AF102 - Introduction to Accounting and Financial Management Assignment

VerifiedAdded on 2022/12/15

|6

|919

|276

Homework Assignment

AI Summary

This assignment, prepared for the AF102 course at the University of the South Pacific, analyzes and compares conventional and activity-based costing (ABC) methods. It begins by outlining the conventional product costing system, where overhead costs are allocated based on machine hours. The assignment then details the ABC method, including the identification of overhead cost pools and cost drivers. It calculates the cost per unit for each product using both methods, revealing differences in per-unit costs and assessing the reasons behind these variations. The analysis includes defining volume-based drivers and explaining how they facilitate overhead allocation. Finally, the assignment briefly touches upon activity-based management, highlighting how it uses ABC to evaluate business activities and improve decision-making. The assignment includes calculations, explanations, and references to support its findings.

AF102 – Introduction to

Accounting and Financial

Management Part II

Accounting and Financial

Management Part II

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Conventional product costing system..........................................................................................3

Activity based costing (ABC)......................................................................................................3

A) Defining volume based driver.................................................................................................4

B) Calculating the cost per unit for each product using conventional method............................4

C) Calculating the cost per unit for each product using ABC method........................................5

D) Assessing reasons behind the occurrence of difference in per unit cost as per both the

methods........................................................................................................................................5

E) Activity based management....................................................................................................5

REFERENCES..............................................................................................................................6

Conventional product costing system..........................................................................................3

Activity based costing (ABC)......................................................................................................3

A) Defining volume based driver.................................................................................................4

B) Calculating the cost per unit for each product using conventional method............................4

C) Calculating the cost per unit for each product using ABC method........................................5

D) Assessing reasons behind the occurrence of difference in per unit cost as per both the

methods........................................................................................................................................5

E) Activity based management....................................................................................................5

REFERENCES..............................................................................................................................6

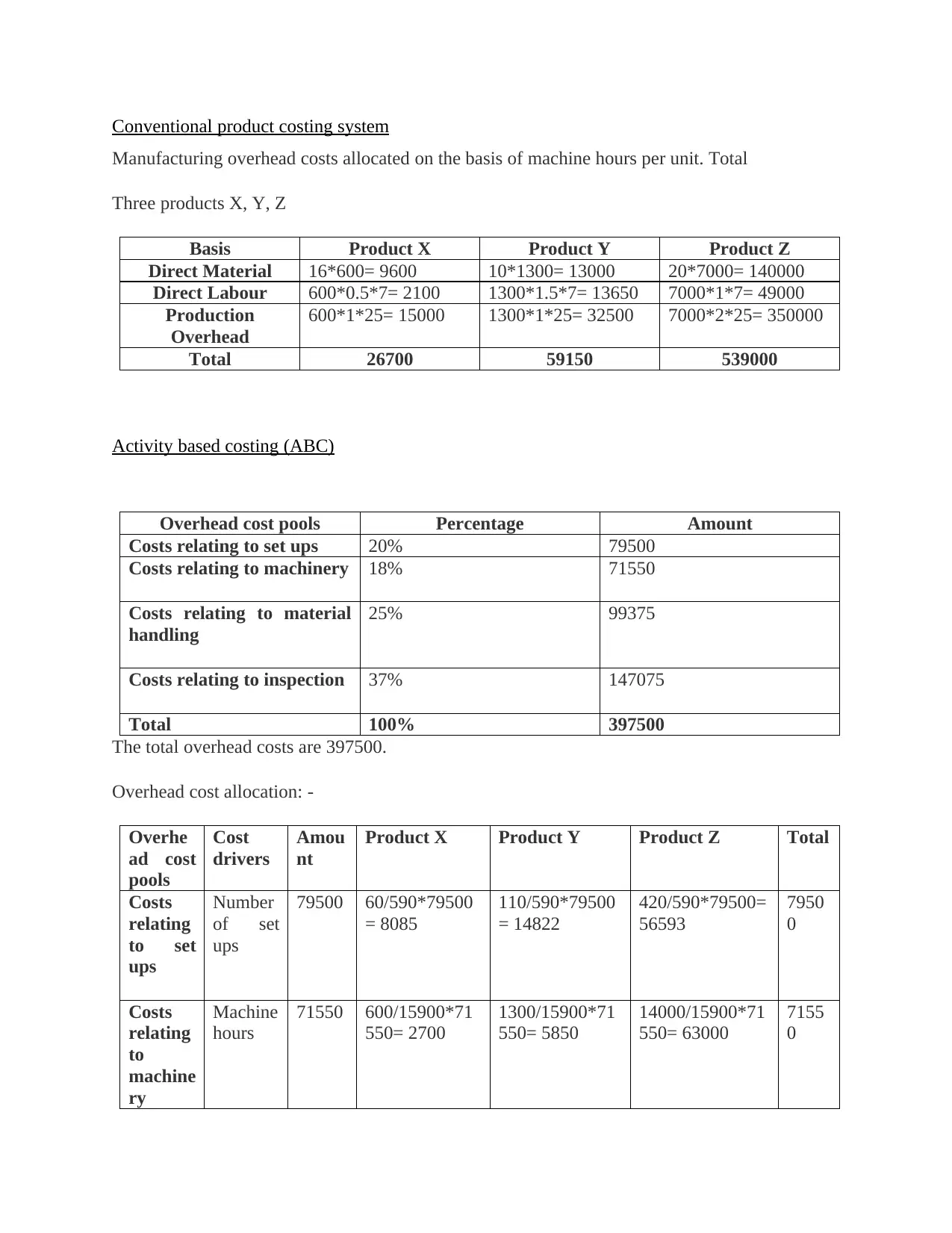

Conventional product costing system

Manufacturing overhead costs allocated on the basis of machine hours per unit. Total

Three products X, Y, Z

Basis Product X Product Y Product Z

Direct Material 16*600= 9600 10*1300= 13000 20*7000= 140000

Direct Labour 600*0.5*7= 2100 1300*1.5*7= 13650 7000*1*7= 49000

Production

Overhead

600*1*25= 15000 1300*1*25= 32500 7000*2*25= 350000

Total 26700 59150 539000

Activity based costing (ABC)

Overhead cost pools Percentage Amount

Costs relating to set ups 20% 79500

Costs relating to machinery 18% 71550

Costs relating to material

handling

25% 99375

Costs relating to inspection 37% 147075

Total 100% 397500

The total overhead costs are 397500.

Overhead cost allocation: -

Overhe

ad cost

pools

Cost

drivers

Amou

nt

Product X Product Y Product Z Total

Costs

relating

to set

ups

Number

of set

ups

79500 60/590*79500

= 8085

110/590*79500

= 14822

420/590*79500=

56593

7950

0

Costs

relating

to

machine

ry

Machine

hours

71550 600/15900*71

550= 2700

1300/15900*71

550= 5850

14000/15900*71

550= 63000

7155

0

Manufacturing overhead costs allocated on the basis of machine hours per unit. Total

Three products X, Y, Z

Basis Product X Product Y Product Z

Direct Material 16*600= 9600 10*1300= 13000 20*7000= 140000

Direct Labour 600*0.5*7= 2100 1300*1.5*7= 13650 7000*1*7= 49000

Production

Overhead

600*1*25= 15000 1300*1*25= 32500 7000*2*25= 350000

Total 26700 59150 539000

Activity based costing (ABC)

Overhead cost pools Percentage Amount

Costs relating to set ups 20% 79500

Costs relating to machinery 18% 71550

Costs relating to material

handling

25% 99375

Costs relating to inspection 37% 147075

Total 100% 397500

The total overhead costs are 397500.

Overhead cost allocation: -

Overhe

ad cost

pools

Cost

drivers

Amou

nt

Product X Product Y Product Z Total

Costs

relating

to set

ups

Number

of set

ups

79500 60/590*79500

= 8085

110/590*79500

= 14822

420/590*79500=

56593

7950

0

Costs

relating

to

machine

ry

Machine

hours

71550 600/15900*71

550= 2700

1300/15900*71

550= 5850

14000/15900*71

550= 63000

7155

0

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

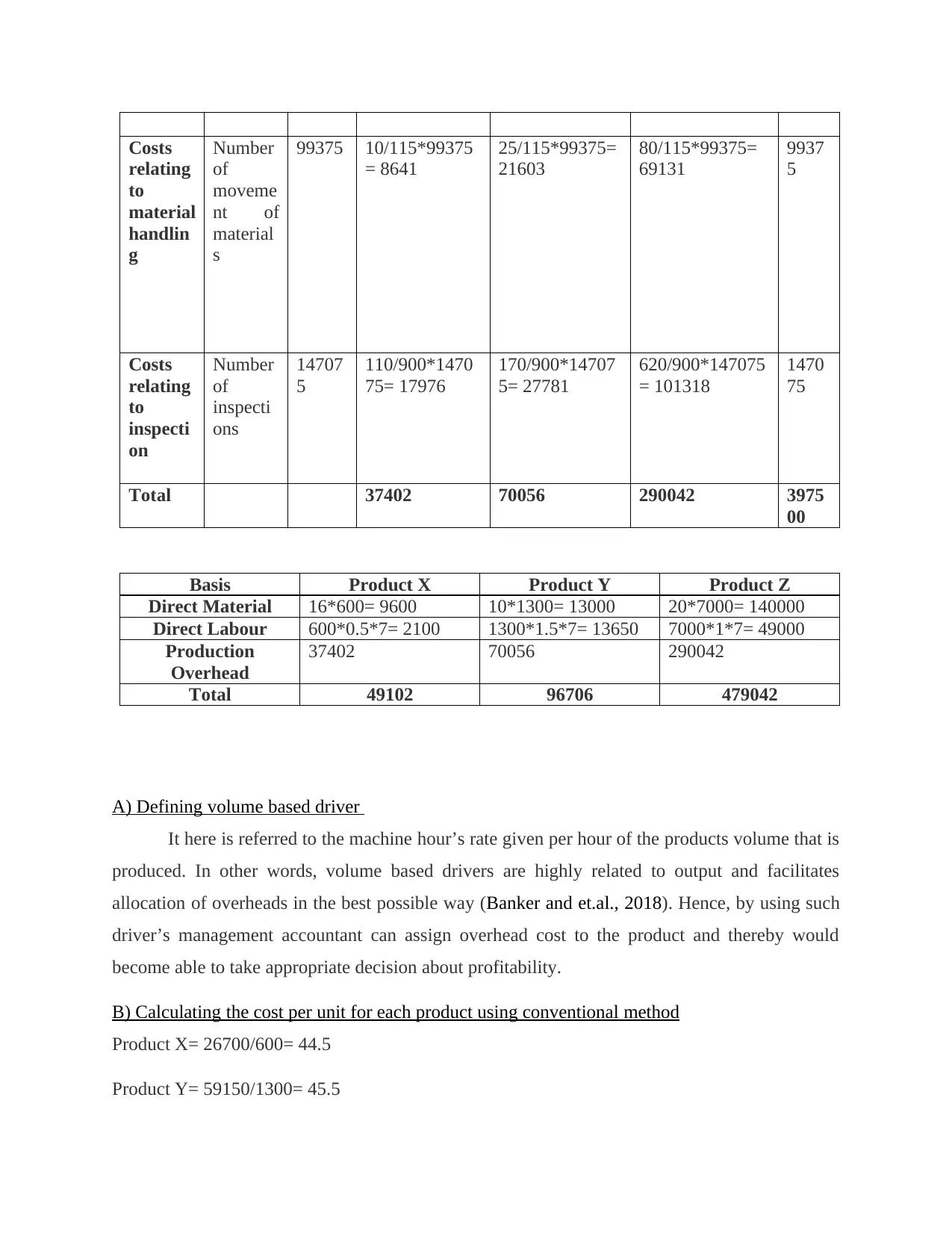

Costs

relating

to

material

handlin

g

Number

of

moveme

nt of

material

s

99375 10/115*99375

= 8641

25/115*99375=

21603

80/115*99375=

69131

9937

5

Costs

relating

to

inspecti

on

Number

of

inspecti

ons

14707

5

110/900*1470

75= 17976

170/900*14707

5= 27781

620/900*147075

= 101318

1470

75

Total 37402 70056 290042 3975

00

Basis Product X Product Y Product Z

Direct Material 16*600= 9600 10*1300= 13000 20*7000= 140000

Direct Labour 600*0.5*7= 2100 1300*1.5*7= 13650 7000*1*7= 49000

Production

Overhead

37402 70056 290042

Total 49102 96706 479042

A) Defining volume based driver

It here is referred to the machine hour’s rate given per hour of the products volume that is

produced. In other words, volume based drivers are highly related to output and facilitates

allocation of overheads in the best possible way (Banker and et.al., 2018). Hence, by using such

driver’s management accountant can assign overhead cost to the product and thereby would

become able to take appropriate decision about profitability.

B) Calculating the cost per unit for each product using conventional method

Product X= 26700/600= 44.5

Product Y= 59150/1300= 45.5

relating

to

material

handlin

g

Number

of

moveme

nt of

material

s

99375 10/115*99375

= 8641

25/115*99375=

21603

80/115*99375=

69131

9937

5

Costs

relating

to

inspecti

on

Number

of

inspecti

ons

14707

5

110/900*1470

75= 17976

170/900*14707

5= 27781

620/900*147075

= 101318

1470

75

Total 37402 70056 290042 3975

00

Basis Product X Product Y Product Z

Direct Material 16*600= 9600 10*1300= 13000 20*7000= 140000

Direct Labour 600*0.5*7= 2100 1300*1.5*7= 13650 7000*1*7= 49000

Production

Overhead

37402 70056 290042

Total 49102 96706 479042

A) Defining volume based driver

It here is referred to the machine hour’s rate given per hour of the products volume that is

produced. In other words, volume based drivers are highly related to output and facilitates

allocation of overheads in the best possible way (Banker and et.al., 2018). Hence, by using such

driver’s management accountant can assign overhead cost to the product and thereby would

become able to take appropriate decision about profitability.

B) Calculating the cost per unit for each product using conventional method

Product X= 26700/600= 44.5

Product Y= 59150/1300= 45.5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Product Z= 539000/ 7000= 77

C) Calculating the cost per unit for each product using ABC method

Product X= 49102/600= 81.8

Product Y= 96706/1300= 74.38

Product Z= 479042/ 7000= 68.43

D) Assessing reasons behind the occurrence of difference in per unit cost as per both the methods

In the conventional method the overhead allocation was done on the basis of machine

hour rate per unit. Whereas on the contrary in case of activity based costing the overheads

are separately allocable based on the cost driver’s data that has been provided.

In case of product Z the cost per unit has decreased significantly because earlier they had

double the machine hours used and higher the volume of production, which increased its

per unit cost. But on the other hand in the ABC method it has suitable allocation based on

the cost drivers that are applicable to the various products.

The systematic overhead distribution on the basis of particular activity pool and the cost

drivers have helped in generating viable cost per unit of the products.

E) Activity based management

It is the method to know the various activities that are performed by the business and also

evaluate the cost per unit based on the activity based costing method. In this the distribution of

the overheads among the various products are done on the basis of cost drivers (Quesado and

Silva, 2021). The cost driver have been developed on the basis of its applicability for particular

activity. The shall help in the continuous improvement of the business as this is suitable method

of allocation and shall be providing the rightful results in terms of the cost per unit. It shall also

ensure that the business decisions based on these cost are effectively taken shaping the future

prospects of the company.

C) Calculating the cost per unit for each product using ABC method

Product X= 49102/600= 81.8

Product Y= 96706/1300= 74.38

Product Z= 479042/ 7000= 68.43

D) Assessing reasons behind the occurrence of difference in per unit cost as per both the methods

In the conventional method the overhead allocation was done on the basis of machine

hour rate per unit. Whereas on the contrary in case of activity based costing the overheads

are separately allocable based on the cost driver’s data that has been provided.

In case of product Z the cost per unit has decreased significantly because earlier they had

double the machine hours used and higher the volume of production, which increased its

per unit cost. But on the other hand in the ABC method it has suitable allocation based on

the cost drivers that are applicable to the various products.

The systematic overhead distribution on the basis of particular activity pool and the cost

drivers have helped in generating viable cost per unit of the products.

E) Activity based management

It is the method to know the various activities that are performed by the business and also

evaluate the cost per unit based on the activity based costing method. In this the distribution of

the overheads among the various products are done on the basis of cost drivers (Quesado and

Silva, 2021). The cost driver have been developed on the basis of its applicability for particular

activity. The shall help in the continuous improvement of the business as this is suitable method

of allocation and shall be providing the rightful results in terms of the cost per unit. It shall also

ensure that the business decisions based on these cost are effectively taken shaping the future

prospects of the company.

REFERENCES

Books and Journals

Banker, R. D. and et.al., 2018. Cost management research. Journal of Management Accounting

Research. 30(3). pp.187-209.

Quesado, P. and Silva, R., 2021. Activity-Based Costing (ABC) and Its Implication for Open

Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 7(1). p.41.

Books and Journals

Banker, R. D. and et.al., 2018. Cost management research. Journal of Management Accounting

Research. 30(3). pp.187-209.

Quesado, P. and Silva, R., 2021. Activity-Based Costing (ABC) and Its Implication for Open

Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 7(1). p.41.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Management Accounting: Costing Analysis of Office Desks - [Company]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fjv%2Fc197923795a34b81bdce50f667d18d4c.jpg&w=256&q=75)