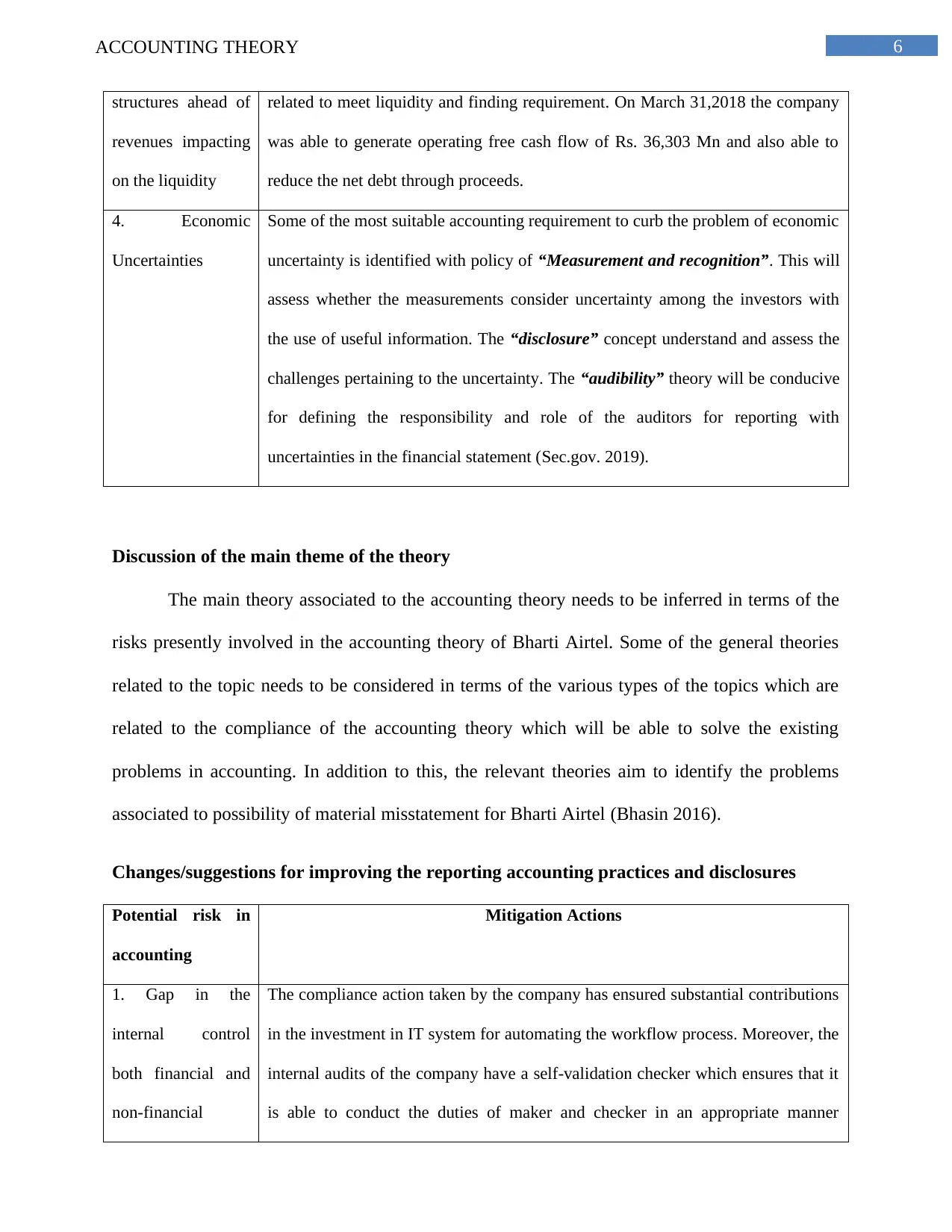

Details of the issues in accounting

Potential risk in

accounting

Definition of Risk

1. Gap in the internal

control both financial

and non-financial

This problem is related to the process of the compliance which will not only

lead to frauds, wastages and loss having an adverse impact on the accounting of

Airtel Brand.

2. Adverse fiscal or

regulatory taxation

inclusive of the risk of

compliance

The various types of the tax policy developments and regulatory development in

India, South Asia and Africa can pose several accounting challenges not only in

Airtel but telecom sector in whole.

3. Increasing cost

structures ahead of

revenues impacting on

the liquidity

The overall increment in the cost structures has led to changes in accounting as

per volumes of new sites rollouts, capacity and increase in rates increase due to

inflation, Fx impacts, wage hikes and energy.

4. Economic The volatility pertaining to the economic factors such as inflation, interest rates

standard followed by the company is seen in accordance with “Indian Accounting Standards

(Ind AS)”, which is prescribed as per “section 133 of the Companies Act,2013. These rules are

read with “Indian Accounting Standards) Rules, 2015” which are amended with the accounting

principles accepted in India (Bhasin 2015).

Relevant Theories

The important theories are considered as per Management’s Responsibility for the

Standalone Financial Statements, regulatory requirement and responsibility of the management

for internal financial controls (Narayanaswamy 2017).

Critical Analysis

Details of the issues in accounting

Potential risk in

accounting

Definition of Risk

1. Gap in the internal

control both financial

and non-financial

This problem is related to the process of the compliance which will not only

lead to frauds, wastages and loss having an adverse impact on the accounting of

Airtel Brand.

2. Adverse fiscal or

regulatory taxation

inclusive of the risk of

compliance

The various types of the tax policy developments and regulatory development in

India, South Asia and Africa can pose several accounting challenges not only in

Airtel but telecom sector in whole.

3. Increasing cost

structures ahead of

revenues impacting on

the liquidity

The overall increment in the cost structures has led to changes in accounting as

per volumes of new sites rollouts, capacity and increase in rates increase due to

inflation, Fx impacts, wage hikes and energy.

4. Economic The volatility pertaining to the economic factors such as inflation, interest rates

5ACCOUNTING THEORY

Uncertainties and fluctuations in the currency has posed several challenges which will bring

majority of the changes in the accounting.

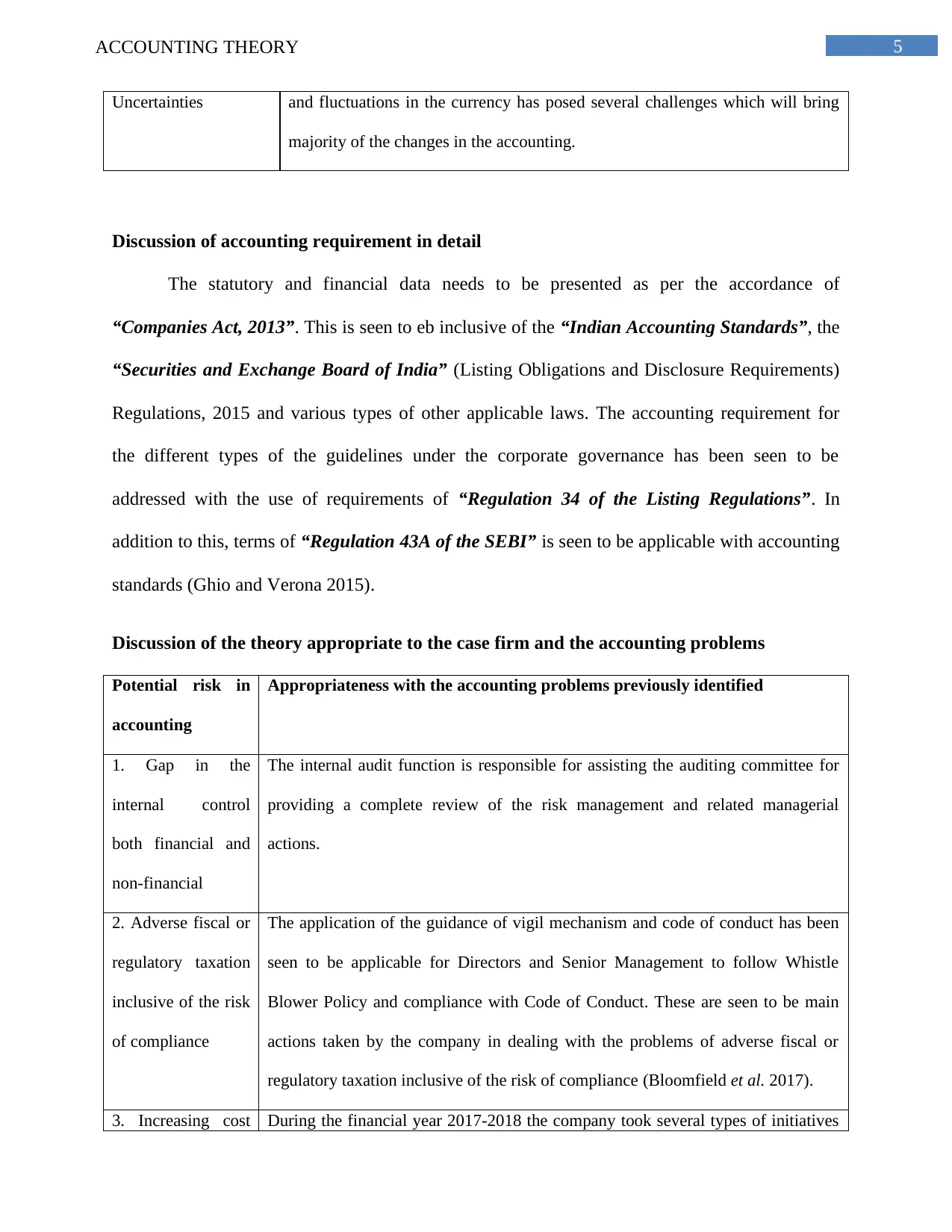

Discussion of accounting requirement in detail

The statutory and financial data needs to be presented as per the accordance of

“Companies Act, 2013”. This is seen to eb inclusive of the “Indian Accounting Standards”, the

“Securities and Exchange Board of India” (Listing Obligations and Disclosure Requirements)

Regulations, 2015 and various types of other applicable laws. The accounting requirement for

the different types of the guidelines under the corporate governance has been seen to be

addressed with the use of requirements of “Regulation 34 of the Listing Regulations”. In

addition to this, terms of “Regulation 43A of the SEBI” is seen to be applicable with accounting

standards (Ghio and Verona 2015).

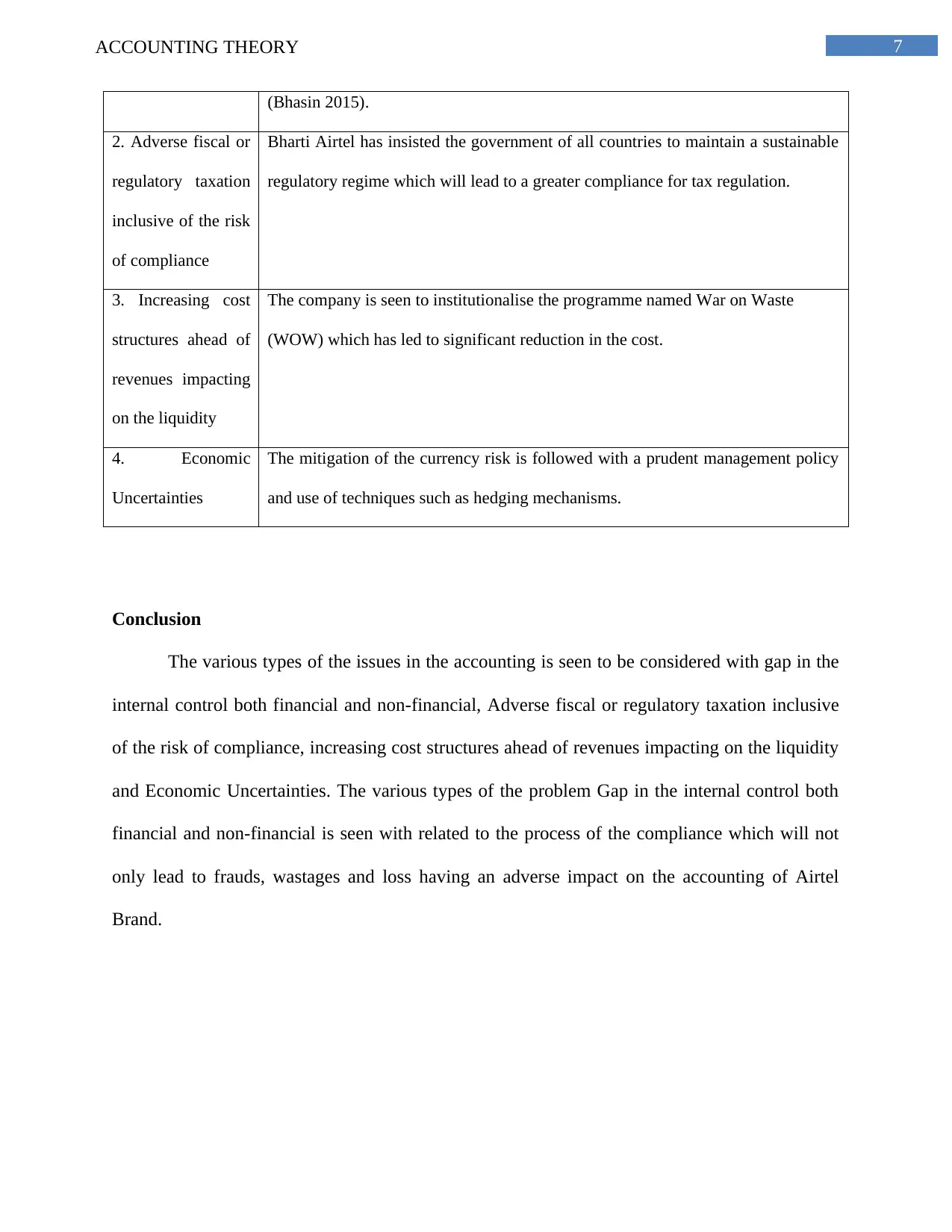

Discussion of the theory appropriate to the case firm and the accounting problems

Potential risk in

accounting

Appropriateness with the accounting problems previously identified

1. Gap in the

internal control

both financial and

non-financial

The internal audit function is responsible for assisting the auditing committee for

providing a complete review of the risk management and related managerial

actions.

2. Adverse fiscal or

regulatory taxation

inclusive of the risk

of compliance

The application of the guidance of vigil mechanism and code of conduct has been

seen to be applicable for Directors and Senior Management to follow Whistle

Blower Policy and compliance with Code of Conduct. These are seen to be main

actions taken by the company in dealing with the problems of adverse fiscal or

regulatory taxation inclusive of the risk of compliance (Bloomfield et al. 2017).

3. Increasing cost During the financial year 2017-2018 the company took several types of initiatives

Uncertainties and fluctuations in the currency has posed several challenges which will bring

majority of the changes in the accounting.

Discussion of accounting requirement in detail

The statutory and financial data needs to be presented as per the accordance of

“Companies Act, 2013”. This is seen to eb inclusive of the “Indian Accounting Standards”, the

“Securities and Exchange Board of India” (Listing Obligations and Disclosure Requirements)

Regulations, 2015 and various types of other applicable laws. The accounting requirement for

the different types of the guidelines under the corporate governance has been seen to be

addressed with the use of requirements of “Regulation 34 of the Listing Regulations”. In

addition to this, terms of “Regulation 43A of the SEBI” is seen to be applicable with accounting

standards (Ghio and Verona 2015).

Discussion of the theory appropriate to the case firm and the accounting problems

Potential risk in

accounting

Appropriateness with the accounting problems previously identified

1. Gap in the

internal control

both financial and

non-financial

The internal audit function is responsible for assisting the auditing committee for

providing a complete review of the risk management and related managerial

actions.

2. Adverse fiscal or

regulatory taxation

inclusive of the risk

of compliance

The application of the guidance of vigil mechanism and code of conduct has been

seen to be applicable for Directors and Senior Management to follow Whistle

Blower Policy and compliance with Code of Conduct. These are seen to be main

actions taken by the company in dealing with the problems of adverse fiscal or

regulatory taxation inclusive of the risk of compliance (Bloomfield et al. 2017).

3. Increasing cost During the financial year 2017-2018 the company took several types of initiatives

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING THEORY

structures ahead of

revenues impacting

on the liquidity

related to meet liquidity and finding requirement. On March 31,2018 the company

was able to generate operating free cash flow of Rs. 36,303 Mn and also able to

reduce the net debt through proceeds.

4. Economic

Uncertainties

Some of the most suitable accounting requirement to curb the problem of economic

uncertainty is identified with policy of “Measurement and recognition”. This will

assess whether the measurements consider uncertainty among the investors with

the use of useful information. The “disclosure” concept understand and assess the

challenges pertaining to the uncertainty. The “audibility” theory will be conducive

for defining the responsibility and role of the auditors for reporting with

uncertainties in the financial statement (Sec.gov. 2019).

Discussion of the main theme of the theory

The main theory associated to the accounting theory needs to be inferred in terms of the

risks presently involved in the accounting theory of Bharti Airtel. Some of the general theories

related to the topic needs to be considered in terms of the various types of the topics which are

related to the compliance of the accounting theory which will be able to solve the existing

problems in accounting. In addition to this, the relevant theories aim to identify the problems

associated to possibility of material misstatement for Bharti Airtel (Bhasin 2016).

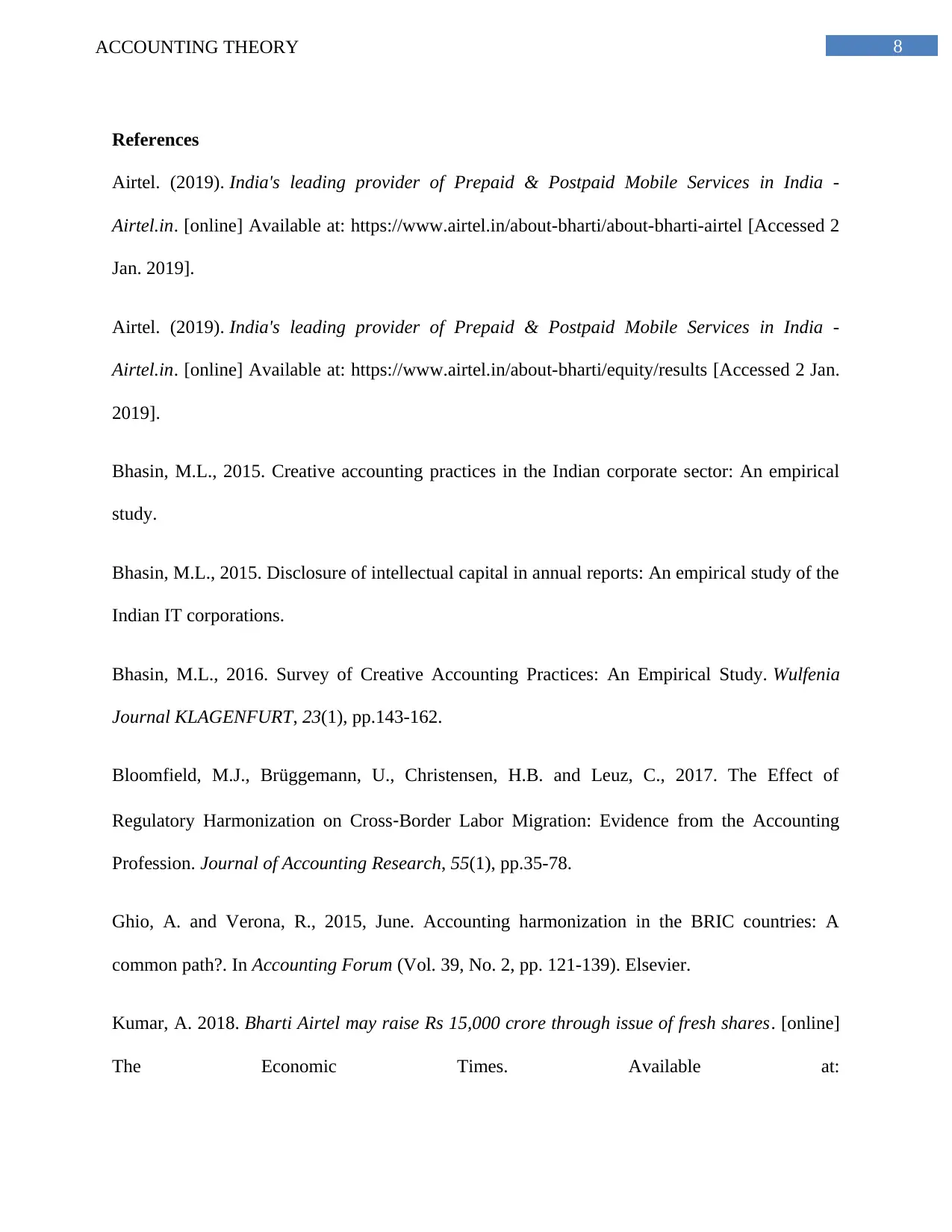

Changes/suggestions for improving the reporting accounting practices and disclosures

Potential risk in

accounting

Mitigation Actions

1. Gap in the

internal control

both financial and

non-financial

The compliance action taken by the company has ensured substantial contributions

in the investment in IT system for automating the workflow process. Moreover, the

internal audits of the company have a self-validation checker which ensures that it

is able to conduct the duties of maker and checker in an appropriate manner

structures ahead of

revenues impacting

on the liquidity

related to meet liquidity and finding requirement. On March 31,2018 the company

was able to generate operating free cash flow of Rs. 36,303 Mn and also able to

reduce the net debt through proceeds.

4. Economic

Uncertainties

Some of the most suitable accounting requirement to curb the problem of economic

uncertainty is identified with policy of “Measurement and recognition”. This will

assess whether the measurements consider uncertainty among the investors with

the use of useful information. The “disclosure” concept understand and assess the

challenges pertaining to the uncertainty. The “audibility” theory will be conducive

for defining the responsibility and role of the auditors for reporting with

uncertainties in the financial statement (Sec.gov. 2019).

Discussion of the main theme of the theory

The main theory associated to the accounting theory needs to be inferred in terms of the

risks presently involved in the accounting theory of Bharti Airtel. Some of the general theories

related to the topic needs to be considered in terms of the various types of the topics which are

related to the compliance of the accounting theory which will be able to solve the existing

problems in accounting. In addition to this, the relevant theories aim to identify the problems

associated to possibility of material misstatement for Bharti Airtel (Bhasin 2016).

Changes/suggestions for improving the reporting accounting practices and disclosures

Potential risk in

accounting

Mitigation Actions

1. Gap in the

internal control

both financial and

non-financial

The compliance action taken by the company has ensured substantial contributions

in the investment in IT system for automating the workflow process. Moreover, the

internal audits of the company have a self-validation checker which ensures that it

is able to conduct the duties of maker and checker in an appropriate manner

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING THEORY

(Bhasin 2015).

2. Adverse fiscal or

regulatory taxation

inclusive of the risk

of compliance

Bharti Airtel has insisted the government of all countries to maintain a sustainable

regulatory regime which will lead to a greater compliance for tax regulation.

3. Increasing cost

structures ahead of

revenues impacting

on the liquidity

The company is seen to institutionalise the programme named War on Waste

(WOW) which has led to significant reduction in the cost.

4. Economic

Uncertainties

The mitigation of the currency risk is followed with a prudent management policy

and use of techniques such as hedging mechanisms.

Conclusion

The various types of the issues in the accounting is seen to be considered with gap in the

internal control both financial and non-financial, Adverse fiscal or regulatory taxation inclusive

of the risk of compliance, increasing cost structures ahead of revenues impacting on the liquidity

and Economic Uncertainties. The various types of the problem Gap in the internal control both

financial and non-financial is seen with related to the process of the compliance which will not

only lead to frauds, wastages and loss having an adverse impact on the accounting of Airtel

Brand.

(Bhasin 2015).

2. Adverse fiscal or

regulatory taxation

inclusive of the risk

of compliance

Bharti Airtel has insisted the government of all countries to maintain a sustainable

regulatory regime which will lead to a greater compliance for tax regulation.

3. Increasing cost

structures ahead of

revenues impacting

on the liquidity

The company is seen to institutionalise the programme named War on Waste

(WOW) which has led to significant reduction in the cost.

4. Economic

Uncertainties

The mitigation of the currency risk is followed with a prudent management policy

and use of techniques such as hedging mechanisms.

Conclusion

The various types of the issues in the accounting is seen to be considered with gap in the

internal control both financial and non-financial, Adverse fiscal or regulatory taxation inclusive

of the risk of compliance, increasing cost structures ahead of revenues impacting on the liquidity

and Economic Uncertainties. The various types of the problem Gap in the internal control both

financial and non-financial is seen with related to the process of the compliance which will not

only lead to frauds, wastages and loss having an adverse impact on the accounting of Airtel

Brand.

8ACCOUNTING THEORY

References

Airtel. (2019). India's leading provider of Prepaid & Postpaid Mobile Services in India -

Airtel.in. [online] Available at: https://www.airtel.in/about-bharti/about-bharti-airtel [Accessed 2

Jan. 2019].

Airtel. (2019). India's leading provider of Prepaid & Postpaid Mobile Services in India -

Airtel.in. [online] Available at: https://www.airtel.in/about-bharti/equity/results [Accessed 2 Jan.

2019].

Bhasin, M.L., 2015. Creative accounting practices in the Indian corporate sector: An empirical

study.

Bhasin, M.L., 2015. Disclosure of intellectual capital in annual reports: An empirical study of the

Indian IT corporations.

Bhasin, M.L., 2016. Survey of Creative Accounting Practices: An Empirical Study. Wulfenia

Journal KLAGENFURT, 23(1), pp.143-162.

Bloomfield, M.J., Brüggemann, U., Christensen, H.B. and Leuz, C., 2017. The Effect of

Regulatory Harmonization on Cross‐Border Labor Migration: Evidence from the Accounting

Profession. Journal of Accounting Research, 55(1), pp.35-78.

Ghio, A. and Verona, R., 2015, June. Accounting harmonization in the BRIC countries: A

common path?. In Accounting Forum (Vol. 39, No. 2, pp. 121-139). Elsevier.

Kumar, A. 2018. Bharti Airtel may raise Rs 15,000 crore through issue of fresh shares. [online]

The Economic Times. Available at:

References

Airtel. (2019). India's leading provider of Prepaid & Postpaid Mobile Services in India -

Airtel.in. [online] Available at: https://www.airtel.in/about-bharti/about-bharti-airtel [Accessed 2

Jan. 2019].

Airtel. (2019). India's leading provider of Prepaid & Postpaid Mobile Services in India -

Airtel.in. [online] Available at: https://www.airtel.in/about-bharti/equity/results [Accessed 2 Jan.

2019].

Bhasin, M.L., 2015. Creative accounting practices in the Indian corporate sector: An empirical

study.

Bhasin, M.L., 2015. Disclosure of intellectual capital in annual reports: An empirical study of the

Indian IT corporations.

Bhasin, M.L., 2016. Survey of Creative Accounting Practices: An Empirical Study. Wulfenia

Journal KLAGENFURT, 23(1), pp.143-162.

Bloomfield, M.J., Brüggemann, U., Christensen, H.B. and Leuz, C., 2017. The Effect of

Regulatory Harmonization on Cross‐Border Labor Migration: Evidence from the Accounting

Profession. Journal of Accounting Research, 55(1), pp.35-78.

Ghio, A. and Verona, R., 2015, June. Accounting harmonization in the BRIC countries: A

common path?. In Accounting Forum (Vol. 39, No. 2, pp. 121-139). Elsevier.

Kumar, A. 2018. Bharti Airtel may raise Rs 15,000 crore through issue of fresh shares. [online]

The Economic Times. Available at:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING THEORY

https://economictimes.indiatimes.com/markets/stocks/news/bharti-airtel-may-raise-rs-15000-

crore-through-issue-of-fresh-shares/articleshow/66837382.cms [Accessed 2 Jan. 2019].

Narayanaswamy, R., 2017. Financial Accounting: A Managerial Perspective. PHI Learning Pvt.

Ltd.

Sec.gov. (2019). SEC.gov | Measurement Uncertainty in Financial Reporting: How Much to

Recognize and How Best to Communicate It. [online] Available at:

https://www.sec.gov/about/offices/oca/ocafrseries-briefing-measurement.htm [Accessed 2 Jan.

2019].

https://economictimes.indiatimes.com/markets/stocks/news/bharti-airtel-may-raise-rs-15000-

crore-through-issue-of-fresh-shares/articleshow/66837382.cms [Accessed 2 Jan. 2019].

Narayanaswamy, R., 2017. Financial Accounting: A Managerial Perspective. PHI Learning Pvt.

Ltd.

Sec.gov. (2019). SEC.gov | Measurement Uncertainty in Financial Reporting: How Much to

Recognize and How Best to Communicate It. [online] Available at:

https://www.sec.gov/about/offices/oca/ocafrseries-briefing-measurement.htm [Accessed 2 Jan.

2019].

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.