In-Depth Case Study: Financial Viability of the Airbus A3XX Project

VerifiedAdded on 2023/06/10

|9

|1971

|378

Case Study

AI Summary

This case study delves into the financial aspects of the Airbus A3XX project, examining its initial approval, development costs, and market predictions. It compares Airbus's strategies with those of its competitor, Boeing, particularly focusing on the demand for very large aircraft (VLA). The analysis includes a discussion of Airbus's Global Market Forecast (GMF), expected profit margins, and potential return on investment. The study also evaluates the project's NPV, considers the risks and uncertainties involved, and contrasts Airbus's optimistic outlook with Boeing's more conservative approach. Finally, it discusses the potential for the A3XX project to be a provision for future market demands in the aviation industry. Desklib offers this and other solved assignments to aid students in their studies.

Running header: FINANCE

Finance

Name of the Student:

Name of the University:

Authors Note:

Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE

Table of Contents

Answer to Question 1.................................................................................................................2

Answer to Question 2.................................................................................................................3

Answer to Question 3.................................................................................................................4

Answer to Question 4.................................................................................................................5

Answer to Question 5.................................................................................................................6

Answer to Question 6.................................................................................................................6

Reference....................................................................................................................................7

Table of Contents

Answer to Question 1.................................................................................................................2

Answer to Question 2.................................................................................................................3

Answer to Question 3.................................................................................................................4

Answer to Question 4.................................................................................................................5

Answer to Question 5.................................................................................................................6

Answer to Question 6.................................................................................................................6

Reference....................................................................................................................................7

2FINANCE

Answer to Question 1

On June 23, 2000, a super jumbo jet named A3XX was approved by the Airbus

Industry’s Supervisory Board. This jet could provide the carrying capacity to 550 to 990

passengers. This jumbo jet had a list price of $216 million and it cost $13 billion to develop.

The development of this aircraft was ongoing since 1990. The Authorization to Offer (ATO)

permitted the company to start delivering this aircraft by 2006. The company announced

about the first order of the aircraft in July 2000. It got a total of twenty two orders of that

model from Air France, Emirates Airlines and International Lease Finance Corporation. The

management of the company also expected to notice a considerable hike in the market of very

large aircraft (VLA) in the next 20 year (they assumed to sell as much as 750 aircrafts in the

meantime). The management even predicted that they would break on an undisclosed cash

flow basis as selling 250 planes (Adler et al. 2018). They also expected that the sales of this

particular model would help to gain the profit of $350 billion.

There is no doubt that Airbus was one of the leading companies in Aviation industry.

But their main competitor in this industry was Boeing Company. It had been ruled the

aviation industry for more than fifty years. The market was also in favour of Boeing since the

World War II. The sales of Boeing aircraft used to gain two third of its revenue from the

commercial aircraft. The rest was dependable upon fighter jets and space shuttle. They also

provided 14 models from 5 aircraft families. The flagship of the Boeing industry was the 747-

400. It was also a very large aircraft (VLA) which could carry up to 420 passengers and had

three different classes to offer. The Boeing Company announced about the initial 25 order of

this aircraft and its stock price jumped at 5.1%. The management of the company expected

that this specific model would generate sales more than 700 planes in between 1980. But this

prediction failed as this project failed and this caused the company to face a very difficult

situation.

Answer to Question 1

On June 23, 2000, a super jumbo jet named A3XX was approved by the Airbus

Industry’s Supervisory Board. This jet could provide the carrying capacity to 550 to 990

passengers. This jumbo jet had a list price of $216 million and it cost $13 billion to develop.

The development of this aircraft was ongoing since 1990. The Authorization to Offer (ATO)

permitted the company to start delivering this aircraft by 2006. The company announced

about the first order of the aircraft in July 2000. It got a total of twenty two orders of that

model from Air France, Emirates Airlines and International Lease Finance Corporation. The

management of the company also expected to notice a considerable hike in the market of very

large aircraft (VLA) in the next 20 year (they assumed to sell as much as 750 aircrafts in the

meantime). The management even predicted that they would break on an undisclosed cash

flow basis as selling 250 planes (Adler et al. 2018). They also expected that the sales of this

particular model would help to gain the profit of $350 billion.

There is no doubt that Airbus was one of the leading companies in Aviation industry.

But their main competitor in this industry was Boeing Company. It had been ruled the

aviation industry for more than fifty years. The market was also in favour of Boeing since the

World War II. The sales of Boeing aircraft used to gain two third of its revenue from the

commercial aircraft. The rest was dependable upon fighter jets and space shuttle. They also

provided 14 models from 5 aircraft families. The flagship of the Boeing industry was the 747-

400. It was also a very large aircraft (VLA) which could carry up to 420 passengers and had

three different classes to offer. The Boeing Company announced about the initial 25 order of

this aircraft and its stock price jumped at 5.1%. The management of the company expected

that this specific model would generate sales more than 700 planes in between 1980. But this

prediction failed as this project failed and this caused the company to face a very difficult

situation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE

As of 1990s, the 90% of the sold aircrafts was large aircrafts (consisting seats

between 70-400) and the number was quite sufficient at that time. There were demands for

very large aircrafts, but not enough to compensate the huge expenses regarding the

manufacturing and development of such huge aircrafts. There was a huge amount of

uncertainty regarding launching such aircrafts as the demands was not up to the expectations.

Thus the company should wait till there was enough demand to ensure enough order for the

model of the aircraft (DeCorla-Souza and Farajian 2017). If it postponed the project for the

future, there might be a chance that Boeing Company would leave them behind in the case of

large aircrafts. But when it comes to the matter of launching, where the huge amount of

capital is invested, the company should be more careful regarding that matter.

Answer to Question 2

In the Global Market Forecast (GMF) published by Airbus, they assumed and

indicated about some of the key features of the growth in the aviation industry. In 2000, the

GMF stated the growth forecast about the upcoming 20 years where it showed there will be a

hike on the worldwide passenger traffic by 4.9%. Airbus also predicted the demand for new

aircrafts on an overall basis of 10,000 routes linking 2,000 airports. The company also

forecasted for 14,661 new passenger aircrafts on which 1550 aircrafts for carrying 500 and

above passengers (Duckett and Willcox 2015). While Boeing forecasted a much smaller very

large aircraft market. They also targeted specifically the long distance flights as the major

benefactor of the very large aircrafts. But at the same time, the increasing frequency of flights

can also mar the market of very large aircrafts. For this scenario, the 747-400 would be the

perfect choice for the airlines companies.

As Airbus had not disclosed the exact cost of the project, it can be assumed that the

development of the aircraft might reach at the cost of $15 billion or more. The expected price

As of 1990s, the 90% of the sold aircrafts was large aircrafts (consisting seats

between 70-400) and the number was quite sufficient at that time. There were demands for

very large aircrafts, but not enough to compensate the huge expenses regarding the

manufacturing and development of such huge aircrafts. There was a huge amount of

uncertainty regarding launching such aircrafts as the demands was not up to the expectations.

Thus the company should wait till there was enough demand to ensure enough order for the

model of the aircraft (DeCorla-Souza and Farajian 2017). If it postponed the project for the

future, there might be a chance that Boeing Company would leave them behind in the case of

large aircrafts. But when it comes to the matter of launching, where the huge amount of

capital is invested, the company should be more careful regarding that matter.

Answer to Question 2

In the Global Market Forecast (GMF) published by Airbus, they assumed and

indicated about some of the key features of the growth in the aviation industry. In 2000, the

GMF stated the growth forecast about the upcoming 20 years where it showed there will be a

hike on the worldwide passenger traffic by 4.9%. Airbus also predicted the demand for new

aircrafts on an overall basis of 10,000 routes linking 2,000 airports. The company also

forecasted for 14,661 new passenger aircrafts on which 1550 aircrafts for carrying 500 and

above passengers (Duckett and Willcox 2015). While Boeing forecasted a much smaller very

large aircraft market. They also targeted specifically the long distance flights as the major

benefactor of the very large aircrafts. But at the same time, the increasing frequency of flights

can also mar the market of very large aircrafts. For this scenario, the 747-400 would be the

perfect choice for the airlines companies.

As Airbus had not disclosed the exact cost of the project, it can be assumed that the

development of the aircraft might reach at the cost of $15 billion or more. The expected price

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE

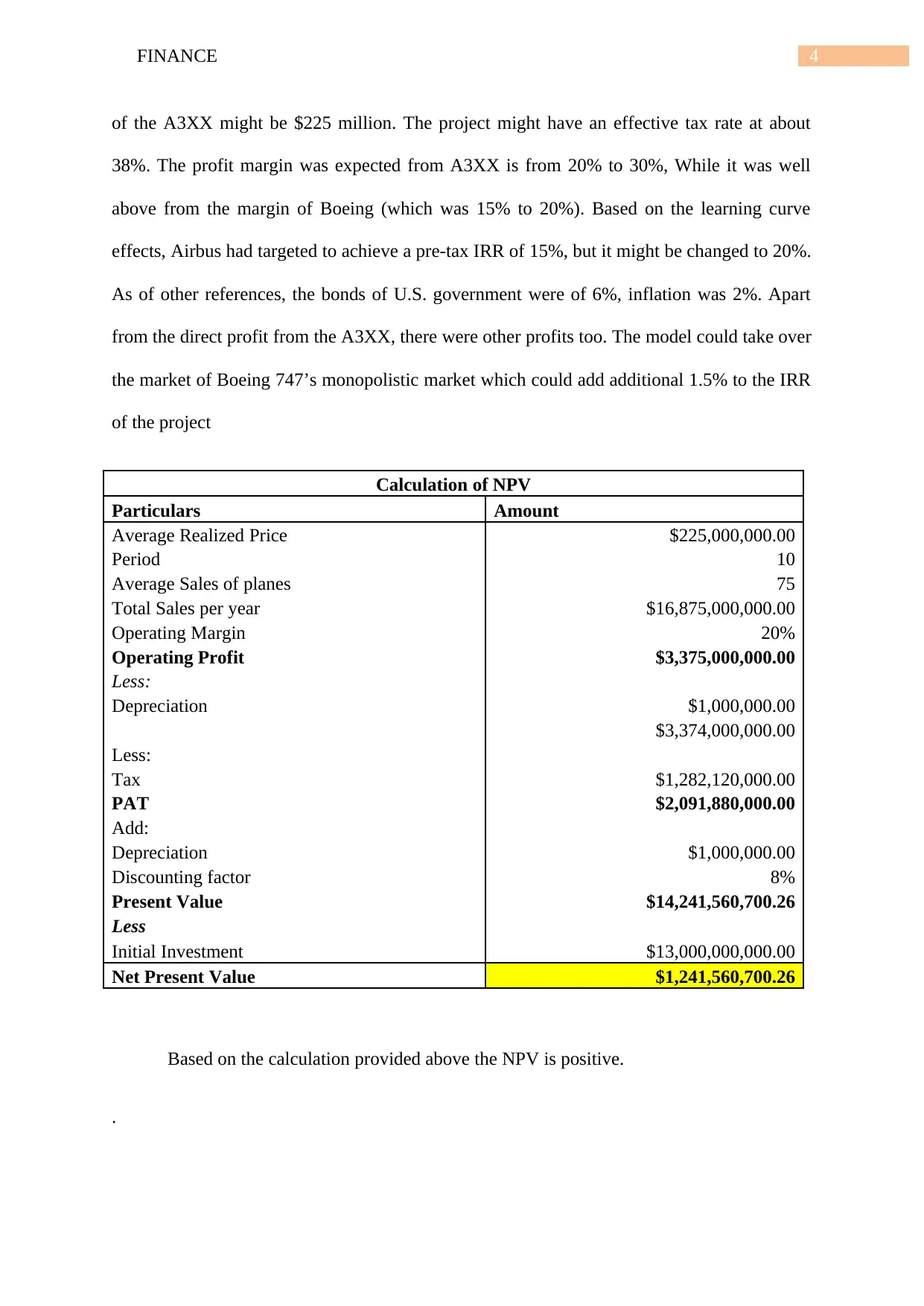

of the A3XX might be $225 million. The project might have an effective tax rate at about

38%. The profit margin was expected from A3XX is from 20% to 30%, While it was well

above from the margin of Boeing (which was 15% to 20%). Based on the learning curve

effects, Airbus had targeted to achieve a pre-tax IRR of 15%, but it might be changed to 20%.

As of other references, the bonds of U.S. government were of 6%, inflation was 2%. Apart

from the direct profit from the A3XX, there were other profits too. The model could take over

the market of Boeing 747’s monopolistic market which could add additional 1.5% to the IRR

of the project

Calculation of NPV

Particulars Amount

Average Realized Price $225,000,000.00

Period 10

Average Sales of planes 75

Total Sales per year $16,875,000,000.00

Operating Margin 20%

Operating Profit $3,375,000,000.00

Less:

Depreciation $1,000,000.00

$3,374,000,000.00

Less:

Tax $1,282,120,000.00

PAT $2,091,880,000.00

Add:

Depreciation $1,000,000.00

Discounting factor 8%

Present Value $14,241,560,700.26

Less

Initial Investment $13,000,000,000.00

Net Present Value $1,241,560,700.26

Based on the calculation provided above the NPV is positive.

.

of the A3XX might be $225 million. The project might have an effective tax rate at about

38%. The profit margin was expected from A3XX is from 20% to 30%, While it was well

above from the margin of Boeing (which was 15% to 20%). Based on the learning curve

effects, Airbus had targeted to achieve a pre-tax IRR of 15%, but it might be changed to 20%.

As of other references, the bonds of U.S. government were of 6%, inflation was 2%. Apart

from the direct profit from the A3XX, there were other profits too. The model could take over

the market of Boeing 747’s monopolistic market which could add additional 1.5% to the IRR

of the project

Calculation of NPV

Particulars Amount

Average Realized Price $225,000,000.00

Period 10

Average Sales of planes 75

Total Sales per year $16,875,000,000.00

Operating Margin 20%

Operating Profit $3,375,000,000.00

Less:

Depreciation $1,000,000.00

$3,374,000,000.00

Less:

Tax $1,282,120,000.00

PAT $2,091,880,000.00

Add:

Depreciation $1,000,000.00

Discounting factor 8%

Present Value $14,241,560,700.26

Less

Initial Investment $13,000,000,000.00

Net Present Value $1,241,560,700.26

Based on the calculation provided above the NPV is positive.

.

5FINANCE

Answer to Question 3

According to the given data submitted by Airbus, the project was supposed to gain the

expected margin of at least 20%. This analysis however is disagreed in many areas. On one

hand, the exact data is insufficient to account the reliable amount to rely on. On the other

hand, there was also some disagreement regarding the amount of development cost, tax rate

and AIC’s tax status.

But as the demand was not as big as the project, there was very little chance of

success. The initial response from the clients was hopeful, but a long term project cannot rely

on ‘launch’ customers as they are received substantial discount. The company could not start

the production without getting 50-100 order to secure the overall uninterrupted production.

The project was not that influential at that time as the market was not that responsive towards

the product. So the project was regarded as a lose at that concurrent time.

Answer to Question 4

In the Global Market Forecast of Airbus and Current Market Outlook of Boeing, there

are some contrasts that can be seen in both companies’ forecast. Airbus emphasises that to

accumulate with the growing number of the worldwide passenger traffic, there will shortly be

a huge demand for the very large aircrafts. Though Boeing stated that the increasing

frequency of the flights, shorter routes, opening new airports can manage the growing

number of the passenger traffic. But according to Airbus, these are not the permanent

solutions. In order to accumulate growing passengers year by year, the airlines must have to

prepare by increasing the number of seats in the aircrafts.

Though the growing number of airports and aircrafts can provide a temporary solution

to the suffering and waiting of the consumers, it is not a permanent solution. The aviation

industry was started to booming that time. The airlines were trying to gain as much

Answer to Question 3

According to the given data submitted by Airbus, the project was supposed to gain the

expected margin of at least 20%. This analysis however is disagreed in many areas. On one

hand, the exact data is insufficient to account the reliable amount to rely on. On the other

hand, there was also some disagreement regarding the amount of development cost, tax rate

and AIC’s tax status.

But as the demand was not as big as the project, there was very little chance of

success. The initial response from the clients was hopeful, but a long term project cannot rely

on ‘launch’ customers as they are received substantial discount. The company could not start

the production without getting 50-100 order to secure the overall uninterrupted production.

The project was not that influential at that time as the market was not that responsive towards

the product. So the project was regarded as a lose at that concurrent time.

Answer to Question 4

In the Global Market Forecast of Airbus and Current Market Outlook of Boeing, there

are some contrasts that can be seen in both companies’ forecast. Airbus emphasises that to

accumulate with the growing number of the worldwide passenger traffic, there will shortly be

a huge demand for the very large aircrafts. Though Boeing stated that the increasing

frequency of the flights, shorter routes, opening new airports can manage the growing

number of the passenger traffic. But according to Airbus, these are not the permanent

solutions. In order to accumulate growing passengers year by year, the airlines must have to

prepare by increasing the number of seats in the aircrafts.

Though the growing number of airports and aircrafts can provide a temporary solution

to the suffering and waiting of the consumers, it is not a permanent solution. The aviation

industry was started to booming that time. The airlines were trying to gain as much

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE

passengers as possible to gain the maximum profits. So it is supposed that Boeing should not

understate the huge possibility of very large aircrafts. Beside this, Boeing had their existing

model 747 in market. Observing the subsequent demands of such aircrafts in the market, It is

natural for the company to not to take too much interest in developing and launching new

aircrafts. Apart from this, they may upgrade the 747 version to a modified one.

Answer to Question 5

As Airbus is a government-backed company, they could neutralize the idea as a

provision. The idea was great but poorly executed. So there were scopes to make

improvements in that existing idea. Apart from this, the project could be used as a provision

of the company because in future, the demand for very large aircrafts was to be observed.

Beside this, the project had every potentiality to beat Boeing 747 in the field of very large

aircraft.

Answer to Question 6

This was the starting of an era where very large aircrafts was going to take over the

market. The airlines industry started to feel the need of very large aircrafts very soon as to

provide enough service to their clients. For this, very large aircrafts were the best option

available to them (Nekhlyudov et al. 2016). As the industry was booming, new types of

VLA was emerging in the market. Aircrafts like A380, A340, various models of Boeing 747

was starting to take their own place in the aviation industry. With the demands, the

production also started to increase day by day. Till now the sales of only B747 aircrafts has

reached over 615. And the sales of A380 have reached at 337. Regardless of other models of

other companies, it can be said that the aviation industry is getting accustomed with the new

VLA aircrafts to fulfil the needs of the market.

passengers as possible to gain the maximum profits. So it is supposed that Boeing should not

understate the huge possibility of very large aircrafts. Beside this, Boeing had their existing

model 747 in market. Observing the subsequent demands of such aircrafts in the market, It is

natural for the company to not to take too much interest in developing and launching new

aircrafts. Apart from this, they may upgrade the 747 version to a modified one.

Answer to Question 5

As Airbus is a government-backed company, they could neutralize the idea as a

provision. The idea was great but poorly executed. So there were scopes to make

improvements in that existing idea. Apart from this, the project could be used as a provision

of the company because in future, the demand for very large aircrafts was to be observed.

Beside this, the project had every potentiality to beat Boeing 747 in the field of very large

aircraft.

Answer to Question 6

This was the starting of an era where very large aircrafts was going to take over the

market. The airlines industry started to feel the need of very large aircrafts very soon as to

provide enough service to their clients. For this, very large aircrafts were the best option

available to them (Nekhlyudov et al. 2016). As the industry was booming, new types of

VLA was emerging in the market. Aircrafts like A380, A340, various models of Boeing 747

was starting to take their own place in the aviation industry. With the demands, the

production also started to increase day by day. Till now the sales of only B747 aircrafts has

reached over 615. And the sales of A380 have reached at 337. Regardless of other models of

other companies, it can be said that the aviation industry is getting accustomed with the new

VLA aircrafts to fulfil the needs of the market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE

8FINANCE

Reference

Adler, L., Yi, D., Li, M., Mcbroom, B., Hauck, L., Sammer, C., Jones, C., Shaw, T. and

Classen, D., 2018. Impact of inpatient harms on hospital finances and patient clinical

outcomes. Journal of patient safety, 14(2), p.67.

DeCorla-Souza, P. and Farajian, M., 2017. Evaluation of a Nontraditional Approach to Fund,

Finance, and Manage Metropolitan Freeways. Transportation Research Record: Journal of

the Transportation Research Board, (2670), pp.33-41.

Duckett, S. and Willcox, S., 2015. The Australian health care system (No. Ed. 5). Oxford

University Press.

Nekhlyudov, L., Walker, R., Ziebell, R., Rabin, B., Nutt, S. and Chubak, J., 2016. Cancer

survivors’ experiences with insurance, finances, and employment: results from a multisite

study. Journal of Cancer Survivorship, 10(6), pp.1104-1111.

Reference

Adler, L., Yi, D., Li, M., Mcbroom, B., Hauck, L., Sammer, C., Jones, C., Shaw, T. and

Classen, D., 2018. Impact of inpatient harms on hospital finances and patient clinical

outcomes. Journal of patient safety, 14(2), p.67.

DeCorla-Souza, P. and Farajian, M., 2017. Evaluation of a Nontraditional Approach to Fund,

Finance, and Manage Metropolitan Freeways. Transportation Research Record: Journal of

the Transportation Research Board, (2670), pp.33-41.

Duckett, S. and Willcox, S., 2015. The Australian health care system (No. Ed. 5). Oxford

University Press.

Nekhlyudov, L., Walker, R., Ziebell, R., Rabin, B., Nutt, S. and Chubak, J., 2016. Cancer

survivors’ experiences with insurance, finances, and employment: results from a multisite

study. Journal of Cancer Survivorship, 10(6), pp.1104-1111.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.