Advanced Financial Accounting Reporting | Desklib

VerifiedAdded on 2023/06/08

|7

|1293

|241

AI Summary

This article covers topics like subsidiary features, partial goodwill method, NCI, inter-group transactions, and equity method. It explains the difference between a subsidiary and an associate, and why inter-group transactions must be eliminated. It also discusses whether NCI is better considered as equity or debt. The article provides solved examples and working notes for better understanding.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Advanced financial

accounting reporting

accounting reporting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Contents

QUESTION 1.............................................................................................................................3

QUESTION 2.............................................................................................................................4

QUESTION 3.............................................................................................................................4

QUESTION 4.............................................................................................................................5

a. Explain NCI is better considered as equity or debt............................................................5

b. Explain why inter-group transactions must be eliminated.................................................6

QUESTION 5.............................................................................................................................6

QUESTION 1.............................................................................................................................3

QUESTION 2.............................................................................................................................4

QUESTION 3.............................................................................................................................4

QUESTION 4.............................................................................................................................5

a. Explain NCI is better considered as equity or debt............................................................5

b. Explain why inter-group transactions must be eliminated.................................................6

QUESTION 5.............................................................................................................................6

QUESTION 1

Subsidiary features are the elements over which the parent company controls, such as

the ability to monitor monetary and work matters and derive benefits from their exercise. To

do this, parents need to have more than half the level of ownership in the holding

organization. Also, the parent company should be organized as a free business element to

obtain subsidiary companies

Employees are mentioned as a substance that parents can exert key influence but cannot

control. If the parent company acquires 20%-half ownership in the holding organization, the

parent company can choose the currency, function, and different options that affect the

employees.

Organizations can hold fluctuating levels of interest in different organizations by

acquiring equity. The shareholding section summarizes the powers and different freedoms an

organization has over a holding organization. There are two important structures that these

types of holding organizations can adopt, namely specific subsidiaries or associates. An

organization that is interested in another organization is called a "parent organization". An

important contrast between a subsidiary and a partner is that while an auxiliary is an

organization in which the parent is the larger investor, the parent is a firm minority among the

partners.

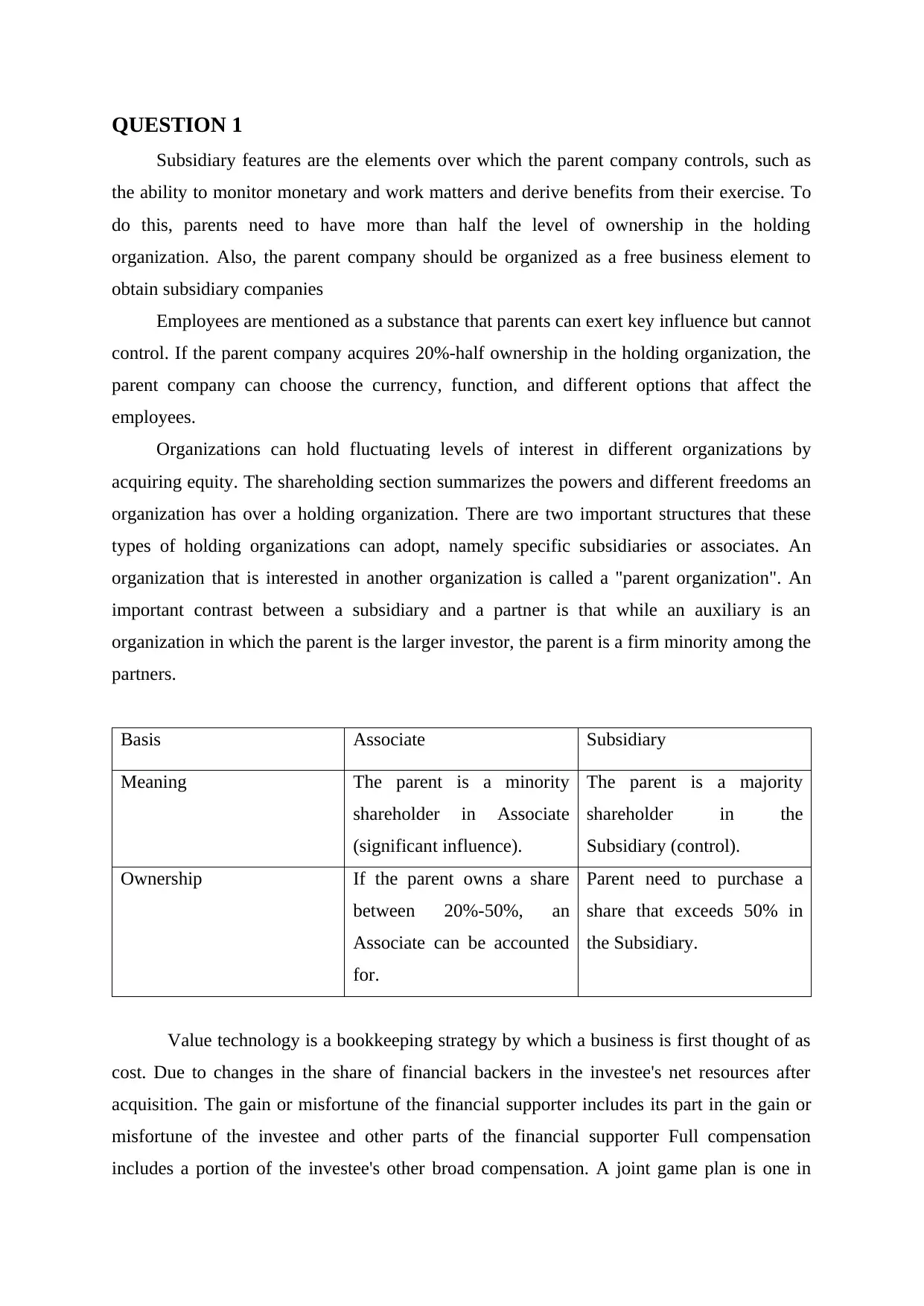

Basis Associate Subsidiary

Meaning The parent is a minority

shareholder in Associate

(significant influence).

The parent is a majority

shareholder in the

Subsidiary (control).

Ownership If the parent owns a share

between 20%-50%, an

Associate can be accounted

for.

Parent need to purchase a

share that exceeds 50% in

the Subsidiary.

Value technology is a bookkeeping strategy by which a business is first thought of as

cost. Due to changes in the share of financial backers in the investee's net resources after

acquisition. The gain or misfortune of the financial supporter includes its part in the gain or

misfortune of the investee and other parts of the financial supporter Full compensation

includes a portion of the investee's other broad compensation. A joint game plan is one in

Subsidiary features are the elements over which the parent company controls, such as

the ability to monitor monetary and work matters and derive benefits from their exercise. To

do this, parents need to have more than half the level of ownership in the holding

organization. Also, the parent company should be organized as a free business element to

obtain subsidiary companies

Employees are mentioned as a substance that parents can exert key influence but cannot

control. If the parent company acquires 20%-half ownership in the holding organization, the

parent company can choose the currency, function, and different options that affect the

employees.

Organizations can hold fluctuating levels of interest in different organizations by

acquiring equity. The shareholding section summarizes the powers and different freedoms an

organization has over a holding organization. There are two important structures that these

types of holding organizations can adopt, namely specific subsidiaries or associates. An

organization that is interested in another organization is called a "parent organization". An

important contrast between a subsidiary and a partner is that while an auxiliary is an

organization in which the parent is the larger investor, the parent is a firm minority among the

partners.

Basis Associate Subsidiary

Meaning The parent is a minority

shareholder in Associate

(significant influence).

The parent is a majority

shareholder in the

Subsidiary (control).

Ownership If the parent owns a share

between 20%-50%, an

Associate can be accounted

for.

Parent need to purchase a

share that exceeds 50% in

the Subsidiary.

Value technology is a bookkeeping strategy by which a business is first thought of as

cost. Due to changes in the share of financial backers in the investee's net resources after

acquisition. The gain or misfortune of the financial supporter includes its part in the gain or

misfortune of the investee and other parts of the financial supporter Full compensation

includes a portion of the investee's other broad compensation. A joint game plan is one in

which at least two rallies have joint control. Joint control is the legally agreed sharing of

control throughout the action that exists only in

The selection of related exercises requires unanimous consent of the party’s shared

control.

A joint effort is a joint game plan through which collective control of the course of

action is possible. Freedom to net resources in the course of action. The joint venture in

which the joint ventures participate has joint control over the joint venture.

QUESTION 2

Particulars Debit Credit

Retained Earnings of Morrison Ltd

Retained Earnings of Scarlett Ltd

1000

1000

Retained Earnings of Scarlett Ltd

Patent of Morrison Ltd

8000

8000

Retained Earnings of Scarlett Ltd

Machine

2000

2000

Allowance for Depreciation on Machine

Depreciation on Machine

200

200

Retained Earnings of Morrison Ltd

Inventory of Scarlett Ltd

3000

3000

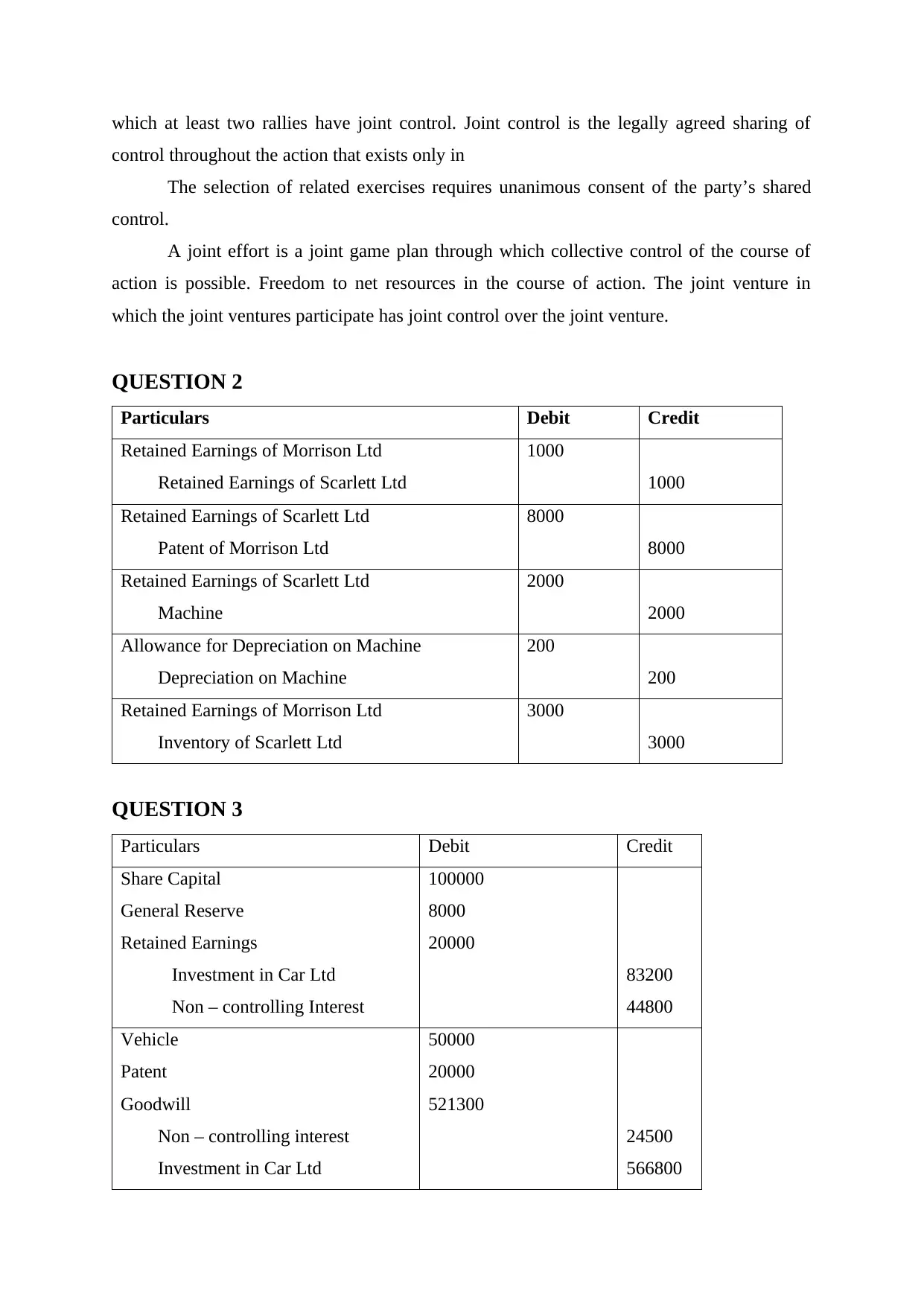

QUESTION 3

Particulars Debit Credit

Share Capital

General Reserve

Retained Earnings

Investment in Car Ltd

Non – controlling Interest

100000

8000

20000

83200

44800

Vehicle

Patent

Goodwill

Non – controlling interest

Investment in Car Ltd

50000

20000

521300

24500

566800

control throughout the action that exists only in

The selection of related exercises requires unanimous consent of the party’s shared

control.

A joint effort is a joint game plan through which collective control of the course of

action is possible. Freedom to net resources in the course of action. The joint venture in

which the joint ventures participate has joint control over the joint venture.

QUESTION 2

Particulars Debit Credit

Retained Earnings of Morrison Ltd

Retained Earnings of Scarlett Ltd

1000

1000

Retained Earnings of Scarlett Ltd

Patent of Morrison Ltd

8000

8000

Retained Earnings of Scarlett Ltd

Machine

2000

2000

Allowance for Depreciation on Machine

Depreciation on Machine

200

200

Retained Earnings of Morrison Ltd

Inventory of Scarlett Ltd

3000

3000

QUESTION 3

Particulars Debit Credit

Share Capital

General Reserve

Retained Earnings

Investment in Car Ltd

Non – controlling Interest

100000

8000

20000

83200

44800

Vehicle

Patent

Goodwill

Non – controlling interest

Investment in Car Ltd

50000

20000

521300

24500

566800

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

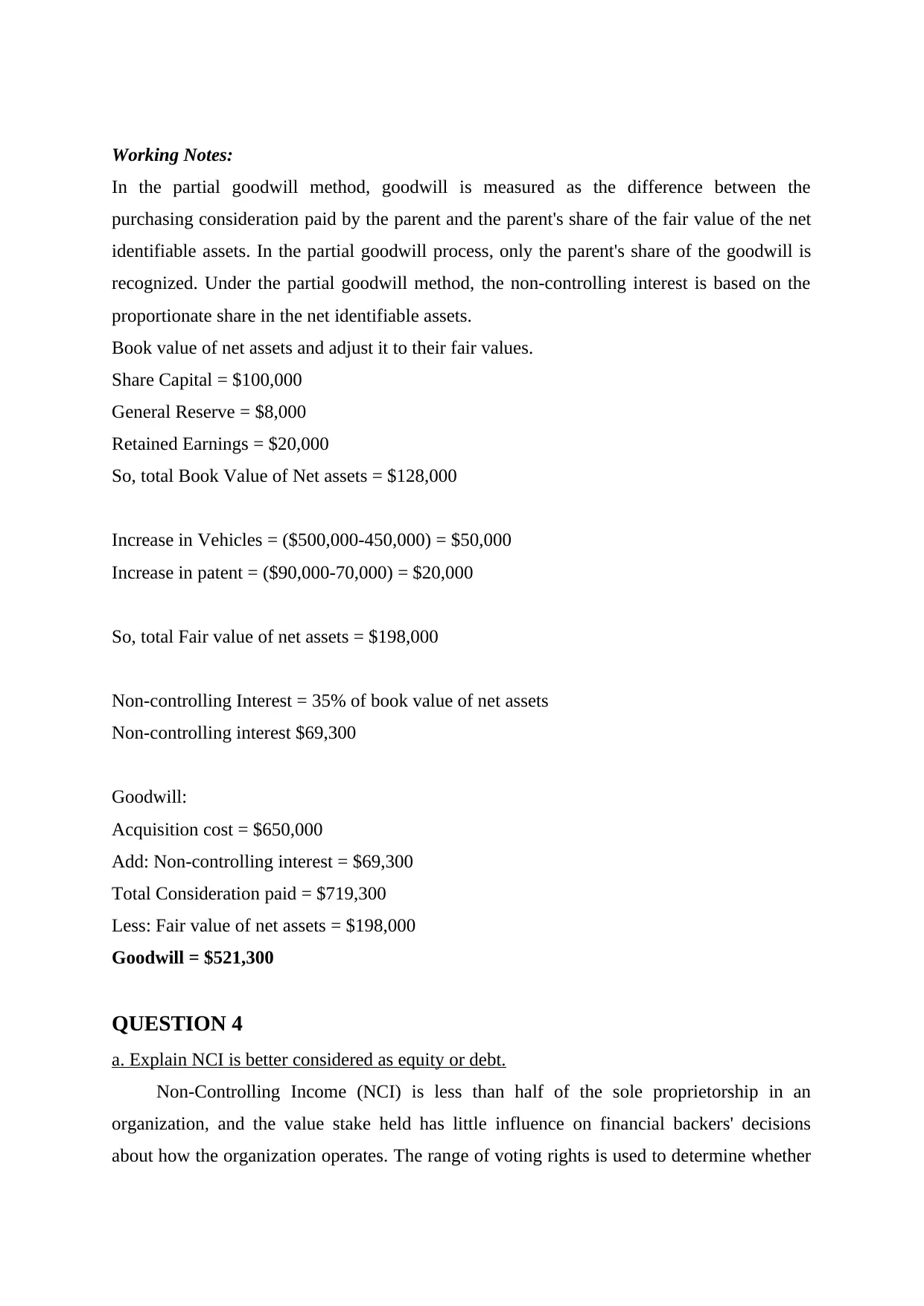

Working Notes:

In the partial goodwill method, goodwill is measured as the difference between the

purchasing consideration paid by the parent and the parent's share of the fair value of the net

identifiable assets. In the partial goodwill process, only the parent's share of the goodwill is

recognized. Under the partial goodwill method, the non-controlling interest is based on the

proportionate share in the net identifiable assets.

Book value of net assets and adjust it to their fair values.

Share Capital = $100,000

General Reserve = $8,000

Retained Earnings = $20,000

So, total Book Value of Net assets = $128,000

Increase in Vehicles = ($500,000-450,000) = $50,000

Increase in patent = ($90,000-70,000) = $20,000

So, total Fair value of net assets = $198,000

Non-controlling Interest = 35% of book value of net assets

Non-controlling interest $69,300

Goodwill:

Acquisition cost = $650,000

Add: Non-controlling interest = $69,300

Total Consideration paid = $719,300

Less: Fair value of net assets = $198,000

Goodwill = $521,300

QUESTION 4

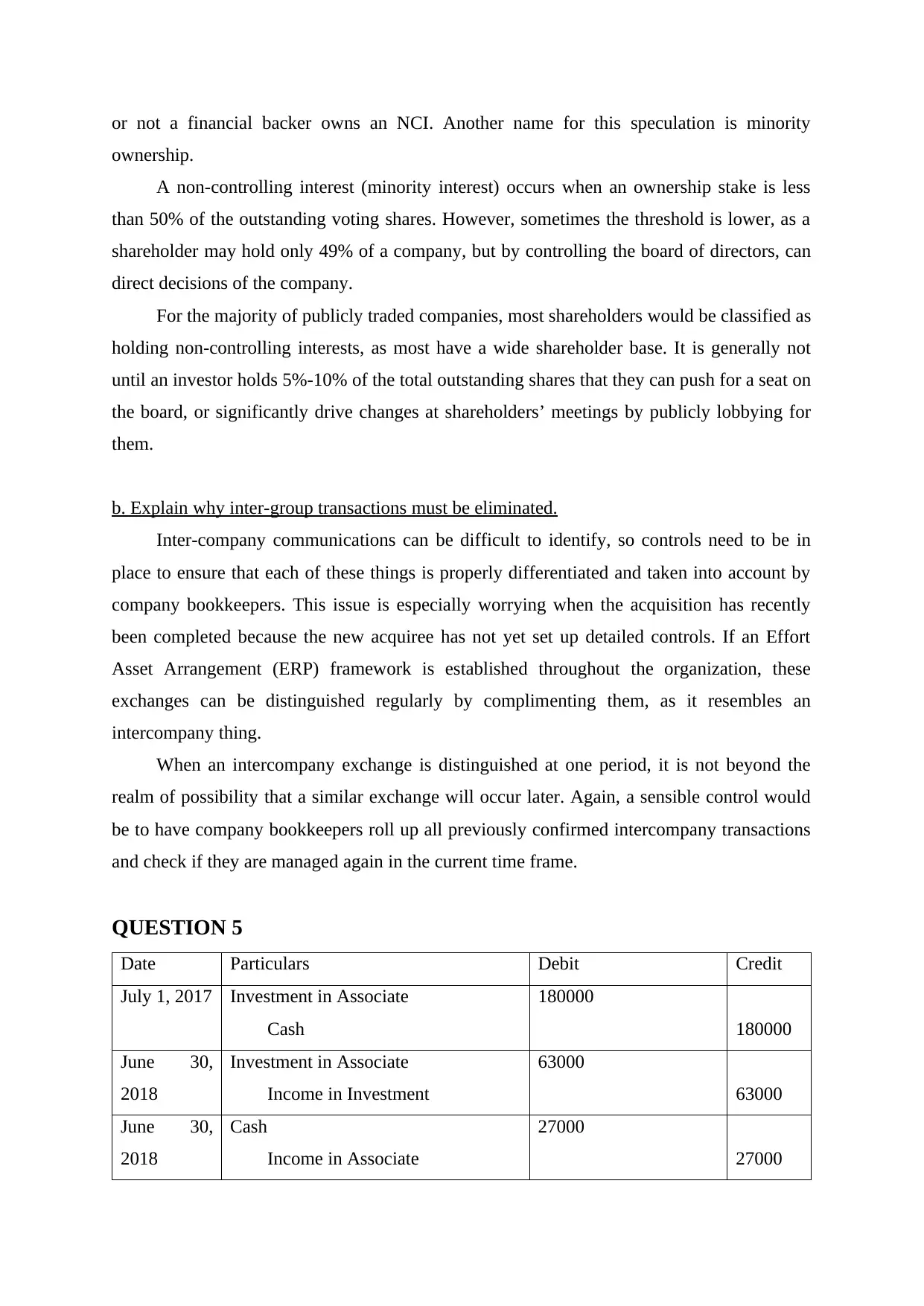

a. Explain NCI is better considered as equity or debt.

Non-Controlling Income (NCI) is less than half of the sole proprietorship in an

organization, and the value stake held has little influence on financial backers' decisions

about how the organization operates. The range of voting rights is used to determine whether

In the partial goodwill method, goodwill is measured as the difference between the

purchasing consideration paid by the parent and the parent's share of the fair value of the net

identifiable assets. In the partial goodwill process, only the parent's share of the goodwill is

recognized. Under the partial goodwill method, the non-controlling interest is based on the

proportionate share in the net identifiable assets.

Book value of net assets and adjust it to their fair values.

Share Capital = $100,000

General Reserve = $8,000

Retained Earnings = $20,000

So, total Book Value of Net assets = $128,000

Increase in Vehicles = ($500,000-450,000) = $50,000

Increase in patent = ($90,000-70,000) = $20,000

So, total Fair value of net assets = $198,000

Non-controlling Interest = 35% of book value of net assets

Non-controlling interest $69,300

Goodwill:

Acquisition cost = $650,000

Add: Non-controlling interest = $69,300

Total Consideration paid = $719,300

Less: Fair value of net assets = $198,000

Goodwill = $521,300

QUESTION 4

a. Explain NCI is better considered as equity or debt.

Non-Controlling Income (NCI) is less than half of the sole proprietorship in an

organization, and the value stake held has little influence on financial backers' decisions

about how the organization operates. The range of voting rights is used to determine whether

or not a financial backer owns an NCI. Another name for this speculation is minority

ownership.

A non-controlling interest (minority interest) occurs when an ownership stake is less

than 50% of the outstanding voting shares. However, sometimes the threshold is lower, as a

shareholder may hold only 49% of a company, but by controlling the board of directors, can

direct decisions of the company.

For the majority of publicly traded companies, most shareholders would be classified as

holding non-controlling interests, as most have a wide shareholder base. It is generally not

until an investor holds 5%-10% of the total outstanding shares that they can push for a seat on

the board, or significantly drive changes at shareholders’ meetings by publicly lobbying for

them.

b. Explain why inter-group transactions must be eliminated.

Inter-company communications can be difficult to identify, so controls need to be in

place to ensure that each of these things is properly differentiated and taken into account by

company bookkeepers. This issue is especially worrying when the acquisition has recently

been completed because the new acquiree has not yet set up detailed controls. If an Effort

Asset Arrangement (ERP) framework is established throughout the organization, these

exchanges can be distinguished regularly by complimenting them, as it resembles an

intercompany thing.

When an intercompany exchange is distinguished at one period, it is not beyond the

realm of possibility that a similar exchange will occur later. Again, a sensible control would

be to have company bookkeepers roll up all previously confirmed intercompany transactions

and check if they are managed again in the current time frame.

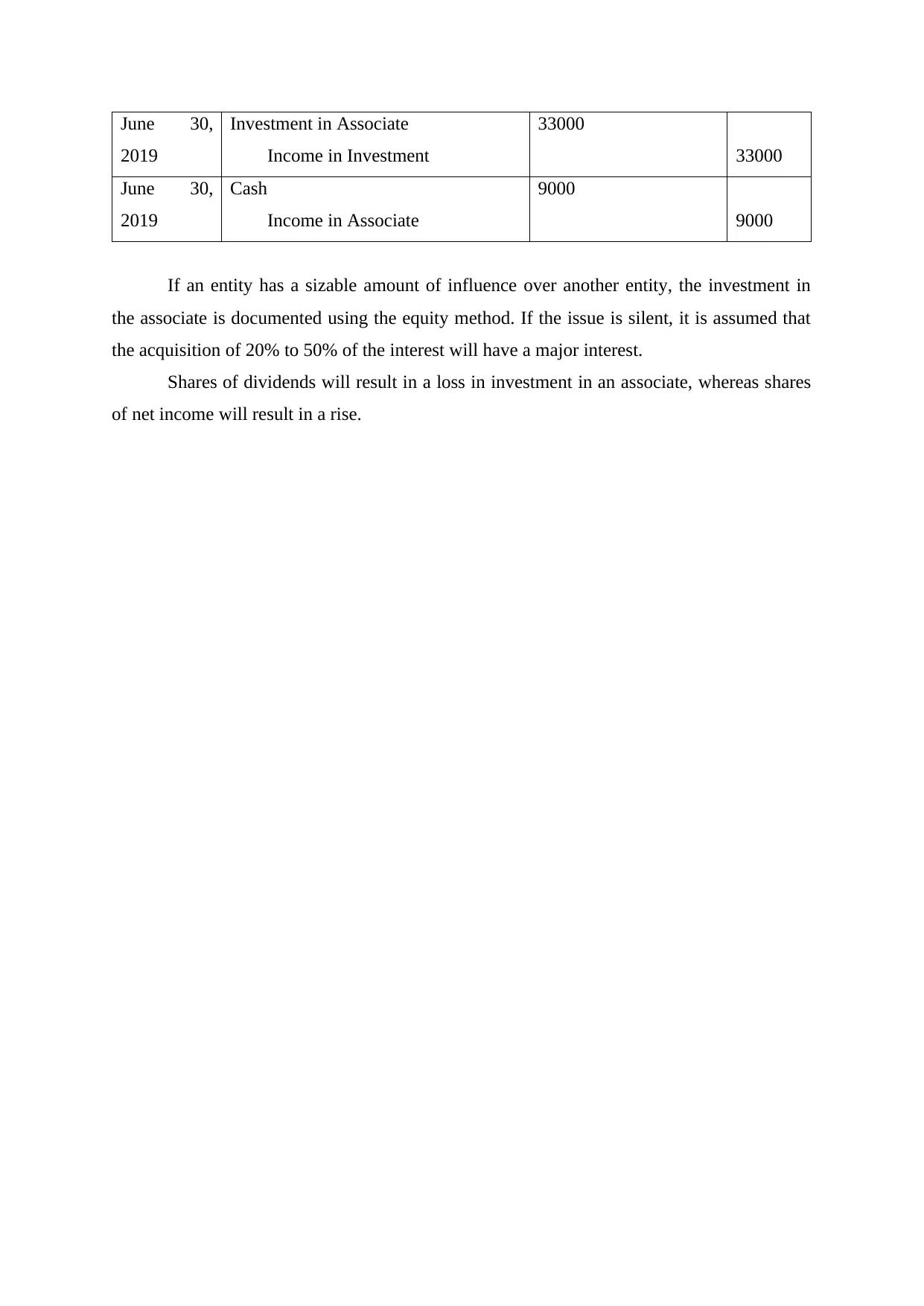

QUESTION 5

Date Particulars Debit Credit

July 1, 2017 Investment in Associate

Cash

180000

180000

June 30,

2018

Investment in Associate

Income in Investment

63000

63000

June 30,

2018

Cash

Income in Associate

27000

27000

ownership.

A non-controlling interest (minority interest) occurs when an ownership stake is less

than 50% of the outstanding voting shares. However, sometimes the threshold is lower, as a

shareholder may hold only 49% of a company, but by controlling the board of directors, can

direct decisions of the company.

For the majority of publicly traded companies, most shareholders would be classified as

holding non-controlling interests, as most have a wide shareholder base. It is generally not

until an investor holds 5%-10% of the total outstanding shares that they can push for a seat on

the board, or significantly drive changes at shareholders’ meetings by publicly lobbying for

them.

b. Explain why inter-group transactions must be eliminated.

Inter-company communications can be difficult to identify, so controls need to be in

place to ensure that each of these things is properly differentiated and taken into account by

company bookkeepers. This issue is especially worrying when the acquisition has recently

been completed because the new acquiree has not yet set up detailed controls. If an Effort

Asset Arrangement (ERP) framework is established throughout the organization, these

exchanges can be distinguished regularly by complimenting them, as it resembles an

intercompany thing.

When an intercompany exchange is distinguished at one period, it is not beyond the

realm of possibility that a similar exchange will occur later. Again, a sensible control would

be to have company bookkeepers roll up all previously confirmed intercompany transactions

and check if they are managed again in the current time frame.

QUESTION 5

Date Particulars Debit Credit

July 1, 2017 Investment in Associate

Cash

180000

180000

June 30,

2018

Investment in Associate

Income in Investment

63000

63000

June 30,

2018

Cash

Income in Associate

27000

27000

June 30,

2019

Investment in Associate

Income in Investment

33000

33000

June 30,

2019

Cash

Income in Associate

9000

9000

If an entity has a sizable amount of influence over another entity, the investment in

the associate is documented using the equity method. If the issue is silent, it is assumed that

the acquisition of 20% to 50% of the interest will have a major interest.

Shares of dividends will result in a loss in investment in an associate, whereas shares

of net income will result in a rise.

2019

Investment in Associate

Income in Investment

33000

33000

June 30,

2019

Cash

Income in Associate

9000

9000

If an entity has a sizable amount of influence over another entity, the investment in

the associate is documented using the equity method. If the issue is silent, it is assumed that

the acquisition of 20% to 50% of the interest will have a major interest.

Shares of dividends will result in a loss in investment in an associate, whereas shares

of net income will result in a rise.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.