Analysis of Corporate External Reporting Practices

VerifiedAdded on 2023/03/31

|21

|4361

|326

AI Summary

This assignment analyzes the practices of corporate external reporting, including the history and development of conceptual framework for financial reporting. It discusses concerns of Australian accounting profession and the application of the conceptual framework by a specific company. It also compares sustainability reporting guidelines and integrated reporting framework.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: ACCOUNTING THEORY & CONTEMPORARY ISSSUES

ACCOUNTING THEORY & CONTEMPORARY ISSUES

Name of the Student

Name of the University

Author Note

ACCOUNTING THEORY & CONTEMPORARY ISSUES

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING THEORY & CONTEMPORARY ISSUES

Executive Summary

The aim of this assignment is to do the analysis of the practices of the corporate

external reporting. For this, literature review of history and development of conceptual

framework for financial reporting will be discussed. In addition, concerns of Australian

accounting profession and academic concern regarding their application will be discussed.

Moreover, application of the conceptual framework by the Southern Cross Media Group

Limited will be discussed, which have described that company has prepared and recorded the

transactions as per the accounting standard. Further, Sustainability reporting guidelines and

Integrated Reporting framework has been compared, contrasted and its applicability will be

discussed. Moreover, integrated reporting checklist will be prepared and compared with the

Truworths International Limited. Lastly, comparison will be done on Australian company

corporate social responsibility report and financial report with South African company

integrated report, which states that integrated report is summary and one report that consist of

information of corporate social responsibility and financial performance.

Executive Summary

The aim of this assignment is to do the analysis of the practices of the corporate

external reporting. For this, literature review of history and development of conceptual

framework for financial reporting will be discussed. In addition, concerns of Australian

accounting profession and academic concern regarding their application will be discussed.

Moreover, application of the conceptual framework by the Southern Cross Media Group

Limited will be discussed, which have described that company has prepared and recorded the

transactions as per the accounting standard. Further, Sustainability reporting guidelines and

Integrated Reporting framework has been compared, contrasted and its applicability will be

discussed. Moreover, integrated reporting checklist will be prepared and compared with the

Truworths International Limited. Lastly, comparison will be done on Australian company

corporate social responsibility report and financial report with South African company

integrated report, which states that integrated report is summary and one report that consist of

information of corporate social responsibility and financial performance.

2ACCOUNTING THEORY & CONTEMPORARY ISSUES

Table of Contents

Introduction................................................................................................................................3

Part A.........................................................................................................................................3

Literature Review...................................................................................................................4

Application of Conceptual Framework for Financial Reporting...........................................5

Academic Concerns about the Quality of Conceptual Framework for Financial Reporting. 6

Application of Conceptual Framework by the Company......................................................7

Part B..........................................................................................................................................8

Comparison between Sustainability Reporting Guidelines and International Integrated

Reporting Framework............................................................................................................8

Strengths and Weaknesses of Conventional Accounting.......................................................9

Applicability of Theories of contents of Sustainability and Integrated Reports..................11

Index of Integrated Report Components..............................................................................12

Comparison of contents of Australian company’s corporate social responsibility reporting

with Integrated Report of South African Company.............................................................16

Conclusion................................................................................................................................17

Reference..................................................................................................................................18

Table of Contents

Introduction................................................................................................................................3

Part A.........................................................................................................................................3

Literature Review...................................................................................................................4

Application of Conceptual Framework for Financial Reporting...........................................5

Academic Concerns about the Quality of Conceptual Framework for Financial Reporting. 6

Application of Conceptual Framework by the Company......................................................7

Part B..........................................................................................................................................8

Comparison between Sustainability Reporting Guidelines and International Integrated

Reporting Framework............................................................................................................8

Strengths and Weaknesses of Conventional Accounting.......................................................9

Applicability of Theories of contents of Sustainability and Integrated Reports..................11

Index of Integrated Report Components..............................................................................12

Comparison of contents of Australian company’s corporate social responsibility reporting

with Integrated Report of South African Company.............................................................16

Conclusion................................................................................................................................17

Reference..................................................................................................................................18

3ACCOUNTING THEORY & CONTEMPORARY ISSUES

Introduction

The aim of this assignment is to do the analysis on the different aspects of the

corporate external reporting practices. Therefore, for analysis, two companies will be taken

into consideration. First company will be STHN Cross Media and second company will be

Truworths International Limited. Southern Cross Media Group is known to be one of the

major media company of Australia (Southern Cross Austereo., 2019). Moreover, Truworths

is the retailer in clothing based in Cape Town, South Africa. This company is engaged in

selling cloths under various brands (Truworths, 2019). Hence, under this assignment,

discussion will be done on conceptual framework, which includes literature review of the

history and development of conceptual framework for the financial reporting, discussion on

Australian accounting profession’s concerns regarding the IASB/IFRS application. Moreover,

discussion will be on the review of the journal articles and application of the conceptual

framework by the company. Further, integrated/ sustainability reporting will be discussed that

includes comparison and contrast of sustainability reporting guidelines of Global Reporting

initiative and International Integrated Reporting framework of International Integrated

Reporting Council for the explanation of holistic view of the corporate social responsibility

and overall performance. In addition, rigour of conventional accounting, applicability of the

theory of the sustainability contents and integrated reports will be discussed. Moreover, index

will be prepared of the various components of the integrated reports of the South African

Company. Lastly, the comparison will be done on corporate social responsibility reporting,

and reporting of financial performance of Australian company with contents and index of the

South Australian, company integrated report (Cheng et al., 2014).

Part A

a)

Introduction

The aim of this assignment is to do the analysis on the different aspects of the

corporate external reporting practices. Therefore, for analysis, two companies will be taken

into consideration. First company will be STHN Cross Media and second company will be

Truworths International Limited. Southern Cross Media Group is known to be one of the

major media company of Australia (Southern Cross Austereo., 2019). Moreover, Truworths

is the retailer in clothing based in Cape Town, South Africa. This company is engaged in

selling cloths under various brands (Truworths, 2019). Hence, under this assignment,

discussion will be done on conceptual framework, which includes literature review of the

history and development of conceptual framework for the financial reporting, discussion on

Australian accounting profession’s concerns regarding the IASB/IFRS application. Moreover,

discussion will be on the review of the journal articles and application of the conceptual

framework by the company. Further, integrated/ sustainability reporting will be discussed that

includes comparison and contrast of sustainability reporting guidelines of Global Reporting

initiative and International Integrated Reporting framework of International Integrated

Reporting Council for the explanation of holistic view of the corporate social responsibility

and overall performance. In addition, rigour of conventional accounting, applicability of the

theory of the sustainability contents and integrated reports will be discussed. Moreover, index

will be prepared of the various components of the integrated reports of the South African

Company. Lastly, the comparison will be done on corporate social responsibility reporting,

and reporting of financial performance of Australian company with contents and index of the

South Australian, company integrated report (Cheng et al., 2014).

Part A

a)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING THEORY & CONTEMPORARY ISSUES

Literature Review

History and Development of Conceptual Framework for Financial Reporting

Around the world, USA has major influence on accounting standard. They follow

Financial Accounting Standard Board that includes various standards, which are disseminated

by committee of international accounting standard. However, rest of the world follows IASB.

Moreover, moving towards principles based accounting from the rules-based accounting, UK

has introduced conceptual framework. Since 1980s, conceptual framework statements are in

existence in Australia, UK and Canada (Henderson et al., 2015).

After the depression of 1929-1923, the Tentative Statement of the Accounting

Principles Underlying the Corporate Financial Statements influenced Patron and Littleton

monograph. It was the USA first institutional effort for developing the conceptual framework

of the business organizations. After the World War II, the need for the accounting standards

as well as globally accepted conceptual framework has increased. During the year 1973,

Wheat Committee recommendations has started the new era of the standards setting in USA

along with the formation of Financial Accounting Standards Board of the standard setting,

Financial Accounting Standards Advisory Council as well as Financial Accounting

Standards. Further, for addressing harmonization accounting standards need, International

Accounting Standards Committee was formed in the year 1973.During the year 1978 and

2000; 7 Statements of the Financial Accounting Concepts were published by FASB. This

serves as the conceptual framework of FASB. During the year 1989, single document of the

framework was published by the IASC. IASB and FASB has announced for their new joint

agenda in order to revisit both of the company’s conceptual frameworks. Moreover, in the

year 2010, the first stage of joint project of conceptual framework was published by the IASB

and FASB. This phase of conceptual framework dealt with the qualitative characteristic and

objectives of the financial reporting. Later, in the year 2013, IASB has published for the

Literature Review

History and Development of Conceptual Framework for Financial Reporting

Around the world, USA has major influence on accounting standard. They follow

Financial Accounting Standard Board that includes various standards, which are disseminated

by committee of international accounting standard. However, rest of the world follows IASB.

Moreover, moving towards principles based accounting from the rules-based accounting, UK

has introduced conceptual framework. Since 1980s, conceptual framework statements are in

existence in Australia, UK and Canada (Henderson et al., 2015).

After the depression of 1929-1923, the Tentative Statement of the Accounting

Principles Underlying the Corporate Financial Statements influenced Patron and Littleton

monograph. It was the USA first institutional effort for developing the conceptual framework

of the business organizations. After the World War II, the need for the accounting standards

as well as globally accepted conceptual framework has increased. During the year 1973,

Wheat Committee recommendations has started the new era of the standards setting in USA

along with the formation of Financial Accounting Standards Board of the standard setting,

Financial Accounting Standards Advisory Council as well as Financial Accounting

Standards. Further, for addressing harmonization accounting standards need, International

Accounting Standards Committee was formed in the year 1973.During the year 1978 and

2000; 7 Statements of the Financial Accounting Concepts were published by FASB. This

serves as the conceptual framework of FASB. During the year 1989, single document of the

framework was published by the IASC. IASB and FASB has announced for their new joint

agenda in order to revisit both of the company’s conceptual frameworks. Moreover, in the

year 2010, the first stage of joint project of conceptual framework was published by the IASB

and FASB. This phase of conceptual framework dealt with the qualitative characteristic and

objectives of the financial reporting. Later, in the year 2013, IASB has published for the

5ACCOUNTING THEORY & CONTEMPORARY ISSUES

discussion paper in order to request for the comments for releasing the exposure draft of

revised sections for the first quarter of the year 2015 (Tschopp & Huefner, 2015).

According to Dickson Adom, theoretical and conceptual framework guided the

research path and offered the foundation for the credibility establishment (THEORETICAL AND

CONCEPTUAL FRAMEWORK: MANDATORY INGREDIENTS OF A QUALITY RESEARCH, 2019).

According to Rosa Caiazza, conceptual framework works for the innovations for the

sustainability. It is because conceptual framework aims for providing the framework for the

classification of the transfer of the knowledge as well as their effects on the competitiveness

of firms (Innovation for sustainability, 2019).

b)

Application of Conceptual Framework for Financial Reporting

There is no guarantee of the high quality financial reporting solely by the

development of the accounting standards with strong theoretical bases. There are various

issues and concerns regarding the application of the conceptual framework for the financial

reporting. Following are the some of the Australian profession’s concerns and application

issues that arises while applying IFRS/IASB:

According to ACCA, the restructured conceptual framework of IASB has raised the

thorny issues. There are some proposals from the IASB, in order to update the

conceptual framework for financial reporting that has led to the detailed discussions

(ACCA Global, 2019).

According to KPMG Luxembourg, the financial statements information are not

enough, too much irrelevant, and not effectively communicated (Danilenko, 2018).

According to Leavitt Walmsley Associates, the purpose of framework document is for

setting out the concepts, which underlie the presentation and preparation of the

discussion paper in order to request for the comments for releasing the exposure draft of

revised sections for the first quarter of the year 2015 (Tschopp & Huefner, 2015).

According to Dickson Adom, theoretical and conceptual framework guided the

research path and offered the foundation for the credibility establishment (THEORETICAL AND

CONCEPTUAL FRAMEWORK: MANDATORY INGREDIENTS OF A QUALITY RESEARCH, 2019).

According to Rosa Caiazza, conceptual framework works for the innovations for the

sustainability. It is because conceptual framework aims for providing the framework for the

classification of the transfer of the knowledge as well as their effects on the competitiveness

of firms (Innovation for sustainability, 2019).

b)

Application of Conceptual Framework for Financial Reporting

There is no guarantee of the high quality financial reporting solely by the

development of the accounting standards with strong theoretical bases. There are various

issues and concerns regarding the application of the conceptual framework for the financial

reporting. Following are the some of the Australian profession’s concerns and application

issues that arises while applying IFRS/IASB:

According to ACCA, the restructured conceptual framework of IASB has raised the

thorny issues. There are some proposals from the IASB, in order to update the

conceptual framework for financial reporting that has led to the detailed discussions

(ACCA Global, 2019).

According to KPMG Luxembourg, the financial statements information are not

enough, too much irrelevant, and not effectively communicated (Danilenko, 2018).

According to Leavitt Walmsley Associates, the purpose of framework document is for

setting out the concepts, which underlie the presentation and preparation of the

6ACCOUNTING THEORY & CONTEMPORARY ISSUES

financial statements for the external users as described in the conceptual framework

for the financial reporting. Application of which enhances qualitative characteristics

(Collings & Profile, 2019).

c)

Academic Concerns about the Quality of Conceptual Framework for Financial

Reporting

According to Siriyama Herath, the determination of the quality of the financial

reporting depends upon the accounting reporting value. All across the world, there is the great

demand for providing the more clearer and full definitions of the quality of the financial

reporting. The high quality financial reporting helps in influencing the users for making the

investments decisions and enhancing the market efficiency. Moreover, providing the ideal

methods for the assessment of the financial reporting quality is another globalized demand.

The higher financial reporting quality the more beneficial will be for the investors and the

users of financial reports (Herath & Albarqi, 2017).

According to Ying Zhang, the current corporate governance that is conducted by the

IASB and FASB provides broader literature on the financialisation and neoliberalism.

Through the configuration of newly globalized conceptual framework, the architecture of

regulatory in accounting will work for sustaining finance centrality in the economy of GFC,

despite of the many deficiencies (Zhang & Andrew, 2014)

According to R Macve, the inherent limitations of the value and income measurement

is remain unrealistic for expecting official attempts to develop the conceptual frameworks for

the financial reporting in order to provide coherent basis for resolving accounting problems

(Macve, 2015).

d)

financial statements for the external users as described in the conceptual framework

for the financial reporting. Application of which enhances qualitative characteristics

(Collings & Profile, 2019).

c)

Academic Concerns about the Quality of Conceptual Framework for Financial

Reporting

According to Siriyama Herath, the determination of the quality of the financial

reporting depends upon the accounting reporting value. All across the world, there is the great

demand for providing the more clearer and full definitions of the quality of the financial

reporting. The high quality financial reporting helps in influencing the users for making the

investments decisions and enhancing the market efficiency. Moreover, providing the ideal

methods for the assessment of the financial reporting quality is another globalized demand.

The higher financial reporting quality the more beneficial will be for the investors and the

users of financial reports (Herath & Albarqi, 2017).

According to Ying Zhang, the current corporate governance that is conducted by the

IASB and FASB provides broader literature on the financialisation and neoliberalism.

Through the configuration of newly globalized conceptual framework, the architecture of

regulatory in accounting will work for sustaining finance centrality in the economy of GFC,

despite of the many deficiencies (Zhang & Andrew, 2014)

According to R Macve, the inherent limitations of the value and income measurement

is remain unrealistic for expecting official attempts to develop the conceptual frameworks for

the financial reporting in order to provide coherent basis for resolving accounting problems

(Macve, 2015).

d)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING THEORY & CONTEMPORARY ISSUES

Application of Conceptual Framework by the Company

STHN Cross Media has used the significant as well as other policies of accounting,

which summarizes the basis of measurement used and they are relevant for understanding the

financial statements, which is being provided through the financial statements notes. For all

the presented years, the policies have been applied consistently. The company has prepared

general purpose financial report according to the Corporation Act 2001 and Australian

Accounting Standards. The company operates for profit motive for the purpose of the

preparations of the financial statements. Apart from that, financial statements are prepared in

compliance with the Australian Accounting Standards that ensures that financial statements

as well as its notes are prepared and complied with the International Financial Reporting

Standards that is issued by International Accounting Standards Board

(Southerncrossaustereo.com.au, 2019).

i)

The financial statements that have been prepared are Statements of Comprehensive

Income, Statements of financial position, Statements of changes in equity and Statements of

cash flows. The company prepares these statements for presenting the financial performance

of the company at the particular time period. Southern Cross Media Limited has prepared

general purpose financial statements such as income statements, balance sheet, owners’

equity as well as cash flows statement. The company has aimed for providing relevant

information through these statements, which are useful for the stakeholders for taking

necessary decisions (Southerncrossaustereo.com.au, 2019).

ii)

Moreover, the preparation of the financial statements is done under historical cost

convention that is modified by revaluation of some of the financial assets as well as liabilities

Application of Conceptual Framework by the Company

STHN Cross Media has used the significant as well as other policies of accounting,

which summarizes the basis of measurement used and they are relevant for understanding the

financial statements, which is being provided through the financial statements notes. For all

the presented years, the policies have been applied consistently. The company has prepared

general purpose financial report according to the Corporation Act 2001 and Australian

Accounting Standards. The company operates for profit motive for the purpose of the

preparations of the financial statements. Apart from that, financial statements are prepared in

compliance with the Australian Accounting Standards that ensures that financial statements

as well as its notes are prepared and complied with the International Financial Reporting

Standards that is issued by International Accounting Standards Board

(Southerncrossaustereo.com.au, 2019).

i)

The financial statements that have been prepared are Statements of Comprehensive

Income, Statements of financial position, Statements of changes in equity and Statements of

cash flows. The company prepares these statements for presenting the financial performance

of the company at the particular time period. Southern Cross Media Limited has prepared

general purpose financial statements such as income statements, balance sheet, owners’

equity as well as cash flows statement. The company has aimed for providing relevant

information through these statements, which are useful for the stakeholders for taking

necessary decisions (Southerncrossaustereo.com.au, 2019).

ii)

Moreover, the preparation of the financial statements is done under historical cost

convention that is modified by revaluation of some of the financial assets as well as liabilities

8ACCOUNTING THEORY & CONTEMPORARY ISSUES

at the fair value and through the profit or losses. Further, as and when necessary, the

adjustments have been done to comparative figures for conforming to the changes in current

year. Southern Cross Media has opted for the historical cost accounting because it is

considered more comparable, reliable, verifiable as well as consistent.

iii)

The qualitative characteristic of the information that has been exhibit in the various

financial reports of the company is relevance. This qualitative characteristic of the

information exhibit in the financial reports of the company. Generally, relevance is associated

with the information that is useful, timely, going for making the difference and has the

predictive value (Southerncrossaustereo.com.au, 2019).

Part B

a)

Comparison between Sustainability Reporting Guidelines and International Integrated

Reporting Framework

Sustainability Reporting Guidelines

The guidelines of GRI are used by the reporting organizations for disclosing the most

critical impacts whether positive or negative on the environment, economy and the society. It

helps in generating the relevant, reliable as well as the standardized information for assessing

the risks and the opportunities as well as enabling more of the informed decision-making that

is within the business entity and among the stakeholders. G4 has been designed for applying

it universally to all the sectors, types and the organizations whether it is small or large all

across the world. The presentation of the guidelines is in two parts. First part is reporting

principles and standard disclosures, which contains the reporting principle, standardized

disclosures as well as criteria that are to be applied by the organizations for preparing their

at the fair value and through the profit or losses. Further, as and when necessary, the

adjustments have been done to comparative figures for conforming to the changes in current

year. Southern Cross Media has opted for the historical cost accounting because it is

considered more comparable, reliable, verifiable as well as consistent.

iii)

The qualitative characteristic of the information that has been exhibit in the various

financial reports of the company is relevance. This qualitative characteristic of the

information exhibit in the financial reports of the company. Generally, relevance is associated

with the information that is useful, timely, going for making the difference and has the

predictive value (Southerncrossaustereo.com.au, 2019).

Part B

a)

Comparison between Sustainability Reporting Guidelines and International Integrated

Reporting Framework

Sustainability Reporting Guidelines

The guidelines of GRI are used by the reporting organizations for disclosing the most

critical impacts whether positive or negative on the environment, economy and the society. It

helps in generating the relevant, reliable as well as the standardized information for assessing

the risks and the opportunities as well as enabling more of the informed decision-making that

is within the business entity and among the stakeholders. G4 has been designed for applying

it universally to all the sectors, types and the organizations whether it is small or large all

across the world. The presentation of the guidelines is in two parts. First part is reporting

principles and standard disclosures, which contains the reporting principle, standardized

disclosures as well as criteria that are to be applied by the organizations for preparing their

9ACCOUNTING THEORY & CONTEMPORARY ISSUES

sustainability report, which is according to the guidelines. The second part is implementation

manual that includes explanations of way of applying the reporting principles, way of

preparing the information to be disclosed as well as way for interpreting different concepts in

the given guidelines. Moreover, glossary, other sources references and general reporting

notes are included as well (Global Reporting Initiative, 2019).

International Integrated Reporting Framework

It is the process that is founded on the integrated thinking, which results in the

periodically issued integrated report by the company about the creation of the value over time

as well as is related to the communications regarding the various aspects of the value

creation. It is the concise communication that is about the governance, performance,

prospects and the strategy, which is in context of the external environment in order to lead for

creating value in short-term, medium-term and long-term.

In order to accelerate adoption of the integrated reporting, International Integrated

Reporting Framework is used. The framework has the purpose of establishing the content

element and guiding principles, which governs overall content of integrated report as well as

explaining the fundamental concepts that helps in underpinning them (Integrated Reporting,

2019).

Therefore, sustainability reporting is all about the communication of the approach of

the entity for the key environmental as well as social issues management. It is relating to the

one of the most important factor of the performance of the company, without the help of

which the integrated report will be complete.

b)

sustainability report, which is according to the guidelines. The second part is implementation

manual that includes explanations of way of applying the reporting principles, way of

preparing the information to be disclosed as well as way for interpreting different concepts in

the given guidelines. Moreover, glossary, other sources references and general reporting

notes are included as well (Global Reporting Initiative, 2019).

International Integrated Reporting Framework

It is the process that is founded on the integrated thinking, which results in the

periodically issued integrated report by the company about the creation of the value over time

as well as is related to the communications regarding the various aspects of the value

creation. It is the concise communication that is about the governance, performance,

prospects and the strategy, which is in context of the external environment in order to lead for

creating value in short-term, medium-term and long-term.

In order to accelerate adoption of the integrated reporting, International Integrated

Reporting Framework is used. The framework has the purpose of establishing the content

element and guiding principles, which governs overall content of integrated report as well as

explaining the fundamental concepts that helps in underpinning them (Integrated Reporting,

2019).

Therefore, sustainability reporting is all about the communication of the approach of

the entity for the key environmental as well as social issues management. It is relating to the

one of the most important factor of the performance of the company, without the help of

which the integrated report will be complete.

b)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ACCOUNTING THEORY & CONTEMPORARY ISSUES

Strengths and Weaknesses of Conventional Accounting

Conventional accounting is the system of the accounting that is used for providing the

information to the managers within the organization. The powerful tool that is used for the

business organization for reporting performance of profit to the investors and other

stakeholders. It is also known as historical accounting.

Strength of Conventional Accounting

It helps in maintaining the objectivity as well as reliability of the accounting

information. Manipulations of data cannot be done because the business transactions

are recorded on the objective basis.

The concept of conventional accounting is quite simple. The record of the transactions

is at the original amounts. Restatement of the financial statements does not have to be

done every year for reflecting the changes in the values.

It is used consistently over the time, which enhances inter and intra comparability of

the financial statements (Schaltegger & Burritt 2017)

Limitations of Conventional Accounting

Under this, price level changes are not taken into account. If the financial statements

are prepared by the system of conventional then it states only the historical facts. It

fails to give the correct and realistic picture of the state of the affairs for the concern.

Gain or losses on the account of the holding inventories might be mixes up with the

operating gains or losses. For determining the true operating performances, the

holding gains or the losses are segregated from the operating losses and gains.

Tax is generally levied on the money profit. In conventional accounting, the money

profit does not represent the real profit. Therefore, there is overstatement of the

Strengths and Weaknesses of Conventional Accounting

Conventional accounting is the system of the accounting that is used for providing the

information to the managers within the organization. The powerful tool that is used for the

business organization for reporting performance of profit to the investors and other

stakeholders. It is also known as historical accounting.

Strength of Conventional Accounting

It helps in maintaining the objectivity as well as reliability of the accounting

information. Manipulations of data cannot be done because the business transactions

are recorded on the objective basis.

The concept of conventional accounting is quite simple. The record of the transactions

is at the original amounts. Restatement of the financial statements does not have to be

done every year for reflecting the changes in the values.

It is used consistently over the time, which enhances inter and intra comparability of

the financial statements (Schaltegger & Burritt 2017)

Limitations of Conventional Accounting

Under this, price level changes are not taken into account. If the financial statements

are prepared by the system of conventional then it states only the historical facts. It

fails to give the correct and realistic picture of the state of the affairs for the concern.

Gain or losses on the account of the holding inventories might be mixes up with the

operating gains or losses. For determining the true operating performances, the

holding gains or the losses are segregated from the operating losses and gains.

Tax is generally levied on the money profit. In conventional accounting, the money

profit does not represent the real profit. Therefore, there is overstatement of the

11ACCOUNTING THEORY & CONTEMPORARY ISSUES

reported profits and the assets under this are understand in the conditions of

inflationary.

In the position statements, the fixed assets are shown at the cost of its acquisitions.

Moreover, the purchases of the assets at the different point of time are mixed up

together in additions to the existing assets.

The depreciation is charged on historical cost of assets. Depreciation charges of the

fixed charges are based on original purchases price. The assets replacement cost

exceeds far of the original cost (Kirkman, 2014)

Therefore, in order to promote the uses of the sustainability as well as contributing to the

sustainable global economy, conventional accounting plays the important role for the welfare

of the society as a whole. In addition, integrated reporting with the help of conventional

accounting enhances the decision-making powers of the investors and other stakeholders.

c)

Applicability of Theories of contents of Sustainability and Integrated Reports

According to Cory Searcy, the research has showed that report content are determined

by the conducting the internal evaluation, following standards and other methods. Around

five companies were found developing fully integrated reports and other fifteen was found

including some aspects of sustainability in the annual reports. However, for the development

of the sustainability reports, the key challenges was identified such as data collection,

timeliness, selecting content as well as striking the appropriate balance in the reporting.

Moreover, there is various potential future for the uses of sustainability reports such as

improvement for the ability of tracking performance of real-time (Searcy & Buslovich, 2013)

According to Ronel Rensburg, potential benefits of the integrated reporting are

measured by the effectiveness from the perspective of the stakeholders. It has been found in

reported profits and the assets under this are understand in the conditions of

inflationary.

In the position statements, the fixed assets are shown at the cost of its acquisitions.

Moreover, the purchases of the assets at the different point of time are mixed up

together in additions to the existing assets.

The depreciation is charged on historical cost of assets. Depreciation charges of the

fixed charges are based on original purchases price. The assets replacement cost

exceeds far of the original cost (Kirkman, 2014)

Therefore, in order to promote the uses of the sustainability as well as contributing to the

sustainable global economy, conventional accounting plays the important role for the welfare

of the society as a whole. In addition, integrated reporting with the help of conventional

accounting enhances the decision-making powers of the investors and other stakeholders.

c)

Applicability of Theories of contents of Sustainability and Integrated Reports

According to Cory Searcy, the research has showed that report content are determined

by the conducting the internal evaluation, following standards and other methods. Around

five companies were found developing fully integrated reports and other fifteen was found

including some aspects of sustainability in the annual reports. However, for the development

of the sustainability reports, the key challenges was identified such as data collection,

timeliness, selecting content as well as striking the appropriate balance in the reporting.

Moreover, there is various potential future for the uses of sustainability reports such as

improvement for the ability of tracking performance of real-time (Searcy & Buslovich, 2013)

According to Ronel Rensburg, potential benefits of the integrated reporting are

measured by the effectiveness from the perspective of the stakeholders. It has been found in

12ACCOUNTING THEORY & CONTEMPORARY ISSUES

the study that very few of the stakeholders use integrated reports as one of the main source of

the investment and financial investments. Further, the companies use still interim and annual

reports as the main source of financial information. However, there are various opportunities

for the integrated reporting in future (Rensburg & Botha, 2014).

d)

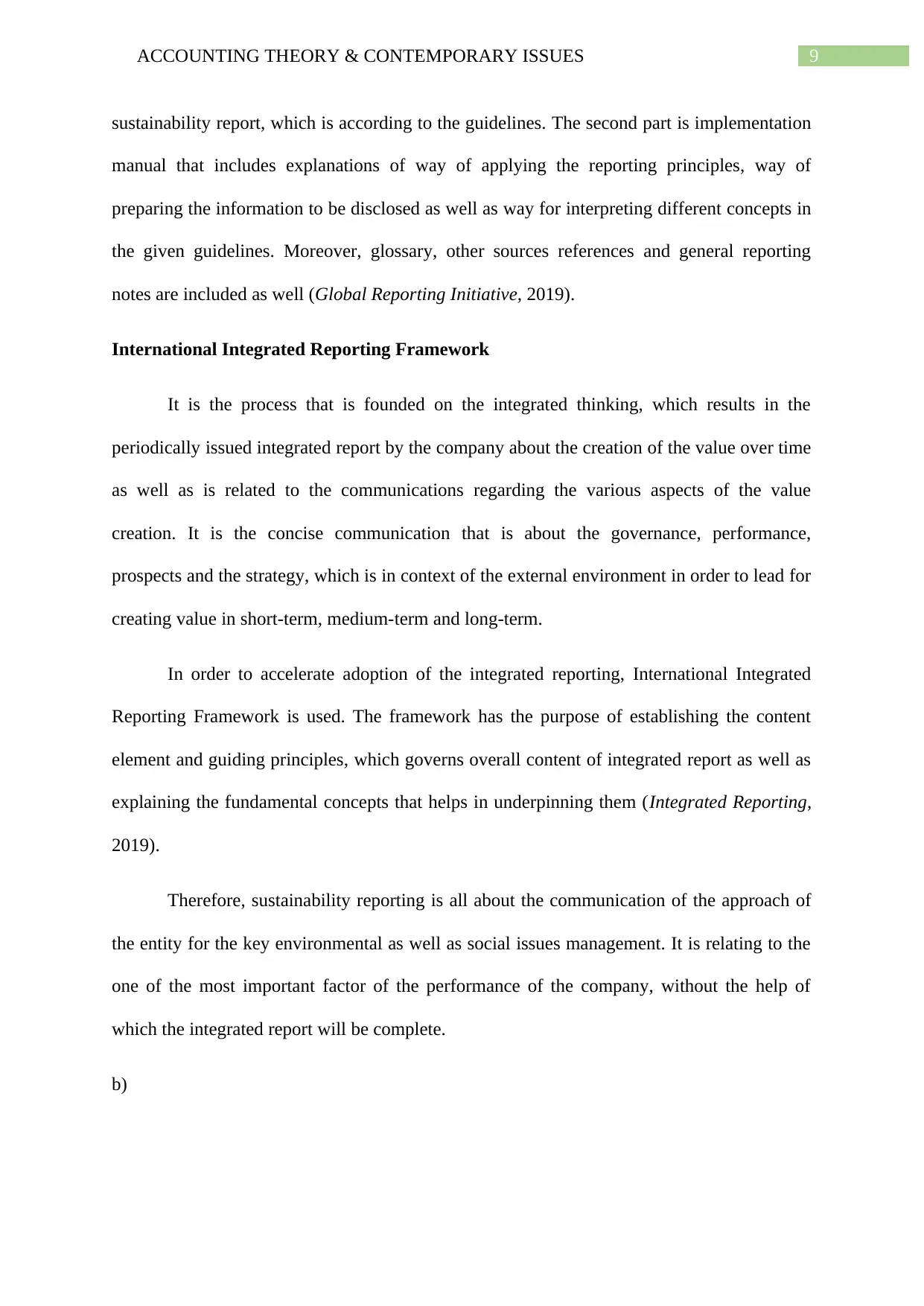

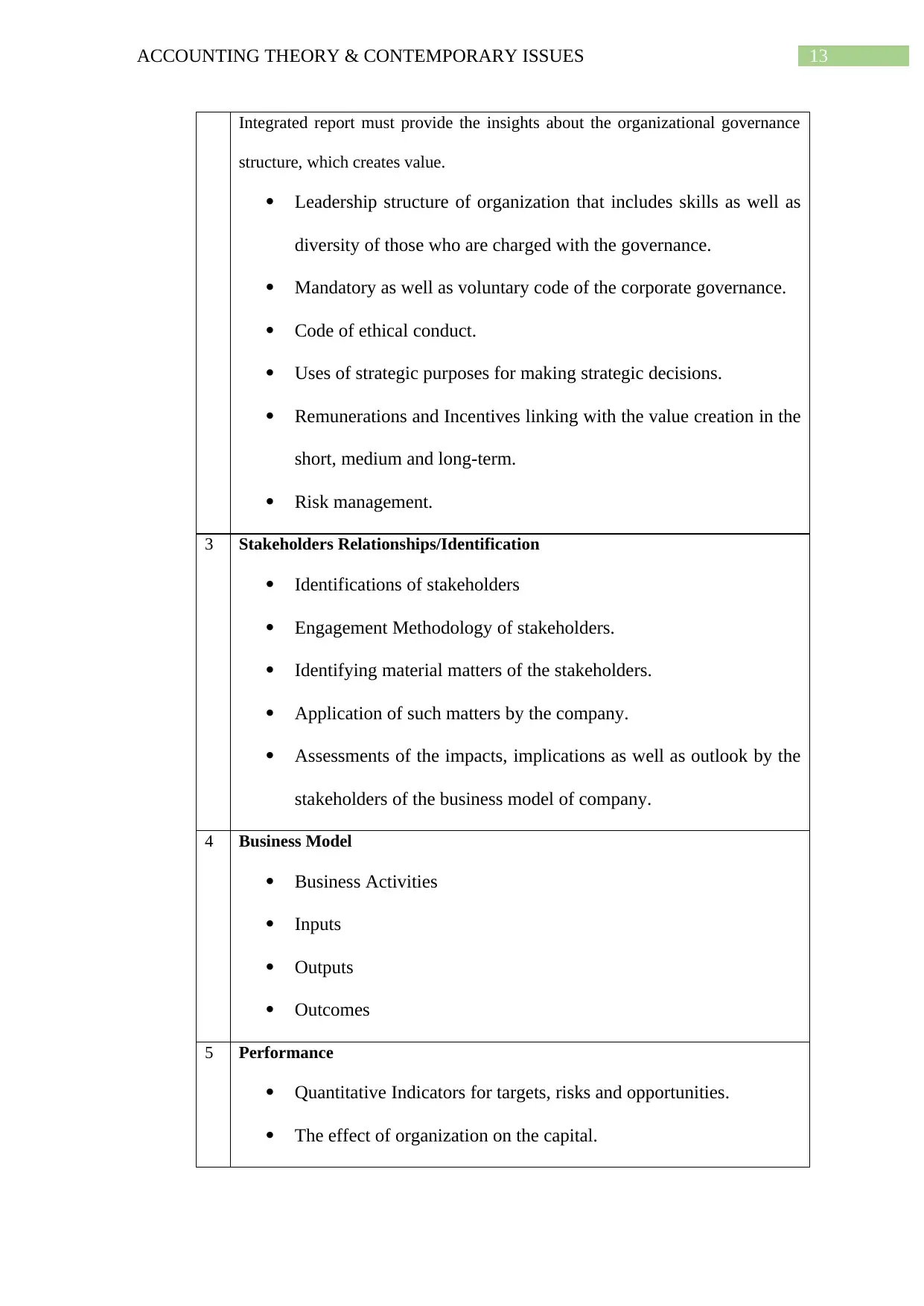

Index of Integrated Report Components

Preparation of Index of the various Components of Integrated Report

Components of Integrated Report

1 Organizational Overview and External Environment

The main activities of organization and environment in which it operates has to be

disclosed in the integrated reports.

Organization’s

o Principal activities as well as markets

o Ethics, culture and the values

o Position within value chain

o Operating and Ownership Structure

o Factors of market positioning and competitive landscape.

Key Qualitative Structure such as total number of employees,

revenues and total number of operating countries and so on.

Factors that affects organization’s response and external response,

which includes social, commercial, environmental, political and

legal context that affects the ability of the company for creating

value in short, medium and long-term.

2 Governance

the study that very few of the stakeholders use integrated reports as one of the main source of

the investment and financial investments. Further, the companies use still interim and annual

reports as the main source of financial information. However, there are various opportunities

for the integrated reporting in future (Rensburg & Botha, 2014).

d)

Index of Integrated Report Components

Preparation of Index of the various Components of Integrated Report

Components of Integrated Report

1 Organizational Overview and External Environment

The main activities of organization and environment in which it operates has to be

disclosed in the integrated reports.

Organization’s

o Principal activities as well as markets

o Ethics, culture and the values

o Position within value chain

o Operating and Ownership Structure

o Factors of market positioning and competitive landscape.

Key Qualitative Structure such as total number of employees,

revenues and total number of operating countries and so on.

Factors that affects organization’s response and external response,

which includes social, commercial, environmental, political and

legal context that affects the ability of the company for creating

value in short, medium and long-term.

2 Governance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ACCOUNTING THEORY & CONTEMPORARY ISSUES

Integrated report must provide the insights about the organizational governance

structure, which creates value.

Leadership structure of organization that includes skills as well as

diversity of those who are charged with the governance.

Mandatory as well as voluntary code of the corporate governance.

Code of ethical conduct.

Uses of strategic purposes for making strategic decisions.

Remunerations and Incentives linking with the value creation in the

short, medium and long-term.

Risk management.

3 Stakeholders Relationships/Identification

Identifications of stakeholders

Engagement Methodology of stakeholders.

Identifying material matters of the stakeholders.

Application of such matters by the company.

Assessments of the impacts, implications as well as outlook by the

stakeholders of the business model of company.

4 Business Model

Business Activities

Inputs

Outputs

Outcomes

5 Performance

Quantitative Indicators for targets, risks and opportunities.

The effect of organization on the capital.

Integrated report must provide the insights about the organizational governance

structure, which creates value.

Leadership structure of organization that includes skills as well as

diversity of those who are charged with the governance.

Mandatory as well as voluntary code of the corporate governance.

Code of ethical conduct.

Uses of strategic purposes for making strategic decisions.

Remunerations and Incentives linking with the value creation in the

short, medium and long-term.

Risk management.

3 Stakeholders Relationships/Identification

Identifications of stakeholders

Engagement Methodology of stakeholders.

Identifying material matters of the stakeholders.

Application of such matters by the company.

Assessments of the impacts, implications as well as outlook by the

stakeholders of the business model of company.

4 Business Model

Business Activities

Inputs

Outputs

Outcomes

5 Performance

Quantitative Indicators for targets, risks and opportunities.

The effect of organization on the capital.

14ACCOUNTING THEORY & CONTEMPORARY ISSUES

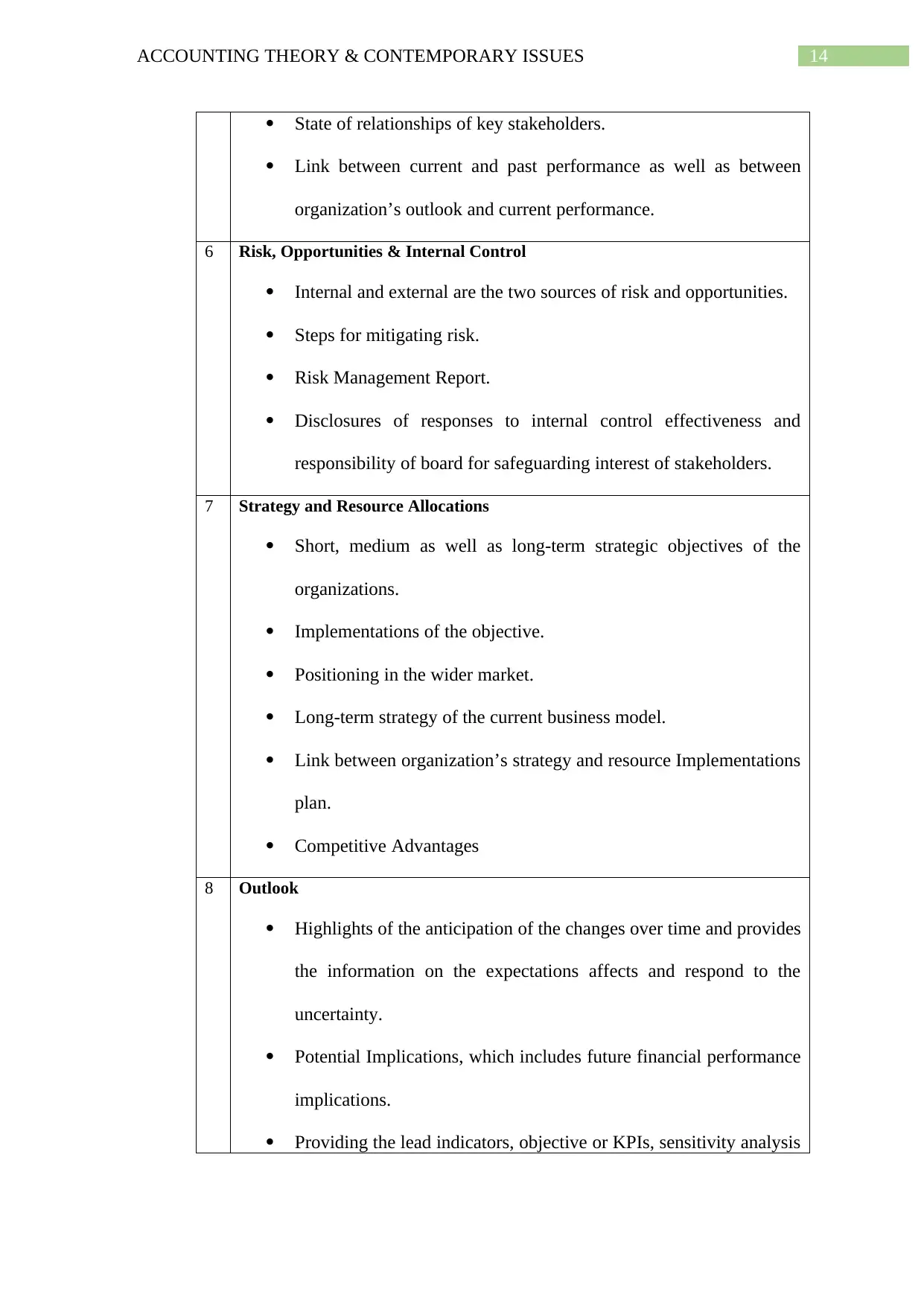

State of relationships of key stakeholders.

Link between current and past performance as well as between

organization’s outlook and current performance.

6 Risk, Opportunities & Internal Control

Internal and external are the two sources of risk and opportunities.

Steps for mitigating risk.

Risk Management Report.

Disclosures of responses to internal control effectiveness and

responsibility of board for safeguarding interest of stakeholders.

7 Strategy and Resource Allocations

Short, medium as well as long-term strategic objectives of the

organizations.

Implementations of the objective.

Positioning in the wider market.

Long-term strategy of the current business model.

Link between organization’s strategy and resource Implementations

plan.

Competitive Advantages

8 Outlook

Highlights of the anticipation of the changes over time and provides

the information on the expectations affects and respond to the

uncertainty.

Potential Implications, which includes future financial performance

implications.

Providing the lead indicators, objective or KPIs, sensitivity analysis

State of relationships of key stakeholders.

Link between current and past performance as well as between

organization’s outlook and current performance.

6 Risk, Opportunities & Internal Control

Internal and external are the two sources of risk and opportunities.

Steps for mitigating risk.

Risk Management Report.

Disclosures of responses to internal control effectiveness and

responsibility of board for safeguarding interest of stakeholders.

7 Strategy and Resource Allocations

Short, medium as well as long-term strategic objectives of the

organizations.

Implementations of the objective.

Positioning in the wider market.

Long-term strategy of the current business model.

Link between organization’s strategy and resource Implementations

plan.

Competitive Advantages

8 Outlook

Highlights of the anticipation of the changes over time and provides

the information on the expectations affects and respond to the

uncertainty.

Potential Implications, which includes future financial performance

implications.

Providing the lead indicators, objective or KPIs, sensitivity analysis

15ACCOUNTING THEORY & CONTEMPORARY ISSUES

and relevant information from the recognized external sources.

9 Basis of the Preparation and Presentation

Summary of the materiality determination process of organization.

Description and determination of reporting boundary.

Summary of methods and significant framework for the evaluation

of the material matters.

Table 1: Integrated Reporting Checklist (The IIRC | Integrated Reporting. 2019)

Truworths International Limited has disclosed the information on the following

components:

Overview: This Company provides the review of the year 2018 and outlook for the

year 2019, the reporting approach, profile of the company, investment case and retail

trading environment.

Creation of the Sustainable Value: It consists of disclosure by the company on

business philosophy, group strategy, material issues, risks and opportunities, business

model of value creation and building of the quality relationship with stakeholders.

Governance: The Company provides the report from the chairman, disclosures of

board of directors, group leadership, board and governance process and report of

remuneration committee.

Performance Review: The Company provides report of the CEO, CFO report, Five-

year review of the financial performance and summarized annual financial statements.

Operational Review: Company has disclosed the information that includes market-

leading brand portfolio, management of the fashion risk, and optimization of supply

chain efficiency, management of account risk, retail presence and human capital

report.

and relevant information from the recognized external sources.

9 Basis of the Preparation and Presentation

Summary of the materiality determination process of organization.

Description and determination of reporting boundary.

Summary of methods and significant framework for the evaluation

of the material matters.

Table 1: Integrated Reporting Checklist (The IIRC | Integrated Reporting. 2019)

Truworths International Limited has disclosed the information on the following

components:

Overview: This Company provides the review of the year 2018 and outlook for the

year 2019, the reporting approach, profile of the company, investment case and retail

trading environment.

Creation of the Sustainable Value: It consists of disclosure by the company on

business philosophy, group strategy, material issues, risks and opportunities, business

model of value creation and building of the quality relationship with stakeholders.

Governance: The Company provides the report from the chairman, disclosures of

board of directors, group leadership, board and governance process and report of

remuneration committee.

Performance Review: The Company provides report of the CEO, CFO report, Five-

year review of the financial performance and summarized annual financial statements.

Operational Review: Company has disclosed the information that includes market-

leading brand portfolio, management of the fashion risk, and optimization of supply

chain efficiency, management of account risk, retail presence and human capital

report.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16ACCOUNTING THEORY & CONTEMPORARY ISSUES

Shareholders Information: This Company provides the additional information that

is relevant to the shareholders as well as other stakeholders.

Financial Performance: The company’s gross profit margin is stable, operating

margin is down, cash from operations is high, net asset value per share is high, annual

dividend per share is down and comparable diluted headline earning per share is

down.

Outlook: For the year 2019, the company has primarily focused on the growing

business of the e-commerce, the trading environment will be continuing for negatively

impact by the political uncertainty that relates to Brexit negotiations outcomes and

stability of inflation, better growth of employment and expectation of positive wage

inflation for UK household disposable income (Truworths International, 2019).

Therefore, Truworths has disclosed the information against each of the components.

e)

Comparison of contents of Australian company’s corporate social responsibility

reporting with Integrated Report of South African Company.

Southern Cross Media Group does not prepare the integrated report, rather company

prepares the report on the corporate governance statement, which describes the way the

business is managed and it describes how the company is carrying out the business as per the

desires of the stakeholders that is conducted by concerned committees and board of directors.

In addition, the company prepares annual report, which is prepared for disclosing financial

performances of the company. The corporate social responsibility report of the company

consists of board of directors which includes their composition, skill, independence, role,

remuneration and so on, board committee, executive remuneration and performances, risk

management and integrity of the financial reporting, company policies and sustainability.

Shareholders Information: This Company provides the additional information that

is relevant to the shareholders as well as other stakeholders.

Financial Performance: The company’s gross profit margin is stable, operating

margin is down, cash from operations is high, net asset value per share is high, annual

dividend per share is down and comparable diluted headline earning per share is

down.

Outlook: For the year 2019, the company has primarily focused on the growing

business of the e-commerce, the trading environment will be continuing for negatively

impact by the political uncertainty that relates to Brexit negotiations outcomes and

stability of inflation, better growth of employment and expectation of positive wage

inflation for UK household disposable income (Truworths International, 2019).

Therefore, Truworths has disclosed the information against each of the components.

e)

Comparison of contents of Australian company’s corporate social responsibility

reporting with Integrated Report of South African Company.

Southern Cross Media Group does not prepare the integrated report, rather company

prepares the report on the corporate governance statement, which describes the way the

business is managed and it describes how the company is carrying out the business as per the

desires of the stakeholders that is conducted by concerned committees and board of directors.

In addition, the company prepares annual report, which is prepared for disclosing financial

performances of the company. The corporate social responsibility report of the company

consists of board of directors which includes their composition, skill, independence, role,

remuneration and so on, board committee, executive remuneration and performances, risk

management and integrity of the financial reporting, company policies and sustainability.

17ACCOUNTING THEORY & CONTEMPORARY ISSUES

Moreover, annual report of the company consists of the financial performance of company

that includes income statements and balance sheet as well as activities of the company

(Southerncrossaustereo.com.au. 2019).

Hence, the difference between the integrated report and corporate social responsibility

reporting and annual report is that integrated report summarizes all information of corporate

social responsibility and annual report in one report as compare to disclosing in two different

reports.

Conclusion

Therefore, it is concluded from the analysis that conceptual framework provides the

basis and sets the objectives for the general purpose financial reporting. However, there are

certain concerns of accounting professional and academic regarding the benefits as well as

limitations of the conceptual framework for the financial reporting. Moreover, Southern

Cross Media Group has prepared the financial statements according to the guidelines set by

the Australian accounting standards and Corporation Act 2001. Further, comparison has been

done on Sustainability reporting guidelines and International integrated reporting. In addition,

rigour of conventional accounting has been discussed. Moreover, theories have been

explained regarding contents of sustainability and integrated reports. Further, checklist of

integrated reporting has been prepared. Lastly, comparison has been done on integrated report

of South African company, corporate social responsibility report, and financial report of

Australian company.

Moreover, annual report of the company consists of the financial performance of company

that includes income statements and balance sheet as well as activities of the company

(Southerncrossaustereo.com.au. 2019).

Hence, the difference between the integrated report and corporate social responsibility

reporting and annual report is that integrated report summarizes all information of corporate

social responsibility and annual report in one report as compare to disclosing in two different

reports.

Conclusion

Therefore, it is concluded from the analysis that conceptual framework provides the

basis and sets the objectives for the general purpose financial reporting. However, there are

certain concerns of accounting professional and academic regarding the benefits as well as

limitations of the conceptual framework for the financial reporting. Moreover, Southern

Cross Media Group has prepared the financial statements according to the guidelines set by

the Australian accounting standards and Corporation Act 2001. Further, comparison has been

done on Sustainability reporting guidelines and International integrated reporting. In addition,

rigour of conventional accounting has been discussed. Moreover, theories have been

explained regarding contents of sustainability and integrated reports. Further, checklist of

integrated reporting has been prepared. Lastly, comparison has been done on integrated report

of South African company, corporate social responsibility report, and financial report of

Australian company.

18ACCOUNTING THEORY & CONTEMPORARY ISSUES

Reference

(2019). Southerncrossaustereo.com.au. Retrieved 27 May 2019, from

https://www.southerncrossaustereo.com.au/media/1303/scx0005_sca_annual-report-

2018_200dpi_high.pdf

ACCA Global. (2019) www.accaglobal.com, A. Conceptual frameworks | F7 Financial

Reporting | ACCA Qualification | Students. Accaglobal.com. Retrieved 27 May 2019,

from

https://www.accaglobal.com/in/en/student/exam-support-resources/fundamentals-

exams-study-resources/f7/technical-articles/conceptual-framework-need.html

Cheng, M., Green, W., Conradie, P., Konishi, N., & Romi, A. (2014). The international

integrated reporting framework: key issues and future research opportunities. Journal

of International Financial Management & Accounting, 25(1), 90-119.

Collings, S., & Profile, A. (2019).Conceptual Framework for Financial Reporting: an

overview : Steve Collings. Stevecollings.co.uk. Retrieved 27 May 2019, from

http://stevecollings.co.uk/conceptual-framework-for-financial-reporting-an-overview/

Danilenko, O. (2018). The revised Conceptual Framework: new ground rules - KPMG

Luxembourg. KPMG Luxembourg. Retrieved 27 May 2019, from

https://blog.kpmg.lu/the-revised-conceptual-framework-new-ground-rules/

Global Reporting Initiative . (2019). Globalreporting.org. Retrieved 27 May 2019, from

https://www.globalreporting.org/Pages/default.aspx

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial

accounting. Pearson Higher Education AU.

Reference

(2019). Southerncrossaustereo.com.au. Retrieved 27 May 2019, from

https://www.southerncrossaustereo.com.au/media/1303/scx0005_sca_annual-report-

2018_200dpi_high.pdf

ACCA Global. (2019) www.accaglobal.com, A. Conceptual frameworks | F7 Financial

Reporting | ACCA Qualification | Students. Accaglobal.com. Retrieved 27 May 2019,

from

https://www.accaglobal.com/in/en/student/exam-support-resources/fundamentals-

exams-study-resources/f7/technical-articles/conceptual-framework-need.html

Cheng, M., Green, W., Conradie, P., Konishi, N., & Romi, A. (2014). The international

integrated reporting framework: key issues and future research opportunities. Journal

of International Financial Management & Accounting, 25(1), 90-119.

Collings, S., & Profile, A. (2019).Conceptual Framework for Financial Reporting: an

overview : Steve Collings. Stevecollings.co.uk. Retrieved 27 May 2019, from

http://stevecollings.co.uk/conceptual-framework-for-financial-reporting-an-overview/

Danilenko, O. (2018). The revised Conceptual Framework: new ground rules - KPMG

Luxembourg. KPMG Luxembourg. Retrieved 27 May 2019, from

https://blog.kpmg.lu/the-revised-conceptual-framework-new-ground-rules/

Global Reporting Initiative . (2019). Globalreporting.org. Retrieved 27 May 2019, from

https://www.globalreporting.org/Pages/default.aspx

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial

accounting. Pearson Higher Education AU.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19ACCOUNTING THEORY & CONTEMPORARY ISSUES

Herath, S.K. & Albarqi, N. (2017). Financial reporting quality: A literature

review. International Business Management and Commerce, 2(2).

Innovation for sustainability (2019) Innovation for sustainability: a conceptual framework |

Journal of Management Development | Vol 36, No 1.. Journal Of Management

Development. Retrieved from https://www.emeraldinsight.com/doi/full/10.1108/JMD-

09-2014-0099

Integrated Reporting. (2019) International <IR> Framework . Integratedreporting.org.

Retrieved 27 May 2019, from http://integratedreporting.org/resource/international-ir-

framework/

Kirkman, P. (2014). Accounting Under Inflationary Conditions (RLE Accounting).

Routledge.

Macve, R. (2015). A Conceptual Framework for Financial Accounting and Reporting:

Vision, Tool, Or Threat?. Routledge.

Rensburg, R., & Botha, E. (2014). Is Integrated Reporting the silver bullet of financial

communication? A stakeholder perspective from South Africa. Public Relations

Review, 40(2), 144-152. doi:10.1016/j.pubrev.2013.11.016

SCA Corporate Website | Southern Cross Austereo. (2019). Southerncrossaustereo.com.au.

Retrieved 27 May 2019, from https://www.southerncrossaustereo.com.au/

Schaltegger, S., & Burritt, R. (2017). Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Searcy, C., & Buslovich, R. (2013). Corporate Perspectives on the Development and Use of

Sustainability Reports. Journal Of Business Ethics, 121(2), 149-169.

doi:10.1007/s10551-013-1701-7

Herath, S.K. & Albarqi, N. (2017). Financial reporting quality: A literature

review. International Business Management and Commerce, 2(2).

Innovation for sustainability (2019) Innovation for sustainability: a conceptual framework |

Journal of Management Development | Vol 36, No 1.. Journal Of Management

Development. Retrieved from https://www.emeraldinsight.com/doi/full/10.1108/JMD-

09-2014-0099

Integrated Reporting. (2019) International <IR> Framework . Integratedreporting.org.

Retrieved 27 May 2019, from http://integratedreporting.org/resource/international-ir-

framework/

Kirkman, P. (2014). Accounting Under Inflationary Conditions (RLE Accounting).

Routledge.

Macve, R. (2015). A Conceptual Framework for Financial Accounting and Reporting:

Vision, Tool, Or Threat?. Routledge.

Rensburg, R., & Botha, E. (2014). Is Integrated Reporting the silver bullet of financial

communication? A stakeholder perspective from South Africa. Public Relations

Review, 40(2), 144-152. doi:10.1016/j.pubrev.2013.11.016

SCA Corporate Website | Southern Cross Austereo. (2019). Southerncrossaustereo.com.au.

Retrieved 27 May 2019, from https://www.southerncrossaustereo.com.au/

Schaltegger, S., & Burritt, R. (2017). Contemporary environmental accounting: issues,

concepts and practice. Routledge.

Searcy, C., & Buslovich, R. (2013). Corporate Perspectives on the Development and Use of

Sustainability Reports. Journal Of Business Ethics, 121(2), 149-169.

doi:10.1007/s10551-013-1701-7

20ACCOUNTING THEORY & CONTEMPORARY ISSUES

Southerncrossaustereo.com.au. (2019) Retrieved 27 May 2019, from

https://www.southerncrossaustereo.com.au/media/1303/scx0005_sca_annual-report-

2018_200dpi_high.pdf

Southerncrossaustereo.com.au. (2019). Retrieved 27 May 2019, from

https://www.southerncrossaustereo.com.au/media/1080/corporate-governance-

statement-2017.pdf

The IIRC | Integrated Reporting. (2019). Integratedreporting.org. Retrieved 27 May 2019,

from https://integratedreporting.org/the-iirc-2/

THEORETICAL AND CONCEPTUAL FRAMEWORK: MANDATORY INGREDIENTS

OF A QUALITY RESEARCH. (2019). Retrieved from

https://www.researchgate.net/publication/322204158_THEORETICAL_AND_CONC

EPTUAL_FRAMEWORK_MANDATORY_INGREDIENTS_OF_A_QUALITY_R

ESEARCH

Truworths | Online Fashion & Trends. (2019). Truworths. Retrieved 27 May 2019, from

https://www.truworths.co.za/

Truworths International. (2019). Retrieved from

https://www.truworthsinternational.com/annualreport2018/

Tschopp, D., & Huefner, R. J. (2015). Comparing the evolution of CSR reporting to that of

financial reporting. Journal of Business Ethics, 127(3), 565-577.

Zhang, Y., & Andrew, J. (2014). Financialisation and the conceptual framework. Critical

perspectives on accounting, 25(1), 17-26.

Southerncrossaustereo.com.au. (2019) Retrieved 27 May 2019, from

https://www.southerncrossaustereo.com.au/media/1303/scx0005_sca_annual-report-

2018_200dpi_high.pdf

Southerncrossaustereo.com.au. (2019). Retrieved 27 May 2019, from

https://www.southerncrossaustereo.com.au/media/1080/corporate-governance-

statement-2017.pdf

The IIRC | Integrated Reporting. (2019). Integratedreporting.org. Retrieved 27 May 2019,

from https://integratedreporting.org/the-iirc-2/

THEORETICAL AND CONCEPTUAL FRAMEWORK: MANDATORY INGREDIENTS

OF A QUALITY RESEARCH. (2019). Retrieved from

https://www.researchgate.net/publication/322204158_THEORETICAL_AND_CONC

EPTUAL_FRAMEWORK_MANDATORY_INGREDIENTS_OF_A_QUALITY_R

ESEARCH

Truworths | Online Fashion & Trends. (2019). Truworths. Retrieved 27 May 2019, from

https://www.truworths.co.za/

Truworths International. (2019). Retrieved from

https://www.truworthsinternational.com/annualreport2018/

Tschopp, D., & Huefner, R. J. (2015). Comparing the evolution of CSR reporting to that of

financial reporting. Journal of Business Ethics, 127(3), 565-577.

Zhang, Y., & Andrew, J. (2014). Financialisation and the conceptual framework. Critical

perspectives on accounting, 25(1), 17-26.

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.