Financial Accounting Report: Fair Value and Valuation Techniques

VerifiedAdded on 2020/07/22

|13

|3631

|48

Report

AI Summary

This report delves into the debate between fair value and historical cost accounting, a significant discussion in accounting literature. It explores the application of International Financial Reporting Standards (IFRS) and examines the selection between these accounting practices through a quasi-experiment. The report discusses fair value measurement based on an "exit price" notion and the fair value hierarchy, emphasizing market-based valuation. It covers the measurement of fair value, including the specific asset or liability, valuation basis, and valuation techniques. Furthermore, the report analyzes the valuation practices of three companies—Unilever plc, American Tower Corporation, and BHP Billiton—listed on different stock exchanges, examining their balance sheets and accounting methods. The analysis includes the benefits and challenges of fair value measurement and a detailed examination of the valuation practices employed by each company, considering their adherence to accounting standards and the treatment of assets, liabilities, and equity. The report also mentions valuation techniques like market, cost, and income approaches.

Advance Financial Accounting

Report

Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

The variety between fair value and historical cost accounting is the one which is highly

debated components in an accounting literature. While debate on these two topic started from

1930s, which is still disturbed (Macve, 2015). One disorder is move debate forward which is

deficiency of sign on the selection between these aforementioned accounting practices, when

selection a quasi-experiment rooted in the current essential consideration of the International

Financial Reporting Standard to learning the “market solution for selection between historical

cost and appropriate value accounting approaches. The current setting which exploits IFRS

implementation that has a precious distinction from Australia, UK, and US settings implemented

before going to have research. The selection between historical and fair value is that the

company is moving forward to make their business objectives in an effective manner (Rajgopal

and Venkatachalam, 2011).

1.

Fair value measurement implements to IFRSs which needs to enable FVM and renders a

individual IFRS framework for calculating fair value and needs releases about the FVM. The

Standard elaborates fair value on the basis of an “exit price’ notion and implements a “FVH”.

The standard elaborates fair value by relying of an “exit price” notion and implements a “fair

value hierarchy”, which emerge in the market based, instead of entity-specific, measurement.

The fair value hierarchy emerges to enhance reliability in the FVM and connected

releases via “FVH” the hierarchy classified the inputs applied in the valuation tools into three

levels (Hoyle, Schaefer and Doupnik, 2015). The hierarchy renders the maximum importance to

cited prices in active markets for resemble assets or liabilities and the lower priority to

unobservable inputs.

Measurement of fair value: The main aim of a FVM is to forecast the price under which an

arranged transaction to offer the asset or to transfer responsibility which will take place between

market participants during the measurement date as per the current market conditions. An

adequate value measurement needs an entity to elaborates of all of the below mentioned:

The particular asset or liability which is the subject of the measurement.

For a non-financial asset, valuation basis which is adequate for the measurement.

Principle market for the asset or liability.

1

The variety between fair value and historical cost accounting is the one which is highly

debated components in an accounting literature. While debate on these two topic started from

1930s, which is still disturbed (Macve, 2015). One disorder is move debate forward which is

deficiency of sign on the selection between these aforementioned accounting practices, when

selection a quasi-experiment rooted in the current essential consideration of the International

Financial Reporting Standard to learning the “market solution for selection between historical

cost and appropriate value accounting approaches. The current setting which exploits IFRS

implementation that has a precious distinction from Australia, UK, and US settings implemented

before going to have research. The selection between historical and fair value is that the

company is moving forward to make their business objectives in an effective manner (Rajgopal

and Venkatachalam, 2011).

1.

Fair value measurement implements to IFRSs which needs to enable FVM and renders a

individual IFRS framework for calculating fair value and needs releases about the FVM. The

Standard elaborates fair value on the basis of an “exit price’ notion and implements a “FVH”.

The standard elaborates fair value by relying of an “exit price” notion and implements a “fair

value hierarchy”, which emerge in the market based, instead of entity-specific, measurement.

The fair value hierarchy emerges to enhance reliability in the FVM and connected

releases via “FVH” the hierarchy classified the inputs applied in the valuation tools into three

levels (Hoyle, Schaefer and Doupnik, 2015). The hierarchy renders the maximum importance to

cited prices in active markets for resemble assets or liabilities and the lower priority to

unobservable inputs.

Measurement of fair value: The main aim of a FVM is to forecast the price under which an

arranged transaction to offer the asset or to transfer responsibility which will take place between

market participants during the measurement date as per the current market conditions. An

adequate value measurement needs an entity to elaborates of all of the below mentioned:

The particular asset or liability which is the subject of the measurement.

For a non-financial asset, valuation basis which is adequate for the measurement.

Principle market for the asset or liability.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Valuation tools are adequate for the extent, adopting the accessibility of the data with

which to grow inputs which characterizes the assumptions that market contributors will

implement at the pricing of assets or liability and of the fair value hierarchy under which

the inputs are segregated.

2.

It has been recognised that the intangibles can be critically and potentially affect firms’

financial policies. At the time of initial recognition fixed asset are known at cost of production.

In self-made or acquisition price, if this is acquired abroad, the costs incurred after

commissioning to increase productivity (Hope, Thomas and Vyas, 2013). The maintenance cost

or other related asset will improve the productivity and enhance their productivity capacity costs

shall be considered an expense, there are modifications on the subsequent valuation of that

comprise non- current assets which permits.

Benefits:

1. The process of determining the fair value of tangible fixed assets appropriately adjusted

price or a less active market adjusted changes in economic condition (Mulford and

Comiskey, 2011).

2. Challenges:

If the fair value increases, then in that case, the equity get transfer in a balance

item for revaluation surplus and vice-versa

If the reduction in fair value occurred, it will in general in the income statement.

If the reduction in the value is a reversal account, if the loss exceeds this amount.

Then in that case, it will be charge to income statement. It can-not exists a

negative revaluation reserve for a particular asset.

3.

Valuation tools are adequate in the conditions and for which efficient data are accessible to

calculate fair value, optimising the use of concerned observable inputs and lowering the

application of unobservable inputs (Dyreng, Mayew and Williams, 2012).

The objective of implementing a valuation tools is to forecast the price under which

systematic transaction to offer the asset or to relocate the liability will take place between market

2

which to grow inputs which characterizes the assumptions that market contributors will

implement at the pricing of assets or liability and of the fair value hierarchy under which

the inputs are segregated.

2.

It has been recognised that the intangibles can be critically and potentially affect firms’

financial policies. At the time of initial recognition fixed asset are known at cost of production.

In self-made or acquisition price, if this is acquired abroad, the costs incurred after

commissioning to increase productivity (Hope, Thomas and Vyas, 2013). The maintenance cost

or other related asset will improve the productivity and enhance their productivity capacity costs

shall be considered an expense, there are modifications on the subsequent valuation of that

comprise non- current assets which permits.

Benefits:

1. The process of determining the fair value of tangible fixed assets appropriately adjusted

price or a less active market adjusted changes in economic condition (Mulford and

Comiskey, 2011).

2. Challenges:

If the fair value increases, then in that case, the equity get transfer in a balance

item for revaluation surplus and vice-versa

If the reduction in fair value occurred, it will in general in the income statement.

If the reduction in the value is a reversal account, if the loss exceeds this amount.

Then in that case, it will be charge to income statement. It can-not exists a

negative revaluation reserve for a particular asset.

3.

Valuation tools are adequate in the conditions and for which efficient data are accessible to

calculate fair value, optimising the use of concerned observable inputs and lowering the

application of unobservable inputs (Dyreng, Mayew and Williams, 2012).

The objective of implementing a valuation tools is to forecast the price under which

systematic transaction to offer the asset or to relocate the liability will take place between market

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

participants and measurement date as per the present market conditions. Basically, there are three

most common valuation techniques which are as follows:

Market approach: This approach uses prices and other concerned information produced

by the market transactions covering equal or comparable assets, liabilities.

Cost approach: This refers to the amount which will requires now to exchange the service

capacity of an asset (Francis and et.al., 2015).

Income approach: This changes future cash flows or expenses amount to an existing

amount, reflecting existing market prospects about those future amounts (Deegan, 2013).

In few of the cases, a single valuation tools would be more adequate, while on the hand, others

multiple valuation tools would be adequate.

Under this case, three companies are going to select from different stock exchanges as

this can be said that the one company will be selected from the ASX stock exchange which are

operates, second one is from the FTSE stock exchange, and third one is selected from the NYSE.

From UK FTSE market, Unilever plc is selected, while in NYSE market, American

power corporation is going to be selected. From the Australian market, BHP Billiton is selected.

By analysing the balance sheet of the firms’ a proper conclusion can be drawn in an effective

manner. however, this can be said that the company can use their techniques in an effective

manner. the definition of “fair value” is that which is applied to the highly adopted and disclosed

information which is calculated implementing fair value measurement in U.S.

Where disclosures are needed to be rendered for each class of assets or liability, a firm

identifies adequate classes on the basis of nature, characteristics and risks of the asset or liability,

and level of FVH under which the FVM is segregated.

Identifying an adequate class of assets and liabilities for which exposes about the FVM must

need to render judgement (Crawford and et.al., 2012). A class of assets and liabilities would

normally need disaggregation than the line items reflected in the statement of financial position.

There are few disclosures which are segregated on whether the measurements are:

Recurring fair value measurements- FVMs enables by other IFRSs which are to be

recognised in the statement of financial position at the end of each reporting period.

Non-recurring fair value measurements: These FVMs which are needed by other

IFRSs to be measured in the statement of financial position in a precise position.

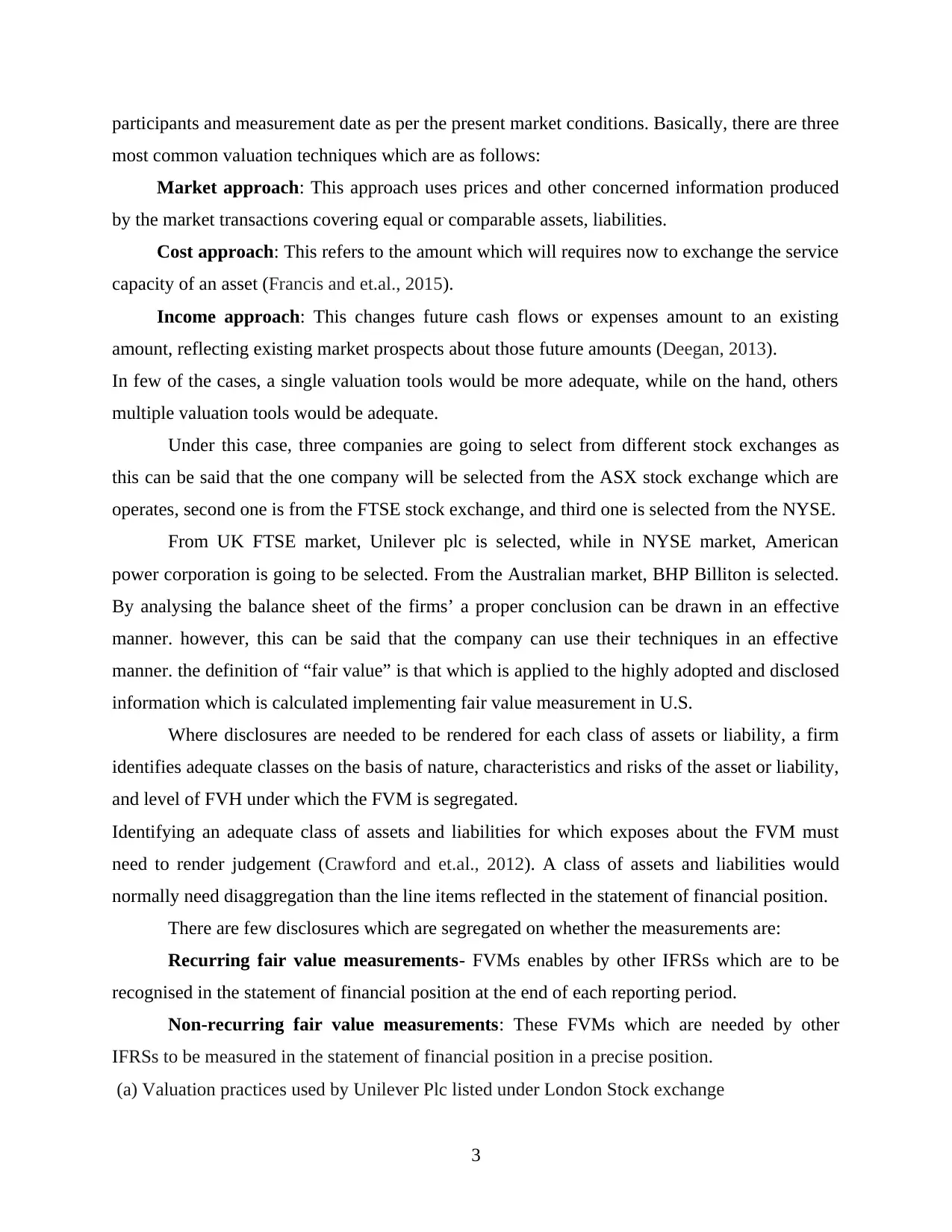

(a) Valuation practices used by Unilever Plc listed under London Stock exchange

3

most common valuation techniques which are as follows:

Market approach: This approach uses prices and other concerned information produced

by the market transactions covering equal or comparable assets, liabilities.

Cost approach: This refers to the amount which will requires now to exchange the service

capacity of an asset (Francis and et.al., 2015).

Income approach: This changes future cash flows or expenses amount to an existing

amount, reflecting existing market prospects about those future amounts (Deegan, 2013).

In few of the cases, a single valuation tools would be more adequate, while on the hand, others

multiple valuation tools would be adequate.

Under this case, three companies are going to select from different stock exchanges as

this can be said that the one company will be selected from the ASX stock exchange which are

operates, second one is from the FTSE stock exchange, and third one is selected from the NYSE.

From UK FTSE market, Unilever plc is selected, while in NYSE market, American

power corporation is going to be selected. From the Australian market, BHP Billiton is selected.

By analysing the balance sheet of the firms’ a proper conclusion can be drawn in an effective

manner. however, this can be said that the company can use their techniques in an effective

manner. the definition of “fair value” is that which is applied to the highly adopted and disclosed

information which is calculated implementing fair value measurement in U.S.

Where disclosures are needed to be rendered for each class of assets or liability, a firm

identifies adequate classes on the basis of nature, characteristics and risks of the asset or liability,

and level of FVH under which the FVM is segregated.

Identifying an adequate class of assets and liabilities for which exposes about the FVM must

need to render judgement (Crawford and et.al., 2012). A class of assets and liabilities would

normally need disaggregation than the line items reflected in the statement of financial position.

There are few disclosures which are segregated on whether the measurements are:

Recurring fair value measurements- FVMs enables by other IFRSs which are to be

recognised in the statement of financial position at the end of each reporting period.

Non-recurring fair value measurements: These FVMs which are needed by other

IFRSs to be measured in the statement of financial position in a precise position.

(a) Valuation practices used by Unilever Plc listed under London Stock exchange

3

Balance sheet of Unilever Plc

4

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Period ending 31/12/16

Particulars Amount

Current assets

Cash and bank balance 3382000

Short- period investments 565000

Net receivables 3854000

Stock 4278000

Other current and liquid assets 1120000

Total of current assets 13884000

Long-term investments 491000

Land, equipment and plant -

Goodwill 17624000

Immaterial assets -

Accumulated depreciation and reduction -

Other assets -

Postponed long-duration asset expenses 1354000

Total assets 56429000

Current liabilities

Creditors 8591000

Short duration liabilities and debts 16595000

Other current liabilities 2392000

Total current liabilities 20556000

Long-term debt 11011000

Other liabilities -

Minority interest -

Negative goodwill -

Total liabilities 39449000

Equity of share holders

Miscellaneous stock warrants -

Redeemable preference inventories -

Preferred inventories -

5

Particulars Amount

Current assets

Cash and bank balance 3382000

Short- period investments 565000

Net receivables 3854000

Stock 4278000

Other current and liquid assets 1120000

Total of current assets 13884000

Long-term investments 491000

Land, equipment and plant -

Goodwill 17624000

Immaterial assets -

Accumulated depreciation and reduction -

Other assets -

Postponed long-duration asset expenses 1354000

Total assets 56429000

Current liabilities

Creditors 8591000

Short duration liabilities and debts 16595000

Other current liabilities 2392000

Total current liabilities 20556000

Long-term debt 11011000

Other liabilities -

Minority interest -

Negative goodwill -

Total liabilities 39449000

Equity of share holders

Miscellaneous stock warrants -

Redeemable preference inventories -

Preferred inventories -

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

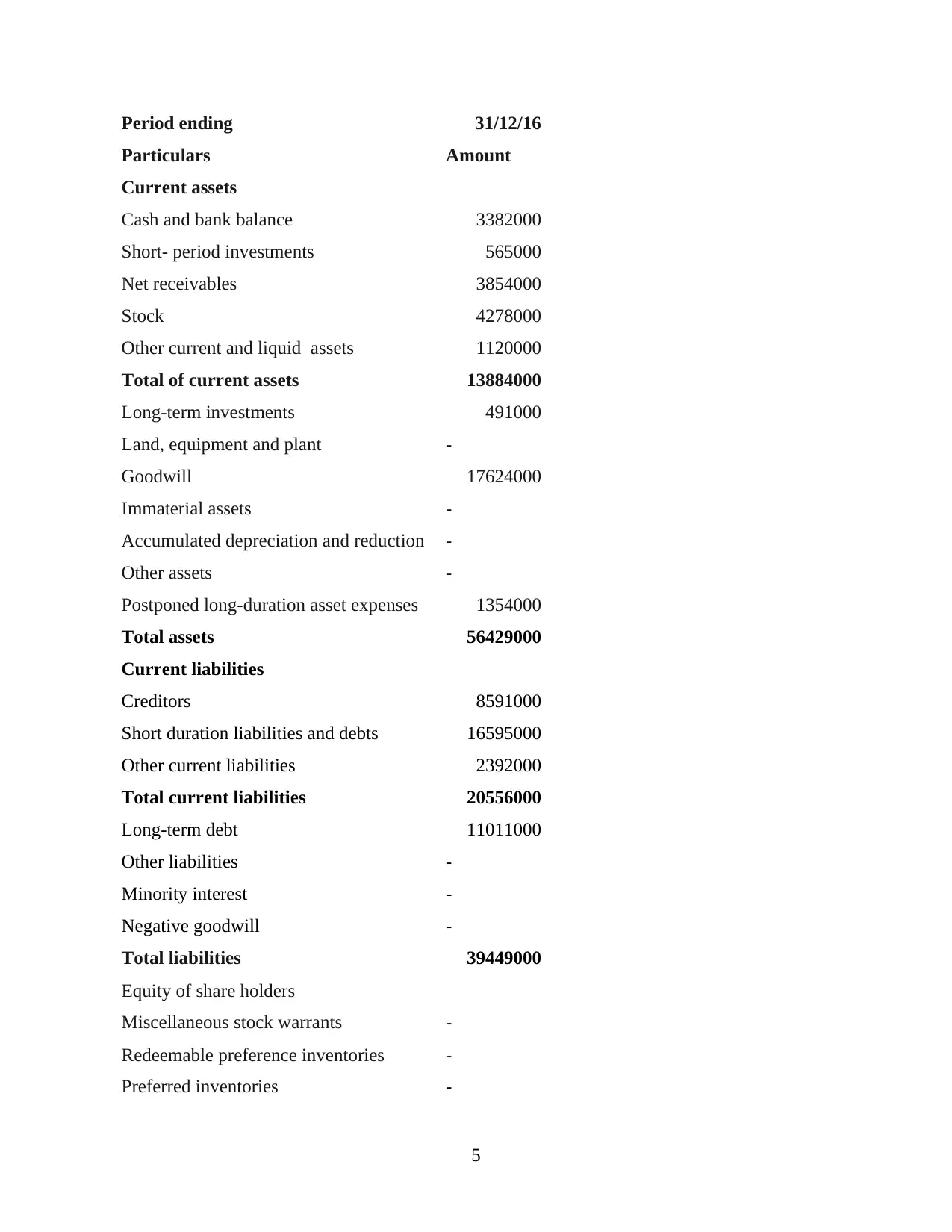

Common inventories 618000

Profits and retain earnings 23179000

Exchequer stock -7443000

Excess over expenditure 134000

Other equities and share holdings -

Total share-holding and equities -

Net tactual assets -

As per balance sheet of Unilever plc. It is seen that the assets are shown on book value

and there is a separate provision are made in respect of charging depreciation and making tax

provisions (Costello, 2011). Retained earnings shows the balance carried forward to next

forthcoming years. Company uses written dimensioning method to evaluate the depreciation

amount and maximise the profitability in respect of major portion. Intangible assets as Patents

rights and goodwill is evaluated on the basis of market value.

(b)Valuation practices used by American Tower Corporation listed under New York Stock

exchange

American Tower corporation

Period ending 31/12/16

Particulars Amount

Current assets

Total current assets 1689870

Short-term investments 4026

Land, equipment and plants 10517258

Other current assets 441033

Other assets -

Net receivables 308369

Long-term investments 841523

Inventory -

Intangible assets 11274611

Goodwill 5070680

Deferred long-term asset charges 1485208

Cash and cash equivalents 936442

6

Profits and retain earnings 23179000

Exchequer stock -7443000

Excess over expenditure 134000

Other equities and share holdings -

Total share-holding and equities -

Net tactual assets -

As per balance sheet of Unilever plc. It is seen that the assets are shown on book value

and there is a separate provision are made in respect of charging depreciation and making tax

provisions (Costello, 2011). Retained earnings shows the balance carried forward to next

forthcoming years. Company uses written dimensioning method to evaluate the depreciation

amount and maximise the profitability in respect of major portion. Intangible assets as Patents

rights and goodwill is evaluated on the basis of market value.

(b)Valuation practices used by American Tower Corporation listed under New York Stock

exchange

American Tower corporation

Period ending 31/12/16

Particulars Amount

Current assets

Total current assets 1689870

Short-term investments 4026

Land, equipment and plants 10517258

Other current assets 441033

Other assets -

Net receivables 308369

Long-term investments 841523

Inventory -

Intangible assets 11274611

Goodwill 5070680

Deferred long-term asset charges 1485208

Cash and cash equivalents 936442

6

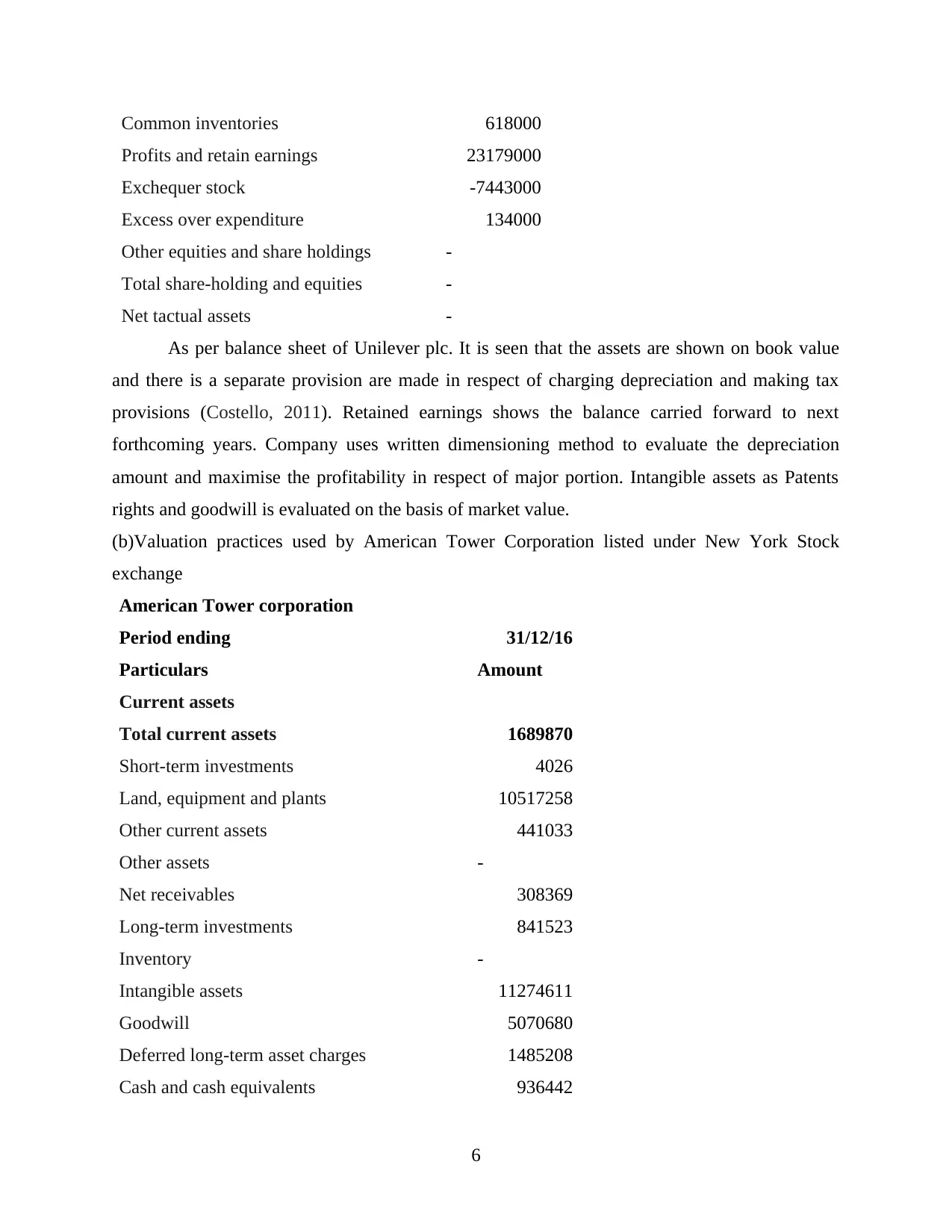

Accumulated amortisation -

Total assets 30879150

Current liabilities

Total of current liabilities 1631269

Short/current long-duration liabilities 238806

Other liabilities 2108230

Other current liabilities 245387

Minority interest 212305

Long-term debt 18294659

Deferred revenue expenditures and liabilities 777572

Accounts payable 1147076

Adverse balance of goodwill -

Total liabilities 23024035

Equity of shareholder's and inventory

holders

Miscellaneous stock options and warrants 1091220

Redeemable preference share holdings -

Treasury inventory -207740

Total stockholder equity 6763895

Retained earnings -1076965

Preferred stock -

Other stockholder equity -1999332

Common stock 4299

Capital surplus 10043559

Net tangible assets -9581396

As per above mentioned financial statement of American Tower Corporation. Value of

common stock and valuation of assets are recorded on cost and related to various book value.

Goodwill and intangible assets are record on net realisable value (Choi and Meek, 2011). There

is a price of stock is recorded on the cost after deducting the margin of profit and deducting the

additional expenses. All the other formats are followed as per rules and guidelines provided by

7

Total assets 30879150

Current liabilities

Total of current liabilities 1631269

Short/current long-duration liabilities 238806

Other liabilities 2108230

Other current liabilities 245387

Minority interest 212305

Long-term debt 18294659

Deferred revenue expenditures and liabilities 777572

Accounts payable 1147076

Adverse balance of goodwill -

Total liabilities 23024035

Equity of shareholder's and inventory

holders

Miscellaneous stock options and warrants 1091220

Redeemable preference share holdings -

Treasury inventory -207740

Total stockholder equity 6763895

Retained earnings -1076965

Preferred stock -

Other stockholder equity -1999332

Common stock 4299

Capital surplus 10043559

Net tangible assets -9581396

As per above mentioned financial statement of American Tower Corporation. Value of

common stock and valuation of assets are recorded on cost and related to various book value.

Goodwill and intangible assets are record on net realisable value (Choi and Meek, 2011). There

is a price of stock is recorded on the cost after deducting the margin of profit and deducting the

additional expenses. All the other formats are followed as per rules and guidelines provided by

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

GAAP and IFRS. Accounting standards are also considered to analyse the effect of provision for

tax.

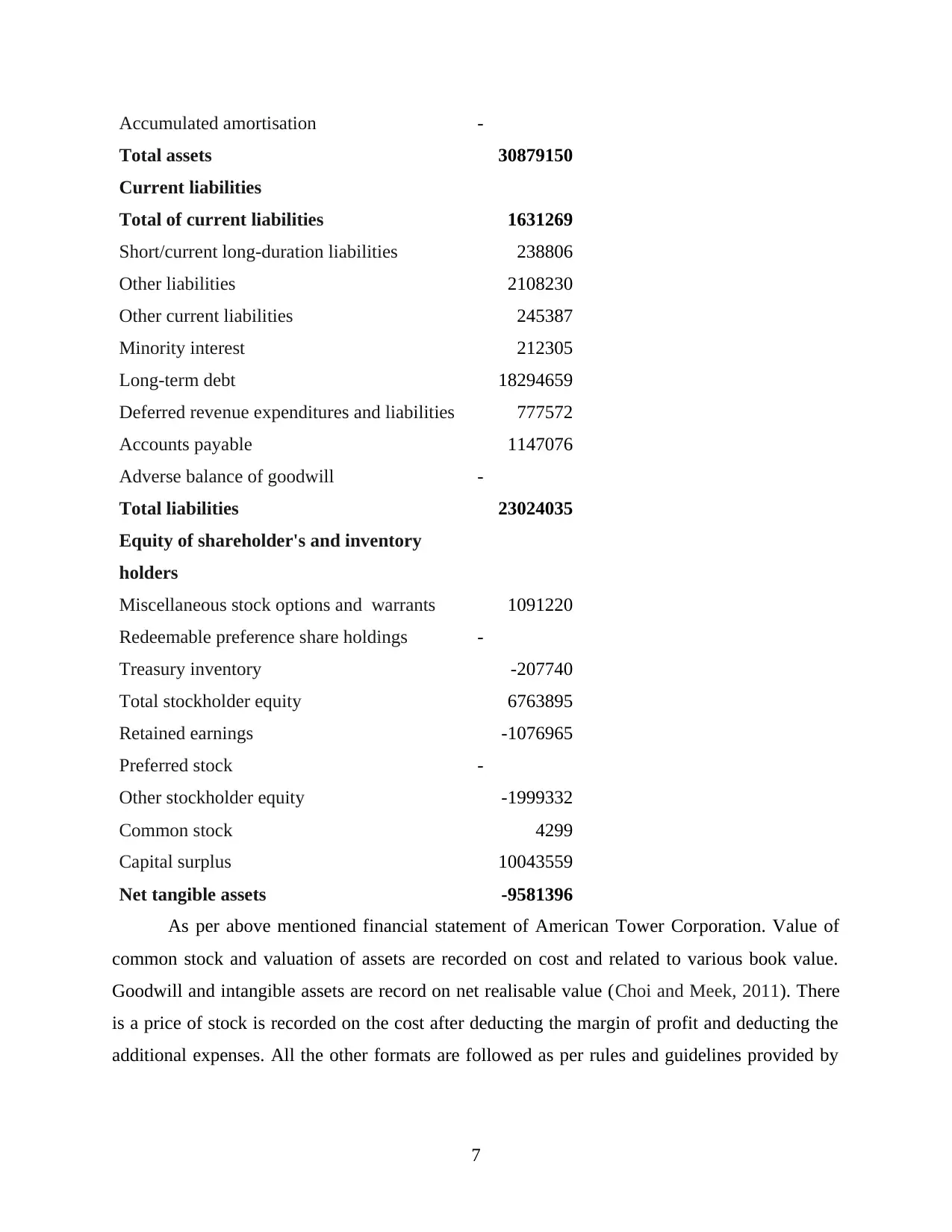

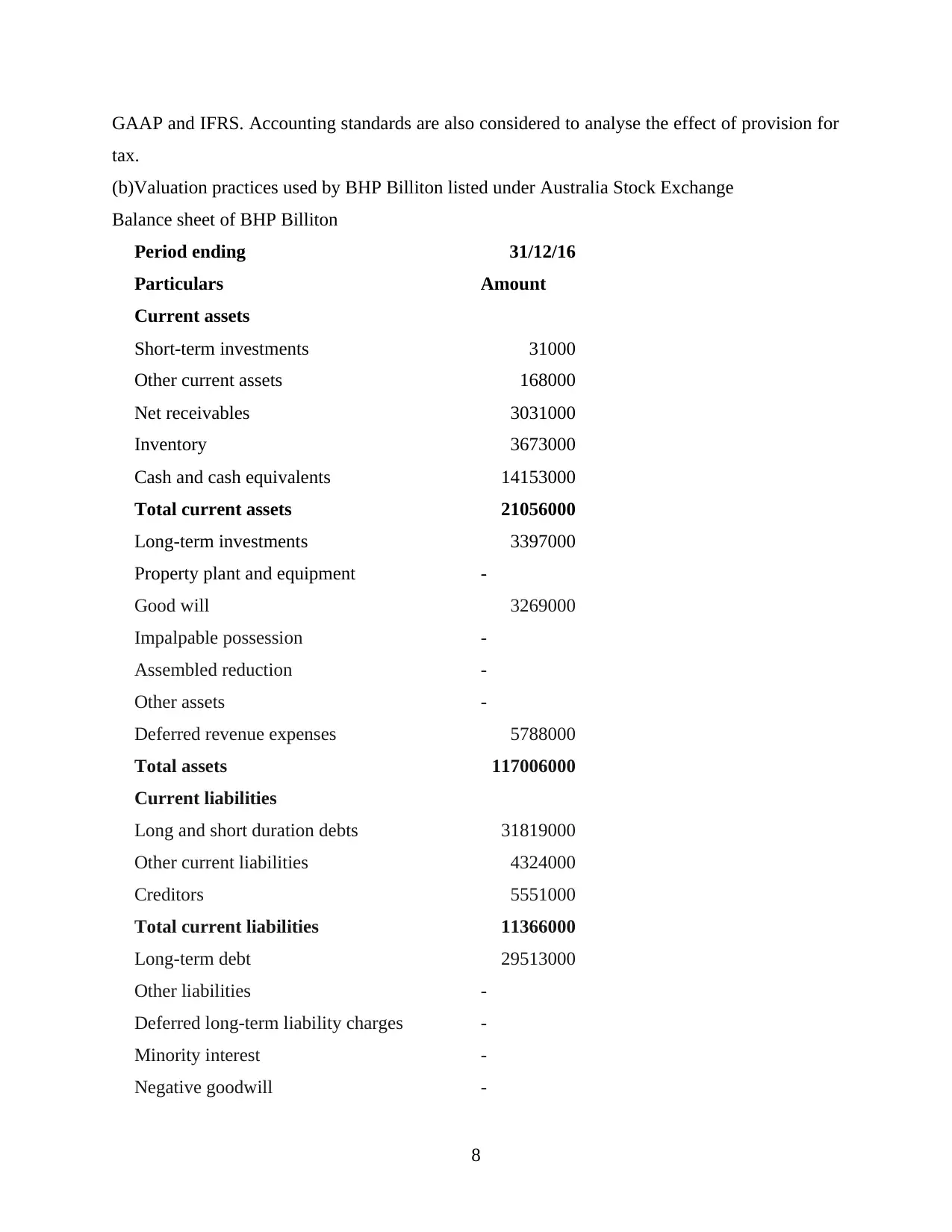

(b)Valuation practices used by BHP Billiton listed under Australia Stock Exchange

Balance sheet of BHP Billiton

Period ending 31/12/16

Particulars Amount

Current assets

Short-term investments 31000

Other current assets 168000

Net receivables 3031000

Inventory 3673000

Cash and cash equivalents 14153000

Total current assets 21056000

Long-term investments 3397000

Property plant and equipment -

Good will 3269000

Impalpable possession -

Assembled reduction -

Other assets -

Deferred revenue expenses 5788000

Total assets 117006000

Current liabilities

Long and short duration debts 31819000

Other current liabilities 4324000

Creditors 5551000

Total current liabilities 11366000

Long-term debt 29513000

Other liabilities -

Deferred long-term liability charges -

Minority interest -

Negative goodwill -

8

tax.

(b)Valuation practices used by BHP Billiton listed under Australia Stock Exchange

Balance sheet of BHP Billiton

Period ending 31/12/16

Particulars Amount

Current assets

Short-term investments 31000

Other current assets 168000

Net receivables 3031000

Inventory 3673000

Cash and cash equivalents 14153000

Total current assets 21056000

Long-term investments 3397000

Property plant and equipment -

Good will 3269000

Impalpable possession -

Assembled reduction -

Other assets -

Deferred revenue expenses 5788000

Total assets 117006000

Current liabilities

Long and short duration debts 31819000

Other current liabilities 4324000

Creditors 5551000

Total current liabilities 11366000

Long-term debt 29513000

Other liabilities -

Deferred long-term liability charges -

Minority interest -

Negative goodwill -

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

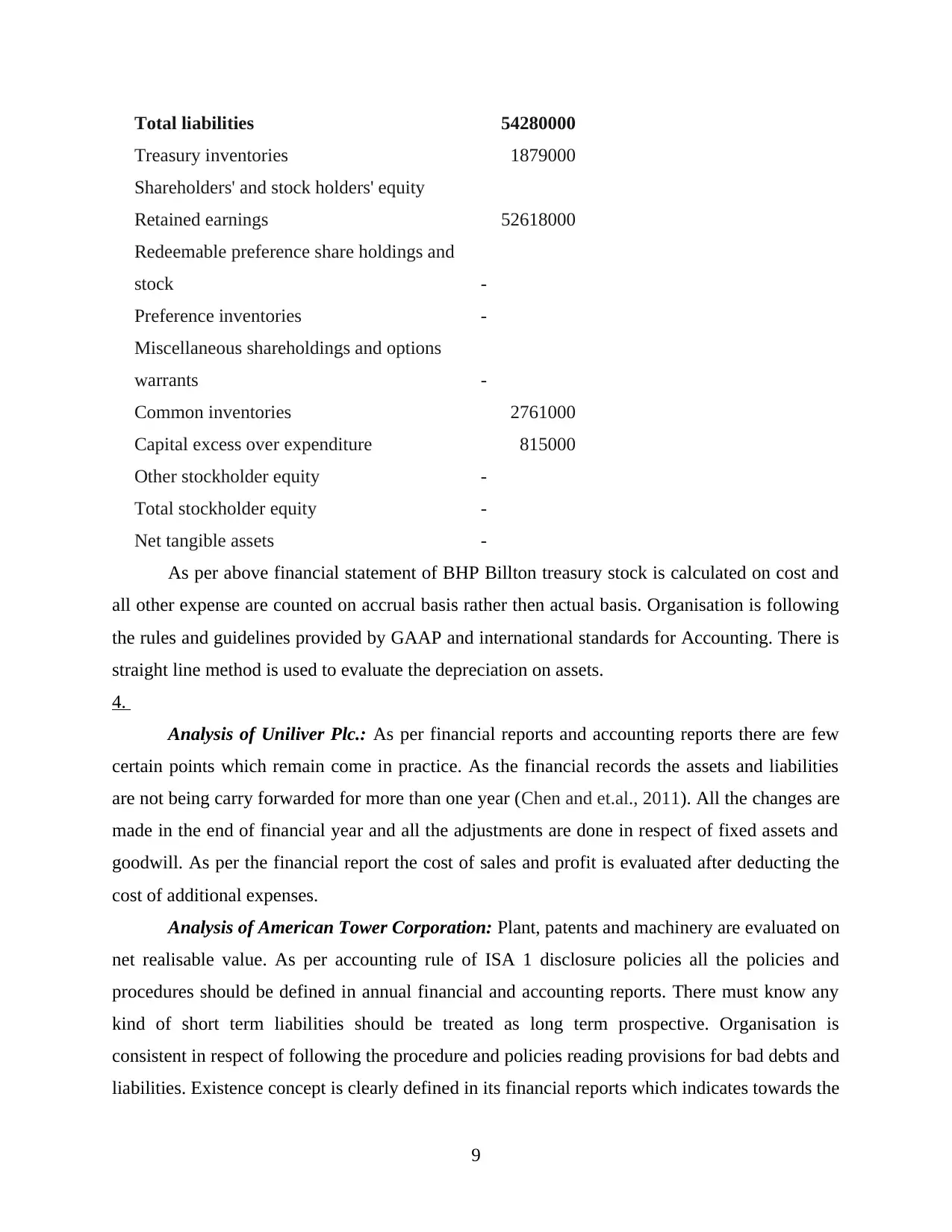

Total liabilities 54280000

Treasury inventories 1879000

Shareholders' and stock holders' equity

Retained earnings 52618000

Redeemable preference share holdings and

stock -

Preference inventories -

Miscellaneous shareholdings and options

warrants -

Common inventories 2761000

Capital excess over expenditure 815000

Other stockholder equity -

Total stockholder equity -

Net tangible assets -

As per above financial statement of BHP Billton treasury stock is calculated on cost and

all other expense are counted on accrual basis rather then actual basis. Organisation is following

the rules and guidelines provided by GAAP and international standards for Accounting. There is

straight line method is used to evaluate the depreciation on assets.

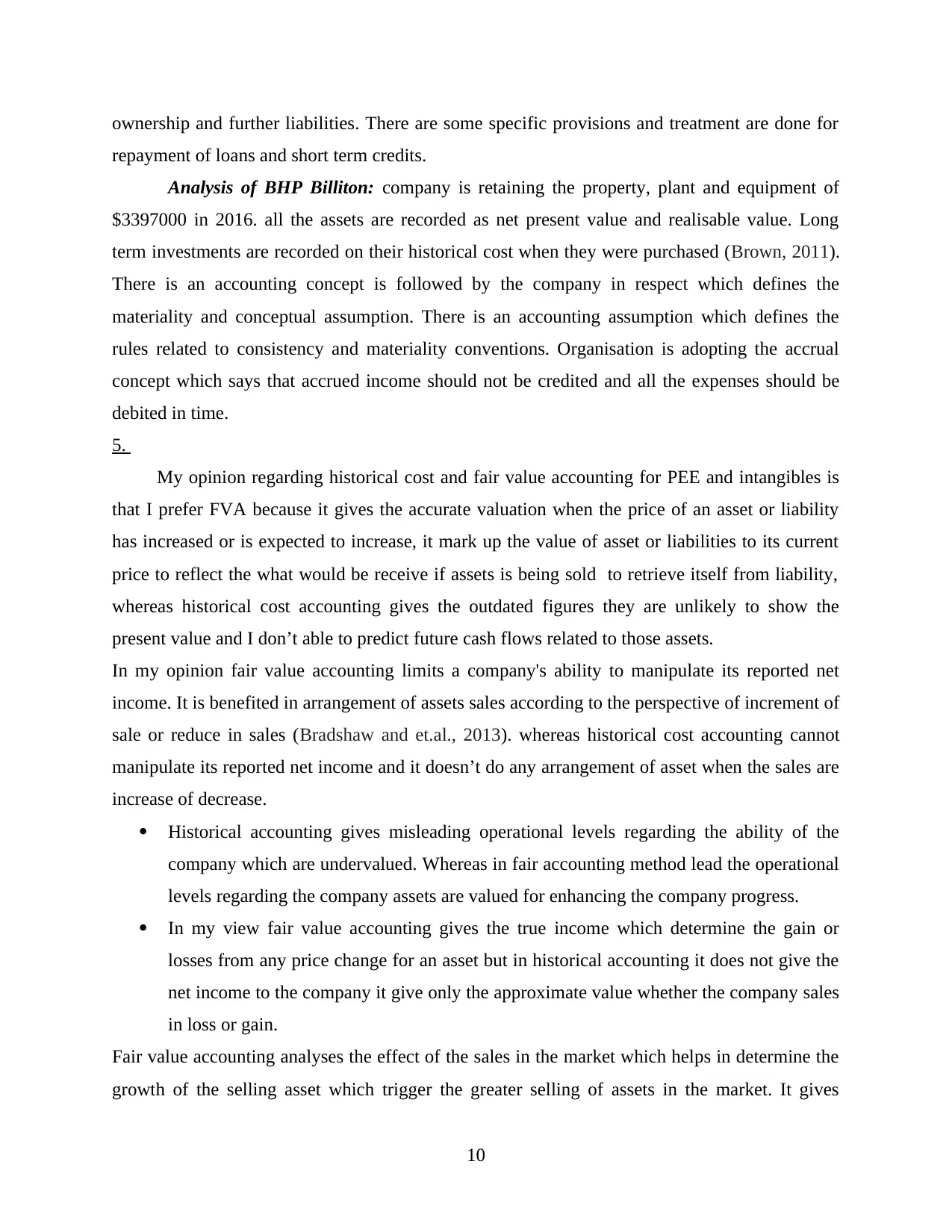

4.

Analysis of Uniliver Plc.: As per financial reports and accounting reports there are few

certain points which remain come in practice. As the financial records the assets and liabilities

are not being carry forwarded for more than one year (Chen and et.al., 2011). All the changes are

made in the end of financial year and all the adjustments are done in respect of fixed assets and

goodwill. As per the financial report the cost of sales and profit is evaluated after deducting the

cost of additional expenses.

Analysis of American Tower Corporation: Plant, patents and machinery are evaluated on

net realisable value. As per accounting rule of ISA 1 disclosure policies all the policies and

procedures should be defined in annual financial and accounting reports. There must know any

kind of short term liabilities should be treated as long term prospective. Organisation is

consistent in respect of following the procedure and policies reading provisions for bad debts and

liabilities. Existence concept is clearly defined in its financial reports which indicates towards the

9

Treasury inventories 1879000

Shareholders' and stock holders' equity

Retained earnings 52618000

Redeemable preference share holdings and

stock -

Preference inventories -

Miscellaneous shareholdings and options

warrants -

Common inventories 2761000

Capital excess over expenditure 815000

Other stockholder equity -

Total stockholder equity -

Net tangible assets -

As per above financial statement of BHP Billton treasury stock is calculated on cost and

all other expense are counted on accrual basis rather then actual basis. Organisation is following

the rules and guidelines provided by GAAP and international standards for Accounting. There is

straight line method is used to evaluate the depreciation on assets.

4.

Analysis of Uniliver Plc.: As per financial reports and accounting reports there are few

certain points which remain come in practice. As the financial records the assets and liabilities

are not being carry forwarded for more than one year (Chen and et.al., 2011). All the changes are

made in the end of financial year and all the adjustments are done in respect of fixed assets and

goodwill. As per the financial report the cost of sales and profit is evaluated after deducting the

cost of additional expenses.

Analysis of American Tower Corporation: Plant, patents and machinery are evaluated on

net realisable value. As per accounting rule of ISA 1 disclosure policies all the policies and

procedures should be defined in annual financial and accounting reports. There must know any

kind of short term liabilities should be treated as long term prospective. Organisation is

consistent in respect of following the procedure and policies reading provisions for bad debts and

liabilities. Existence concept is clearly defined in its financial reports which indicates towards the

9

ownership and further liabilities. There are some specific provisions and treatment are done for

repayment of loans and short term credits.

Analysis of BHP Billiton: company is retaining the property, plant and equipment of

$3397000 in 2016. all the assets are recorded as net present value and realisable value. Long

term investments are recorded on their historical cost when they were purchased (Brown, 2011).

There is an accounting concept is followed by the company in respect which defines the

materiality and conceptual assumption. There is an accounting assumption which defines the

rules related to consistency and materiality conventions. Organisation is adopting the accrual

concept which says that accrued income should not be credited and all the expenses should be

debited in time.

5.

My opinion regarding historical cost and fair value accounting for PEE and intangibles is

that I prefer FVA because it gives the accurate valuation when the price of an asset or liability

has increased or is expected to increase, it mark up the value of asset or liabilities to its current

price to reflect the what would be receive if assets is being sold to retrieve itself from liability,

whereas historical cost accounting gives the outdated figures they are unlikely to show the

present value and I don’t able to predict future cash flows related to those assets.

In my opinion fair value accounting limits a company's ability to manipulate its reported net

income. It is benefited in arrangement of assets sales according to the perspective of increment of

sale or reduce in sales (Bradshaw and et.al., 2013). whereas historical cost accounting cannot

manipulate its reported net income and it doesn’t do any arrangement of asset when the sales are

increase of decrease.

Historical accounting gives misleading operational levels regarding the ability of the

company which are undervalued. Whereas in fair accounting method lead the operational

levels regarding the company assets are valued for enhancing the company progress.

In my view fair value accounting gives the true income which determine the gain or

losses from any price change for an asset but in historical accounting it does not give the

net income to the company it give only the approximate value whether the company sales

in loss or gain.

Fair value accounting analyses the effect of the sales in the market which helps in determine the

growth of the selling asset which trigger the greater selling of assets in the market. It gives

10

repayment of loans and short term credits.

Analysis of BHP Billiton: company is retaining the property, plant and equipment of

$3397000 in 2016. all the assets are recorded as net present value and realisable value. Long

term investments are recorded on their historical cost when they were purchased (Brown, 2011).

There is an accounting concept is followed by the company in respect which defines the

materiality and conceptual assumption. There is an accounting assumption which defines the

rules related to consistency and materiality conventions. Organisation is adopting the accrual

concept which says that accrued income should not be credited and all the expenses should be

debited in time.

5.

My opinion regarding historical cost and fair value accounting for PEE and intangibles is

that I prefer FVA because it gives the accurate valuation when the price of an asset or liability

has increased or is expected to increase, it mark up the value of asset or liabilities to its current

price to reflect the what would be receive if assets is being sold to retrieve itself from liability,

whereas historical cost accounting gives the outdated figures they are unlikely to show the

present value and I don’t able to predict future cash flows related to those assets.

In my opinion fair value accounting limits a company's ability to manipulate its reported net

income. It is benefited in arrangement of assets sales according to the perspective of increment of

sale or reduce in sales (Bradshaw and et.al., 2013). whereas historical cost accounting cannot

manipulate its reported net income and it doesn’t do any arrangement of asset when the sales are

increase of decrease.

Historical accounting gives misleading operational levels regarding the ability of the

company which are undervalued. Whereas in fair accounting method lead the operational

levels regarding the company assets are valued for enhancing the company progress.

In my view fair value accounting gives the true income which determine the gain or

losses from any price change for an asset but in historical accounting it does not give the

net income to the company it give only the approximate value whether the company sales

in loss or gain.

Fair value accounting analyses the effect of the sales in the market which helps in determine the

growth of the selling asset which trigger the greater selling of assets in the market. It gives

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.