Feasibility Report on Activity Based Budgeting for Pethe Industrial Marketing Company

VerifiedAdded on 2023/06/04

|14

|4162

|361

AI Summary

This report analyzes the applicability of activity based budgeting in Pethe Industrial Marketing Company and suggests its adoption. It discusses the features of ABB, differences between ABB and traditional budgeting, and its suitability for the company.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

PHILLIPS CONSULTING LIMITED

4TH FLOOR, UBA HOUSE, MARINA , LAGOS

Phone : +234 (0) 906 000 0804

A FEASIBILITY REPORT

ON THE IMPLEMENTATION OF THE

ACTIVITY BASED BUDGETING

PREPARED FOR

PETHE INDUSTRIAL MARKETING COMPANY PRIVATE LIMITED

PREPARED BY

STUDENT

STUDENT ID

STUDENT

STUDENT ID

STUDENT

STUDENT ID

CLIENT’S CONTACT: NAME

DESIGNATION: CHIEF EXECUTIVE OFFICER

PHONE ; 022-24223976,FAX : 022-24228998

ADDRESS : 69, S.K. BOLE ROAD, DAGDIWADI, NEAR PORTEGUESE CHURCH

XXXX (W), XXXXXX- 900028

1 | P a g e

4TH FLOOR, UBA HOUSE, MARINA , LAGOS

Phone : +234 (0) 906 000 0804

A FEASIBILITY REPORT

ON THE IMPLEMENTATION OF THE

ACTIVITY BASED BUDGETING

PREPARED FOR

PETHE INDUSTRIAL MARKETING COMPANY PRIVATE LIMITED

PREPARED BY

STUDENT

STUDENT ID

STUDENT

STUDENT ID

STUDENT

STUDENT ID

CLIENT’S CONTACT: NAME

DESIGNATION: CHIEF EXECUTIVE OFFICER

PHONE ; 022-24223976,FAX : 022-24228998

ADDRESS : 69, S.K. BOLE ROAD, DAGDIWADI, NEAR PORTEGUESE CHURCH

XXXX (W), XXXXXX- 900028

1 | P a g e

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EXECUTIVE SUMMARY

In the given assignment we have analyzed the applicability of the activity based budgeting in a

manufacturing concern, Pethe Industrial Marketing Company Limited, and after the overall

analysis we suggested that it would be viable for the company to adopt the ABB as it budgeting

system within the company.

2 | P a g e

In the given assignment we have analyzed the applicability of the activity based budgeting in a

manufacturing concern, Pethe Industrial Marketing Company Limited, and after the overall

analysis we suggested that it would be viable for the company to adopt the ABB as it budgeting

system within the company.

2 | P a g e

TABLE OF CONTENTS

Introduction.............................................................................................................................................................................. 4

Key Points.................................................................................................................................................................................. 4

a). A brief description of the Client Company......................................................................................................... 4

b). Description of ABB and its features...................................................................................................................... 5

Features of Activity Based Budgeting........................................................................................................................ 7

c). Difference between ABB and Traditional Budgeting system......................................................................8

Difference between traditional budget and Activity based budgeting.......................................................11

d). Discussion on the Suitability of ABB................................................................................................................. 13

Conclusion............................................................................................................................................................................... 13

References............................................................................................................................................................................... 14

3 | P a g e

Introduction.............................................................................................................................................................................. 4

Key Points.................................................................................................................................................................................. 4

a). A brief description of the Client Company......................................................................................................... 4

b). Description of ABB and its features...................................................................................................................... 5

Features of Activity Based Budgeting........................................................................................................................ 7

c). Difference between ABB and Traditional Budgeting system......................................................................8

Difference between traditional budget and Activity based budgeting.......................................................11

d). Discussion on the Suitability of ABB................................................................................................................. 13

Conclusion............................................................................................................................................................................... 13

References............................................................................................................................................................................... 14

3 | P a g e

INTRODUCTION

At present, Pethe Industrial Marketing Company Private Limited has been analyzing and

reviewing the viability of the system of budgeting being practiced by the company in order to

bring about improvement in the budgeting process. For the purpose of implementation of a

better budgeting practice the chief executive officer of the company has been looking for

prospects (Bennuona, et al., 2010). Through various seminars, the officer came across the

benefits of the activity based budgeting and after proper evaluation of this system of budgeting,

the company has proposed to adopt this system of budgeting in front of Phillips Consulting. For

the purpose of the adoption of this system of budgeting Phillips Consulting is required to

submit a report on the feasibility of adopting the activity based budgeting system in the current

scenario of the company.

KEY POINTS

A). A BRIEF DESCRIPTION OF THE CLIENT COMPANY

Pethe Industries marketing is a leading manufacturing company since 1965 of electromagnetic

brakes, clutches, crane controls and motors of high quality. Pethe industries is also an exporter

and supplier of various kinds of material handling equipment’s, industrial brakes industrial

clutches, gear boxes, reduction gears, gear cuttings, couplings and electric engine and motors,

etc. These involves variety of activities like storage, transmission, transformation, fabrication,

etc. for the performance of such activities there are various other activities which are involved

like, recruitment of staff and labor, training process, engineering services, documentation,

building rent or factory rent, machine on hire, travelling and conveyance and many more. The

cost drivers which are related to these activities are machine hours, labor hours, number of

machine set up, number of production runs, batch total, number of units produced, etc.

(Bromwich & Scapens, 2016). There are various non value added activities with respect of the

manufacturing process like waiting time or idle time, transportation, handling (moving things),

excess inventory buildup or useless inventory, defects and many other types of non value

added activities. For the purpose of carrying out the operations smoothly, our client company

has implemented high tech machinery and various amenities, the company has also incurred

cost in relation to the recruitment of a team having dexterous professionals. We have observed

that during the past few years the profit of the company has remained at edge due to

incurrence of cost in various improvements in the production system. Other than the cost

incurred by the company as mentioned above there are various other factors which has

4 | P a g e

At present, Pethe Industrial Marketing Company Private Limited has been analyzing and

reviewing the viability of the system of budgeting being practiced by the company in order to

bring about improvement in the budgeting process. For the purpose of implementation of a

better budgeting practice the chief executive officer of the company has been looking for

prospects (Bennuona, et al., 2010). Through various seminars, the officer came across the

benefits of the activity based budgeting and after proper evaluation of this system of budgeting,

the company has proposed to adopt this system of budgeting in front of Phillips Consulting. For

the purpose of the adoption of this system of budgeting Phillips Consulting is required to

submit a report on the feasibility of adopting the activity based budgeting system in the current

scenario of the company.

KEY POINTS

A). A BRIEF DESCRIPTION OF THE CLIENT COMPANY

Pethe Industries marketing is a leading manufacturing company since 1965 of electromagnetic

brakes, clutches, crane controls and motors of high quality. Pethe industries is also an exporter

and supplier of various kinds of material handling equipment’s, industrial brakes industrial

clutches, gear boxes, reduction gears, gear cuttings, couplings and electric engine and motors,

etc. These involves variety of activities like storage, transmission, transformation, fabrication,

etc. for the performance of such activities there are various other activities which are involved

like, recruitment of staff and labor, training process, engineering services, documentation,

building rent or factory rent, machine on hire, travelling and conveyance and many more. The

cost drivers which are related to these activities are machine hours, labor hours, number of

machine set up, number of production runs, batch total, number of units produced, etc.

(Bromwich & Scapens, 2016). There are various non value added activities with respect of the

manufacturing process like waiting time or idle time, transportation, handling (moving things),

excess inventory buildup or useless inventory, defects and many other types of non value

added activities. For the purpose of carrying out the operations smoothly, our client company

has implemented high tech machinery and various amenities, the company has also incurred

cost in relation to the recruitment of a team having dexterous professionals. We have observed

that during the past few years the profit of the company has remained at edge due to

incurrence of cost in various improvements in the production system. Other than the cost

incurred by the company as mentioned above there are various other factors which has

4 | P a g e

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

affected the growth of the company like slow decision making process, which is very important,

etc. (Choy, 2018).

With the increasing development in the manufacturing industry and constantly growing

competition, the company has also appointed a special team of professionals who are skillful

and experts in this field. This is expected to increase the clientele of the company far and wide.

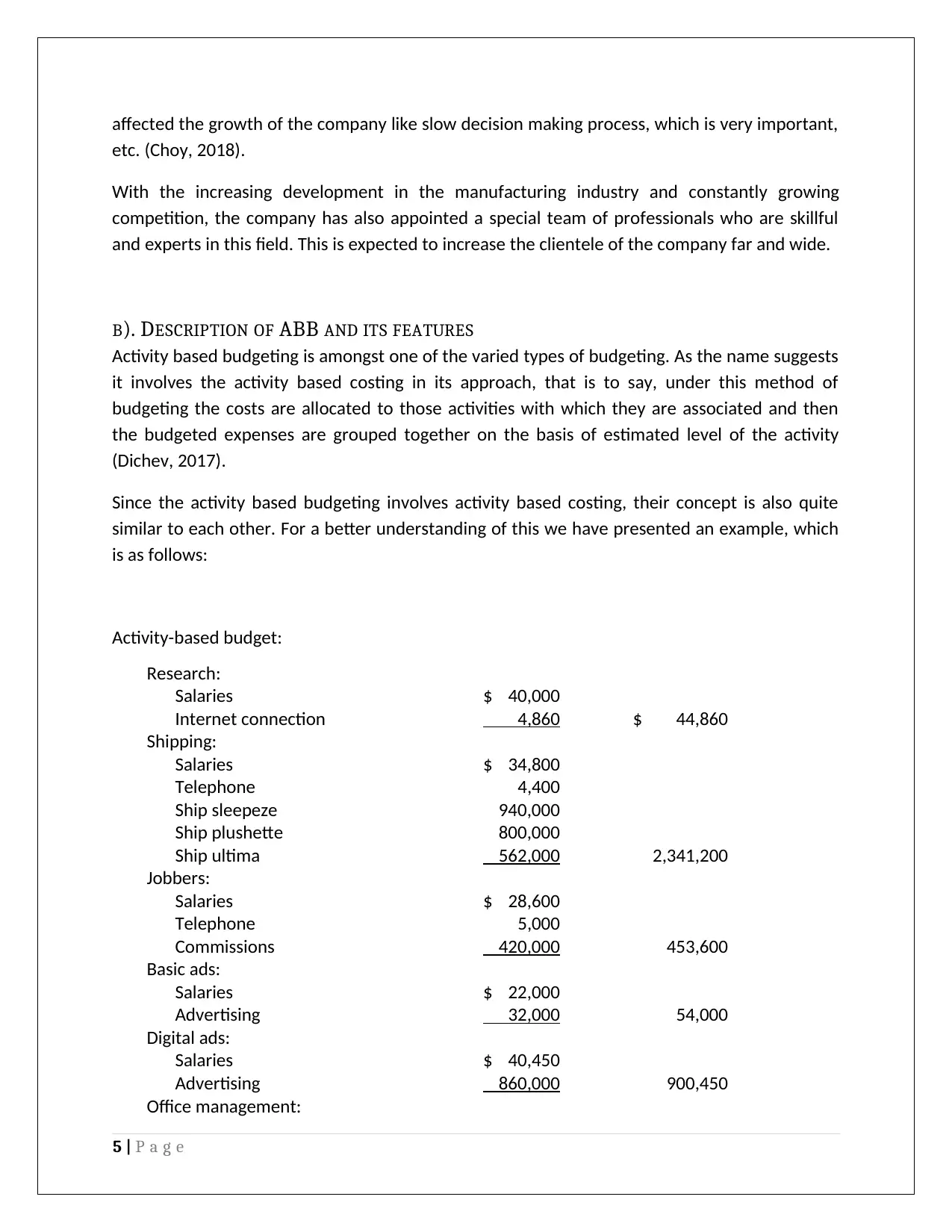

B). DESCRIPTION OF ABB AND ITS FEATURES

Activity based budgeting is amongst one of the varied types of budgeting. As the name suggests

it involves the activity based costing in its approach, that is to say, under this method of

budgeting the costs are allocated to those activities with which they are associated and then

the budgeted expenses are grouped together on the basis of estimated level of the activity

(Dichev, 2017).

Since the activity based budgeting involves activity based costing, their concept is also quite

similar to each other. For a better understanding of this we have presented an example, which

is as follows:

Activity-based budget:

Research:

Salaries $ 40,000

Internet connection 4,860 $ 44,860

Shipping:

Salaries $ 34,800

Telephone 4,400

Ship sleepeze 940,000

Ship plushette 800,000

Ship ultima 562,000 2,341,200

Jobbers:

Salaries $ 28,600

Telephone 5,000

Commissions 420,000 453,600

Basic ads:

Salaries $ 22,000

Advertising 32,000 54,000

Digital ads:

Salaries $ 40,450

Advertising 860,000 900,450

Office management:

5 | P a g e

etc. (Choy, 2018).

With the increasing development in the manufacturing industry and constantly growing

competition, the company has also appointed a special team of professionals who are skillful

and experts in this field. This is expected to increase the clientele of the company far and wide.

B). DESCRIPTION OF ABB AND ITS FEATURES

Activity based budgeting is amongst one of the varied types of budgeting. As the name suggests

it involves the activity based costing in its approach, that is to say, under this method of

budgeting the costs are allocated to those activities with which they are associated and then

the budgeted expenses are grouped together on the basis of estimated level of the activity

(Dichev, 2017).

Since the activity based budgeting involves activity based costing, their concept is also quite

similar to each other. For a better understanding of this we have presented an example, which

is as follows:

Activity-based budget:

Research:

Salaries $ 40,000

Internet connection 4,860 $ 44,860

Shipping:

Salaries $ 34,800

Telephone 4,400

Ship sleepeze 940,000

Ship plushette 800,000

Ship ultima 562,000 2,341,200

Jobbers:

Salaries $ 28,600

Telephone 5,000

Commissions 420,000 453,600

Basic ads:

Salaries $ 22,000

Advertising 32,000 54,000

Digital ads:

Salaries $ 40,450

Advertising 860,000 900,450

Office management:

5 | P a g e

Salaries $ 52,000

Depreciation 32,000

Supplies and Internet 18,900 102,900

Total $3,897,010

2. From the above data we can clearly see that the activity which is adding most amounts to

the cost is shipping. The second most cost intensive activity is the digital advertisements,

which is followed by jobbers’ activity (Werner, 2017). The management should look into

this matter to identify the reasons behind such high costs and evaluate different ways to

reduce the same. For instance, instead of digital advertisement which is quite expensive,

they can use broadcasting on radios, written advertisements like pamphlets, print media,

etc. however, during the year of initial startup the company has to use advertisement

media which reaches to wide range of people. Hence cost reduction in advertisements

could be very difficult.

There are several points that need to be identified while the development of an activity based

budgeting system. These points are as follows:

i) What is the relation between the various activity drivers or cost driver and the main

source of the activity driver or cost driver in respective cases?

ii) The ways in which the source of the activity driver can be changed and the effect it

will have on the requirement of the resources for the activity (Timothy, 2004).

iii) Analysis of the activities being performed by the organization in order to ensure that

the activities are being performed thoroughly and the required quality standards

have been met.

There are numerous things that are viewed while carrying on the process of activity based

budgeting. This involves the identification of the outputs being produced by the organization

along with the various resources which are required to perform the activity of production of the

output. Since the activity based budgeting is about allocating the cost to the respective activity

in relation to a particular goods or services, these allocation of costs to products is determined

on the basis of the characteristics of the products or services (Alexander, 2016).

As we know the implementation of the activity based budget involves activity based costing, it

is highly important for the organization adopting the activity based budget to follow the

approach of activity based costing as the system of cost accounting in order to have an effective

budgeting base within the organization.

6 | P a g e

Depreciation 32,000

Supplies and Internet 18,900 102,900

Total $3,897,010

2. From the above data we can clearly see that the activity which is adding most amounts to

the cost is shipping. The second most cost intensive activity is the digital advertisements,

which is followed by jobbers’ activity (Werner, 2017). The management should look into

this matter to identify the reasons behind such high costs and evaluate different ways to

reduce the same. For instance, instead of digital advertisement which is quite expensive,

they can use broadcasting on radios, written advertisements like pamphlets, print media,

etc. however, during the year of initial startup the company has to use advertisement

media which reaches to wide range of people. Hence cost reduction in advertisements

could be very difficult.

There are several points that need to be identified while the development of an activity based

budgeting system. These points are as follows:

i) What is the relation between the various activity drivers or cost driver and the main

source of the activity driver or cost driver in respective cases?

ii) The ways in which the source of the activity driver can be changed and the effect it

will have on the requirement of the resources for the activity (Timothy, 2004).

iii) Analysis of the activities being performed by the organization in order to ensure that

the activities are being performed thoroughly and the required quality standards

have been met.

There are numerous things that are viewed while carrying on the process of activity based

budgeting. This involves the identification of the outputs being produced by the organization

along with the various resources which are required to perform the activity of production of the

output. Since the activity based budgeting is about allocating the cost to the respective activity

in relation to a particular goods or services, these allocation of costs to products is determined

on the basis of the characteristics of the products or services (Alexander, 2016).

As we know the implementation of the activity based budget involves activity based costing, it

is highly important for the organization adopting the activity based budget to follow the

approach of activity based costing as the system of cost accounting in order to have an effective

budgeting base within the organization.

6 | P a g e

Before implementing the activity based budgeting, an organization is required to make note of

several fundamental principles in relation to the activity based budgeting. These principles are:

i) There should be formed proper connection between the organization’s strategy and

its activities.

ii) For the formation of the connection as stated above, proper gap analysis should be

conducted.

iii) Ascertaining the management of the capacity and proper estimation of the

organization’s revenue (Linden & Freeman, 2017).

iv) The connection between the organizational strategy and its business.

The implementation of the activity based budgeting should be considered where the overheads

cost forms significant part of the total operational cost. Since the activity based budgeting is

based on allocating the cost to the specific activities, it is most favorable in those undertakings

where there are numerous activities involved and not where there is only activity which have

highest proportion in total operational cost (Erik & Jan, 2017).

FEATURES OF ACTIVITY BASED BUDGETING

The main features of Activity Based Budgeting have been discussed in brief hereunder:

i) Activity based budgeting is a process of planning which is connected to the strategic

objectives of the organization

ii) It makes the use of a well proven technique of activity analysis, which is being

considered as the heart of all activity based system

iii) It involves the identification of those opportunities which improves the cost

iv) It identifies the existence of interdependencies amongst the various departments of

the organization

v) It enables the various departments of the organization in the proper management of

various resources and related cost more efficiently

vi) It focuses on the achievement of the organizational goals and objectives

vii) It enables the management of the organization to have proper control over the

budgeting processes

viii) It makes use of those assumptions which are more realistic and ensures involvement

various employees of the organization in its preparation

ix) It involves identification of various cost drivers and activities along with cost pools,

which makes it a very complex process (Dumay & Baard, 2017)

x) Activity based budgeting is oriented more towards the achievement of short term

organizational goals rather than long term goals.

7 | P a g e

several fundamental principles in relation to the activity based budgeting. These principles are:

i) There should be formed proper connection between the organization’s strategy and

its activities.

ii) For the formation of the connection as stated above, proper gap analysis should be

conducted.

iii) Ascertaining the management of the capacity and proper estimation of the

organization’s revenue (Linden & Freeman, 2017).

iv) The connection between the organizational strategy and its business.

The implementation of the activity based budgeting should be considered where the overheads

cost forms significant part of the total operational cost. Since the activity based budgeting is

based on allocating the cost to the specific activities, it is most favorable in those undertakings

where there are numerous activities involved and not where there is only activity which have

highest proportion in total operational cost (Erik & Jan, 2017).

FEATURES OF ACTIVITY BASED BUDGETING

The main features of Activity Based Budgeting have been discussed in brief hereunder:

i) Activity based budgeting is a process of planning which is connected to the strategic

objectives of the organization

ii) It makes the use of a well proven technique of activity analysis, which is being

considered as the heart of all activity based system

iii) It involves the identification of those opportunities which improves the cost

iv) It identifies the existence of interdependencies amongst the various departments of

the organization

v) It enables the various departments of the organization in the proper management of

various resources and related cost more efficiently

vi) It focuses on the achievement of the organizational goals and objectives

vii) It enables the management of the organization to have proper control over the

budgeting processes

viii) It makes use of those assumptions which are more realistic and ensures involvement

various employees of the organization in its preparation

ix) It involves identification of various cost drivers and activities along with cost pools,

which makes it a very complex process (Dumay & Baard, 2017)

x) Activity based budgeting is oriented more towards the achievement of short term

organizational goals rather than long term goals.

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

C). DIFFERENCE BETWEEN ABB AND TRADITIONAL BUDGETING SYSTEM

Traditional system of Budgeting

Traditional budgeting is the conventional method of budgeting which involves preparing of

the budget on the basis of the budgets of previous year. Under this method of budgeting

the budget of the current year is prepared by making appropriate changes in budget of the

last year by making required adjustment to the expenditures on the basis of the rate of

inflation, demand of consumers, circumstances prevailing in the market, etc. the budget of

the current year includes the revenues and costs of previous year as well. The traditional

budget involves justification of only those items in the current year budget which are over

and above the budget of the previous year (Raiborn, et al., 2016).

Traditional Budgeting has the following features:

i) Traditional budget is prepared on the basis of the budgets being prepared in the

previous year. It takes the last year’s budget as base.

ii) Justification is done in this budget of only those items which are in excessive of the

previous year’s budget.

iii) This budget is not totally revised, rather only appropriate changes and adjustment

are done to the items of expenses on the basis of current year’s market condition,

like inflation, etc. (Jones, 2017).

iv) The issues relating to the different departments within the organization are totally

ignored by this method of budgeting.

The following points are required to be kept in mind while preparing the traditional

budget:

i) For the hassle free application of the traditional budgets the management of

the organization is required to collect all the detail relating to the input to be

used in the preparation of the budget.

ii) Determining the target for a budget is very important. In order to do so, the

management of the organization should make comparisons with the

associate organizations.

iii) After the preparation of the budget, the same should be reviewed by the

managers and their response on the same, if any should also be considered

in the budget.

8 | P a g e

Traditional system of Budgeting

Traditional budgeting is the conventional method of budgeting which involves preparing of

the budget on the basis of the budgets of previous year. Under this method of budgeting

the budget of the current year is prepared by making appropriate changes in budget of the

last year by making required adjustment to the expenditures on the basis of the rate of

inflation, demand of consumers, circumstances prevailing in the market, etc. the budget of

the current year includes the revenues and costs of previous year as well. The traditional

budget involves justification of only those items in the current year budget which are over

and above the budget of the previous year (Raiborn, et al., 2016).

Traditional Budgeting has the following features:

i) Traditional budget is prepared on the basis of the budgets being prepared in the

previous year. It takes the last year’s budget as base.

ii) Justification is done in this budget of only those items which are in excessive of the

previous year’s budget.

iii) This budget is not totally revised, rather only appropriate changes and adjustment

are done to the items of expenses on the basis of current year’s market condition,

like inflation, etc. (Jones, 2017).

iv) The issues relating to the different departments within the organization are totally

ignored by this method of budgeting.

The following points are required to be kept in mind while preparing the traditional

budget:

i) For the hassle free application of the traditional budgets the management of

the organization is required to collect all the detail relating to the input to be

used in the preparation of the budget.

ii) Determining the target for a budget is very important. In order to do so, the

management of the organization should make comparisons with the

associate organizations.

iii) After the preparation of the budget, the same should be reviewed by the

managers and their response on the same, if any should also be considered

in the budget.

8 | P a g e

The key limitations of the traditional budgeting system are as follows:

i) As discussed above, the traditional budget takes the past year’s budgetary

data into consideration, it requires analyzing the figures of the last year with

great accuracy in order to prepare current year’s budget.

ii) The preparation of traditional budget involves great amount of modifications

being done by the management due to which the traditional budget fails to

reflect the goals and objectives of the organization (Mun & Shin, 2018).

We have taken help of the following example in order to understand the

concept of traditional budget with more ease:

Classification Last Fiscal Year Current Budget Next Fiscal Year

Personnel Services

1110 Salaries $622,454 $730,500 $895,625

1120 Wages $95,000 $155,000 $245,000

1130 Overtime Payments $46,800 $50,555 $58,400

Subtotal: Personnel Services $764,254 $936,055 $1,199,025

Contractual Services

1210 General Repairs $498 $520 $625

1220 Utility Services $1,006 $2,200 $3,320

1230 Motor Vehicle Repairs $3,250 $4,740 $5,605

1240 Travel $2,000 $3,200 $4,800

1250 Professional Services $6,200 $7,800 $7,920

1260 Communications $845 $980 $1,060

1270 Printing $2,000 $2,400 $3,950

1280 Computing Services $6,623 $7,900 $9,000

1290 Other Contractual Services $3,000 $4,010 $5,540

Subtotal: Contractual Services $25,422 $33,750 $41,820

Supplies and Materials

1310 Office Supplies $5,607 $6,200 $7,840

1320 Fuel Supplies $7,440 $8,790 $9,905

1330 Operating Supplies $3,367 $4,950 $5,990

9 | P a g e

i) As discussed above, the traditional budget takes the past year’s budgetary

data into consideration, it requires analyzing the figures of the last year with

great accuracy in order to prepare current year’s budget.

ii) The preparation of traditional budget involves great amount of modifications

being done by the management due to which the traditional budget fails to

reflect the goals and objectives of the organization (Mun & Shin, 2018).

We have taken help of the following example in order to understand the

concept of traditional budget with more ease:

Classification Last Fiscal Year Current Budget Next Fiscal Year

Personnel Services

1110 Salaries $622,454 $730,500 $895,625

1120 Wages $95,000 $155,000 $245,000

1130 Overtime Payments $46,800 $50,555 $58,400

Subtotal: Personnel Services $764,254 $936,055 $1,199,025

Contractual Services

1210 General Repairs $498 $520 $625

1220 Utility Services $1,006 $2,200 $3,320

1230 Motor Vehicle Repairs $3,250 $4,740 $5,605

1240 Travel $2,000 $3,200 $4,800

1250 Professional Services $6,200 $7,800 $7,920

1260 Communications $845 $980 $1,060

1270 Printing $2,000 $2,400 $3,950

1280 Computing Services $6,623 $7,900 $9,000

1290 Other Contractual Services $3,000 $4,010 $5,540

Subtotal: Contractual Services $25,422 $33,750 $41,820

Supplies and Materials

1310 Office Supplies $5,607 $6,200 $7,840

1320 Fuel Supplies $7,440 $8,790 $9,905

1330 Operating Supplies $3,367 $4,950 $5,990

9 | P a g e

1340 Maintenance Supplies $2,890 $3,670 $4,640

1350 Drugs & Chemicals $8,996 $9,995 $10,675

1360 Food Supplies $4,565 $5,800 $7,010

1370 Clothing & Linens $9,506 $10,600 $11,800

1380 Education & Recreation

Supplies $5,006 $6,200 $7,500

1390 Other Supplies $3,000 $4,450 $5,850

Subtotal: Supplies & Materials $50,377 $60,655 $71,210

1410 Office Equipment $54,550 $61,500 $71,000

1420 Electrical Equipment $20,500 $26,500 $34,480

1430 Motor Vehicles $40,000 $55,000 $54,000

1440 Highway Equipment 0 0 0

1450 Medical & Lab Equipment 0 $200 $400

1480 Data Processing Equipment 0 $4,000 $6,500

1490 Other Equipment 0 0 0

Subtotal: Equipment $165,427 $147,200 $166,380

Current Obligations

1530 Rental Charges 0 0 0

1540 Insurance $5,800 $6,800 $7,500

1550 Dues & Subscriptions $60 $85 $105

1560 Electrostatic Reproduction $450 $7,30 $850

1590 Other Obligations $100 $150 $210

Subtotal: Current Obligations $6,410 $7,035 $8,665

Employee Benefits

1610 Retirement & Pension Benefits $83,200 $98,300 $110,450

1620 Social Security Contributions $60,000 $75,005 $87,500

1640 Group Insurance $24,270 $36,000 $48,400

1650 Medical/Hospital Insurance $200,520 $314,250 $417,290

Subtotal: Employee Benefits $367,990 $523,555 $663,640

TOTALS $1,379,880 $1,708,250 $2,150,240

The various advantages of the traditional budgeting have been discussed below:

10 | P a g e

1350 Drugs & Chemicals $8,996 $9,995 $10,675

1360 Food Supplies $4,565 $5,800 $7,010

1370 Clothing & Linens $9,506 $10,600 $11,800

1380 Education & Recreation

Supplies $5,006 $6,200 $7,500

1390 Other Supplies $3,000 $4,450 $5,850

Subtotal: Supplies & Materials $50,377 $60,655 $71,210

1410 Office Equipment $54,550 $61,500 $71,000

1420 Electrical Equipment $20,500 $26,500 $34,480

1430 Motor Vehicles $40,000 $55,000 $54,000

1440 Highway Equipment 0 0 0

1450 Medical & Lab Equipment 0 $200 $400

1480 Data Processing Equipment 0 $4,000 $6,500

1490 Other Equipment 0 0 0

Subtotal: Equipment $165,427 $147,200 $166,380

Current Obligations

1530 Rental Charges 0 0 0

1540 Insurance $5,800 $6,800 $7,500

1550 Dues & Subscriptions $60 $85 $105

1560 Electrostatic Reproduction $450 $7,30 $850

1590 Other Obligations $100 $150 $210

Subtotal: Current Obligations $6,410 $7,035 $8,665

Employee Benefits

1610 Retirement & Pension Benefits $83,200 $98,300 $110,450

1620 Social Security Contributions $60,000 $75,005 $87,500

1640 Group Insurance $24,270 $36,000 $48,400

1650 Medical/Hospital Insurance $200,520 $314,250 $417,290

Subtotal: Employee Benefits $367,990 $523,555 $663,640

TOTALS $1,379,880 $1,708,250 $2,150,240

The various advantages of the traditional budgeting have been discussed below:

10 | P a g e

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

i) The traditional budgeting makes the management of activities with stability and

ease, it thus provides a framework of control

ii) Decentralization within an organization becomes easier with the help of traditional

budgeting, there are many organizations which recognizes the advantages of

decentralization like banks, etc. (Messinger, et al., 2017)

iii) Traditional budgets are easy to understand and control. The preparation of

traditional budget is also not difficult.

iv) Traditional budgeting has become a part of the organizational culture of many

organizations which makes its abolition quite difficult as a fundamental method of

operating.

Although traditional budgeting has several advantages, it also has the following

disadvantages as well:

i) In the preparation of traditional budget, the chances of human error are very

high, since it involves study of a lot of spreadsheets, so mistakes are bound

to be committed

ii) The preparation of traditional budget requires analyzing the past year’s

budgets, which tends to be very time consuming process

iii) It fails to increase the employee morale and in providing incentives to them.

iv) The traditional budgets only take into consideration the quantitative aspects

while it ignores the qualitative aspects.

v) The traditional budgeting does not provide any alignment between the

organizational spending and strategy.

vi) The assumptions on which it is based are not scientific and more or less are

guess work.

Witnessing the various limitations and drawbacks of the traditional budgeting, two

approaches have been introduced. These are beyond budgeting and better budgeting.

While the former focuses on the solutions of various problems, the latter is concerned

about the evaluation of performance.

DIFFERENCE BETWEEN TRADITIONAL BUDGET AND ACTIVITY BASED BUDGETING

We have summarized the major differences between the activity based budgeting and

traditional budgeting in the statement being presented below.

Sl No. Basis ABB Traditional Budgeting

System

11 | P a g e

ease, it thus provides a framework of control

ii) Decentralization within an organization becomes easier with the help of traditional

budgeting, there are many organizations which recognizes the advantages of

decentralization like banks, etc. (Messinger, et al., 2017)

iii) Traditional budgets are easy to understand and control. The preparation of

traditional budget is also not difficult.

iv) Traditional budgeting has become a part of the organizational culture of many

organizations which makes its abolition quite difficult as a fundamental method of

operating.

Although traditional budgeting has several advantages, it also has the following

disadvantages as well:

i) In the preparation of traditional budget, the chances of human error are very

high, since it involves study of a lot of spreadsheets, so mistakes are bound

to be committed

ii) The preparation of traditional budget requires analyzing the past year’s

budgets, which tends to be very time consuming process

iii) It fails to increase the employee morale and in providing incentives to them.

iv) The traditional budgets only take into consideration the quantitative aspects

while it ignores the qualitative aspects.

v) The traditional budgeting does not provide any alignment between the

organizational spending and strategy.

vi) The assumptions on which it is based are not scientific and more or less are

guess work.

Witnessing the various limitations and drawbacks of the traditional budgeting, two

approaches have been introduced. These are beyond budgeting and better budgeting.

While the former focuses on the solutions of various problems, the latter is concerned

about the evaluation of performance.

DIFFERENCE BETWEEN TRADITIONAL BUDGET AND ACTIVITY BASED BUDGETING

We have summarized the major differences between the activity based budgeting and

traditional budgeting in the statement being presented below.

Sl No. Basis ABB Traditional Budgeting

System

11 | P a g e

1. Orientation The orientation of

this system of

budgeting is towards

activity and process

The orientation of this

system of budgeting is

towards outcome.

2 Nature It is of dynamic

nature

It is of static nature

3 Goal The main focus of

this system of

budgeting is short

term goals

The focus of this

budgeting system is on

long term goals

4 Approach The approach

adopted by this

budgeting system is

participative

approach.

This system of

budgeting does not

follow participative

approach.

5 Control The level of control

over the system is

more

The level of control

over the system is less

6 Complexity This system of

budgeting is more

complex

This system of

budgeting is quite

simple

7 Accuracy This system of

budgeting provides a

more accurate result

The level of accuracy in

this budgeting system

is less

8 Support The support of the

lower management

is more in this case

The support of the

higher management is

more in this case

9 Implementation The implementation

process is quite

difficult

No such difficulty is

involved

10 Wasteful

Expenditure

Under this budgeting

system it is easy to

identify the wasteful

expenditure

It does not help in

identifying wasteful

expenditure

11 Time This budgeting

system is more time

consuming

This is less time

consuming

12 Volume of overhead This should be

adopted where the

overhead costs are

high

This should be adopted

where the overhead

costs are low

12 | P a g e

this system of

budgeting is towards

activity and process

The orientation of this

system of budgeting is

towards outcome.

2 Nature It is of dynamic

nature

It is of static nature

3 Goal The main focus of

this system of

budgeting is short

term goals

The focus of this

budgeting system is on

long term goals

4 Approach The approach

adopted by this

budgeting system is

participative

approach.

This system of

budgeting does not

follow participative

approach.

5 Control The level of control

over the system is

more

The level of control

over the system is less

6 Complexity This system of

budgeting is more

complex

This system of

budgeting is quite

simple

7 Accuracy This system of

budgeting provides a

more accurate result

The level of accuracy in

this budgeting system

is less

8 Support The support of the

lower management

is more in this case

The support of the

higher management is

more in this case

9 Implementation The implementation

process is quite

difficult

No such difficulty is

involved

10 Wasteful

Expenditure

Under this budgeting

system it is easy to

identify the wasteful

expenditure

It does not help in

identifying wasteful

expenditure

11 Time This budgeting

system is more time

consuming

This is less time

consuming

12 Volume of overhead This should be

adopted where the

overhead costs are

high

This should be adopted

where the overhead

costs are low

12 | P a g e

D). DISCUSSION ON THE SUITABILITY OF ABB

From the above detailed discussion there are various points we need to discuss before deciding

the adoption of activity based budgeting in our client company, these are:

i) The impact that the activity based budgeting will have on the performance and

profit of Pethe Industrial Marketing Company Limited?

ii) Will the implementation of this system of budgeting bring about any improvement

in the cost allocation system of the organization?

iii) The steps which are required to be followed by our client company for an effective

implementation of the activity based budgeting?

iv) The availability of ample amount of resources as well as time with the client

company for the implementation of activity based budgeting.

As we know, that our client is a manufacturing concern, which involves various types of

activities in the manufacturing process (Marques, 2018). The operational cost is high and the

company is keen in knowing the activities which consumes the maximum portion of cost. The

activity based budgeting involves identifying the cost drivers and allocating the cost associated

with each activity. This might help the company in getting the desired results.

In our opinion and from the analysis of various aspects of the activity based budgeting being

done above, we could advice Pethe Industrial Marketing Company Limited to adopt activity

based budgeting practice within its organization. However, the company must be able to

implement the budgeting practices properly without any compromise. Once implemented in an

organization the activity based budgeting tends to bring about various improvements in the

business processes (Goldmann, 2016).

CONCLUSION

On the basis of the overall analysis of the activity based budgeting in this report, we would like

to suggest Pethe Industrial Marketing Company Limited to implement the activity based

budgeting in its company in order to bring about improvements in its cost allocation system and

identification of various cost activities.

REFERENCES

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

13 | P a g e

From the above detailed discussion there are various points we need to discuss before deciding

the adoption of activity based budgeting in our client company, these are:

i) The impact that the activity based budgeting will have on the performance and

profit of Pethe Industrial Marketing Company Limited?

ii) Will the implementation of this system of budgeting bring about any improvement

in the cost allocation system of the organization?

iii) The steps which are required to be followed by our client company for an effective

implementation of the activity based budgeting?

iv) The availability of ample amount of resources as well as time with the client

company for the implementation of activity based budgeting.

As we know, that our client is a manufacturing concern, which involves various types of

activities in the manufacturing process (Marques, 2018). The operational cost is high and the

company is keen in knowing the activities which consumes the maximum portion of cost. The

activity based budgeting involves identifying the cost drivers and allocating the cost associated

with each activity. This might help the company in getting the desired results.

In our opinion and from the analysis of various aspects of the activity based budgeting being

done above, we could advice Pethe Industrial Marketing Company Limited to adopt activity

based budgeting practice within its organization. However, the company must be able to

implement the budgeting practices properly without any compromise. Once implemented in an

organization the activity based budgeting tends to bring about various improvements in the

business processes (Goldmann, 2016).

CONCLUSION

On the basis of the overall analysis of the activity based budgeting in this report, we would like

to suggest Pethe Industrial Marketing Company Limited to implement the activity based

budgeting in its company in order to bring about improvements in its cost allocation system and

identification of various cost activities.

REFERENCES

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

13 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Bennuona, K., Meredith, G. & Marchant, T., 2010. Improved capital budgeting decision making:

Evidence from Canada. Emerald Management Division, 48(2), pp. 225-247.

Bromwich, M. & Scapens, R., 2016. Management Accounting Research: 25 years on. Management

Accounting Research, Volume 31, pp. 1-9.

Choy, Y. K., 2018. Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview

Analysis. Ecological Economics, p. 145.

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Dumay, J. & Baard, V., 2017. An introduction to interventionist research in accounting.. The

Routledge Companion to Qualitative Accounting Research Methods, p. 265.

Erik, H. & Jan, B., 2017. Supply chain management and activity-based costing: Current status and

directions for the future. International Journal of Physical Distribution & Logistics Management,

47(8), pp. 712-735.

Goldmann, K., 2016. Financial Liquidity and Profitability Management in Practice of Polish Business.

Financial Environment and Business Development, Volume 4, pp. 103-112.

Jones, P., 2017. Statistical Sampling and Risk Analysis in Auditing. NY: Routledge.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making.

Business Ethics Quarterly, 27(3), pp. 353-379.

Marques, R. P. F., 2018. Continuous Assurance and the Use of Technology for Business Compliance.

Encyclopedia of Information Science and Technology, pp. 820-830.

Messinger, B. L., Rogers, D. N. & & Hawker, C. D., 2017. Use of Automation and Process Improvement

to Achieve a Six Sigma Level of Nonanalytic Quality. The Journal of Applied Laboratory Medicine: An

AACC Publication.

Mun, K. & Shin, I., 2018. A close look at the role of regulatory fit in consumers’ responses to unethical

firms.. s.l.:s.n.

Raiborn, C., Butler, J. & Martin, K., 2016. The internal audit function: A prerequisite for Good

Governance. Journal of Corporate Accounting and Finance, 28(2), pp. 10-21.

Timothy, G., 2004. Managing interest rate risk in a rising rate environment. RMA Journal, Risk

Management Association (RMA), November.

Werner, M., 2017. Financial process mining - Accounting data structure dependent control flow

inference. International Journal of Accounting Information Systems, Volume 25, pp. 57-80.

14 | P a g e

Evidence from Canada. Emerald Management Division, 48(2), pp. 225-247.

Bromwich, M. & Scapens, R., 2016. Management Accounting Research: 25 years on. Management

Accounting Research, Volume 31, pp. 1-9.

Choy, Y. K., 2018. Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview

Analysis. Ecological Economics, p. 145.

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Dumay, J. & Baard, V., 2017. An introduction to interventionist research in accounting.. The

Routledge Companion to Qualitative Accounting Research Methods, p. 265.

Erik, H. & Jan, B., 2017. Supply chain management and activity-based costing: Current status and

directions for the future. International Journal of Physical Distribution & Logistics Management,

47(8), pp. 712-735.

Goldmann, K., 2016. Financial Liquidity and Profitability Management in Practice of Polish Business.

Financial Environment and Business Development, Volume 4, pp. 103-112.

Jones, P., 2017. Statistical Sampling and Risk Analysis in Auditing. NY: Routledge.

Linden, B. & Freeman, R., 2017. Profit and Other Values: Thick Evaluation in Decision Making.

Business Ethics Quarterly, 27(3), pp. 353-379.

Marques, R. P. F., 2018. Continuous Assurance and the Use of Technology for Business Compliance.

Encyclopedia of Information Science and Technology, pp. 820-830.

Messinger, B. L., Rogers, D. N. & & Hawker, C. D., 2017. Use of Automation and Process Improvement

to Achieve a Six Sigma Level of Nonanalytic Quality. The Journal of Applied Laboratory Medicine: An

AACC Publication.

Mun, K. & Shin, I., 2018. A close look at the role of regulatory fit in consumers’ responses to unethical

firms.. s.l.:s.n.

Raiborn, C., Butler, J. & Martin, K., 2016. The internal audit function: A prerequisite for Good

Governance. Journal of Corporate Accounting and Finance, 28(2), pp. 10-21.

Timothy, G., 2004. Managing interest rate risk in a rising rate environment. RMA Journal, Risk

Management Association (RMA), November.

Werner, M., 2017. Financial process mining - Accounting data structure dependent control flow

inference. International Journal of Accounting Information Systems, Volume 25, pp. 57-80.

14 | P a g e

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.