AGL Energy Limited: A Comprehensive Financial Analysis

VerifiedAdded on 2024/05/31

|22

|3082

|62

AI Summary

This report provides a comprehensive financial analysis of AGL Energy Limited, a leading Australian energy company. It examines the company's ownership governance structure, calculates key financial ratios, analyzes share price trends, and determines the weighted average cost of capital (WACC). The report also explores the company's dividend policy and recommends investment strategies based on the findings.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

HI5002: Finance for business

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Introduction....................................................................................................................................3

Portfolio..........................................................................................................................................4

1. A brief description of Company...........................................................................................4

2. Ownership Governance Structure.......................................................................................5

3. Calculation of Ratios.............................................................................................................7

4. Two graphs from www.asx.com.au with the description of results..................................9

5. Significant factors that influenced share price.................................................................11

6. Calculation of ’ beta values and Expected Rates of Return using the CAPM...............12

7. Weighted Average Cost of Capital (WACC).....................................................................13

8. Preferred optimal capital structure...................................................................................15

9. Dividend Policy....................................................................................................................17

10. Letter Recommendation....................................................................................................18

Conclusion....................................................................................................................................19

References.....................................................................................................................................20

2

Introduction....................................................................................................................................3

Portfolio..........................................................................................................................................4

1. A brief description of Company...........................................................................................4

2. Ownership Governance Structure.......................................................................................5

3. Calculation of Ratios.............................................................................................................7

4. Two graphs from www.asx.com.au with the description of results..................................9

5. Significant factors that influenced share price.................................................................11

6. Calculation of ’ beta values and Expected Rates of Return using the CAPM...............12

7. Weighted Average Cost of Capital (WACC).....................................................................13

8. Preferred optimal capital structure...................................................................................15

9. Dividend Policy....................................................................................................................17

10. Letter Recommendation....................................................................................................18

Conclusion....................................................................................................................................19

References.....................................................................................................................................20

2

Introduction

The company is required to be managed in such manner that success is attained. For this, all the

resources which are available with it shall be used in most appropriate manner. In this report, the

overview of the company will be provided which in the given case is taken as AGL Limited. The

governance structure of the company will be provided and then the ratios will be calculated so

that performance of the company can be evaluated in most appropriate manner. Graphs will be

also included so that the fluctuations in the share price can be ascertained in the appropriate

manner. The dividend policy and the cost of capital and rate of return will also be calculated in

the report.

3

The company is required to be managed in such manner that success is attained. For this, all the

resources which are available with it shall be used in most appropriate manner. In this report, the

overview of the company will be provided which in the given case is taken as AGL Limited. The

governance structure of the company will be provided and then the ratios will be calculated so

that performance of the company can be evaluated in most appropriate manner. Graphs will be

also included so that the fluctuations in the share price can be ascertained in the appropriate

manner. The dividend policy and the cost of capital and rate of return will also be calculated in

the report.

3

Portfolio

1. A brief description of Company

AGL energy is an Australian company which is operating in the electricity generation. This is

one of the largest ASX listed investors which is dealing with the renewable energy. The numbers

of customer accounts are more than 3.6 million (AGL, 2017). The aim of the company is to

enhance and achieve growth in the carbon-constrained world. They work in such manner by

which customers are supported and also contribute to the charity partners. The portfolio of the

company is diverse and it includes peaking, intermediate generation plants, a base which is

spread in the traditional thermal generation, storage and natural gas. There are various renewable

energy sources which are also used by the company such as wind, solar and hydro.

4

1. A brief description of Company

AGL energy is an Australian company which is operating in the electricity generation. This is

one of the largest ASX listed investors which is dealing with the renewable energy. The numbers

of customer accounts are more than 3.6 million (AGL, 2017). The aim of the company is to

enhance and achieve growth in the carbon-constrained world. They work in such manner by

which customers are supported and also contribute to the charity partners. The portfolio of the

company is diverse and it includes peaking, intermediate generation plants, a base which is

spread in the traditional thermal generation, storage and natural gas. There are various renewable

energy sources which are also used by the company such as wind, solar and hydro.

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2. Ownership Governance Structure

i)

Main substantial shareholders

Having more than 20% shareholding: The person who holds the shares in the company are

considered as the shareholders and out of them some are considered as the substantial

shareholder. They are the ones who will be holding the shares of more than 20% total stake. In

the company, there is no such shareholder who is holding this large number of shares (AGL,

2017).

Having more than 5%: The shareholders who are holding the more than 5% present of the

stake, are also required to be identified. There is only one shareholder who is holding the 5.42%

of the stake which has 352055 shares and that is HSBC Custody Nominees (Australia) Limited.

ii)

Designation Name

Chairman Jerry Maycock

Managing Director & CEO Andy Vesey

Director Jeremy Maycock

Director Jacqueline Hey

Director Les Hosking

Director Graeme Hunt

5

i)

Main substantial shareholders

Having more than 20% shareholding: The person who holds the shares in the company are

considered as the shareholders and out of them some are considered as the substantial

shareholder. They are the ones who will be holding the shares of more than 20% total stake. In

the company, there is no such shareholder who is holding this large number of shares (AGL,

2017).

Having more than 5%: The shareholders who are holding the more than 5% present of the

stake, are also required to be identified. There is only one shareholder who is holding the 5.42%

of the stake which has 352055 shares and that is HSBC Custody Nominees (Australia) Limited.

ii)

Designation Name

Chairman Jerry Maycock

Managing Director & CEO Andy Vesey

Director Jeremy Maycock

Director Jacqueline Hey

Director Les Hosking

Director Graeme Hunt

5

Director Belinda Hutchinson

Director Peter Botten

Director Diane Smith-Gander

Director John Stanhope AM

There is no such person who is holding the substantial interest in the company and so it cannot

be said that the company is a family company.

6

Director Peter Botten

Director Diane Smith-Gander

Director John Stanhope AM

There is no such person who is holding the substantial interest in the company and so it cannot

be said that the company is a family company.

6

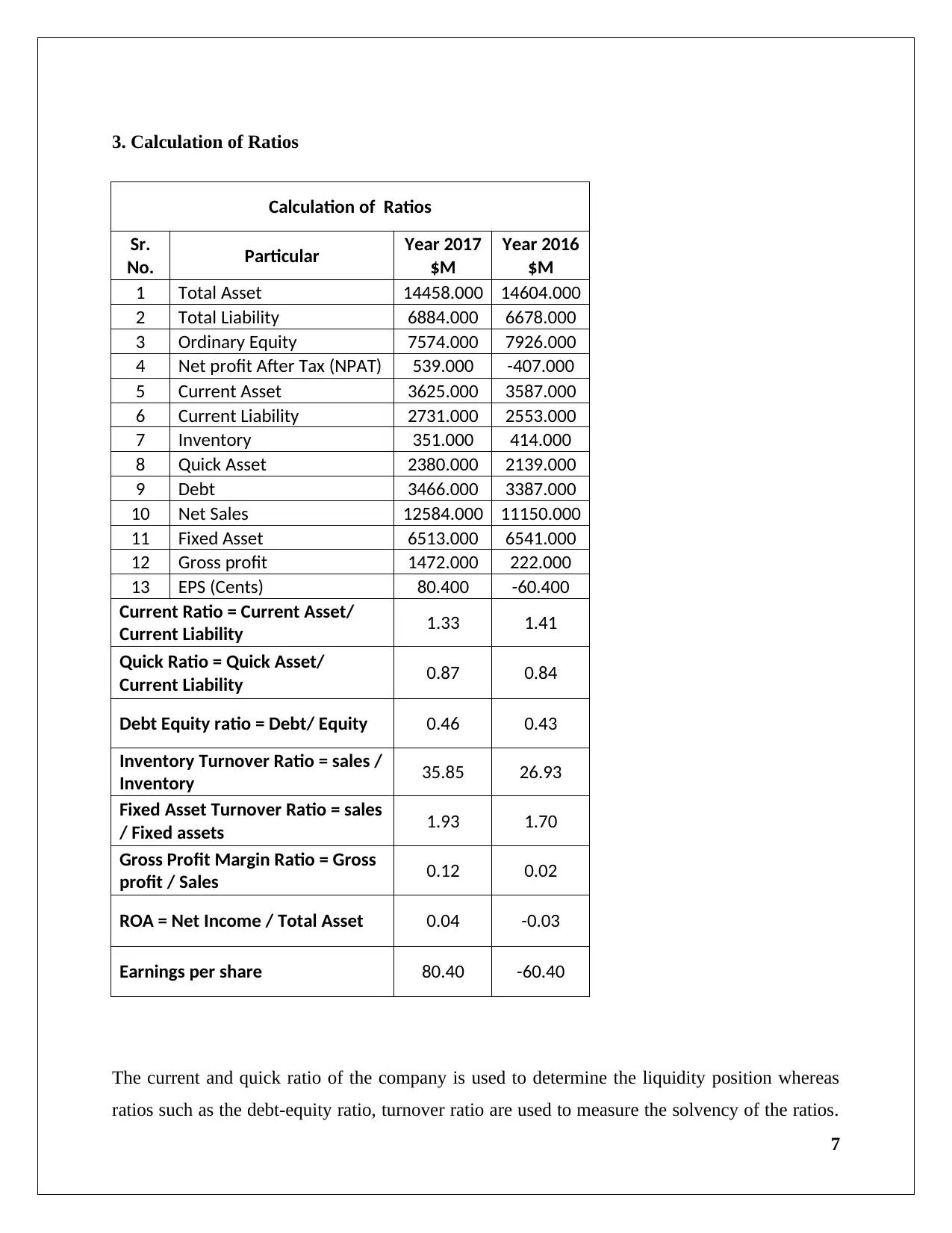

3. Calculation of Ratios

Calculation of Ratios

Sr.

No. Particular Year 2017

$M

Year 2016

$M

1 Total Asset 14458.000 14604.000

2 Total Liability 6884.000 6678.000

3 Ordinary Equity 7574.000 7926.000

4 Net profit After Tax (NPAT) 539.000 -407.000

5 Current Asset 3625.000 3587.000

6 Current Liability 2731.000 2553.000

7 Inventory 351.000 414.000

8 Quick Asset 2380.000 2139.000

9 Debt 3466.000 3387.000

10 Net Sales 12584.000 11150.000

11 Fixed Asset 6513.000 6541.000

12 Gross profit 1472.000 222.000

13 EPS (Cents) 80.400 -60.400

Current Ratio = Current Asset/

Current Liability 1.33 1.41

Quick Ratio = Quick Asset/

Current Liability 0.87 0.84

Debt Equity ratio = Debt/ Equity 0.46 0.43

Inventory Turnover Ratio = sales /

Inventory 35.85 26.93

Fixed Asset Turnover Ratio = sales

/ Fixed assets 1.93 1.70

Gross Profit Margin Ratio = Gross

profit / Sales 0.12 0.02

ROA = Net Income / Total Asset 0.04 -0.03

Earnings per share 80.40 -60.40

The current and quick ratio of the company is used to determine the liquidity position whereas

ratios such as the debt-equity ratio, turnover ratio are used to measure the solvency of the ratios.

7

Calculation of Ratios

Sr.

No. Particular Year 2017

$M

Year 2016

$M

1 Total Asset 14458.000 14604.000

2 Total Liability 6884.000 6678.000

3 Ordinary Equity 7574.000 7926.000

4 Net profit After Tax (NPAT) 539.000 -407.000

5 Current Asset 3625.000 3587.000

6 Current Liability 2731.000 2553.000

7 Inventory 351.000 414.000

8 Quick Asset 2380.000 2139.000

9 Debt 3466.000 3387.000

10 Net Sales 12584.000 11150.000

11 Fixed Asset 6513.000 6541.000

12 Gross profit 1472.000 222.000

13 EPS (Cents) 80.400 -60.400

Current Ratio = Current Asset/

Current Liability 1.33 1.41

Quick Ratio = Quick Asset/

Current Liability 0.87 0.84

Debt Equity ratio = Debt/ Equity 0.46 0.43

Inventory Turnover Ratio = sales /

Inventory 35.85 26.93

Fixed Asset Turnover Ratio = sales

/ Fixed assets 1.93 1.70

Gross Profit Margin Ratio = Gross

profit / Sales 0.12 0.02

ROA = Net Income / Total Asset 0.04 -0.03

Earnings per share 80.40 -60.40

The current and quick ratio of the company is used to determine the liquidity position whereas

ratios such as the debt-equity ratio, turnover ratio are used to measure the solvency of the ratios.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The profitability ratio of the company states about the performance of the company during the

year as well as the return that is being provided to the shareholders of the company (Basu, 2018).

The company current ratio and quick ratio which are ideal for the organisation are 2:1 and 1:1

respectively. The ratio has decreased from 1.41 to 1.33 but it is still in a satisfactory position as

the company can meet the short term as well as long-term liabilities. In case of quick assets, the

company should try to strengthen the assets so that there is no problem (Hossan, 2010).

The Debt equity ratio of the company has increased from 0.43 to 0.46. The company position is

still satisfactory as there is a balance of both the debt and equity in the capital structure. The

Turnover ratio of the company increased with the increase in the revenue as well as the fixed

asset turnover ratio which is a positive sign.

The performance ratio of the previous year were not at all satisfactory as the company incurred

losses but in current year company is able to provide a positive return to the stakeholders of the

company with better and effective results in terms of return on asset, gross profit margin as well

a earning per share (Hossan, 2010).

8

year as well as the return that is being provided to the shareholders of the company (Basu, 2018).

The company current ratio and quick ratio which are ideal for the organisation are 2:1 and 1:1

respectively. The ratio has decreased from 1.41 to 1.33 but it is still in a satisfactory position as

the company can meet the short term as well as long-term liabilities. In case of quick assets, the

company should try to strengthen the assets so that there is no problem (Hossan, 2010).

The Debt equity ratio of the company has increased from 0.43 to 0.46. The company position is

still satisfactory as there is a balance of both the debt and equity in the capital structure. The

Turnover ratio of the company increased with the increase in the revenue as well as the fixed

asset turnover ratio which is a positive sign.

The performance ratio of the previous year were not at all satisfactory as the company incurred

losses but in current year company is able to provide a positive return to the stakeholders of the

company with better and effective results in terms of return on asset, gross profit margin as well

a earning per share (Hossan, 2010).

8

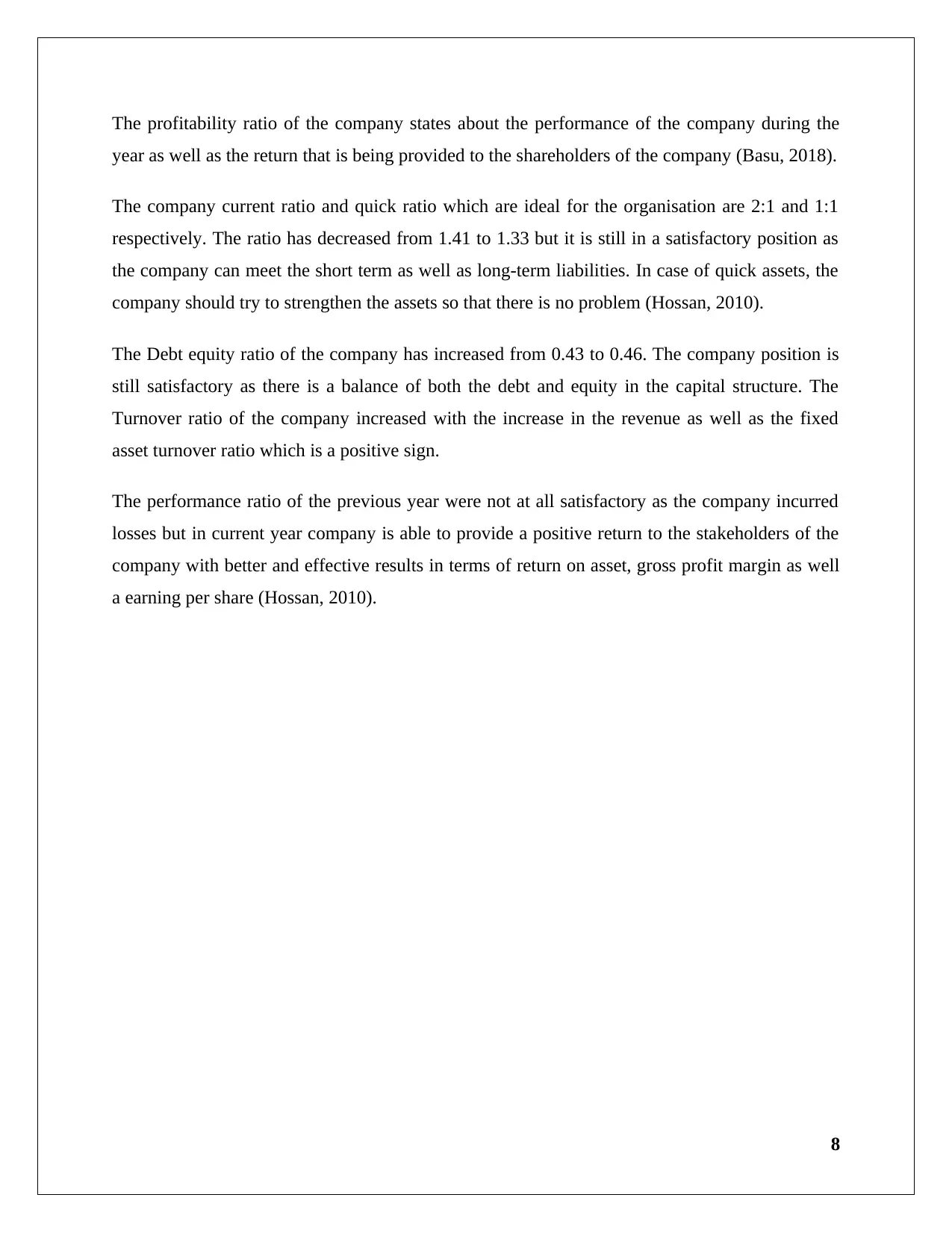

4. Two graphs from www.asx.com.au with the description of results

(i) The share price of the Company for 2 Years and comparison with all ords index

(Figure – Share price of Company for last 2 years)

(Source – Reuters, 2018)

9

(i) The share price of the Company for 2 Years and comparison with all ords index

(Figure – Share price of Company for last 2 years)

(Source – Reuters, 2018)

9

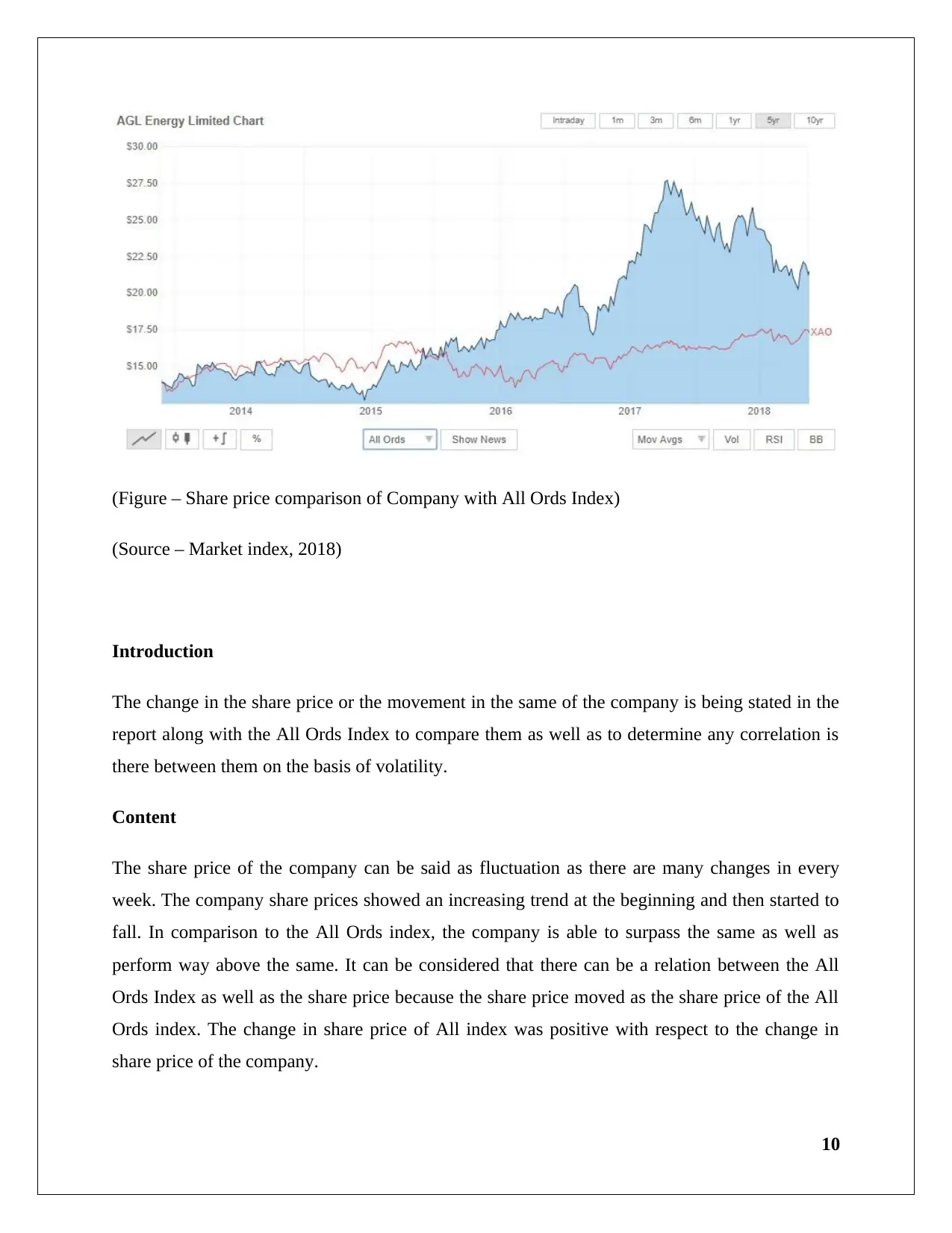

(Figure – Share price comparison of Company with All Ords Index)

(Source – Market index, 2018)

Introduction

The change in the share price or the movement in the same of the company is being stated in the

report along with the All Ords Index to compare them as well as to determine any correlation is

there between them on the basis of volatility.

Content

The share price of the company can be said as fluctuation as there are many changes in every

week. The company share prices showed an increasing trend at the beginning and then started to

fall. In comparison to the All Ords index, the company is able to surpass the same as well as

perform way above the same. It can be considered that there can be a relation between the All

Ords Index as well as the share price because the share price moved as the share price of the All

Ords index. The change in share price of All index was positive with respect to the change in

share price of the company.

10

(Source – Market index, 2018)

Introduction

The change in the share price or the movement in the same of the company is being stated in the

report along with the All Ords Index to compare them as well as to determine any correlation is

there between them on the basis of volatility.

Content

The share price of the company can be said as fluctuation as there are many changes in every

week. The company share prices showed an increasing trend at the beginning and then started to

fall. In comparison to the All Ords index, the company is able to surpass the same as well as

perform way above the same. It can be considered that there can be a relation between the All

Ords Index as well as the share price because the share price moved as the share price of the All

Ords index. The change in share price of All index was positive with respect to the change in

share price of the company.

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Conclusion

It can be concluded with the help of the above report the company is very strong and have higher

share price than the All Ords Index. There is volatility in the share price but not much as there

are fluctuations in the share price of the company.

11

It can be concluded with the help of the above report the company is very strong and have higher

share price than the All Ords Index. There is volatility in the share price but not much as there

are fluctuations in the share price of the company.

11

5. Significant factors that influenced share price

Since AGL Energy Limited is a business organization which deals majorly with energy

production, there are various factors affecting the determination of share price. These factors can

be broadly classified into two major categories, namely, internal or external factors

(Aruomoaghe & Agbo, 2013). Another basis or point of classification can be minor or major.

Whatever be the point of classification, all the factors need to be analysed accordingly. Ignorance

of a single factor can bring a major change in the share price and as such can affect the

determination of share price to a major extent.

Some of the major factors responsible for influencing or determination of share price are relating

to nations related or factors relating to outside the international boundaries. The most prominent

factors are the political and economic factors. This is because energy production sector is the

sector which involves continuous updating or modification with the changing scenario. Any

change in the economic scenario prevalent in the Australia or world, this sector is highly affected

or influenced by any slight change. Another factor that is affected is the cost of fuel or other

manufacturing inputs that are used to produce or manufacture the energy. Besides, cost of labor,

political situations, GDP of Australia, its political relations with other countries are also some

major factors that also need to be considered.

12

Since AGL Energy Limited is a business organization which deals majorly with energy

production, there are various factors affecting the determination of share price. These factors can

be broadly classified into two major categories, namely, internal or external factors

(Aruomoaghe & Agbo, 2013). Another basis or point of classification can be minor or major.

Whatever be the point of classification, all the factors need to be analysed accordingly. Ignorance

of a single factor can bring a major change in the share price and as such can affect the

determination of share price to a major extent.

Some of the major factors responsible for influencing or determination of share price are relating

to nations related or factors relating to outside the international boundaries. The most prominent

factors are the political and economic factors. This is because energy production sector is the

sector which involves continuous updating or modification with the changing scenario. Any

change in the economic scenario prevalent in the Australia or world, this sector is highly affected

or influenced by any slight change. Another factor that is affected is the cost of fuel or other

manufacturing inputs that are used to produce or manufacture the energy. Besides, cost of labor,

political situations, GDP of Australia, its political relations with other countries are also some

major factors that also need to be considered.

12

6. Calculation of ’ beta values and Expected Rates of Return using the CAPM

i) The (β) value of the company is 0.60 (Reuters, 2018).

ii) The rate of return as per CAPM is = Rf + (β) (Market risk premium)

Where,

Rf is the Risk-free rate

Rate of return = 4% + 0.60*6%

= 4% +3.6%

= 7.6%

iii)

The company can be chosen as a conservative investment due to the low rate of return. The low

rate of return but above the risk-free rate indicates that the risk involved with the share price of

the company is minimal. The shareholders are less prone to any losses as there are chances of

less fluctuation along with the long-term returns and growth (Kennon, 2017). The company with

the least risk involved with regards to the return of the shareholders is stated as the conservative

investment. There can be chances that the return provided on the shares is not very much high

but in the long term there are fewer chances of any loss and good chances of satisfactory returns

13

i) The (β) value of the company is 0.60 (Reuters, 2018).

ii) The rate of return as per CAPM is = Rf + (β) (Market risk premium)

Where,

Rf is the Risk-free rate

Rate of return = 4% + 0.60*6%

= 4% +3.6%

= 7.6%

iii)

The company can be chosen as a conservative investment due to the low rate of return. The low

rate of return but above the risk-free rate indicates that the risk involved with the share price of

the company is minimal. The shareholders are less prone to any losses as there are chances of

less fluctuation along with the long-term returns and growth (Kennon, 2017). The company with

the least risk involved with regards to the return of the shareholders is stated as the conservative

investment. There can be chances that the return provided on the shares is not very much high

but in the long term there are fewer chances of any loss and good chances of satisfactory returns

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

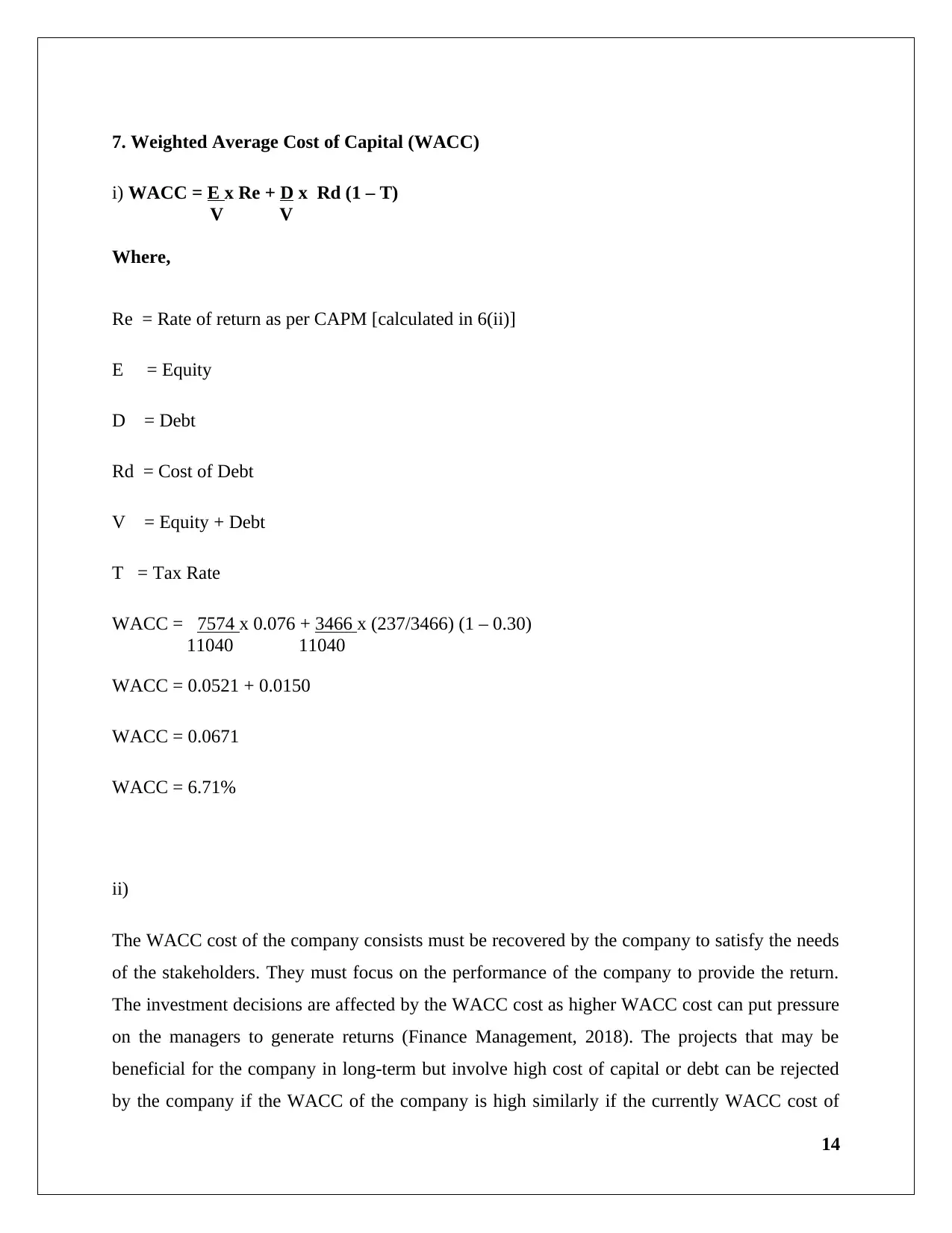

7. Weighted Average Cost of Capital (WACC)

i) WACC = E x Re + D x Rd (1 – T)

V V

Where,

Re = Rate of return as per CAPM [calculated in 6(ii)]

E = Equity

D = Debt

Rd = Cost of Debt

V = Equity + Debt

T = Tax Rate

WACC = 7574 x 0.076 + 3466 x (237/3466) (1 – 0.30)

11040 11040

WACC = 0.0521 + 0.0150

WACC = 0.0671

WACC = 6.71%

ii)

The WACC cost of the company consists must be recovered by the company to satisfy the needs

of the stakeholders. They must focus on the performance of the company to provide the return.

The investment decisions are affected by the WACC cost as higher WACC cost can put pressure

on the managers to generate returns (Finance Management, 2018). The projects that may be

beneficial for the company in long-term but involve high cost of capital or debt can be rejected

by the company if the WACC of the company is high similarly if the currently WACC cost of

14

i) WACC = E x Re + D x Rd (1 – T)

V V

Where,

Re = Rate of return as per CAPM [calculated in 6(ii)]

E = Equity

D = Debt

Rd = Cost of Debt

V = Equity + Debt

T = Tax Rate

WACC = 7574 x 0.076 + 3466 x (237/3466) (1 – 0.30)

11040 11040

WACC = 0.0521 + 0.0150

WACC = 0.0671

WACC = 6.71%

ii)

The WACC cost of the company consists must be recovered by the company to satisfy the needs

of the stakeholders. They must focus on the performance of the company to provide the return.

The investment decisions are affected by the WACC cost as higher WACC cost can put pressure

on the managers to generate returns (Finance Management, 2018). The projects that may be

beneficial for the company in long-term but involve high cost of capital or debt can be rejected

by the company if the WACC of the company is high similarly if the currently WACC cost of

14

company is lower there are chances that even a high-cost investment decision may also be

selected having long-term benefits (KPMG, 2015).

15

selected having long-term benefits (KPMG, 2015).

15

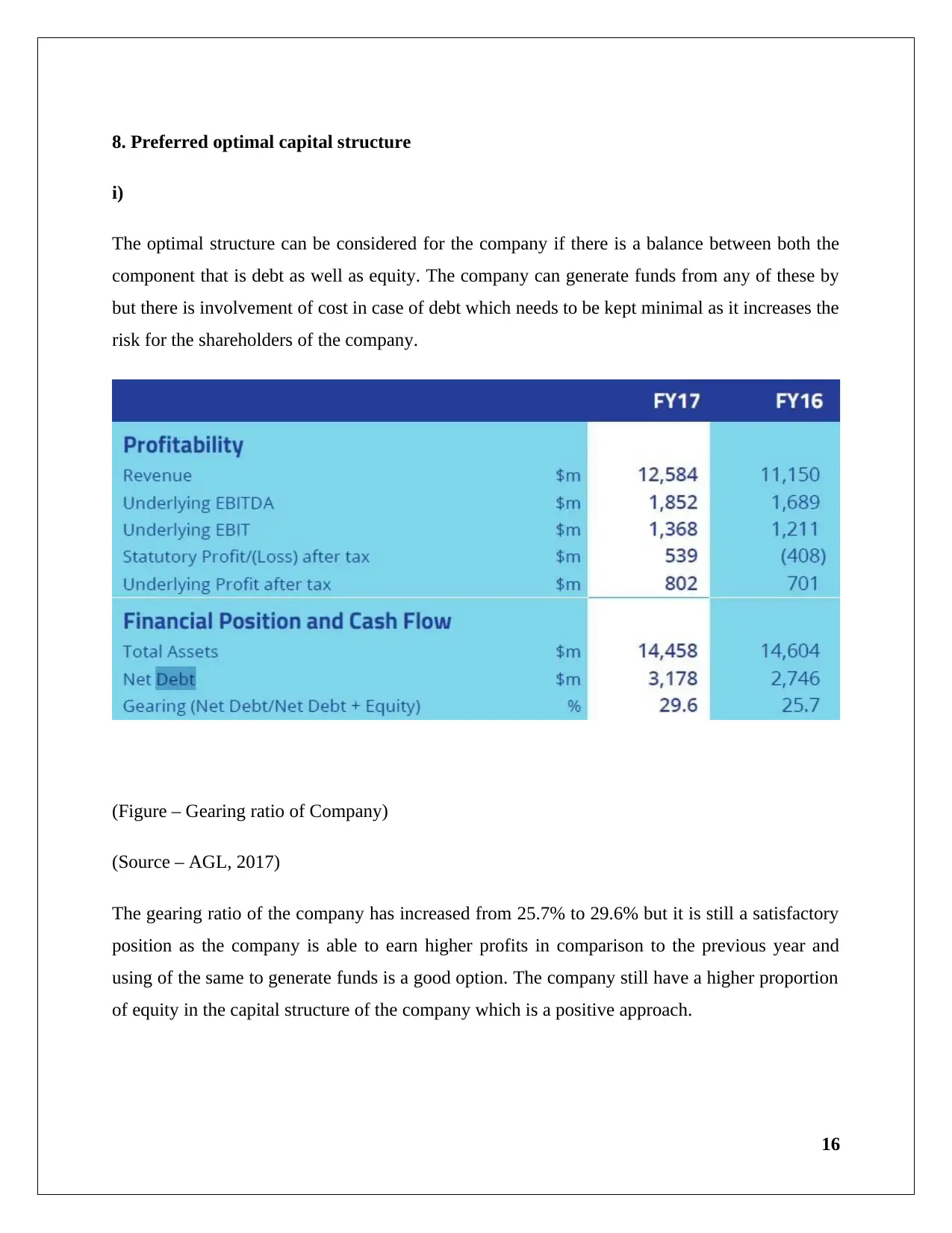

8. Preferred optimal capital structure

i)

The optimal structure can be considered for the company if there is a balance between both the

component that is debt as well as equity. The company can generate funds from any of these by

but there is involvement of cost in case of debt which needs to be kept minimal as it increases the

risk for the shareholders of the company.

(Figure – Gearing ratio of Company)

(Source – AGL, 2017)

The gearing ratio of the company has increased from 25.7% to 29.6% but it is still a satisfactory

position as the company is able to earn higher profits in comparison to the previous year and

using of the same to generate funds is a good option. The company still have a higher proportion

of equity in the capital structure of the company which is a positive approach.

16

i)

The optimal structure can be considered for the company if there is a balance between both the

component that is debt as well as equity. The company can generate funds from any of these by

but there is involvement of cost in case of debt which needs to be kept minimal as it increases the

risk for the shareholders of the company.

(Figure – Gearing ratio of Company)

(Source – AGL, 2017)

The gearing ratio of the company has increased from 25.7% to 29.6% but it is still a satisfactory

position as the company is able to earn higher profits in comparison to the previous year and

using of the same to generate funds is a good option. The company still have a higher proportion

of equity in the capital structure of the company which is a positive approach.

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

ii)

The change has been reflected in the gearing ratio of the company as the debt component has

increased during the year from 3086 million to 3173 million and also there is a decrease in the

shareholder's fund or equity from 7926 million to 7574 million.

17

The change has been reflected in the gearing ratio of the company as the debt component has

increased during the year from 3086 million to 3173 million and also there is a decrease in the

shareholder's fund or equity from 7926 million to 7574 million.

17

9. Dividend Policy

During the financial year 2017, AGL Energy Limited has paid interim as well as the final

dividend. Interim dividend amounting 41 cents per share has been paid on 27th March 2017.

Final dividend amounting 50 cents has been paid on 22nd September 2017. Both these dividends

have been franked up to 80%. Such higher dividend payout ratio and payment of interim

dividend indicate that the company is earning sufficient and adequate profits by properly

managing its financial resources. It also indicates that the company has not any future plans or

expansion plans and there are adequate plans for meeting any contingency or uncertainty

(Amirya, et. al., 2014).

In comparison with the previous financial year 2016, it can be observed that company is

maintaining the same dividend policy since it has paid an interim and final dividend in the year

2016 as well (Aruomoaghe & Agbo, 2013). However, the amount of dividend paid in the year

2016 is much lower in comparison to the current year 2017. Another prominent year to be kept in

mind is that dividend paid in 2016 is fully franked.

18

During the financial year 2017, AGL Energy Limited has paid interim as well as the final

dividend. Interim dividend amounting 41 cents per share has been paid on 27th March 2017.

Final dividend amounting 50 cents has been paid on 22nd September 2017. Both these dividends

have been franked up to 80%. Such higher dividend payout ratio and payment of interim

dividend indicate that the company is earning sufficient and adequate profits by properly

managing its financial resources. It also indicates that the company has not any future plans or

expansion plans and there are adequate plans for meeting any contingency or uncertainty

(Amirya, et. al., 2014).

In comparison with the previous financial year 2016, it can be observed that company is

maintaining the same dividend policy since it has paid an interim and final dividend in the year

2016 as well (Aruomoaghe & Agbo, 2013). However, the amount of dividend paid in the year

2016 is much lower in comparison to the current year 2017. Another prominent year to be kept in

mind is that dividend paid in 2016 is fully franked.

18

10. Letter Recommendation

Letter of Recommendation

To,

The Client,

The above company is very much suitable for the portfolio investment as there is an increase in

the share price of the company and is high above the All Ords index. The company can is a

conservative investment in the long-term growth and sustainability. The performance of the

company not only improved but also managed to generate profit during the year. The company

was able to provide good returns to the stakeholders of the company with minimal risk due to the

effective optimal capital structure. The company had incurred losses in the previous year but

managed to increase the sales in the current year as well as profitability. The company future

looks strong with the low-cost capital of the company. The WACC cost of the company is not

very much high which provide liberty to choose any investment to the company.

19

Letter of Recommendation

To,

The Client,

The above company is very much suitable for the portfolio investment as there is an increase in

the share price of the company and is high above the All Ords index. The company can is a

conservative investment in the long-term growth and sustainability. The performance of the

company not only improved but also managed to generate profit during the year. The company

was able to provide good returns to the stakeholders of the company with minimal risk due to the

effective optimal capital structure. The company had incurred losses in the previous year but

managed to increase the sales in the current year as well as profitability. The company future

looks strong with the low-cost capital of the company. The WACC cost of the company is not

very much high which provide liberty to choose any investment to the company.

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

From the report, it can be concluded that business shall maintain the finance inappropriate

manner and for that various aspect are taken into consideration. In this, the corporate structure

has been identifying. The calculations are made for the ratios and other rates in relation to cost

and returns. The dividend policy is also determined and the recommendations are provided

which are to be followed by the investors.

20

From the report, it can be concluded that business shall maintain the finance inappropriate

manner and for that various aspect are taken into consideration. In this, the corporate structure

has been identifying. The calculations are made for the ratios and other rates in relation to cost

and returns. The dividend policy is also determined and the recommendations are provided

which are to be followed by the investors.

20

References

AGL, (2017). AGL 2017 Annual Report. AGL. [Online]. Available at

https://www.agl.com.au/about-agl/media-centre/asx-and-media-releases/2017/august/agl-

2017-annual-report. [Accessed on 22 May 2018]

Amirya, M., Djamhuri, A., & Ludigdo, U., 2014. Development of Accounting and

Budget System of General Services Board in Universitas Brawijaya: Study of

Interpretive. International Journal of Humanities and Social Science.

Aruomoaghe, J., & Agbo, S., 2013. Application of Variance Analysis for Performance

Evaluation: A Cost/Benefit Approach. Research Journal of Finance and Accounting.

Basu, C., (2018). Four Basic Types of Financial Ratios Used to Measure a Company's

Performance. Chron. [Online]. Also available at http://smallbusiness.chron.com/four-

basic-types-financial-ratios-used-measure-companys-performance-25299.html.

[Accessed on 22 May 2018]

Finance Management, (2018). Importance and Use of Weighted Average Cost of Capital

(WACC). Finance Management. [Online]. Available at

https://efinancemanagement.com/investment-decisions/importance-and-use-of-weighted-

average-cost-of-capital-wacc. [Accessed on 22 May 2018]

Hossan, F., (2010). Performance evaluation and ratio analysis of Pharmaceutical

Company in Bangladesh. West. [Online]. Also available at

http://hv.diva-portal.org/smash/get/diva2:323754/FULLTEXT01.pdf. [Accessed on 22-

05-2018].

Kennon, J., (2017). What Is a Good Return on Your Investments?. The balance. [Online].

Available at https://www.investsmart.com.au/shares/asx-wow/woolworths-group-

limited/announcements?page=2. [Accessed on 22 May 2018]

KPMG, (2015). Cost of Capital Study 2015. KPMG. [Online]. Also Available

https://assets.kpmg.com/content/dam/kpmg/pdf/2016/01/kpmg-cost-of-capital-study-

2015.pdf. [Accessed on 22 May 2018]

21

AGL, (2017). AGL 2017 Annual Report. AGL. [Online]. Available at

https://www.agl.com.au/about-agl/media-centre/asx-and-media-releases/2017/august/agl-

2017-annual-report. [Accessed on 22 May 2018]

Amirya, M., Djamhuri, A., & Ludigdo, U., 2014. Development of Accounting and

Budget System of General Services Board in Universitas Brawijaya: Study of

Interpretive. International Journal of Humanities and Social Science.

Aruomoaghe, J., & Agbo, S., 2013. Application of Variance Analysis for Performance

Evaluation: A Cost/Benefit Approach. Research Journal of Finance and Accounting.

Basu, C., (2018). Four Basic Types of Financial Ratios Used to Measure a Company's

Performance. Chron. [Online]. Also available at http://smallbusiness.chron.com/four-

basic-types-financial-ratios-used-measure-companys-performance-25299.html.

[Accessed on 22 May 2018]

Finance Management, (2018). Importance and Use of Weighted Average Cost of Capital

(WACC). Finance Management. [Online]. Available at

https://efinancemanagement.com/investment-decisions/importance-and-use-of-weighted-

average-cost-of-capital-wacc. [Accessed on 22 May 2018]

Hossan, F., (2010). Performance evaluation and ratio analysis of Pharmaceutical

Company in Bangladesh. West. [Online]. Also available at

http://hv.diva-portal.org/smash/get/diva2:323754/FULLTEXT01.pdf. [Accessed on 22-

05-2018].

Kennon, J., (2017). What Is a Good Return on Your Investments?. The balance. [Online].

Available at https://www.investsmart.com.au/shares/asx-wow/woolworths-group-

limited/announcements?page=2. [Accessed on 22 May 2018]

KPMG, (2015). Cost of Capital Study 2015. KPMG. [Online]. Also Available

https://assets.kpmg.com/content/dam/kpmg/pdf/2016/01/kpmg-cost-of-capital-study-

2015.pdf. [Accessed on 22 May 2018]

21

Market Index, (2018). AGL Energy Limited Chart. Market Index. [Online]. Available at

https://www.marketindex.com.au/asx/agl. [Accessed on 22 May 2018]

Momani, G.F. and Alsharari, M.A., 2012. Impact of Economic Factors on the Stock

Prices at Amman Stock Market (1992-2010). International Journal of Economics and

Finance, 4(1), p.151.

Reuters, (2018). AGL Energy Ltd (AGL.AX). Reuters. [Online]. Available at

https://www.reuters.com/finance/stocks/chart/AGL.AX. [Accessed on 22 May 2018]

22

https://www.marketindex.com.au/asx/agl. [Accessed on 22 May 2018]

Momani, G.F. and Alsharari, M.A., 2012. Impact of Economic Factors on the Stock

Prices at Amman Stock Market (1992-2010). International Journal of Economics and

Finance, 4(1), p.151.

Reuters, (2018). AGL Energy Ltd (AGL.AX). Reuters. [Online]. Available at

https://www.reuters.com/finance/stocks/chart/AGL.AX. [Accessed on 22 May 2018]

22

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.