ACC3115 Advanced Financial Data Analysis: Coca-Cola Ratio Analysis

VerifiedAdded on 2023/06/08

|13

|1856

|487

Report

AI Summary

This assignment solution provides a detailed financial data analysis, covering ratio analysis of Coca-Cola for 2020 and 2021, time value of money calculations including future value, effective annual interest rate, present value, simple interest, payback period, present value of annuity, and maximum loan amount. It also includes an investment appraisal with sales forecasts, cost analysis, and profitability assessments, using techniques like discounted payback period, net present value, present value index, and simple payback period. The report concludes with references to various books and journals used for the analysis. Desklib is a platform where students can find similar solved assignments and resources.

ACC3115

ADVANCED

FINANCIAL DATA

ANALYSIS

ADVANCED

FINANCIAL DATA

ANALYSIS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

PART 1 – RATIO ANALYSIS.......................................................................................................3

Interpretation of above calculated ratios.....................................................................................6

PART 2 – TIME VALUE OF MONEY CALCULATIONS..........................................................6

1. Calculation of future value......................................................................................................6

2. Calculate of effective annual interest rate...............................................................................6

3. calculation of present value.....................................................................................................6

4. Calculation of simple interest..................................................................................................7

5. Calculation of payback period................................................................................................7

6.Calculation of present value of annuity...................................................................................7

7. Calculation of maximum amount borrowed by the customer.................................................8

PART 3 – INVESTMENT APPRAISAL........................................................................................9

REFERENCES..............................................................................................................................11

PART 1 – RATIO ANALYSIS.......................................................................................................3

Interpretation of above calculated ratios.....................................................................................6

PART 2 – TIME VALUE OF MONEY CALCULATIONS..........................................................6

1. Calculation of future value......................................................................................................6

2. Calculate of effective annual interest rate...............................................................................6

3. calculation of present value.....................................................................................................6

4. Calculation of simple interest..................................................................................................7

5. Calculation of payback period................................................................................................7

6.Calculation of present value of annuity...................................................................................7

7. Calculation of maximum amount borrowed by the customer.................................................8

PART 3 – INVESTMENT APPRAISAL........................................................................................9

REFERENCES..............................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

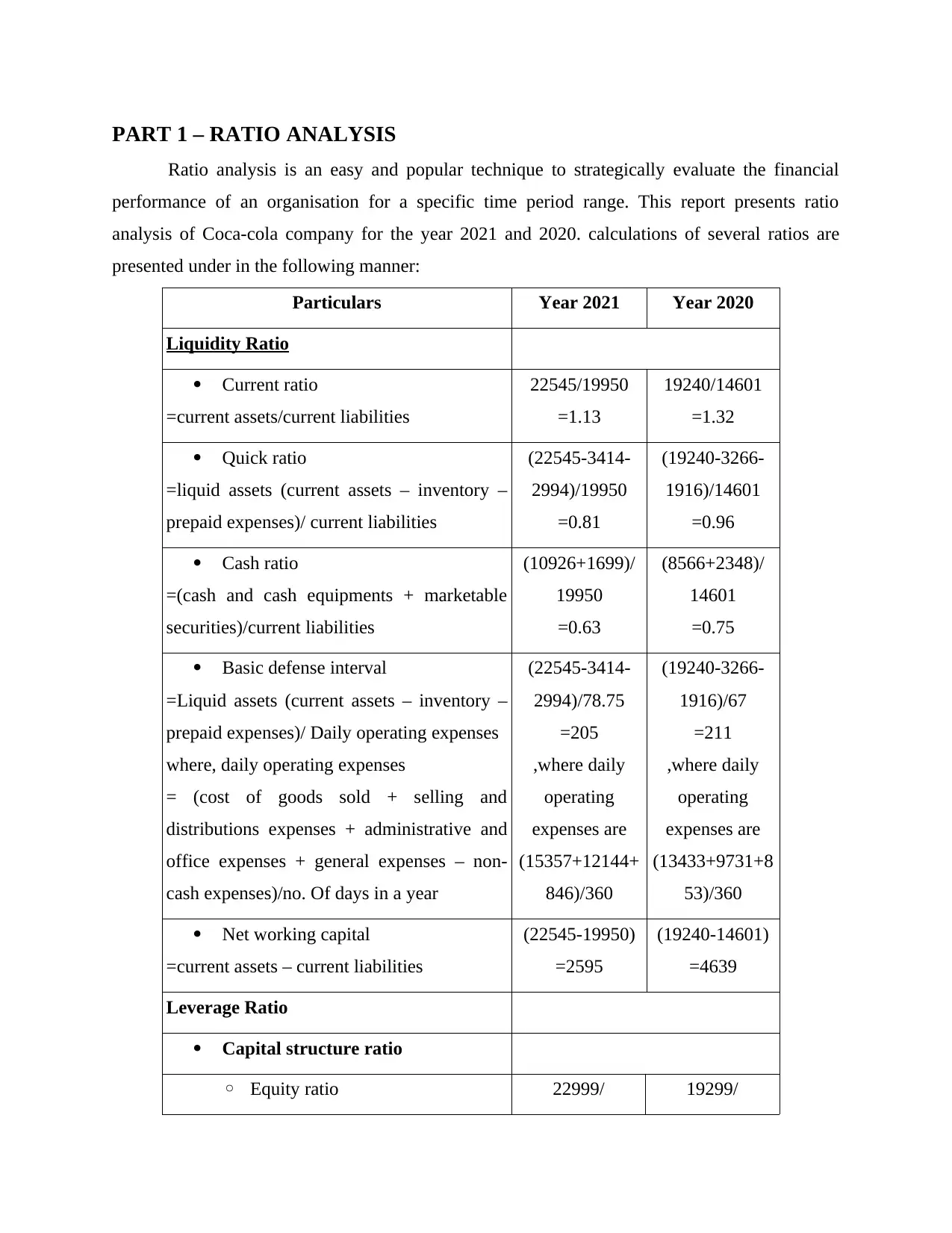

PART 1 – RATIO ANALYSIS

Ratio analysis is an easy and popular technique to strategically evaluate the financial

performance of an organisation for a specific time period range. This report presents ratio

analysis of Coca-cola company for the year 2021 and 2020. calculations of several ratios are

presented under in the following manner:

Particulars Year 2021 Year 2020

Liquidity Ratio

Current ratio

=current assets/current liabilities

22545/19950

=1.13

19240/14601

=1.32

Quick ratio

=liquid assets (current assets – inventory –

prepaid expenses)/ current liabilities

(22545-3414-

2994)/19950

=0.81

(19240-3266-

1916)/14601

=0.96

Cash ratio

=(cash and cash equipments + marketable

securities)/current liabilities

(10926+1699)/

19950

=0.63

(8566+2348)/

14601

=0.75

Basic defense interval

=Liquid assets (current assets – inventory –

prepaid expenses)/ Daily operating expenses

where, daily operating expenses

= (cost of goods sold + selling and

distributions expenses + administrative and

office expenses + general expenses – non-

cash expenses)/no. Of days in a year

(22545-3414-

2994)/78.75

=205

,where daily

operating

expenses are

(15357+12144+

846)/360

(19240-3266-

1916)/67

=211

,where daily

operating

expenses are

(13433+9731+8

53)/360

Net working capital

=current assets – current liabilities

(22545-19950)

=2595

(19240-14601)

=4639

Leverage Ratio

Capital structure ratio

◦ Equity ratio 22999/ 19299/

Ratio analysis is an easy and popular technique to strategically evaluate the financial

performance of an organisation for a specific time period range. This report presents ratio

analysis of Coca-cola company for the year 2021 and 2020. calculations of several ratios are

presented under in the following manner:

Particulars Year 2021 Year 2020

Liquidity Ratio

Current ratio

=current assets/current liabilities

22545/19950

=1.13

19240/14601

=1.32

Quick ratio

=liquid assets (current assets – inventory –

prepaid expenses)/ current liabilities

(22545-3414-

2994)/19950

=0.81

(19240-3266-

1916)/14601

=0.96

Cash ratio

=(cash and cash equipments + marketable

securities)/current liabilities

(10926+1699)/

19950

=0.63

(8566+2348)/

14601

=0.75

Basic defense interval

=Liquid assets (current assets – inventory –

prepaid expenses)/ Daily operating expenses

where, daily operating expenses

= (cost of goods sold + selling and

distributions expenses + administrative and

office expenses + general expenses – non-

cash expenses)/no. Of days in a year

(22545-3414-

2994)/78.75

=205

,where daily

operating

expenses are

(15357+12144+

846)/360

(19240-3266-

1916)/67

=211

,where daily

operating

expenses are

(13433+9731+8

53)/360

Net working capital

=current assets – current liabilities

(22545-19950)

=2595

(19240-14601)

=4639

Leverage Ratio

Capital structure ratio

◦ Equity ratio 22999/ 19299/

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

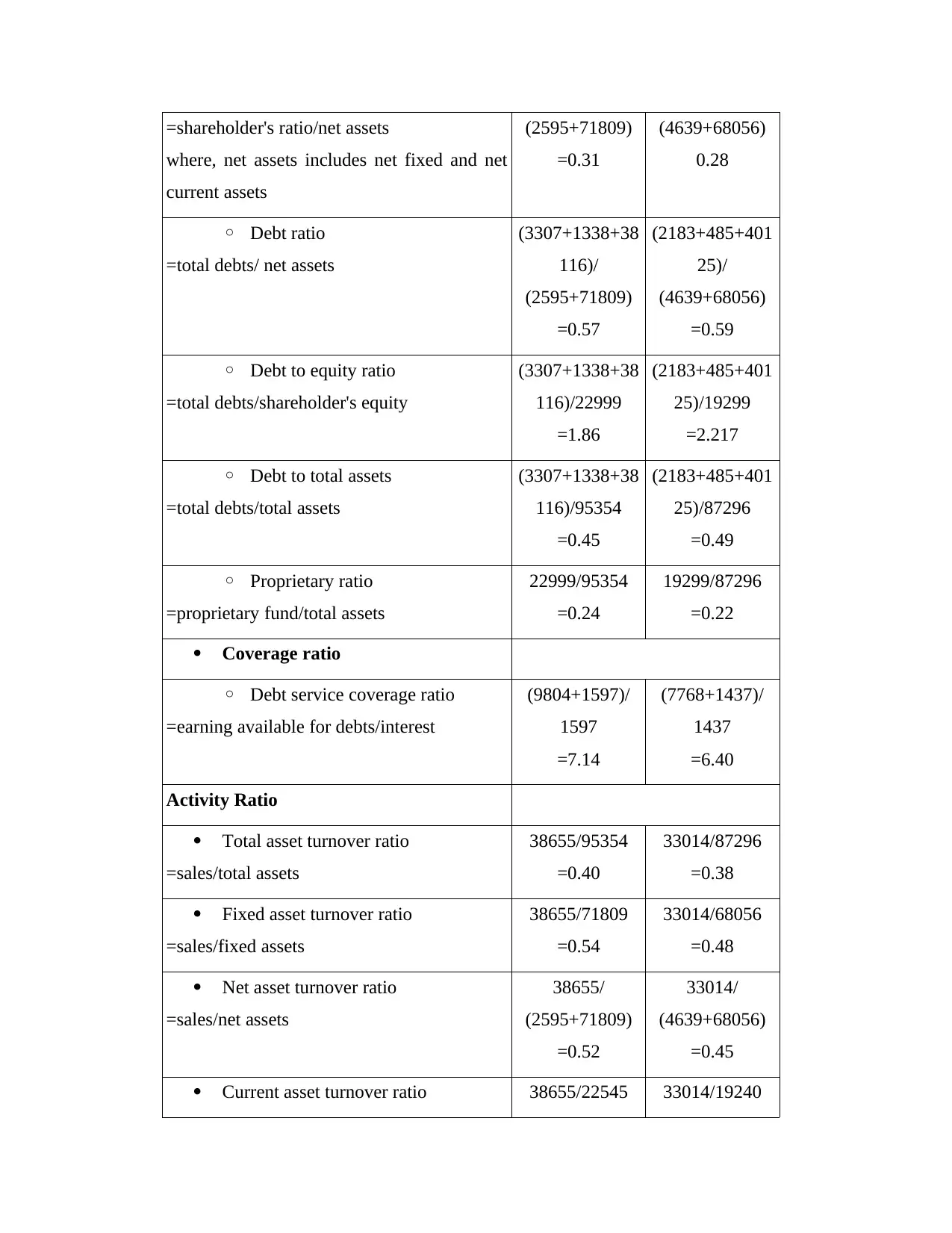

=shareholder's ratio/net assets

where, net assets includes net fixed and net

current assets

(2595+71809)

=0.31

(4639+68056)

0.28

◦ Debt ratio

=total debts/ net assets

(3307+1338+38

116)/

(2595+71809)

=0.57

(2183+485+401

25)/

(4639+68056)

=0.59

◦ Debt to equity ratio

=total debts/shareholder's equity

(3307+1338+38

116)/22999

=1.86

(2183+485+401

25)/19299

=2.217

◦ Debt to total assets

=total debts/total assets

(3307+1338+38

116)/95354

=0.45

(2183+485+401

25)/87296

=0.49

◦ Proprietary ratio

=proprietary fund/total assets

22999/95354

=0.24

19299/87296

=0.22

Coverage ratio

◦ Debt service coverage ratio

=earning available for debts/interest

(9804+1597)/

1597

=7.14

(7768+1437)/

1437

=6.40

Activity Ratio

Total asset turnover ratio

=sales/total assets

38655/95354

=0.40

33014/87296

=0.38

Fixed asset turnover ratio

=sales/fixed assets

38655/71809

=0.54

33014/68056

=0.48

Net asset turnover ratio

=sales/net assets

38655/

(2595+71809)

=0.52

33014/

(4639+68056)

=0.45

Current asset turnover ratio 38655/22545 33014/19240

where, net assets includes net fixed and net

current assets

(2595+71809)

=0.31

(4639+68056)

0.28

◦ Debt ratio

=total debts/ net assets

(3307+1338+38

116)/

(2595+71809)

=0.57

(2183+485+401

25)/

(4639+68056)

=0.59

◦ Debt to equity ratio

=total debts/shareholder's equity

(3307+1338+38

116)/22999

=1.86

(2183+485+401

25)/19299

=2.217

◦ Debt to total assets

=total debts/total assets

(3307+1338+38

116)/95354

=0.45

(2183+485+401

25)/87296

=0.49

◦ Proprietary ratio

=proprietary fund/total assets

22999/95354

=0.24

19299/87296

=0.22

Coverage ratio

◦ Debt service coverage ratio

=earning available for debts/interest

(9804+1597)/

1597

=7.14

(7768+1437)/

1437

=6.40

Activity Ratio

Total asset turnover ratio

=sales/total assets

38655/95354

=0.40

33014/87296

=0.38

Fixed asset turnover ratio

=sales/fixed assets

38655/71809

=0.54

33014/68056

=0.48

Net asset turnover ratio

=sales/net assets

38655/

(2595+71809)

=0.52

33014/

(4639+68056)

=0.45

Current asset turnover ratio 38655/22545 33014/19240

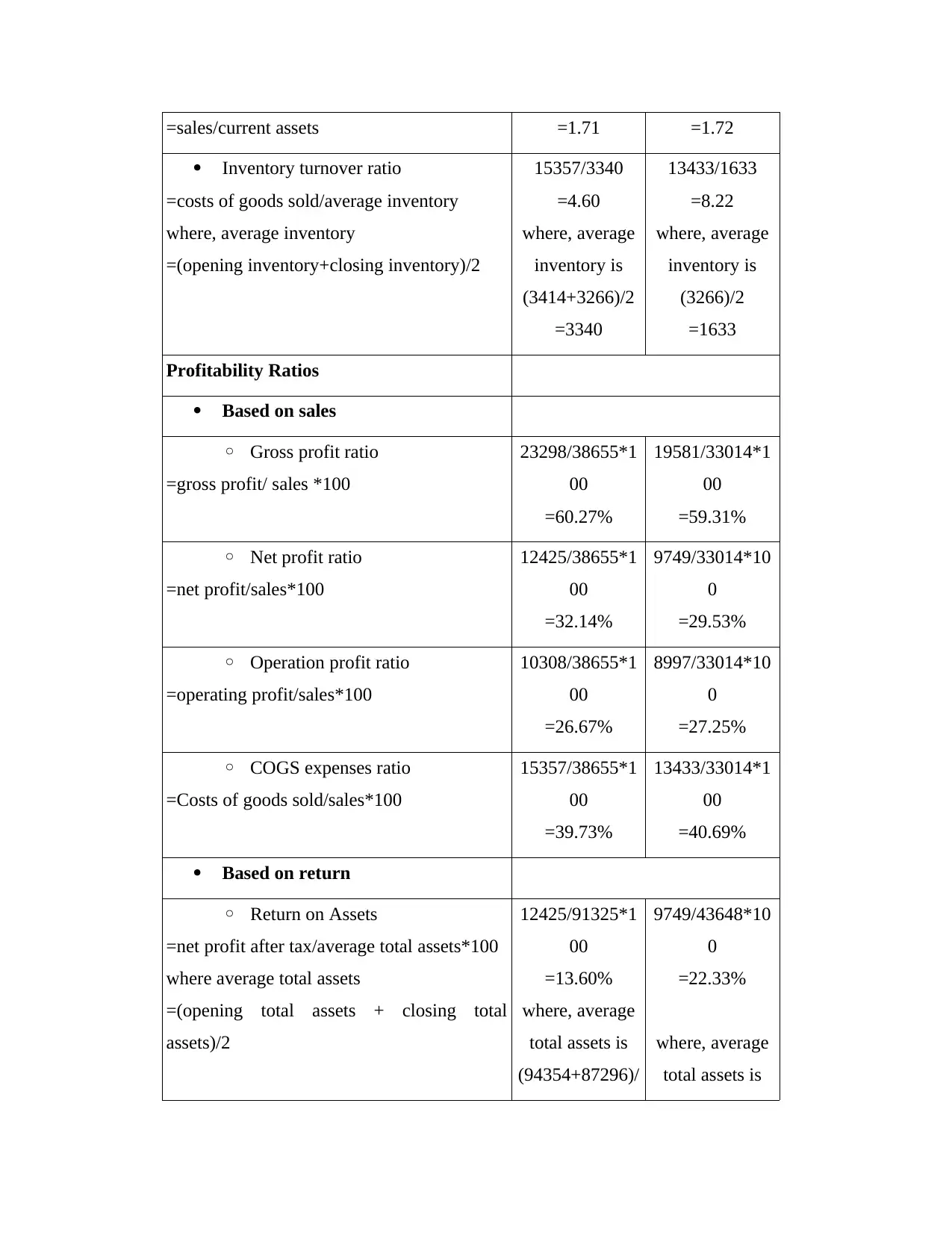

=sales/current assets =1.71 =1.72

Inventory turnover ratio

=costs of goods sold/average inventory

where, average inventory

=(opening inventory+closing inventory)/2

15357/3340

=4.60

where, average

inventory is

(3414+3266)/2

=3340

13433/1633

=8.22

where, average

inventory is

(3266)/2

=1633

Profitability Ratios

Based on sales

◦ Gross profit ratio

=gross profit/ sales *100

23298/38655*1

00

=60.27%

19581/33014*1

00

=59.31%

◦ Net profit ratio

=net profit/sales*100

12425/38655*1

00

=32.14%

9749/33014*10

0

=29.53%

◦ Operation profit ratio

=operating profit/sales*100

10308/38655*1

00

=26.67%

8997/33014*10

0

=27.25%

◦ COGS expenses ratio

=Costs of goods sold/sales*100

15357/38655*1

00

=39.73%

13433/33014*1

00

=40.69%

Based on return

◦ Return on Assets

=net profit after tax/average total assets*100

where average total assets

=(opening total assets + closing total

assets)/2

12425/91325*1

00

=13.60%

where, average

total assets is

(94354+87296)/

9749/43648*10

0

=22.33%

where, average

total assets is

Inventory turnover ratio

=costs of goods sold/average inventory

where, average inventory

=(opening inventory+closing inventory)/2

15357/3340

=4.60

where, average

inventory is

(3414+3266)/2

=3340

13433/1633

=8.22

where, average

inventory is

(3266)/2

=1633

Profitability Ratios

Based on sales

◦ Gross profit ratio

=gross profit/ sales *100

23298/38655*1

00

=60.27%

19581/33014*1

00

=59.31%

◦ Net profit ratio

=net profit/sales*100

12425/38655*1

00

=32.14%

9749/33014*10

0

=29.53%

◦ Operation profit ratio

=operating profit/sales*100

10308/38655*1

00

=26.67%

8997/33014*10

0

=27.25%

◦ COGS expenses ratio

=Costs of goods sold/sales*100

15357/38655*1

00

=39.73%

13433/33014*1

00

=40.69%

Based on return

◦ Return on Assets

=net profit after tax/average total assets*100

where average total assets

=(opening total assets + closing total

assets)/2

12425/91325*1

00

=13.60%

where, average

total assets is

(94354+87296)/

9749/43648*10

0

=22.33%

where, average

total assets is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2

=91325

(87296)/2

=43648

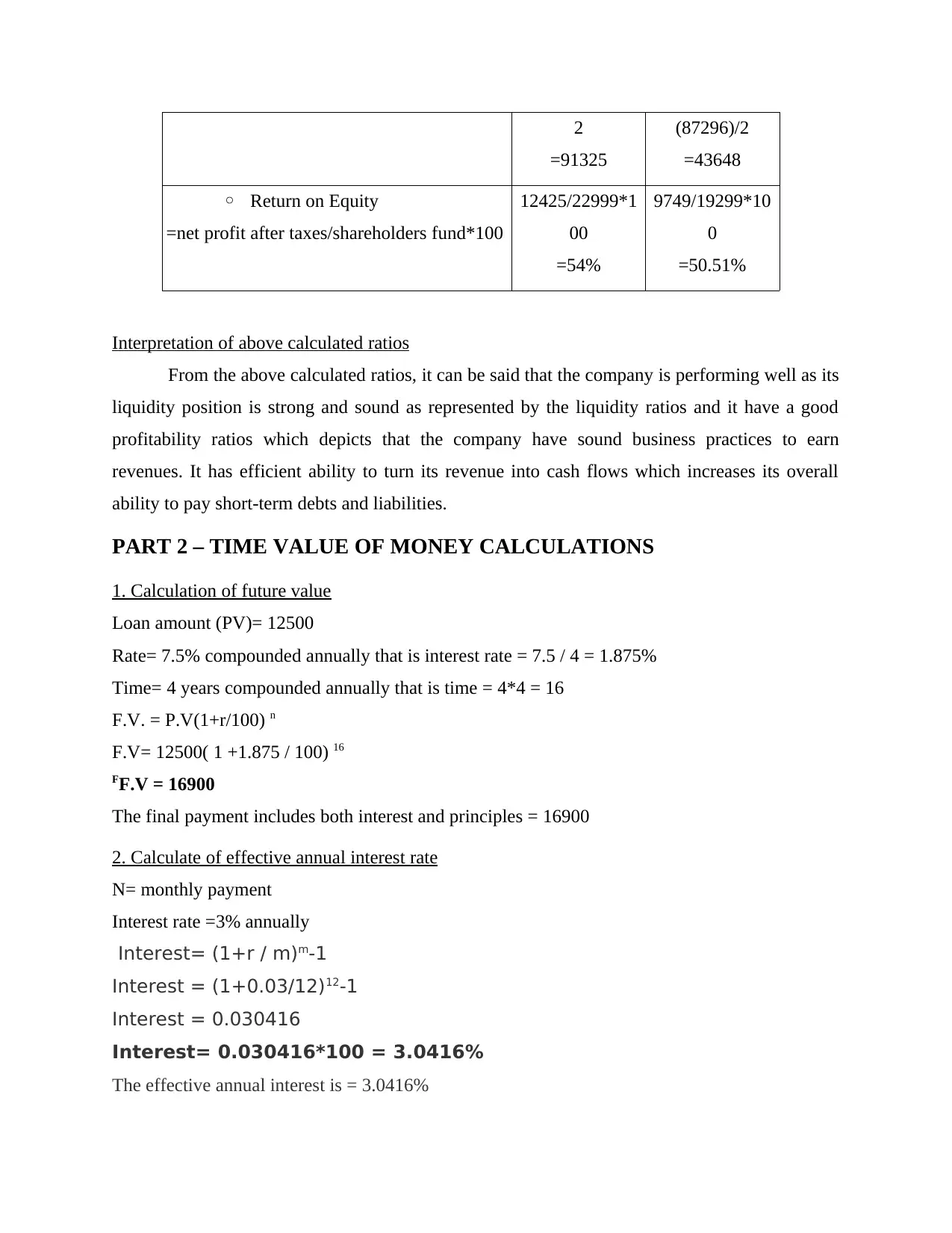

◦ Return on Equity

=net profit after taxes/shareholders fund*100

12425/22999*1

00

=54%

9749/19299*10

0

=50.51%

Interpretation of above calculated ratios

From the above calculated ratios, it can be said that the company is performing well as its

liquidity position is strong and sound as represented by the liquidity ratios and it have a good

profitability ratios which depicts that the company have sound business practices to earn

revenues. It has efficient ability to turn its revenue into cash flows which increases its overall

ability to pay short-term debts and liabilities.

PART 2 – TIME VALUE OF MONEY CALCULATIONS

1. Calculation of future value

Loan amount (PV)= 12500

Rate= 7.5% compounded annually that is interest rate = 7.5 / 4 = 1.875%

Time= 4 years compounded annually that is time = 4*4 = 16

F.V. = P.V(1+r/100) n

F.V= 12500( 1 +1.875 / 100) 16

FF.V = 16900

The final payment includes both interest and principles = 16900

2. Calculate of effective annual interest rate

N= monthly payment

Interest rate =3% annually

Interest= (1+r / m)m-1

Interest = (1+0.03/12)12-1

Interest = 0.030416

Interest= 0.030416*100 = 3.0416%

The effective annual interest is = 3.0416%

=91325

(87296)/2

=43648

◦ Return on Equity

=net profit after taxes/shareholders fund*100

12425/22999*1

00

=54%

9749/19299*10

0

=50.51%

Interpretation of above calculated ratios

From the above calculated ratios, it can be said that the company is performing well as its

liquidity position is strong and sound as represented by the liquidity ratios and it have a good

profitability ratios which depicts that the company have sound business practices to earn

revenues. It has efficient ability to turn its revenue into cash flows which increases its overall

ability to pay short-term debts and liabilities.

PART 2 – TIME VALUE OF MONEY CALCULATIONS

1. Calculation of future value

Loan amount (PV)= 12500

Rate= 7.5% compounded annually that is interest rate = 7.5 / 4 = 1.875%

Time= 4 years compounded annually that is time = 4*4 = 16

F.V. = P.V(1+r/100) n

F.V= 12500( 1 +1.875 / 100) 16

FF.V = 16900

The final payment includes both interest and principles = 16900

2. Calculate of effective annual interest rate

N= monthly payment

Interest rate =3% annually

Interest= (1+r / m)m-1

Interest = (1+0.03/12)12-1

Interest = 0.030416

Interest= 0.030416*100 = 3.0416%

The effective annual interest is = 3.0416%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

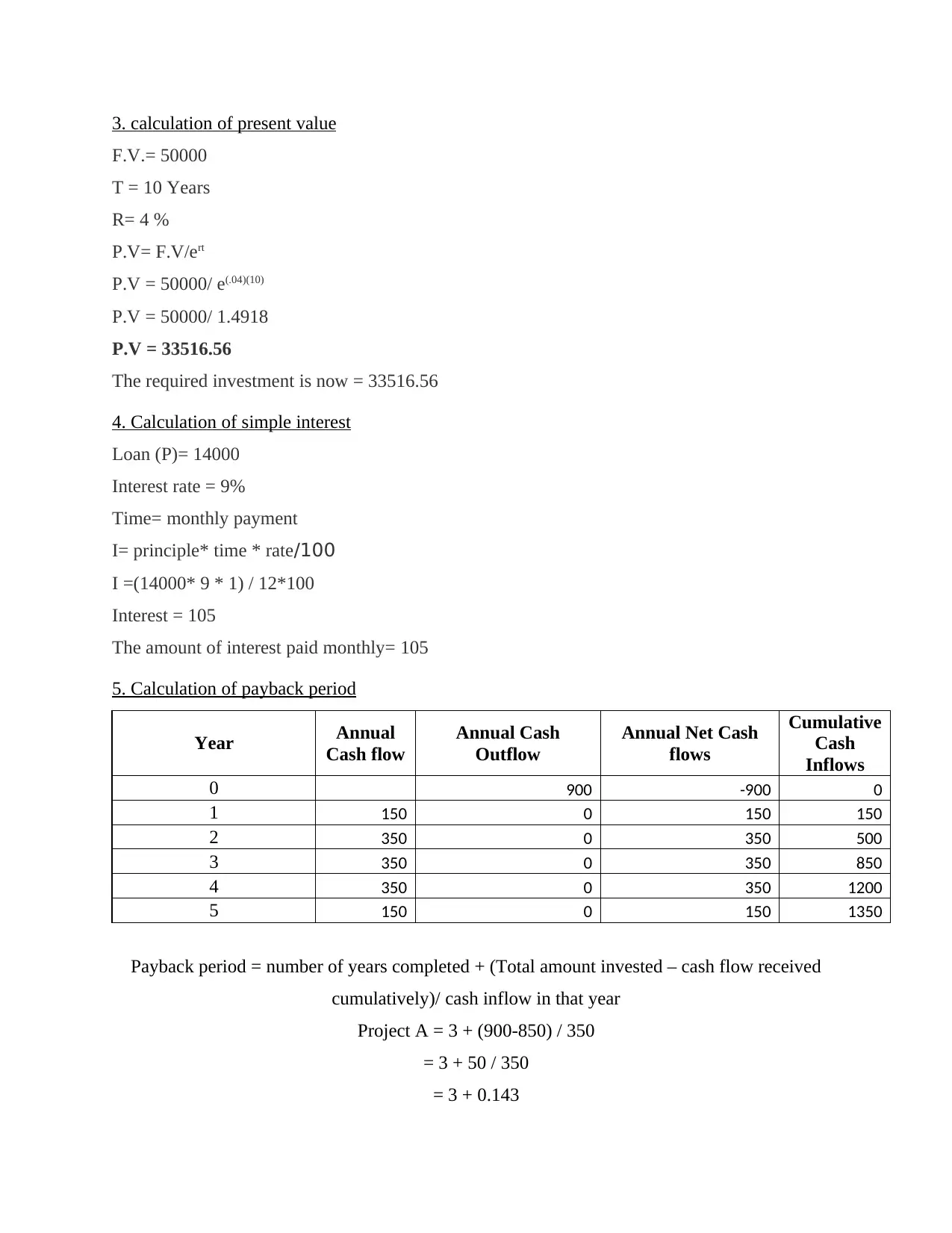

3. calculation of present value

F.V.= 50000

T = 10 Years

R= 4 %

P.V= F.V/ert

P.V = 50000/ e(.04)(10)

P.V = 50000/ 1.4918

P.V = 33516.56

The required investment is now = 33516.56

4. Calculation of simple interest

Loan (P)= 14000

Interest rate = 9%

Time= monthly payment

I= principle* time * rate/100

I =(14000* 9 * 1) / 12*100

Interest = 105

The amount of interest paid monthly= 105

5. Calculation of payback period

Year Annual

Cash flow

Annual Cash

Outflow

Annual Net Cash

flows

Cumulative

Cash

Inflows

0 900 -900 0

1 150 0 150 150

2 350 0 350 500

3 350 0 350 850

4 350 0 350 1200

5 150 0 150 1350

Payback period = number of years completed + (Total amount invested – cash flow received

cumulatively)/ cash inflow in that year

Project A = 3 + (900-850) / 350

= 3 + 50 / 350

= 3 + 0.143

F.V.= 50000

T = 10 Years

R= 4 %

P.V= F.V/ert

P.V = 50000/ e(.04)(10)

P.V = 50000/ 1.4918

P.V = 33516.56

The required investment is now = 33516.56

4. Calculation of simple interest

Loan (P)= 14000

Interest rate = 9%

Time= monthly payment

I= principle* time * rate/100

I =(14000* 9 * 1) / 12*100

Interest = 105

The amount of interest paid monthly= 105

5. Calculation of payback period

Year Annual

Cash flow

Annual Cash

Outflow

Annual Net Cash

flows

Cumulative

Cash

Inflows

0 900 -900 0

1 150 0 150 150

2 350 0 350 500

3 350 0 350 850

4 350 0 350 1200

5 150 0 150 1350

Payback period = number of years completed + (Total amount invested – cash flow received

cumulatively)/ cash inflow in that year

Project A = 3 + (900-850) / 350

= 3 + 50 / 350

= 3 + 0.143

= 3.143 years

6.Calculation of present value of annuity

Monthly annuity = 720

interest rate= 3% p.a that is monthly payment = 3/12= 0.25%

year= 5 year monthly payment that is = 5*12= 60

Present value of the ordinary annuity = 40066.29

7. Calculation of maximum amount borrowed by the customer

P.V = 10000

interest rate = 3% p.a compounded annually = 3/12 = 0.25%

time = 3 *1 2= 36 month

F.V. = P.V(1+r/100) n

F.V=10000(1+ 0.25/ 100)36

F.V= 11391.96

Saving = 500 per month

t = 36 month

interest = 4% p.a monthly= 4 / 12 = 0.33%

F.V. = P.V(1+r/100) n

F.V=500(1+0.33/100) 36

F.V= 16944.06

(I) the amount accumulated by in three years time = (11391.96+ 16944.06) = 28336.02

The maximum amount of the mortgage to be taken out = 28336.02

(ii) P.V = 28336.02

Time = 25years

rate= 6%

payment = p *(r / n) * ( 1 + r / n)*n(t))/ 1 +r / n) *n(t) – 1

Payment = 28336.02(0.06 / 25)*(1 + 0.06 / 25)*1(25)) /(1+0.06/25)* 1 (25)-1

The monthly mortgage payment, assuming this maximum amount is borrowed=73.7842 monthly

6.Calculation of present value of annuity

Monthly annuity = 720

interest rate= 3% p.a that is monthly payment = 3/12= 0.25%

year= 5 year monthly payment that is = 5*12= 60

Present value of the ordinary annuity = 40066.29

7. Calculation of maximum amount borrowed by the customer

P.V = 10000

interest rate = 3% p.a compounded annually = 3/12 = 0.25%

time = 3 *1 2= 36 month

F.V. = P.V(1+r/100) n

F.V=10000(1+ 0.25/ 100)36

F.V= 11391.96

Saving = 500 per month

t = 36 month

interest = 4% p.a monthly= 4 / 12 = 0.33%

F.V. = P.V(1+r/100) n

F.V=500(1+0.33/100) 36

F.V= 16944.06

(I) the amount accumulated by in three years time = (11391.96+ 16944.06) = 28336.02

The maximum amount of the mortgage to be taken out = 28336.02

(ii) P.V = 28336.02

Time = 25years

rate= 6%

payment = p *(r / n) * ( 1 + r / n)*n(t))/ 1 +r / n) *n(t) – 1

Payment = 28336.02(0.06 / 25)*(1 + 0.06 / 25)*1(25)) /(1+0.06/25)* 1 (25)-1

The monthly mortgage payment, assuming this maximum amount is borrowed=73.7842 monthly

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

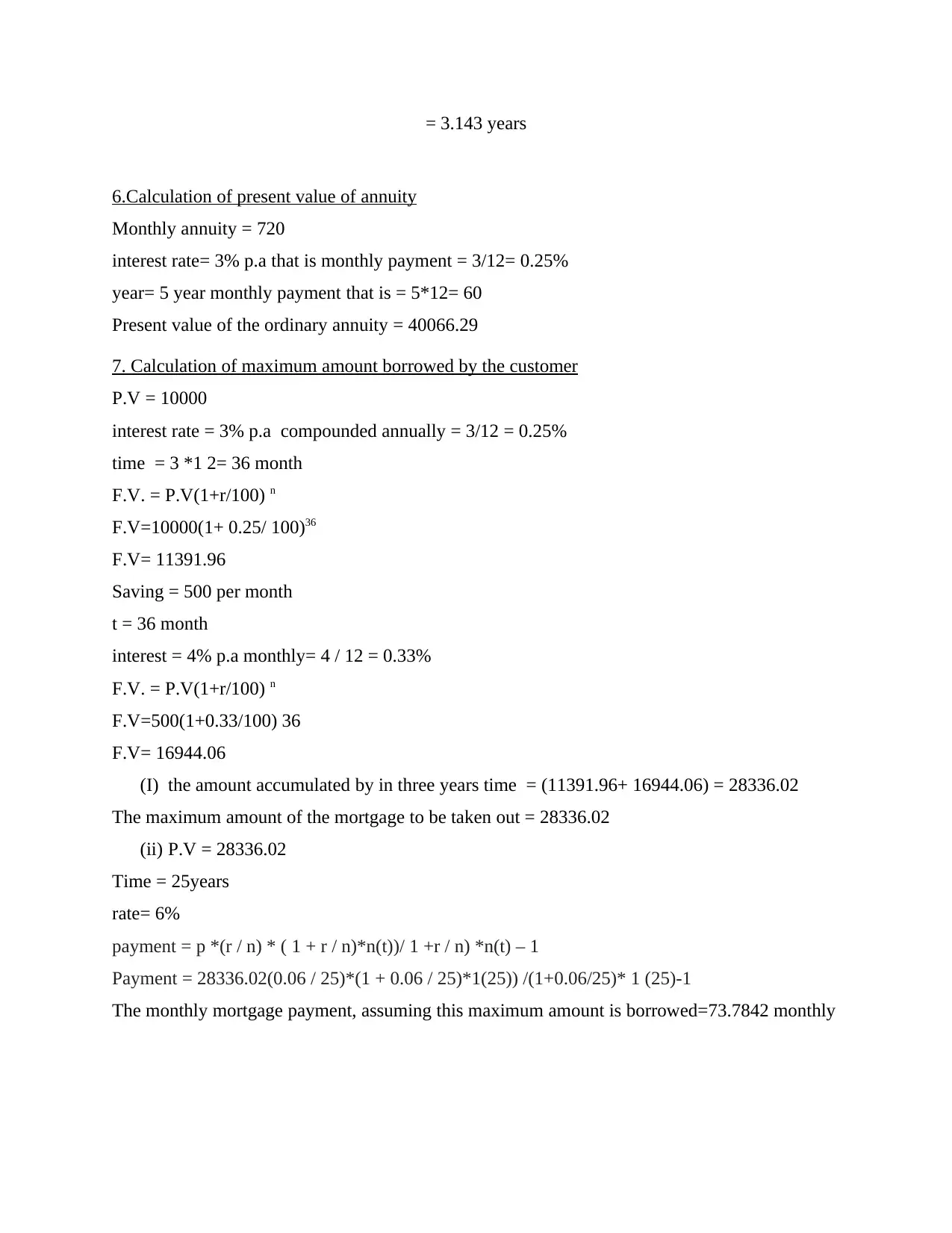

PART 3 – INVESTMENT APPRAISAL

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Sales units 50000 60000 72000 54000 40500 30375

Sales prices 55 56.38 57.78 59.22 60.7 62.22

Sales

revenue (a)

amount in £

£2,750,000.

00

£3,382,800.

00

£4,160,160.

00

£3,197,880.

00

£2,458,350.

00

£1,889,932.

50

Scrap value £150,000.00

Total

inflow

£2,750,000.

00

£3,382,800.

00

£4,160,160.

00

£3,197,880.

00

£2,458,350.

00

£2,039,932.

00

Less-

Cost of sales

65% of sales

£1,787,500.

00

£2,198,820.

00

£2,704,104.

00

£1,822,791.

60

£1,401,259.

50

£1,077,261.

53

Market

research

£500,000.00

Selling and

administrati

ve expenses

£750,000.00

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Sales units 50000 60000 72000 54000 40500 30375

Sales prices 55 56.38 57.78 59.22 60.7 62.22

Sales

revenue (a)

amount in £

£2,750,000.

00

£3,382,800.

00

£4,160,160.

00

£3,197,880.

00

£2,458,350.

00

£1,889,932.

50

Scrap value £150,000.00

Total

inflow

£2,750,000.

00

£3,382,800.

00

£4,160,160.

00

£3,197,880.

00

£2,458,350.

00

£2,039,932.

00

Less-

Cost of sales

65% of sales

£1,787,500.

00

£2,198,820.

00

£2,704,104.

00

£1,822,791.

60

£1,401,259.

50

£1,077,261.

53

Market

research

£500,000.00

Selling and

administrati

ve expenses

£750,000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Lease rent £150,000.00

Working

capital

requirement

£400,000.00 £492,044.00 £605,115.00 £465,147.00 £357,579.00 £274,900.00

Total

outflow

£3,587,500.

00

£2,690,864.

00

£3,309,219.

00

£2,287,938.

60

£1,758,838.

50

£1,352,161.

53

Net profit

before tax

-

£837,500.00

£691,936.00 £850,941.00 £909,941.40 £699,511.50 £687,770.47

Less: tax

expense @

21%

-

£175,875.00

£145306.56 £178,697.61 £191,087.69 £146,897.42 £144431.80

Net profit

after tax

-

£1,013,375.

00

£546,629.44 £672,243.39 £718,853.71 £552,614.08 £543,338.67

Cost of

capital @

18%

1 0.85 0.72 0.61 0.52 0.44

Net

discounted

cash flows

-

£1013375.0

0

£464,635.02 £484,015.24 £438,500.76 £287,359.32 £239069.01

As per discounted payback period technique

=2 year + £64724.74/438500.76

=2.15 year

As per Net present value technique

= net present cash inflow – net present cash outflow

= £1913579.35 - £1013375.00

= £900204.35

Working

capital

requirement

£400,000.00 £492,044.00 £605,115.00 £465,147.00 £357,579.00 £274,900.00

Total

outflow

£3,587,500.

00

£2,690,864.

00

£3,309,219.

00

£2,287,938.

60

£1,758,838.

50

£1,352,161.

53

Net profit

before tax

-

£837,500.00

£691,936.00 £850,941.00 £909,941.40 £699,511.50 £687,770.47

Less: tax

expense @

21%

-

£175,875.00

£145306.56 £178,697.61 £191,087.69 £146,897.42 £144431.80

Net profit

after tax

-

£1,013,375.

00

£546,629.44 £672,243.39 £718,853.71 £552,614.08 £543,338.67

Cost of

capital @

18%

1 0.85 0.72 0.61 0.52 0.44

Net

discounted

cash flows

-

£1013375.0

0

£464,635.02 £484,015.24 £438,500.76 £287,359.32 £239069.01

As per discounted payback period technique

=2 year + £64724.74/438500.76

=2.15 year

As per Net present value technique

= net present cash inflow – net present cash outflow

= £1913579.35 - £1013375.00

= £900204.35

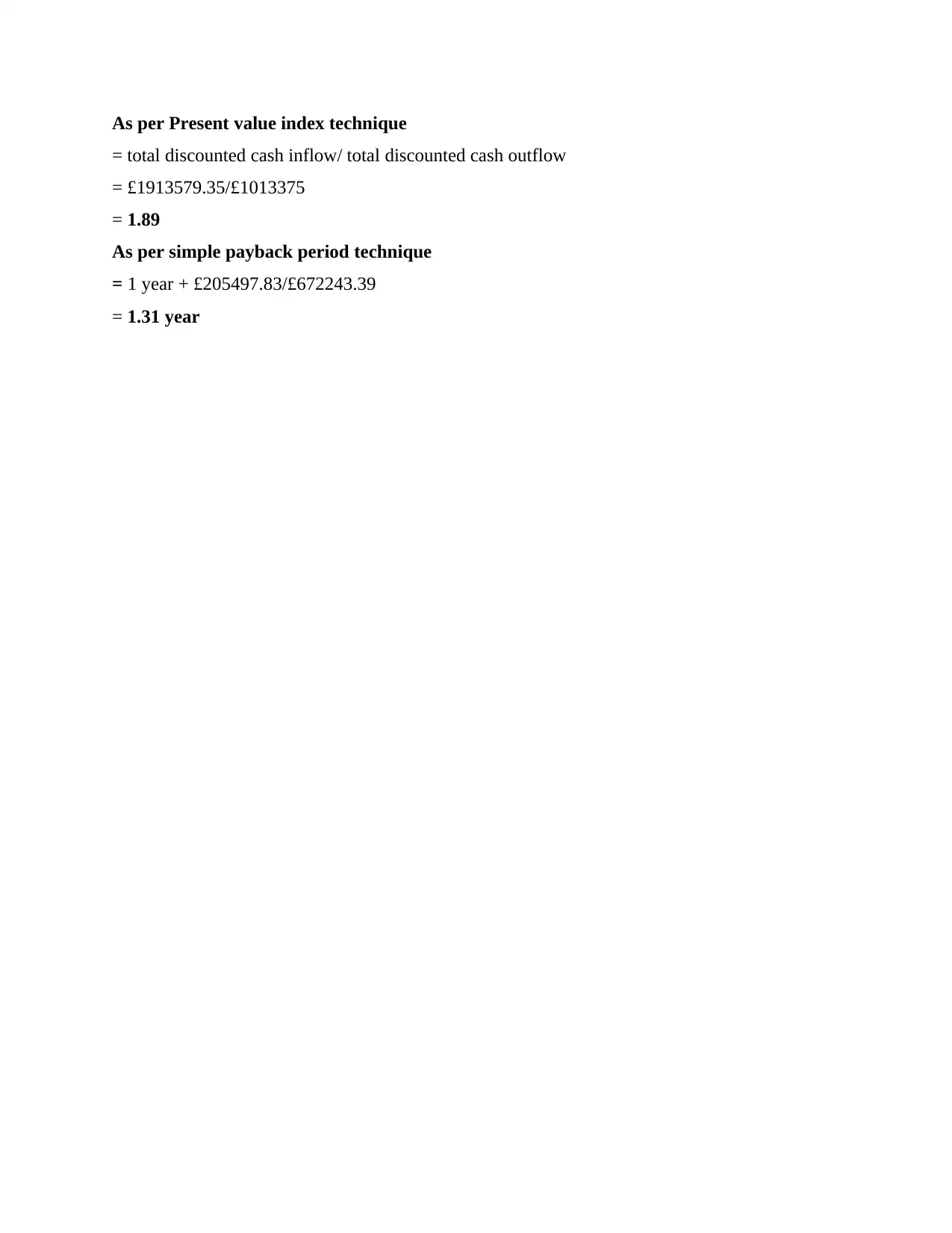

As per Present value index technique

= total discounted cash inflow/ total discounted cash outflow

= £1913579.35/£1013375

= 1.89

As per simple payback period technique

= 1 year + £205497.83/£672243.39

= 1.31 year

= total discounted cash inflow/ total discounted cash outflow

= £1913579.35/£1013375

= 1.89

As per simple payback period technique

= 1 year + £205497.83/£672243.39

= 1.31 year

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.