Accounting Theory Solved Assignment

VerifiedAdded on 2021/02/20

|11

|3118

|79

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACCOUNTING THEORY

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

BACKGROUND OF THE ORGANISATION ..............................................................................1

SCOPE ............................................................................................................................................2

PRELIMINARY ANALYSIS FINDINGS......................................................................................3

How information disclosed in the financial statements of financial position are employed.......3

Comparison between fixed and flexible format statements of financial position and

classification of assets and liabilities...........................................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

BACKGROUND OF THE ORGANISATION ..............................................................................1

SCOPE ............................................................................................................................................2

PRELIMINARY ANALYSIS FINDINGS......................................................................................3

How information disclosed in the financial statements of financial position are employed.......3

Comparison between fixed and flexible format statements of financial position and

classification of assets and liabilities...........................................................................................6

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................9

INTRODUCTION

Accounting theory is a framework or methodologies used to study the principles of

financial reporting (Schroeder and et.al., 2019). Accounting theory involves both historic

accounting practices and the way changes are made in the regulatory framework that regulate

financial reporting and statements. The objectives of accounting theory is maintain cash accounts

through cash books and find out cash balance for a specific day, to maintain ledger and journals

for the day. It helps in detecting errors and in rectifying them. It helps in finding out the total

capital on a particular day. It deals in explaining the existing practices to gain a better

understanding. It is a part of accounting which consists of procedures and statement of

principles. The information present in the financial statements of the company helps

management of company in taking better decisions and predict the uncertainty or expenses and

income. Financial statements of a company are very beneficial for stakeholders as it depicts the

financial position of a company. Present report includes different accounting theories used by

Rio Tinto which operates in mining industry. Report will highlight the sustainability of

accounting in context to mining company Rio Tinto. Further report will also include how

information disclosed in the financial statement is used and comparison between fixed format

and flexible format statement of financial position.

BACKGROUND OF THE ORGANISATION

Mining industry of Australia is a big contributor of income in the economy. It is a big

source of income for the Australian economy in exporting. Royalty, employment and payments.

Mining industry overall contribution in the economy was $250 billion in exports. It is one of the

most leading industry providing employment to the people build strong economy by its

contribution (Vollmer, 2019).

Rio Tinto is one of the largest mining company in the mining industry. It is an Anglo-

Australian company established in 1873. Company is developed and grown through a series of

mergers and acquisitions and now it is a leading producer of many commodities which include

ore, aluminium, diamonds, uranium, copper, iron, gold as well as coal, titanium and many more

commodities. Rio Tinto is operating in 6 continents but mainly focusing on Australia and

Canada. The main business of Rio Tinto is to produce raw materials and processing of these

minerals with the help of plants devoted to processing of bauxite into aluminium and smelting of

iron ore into iron (Otley, 2016). Company also produce various by-products from the processing

1

Accounting theory is a framework or methodologies used to study the principles of

financial reporting (Schroeder and et.al., 2019). Accounting theory involves both historic

accounting practices and the way changes are made in the regulatory framework that regulate

financial reporting and statements. The objectives of accounting theory is maintain cash accounts

through cash books and find out cash balance for a specific day, to maintain ledger and journals

for the day. It helps in detecting errors and in rectifying them. It helps in finding out the total

capital on a particular day. It deals in explaining the existing practices to gain a better

understanding. It is a part of accounting which consists of procedures and statement of

principles. The information present in the financial statements of the company helps

management of company in taking better decisions and predict the uncertainty or expenses and

income. Financial statements of a company are very beneficial for stakeholders as it depicts the

financial position of a company. Present report includes different accounting theories used by

Rio Tinto which operates in mining industry. Report will highlight the sustainability of

accounting in context to mining company Rio Tinto. Further report will also include how

information disclosed in the financial statement is used and comparison between fixed format

and flexible format statement of financial position.

BACKGROUND OF THE ORGANISATION

Mining industry of Australia is a big contributor of income in the economy. It is a big

source of income for the Australian economy in exporting. Royalty, employment and payments.

Mining industry overall contribution in the economy was $250 billion in exports. It is one of the

most leading industry providing employment to the people build strong economy by its

contribution (Vollmer, 2019).

Rio Tinto is one of the largest mining company in the mining industry. It is an Anglo-

Australian company established in 1873. Company is developed and grown through a series of

mergers and acquisitions and now it is a leading producer of many commodities which include

ore, aluminium, diamonds, uranium, copper, iron, gold as well as coal, titanium and many more

commodities. Rio Tinto is operating in 6 continents but mainly focusing on Australia and

Canada. The main business of Rio Tinto is to produce raw materials and processing of these

minerals with the help of plants devoted to processing of bauxite into aluminium and smelting of

iron ore into iron (Otley, 2016). Company also produce various by-products from the processing

1

of its minerals and resources. The management of the firm mainly concentrates on identifying,

managing extracting and mining the minerals and resources.

As company is a leader in mining industry, it makes a huge investments in the adoption

of technologies to reduce the cost of production. Company was criticised for the environmental

damage but afterwards company has maintain excellent record in protecting environment.

Company is performing a clear and effective strategy which helps Rio Tinto in achieving high

value in the market (Rutherford, 2016). The objective of the company is to to provide value to its

stakeholders by leveraging group scale. Organisation will also collaborate or merge with other

business units in order to gain a competitive advantage and reduce total cost of goods and

services. This business corporation use different strategies to evaluate its assets and determine

new better opportunities which will be beneficial for company to sustain in the market. Company

also practice corporate governance and disclose its financial statements to determine the

performance and financial stability of the business in front of stakeholders (Zeff, 2018).

Financial information is beneficial for stakeholders in decision making as they are able to decide

whether to invest in the company or not. Company follow all the accounting standards and

disclose correct information, it help company in maintaining sustainability of accounting. Rio

Tinto engage in adopting new technologies and innovating its products and services to increase

productivity (Engel, 2019).

SCOPE

The Scope of sustainability accounting in Rio Tinto as it help in ensuring operational

activity of business effective for the purpose of increasing productivity for the future. It help in

improving reputation and brand loyalty of the company that improves performance as well as

gaining larger share in the market. As Rio Tinto is dealing in metals and mining operation that

require more sustainability in business for increasing production of business (Nitzl, 2016). It help

in maintaining transparency in business so this topic is chosen for doing further study. Through

this process and system will improved for extracting metals from mines. It acts as introducing

innovative ideas that lead to further improvement in business operations in Rio Tinto.

It provide Competitive advantage in the market as providing best quality metals to its

consumers that help in building trust and brand loyalty towards company (MacGillivray, 2017).

Different strategies will be made for improving sustainability and help in evaluating strength and

weakness that provide growth in future perspective. Sustainability accounting reduces

2

managing extracting and mining the minerals and resources.

As company is a leader in mining industry, it makes a huge investments in the adoption

of technologies to reduce the cost of production. Company was criticised for the environmental

damage but afterwards company has maintain excellent record in protecting environment.

Company is performing a clear and effective strategy which helps Rio Tinto in achieving high

value in the market (Rutherford, 2016). The objective of the company is to to provide value to its

stakeholders by leveraging group scale. Organisation will also collaborate or merge with other

business units in order to gain a competitive advantage and reduce total cost of goods and

services. This business corporation use different strategies to evaluate its assets and determine

new better opportunities which will be beneficial for company to sustain in the market. Company

also practice corporate governance and disclose its financial statements to determine the

performance and financial stability of the business in front of stakeholders (Zeff, 2018).

Financial information is beneficial for stakeholders in decision making as they are able to decide

whether to invest in the company or not. Company follow all the accounting standards and

disclose correct information, it help company in maintaining sustainability of accounting. Rio

Tinto engage in adopting new technologies and innovating its products and services to increase

productivity (Engel, 2019).

SCOPE

The Scope of sustainability accounting in Rio Tinto as it help in ensuring operational

activity of business effective for the purpose of increasing productivity for the future. It help in

improving reputation and brand loyalty of the company that improves performance as well as

gaining larger share in the market. As Rio Tinto is dealing in metals and mining operation that

require more sustainability in business for increasing production of business (Nitzl, 2016). It help

in maintaining transparency in business so this topic is chosen for doing further study. Through

this process and system will improved for extracting metals from mines. It acts as introducing

innovative ideas that lead to further improvement in business operations in Rio Tinto.

It provide Competitive advantage in the market as providing best quality metals to its

consumers that help in building trust and brand loyalty towards company (MacGillivray, 2017).

Different strategies will be made for improving sustainability and help in evaluating strength and

weakness that provide growth in future perspective. Sustainability accounting reduces

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

compliance cost and help in regulating requirements of customers. Through this cost

performance of business can be measured and enhance effective of resources so that may not

create problem in future to Rio Tinto. This help in maintaining sustainability and achieving

objective of the company effectively and efficiently. For using this concept into Rio Tinto

company do not require procedures that will be followed into company for enhancing business

operations. On the other, it also has certain limitations that affect measurement of sustainability

in business that is the biggest challenge for it. Implementing this method in accounting theory

help in developing consistency in working process and streamlining different methods that will

be used by Rio Tinto. Therefore, different strategies is being implemented for extracting metal

from mines by using sustainability accounting method into business.

PRELIMINARY ANALYSIS FINDINGS

How information disclosed in the financial statements of financial position are employed

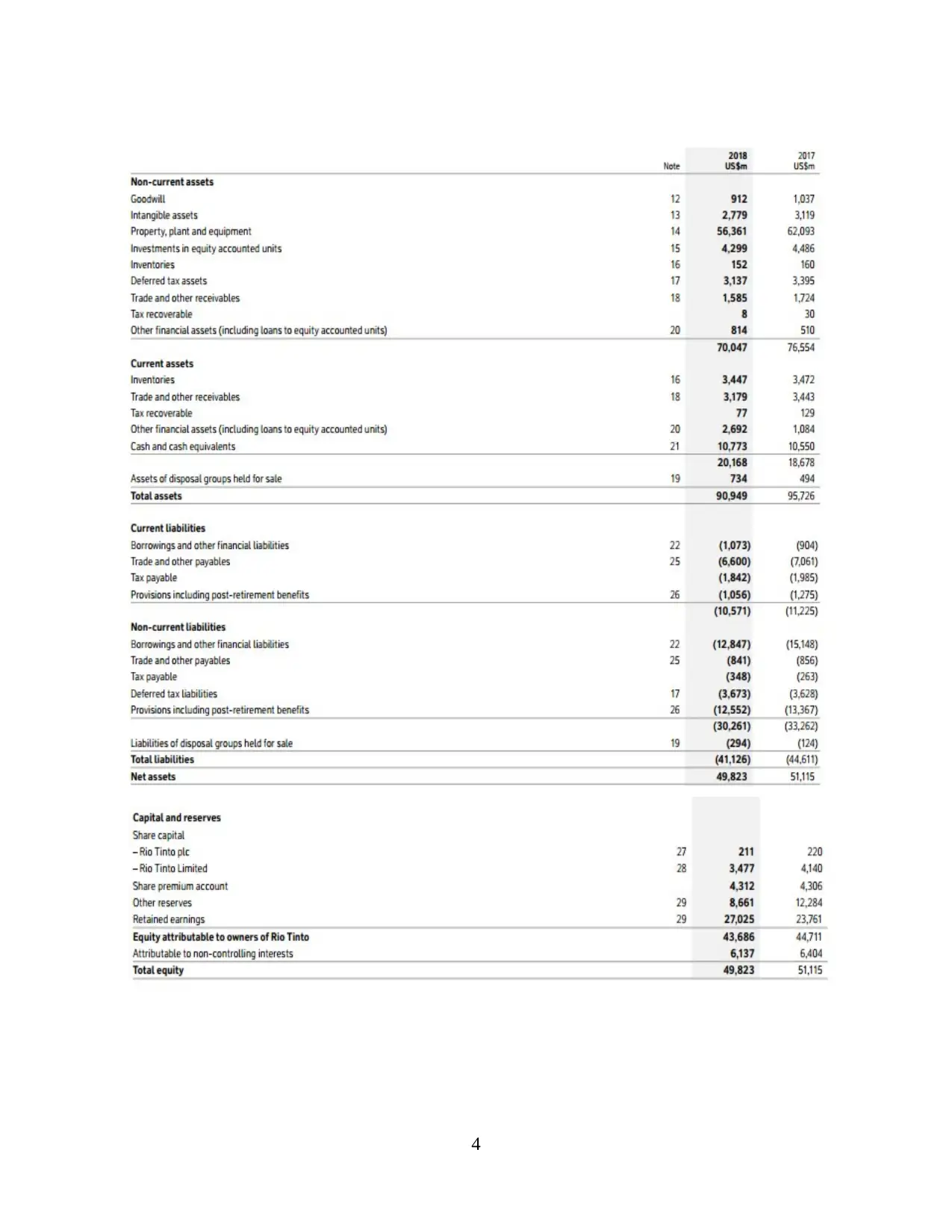

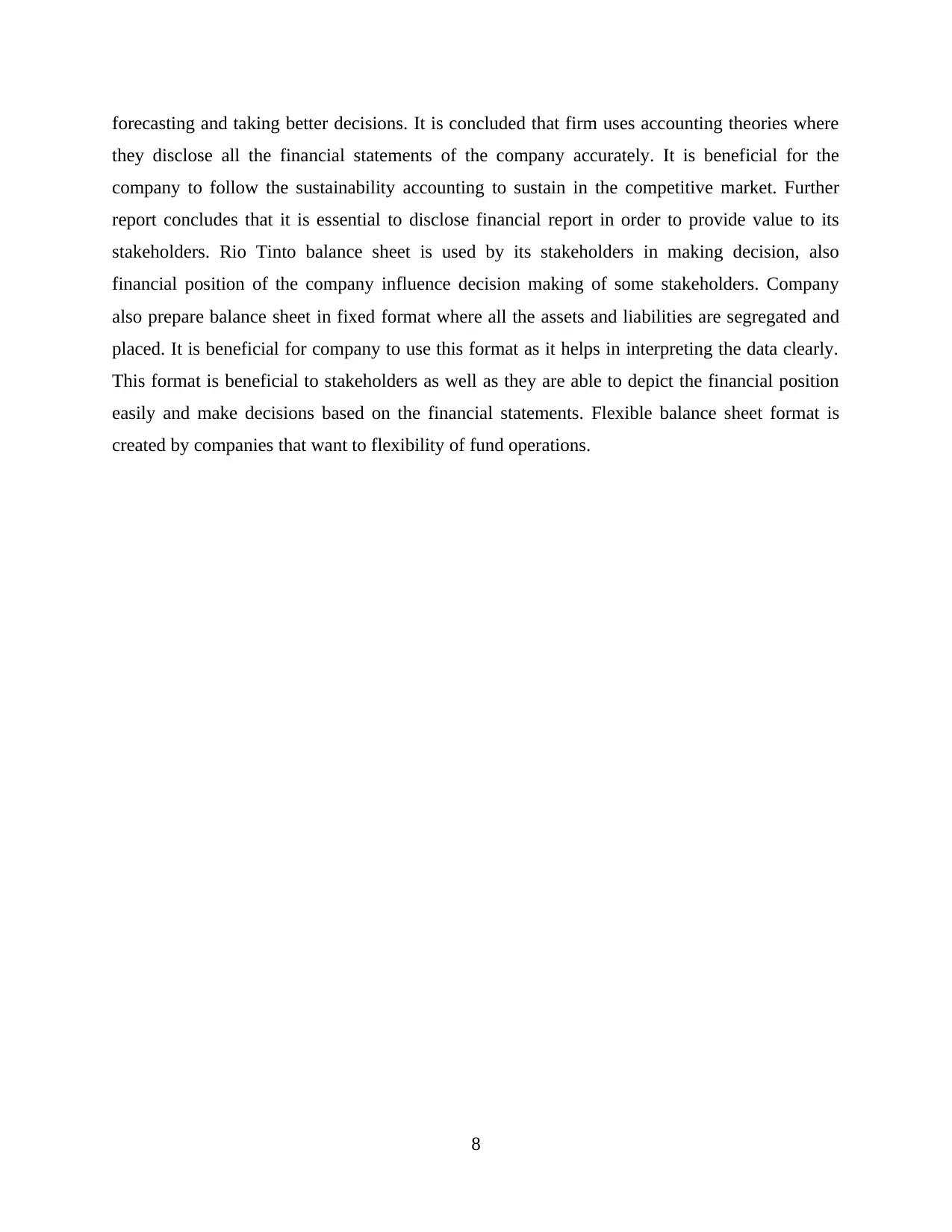

Financial statements are report maintain by company annually which includes all the

transaction done in a years in order to determine the financial position of the company. With the

help of financial statements management of Rio Tinto forecast the expenses, profitability of

future time (Koszegi and Matejka, 2018). Financial statements includes income statements, cash

flow statements and balance sheet. To find out the financial performance and position of a

company balance sheet is analysed and interpreted. Company need to ensure that financial

statements disclosed by them are correct, accurate and there is no manipulation is made.

Financial statements are used by different stakeholders to decide whether investment need to be

made or not. Rio Tinto stakeholders use this statements in order to find the stability of the

company and whether company is paying tax on regular basis or not.

Rio Tinto disclose its balance sheet in the following manner:

3

performance of business can be measured and enhance effective of resources so that may not

create problem in future to Rio Tinto. This help in maintaining sustainability and achieving

objective of the company effectively and efficiently. For using this concept into Rio Tinto

company do not require procedures that will be followed into company for enhancing business

operations. On the other, it also has certain limitations that affect measurement of sustainability

in business that is the biggest challenge for it. Implementing this method in accounting theory

help in developing consistency in working process and streamlining different methods that will

be used by Rio Tinto. Therefore, different strategies is being implemented for extracting metal

from mines by using sustainability accounting method into business.

PRELIMINARY ANALYSIS FINDINGS

How information disclosed in the financial statements of financial position are employed

Financial statements are report maintain by company annually which includes all the

transaction done in a years in order to determine the financial position of the company. With the

help of financial statements management of Rio Tinto forecast the expenses, profitability of

future time (Koszegi and Matejka, 2018). Financial statements includes income statements, cash

flow statements and balance sheet. To find out the financial performance and position of a

company balance sheet is analysed and interpreted. Company need to ensure that financial

statements disclosed by them are correct, accurate and there is no manipulation is made.

Financial statements are used by different stakeholders to decide whether investment need to be

made or not. Rio Tinto stakeholders use this statements in order to find the stability of the

company and whether company is paying tax on regular basis or not.

Rio Tinto disclose its balance sheet in the following manner:

3

4

Information disclosed in the financial statements are used by various stakeholders of the

company. Stakeholders are those individual who have interest in the company and want to invest

in the company (Coad, Jack, L. and Kholeif, 2016). By investing they are entitled with some part

of ownership thus, they have right to see the financial position of the company. If a company is

in profit than stakeholders will invest more money whereas if company face loss then they take

their money off from the company. It is necessary to maintain relation with both internal and

external stakeholders. Stakeholders of Rio Tinto are as follows:

Board of directors: Management of the company need to know the financial

performance of the company as they formulate policies and strategies to compete in the

market. It is essential for them to know each and every detail of financials so that it is

easy for them in forecasting the future expense and frame policies against its competitors

and sustain in the market (Goddard and et.al., 2016). Management gain insights from the

financial statement which help them in monitoring and controlling business performance.

Investors: As investors have stake in the company they need to know the financial

position of the company in determining whether company has invested their money

appropriately. Investors are interest in the financial statement of the organisation in order

to earn high return on investment. It is essential for company to disclose accurate

information and maintain interest of stakeholders in the company (Schroeder and et.al.,

2019). Decisions of the stakeholders are influenced by the disclosure of financial

statements such as what amount to invest, whether to invest for long term or short term.

Customers: Customers are one of the most important stakeholders of the company as

business exist to satisfy customers. Customers are affected by the quality of work and

products provided to them. Customers also want to know the financial information of

company as their decisions are influenced by it. Rio Tinto make sure that their customers

are satisfied and do not switch to their competitors. Customers also need to know the

stability of firm financially and decide whether company is able to provide quality

products or not (Rutherford, 2016).

Governments: One of the main stakeholders using the financial statements of the firm

are government. They are considered as the major stakeholders as they collect tax from

the company. Through financial statements they are able to identify whether Rio Tinto is

paying tax regularly or not. Government make sure that whether company is collecting

5

company. Stakeholders are those individual who have interest in the company and want to invest

in the company (Coad, Jack, L. and Kholeif, 2016). By investing they are entitled with some part

of ownership thus, they have right to see the financial position of the company. If a company is

in profit than stakeholders will invest more money whereas if company face loss then they take

their money off from the company. It is necessary to maintain relation with both internal and

external stakeholders. Stakeholders of Rio Tinto are as follows:

Board of directors: Management of the company need to know the financial

performance of the company as they formulate policies and strategies to compete in the

market. It is essential for them to know each and every detail of financials so that it is

easy for them in forecasting the future expense and frame policies against its competitors

and sustain in the market (Goddard and et.al., 2016). Management gain insights from the

financial statement which help them in monitoring and controlling business performance.

Investors: As investors have stake in the company they need to know the financial

position of the company in determining whether company has invested their money

appropriately. Investors are interest in the financial statement of the organisation in order

to earn high return on investment. It is essential for company to disclose accurate

information and maintain interest of stakeholders in the company (Schroeder and et.al.,

2019). Decisions of the stakeholders are influenced by the disclosure of financial

statements such as what amount to invest, whether to invest for long term or short term.

Customers: Customers are one of the most important stakeholders of the company as

business exist to satisfy customers. Customers are affected by the quality of work and

products provided to them. Customers also want to know the financial information of

company as their decisions are influenced by it. Rio Tinto make sure that their customers

are satisfied and do not switch to their competitors. Customers also need to know the

stability of firm financially and decide whether company is able to provide quality

products or not (Rutherford, 2016).

Governments: One of the main stakeholders using the financial statements of the firm

are government. They are considered as the major stakeholders as they collect tax from

the company. Through financial statements they are able to identify whether Rio Tinto is

paying tax regularly or not. Government make sure that whether company is collecting

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

tax from its employees or not, it is beneficial for as company contributes to the overall

gross domestic products (Koszegi and Matejka, 2018).

Competitors: To compete in the market it is essential for the company itself to know its

financial health and performance to be able to alter competitive strategies and sustain in

the market. Financials are important for company to determine the strength and weakness

of the firm and maintain competitive advantage. For example if Rio Tinto is having

strong financial position then company will be able to invest in new technologies, reduce

its production cost and compete in the market by increasing its market share and profits

(Coad, Jack, L. and Kholeif, 2016).

Employees: Employees are one who are responsible to increase the productivity and

profitability of the company. They use financial statements in determining the profits in

hope of achieving bonus and benefits. Nature of the business decides health and safety of

the employees. As Rio Tinto is in mining industry it is very important for them to provide

health and safety to their staff. This will motivate employees and increase their morale.

After the disclosure of financial reports they expect both monetary and non-monetary

rewards (Otley, 2016).

Comparison between fixed and flexible format statements of financial position and classification

of assets and liabilities

Flexible balance sheet:

Under this format, it is not necessary to mention every single detail in the balance sheet.

Accountants have choice to bifurcate major heading like fixed assets, current assets, current

liabilities, equity and long term liabilities. Flexible balance sheet is also called horizontal format

of preparing a balance sheet where liabilities are shown on the left side and assets are shown on

the right side. Under flexible format accumulated depreciation is not mentioned and equity is

also not mentioned under separate head. In this format cash in hand and cash at bank is shown

separately in the right side of the balance sheet and are not further classified (Engel, 2019).

Fixed balance sheet:

Flexed format of Balanchine sheet is very popular in the organisations as per schedule 6

it is made compulsory for each company to follow fixed format of balance sheet. According to

the accounting standards under schedule 6 balance sheet is prepared in the vertical format

including different headings and sub-headings. Under this format it is necessary for company to

6

gross domestic products (Koszegi and Matejka, 2018).

Competitors: To compete in the market it is essential for the company itself to know its

financial health and performance to be able to alter competitive strategies and sustain in

the market. Financials are important for company to determine the strength and weakness

of the firm and maintain competitive advantage. For example if Rio Tinto is having

strong financial position then company will be able to invest in new technologies, reduce

its production cost and compete in the market by increasing its market share and profits

(Coad, Jack, L. and Kholeif, 2016).

Employees: Employees are one who are responsible to increase the productivity and

profitability of the company. They use financial statements in determining the profits in

hope of achieving bonus and benefits. Nature of the business decides health and safety of

the employees. As Rio Tinto is in mining industry it is very important for them to provide

health and safety to their staff. This will motivate employees and increase their morale.

After the disclosure of financial reports they expect both monetary and non-monetary

rewards (Otley, 2016).

Comparison between fixed and flexible format statements of financial position and classification

of assets and liabilities

Flexible balance sheet:

Under this format, it is not necessary to mention every single detail in the balance sheet.

Accountants have choice to bifurcate major heading like fixed assets, current assets, current

liabilities, equity and long term liabilities. Flexible balance sheet is also called horizontal format

of preparing a balance sheet where liabilities are shown on the left side and assets are shown on

the right side. Under flexible format accumulated depreciation is not mentioned and equity is

also not mentioned under separate head. In this format cash in hand and cash at bank is shown

separately in the right side of the balance sheet and are not further classified (Engel, 2019).

Fixed balance sheet:

Flexed format of Balanchine sheet is very popular in the organisations as per schedule 6

it is made compulsory for each company to follow fixed format of balance sheet. According to

the accounting standards under schedule 6 balance sheet is prepared in the vertical format

including different headings and sub-headings. Under this format it is necessary for company to

6

mention every single detail in balance sheet and bifurcate details according to suitable headings

(Koszegi and Matejka, 2018). Investments, fixed assets, cash in hand and at bank are shown

under separate head. Profits are shown as retained earnings, it is shown under shareholders

equity. Preference shares, equity shares and debentures are also shown under the same heading.

The format of fixed balance sheet is first total assets is calculated in the balance sheet from

which current liabilities are deducted. The amount remaining will be equal to the share holders

equity and balance sheet is matched.

Rio Tinto uses fixed balance sheet format and mention minute detail with working notes.

Firstly under non-current assets goodwill, plants and machinery, equipments, inventories,

intangible assets, trade receivables, tax recoverable and other financial assets are mentioned.

Second heading contains current assets where inventories and cash and cash equivalents are

mentioned (Goddard and et.al., 2016). These two heading are added in order to get total assets.

Further the balance sheet continued by putting third heading of current liabilities which includes

borrowings, trade payables, tax payable and provisions of retirement benefits. Under the fourth

which is non-current liabilities which includes deferred tax liabilities. By adding both the

liabilities total liability is determined, further total liability is subtracted from total assets to get

net assets. Further balance sheet includes capital and reserve where share capital is mentioned,

reserves are mentioned, retained earnings etc. In order to match the balance sheet net assets and

total equity need to be equal.

It is beneficial for company to use fixed format regardless to flexible format because it

provides every detail which is useful for companies (Vollmer, 2019). All the current assets,

current liabilities and shareholders capital is presented in different heading. It becomes easy for

management of Rio Tinto to interpret and analyse balance sheet to identify the performance. On

the other hand in flexible format minute details are not mentioned which may lead to wrong

interpretation about the performance of company. Fixed format is beneficial for stakeholders as

well because they are able to depict the financial position of the company and take decision

regarding investment (Goddard and et.al., 2016).

CONCLUSION

From the above study it is concluded that accounting or financials of the company is very

beneficial for every organisation in determining its financial position. Companies follows

accounting theory which are a set of procedures or methodologies which help management in

7

(Koszegi and Matejka, 2018). Investments, fixed assets, cash in hand and at bank are shown

under separate head. Profits are shown as retained earnings, it is shown under shareholders

equity. Preference shares, equity shares and debentures are also shown under the same heading.

The format of fixed balance sheet is first total assets is calculated in the balance sheet from

which current liabilities are deducted. The amount remaining will be equal to the share holders

equity and balance sheet is matched.

Rio Tinto uses fixed balance sheet format and mention minute detail with working notes.

Firstly under non-current assets goodwill, plants and machinery, equipments, inventories,

intangible assets, trade receivables, tax recoverable and other financial assets are mentioned.

Second heading contains current assets where inventories and cash and cash equivalents are

mentioned (Goddard and et.al., 2016). These two heading are added in order to get total assets.

Further the balance sheet continued by putting third heading of current liabilities which includes

borrowings, trade payables, tax payable and provisions of retirement benefits. Under the fourth

which is non-current liabilities which includes deferred tax liabilities. By adding both the

liabilities total liability is determined, further total liability is subtracted from total assets to get

net assets. Further balance sheet includes capital and reserve where share capital is mentioned,

reserves are mentioned, retained earnings etc. In order to match the balance sheet net assets and

total equity need to be equal.

It is beneficial for company to use fixed format regardless to flexible format because it

provides every detail which is useful for companies (Vollmer, 2019). All the current assets,

current liabilities and shareholders capital is presented in different heading. It becomes easy for

management of Rio Tinto to interpret and analyse balance sheet to identify the performance. On

the other hand in flexible format minute details are not mentioned which may lead to wrong

interpretation about the performance of company. Fixed format is beneficial for stakeholders as

well because they are able to depict the financial position of the company and take decision

regarding investment (Goddard and et.al., 2016).

CONCLUSION

From the above study it is concluded that accounting or financials of the company is very

beneficial for every organisation in determining its financial position. Companies follows

accounting theory which are a set of procedures or methodologies which help management in

7

forecasting and taking better decisions. It is concluded that firm uses accounting theories where

they disclose all the financial statements of the company accurately. It is beneficial for the

company to follow the sustainability accounting to sustain in the competitive market. Further

report concludes that it is essential to disclose financial report in order to provide value to its

stakeholders. Rio Tinto balance sheet is used by its stakeholders in making decision, also

financial position of the company influence decision making of some stakeholders. Company

also prepare balance sheet in fixed format where all the assets and liabilities are segregated and

placed. It is beneficial for company to use this format as it helps in interpreting the data clearly.

This format is beneficial to stakeholders as well as they are able to depict the financial position

easily and make decisions based on the financial statements. Flexible balance sheet format is

created by companies that want to flexibility of fund operations.

8

they disclose all the financial statements of the company accurately. It is beneficial for the

company to follow the sustainability accounting to sustain in the competitive market. Further

report concludes that it is essential to disclose financial report in order to provide value to its

stakeholders. Rio Tinto balance sheet is used by its stakeholders in making decision, also

financial position of the company influence decision making of some stakeholders. Company

also prepare balance sheet in fixed format where all the assets and liabilities are segregated and

placed. It is beneficial for company to use this format as it helps in interpreting the data clearly.

This format is beneficial to stakeholders as well as they are able to depict the financial position

easily and make decisions based on the financial statements. Flexible balance sheet format is

created by companies that want to flexibility of fund operations.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and Journals

Coad, A., Jack, L. and Kholeif, A., 2016. Strong structuration theory in accounting research.

Accounting, auditing & accountability journal. 29(7). pp.1138-1144.

Engel, C. J., 2019. THE ACCEPTABILITY OF ONLINE DEGREES FOR OBTAINING

ENTRY-LEVEL EMPLOYMENT IN THE ACCOUNTING PROFESSION: A

THEORETICAL FRAMEWORK. GLOBAL JOURNAL OF BUSINESS DISCIPLINES.

3(1). p.15.

Goddard, A. and et.al., 2016. The two publics and institutional theory–A study of public sector

accounting in Tanzania. Critical Perspectives on Accounting. 40. pp.8-25.

Koszegi, B. and Matejka, F., 2018. An attention-based theory of mental accounting.

MacGillivray, A., 2017. Accounting for change: indicators for sustainable development.

In Tomorrow’s History (pp. 122-129). Routledge.

Nitzl, C., 2016. The use of partial least squares structural equation modelling (PLS-SEM) in

management accounting research: Directions for future theory development. Journal of

Accounting Literature. 37. pp.19-35.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–2014.

Management accounting research. 31. pp.45-62.

Rutherford, B.A., 2016. Articulating accounting principles: Classical accounting theory as the

pursuit of “explanation by embodiment”. Journal of Applied Accounting Research. 17(2).

pp.118-135.

Schroeder, R. G. and et.al., 2019. Financial accounting theory and analysis: text and cases. John

Wiley & Sons.

Vollmer, H., 2019. Accounting for tacit coordination: The passing of accounts and the broader

case for accounting theory. Accounting, Organizations and Society. 73. pp.15-34.

Zeff, S. A., 2018. My accounting theory seminar. Accounting Historians Journal. 45(1). pp.135-

140.

9

Books and Journals

Coad, A., Jack, L. and Kholeif, A., 2016. Strong structuration theory in accounting research.

Accounting, auditing & accountability journal. 29(7). pp.1138-1144.

Engel, C. J., 2019. THE ACCEPTABILITY OF ONLINE DEGREES FOR OBTAINING

ENTRY-LEVEL EMPLOYMENT IN THE ACCOUNTING PROFESSION: A

THEORETICAL FRAMEWORK. GLOBAL JOURNAL OF BUSINESS DISCIPLINES.

3(1). p.15.

Goddard, A. and et.al., 2016. The two publics and institutional theory–A study of public sector

accounting in Tanzania. Critical Perspectives on Accounting. 40. pp.8-25.

Koszegi, B. and Matejka, F., 2018. An attention-based theory of mental accounting.

MacGillivray, A., 2017. Accounting for change: indicators for sustainable development.

In Tomorrow’s History (pp. 122-129). Routledge.

Nitzl, C., 2016. The use of partial least squares structural equation modelling (PLS-SEM) in

management accounting research: Directions for future theory development. Journal of

Accounting Literature. 37. pp.19-35.

Otley, D., 2016. The contingency theory of management accounting and control: 1980–2014.

Management accounting research. 31. pp.45-62.

Rutherford, B.A., 2016. Articulating accounting principles: Classical accounting theory as the

pursuit of “explanation by embodiment”. Journal of Applied Accounting Research. 17(2).

pp.118-135.

Schroeder, R. G. and et.al., 2019. Financial accounting theory and analysis: text and cases. John

Wiley & Sons.

Vollmer, H., 2019. Accounting for tacit coordination: The passing of accounts and the broader

case for accounting theory. Accounting, Organizations and Society. 73. pp.15-34.

Zeff, S. A., 2018. My accounting theory seminar. Accounting Historians Journal. 45(1). pp.135-

140.

9

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.