Financial Statements Analysis Example

VerifiedAdded on 2020/05/11

|35

|2640

|36

AI Summary

This solved assignment presents a detailed example of financial statement analysis. It outlines various accounts like Bank Loan, Share Capital, Dividends Paid, Retained Earnings, Sales, Cost of Sales, and numerous expenses. The data is presented with opening balances and closing balances, allowing for an understanding of the company's financial performance over a specific period.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

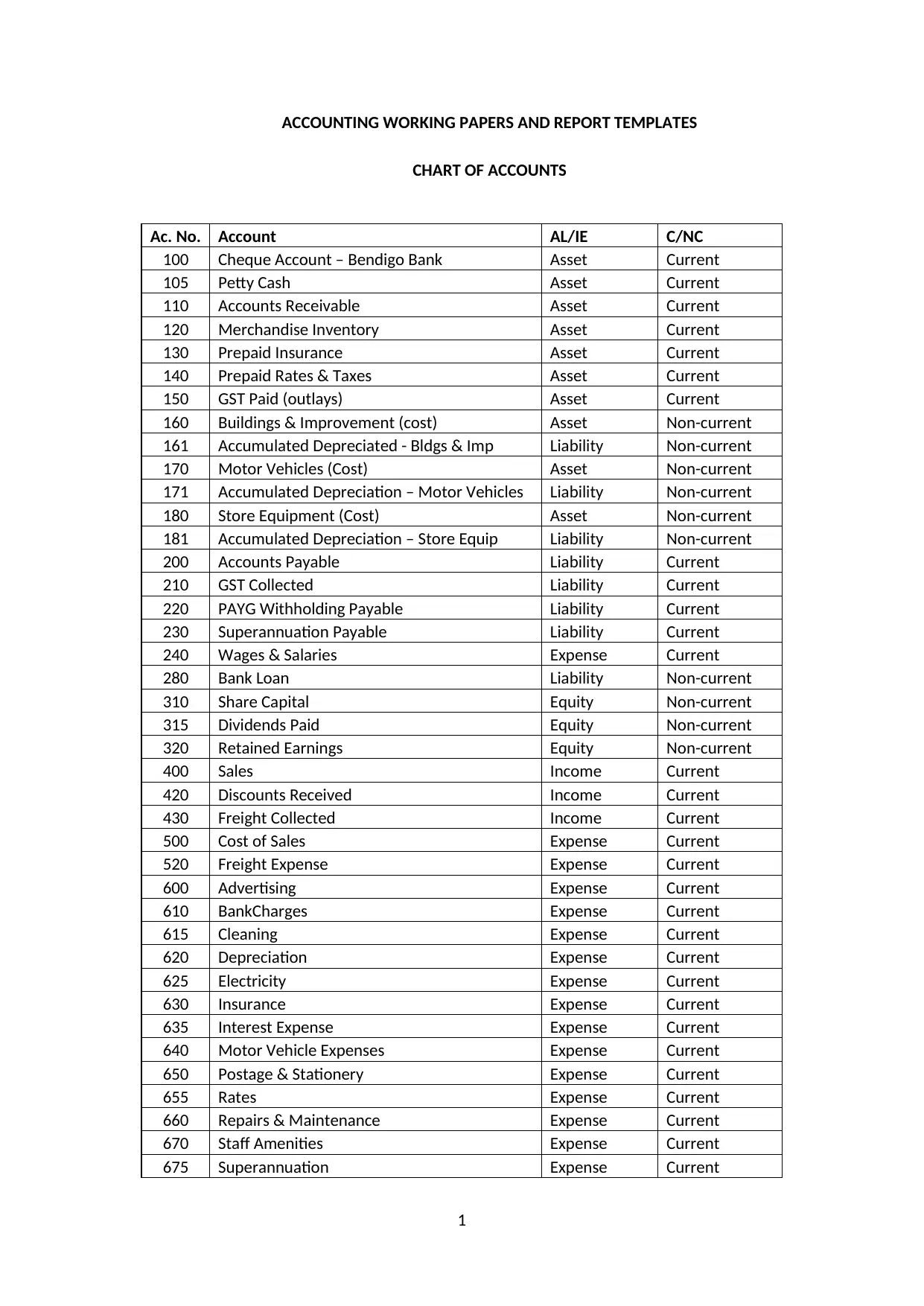

ACCOUNTING WORKING PAPERS AND REPORT TEMPLATES

CHART OF ACCOUNTS

Ac. No. Account AL/IE C/NC

100 Cheque Account – Bendigo Bank Asset Current

105 Petty Cash Asset Current

110 Accounts Receivable Asset Current

120 Merchandise Inventory Asset Current

130 Prepaid Insurance Asset Current

140 Prepaid Rates & Taxes Asset Current

150 GST Paid (outlays) Asset Current

160 Buildings & Improvement (cost) Asset Non-current

161 Accumulated Depreciated - Bldgs & Imp Liability Non-current

170 Motor Vehicles (Cost) Asset Non-current

171 Accumulated Depreciation – Motor Vehicles Liability Non-current

180 Store Equipment (Cost) Asset Non-current

181 Accumulated Depreciation – Store Equip Liability Non-current

200 Accounts Payable Liability Current

210 GST Collected Liability Current

220 PAYG Withholding Payable Liability Current

230 Superannuation Payable Liability Current

240 Wages & Salaries Expense Current

280 Bank Loan Liability Non-current

310 Share Capital Equity Non-current

315 Dividends Paid Equity Non-current

320 Retained Earnings Equity Non-current

400 Sales Income Current

420 Discounts Received Income Current

430 Freight Collected Income Current

500 Cost of Sales Expense Current

520 Freight Expense Expense Current

600 Advertising Expense Current

610 BankCharges Expense Current

615 Cleaning Expense Current

620 Depreciation Expense Current

625 Electricity Expense Current

630 Insurance Expense Current

635 Interest Expense Expense Current

640 Motor Vehicle Expenses Expense Current

650 Postage & Stationery Expense Current

655 Rates Expense Current

660 Repairs & Maintenance Expense Current

670 Staff Amenities Expense Current

675 Superannuation Expense Current

1

CHART OF ACCOUNTS

Ac. No. Account AL/IE C/NC

100 Cheque Account – Bendigo Bank Asset Current

105 Petty Cash Asset Current

110 Accounts Receivable Asset Current

120 Merchandise Inventory Asset Current

130 Prepaid Insurance Asset Current

140 Prepaid Rates & Taxes Asset Current

150 GST Paid (outlays) Asset Current

160 Buildings & Improvement (cost) Asset Non-current

161 Accumulated Depreciated - Bldgs & Imp Liability Non-current

170 Motor Vehicles (Cost) Asset Non-current

171 Accumulated Depreciation – Motor Vehicles Liability Non-current

180 Store Equipment (Cost) Asset Non-current

181 Accumulated Depreciation – Store Equip Liability Non-current

200 Accounts Payable Liability Current

210 GST Collected Liability Current

220 PAYG Withholding Payable Liability Current

230 Superannuation Payable Liability Current

240 Wages & Salaries Expense Current

280 Bank Loan Liability Non-current

310 Share Capital Equity Non-current

315 Dividends Paid Equity Non-current

320 Retained Earnings Equity Non-current

400 Sales Income Current

420 Discounts Received Income Current

430 Freight Collected Income Current

500 Cost of Sales Expense Current

520 Freight Expense Expense Current

600 Advertising Expense Current

610 BankCharges Expense Current

615 Cleaning Expense Current

620 Depreciation Expense Current

625 Electricity Expense Current

630 Insurance Expense Current

635 Interest Expense Expense Current

640 Motor Vehicle Expenses Expense Current

650 Postage & Stationery Expense Current

655 Rates Expense Current

660 Repairs & Maintenance Expense Current

670 Staff Amenities Expense Current

675 Superannuation Expense Current

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

680 Telephone Expense Current

685 Wages & Salaries Expense Current

2

685 Wages & Salaries Expense Current

2

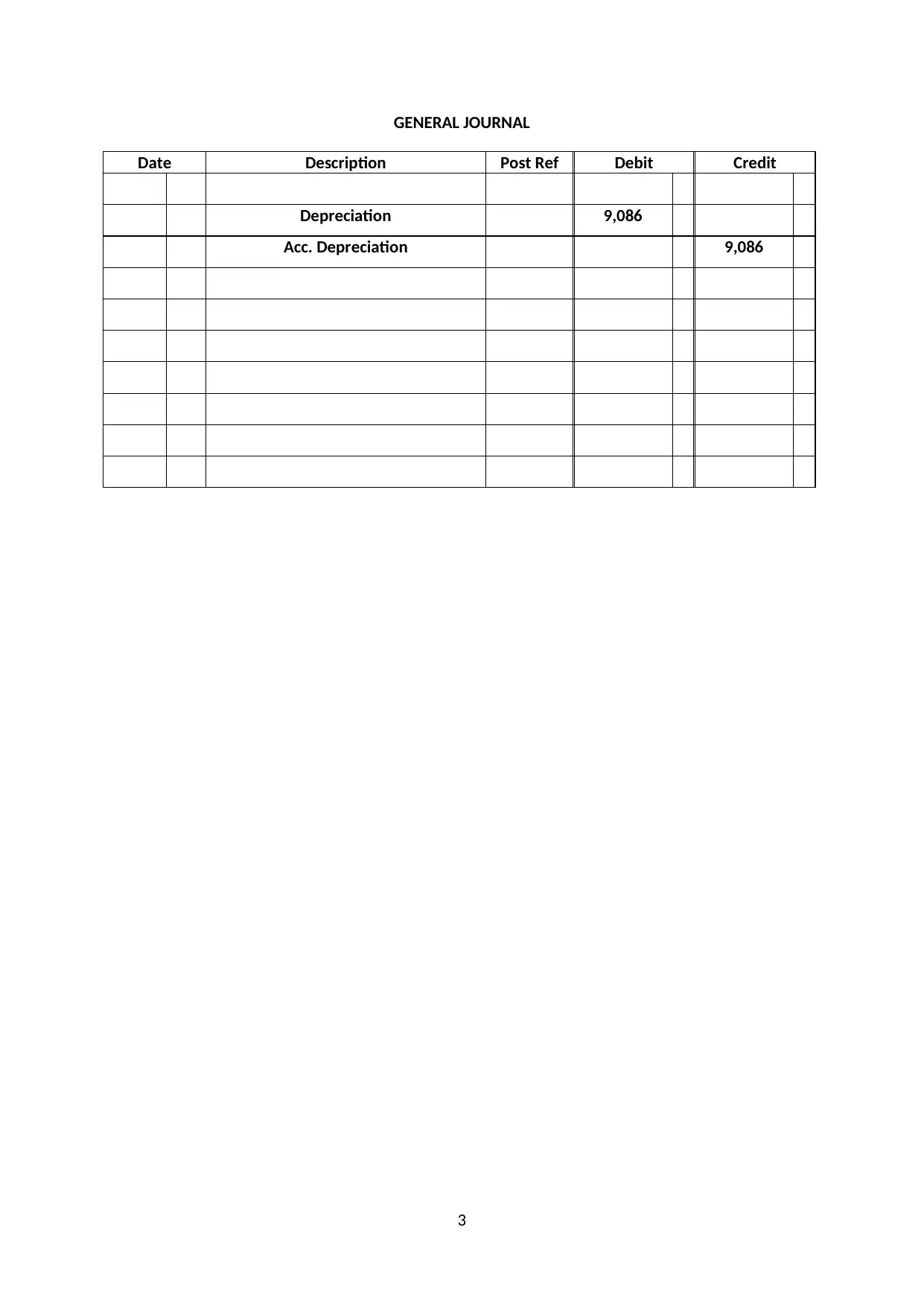

GENERAL JOURNAL

Date Description Post Ref Debit Credit

Depreciation 9,086

Acc. Depreciation 9,086

3

Date Description Post Ref Debit Credit

Depreciation 9,086

Acc. Depreciation 9,086

3

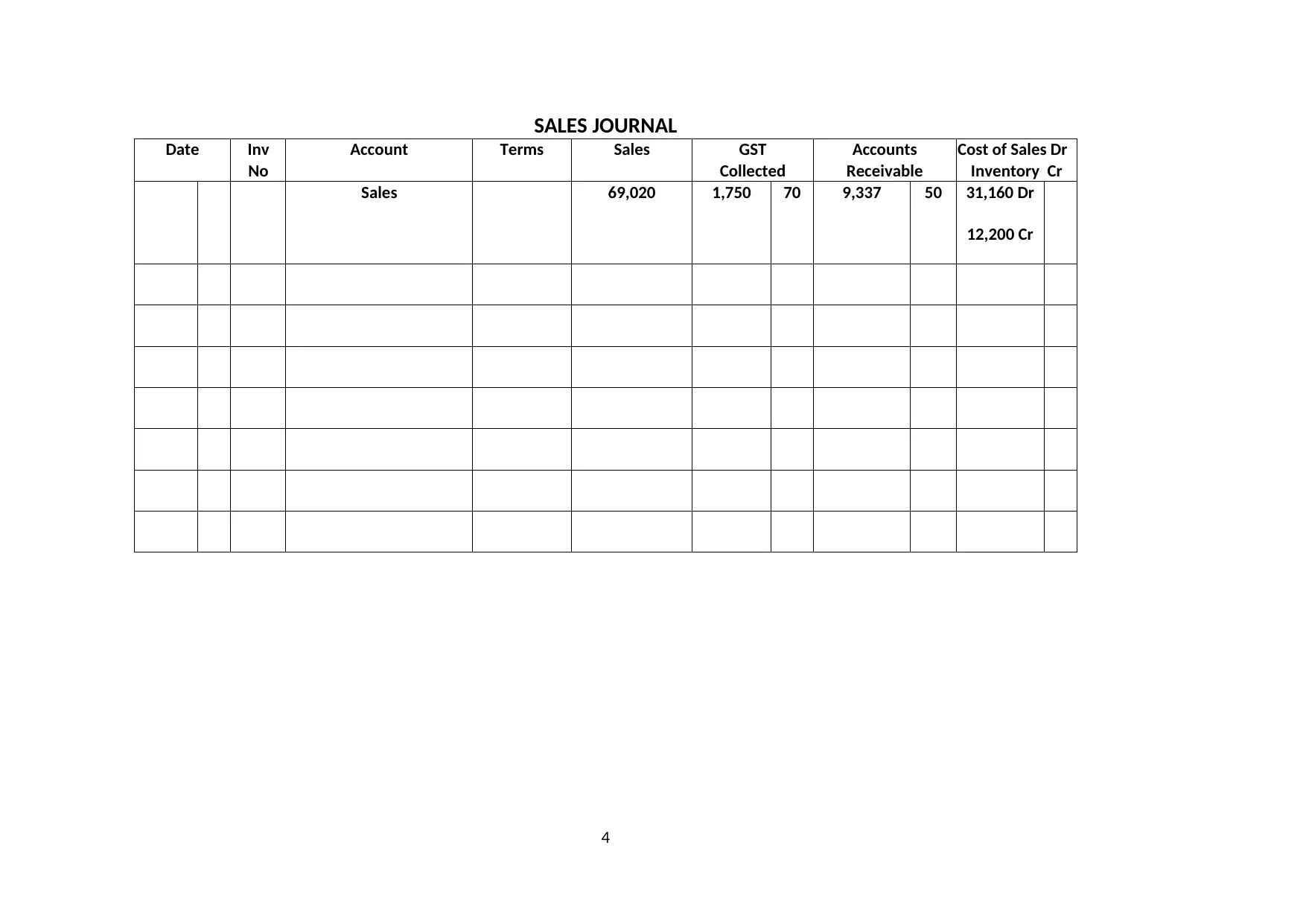

SALES JOURNAL

Date Inv

No

Account Terms Sales GST

Collected

Accounts

Receivable

Cost of Sales Dr

Inventory Cr

Sales 69,020 1,750 70 9,337 50 31,160 Dr

12,200 Cr

4

Date Inv

No

Account Terms Sales GST

Collected

Accounts

Receivable

Cost of Sales Dr

Inventory Cr

Sales 69,020 1,750 70 9,337 50 31,160 Dr

12,200 Cr

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

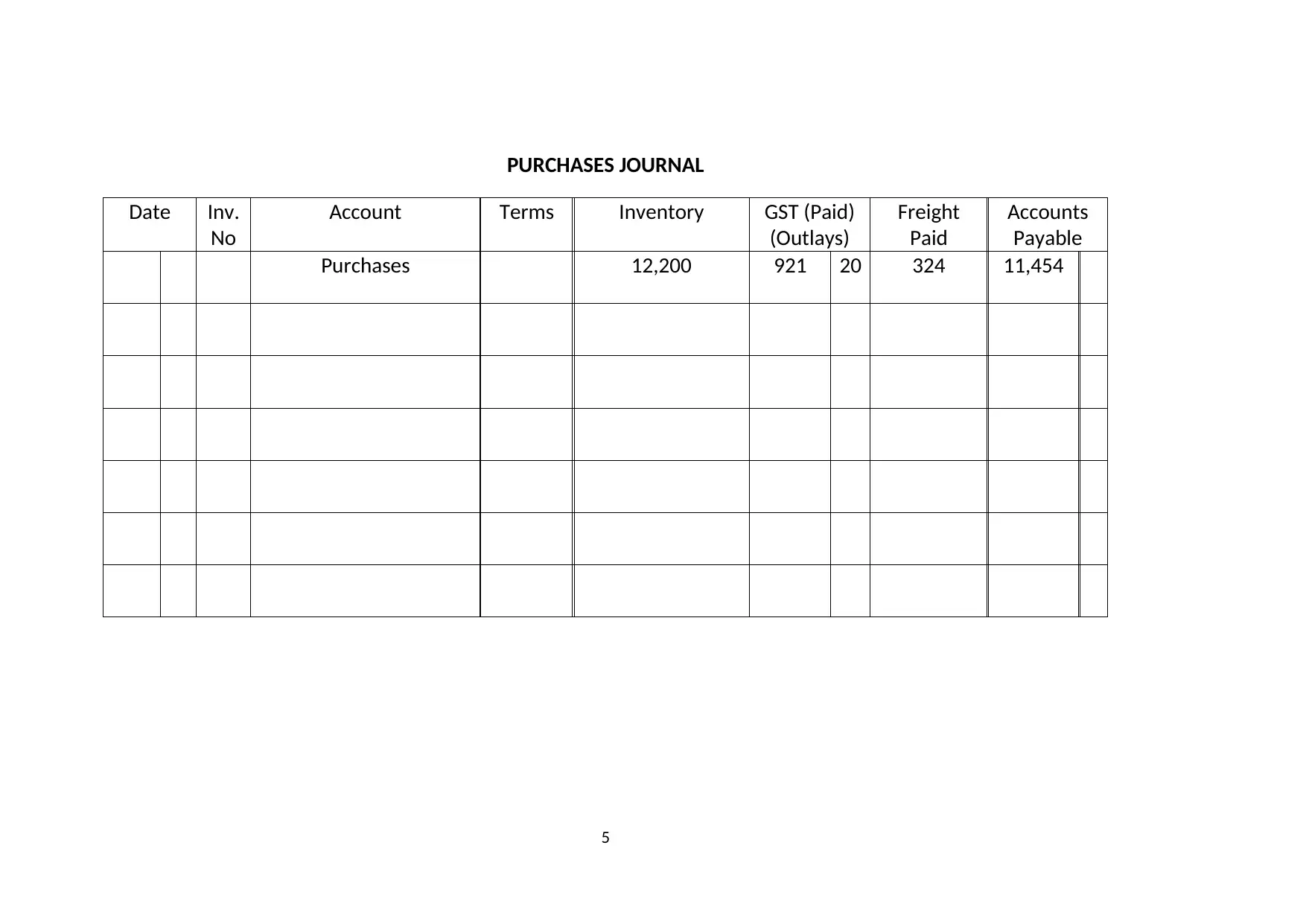

PURCHASES JOURNAL

Date Inv.

No

Account Terms Inventory GST (Paid)

(Outlays)

Freight

Paid

Accounts

Payable

Purchases 12,200 921 20 324 11,454

5

Date Inv.

No

Account Terms Inventory GST (Paid)

(Outlays)

Freight

Paid

Accounts

Payable

Purchases 12,200 921 20 324 11,454

5

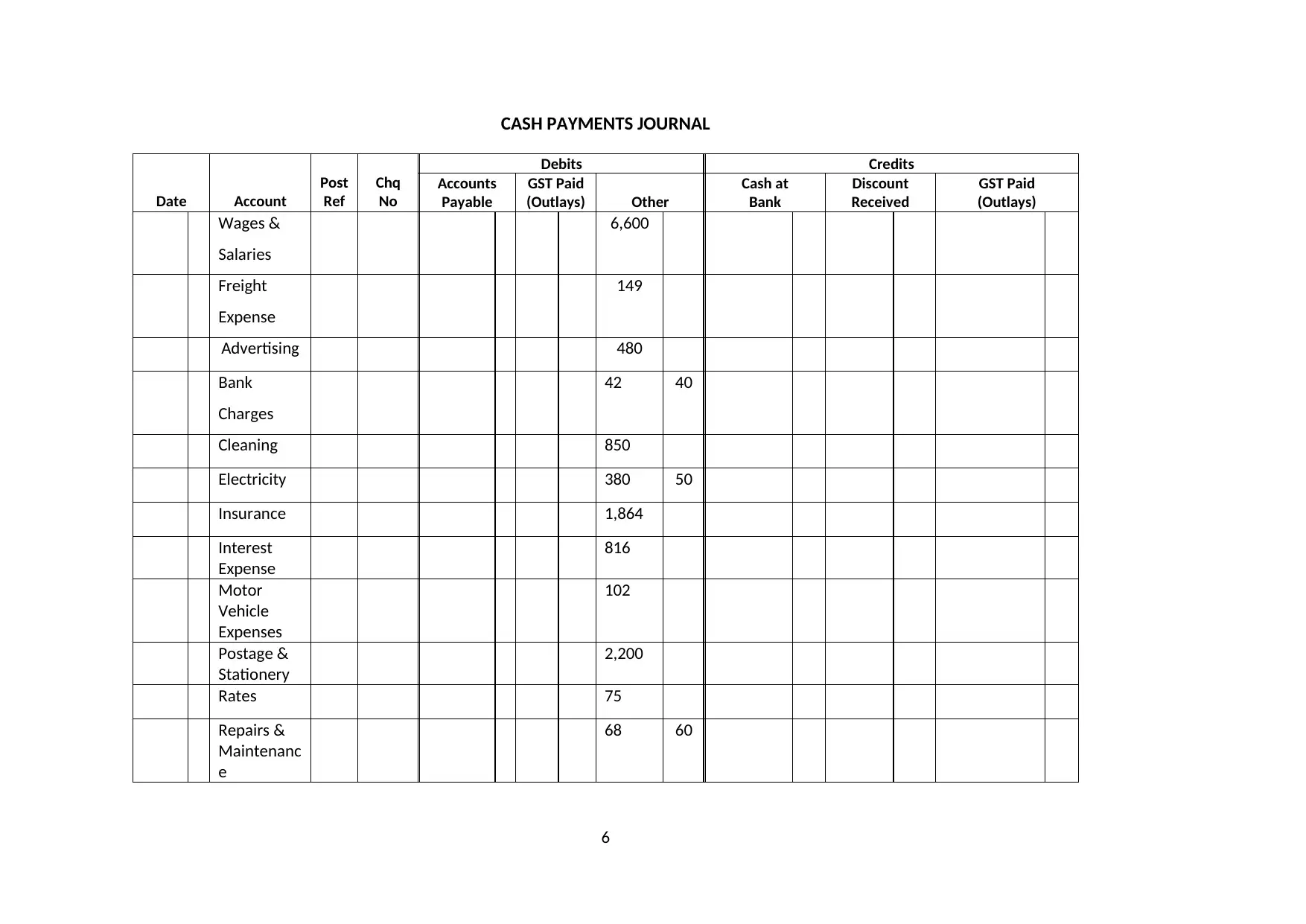

CASH PAYMENTS JOURNAL

Date Account

Post

Ref

Chq

No

Debits Credits

Accounts

Payable

GST Paid

(Outlays) Other

Cash at

Bank

Discount

Received

GST Paid

(Outlays)

Wages &

Salaries

6,600

Freight

Expense

149

Advertising 480

Bank

Charges

42 40

Cleaning 850

Electricity 380 50

Insurance 1,864

Interest

Expense

816

Motor

Vehicle

Expenses

102

Postage &

Stationery

2,200

Rates 75

Repairs &

Maintenanc

e

68 60

6

Date Account

Post

Ref

Chq

No

Debits Credits

Accounts

Payable

GST Paid

(Outlays) Other

Cash at

Bank

Discount

Received

GST Paid

(Outlays)

Wages &

Salaries

6,600

Freight

Expense

149

Advertising 480

Bank

Charges

42 40

Cleaning 850

Electricity 380 50

Insurance 1,864

Interest

Expense

816

Motor

Vehicle

Expenses

102

Postage &

Stationery

2,200

Rates 75

Repairs &

Maintenanc

e

68 60

6

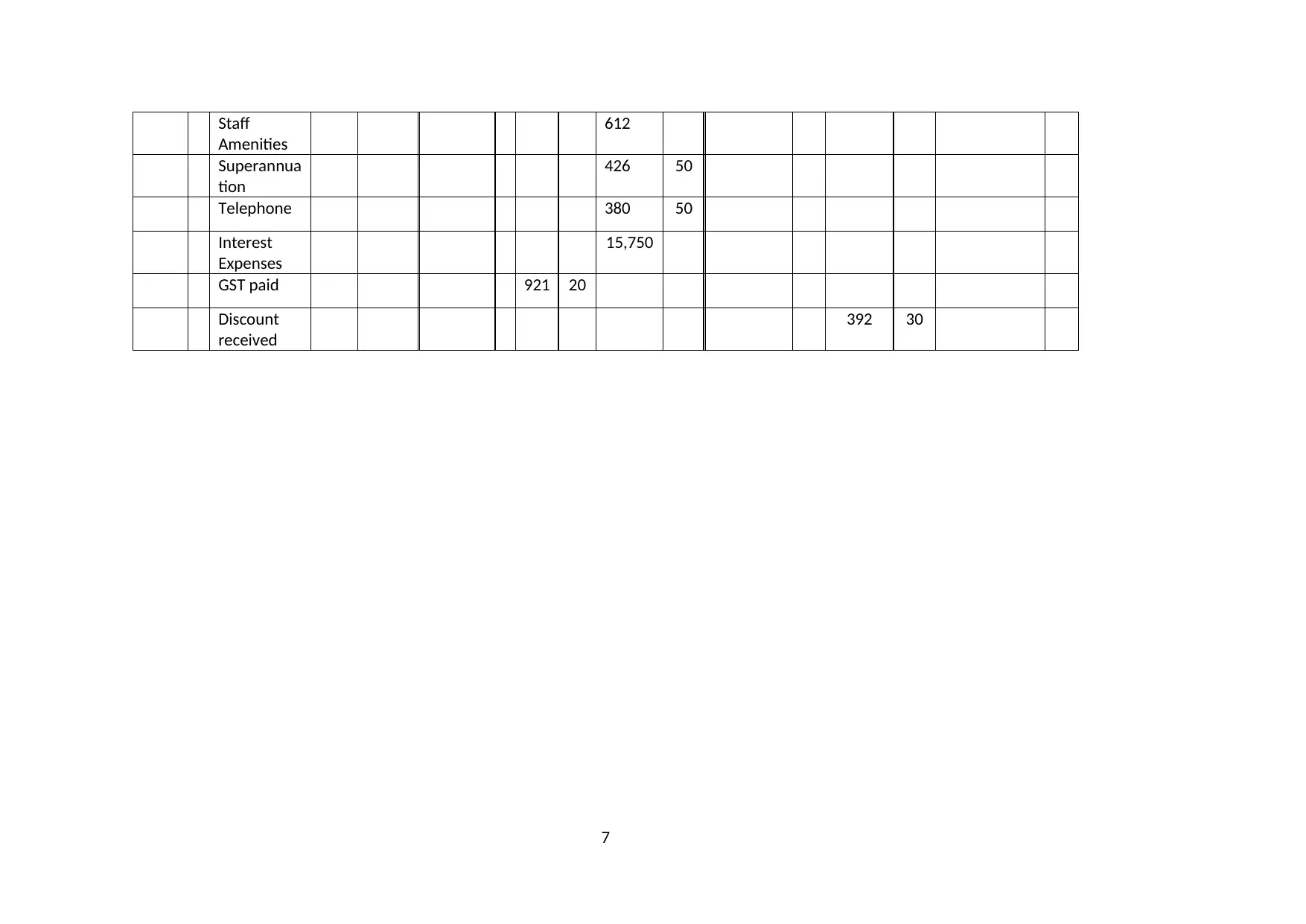

Staff

Amenities

612

Superannua

tion

426 50

Telephone 380 50

Interest

Expenses

15,750

GST paid 921 20

Discount

received

392 30

7

Amenities

612

Superannua

tion

426 50

Telephone 380 50

Interest

Expenses

15,750

GST paid 921 20

Discount

received

392 30

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

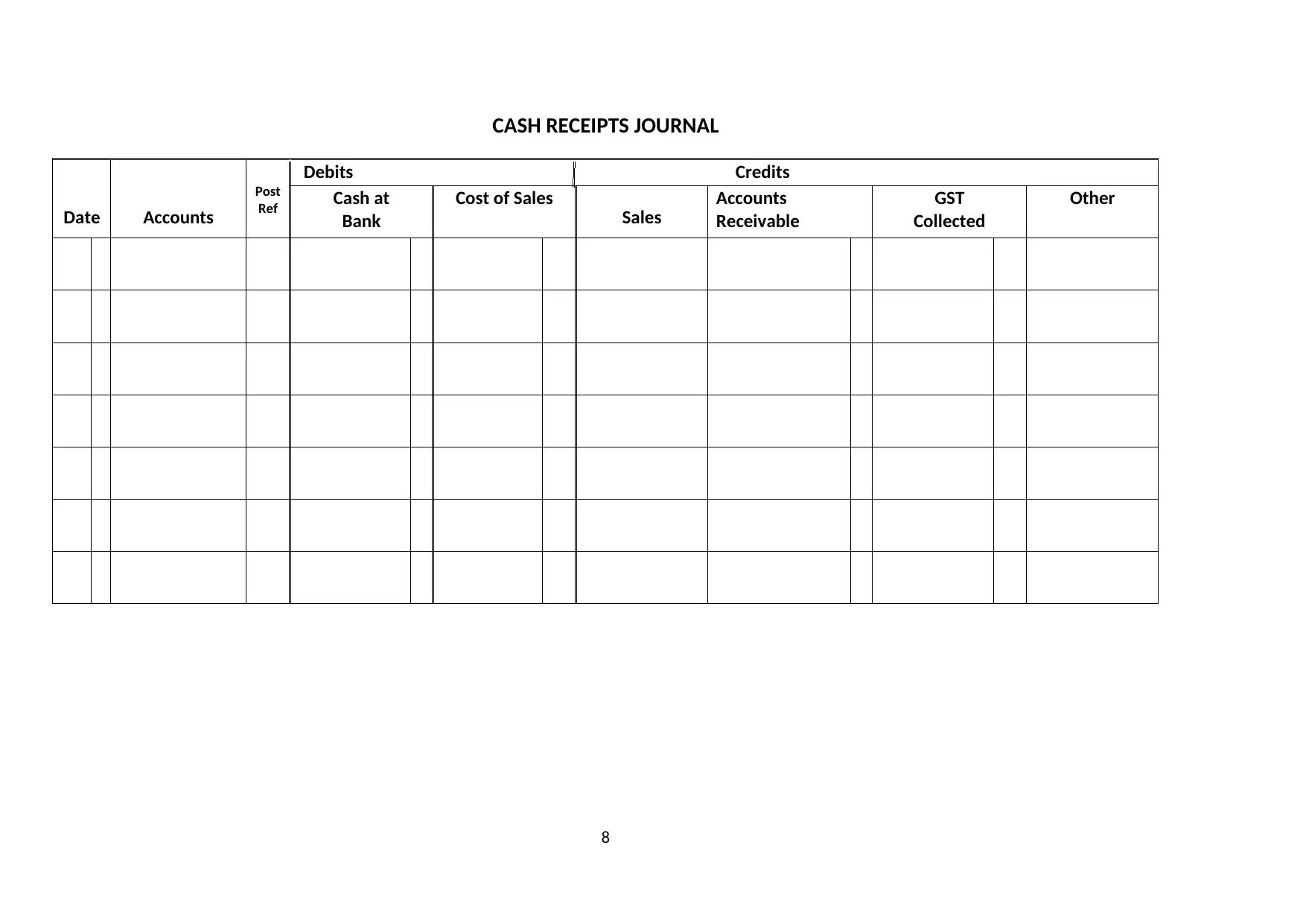

CASH RECEIPTS JOURNAL

Date Accounts

Post

Ref

Debits Credits

Cash at

Bank

Cost of Sales

Sales

Accounts

Receivable

GST

Collected

Other

8

Date Accounts

Post

Ref

Debits Credits

Cash at

Bank

Cost of Sales

Sales

Accounts

Receivable

GST

Collected

Other

8

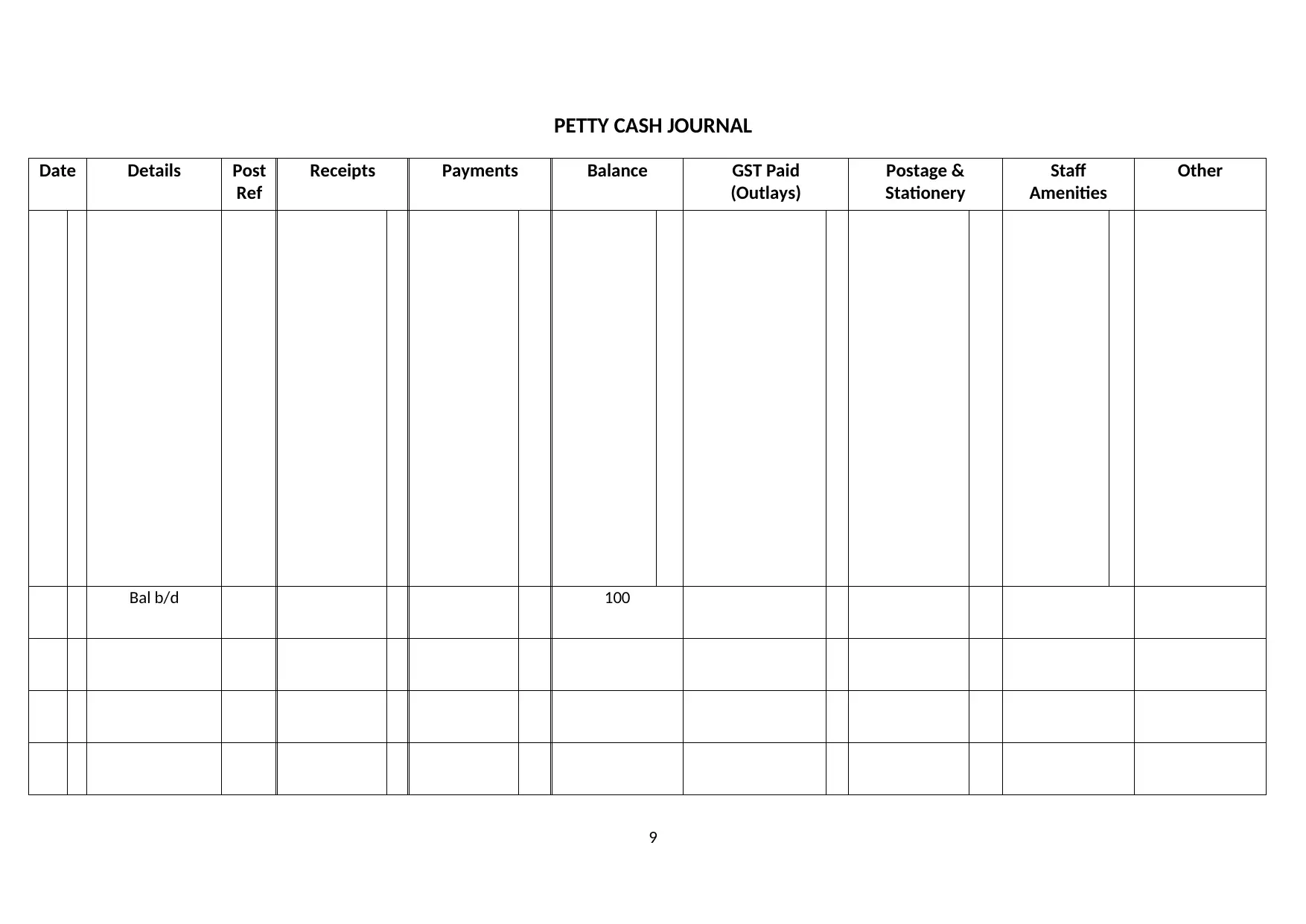

PETTY CASH JOURNAL

Date Details Post

Ref

Receipts Payments Balance GST Paid

(Outlays)

Postage &

Stationery

Staff

Amenities

Other

Bal b/d 100

9

Date Details Post

Ref

Receipts Payments Balance GST Paid

(Outlays)

Postage &

Stationery

Staff

Amenities

Other

Bal b/d 100

9

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

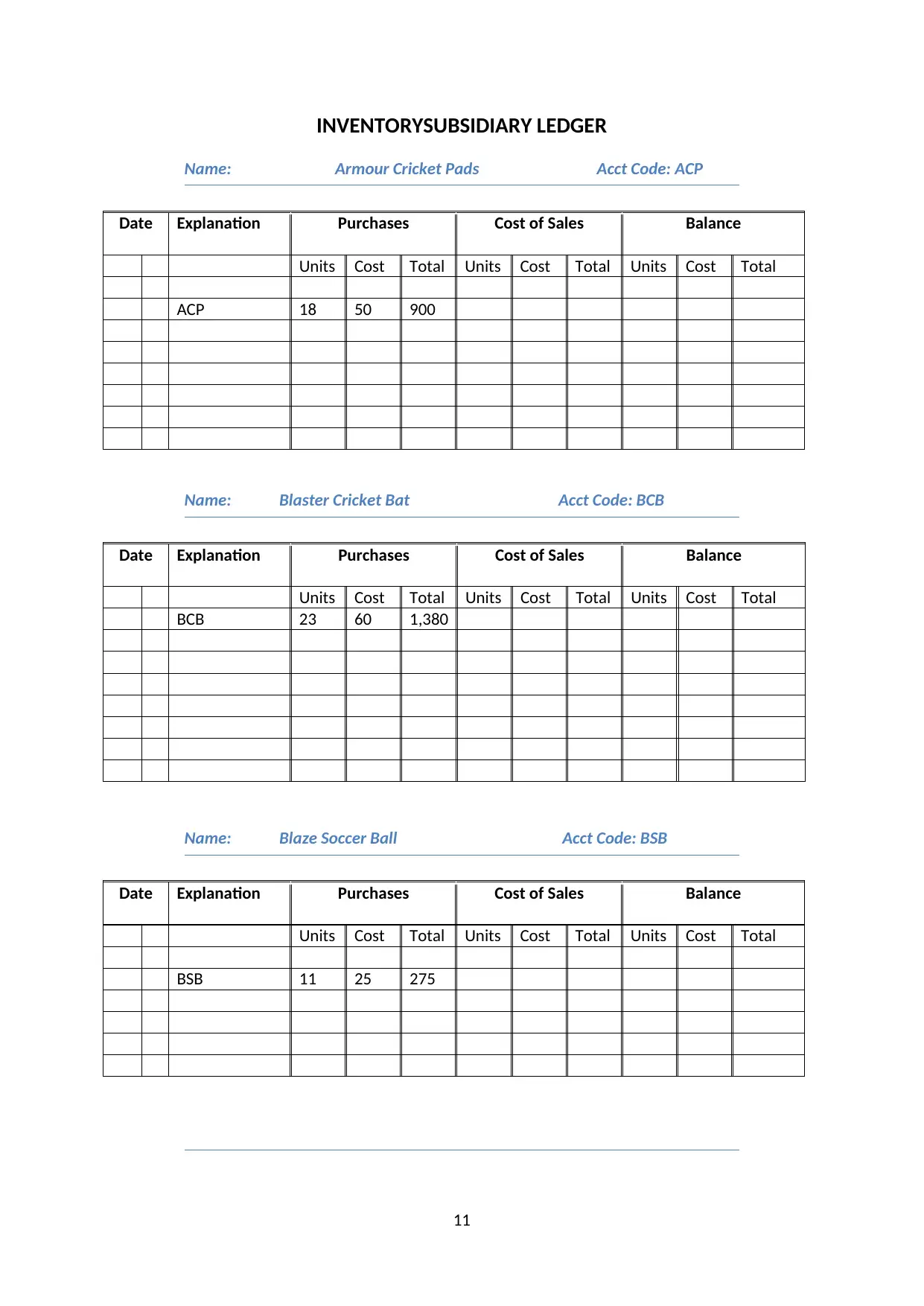

INVENTORYSUBSIDIARY LEDGER

Name: Armour Cricket Pads Acct Code: ACP

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

ACP 18 50 900

Name: Blaster Cricket Bat Acct Code: BCB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

BCB 23 60 1,380

Name: Blaze Soccer Ball Acct Code: BSB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

BSB 11 25 275

11

Name: Armour Cricket Pads Acct Code: ACP

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

ACP 18 50 900

Name: Blaster Cricket Bat Acct Code: BCB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

BCB 23 60 1,380

Name: Blaze Soccer Ball Acct Code: BSB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

BSB 11 25 275

11

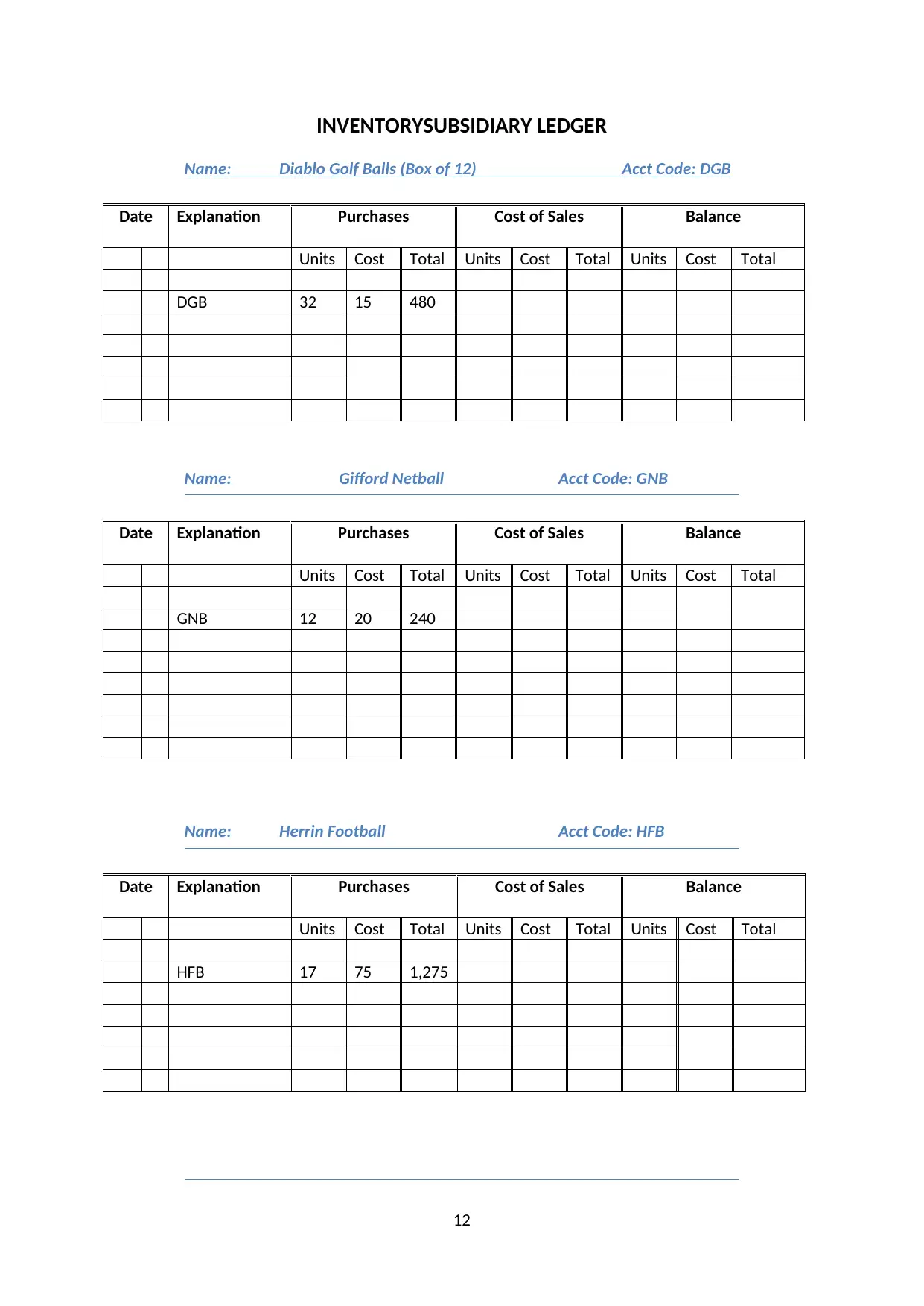

INVENTORYSUBSIDIARY LEDGER

Name: Diablo Golf Balls (Box of 12) Acct Code: DGB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

DGB 32 15 480

Name: Gifford Netball Acct Code: GNB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

GNB 12 20 240

Name: Herrin Football Acct Code: HFB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

HFB 17 75 1,275

12

Name: Diablo Golf Balls (Box of 12) Acct Code: DGB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

DGB 32 15 480

Name: Gifford Netball Acct Code: GNB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

GNB 12 20 240

Name: Herrin Football Acct Code: HFB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

HFB 17 75 1,275

12

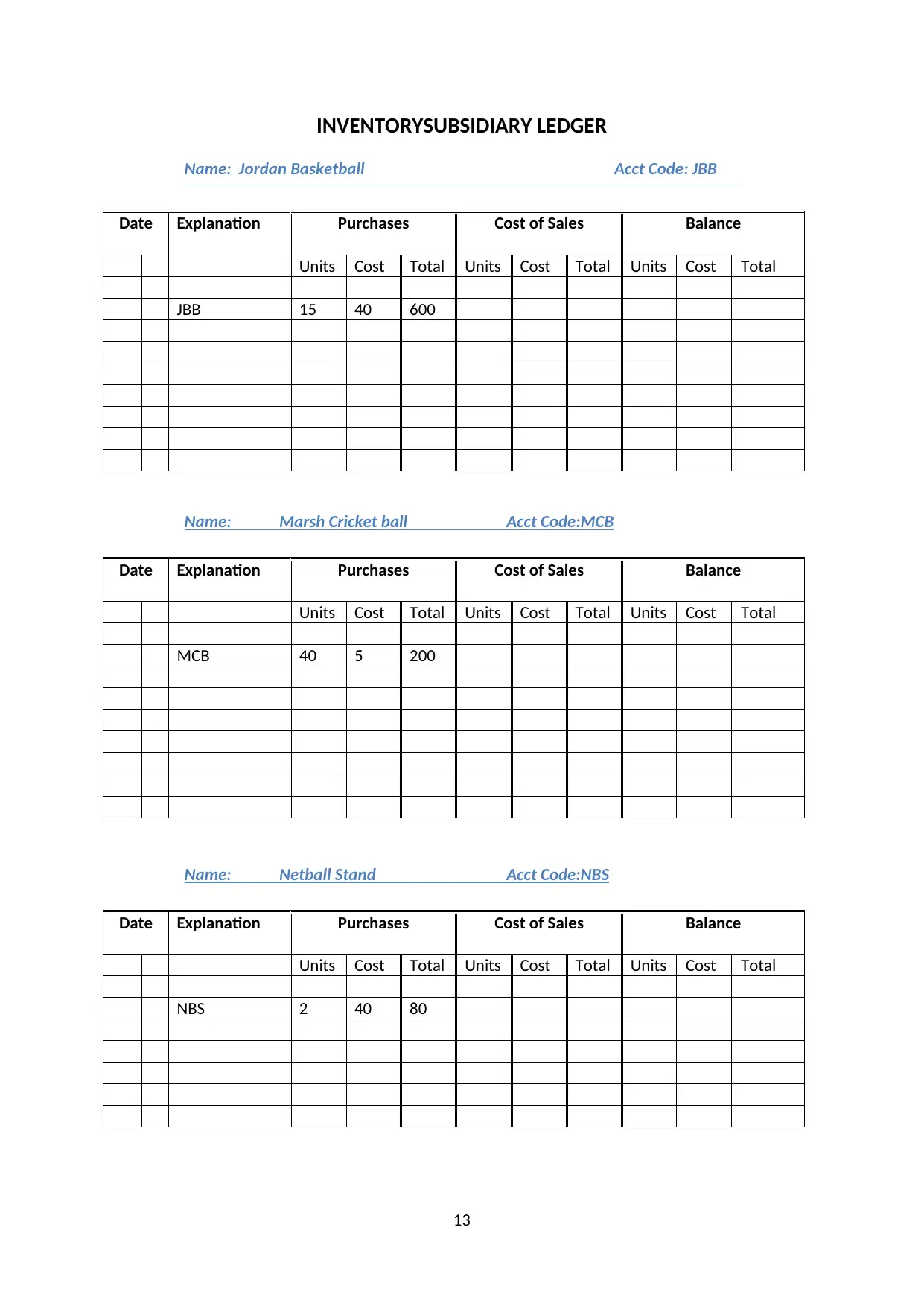

INVENTORYSUBSIDIARY LEDGER

Name: Jordan Basketball Acct Code: JBB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

JBB 15 40 600

Name: Marsh Cricket ball Acct Code:MCB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

MCB 40 5 200

Name: Netball Stand Acct Code:NBS

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

NBS 2 40 80

13

Name: Jordan Basketball Acct Code: JBB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

JBB 15 40 600

Name: Marsh Cricket ball Acct Code:MCB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

MCB 40 5 200

Name: Netball Stand Acct Code:NBS

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

NBS 2 40 80

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

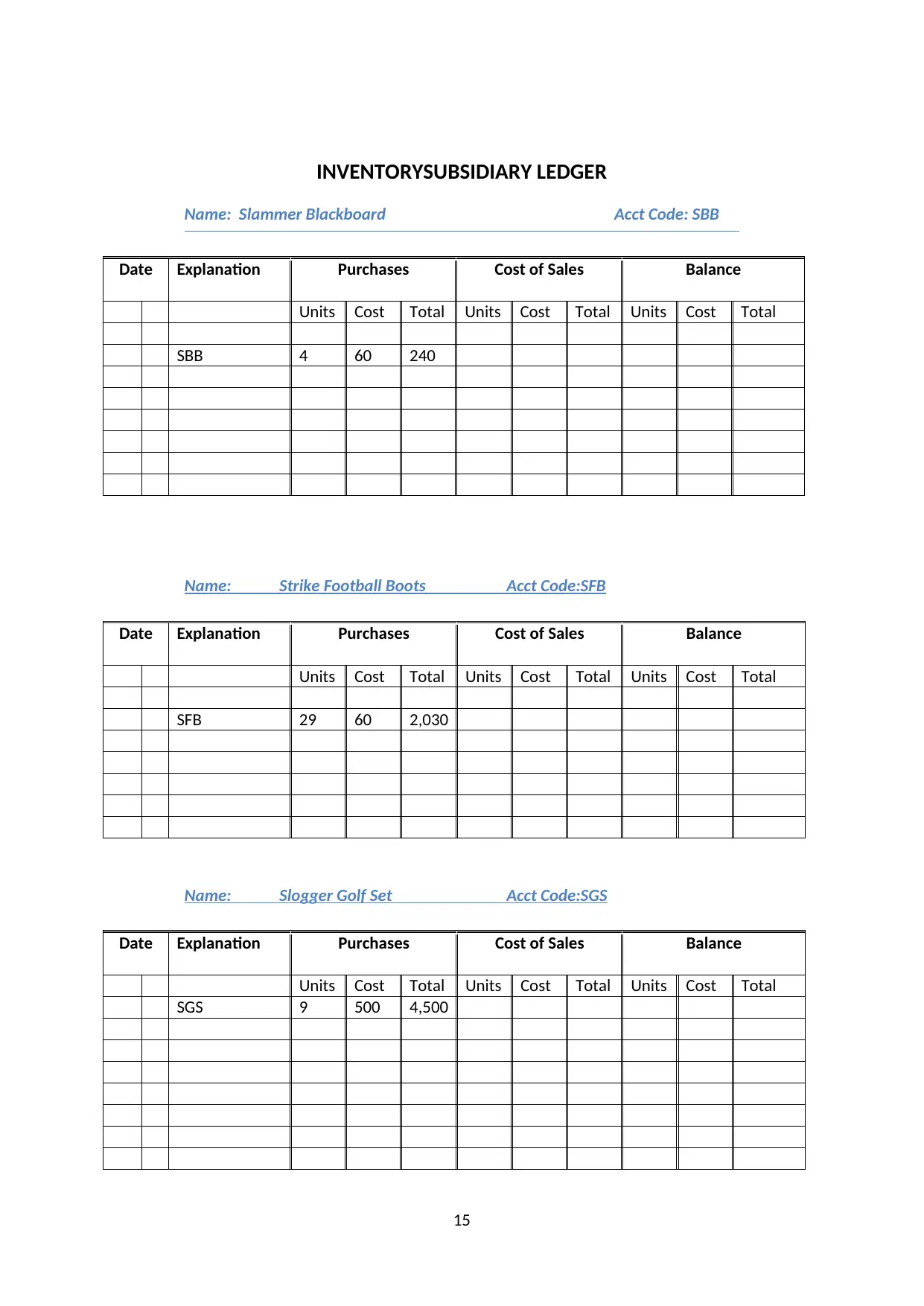

INVENTORYSUBSIDIARY LEDGER

Name: Slammer Blackboard Acct Code: SBB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

SBB 4 60 240

Name: Strike Football Boots Acct Code:SFB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

SFB 29 60 2,030

Name: Slogger Golf Set Acct Code:SGS

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

SGS 9 500 4,500

15

Name: Slammer Blackboard Acct Code: SBB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

SBB 4 60 240

Name: Strike Football Boots Acct Code:SFB

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

SFB 29 60 2,030

Name: Slogger Golf Set Acct Code:SGS

Date Explanation Purchases Cost of Sales Balance

Units Cost Total Units Cost Total Units Cost Total

SGS 9 500 4,500

15

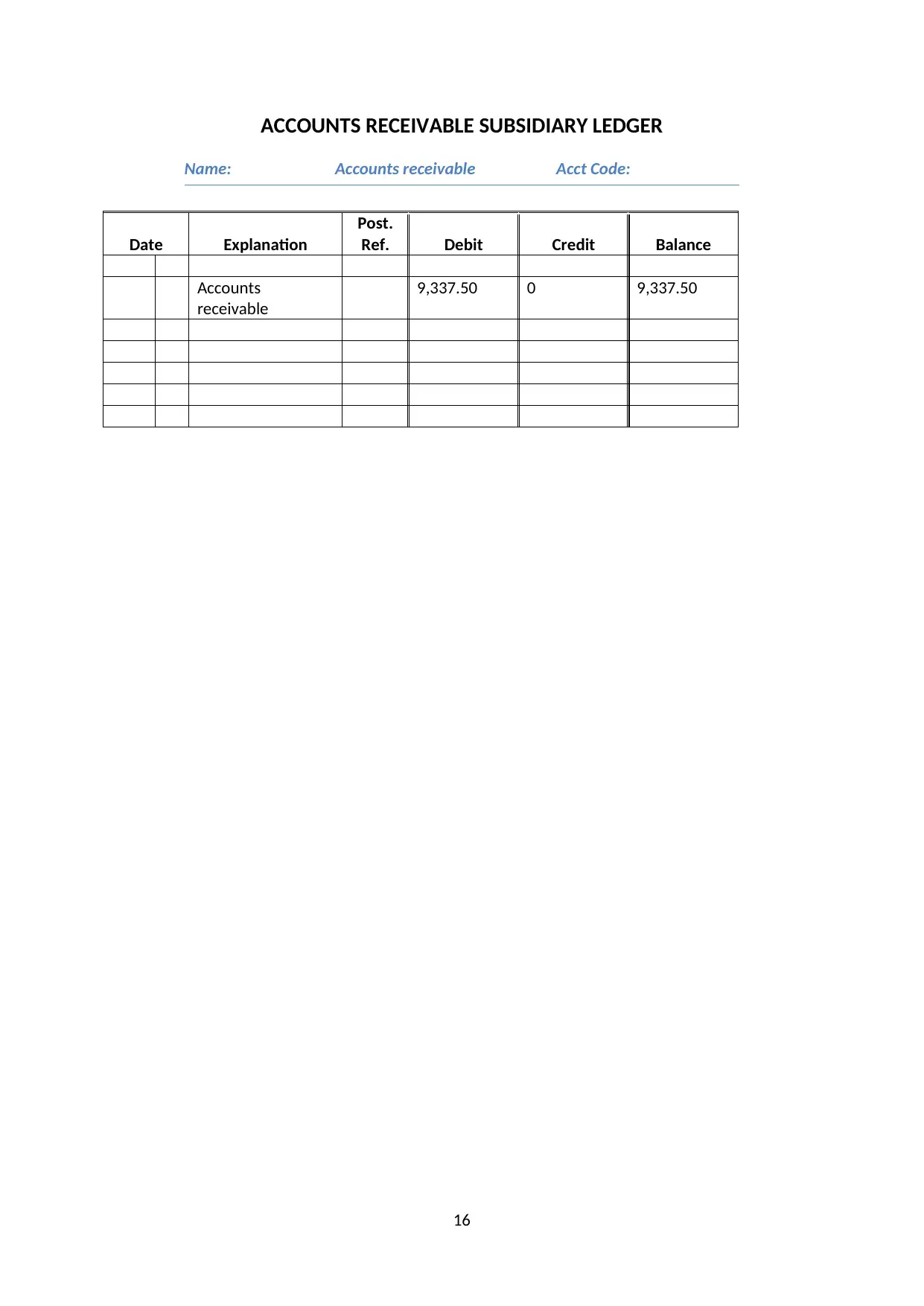

ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER

Name: Accounts receivable Acct Code:

Date Explanation

Post.

Ref. Debit Credit Balance

Accounts

receivable

9,337.50 0 9,337.50

16

Name: Accounts receivable Acct Code:

Date Explanation

Post.

Ref. Debit Credit Balance

Accounts

receivable

9,337.50 0 9,337.50

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

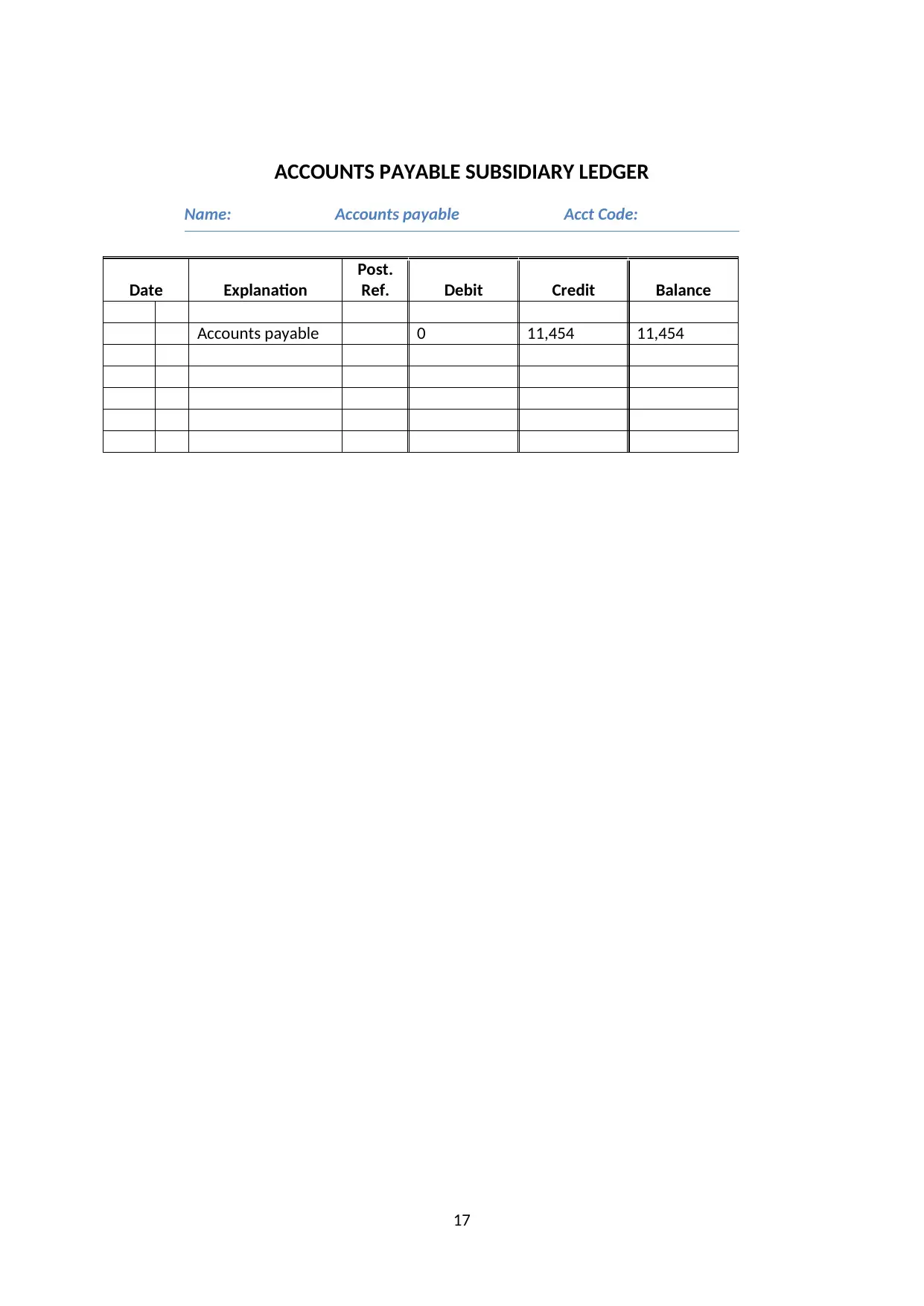

ACCOUNTS PAYABLE SUBSIDIARY LEDGER

Name: Accounts payable Acct Code:

Date Explanation

Post.

Ref. Debit Credit Balance

Accounts payable 0 11,454 11,454

17

Name: Accounts payable Acct Code:

Date Explanation

Post.

Ref. Debit Credit Balance

Accounts payable 0 11,454 11,454

17

GENERAL LEDGER

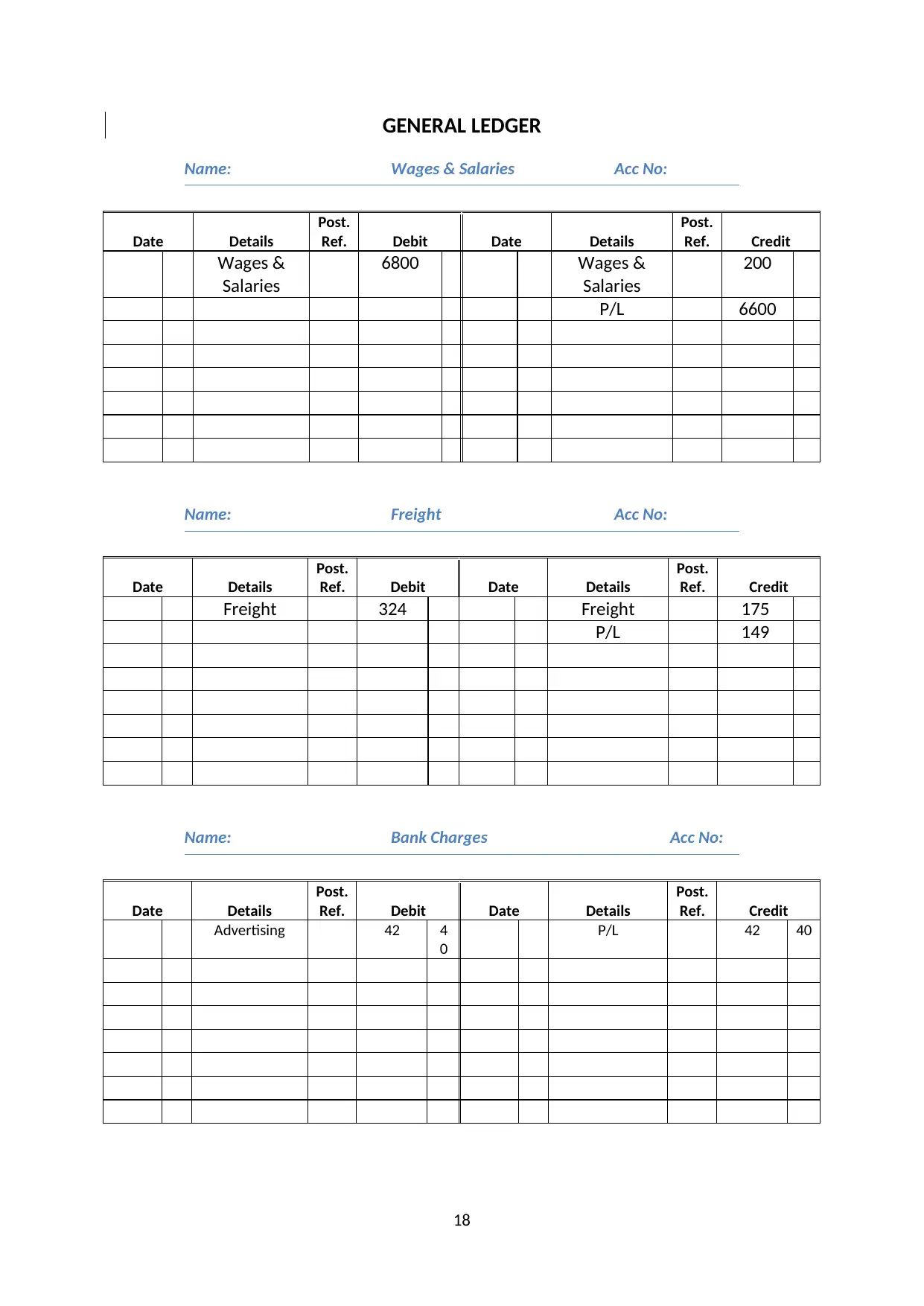

Name: Wages & Salaries Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Wages &

Salaries

6800 Wages &

Salaries

200

P/L 6600

Name: Freight Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Freight 324 Freight 175

P/L 149

Name: Bank Charges Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Advertising 42 4

0

P/L 42 40

18

Name: Wages & Salaries Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Wages &

Salaries

6800 Wages &

Salaries

200

P/L 6600

Name: Freight Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Freight 324 Freight 175

P/L 149

Name: Bank Charges Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Advertising 42 4

0

P/L 42 40

18

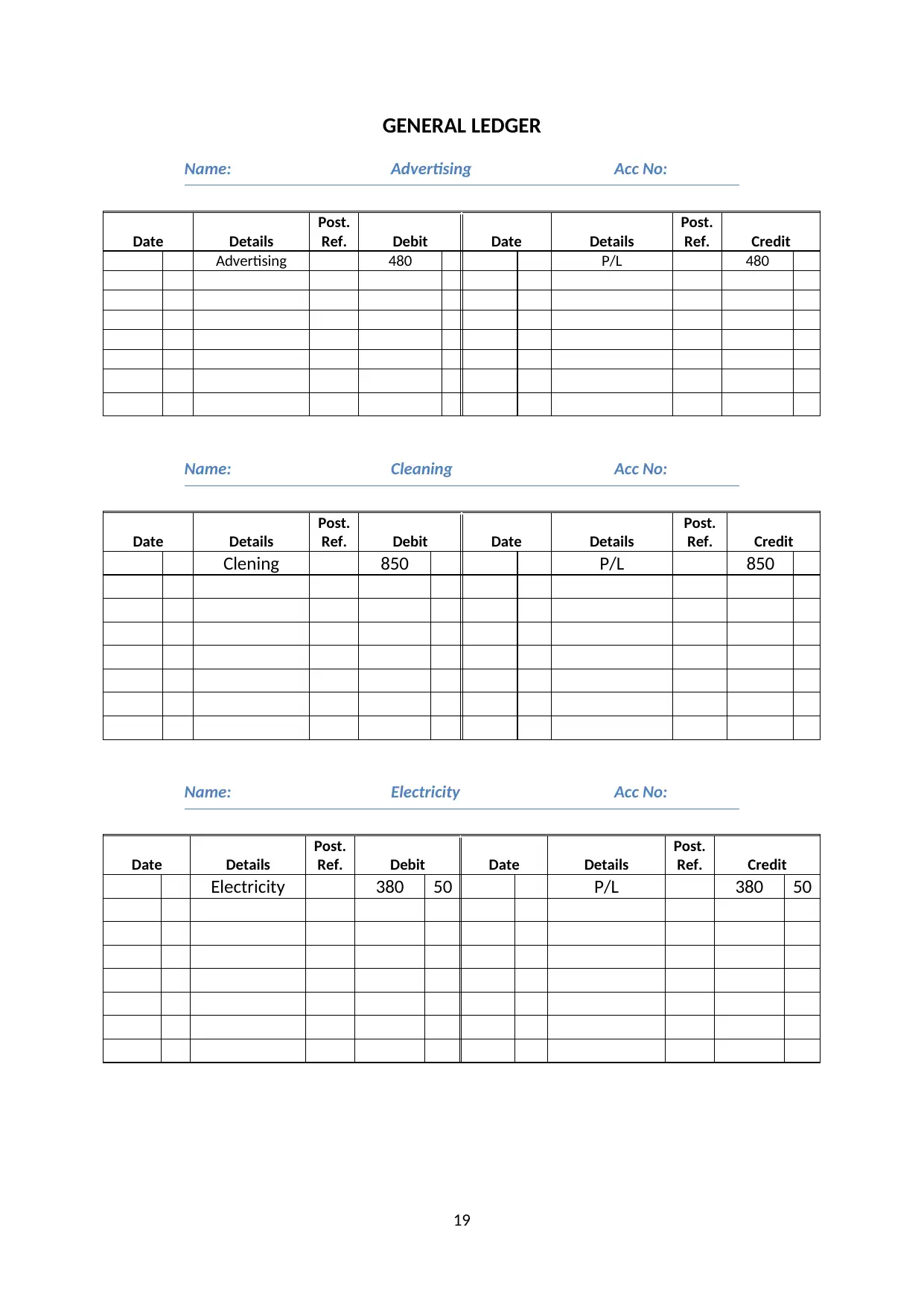

GENERAL LEDGER

Name: Advertising Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Advertising 480 P/L 480

Name: Cleaning Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Clening 850 P/L 850

Name: Electricity Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Electricity 380 50 P/L 380 50

19

Name: Advertising Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Advertising 480 P/L 480

Name: Cleaning Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Clening 850 P/L 850

Name: Electricity Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Electricity 380 50 P/L 380 50

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

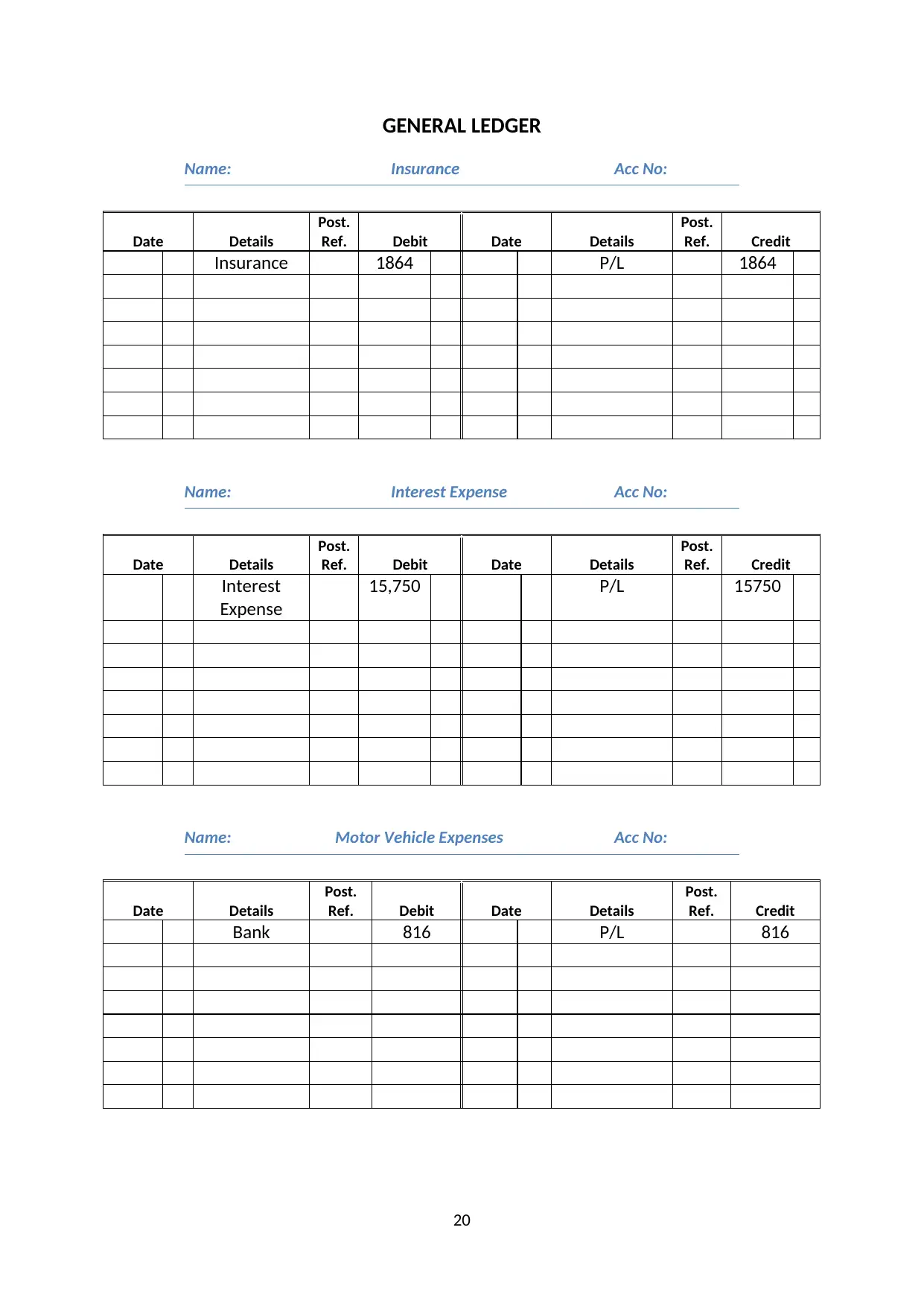

GENERAL LEDGER

Name: Insurance Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Insurance 1864 P/L 1864

Name: Interest Expense Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Interest

Expense

15,750 P/L 15750

Name: Motor Vehicle Expenses Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 816 P/L 816

20

Name: Insurance Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Insurance 1864 P/L 1864

Name: Interest Expense Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Interest

Expense

15,750 P/L 15750

Name: Motor Vehicle Expenses Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 816 P/L 816

20

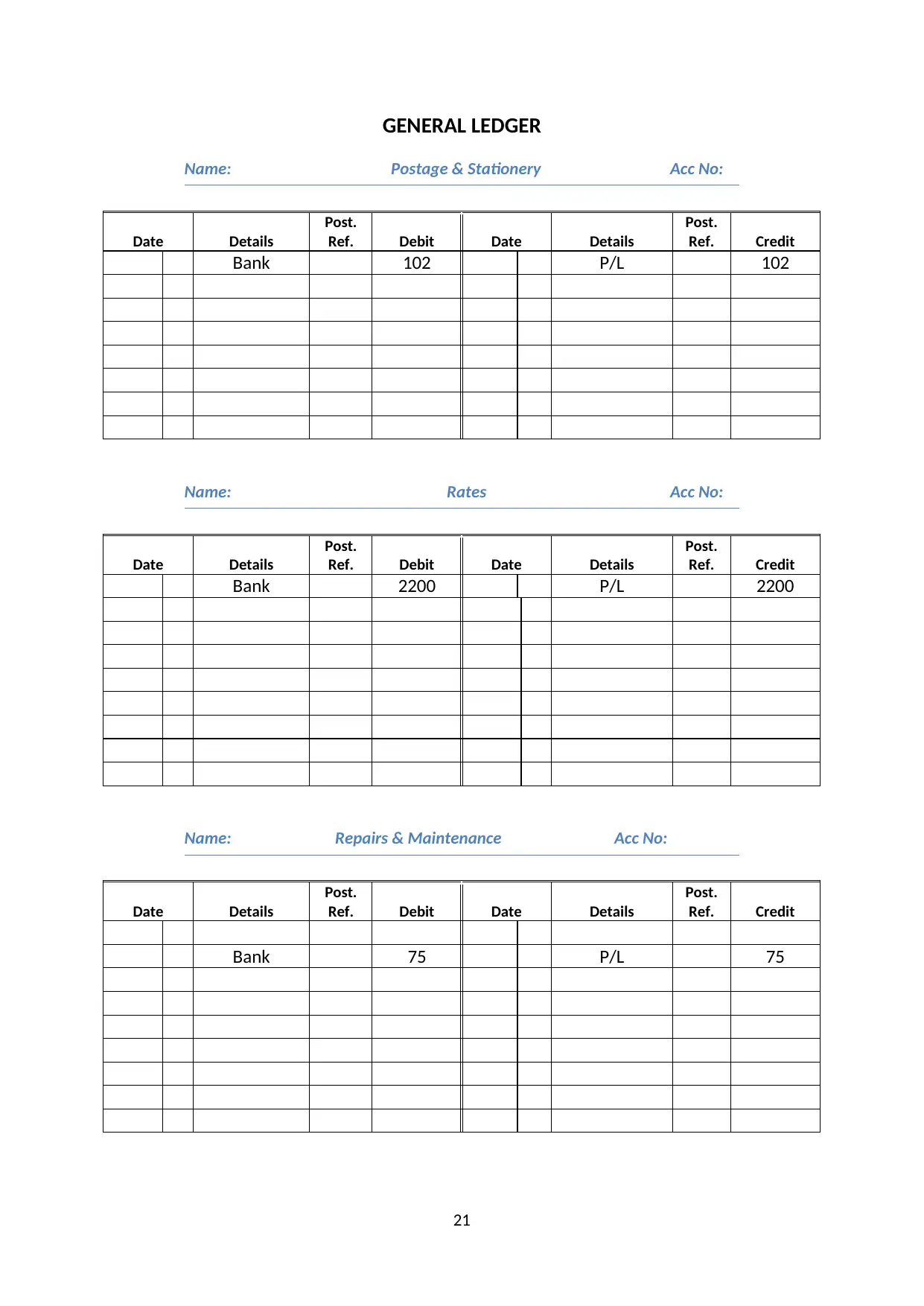

GENERAL LEDGER

Name: Postage & Stationery Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 102 P/L 102

Name: Rates Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 2200 P/L 2200

Name: Repairs & Maintenance Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 75 P/L 75

21

Name: Postage & Stationery Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 102 P/L 102

Name: Rates Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 2200 P/L 2200

Name: Repairs & Maintenance Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 75 P/L 75

21

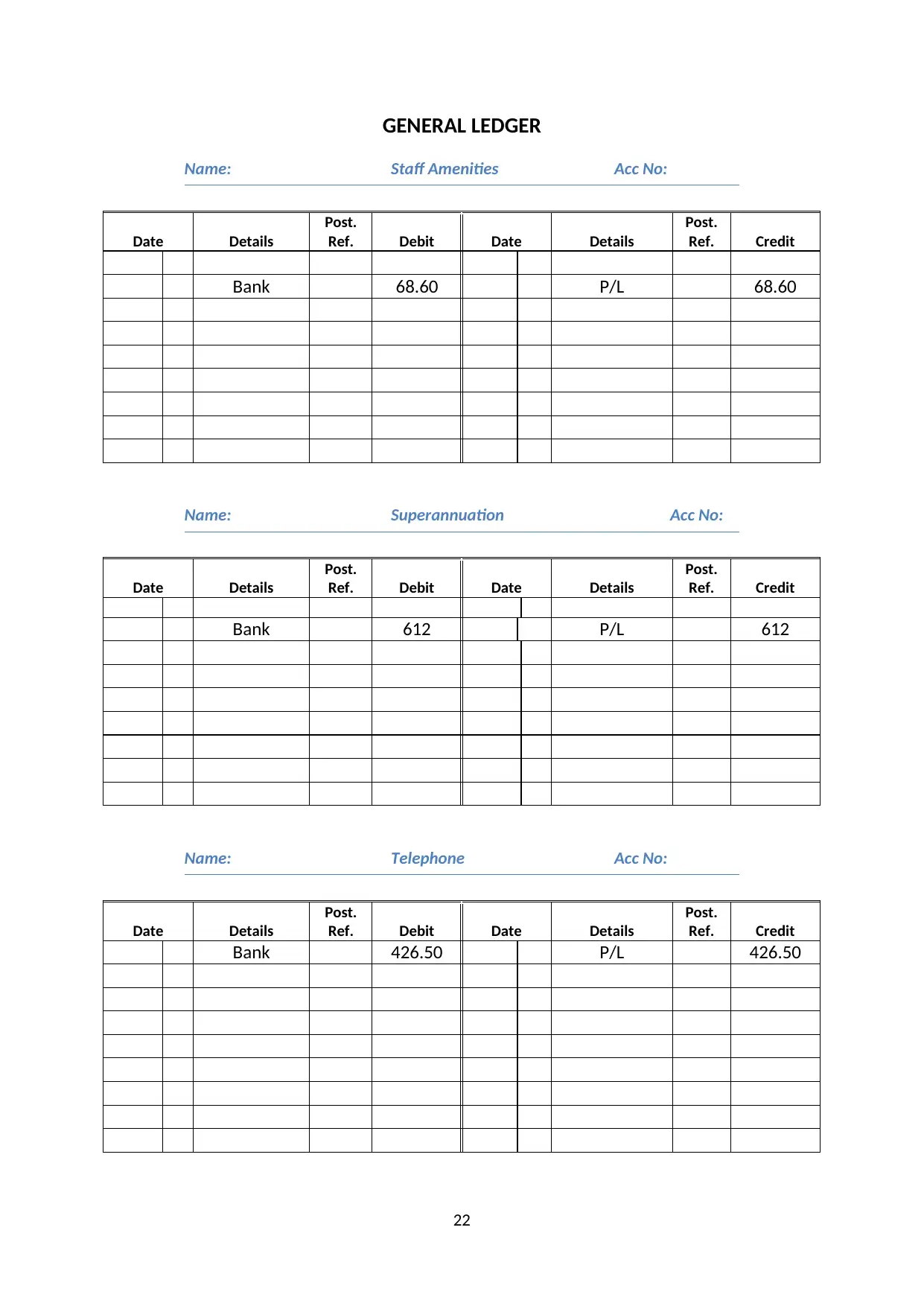

GENERAL LEDGER

Name: Staff Amenities Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 68.60 P/L 68.60

Name: Superannuation Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 612 P/L 612

Name: Telephone Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 426.50 P/L 426.50

22

Name: Staff Amenities Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 68.60 P/L 68.60

Name: Superannuation Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 612 P/L 612

Name: Telephone Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bank 426.50 P/L 426.50

22

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

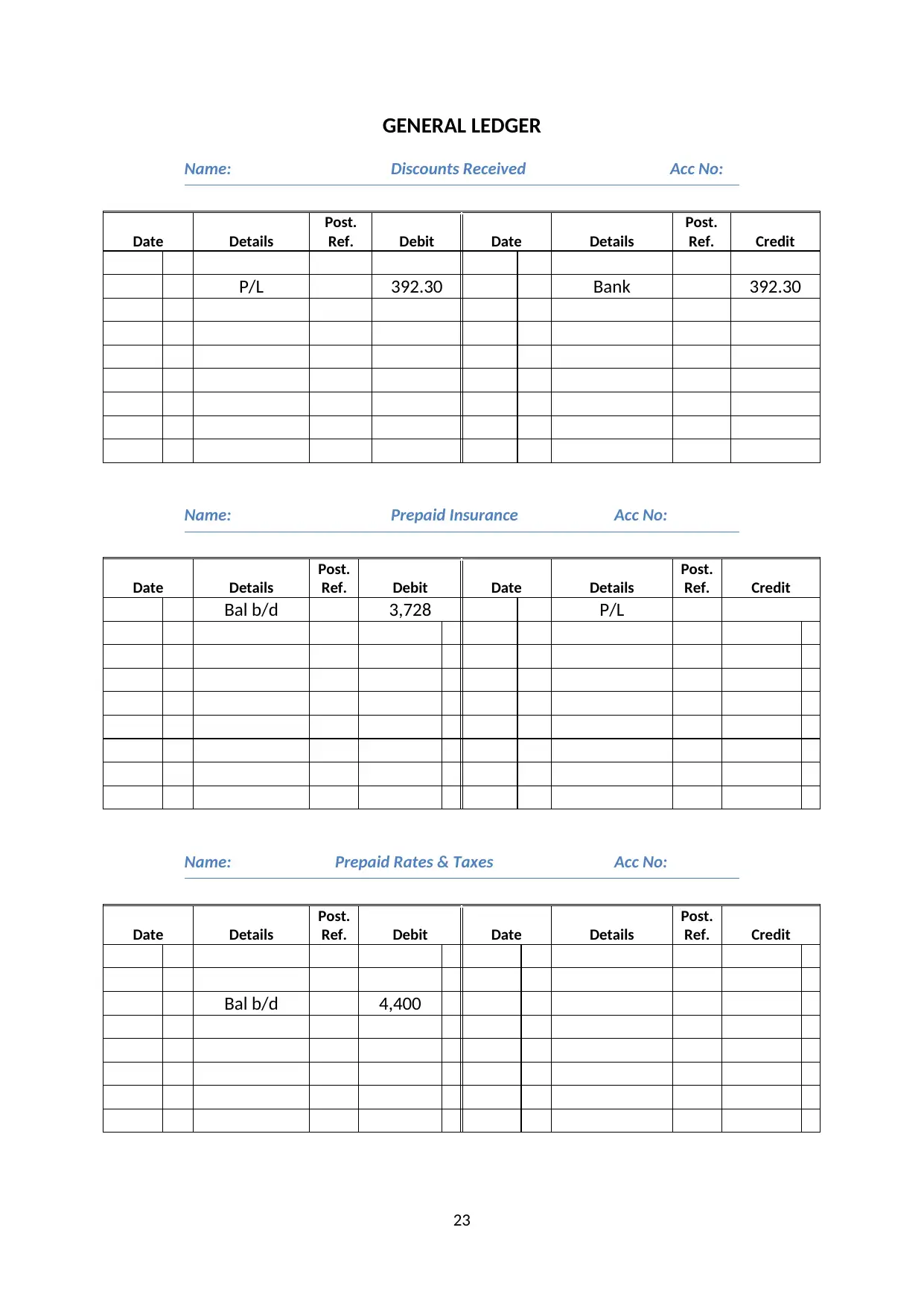

GENERAL LEDGER

Name: Discounts Received Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

P/L 392.30 Bank 392.30

Name: Prepaid Insurance Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 3,728 P/L

Name: Prepaid Rates & Taxes Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 4,400

23

Name: Discounts Received Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

P/L 392.30 Bank 392.30

Name: Prepaid Insurance Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 3,728 P/L

Name: Prepaid Rates & Taxes Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 4,400

23

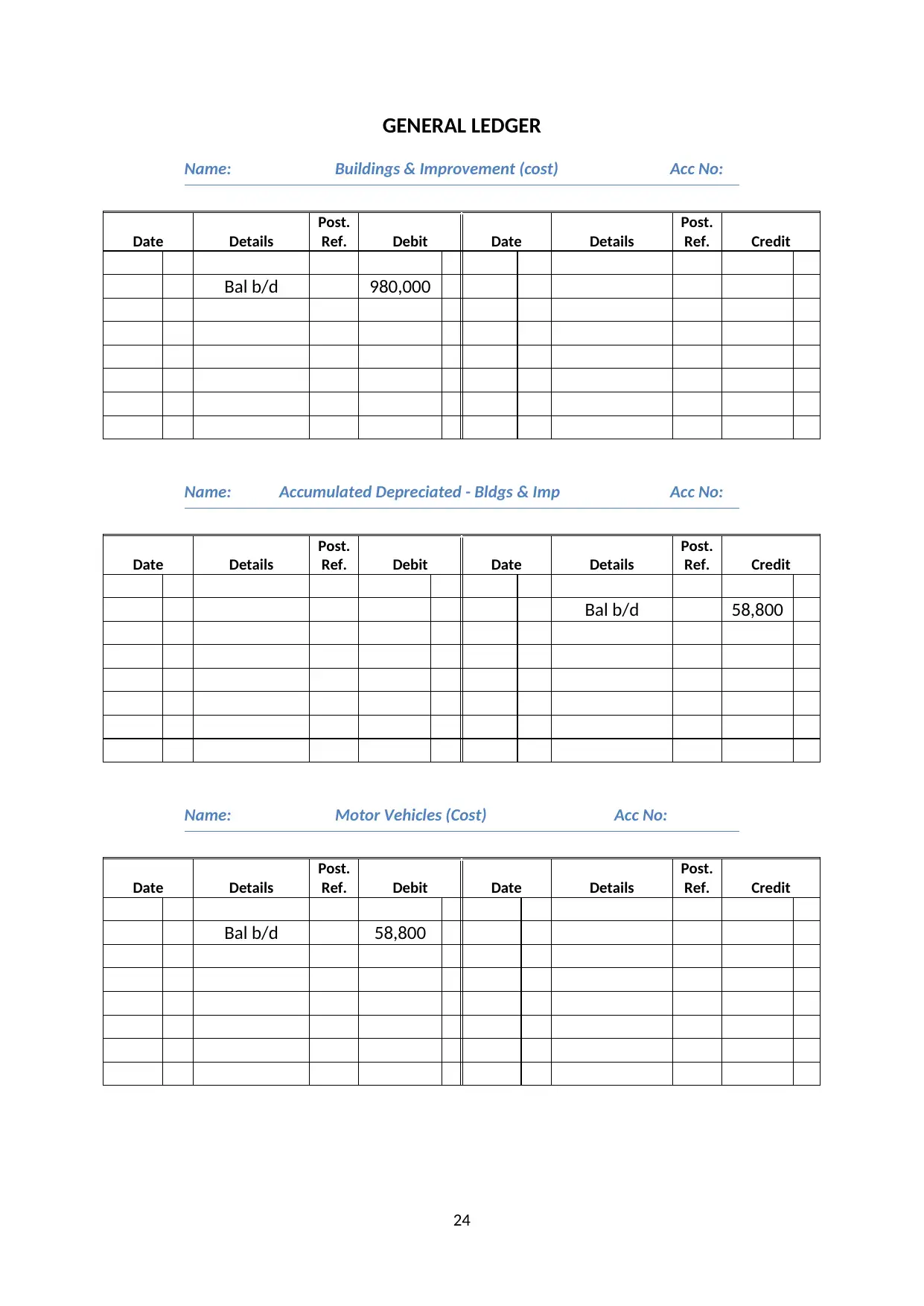

GENERAL LEDGER

Name: Buildings & Improvement (cost) Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 980,000

Name: Accumulated Depreciated - Bldgs & Imp Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 58,800

Name: Motor Vehicles (Cost) Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 58,800

24

Name: Buildings & Improvement (cost) Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 980,000

Name: Accumulated Depreciated - Bldgs & Imp Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 58,800

Name: Motor Vehicles (Cost) Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 58,800

24

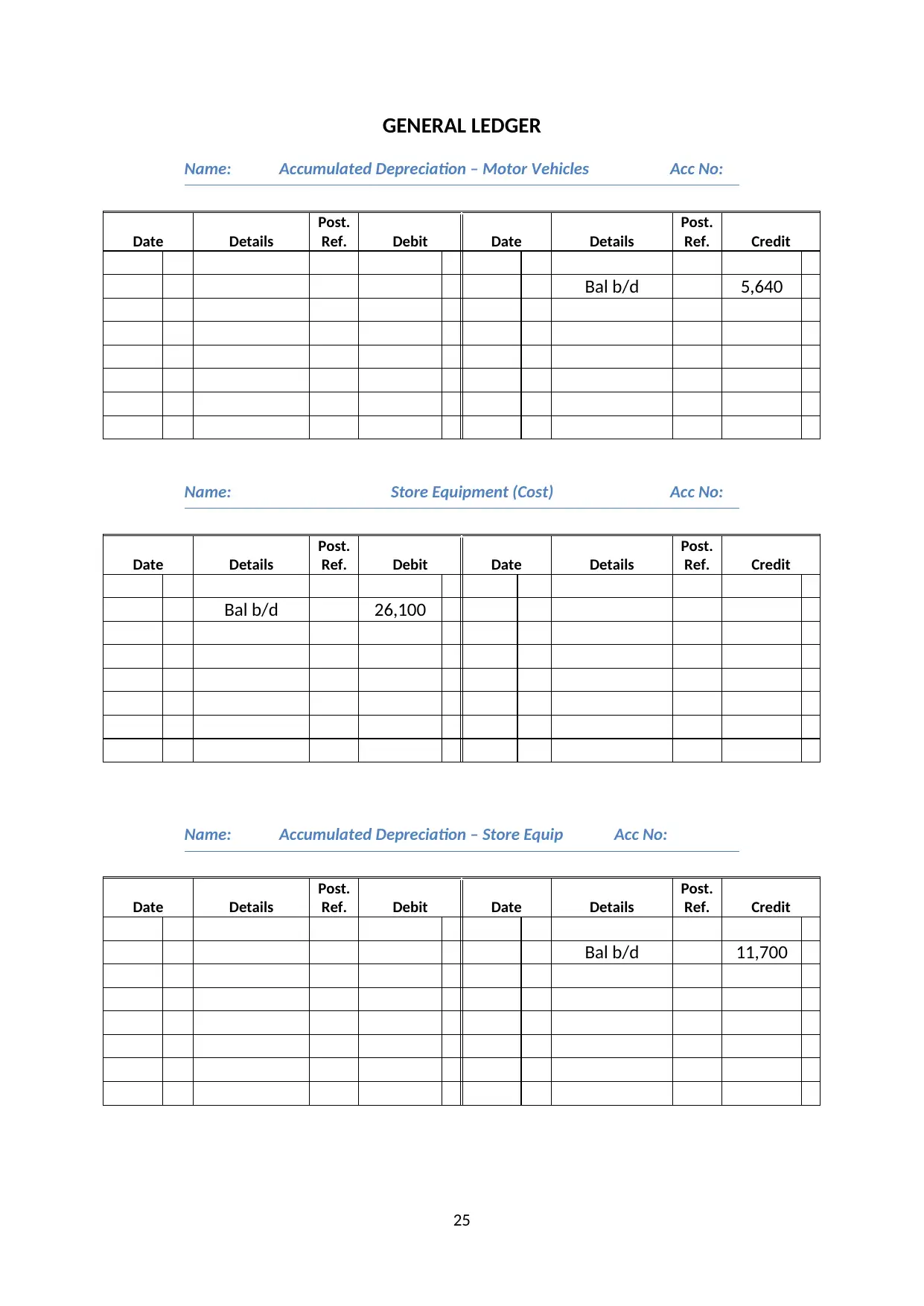

GENERAL LEDGER

Name: Accumulated Depreciation – Motor Vehicles Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 5,640

Name: Store Equipment (Cost) Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 26,100

Name: Accumulated Depreciation – Store Equip Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 11,700

25

Name: Accumulated Depreciation – Motor Vehicles Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 5,640

Name: Store Equipment (Cost) Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 26,100

Name: Accumulated Depreciation – Store Equip Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 11,700

25

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

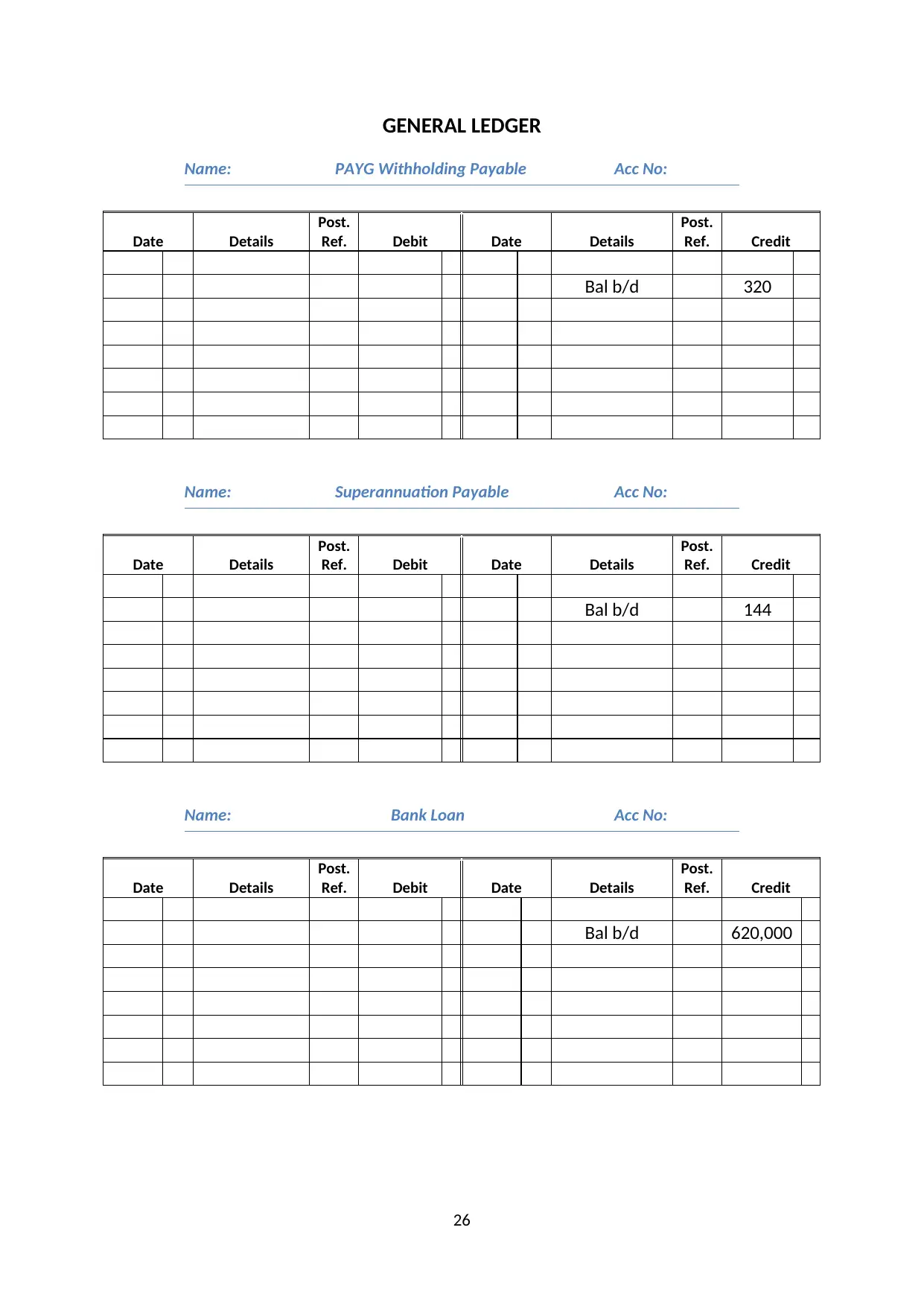

GENERAL LEDGER

Name: PAYG Withholding Payable Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 320

Name: Superannuation Payable Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 144

Name: Bank Loan Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 620,000

26

Name: PAYG Withholding Payable Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 320

Name: Superannuation Payable Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 144

Name: Bank Loan Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 620,000

26

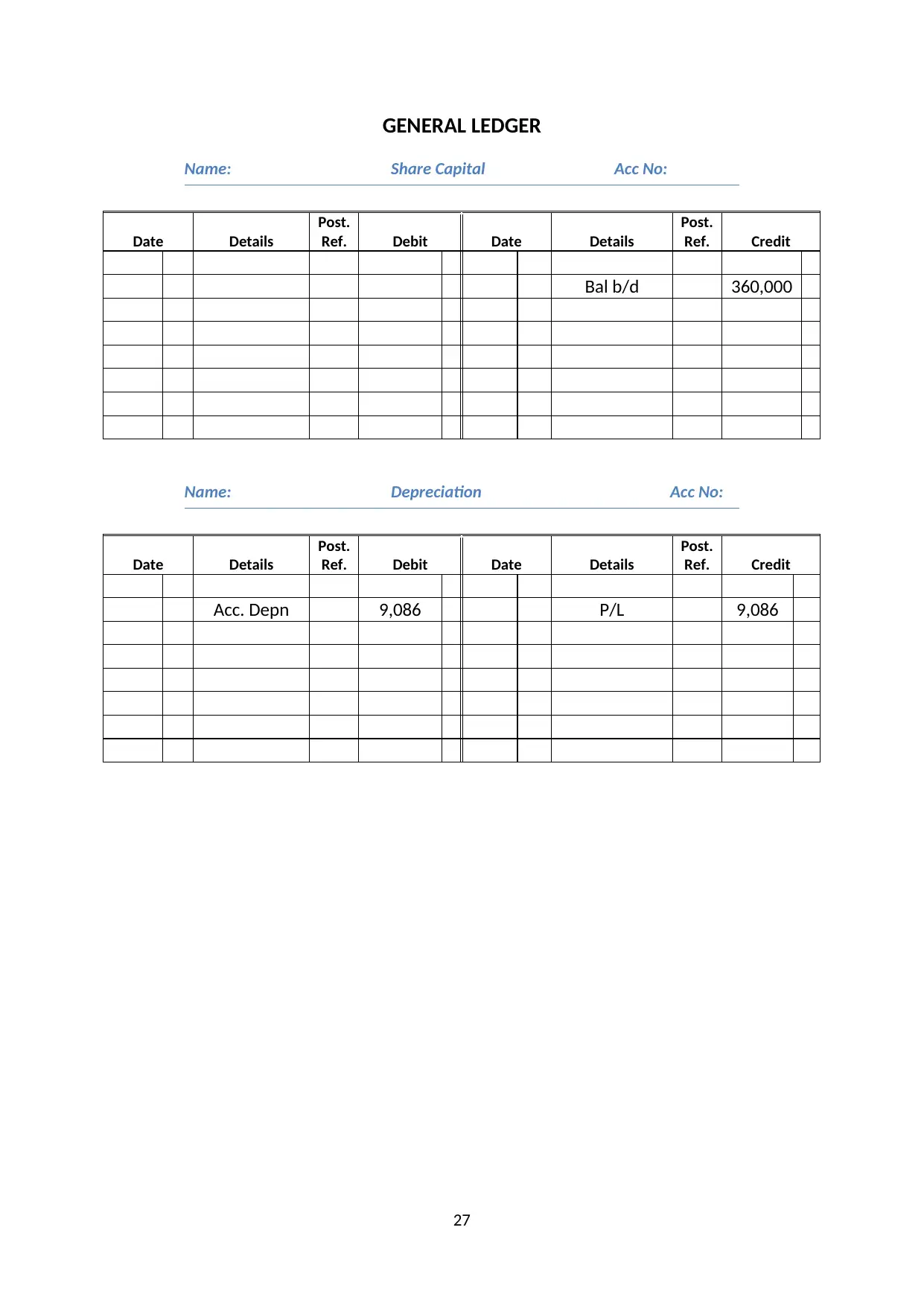

GENERAL LEDGER

Name: Share Capital Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 360,000

Name: Depreciation Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Acc. Depn 9,086 P/L 9,086

27

Name: Share Capital Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Bal b/d 360,000

Name: Depreciation Acc No:

Date Details

Post.

Ref. Debit Date Details

Post.

Ref. Credit

Acc. Depn 9,086 P/L 9,086

27

28

REPORTS

REPORTS

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

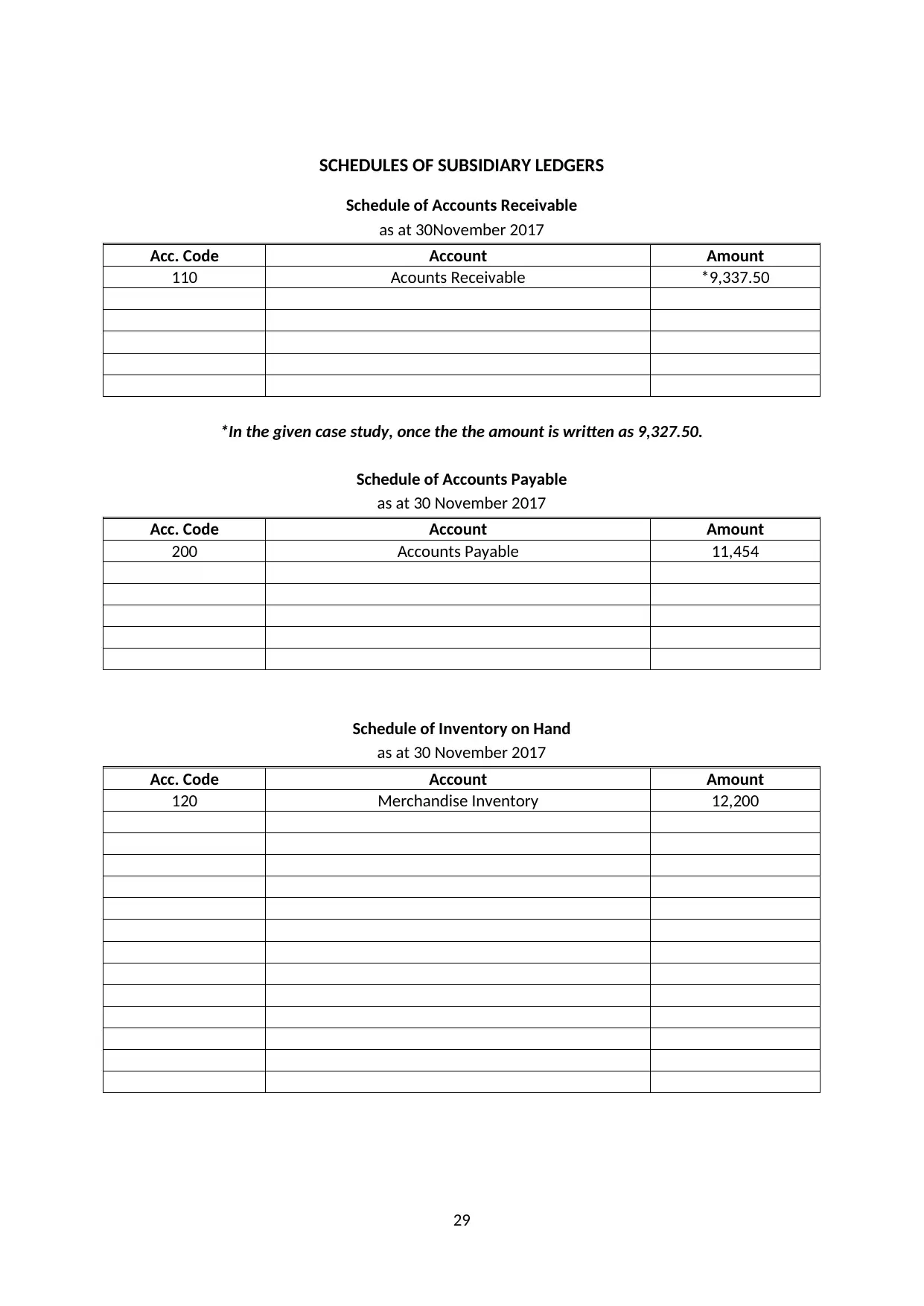

SCHEDULES OF SUBSIDIARY LEDGERS

Schedule of Accounts Receivable

as at 30November 2017

Acc. Code Account Amount

110 Acounts Receivable *9,337.50

*In the given case study, once the the amount is written as 9,327.50.

Schedule of Accounts Payable

as at 30 November 2017

Acc. Code Account Amount

200 Accounts Payable 11,454

Schedule of Inventory on Hand

as at 30 November 2017

Acc. Code Account Amount

120 Merchandise Inventory 12,200

29

Schedule of Accounts Receivable

as at 30November 2017

Acc. Code Account Amount

110 Acounts Receivable *9,337.50

*In the given case study, once the the amount is written as 9,327.50.

Schedule of Accounts Payable

as at 30 November 2017

Acc. Code Account Amount

200 Accounts Payable 11,454

Schedule of Inventory on Hand

as at 30 November 2017

Acc. Code Account Amount

120 Merchandise Inventory 12,200

29

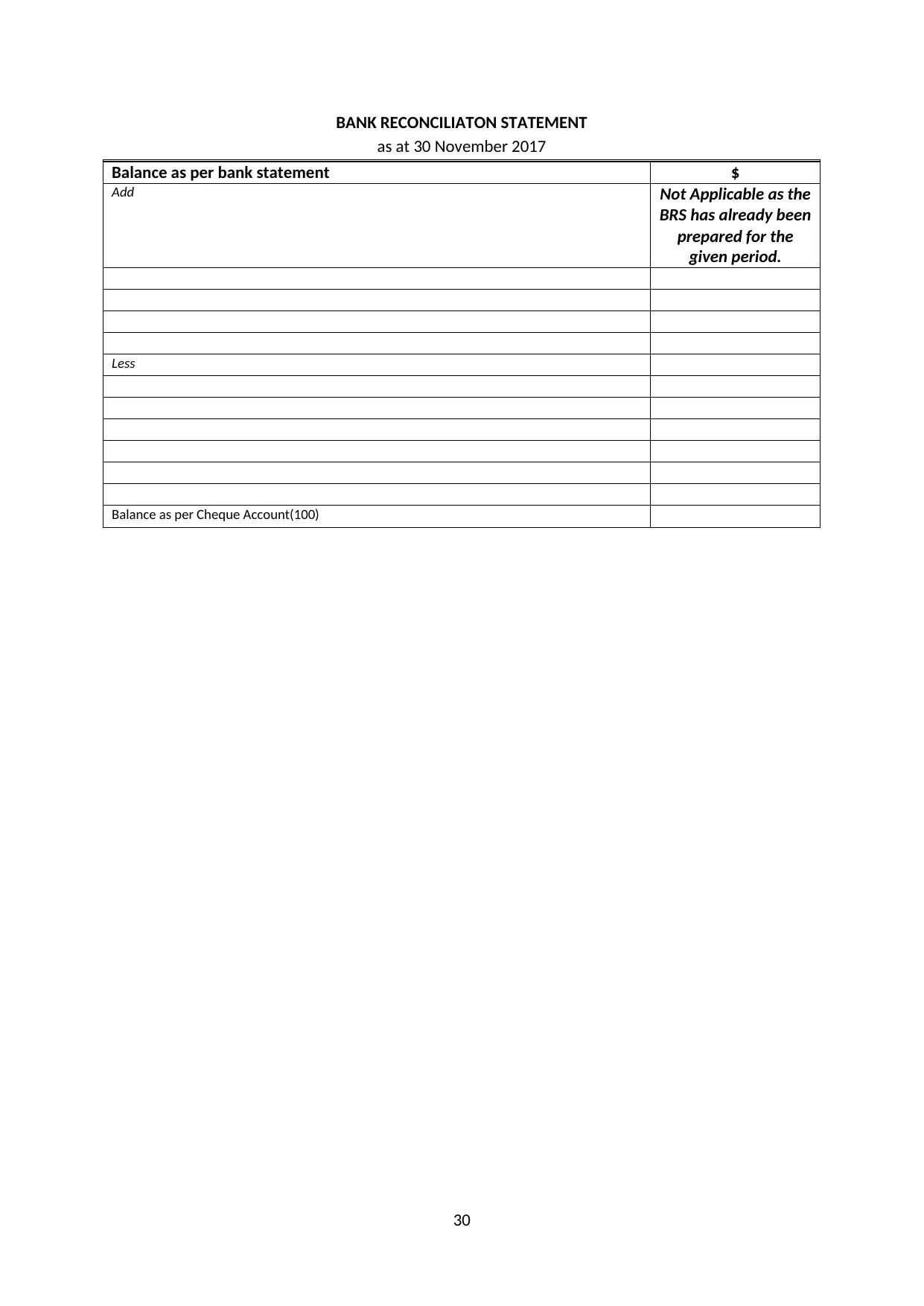

BANK RECONCILIATON STATEMENT

as at 30 November 2017

Balance as per bank statement $

Add Not Applicable as the

BRS has already been

prepared for the

given period.

Less

Balance as per Cheque Account(100)

30

as at 30 November 2017

Balance as per bank statement $

Add Not Applicable as the

BRS has already been

prepared for the

given period.

Less

Balance as per Cheque Account(100)

30

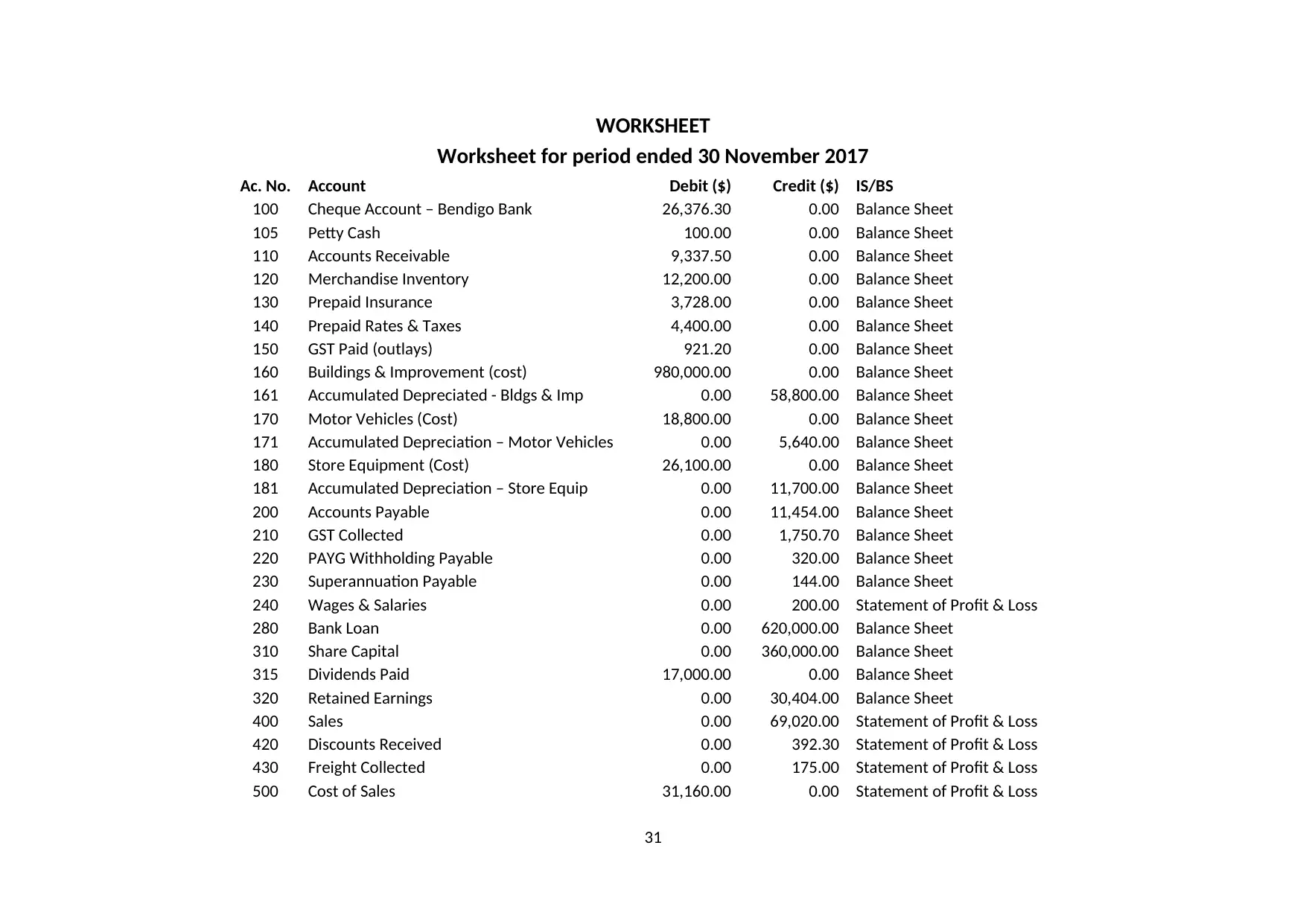

WORKSHEET

Worksheet for period ended 30 November 2017

Ac. No. Account Debit ($) Credit ($) IS/BS

100 Cheque Account – Bendigo Bank 26,376.30 0.00 Balance Sheet

105 Petty Cash 100.00 0.00 Balance Sheet

110 Accounts Receivable 9,337.50 0.00 Balance Sheet

120 Merchandise Inventory 12,200.00 0.00 Balance Sheet

130 Prepaid Insurance 3,728.00 0.00 Balance Sheet

140 Prepaid Rates & Taxes 4,400.00 0.00 Balance Sheet

150 GST Paid (outlays) 921.20 0.00 Balance Sheet

160 Buildings & Improvement (cost) 980,000.00 0.00 Balance Sheet

161 Accumulated Depreciated - Bldgs & Imp 0.00 58,800.00 Balance Sheet

170 Motor Vehicles (Cost) 18,800.00 0.00 Balance Sheet

171 Accumulated Depreciation – Motor Vehicles 0.00 5,640.00 Balance Sheet

180 Store Equipment (Cost) 26,100.00 0.00 Balance Sheet

181 Accumulated Depreciation – Store Equip 0.00 11,700.00 Balance Sheet

200 Accounts Payable 0.00 11,454.00 Balance Sheet

210 GST Collected 0.00 1,750.70 Balance Sheet

220 PAYG Withholding Payable 0.00 320.00 Balance Sheet

230 Superannuation Payable 0.00 144.00 Balance Sheet

240 Wages & Salaries 0.00 200.00 Statement of Profit & Loss

280 Bank Loan 0.00 620,000.00 Balance Sheet

310 Share Capital 0.00 360,000.00 Balance Sheet

315 Dividends Paid 17,000.00 0.00 Balance Sheet

320 Retained Earnings 0.00 30,404.00 Balance Sheet

400 Sales 0.00 69,020.00 Statement of Profit & Loss

420 Discounts Received 0.00 392.30 Statement of Profit & Loss

430 Freight Collected 0.00 175.00 Statement of Profit & Loss

500 Cost of Sales 31,160.00 0.00 Statement of Profit & Loss

31

Worksheet for period ended 30 November 2017

Ac. No. Account Debit ($) Credit ($) IS/BS

100 Cheque Account – Bendigo Bank 26,376.30 0.00 Balance Sheet

105 Petty Cash 100.00 0.00 Balance Sheet

110 Accounts Receivable 9,337.50 0.00 Balance Sheet

120 Merchandise Inventory 12,200.00 0.00 Balance Sheet

130 Prepaid Insurance 3,728.00 0.00 Balance Sheet

140 Prepaid Rates & Taxes 4,400.00 0.00 Balance Sheet

150 GST Paid (outlays) 921.20 0.00 Balance Sheet

160 Buildings & Improvement (cost) 980,000.00 0.00 Balance Sheet

161 Accumulated Depreciated - Bldgs & Imp 0.00 58,800.00 Balance Sheet

170 Motor Vehicles (Cost) 18,800.00 0.00 Balance Sheet

171 Accumulated Depreciation – Motor Vehicles 0.00 5,640.00 Balance Sheet

180 Store Equipment (Cost) 26,100.00 0.00 Balance Sheet

181 Accumulated Depreciation – Store Equip 0.00 11,700.00 Balance Sheet

200 Accounts Payable 0.00 11,454.00 Balance Sheet

210 GST Collected 0.00 1,750.70 Balance Sheet

220 PAYG Withholding Payable 0.00 320.00 Balance Sheet

230 Superannuation Payable 0.00 144.00 Balance Sheet

240 Wages & Salaries 0.00 200.00 Statement of Profit & Loss

280 Bank Loan 0.00 620,000.00 Balance Sheet

310 Share Capital 0.00 360,000.00 Balance Sheet

315 Dividends Paid 17,000.00 0.00 Balance Sheet

320 Retained Earnings 0.00 30,404.00 Balance Sheet

400 Sales 0.00 69,020.00 Statement of Profit & Loss

420 Discounts Received 0.00 392.30 Statement of Profit & Loss

430 Freight Collected 0.00 175.00 Statement of Profit & Loss

500 Cost of Sales 31,160.00 0.00 Statement of Profit & Loss

31

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

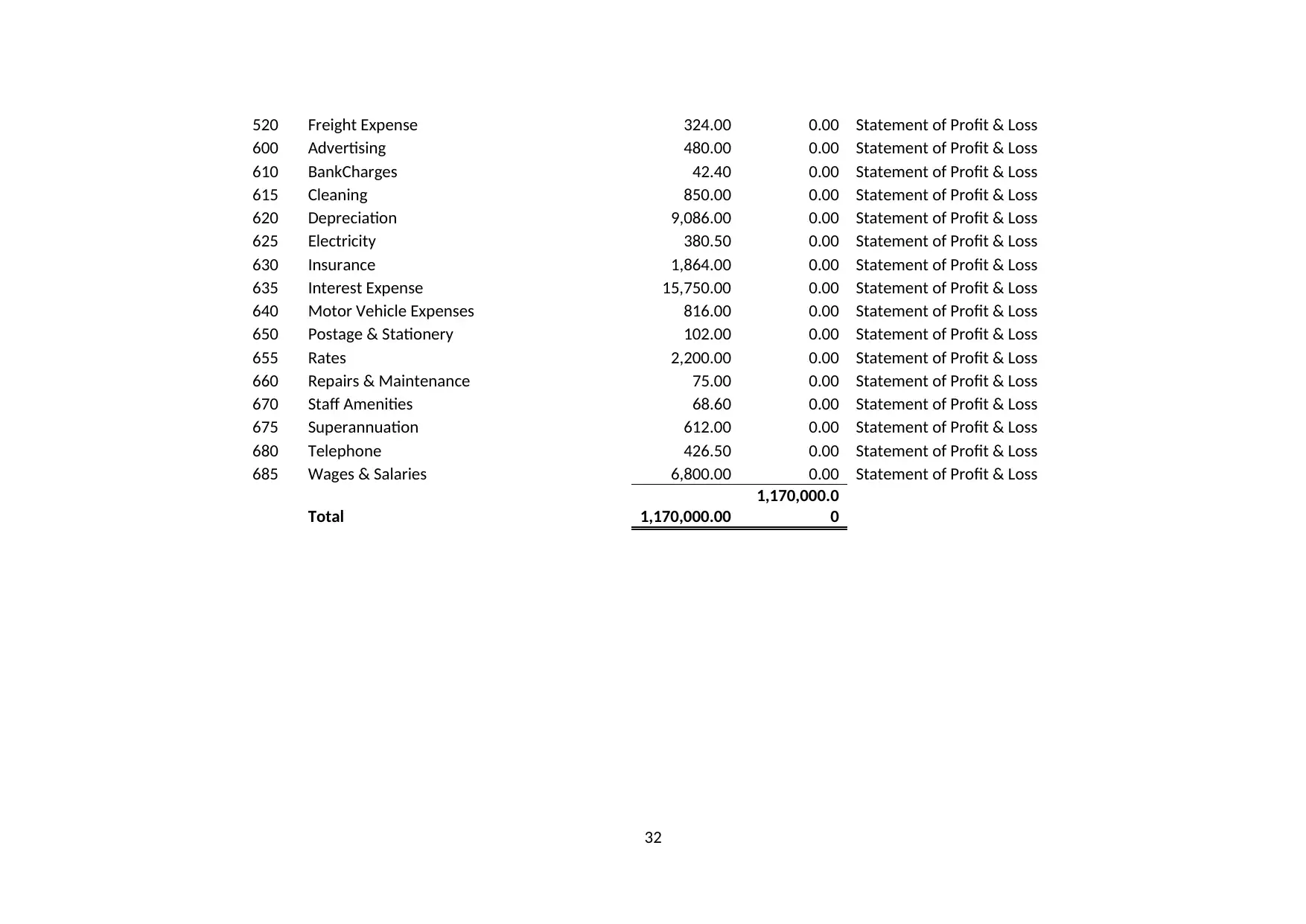

520 Freight Expense 324.00 0.00 Statement of Profit & Loss

600 Advertising 480.00 0.00 Statement of Profit & Loss

610 BankCharges 42.40 0.00 Statement of Profit & Loss

615 Cleaning 850.00 0.00 Statement of Profit & Loss

620 Depreciation 9,086.00 0.00 Statement of Profit & Loss

625 Electricity 380.50 0.00 Statement of Profit & Loss

630 Insurance 1,864.00 0.00 Statement of Profit & Loss

635 Interest Expense 15,750.00 0.00 Statement of Profit & Loss

640 Motor Vehicle Expenses 816.00 0.00 Statement of Profit & Loss

650 Postage & Stationery 102.00 0.00 Statement of Profit & Loss

655 Rates 2,200.00 0.00 Statement of Profit & Loss

660 Repairs & Maintenance 75.00 0.00 Statement of Profit & Loss

670 Staff Amenities 68.60 0.00 Statement of Profit & Loss

675 Superannuation 612.00 0.00 Statement of Profit & Loss

680 Telephone 426.50 0.00 Statement of Profit & Loss

685 Wages & Salaries 6,800.00 0.00 Statement of Profit & Loss

Total 1,170,000.00

1,170,000.0

0

32

600 Advertising 480.00 0.00 Statement of Profit & Loss

610 BankCharges 42.40 0.00 Statement of Profit & Loss

615 Cleaning 850.00 0.00 Statement of Profit & Loss

620 Depreciation 9,086.00 0.00 Statement of Profit & Loss

625 Electricity 380.50 0.00 Statement of Profit & Loss

630 Insurance 1,864.00 0.00 Statement of Profit & Loss

635 Interest Expense 15,750.00 0.00 Statement of Profit & Loss

640 Motor Vehicle Expenses 816.00 0.00 Statement of Profit & Loss

650 Postage & Stationery 102.00 0.00 Statement of Profit & Loss

655 Rates 2,200.00 0.00 Statement of Profit & Loss

660 Repairs & Maintenance 75.00 0.00 Statement of Profit & Loss

670 Staff Amenities 68.60 0.00 Statement of Profit & Loss

675 Superannuation 612.00 0.00 Statement of Profit & Loss

680 Telephone 426.50 0.00 Statement of Profit & Loss

685 Wages & Salaries 6,800.00 0.00 Statement of Profit & Loss

Total 1,170,000.00

1,170,000.0

0

32

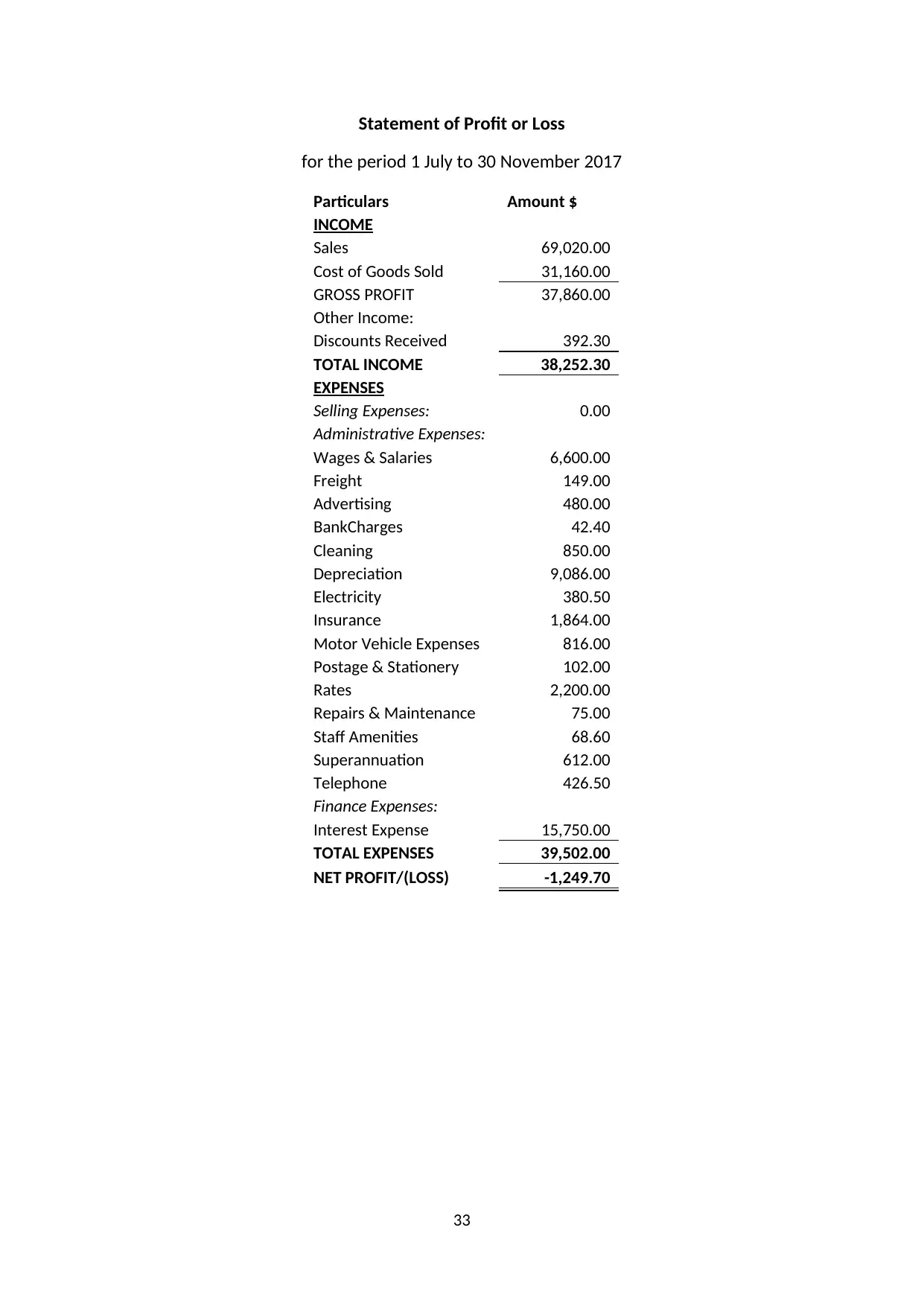

Statement of Profit or Loss

for the period 1 July to 30 November 2017

Particulars Amount $

INCOME

Sales 69,020.00

Cost of Goods Sold 31,160.00

GROSS PROFIT 37,860.00

Other Income:

Discounts Received 392.30

TOTAL INCOME 38,252.30

EXPENSES

Selling Expenses: 0.00

Administrative Expenses:

Wages & Salaries 6,600.00

Freight 149.00

Advertising 480.00

BankCharges 42.40

Cleaning 850.00

Depreciation 9,086.00

Electricity 380.50

Insurance 1,864.00

Motor Vehicle Expenses 816.00

Postage & Stationery 102.00

Rates 2,200.00

Repairs & Maintenance 75.00

Staff Amenities 68.60

Superannuation 612.00

Telephone 426.50

Finance Expenses:

Interest Expense 15,750.00

TOTAL EXPENSES 39,502.00

NET PROFIT/(LOSS) -1,249.70

33

for the period 1 July to 30 November 2017

Particulars Amount $

INCOME

Sales 69,020.00

Cost of Goods Sold 31,160.00

GROSS PROFIT 37,860.00

Other Income:

Discounts Received 392.30

TOTAL INCOME 38,252.30

EXPENSES

Selling Expenses: 0.00

Administrative Expenses:

Wages & Salaries 6,600.00

Freight 149.00

Advertising 480.00

BankCharges 42.40

Cleaning 850.00

Depreciation 9,086.00

Electricity 380.50

Insurance 1,864.00

Motor Vehicle Expenses 816.00

Postage & Stationery 102.00

Rates 2,200.00

Repairs & Maintenance 75.00

Staff Amenities 68.60

Superannuation 612.00

Telephone 426.50

Finance Expenses:

Interest Expense 15,750.00

TOTAL EXPENSES 39,502.00

NET PROFIT/(LOSS) -1,249.70

33

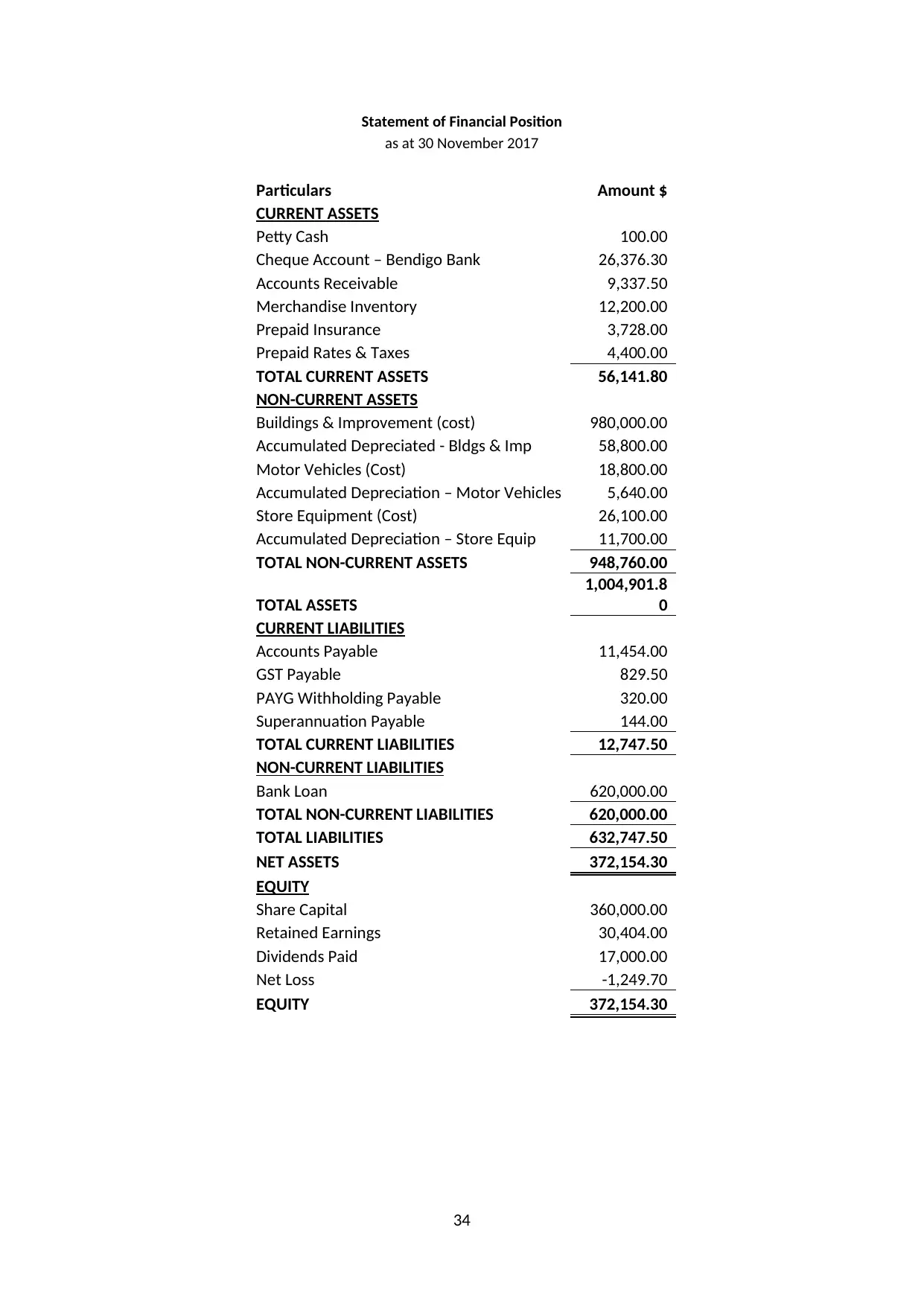

Statement of Financial Position

as at 30 November 2017

Particulars Amount $

CURRENT ASSETS

Petty Cash 100.00

Cheque Account – Bendigo Bank 26,376.30

Accounts Receivable 9,337.50

Merchandise Inventory 12,200.00

Prepaid Insurance 3,728.00

Prepaid Rates & Taxes 4,400.00

TOTAL CURRENT ASSETS 56,141.80

NON-CURRENT ASSETS

Buildings & Improvement (cost) 980,000.00

Accumulated Depreciated - Bldgs & Imp 58,800.00

Motor Vehicles (Cost) 18,800.00

Accumulated Depreciation – Motor Vehicles 5,640.00

Store Equipment (Cost) 26,100.00

Accumulated Depreciation – Store Equip 11,700.00

TOTAL NON-CURRENT ASSETS 948,760.00

TOTAL ASSETS

1,004,901.8

0

CURRENT LIABILITIES

Accounts Payable 11,454.00

GST Payable 829.50

PAYG Withholding Payable 320.00

Superannuation Payable 144.00

TOTAL CURRENT LIABILITIES 12,747.50

NON-CURRENT LIABILITIES

Bank Loan 620,000.00

TOTAL NON-CURRENT LIABILITIES 620,000.00

TOTAL LIABILITIES 632,747.50

NET ASSETS 372,154.30

EQUITY

Share Capital 360,000.00

Retained Earnings 30,404.00

Dividends Paid 17,000.00

Net Loss -1,249.70

EQUITY 372,154.30

34

as at 30 November 2017

Particulars Amount $

CURRENT ASSETS

Petty Cash 100.00

Cheque Account – Bendigo Bank 26,376.30

Accounts Receivable 9,337.50

Merchandise Inventory 12,200.00

Prepaid Insurance 3,728.00

Prepaid Rates & Taxes 4,400.00

TOTAL CURRENT ASSETS 56,141.80

NON-CURRENT ASSETS

Buildings & Improvement (cost) 980,000.00

Accumulated Depreciated - Bldgs & Imp 58,800.00

Motor Vehicles (Cost) 18,800.00

Accumulated Depreciation – Motor Vehicles 5,640.00

Store Equipment (Cost) 26,100.00

Accumulated Depreciation – Store Equip 11,700.00

TOTAL NON-CURRENT ASSETS 948,760.00

TOTAL ASSETS

1,004,901.8

0

CURRENT LIABILITIES

Accounts Payable 11,454.00

GST Payable 829.50

PAYG Withholding Payable 320.00

Superannuation Payable 144.00

TOTAL CURRENT LIABILITIES 12,747.50

NON-CURRENT LIABILITIES

Bank Loan 620,000.00

TOTAL NON-CURRENT LIABILITIES 620,000.00

TOTAL LIABILITIES 632,747.50

NET ASSETS 372,154.30

EQUITY

Share Capital 360,000.00

Retained Earnings 30,404.00

Dividends Paid 17,000.00

Net Loss -1,249.70

EQUITY 372,154.30

34

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

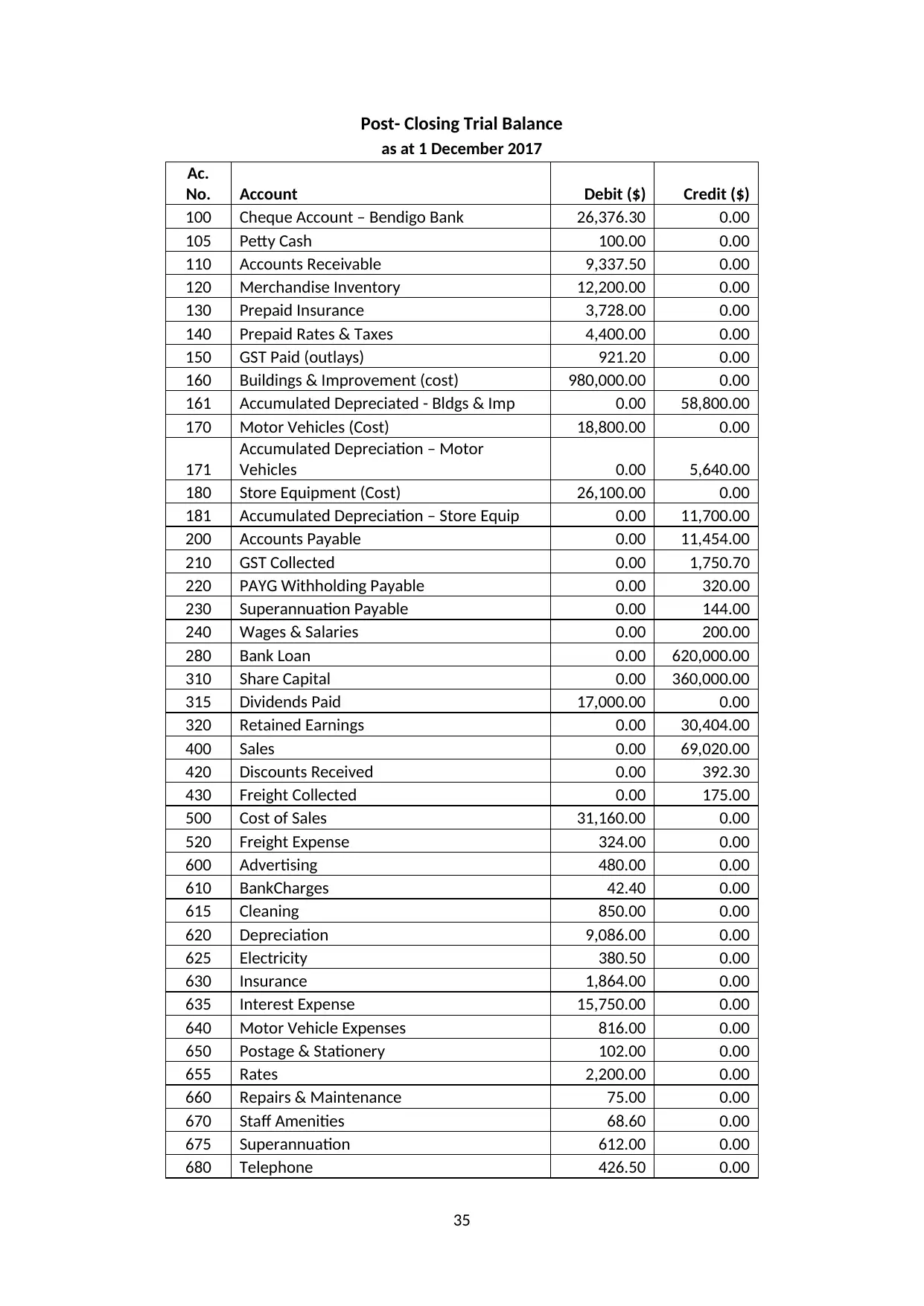

Post- Closing Trial Balance

as at 1 December 2017

Ac.

No. Account Debit ($) Credit ($)

100 Cheque Account – Bendigo Bank 26,376.30 0.00

105 Petty Cash 100.00 0.00

110 Accounts Receivable 9,337.50 0.00

120 Merchandise Inventory 12,200.00 0.00

130 Prepaid Insurance 3,728.00 0.00

140 Prepaid Rates & Taxes 4,400.00 0.00

150 GST Paid (outlays) 921.20 0.00

160 Buildings & Improvement (cost) 980,000.00 0.00

161 Accumulated Depreciated - Bldgs & Imp 0.00 58,800.00

170 Motor Vehicles (Cost) 18,800.00 0.00

171

Accumulated Depreciation – Motor

Vehicles 0.00 5,640.00

180 Store Equipment (Cost) 26,100.00 0.00

181 Accumulated Depreciation – Store Equip 0.00 11,700.00

200 Accounts Payable 0.00 11,454.00

210 GST Collected 0.00 1,750.70

220 PAYG Withholding Payable 0.00 320.00

230 Superannuation Payable 0.00 144.00

240 Wages & Salaries 0.00 200.00

280 Bank Loan 0.00 620,000.00

310 Share Capital 0.00 360,000.00

315 Dividends Paid 17,000.00 0.00

320 Retained Earnings 0.00 30,404.00

400 Sales 0.00 69,020.00

420 Discounts Received 0.00 392.30

430 Freight Collected 0.00 175.00

500 Cost of Sales 31,160.00 0.00

520 Freight Expense 324.00 0.00

600 Advertising 480.00 0.00

610 BankCharges 42.40 0.00

615 Cleaning 850.00 0.00

620 Depreciation 9,086.00 0.00

625 Electricity 380.50 0.00

630 Insurance 1,864.00 0.00

635 Interest Expense 15,750.00 0.00

640 Motor Vehicle Expenses 816.00 0.00

650 Postage & Stationery 102.00 0.00

655 Rates 2,200.00 0.00

660 Repairs & Maintenance 75.00 0.00

670 Staff Amenities 68.60 0.00

675 Superannuation 612.00 0.00

680 Telephone 426.50 0.00

35

as at 1 December 2017

Ac.

No. Account Debit ($) Credit ($)

100 Cheque Account – Bendigo Bank 26,376.30 0.00

105 Petty Cash 100.00 0.00

110 Accounts Receivable 9,337.50 0.00

120 Merchandise Inventory 12,200.00 0.00

130 Prepaid Insurance 3,728.00 0.00

140 Prepaid Rates & Taxes 4,400.00 0.00

150 GST Paid (outlays) 921.20 0.00

160 Buildings & Improvement (cost) 980,000.00 0.00

161 Accumulated Depreciated - Bldgs & Imp 0.00 58,800.00

170 Motor Vehicles (Cost) 18,800.00 0.00

171

Accumulated Depreciation – Motor

Vehicles 0.00 5,640.00

180 Store Equipment (Cost) 26,100.00 0.00

181 Accumulated Depreciation – Store Equip 0.00 11,700.00

200 Accounts Payable 0.00 11,454.00

210 GST Collected 0.00 1,750.70

220 PAYG Withholding Payable 0.00 320.00

230 Superannuation Payable 0.00 144.00

240 Wages & Salaries 0.00 200.00

280 Bank Loan 0.00 620,000.00

310 Share Capital 0.00 360,000.00

315 Dividends Paid 17,000.00 0.00

320 Retained Earnings 0.00 30,404.00

400 Sales 0.00 69,020.00

420 Discounts Received 0.00 392.30

430 Freight Collected 0.00 175.00

500 Cost of Sales 31,160.00 0.00

520 Freight Expense 324.00 0.00

600 Advertising 480.00 0.00

610 BankCharges 42.40 0.00

615 Cleaning 850.00 0.00

620 Depreciation 9,086.00 0.00

625 Electricity 380.50 0.00

630 Insurance 1,864.00 0.00

635 Interest Expense 15,750.00 0.00

640 Motor Vehicle Expenses 816.00 0.00

650 Postage & Stationery 102.00 0.00

655 Rates 2,200.00 0.00

660 Repairs & Maintenance 75.00 0.00

670 Staff Amenities 68.60 0.00

675 Superannuation 612.00 0.00

680 Telephone 426.50 0.00

35

1 out of 35

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.