Investment Appraisal: Sensitivity Analysis & Capital Budgeting Project

VerifiedAdded on 2023/04/23

|11

|2437

|367

Report

AI Summary

This report provides a detailed analysis of sensitivity and scenario analysis in the context of capital budgeting. It explains the concepts of both analyses, highlighting their advantages and disadvantages in evaluating project viability. Furthermore, the report calculates key financial metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), payback period, discounted payback period, and profitability index for a proposed project. The calculations indicate a positive NPV and a favorable IRR, suggesting the project's financial viability and potential for increasing the organization's profitability. The report concludes that the investment appraisal techniques support the acceptance of the project for investment purposes, emphasizing its potential to generate high income from operations.

Running head: ADVANCE FINANCIAL ACCOUNTING

Advance Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Advance Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ADVANCE FINANCIAL ACCOUNTING

Table of Contents

Question 1:.......................................................................................................................................2

a) Explaining the concept of Sensitivity Analysis:..........................................................................2

b) Explaining the concept of Scenario analysis in capital budgeting process:................................3

Question 2: Calculating the net present value, IRR, Payback period, discounted payback period

and profitability index of the proposed project................................................................................5

References and Bibliography:..........................................................................................................8

Table of Contents

Question 1:.......................................................................................................................................2

a) Explaining the concept of Sensitivity Analysis:..........................................................................2

b) Explaining the concept of Scenario analysis in capital budgeting process:................................3

Question 2: Calculating the net present value, IRR, Payback period, discounted payback period

and profitability index of the proposed project................................................................................5

References and Bibliography:..........................................................................................................8

2ADVANCE FINANCIAL ACCOUNTING

Question 1:

a) Explaining the concept of Sensitivity Analysis:

Sensitivity analysis is an adequate technique, which is used by the organisation for

analysing the critical variables of the project. The sensitivity method portrays the additional

analysis, which is needed by the organisation for evaluating the proposed project’s future

outcome before allowing the investment to be conducted. The sensitivity analysis is conducted

by altering the key assumptions of the capital project for detecting its performance in the long

run. The net present value of the project is an adequate investment appraisal technique, which is

derived from the net cash flows. The change in the variable factors of the NPV will directly alter

its value, which directly indicates that NPV sensitive to the variable factors. In addition, the

sensitivity of a capital budgeting project is analysed with the reference to the level of revenues,

operating margin, expected growth rate in revenues, and working capital requirements

(Borgonovo and Plischke 2016).

The sensitivity analysis directly allows the organisation to understand the impact of

changing variables on the viability of the project to deliver positive cash flows. Moreover, it

could be assumed that change in the selling price by 5% will alter the NPV by 10%, which

directly indicates that NPV is sensitive to change in selling price. Sensitivity analysis involves

certain steps, where adequate identification of the variables is needed for detecting the

quantitative relationship among the variables. Moreover, analysis on the impact of changes on

the NPV is detected to highlight the components, which can alter the value. Iooss and Lemaitre

Question 1:

a) Explaining the concept of Sensitivity Analysis:

Sensitivity analysis is an adequate technique, which is used by the organisation for

analysing the critical variables of the project. The sensitivity method portrays the additional

analysis, which is needed by the organisation for evaluating the proposed project’s future

outcome before allowing the investment to be conducted. The sensitivity analysis is conducted

by altering the key assumptions of the capital project for detecting its performance in the long

run. The net present value of the project is an adequate investment appraisal technique, which is

derived from the net cash flows. The change in the variable factors of the NPV will directly alter

its value, which directly indicates that NPV sensitive to the variable factors. In addition, the

sensitivity of a capital budgeting project is analysed with the reference to the level of revenues,

operating margin, expected growth rate in revenues, and working capital requirements

(Borgonovo and Plischke 2016).

The sensitivity analysis directly allows the organisation to understand the impact of

changing variables on the viability of the project to deliver positive cash flows. Moreover, it

could be assumed that change in the selling price by 5% will alter the NPV by 10%, which

directly indicates that NPV is sensitive to change in selling price. Sensitivity analysis involves

certain steps, where adequate identification of the variables is needed for detecting the

quantitative relationship among the variables. Moreover, analysis on the impact of changes on

the NPV is detected to highlight the components, which can alter the value. Iooss and Lemaitre

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ADVANCE FINANCIAL ACCOUNTING

(2015) mentioned that with the help sensitivity analysis companies are able to understand the

level of alternations that can be made by the variable components of the project.

There are specific advantages and disadvantages of the sensitivity analysis, which can

help in detecting the financial viability of the project. The major advantage of sensitivity analysis

is the benefit it gives to the organisation in viewing a greater visibility to the weak spot in an

investment. This detection of the weakness mainly helps in understanding the level of

improvements that needs to be conducted for raising the performance of the proposed project.

The second advantage of sensitivity analysis is that it allows the management to critically

investigate factors that validate the assumptions of the project. Moreover, the sensitivity analysis

aids the management in making proper decision regarding commencement of the project (Ding

and VanderWeele 2016).

The major disadvantage of sensitivity analysis is that variable is often interdependent,

which make the examining of the components for each individually unrealistic. Moreover, the

sensitivity analysis is based on past data, which might not be effective in future. Furthermore, the

sensitivity analysis is open to subjective interpretation and risk preference, which is different for

each individual or the decision maker. Moreover, the sensitivity analysis method is not

considered as risk measuring or risk reducing technique. Hence, it could be understood that by

using the sensitivity analysis the organisation is not able to gather clear decision rule for the

investment (Pianosi, Sarrazin and Wagener 2015).

b) Explaining the concept of Scenario analysis in capital budgeting process:

The scenario analysis is an effective measure that allows the organisation to evaluate the

performance of the project under number of scenarios. The scenario analysis is considered to be

(2015) mentioned that with the help sensitivity analysis companies are able to understand the

level of alternations that can be made by the variable components of the project.

There are specific advantages and disadvantages of the sensitivity analysis, which can

help in detecting the financial viability of the project. The major advantage of sensitivity analysis

is the benefit it gives to the organisation in viewing a greater visibility to the weak spot in an

investment. This detection of the weakness mainly helps in understanding the level of

improvements that needs to be conducted for raising the performance of the proposed project.

The second advantage of sensitivity analysis is that it allows the management to critically

investigate factors that validate the assumptions of the project. Moreover, the sensitivity analysis

aids the management in making proper decision regarding commencement of the project (Ding

and VanderWeele 2016).

The major disadvantage of sensitivity analysis is that variable is often interdependent,

which make the examining of the components for each individually unrealistic. Moreover, the

sensitivity analysis is based on past data, which might not be effective in future. Furthermore, the

sensitivity analysis is open to subjective interpretation and risk preference, which is different for

each individual or the decision maker. Moreover, the sensitivity analysis method is not

considered as risk measuring or risk reducing technique. Hence, it could be understood that by

using the sensitivity analysis the organisation is not able to gather clear decision rule for the

investment (Pianosi, Sarrazin and Wagener 2015).

b) Explaining the concept of Scenario analysis in capital budgeting process:

The scenario analysis is an effective measure that allows the organisation to evaluate the

performance of the project under number of scenarios. The scenario analysis is considered to be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ADVANCE FINANCIAL ACCOUNTING

more complex than sensitivity analysis, as all the relevant inputs in the method is changed.

Moreover, the scenario analysis is used by the organisation for analysing the expected value of

an investment under number of situations. Moreover, scenario analysis is quite similar to the

simulations, where two extreme and one base case is scenario is used. Bańbura, Giannone and

Lenza (2015) stated that scenario analysis is a decision-making tool, which is used by the

organisation to detect how alternative situations can have impact on its outcome.

The scenario analysis is based on the NPV and IRR value of the project, which eventually

helps in understanding the impact of alternative inputs on the current financial projection of the

project. Scenario analysis has certain steps, which needs to be evaluated by the organisation for

detecting the financial viability of the project. The first step of the scenario analysis is to find the

values of the base case scenario, which comprises of most likely value for each input. This will

help in detecting the base case position of the project, where base rates of cash flow growth, tax

rate, and discount rate is evaluated. The second step is to derive the lowest possible values for

each variables of the project, which help in detecting the worst-case scenario. The worst-case

scenario is evaluated on the basis of NPV and IRR of the project, which helps in detecting the

level of minimum returns that is provided from an investment. Lastly, the highest possible values

for each variables of the project are derived for detecting the best-case scenario of the proposed

project (Bauer et al. 2015).

The scenario analysis process allows the organisation to understand the level of possible

implications and benefits of different approaches of the project. In addition, the scenario analysis

projects all the possible outcomes under base case, worst-case and best-case scenario, which can

be utilised by the organisation, while making adequate investment decisions. Hence, the method

allows the organisation to see the possible consequence and benefit from the project under

more complex than sensitivity analysis, as all the relevant inputs in the method is changed.

Moreover, the scenario analysis is used by the organisation for analysing the expected value of

an investment under number of situations. Moreover, scenario analysis is quite similar to the

simulations, where two extreme and one base case is scenario is used. Bańbura, Giannone and

Lenza (2015) stated that scenario analysis is a decision-making tool, which is used by the

organisation to detect how alternative situations can have impact on its outcome.

The scenario analysis is based on the NPV and IRR value of the project, which eventually

helps in understanding the impact of alternative inputs on the current financial projection of the

project. Scenario analysis has certain steps, which needs to be evaluated by the organisation for

detecting the financial viability of the project. The first step of the scenario analysis is to find the

values of the base case scenario, which comprises of most likely value for each input. This will

help in detecting the base case position of the project, where base rates of cash flow growth, tax

rate, and discount rate is evaluated. The second step is to derive the lowest possible values for

each variables of the project, which help in detecting the worst-case scenario. The worst-case

scenario is evaluated on the basis of NPV and IRR of the project, which helps in detecting the

level of minimum returns that is provided from an investment. Lastly, the highest possible values

for each variables of the project are derived for detecting the best-case scenario of the proposed

project (Bauer et al. 2015).

The scenario analysis process allows the organisation to understand the level of possible

implications and benefits of different approaches of the project. In addition, the scenario analysis

projects all the possible outcomes under base case, worst-case and best-case scenario, which can

be utilised by the organisation, while making adequate investment decisions. Hence, the method

allows the organisation to see the possible consequence and benefit from the project under

5ADVANCE FINANCIAL ACCOUNTING

different sets of factors. There are some disadvantages of scenario analysis, which is mainly

focused on the interpretation of its results. The parameters of the analysis are subjective in

nature, which in turn in very difficult to measure by the organisation. Hence, the method can

pose difficulty for the organisation, while analysing the performance of a project on future date

(Pinngarm et al. 2017).

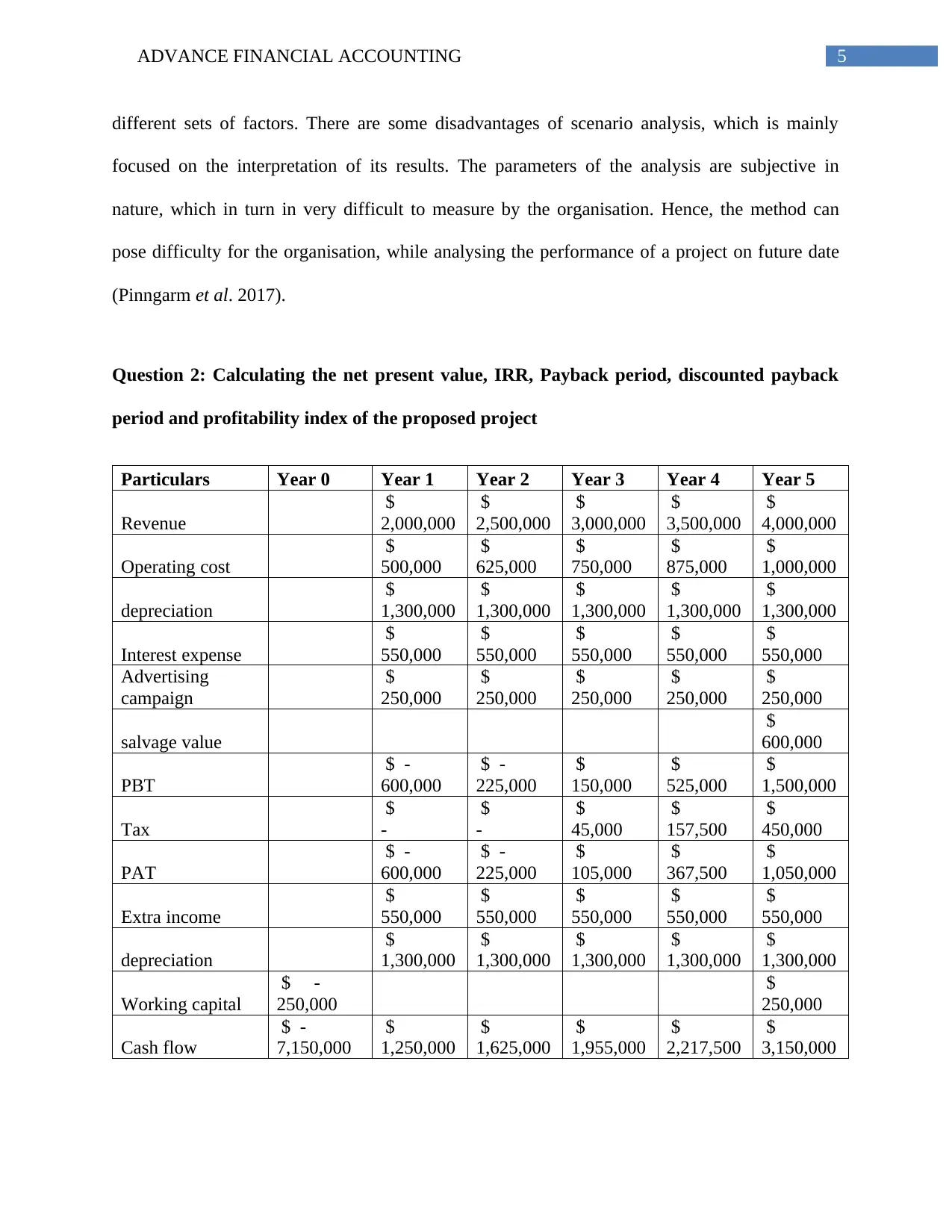

Question 2: Calculating the net present value, IRR, Payback period, discounted payback

period and profitability index of the proposed project

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Revenue

$

2,000,000

$

2,500,000

$

3,000,000

$

3,500,000

$

4,000,000

Operating cost

$

500,000

$

625,000

$

750,000

$

875,000

$

1,000,000

depreciation

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

Interest expense

$

550,000

$

550,000

$

550,000

$

550,000

$

550,000

Advertising

campaign

$

250,000

$

250,000

$

250,000

$

250,000

$

250,000

salvage value

$

600,000

PBT

$ -

600,000

$ -

225,000

$

150,000

$

525,000

$

1,500,000

Tax

$

-

$

-

$

45,000

$

157,500

$

450,000

PAT

$ -

600,000

$ -

225,000

$

105,000

$

367,500

$

1,050,000

Extra income

$

550,000

$

550,000

$

550,000

$

550,000

$

550,000

depreciation

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

Working capital

$ -

250,000

$

250,000

Cash flow

$ -

7,150,000

$

1,250,000

$

1,625,000

$

1,955,000

$

2,217,500

$

3,150,000

different sets of factors. There are some disadvantages of scenario analysis, which is mainly

focused on the interpretation of its results. The parameters of the analysis are subjective in

nature, which in turn in very difficult to measure by the organisation. Hence, the method can

pose difficulty for the organisation, while analysing the performance of a project on future date

(Pinngarm et al. 2017).

Question 2: Calculating the net present value, IRR, Payback period, discounted payback

period and profitability index of the proposed project

Particulars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Revenue

$

2,000,000

$

2,500,000

$

3,000,000

$

3,500,000

$

4,000,000

Operating cost

$

500,000

$

625,000

$

750,000

$

875,000

$

1,000,000

depreciation

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

Interest expense

$

550,000

$

550,000

$

550,000

$

550,000

$

550,000

Advertising

campaign

$

250,000

$

250,000

$

250,000

$

250,000

$

250,000

salvage value

$

600,000

PBT

$ -

600,000

$ -

225,000

$

150,000

$

525,000

$

1,500,000

Tax

$

-

$

-

$

45,000

$

157,500

$

450,000

PAT

$ -

600,000

$ -

225,000

$

105,000

$

367,500

$

1,050,000

Extra income

$

550,000

$

550,000

$

550,000

$

550,000

$

550,000

depreciation

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

$

1,300,000

Working capital

$ -

250,000

$

250,000

Cash flow

$ -

7,150,000

$

1,250,000

$

1,625,000

$

1,955,000

$

2,217,500

$

3,150,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ADVANCE FINANCIAL ACCOUNTING

Yea

r Cash Flow

Discounting

rate Dis-cashflow

Cumm-

cashflow

Dis Cumm-

cashflow

0

$ -

7,150,000 1.00

$ -

7,150,000

$ -

7,150,000 $ -7,150,000

1

$

1,250,000 0.91

$

1,136,364

$ -

5,900,000 $ -6,013,636

2

$

1,625,000 0.83

$

1,342,975

$ -

4,275,000 $ -4,670,661

3

$

1,955,000 0.75

$

1,468,820

$ -

2,320,000 $ -3,201,841

4

$

2,217,500 0.68

$

1,514,582

$ -

102,500 $ -1,687,258

5

$

3,150,000 0.62

$

1,955,902

$

3,047,500 $ 268,644

NPV $ 268,643.78

IRR 11.26%

Payback period 4.0 Years

Dis-Payback period 4.5 Years

Profitability Index 1.04

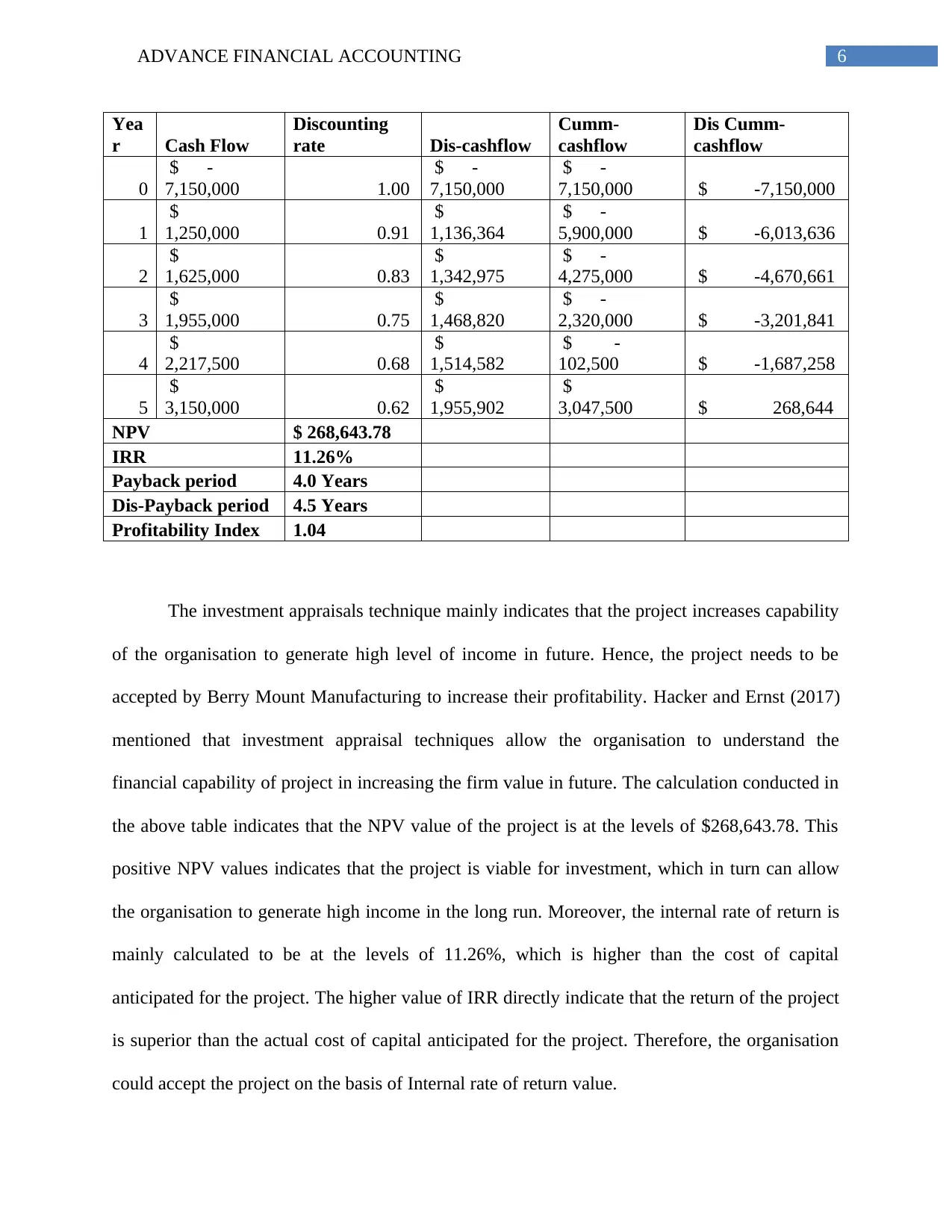

The investment appraisals technique mainly indicates that the project increases capability

of the organisation to generate high level of income in future. Hence, the project needs to be

accepted by Berry Mount Manufacturing to increase their profitability. Hacker and Ernst (2017)

mentioned that investment appraisal techniques allow the organisation to understand the

financial capability of project in increasing the firm value in future. The calculation conducted in

the above table indicates that the NPV value of the project is at the levels of $268,643.78. This

positive NPV values indicates that the project is viable for investment, which in turn can allow

the organisation to generate high income in the long run. Moreover, the internal rate of return is

mainly calculated to be at the levels of 11.26%, which is higher than the cost of capital

anticipated for the project. The higher value of IRR directly indicate that the return of the project

is superior than the actual cost of capital anticipated for the project. Therefore, the organisation

could accept the project on the basis of Internal rate of return value.

Yea

r Cash Flow

Discounting

rate Dis-cashflow

Cumm-

cashflow

Dis Cumm-

cashflow

0

$ -

7,150,000 1.00

$ -

7,150,000

$ -

7,150,000 $ -7,150,000

1

$

1,250,000 0.91

$

1,136,364

$ -

5,900,000 $ -6,013,636

2

$

1,625,000 0.83

$

1,342,975

$ -

4,275,000 $ -4,670,661

3

$

1,955,000 0.75

$

1,468,820

$ -

2,320,000 $ -3,201,841

4

$

2,217,500 0.68

$

1,514,582

$ -

102,500 $ -1,687,258

5

$

3,150,000 0.62

$

1,955,902

$

3,047,500 $ 268,644

NPV $ 268,643.78

IRR 11.26%

Payback period 4.0 Years

Dis-Payback period 4.5 Years

Profitability Index 1.04

The investment appraisals technique mainly indicates that the project increases capability

of the organisation to generate high level of income in future. Hence, the project needs to be

accepted by Berry Mount Manufacturing to increase their profitability. Hacker and Ernst (2017)

mentioned that investment appraisal techniques allow the organisation to understand the

financial capability of project in increasing the firm value in future. The calculation conducted in

the above table indicates that the NPV value of the project is at the levels of $268,643.78. This

positive NPV values indicates that the project is viable for investment, which in turn can allow

the organisation to generate high income in the long run. Moreover, the internal rate of return is

mainly calculated to be at the levels of 11.26%, which is higher than the cost of capital

anticipated for the project. The higher value of IRR directly indicate that the return of the project

is superior than the actual cost of capital anticipated for the project. Therefore, the organisation

could accept the project on the basis of Internal rate of return value.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ADVANCE FINANCIAL ACCOUNTING

Furthermore, the payback period and the discounted payback period of the project is

lower than 5 years, which indicates that the initial investment will be recovered within the life-

cycle of the project. The payback period is only calculated by the company to understand the

minimum time that will be taken by the project to return the investment capital. However, the

method does not provide in-depth knowledge regarding the projects capability for detecting

capability of the project to increase returns of the organisation. The profitability index of the

proposed project is mainly at the levels of 1.04, which is higher than 1. This directly indicates

that the project has a viable option for the organisation to generate high level of income from

operations.

The investment appraisal techniques calculated for the proposed project directly indicates

its positive financial viability. Hence, the organisation can select the project for investment

purposes to raise the level of income from operations.

Furthermore, the payback period and the discounted payback period of the project is

lower than 5 years, which indicates that the initial investment will be recovered within the life-

cycle of the project. The payback period is only calculated by the company to understand the

minimum time that will be taken by the project to return the investment capital. However, the

method does not provide in-depth knowledge regarding the projects capability for detecting

capability of the project to increase returns of the organisation. The profitability index of the

proposed project is mainly at the levels of 1.04, which is higher than 1. This directly indicates

that the project has a viable option for the organisation to generate high level of income from

operations.

The investment appraisal techniques calculated for the proposed project directly indicates

its positive financial viability. Hence, the organisation can select the project for investment

purposes to raise the level of income from operations.

8ADVANCE FINANCIAL ACCOUNTING

References and Bibliography:

Bańbura, M., Giannone, D. and Lenza, M., 2015. Conditional forecasts and scenario analysis

with vector autoregressions for large cross-sections. International Journal of Forecasting, 31(3),

pp.739-756.

Bauer, C., Hofer, J., Althaus, H.J., Del Duce, A. and Simons, A., 2015. The environmental

performance of current and future passenger vehicles: life cycle assessment based on a novel

scenario analysis framework. Applied energy, 157, pp.871-883.

Borgonovo, E. and Plischke, E., 2016. Sensitivity analysis: a review of recent

advances. European Journal of Operational Research, 248(3), pp.869-887.

Borgonovo, E. and Plischke, E., 2016. Sensitivity analysis: a review of recent

advances. European Journal of Operational Research, 248(3), pp.869-887.

Ding, P. and VanderWeele, T.J., 2016. Sensitivity analysis without assumptions. Epidemiology

(Cambridge, Mass.), 27(3), p.368.

Gao, L., Bryan, B.A., Nolan, M., Connor, J.D., Song, X. and Zhao, G., 2016. Robust global

sensitivity analysis under deep uncertainty via scenario analysis. Environmental Modelling &

Software, 76, pp.154-166.

Häcker, J. and Ernst, D., 2017. Investment Appraisal. In Financial Modeling (pp. 343-384).

Palgrave Macmillan, London.

References and Bibliography:

Bańbura, M., Giannone, D. and Lenza, M., 2015. Conditional forecasts and scenario analysis

with vector autoregressions for large cross-sections. International Journal of Forecasting, 31(3),

pp.739-756.

Bauer, C., Hofer, J., Althaus, H.J., Del Duce, A. and Simons, A., 2015. The environmental

performance of current and future passenger vehicles: life cycle assessment based on a novel

scenario analysis framework. Applied energy, 157, pp.871-883.

Borgonovo, E. and Plischke, E., 2016. Sensitivity analysis: a review of recent

advances. European Journal of Operational Research, 248(3), pp.869-887.

Borgonovo, E. and Plischke, E., 2016. Sensitivity analysis: a review of recent

advances. European Journal of Operational Research, 248(3), pp.869-887.

Ding, P. and VanderWeele, T.J., 2016. Sensitivity analysis without assumptions. Epidemiology

(Cambridge, Mass.), 27(3), p.368.

Gao, L., Bryan, B.A., Nolan, M., Connor, J.D., Song, X. and Zhao, G., 2016. Robust global

sensitivity analysis under deep uncertainty via scenario analysis. Environmental Modelling &

Software, 76, pp.154-166.

Häcker, J. and Ernst, D., 2017. Investment Appraisal. In Financial Modeling (pp. 343-384).

Palgrave Macmillan, London.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ADVANCE FINANCIAL ACCOUNTING

Iooss, B. and Lemaître, P., 2015. A review on global sensitivity analysis methods. In Uncertainty

management in simulation-optimization of complex systems (pp. 101-122). Springer, Boston,

MA.

Konstantin, P. and Konstantin, M., 2018. Investment Appraisal Methods. In Power and Energy

Systems Engineering Economics (pp. 39-64). Springer, Cham.

Li, F.G. and Trutnevyte, E., 2017. Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, pp.89-109.

Locatelli, G., Invernizzi, D.C. and Mancini, M., 2016. Investment and risk appraisal in energy

storage systems: A real options approach. Energy, 104, pp.114-131.

Pianosi, F., Beven, K., Freer, J., Hall, J.W., Rougier, J., Stephenson, D.B. and Wagener, T.,

2016. Sensitivity analysis of environmental models: A systematic review with practical

workflow. Environmental Modelling & Software, 79, pp.214-232.

Pianosi, F., Sarrazin, F. and Wagener, T., 2015. A Matlab toolbox for global sensitivity

analysis. Environmental Modelling & Software, 70, pp.80-85.

Pinngarm, P., Ninsonti, H., Pavasant, P., Jesdapipat, S. and Setthapun, W., 2017. Scenario

analysis for Green City model: Case study of Chiang Mai World Green City Model,

Thailand. Journal of Renewable Energy and Smart Grid Technology, 12(1), pp.23-36.

Upton, J., Murphy, M., De Boer, I.J.M., Koerkamp, P.G., Berentsen, P.B.M. and Shalloo, L.,

2015. Investment appraisal of technology innovations on dairy farm electricity

consumption. Journal of dairy science, 98(2), pp.898-909.

Iooss, B. and Lemaître, P., 2015. A review on global sensitivity analysis methods. In Uncertainty

management in simulation-optimization of complex systems (pp. 101-122). Springer, Boston,

MA.

Konstantin, P. and Konstantin, M., 2018. Investment Appraisal Methods. In Power and Energy

Systems Engineering Economics (pp. 39-64). Springer, Cham.

Li, F.G. and Trutnevyte, E., 2017. Investment appraisal of cost-optimal and near-optimal

pathways for the UK electricity sector transition to 2050. Applied energy, 189, pp.89-109.

Locatelli, G., Invernizzi, D.C. and Mancini, M., 2016. Investment and risk appraisal in energy

storage systems: A real options approach. Energy, 104, pp.114-131.

Pianosi, F., Beven, K., Freer, J., Hall, J.W., Rougier, J., Stephenson, D.B. and Wagener, T.,

2016. Sensitivity analysis of environmental models: A systematic review with practical

workflow. Environmental Modelling & Software, 79, pp.214-232.

Pianosi, F., Sarrazin, F. and Wagener, T., 2015. A Matlab toolbox for global sensitivity

analysis. Environmental Modelling & Software, 70, pp.80-85.

Pinngarm, P., Ninsonti, H., Pavasant, P., Jesdapipat, S. and Setthapun, W., 2017. Scenario

analysis for Green City model: Case study of Chiang Mai World Green City Model,

Thailand. Journal of Renewable Energy and Smart Grid Technology, 12(1), pp.23-36.

Upton, J., Murphy, M., De Boer, I.J.M., Koerkamp, P.G., Berentsen, P.B.M. and Shalloo, L.,

2015. Investment appraisal of technology innovations on dairy farm electricity

consumption. Journal of dairy science, 98(2), pp.898-909.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ADVANCE FINANCIAL ACCOUNTING

VanderWeele, T.J. and Ding, P., 2017. Sensitivity analysis in observational research: introducing

the E-value. Annals of internal medicine, 167(4), pp.268-274.

VanderWeele, T.J. and Ding, P., 2017. Sensitivity analysis in observational research: introducing

the E-value. Annals of internal medicine, 167(4), pp.268-274.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.