MBA Assignment 1: Cost Allocation, Profitability, and Investment

VerifiedAdded on 2023/04/22

|20

|3569

|342

Homework Assignment

AI Summary

This MBA assignment analyzes the financial aspects of DPC College, a start-up institution offering Bachelor's and Master's programs. The assignment begins by comparing traditional and activity-based costing methods, highlighting their impact on program profitability and the allocation of indirect costs. It then delves into decision-making, recommending the most suitable costing method and outlining its pros and cons. Further, the assignment addresses potential changes to the income statement, considering their positive and negative impacts on profitability. Finally, it evaluates investment proposals using the accounting rate of return, payback period, and weighted average cost of capital, providing a comprehensive financial analysis of the college's operations and investment strategies.

MBA Assignment

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Task 1........................................................................................................................3

Task 2........................................................................................................................6

Task 3........................................................................................................................9

Task 4......................................................................................................................10

References...............................................................................................................18

2

Task 1........................................................................................................................3

Task 2........................................................................................................................6

Task 3........................................................................................................................9

Task 4......................................................................................................................10

References...............................................................................................................18

2

Task 1

In the field of costing accounting, traditional and activity- based costing are two different

methods for apportioning indirect costs to units which are produced. Both methods estimate

indirect costs which are related to the production of units and afterwards allocate these costs to

products which are based on cost-driver rate.

Traditional costing is simple and less accurate as compare to the ABC (Activity Based Costing),

and typically allocates indirect costs to units which are basically based on an arbitrary average

rate (Parker and Fleischman, 2017). Whereas Activity based costing is more accurate and

complex than traditional costing because this method allocates indirect or overhead costs to

activities and afterwards allocates the costs to units which are produced based on the units or

products usage of the activities (Horngren, et. al., 2013).

Why profits per program differ so much under the two cost allocation methods are

discussed below:

The profits per program are different because both methods use common expenses in different

manner. The first method is called traditional costing which requires all common expenses, i.e.

expenses which are not directly assigned to cost objects, be allocated based on number of

students (Haroun, 2015).

For example, if indirect expenses are 200€ and there are 15 students totally, each student is

assigned 200/15 = 13€. If a program has 10 students, then 13*10 = 130€ of indirect expenses are

assigned to it.

The next approach is Activity based costing, which requires indirect expenses are first assigned

to activities and then to cost objects.

For example, four activities i.e. academic, recruitment, networking, and administration and three

cost objects that are the three program of studies.

3

In the field of costing accounting, traditional and activity- based costing are two different

methods for apportioning indirect costs to units which are produced. Both methods estimate

indirect costs which are related to the production of units and afterwards allocate these costs to

products which are based on cost-driver rate.

Traditional costing is simple and less accurate as compare to the ABC (Activity Based Costing),

and typically allocates indirect costs to units which are basically based on an arbitrary average

rate (Parker and Fleischman, 2017). Whereas Activity based costing is more accurate and

complex than traditional costing because this method allocates indirect or overhead costs to

activities and afterwards allocates the costs to units which are produced based on the units or

products usage of the activities (Horngren, et. al., 2013).

Why profits per program differ so much under the two cost allocation methods are

discussed below:

The profits per program are different because both methods use common expenses in different

manner. The first method is called traditional costing which requires all common expenses, i.e.

expenses which are not directly assigned to cost objects, be allocated based on number of

students (Haroun, 2015).

For example, if indirect expenses are 200€ and there are 15 students totally, each student is

assigned 200/15 = 13€. If a program has 10 students, then 13*10 = 130€ of indirect expenses are

assigned to it.

The next approach is Activity based costing, which requires indirect expenses are first assigned

to activities and then to cost objects.

For example, four activities i.e. academic, recruitment, networking, and administration and three

cost objects that are the three program of studies.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

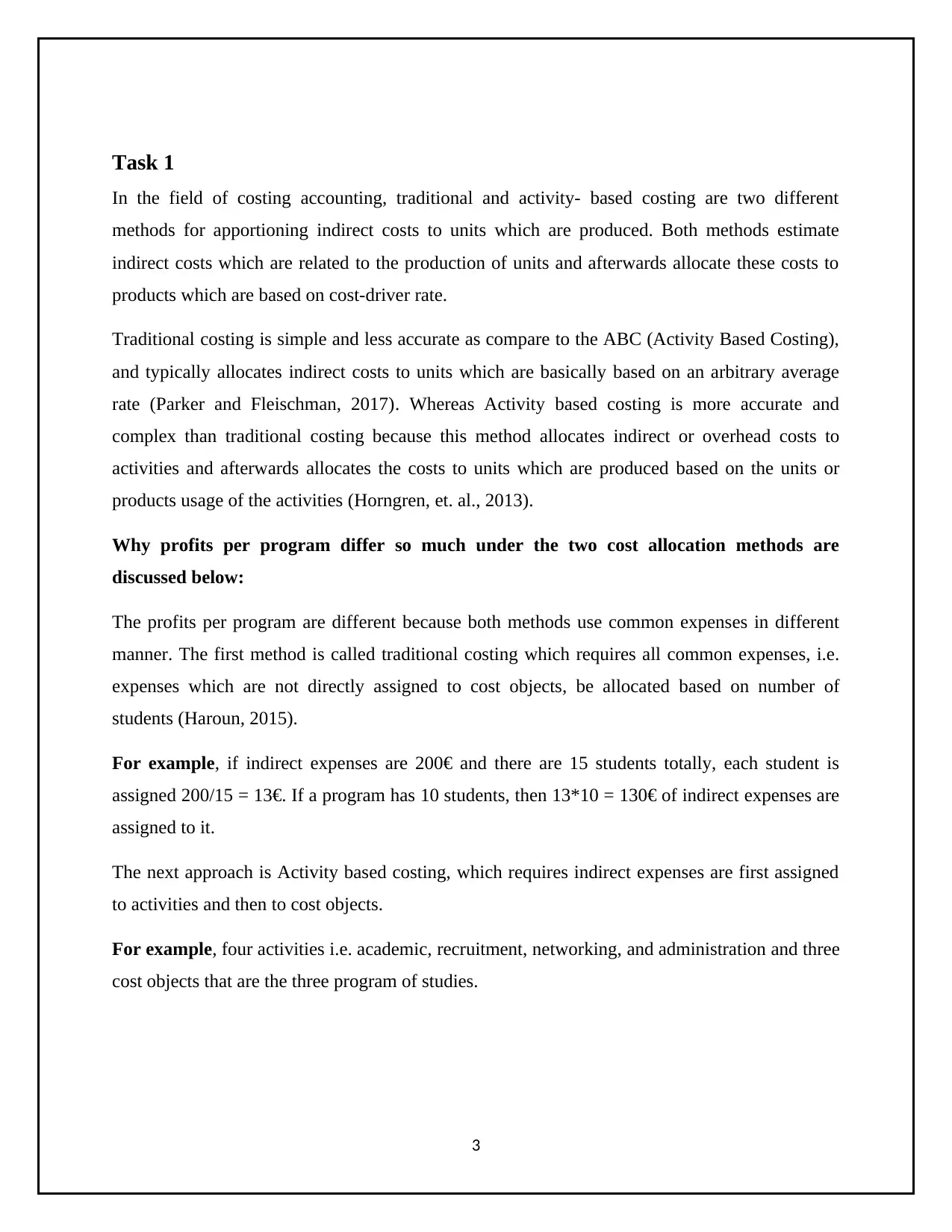

Income statement (Traditional allocation)

Income statement (ABC allocation)

Note: Due to difference in Allocated expenses both method shows different Net Income which

are represented in above two images. Both method assigned common expenses i.e. 303600€ in

different manner which affects the net income of the DPC’s.

4

Income statement (ABC allocation)

Note: Due to difference in Allocated expenses both method shows different Net Income which

are represented in above two images. Both method assigned common expenses i.e. 303600€ in

different manner which affects the net income of the DPC’s.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

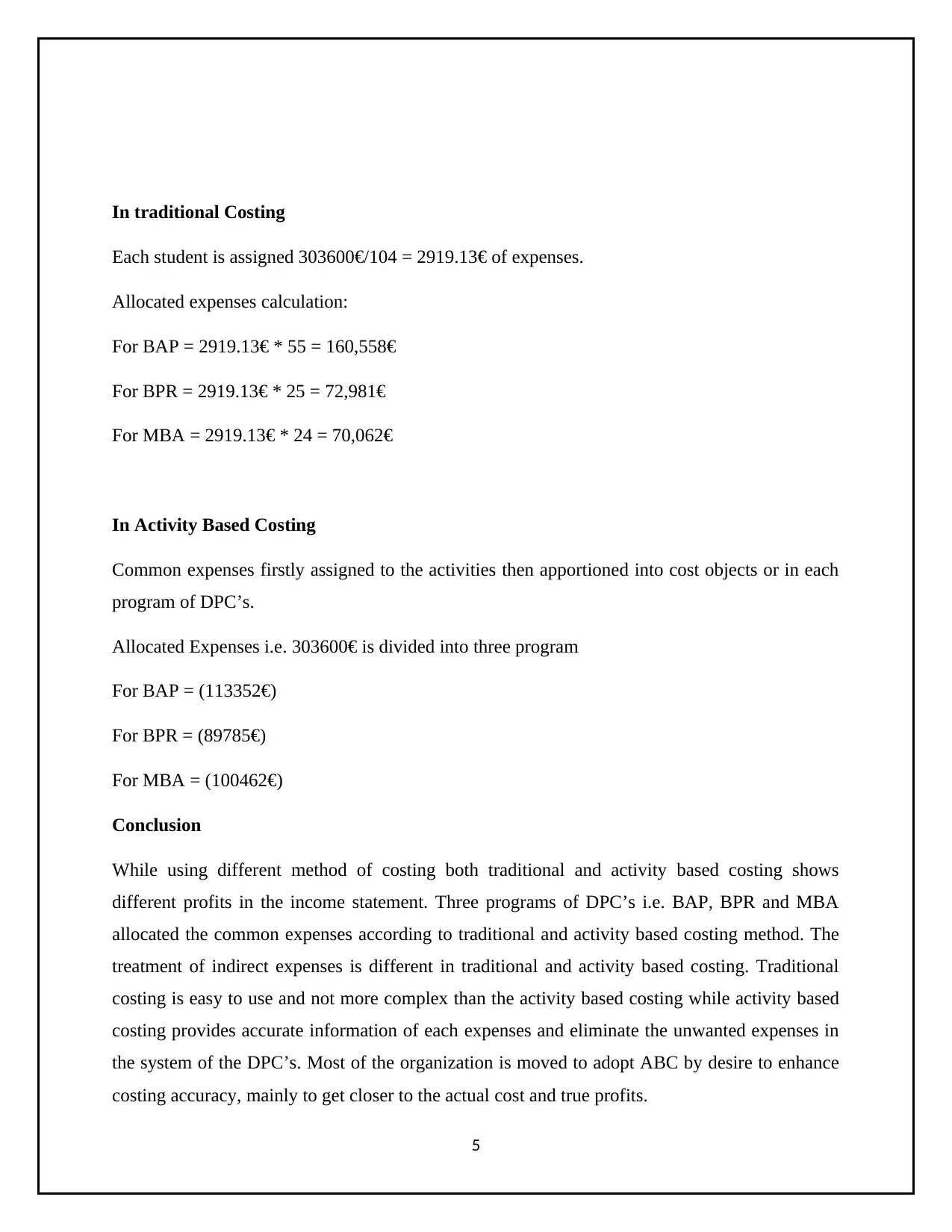

In traditional Costing

Each student is assigned 303600€/104 = 2919.13€ of expenses.

Allocated expenses calculation:

For BAP = 2919.13€ * 55 = 160,558€

For BPR = 2919.13€ * 25 = 72,981€

For MBA = 2919.13€ * 24 = 70,062€

In Activity Based Costing

Common expenses firstly assigned to the activities then apportioned into cost objects or in each

program of DPC’s.

Allocated Expenses i.e. 303600€ is divided into three program

For BAP = (113352€)

For BPR = (89785€)

For MBA = (100462€)

Conclusion

While using different method of costing both traditional and activity based costing shows

different profits in the income statement. Three programs of DPC’s i.e. BAP, BPR and MBA

allocated the common expenses according to traditional and activity based costing method. The

treatment of indirect expenses is different in traditional and activity based costing. Traditional

costing is easy to use and not more complex than the activity based costing while activity based

costing provides accurate information of each expenses and eliminate the unwanted expenses in

the system of the DPC’s. Most of the organization is moved to adopt ABC by desire to enhance

costing accuracy, mainly to get closer to the actual cost and true profits.

5

Each student is assigned 303600€/104 = 2919.13€ of expenses.

Allocated expenses calculation:

For BAP = 2919.13€ * 55 = 160,558€

For BPR = 2919.13€ * 25 = 72,981€

For MBA = 2919.13€ * 24 = 70,062€

In Activity Based Costing

Common expenses firstly assigned to the activities then apportioned into cost objects or in each

program of DPC’s.

Allocated Expenses i.e. 303600€ is divided into three program

For BAP = (113352€)

For BPR = (89785€)

For MBA = (100462€)

Conclusion

While using different method of costing both traditional and activity based costing shows

different profits in the income statement. Three programs of DPC’s i.e. BAP, BPR and MBA

allocated the common expenses according to traditional and activity based costing method. The

treatment of indirect expenses is different in traditional and activity based costing. Traditional

costing is easy to use and not more complex than the activity based costing while activity based

costing provides accurate information of each expenses and eliminate the unwanted expenses in

the system of the DPC’s. Most of the organization is moved to adopt ABC by desire to enhance

costing accuracy, mainly to get closer to the actual cost and true profits.

5

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Task 2

According to Task 1 both method use common expenses or indirect expenses in different manner

which represents the allocated expenses for each program differently. The two costing methods

lead to different outcomes because two methods use different calculation for the common

expenses or indirect expenses. Both costing methods affect the decisions of an organization

differently and it is depends upon the organization to select the appropriate method for the

growth and development.

Both methods of costing have many advantages as well as limitations. Determine which costing

method will be suitable for the organization; the manager should consider the specific

requirements and time frame. Traditional costing should be used when accuracy won’t be

affected by activities and time is also limited whereas Activity- based costing should be utilized

when accuracy is important and this method makes easy to understand and visualize all indirect

expenses and activities (Estampe, et. al., 2013).

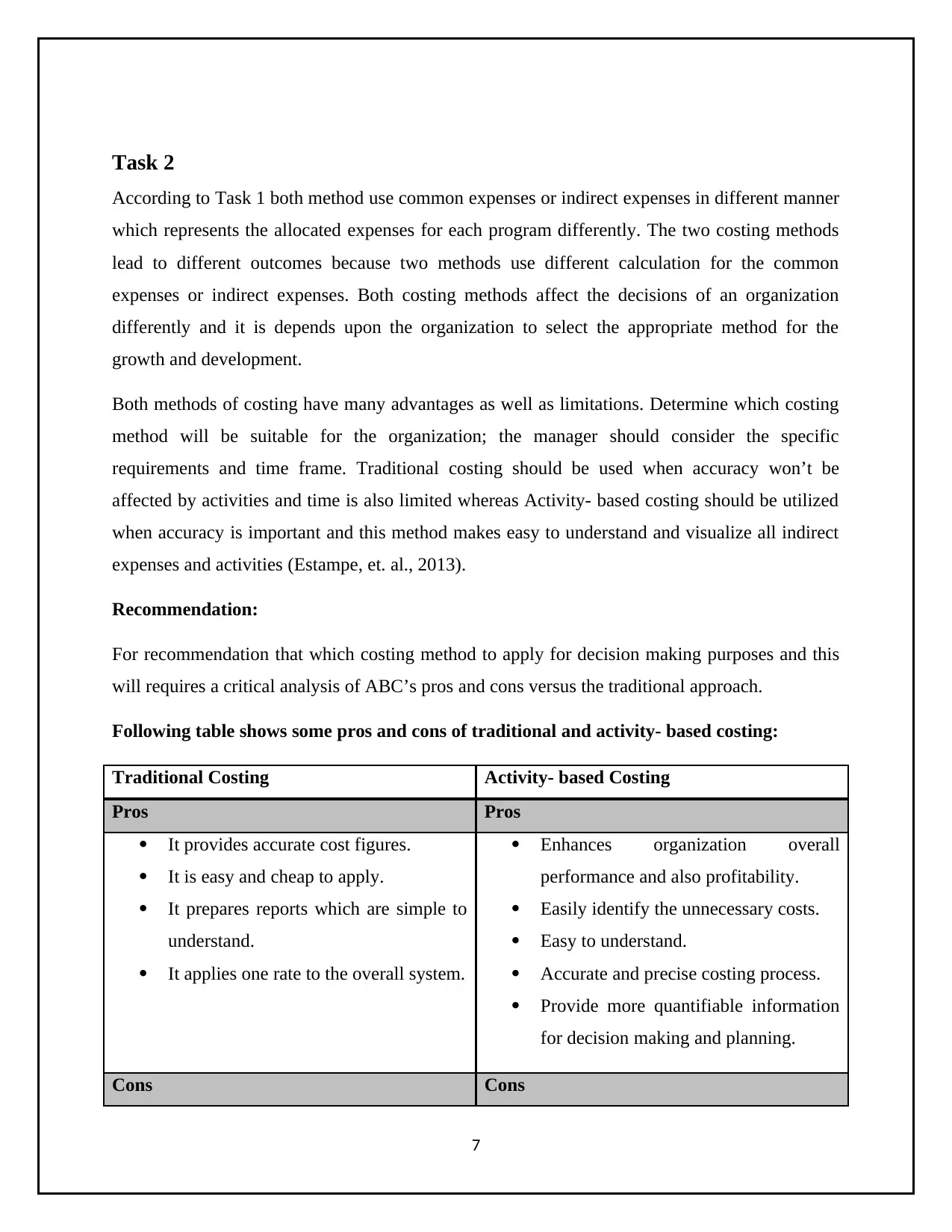

Recommendation:

For recommendation that which costing method to apply for decision making purposes and this

will requires a critical analysis of ABC’s pros and cons versus the traditional approach.

Following table shows some pros and cons of traditional and activity- based costing:

Traditional Costing Activity- based Costing

Pros Pros

It provides accurate cost figures.

It is easy and cheap to apply.

It prepares reports which are simple to

understand.

It applies one rate to the overall system.

Enhances organization overall

performance and also profitability.

Easily identify the unnecessary costs.

Easy to understand.

Accurate and precise costing process.

Provide more quantifiable information

for decision making and planning.

Cons Cons

7

According to Task 1 both method use common expenses or indirect expenses in different manner

which represents the allocated expenses for each program differently. The two costing methods

lead to different outcomes because two methods use different calculation for the common

expenses or indirect expenses. Both costing methods affect the decisions of an organization

differently and it is depends upon the organization to select the appropriate method for the

growth and development.

Both methods of costing have many advantages as well as limitations. Determine which costing

method will be suitable for the organization; the manager should consider the specific

requirements and time frame. Traditional costing should be used when accuracy won’t be

affected by activities and time is also limited whereas Activity- based costing should be utilized

when accuracy is important and this method makes easy to understand and visualize all indirect

expenses and activities (Estampe, et. al., 2013).

Recommendation:

For recommendation that which costing method to apply for decision making purposes and this

will requires a critical analysis of ABC’s pros and cons versus the traditional approach.

Following table shows some pros and cons of traditional and activity- based costing:

Traditional Costing Activity- based Costing

Pros Pros

It provides accurate cost figures.

It is easy and cheap to apply.

It prepares reports which are simple to

understand.

It applies one rate to the overall system.

Enhances organization overall

performance and also profitability.

Easily identify the unnecessary costs.

Easy to understand.

Accurate and precise costing process.

Provide more quantifiable information

for decision making and planning.

Cons Cons

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

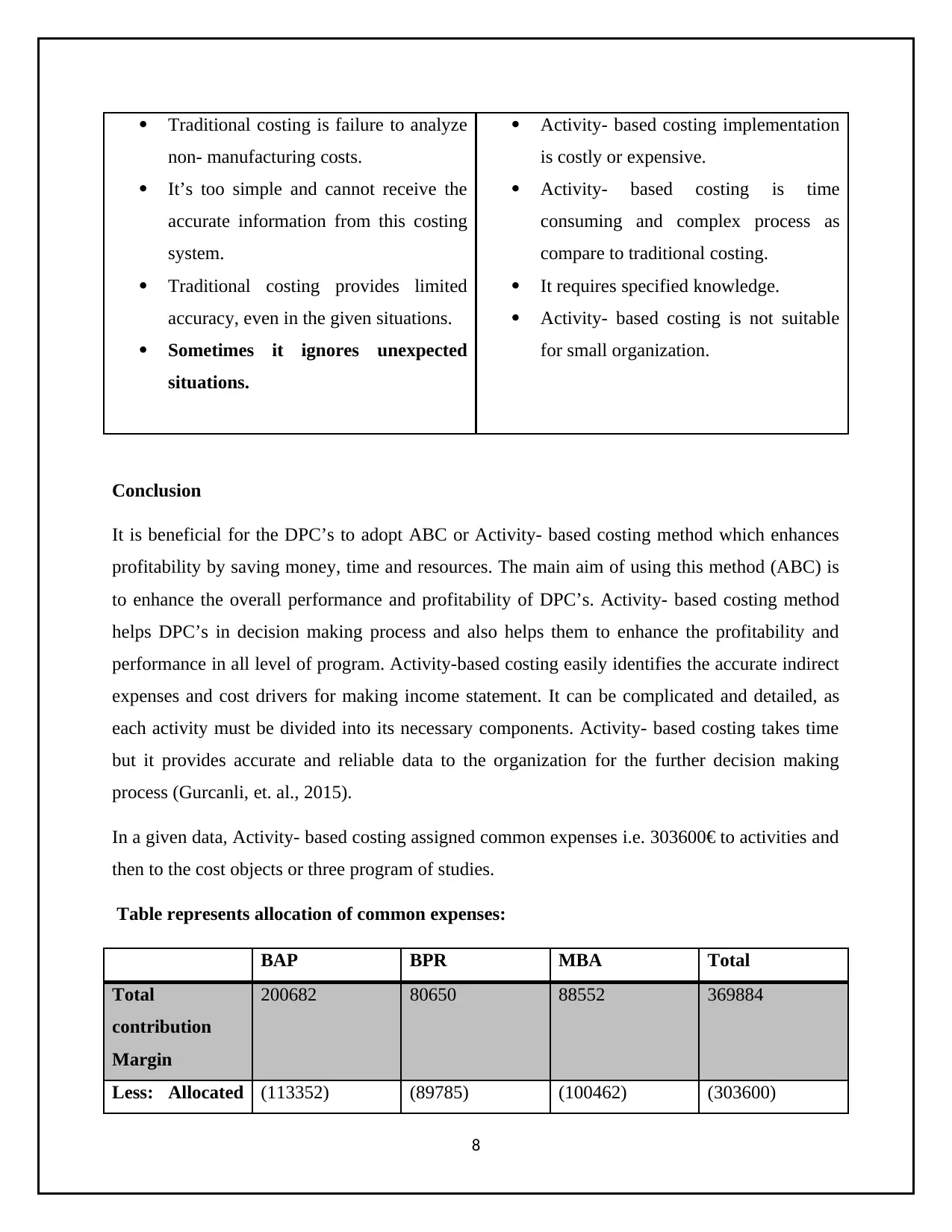

Traditional costing is failure to analyze

non- manufacturing costs.

It’s too simple and cannot receive the

accurate information from this costing

system.

Traditional costing provides limited

accuracy, even in the given situations.

Sometimes it ignores unexpected

situations.

Activity- based costing implementation

is costly or expensive.

Activity- based costing is time

consuming and complex process as

compare to traditional costing.

It requires specified knowledge.

Activity- based costing is not suitable

for small organization.

Conclusion

It is beneficial for the DPC’s to adopt ABC or Activity- based costing method which enhances

profitability by saving money, time and resources. The main aim of using this method (ABC) is

to enhance the overall performance and profitability of DPC’s. Activity- based costing method

helps DPC’s in decision making process and also helps them to enhance the profitability and

performance in all level of program. Activity-based costing easily identifies the accurate indirect

expenses and cost drivers for making income statement. It can be complicated and detailed, as

each activity must be divided into its necessary components. Activity- based costing takes time

but it provides accurate and reliable data to the organization for the further decision making

process (Gurcanli, et. al., 2015).

In a given data, Activity- based costing assigned common expenses i.e. 303600€ to activities and

then to the cost objects or three program of studies.

Table represents allocation of common expenses:

BAP BPR MBA Total

Total

contribution

Margin

200682 80650 88552 369884

Less: Allocated (113352) (89785) (100462) (303600)

8

non- manufacturing costs.

It’s too simple and cannot receive the

accurate information from this costing

system.

Traditional costing provides limited

accuracy, even in the given situations.

Sometimes it ignores unexpected

situations.

Activity- based costing implementation

is costly or expensive.

Activity- based costing is time

consuming and complex process as

compare to traditional costing.

It requires specified knowledge.

Activity- based costing is not suitable

for small organization.

Conclusion

It is beneficial for the DPC’s to adopt ABC or Activity- based costing method which enhances

profitability by saving money, time and resources. The main aim of using this method (ABC) is

to enhance the overall performance and profitability of DPC’s. Activity- based costing method

helps DPC’s in decision making process and also helps them to enhance the profitability and

performance in all level of program. Activity-based costing easily identifies the accurate indirect

expenses and cost drivers for making income statement. It can be complicated and detailed, as

each activity must be divided into its necessary components. Activity- based costing takes time

but it provides accurate and reliable data to the organization for the further decision making

process (Gurcanli, et. al., 2015).

In a given data, Activity- based costing assigned common expenses i.e. 303600€ to activities and

then to the cost objects or three program of studies.

Table represents allocation of common expenses:

BAP BPR MBA Total

Total

contribution

Margin

200682 80650 88552 369884

Less: Allocated (113352) (89785) (100462) (303600)

8

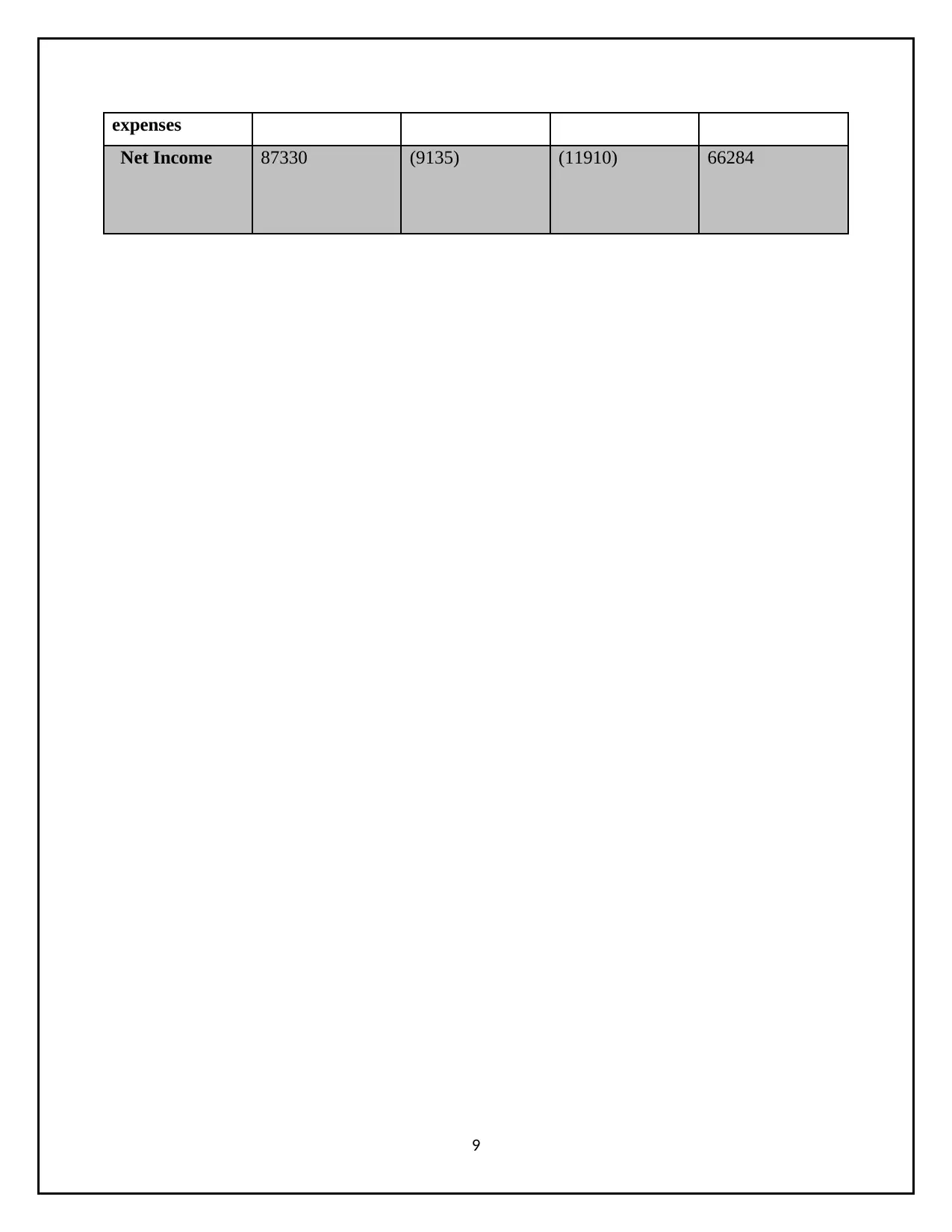

expenses

Net Income 87330 (9135) (11910) 66284

9

Net Income 87330 (9135) (11910) 66284

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

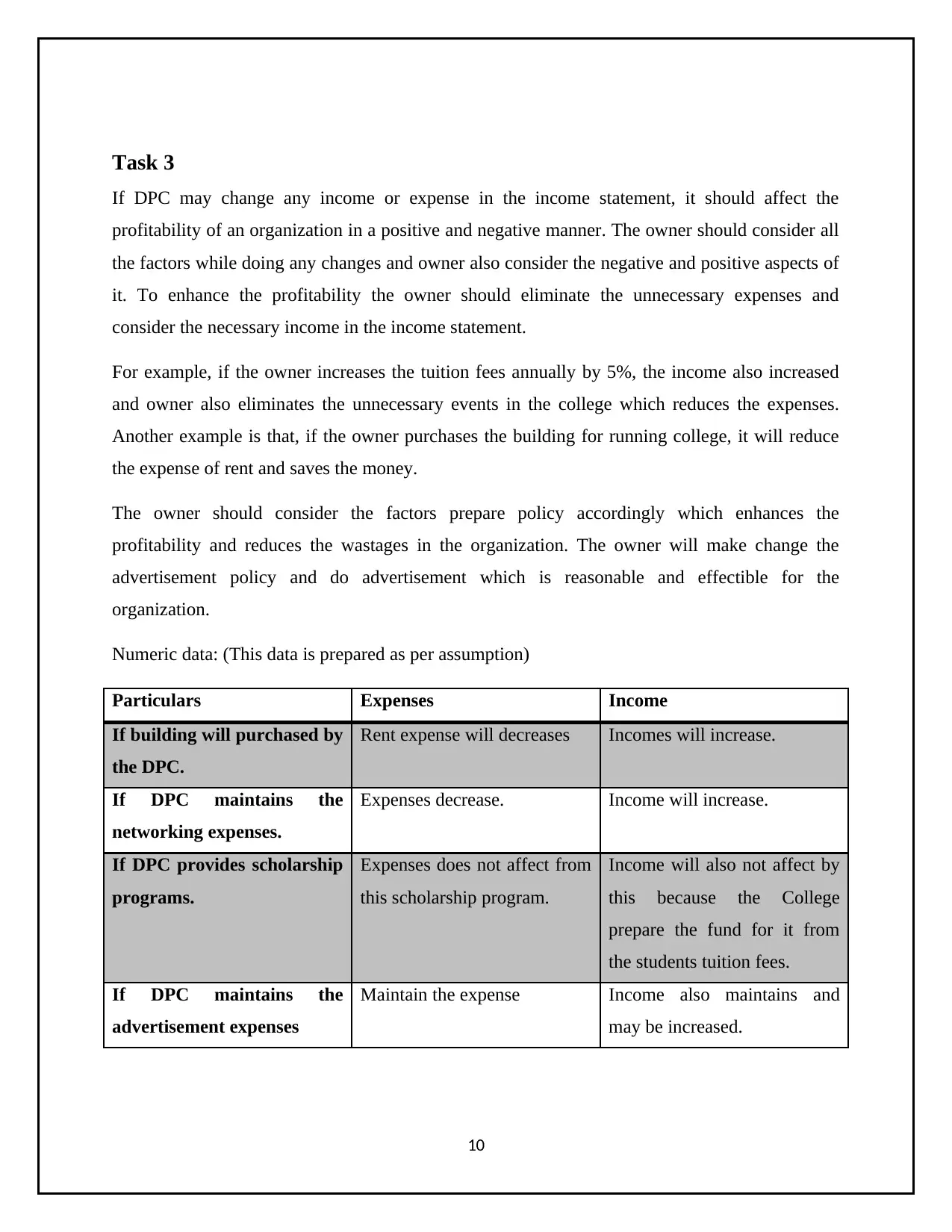

Task 3

If DPC may change any income or expense in the income statement, it should affect the

profitability of an organization in a positive and negative manner. The owner should consider all

the factors while doing any changes and owner also consider the negative and positive aspects of

it. To enhance the profitability the owner should eliminate the unnecessary expenses and

consider the necessary income in the income statement.

For example, if the owner increases the tuition fees annually by 5%, the income also increased

and owner also eliminates the unnecessary events in the college which reduces the expenses.

Another example is that, if the owner purchases the building for running college, it will reduce

the expense of rent and saves the money.

The owner should consider the factors prepare policy accordingly which enhances the

profitability and reduces the wastages in the organization. The owner will make change the

advertisement policy and do advertisement which is reasonable and effectible for the

organization.

Numeric data: (This data is prepared as per assumption)

Particulars Expenses Income

If building will purchased by

the DPC.

Rent expense will decreases Incomes will increase.

If DPC maintains the

networking expenses.

Expenses decrease. Income will increase.

If DPC provides scholarship

programs.

Expenses does not affect from

this scholarship program.

Income will also not affect by

this because the College

prepare the fund for it from

the students tuition fees.

If DPC maintains the

advertisement expenses

Maintain the expense Income also maintains and

may be increased.

10

If DPC may change any income or expense in the income statement, it should affect the

profitability of an organization in a positive and negative manner. The owner should consider all

the factors while doing any changes and owner also consider the negative and positive aspects of

it. To enhance the profitability the owner should eliminate the unnecessary expenses and

consider the necessary income in the income statement.

For example, if the owner increases the tuition fees annually by 5%, the income also increased

and owner also eliminates the unnecessary events in the college which reduces the expenses.

Another example is that, if the owner purchases the building for running college, it will reduce

the expense of rent and saves the money.

The owner should consider the factors prepare policy accordingly which enhances the

profitability and reduces the wastages in the organization. The owner will make change the

advertisement policy and do advertisement which is reasonable and effectible for the

organization.

Numeric data: (This data is prepared as per assumption)

Particulars Expenses Income

If building will purchased by

the DPC.

Rent expense will decreases Incomes will increase.

If DPC maintains the

networking expenses.

Expenses decrease. Income will increase.

If DPC provides scholarship

programs.

Expenses does not affect from

this scholarship program.

Income will also not affect by

this because the College

prepare the fund for it from

the students tuition fees.

If DPC maintains the

advertisement expenses

Maintain the expense Income also maintains and

may be increased.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

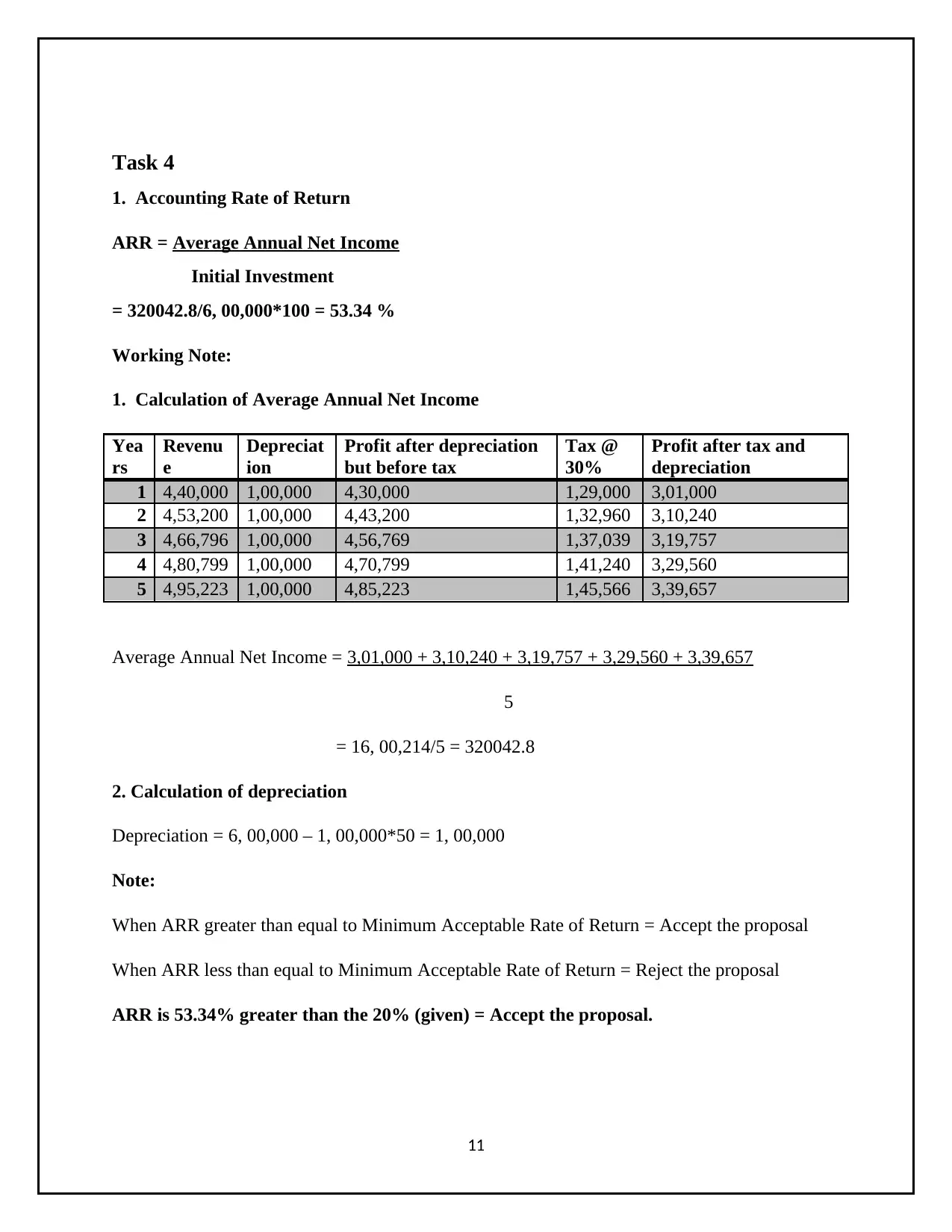

Task 4

1. Accounting Rate of Return

ARR = Average Annual Net Income

Initial Investment

= 320042.8/6, 00,000*100 = 53.34 %

Working Note:

1. Calculation of Average Annual Net Income

Yea

rs

Revenu

e

Depreciat

ion

Profit after depreciation

but before tax

Tax @

30%

Profit after tax and

depreciation

1 4,40,000 1,00,000 4,30,000 1,29,000 3,01,000

2 4,53,200 1,00,000 4,43,200 1,32,960 3,10,240

3 4,66,796 1,00,000 4,56,769 1,37,039 3,19,757

4 4,80,799 1,00,000 4,70,799 1,41,240 3,29,560

5 4,95,223 1,00,000 4,85,223 1,45,566 3,39,657

Average Annual Net Income = 3,01,000 + 3,10,240 + 3,19,757 + 3,29,560 + 3,39,657

5

= 16, 00,214/5 = 320042.8

2. Calculation of depreciation

Depreciation = 6, 00,000 – 1, 00,000*50 = 1, 00,000

Note:

When ARR greater than equal to Minimum Acceptable Rate of Return = Accept the proposal

When ARR less than equal to Minimum Acceptable Rate of Return = Reject the proposal

ARR is 53.34% greater than the 20% (given) = Accept the proposal.

11

1. Accounting Rate of Return

ARR = Average Annual Net Income

Initial Investment

= 320042.8/6, 00,000*100 = 53.34 %

Working Note:

1. Calculation of Average Annual Net Income

Yea

rs

Revenu

e

Depreciat

ion

Profit after depreciation

but before tax

Tax @

30%

Profit after tax and

depreciation

1 4,40,000 1,00,000 4,30,000 1,29,000 3,01,000

2 4,53,200 1,00,000 4,43,200 1,32,960 3,10,240

3 4,66,796 1,00,000 4,56,769 1,37,039 3,19,757

4 4,80,799 1,00,000 4,70,799 1,41,240 3,29,560

5 4,95,223 1,00,000 4,85,223 1,45,566 3,39,657

Average Annual Net Income = 3,01,000 + 3,10,240 + 3,19,757 + 3,29,560 + 3,39,657

5

= 16, 00,214/5 = 320042.8

2. Calculation of depreciation

Depreciation = 6, 00,000 – 1, 00,000*50 = 1, 00,000

Note:

When ARR greater than equal to Minimum Acceptable Rate of Return = Accept the proposal

When ARR less than equal to Minimum Acceptable Rate of Return = Reject the proposal

ARR is 53.34% greater than the 20% (given) = Accept the proposal.

11

Accounting Rate of Return

The accounting rate of return of an investment measures the average annual net income as a

percentage of the investment (Tappura, et. al., 2015).

It is calculated by using the following formulae

ARR = Average Annual Net Income/ Initial Investment

ARR Pros

It is very easy to use and calculate.

ARR recognizes the concept of net income (income after tax and depreciation) which is

important factor in the evaluation of investment proposal.

ARR provides a clear picture of project profitability.

ARR method is useful to measure the recent performance of an organization.

ARR Cons

ARR ignores the time value of money and considers the value of all cash flows to be

equal.

ARR also ignores the external factors of an organization which are also affecting the

project profitability in different manner.

ARR also not consider the cash inflows which are more vital than the profits of

accounting (Lara, et. al., 2016).

On the basis of ARR a fair rate of return cannot be easily determined.

12

The accounting rate of return of an investment measures the average annual net income as a

percentage of the investment (Tappura, et. al., 2015).

It is calculated by using the following formulae

ARR = Average Annual Net Income/ Initial Investment

ARR Pros

It is very easy to use and calculate.

ARR recognizes the concept of net income (income after tax and depreciation) which is

important factor in the evaluation of investment proposal.

ARR provides a clear picture of project profitability.

ARR method is useful to measure the recent performance of an organization.

ARR Cons

ARR ignores the time value of money and considers the value of all cash flows to be

equal.

ARR also ignores the external factors of an organization which are also affecting the

project profitability in different manner.

ARR also not consider the cash inflows which are more vital than the profits of

accounting (Lara, et. al., 2016).

On the basis of ARR a fair rate of return cannot be easily determined.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.