ACCT 1211: Accounting I - Assignment 7

VerifiedAdded on 2023/05/28

|5

|855

|77

AI Summary

This text provides solutions to Assignment 7 of ACCT 1211: Accounting I course. It covers topics such as bank errors, internal control procedures, petty cash system and more.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ACCT 1211: Accounting I A7-1

Acct 1211_Student ID_Student

Name_Assignment_7

Question 1

(20 marks)

A.

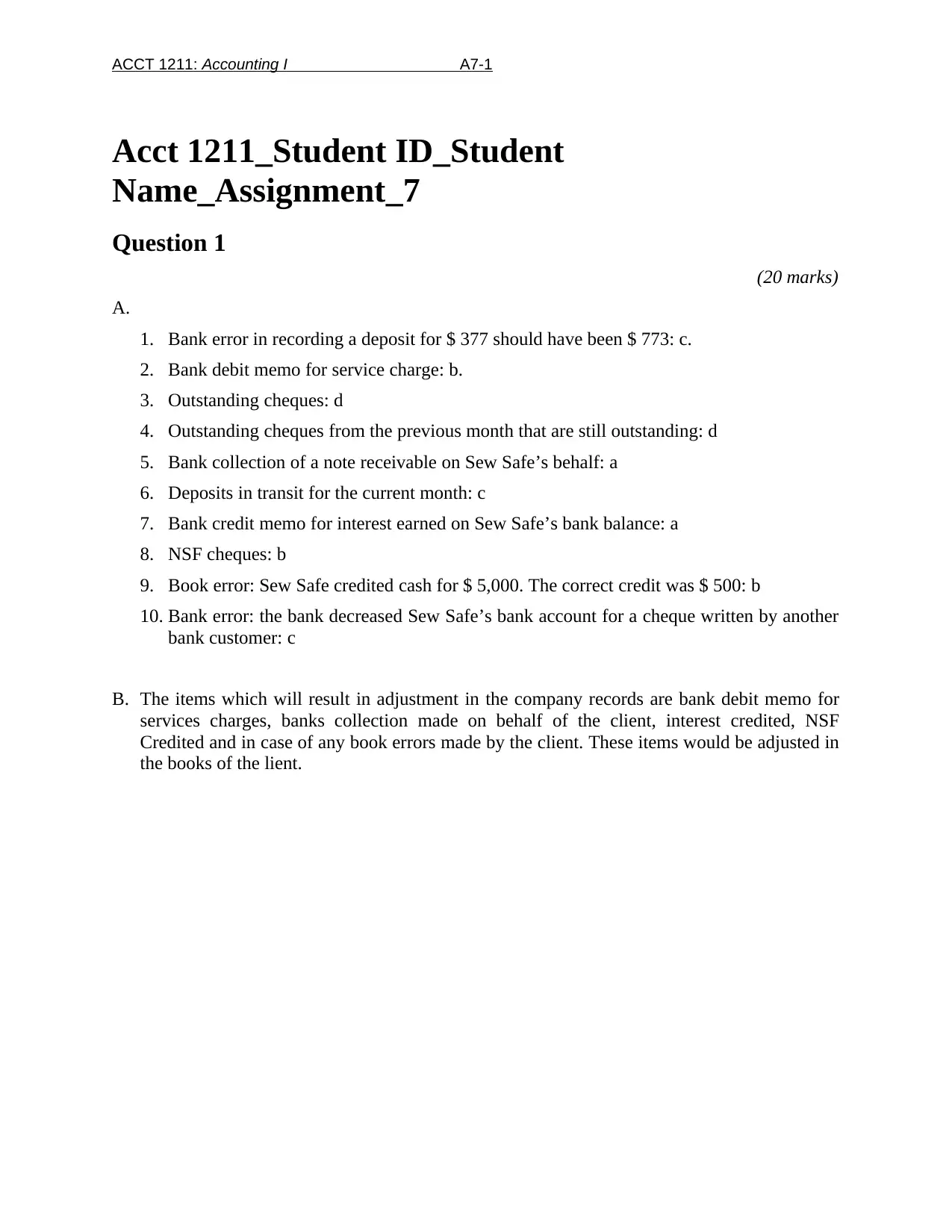

1. Bank error in recording a deposit for $ 377 should have been $ 773: c.

2. Bank debit memo for service charge: b.

3. Outstanding cheques: d

4. Outstanding cheques from the previous month that are still outstanding: d

5. Bank collection of a note receivable on Sew Safe’s behalf: a

6. Deposits in transit for the current month: c

7. Bank credit memo for interest earned on Sew Safe’s bank balance: a

8. NSF cheques: b

9. Book error: Sew Safe credited cash for $ 5,000. The correct credit was $ 500: b

10. Bank error: the bank decreased Sew Safe’s bank account for a cheque written by another

bank customer: c

B. The items which will result in adjustment in the company records are bank debit memo for

services charges, banks collection made on behalf of the client, interest credited, NSF

Credited and in case of any book errors made by the client. These items would be adjusted in

the books of the lient.

Acct 1211_Student ID_Student

Name_Assignment_7

Question 1

(20 marks)

A.

1. Bank error in recording a deposit for $ 377 should have been $ 773: c.

2. Bank debit memo for service charge: b.

3. Outstanding cheques: d

4. Outstanding cheques from the previous month that are still outstanding: d

5. Bank collection of a note receivable on Sew Safe’s behalf: a

6. Deposits in transit for the current month: c

7. Bank credit memo for interest earned on Sew Safe’s bank balance: a

8. NSF cheques: b

9. Book error: Sew Safe credited cash for $ 5,000. The correct credit was $ 500: b

10. Bank error: the bank decreased Sew Safe’s bank account for a cheque written by another

bank customer: c

B. The items which will result in adjustment in the company records are bank debit memo for

services charges, banks collection made on behalf of the client, interest credited, NSF

Credited and in case of any book errors made by the client. These items would be adjusted in

the books of the lient.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

A7-2 Assignment 7

Question 2

(20 marks)

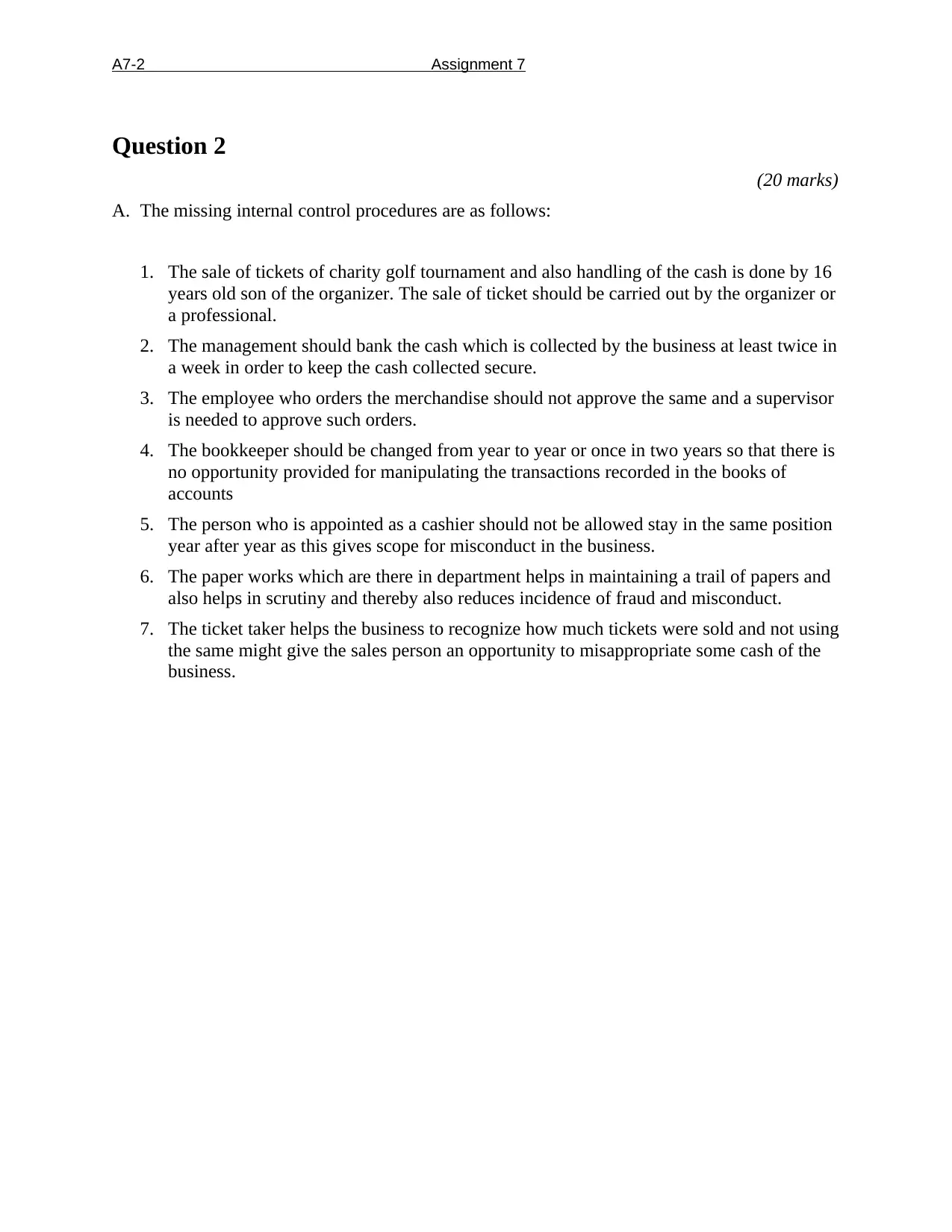

A. The missing internal control procedures are as follows:

1. The sale of tickets of charity golf tournament and also handling of the cash is done by 16

years old son of the organizer. The sale of ticket should be carried out by the organizer or

a professional.

2. The management should bank the cash which is collected by the business at least twice in

a week in order to keep the cash collected secure.

3. The employee who orders the merchandise should not approve the same and a supervisor

is needed to approve such orders.

4. The bookkeeper should be changed from year to year or once in two years so that there is

no opportunity provided for manipulating the transactions recorded in the books of

accounts

5. The person who is appointed as a cashier should not be allowed stay in the same position

year after year as this gives scope for misconduct in the business.

6. The paper works which are there in department helps in maintaining a trail of papers and

also helps in scrutiny and thereby also reduces incidence of fraud and misconduct.

7. The ticket taker helps the business to recognize how much tickets were sold and not using

the same might give the sales person an opportunity to misappropriate some cash of the

business.

Question 2

(20 marks)

A. The missing internal control procedures are as follows:

1. The sale of tickets of charity golf tournament and also handling of the cash is done by 16

years old son of the organizer. The sale of ticket should be carried out by the organizer or

a professional.

2. The management should bank the cash which is collected by the business at least twice in

a week in order to keep the cash collected secure.

3. The employee who orders the merchandise should not approve the same and a supervisor

is needed to approve such orders.

4. The bookkeeper should be changed from year to year or once in two years so that there is

no opportunity provided for manipulating the transactions recorded in the books of

accounts

5. The person who is appointed as a cashier should not be allowed stay in the same position

year after year as this gives scope for misconduct in the business.

6. The paper works which are there in department helps in maintaining a trail of papers and

also helps in scrutiny and thereby also reduces incidence of fraud and misconduct.

7. The ticket taker helps the business to recognize how much tickets were sold and not using

the same might give the sales person an opportunity to misappropriate some cash of the

business.

ACCT 1211: Accounting I A7-3

Question 3

(30 marks)

A.

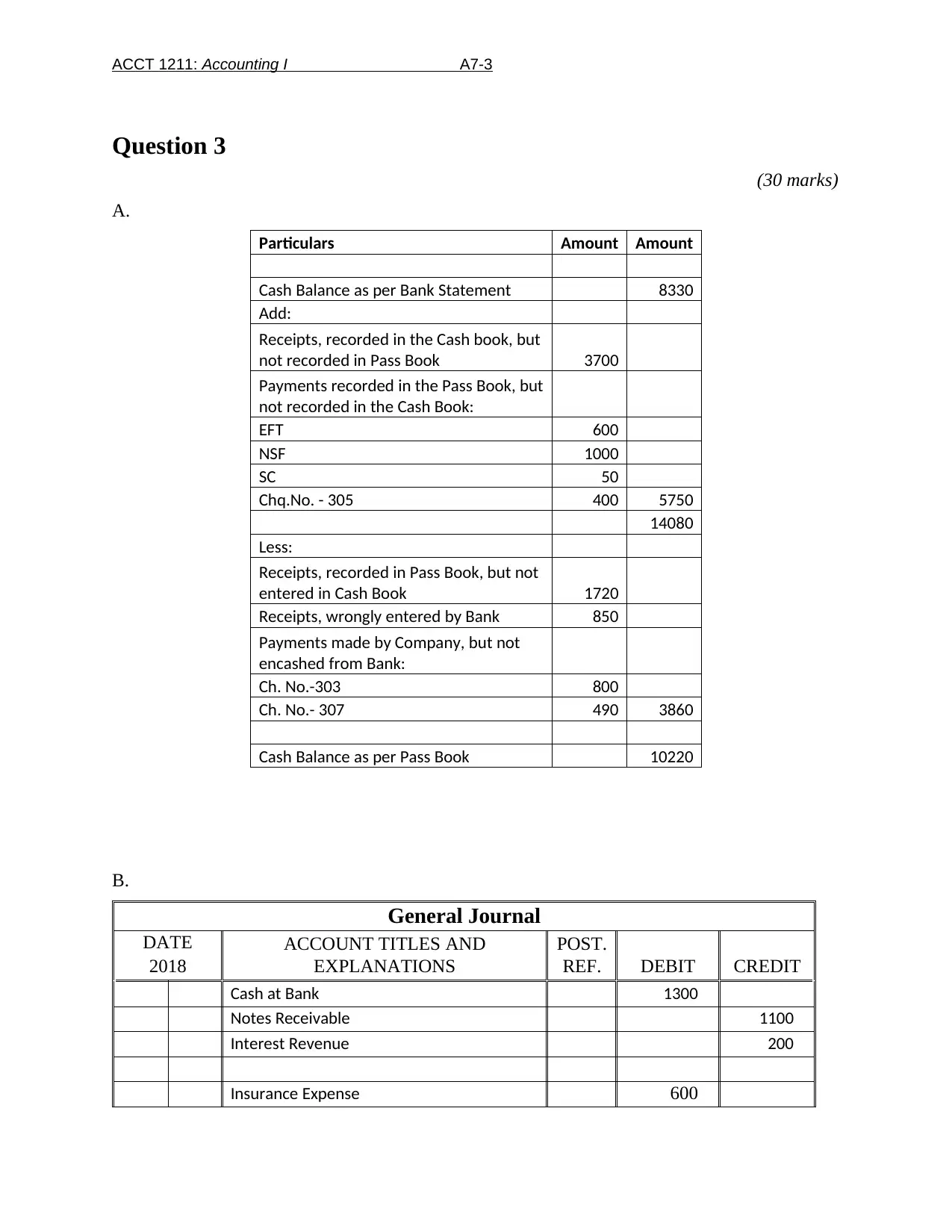

Particulars Amount Amount

Cash Balance as per Bank Statement 8330

Add:

Receipts, recorded in the Cash book, but

not recorded in Pass Book 3700

Payments recorded in the Pass Book, but

not recorded in the Cash Book:

EFT 600

NSF 1000

SC 50

Chq.No. - 305 400 5750

14080

Less:

Receipts, recorded in Pass Book, but not

entered in Cash Book 1720

Receipts, wrongly entered by Bank 850

Payments made by Company, but not

encashed from Bank:

Ch. No.-303 800

Ch. No.- 307 490 3860

Cash Balance as per Pass Book 10220

B.

General Journal

DATE

2018

ACCOUNT TITLES AND

EXPLANATIONS

POST.

REF. DEBIT CREDIT

Cash at Bank 1300

Notes Receivable 1100

Interest Revenue 200

Insurance Expense 600

Question 3

(30 marks)

A.

Particulars Amount Amount

Cash Balance as per Bank Statement 8330

Add:

Receipts, recorded in the Cash book, but

not recorded in Pass Book 3700

Payments recorded in the Pass Book, but

not recorded in the Cash Book:

EFT 600

NSF 1000

SC 50

Chq.No. - 305 400 5750

14080

Less:

Receipts, recorded in Pass Book, but not

entered in Cash Book 1720

Receipts, wrongly entered by Bank 850

Payments made by Company, but not

encashed from Bank:

Ch. No.-303 800

Ch. No.- 307 490 3860

Cash Balance as per Pass Book 10220

B.

General Journal

DATE

2018

ACCOUNT TITLES AND

EXPLANATIONS

POST.

REF. DEBIT CREDIT

Cash at Bank 1300

Notes Receivable 1100

Interest Revenue 200

Insurance Expense 600

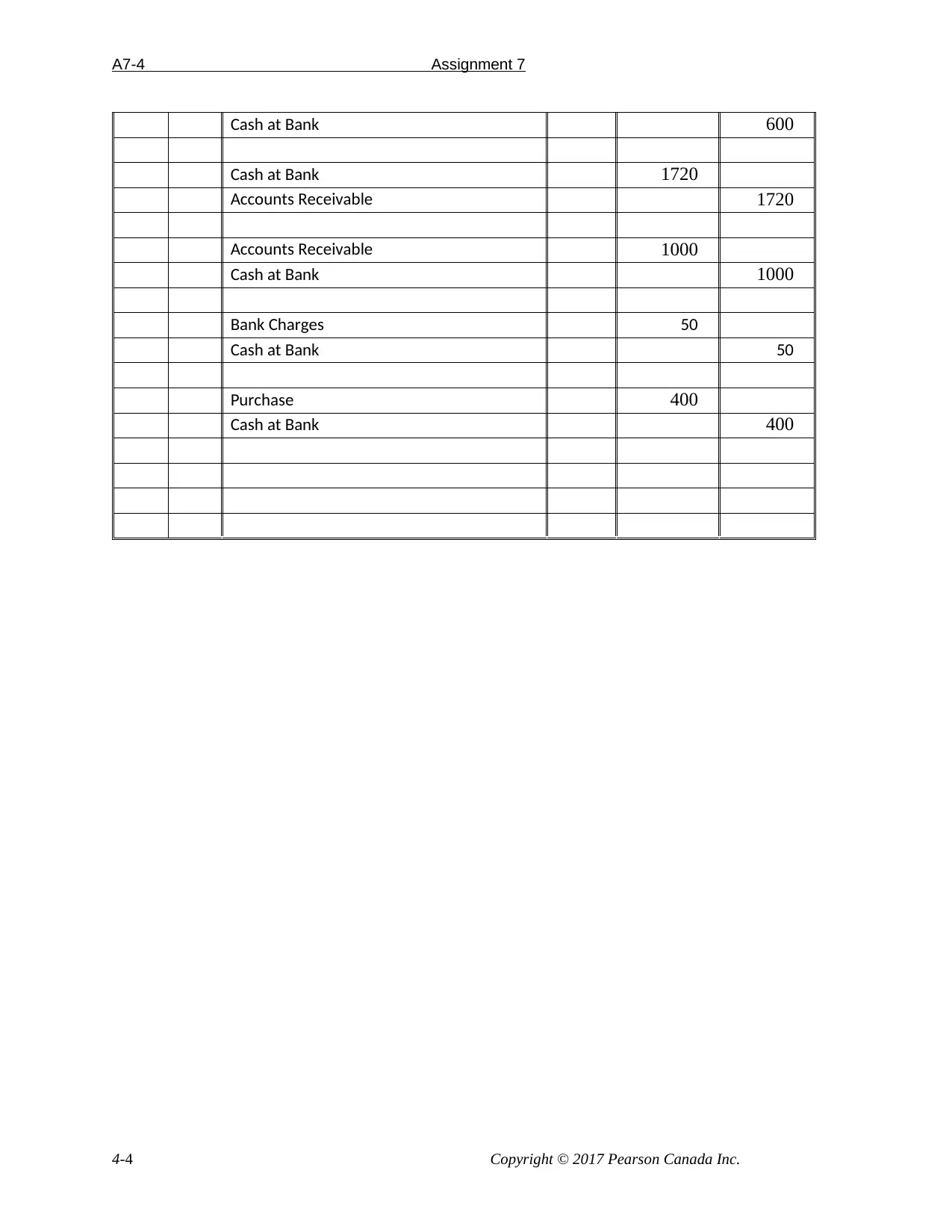

A7-4 Assignment 7

Cash at Bank 600

Cash at Bank 1720

Accounts Receivable 1720

Accounts Receivable 1000

Cash at Bank 1000

Bank Charges 50

Cash at Bank 50

Purchase 400

Cash at Bank 400

4-4 Copyright © 2017 Pearson Canada Inc.

Cash at Bank 600

Cash at Bank 1720

Accounts Receivable 1720

Accounts Receivable 1000

Cash at Bank 1000

Bank Charges 50

Cash at Bank 50

Purchase 400

Cash at Bank 400

4-4 Copyright © 2017 Pearson Canada Inc.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ACCT 1211: Accounting I A7-5

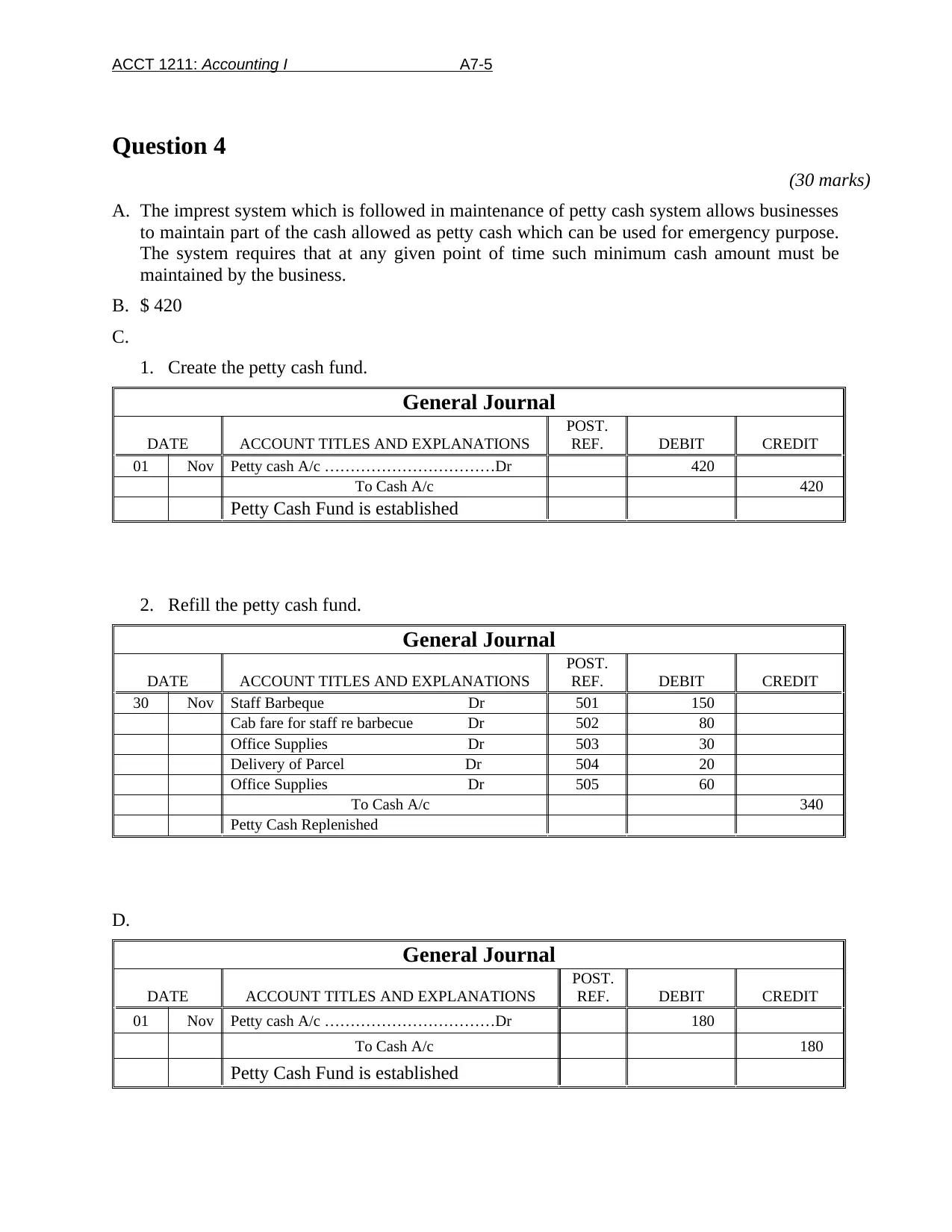

Question 4

(30 marks)

A. The imprest system which is followed in maintenance of petty cash system allows businesses

to maintain part of the cash allowed as petty cash which can be used for emergency purpose.

The system requires that at any given point of time such minimum cash amount must be

maintained by the business.

B. $ 420

C.

1. Create the petty cash fund.

General Journal

DATE ACCOUNT TITLES AND EXPLANATIONS

POST.

REF. DEBIT CREDIT

01 Nov Petty cash A/c ……………………………Dr 420

To Cash A/c 420

Petty Cash Fund is established

2. Refill the petty cash fund.

General Journal

DATE ACCOUNT TITLES AND EXPLANATIONS

POST.

REF. DEBIT CREDIT

30 Nov Staff Barbeque Dr 501 150

Cab fare for staff re barbecue Dr 502 80

Office Supplies Dr 503 30

Delivery of Parcel Dr 504 20

Office Supplies Dr 505 60

To Cash A/c 340

Petty Cash Replenished

D.

General Journal

DATE ACCOUNT TITLES AND EXPLANATIONS

POST.

REF. DEBIT CREDIT

01 Nov Petty cash A/c ……………………………Dr 180

To Cash A/c 180

Petty Cash Fund is established

Question 4

(30 marks)

A. The imprest system which is followed in maintenance of petty cash system allows businesses

to maintain part of the cash allowed as petty cash which can be used for emergency purpose.

The system requires that at any given point of time such minimum cash amount must be

maintained by the business.

B. $ 420

C.

1. Create the petty cash fund.

General Journal

DATE ACCOUNT TITLES AND EXPLANATIONS

POST.

REF. DEBIT CREDIT

01 Nov Petty cash A/c ……………………………Dr 420

To Cash A/c 420

Petty Cash Fund is established

2. Refill the petty cash fund.

General Journal

DATE ACCOUNT TITLES AND EXPLANATIONS

POST.

REF. DEBIT CREDIT

30 Nov Staff Barbeque Dr 501 150

Cab fare for staff re barbecue Dr 502 80

Office Supplies Dr 503 30

Delivery of Parcel Dr 504 20

Office Supplies Dr 505 60

To Cash A/c 340

Petty Cash Replenished

D.

General Journal

DATE ACCOUNT TITLES AND EXPLANATIONS

POST.

REF. DEBIT CREDIT

01 Nov Petty cash A/c ……………………………Dr 180

To Cash A/c 180

Petty Cash Fund is established

1 out of 5

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.