CPA Advanced Taxation: Dr. Wong's Residency & Income Tax Assessment

VerifiedAdded on 2023/06/10

|10

|2263

|272

Case Study

AI Summary

This assignment provides a comprehensive analysis of Dr. Peter Wong's tax residency status in Australia from 2015 to 2018, considering his move to New York and subsequent income streams. It applies relevant sections of the ITAA 1936 and ITAA 1997, alongside case law, to determine his residency under the reside test, domicile test, 183-day test, and superannuation test. The analysis calculates his Australian assessable income for each year, including salaries, rental income, dividends, and interest, while accounting for foreign income tax offsets. Furthermore, it examines the tax implications of Joseph's superannuation lump sum benefit, applying relevant taxation rulings and acts to calculate the total tax payable. The document provides a detailed overview of Dr. Wong's tax obligations and liabilities based on his residency status and income sources.

Running head: ADVANCE TAXATION

Advance Taxation

Name of the Student

Name of the University

Authors Note

Course ID

Advance Taxation

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ADVANCE TAXATION

Table of Contents

Answer to question 1 A:.............................................................................................................2

Answer to Question B:...............................................................................................................5

Answer to Question 2:................................................................................................................7

References:.................................................................................................................................9

Table of Contents

Answer to question 1 A:.............................................................................................................2

Answer to Question B:...............................................................................................................5

Answer to Question 2:................................................................................................................7

References:.................................................................................................................................9

2ADVANCE TAXATION

Answer to question 1 A:

According to “section 6 (1) of the ITAA 1936” an Australian resident represents the

person other than the company that is residing in Australia and consist of the person that has

their domicile in Australian unless the commissioner is content that the person’s permanent

place of resident is outside Australia (Woellner et al. 2016). It also includes person that has

been Australia either on continuous basis or intermittently for more than one-half of the

income year except the commissioner is content that the person’s actual place of abode of

outside Australia and does not intends of taking up Australian residency. To determine the

residency test of an individual there are four alternate test. This includes;

a. Resides Test

b. Domicile Test

c. 183 Days Test

d. Superannuation Test

The current case study is based on determining whether Dr Wong would be held as

the Australian resident for taxation purpose for the period of 1st July 2015 to 30 June 2018.

Reside Test:

The Reside test represents that dwell permanently or for the considerable time period.

The court of law in “FCT v Miller (1946)” stated that residency of the person is reliant on

the circumstances of the case or by observing into the character of an individual behaviour

while their stay in Australia (Braithwaite 2017). The “taxation ruling of 98/17” explains that

the intention of taxpayer or the purpose of presence is necessary in determining the residency

test. As evident from the situation of Dr Wong it is noticed that he stayed in Australia and

was the Australian resident for the period of 2015. Dr Wong also held the property in Sydney

which was leased out by him during his visit to New York. With reference to the case of

Answer to question 1 A:

According to “section 6 (1) of the ITAA 1936” an Australian resident represents the

person other than the company that is residing in Australia and consist of the person that has

their domicile in Australian unless the commissioner is content that the person’s permanent

place of resident is outside Australia (Woellner et al. 2016). It also includes person that has

been Australia either on continuous basis or intermittently for more than one-half of the

income year except the commissioner is content that the person’s actual place of abode of

outside Australia and does not intends of taking up Australian residency. To determine the

residency test of an individual there are four alternate test. This includes;

a. Resides Test

b. Domicile Test

c. 183 Days Test

d. Superannuation Test

The current case study is based on determining whether Dr Wong would be held as

the Australian resident for taxation purpose for the period of 1st July 2015 to 30 June 2018.

Reside Test:

The Reside test represents that dwell permanently or for the considerable time period.

The court of law in “FCT v Miller (1946)” stated that residency of the person is reliant on

the circumstances of the case or by observing into the character of an individual behaviour

while their stay in Australia (Braithwaite 2017). The “taxation ruling of 98/17” explains that

the intention of taxpayer or the purpose of presence is necessary in determining the residency

test. As evident from the situation of Dr Wong it is noticed that he stayed in Australia and

was the Australian resident for the period of 2015. Dr Wong also held the property in Sydney

which was leased out by him during his visit to New York. With reference to the case of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ADVANCE TAXATION

“FCT v Sneddon (2012)” it can be stated that Dr Wong for the period of 2015 was the

Australian resident under the Reside Test (Saad 2014). In the later instances it was noticed

that Dr Wong permanently moved to New York. Commencing from the year 1st January 2016

Dr Wong would not be held as the Australian resident under the Reside Test as the taxpayer

did not expressed the interest of residing in Australia.

Domicile Test:

According to “section 6 (1) (a) of the ITAA 1997” an individual would be held as

the Australian resident if the person has the domicile in Australian, unless it is found that a

person has the permanent place of abode outside of Australia. As evident Dr Wong held the

resident in Australia during his stay in New York. Citing the reference of “FCT v Applegate

(1979)” the court of law stated that the permanent does not represents everlasting or forever

and it is evaluated objectively for each year (Robin 2017). The permanent place of abode for

Dr Wong was in Australia and under the “Domicile Act 1982” he would be held as the

Australian resident for the income tax year ended 2015. However, from the year 2016

onwards Dr Wong cannot be held as the Australian resident since the taxpayer has abandoned

his residence that he held in Australia.

183 Days Test:

Under the 183 days test an individual would be considered as the Australian resident

if the person has been present in Australia either on continuous basis or intermittently for

more than half of the income year. An exception is that a person would not be held as the

Australian resident if he does not hold the intention of taking up the Australian residency

(Maley 2018). With respect to the 183 days test Dr Wong would only be held as the

Australian resident Australia for the year 2015 since he did spent around 183 days in

Australia however late for years 2016, 2017 and 2018 he will be not be considered resident of

“FCT v Sneddon (2012)” it can be stated that Dr Wong for the period of 2015 was the

Australian resident under the Reside Test (Saad 2014). In the later instances it was noticed

that Dr Wong permanently moved to New York. Commencing from the year 1st January 2016

Dr Wong would not be held as the Australian resident under the Reside Test as the taxpayer

did not expressed the interest of residing in Australia.

Domicile Test:

According to “section 6 (1) (a) of the ITAA 1997” an individual would be held as

the Australian resident if the person has the domicile in Australian, unless it is found that a

person has the permanent place of abode outside of Australia. As evident Dr Wong held the

resident in Australia during his stay in New York. Citing the reference of “FCT v Applegate

(1979)” the court of law stated that the permanent does not represents everlasting or forever

and it is evaluated objectively for each year (Robin 2017). The permanent place of abode for

Dr Wong was in Australia and under the “Domicile Act 1982” he would be held as the

Australian resident for the income tax year ended 2015. However, from the year 2016

onwards Dr Wong cannot be held as the Australian resident since the taxpayer has abandoned

his residence that he held in Australia.

183 Days Test:

Under the 183 days test an individual would be considered as the Australian resident

if the person has been present in Australia either on continuous basis or intermittently for

more than half of the income year. An exception is that a person would not be held as the

Australian resident if he does not hold the intention of taking up the Australian residency

(Maley 2018). With respect to the 183 days test Dr Wong would only be held as the

Australian resident Australia for the year 2015 since he did spent around 183 days in

Australia however late for years 2016, 2017 and 2018 he will be not be considered resident of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ADVANCE TAXATION

Australia. This is because the permanent place of abode for the taxpayer was outside of

Australia.

Superannuation Test:

The superannuation test is not applicable for Dr Wong since he is not the member of a

commonwealth superannuation fund.

The source of fund is also important consideration while determining the resident

status. The “Subsection 6-5(3) (a) and 6-10(5)(a) of ITAA 1997” argue that income from

Australia sources help decide the virtue (Maley 2018). Dr Wong received salary from Apex

into his Australian bank of $ 50,000 each month during 2015 and therefore despite being the

fact that he was in the New York during second half period of 2015, he will be considered as

resident of Australia. The case law of “Nathan v FCT (1918) 25 CLR 183” ague that real

source of income help determine the resident status. Dr Wong received Australian income

during the year 2015 however he started getting annual salary of $100,000 plus travel

allowance of $10,000 from New York University starting Jan 2016 hence he will be

considered resident of the United States from 2016 onwards.

Dr Wong residency status will be as follows based on legislation, case law and

relevant tax rulings:

2015 – Australian residency (source of fund, 183 day test, domicile test).

2016 to 2018 – Non-resident Australian (source of fund, 183 day test).

Hence, Dr Wong will only be considered Australian resident for one year of 2015 and

for rest he will be considered as non-resident Australian and his income is subjected to non-

taxation in the Australia due to being non-resident of Australia.

Australia. This is because the permanent place of abode for the taxpayer was outside of

Australia.

Superannuation Test:

The superannuation test is not applicable for Dr Wong since he is not the member of a

commonwealth superannuation fund.

The source of fund is also important consideration while determining the resident

status. The “Subsection 6-5(3) (a) and 6-10(5)(a) of ITAA 1997” argue that income from

Australia sources help decide the virtue (Maley 2018). Dr Wong received salary from Apex

into his Australian bank of $ 50,000 each month during 2015 and therefore despite being the

fact that he was in the New York during second half period of 2015, he will be considered as

resident of Australia. The case law of “Nathan v FCT (1918) 25 CLR 183” ague that real

source of income help determine the resident status. Dr Wong received Australian income

during the year 2015 however he started getting annual salary of $100,000 plus travel

allowance of $10,000 from New York University starting Jan 2016 hence he will be

considered resident of the United States from 2016 onwards.

Dr Wong residency status will be as follows based on legislation, case law and

relevant tax rulings:

2015 – Australian residency (source of fund, 183 day test, domicile test).

2016 to 2018 – Non-resident Australian (source of fund, 183 day test).

Hence, Dr Wong will only be considered Australian resident for one year of 2015 and

for rest he will be considered as non-resident Australian and his income is subjected to non-

taxation in the Australia due to being non-resident of Australia.

5ADVANCE TAXATION

Answer to Question B:

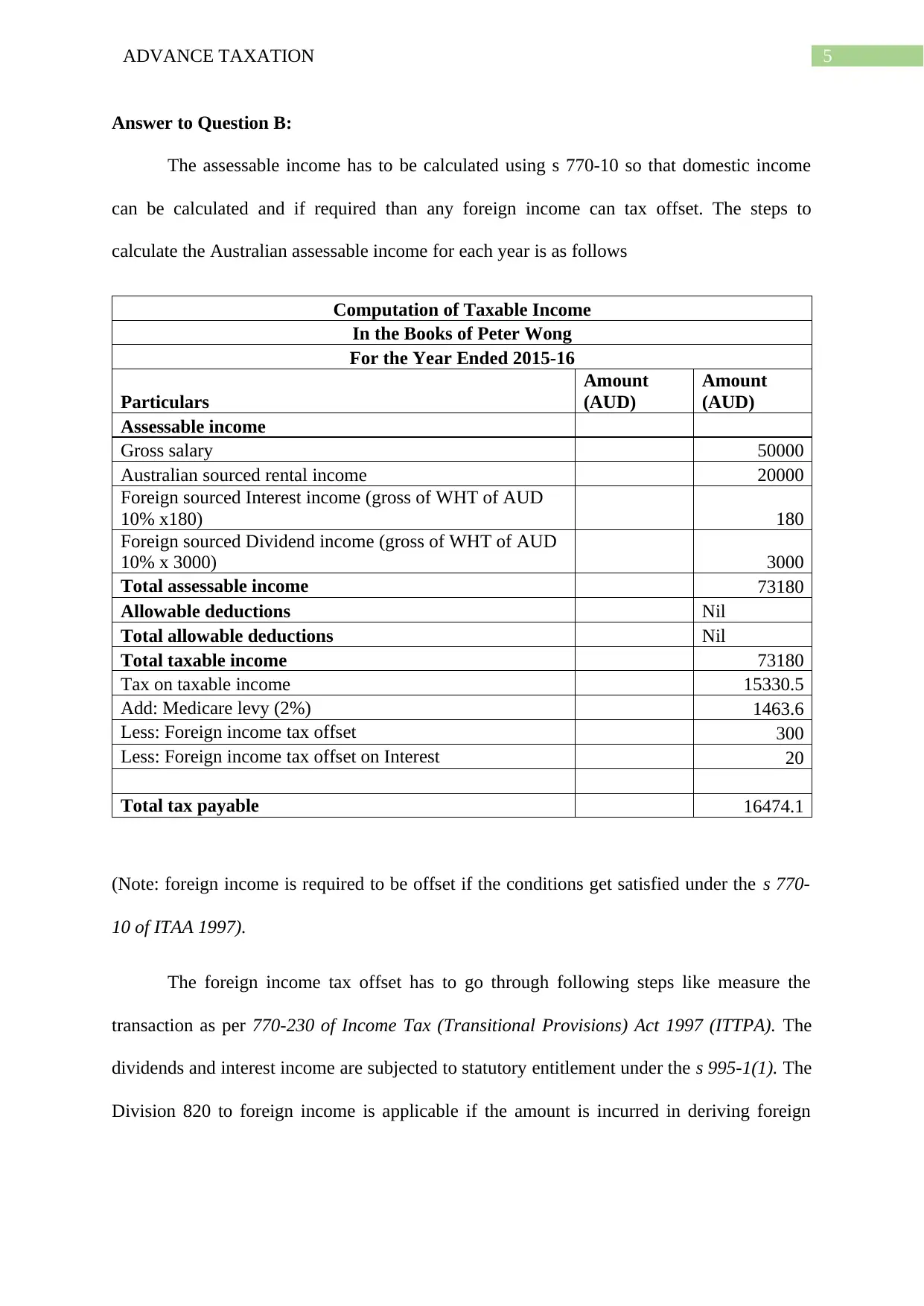

The assessable income has to be calculated using s 770-10 so that domestic income

can be calculated and if required than any foreign income can tax offset. The steps to

calculate the Australian assessable income for each year is as follows

Computation of Taxable Income

In the Books of Peter Wong

For the Year Ended 2015-16

Particulars

Amount

(AUD)

Amount

(AUD)

Assessable income

Gross salary 50000

Australian sourced rental income 20000

Foreign sourced Interest income (gross of WHT of AUD

10% x180) 180

Foreign sourced Dividend income (gross of WHT of AUD

10% x 3000) 3000

Total assessable income 73180

Allowable deductions Nil

Total allowable deductions Nil

Total taxable income 73180

Tax on taxable income 15330.5

Add: Medicare levy (2%) 1463.6

Less: Foreign income tax offset 300

Less: Foreign income tax offset on Interest 20

Total tax payable 16474.1

(Note: foreign income is required to be offset if the conditions get satisfied under the s 770-

10 of ITAA 1997).

The foreign income tax offset has to go through following steps like measure the

transaction as per 770-230 of Income Tax (Transitional Provisions) Act 1997 (ITTPA). The

dividends and interest income are subjected to statutory entitlement under the s 995-1(1). The

Division 820 to foreign income is applicable if the amount is incurred in deriving foreign

Answer to Question B:

The assessable income has to be calculated using s 770-10 so that domestic income

can be calculated and if required than any foreign income can tax offset. The steps to

calculate the Australian assessable income for each year is as follows

Computation of Taxable Income

In the Books of Peter Wong

For the Year Ended 2015-16

Particulars

Amount

(AUD)

Amount

(AUD)

Assessable income

Gross salary 50000

Australian sourced rental income 20000

Foreign sourced Interest income (gross of WHT of AUD

10% x180) 180

Foreign sourced Dividend income (gross of WHT of AUD

10% x 3000) 3000

Total assessable income 73180

Allowable deductions Nil

Total allowable deductions Nil

Total taxable income 73180

Tax on taxable income 15330.5

Add: Medicare levy (2%) 1463.6

Less: Foreign income tax offset 300

Less: Foreign income tax offset on Interest 20

Total tax payable 16474.1

(Note: foreign income is required to be offset if the conditions get satisfied under the s 770-

10 of ITAA 1997).

The foreign income tax offset has to go through following steps like measure the

transaction as per 770-230 of Income Tax (Transitional Provisions) Act 1997 (ITTPA). The

dividends and interest income are subjected to statutory entitlement under the s 995-1(1). The

Division 820 to foreign income is applicable if the amount is incurred in deriving foreign

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ADVANCE TAXATION

income like dividends income and interest income from US based sources (Braithwaite

2017). The interest withholding tax of 10% comes under s 128B (2).

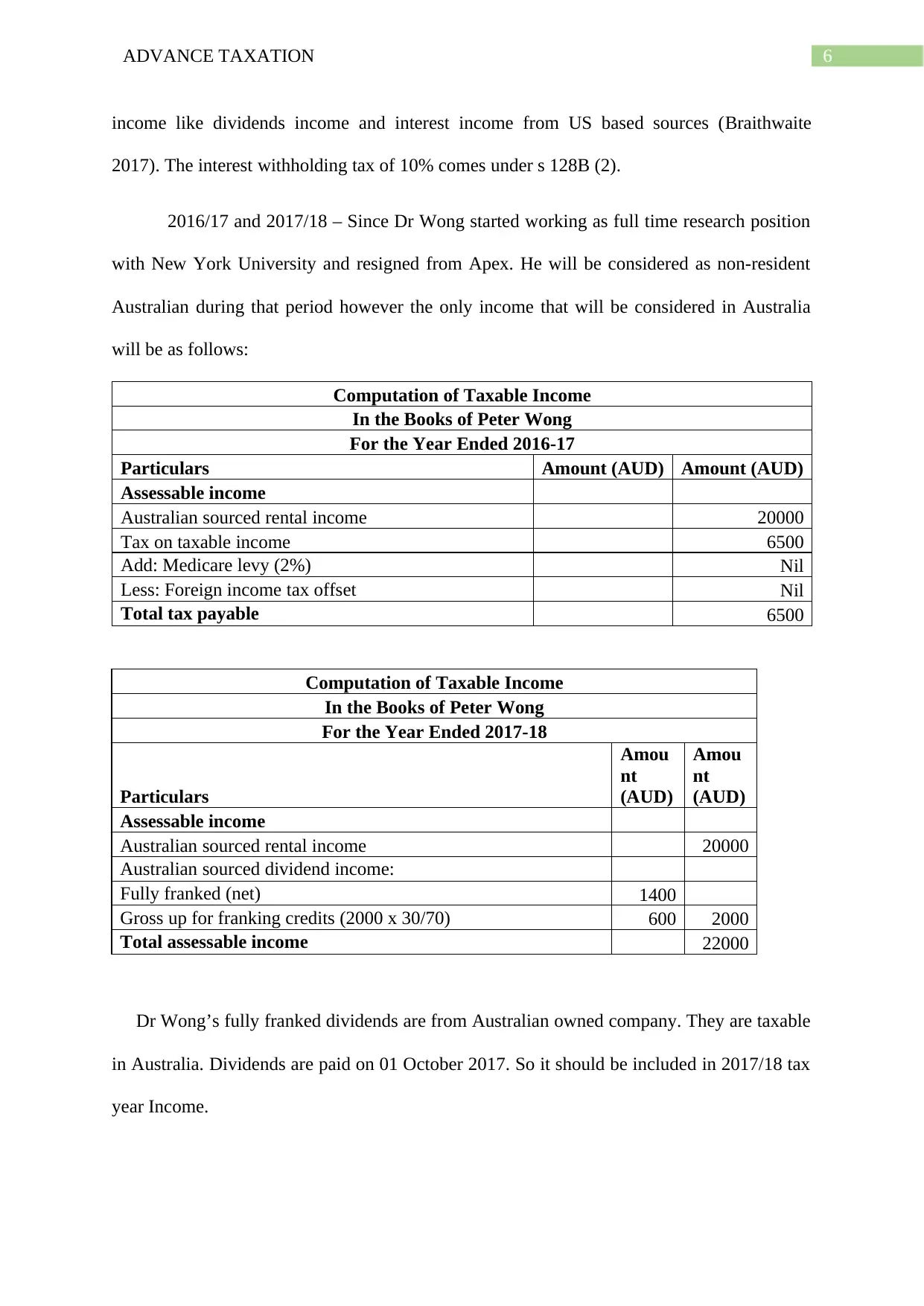

2016/17 and 2017/18 – Since Dr Wong started working as full time research position

with New York University and resigned from Apex. He will be considered as non-resident

Australian during that period however the only income that will be considered in Australia

will be as follows:

Computation of Taxable Income

In the Books of Peter Wong

For the Year Ended 2016-17

Particulars Amount (AUD) Amount (AUD)

Assessable income

Australian sourced rental income 20000

Tax on taxable income 6500

Add: Medicare levy (2%) Nil

Less: Foreign income tax offset Nil

Total tax payable 6500

Computation of Taxable Income

In the Books of Peter Wong

For the Year Ended 2017-18

Particulars

Amou

nt

(AUD)

Amou

nt

(AUD)

Assessable income

Australian sourced rental income 20000

Australian sourced dividend income:

Fully franked (net) 1400

Gross up for franking credits (2000 x 30/70) 600 2000

Total assessable income 22000

Dr Wong’s fully franked dividends are from Australian owned company. They are taxable

in Australia. Dividends are paid on 01 October 2017. So it should be included in 2017/18 tax

year Income.

income like dividends income and interest income from US based sources (Braithwaite

2017). The interest withholding tax of 10% comes under s 128B (2).

2016/17 and 2017/18 – Since Dr Wong started working as full time research position

with New York University and resigned from Apex. He will be considered as non-resident

Australian during that period however the only income that will be considered in Australia

will be as follows:

Computation of Taxable Income

In the Books of Peter Wong

For the Year Ended 2016-17

Particulars Amount (AUD) Amount (AUD)

Assessable income

Australian sourced rental income 20000

Tax on taxable income 6500

Add: Medicare levy (2%) Nil

Less: Foreign income tax offset Nil

Total tax payable 6500

Computation of Taxable Income

In the Books of Peter Wong

For the Year Ended 2017-18

Particulars

Amou

nt

(AUD)

Amou

nt

(AUD)

Assessable income

Australian sourced rental income 20000

Australian sourced dividend income:

Fully franked (net) 1400

Gross up for franking credits (2000 x 30/70) 600 2000

Total assessable income 22000

Dr Wong’s fully franked dividends are from Australian owned company. They are taxable

in Australia. Dividends are paid on 01 October 2017. So it should be included in 2017/18 tax

year Income.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ADVANCE TAXATION

The rates of tax withholding applicable for the Dr Wong for the income during year 2017/18

is 30% as per Income Tax (Dividends, Interest and Royalties Withholding Tax) Act 1974. Dr

Wong is liable to pay the taxes and need to disclose income from entity as per the Taxation

Administration Regulations 1976.

The non-resident of Australia is not required to include the foreign source of earning

in Australia while Dr Wong has to pay the taxes in the United States for the income received

from the New York University. Dr Wong period of stay in the United States will be

considered their status as non-resident during that year 2016/17 and 2017/18.

Answer to Question 2:

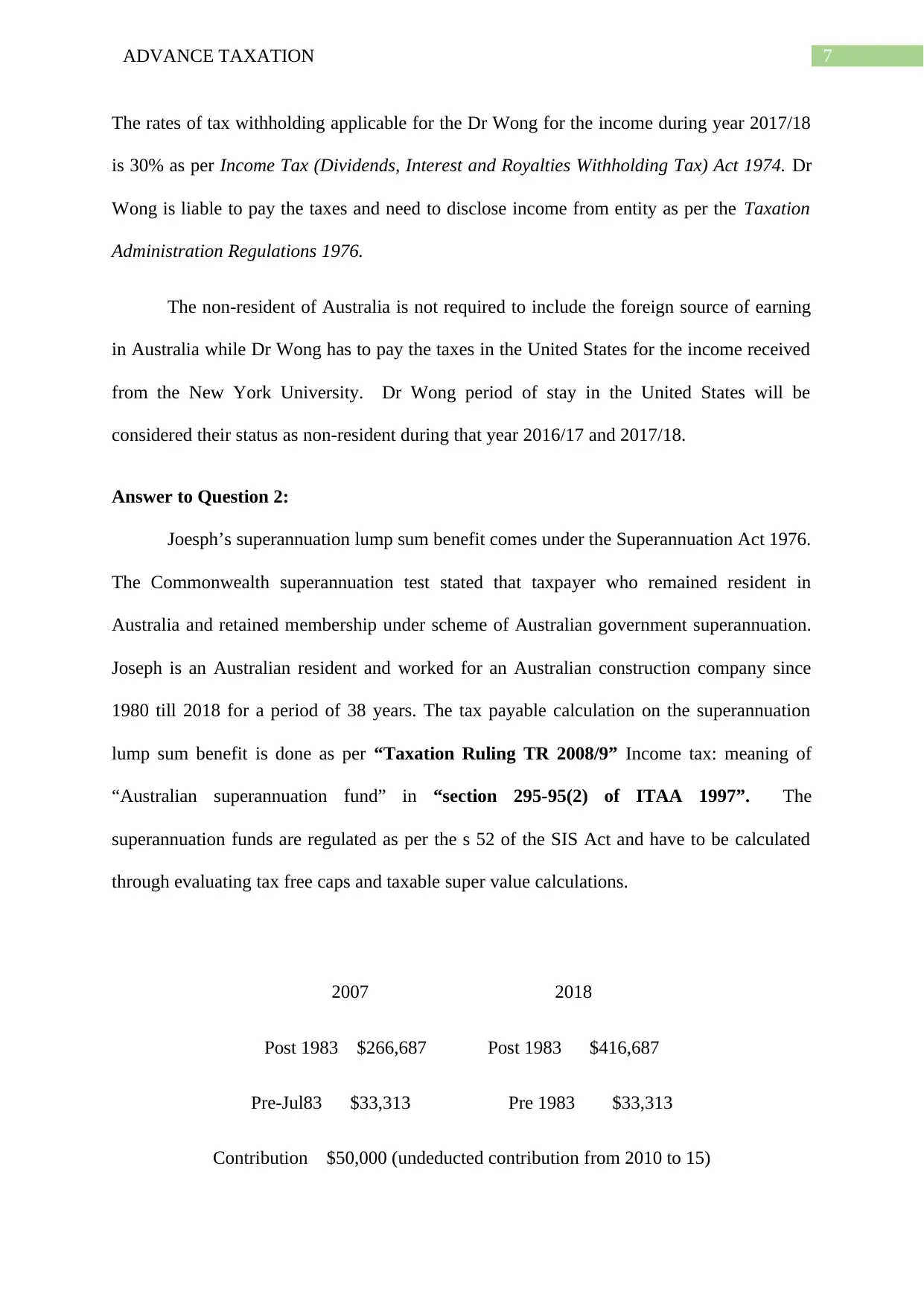

Joesph’s superannuation lump sum benefit comes under the Superannuation Act 1976.

The Commonwealth superannuation test stated that taxpayer who remained resident in

Australia and retained membership under scheme of Australian government superannuation.

Joseph is an Australian resident and worked for an Australian construction company since

1980 till 2018 for a period of 38 years. The tax payable calculation on the superannuation

lump sum benefit is done as per “Taxation Ruling TR 2008/9” Income tax: meaning of

“Australian superannuation fund” in “section 295-95(2) of ITAA 1997”. The

superannuation funds are regulated as per the s 52 of the SIS Act and have to be calculated

through evaluating tax free caps and taxable super value calculations.

2007 2018

Post 1983 $266,687 Post 1983 $416,687

Pre-Jul83 $33,313 Pre 1983 $33,313

Contribution $50,000 (undeducted contribution from 2010 to 15)

The rates of tax withholding applicable for the Dr Wong for the income during year 2017/18

is 30% as per Income Tax (Dividends, Interest and Royalties Withholding Tax) Act 1974. Dr

Wong is liable to pay the taxes and need to disclose income from entity as per the Taxation

Administration Regulations 1976.

The non-resident of Australia is not required to include the foreign source of earning

in Australia while Dr Wong has to pay the taxes in the United States for the income received

from the New York University. Dr Wong period of stay in the United States will be

considered their status as non-resident during that year 2016/17 and 2017/18.

Answer to Question 2:

Joesph’s superannuation lump sum benefit comes under the Superannuation Act 1976.

The Commonwealth superannuation test stated that taxpayer who remained resident in

Australia and retained membership under scheme of Australian government superannuation.

Joseph is an Australian resident and worked for an Australian construction company since

1980 till 2018 for a period of 38 years. The tax payable calculation on the superannuation

lump sum benefit is done as per “Taxation Ruling TR 2008/9” Income tax: meaning of

“Australian superannuation fund” in “section 295-95(2) of ITAA 1997”. The

superannuation funds are regulated as per the s 52 of the SIS Act and have to be calculated

through evaluating tax free caps and taxable super value calculations.

2007 2018

Post 1983 $266,687 Post 1983 $416,687

Pre-Jul83 $33,313 Pre 1983 $33,313

Contribution $50,000 (undeducted contribution from 2010 to 15)

8ADVANCE TAXATION

-------------- --------------

$300,000 $500,000

Joseph received $ 500,000 as superannuation fund during year 2018 while there is

applicable tax offset of 15% at margin rates. The lower tax cap is around $ 200,000 for the

year 2018 therefore the next taxable value will be $ 416,687- $ 200,000 (lower tax cap) - $

50,000 (undeducted contributions made between 2010 and 2015) - $33,313 (Pre july 1983

component). The complying taxed superannuation fund for Joseph is done through applying

tax caps of s 307-345 ITAA97. The total tax payable on the given superannuation payments

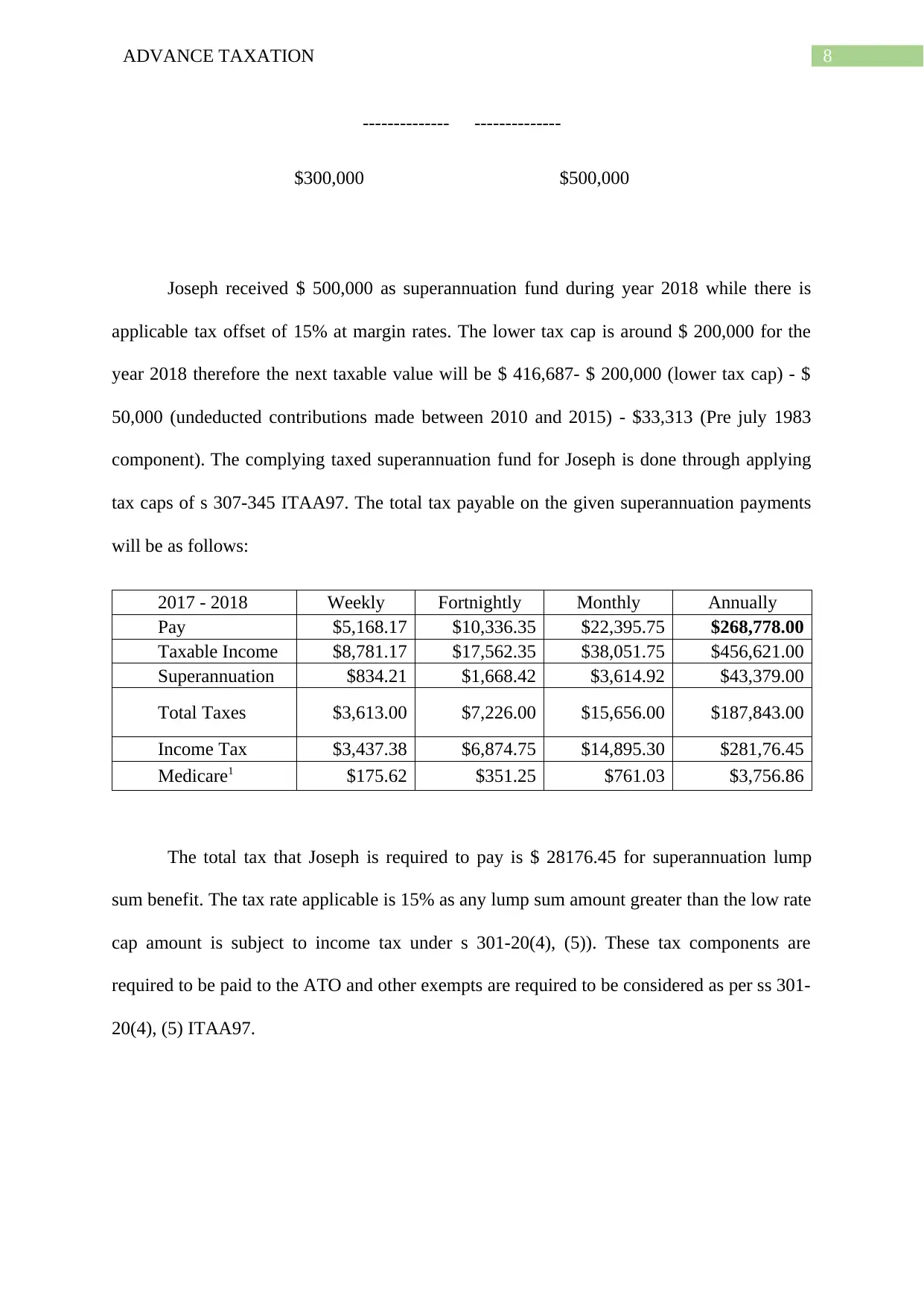

will be as follows:

2017 - 2018 Weekly Fortnightly Monthly Annually

Pay $5,168.17 $10,336.35 $22,395.75 $268,778.00

Taxable Income $8,781.17 $17,562.35 $38,051.75 $456,621.00

Superannuation $834.21 $1,668.42 $3,614.92 $43,379.00

Total Taxes $3,613.00 $7,226.00 $15,656.00 $187,843.00

Income Tax $3,437.38 $6,874.75 $14,895.30 $281,76.45

Medicare1 $175.62 $351.25 $761.03 $3,756.86

The total tax that Joseph is required to pay is $ 28176.45 for superannuation lump

sum benefit. The tax rate applicable is 15% as any lump sum amount greater than the low rate

cap amount is subject to income tax under s 301-20(4), (5)). These tax components are

required to be paid to the ATO and other exempts are required to be considered as per ss 301-

20(4), (5) ITAA97.

-------------- --------------

$300,000 $500,000

Joseph received $ 500,000 as superannuation fund during year 2018 while there is

applicable tax offset of 15% at margin rates. The lower tax cap is around $ 200,000 for the

year 2018 therefore the next taxable value will be $ 416,687- $ 200,000 (lower tax cap) - $

50,000 (undeducted contributions made between 2010 and 2015) - $33,313 (Pre july 1983

component). The complying taxed superannuation fund for Joseph is done through applying

tax caps of s 307-345 ITAA97. The total tax payable on the given superannuation payments

will be as follows:

2017 - 2018 Weekly Fortnightly Monthly Annually

Pay $5,168.17 $10,336.35 $22,395.75 $268,778.00

Taxable Income $8,781.17 $17,562.35 $38,051.75 $456,621.00

Superannuation $834.21 $1,668.42 $3,614.92 $43,379.00

Total Taxes $3,613.00 $7,226.00 $15,656.00 $187,843.00

Income Tax $3,437.38 $6,874.75 $14,895.30 $281,76.45

Medicare1 $175.62 $351.25 $761.03 $3,756.86

The total tax that Joseph is required to pay is $ 28176.45 for superannuation lump

sum benefit. The tax rate applicable is 15% as any lump sum amount greater than the low rate

cap amount is subject to income tax under s 301-20(4), (5)). These tax components are

required to be paid to the ATO and other exempts are required to be considered as per ss 301-

20(4), (5) ITAA97.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ADVANCE TAXATION

References:

Blakelock, S. and King, P., 2017. Taxation law: The advance of ATO data

matching. Proctor, The, 37(6), p.18.

Braithwaite, V., 2017. Taxing democracy: Understanding tax avoidance and evasion.

Routledge.

Maley, M.N., 2018. Australian Taxation Office Guidance on the Diverted Profits Tax.

ROBIN, H., 2017. AUSTRALIAN TAXATION LAW 2017. OXFORD University Press.

Saad, N., 2014. Tax knowledge, tax complexity and tax compliance: Taxpayers’

view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

References:

Blakelock, S. and King, P., 2017. Taxation law: The advance of ATO data

matching. Proctor, The, 37(6), p.18.

Braithwaite, V., 2017. Taxing democracy: Understanding tax avoidance and evasion.

Routledge.

Maley, M.N., 2018. Australian Taxation Office Guidance on the Diverted Profits Tax.

ROBIN, H., 2017. AUSTRALIAN TAXATION LAW 2017. OXFORD University Press.

Saad, N., 2014. Tax knowledge, tax complexity and tax compliance: Taxpayers’

view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.