Financial Analysis of Apollo Tourism and Leisure Ltd

VerifiedAdded on 2020/05/11

|13

|2143

|61

AI Summary

The assignment focuses on a comprehensive financial analysis of Apollo Tourism and Leisure Ltd. It delves into the company's capital structure, highlighting the proportion of debt and equity financing. The analysis also assesses the company's market performance, referencing profitability trends and cash flow position. Key financial indicators are examined to evaluate the overall financial health and stability of Apollo Tourism and Leisure Ltd.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

RUNNING HEAD: ACCOUNTS ASSIGNMENT

ACCOUNTS ASSIGNMENT

ACCOUNTS ASSIGNMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ACCOUNTS ASSIGNMENT 1

Contents

INTRODUCTION.....................................................................................................................................2

DEBT VALUATION..............................................................................................................................2

SHARE VALUATION............................................................................................................................4

COST OF CAPITAL...............................................................................................................................7

MARKET ANALYSIS...........................................................................................................................10

REFERENCES........................................................................................................................................12

Contents

INTRODUCTION.....................................................................................................................................2

DEBT VALUATION..............................................................................................................................2

SHARE VALUATION............................................................................................................................4

COST OF CAPITAL...............................................................................................................................7

MARKET ANALYSIS...........................................................................................................................10

REFERENCES........................................................................................................................................12

ACCOUNTS ASSIGNMENT 2

INTRODUCTION

Apollo Tourism and Leisure Ltd is used for this question. Apollo is the Australian

based company and since 1985, the company has come into operations but in November 2016

the company has become listed in ASX (ASX: ATL). The main business activities of the

company are to do producing, wholesaling, leasing, retailing and issuing the wide varieties of

leisure activities such as motorhomes, campervans and caravans. The other business locations

of Apollo around the world are US, Canada, North America and New Zealand. The central

agenda of Apollo is to fulfil the potentials of the clients (Prospectus, 2017).

DEBT VALUATION

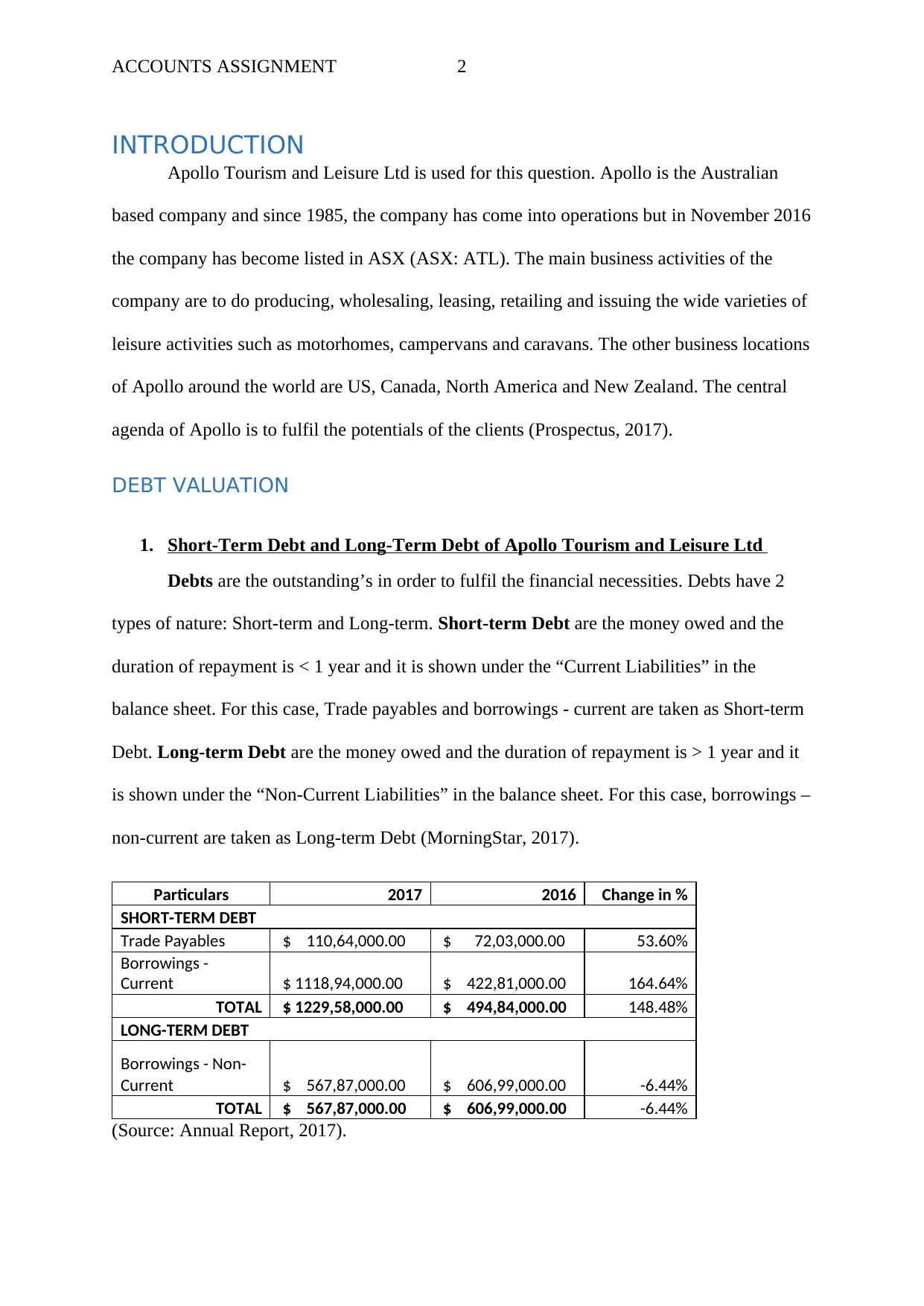

1. Short-Term Debt and Long-Term Debt of Apollo Tourism and Leisure Ltd

Debts are the outstanding’s in order to fulfil the financial necessities. Debts have 2

types of nature: Short-term and Long-term. Short-term Debt are the money owed and the

duration of repayment is < 1 year and it is shown under the “Current Liabilities” in the

balance sheet. For this case, Trade payables and borrowings - current are taken as Short-term

Debt. Long-term Debt are the money owed and the duration of repayment is > 1 year and it

is shown under the “Non-Current Liabilities” in the balance sheet. For this case, borrowings –

non-current are taken as Long-term Debt (MorningStar, 2017).

Particulars 2017 2016 Change in %

SHORT-TERM DEBT

Trade Payables $ 110,64,000.00 $ 72,03,000.00 53.60%

Borrowings -

Current $ 1118,94,000.00 $ 422,81,000.00 164.64%

TOTAL $ 1229,58,000.00 $ 494,84,000.00 148.48%

LONG-TERM DEBT

Borrowings - Non-

Current $ 567,87,000.00 $ 606,99,000.00 -6.44%

TOTAL $ 567,87,000.00 $ 606,99,000.00 -6.44%

(Source: Annual Report, 2017).

INTRODUCTION

Apollo Tourism and Leisure Ltd is used for this question. Apollo is the Australian

based company and since 1985, the company has come into operations but in November 2016

the company has become listed in ASX (ASX: ATL). The main business activities of the

company are to do producing, wholesaling, leasing, retailing and issuing the wide varieties of

leisure activities such as motorhomes, campervans and caravans. The other business locations

of Apollo around the world are US, Canada, North America and New Zealand. The central

agenda of Apollo is to fulfil the potentials of the clients (Prospectus, 2017).

DEBT VALUATION

1. Short-Term Debt and Long-Term Debt of Apollo Tourism and Leisure Ltd

Debts are the outstanding’s in order to fulfil the financial necessities. Debts have 2

types of nature: Short-term and Long-term. Short-term Debt are the money owed and the

duration of repayment is < 1 year and it is shown under the “Current Liabilities” in the

balance sheet. For this case, Trade payables and borrowings - current are taken as Short-term

Debt. Long-term Debt are the money owed and the duration of repayment is > 1 year and it

is shown under the “Non-Current Liabilities” in the balance sheet. For this case, borrowings –

non-current are taken as Long-term Debt (MorningStar, 2017).

Particulars 2017 2016 Change in %

SHORT-TERM DEBT

Trade Payables $ 110,64,000.00 $ 72,03,000.00 53.60%

Borrowings -

Current $ 1118,94,000.00 $ 422,81,000.00 164.64%

TOTAL $ 1229,58,000.00 $ 494,84,000.00 148.48%

LONG-TERM DEBT

Borrowings - Non-

Current $ 567,87,000.00 $ 606,99,000.00 -6.44%

TOTAL $ 567,87,000.00 $ 606,99,000.00 -6.44%

(Source: Annual Report, 2017).

ACCOUNTS ASSIGNMENT 3

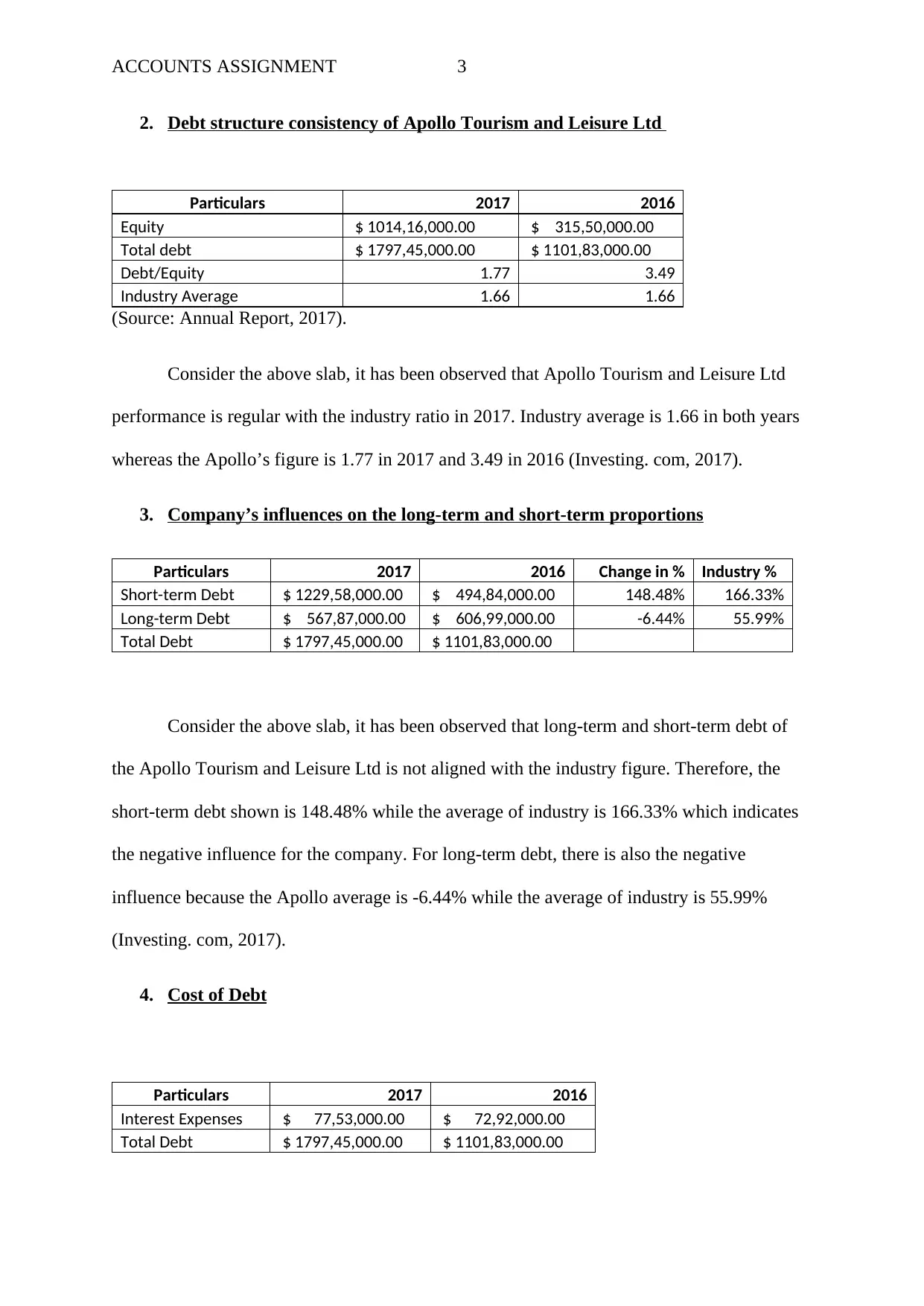

2. Debt structure consistency of Apollo Tourism and Leisure Ltd

Particulars 2017 2016

Equity $ 1014,16,000.00 $ 315,50,000.00

Total debt $ 1797,45,000.00 $ 1101,83,000.00

Debt/Equity 1.77 3.49

Industry Average 1.66 1.66

(Source: Annual Report, 2017).

Consider the above slab, it has been observed that Apollo Tourism and Leisure Ltd

performance is regular with the industry ratio in 2017. Industry average is 1.66 in both years

whereas the Apollo’s figure is 1.77 in 2017 and 3.49 in 2016 (Investing. com, 2017).

3. Company’s influences on the long-term and short-term proportions

Particulars 2017 2016 Change in % Industry %

Short-term Debt $ 1229,58,000.00 $ 494,84,000.00 148.48% 166.33%

Long-term Debt $ 567,87,000.00 $ 606,99,000.00 -6.44% 55.99%

Total Debt $ 1797,45,000.00 $ 1101,83,000.00

Consider the above slab, it has been observed that long-term and short-term debt of

the Apollo Tourism and Leisure Ltd is not aligned with the industry figure. Therefore, the

short-term debt shown is 148.48% while the average of industry is 166.33% which indicates

the negative influence for the company. For long-term debt, there is also the negative

influence because the Apollo average is -6.44% while the average of industry is 55.99%

(Investing. com, 2017).

4. Cost of Debt

Particulars 2017 2016

Interest Expenses $ 77,53,000.00 $ 72,92,000.00

Total Debt $ 1797,45,000.00 $ 1101,83,000.00

2. Debt structure consistency of Apollo Tourism and Leisure Ltd

Particulars 2017 2016

Equity $ 1014,16,000.00 $ 315,50,000.00

Total debt $ 1797,45,000.00 $ 1101,83,000.00

Debt/Equity 1.77 3.49

Industry Average 1.66 1.66

(Source: Annual Report, 2017).

Consider the above slab, it has been observed that Apollo Tourism and Leisure Ltd

performance is regular with the industry ratio in 2017. Industry average is 1.66 in both years

whereas the Apollo’s figure is 1.77 in 2017 and 3.49 in 2016 (Investing. com, 2017).

3. Company’s influences on the long-term and short-term proportions

Particulars 2017 2016 Change in % Industry %

Short-term Debt $ 1229,58,000.00 $ 494,84,000.00 148.48% 166.33%

Long-term Debt $ 567,87,000.00 $ 606,99,000.00 -6.44% 55.99%

Total Debt $ 1797,45,000.00 $ 1101,83,000.00

Consider the above slab, it has been observed that long-term and short-term debt of

the Apollo Tourism and Leisure Ltd is not aligned with the industry figure. Therefore, the

short-term debt shown is 148.48% while the average of industry is 166.33% which indicates

the negative influence for the company. For long-term debt, there is also the negative

influence because the Apollo average is -6.44% while the average of industry is 55.99%

(Investing. com, 2017).

4. Cost of Debt

Particulars 2017 2016

Interest Expenses $ 77,53,000.00 $ 72,92,000.00

Total Debt $ 1797,45,000.00 $ 1101,83,000.00

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ACCOUNTS ASSIGNMENT 4

Cost of Debt

[Interest

expenses/Total

Debt] 4.31% 6.62%

(Source: Annual Report, 2017).

SHARE VALUATION

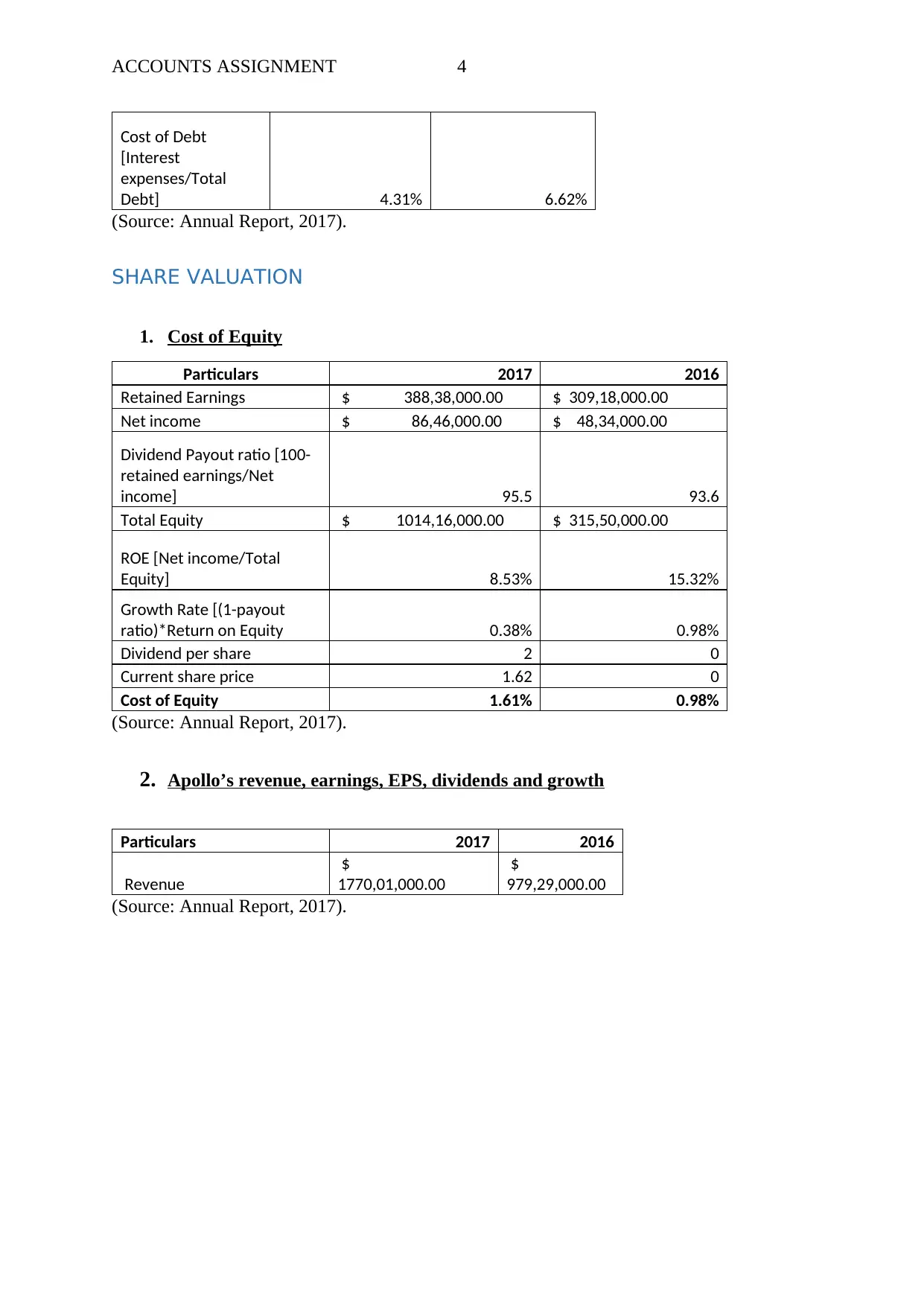

1. Cost of Equity

Particulars 2017 2016

Retained Earnings $ 388,38,000.00 $ 309,18,000.00

Net income $ 86,46,000.00 $ 48,34,000.00

Dividend Payout ratio [100-

retained earnings/Net

income] 95.5 93.6

Total Equity $ 1014,16,000.00 $ 315,50,000.00

ROE [Net income/Total

Equity] 8.53% 15.32%

Growth Rate [(1-payout

ratio)*Return on Equity 0.38% 0.98%

Dividend per share 2 0

Current share price 1.62 0

Cost of Equity 1.61% 0.98%

(Source: Annual Report, 2017).

2. Apollo’s revenue, earnings, EPS, dividends and growth

Particulars 2017 2016

Revenue

$

1770,01,000.00

$

979,29,000.00

(Source: Annual Report, 2017).

Cost of Debt

[Interest

expenses/Total

Debt] 4.31% 6.62%

(Source: Annual Report, 2017).

SHARE VALUATION

1. Cost of Equity

Particulars 2017 2016

Retained Earnings $ 388,38,000.00 $ 309,18,000.00

Net income $ 86,46,000.00 $ 48,34,000.00

Dividend Payout ratio [100-

retained earnings/Net

income] 95.5 93.6

Total Equity $ 1014,16,000.00 $ 315,50,000.00

ROE [Net income/Total

Equity] 8.53% 15.32%

Growth Rate [(1-payout

ratio)*Return on Equity 0.38% 0.98%

Dividend per share 2 0

Current share price 1.62 0

Cost of Equity 1.61% 0.98%

(Source: Annual Report, 2017).

2. Apollo’s revenue, earnings, EPS, dividends and growth

Particulars 2017 2016

Revenue

$

1770,01,000.00

$

979,29,000.00

(Source: Annual Report, 2017).

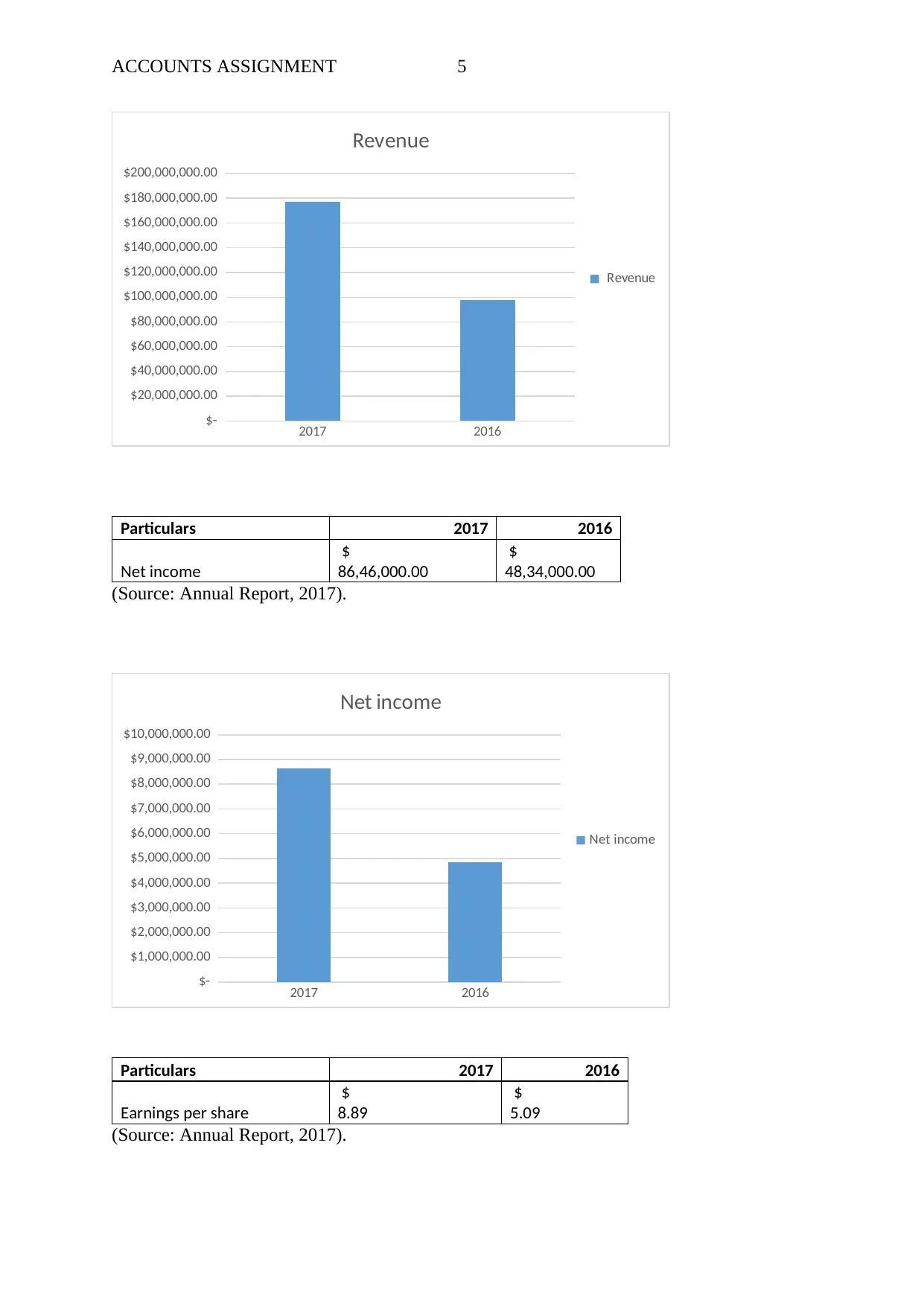

ACCOUNTS ASSIGNMENT 5

2017 2016

$-

$20,000,000.00

$40,000,000.00

$60,000,000.00

$80,000,000.00

$100,000,000.00

$120,000,000.00

$140,000,000.00

$160,000,000.00

$180,000,000.00

$200,000,000.00

Revenue

Revenue

Particulars 2017 2016

Net income

$

86,46,000.00

$

48,34,000.00

(Source: Annual Report, 2017).

2017 2016

$-

$1,000,000.00

$2,000,000.00

$3,000,000.00

$4,000,000.00

$5,000,000.00

$6,000,000.00

$7,000,000.00

$8,000,000.00

$9,000,000.00

$10,000,000.00

Net income

Net income

Particulars 2017 2016

Earnings per share

$

8.89

$

5.09

(Source: Annual Report, 2017).

2017 2016

$-

$20,000,000.00

$40,000,000.00

$60,000,000.00

$80,000,000.00

$100,000,000.00

$120,000,000.00

$140,000,000.00

$160,000,000.00

$180,000,000.00

$200,000,000.00

Revenue

Revenue

Particulars 2017 2016

Net income

$

86,46,000.00

$

48,34,000.00

(Source: Annual Report, 2017).

2017 2016

$-

$1,000,000.00

$2,000,000.00

$3,000,000.00

$4,000,000.00

$5,000,000.00

$6,000,000.00

$7,000,000.00

$8,000,000.00

$9,000,000.00

$10,000,000.00

Net income

Net income

Particulars 2017 2016

Earnings per share

$

8.89

$

5.09

(Source: Annual Report, 2017).

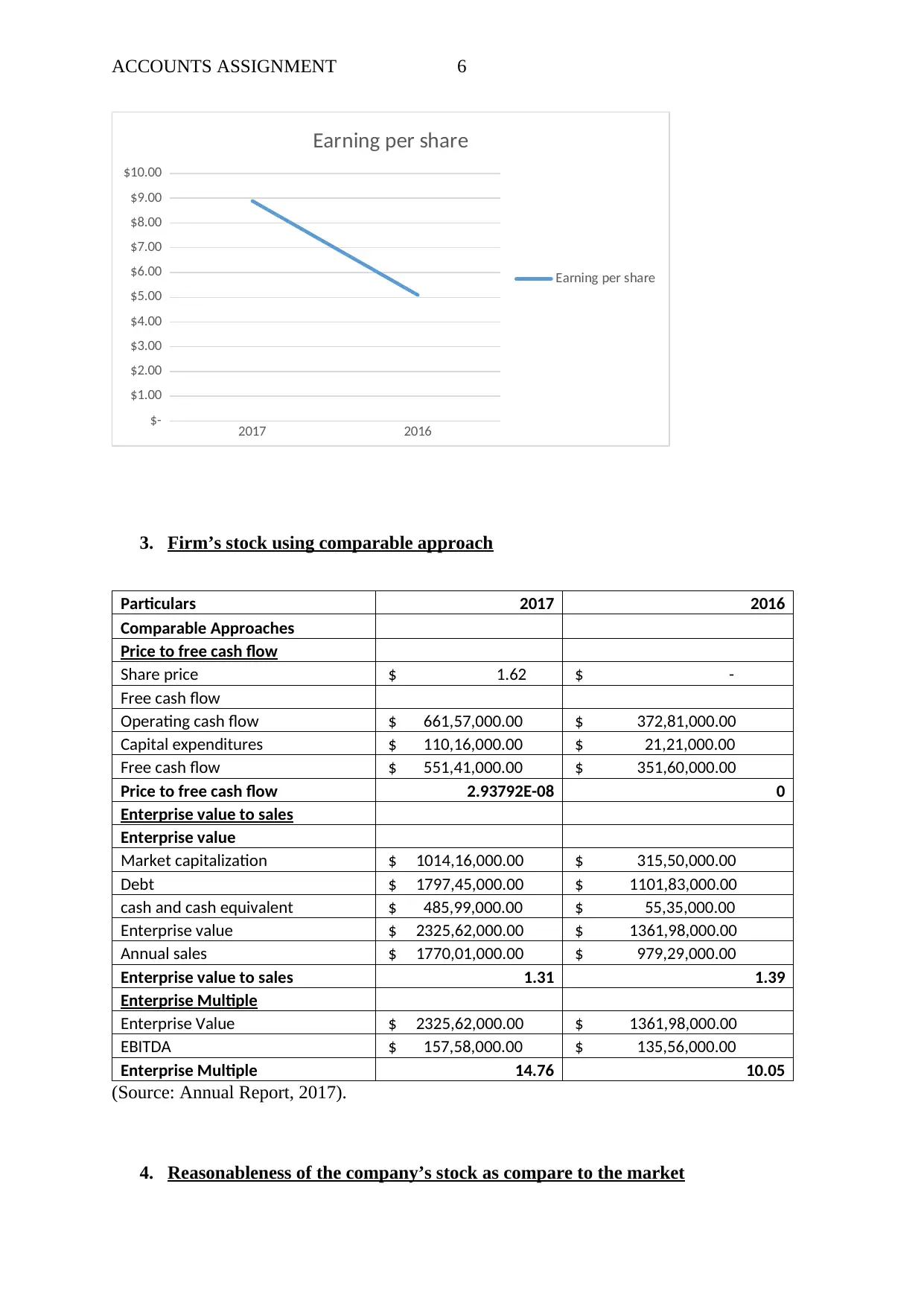

ACCOUNTS ASSIGNMENT 6

2017 2016

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

$10.00

Earning per share

Earning per share

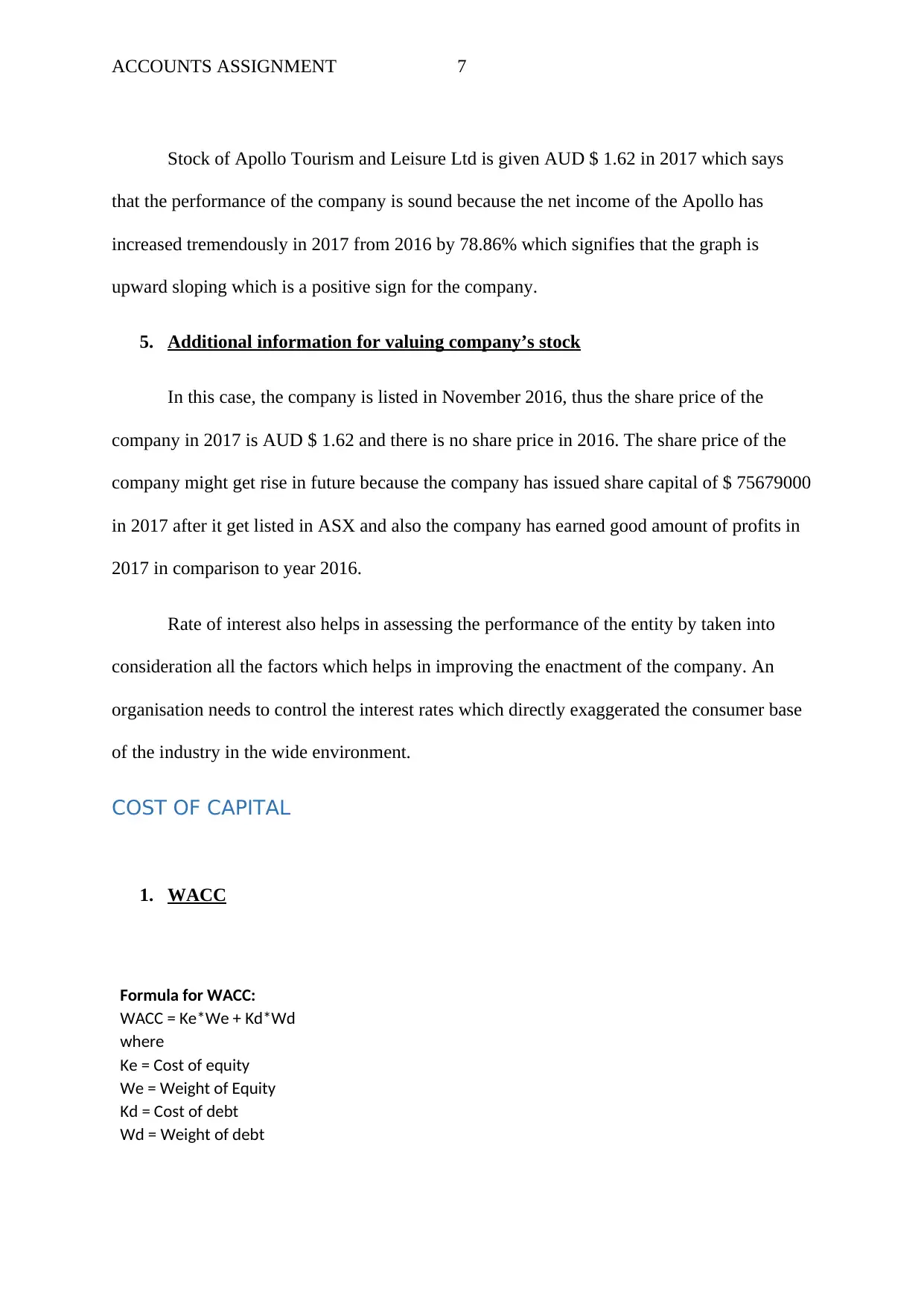

3. Firm’s stock using comparable approach

Particulars 2017 2016

Comparable Approaches

Price to free cash flow

Share price $ 1.62 $ -

Free cash flow

Operating cash flow $ 661,57,000.00 $ 372,81,000.00

Capital expenditures $ 110,16,000.00 $ 21,21,000.00

Free cash flow $ 551,41,000.00 $ 351,60,000.00

Price to free cash flow 2.93792E-08 0

Enterprise value to sales

Enterprise value

Market capitalization $ 1014,16,000.00 $ 315,50,000.00

Debt $ 1797,45,000.00 $ 1101,83,000.00

cash and cash equivalent $ 485,99,000.00 $ 55,35,000.00

Enterprise value $ 2325,62,000.00 $ 1361,98,000.00

Annual sales $ 1770,01,000.00 $ 979,29,000.00

Enterprise value to sales 1.31 1.39

Enterprise Multiple

Enterprise Value $ 2325,62,000.00 $ 1361,98,000.00

EBITDA $ 157,58,000.00 $ 135,56,000.00

Enterprise Multiple 14.76 10.05

(Source: Annual Report, 2017).

4. Reasonableness of the company’s stock as compare to the market

2017 2016

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$9.00

$10.00

Earning per share

Earning per share

3. Firm’s stock using comparable approach

Particulars 2017 2016

Comparable Approaches

Price to free cash flow

Share price $ 1.62 $ -

Free cash flow

Operating cash flow $ 661,57,000.00 $ 372,81,000.00

Capital expenditures $ 110,16,000.00 $ 21,21,000.00

Free cash flow $ 551,41,000.00 $ 351,60,000.00

Price to free cash flow 2.93792E-08 0

Enterprise value to sales

Enterprise value

Market capitalization $ 1014,16,000.00 $ 315,50,000.00

Debt $ 1797,45,000.00 $ 1101,83,000.00

cash and cash equivalent $ 485,99,000.00 $ 55,35,000.00

Enterprise value $ 2325,62,000.00 $ 1361,98,000.00

Annual sales $ 1770,01,000.00 $ 979,29,000.00

Enterprise value to sales 1.31 1.39

Enterprise Multiple

Enterprise Value $ 2325,62,000.00 $ 1361,98,000.00

EBITDA $ 157,58,000.00 $ 135,56,000.00

Enterprise Multiple 14.76 10.05

(Source: Annual Report, 2017).

4. Reasonableness of the company’s stock as compare to the market

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTS ASSIGNMENT 7

Stock of Apollo Tourism and Leisure Ltd is given AUD $ 1.62 in 2017 which says

that the performance of the company is sound because the net income of the Apollo has

increased tremendously in 2017 from 2016 by 78.86% which signifies that the graph is

upward sloping which is a positive sign for the company.

5. Additional information for valuing company’s stock

In this case, the company is listed in November 2016, thus the share price of the

company in 2017 is AUD $ 1.62 and there is no share price in 2016. The share price of the

company might get rise in future because the company has issued share capital of $ 75679000

in 2017 after it get listed in ASX and also the company has earned good amount of profits in

2017 in comparison to year 2016.

Rate of interest also helps in assessing the performance of the entity by taken into

consideration all the factors which helps in improving the enactment of the company. An

organisation needs to control the interest rates which directly exaggerated the consumer base

of the industry in the wide environment.

COST OF CAPITAL

1. WACC

Formula for WACC:

WACC = Ke*We + Kd*Wd

where

Ke = Cost of equity

We = Weight of Equity

Kd = Cost of debt

Wd = Weight of debt

Stock of Apollo Tourism and Leisure Ltd is given AUD $ 1.62 in 2017 which says

that the performance of the company is sound because the net income of the Apollo has

increased tremendously in 2017 from 2016 by 78.86% which signifies that the graph is

upward sloping which is a positive sign for the company.

5. Additional information for valuing company’s stock

In this case, the company is listed in November 2016, thus the share price of the

company in 2017 is AUD $ 1.62 and there is no share price in 2016. The share price of the

company might get rise in future because the company has issued share capital of $ 75679000

in 2017 after it get listed in ASX and also the company has earned good amount of profits in

2017 in comparison to year 2016.

Rate of interest also helps in assessing the performance of the entity by taken into

consideration all the factors which helps in improving the enactment of the company. An

organisation needs to control the interest rates which directly exaggerated the consumer base

of the industry in the wide environment.

COST OF CAPITAL

1. WACC

Formula for WACC:

WACC = Ke*We + Kd*Wd

where

Ke = Cost of equity

We = Weight of Equity

Kd = Cost of debt

Wd = Weight of debt

ACCOUNTS ASSIGNMENT 8

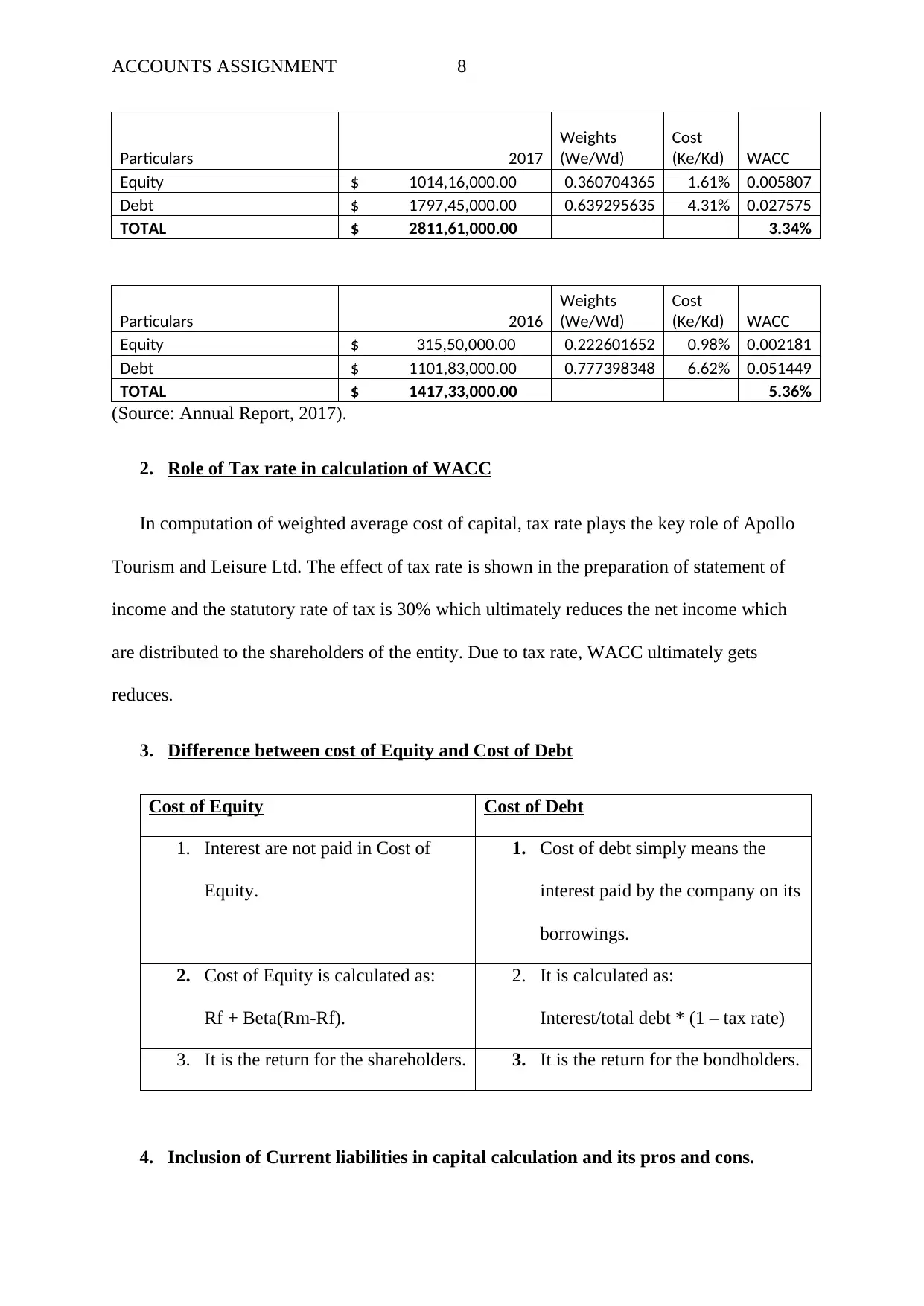

Particulars 2017

Weights

(We/Wd)

Cost

(Ke/Kd) WACC

Equity $ 1014,16,000.00 0.360704365 1.61% 0.005807

Debt $ 1797,45,000.00 0.639295635 4.31% 0.027575

TOTAL $ 2811,61,000.00 3.34%

Particulars 2016

Weights

(We/Wd)

Cost

(Ke/Kd) WACC

Equity $ 315,50,000.00 0.222601652 0.98% 0.002181

Debt $ 1101,83,000.00 0.777398348 6.62% 0.051449

TOTAL $ 1417,33,000.00 5.36%

(Source: Annual Report, 2017).

2. Role of Tax rate in calculation of WACC

In computation of weighted average cost of capital, tax rate plays the key role of Apollo

Tourism and Leisure Ltd. The effect of tax rate is shown in the preparation of statement of

income and the statutory rate of tax is 30% which ultimately reduces the net income which

are distributed to the shareholders of the entity. Due to tax rate, WACC ultimately gets

reduces.

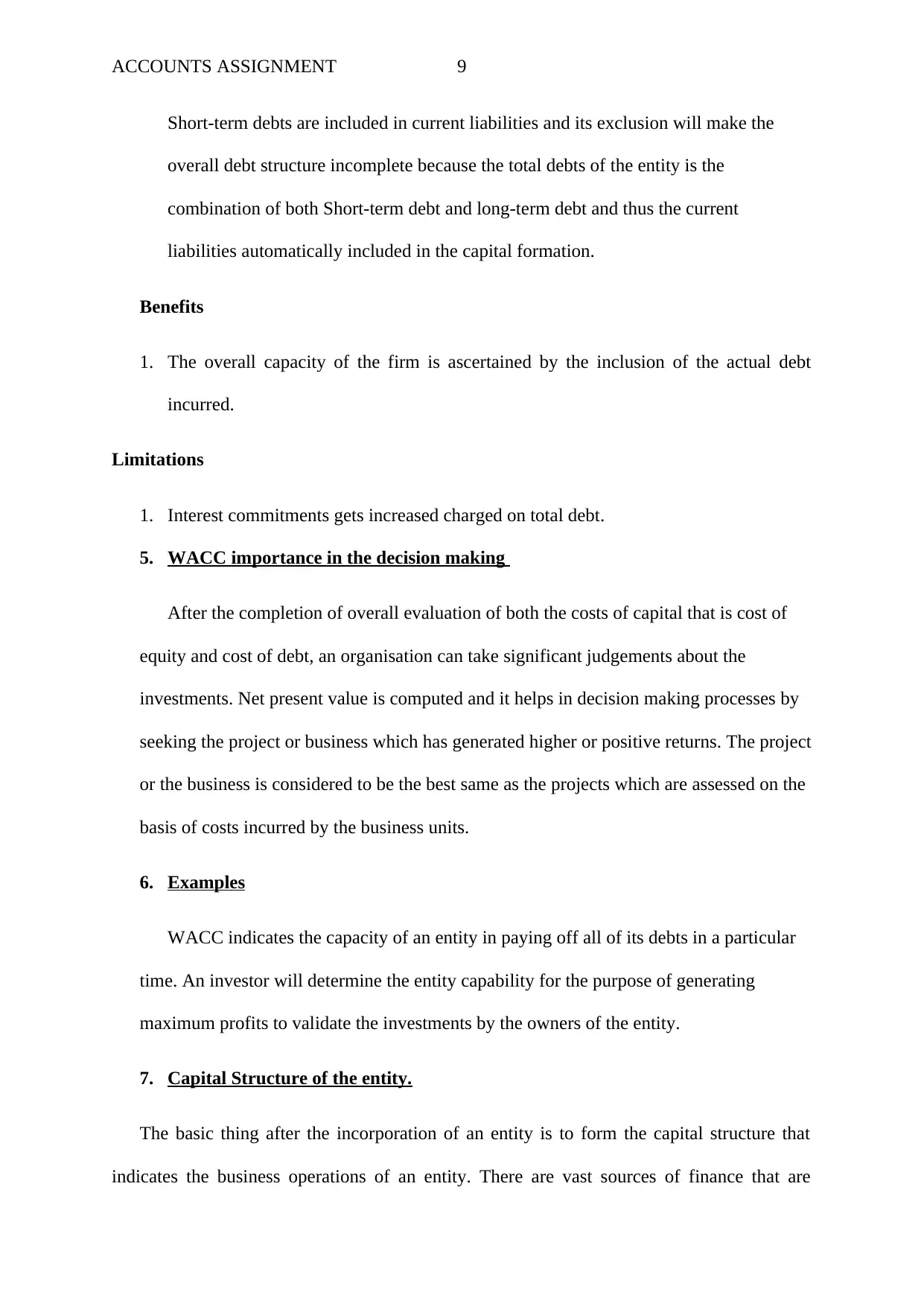

3. Difference between cost of Equity and Cost of Debt

Cost of Equity Cost of Debt

1. Interest are not paid in Cost of

Equity.

1. Cost of debt simply means the

interest paid by the company on its

borrowings.

2. Cost of Equity is calculated as:

Rf + Beta(Rm-Rf).

2. It is calculated as:

Interest/total debt * (1 – tax rate)

3. It is the return for the shareholders. 3. It is the return for the bondholders.

4. Inclusion of Current liabilities in capital calculation and its pros and cons.

Particulars 2017

Weights

(We/Wd)

Cost

(Ke/Kd) WACC

Equity $ 1014,16,000.00 0.360704365 1.61% 0.005807

Debt $ 1797,45,000.00 0.639295635 4.31% 0.027575

TOTAL $ 2811,61,000.00 3.34%

Particulars 2016

Weights

(We/Wd)

Cost

(Ke/Kd) WACC

Equity $ 315,50,000.00 0.222601652 0.98% 0.002181

Debt $ 1101,83,000.00 0.777398348 6.62% 0.051449

TOTAL $ 1417,33,000.00 5.36%

(Source: Annual Report, 2017).

2. Role of Tax rate in calculation of WACC

In computation of weighted average cost of capital, tax rate plays the key role of Apollo

Tourism and Leisure Ltd. The effect of tax rate is shown in the preparation of statement of

income and the statutory rate of tax is 30% which ultimately reduces the net income which

are distributed to the shareholders of the entity. Due to tax rate, WACC ultimately gets

reduces.

3. Difference between cost of Equity and Cost of Debt

Cost of Equity Cost of Debt

1. Interest are not paid in Cost of

Equity.

1. Cost of debt simply means the

interest paid by the company on its

borrowings.

2. Cost of Equity is calculated as:

Rf + Beta(Rm-Rf).

2. It is calculated as:

Interest/total debt * (1 – tax rate)

3. It is the return for the shareholders. 3. It is the return for the bondholders.

4. Inclusion of Current liabilities in capital calculation and its pros and cons.

ACCOUNTS ASSIGNMENT 9

Short-term debts are included in current liabilities and its exclusion will make the

overall debt structure incomplete because the total debts of the entity is the

combination of both Short-term debt and long-term debt and thus the current

liabilities automatically included in the capital formation.

Benefits

1. The overall capacity of the firm is ascertained by the inclusion of the actual debt

incurred.

Limitations

1. Interest commitments gets increased charged on total debt.

5. WACC importance in the decision making

After the completion of overall evaluation of both the costs of capital that is cost of

equity and cost of debt, an organisation can take significant judgements about the

investments. Net present value is computed and it helps in decision making processes by

seeking the project or business which has generated higher or positive returns. The project

or the business is considered to be the best same as the projects which are assessed on the

basis of costs incurred by the business units.

6. Examples

WACC indicates the capacity of an entity in paying off all of its debts in a particular

time. An investor will determine the entity capability for the purpose of generating

maximum profits to validate the investments by the owners of the entity.

7. Capital Structure of the entity.

The basic thing after the incorporation of an entity is to form the capital structure that

indicates the business operations of an entity. There are vast sources of finance that are

Short-term debts are included in current liabilities and its exclusion will make the

overall debt structure incomplete because the total debts of the entity is the

combination of both Short-term debt and long-term debt and thus the current

liabilities automatically included in the capital formation.

Benefits

1. The overall capacity of the firm is ascertained by the inclusion of the actual debt

incurred.

Limitations

1. Interest commitments gets increased charged on total debt.

5. WACC importance in the decision making

After the completion of overall evaluation of both the costs of capital that is cost of

equity and cost of debt, an organisation can take significant judgements about the

investments. Net present value is computed and it helps in decision making processes by

seeking the project or business which has generated higher or positive returns. The project

or the business is considered to be the best same as the projects which are assessed on the

basis of costs incurred by the business units.

6. Examples

WACC indicates the capacity of an entity in paying off all of its debts in a particular

time. An investor will determine the entity capability for the purpose of generating

maximum profits to validate the investments by the owners of the entity.

7. Capital Structure of the entity.

The basic thing after the incorporation of an entity is to form the capital structure that

indicates the business operations of an entity. There are vast sources of finance that are

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ACCOUNTS ASSIGNMENT 10

included in the firm having different weights of equity and debt. There is need to form the

adequate capital structure by the entity after the external opportunities and the expectations

have been analysed.

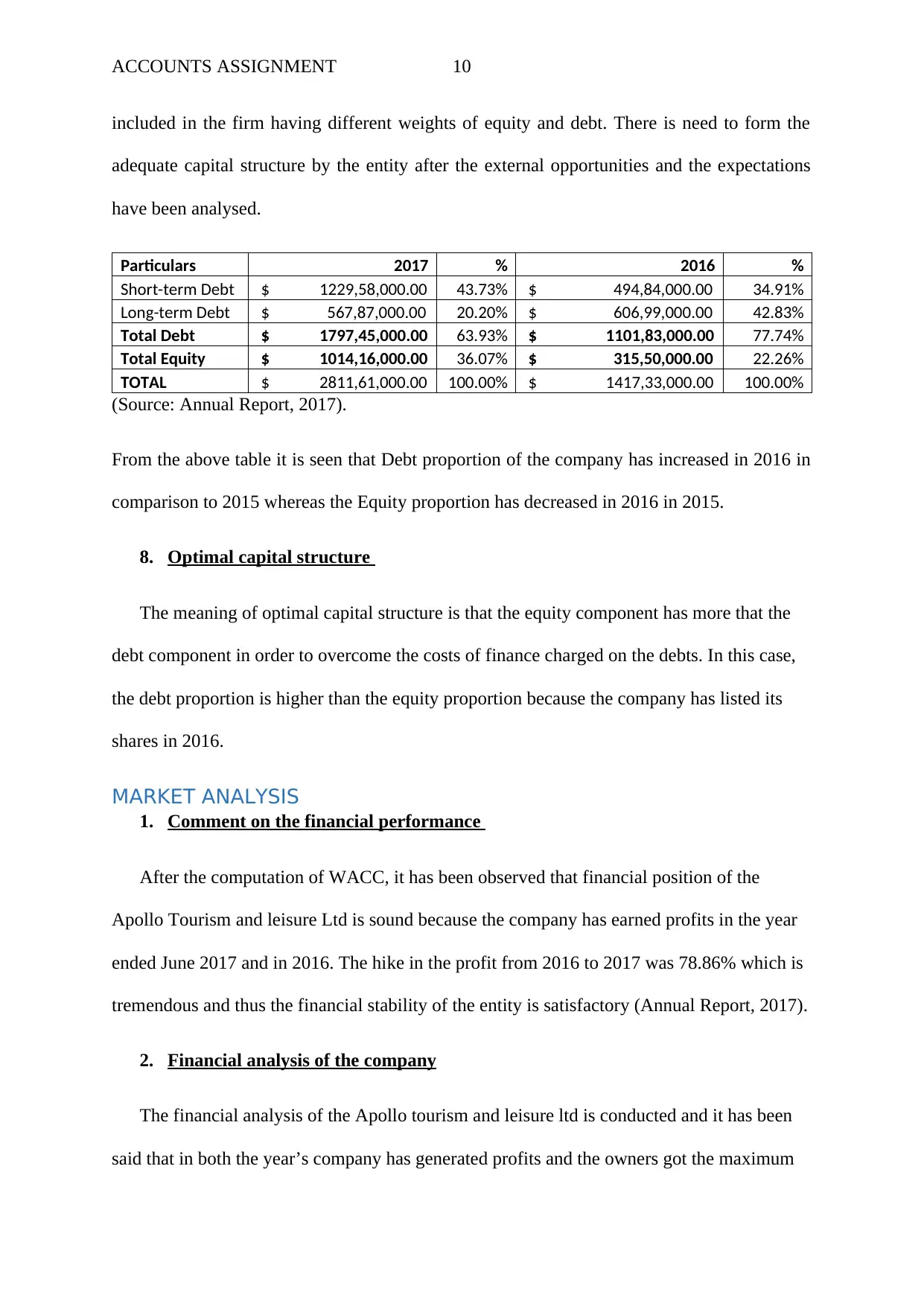

Particulars 2017 % 2016 %

Short-term Debt $ 1229,58,000.00 43.73% $ 494,84,000.00 34.91%

Long-term Debt $ 567,87,000.00 20.20% $ 606,99,000.00 42.83%

Total Debt $ 1797,45,000.00 63.93% $ 1101,83,000.00 77.74%

Total Equity $ 1014,16,000.00 36.07% $ 315,50,000.00 22.26%

TOTAL $ 2811,61,000.00 100.00% $ 1417,33,000.00 100.00%

(Source: Annual Report, 2017).

From the above table it is seen that Debt proportion of the company has increased in 2016 in

comparison to 2015 whereas the Equity proportion has decreased in 2016 in 2015.

8. Optimal capital structure

The meaning of optimal capital structure is that the equity component has more that the

debt component in order to overcome the costs of finance charged on the debts. In this case,

the debt proportion is higher than the equity proportion because the company has listed its

shares in 2016.

MARKET ANALYSIS

1. Comment on the financial performance

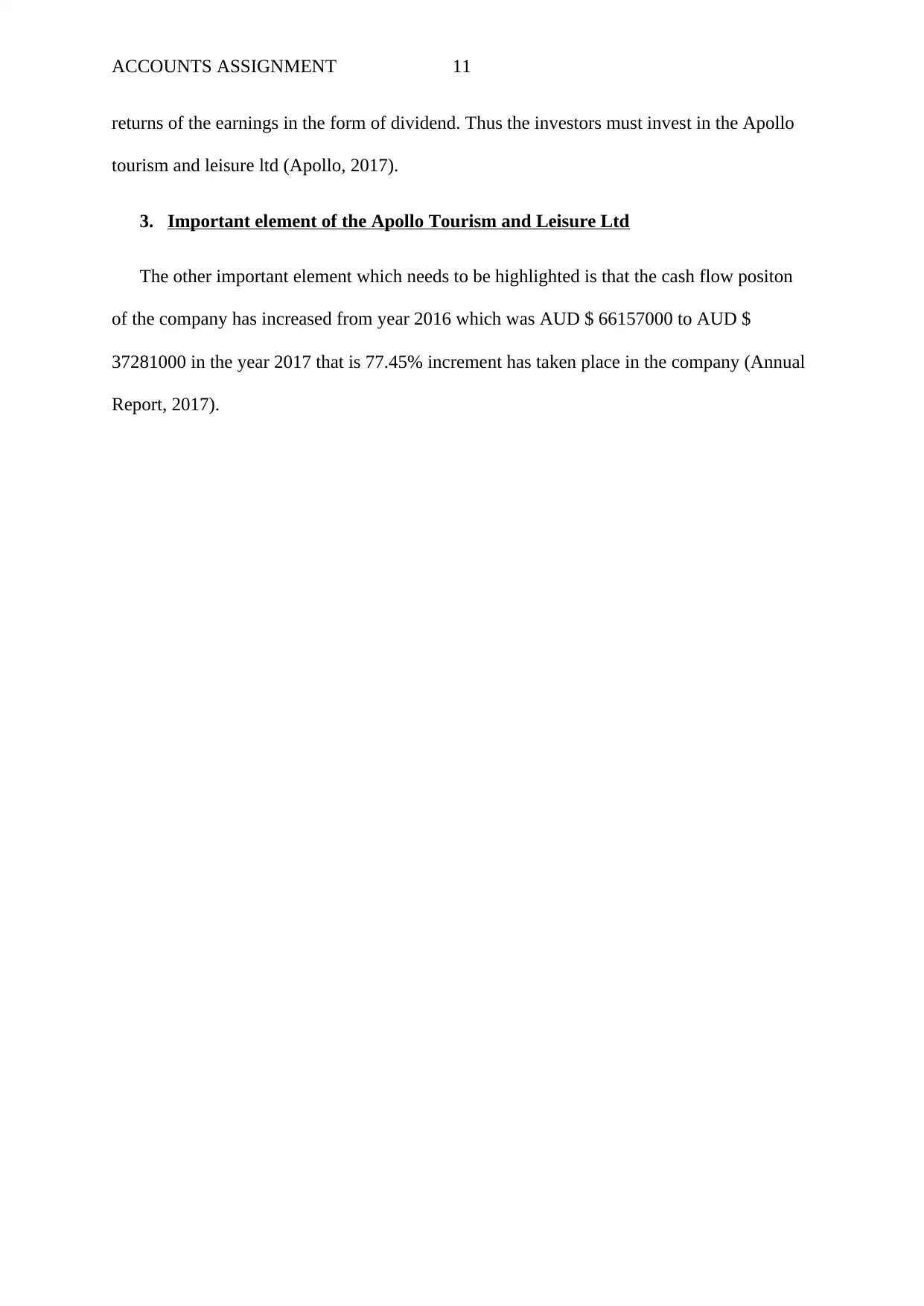

After the computation of WACC, it has been observed that financial position of the

Apollo Tourism and leisure Ltd is sound because the company has earned profits in the year

ended June 2017 and in 2016. The hike in the profit from 2016 to 2017 was 78.86% which is

tremendous and thus the financial stability of the entity is satisfactory (Annual Report, 2017).

2. Financial analysis of the company

The financial analysis of the Apollo tourism and leisure ltd is conducted and it has been

said that in both the year’s company has generated profits and the owners got the maximum

included in the firm having different weights of equity and debt. There is need to form the

adequate capital structure by the entity after the external opportunities and the expectations

have been analysed.

Particulars 2017 % 2016 %

Short-term Debt $ 1229,58,000.00 43.73% $ 494,84,000.00 34.91%

Long-term Debt $ 567,87,000.00 20.20% $ 606,99,000.00 42.83%

Total Debt $ 1797,45,000.00 63.93% $ 1101,83,000.00 77.74%

Total Equity $ 1014,16,000.00 36.07% $ 315,50,000.00 22.26%

TOTAL $ 2811,61,000.00 100.00% $ 1417,33,000.00 100.00%

(Source: Annual Report, 2017).

From the above table it is seen that Debt proportion of the company has increased in 2016 in

comparison to 2015 whereas the Equity proportion has decreased in 2016 in 2015.

8. Optimal capital structure

The meaning of optimal capital structure is that the equity component has more that the

debt component in order to overcome the costs of finance charged on the debts. In this case,

the debt proportion is higher than the equity proportion because the company has listed its

shares in 2016.

MARKET ANALYSIS

1. Comment on the financial performance

After the computation of WACC, it has been observed that financial position of the

Apollo Tourism and leisure Ltd is sound because the company has earned profits in the year

ended June 2017 and in 2016. The hike in the profit from 2016 to 2017 was 78.86% which is

tremendous and thus the financial stability of the entity is satisfactory (Annual Report, 2017).

2. Financial analysis of the company

The financial analysis of the Apollo tourism and leisure ltd is conducted and it has been

said that in both the year’s company has generated profits and the owners got the maximum

ACCOUNTS ASSIGNMENT 11

returns of the earnings in the form of dividend. Thus the investors must invest in the Apollo

tourism and leisure ltd (Apollo, 2017).

3. Important element of the Apollo Tourism and Leisure Ltd

The other important element which needs to be highlighted is that the cash flow positon

of the company has increased from year 2016 which was AUD $ 66157000 to AUD $

37281000 in the year 2017 that is 77.45% increment has taken place in the company (Annual

Report, 2017).

returns of the earnings in the form of dividend. Thus the investors must invest in the Apollo

tourism and leisure ltd (Apollo, 2017).

3. Important element of the Apollo Tourism and Leisure Ltd

The other important element which needs to be highlighted is that the cash flow positon

of the company has increased from year 2016 which was AUD $ 66157000 to AUD $

37281000 in the year 2017 that is 77.45% increment has taken place in the company (Annual

Report, 2017).

ACCOUNTS ASSIGNMENT 12

REFERENCES

Prospectus, 2017, Apollo Tourism and Leisure Ltd, viewed on 20 October 2017 from

https://www.morgans.com.au/morgans-assets/PDFs/Apollo-prospectus.pdf.

Apollo, 2017, About Us, viewed on 20 October 2017 from https://apollotourism.com/about-

us/.

Annual Report, 2017, Apollo Tourism and Leisure Ltd, 2017, viewed on 20 October 2017

from

https://atl.irmau.com/site/PDF/1100_0/AnnualReporttoshareholders.

Investing.com, 2017, Apollo Tourism and Leisure Ltd (ATL), viewed on 20 October 2017

from https://ca.investing.com/equities/apollo-tourism-leisure-ltd-ratios.

Financial Times, 2017, Apollo Tourism and Leisure Ltd, viewed on 20 October 2017 from

https://markets.ft.com/data/equities/tearsheet/charts?s=ATL:ASX.

MorningStar, 2017, Apollo Tourism and Leisure Ltd (ATL), viewed on 20 October 2017 from

http://performance.morningstar.com/stock/performancereturn.action?

t=ATL®ion=aus&culture=en-US.

REFERENCES

Prospectus, 2017, Apollo Tourism and Leisure Ltd, viewed on 20 October 2017 from

https://www.morgans.com.au/morgans-assets/PDFs/Apollo-prospectus.pdf.

Apollo, 2017, About Us, viewed on 20 October 2017 from https://apollotourism.com/about-

us/.

Annual Report, 2017, Apollo Tourism and Leisure Ltd, 2017, viewed on 20 October 2017

from

https://atl.irmau.com/site/PDF/1100_0/AnnualReporttoshareholders.

Investing.com, 2017, Apollo Tourism and Leisure Ltd (ATL), viewed on 20 October 2017

from https://ca.investing.com/equities/apollo-tourism-leisure-ltd-ratios.

Financial Times, 2017, Apollo Tourism and Leisure Ltd, viewed on 20 October 2017 from

https://markets.ft.com/data/equities/tearsheet/charts?s=ATL:ASX.

MorningStar, 2017, Apollo Tourism and Leisure Ltd (ATL), viewed on 20 October 2017 from

http://performance.morningstar.com/stock/performancereturn.action?

t=ATL®ion=aus&culture=en-US.

1 out of 13

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.