ACCT1001 - Financial Planning: Budgeting, Investment Decisions

VerifiedAdded on 2023/06/07

|9

|1949

|169

Homework Assignment

AI Summary

This assignment solution for ACCT1001 covers several key areas of business finance. It begins with break-even point (BEP) calculations, including determining BEP in units and monetary terms, and the number of units required to achieve a desired profit. The solution then presents a cash bu...

ACCT1001 Accounting and

finance for business T

finance for business T

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

MAIN BODY..................................................................................................................................3

Question – 1.................................................................................................................................3

Question – 2.................................................................................................................................4

Question – 3.................................................................................................................................5

Question – 4.................................................................................................................................6

Question – 5.................................................................................................................................7

REFERENCES................................................................................................................................1

MAIN BODY..................................................................................................................................3

Question – 1.................................................................................................................................3

Question – 2.................................................................................................................................4

Question – 3.................................................................................................................................5

Question – 4.................................................................................................................................6

Question – 5.................................................................................................................................7

REFERENCES................................................................................................................................1

MAIN BODY

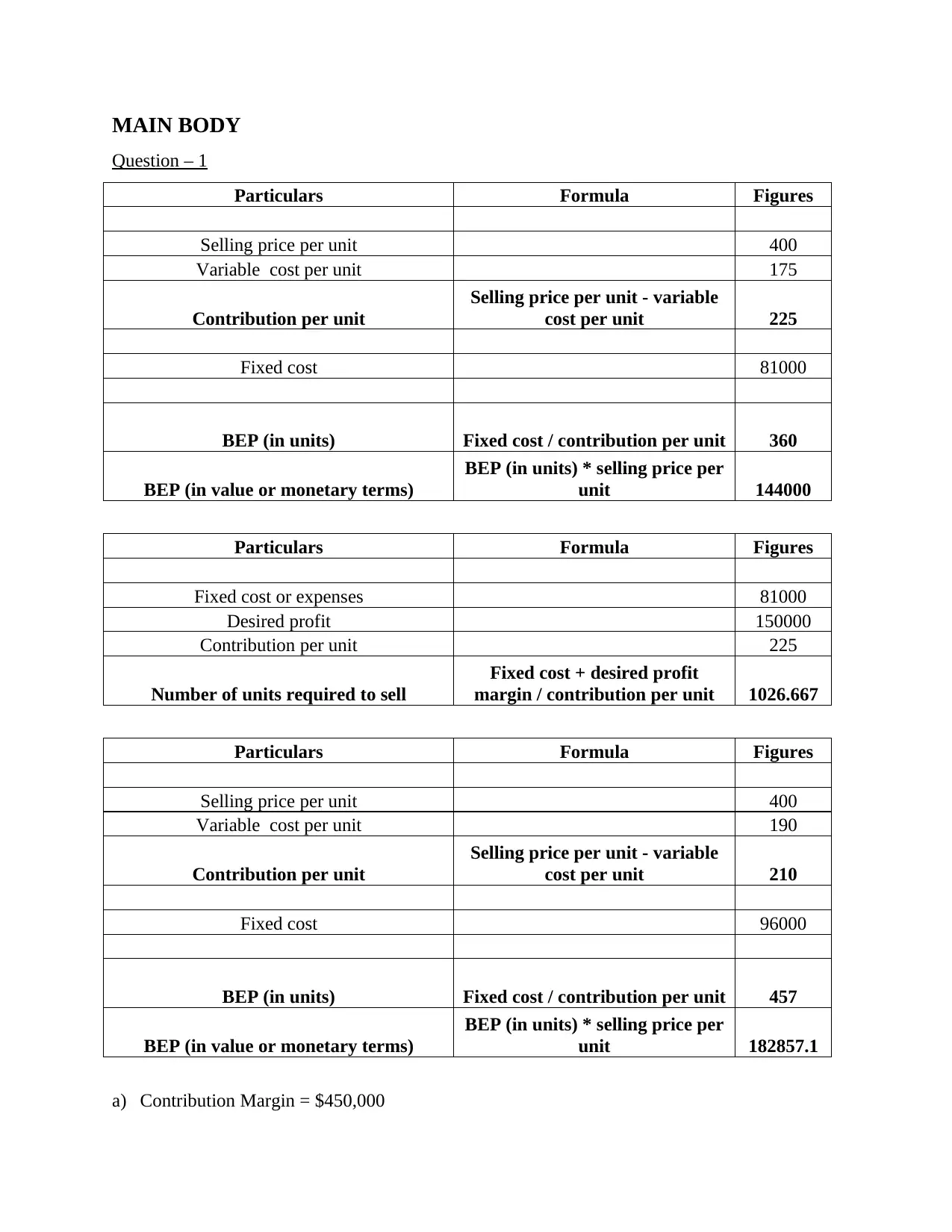

Question – 1

Particulars Formula Figures

Selling price per unit 400

Variable cost per unit 175

Contribution per unit

Selling price per unit - variable

cost per unit 225

Fixed cost 81000

BEP (in units) Fixed cost / contribution per unit 360

BEP (in value or monetary terms)

BEP (in units) * selling price per

unit 144000

Particulars Formula Figures

Fixed cost or expenses 81000

Desired profit 150000

Contribution per unit 225

Number of units required to sell

Fixed cost + desired profit

margin / contribution per unit 1026.667

Particulars Formula Figures

Selling price per unit 400

Variable cost per unit 190

Contribution per unit

Selling price per unit - variable

cost per unit 210

Fixed cost 96000

BEP (in units) Fixed cost / contribution per unit 457

BEP (in value or monetary terms)

BEP (in units) * selling price per

unit 182857.1

a) Contribution Margin = $450,000

Question – 1

Particulars Formula Figures

Selling price per unit 400

Variable cost per unit 175

Contribution per unit

Selling price per unit - variable

cost per unit 225

Fixed cost 81000

BEP (in units) Fixed cost / contribution per unit 360

BEP (in value or monetary terms)

BEP (in units) * selling price per

unit 144000

Particulars Formula Figures

Fixed cost or expenses 81000

Desired profit 150000

Contribution per unit 225

Number of units required to sell

Fixed cost + desired profit

margin / contribution per unit 1026.667

Particulars Formula Figures

Selling price per unit 400

Variable cost per unit 190

Contribution per unit

Selling price per unit - variable

cost per unit 210

Fixed cost 96000

BEP (in units) Fixed cost / contribution per unit 457

BEP (in value or monetary terms)

BEP (in units) * selling price per

unit 182857.1

a) Contribution Margin = $450,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

b) Contribution Margin Ratio = 56.25% (contribution margin/selling price*100)

c) Breakeven Point

In units = 360 units

In dollars = $144000

d) Number of golf clubs to be sold to get net profit of $150,000 = 1026.67 units

e) Margin of Safety = $236000

The above margin of safety denotes the difference between actual expected sales and break –

even sales. Therefore, this is the volume of sales that the company can compromise before

the operations of a company becomes unprofitable i.e., the point of break – even is reached.

It also tells that how much volume or units of sales are done above the breakeven point.

f) New breakeven point in units = 457 units. Since advertising cost is a fixed cost therefore, it

will be added in fixed costs and additional 15% of material will be increased in the variable

cost per unit.

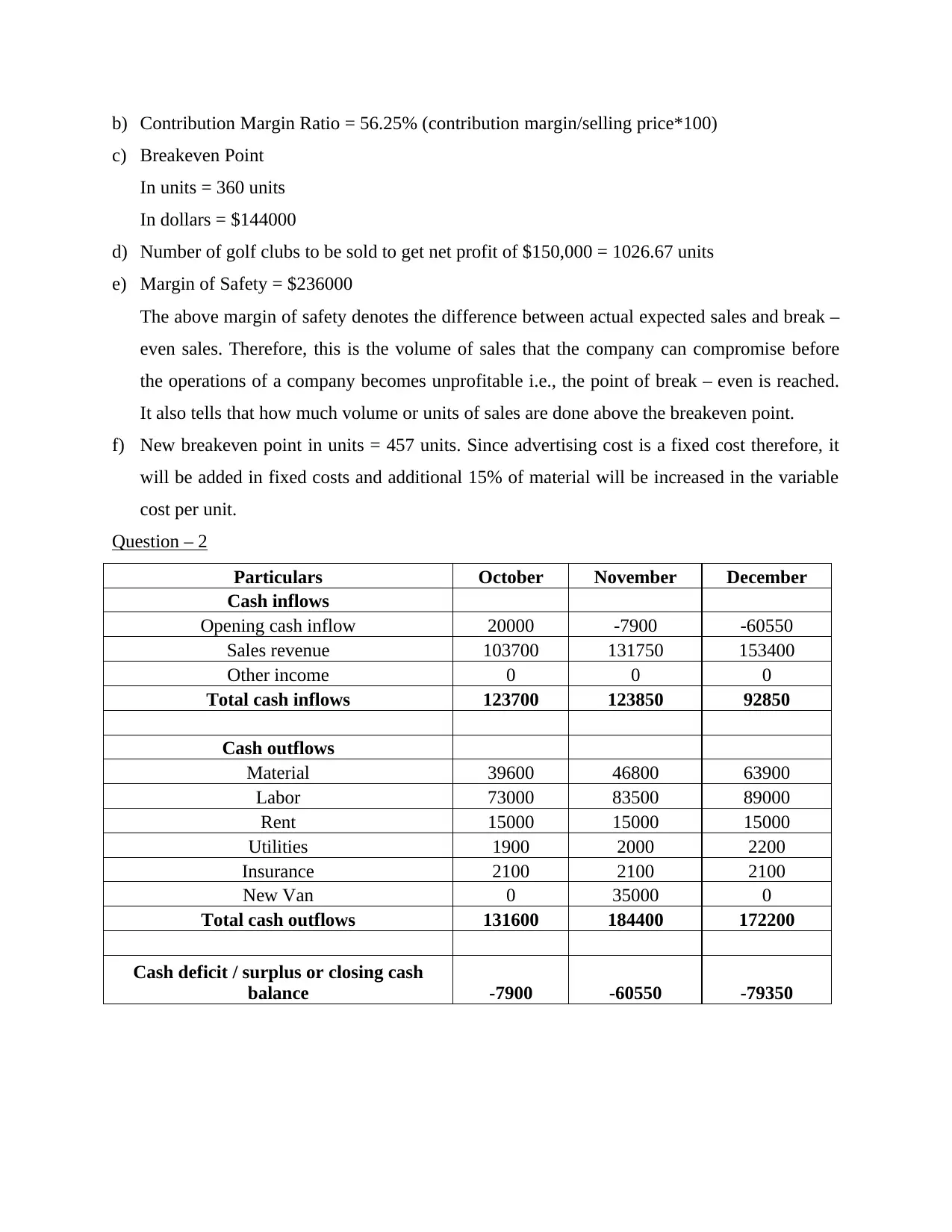

Question – 2

Particulars October November December

Cash inflows

Opening cash inflow 20000 -7900 -60550

Sales revenue 103700 131750 153400

Other income 0 0 0

Total cash inflows 123700 123850 92850

Cash outflows

Material 39600 46800 63900

Labor 73000 83500 89000

Rent 15000 15000 15000

Utilities 1900 2000 2200

Insurance 2100 2100 2100

New Van 0 35000 0

Total cash outflows 131600 184400 172200

Cash deficit / surplus or closing cash

balance -7900 -60550 -79350

c) Breakeven Point

In units = 360 units

In dollars = $144000

d) Number of golf clubs to be sold to get net profit of $150,000 = 1026.67 units

e) Margin of Safety = $236000

The above margin of safety denotes the difference between actual expected sales and break –

even sales. Therefore, this is the volume of sales that the company can compromise before

the operations of a company becomes unprofitable i.e., the point of break – even is reached.

It also tells that how much volume or units of sales are done above the breakeven point.

f) New breakeven point in units = 457 units. Since advertising cost is a fixed cost therefore, it

will be added in fixed costs and additional 15% of material will be increased in the variable

cost per unit.

Question – 2

Particulars October November December

Cash inflows

Opening cash inflow 20000 -7900 -60550

Sales revenue 103700 131750 153400

Other income 0 0 0

Total cash inflows 123700 123850 92850

Cash outflows

Material 39600 46800 63900

Labor 73000 83500 89000

Rent 15000 15000 15000

Utilities 1900 2000 2200

Insurance 2100 2100 2100

New Van 0 35000 0

Total cash outflows 131600 184400 172200

Cash deficit / surplus or closing cash

balance -7900 -60550 -79350

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question – 3

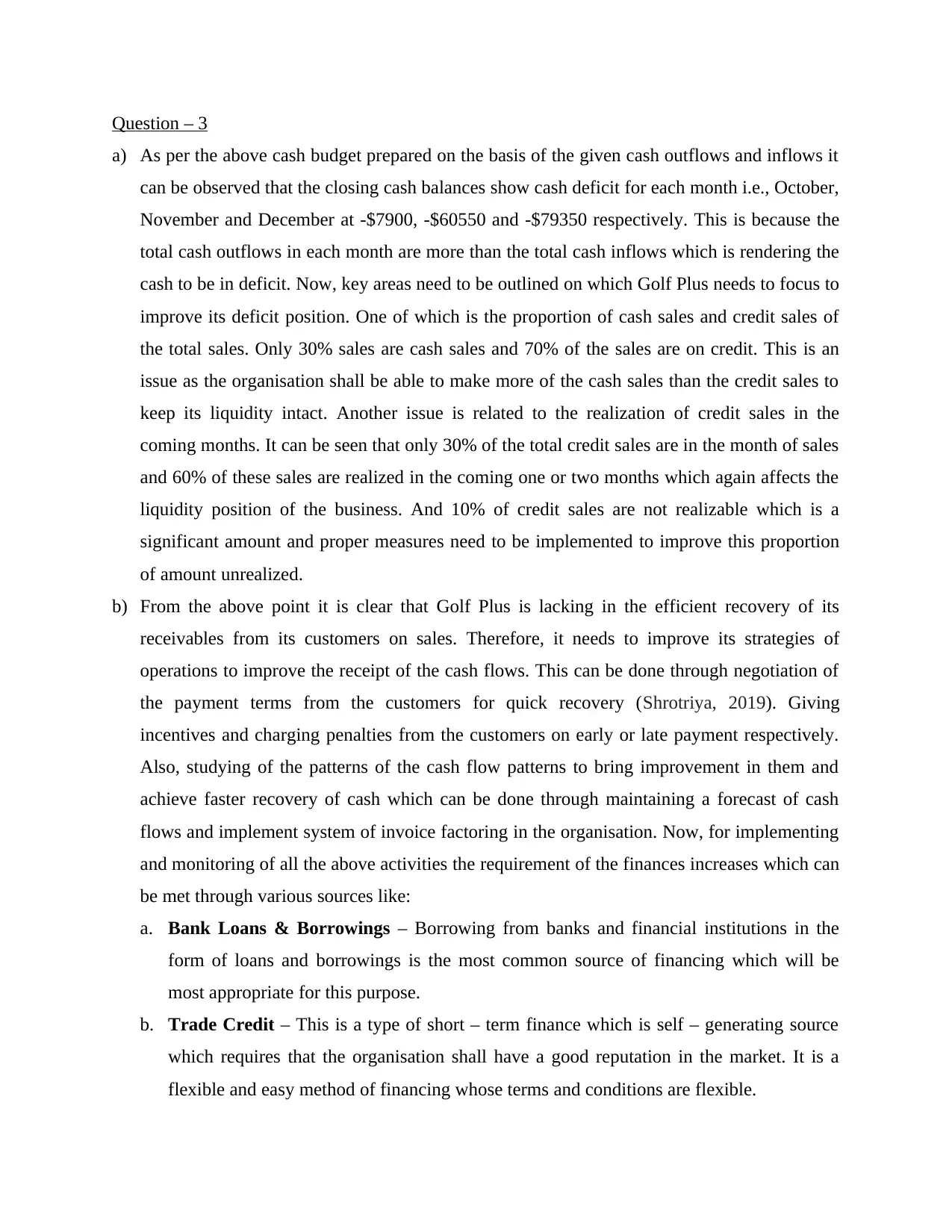

a) As per the above cash budget prepared on the basis of the given cash outflows and inflows it

can be observed that the closing cash balances show cash deficit for each month i.e., October,

November and December at -$7900, -$60550 and -$79350 respectively. This is because the

total cash outflows in each month are more than the total cash inflows which is rendering the

cash to be in deficit. Now, key areas need to be outlined on which Golf Plus needs to focus to

improve its deficit position. One of which is the proportion of cash sales and credit sales of

the total sales. Only 30% sales are cash sales and 70% of the sales are on credit. This is an

issue as the organisation shall be able to make more of the cash sales than the credit sales to

keep its liquidity intact. Another issue is related to the realization of credit sales in the

coming months. It can be seen that only 30% of the total credit sales are in the month of sales

and 60% of these sales are realized in the coming one or two months which again affects the

liquidity position of the business. And 10% of credit sales are not realizable which is a

significant amount and proper measures need to be implemented to improve this proportion

of amount unrealized.

b) From the above point it is clear that Golf Plus is lacking in the efficient recovery of its

receivables from its customers on sales. Therefore, it needs to improve its strategies of

operations to improve the receipt of the cash flows. This can be done through negotiation of

the payment terms from the customers for quick recovery (Shrotriya, 2019). Giving

incentives and charging penalties from the customers on early or late payment respectively.

Also, studying of the patterns of the cash flow patterns to bring improvement in them and

achieve faster recovery of cash which can be done through maintaining a forecast of cash

flows and implement system of invoice factoring in the organisation. Now, for implementing

and monitoring of all the above activities the requirement of the finances increases which can

be met through various sources like:

a. Bank Loans & Borrowings – Borrowing from banks and financial institutions in the

form of loans and borrowings is the most common source of financing which will be

most appropriate for this purpose.

b. Trade Credit – This is a type of short – term finance which is self – generating source

which requires that the organisation shall have a good reputation in the market. It is a

flexible and easy method of financing whose terms and conditions are flexible.

a) As per the above cash budget prepared on the basis of the given cash outflows and inflows it

can be observed that the closing cash balances show cash deficit for each month i.e., October,

November and December at -$7900, -$60550 and -$79350 respectively. This is because the

total cash outflows in each month are more than the total cash inflows which is rendering the

cash to be in deficit. Now, key areas need to be outlined on which Golf Plus needs to focus to

improve its deficit position. One of which is the proportion of cash sales and credit sales of

the total sales. Only 30% sales are cash sales and 70% of the sales are on credit. This is an

issue as the organisation shall be able to make more of the cash sales than the credit sales to

keep its liquidity intact. Another issue is related to the realization of credit sales in the

coming months. It can be seen that only 30% of the total credit sales are in the month of sales

and 60% of these sales are realized in the coming one or two months which again affects the

liquidity position of the business. And 10% of credit sales are not realizable which is a

significant amount and proper measures need to be implemented to improve this proportion

of amount unrealized.

b) From the above point it is clear that Golf Plus is lacking in the efficient recovery of its

receivables from its customers on sales. Therefore, it needs to improve its strategies of

operations to improve the receipt of the cash flows. This can be done through negotiation of

the payment terms from the customers for quick recovery (Shrotriya, 2019). Giving

incentives and charging penalties from the customers on early or late payment respectively.

Also, studying of the patterns of the cash flow patterns to bring improvement in them and

achieve faster recovery of cash which can be done through maintaining a forecast of cash

flows and implement system of invoice factoring in the organisation. Now, for implementing

and monitoring of all the above activities the requirement of the finances increases which can

be met through various sources like:

a. Bank Loans & Borrowings – Borrowing from banks and financial institutions in the

form of loans and borrowings is the most common source of financing which will be

most appropriate for this purpose.

b. Trade Credit – This is a type of short – term finance which is self – generating source

which requires that the organisation shall have a good reputation in the market. It is a

flexible and easy method of financing whose terms and conditions are flexible.

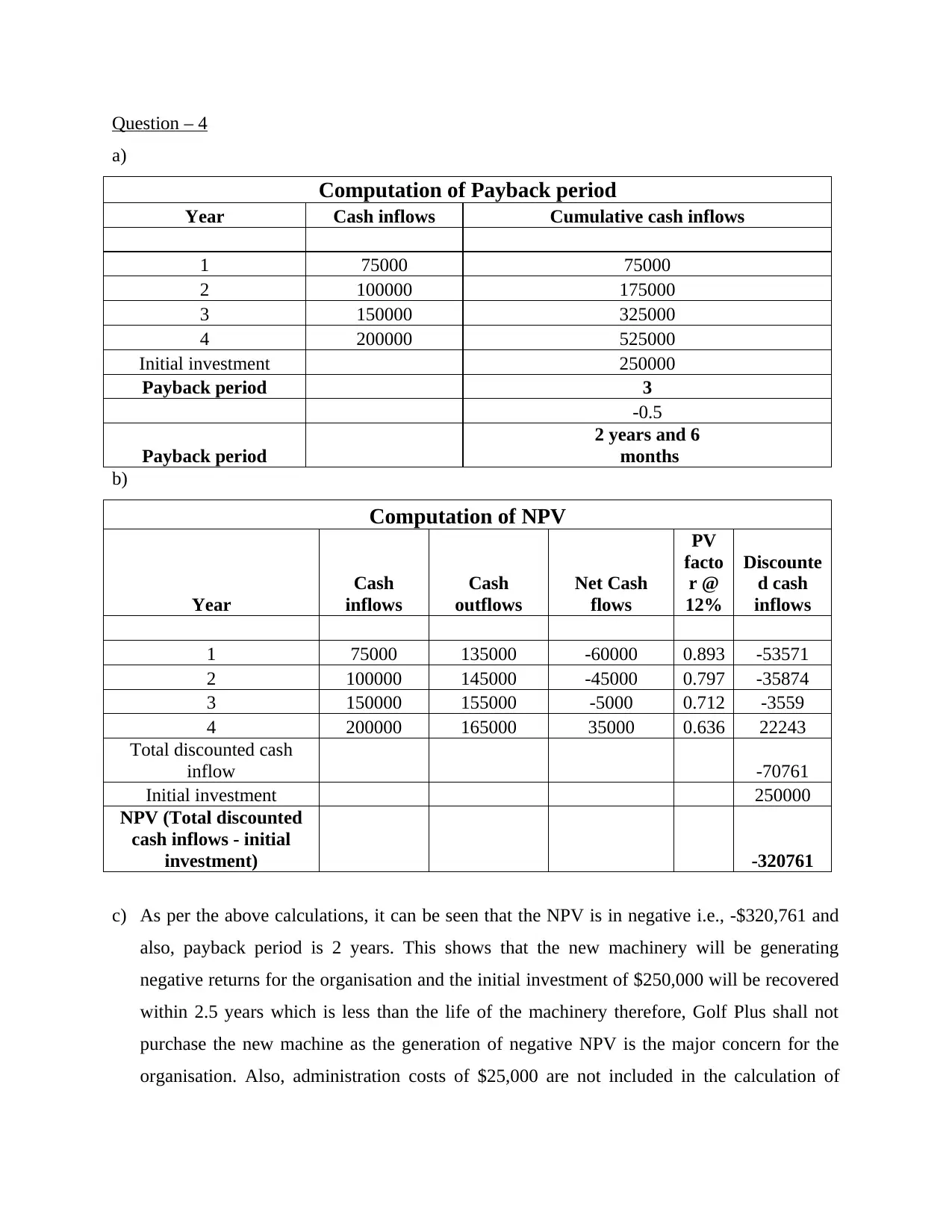

Question – 4

a)

Computation of Payback period

Year Cash inflows Cumulative cash inflows

1 75000 75000

2 100000 175000

3 150000 325000

4 200000 525000

Initial investment 250000

Payback period 3

-0.5

Payback period

2 years and 6

months

b)

Computation of NPV

Year

Cash

inflows

Cash

outflows

Net Cash

flows

PV

facto

r @

12%

Discounte

d cash

inflows

1 75000 135000 -60000 0.893 -53571

2 100000 145000 -45000 0.797 -35874

3 150000 155000 -5000 0.712 -3559

4 200000 165000 35000 0.636 22243

Total discounted cash

inflow -70761

Initial investment 250000

NPV (Total discounted

cash inflows - initial

investment) -320761

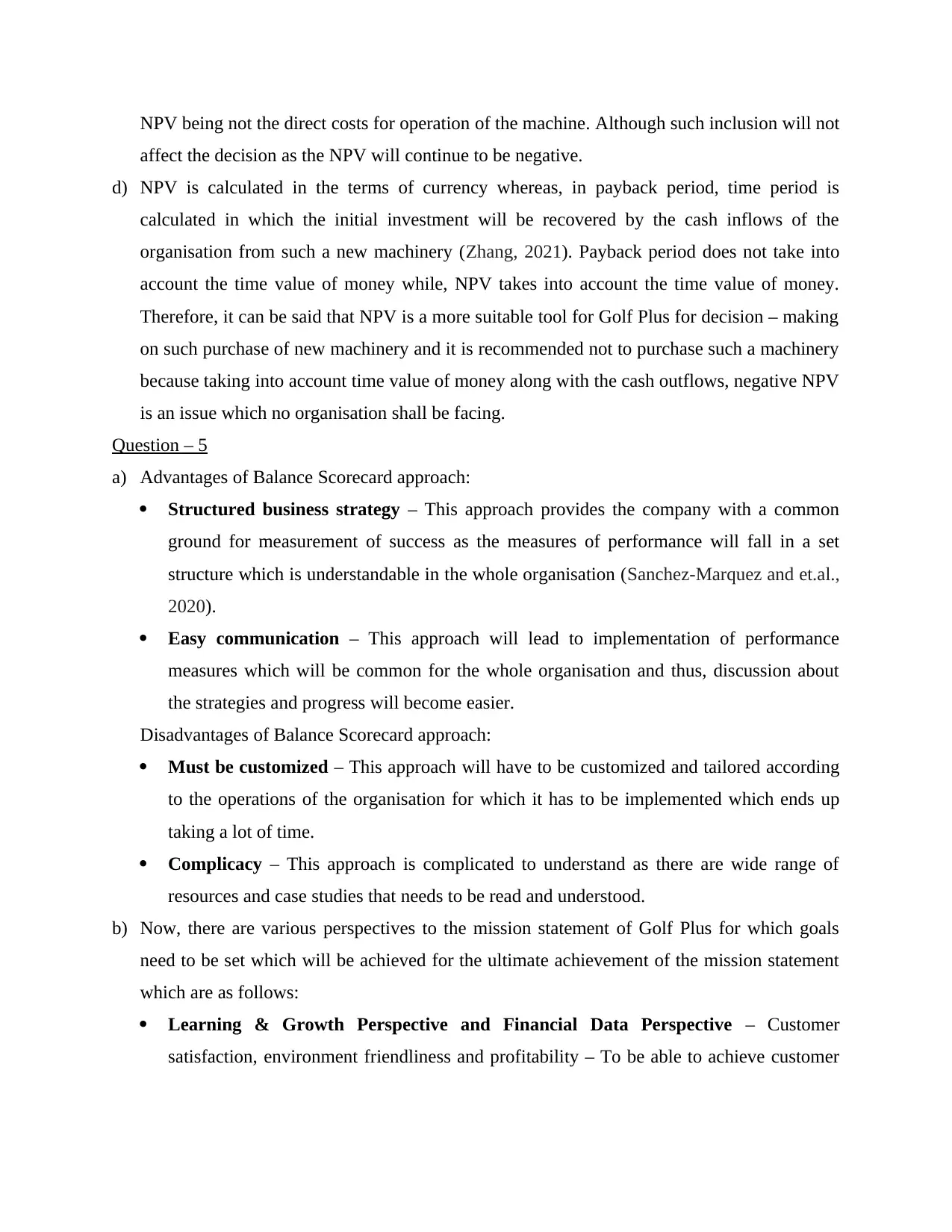

c) As per the above calculations, it can be seen that the NPV is in negative i.e., -$320,761 and

also, payback period is 2 years. This shows that the new machinery will be generating

negative returns for the organisation and the initial investment of $250,000 will be recovered

within 2.5 years which is less than the life of the machinery therefore, Golf Plus shall not

purchase the new machine as the generation of negative NPV is the major concern for the

organisation. Also, administration costs of $25,000 are not included in the calculation of

a)

Computation of Payback period

Year Cash inflows Cumulative cash inflows

1 75000 75000

2 100000 175000

3 150000 325000

4 200000 525000

Initial investment 250000

Payback period 3

-0.5

Payback period

2 years and 6

months

b)

Computation of NPV

Year

Cash

inflows

Cash

outflows

Net Cash

flows

PV

facto

r @

12%

Discounte

d cash

inflows

1 75000 135000 -60000 0.893 -53571

2 100000 145000 -45000 0.797 -35874

3 150000 155000 -5000 0.712 -3559

4 200000 165000 35000 0.636 22243

Total discounted cash

inflow -70761

Initial investment 250000

NPV (Total discounted

cash inflows - initial

investment) -320761

c) As per the above calculations, it can be seen that the NPV is in negative i.e., -$320,761 and

also, payback period is 2 years. This shows that the new machinery will be generating

negative returns for the organisation and the initial investment of $250,000 will be recovered

within 2.5 years which is less than the life of the machinery therefore, Golf Plus shall not

purchase the new machine as the generation of negative NPV is the major concern for the

organisation. Also, administration costs of $25,000 are not included in the calculation of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

NPV being not the direct costs for operation of the machine. Although such inclusion will not

affect the decision as the NPV will continue to be negative.

d) NPV is calculated in the terms of currency whereas, in payback period, time period is

calculated in which the initial investment will be recovered by the cash inflows of the

organisation from such a new machinery (Zhang, 2021). Payback period does not take into

account the time value of money while, NPV takes into account the time value of money.

Therefore, it can be said that NPV is a more suitable tool for Golf Plus for decision – making

on such purchase of new machinery and it is recommended not to purchase such a machinery

because taking into account time value of money along with the cash outflows, negative NPV

is an issue which no organisation shall be facing.

Question – 5

a) Advantages of Balance Scorecard approach:

Structured business strategy – This approach provides the company with a common

ground for measurement of success as the measures of performance will fall in a set

structure which is understandable in the whole organisation (Sanchez-Marquez and et.al.,

2020).

Easy communication – This approach will lead to implementation of performance

measures which will be common for the whole organisation and thus, discussion about

the strategies and progress will become easier.

Disadvantages of Balance Scorecard approach:

Must be customized – This approach will have to be customized and tailored according

to the operations of the organisation for which it has to be implemented which ends up

taking a lot of time.

Complicacy – This approach is complicated to understand as there are wide range of

resources and case studies that needs to be read and understood.

b) Now, there are various perspectives to the mission statement of Golf Plus for which goals

need to be set which will be achieved for the ultimate achievement of the mission statement

which are as follows:

Learning & Growth Perspective and Financial Data Perspective – Customer

satisfaction, environment friendliness and profitability – To be able to achieve customer

affect the decision as the NPV will continue to be negative.

d) NPV is calculated in the terms of currency whereas, in payback period, time period is

calculated in which the initial investment will be recovered by the cash inflows of the

organisation from such a new machinery (Zhang, 2021). Payback period does not take into

account the time value of money while, NPV takes into account the time value of money.

Therefore, it can be said that NPV is a more suitable tool for Golf Plus for decision – making

on such purchase of new machinery and it is recommended not to purchase such a machinery

because taking into account time value of money along with the cash outflows, negative NPV

is an issue which no organisation shall be facing.

Question – 5

a) Advantages of Balance Scorecard approach:

Structured business strategy – This approach provides the company with a common

ground for measurement of success as the measures of performance will fall in a set

structure which is understandable in the whole organisation (Sanchez-Marquez and et.al.,

2020).

Easy communication – This approach will lead to implementation of performance

measures which will be common for the whole organisation and thus, discussion about

the strategies and progress will become easier.

Disadvantages of Balance Scorecard approach:

Must be customized – This approach will have to be customized and tailored according

to the operations of the organisation for which it has to be implemented which ends up

taking a lot of time.

Complicacy – This approach is complicated to understand as there are wide range of

resources and case studies that needs to be read and understood.

b) Now, there are various perspectives to the mission statement of Golf Plus for which goals

need to be set which will be achieved for the ultimate achievement of the mission statement

which are as follows:

Learning & Growth Perspective and Financial Data Perspective – Customer

satisfaction, environment friendliness and profitability – To be able to achieve customer

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

satisfaction along with being operating on sustainable front and most importantly, being

profitable and increase the volume of business.

Business Processes Perspective – Production of high quality golf clubs – To be able to

focus on the processes of business for producing the high quality clubs for the customers.

Customer perspective – Suitability of the clubs to the individual using it – To be able to

produce such types of clubs which will be addressing the individual needs of the golfers

to enhance their playing experience.

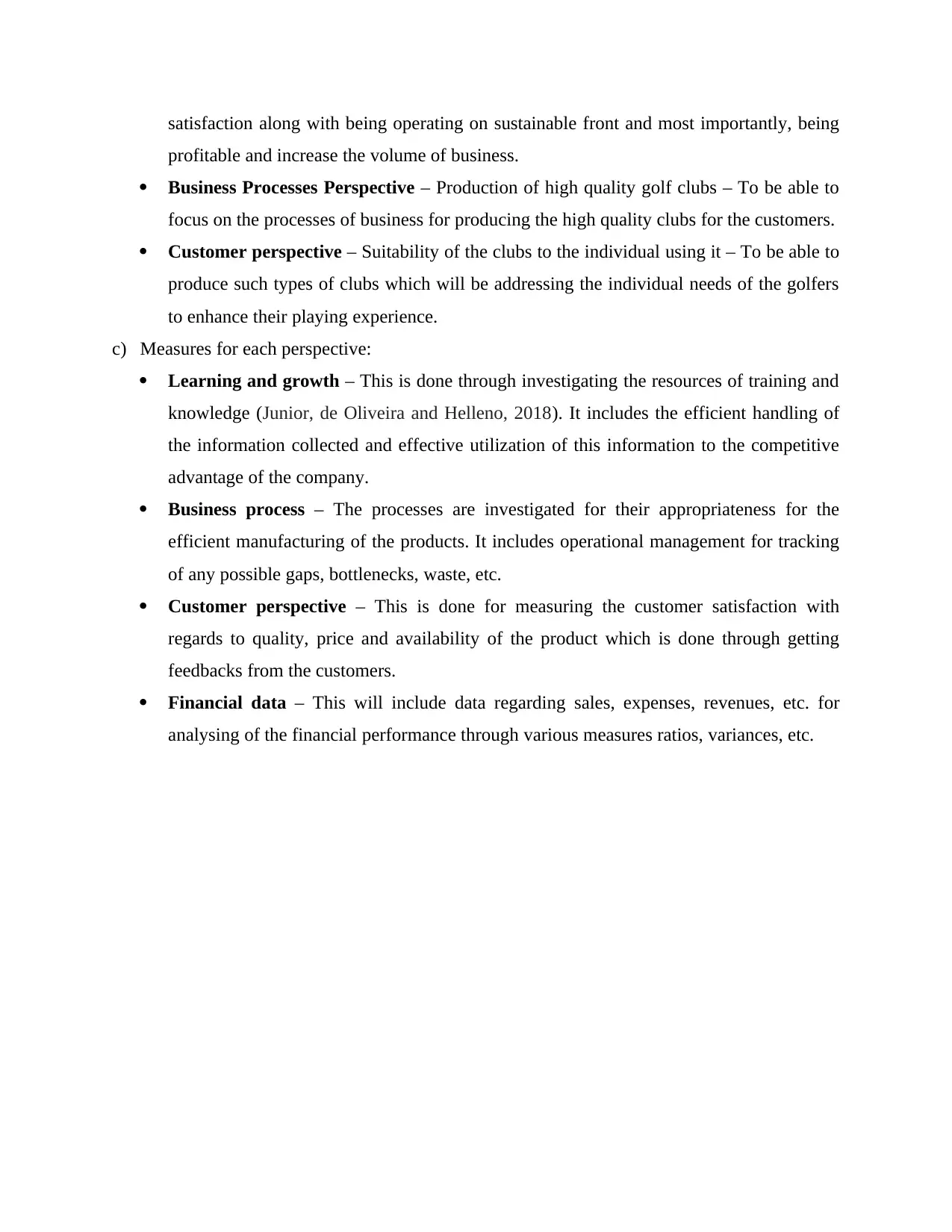

c) Measures for each perspective:

Learning and growth – This is done through investigating the resources of training and

knowledge (Junior, de Oliveira and Helleno, 2018). It includes the efficient handling of

the information collected and effective utilization of this information to the competitive

advantage of the company.

Business process – The processes are investigated for their appropriateness for the

efficient manufacturing of the products. It includes operational management for tracking

of any possible gaps, bottlenecks, waste, etc.

Customer perspective – This is done for measuring the customer satisfaction with

regards to quality, price and availability of the product which is done through getting

feedbacks from the customers.

Financial data – This will include data regarding sales, expenses, revenues, etc. for

analysing of the financial performance through various measures ratios, variances, etc.

profitable and increase the volume of business.

Business Processes Perspective – Production of high quality golf clubs – To be able to

focus on the processes of business for producing the high quality clubs for the customers.

Customer perspective – Suitability of the clubs to the individual using it – To be able to

produce such types of clubs which will be addressing the individual needs of the golfers

to enhance their playing experience.

c) Measures for each perspective:

Learning and growth – This is done through investigating the resources of training and

knowledge (Junior, de Oliveira and Helleno, 2018). It includes the efficient handling of

the information collected and effective utilization of this information to the competitive

advantage of the company.

Business process – The processes are investigated for their appropriateness for the

efficient manufacturing of the products. It includes operational management for tracking

of any possible gaps, bottlenecks, waste, etc.

Customer perspective – This is done for measuring the customer satisfaction with

regards to quality, price and availability of the product which is done through getting

feedbacks from the customers.

Financial data – This will include data regarding sales, expenses, revenues, etc. for

analysing of the financial performance through various measures ratios, variances, etc.

REFERENCES

Books and Journals

Junior, A. N., de Oliveira, M. C. and Helleno, A. L., 2018. Sustainability evaluation model for

manufacturing systems based on the correlation between triple bottom line dimensions

and balanced scorecard perspectives. Journal of Cleaner Production. 190. pp.84-93.

Sanchez-Marquez, R. and et.al., 2020. A systemic methodology for the reduction of complexity

of the balanced scorecard in the manufacturing environment. Cogent business &

management. 7(1). p.1720944.

Shrotriya, V., 2019. Internal sources of finance for business organizations. International Journal

of Research and Analytical Reviews (IJRAR). 6(2). pp.933-940.

Zhang, S., 2021, December. Comparison of Different Investment Decisions Linked with

Discount Rate. In 2021 3rd International Conference on Economic Management and

Cultural Industry (ICEMCI 2021) (pp. 2076-2080). Atlantis Press.

1

Books and Journals

Junior, A. N., de Oliveira, M. C. and Helleno, A. L., 2018. Sustainability evaluation model for

manufacturing systems based on the correlation between triple bottom line dimensions

and balanced scorecard perspectives. Journal of Cleaner Production. 190. pp.84-93.

Sanchez-Marquez, R. and et.al., 2020. A systemic methodology for the reduction of complexity

of the balanced scorecard in the manufacturing environment. Cogent business &

management. 7(1). p.1720944.

Shrotriya, V., 2019. Internal sources of finance for business organizations. International Journal

of Research and Analytical Reviews (IJRAR). 6(2). pp.933-940.

Zhang, S., 2021, December. Comparison of Different Investment Decisions Linked with

Discount Rate. In 2021 3rd International Conference on Economic Management and

Cultural Industry (ICEMCI 2021) (pp. 2076-2080). Atlantis Press.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.