Financial Statement Analysis

VerifiedAdded on 2020/03/02

|7

|1506

|41

AI Summary

This assignment presents a set of financial statements for a company dated June 30th, 2017. It includes details on current and non-current assets, along with current and non-current liabilities. The statement also breaks down the company's equity into share capital, general reserve, and retained earnings. Users can analyze the provided information to understand the company's financial health and position.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

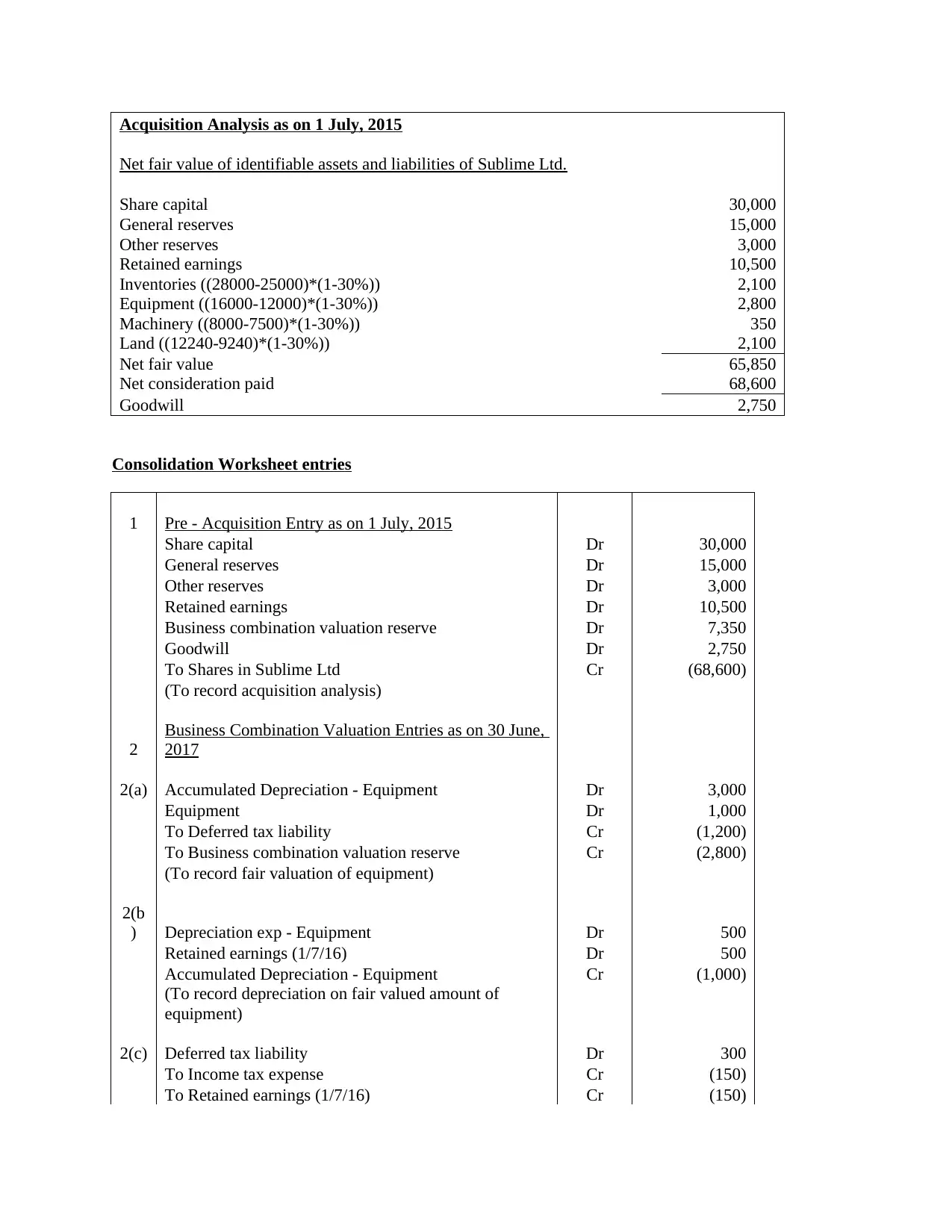

Acquisition Analysis as on 1 July, 2015

Net fair value of identifiable assets and liabilities of Sublime Ltd.

Share capital 30,000

General reserves 15,000

Other reserves 3,000

Retained earnings 10,500

Inventories ((28000-25000)*(1-30%)) 2,100

Equipment ((16000-12000)*(1-30%)) 2,800

Machinery ((8000-7500)*(1-30%)) 350

Land ((12240-9240)*(1-30%)) 2,100

Net fair value 65,850

Net consideration paid 68,600

Goodwill 2,750

Consolidation Worksheet entries

1 Pre - Acquisition Entry as on 1 July, 2015

Share capital Dr 30,000

General reserves Dr 15,000

Other reserves Dr 3,000

Retained earnings Dr 10,500

Business combination valuation reserve Dr 7,350

Goodwill Dr 2,750

To Shares in Sublime Ltd Cr (68,600)

(To record acquisition analysis)

2

Business Combination Valuation Entries as on 30 June,

2017

2(a) Accumulated Depreciation - Equipment Dr 3,000

Equipment Dr 1,000

To Deferred tax liability Cr (1,200)

To Business combination valuation reserve Cr (2,800)

(To record fair valuation of equipment)

2(b

) Depreciation exp - Equipment Dr 500

Retained earnings (1/7/16) Dr 500

Accumulated Depreciation - Equipment Cr (1,000)

(To record depreciation on fair valued amount of

equipment)

2(c) Deferred tax liability Dr 300

To Income tax expense Cr (150)

To Retained earnings (1/7/16) Cr (150)

Net fair value of identifiable assets and liabilities of Sublime Ltd.

Share capital 30,000

General reserves 15,000

Other reserves 3,000

Retained earnings 10,500

Inventories ((28000-25000)*(1-30%)) 2,100

Equipment ((16000-12000)*(1-30%)) 2,800

Machinery ((8000-7500)*(1-30%)) 350

Land ((12240-9240)*(1-30%)) 2,100

Net fair value 65,850

Net consideration paid 68,600

Goodwill 2,750

Consolidation Worksheet entries

1 Pre - Acquisition Entry as on 1 July, 2015

Share capital Dr 30,000

General reserves Dr 15,000

Other reserves Dr 3,000

Retained earnings Dr 10,500

Business combination valuation reserve Dr 7,350

Goodwill Dr 2,750

To Shares in Sublime Ltd Cr (68,600)

(To record acquisition analysis)

2

Business Combination Valuation Entries as on 30 June,

2017

2(a) Accumulated Depreciation - Equipment Dr 3,000

Equipment Dr 1,000

To Deferred tax liability Cr (1,200)

To Business combination valuation reserve Cr (2,800)

(To record fair valuation of equipment)

2(b

) Depreciation exp - Equipment Dr 500

Retained earnings (1/7/16) Dr 500

Accumulated Depreciation - Equipment Cr (1,000)

(To record depreciation on fair valued amount of

equipment)

2(c) Deferred tax liability Dr 300

To Income tax expense Cr (150)

To Retained earnings (1/7/16) Cr (150)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

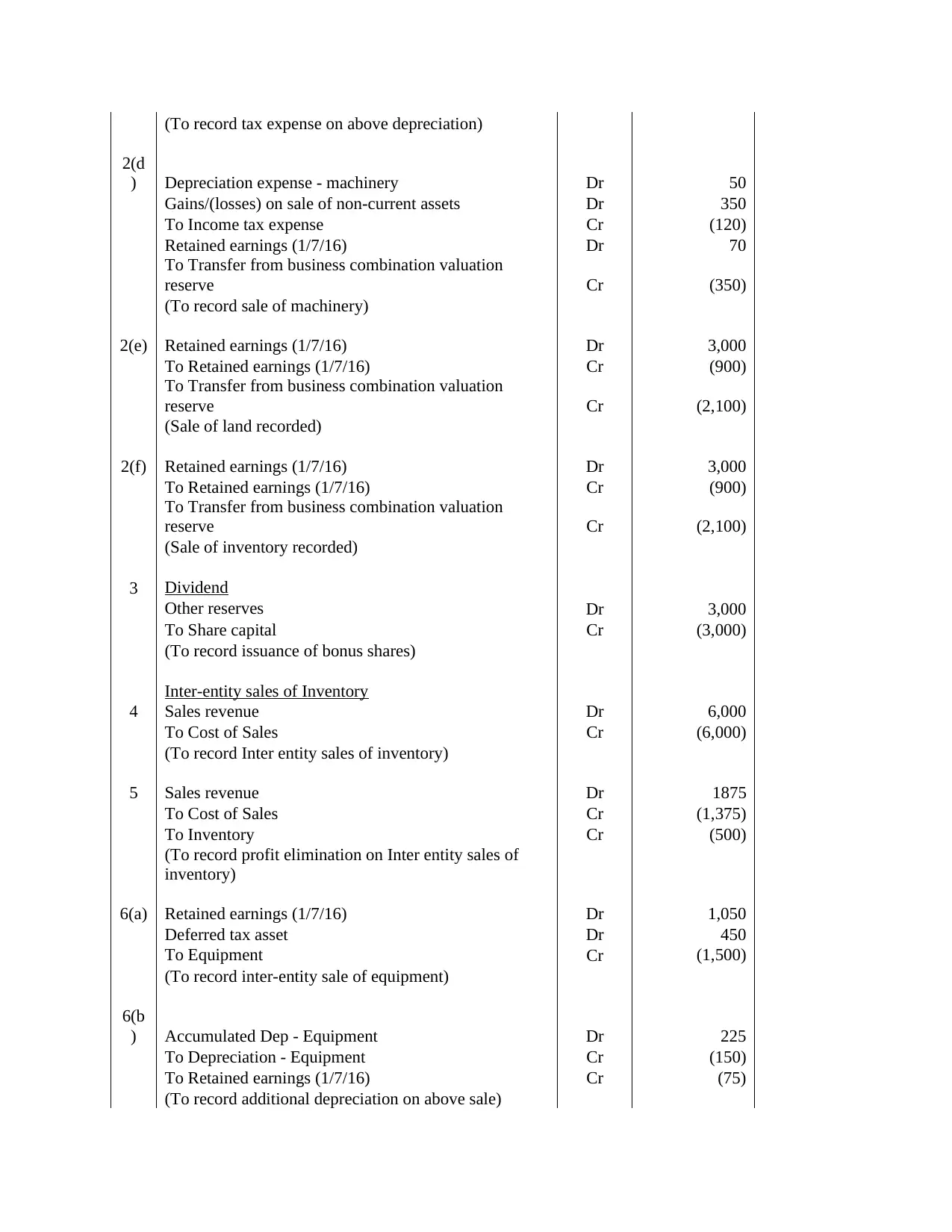

(To record tax expense on above depreciation)

2(d

) Depreciation expense - machinery Dr 50

Gains/(losses) on sale of non-current assets Dr 350

To Income tax expense Cr (120)

Retained earnings (1/7/16) Dr 70

To Transfer from business combination valuation

reserve Cr (350)

(To record sale of machinery)

2(e) Retained earnings (1/7/16) Dr 3,000

To Retained earnings (1/7/16) Cr (900)

To Transfer from business combination valuation

reserve Cr (2,100)

(Sale of land recorded)

2(f) Retained earnings (1/7/16) Dr 3,000

To Retained earnings (1/7/16) Cr (900)

To Transfer from business combination valuation

reserve Cr (2,100)

(Sale of inventory recorded)

3 Dividend

Other reserves Dr 3,000

To Share capital Cr (3,000)

(To record issuance of bonus shares)

Inter-entity sales of Inventory

4 Sales revenue Dr 6,000

To Cost of Sales Cr (6,000)

(To record Inter entity sales of inventory)

5 Sales revenue Dr 1875

To Cost of Sales Cr (1,375)

To Inventory Cr (500)

(To record profit elimination on Inter entity sales of

inventory)

6(a) Retained earnings (1/7/16) Dr 1,050

Deferred tax asset Dr 450

To Equipment Cr (1,500)

(To record inter-entity sale of equipment)

6(b

) Accumulated Dep - Equipment Dr 225

To Depreciation - Equipment Cr (150)

To Retained earnings (1/7/16) Cr (75)

(To record additional depreciation on above sale)

2(d

) Depreciation expense - machinery Dr 50

Gains/(losses) on sale of non-current assets Dr 350

To Income tax expense Cr (120)

Retained earnings (1/7/16) Dr 70

To Transfer from business combination valuation

reserve Cr (350)

(To record sale of machinery)

2(e) Retained earnings (1/7/16) Dr 3,000

To Retained earnings (1/7/16) Cr (900)

To Transfer from business combination valuation

reserve Cr (2,100)

(Sale of land recorded)

2(f) Retained earnings (1/7/16) Dr 3,000

To Retained earnings (1/7/16) Cr (900)

To Transfer from business combination valuation

reserve Cr (2,100)

(Sale of inventory recorded)

3 Dividend

Other reserves Dr 3,000

To Share capital Cr (3,000)

(To record issuance of bonus shares)

Inter-entity sales of Inventory

4 Sales revenue Dr 6,000

To Cost of Sales Cr (6,000)

(To record Inter entity sales of inventory)

5 Sales revenue Dr 1875

To Cost of Sales Cr (1,375)

To Inventory Cr (500)

(To record profit elimination on Inter entity sales of

inventory)

6(a) Retained earnings (1/7/16) Dr 1,050

Deferred tax asset Dr 450

To Equipment Cr (1,500)

(To record inter-entity sale of equipment)

6(b

) Accumulated Dep - Equipment Dr 225

To Depreciation - Equipment Cr (150)

To Retained earnings (1/7/16) Cr (75)

(To record additional depreciation on above sale)

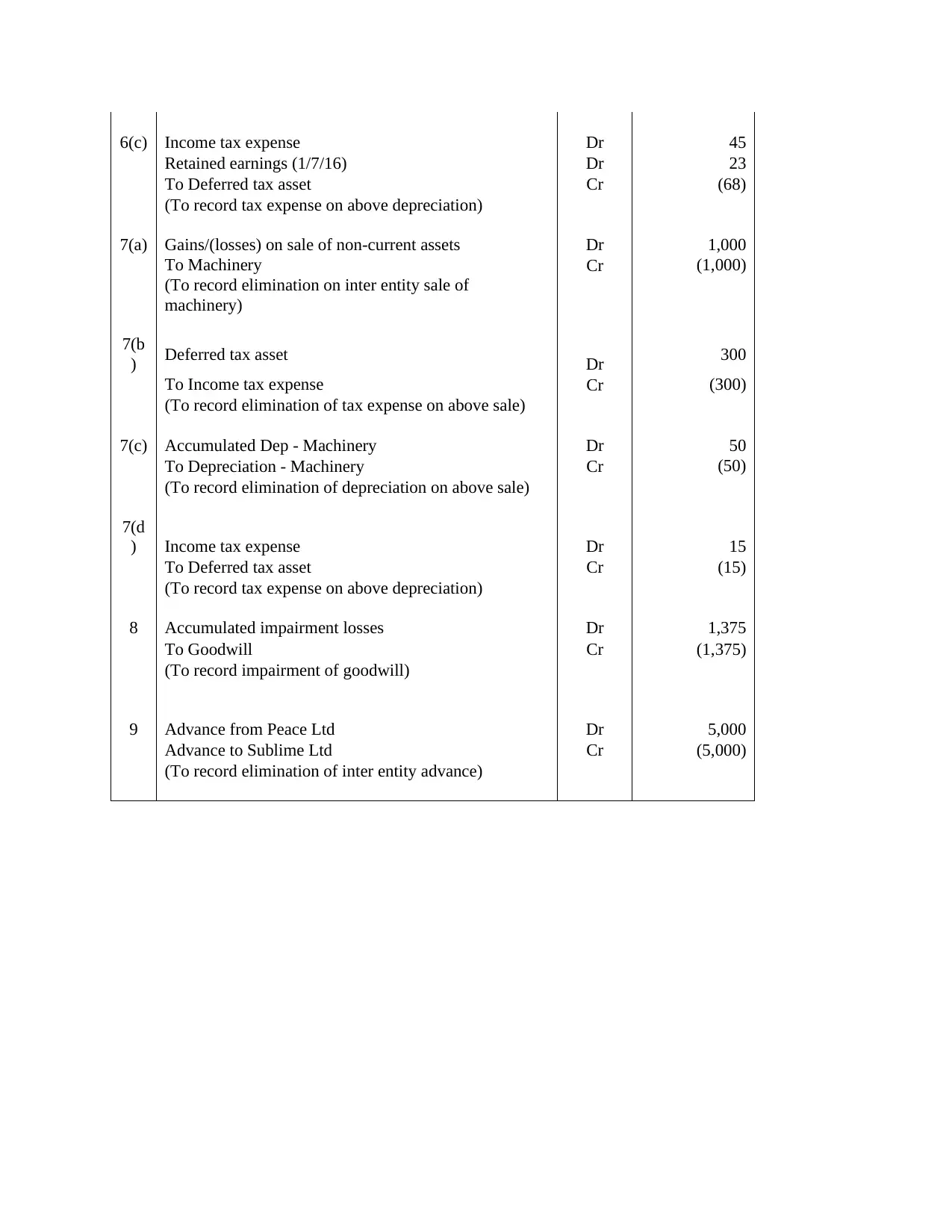

6(c) Income tax expense Dr 45

Retained earnings (1/7/16) Dr 23

To Deferred tax asset Cr (68)

(To record tax expense on above depreciation)

7(a) Gains/(losses) on sale of non-current assets Dr 1,000

To Machinery Cr (1,000)

(To record elimination on inter entity sale of

machinery)

7(b

) Deferred tax asset Dr 300

To Income tax expense Cr (300)

(To record elimination of tax expense on above sale)

7(c) Accumulated Dep - Machinery Dr 50

To Depreciation - Machinery Cr (50)

(To record elimination of depreciation on above sale)

7(d

) Income tax expense Dr 15

To Deferred tax asset Cr (15)

(To record tax expense on above depreciation)

8 Accumulated impairment losses Dr 1,375

To Goodwill Cr (1,375)

(To record impairment of goodwill)

9 Advance from Peace Ltd Dr 5,000

Advance to Sublime Ltd Cr (5,000)

(To record elimination of inter entity advance)

Retained earnings (1/7/16) Dr 23

To Deferred tax asset Cr (68)

(To record tax expense on above depreciation)

7(a) Gains/(losses) on sale of non-current assets Dr 1,000

To Machinery Cr (1,000)

(To record elimination on inter entity sale of

machinery)

7(b

) Deferred tax asset Dr 300

To Income tax expense Cr (300)

(To record elimination of tax expense on above sale)

7(c) Accumulated Dep - Machinery Dr 50

To Depreciation - Machinery Cr (50)

(To record elimination of depreciation on above sale)

7(d

) Income tax expense Dr 15

To Deferred tax asset Cr (15)

(To record tax expense on above depreciation)

8 Accumulated impairment losses Dr 1,375

To Goodwill Cr (1,375)

(To record impairment of goodwill)

9 Advance from Peace Ltd Dr 5,000

Advance to Sublime Ltd Cr (5,000)

(To record elimination of inter entity advance)

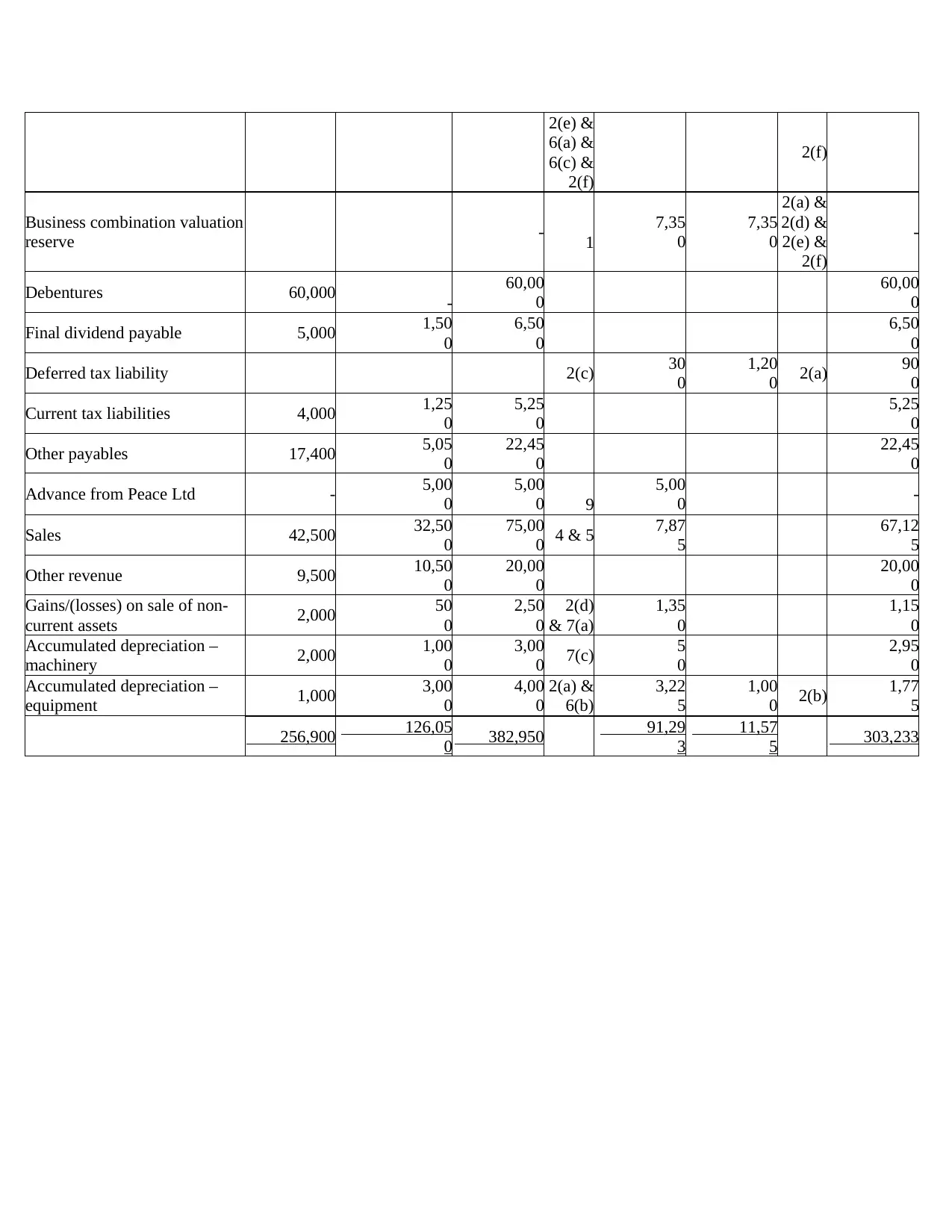

Consolidation Worksheet

Debit balances Peace Ltd Sublime Ltd Total Adjustments

$ $ Ref. Dr Cr Ref. Total

Shares in Sublime Ltd 68,600 -

68,60

0

68,60

0 1 -

Inventory 85,790 35,16

0 120,950 50

0 5 120,450

Other current assets 4,310 1,55

0

5,86

0

5,86

0

Deferred tax assets 8,100 3,70

0

11,80

0

6(a) &

7(b)

75

0

8

3

6(c) &

7(d)

12,46

8

Machinery 14,000 11,00

0

25,00

0

1,00

0 7(a) 24,00

0

Land - 12,24

0

12,24

0

12,24

0

Equipment 17,000 18,65

0

35,65

0 2(a) 1,00

0

1,50

0 6(a) 35,15

0

Goodwill - 1

2,75

0

1,37

5 8

1,37

5

Cost of sales 32,500 26,75

0

59,25

0

7,37

5 4 & 5 51,87

5

Other expenses 11,000 13,50

0

24,50

0

24,50

0

Accumulated impairment losses 8

1,37

5

1,37

5

Depreciation exp - Equipment 2(b) 50

0

15

0 6(b) 35

0

Depreciation expense -

machinery 2(d) 5

0

5

0 7(c) -

Income tax expense 3,600 1,00

0

4,60

0

6(c) &

7(d)

6

0

57

0

2(c) &

2(d) &

7(b)

4,09

0

Interim dividend paid 2,000 1,00

0

3,00

0

3,00

0

Final dividend declared 5,000 1,50

0

6,50

0

6,50

0

Advance to Sublime Ltd 5,000 -

5,00

0

5,00

0 9 -

256,900 126,05

0 382,950 6,48

5

86,20

3 303,233

Credit balances

Share capital 85,000 33,00

0 118,000 1 & 3 33,00

0

85,00

0

General reserve 20,500 15,00

0

35,50

0 1

15,00

0

20,50

0

Retained earnings (1/7/16) 8,000 17,75

0

25,75

0

1 &

2(b) &

2(d) &

18,14

3

2,02

5

2(c) &

2(e) &

6(b) &

9,63

3

Debit balances Peace Ltd Sublime Ltd Total Adjustments

$ $ Ref. Dr Cr Ref. Total

Shares in Sublime Ltd 68,600 -

68,60

0

68,60

0 1 -

Inventory 85,790 35,16

0 120,950 50

0 5 120,450

Other current assets 4,310 1,55

0

5,86

0

5,86

0

Deferred tax assets 8,100 3,70

0

11,80

0

6(a) &

7(b)

75

0

8

3

6(c) &

7(d)

12,46

8

Machinery 14,000 11,00

0

25,00

0

1,00

0 7(a) 24,00

0

Land - 12,24

0

12,24

0

12,24

0

Equipment 17,000 18,65

0

35,65

0 2(a) 1,00

0

1,50

0 6(a) 35,15

0

Goodwill - 1

2,75

0

1,37

5 8

1,37

5

Cost of sales 32,500 26,75

0

59,25

0

7,37

5 4 & 5 51,87

5

Other expenses 11,000 13,50

0

24,50

0

24,50

0

Accumulated impairment losses 8

1,37

5

1,37

5

Depreciation exp - Equipment 2(b) 50

0

15

0 6(b) 35

0

Depreciation expense -

machinery 2(d) 5

0

5

0 7(c) -

Income tax expense 3,600 1,00

0

4,60

0

6(c) &

7(d)

6

0

57

0

2(c) &

2(d) &

7(b)

4,09

0

Interim dividend paid 2,000 1,00

0

3,00

0

3,00

0

Final dividend declared 5,000 1,50

0

6,50

0

6,50

0

Advance to Sublime Ltd 5,000 -

5,00

0

5,00

0 9 -

256,900 126,05

0 382,950 6,48

5

86,20

3 303,233

Credit balances

Share capital 85,000 33,00

0 118,000 1 & 3 33,00

0

85,00

0

General reserve 20,500 15,00

0

35,50

0 1

15,00

0

20,50

0

Retained earnings (1/7/16) 8,000 17,75

0

25,75

0

1 &

2(b) &

2(d) &

18,14

3

2,02

5

2(c) &

2(e) &

6(b) &

9,63

3

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2(e) &

6(a) &

6(c) &

2(f)

2(f)

Business combination valuation

reserve - 1

7,35

0

7,35

0

2(a) &

2(d) &

2(e) &

2(f)

-

Debentures 60,000 -

60,00

0

60,00

0

Final dividend payable 5,000 1,50

0

6,50

0

6,50

0

Deferred tax liability 2(c) 30

0

1,20

0 2(a) 90

0

Current tax liabilities 4,000 1,25

0

5,25

0

5,25

0

Other payables 17,400 5,05

0

22,45

0

22,45

0

Advance from Peace Ltd - 5,00

0

5,00

0 9

5,00

0 -

Sales 42,500 32,50

0

75,00

0 4 & 5 7,87

5

67,12

5

Other revenue 9,500 10,50

0

20,00

0

20,00

0

Gains/(losses) on sale of non-

current assets 2,000 50

0

2,50

0

2(d)

& 7(a)

1,35

0

1,15

0

Accumulated depreciation –

machinery 2,000 1,00

0

3,00

0 7(c) 5

0

2,95

0

Accumulated depreciation –

equipment 1,000 3,00

0

4,00

0

2(a) &

6(b)

3,22

5

1,00

0 2(b) 1,77

5

256,900 126,05

0 382,950 91,29

3

11,57

5 303,233

6(a) &

6(c) &

2(f)

2(f)

Business combination valuation

reserve - 1

7,35

0

7,35

0

2(a) &

2(d) &

2(e) &

2(f)

-

Debentures 60,000 -

60,00

0

60,00

0

Final dividend payable 5,000 1,50

0

6,50

0

6,50

0

Deferred tax liability 2(c) 30

0

1,20

0 2(a) 90

0

Current tax liabilities 4,000 1,25

0

5,25

0

5,25

0

Other payables 17,400 5,05

0

22,45

0

22,45

0

Advance from Peace Ltd - 5,00

0

5,00

0 9

5,00

0 -

Sales 42,500 32,50

0

75,00

0 4 & 5 7,87

5

67,12

5

Other revenue 9,500 10,50

0

20,00

0

20,00

0

Gains/(losses) on sale of non-

current assets 2,000 50

0

2,50

0

2(d)

& 7(a)

1,35

0

1,15

0

Accumulated depreciation –

machinery 2,000 1,00

0

3,00

0 7(c) 5

0

2,95

0

Accumulated depreciation –

equipment 1,000 3,00

0

4,00

0

2(a) &

6(b)

3,22

5

1,00

0 2(b) 1,77

5

256,900 126,05

0 382,950 91,29

3

11,57

5 303,233

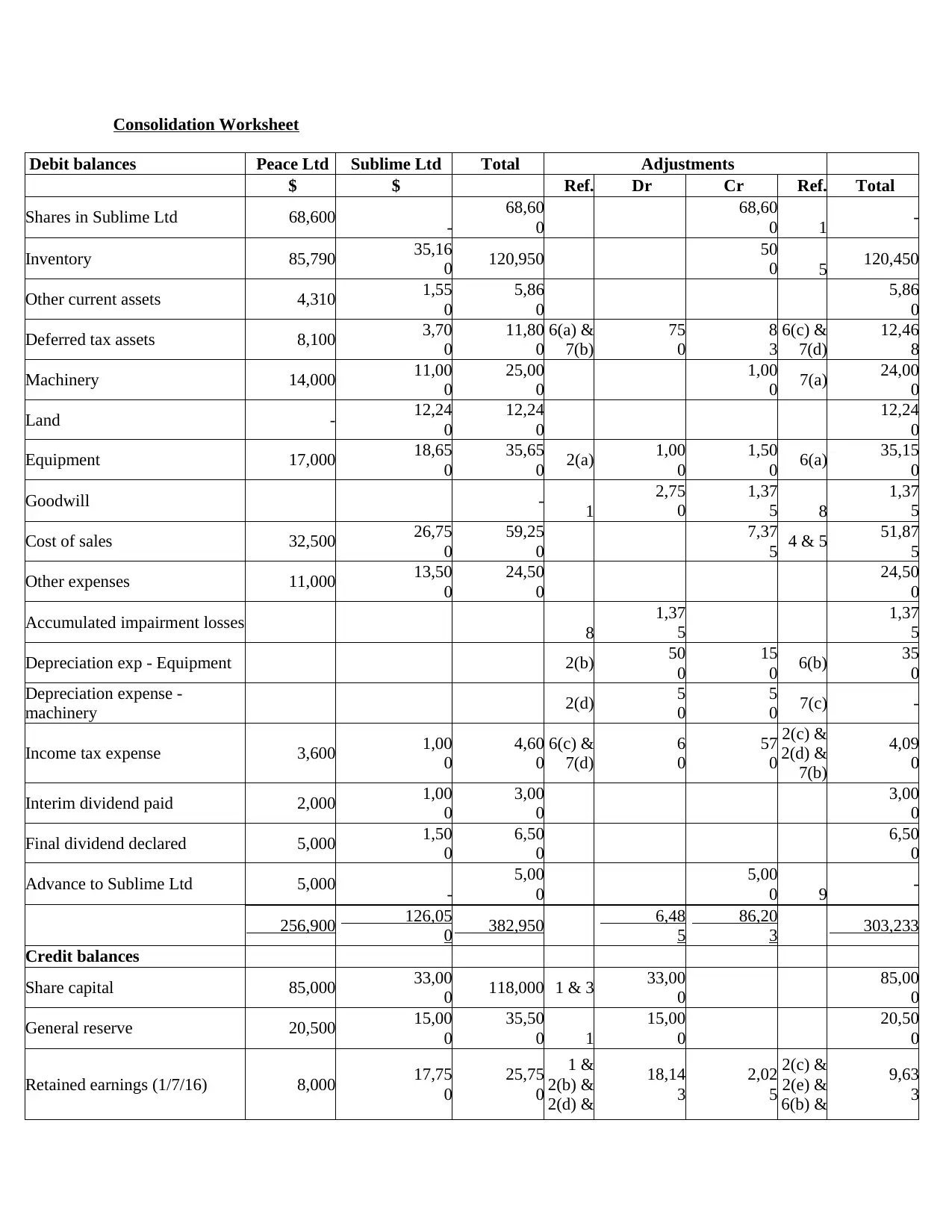

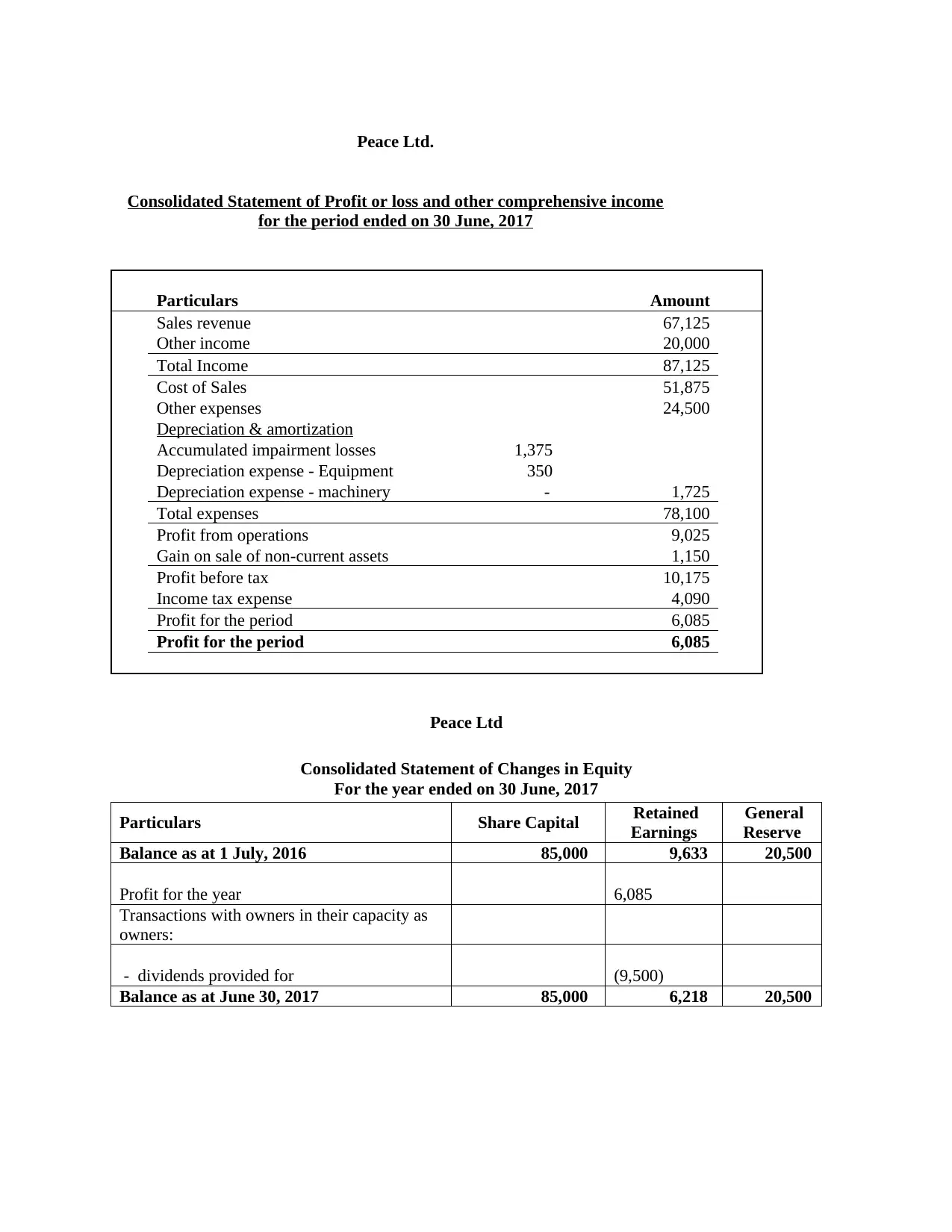

Peace Ltd.

Consolidated Statement of Profit or loss and other comprehensive income

for the period ended on 30 June, 2017

Particulars Amount

Sales revenue 67,125

Other income 20,000

Total Income 87,125

Cost of Sales 51,875

Other expenses 24,500

Depreciation & amortization

Accumulated impairment losses 1,375

Depreciation expense - Equipment 350

Depreciation expense - machinery - 1,725

Total expenses 78,100

Profit from operations 9,025

Gain on sale of non-current assets 1,150

Profit before tax 10,175

Income tax expense 4,090

Profit for the period 6,085

Profit for the period 6,085

Peace Ltd

Consolidated Statement of Changes in Equity

For the year ended on 30 June, 2017

Particulars Share Capital Retained

Earnings

General

Reserve

Balance as at 1 July, 2016 85,000 9,633 20,500

Profit for the year 6,085

Transactions with owners in their capacity as

owners:

- dividends provided for (9,500)

Balance as at June 30, 2017 85,000 6,218 20,500

Consolidated Statement of Profit or loss and other comprehensive income

for the period ended on 30 June, 2017

Particulars Amount

Sales revenue 67,125

Other income 20,000

Total Income 87,125

Cost of Sales 51,875

Other expenses 24,500

Depreciation & amortization

Accumulated impairment losses 1,375

Depreciation expense - Equipment 350

Depreciation expense - machinery - 1,725

Total expenses 78,100

Profit from operations 9,025

Gain on sale of non-current assets 1,150

Profit before tax 10,175

Income tax expense 4,090

Profit for the period 6,085

Profit for the period 6,085

Peace Ltd

Consolidated Statement of Changes in Equity

For the year ended on 30 June, 2017

Particulars Share Capital Retained

Earnings

General

Reserve

Balance as at 1 July, 2016 85,000 9,633 20,500

Profit for the year 6,085

Transactions with owners in their capacity as

owners:

- dividends provided for (9,500)

Balance as at June 30, 2017 85,000 6,218 20,500

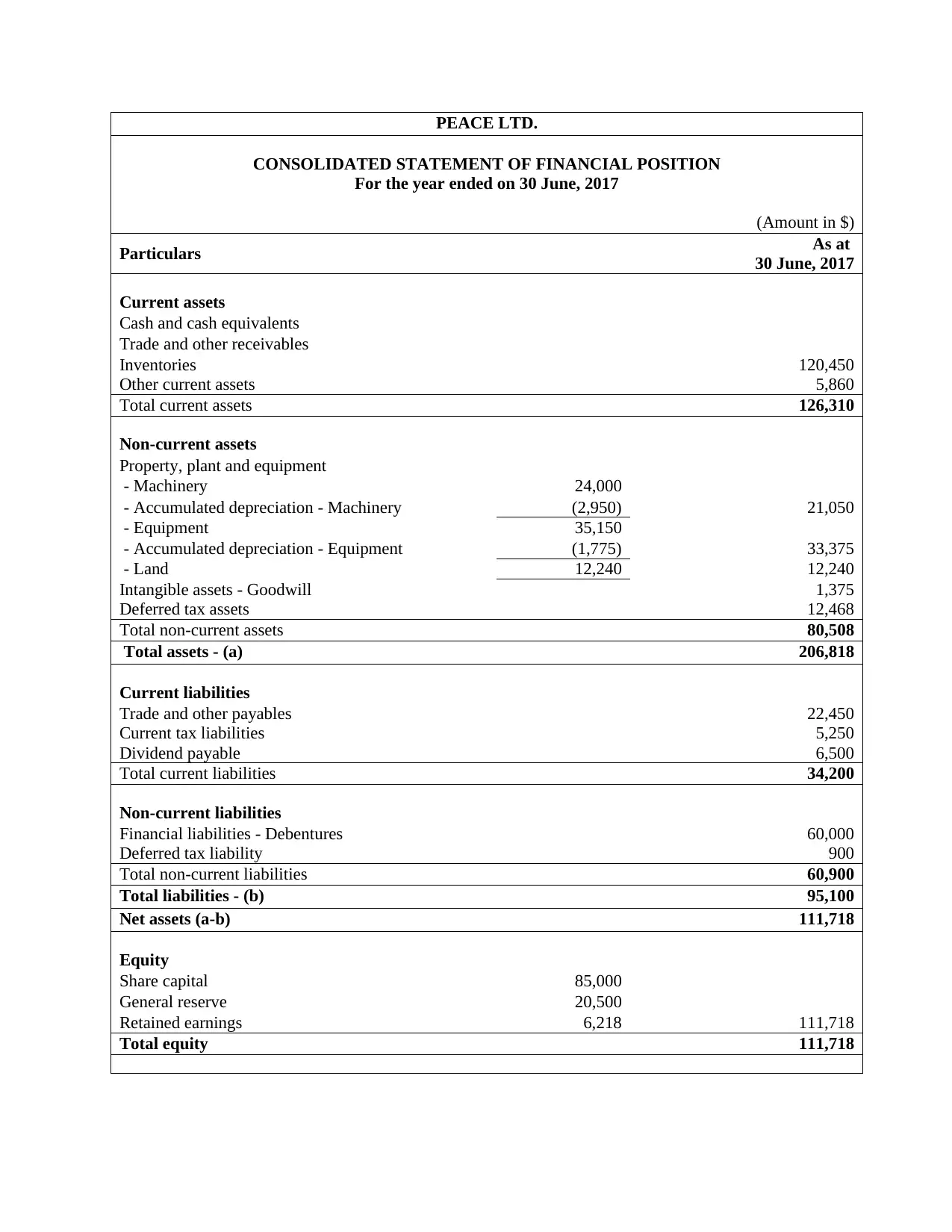

PEACE LTD.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended on 30 June, 2017

(Amount in $)

Particulars As at

30 June, 2017

Current assets

Cash and cash equivalents

Trade and other receivables

Inventories 120,450

Other current assets 5,860

Total current assets 126,310

Non-current assets

Property, plant and equipment

- Machinery 24,000

- Accumulated depreciation - Machinery (2,950) 21,050

- Equipment 35,150

- Accumulated depreciation - Equipment (1,775) 33,375

- Land 12,240 12,240

Intangible assets - Goodwill 1,375

Deferred tax assets 12,468

Total non-current assets 80,508

Total assets - (a) 206,818

Current liabilities

Trade and other payables 22,450

Current tax liabilities 5,250

Dividend payable 6,500

Total current liabilities 34,200

Non-current liabilities

Financial liabilities - Debentures 60,000

Deferred tax liability 900

Total non-current liabilities 60,900

Total liabilities - (b) 95,100

Net assets (a-b) 111,718

Equity

Share capital 85,000

General reserve 20,500

Retained earnings 6,218 111,718

Total equity 111,718

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended on 30 June, 2017

(Amount in $)

Particulars As at

30 June, 2017

Current assets

Cash and cash equivalents

Trade and other receivables

Inventories 120,450

Other current assets 5,860

Total current assets 126,310

Non-current assets

Property, plant and equipment

- Machinery 24,000

- Accumulated depreciation - Machinery (2,950) 21,050

- Equipment 35,150

- Accumulated depreciation - Equipment (1,775) 33,375

- Land 12,240 12,240

Intangible assets - Goodwill 1,375

Deferred tax assets 12,468

Total non-current assets 80,508

Total assets - (a) 206,818

Current liabilities

Trade and other payables 22,450

Current tax liabilities 5,250

Dividend payable 6,500

Total current liabilities 34,200

Non-current liabilities

Financial liabilities - Debentures 60,000

Deferred tax liability 900

Total non-current liabilities 60,900

Total liabilities - (b) 95,100

Net assets (a-b) 111,718

Equity

Share capital 85,000

General reserve 20,500

Retained earnings 6,218 111,718

Total equity 111,718

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.