Advance Accounting Homework: Partnership, Trust, PSI, Superannuation

VerifiedAdded on 2020/07/22

|9

|1347

|71

Homework Assignment

AI Summary

This document provides a detailed solution to an advance accounting assignment, covering several key areas of taxation and financial reporting in the Australian context. The solution begins with the calculation of partnership net income, considering interest on capital, drawings, and partner salaries. It then moves on to trust taxation, including the determination of net income and the application of previous year losses. The assignment also addresses personal service income (PSI) and its classification, along with the calculation of taxable income for individuals and entities. Further, it includes the taxation of complying superannuation funds, considering concessional tax rates and non-arm's length income. The solution proceeds to cover fringe benefits tax (FBT), calculating taxable fringe benefits and tax payable, and also includes a franking account reconciliation and calculation of taxable income and net tax payable. Finally, the solution covers the calculation of depreciation for various assets. The assignment references relevant Australian taxation laws and rulings.

ADVANCE ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Activity: 1....................................................................................................................................1

Activity 2.....................................................................................................................................1

Activity 3.....................................................................................................................................2

Activity 4.....................................................................................................................................3

Activity 5.....................................................................................................................................4

Activity 6.....................................................................................................................................5

Activity 7.....................................................................................................................................5

Activity 8.....................................................................................................................................6

REFERENCES................................................................................................................................7

Activity: 1....................................................................................................................................1

Activity 2.....................................................................................................................................1

Activity 3.....................................................................................................................................2

Activity 4.....................................................................................................................................3

Activity 5.....................................................................................................................................4

Activity 6.....................................................................................................................................5

Activity 7.....................................................................................................................................5

Activity 8.....................................................................................................................................6

REFERENCES................................................................................................................................7

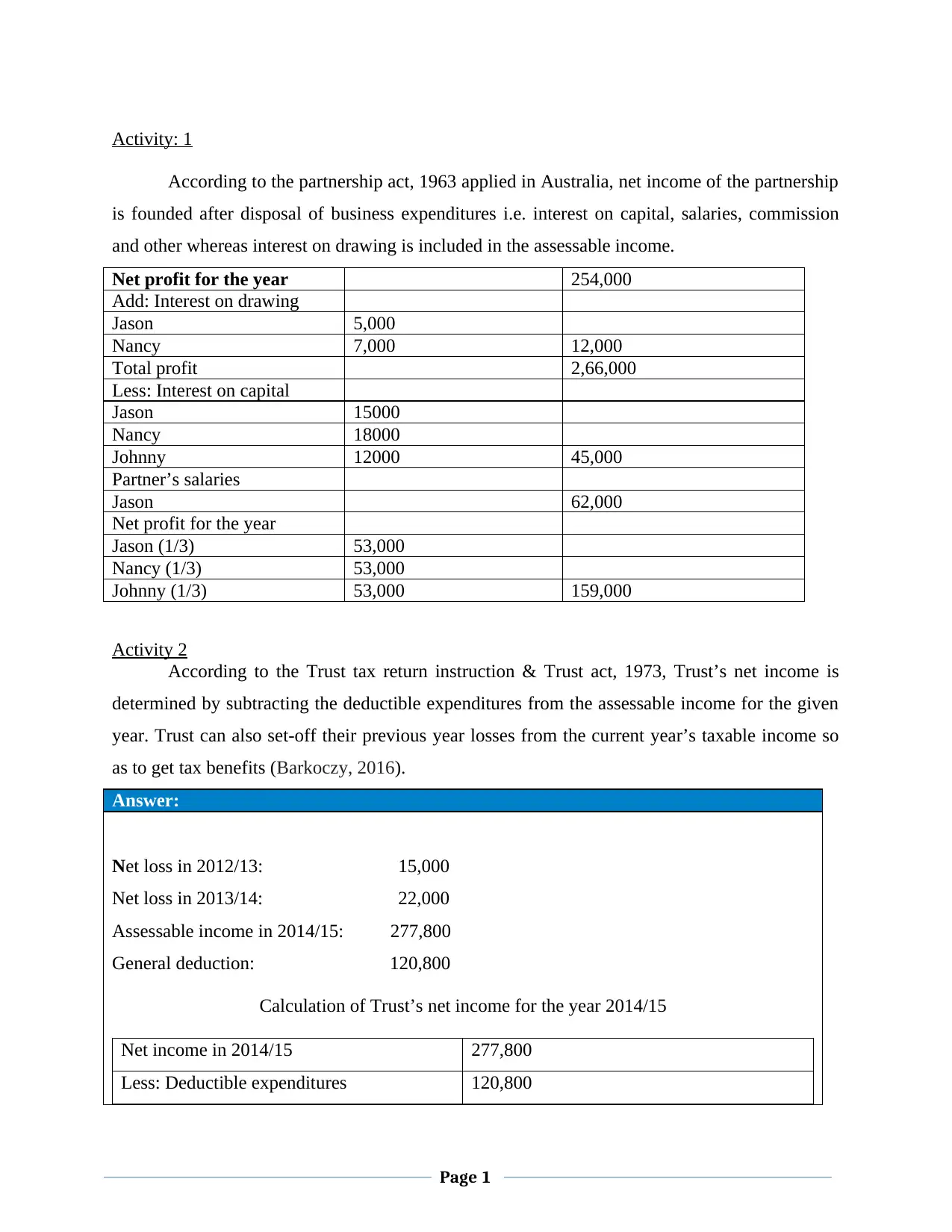

Activity: 1

According to the partnership act, 1963 applied in Australia, net income of the partnership

is founded after disposal of business expenditures i.e. interest on capital, salaries, commission

and other whereas interest on drawing is included in the assessable income.

Net profit for the year 254,000

Add: Interest on drawing

Jason 5,000

Nancy 7,000 12,000

Total profit 2,66,000

Less: Interest on capital

Jason 15000

Nancy 18000

Johnny 12000 45,000

Partner’s salaries

Jason 62,000

Net profit for the year

Jason (1/3) 53,000

Nancy (1/3) 53,000

Johnny (1/3) 53,000 159,000

Activity 2

According to the Trust tax return instruction & Trust act, 1973, Trust’s net income is

determined by subtracting the deductible expenditures from the assessable income for the given

year. Trust can also set-off their previous year losses from the current year’s taxable income so

as to get tax benefits (Barkoczy, 2016).

Answer:

Net loss in 2012/13: 15,000

Net loss in 2013/14: 22,000

Assessable income in 2014/15: 277,800

General deduction: 120,800

Calculation of Trust’s net income for the year 2014/15

Net income in 2014/15 277,800

Less: Deductible expenditures 120,800

Page 1

According to the partnership act, 1963 applied in Australia, net income of the partnership

is founded after disposal of business expenditures i.e. interest on capital, salaries, commission

and other whereas interest on drawing is included in the assessable income.

Net profit for the year 254,000

Add: Interest on drawing

Jason 5,000

Nancy 7,000 12,000

Total profit 2,66,000

Less: Interest on capital

Jason 15000

Nancy 18000

Johnny 12000 45,000

Partner’s salaries

Jason 62,000

Net profit for the year

Jason (1/3) 53,000

Nancy (1/3) 53,000

Johnny (1/3) 53,000 159,000

Activity 2

According to the Trust tax return instruction & Trust act, 1973, Trust’s net income is

determined by subtracting the deductible expenditures from the assessable income for the given

year. Trust can also set-off their previous year losses from the current year’s taxable income so

as to get tax benefits (Barkoczy, 2016).

Answer:

Net loss in 2012/13: 15,000

Net loss in 2013/14: 22,000

Assessable income in 2014/15: 277,800

General deduction: 120,800

Calculation of Trust’s net income for the year 2014/15

Net income in 2014/15 277,800

Less: Deductible expenditures 120,800

Page 1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

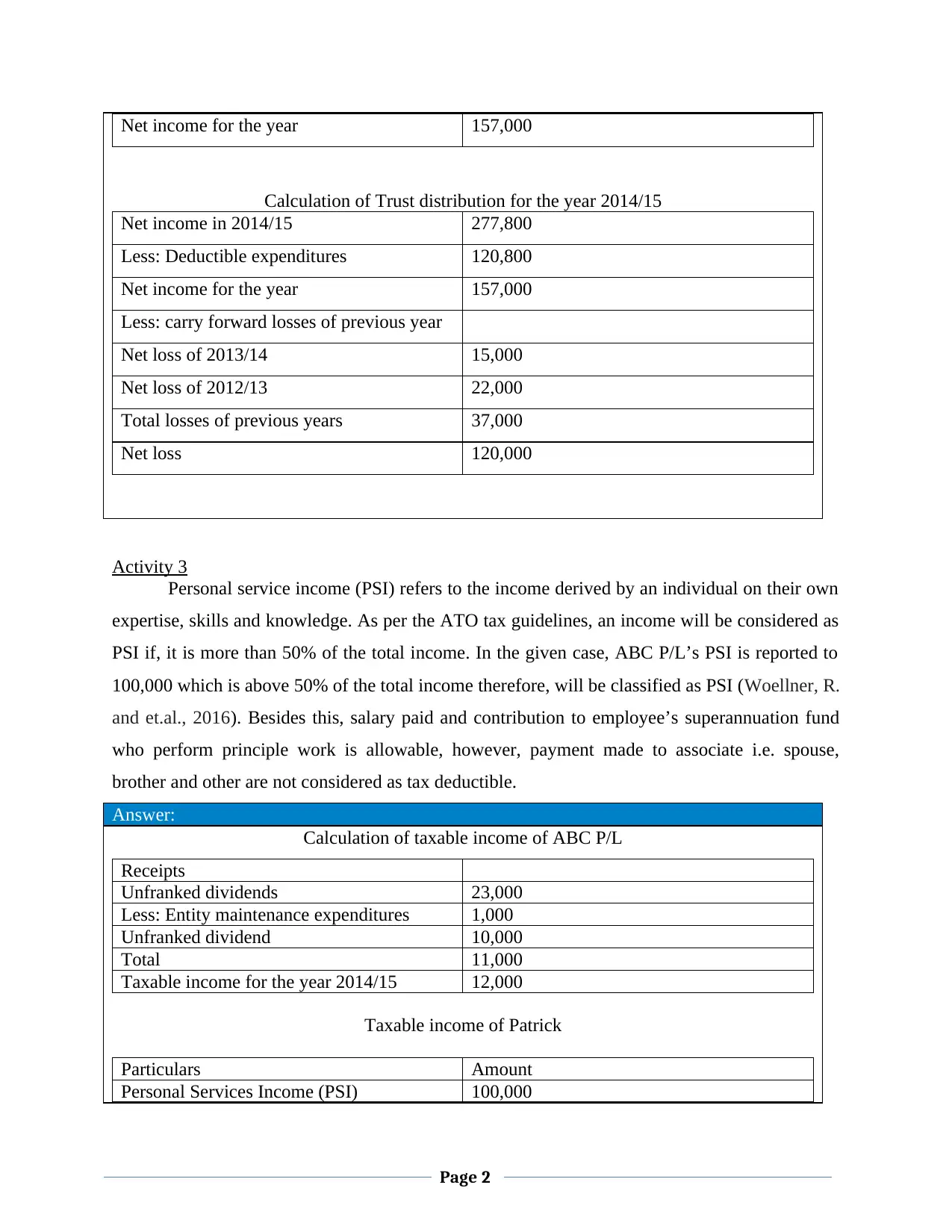

Net income for the year 157,000

Calculation of Trust distribution for the year 2014/15

Net income in 2014/15 277,800

Less: Deductible expenditures 120,800

Net income for the year 157,000

Less: carry forward losses of previous year

Net loss of 2013/14 15,000

Net loss of 2012/13 22,000

Total losses of previous years 37,000

Net loss 120,000

Activity 3

Personal service income (PSI) refers to the income derived by an individual on their own

expertise, skills and knowledge. As per the ATO tax guidelines, an income will be considered as

PSI if, it is more than 50% of the total income. In the given case, ABC P/L’s PSI is reported to

100,000 which is above 50% of the total income therefore, will be classified as PSI (Woellner, R.

and et.al., 2016). Besides this, salary paid and contribution to employee’s superannuation fund

who perform principle work is allowable, however, payment made to associate i.e. spouse,

brother and other are not considered as tax deductible.

Answer:

Calculation of taxable income of ABC P/L

Receipts

Unfranked dividends 23,000

Less: Entity maintenance expenditures 1,000

Unfranked dividend 10,000

Total 11,000

Taxable income for the year 2014/15 12,000

Taxable income of Patrick

Particulars Amount

Personal Services Income (PSI) 100,000

Page 2

Calculation of Trust distribution for the year 2014/15

Net income in 2014/15 277,800

Less: Deductible expenditures 120,800

Net income for the year 157,000

Less: carry forward losses of previous year

Net loss of 2013/14 15,000

Net loss of 2012/13 22,000

Total losses of previous years 37,000

Net loss 120,000

Activity 3

Personal service income (PSI) refers to the income derived by an individual on their own

expertise, skills and knowledge. As per the ATO tax guidelines, an income will be considered as

PSI if, it is more than 50% of the total income. In the given case, ABC P/L’s PSI is reported to

100,000 which is above 50% of the total income therefore, will be classified as PSI (Woellner, R.

and et.al., 2016). Besides this, salary paid and contribution to employee’s superannuation fund

who perform principle work is allowable, however, payment made to associate i.e. spouse,

brother and other are not considered as tax deductible.

Answer:

Calculation of taxable income of ABC P/L

Receipts

Unfranked dividends 23,000

Less: Entity maintenance expenditures 1,000

Unfranked dividend 10,000

Total 11,000

Taxable income for the year 2014/15 12,000

Taxable income of Patrick

Particulars Amount

Personal Services Income (PSI) 100,000

Page 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

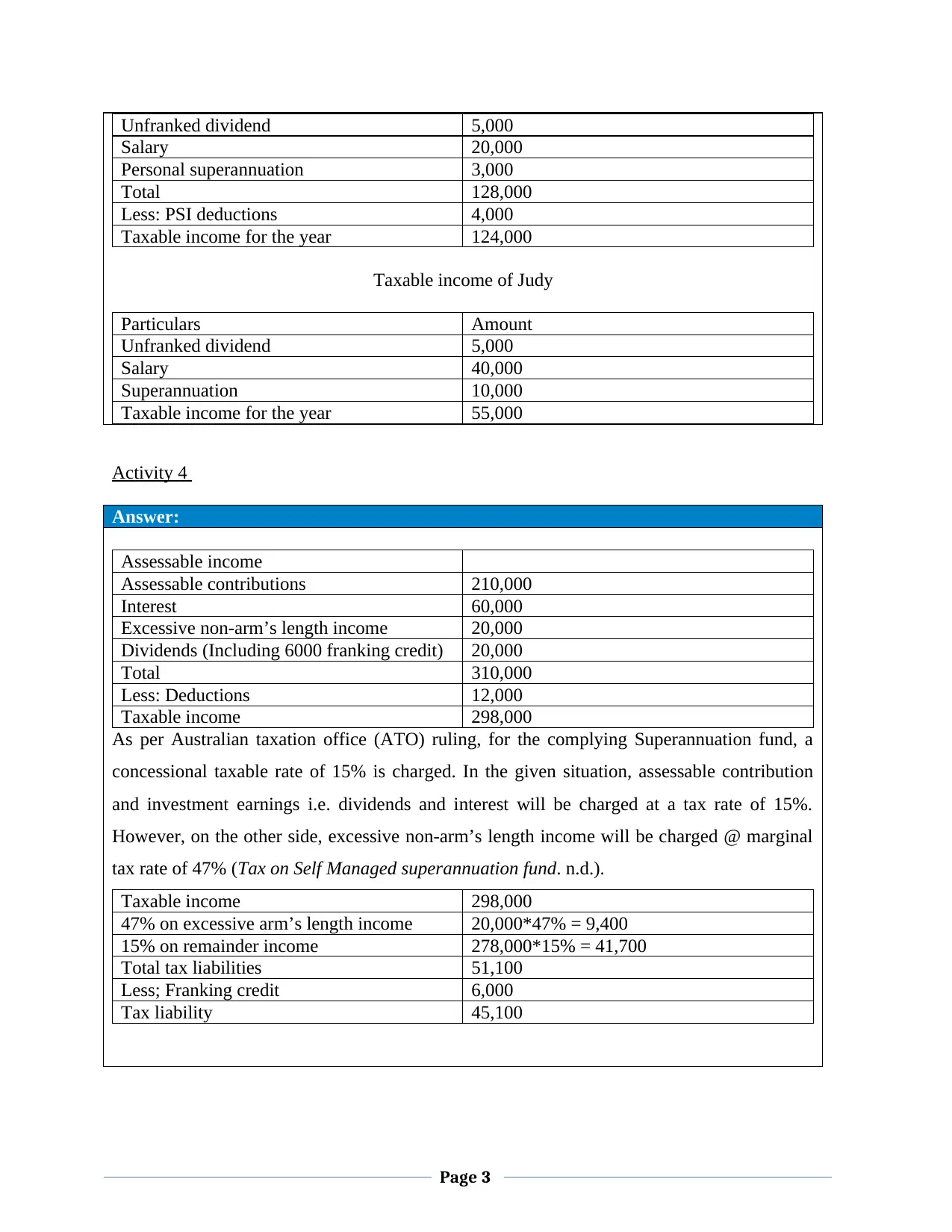

Unfranked dividend 5,000

Salary 20,000

Personal superannuation 3,000

Total 128,000

Less: PSI deductions 4,000

Taxable income for the year 124,000

Taxable income of Judy

Particulars Amount

Unfranked dividend 5,000

Salary 40,000

Superannuation 10,000

Taxable income for the year 55,000

Activity 4

Answer:

Assessable income

Assessable contributions 210,000

Interest 60,000

Excessive non-arm’s length income 20,000

Dividends (Including 6000 franking credit) 20,000

Total 310,000

Less: Deductions 12,000

Taxable income 298,000

As per Australian taxation office (ATO) ruling, for the complying Superannuation fund, a

concessional taxable rate of 15% is charged. In the given situation, assessable contribution

and investment earnings i.e. dividends and interest will be charged at a tax rate of 15%.

However, on the other side, excessive non-arm’s length income will be charged @ marginal

tax rate of 47% (Tax on Self Managed superannuation fund. n.d.).

Taxable income 298,000

47% on excessive arm’s length income 20,000*47% = 9,400

15% on remainder income 278,000*15% = 41,700

Total tax liabilities 51,100

Less; Franking credit 6,000

Tax liability 45,100

Page 3

Salary 20,000

Personal superannuation 3,000

Total 128,000

Less: PSI deductions 4,000

Taxable income for the year 124,000

Taxable income of Judy

Particulars Amount

Unfranked dividend 5,000

Salary 40,000

Superannuation 10,000

Taxable income for the year 55,000

Activity 4

Answer:

Assessable income

Assessable contributions 210,000

Interest 60,000

Excessive non-arm’s length income 20,000

Dividends (Including 6000 franking credit) 20,000

Total 310,000

Less: Deductions 12,000

Taxable income 298,000

As per Australian taxation office (ATO) ruling, for the complying Superannuation fund, a

concessional taxable rate of 15% is charged. In the given situation, assessable contribution

and investment earnings i.e. dividends and interest will be charged at a tax rate of 15%.

However, on the other side, excessive non-arm’s length income will be charged @ marginal

tax rate of 47% (Tax on Self Managed superannuation fund. n.d.).

Taxable income 298,000

47% on excessive arm’s length income 20,000*47% = 9,400

15% on remainder income 278,000*15% = 41,700

Total tax liabilities 51,100

Less; Franking credit 6,000

Tax liability 45,100

Page 3

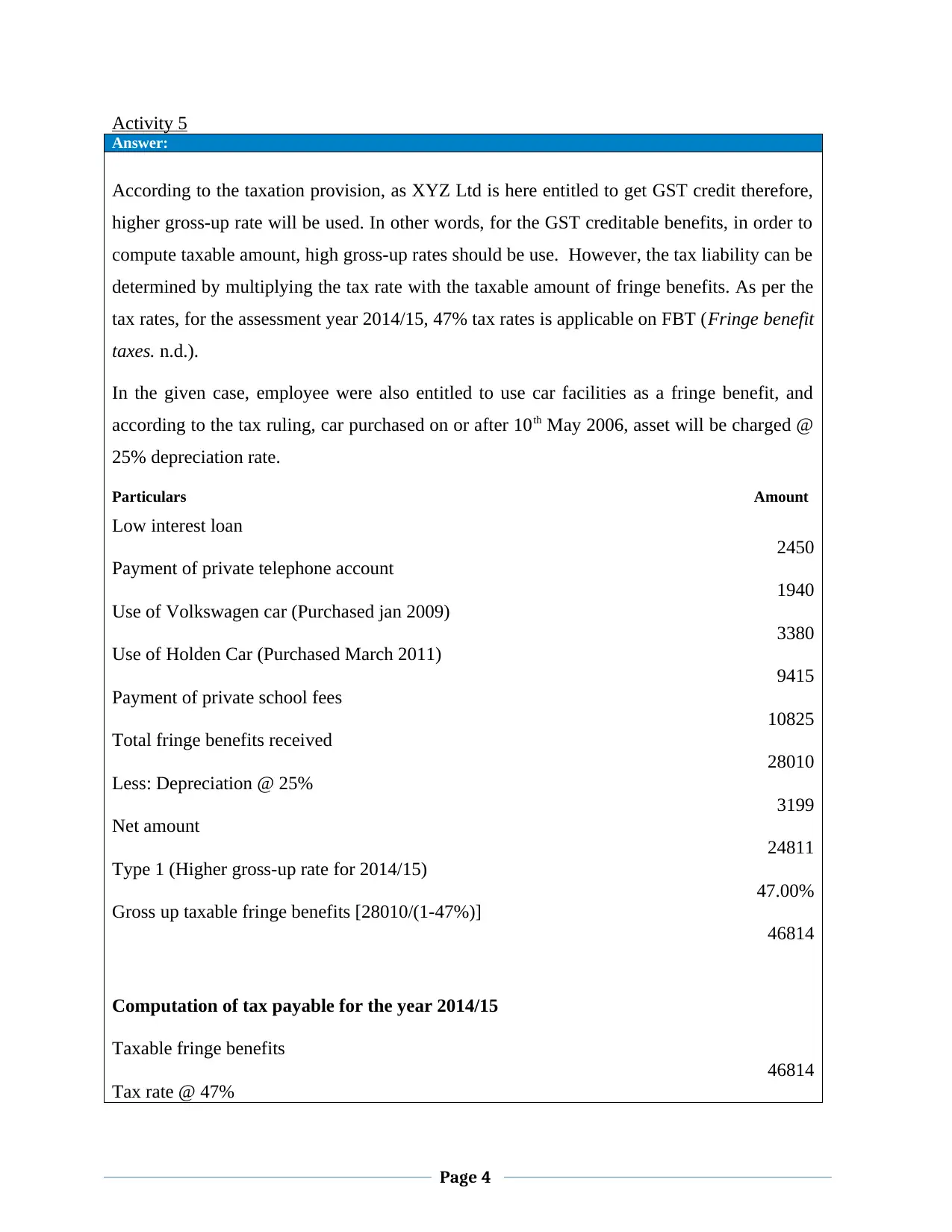

Activity 5

Answer:

According to the taxation provision, as XYZ Ltd is here entitled to get GST credit therefore,

higher gross-up rate will be used. In other words, for the GST creditable benefits, in order to

compute taxable amount, high gross-up rates should be use. However, the tax liability can be

determined by multiplying the tax rate with the taxable amount of fringe benefits. As per the

tax rates, for the assessment year 2014/15, 47% tax rates is applicable on FBT (Fringe benefit

taxes. n.d.).

In the given case, employee were also entitled to use car facilities as a fringe benefit, and

according to the tax ruling, car purchased on or after 10th May 2006, asset will be charged @

25% depreciation rate.

Particulars Amount

Low interest loan

2450

Payment of private telephone account

1940

Use of Volkswagen car (Purchased jan 2009)

3380

Use of Holden Car (Purchased March 2011)

9415

Payment of private school fees

10825

Total fringe benefits received

28010

Less: Depreciation @ 25%

3199

Net amount

24811

Type 1 (Higher gross-up rate for 2014/15)

47.00%

Gross up taxable fringe benefits [28010/(1-47%)]

46814

Computation of tax payable for the year 2014/15

Taxable fringe benefits

46814

Tax rate @ 47%

Page 4

Answer:

According to the taxation provision, as XYZ Ltd is here entitled to get GST credit therefore,

higher gross-up rate will be used. In other words, for the GST creditable benefits, in order to

compute taxable amount, high gross-up rates should be use. However, the tax liability can be

determined by multiplying the tax rate with the taxable amount of fringe benefits. As per the

tax rates, for the assessment year 2014/15, 47% tax rates is applicable on FBT (Fringe benefit

taxes. n.d.).

In the given case, employee were also entitled to use car facilities as a fringe benefit, and

according to the tax ruling, car purchased on or after 10th May 2006, asset will be charged @

25% depreciation rate.

Particulars Amount

Low interest loan

2450

Payment of private telephone account

1940

Use of Volkswagen car (Purchased jan 2009)

3380

Use of Holden Car (Purchased March 2011)

9415

Payment of private school fees

10825

Total fringe benefits received

28010

Less: Depreciation @ 25%

3199

Net amount

24811

Type 1 (Higher gross-up rate for 2014/15)

47.00%

Gross up taxable fringe benefits [28010/(1-47%)]

46814

Computation of tax payable for the year 2014/15

Taxable fringe benefits

46814

Tax rate @ 47%

Page 4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

22003

Net fringe benefits received

24811

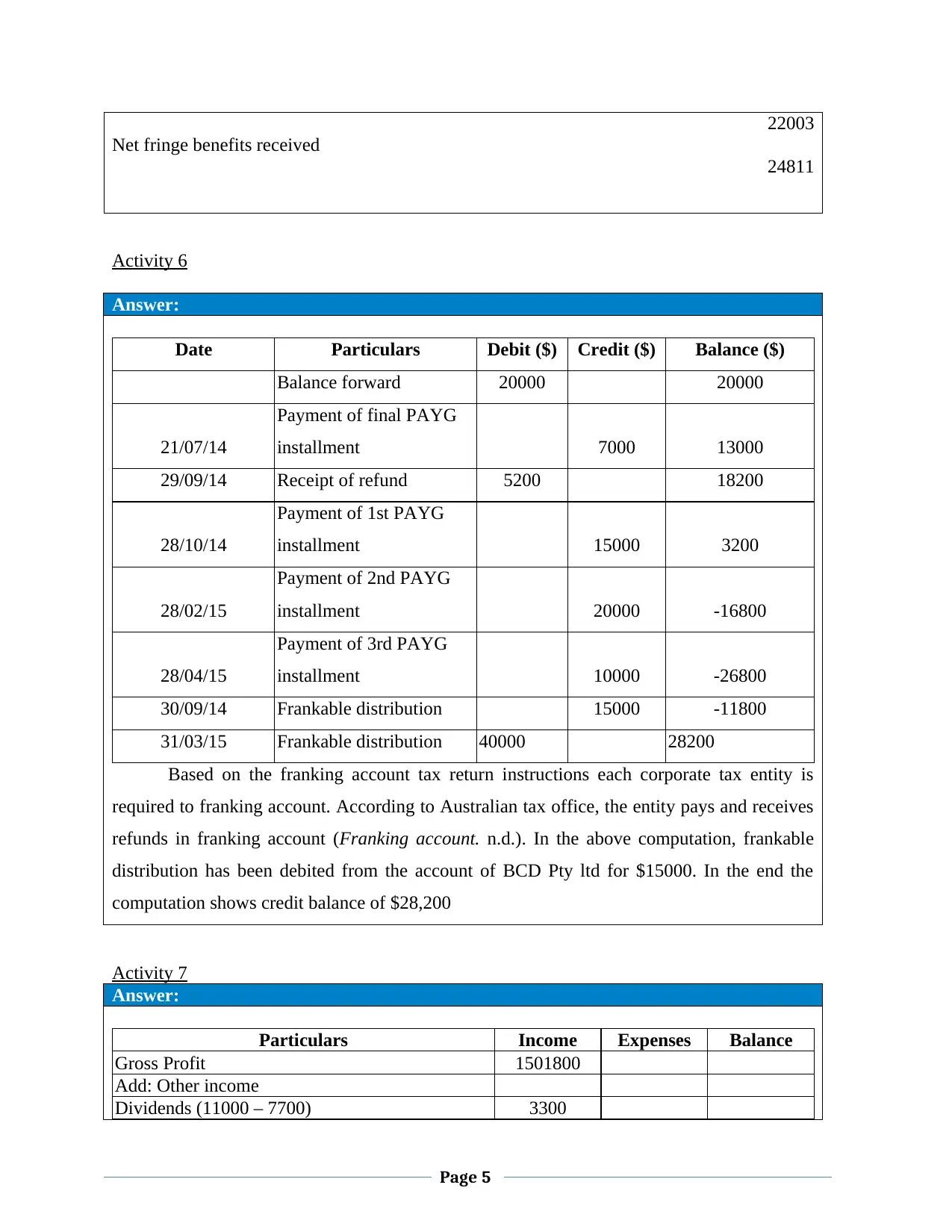

Activity 6

Answer:

Date Particulars Debit ($) Credit ($) Balance ($)

Balance forward 20000 20000

21/07/14

Payment of final PAYG

installment 7000 13000

29/09/14 Receipt of refund 5200 18200

28/10/14

Payment of 1st PAYG

installment 15000 3200

28/02/15

Payment of 2nd PAYG

installment 20000 -16800

28/04/15

Payment of 3rd PAYG

installment 10000 -26800

30/09/14 Frankable distribution 15000 -11800

31/03/15 Frankable distribution 40000 28200

Based on the franking account tax return instructions each corporate tax entity is

required to franking account. According to Australian tax office, the entity pays and receives

refunds in franking account (Franking account. n.d.). In the above computation, frankable

distribution has been debited from the account of BCD Pty ltd for $15000. In the end the

computation shows credit balance of $28,200

Activity 7

Answer:

Particulars Income Expenses Balance

Gross Profit 1501800

Add: Other income

Dividends (11000 – 7700) 3300

Page 5

Net fringe benefits received

24811

Activity 6

Answer:

Date Particulars Debit ($) Credit ($) Balance ($)

Balance forward 20000 20000

21/07/14

Payment of final PAYG

installment 7000 13000

29/09/14 Receipt of refund 5200 18200

28/10/14

Payment of 1st PAYG

installment 15000 3200

28/02/15

Payment of 2nd PAYG

installment 20000 -16800

28/04/15

Payment of 3rd PAYG

installment 10000 -26800

30/09/14 Frankable distribution 15000 -11800

31/03/15 Frankable distribution 40000 28200

Based on the franking account tax return instructions each corporate tax entity is

required to franking account. According to Australian tax office, the entity pays and receives

refunds in franking account (Franking account. n.d.). In the above computation, frankable

distribution has been debited from the account of BCD Pty ltd for $15000. In the end the

computation shows credit balance of $28,200

Activity 7

Answer:

Particulars Income Expenses Balance

Gross Profit 1501800

Add: Other income

Dividends (11000 – 7700) 3300

Page 5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

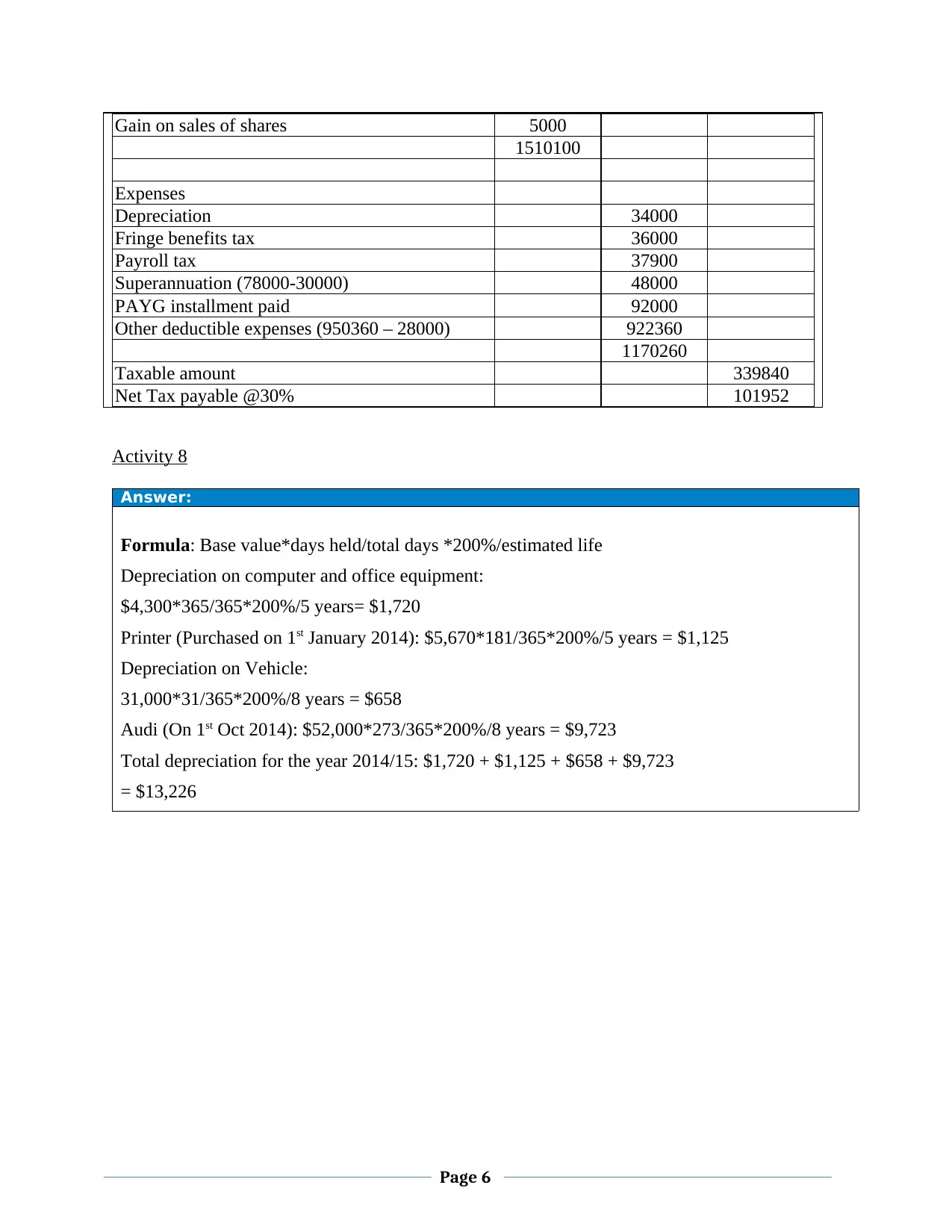

Gain on sales of shares 5000

1510100

Expenses

Depreciation 34000

Fringe benefits tax 36000

Payroll tax 37900

Superannuation (78000-30000) 48000

PAYG installment paid 92000

Other deductible expenses (950360 – 28000) 922360

1170260

Taxable amount 339840

Net Tax payable @30% 101952

Activity 8

Answer:

Formula: Base value*days held/total days *200%/estimated life

Depreciation on computer and office equipment:

$4,300*365/365*200%/5 years= $1,720

Printer (Purchased on 1st January 2014): $5,670*181/365*200%/5 years = $1,125

Depreciation on Vehicle:

31,000*31/365*200%/8 years = $658

Audi (On 1st Oct 2014): $52,000*273/365*200%/8 years = $9,723

Total depreciation for the year 2014/15: $1,720 + $1,125 + $658 + $9,723

= $13,226

Page 6

1510100

Expenses

Depreciation 34000

Fringe benefits tax 36000

Payroll tax 37900

Superannuation (78000-30000) 48000

PAYG installment paid 92000

Other deductible expenses (950360 – 28000) 922360

1170260

Taxable amount 339840

Net Tax payable @30% 101952

Activity 8

Answer:

Formula: Base value*days held/total days *200%/estimated life

Depreciation on computer and office equipment:

$4,300*365/365*200%/5 years= $1,720

Printer (Purchased on 1st January 2014): $5,670*181/365*200%/5 years = $1,125

Depreciation on Vehicle:

31,000*31/365*200%/8 years = $658

Audi (On 1st Oct 2014): $52,000*273/365*200%/8 years = $9,723

Total depreciation for the year 2014/15: $1,720 + $1,125 + $658 + $9,723

= $13,226

Page 6

REFERENCES

Books and Journals

Barkoczy, S., 2016. Foundations of Taxation Law 2016. OUP Catalogue.

Woellner, R. and et.al., 2016. Australian Taxation Law 2016. OUP Catalogue.

Online

Franking account. n.d. [Online]. Available through:

https://www.ato.gov.au/Business/Imputation/Paying-dividends-and-other-distributions/

Franking-account/. [Accessed on 15th June 2017].

Fringe benefit taxes. n.d. [Online]. Available through: < https://www.ato.gov.au/general/fringe-

benefits-tax-(fbt)/how-to-calculate-your-fbt/>. [Accessed on 15th June 2017].

Tax on Self Managed superannuation fund. n.d. [Online]. Available through: <

https://www.ato.gov.au/Super/Self-managed-super-funds/Investing/Tax-on-income/>.

[Accessed on 15th June 2017].

Page 7

Books and Journals

Barkoczy, S., 2016. Foundations of Taxation Law 2016. OUP Catalogue.

Woellner, R. and et.al., 2016. Australian Taxation Law 2016. OUP Catalogue.

Online

Franking account. n.d. [Online]. Available through:

https://www.ato.gov.au/Business/Imputation/Paying-dividends-and-other-distributions/

Franking-account/. [Accessed on 15th June 2017].

Fringe benefit taxes. n.d. [Online]. Available through: < https://www.ato.gov.au/general/fringe-

benefits-tax-(fbt)/how-to-calculate-your-fbt/>. [Accessed on 15th June 2017].

Tax on Self Managed superannuation fund. n.d. [Online]. Available through: <

https://www.ato.gov.au/Super/Self-managed-super-funds/Investing/Tax-on-income/>.

[Accessed on 15th June 2017].

Page 7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.