In-depth Analysis of Capital Structure and Risk Management of AMP

VerifiedAdded on 2023/06/03

|8

|1537

|500

Report

AI Summary

This report provides a comprehensive analysis of AMP Limited's capital structure and risk management strategies. It begins with an overview of the company, followed by an examination of its current capital structure and weighted average cost of capital (WACC), noting the firm's reliance on equity. The report compares AMP's capital structure with that of the Commonwealth Bank of Australia (CBA) and identifies key financial ratios, suggesting areas for improvement in liquidity and profitability. Additionally, it analyzes the risks identified by the directors and the company's risk management efforts, highlighting instances where risks were not adequately managed. The conclusion summarizes the findings and offers recommendations for enhancing AMP's capital structure and risk management practices.

RUNNING HEAD: ACCOUNTING AND FINANCE

Capital structure analysis

Capital structure analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance 2

Part B

Executive summary

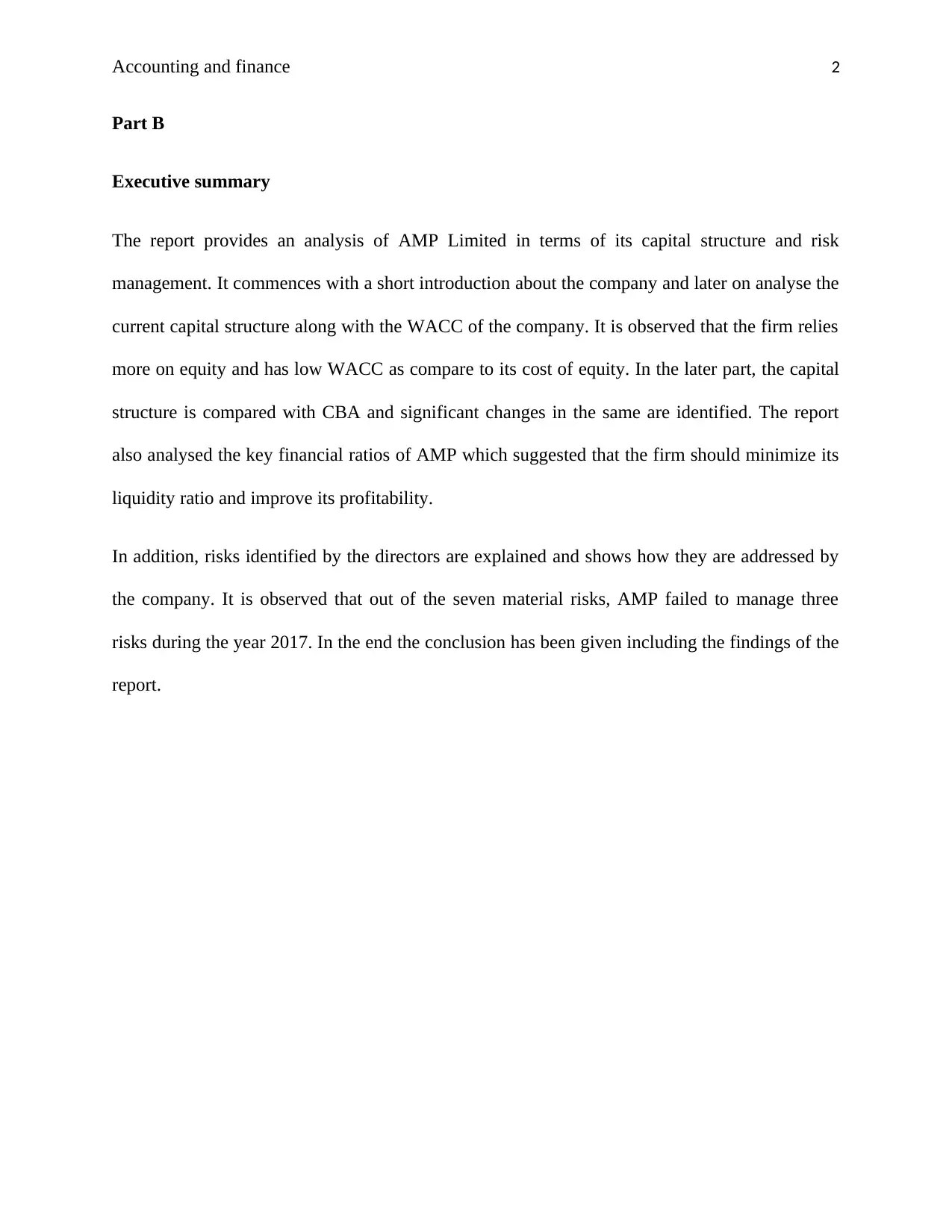

The report provides an analysis of AMP Limited in terms of its capital structure and risk

management. It commences with a short introduction about the company and later on analyse the

current capital structure along with the WACC of the company. It is observed that the firm relies

more on equity and has low WACC as compare to its cost of equity. In the later part, the capital

structure is compared with CBA and significant changes in the same are identified. The report

also analysed the key financial ratios of AMP which suggested that the firm should minimize its

liquidity ratio and improve its profitability.

In addition, risks identified by the directors are explained and shows how they are addressed by

the company. It is observed that out of the seven material risks, AMP failed to manage three

risks during the year 2017. In the end the conclusion has been given including the findings of the

report.

Part B

Executive summary

The report provides an analysis of AMP Limited in terms of its capital structure and risk

management. It commences with a short introduction about the company and later on analyse the

current capital structure along with the WACC of the company. It is observed that the firm relies

more on equity and has low WACC as compare to its cost of equity. In the later part, the capital

structure is compared with CBA and significant changes in the same are identified. The report

also analysed the key financial ratios of AMP which suggested that the firm should minimize its

liquidity ratio and improve its profitability.

In addition, risks identified by the directors are explained and shows how they are addressed by

the company. It is observed that out of the seven material risks, AMP failed to manage three

risks during the year 2017. In the end the conclusion has been given including the findings of the

report.

Accounting and finance 3

Introduction

AMP Limited is an Australia based financial service company which is involved in the business

of providing financial services to the customers across the country. The company was founded in

1849 and got listed on ASX. It operates in Australia and New Zealand and deals in providing

superannuation and investment products, insurance and financial advice, home loans and others.

The report critically evaluates the capital structure of the firm and provides insights about the

fact that whether the company is able to maximize the shareholders’ wealth (Reuters. 2018).

Part 1

Current capital structure of the firm

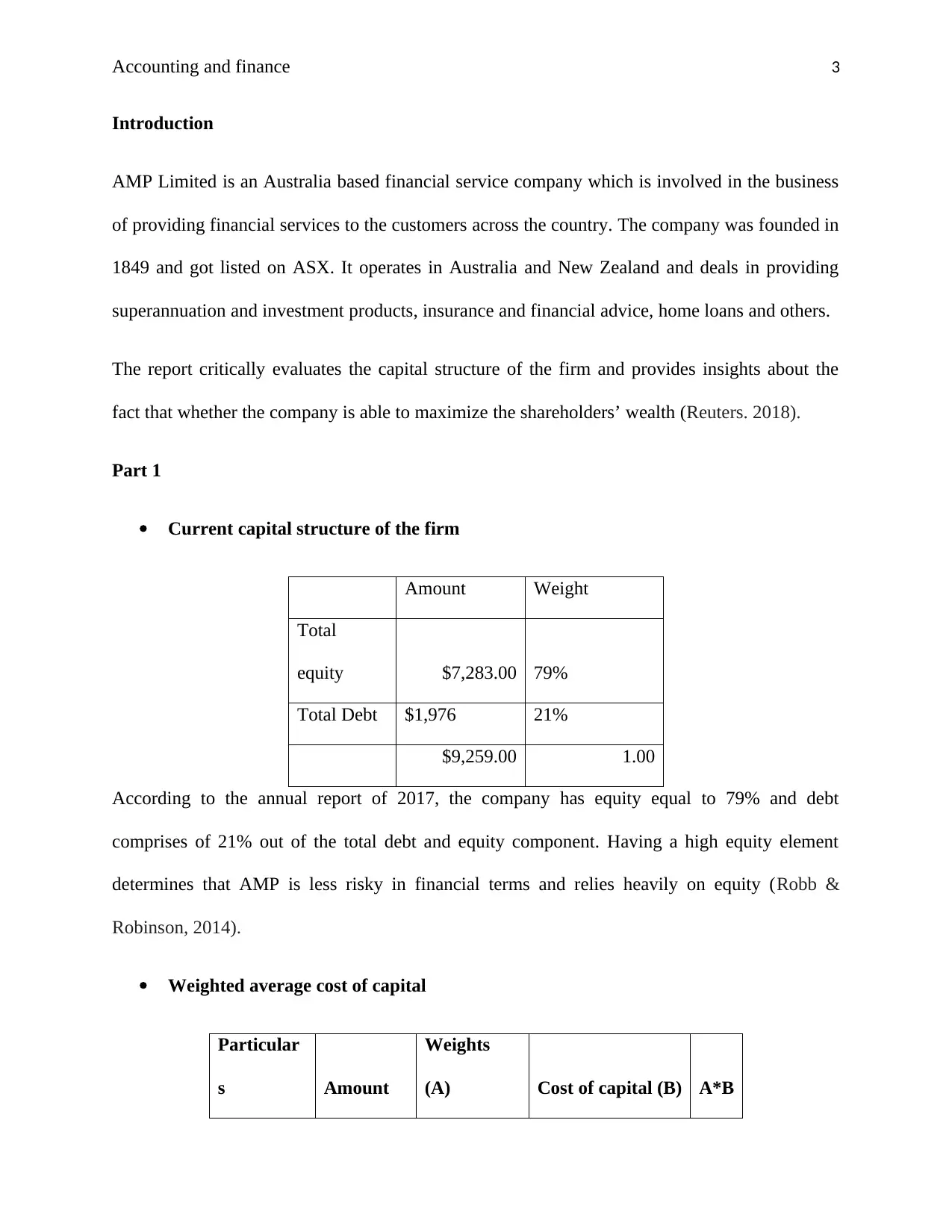

Amount Weight

Total

equity $7,283.00 79%

Total Debt $1,976 21%

$9,259.00 1.00

According to the annual report of 2017, the company has equity equal to 79% and debt

comprises of 21% out of the total debt and equity component. Having a high equity element

determines that AMP is less risky in financial terms and relies heavily on equity (Robb &

Robinson, 2014).

Weighted average cost of capital

Particular

s Amount

Weights

(A) Cost of capital (B) A*B

Introduction

AMP Limited is an Australia based financial service company which is involved in the business

of providing financial services to the customers across the country. The company was founded in

1849 and got listed on ASX. It operates in Australia and New Zealand and deals in providing

superannuation and investment products, insurance and financial advice, home loans and others.

The report critically evaluates the capital structure of the firm and provides insights about the

fact that whether the company is able to maximize the shareholders’ wealth (Reuters. 2018).

Part 1

Current capital structure of the firm

Amount Weight

Total

equity $7,283.00 79%

Total Debt $1,976 21%

$9,259.00 1.00

According to the annual report of 2017, the company has equity equal to 79% and debt

comprises of 21% out of the total debt and equity component. Having a high equity element

determines that AMP is less risky in financial terms and relies heavily on equity (Robb &

Robinson, 2014).

Weighted average cost of capital

Particular

s Amount

Weights

(A) Cost of capital (B) A*B

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and finance 4

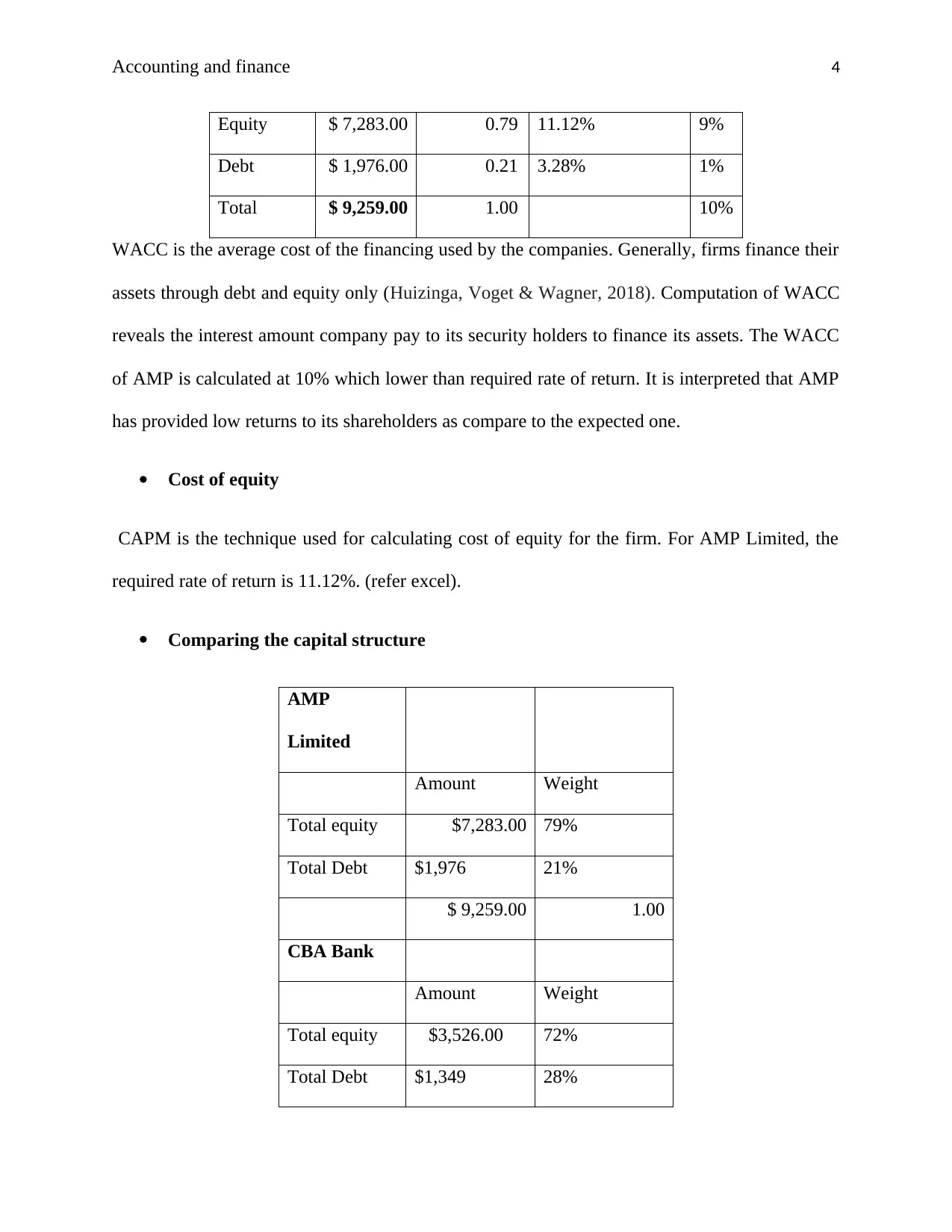

Equity $ 7,283.00 0.79 11.12% 9%

Debt $ 1,976.00 0.21 3.28% 1%

Total $ 9,259.00 1.00 10%

WACC is the average cost of the financing used by the companies. Generally, firms finance their

assets through debt and equity only (Huizinga, Voget & Wagner, 2018). Computation of WACC

reveals the interest amount company pay to its security holders to finance its assets. The WACC

of AMP is calculated at 10% which lower than required rate of return. It is interpreted that AMP

has provided low returns to its shareholders as compare to the expected one.

Cost of equity

CAPM is the technique used for calculating cost of equity for the firm. For AMP Limited, the

required rate of return is 11.12%. (refer excel).

Comparing the capital structure

AMP

Limited

Amount Weight

Total equity $7,283.00 79%

Total Debt $1,976 21%

$ 9,259.00 1.00

CBA Bank

Amount Weight

Total equity $3,526.00 72%

Total Debt $1,349 28%

Equity $ 7,283.00 0.79 11.12% 9%

Debt $ 1,976.00 0.21 3.28% 1%

Total $ 9,259.00 1.00 10%

WACC is the average cost of the financing used by the companies. Generally, firms finance their

assets through debt and equity only (Huizinga, Voget & Wagner, 2018). Computation of WACC

reveals the interest amount company pay to its security holders to finance its assets. The WACC

of AMP is calculated at 10% which lower than required rate of return. It is interpreted that AMP

has provided low returns to its shareholders as compare to the expected one.

Cost of equity

CAPM is the technique used for calculating cost of equity for the firm. For AMP Limited, the

required rate of return is 11.12%. (refer excel).

Comparing the capital structure

AMP

Limited

Amount Weight

Total equity $7,283.00 79%

Total Debt $1,976 21%

$ 9,259.00 1.00

CBA Bank

Amount Weight

Total equity $3,526.00 72%

Total Debt $1,349 28%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance 5

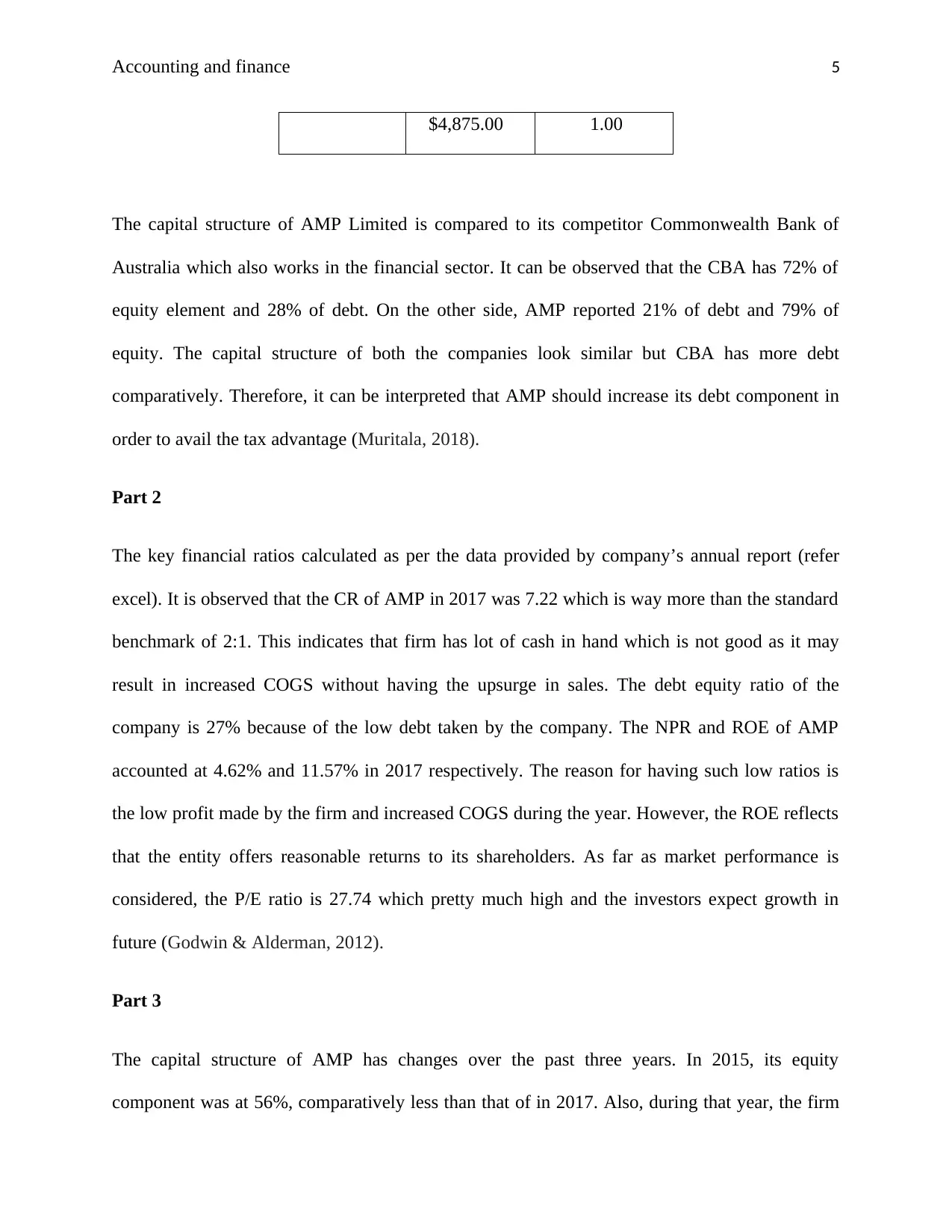

$4,875.00 1.00

The capital structure of AMP Limited is compared to its competitor Commonwealth Bank of

Australia which also works in the financial sector. It can be observed that the CBA has 72% of

equity element and 28% of debt. On the other side, AMP reported 21% of debt and 79% of

equity. The capital structure of both the companies look similar but CBA has more debt

comparatively. Therefore, it can be interpreted that AMP should increase its debt component in

order to avail the tax advantage (Muritala, 2018).

Part 2

The key financial ratios calculated as per the data provided by company’s annual report (refer

excel). It is observed that the CR of AMP in 2017 was 7.22 which is way more than the standard

benchmark of 2:1. This indicates that firm has lot of cash in hand which is not good as it may

result in increased COGS without having the upsurge in sales. The debt equity ratio of the

company is 27% because of the low debt taken by the company. The NPR and ROE of AMP

accounted at 4.62% and 11.57% in 2017 respectively. The reason for having such low ratios is

the low profit made by the firm and increased COGS during the year. However, the ROE reflects

that the entity offers reasonable returns to its shareholders. As far as market performance is

considered, the P/E ratio is 27.74 which pretty much high and the investors expect growth in

future (Godwin & Alderman, 2012).

Part 3

The capital structure of AMP has changes over the past three years. In 2015, its equity

component was at 56%, comparatively less than that of in 2017. Also, during that year, the firm

$4,875.00 1.00

The capital structure of AMP Limited is compared to its competitor Commonwealth Bank of

Australia which also works in the financial sector. It can be observed that the CBA has 72% of

equity element and 28% of debt. On the other side, AMP reported 21% of debt and 79% of

equity. The capital structure of both the companies look similar but CBA has more debt

comparatively. Therefore, it can be interpreted that AMP should increase its debt component in

order to avail the tax advantage (Muritala, 2018).

Part 2

The key financial ratios calculated as per the data provided by company’s annual report (refer

excel). It is observed that the CR of AMP in 2017 was 7.22 which is way more than the standard

benchmark of 2:1. This indicates that firm has lot of cash in hand which is not good as it may

result in increased COGS without having the upsurge in sales. The debt equity ratio of the

company is 27% because of the low debt taken by the company. The NPR and ROE of AMP

accounted at 4.62% and 11.57% in 2017 respectively. The reason for having such low ratios is

the low profit made by the firm and increased COGS during the year. However, the ROE reflects

that the entity offers reasonable returns to its shareholders. As far as market performance is

considered, the P/E ratio is 27.74 which pretty much high and the investors expect growth in

future (Godwin & Alderman, 2012).

Part 3

The capital structure of AMP has changes over the past three years. In 2015, its equity

component was at 56%, comparatively less than that of in 2017. Also, during that year, the firm

Accounting and finance 6

has 44% of the debt which created a preferred balance between the capitals of the firm. However,

the same reduces over the period of three years which resulted in the increase of equity element.

This reflected that AMP is not taking the advantage of increased profit which can be derived by

taking financial leverage. Thus, it will be recommended that it should improve its debt

component so as to take tax benefits (AMP Limited. 2017).

Part 4

The seven type of risks identified by the director in the annual report are strategic, , insurance,

liquidity, concentration, credit, market and operational. The company has properly managed and

address such risk and the disclosure of the same has been made in the annual report. It can be

observed that AMP values risk culture and has formulated a risk management committee to

manage the identified risks in the most effective manner. In 2017, AMP implemented some

initiatives designed especially for integrating awareness into employee decision making. In urge

of addressing the material risks, the company has started giving timely response to its customers

and also made them available with an online platform, on which their queries can be solved

immediately. However, AMP’s Capital Risk and Compliance Committee cannot deeply analyse

the credit risk but it has provided the exposure of wholesale credit risk on invested fixed income

portfolio (AMP Limited. 2017).

Other risks such as market risk which are subjected to some other risks such as currency risks,

interest rate risks and other were also properly managed by the authorized and specific team of

the company. The market risk determines the risk associated with the fair value of assets and

liabilities. AMP’s liquidity risk has increased from $1463 to $3456 over the past five years.

Therefore, it is recommended to the company to properly look after all the risks, modify its

has 44% of the debt which created a preferred balance between the capitals of the firm. However,

the same reduces over the period of three years which resulted in the increase of equity element.

This reflected that AMP is not taking the advantage of increased profit which can be derived by

taking financial leverage. Thus, it will be recommended that it should improve its debt

component so as to take tax benefits (AMP Limited. 2017).

Part 4

The seven type of risks identified by the director in the annual report are strategic, , insurance,

liquidity, concentration, credit, market and operational. The company has properly managed and

address such risk and the disclosure of the same has been made in the annual report. It can be

observed that AMP values risk culture and has formulated a risk management committee to

manage the identified risks in the most effective manner. In 2017, AMP implemented some

initiatives designed especially for integrating awareness into employee decision making. In urge

of addressing the material risks, the company has started giving timely response to its customers

and also made them available with an online platform, on which their queries can be solved

immediately. However, AMP’s Capital Risk and Compliance Committee cannot deeply analyse

the credit risk but it has provided the exposure of wholesale credit risk on invested fixed income

portfolio (AMP Limited. 2017).

Other risks such as market risk which are subjected to some other risks such as currency risks,

interest rate risks and other were also properly managed by the authorized and specific team of

the company. The market risk determines the risk associated with the fair value of assets and

liabilities. AMP’s liquidity risk has increased from $1463 to $3456 over the past five years.

Therefore, it is recommended to the company to properly look after all the risks, modify its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and finance 7

policies and regulations and address all the risks effectively. Overall, it can be observed the three

of the risks are not managed and remaining have been addressed in order to minimize the risk

and follow the risk culture efficiently (AMP Limited. 2017).

Conclusion

The report concludes that AMP needs to bring improvement in its capital structure by taking

more leverage so that its debt component can be increased and an optimal balance can be

maintained in the capitals of the firm. Also, AMP should focus on managing its liquidity risk as

more liquid assets can have a negative impact on the company.

policies and regulations and address all the risks effectively. Overall, it can be observed the three

of the risks are not managed and remaining have been addressed in order to minimize the risk

and follow the risk culture efficiently (AMP Limited. 2017).

Conclusion

The report concludes that AMP needs to bring improvement in its capital structure by taking

more leverage so that its debt component can be increased and an optimal balance can be

maintained in the capitals of the firm. Also, AMP should focus on managing its liquidity risk as

more liquid assets can have a negative impact on the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and finance 8

References

AMP Limited, (2017). Annual report. Retrieved from

http://www.annualreports.com/HostedData/AnnualReports/PDF/OTC_AMLTY_2017.pd

f

Godwin, N., & Alderman, C. (2012). Financial ACCT2. USA: Cengage Learning.

Huizinga, H., Voget, J., & Wagner, W. (2018). Capital gains taxation and the cost of capital:

Evidence from unanticipated cross-border transfers of tax base. Journal of Financial

Economics.

Muritala, T. A. (2018). An empirical analysis of capital structure on firms’ performance in

Nigeria. IJAME.

Reuters (2018). AMP Ltd (AMP.AX). Retrieved from

https://www.reuters.com/finance/stocks/companyProfile/AMP.AX

Robb, A. M., & Robinson, D. T. (2014). The capital structure decisions of new firms. The

Review of Financial Studies, 27(1), 153-179.

References

AMP Limited, (2017). Annual report. Retrieved from

http://www.annualreports.com/HostedData/AnnualReports/PDF/OTC_AMLTY_2017.pd

f

Godwin, N., & Alderman, C. (2012). Financial ACCT2. USA: Cengage Learning.

Huizinga, H., Voget, J., & Wagner, W. (2018). Capital gains taxation and the cost of capital:

Evidence from unanticipated cross-border transfers of tax base. Journal of Financial

Economics.

Muritala, T. A. (2018). An empirical analysis of capital structure on firms’ performance in

Nigeria. IJAME.

Reuters (2018). AMP Ltd (AMP.AX). Retrieved from

https://www.reuters.com/finance/stocks/companyProfile/AMP.AX

Robb, A. M., & Robinson, D. T. (2014). The capital structure decisions of new firms. The

Review of Financial Studies, 27(1), 153-179.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.