Share Trading: Technical vs. Fundamental Analysis in Singapore

VerifiedAdded on 2023/06/10

Advanced Financial Management

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

1

Table of Contents

Introduction:...............................................................................................................................2

Literature Review:......................................................................................................................2

Rational and Methodology:........................................................................................................4

Result and Analysis:...................................................................................................................5

i. Fundamental Analysis portfolio:.............................................................................................5

ii. Technical Analysis portfolio:.................................................................................................6

Conclusion:................................................................................................................................9

References and Bibliography:..................................................................................................10

Appendices:..............................................................................................................................13

2

Introduction:

The assessment aims in identifying the significance of technical and fundamental

analysis by preparing two defence types of portfolios and analysing it in a period. This

evaluation would eventually allow the investor to identify the instruments, which can be used

for detecting investment opportunities. Moreover, for fundamental analysis we have used P/E

ratio and P/BV ratio for detecting stock, whose have higher value in P/E ratio and less than 1

value of P/BV ratio. Furthermore, the technical analysis uses the simple moving averages for

detecting the short-term trend in the stock and identifies the investment opportunities within

the constituents of S&P Indices for Singapore. Adequate discussion of the EMH and

behavioural financial are also conducted for identifying the investors mind set during the

evaluation period. The result analysis section depicts the overall performance of the two

created portfolio and depicted, whether they beat the market or not.

Literature Review:

The concept of EMH and Behavioural finance depicts the mindset of investors, while

conducting investment decisions. The efficient market hypothesis is mainly segregated in

three different levels, which are Strong form, Semi-strong form, and weak form of Efficient

Market Hypothesis. The different level of efficient Market Hypothesis directly indicates the

level of information, which is presented by the company to the investors. This transparency in

the information sharing process directly helps in improving the level of decisions, which is

made by the investors. Hence, with the strong form of efficient market hypothesis there is no

possibility of investors making abnormal returns, as the market discounts the news

adequately to portray the accurate share price of the stock. However, with the semi-strong

and weak form of Efficient market hypothesis the information flow from the company to the

investor is relevantly low, which increases the chance of some investors to make high end

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

abnormal gains. The efficient market hypothesis directly increases the level price changes

that will be conducted on a stock after evaluating the relevant news. On the contrary, Bartos

(2015) argued that due the rigidity in the efficient market hypothesis the organisations and

investors were not paying attention to the declining value of the housing market before the

financial crisis of 2007. Hence, from the evaluation it could be indicated that with the

presence of efficient market hypothesis the information flow about the stock is consistent,

which helps in depicting the correct valuation of their share price.

The behavioural finance is the second concept, which is used by investors in making

relevant decision for their investment. In addition, the behavioural finance is a study of

psychology, which is used in making relevant decisions. The cognitive, emotional, cultural,

and social factors are some emotions, which is faced by the investor while making relevant

decisions. The different economic factors directly have impact on the investment decisions of

organisations. The theory also depicts the participants in the economy behave rationally,

where wealth maximisation is the only concept, which helps them improve the level of

returns from investment. Furthermore, the psychology of investors directly depicts the level

of investment, which they have conducted after evaluating the information. Hence, it could be

detected that investors take irrational decisions during investment, as they are influenced by

behavioural and psychological factors. In this context, Mouna and Jarboui (2015) stated that

the panic attributes of an investor instigate the large fluctuations in share price of stock within

a day, when financial position of the company declines. Therefore, the behavioural finance

directly explains the anomalies, which exist in the real world and where conventional

financial theories have no effect. The investors are keen on behaving differently to the same

information that is been provided to them, which instigates different price movement for the

stock. Hence, investors with the help of technical and fundamental analysis are able to gather

Paraphrase This Document

4

relevant information regarding the current position of the stock, as it increases the probability

of high returns from investment.

Rational and Methodology:

The rational and methodology used in the preparation of the portfolio directly helps in

depicting the strategy, which has been used for selecting the stocks for investment purposes.

Two portfolios have been created for investment purposes, which has used fundamental and

technical methods in selecting the stocks. In this context, Dimpfl and Jank (2016) stated that

investors with the help of technical analysis are able to detect trends of the stock, which help

in pinpointing the stocks that could generate higher returns from investment. On the other

hand, Arthur (2018) indicated that fundamental analysis is used for long-term investment

purposes, as the investor banks on dividends and growth from their investments.

Moreover, the portfolio for fundamental analysis is created by using P/E ratio and P/B

ratio. The stocks with higher P/E ratio are selected, where its P/B ratio needs to lower than 1,

which mainly helps in detecting the level of returns that can be generated from investment.

The fundamental analysis is used on the basis of long term principles, where the stocks

selected for investment is aimed to generate higher returns from investment. The P/E ratio

directly indicates that growth prospects on stock, which can be used by investor to increase

their return from investment. Moreover, the P/B ratio is used for detecting price to book ratio,

where the values lower than 1 indicates that companies shares are undervalued and can be

used for investment purposes. Eiamkanitchat, Moontuy and Ramingwong (2017) stated that

with the use of fundamental analysis tool investors are able to formulate a portfolio, which

can boost the returns from investment.

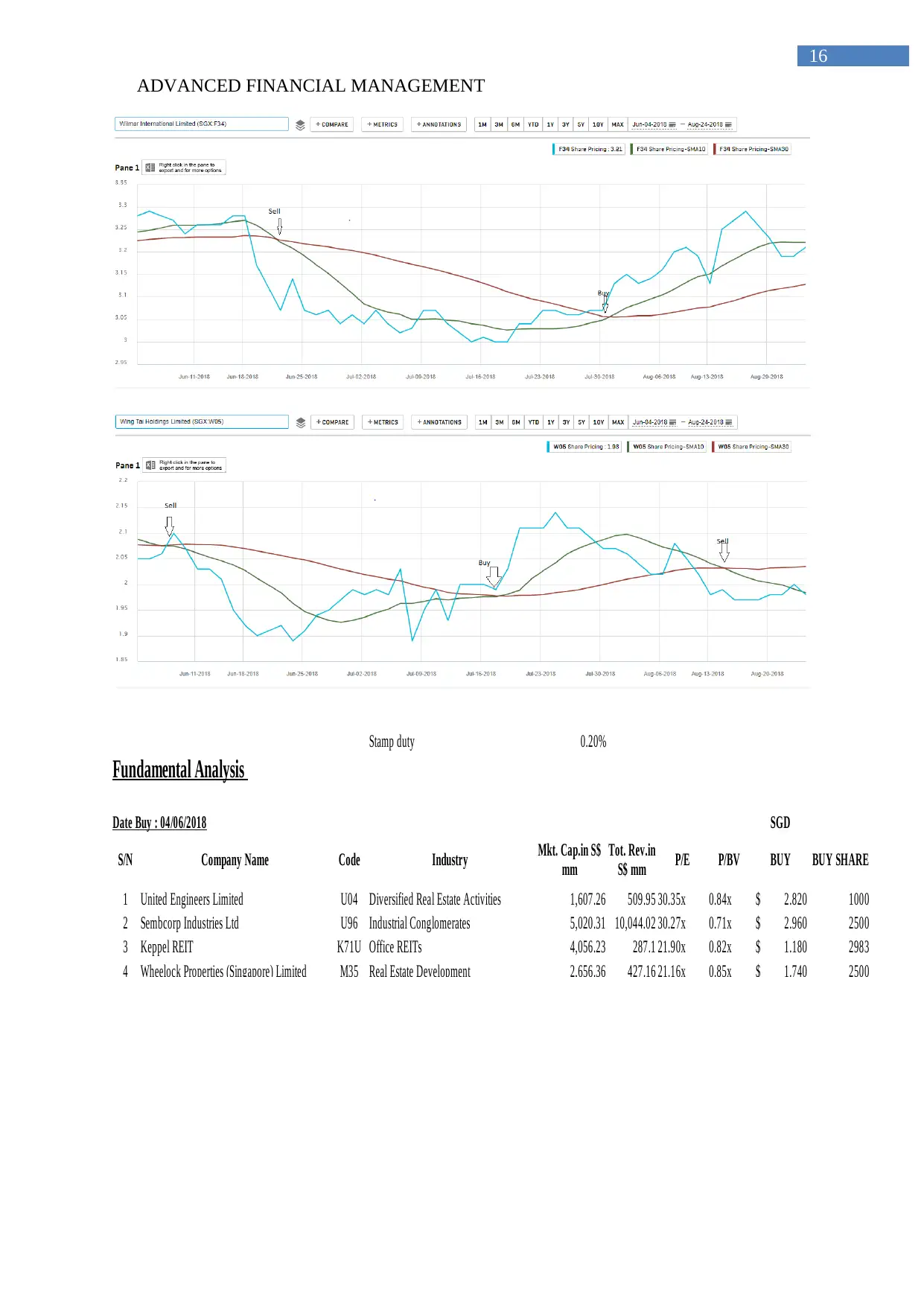

In the similar context, technical analysis is used for selecting stocks that have short-

term investment opportunities. Therefore, investors detecting short-term trend could

5

eventually improve the level of income that can be generated from investment, while

reducing the total risk from investment. The current portfolio is prepared by using moving

averages of 10 days and 30 days for detecting the investment opportunity. The stocks are

selected, when the moving average of 10 days crosses upwards from the moving average of

30 days. This process is used for detecting the investment opportunity in stocks and

formulating the portfolio, which can generate higher returns from investment. In this context,

Ewing and Malik (2016) stated that investors with the use of technical analysis is able to

understand the risk and return attributes of a stock before making any kind of investment

decisions.

Result and Analysis:

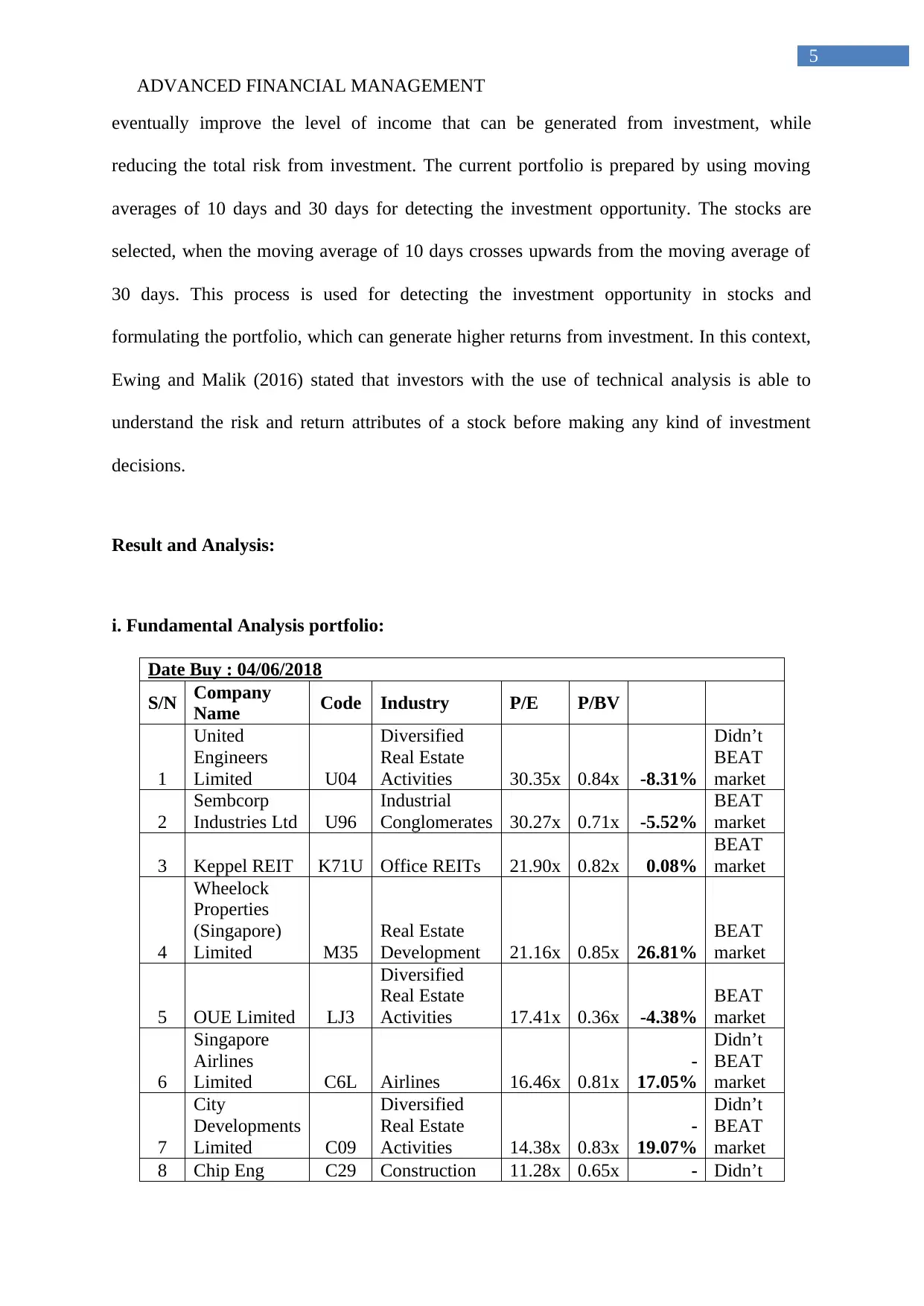

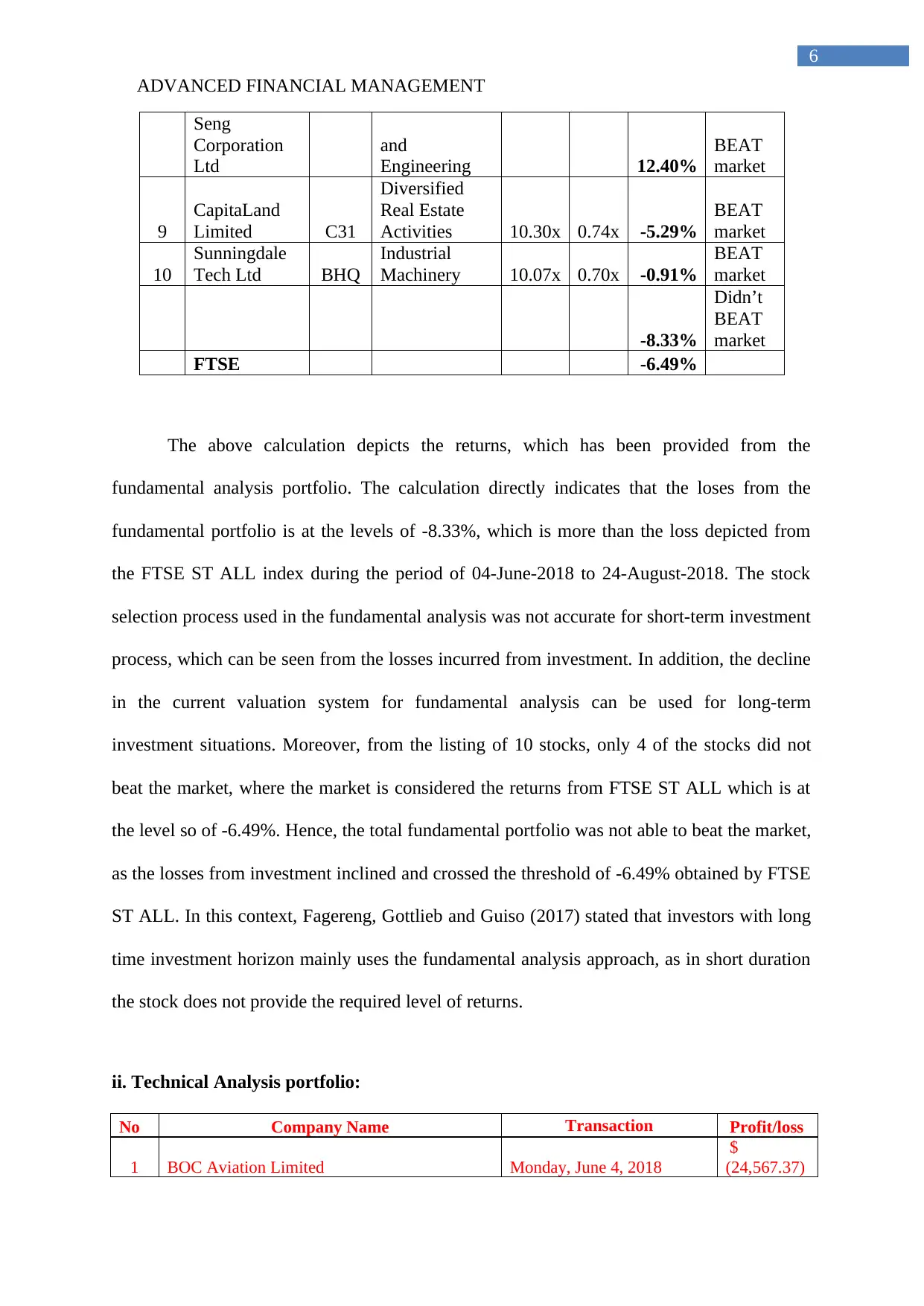

i. Fundamental Analysis portfolio:

Date Buy : 04/06/2018

S/N Company

Name Code Industry P/E P/BV

1

United

Engineers

Limited U04

Diversified

Real Estate

Activities 30.35x 0.84x -8.31%

Didn’t

BEAT

market

2

Sembcorp

Industries Ltd U96

Industrial

Conglomerates 30.27x 0.71x -5.52%

BEAT

market

3 Keppel REIT K71U Office REITs 21.90x 0.82x 0.08%

BEAT

market

4

Wheelock

Properties

(Singapore)

Limited M35

Real Estate

Development 21.16x 0.85x 26.81%

BEAT

market

5 OUE Limited LJ3

Diversified

Real Estate

Activities 17.41x 0.36x -4.38%

BEAT

market

6

Singapore

Airlines

Limited C6L Airlines 16.46x 0.81x

-

17.05%

Didn’t

BEAT

market

7

City

Developments

Limited C09

Diversified

Real Estate

Activities 14.38x 0.83x

-

19.07%

Didn’t

BEAT

market

8 Chip Eng C29 Construction 11.28x 0.65x - Didn’t

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

Seng

Corporation

Ltd

and

Engineering 12.40%

BEAT

market

9

CapitaLand

Limited C31

Diversified

Real Estate

Activities 10.30x 0.74x -5.29%

BEAT

market

10

Sunningdale

Tech Ltd BHQ

Industrial

Machinery 10.07x 0.70x -0.91%

BEAT

market

-8.33%

Didn’t

BEAT

market

FTSE -6.49%

The above calculation depicts the returns, which has been provided from the

fundamental analysis portfolio. The calculation directly indicates that the loses from the

fundamental portfolio is at the levels of -8.33%, which is more than the loss depicted from

the FTSE ST ALL index during the period of 04-June-2018 to 24-August-2018. The stock

selection process used in the fundamental analysis was not accurate for short-term investment

process, which can be seen from the losses incurred from investment. In addition, the decline

in the current valuation system for fundamental analysis can be used for long-term

investment situations. Moreover, from the listing of 10 stocks, only 4 of the stocks did not

beat the market, where the market is considered the returns from FTSE ST ALL which is at

the level so of -6.49%. Hence, the total fundamental portfolio was not able to beat the market,

as the losses from investment inclined and crossed the threshold of -6.49% obtained by FTSE

ST ALL. In this context, Fagereng, Gottlieb and Guiso (2017) stated that investors with long

time investment horizon mainly uses the fundamental analysis approach, as in short duration

the stock does not provide the required level of returns.

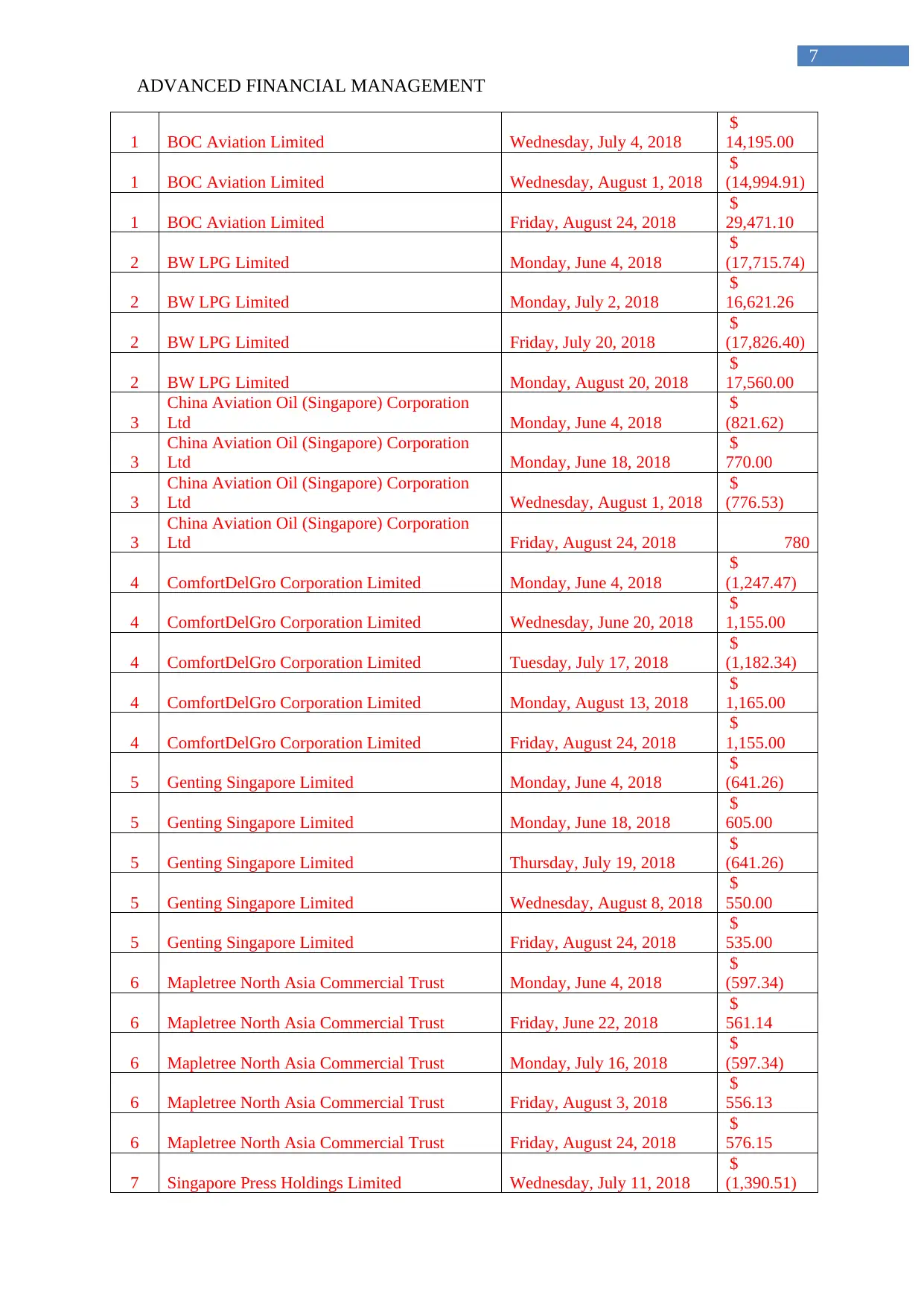

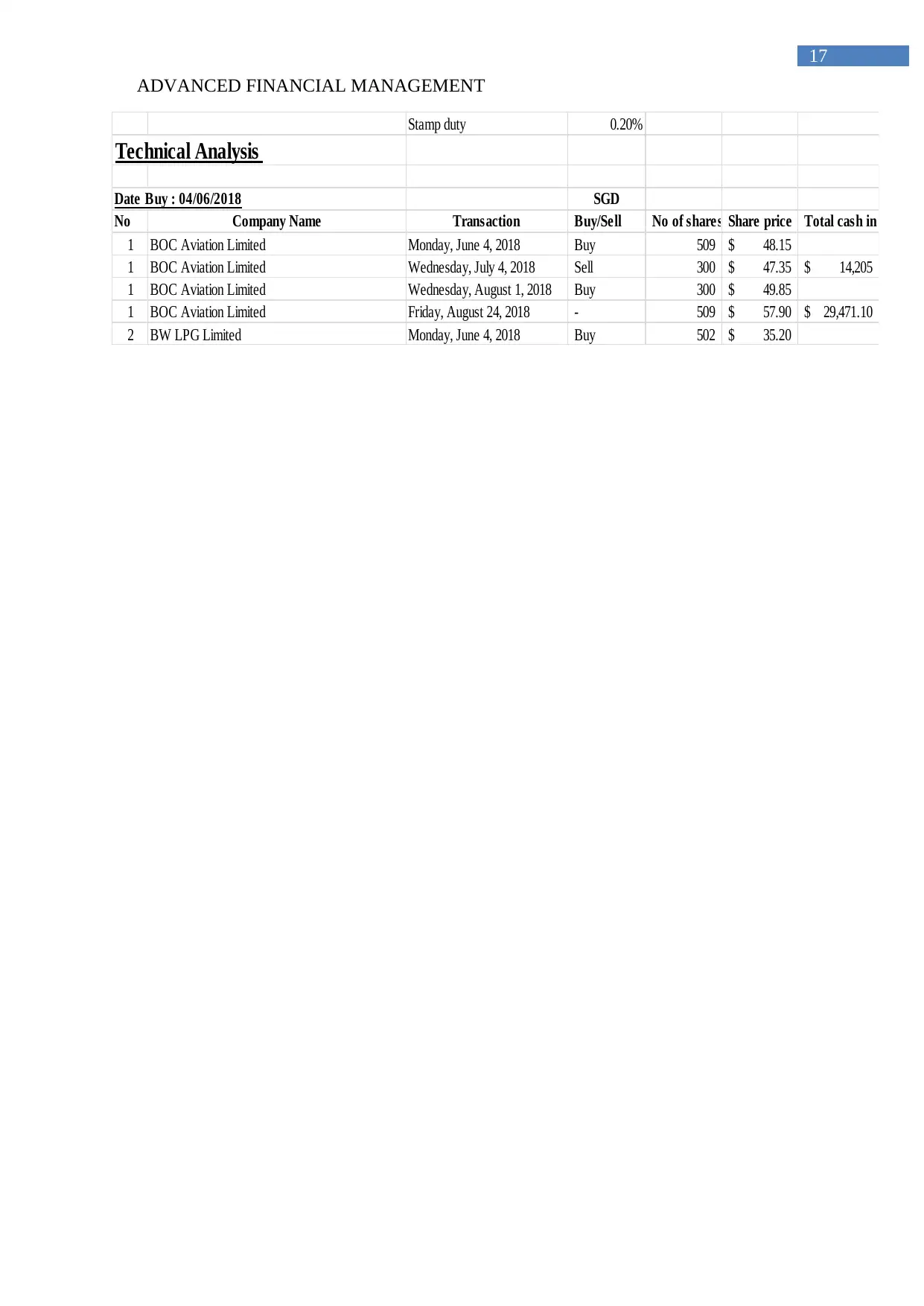

ii. Technical Analysis portfolio:

No Company Name Transaction Profit/loss

1 BOC Aviation Limited Monday, June 4, 2018

$

(24,567.37)

Paraphrase This Document

7

1 BOC Aviation Limited Wednesday, July 4, 2018

$

14,195.00

1 BOC Aviation Limited Wednesday, August 1, 2018

$

(14,994.91)

1 BOC Aviation Limited Friday, August 24, 2018

$

29,471.10

2 BW LPG Limited Monday, June 4, 2018

$

(17,715.74)

2 BW LPG Limited Monday, July 2, 2018

$

16,621.26

2 BW LPG Limited Friday, July 20, 2018

$

(17,826.40)

2 BW LPG Limited Monday, August 20, 2018

$

17,560.00

3

China Aviation Oil (Singapore) Corporation

Ltd Monday, June 4, 2018

$

(821.62)

3

China Aviation Oil (Singapore) Corporation

Ltd Monday, June 18, 2018

$

770.00

3

China Aviation Oil (Singapore) Corporation

Ltd Wednesday, August 1, 2018

$

(776.53)

3

China Aviation Oil (Singapore) Corporation

Ltd Friday, August 24, 2018 780

4 ComfortDelGro Corporation Limited Monday, June 4, 2018

$

(1,247.47)

4 ComfortDelGro Corporation Limited Wednesday, June 20, 2018

$

1,155.00

4 ComfortDelGro Corporation Limited Tuesday, July 17, 2018

$

(1,182.34)

4 ComfortDelGro Corporation Limited Monday, August 13, 2018

$

1,165.00

4 ComfortDelGro Corporation Limited Friday, August 24, 2018

$

1,155.00

5 Genting Singapore Limited Monday, June 4, 2018

$

(641.26)

5 Genting Singapore Limited Monday, June 18, 2018

$

605.00

5 Genting Singapore Limited Thursday, July 19, 2018

$

(641.26)

5 Genting Singapore Limited Wednesday, August 8, 2018

$

550.00

5 Genting Singapore Limited Friday, August 24, 2018

$

535.00

6 Mapletree North Asia Commercial Trust Monday, June 4, 2018

$

(597.34)

6 Mapletree North Asia Commercial Trust Friday, June 22, 2018

$

561.14

6 Mapletree North Asia Commercial Trust Monday, July 16, 2018

$

(597.34)

6 Mapletree North Asia Commercial Trust Friday, August 3, 2018

$

556.13

6 Mapletree North Asia Commercial Trust Friday, August 24, 2018

$

576.15

7 Singapore Press Holdings Limited Wednesday, July 11, 2018

$

(1,390.51)

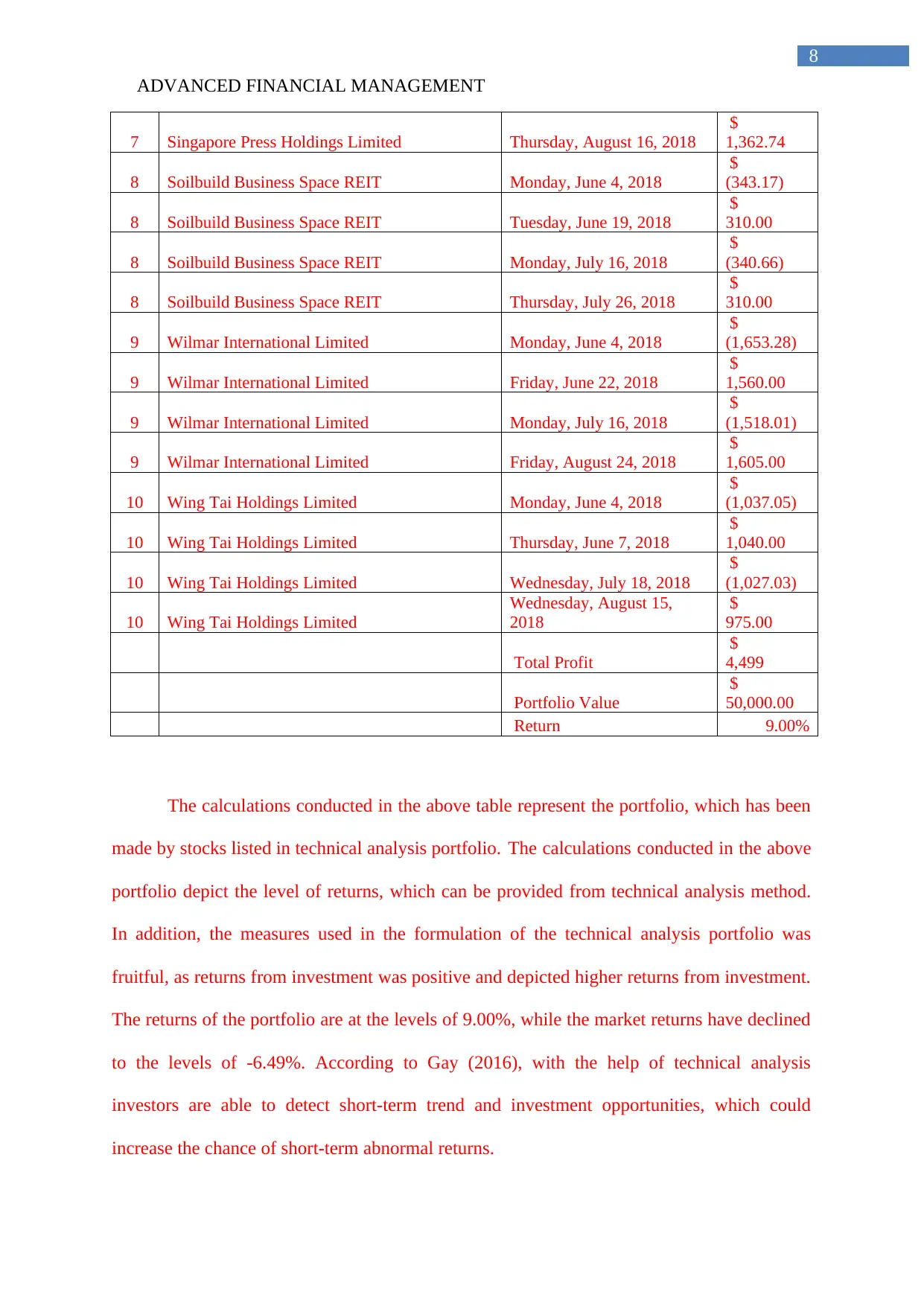

8

7 Singapore Press Holdings Limited Thursday, August 16, 2018

$

1,362.74

8 Soilbuild Business Space REIT Monday, June 4, 2018

$

(343.17)

8 Soilbuild Business Space REIT Tuesday, June 19, 2018

$

310.00

8 Soilbuild Business Space REIT Monday, July 16, 2018

$

(340.66)

8 Soilbuild Business Space REIT Thursday, July 26, 2018

$

310.00

9 Wilmar International Limited Monday, June 4, 2018

$

(1,653.28)

9 Wilmar International Limited Friday, June 22, 2018

$

1,560.00

9 Wilmar International Limited Monday, July 16, 2018

$

(1,518.01)

9 Wilmar International Limited Friday, August 24, 2018

$

1,605.00

10 Wing Tai Holdings Limited Monday, June 4, 2018

$

(1,037.05)

10 Wing Tai Holdings Limited Thursday, June 7, 2018

$

1,040.00

10 Wing Tai Holdings Limited Wednesday, July 18, 2018

$

(1,027.03)

10 Wing Tai Holdings Limited

Wednesday, August 15,

2018

$

975.00

Total Profit

$

4,499

Portfolio Value

$

50,000.00

Return 9.00%

The calculations conducted in the above table represent the portfolio, which has been

made by stocks listed in technical analysis portfolio. The calculations conducted in the above

portfolio depict the level of returns, which can be provided from technical analysis method.

In addition, the measures used in the formulation of the technical analysis portfolio was

fruitful, as returns from investment was positive and depicted higher returns from investment.

The returns of the portfolio are at the levels of 9.00%, while the market returns have declined

to the levels of -6.49%. According to Gay (2016), with the help of technical analysis

investors are able to detect short-term trend and investment opportunities, which could

increase the chance of short-term abnormal returns.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Therefore, from the evaluation of the above two perilous, it could be detected that

technical analysis method can be used for generating higher revenue from investment. The

calculations have depicted that the portfolio created for fundamental analysis did not depict

the current financial trend, which was essential for understanding the short-term investment

scope. However, the technical analysis portfolio depicted the highest value for investment,

which can be used for generating high rate of return from the created portfolio.

Conclusion:

The calculations conduced in the above assessment mainly depicts the significance of

technical analysis over fundamental analysis, which can be used by investor for maximising

the returns from investment. In addition, the method used for the selection of technical

analysis and fundamental analysis portfolio were accurate. However, only technical analysis

was able to beat the market, while fundamental analysis lost, as the trading period was short

and did not support the requirements of fundamental analysis. Moreover, technical analysis

was mainly helpful in improving the returns from investment, as the prepared portfolio

increased returns and beat the market. Hence, investors could use the portfolio for improving

their current return generation capacity and raise the level of invested capital. Therefore, the

investors who are interested relying on the short-term trend of the stock can use technical

analysis method, while long-term investors can use the fundamental analysis method. Lastly,

The EHM and behavioural theory directly affects the decision-making capability of the

investor, when they are making investment decisions.

Paraphrase This Document

10

References and Bibliography:

Arthur, W. B. (2018). Asset pricing under endogenous expectations in an artificial stock

market. In The economy as an evolving complex system II (pp. 31-60). CRC Press.

Au.finance.yahoo.com. (2018). Au.finance.yahoo.com. Retrieved 28 August 2018, from

https://au.finance.yahoo.com/quote/W05.SI/history?

period1=1527964200&period2=1535049000&interval=1d&filter=history&frequency

=1d

Bartos, J. (2015). Does Bitcoin follow the hypothesis of efficient market?. International

Journal of Economic Sciences, 4(2), 10-23.

Capitaliq.com. (2018). Capitaliq.com. Retrieved 28 August 2018, from

https://www.capitaliq.com/CIQDotNet/Index/Constituents.aspx?

CompanyId=226679791

Degutis, A., & Novickyte, L. (2014). The efficient market hypothesis: a critical review of

literature and methodology. Ekonomika, 93(2), 7.

Dimpfl, T., & Jank, S. (2016). Can internet search queries help to predict stock market

volatility?. European Financial Management, 22(2), 171-192.

Eiamkanitchat, N., Moontuy, T., & Ramingwong, S. (2017). Fundamental analysis and

technical analysis integrated system for stock filtration. Cluster Computing, 20(1),

883-894.

Ewing, B. T., & Malik, F. (2016). Volatility spillovers between oil prices and the stock

market under structural breaks. Global finance journal, 29, 12-23.

11

Fagereng, A., Gottlieb, C., & Guiso, L. (2017). Asset market participation and portfolio

choice over the life‐cycle. The Journal of Finance, 72(2), 705-750.

Gay, R. D. (2016). Effect of macroeconomic variables on stock market returns for four

emerging economies: Brazil, Russia, India, and China. The International Business &

Economics Research Journal (Online), 15(3), 119.

Lim, S., Oh, K. W., & Zhu, J. (2014). Use of DEA cross-efficiency evaluation in portfolio

selection: An application to Korean stock market. European Journal of Operational

Research, 236(1), 361-368.

Mensi, W., Hammoudeh, S., & Kang, S. H. (2015). Precious metals, cereal, oil and stock

market linkages and portfolio risk management: Evidence from Saudi

Arabia. Economic Modelling, 51, 340-358.

Mouna, A., & Jarboui, A. (2015). Financial literacy and portfolio diversification: an

observation from the Tunisian stock market. International Journal of Bank

Marketing, 33(6), 808-822.

Schwager, J. D., & Etzkorn, M. (2017). 50 Market Wizard Lessons. A Complete Guide to the

Futures Market: Technical Analysis, Trading Systems, Fundamental Analysis,

Options, Spreads, and Trading Principles, Second Edition, 575-587.

Schwager, J. D., & Etzkorn, M. (2017). Selecting the Best Futures Price Series for System

Testing. A Complete Guide to the Futures Market: Technical Analysis, Trading

Systems, Fundamental Analysis, Options, Spreads, and Trading Principles, Second

Edition, 279-287.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

12

Syriopoulos, T., Makram, B., & Boubaker, A. (2015). Stock market volatility spillovers and

portfolio hedging: BRICS and the financial crisis. International Review of Financial

Analysis, 39, 7-18.

Wang, Y. (2016). Construction and simulation on stock price forecasting model based on

fundamental analysis and technical analysis. RISTI (Revista Iberica de Sistemas e

Tecnologias de Informacao), (E10), 295-304.

Yao, J., Ma, C., & He, W. P. (2014). Investor herding behaviour of Chinese stock

market. International Review of Economics & Finance, 29, 12-29.

Paraphrase This Document

13

Appendices:

14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

15

Paraphrase This Document

16

Stamp duty 0.20%

Fundamental Analysis

Date Buy : 04/06/2018 SGD

S/N Company Name Code Industry P/E P/BV BUY BUY SHARE

1 United Engineers Limited U04 Diversified Real Estate Activities 1,607.26 509.95 30.35x 0.84x $ 2.820 1000

2 Sembcorp Industries Ltd U96 Industrial Conglomerates 5,020.31 10,044.02 30.27x 0.71x $ 2.960 2500

3 Keppel REIT K71U Office REITs 4,056.23 287.1 21.90x 0.82x $ 1.180 2983

4 Wheelock Properties (Singapore) Limited M35 Real Estate Development 2,656.36 427.16 21.16x 0.85x $ 1.740 2500

Mkt. Cap.in S$

mm

Tot. Rev.in

S$ mm

17

Stamp duty 0.20%

Technical Analysis

Date Buy : 04/06/2018 SGD

No Company Name Transaction Buy/Sell No of shares Share price Total cash in

1 BOC Aviation Limited Monday, June 4, 2018 Buy 509 48.15$

1 BOC Aviation Limited Wednesday, July 4, 2018 Sell 300 47.35$ 14,205$

1 BOC Aviation Limited Wednesday, August 1, 2018 Buy 300 49.85$

1 BOC Aviation Limited Friday, August 24, 2018 - 509 57.90$ 29,471.10$

2 BW LPG Limited Monday, June 4, 2018 Buy 502 35.20$

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.