Accounting: Trial Balance, Matching Concept, Conceptual Framework, Credit Cards and Bad Debts

VerifiedAdded on 2023/06/13

|25

|5001

|146

AI Summary

This article covers topics such as trial balance, matching concept, conceptual framework, credit cards and bad debts in accounting. It includes explanations, examples, and journal entries.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING

Accounting

Name of the Student:

Name of the University:

Author’s Note:

Accounting

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

ACCOUNTING

Table of Contents

Question 1........................................................................................................................................3

Requirement A.............................................................................................................................3

Requirement B.............................................................................................................................4

Question 2........................................................................................................................................4

Requirement A.............................................................................................................................4

Requirement B.............................................................................................................................5

Question 3........................................................................................................................................7

Requirement A.............................................................................................................................7

Requirement B.............................................................................................................................8

Question 4......................................................................................................................................10

Requirement A...........................................................................................................................10

Requirement B...........................................................................................................................11

Question 5......................................................................................................................................15

Requirement A...........................................................................................................................15

Requirement B – Journal Entries...............................................................................................18

Journal Entries...........................................................................................................................19

Question 6......................................................................................................................................20

Requirement A...........................................................................................................................20

Requirement B...........................................................................................................................23

ACCOUNTING

Table of Contents

Question 1........................................................................................................................................3

Requirement A.............................................................................................................................3

Requirement B.............................................................................................................................4

Question 2........................................................................................................................................4

Requirement A.............................................................................................................................4

Requirement B.............................................................................................................................5

Question 3........................................................................................................................................7

Requirement A.............................................................................................................................7

Requirement B.............................................................................................................................8

Question 4......................................................................................................................................10

Requirement A...........................................................................................................................10

Requirement B...........................................................................................................................11

Question 5......................................................................................................................................15

Requirement A...........................................................................................................................15

Requirement B – Journal Entries...............................................................................................18

Journal Entries...........................................................................................................................19

Question 6......................................................................................................................................20

Requirement A...........................................................................................................................20

Requirement B...........................................................................................................................23

2

ACCOUNTING

Reference.......................................................................................................................................24

ACCOUNTING

Reference.......................................................................................................................................24

3

ACCOUNTING

Question 1

Requirement A

A trial balance is a statement which is prepared with taking the closing balance of the

different ledger accounts where the debit total balance matches the credit total balance. In simple

words, a trial balance uses closing balance of different ledger accounts which have debit or credit

balances and the statement tallies. If the statement does not tally then there may be certain errors

in the statement. The main use of a trial balance is to check the mathematical accuracy of the

transactions as recorded in the ledger accounts. Every business prepares a trial balance

periodically to ensure that the books of accounts which are made following double entry system

are free from errors which may be due to calculations. This is possible because under double

entry system, the total of debit side will always be equal to the total of credit side. This the

principle which is followed by a trial balance (Needles, Powers and Crosson 2013).

If the trial matches it only means that the mathematical accuracy is there but it does not

mean that their may not be any accounting errors. The matching of trial balance only shows that

there are no calculation errors but there still maty be material errors present in the books of

accounts. For example, an error of omission of an entry will not be identifiable as the trial

balance will match. Another example which can be given is that of bookkeeping error which

means that equal debit and credit been entered into wrong accounts. In this case also, the trial

balance will match but still there is an error in the financial statements.

ACCOUNTING

Question 1

Requirement A

A trial balance is a statement which is prepared with taking the closing balance of the

different ledger accounts where the debit total balance matches the credit total balance. In simple

words, a trial balance uses closing balance of different ledger accounts which have debit or credit

balances and the statement tallies. If the statement does not tally then there may be certain errors

in the statement. The main use of a trial balance is to check the mathematical accuracy of the

transactions as recorded in the ledger accounts. Every business prepares a trial balance

periodically to ensure that the books of accounts which are made following double entry system

are free from errors which may be due to calculations. This is possible because under double

entry system, the total of debit side will always be equal to the total of credit side. This the

principle which is followed by a trial balance (Needles, Powers and Crosson 2013).

If the trial matches it only means that the mathematical accuracy is there but it does not

mean that their may not be any accounting errors. The matching of trial balance only shows that

there are no calculation errors but there still maty be material errors present in the books of

accounts. For example, an error of omission of an entry will not be identifiable as the trial

balance will match. Another example which can be given is that of bookkeeping error which

means that equal debit and credit been entered into wrong accounts. In this case also, the trial

balance will match but still there is an error in the financial statements.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

ACCOUNTING

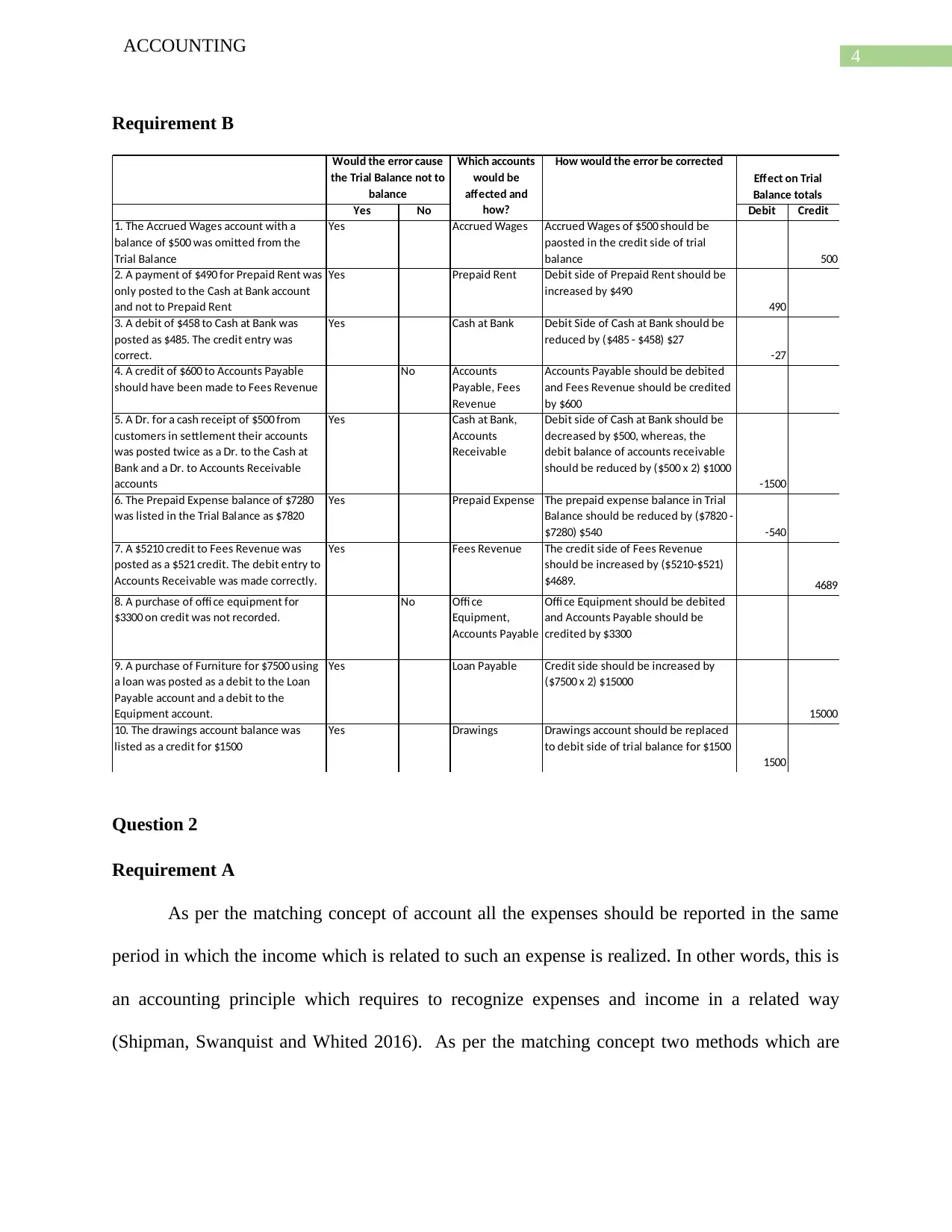

Requirement B

Yes No Debit Credit

1. The Accrued Wages account with a

balance of $500 was omitted from the

Trial Balance

Yes Accrued Wages Accrued Wages of $500 should be

paosted in the credit side of trial

balance 500

2. A payment of $490 for Prepaid Rent was

only posted to the Cash at Bank account

and not to Prepaid Rent

Yes Prepaid Rent Debit side of Prepaid Rent should be

increased by $490

490

3. A debit of $458 to Cash at Bank was

posted as $485. The credit entry was

correct.

Yes Cash at Bank Debit Side of Cash at Bank should be

reduced by ($485 - $458) $27

-27

4. A credit of $600 to Accounts Payable

should have been made to Fees Revenue

No Accounts

Payable, Fees

Revenue

Accounts Payable should be debited

and Fees Revenue should be credited

by $600

5. A Dr. for a cash receipt of $500 from

customers in settlement their accounts

was posted twice as a Dr. to the Cash at

Bank and a Dr. to Accounts Receivable

accounts

Yes Cash at Bank,

Accounts

Receivable

Debit side of Cash at Bank should be

decreased by $500, whereas, the

debit balance of accounts receivable

should be reduced by ($500 x 2) $1000

-1500

6. The Prepaid Expense balance of $7280

was listed in the Trial Balance as $7820

Yes Prepaid Expense The prepaid expense balance in Trial

Balance should be reduced by ($7820 -

$7280) $540 -540

7. A $5210 credit to Fees Revenue was

posted as a $521 credit. The debit entry to

Accounts Receivable was made correctly.

Yes Fees Revenue The credit side of Fees Revenue

should be increased by ($5210-$521)

$4689. 4689

8. A purchase of offi ce equipment for

$3300 on credit was not recorded.

No Offi ce

Equipment,

Accounts Payable

Offi ce Equipment should be debited

and Accounts Payable should be

credited by $3300

9. A purchase of Furniture for $7500 using

a loan was posted as a debit to the Loan

Payable account and a debit to the

Equipment account.

Yes Loan Payable Credit side should be increased by

($7500 x 2) $15000

15000

10. The drawings account balance was

listed as a credit for $1500

Yes Drawings Drawings account should be replaced

to debit side of trial balance for $1500

1500

Would the error cause

the Trial Balance not to

balance

Which accounts

would be

affected and

how?

How would the error be corrected

Effect on Trial

Balance totals

Question 2

Requirement A

As per the matching concept of account all the expenses should be reported in the same

period in which the income which is related to such an expense is realized. In other words, this is

an accounting principle which requires to recognize expenses and income in a related way

(Shipman, Swanquist and Whited 2016). As per the matching concept two methods which are

ACCOUNTING

Requirement B

Yes No Debit Credit

1. The Accrued Wages account with a

balance of $500 was omitted from the

Trial Balance

Yes Accrued Wages Accrued Wages of $500 should be

paosted in the credit side of trial

balance 500

2. A payment of $490 for Prepaid Rent was

only posted to the Cash at Bank account

and not to Prepaid Rent

Yes Prepaid Rent Debit side of Prepaid Rent should be

increased by $490

490

3. A debit of $458 to Cash at Bank was

posted as $485. The credit entry was

correct.

Yes Cash at Bank Debit Side of Cash at Bank should be

reduced by ($485 - $458) $27

-27

4. A credit of $600 to Accounts Payable

should have been made to Fees Revenue

No Accounts

Payable, Fees

Revenue

Accounts Payable should be debited

and Fees Revenue should be credited

by $600

5. A Dr. for a cash receipt of $500 from

customers in settlement their accounts

was posted twice as a Dr. to the Cash at

Bank and a Dr. to Accounts Receivable

accounts

Yes Cash at Bank,

Accounts

Receivable

Debit side of Cash at Bank should be

decreased by $500, whereas, the

debit balance of accounts receivable

should be reduced by ($500 x 2) $1000

-1500

6. The Prepaid Expense balance of $7280

was listed in the Trial Balance as $7820

Yes Prepaid Expense The prepaid expense balance in Trial

Balance should be reduced by ($7820 -

$7280) $540 -540

7. A $5210 credit to Fees Revenue was

posted as a $521 credit. The debit entry to

Accounts Receivable was made correctly.

Yes Fees Revenue The credit side of Fees Revenue

should be increased by ($5210-$521)

$4689. 4689

8. A purchase of offi ce equipment for

$3300 on credit was not recorded.

No Offi ce

Equipment,

Accounts Payable

Offi ce Equipment should be debited

and Accounts Payable should be

credited by $3300

9. A purchase of Furniture for $7500 using

a loan was posted as a debit to the Loan

Payable account and a debit to the

Equipment account.

Yes Loan Payable Credit side should be increased by

($7500 x 2) $15000

15000

10. The drawings account balance was

listed as a credit for $1500

Yes Drawings Drawings account should be replaced

to debit side of trial balance for $1500

1500

Would the error cause

the Trial Balance not to

balance

Which accounts

would be

affected and

how?

How would the error be corrected

Effect on Trial

Balance totals

Question 2

Requirement A

As per the matching concept of account all the expenses should be reported in the same

period in which the income which is related to such an expense is realized. In other words, this is

an accounting principle which requires to recognize expenses and income in a related way

(Shipman, Swanquist and Whited 2016). As per the matching concept two methods which are

5

ACCOUNTING

popularly used in accounting are Accrual system of recognizing and Cash system of

Recognizing.

Under the accrual system of accounting the expenses are recognizes in the year in which

such an expense has been incurred and it does not matter whether cash is paid for such

transaction. In other words, accrual basis of accounting is not dependent on the cash received or

cash paid for recognizing and recording of transactions. Whereas in the case of cash basis of

accounting expenses are recorded when cash is actually paid by the business irrespective of the

fact when the expenses was incurred. Therefore, the major difference between cash basis and

accrual basis is the timing of recognition of transactions.

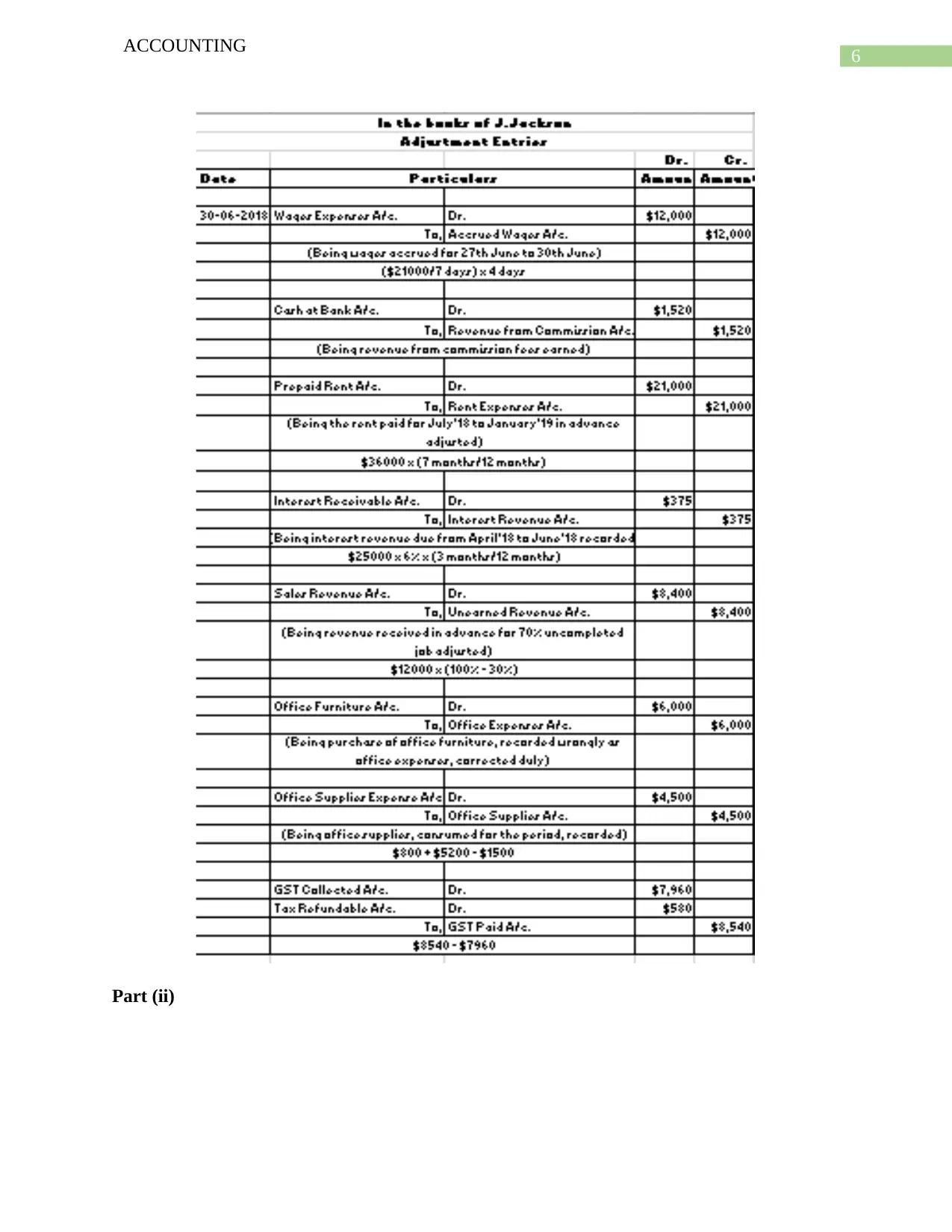

Requirement B

Part (i)

ACCOUNTING

popularly used in accounting are Accrual system of recognizing and Cash system of

Recognizing.

Under the accrual system of accounting the expenses are recognizes in the year in which

such an expense has been incurred and it does not matter whether cash is paid for such

transaction. In other words, accrual basis of accounting is not dependent on the cash received or

cash paid for recognizing and recording of transactions. Whereas in the case of cash basis of

accounting expenses are recorded when cash is actually paid by the business irrespective of the

fact when the expenses was incurred. Therefore, the major difference between cash basis and

accrual basis is the timing of recognition of transactions.

Requirement B

Part (i)

6

ACCOUNTING

Part (ii)

ACCOUNTING

Part (ii)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

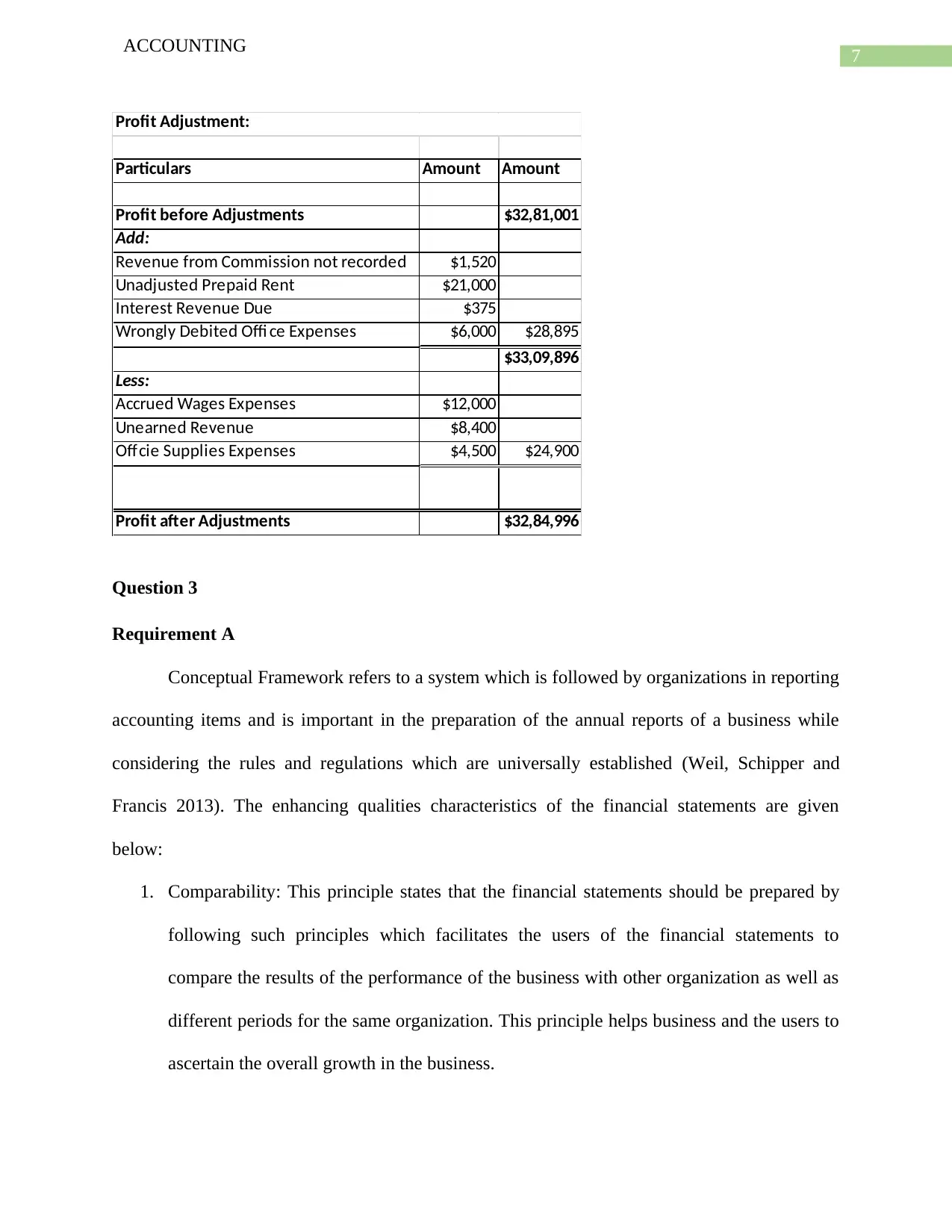

ACCOUNTING

Particulars Amount Amount

Profit before Adjustments $32,81,001

Add:

Revenue from Commission not recorded $1,520

Unadjusted Prepaid Rent $21,000

Interest Revenue Due $375

Wrongly Debited Offi ce Expenses $6,000 $28,895

$33,09,896

Less:

Accrued Wages Expenses $12,000

Unearned Revenue $8,400

Offcie Supplies Expenses $4,500 $24,900

Profit after Adjustments $32,84,996

Profit Adjustment:

Question 3

Requirement A

Conceptual Framework refers to a system which is followed by organizations in reporting

accounting items and is important in the preparation of the annual reports of a business while

considering the rules and regulations which are universally established (Weil, Schipper and

Francis 2013). The enhancing qualities characteristics of the financial statements are given

below:

1. Comparability: This principle states that the financial statements should be prepared by

following such principles which facilitates the users of the financial statements to

compare the results of the performance of the business with other organization as well as

different periods for the same organization. This principle helps business and the users to

ascertain the overall growth in the business.

ACCOUNTING

Particulars Amount Amount

Profit before Adjustments $32,81,001

Add:

Revenue from Commission not recorded $1,520

Unadjusted Prepaid Rent $21,000

Interest Revenue Due $375

Wrongly Debited Offi ce Expenses $6,000 $28,895

$33,09,896

Less:

Accrued Wages Expenses $12,000

Unearned Revenue $8,400

Offcie Supplies Expenses $4,500 $24,900

Profit after Adjustments $32,84,996

Profit Adjustment:

Question 3

Requirement A

Conceptual Framework refers to a system which is followed by organizations in reporting

accounting items and is important in the preparation of the annual reports of a business while

considering the rules and regulations which are universally established (Weil, Schipper and

Francis 2013). The enhancing qualities characteristics of the financial statements are given

below:

1. Comparability: This principle states that the financial statements should be prepared by

following such principles which facilitates the users of the financial statements to

compare the results of the performance of the business with other organization as well as

different periods for the same organization. This principle helps business and the users to

ascertain the overall growth in the business.

8

ACCOUNTING

2. Verifiability: The principle suggest that the information which are presented in the

financial statements of the company should be such that it can be easily be verified by the

business. Any financial information is verifiable if the shareholders of the company can

confirm that the financial information are fairly represented.

3. Timeliness: The principle states that financial information if not presented to the

shareholders in time of their decision-making process, then it is not at all useful. The

principle makes it clear that the information should be provided to the investors before

they are able to take decisions.

4. Understandability: As per this principle, the financial information which are depicted in

the annual reports should be simple and easy to understand and no such information

should be included without appropriate notes and explanations which are complex in

nature and difficult to understand.

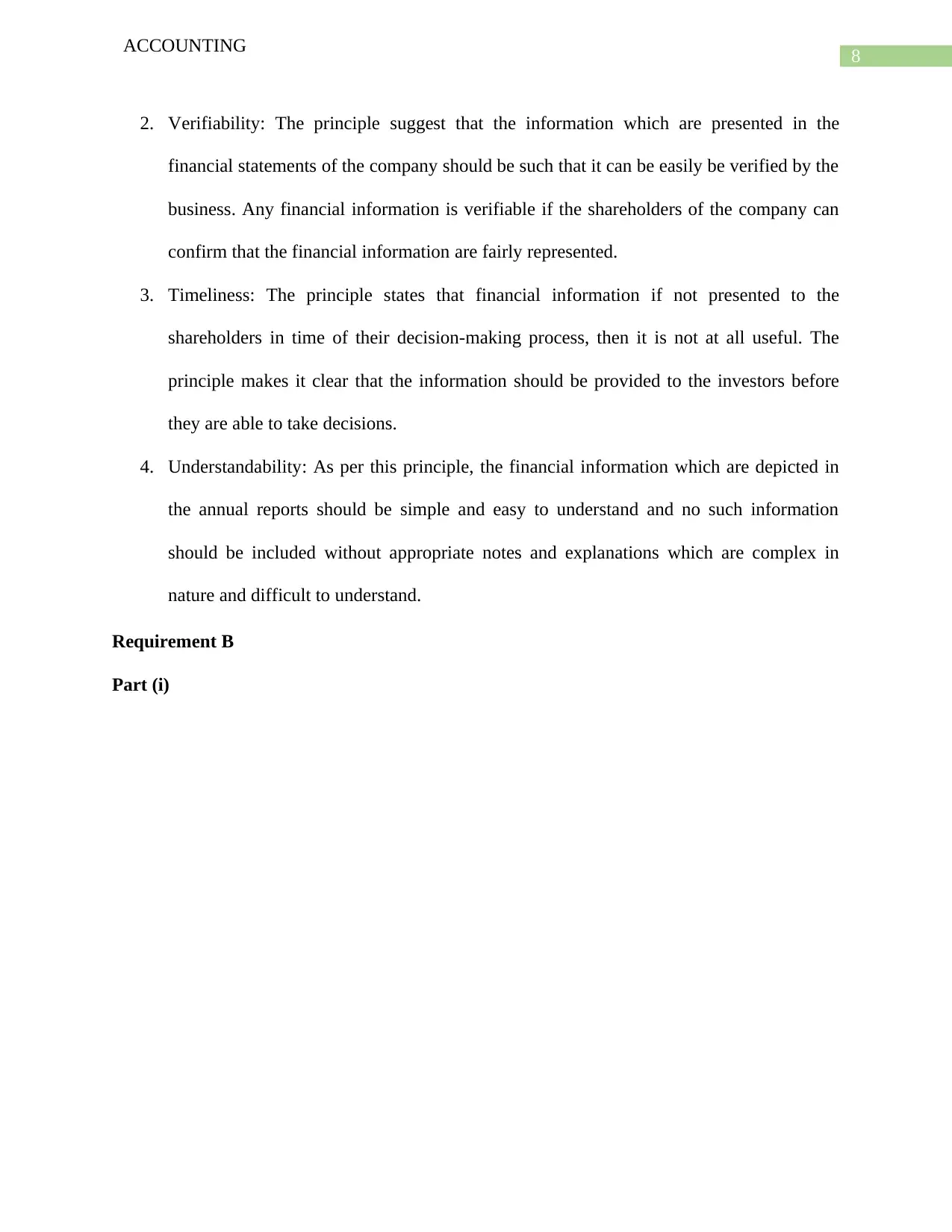

Requirement B

Part (i)

ACCOUNTING

2. Verifiability: The principle suggest that the information which are presented in the

financial statements of the company should be such that it can be easily be verified by the

business. Any financial information is verifiable if the shareholders of the company can

confirm that the financial information are fairly represented.

3. Timeliness: The principle states that financial information if not presented to the

shareholders in time of their decision-making process, then it is not at all useful. The

principle makes it clear that the information should be provided to the investors before

they are able to take decisions.

4. Understandability: As per this principle, the financial information which are depicted in

the annual reports should be simple and easy to understand and no such information

should be included without appropriate notes and explanations which are complex in

nature and difficult to understand.

Requirement B

Part (i)

9

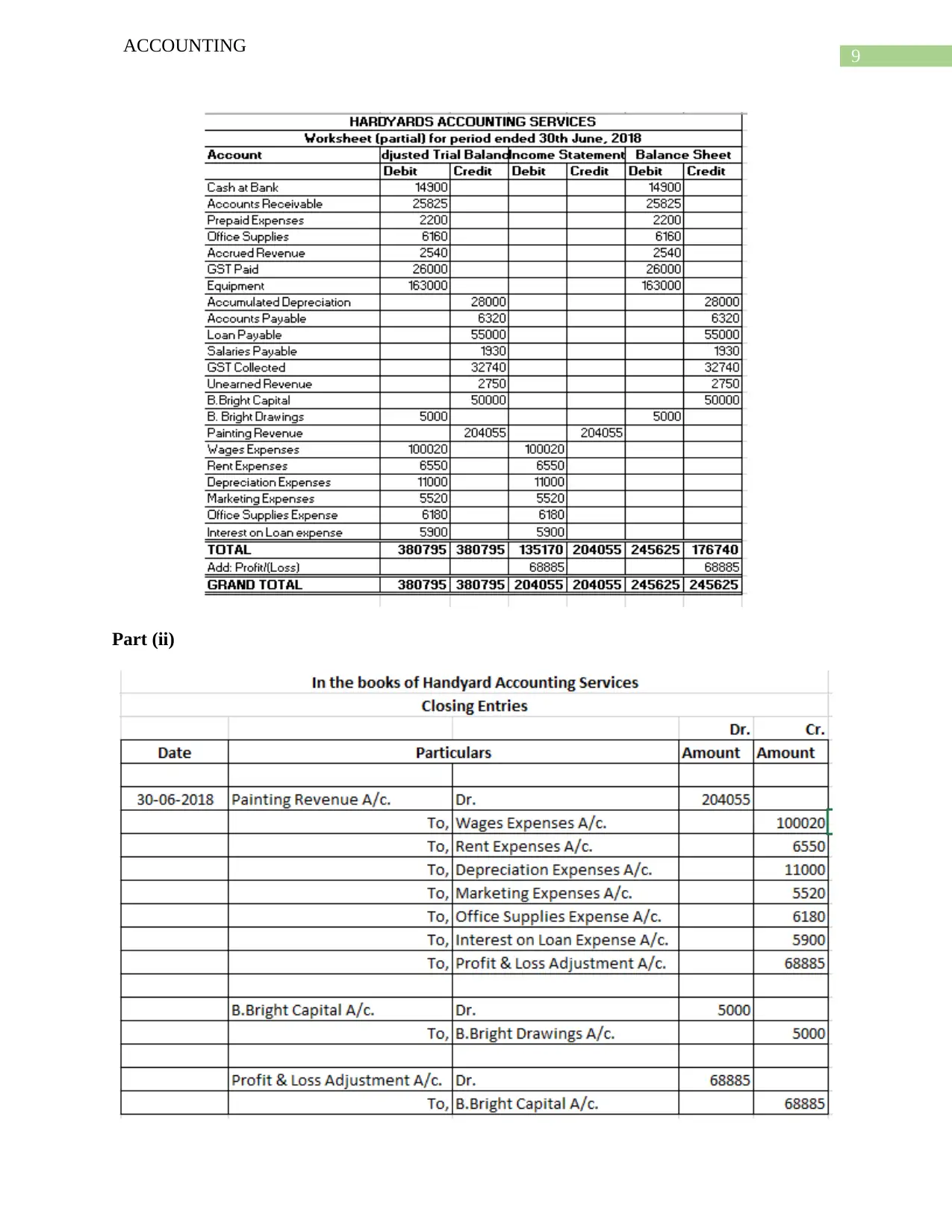

ACCOUNTING

Part (ii)

ACCOUNTING

Part (ii)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

ACCOUNTING

Question 4

Requirement A

a. The use of credit cards will definitely reduce the risks which are associated with normal

credit facilities. The loan amount can directly be dealt with the credit card company. the

process of credit which was previously available will change due to the new credit card

facilities. The credit card facilities will be making the e-commerce facility much easier.

The cost which are to be incurred in case of credit card is related to interest which is

charged at the end of the month. The credit cards are normally protected with a pin code

which is different for different individuals.

b. Account Receivables forms a major part of the financial statements of the company as it

is related to credit sales of the business. The recording and monitoring of account

receivable will not be affected by the introduction of credit cards in the business (Hope,

Thomas and Vyas 2013). This because credit card can be used up to a certain limit which

is not that much in most of the cases, however account receivables transaction may be of

lumpsum amount due to a big order. Therefore, it is necessary for the business to keep

track of the account receivables as effective management of such items results in

increased generation of sales.

Factoring may be defined as a source of financing wherein the account receivables of the

business are sold to financial intermediary who are known as factors at a discount. In simple

words, it is a source of procuring funds by selling off the receivables of the business. It is to be

clearly understood that factoring is not same as a loan and the funds which are received are not to

be considered as debt capital of the business (Michalski 2014).

ACCOUNTING

Question 4

Requirement A

a. The use of credit cards will definitely reduce the risks which are associated with normal

credit facilities. The loan amount can directly be dealt with the credit card company. the

process of credit which was previously available will change due to the new credit card

facilities. The credit card facilities will be making the e-commerce facility much easier.

The cost which are to be incurred in case of credit card is related to interest which is

charged at the end of the month. The credit cards are normally protected with a pin code

which is different for different individuals.

b. Account Receivables forms a major part of the financial statements of the company as it

is related to credit sales of the business. The recording and monitoring of account

receivable will not be affected by the introduction of credit cards in the business (Hope,

Thomas and Vyas 2013). This because credit card can be used up to a certain limit which

is not that much in most of the cases, however account receivables transaction may be of

lumpsum amount due to a big order. Therefore, it is necessary for the business to keep

track of the account receivables as effective management of such items results in

increased generation of sales.

Factoring may be defined as a source of financing wherein the account receivables of the

business are sold to financial intermediary who are known as factors at a discount. In simple

words, it is a source of procuring funds by selling off the receivables of the business. It is to be

clearly understood that factoring is not same as a loan and the funds which are received are not to

be considered as debt capital of the business (Michalski 2014).

11

ACCOUNTING

c. Provision for bad debt are allowed in financial statements in order to estimate the losses

which the business might incur. As per the principle of Conservatism, a business must

always recognize probable losses or liabilities and record the same ahead of income or

assets. Therefore, the business has to recognize such a doubtful debt as a provision. If the

provision is not allowed than it will affect the profit which is generated by the business

which will be showing profits in excess and also impact the value of debtors in the

balance sheet of the company.

Requirement B

Part (i)

ACCOUNTING

c. Provision for bad debt are allowed in financial statements in order to estimate the losses

which the business might incur. As per the principle of Conservatism, a business must

always recognize probable losses or liabilities and record the same ahead of income or

assets. Therefore, the business has to recognize such a doubtful debt as a provision. If the

provision is not allowed than it will affect the profit which is generated by the business

which will be showing profits in excess and also impact the value of debtors in the

balance sheet of the company.

Requirement B

Part (i)

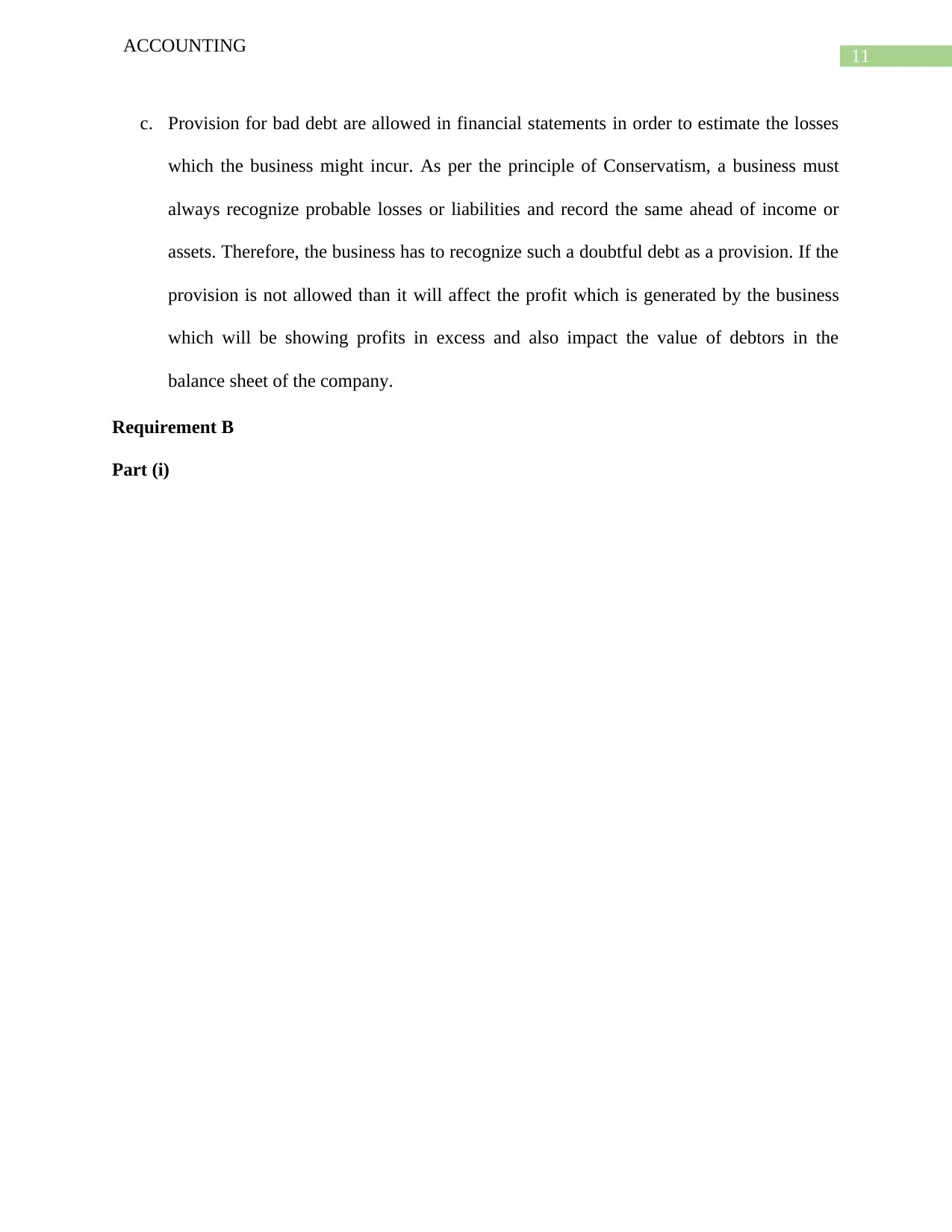

12

ACCOUNTING

Dr. Cr.

Date Amount Amount

Jun-18 Bad Debts Expenses A/c. Dr. 11510

To, Allowance for Doubtful Debts A/c. 11510

Allowance for Doubtful Debts A/c. Dr. 11510

To, Accounts Receivable A/c. 11510

Cash at Bank A/c. Dr. 19910

Accounts Receivable A/c. Dr. 79640

To, Sales A/c. 90500

To, GST Collected A/c. 9050

Cash at Bank A/c. Dr. 121600

To, Accounts Receivable A/c. 121600

Accounts Receivable A/c. Dr. 1870

To, Allowance for Doubtful Debts A/c. 1870

Cash at Bank A/c. Dr. 1870

To, Accounts Receivable A/c. 1870

Accounts Receivable A/c. Dr. 2200

To, Sales A/c. 2000

To, GST Collected A/c. 200

Profit & Loss A/c. Dr. 1565

To, Allowance for Doubtful Debts A/c. 1565

Journal Entries

(Being the balance of allowance for doubtful debts increased)

Particulars

(Being Bad debt expenses recorded)

(Being accounts receivable written off as bad debt)

(Being sales made in cash and credit both)

(Being dues received from customers)

(Being receivables, writted off previously, reinstated)

(Being dues received from reinstated receivables)

(Being unrecorded credit sales recorded properly)

In the books of Homewares Company Ltd.

Part (ii)

ACCOUNTING

Dr. Cr.

Date Amount Amount

Jun-18 Bad Debts Expenses A/c. Dr. 11510

To, Allowance for Doubtful Debts A/c. 11510

Allowance for Doubtful Debts A/c. Dr. 11510

To, Accounts Receivable A/c. 11510

Cash at Bank A/c. Dr. 19910

Accounts Receivable A/c. Dr. 79640

To, Sales A/c. 90500

To, GST Collected A/c. 9050

Cash at Bank A/c. Dr. 121600

To, Accounts Receivable A/c. 121600

Accounts Receivable A/c. Dr. 1870

To, Allowance for Doubtful Debts A/c. 1870

Cash at Bank A/c. Dr. 1870

To, Accounts Receivable A/c. 1870

Accounts Receivable A/c. Dr. 2200

To, Sales A/c. 2000

To, GST Collected A/c. 200

Profit & Loss A/c. Dr. 1565

To, Allowance for Doubtful Debts A/c. 1565

Journal Entries

(Being the balance of allowance for doubtful debts increased)

Particulars

(Being Bad debt expenses recorded)

(Being accounts receivable written off as bad debt)

(Being sales made in cash and credit both)

(Being dues received from customers)

(Being receivables, writted off previously, reinstated)

(Being dues received from reinstated receivables)

(Being unrecorded credit sales recorded properly)

In the books of Homewares Company Ltd.

Part (ii)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

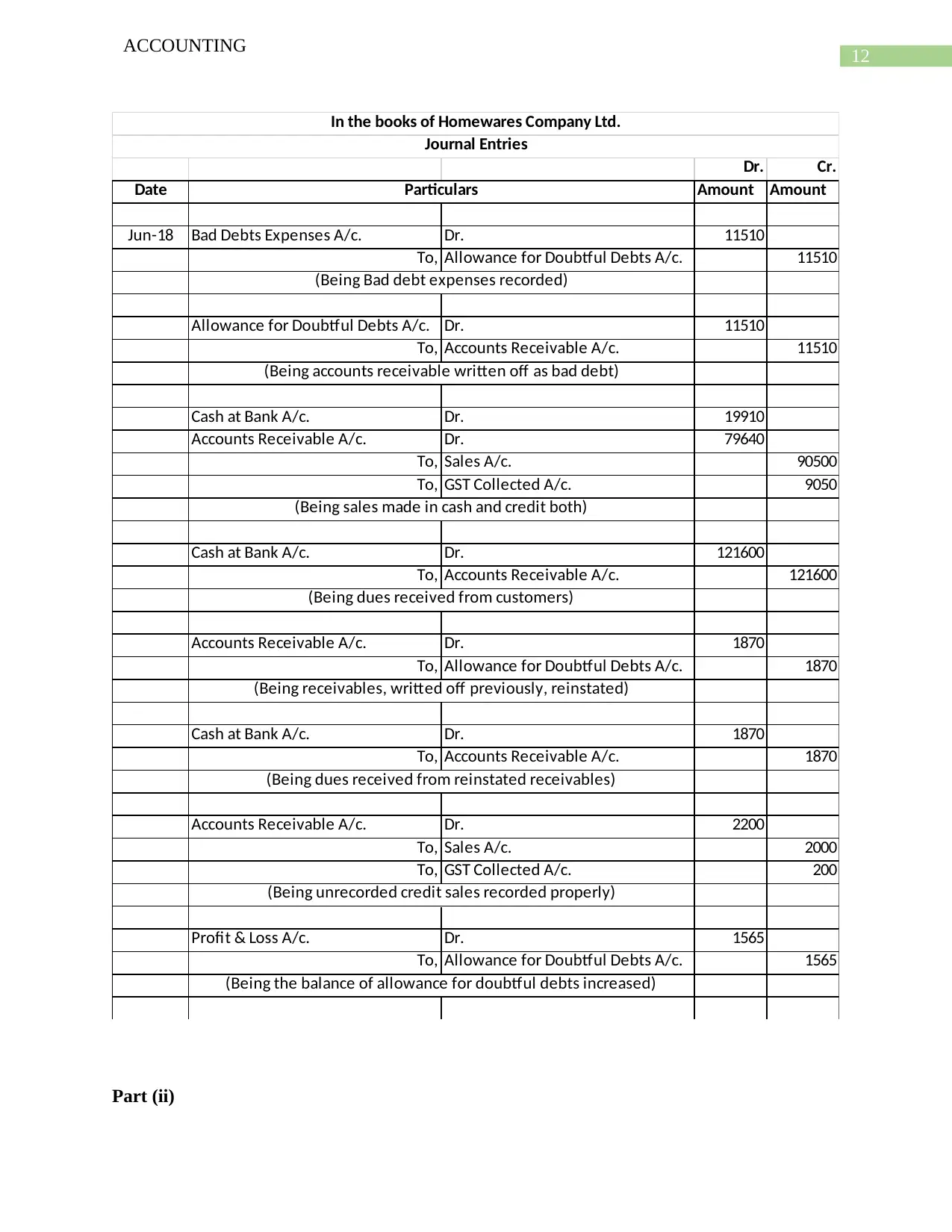

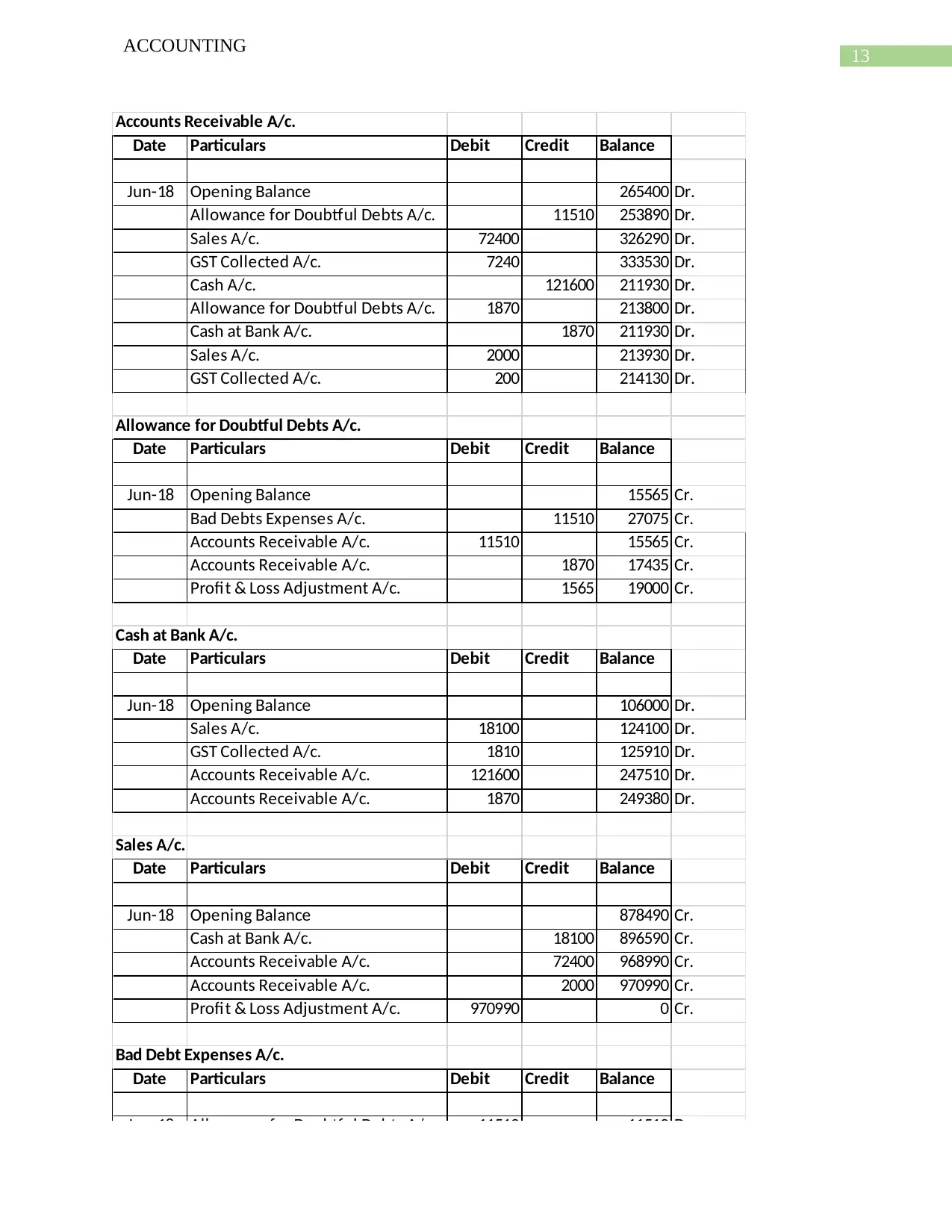

ACCOUNTING

Accounts Receivable A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 265400 Dr.

Allowance for Doubtful Debts A/c. 11510 253890 Dr.

Sales A/c. 72400 326290 Dr.

GST Collected A/c. 7240 333530 Dr.

Cash A/c. 121600 211930 Dr.

Allowance for Doubtful Debts A/c. 1870 213800 Dr.

Cash at Bank A/c. 1870 211930 Dr.

Sales A/c. 2000 213930 Dr.

GST Collected A/c. 200 214130 Dr.

Allowance for Doubtful Debts A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 15565 Cr.

Bad Debts Expenses A/c. 11510 27075 Cr.

Accounts Receivable A/c. 11510 15565 Cr.

Accounts Receivable A/c. 1870 17435 Cr.

Profit & Loss Adjustment A/c. 1565 19000 Cr.

Cash at Bank A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 106000 Dr.

Sales A/c. 18100 124100 Dr.

GST Collected A/c. 1810 125910 Dr.

Accounts Receivable A/c. 121600 247510 Dr.

Accounts Receivable A/c. 1870 249380 Dr.

Sales A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 878490 Cr.

Cash at Bank A/c. 18100 896590 Cr.

Accounts Receivable A/c. 72400 968990 Cr.

Accounts Receivable A/c. 2000 970990 Cr.

Profit & Loss Adjustment A/c. 970990 0 Cr.

Bad Debt Expenses A/c.

Date Particulars Debit Credit Balance

Jun-18 Allowance for Doubtful Debts A/c. 11510 11510 Dr.

Profit & Loss Adjustment A/c. 11510 0

ACCOUNTING

Accounts Receivable A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 265400 Dr.

Allowance for Doubtful Debts A/c. 11510 253890 Dr.

Sales A/c. 72400 326290 Dr.

GST Collected A/c. 7240 333530 Dr.

Cash A/c. 121600 211930 Dr.

Allowance for Doubtful Debts A/c. 1870 213800 Dr.

Cash at Bank A/c. 1870 211930 Dr.

Sales A/c. 2000 213930 Dr.

GST Collected A/c. 200 214130 Dr.

Allowance for Doubtful Debts A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 15565 Cr.

Bad Debts Expenses A/c. 11510 27075 Cr.

Accounts Receivable A/c. 11510 15565 Cr.

Accounts Receivable A/c. 1870 17435 Cr.

Profit & Loss Adjustment A/c. 1565 19000 Cr.

Cash at Bank A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 106000 Dr.

Sales A/c. 18100 124100 Dr.

GST Collected A/c. 1810 125910 Dr.

Accounts Receivable A/c. 121600 247510 Dr.

Accounts Receivable A/c. 1870 249380 Dr.

Sales A/c.

Date Particulars Debit Credit Balance

Jun-18 Opening Balance 878490 Cr.

Cash at Bank A/c. 18100 896590 Cr.

Accounts Receivable A/c. 72400 968990 Cr.

Accounts Receivable A/c. 2000 970990 Cr.

Profit & Loss Adjustment A/c. 970990 0 Cr.

Bad Debt Expenses A/c.

Date Particulars Debit Credit Balance

Jun-18 Allowance for Doubtful Debts A/c. 11510 11510 Dr.

Profit & Loss Adjustment A/c. 11510 0

14

ACCOUNTING

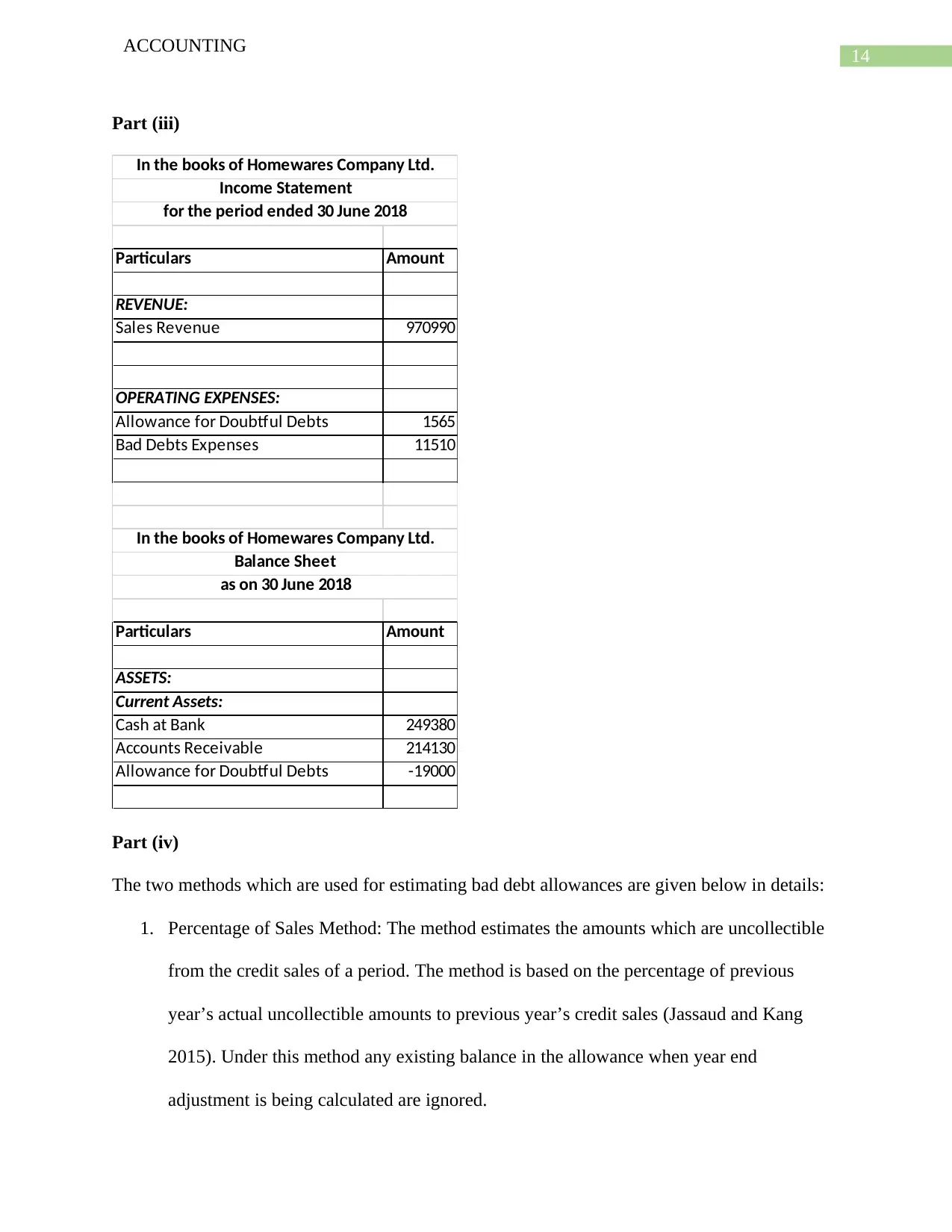

Part (iii)

Particulars Amount

REVENUE:

Sales Revenue 970990

OPERATING EXPENSES:

Allowance for Doubtful Debts 1565

Bad Debts Expenses 11510

Particulars Amount

ASSETS:

Current Assets:

Cash at Bank 249380

Accounts Receivable 214130

Allowance for Doubtful Debts -19000

In the books of Homewares Company Ltd.

Income Statement

for the period ended 30 June 2018

In the books of Homewares Company Ltd.

Balance Sheet

as on 30 June 2018

Part (iv)

The two methods which are used for estimating bad debt allowances are given below in details:

1. Percentage of Sales Method: The method estimates the amounts which are uncollectible

from the credit sales of a period. The method is based on the percentage of previous

year’s actual uncollectible amounts to previous year’s credit sales (Jassaud and Kang

2015). Under this method any existing balance in the allowance when year end

adjustment is being calculated are ignored.

ACCOUNTING

Part (iii)

Particulars Amount

REVENUE:

Sales Revenue 970990

OPERATING EXPENSES:

Allowance for Doubtful Debts 1565

Bad Debts Expenses 11510

Particulars Amount

ASSETS:

Current Assets:

Cash at Bank 249380

Accounts Receivable 214130

Allowance for Doubtful Debts -19000

In the books of Homewares Company Ltd.

Income Statement

for the period ended 30 June 2018

In the books of Homewares Company Ltd.

Balance Sheet

as on 30 June 2018

Part (iv)

The two methods which are used for estimating bad debt allowances are given below in details:

1. Percentage of Sales Method: The method estimates the amounts which are uncollectible

from the credit sales of a period. The method is based on the percentage of previous

year’s actual uncollectible amounts to previous year’s credit sales (Jassaud and Kang

2015). Under this method any existing balance in the allowance when year end

adjustment is being calculated are ignored.

15

ACCOUNTING

2. Percentage of Receivables Method: In this method an estimation is made in order to

determine the desired size of allowance for uncollectible accounts. it is basically the

expenses which the business expects to incur in terms of percentage. This the mostly used

technique where allowance of doubtful debts are shown and in contra entry effect the

amount is deducted from account receivables.

Question 5

Requirement A

Part (i)

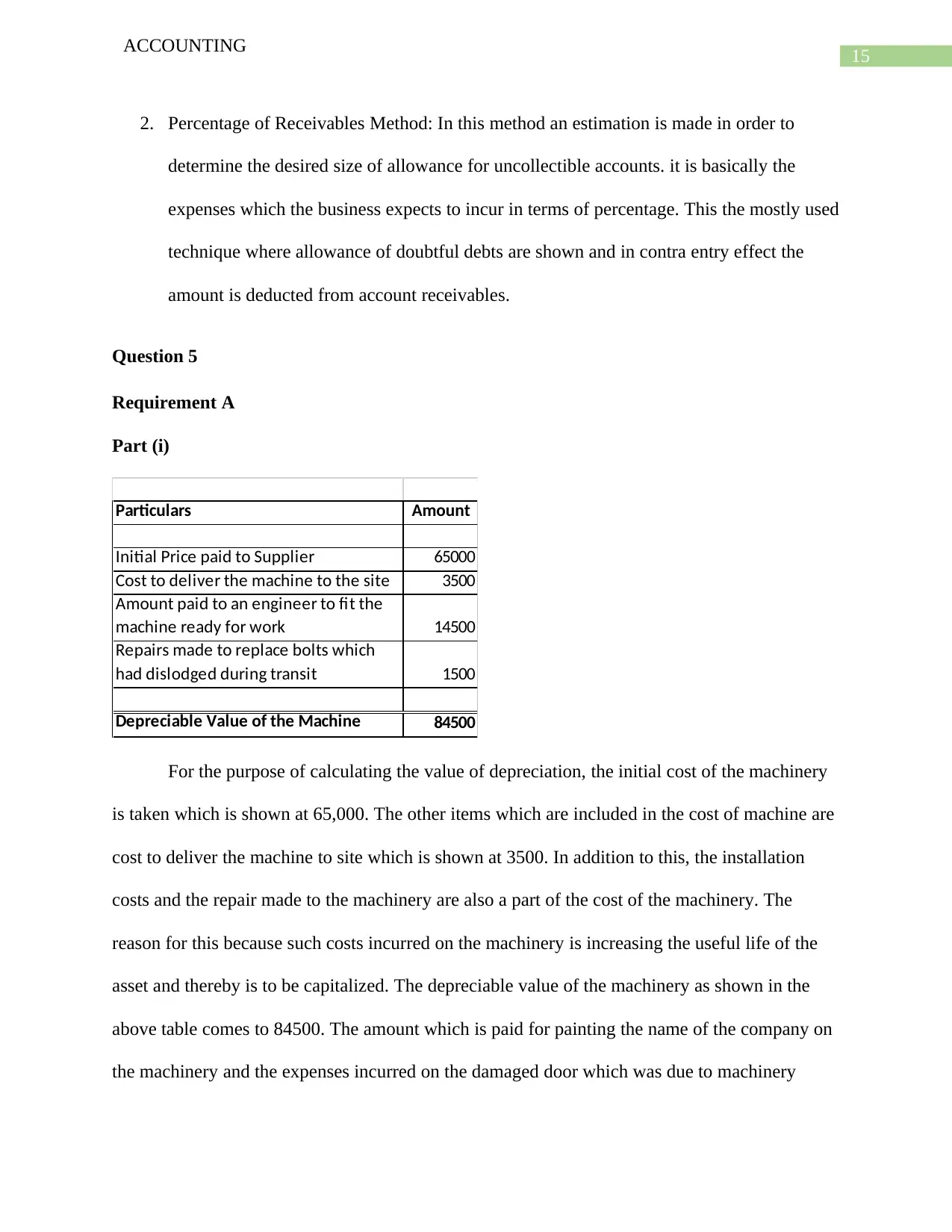

Particulars Amount

Initial Price paid to Supplier 65000

Cost to deliver the machine to the site 3500

Amount paid to an engineer to fit the

machine ready for work 14500

Repairs made to replace bolts which

had dislodged during transit 1500

Depreciable Value of the Machine 84500

For the purpose of calculating the value of depreciation, the initial cost of the machinery

is taken which is shown at 65,000. The other items which are included in the cost of machine are

cost to deliver the machine to site which is shown at 3500. In addition to this, the installation

costs and the repair made to the machinery are also a part of the cost of the machinery. The

reason for this because such costs incurred on the machinery is increasing the useful life of the

asset and thereby is to be capitalized. The depreciable value of the machinery as shown in the

above table comes to 84500. The amount which is paid for painting the name of the company on

the machinery and the expenses incurred on the damaged door which was due to machinery

ACCOUNTING

2. Percentage of Receivables Method: In this method an estimation is made in order to

determine the desired size of allowance for uncollectible accounts. it is basically the

expenses which the business expects to incur in terms of percentage. This the mostly used

technique where allowance of doubtful debts are shown and in contra entry effect the

amount is deducted from account receivables.

Question 5

Requirement A

Part (i)

Particulars Amount

Initial Price paid to Supplier 65000

Cost to deliver the machine to the site 3500

Amount paid to an engineer to fit the

machine ready for work 14500

Repairs made to replace bolts which

had dislodged during transit 1500

Depreciable Value of the Machine 84500

For the purpose of calculating the value of depreciation, the initial cost of the machinery

is taken which is shown at 65,000. The other items which are included in the cost of machine are

cost to deliver the machine to site which is shown at 3500. In addition to this, the installation

costs and the repair made to the machinery are also a part of the cost of the machinery. The

reason for this because such costs incurred on the machinery is increasing the useful life of the

asset and thereby is to be capitalized. The depreciable value of the machinery as shown in the

above table comes to 84500. The amount which is paid for painting the name of the company on

the machinery and the expenses incurred on the damaged door which was due to machinery

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

ACCOUNTING

entering the factory will not be considered as a part of the cost of the machinery as such expenses

does not increasing the useful life of the machine or adds any value to the machinery.

Part (ii)

The two most popular methods which are used for the purpose of calculating the

depreciation are Straight line method and Diminishing value method. In case of straight line

method of depreciation, a fixed amount is charged as depreciation. In the case of Diminishing

value method, depreciation is charged on the value of the asset and is on the basis of certain rate

of depreciation. The amount which is charged as depreciation is changing and variable in nature

(Del Giudice, Manganelli and De Paola 2016).

In the case of straight line method, the net profit will be deducted by the same amount of

depreciation and the amount under this method remains fixed. If the company uses Diminishing

value method then the amount of depreciation charged by the company diminishes with every

year. The profit in case of diminishing value method will be more in comparison to straight line

method of depreciation.

Part (iii)

The revaluation of assets is done when the market value of the assets is more than the

historical cost of the asset. The asset’s value can either be appreciated or depreciated depending

on the type of revaluation which is the company is planning on the assets (Tabari and Adi 2014).

Normally in any business assets are recorded on the basis of historical costs. The market value of

the assets is always fluctuating and therefore there is a high probability that the market value of

the asset will be more than the historical cost of the assets. Therefore, it is up to the choice of the

management whether to value the asset at historical cost or revalue the asset and show the same

at revalued cost. The revaluation of the asset allows the companies to ensure that the asset value

ACCOUNTING

entering the factory will not be considered as a part of the cost of the machinery as such expenses

does not increasing the useful life of the machine or adds any value to the machinery.

Part (ii)

The two most popular methods which are used for the purpose of calculating the

depreciation are Straight line method and Diminishing value method. In case of straight line

method of depreciation, a fixed amount is charged as depreciation. In the case of Diminishing

value method, depreciation is charged on the value of the asset and is on the basis of certain rate

of depreciation. The amount which is charged as depreciation is changing and variable in nature

(Del Giudice, Manganelli and De Paola 2016).

In the case of straight line method, the net profit will be deducted by the same amount of

depreciation and the amount under this method remains fixed. If the company uses Diminishing

value method then the amount of depreciation charged by the company diminishes with every

year. The profit in case of diminishing value method will be more in comparison to straight line

method of depreciation.

Part (iii)

The revaluation of assets is done when the market value of the assets is more than the

historical cost of the asset. The asset’s value can either be appreciated or depreciated depending

on the type of revaluation which is the company is planning on the assets (Tabari and Adi 2014).

Normally in any business assets are recorded on the basis of historical costs. The market value of

the assets is always fluctuating and therefore there is a high probability that the market value of

the asset will be more than the historical cost of the assets. Therefore, it is up to the choice of the

management whether to value the asset at historical cost or revalue the asset and show the same

at revalued cost. The revaluation of the asset allows the companies to ensure that the asset value

17

ACCOUNTING

is up to date with the market value of the asset. It is also to be remembered that the method of

revaluation allows both upward and downward revaluation which is appreciation of the assets as

well as depreciation of the assets.

ACCOUNTING

is up to date with the market value of the asset. It is also to be remembered that the method of

revaluation allows both upward and downward revaluation which is appreciation of the assets as

well as depreciation of the assets.

18

ACCOUNTING

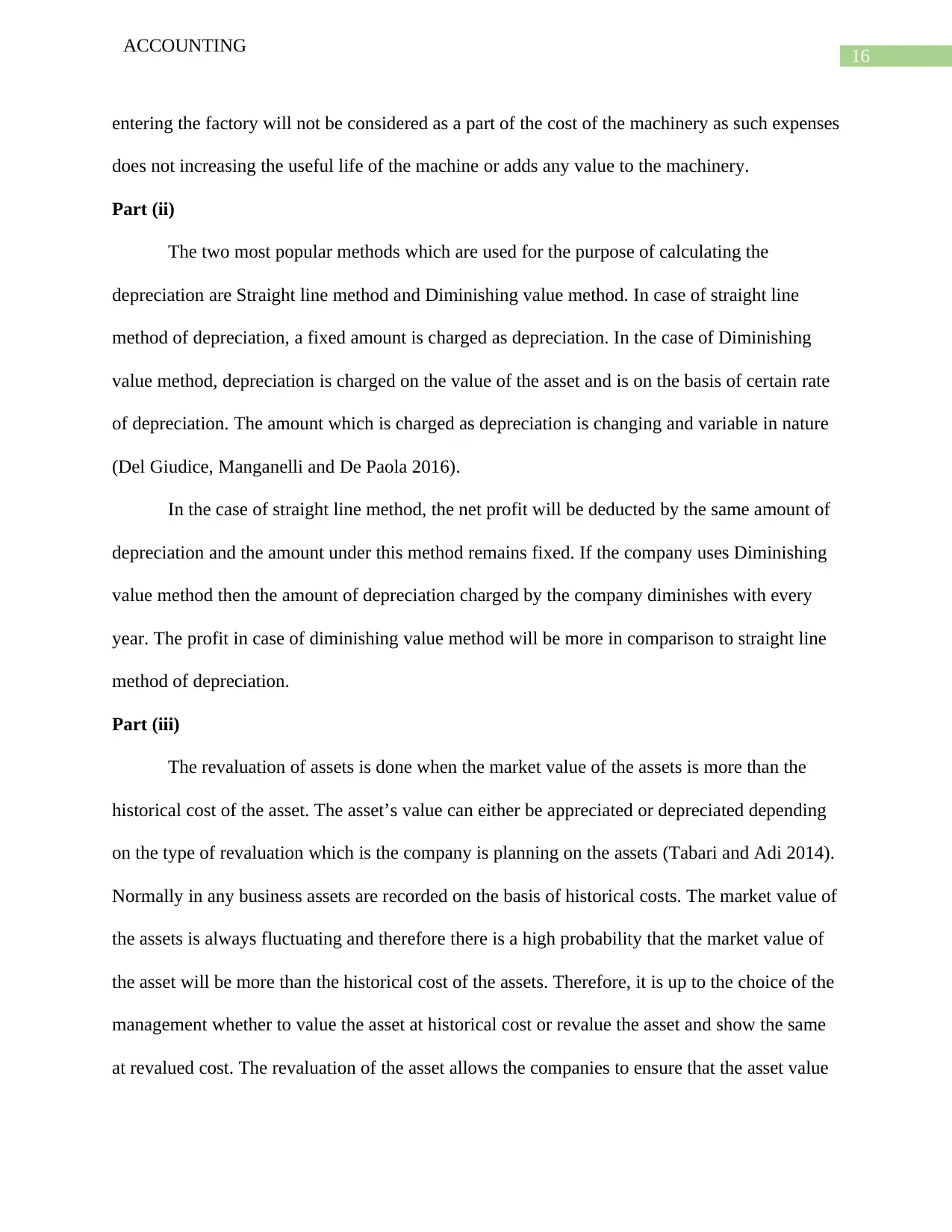

Requirement B – Journal Entries

Dr. Cr.

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $27,000

To, Accum Dep. - Truck 2 A/c. $27,000

Profit & Loss A/c. Dr. $27,000

To, Depreciation Expenses A/c. $27,000

30-06-2016 Depreciation Expenses A/c. Dr. $20,250

To, Accum Dep. - Truck 2 A/c. $20,250

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $27,250

To, Depreciation Expenses A/c. $20,250

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $15,188

To, Accum Dep. - Truck 2 A/c. $15,188

Profit & Loss A/c. Dr. $15,188

To, Depreciation Expenses A/c. $15,188

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $8,543

To, Accum Dep. - Truck 2 A/c. $8,543

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $70,980

Loss on Sale of Assets A/c. Dr. $33,020

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $45,463

To, Depreciation Expenses A/c. $12,443

To, Loss on Sale of Assets A/c. $33,020

Particulars

ACCOUNTING

Requirement B – Journal Entries

Dr. Cr.

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $27,000

To, Accum Dep. - Truck 2 A/c. $27,000

Profit & Loss A/c. Dr. $27,000

To, Depreciation Expenses A/c. $27,000

30-06-2016 Depreciation Expenses A/c. Dr. $20,250

To, Accum Dep. - Truck 2 A/c. $20,250

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $27,250

To, Depreciation Expenses A/c. $20,250

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $15,188

To, Accum Dep. - Truck 2 A/c. $15,188

Profit & Loss A/c. Dr. $15,188

To, Depreciation Expenses A/c. $15,188

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $8,543

To, Accum Dep. - Truck 2 A/c. $8,543

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $70,980

Loss on Sale of Assets A/c. Dr. $33,020

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $45,463

To, Depreciation Expenses A/c. $12,443

To, Loss on Sale of Assets A/c. $33,020

Particulars

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

ACCOUNTING

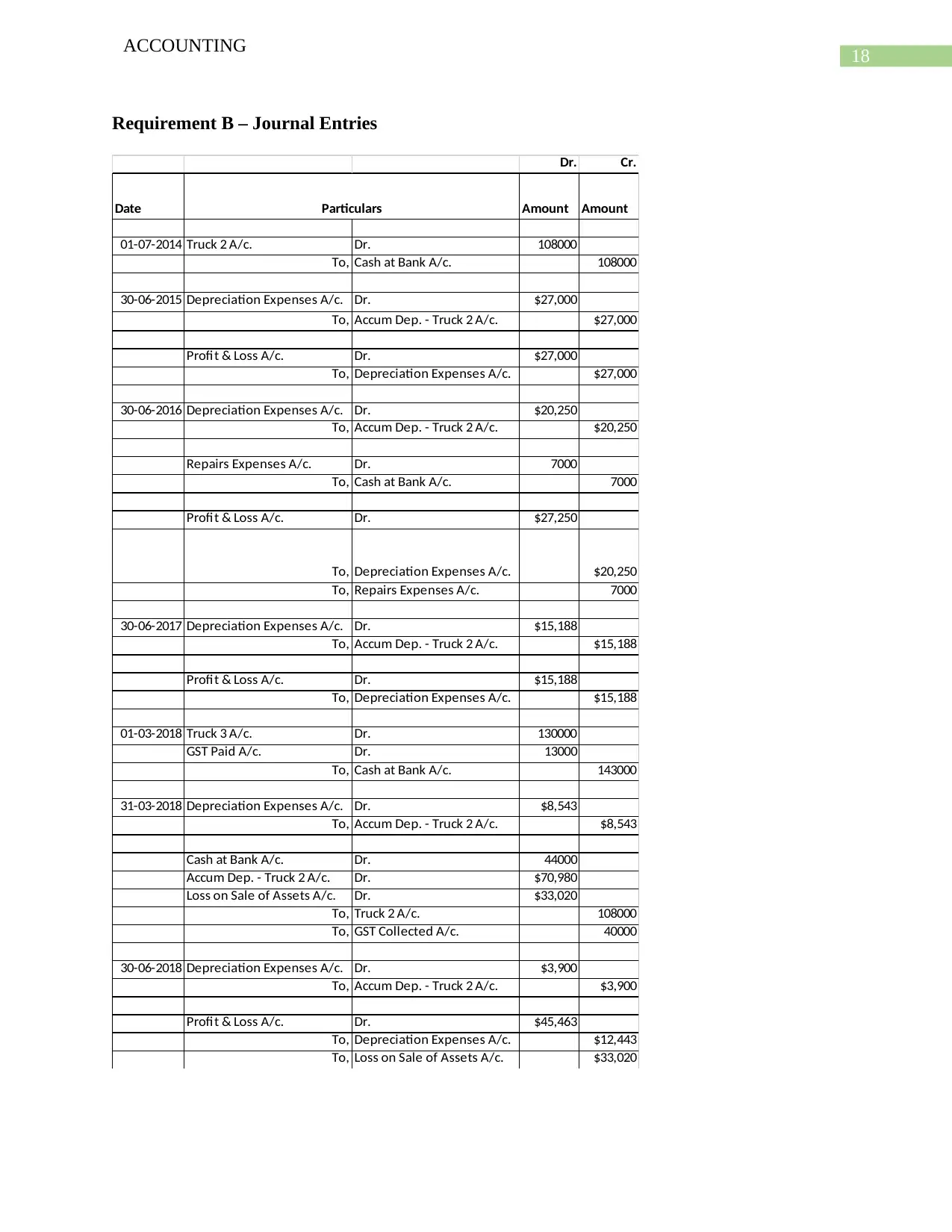

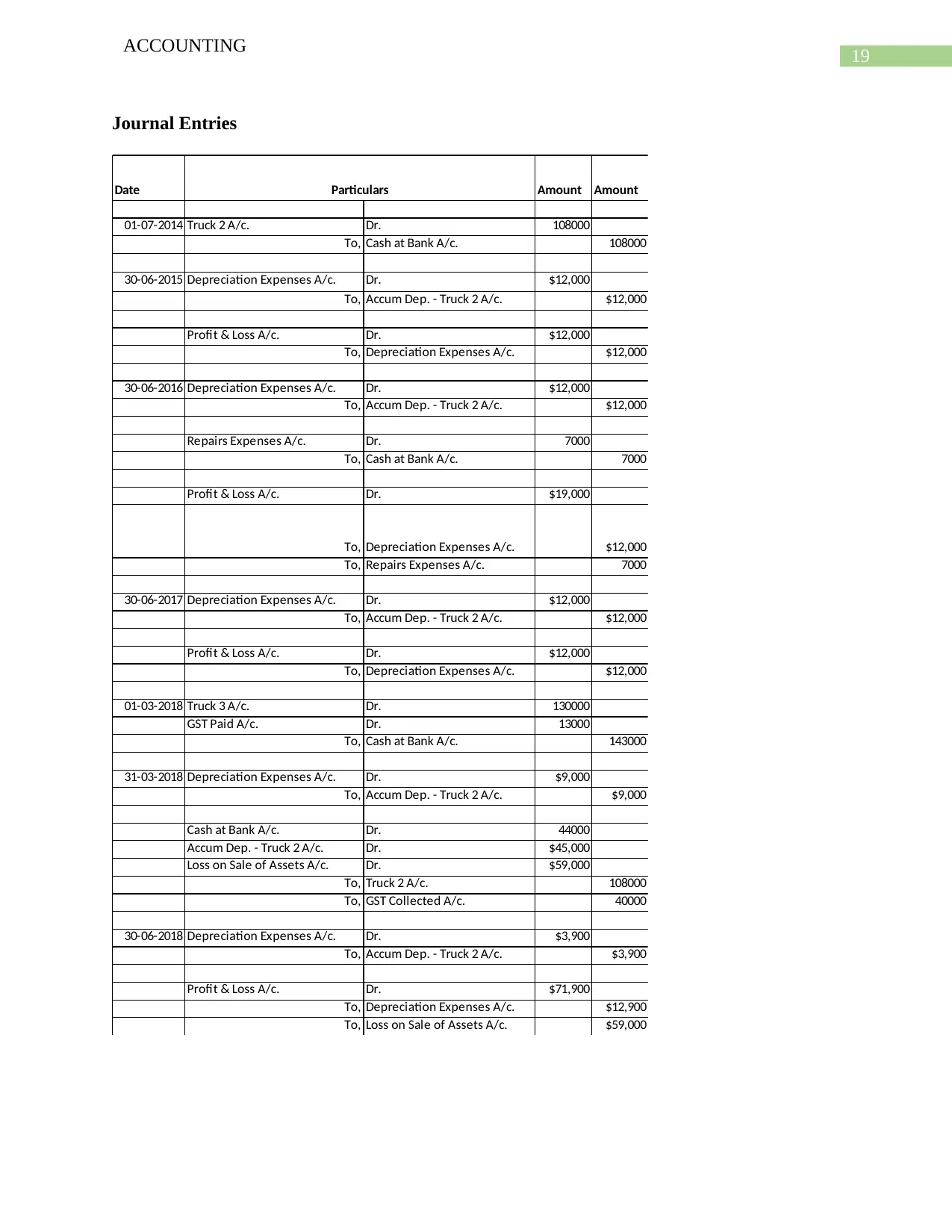

Journal Entries

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

30-06-2016 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $19,000

To, Depreciation Expenses A/c. $12,000

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $9,000

To, Accum Dep. - Truck 2 A/c. $9,000

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $45,000

Loss on Sale of Assets A/c. Dr. $59,000

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $71,900

To, Depreciation Expenses A/c. $12,900

To, Loss on Sale of Assets A/c. $59,000

Particulars

ACCOUNTING

Journal Entries

Date Amount Amount

01-07-2014 Truck 2 A/c. Dr. 108000

To, Cash at Bank A/c. 108000

30-06-2015 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

30-06-2016 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Repairs Expenses A/c. Dr. 7000

To, Cash at Bank A/c. 7000

Profit & Loss A/c. Dr. $19,000

To, Depreciation Expenses A/c. $12,000

To, Repairs Expenses A/c. 7000

30-06-2017 Depreciation Expenses A/c. Dr. $12,000

To, Accum Dep. - Truck 2 A/c. $12,000

Profit & Loss A/c. Dr. $12,000

To, Depreciation Expenses A/c. $12,000

01-03-2018 Truck 3 A/c. Dr. 130000

GST Paid A/c. Dr. 13000

To, Cash at Bank A/c. 143000

31-03-2018 Depreciation Expenses A/c. Dr. $9,000

To, Accum Dep. - Truck 2 A/c. $9,000

Cash at Bank A/c. Dr. 44000

Accum Dep. - Truck 2 A/c. Dr. $45,000

Loss on Sale of Assets A/c. Dr. $59,000

To, Truck 2 A/c. 108000

To, GST Collected A/c. 40000

30-06-2018 Depreciation Expenses A/c. Dr. $3,900

To, Accum Dep. - Truck 2 A/c. $3,900

Profit & Loss A/c. Dr. $71,900

To, Depreciation Expenses A/c. $12,900

To, Loss on Sale of Assets A/c. $59,000

Particulars

20

ACCOUNTING

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

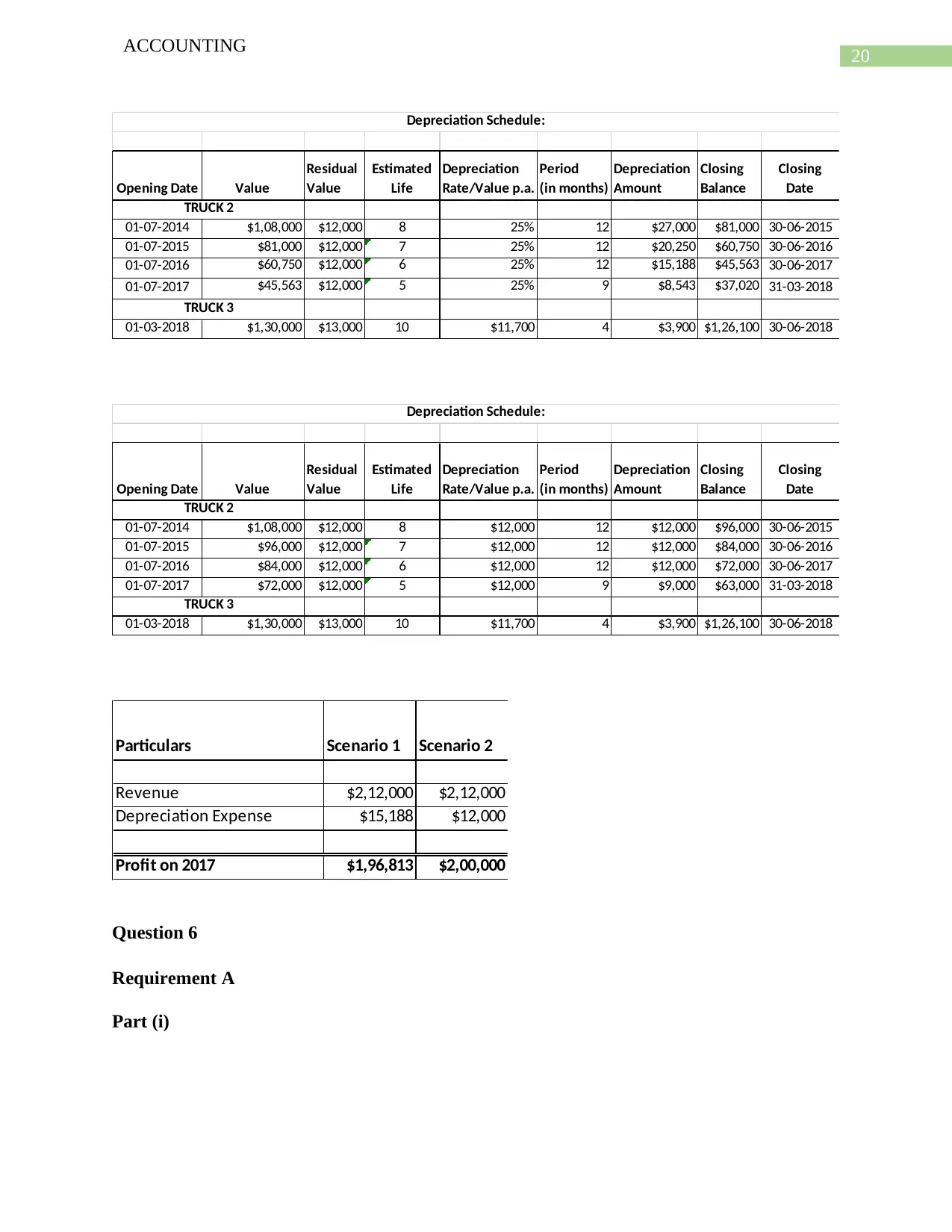

01-07-2014 $1,08,000 $12,000 8 25% 12 $27,000 $81,000 30-06-2015

01-07-2015 $81,000 $12,000 7 25% 12 $20,250 $60,750 30-06-2016

01-07-2016 $60,750 $12,000 6 25% 12 $15,188 $45,563 30-06-2017

01-07-2017 $45,563 $12,000 5 25% 9 $8,543 $37,020 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 $12,000 12 $12,000 $96,000 30-06-2015

01-07-2015 $96,000 $12,000 7 $12,000 12 $12,000 $84,000 30-06-2016

01-07-2016 $84,000 $12,000 6 $12,000 12 $12,000 $72,000 30-06-2017

01-07-2017 $72,000 $12,000 5 $12,000 9 $9,000 $63,000 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Particulars Scenario 1 Scenario 2

Revenue $2,12,000 $2,12,000

Depreciation Expense $15,188 $12,000

Profit on 2017 $1,96,813 $2,00,000

Question 6

Requirement A

Part (i)

ACCOUNTING

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 25% 12 $27,000 $81,000 30-06-2015

01-07-2015 $81,000 $12,000 7 25% 12 $20,250 $60,750 30-06-2016

01-07-2016 $60,750 $12,000 6 25% 12 $15,188 $45,563 30-06-2017

01-07-2017 $45,563 $12,000 5 25% 9 $8,543 $37,020 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Opening Date Value

Residual

Value

Estimated

Life

Depreciation

Rate/Value p.a.

Period

(in months)

Depreciation

Amount

Closing

Balance

Closing

Date

01-07-2014 $1,08,000 $12,000 8 $12,000 12 $12,000 $96,000 30-06-2015

01-07-2015 $96,000 $12,000 7 $12,000 12 $12,000 $84,000 30-06-2016

01-07-2016 $84,000 $12,000 6 $12,000 12 $12,000 $72,000 30-06-2017

01-07-2017 $72,000 $12,000 5 $12,000 9 $9,000 $63,000 31-03-2018

01-03-2018 $1,30,000 $13,000 10 $11,700 4 $3,900 $1,26,100 30-06-2018

Depreciation Schedule:

TRUCK 2

TRUCK 3

Particulars Scenario 1 Scenario 2

Revenue $2,12,000 $2,12,000

Depreciation Expense $15,188 $12,000

Profit on 2017 $1,96,813 $2,00,000

Question 6

Requirement A

Part (i)

21

ACCOUNTING

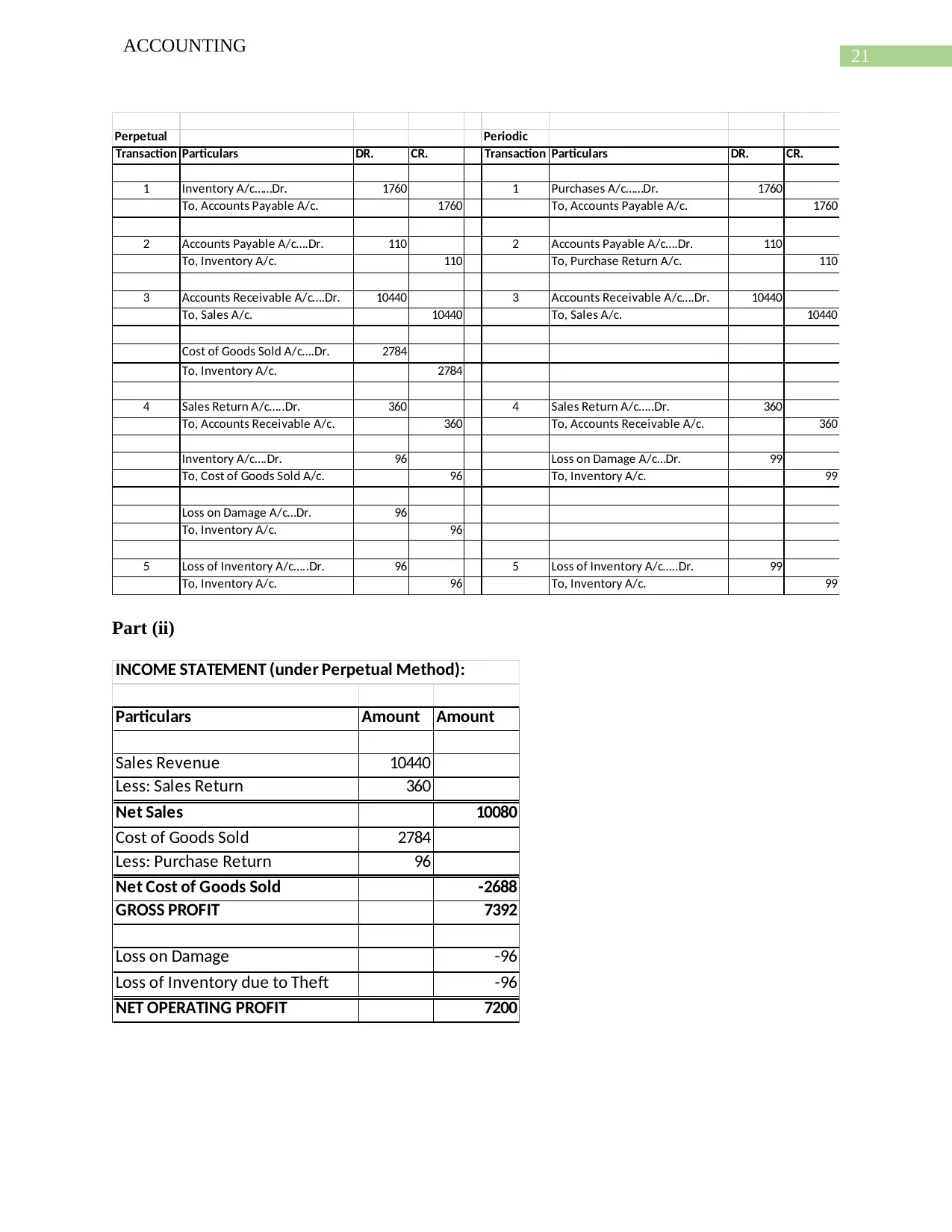

Perpetual Periodic

Transaction Particulars DR. CR. Transaction Particulars DR. CR.

1 Inventory A/c……Dr. 1760 1 Purchases A/c……Dr. 1760

To, Accounts Payable A/c. 1760 To, Accounts Payable A/c. 1760

2 Accounts Payable A/c….Dr. 110 2 Accounts Payable A/c….Dr. 110

To, Inventory A/c. 110 To, Purchase Return A/c. 110

3 Accounts Receivable A/c….Dr. 10440 3 Accounts Receivable A/c….Dr. 10440

To, Sales A/c. 10440 To, Sales A/c. 10440

Cost of Goods Sold A/c….Dr. 2784

To, Inventory A/c. 2784

4 Sales Return A/c…..Dr. 360 4 Sales Return A/c…..Dr. 360

To, Accounts Receivable A/c. 360 To, Accounts Receivable A/c. 360

Inventory A/c….Dr. 96 Loss on Damage A/c…Dr. 99

To, Cost of Goods Sold A/c. 96 To, Inventory A/c. 99

Loss on Damage A/c…Dr. 96

To, Inventory A/c. 96

5 Loss of Inventory A/c…..Dr. 96 5 Loss of Inventory A/c…..Dr. 99

To, Inventory A/c. 96 To, Inventory A/c. 99

Part (ii)

INCOME STATEMENT (under Perpetual Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Cost of Goods Sold 2784

Less: Purchase Return 96

Net Cost of Goods Sold -2688

GROSS PROFIT 7392

Loss on Damage -96

Loss of Inventory due to Theft -96

NET OPERATING PROFIT 7200

ACCOUNTING

Perpetual Periodic

Transaction Particulars DR. CR. Transaction Particulars DR. CR.

1 Inventory A/c……Dr. 1760 1 Purchases A/c……Dr. 1760

To, Accounts Payable A/c. 1760 To, Accounts Payable A/c. 1760

2 Accounts Payable A/c….Dr. 110 2 Accounts Payable A/c….Dr. 110

To, Inventory A/c. 110 To, Purchase Return A/c. 110

3 Accounts Receivable A/c….Dr. 10440 3 Accounts Receivable A/c….Dr. 10440

To, Sales A/c. 10440 To, Sales A/c. 10440

Cost of Goods Sold A/c….Dr. 2784

To, Inventory A/c. 2784

4 Sales Return A/c…..Dr. 360 4 Sales Return A/c…..Dr. 360

To, Accounts Receivable A/c. 360 To, Accounts Receivable A/c. 360

Inventory A/c….Dr. 96 Loss on Damage A/c…Dr. 99

To, Cost of Goods Sold A/c. 96 To, Inventory A/c. 99

Loss on Damage A/c…Dr. 96

To, Inventory A/c. 96

5 Loss of Inventory A/c…..Dr. 96 5 Loss of Inventory A/c…..Dr. 99

To, Inventory A/c. 96 To, Inventory A/c. 99

Part (ii)

INCOME STATEMENT (under Perpetual Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Cost of Goods Sold 2784

Less: Purchase Return 96

Net Cost of Goods Sold -2688

GROSS PROFIT 7392

Loss on Damage -96

Loss of Inventory due to Theft -96

NET OPERATING PROFIT 7200

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22

ACCOUNTING

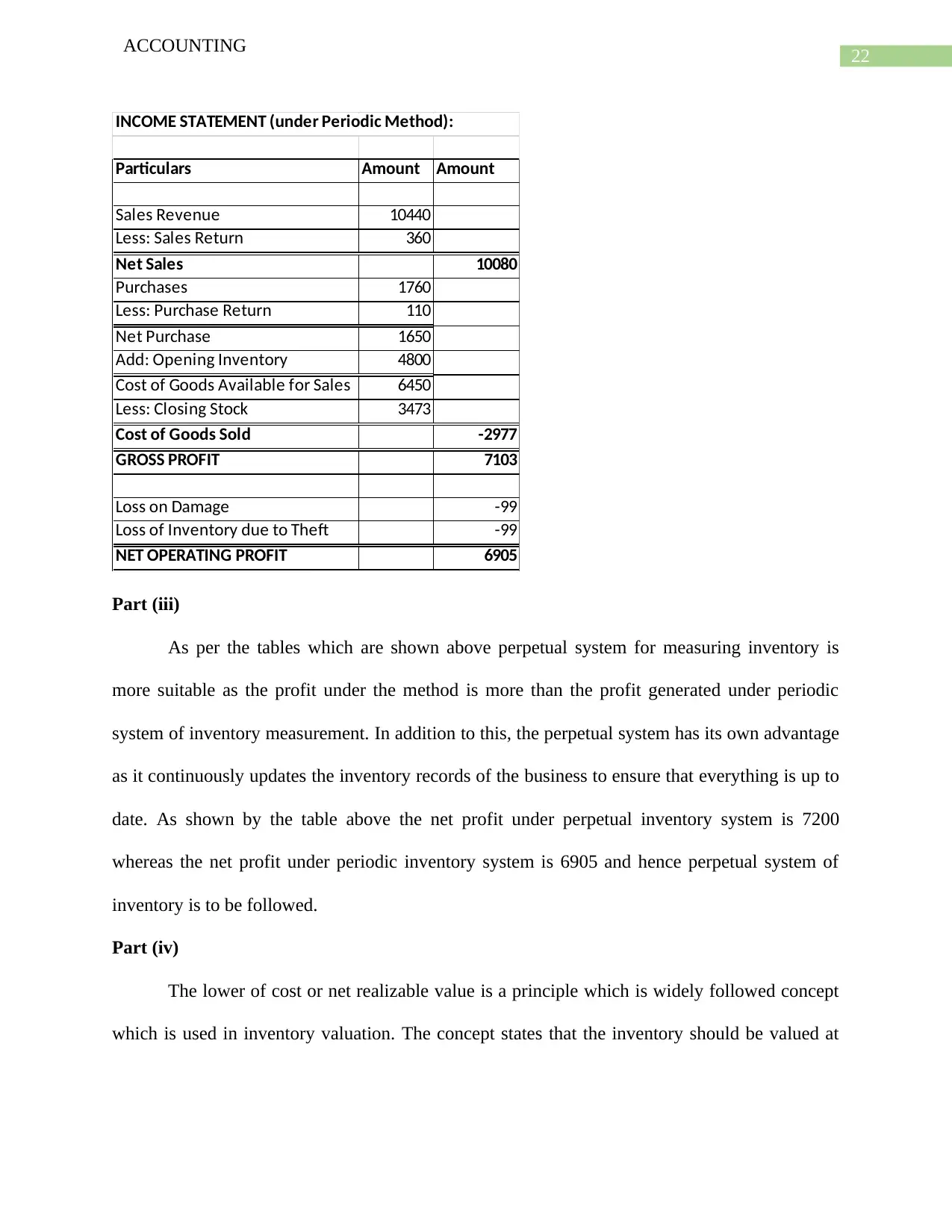

INCOME STATEMENT (under Periodic Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Purchases 1760

Less: Purchase Return 110

Net Purchase 1650

Add: Opening Inventory 4800

Cost of Goods Available for Sales 6450

Less: Closing Stock 3473

Cost of Goods Sold -2977

GROSS PROFIT 7103

Loss on Damage -99

Loss of Inventory due to Theft -99

NET OPERATING PROFIT 6905

Part (iii)

As per the tables which are shown above perpetual system for measuring inventory is

more suitable as the profit under the method is more than the profit generated under periodic

system of inventory measurement. In addition to this, the perpetual system has its own advantage

as it continuously updates the inventory records of the business to ensure that everything is up to

date. As shown by the table above the net profit under perpetual inventory system is 7200

whereas the net profit under periodic inventory system is 6905 and hence perpetual system of

inventory is to be followed.

Part (iv)

The lower of cost or net realizable value is a principle which is widely followed concept

which is used in inventory valuation. The concept states that the inventory should be valued at

ACCOUNTING

INCOME STATEMENT (under Periodic Method):

Particulars Amount Amount

Sales Revenue 10440

Less: Sales Return 360

Net Sales 10080

Purchases 1760

Less: Purchase Return 110

Net Purchase 1650

Add: Opening Inventory 4800

Cost of Goods Available for Sales 6450

Less: Closing Stock 3473

Cost of Goods Sold -2977

GROSS PROFIT 7103

Loss on Damage -99

Loss of Inventory due to Theft -99

NET OPERATING PROFIT 6905

Part (iii)

As per the tables which are shown above perpetual system for measuring inventory is

more suitable as the profit under the method is more than the profit generated under periodic

system of inventory measurement. In addition to this, the perpetual system has its own advantage

as it continuously updates the inventory records of the business to ensure that everything is up to

date. As shown by the table above the net profit under perpetual inventory system is 7200

whereas the net profit under periodic inventory system is 6905 and hence perpetual system of

inventory is to be followed.

Part (iv)

The lower of cost or net realizable value is a principle which is widely followed concept

which is used in inventory valuation. The concept states that the inventory should be valued at

23

ACCOUNTING

cost or net realizable value of the inventory which ever is lower. Net realizable value means the

value at which the inventory is expected to be sold.

Requirement B

Part (i)

a. The revenues of the company are recognized at fair value of the consideration received or

receivable. The revenues of the business are recognized following accrual basis of

accounting which allows business to recognize revenues as and when the transaction take

place.

b. The inventories of the company were recognized on lower of cost and net realizable value

based on the rolling average selling price of the business. The inventory of the company

has a stock loss provision as identified in key audit matters.

c. Depreciation amount of the company is calculated on the basis of straight line method of

depreciation as mentioned in the notes to accounts of the company. The amount of

depreciation was reported as accumulated depreciation and the notes to accounts shows

the break-up of accumulated depreciation.

Part (ii)

The company has made a sustainability report which shows that the company has shown

in the financial statements and the company has won Climate Leadership Award and has the title

of the most profitable business in carbon reduction activity.

The company is committed to making the working environment as efficient as possible in

global supply chain and also ensure that the products which are provided by the company qre of

ethical in nature and sustainable. An ethical sourcing policy was implemented in 2017 across the

group.

ACCOUNTING

cost or net realizable value of the inventory which ever is lower. Net realizable value means the

value at which the inventory is expected to be sold.

Requirement B

Part (i)

a. The revenues of the company are recognized at fair value of the consideration received or

receivable. The revenues of the business are recognized following accrual basis of

accounting which allows business to recognize revenues as and when the transaction take

place.

b. The inventories of the company were recognized on lower of cost and net realizable value

based on the rolling average selling price of the business. The inventory of the company

has a stock loss provision as identified in key audit matters.

c. Depreciation amount of the company is calculated on the basis of straight line method of

depreciation as mentioned in the notes to accounts of the company. The amount of

depreciation was reported as accumulated depreciation and the notes to accounts shows

the break-up of accumulated depreciation.

Part (ii)

The company has made a sustainability report which shows that the company has shown

in the financial statements and the company has won Climate Leadership Award and has the title

of the most profitable business in carbon reduction activity.

The company is committed to making the working environment as efficient as possible in

global supply chain and also ensure that the products which are provided by the company qre of

ethical in nature and sustainable. An ethical sourcing policy was implemented in 2017 across the

group.

24

ACCOUNTING

Reference

Del Giudice, V., Manganelli, B. and De Paola, P., 2016, July. Depreciation methods for firm’s

assets. In International Conference on Computational Science and Its Applications(pp. 214-227).

Springer, Cham.

Hope, O.K., Thomas, W.B. and Vyas, D., 2013. Financial reporting quality of US private and

public firms. The Accounting Review, 88(5), pp.1715-1742.

Jassaud, N. and Kang, M.K., 2015. A strategy for developing a market for nonperforming loans

in Italy (No. 15-24). International Monetary Fund.

Michalski, G., 2014. Factoring and the firm value.

Needles, B.E., Powers, M. and Crosson, S.V., 2013. Principles of accounting. Cengage

Learning.

Shipman, J.E., Swanquist, Q.T. and Whited, R.L., 2016. Propensity score matching in accounting

research. The Accounting Review, 92(1), pp.213-244.

Tabari, N.Y. and Adi, M., 2014. Factors Affecting the Decision to Revaluation of Assets in

Listed Companies of Tehran Stock Exchange (TSE). International Journal of Scientific

Management and Development, 2(8).

Weil, R.L., Schipper, K. and Francis, J., 2013. Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

ACCOUNTING

Reference

Del Giudice, V., Manganelli, B. and De Paola, P., 2016, July. Depreciation methods for firm’s

assets. In International Conference on Computational Science and Its Applications(pp. 214-227).

Springer, Cham.

Hope, O.K., Thomas, W.B. and Vyas, D., 2013. Financial reporting quality of US private and

public firms. The Accounting Review, 88(5), pp.1715-1742.

Jassaud, N. and Kang, M.K., 2015. A strategy for developing a market for nonperforming loans

in Italy (No. 15-24). International Monetary Fund.

Michalski, G., 2014. Factoring and the firm value.

Needles, B.E., Powers, M. and Crosson, S.V., 2013. Principles of accounting. Cengage

Learning.

Shipman, J.E., Swanquist, Q.T. and Whited, R.L., 2016. Propensity score matching in accounting

research. The Accounting Review, 92(1), pp.213-244.

Tabari, N.Y. and Adi, M., 2014. Factors Affecting the Decision to Revaluation of Assets in

Listed Companies of Tehran Stock Exchange (TSE). International Journal of Scientific

Management and Development, 2(8).

Weil, R.L., Schipper, K. and Francis, J., 2013. Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.