Advanced Financial Accounting Report: Coca-Cola Amatil and IFRS

VerifiedAdded on 2020/05/28

|14

|2938

|70

Report

AI Summary

This report provides an in-depth analysis of advanced financial accounting concepts, specifically focusing on asset impairment testing and lease accounting. Part A examines Coca-Cola Amatil's impairment criteria, assumptions, and the subjectivity involved in the impairment testing process, referencing their 2016 annual report. It covers impairment of intangible assets, fixed assets, and the application of IAS 36. Part B explores the impact of accounting modifications on lease accounting, comparing old and new standards, highlighting the implications of operating leases, comparability issues, and the potential impact of these changes on various stakeholders. The report also discusses the impact of the new accounting standard and provides insights on the challenges and benefits of the changes.

Running head: ADVANCED FINANCIAL ACCOUNTING

Advanced Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Advanced Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ADVANCED FINANCIAL ACCOUNTING

Table of Contents

Part A:..............................................................................................................................................2

Answer to Part (i):.......................................................................................................................2

Answer to Part (ii):......................................................................................................................3

Answer to Part (iii):.....................................................................................................................3

Answer to Part (iv):.....................................................................................................................5

Answer to Part (v):.......................................................................................................................5

Answer to Part (vi):.....................................................................................................................6

Answer to Part (vii):....................................................................................................................6

Answer to Part (viii):...................................................................................................................7

Part B:..............................................................................................................................................7

Answer to Part (i):.......................................................................................................................7

Answer to Part (ii):......................................................................................................................8

Answer to Part (iii):.....................................................................................................................8

Answer to Part (iv):.....................................................................................................................9

Answer to Part (v):.......................................................................................................................9

References:....................................................................................................................................11

Table of Contents

Part A:..............................................................................................................................................2

Answer to Part (i):.......................................................................................................................2

Answer to Part (ii):......................................................................................................................3

Answer to Part (iii):.....................................................................................................................3

Answer to Part (iv):.....................................................................................................................5

Answer to Part (v):.......................................................................................................................5

Answer to Part (vi):.....................................................................................................................6

Answer to Part (vii):....................................................................................................................6

Answer to Part (viii):...................................................................................................................7

Part B:..............................................................................................................................................7

Answer to Part (i):.......................................................................................................................7

Answer to Part (ii):......................................................................................................................8

Answer to Part (iii):.....................................................................................................................8

Answer to Part (iv):.....................................................................................................................9

Answer to Part (v):.......................................................................................................................9

References:....................................................................................................................................11

2ADVANCED FINANCIAL ACCOUNTING

Part A:

The objective of this report is to focus on the impairment criteria and assumptions that

Coca-Cola Amatil use in order to conduct asset impairment test. Thus, the report would focus on

the impairment testing processes and the subjectivity associated with such processes. In order to

comment on these processes, the last published annual report for 2016 has been taken into

account, since the annual report of 2017 is yet to be published. Coca-Cola Amatil is one of the

biggest bottlers of non-alcoholic ready-to-drink beverages in the region of Asia-Pacific. The

organisation is involved in operating in six nations including Australia, New Zealand, Papua

New Guinea, Indonesia, Samoa and Fiji. The main products of the organisation include spring

water, soft drinks, fruit juices, flavoured milk, iced tea, tea, coffee and other vegetable products

(Ccamatil.com 2018).

An asset is said to be impaired, when the carrying amount of an asset is higher compared

to its market value. The assets that are probable to be impaired constitute of non-current assets

such as plant, property and equipment and intangible assets like goodwill (Paugam and Ramond

2015). When adjustment is made with the carrying value of the impaired asset, there is recording

of loss in the profit and loss account of the organisation. At the time of writing off impairment,

the carrying cost of the asset would be minimised, since the realisation of adjustments would be

made as loss and thus, there would be reduction in the value of the asset.

Answer to Part (i):

Based on the annual report of Coca-Cola Amatil in 2016, the impairment test for different

groups of assets has been taken into account. Amortisation is not made for goodwill and other

intangible assets; however, annual impairment is tested. In case, the frequency is higher than

Part A:

The objective of this report is to focus on the impairment criteria and assumptions that

Coca-Cola Amatil use in order to conduct asset impairment test. Thus, the report would focus on

the impairment testing processes and the subjectivity associated with such processes. In order to

comment on these processes, the last published annual report for 2016 has been taken into

account, since the annual report of 2017 is yet to be published. Coca-Cola Amatil is one of the

biggest bottlers of non-alcoholic ready-to-drink beverages in the region of Asia-Pacific. The

organisation is involved in operating in six nations including Australia, New Zealand, Papua

New Guinea, Indonesia, Samoa and Fiji. The main products of the organisation include spring

water, soft drinks, fruit juices, flavoured milk, iced tea, tea, coffee and other vegetable products

(Ccamatil.com 2018).

An asset is said to be impaired, when the carrying amount of an asset is higher compared

to its market value. The assets that are probable to be impaired constitute of non-current assets

such as plant, property and equipment and intangible assets like goodwill (Paugam and Ramond

2015). When adjustment is made with the carrying value of the impaired asset, there is recording

of loss in the profit and loss account of the organisation. At the time of writing off impairment,

the carrying cost of the asset would be minimised, since the realisation of adjustments would be

made as loss and thus, there would be reduction in the value of the asset.

Answer to Part (i):

Based on the annual report of Coca-Cola Amatil in 2016, the impairment test for different

groups of assets has been taken into account. Amortisation is not made for goodwill and other

intangible assets; however, annual impairment is tested. In case, the frequency is higher than

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ADVANCED FINANCIAL ACCOUNTING

once in a period because of variations in circumstances or events, it denotes that there is

impairment of assets and the record is made in the financial statements at cost minus any

accumulated impairment loss (Mazzi, Liberatore and Tsalavoutas 2016). The other assets liker

property, plant and equipment, inventory and trade receivables are tested for impairment when it

indicates that the carrying value of the asset could not be recovered.

Answer to Part (ii):

Coca-Cola Amatil carries out a two-step process in relation to impairment testing. The

first step is to compare the fair value of the reporting entity to the carrying value including

goodwill. In case, the carrying value of the unit is higher compared to its fair value, the next

steep of this test is to be conducted in order to determine the impairment loss amount, if any

(Khokan Bepari, Rahman and Taher Mollik 2014). This step compares the implied fair value

related to the reporting unit with the carrying value of that unit. In case, there is excess carrying

amount compared to the implied fair value, the recognition of impairment charge is made in the

amount equal to the excess. The recognised loss could not be more than the carrying asset

amount.

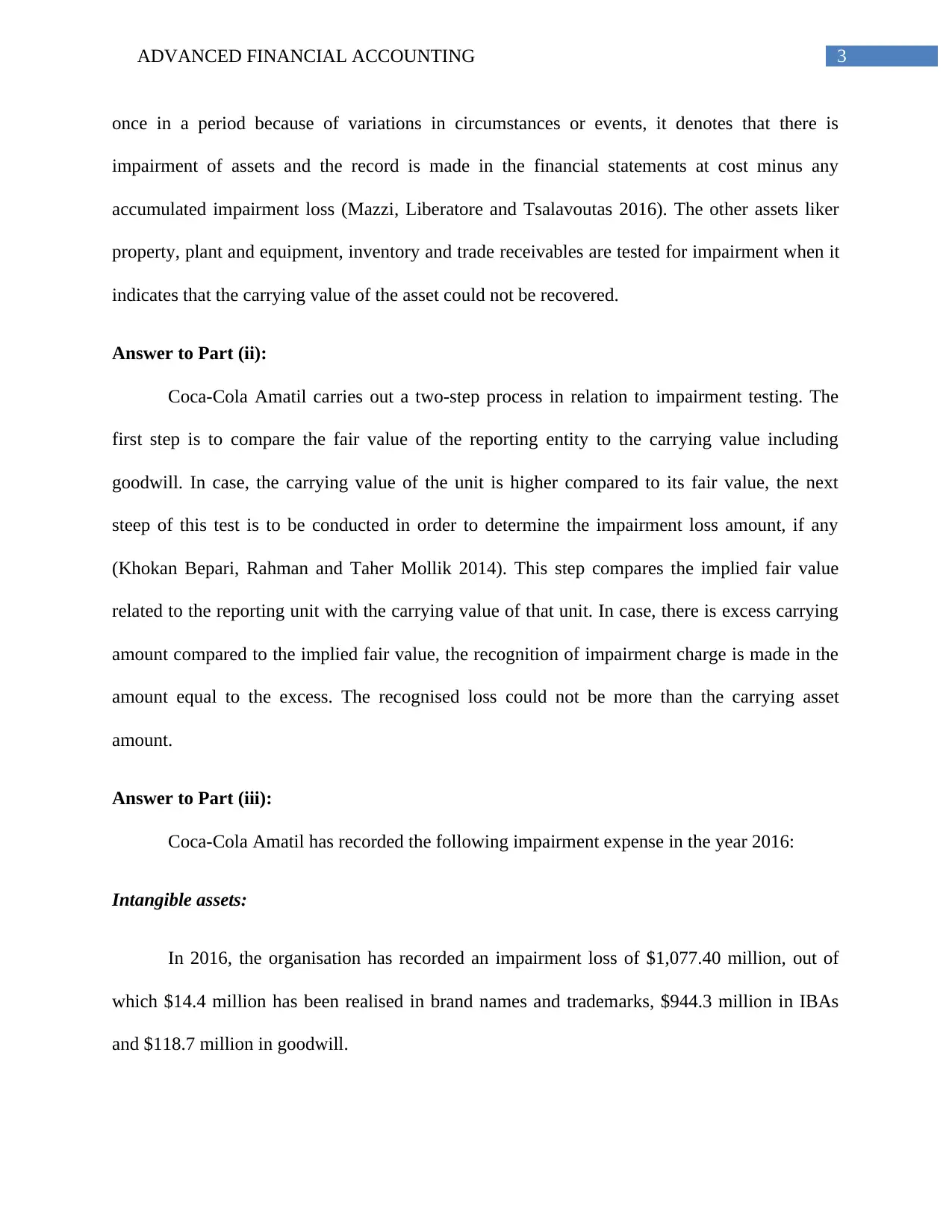

Answer to Part (iii):

Coca-Cola Amatil has recorded the following impairment expense in the year 2016:

Intangible assets:

In 2016, the organisation has recorded an impairment loss of $1,077.40 million, out of

which $14.4 million has been realised in brand names and trademarks, $944.3 million in IBAs

and $118.7 million in goodwill.

once in a period because of variations in circumstances or events, it denotes that there is

impairment of assets and the record is made in the financial statements at cost minus any

accumulated impairment loss (Mazzi, Liberatore and Tsalavoutas 2016). The other assets liker

property, plant and equipment, inventory and trade receivables are tested for impairment when it

indicates that the carrying value of the asset could not be recovered.

Answer to Part (ii):

Coca-Cola Amatil carries out a two-step process in relation to impairment testing. The

first step is to compare the fair value of the reporting entity to the carrying value including

goodwill. In case, the carrying value of the unit is higher compared to its fair value, the next

steep of this test is to be conducted in order to determine the impairment loss amount, if any

(Khokan Bepari, Rahman and Taher Mollik 2014). This step compares the implied fair value

related to the reporting unit with the carrying value of that unit. In case, there is excess carrying

amount compared to the implied fair value, the recognition of impairment charge is made in the

amount equal to the excess. The recognised loss could not be more than the carrying asset

amount.

Answer to Part (iii):

Coca-Cola Amatil has recorded the following impairment expense in the year 2016:

Intangible assets:

In 2016, the organisation has recorded an impairment loss of $1,077.40 million, out of

which $14.4 million has been realised in brand names and trademarks, $944.3 million in IBAs

and $118.7 million in goodwill.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ADVANCED FINANCIAL ACCOUNTING

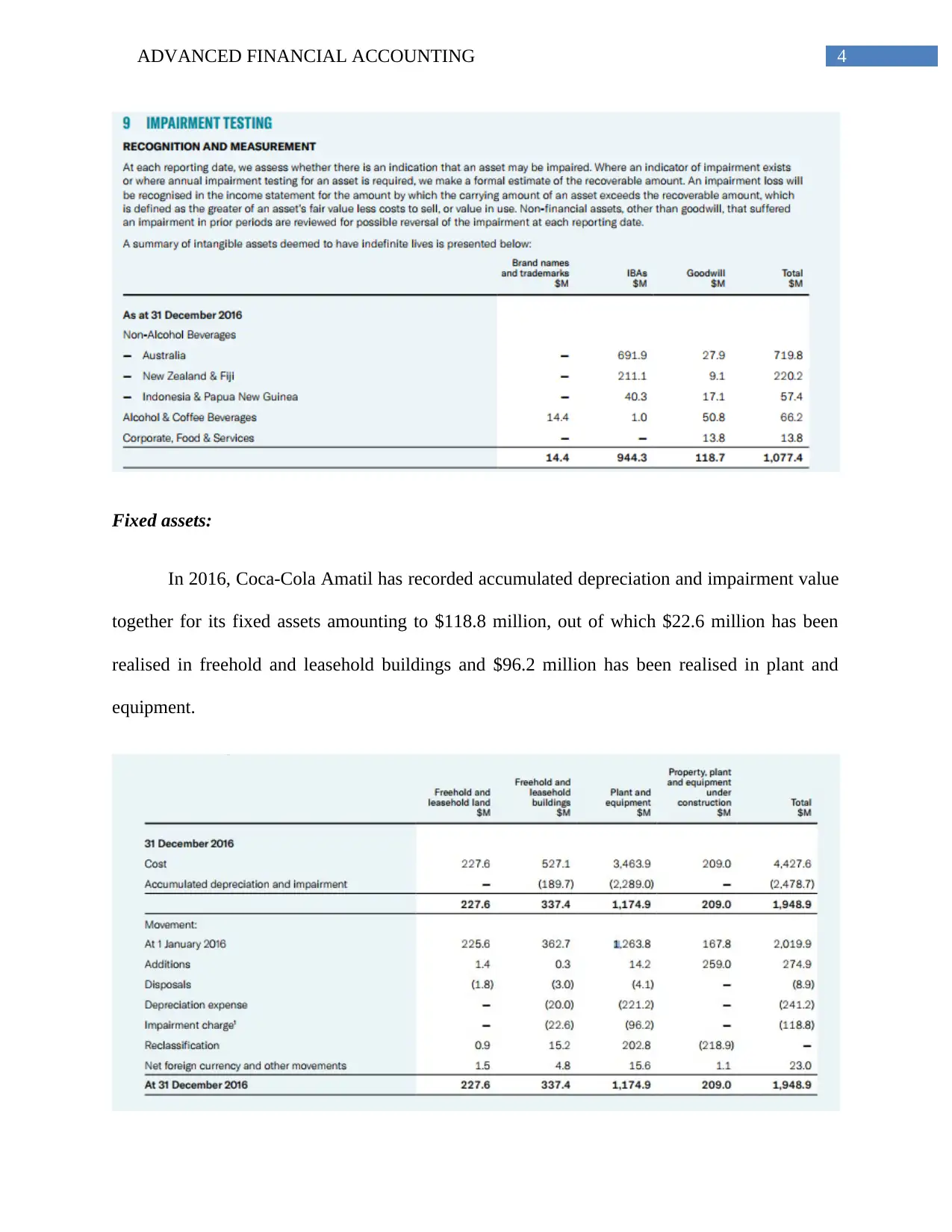

Fixed assets:

In 2016, Coca-Cola Amatil has recorded accumulated depreciation and impairment value

together for its fixed assets amounting to $118.8 million, out of which $22.6 million has been

realised in freehold and leasehold buildings and $96.2 million has been realised in plant and

equipment.

Fixed assets:

In 2016, Coca-Cola Amatil has recorded accumulated depreciation and impairment value

together for its fixed assets amounting to $118.8 million, out of which $22.6 million has been

realised in freehold and leasehold buildings and $96.2 million has been realised in plant and

equipment.

5ADVANCED FINANCIAL ACCOUNTING

Answer to Part (iv):

Due to future concern, Coca-Cola Amatil makes various assumptions and estimates. The

outcomes of the accounting estimates would be similar to the associated actual outcomes (Bauer,

O'Brien and Saeed 2014). Significant risks are involved in assumptions and estimates that might

lead to material misstatements to the carrying amount of the assets in the upcoming year. These

are described with the help of notes to accounts where there is need for such types of

judgements. The analysis of the recoverable value for goodwill and other intangible assets of the

cash-generating units of the firm are conducted because of the market downturn and continual

adverse condition. The recoverable amount is calculated by relating to the cash-generating units

depending on the calculation of value-in-use (Caruso, Ferrari and Pisano 2016). In addition to

this, the calculations use the projections of cash flow depending on financial forecast that the

management has developed for the last five years.

The following assumptions are made for computing the value-in-use:

Discount rates

Growth rates using the extrapolate cash flows beyond the estimated period

EBITDA/ Sales margin

Answer to Part (v):

As per the perception of “IAS 36 Impairment of Assets”, it is identified that it is a typical

IFRS standard, as it requires subjective interpretation and this could be implemented for meeting

managerial needs. Along with this, it does not hinder creative accounting (Benson et al. 2015).

As identified from the annual report of Coca-Cola Amatil, there is involvement of considerable

subjectivity when the management carries out the procedure for impairment test. The reason is

Answer to Part (iv):

Due to future concern, Coca-Cola Amatil makes various assumptions and estimates. The

outcomes of the accounting estimates would be similar to the associated actual outcomes (Bauer,

O'Brien and Saeed 2014). Significant risks are involved in assumptions and estimates that might

lead to material misstatements to the carrying amount of the assets in the upcoming year. These

are described with the help of notes to accounts where there is need for such types of

judgements. The analysis of the recoverable value for goodwill and other intangible assets of the

cash-generating units of the firm are conducted because of the market downturn and continual

adverse condition. The recoverable amount is calculated by relating to the cash-generating units

depending on the calculation of value-in-use (Caruso, Ferrari and Pisano 2016). In addition to

this, the calculations use the projections of cash flow depending on financial forecast that the

management has developed for the last five years.

The following assumptions are made for computing the value-in-use:

Discount rates

Growth rates using the extrapolate cash flows beyond the estimated period

EBITDA/ Sales margin

Answer to Part (v):

As per the perception of “IAS 36 Impairment of Assets”, it is identified that it is a typical

IFRS standard, as it requires subjective interpretation and this could be implemented for meeting

managerial needs. Along with this, it does not hinder creative accounting (Benson et al. 2015).

As identified from the annual report of Coca-Cola Amatil, there is involvement of considerable

subjectivity when the management carries out the procedure for impairment test. The reason is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ADVANCED FINANCIAL ACCOUNTING

that the management of the organisation might exploit its discretion by carrying out the goodwill

test in an opportunistic fashion (Boennen and Glaum 2014). This could be proved by the

goodwill distribution to the cash generating units and computation of recoverable amount when

active prices are not present for goodwill subject to discretion.

Answer to Part (vi):

After critical assessment, it is found out that the most difficult or confusing part is

associated with the impairment indication. Despite the fact that such indications depend on

internal as well as external signs about the asset impairment, the frequency of conducting the test

for goodwill and other intangible assets depend on the management discretion. Hence, there is a

likelihood that the test would be carried out opportunistically, in which there is disparity in

value.

Answer to Part (vii):

In the words of Filip, Jeanjean and Paugam (2015), impairment loss is the variation

between the recoverable amount of an asset and the carrying value of that asset. The recoverable

amount is the higher of the fair value of the asset minus value-in-use and disposal cost. The

determination of fair value is made with the help of sales agreement or the asset in active market

where the asset trading is conducted or the availability of useful information to reveal the amount

at which the asset sale could be made. On the contrary, according to IAS 36, the present value of

future cash flows estimated to be derived from the cash-generating unit or asset could be termed

as the value-in-use. .

that the management of the organisation might exploit its discretion by carrying out the goodwill

test in an opportunistic fashion (Boennen and Glaum 2014). This could be proved by the

goodwill distribution to the cash generating units and computation of recoverable amount when

active prices are not present for goodwill subject to discretion.

Answer to Part (vi):

After critical assessment, it is found out that the most difficult or confusing part is

associated with the impairment indication. Despite the fact that such indications depend on

internal as well as external signs about the asset impairment, the frequency of conducting the test

for goodwill and other intangible assets depend on the management discretion. Hence, there is a

likelihood that the test would be carried out opportunistically, in which there is disparity in

value.

Answer to Part (vii):

In the words of Filip, Jeanjean and Paugam (2015), impairment loss is the variation

between the recoverable amount of an asset and the carrying value of that asset. The recoverable

amount is the higher of the fair value of the asset minus value-in-use and disposal cost. The

determination of fair value is made with the help of sales agreement or the asset in active market

where the asset trading is conducted or the availability of useful information to reveal the amount

at which the asset sale could be made. On the contrary, according to IAS 36, the present value of

future cash flows estimated to be derived from the cash-generating unit or asset could be termed

as the value-in-use. .

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ADVANCED FINANCIAL ACCOUNTING

Answer to Part (viii):

In compliance with IFRS 13, fair value could be determined with the help of the

following points:

Sales agreement

Value of the asset in the active market in which the asset is traded

Availability of useful information to reveal the amount at which the asset sale could be

conducted (Collier 2015).

Hence, fair value is the sale price that both the buyer and the seller could accept by assuming

that both parties have entered in free transactions. Many investments have fair values, which the

market determines where the trading of security is carried out. In addition, fair value represents

the asset and liability values of a firm when the financial statements of the subsidiary

organisations are consolidated with a parent entity. For example, if the shares of an organisation

are traded on exchange, a bid is provided on the market players to get an overview of the share

prices. In such scenario, the stock could be sold to the market leaders at the bid price while the

same could be bought from the market players at the ask price (Bowen and Khan 2014). Hence,

it could be concluded that the trustworthy method of determining the fair stock value is

exchange.

Part B:

Answer to Part (i):

Nearly 50% of the companies using IFRS or US GAAP are affected because of the

accounting modifications. Based on the present status, the companies under US GAAP or IFRS

have leased commitments and assets that amounted to nearly $3.3 million. However, most of

Answer to Part (viii):

In compliance with IFRS 13, fair value could be determined with the help of the

following points:

Sales agreement

Value of the asset in the active market in which the asset is traded

Availability of useful information to reveal the amount at which the asset sale could be

conducted (Collier 2015).

Hence, fair value is the sale price that both the buyer and the seller could accept by assuming

that both parties have entered in free transactions. Many investments have fair values, which the

market determines where the trading of security is carried out. In addition, fair value represents

the asset and liability values of a firm when the financial statements of the subsidiary

organisations are consolidated with a parent entity. For example, if the shares of an organisation

are traded on exchange, a bid is provided on the market players to get an overview of the share

prices. In such scenario, the stock could be sold to the market leaders at the bid price while the

same could be bought from the market players at the ask price (Bowen and Khan 2014). Hence,

it could be concluded that the trustworthy method of determining the fair stock value is

exchange.

Part B:

Answer to Part (i):

Nearly 50% of the companies using IFRS or US GAAP are affected because of the

accounting modifications. Based on the present status, the companies under US GAAP or IFRS

have leased commitments and assets that amounted to nearly $3.3 million. However, most of

8ADVANCED FINANCIAL ACCOUNTING

such information is not revealed in the balance sheet statement, as they are treated as operating

leases (Jack 2015). For compensating this, the investments include the estimations that are

incomparable, inconsistent and wrong. Thus, the previous standard of accounting is not effective

in reflecting economic reality.

Answer to Part (ii):

As per the previous accounting standards, most of the companies have reported 85% of

their leases under the operating lease segment and it failed to represent those under the balance

sheet statement. Despite the fact that operating leases are not recorded in the balance sheet

statement, there is development of actual liabilities (Sinclair and Keller 2014). Thus, during

financial crisis, few major retail firms have been bankrupt, as they did not adjust the updated

economic reality in a rapid manner. Along with this, the companies had considerable

commitments in association with the long-term operating leases. However, the balance sheet

statements were lean deceptively. Therefore, the lease liabilities of the firms under the off-

balance sheet arrangements were 66 times greater than the values of debt in the balance sheet

statement.

Answer to Part (iii):

The previous system of accounting pertaining to lease could result in lack of

comparability. Most of the leases of the aviation industry are reported as operating leases and

they are not recorded under the balance sheet statement. Therefore, an airline associated with

leasing the aircraft fleet is dissimilar to the competitors buying the fleets. However, the financial

obligations related to both types of airlines are identical (Du, Givoly and Alhusaini 2017). This

signifies that level playing field is not present in the airline firms. As the new standard was

such information is not revealed in the balance sheet statement, as they are treated as operating

leases (Jack 2015). For compensating this, the investments include the estimations that are

incomparable, inconsistent and wrong. Thus, the previous standard of accounting is not effective

in reflecting economic reality.

Answer to Part (ii):

As per the previous accounting standards, most of the companies have reported 85% of

their leases under the operating lease segment and it failed to represent those under the balance

sheet statement. Despite the fact that operating leases are not recorded in the balance sheet

statement, there is development of actual liabilities (Sinclair and Keller 2014). Thus, during

financial crisis, few major retail firms have been bankrupt, as they did not adjust the updated

economic reality in a rapid manner. Along with this, the companies had considerable

commitments in association with the long-term operating leases. However, the balance sheet

statements were lean deceptively. Therefore, the lease liabilities of the firms under the off-

balance sheet arrangements were 66 times greater than the values of debt in the balance sheet

statement.

Answer to Part (iii):

The previous system of accounting pertaining to lease could result in lack of

comparability. Most of the leases of the aviation industry are reported as operating leases and

they are not recorded under the balance sheet statement. Therefore, an airline associated with

leasing the aircraft fleet is dissimilar to the competitors buying the fleets. However, the financial

obligations related to both types of airlines are identical (Du, Givoly and Alhusaini 2017). This

signifies that level playing field is not present in the airline firms. As the new standard was

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ADVANCED FINANCIAL ACCOUNTING

introduced, the leases would be recorded as assets and the lessees would record the same as

liabilities. Therefore, it is anticipated that the complexity could be resolved.

Answer to Part (iv):

Any modification in the standard of accounting is likely to have an impact on nearly half

of the listed firms and they are not projected as popular with all the firms. This is because the

modifications might result in controversies and this might lead to warning effects. This is related

to the costs and negative economic situations pertaining to the modifications in the system

(Bamber and McMeeking 2016). Moreover, the commercial effects would be inherent because of

changes.

For instance, various banking covenants and contractual agreements related to the

financial reports of the company like targets of profit in arranging the bonus payment to the

employees or gearing ratio might be required in order to obtain revisions before the new standard

was introduced. Along with this, every business department is required in attaining an overview

of the impact of changes, which comprise of finance, accounting information technology, human

resource, finance department related to investor relations and asset procurement. All these

reasons might lead to loss of popularity of the new accounting standard.

Answer to Part (v):

According to the new accounting standard, it has been identified that most of the

organisations are treating operating leases as off-balance sheet items. Due to this, the investors

and other associated users of the financial reports do not obtain an effective overview of the

financial position of a firm. This hinders them to compare the firms that are leasing assets with

the other organisations involved in buying assets (Watts and Zuo 2016). However, this new

introduced, the leases would be recorded as assets and the lessees would record the same as

liabilities. Therefore, it is anticipated that the complexity could be resolved.

Answer to Part (iv):

Any modification in the standard of accounting is likely to have an impact on nearly half

of the listed firms and they are not projected as popular with all the firms. This is because the

modifications might result in controversies and this might lead to warning effects. This is related

to the costs and negative economic situations pertaining to the modifications in the system

(Bamber and McMeeking 2016). Moreover, the commercial effects would be inherent because of

changes.

For instance, various banking covenants and contractual agreements related to the

financial reports of the company like targets of profit in arranging the bonus payment to the

employees or gearing ratio might be required in order to obtain revisions before the new standard

was introduced. Along with this, every business department is required in attaining an overview

of the impact of changes, which comprise of finance, accounting information technology, human

resource, finance department related to investor relations and asset procurement. All these

reasons might lead to loss of popularity of the new accounting standard.

Answer to Part (v):

According to the new accounting standard, it has been identified that most of the

organisations are treating operating leases as off-balance sheet items. Due to this, the investors

and other associated users of the financial reports do not obtain an effective overview of the

financial position of a firm. This hinders them to compare the firms that are leasing assets with

the other organisations involved in buying assets (Watts and Zuo 2016). However, this new

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ADVANCED FINANCIAL ACCOUNTING

standard is anticipated to update IFTS 16 and this would help in minimising the costs leading to

higher informed decisions pertaining to investment. This would be represented in lease in

contrast to buying decisions in a suitable manner on the part of the management.

standard is anticipated to update IFTS 16 and this would help in minimising the costs leading to

higher informed decisions pertaining to investment. This would be represented in lease in

contrast to buying decisions in a suitable manner on the part of the management.

11ADVANCED FINANCIAL ACCOUNTING

References:

Bamber, M. and McMeeking, K., 2016. An examination of international accounting standard-

setting due process and the implications for legitimacy. The British Accounting Review, 48(1),

pp.59-73.

Bauer, A.M., O'Brien, P.C. and Saeed, U., 2014. Reliability makes accounting relevant: a

comment on the IASB Conceptual Framework project. Accounting in Europe, 11(2), pp.211-217.

Benson, K., Clarkson, P.M., Smith, T. and Tutticci, I., 2015. A review of accounting research in

the Asia Pacific region. Australian Journal of Management, 40(1), pp.36-88.

Boennen, S. and Glaum, M., 2014. Goodwill accounting: A review of the literature.

Bowen, R.M. and Khan, U., 2014. Market reactions to policy deliberations on fair value

accounting and impairment rules during the financial crisis of 2008–2009. Journal of Accounting

and Public Policy, 33(3), pp.233-259.

Caruso, G.D., Ferrari, E.R. and Pisano, V., 2016. Earnings management and goodwill

impairment: An empirical analysis in the Italian M & A context. Journal of Intellectual

Capital, 17(1), pp.120-147.

Ccamatil.com., 2018. Available at:

https://www.ccamatil.com/-/media/Cca/Corporate/Files/Annual-Reports/2017/CCA181-Annual-

Report-2016-low-resolution.ashx [Accessed 20 Jan. 2018].

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision

making. John Wiley & Sons.

References:

Bamber, M. and McMeeking, K., 2016. An examination of international accounting standard-

setting due process and the implications for legitimacy. The British Accounting Review, 48(1),

pp.59-73.

Bauer, A.M., O'Brien, P.C. and Saeed, U., 2014. Reliability makes accounting relevant: a

comment on the IASB Conceptual Framework project. Accounting in Europe, 11(2), pp.211-217.

Benson, K., Clarkson, P.M., Smith, T. and Tutticci, I., 2015. A review of accounting research in

the Asia Pacific region. Australian Journal of Management, 40(1), pp.36-88.

Boennen, S. and Glaum, M., 2014. Goodwill accounting: A review of the literature.

Bowen, R.M. and Khan, U., 2014. Market reactions to policy deliberations on fair value

accounting and impairment rules during the financial crisis of 2008–2009. Journal of Accounting

and Public Policy, 33(3), pp.233-259.

Caruso, G.D., Ferrari, E.R. and Pisano, V., 2016. Earnings management and goodwill

impairment: An empirical analysis in the Italian M & A context. Journal of Intellectual

Capital, 17(1), pp.120-147.

Ccamatil.com., 2018. Available at:

https://www.ccamatil.com/-/media/Cca/Corporate/Files/Annual-Reports/2017/CCA181-Annual-

Report-2016-low-resolution.ashx [Accessed 20 Jan. 2018].

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision

making. John Wiley & Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.