Evaluation and Monitoring of Business Performance

VerifiedAdded on 2020/10/23

|14

|4454

|299

AI Summary

This assignment is a comprehensive report on the evaluation and monitoring of business performance, specifically focusing on financial management principles, risk management, and corporate governance. It includes a detailed analysis of Debenhams' performance, highlighting the importance of transparency in financial reporting and the need to disclose potential losses but not anticipated gains. The report also discusses the impact of economic issues on business performance and provides recommendations for improving financial management strategies. The assignment is based on various academic sources, including books and journals, and is intended for students studying finance or related fields.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

An Analysis and

Evaluation of

Financial

Performance

Evaluation of

Financial

Performance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

1. Identify and evaluate the impact the economy has on Debenhams business organisations:3

2. Evaluate financial information in a range of organisational contexts of Debenhams:.......5

3.Interpretation of key financial information for decision-making and performance monitoring

of Debenhams:........................................................................................................................6

4. Appraise and propose courses of action informed by accounting tools and concepts:....12

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

1. Identify and evaluate the impact the economy has on Debenhams business organisations:3

2. Evaluate financial information in a range of organisational contexts of Debenhams:.......5

3.Interpretation of key financial information for decision-making and performance monitoring

of Debenhams:........................................................................................................................6

4. Appraise and propose courses of action informed by accounting tools and concepts:....12

REFERENCES..............................................................................................................................15

INTRODUCTION

Economics is field of knowledge includes different ways to utilize and allocate the scare

resources in order to generate optimum efficiency. Financial management refers to management

of financial resources with an objective of maximization of wealth. Economics and financial

management is interlinked and closely associated with each other. Objective of both Economics

and financial management is to utilisation of financial resources and to achieve efficiency. A

deep analysis and evaluation of financial performance is necessary in order to take decisions

regarding economics and financial management (Aebi, Sabato and Schmid, 2012). This report

exhibits impact of economy, evaluation of financial information through ratio analysis,

interpretation of key ratios and significant trends, appraise and purpose courses of action

informed by accounting tools and concepts in the context of Debenhams. It is an UK based

multinational retail company and engaged in selling of clothing, household items and furniture

items.\

TASK

1. Identify and evaluate the impact the economy has on Debenhams business organisations:

Overview of company: Debenhams is public limited company and mainly associated

with activity of selling a range of clothing’s for men, women and kids, furniture items and

household items. It has approx. 240 stores and providing unique range, exclusive mix and

differentiated own brands and accessories across 22 countries (Brigham and Houston, 2012).

Directors Introductory Report: In Debenhams, board or directors have direct

monitoring on performance of the business and every board meeting must include operational

reports obtained from members of the Executive Committee regarding current status of execution

of the strategy. In board meeting presentations are called by the board on an adhoc basis from

trading divisions and other business areas such as investor relations, treasury, taxation, health

and safety and human resources. Board of directors using regular updates on governance and on

key risk factors ensuring that risk management framework and profile are compatible with

business strategy. Directors also consider and approve, as the case may be, significant company

decisions, and major changes, approval of annual and interim reports of the Company and all

Economics is field of knowledge includes different ways to utilize and allocate the scare

resources in order to generate optimum efficiency. Financial management refers to management

of financial resources with an objective of maximization of wealth. Economics and financial

management is interlinked and closely associated with each other. Objective of both Economics

and financial management is to utilisation of financial resources and to achieve efficiency. A

deep analysis and evaluation of financial performance is necessary in order to take decisions

regarding economics and financial management (Aebi, Sabato and Schmid, 2012). This report

exhibits impact of economy, evaluation of financial information through ratio analysis,

interpretation of key ratios and significant trends, appraise and purpose courses of action

informed by accounting tools and concepts in the context of Debenhams. It is an UK based

multinational retail company and engaged in selling of clothing, household items and furniture

items.\

TASK

1. Identify and evaluate the impact the economy has on Debenhams business organisations:

Overview of company: Debenhams is public limited company and mainly associated

with activity of selling a range of clothing’s for men, women and kids, furniture items and

household items. It has approx. 240 stores and providing unique range, exclusive mix and

differentiated own brands and accessories across 22 countries (Brigham and Houston, 2012).

Directors Introductory Report: In Debenhams, board or directors have direct

monitoring on performance of the business and every board meeting must include operational

reports obtained from members of the Executive Committee regarding current status of execution

of the strategy. In board meeting presentations are called by the board on an adhoc basis from

trading divisions and other business areas such as investor relations, treasury, taxation, health

and safety and human resources. Board of directors using regular updates on governance and on

key risk factors ensuring that risk management framework and profile are compatible with

business strategy. Directors also consider and approve, as the case may be, significant company

decisions, and major changes, approval of annual and interim reports of the Company and all

preliminary announcements of results, approval of the dividend policy, determination of the

interim dividend and the recommendation of the final dividend and approval regarding opening

of new store.

Stakeholders of Debenhams:

Customer: These are said to be one the crucial stakeholder of the company that a

business can get impacts through the quality of services and their value.

Employees: This seems to be basically related with the income and safety aspect that is

provided by the company to their staffs. It depends up the type of business a company is

running.

Investors: It consists of both shareholders and debtholders. It has been seen that

shareholder usually invest capital in their business and expect to earn a certain rate of

return on the capital.

Shareholder:

Common shareholder: These are those that own a Debenhams common stock. They are

more reliable and prevalent types of shareholder. They do have voting right in any kind of

matters.

Preferred shareholder: These are unlike common shareholder as they own a share of

Debenhams preferred stock and have no voting rights.

Identification and evaluation of impact of economic environment on Debenhams:

Being an UK based company has great impact of economic environment of UK. In recent time

UK as well as other countries has been highly affected by recession. In recession period retail

sector majorly influenced by credit crisis, low purchasing power of customers, scarcity of funds

and investor risk aversion. First adverse impact of recession on Debenhams was decrease in

investor’s confidence due to increase in large debt to obtain fund however company is trying to

pay out debts through regular instalments. This can be seen as major impact of economy on

company. Due to credit crunch in UK purchasing power of individuals has decreased. Now

people prefers to spend money in low cost products and avoiding purchase of luxurious products

therefore Debenhams is trying to switch existing pricing structure to retain customers. In coming

years Economy is estimated to grow out of this problem but in order to maintain growth,

Debenhams is required to evaluate strategies and modify their existing structure of business. In

order to recover from current economic crisis Debenhams is trying to expand business into the

interim dividend and the recommendation of the final dividend and approval regarding opening

of new store.

Stakeholders of Debenhams:

Customer: These are said to be one the crucial stakeholder of the company that a

business can get impacts through the quality of services and their value.

Employees: This seems to be basically related with the income and safety aspect that is

provided by the company to their staffs. It depends up the type of business a company is

running.

Investors: It consists of both shareholders and debtholders. It has been seen that

shareholder usually invest capital in their business and expect to earn a certain rate of

return on the capital.

Shareholder:

Common shareholder: These are those that own a Debenhams common stock. They are

more reliable and prevalent types of shareholder. They do have voting right in any kind of

matters.

Preferred shareholder: These are unlike common shareholder as they own a share of

Debenhams preferred stock and have no voting rights.

Identification and evaluation of impact of economic environment on Debenhams:

Being an UK based company has great impact of economic environment of UK. In recent time

UK as well as other countries has been highly affected by recession. In recession period retail

sector majorly influenced by credit crisis, low purchasing power of customers, scarcity of funds

and investor risk aversion. First adverse impact of recession on Debenhams was decrease in

investor’s confidence due to increase in large debt to obtain fund however company is trying to

pay out debts through regular instalments. This can be seen as major impact of economy on

company. Due to credit crunch in UK purchasing power of individuals has decreased. Now

people prefers to spend money in low cost products and avoiding purchase of luxurious products

therefore Debenhams is trying to switch existing pricing structure to retain customers. In coming

years Economy is estimated to grow out of this problem but in order to maintain growth,

Debenhams is required to evaluate strategies and modify their existing structure of business. In

order to recover from current economic crisis Debenhams is trying to expand business into the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

international market, developing a new customers group by introducing new brands with new

attractive prices (Brooks and Mukherjee, 2013).

In UK's economy interference of online retail market is significant issue for company.

Now customers want to buy product using new technologies and advertising strategy is also

changed due to this. Debenhams is also providing services through online platforms but this also

affects their selling structure and refund polices. By use of latest technologies now, company is

under pressure to convert their existing business format into online retailing business format.

Company is continuously enhancing quality of contents on web site by adding features like

social networking competence, videos and catwalk or outfit projection, an online platform that

spreads current offers and promotions, feature that enables customers to by product by size,

product reviews and feedbacks (Burtonshaw, 2017). Due to Inflation in economy, Debenhams is

facing problems, such as increase in opportunity cost, decreasing purchase power of customers,

discourage investment by investors. Due to inflation, confidence of investors has decreased

which results in withdrawal of support by key investors and may lead to unfavourable debt

equity ratio.

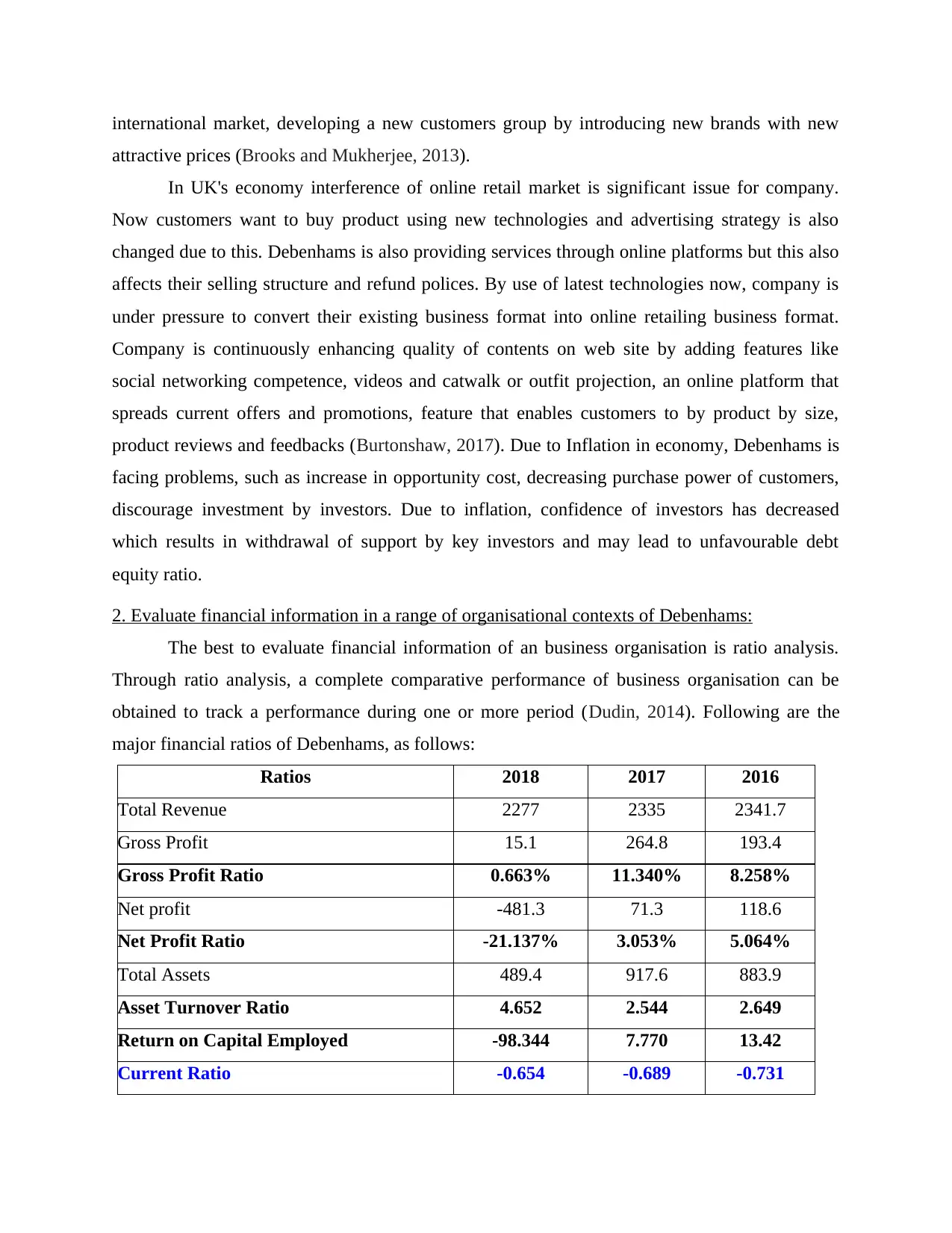

2. Evaluate financial information in a range of organisational contexts of Debenhams:

The best to evaluate financial information of an business organisation is ratio analysis.

Through ratio analysis, a complete comparative performance of business organisation can be

obtained to track a performance during one or more period (Dudin, 2014). Following are the

major financial ratios of Debenhams, as follows:

Ratios 2018 2017 2016

Total Revenue 2277 2335 2341.7

Gross Profit 15.1 264.8 193.4

Gross Profit Ratio 0.663% 11.340% 8.258%

Net profit -481.3 71.3 118.6

Net Profit Ratio -21.137% 3.053% 5.064%

Total Assets 489.4 917.6 883.9

Asset Turnover Ratio 4.652 2.544 2.649

Return on Capital Employed -98.344 7.770 13.42

Current Ratio -0.654 -0.689 -0.731

attractive prices (Brooks and Mukherjee, 2013).

In UK's economy interference of online retail market is significant issue for company.

Now customers want to buy product using new technologies and advertising strategy is also

changed due to this. Debenhams is also providing services through online platforms but this also

affects their selling structure and refund polices. By use of latest technologies now, company is

under pressure to convert their existing business format into online retailing business format.

Company is continuously enhancing quality of contents on web site by adding features like

social networking competence, videos and catwalk or outfit projection, an online platform that

spreads current offers and promotions, feature that enables customers to by product by size,

product reviews and feedbacks (Burtonshaw, 2017). Due to Inflation in economy, Debenhams is

facing problems, such as increase in opportunity cost, decreasing purchase power of customers,

discourage investment by investors. Due to inflation, confidence of investors has decreased

which results in withdrawal of support by key investors and may lead to unfavourable debt

equity ratio.

2. Evaluate financial information in a range of organisational contexts of Debenhams:

The best to evaluate financial information of an business organisation is ratio analysis.

Through ratio analysis, a complete comparative performance of business organisation can be

obtained to track a performance during one or more period (Dudin, 2014). Following are the

major financial ratios of Debenhams, as follows:

Ratios 2018 2017 2016

Total Revenue 2277 2335 2341.7

Gross Profit 15.1 264.8 193.4

Gross Profit Ratio 0.663% 11.340% 8.258%

Net profit -481.3 71.3 118.6

Net Profit Ratio -21.137% 3.053% 5.064%

Total Assets 489.4 917.6 883.9

Asset Turnover Ratio 4.652 2.544 2.649

Return on Capital Employed -98.344 7.770 13.42

Current Ratio -0.654 -0.689 -0.731

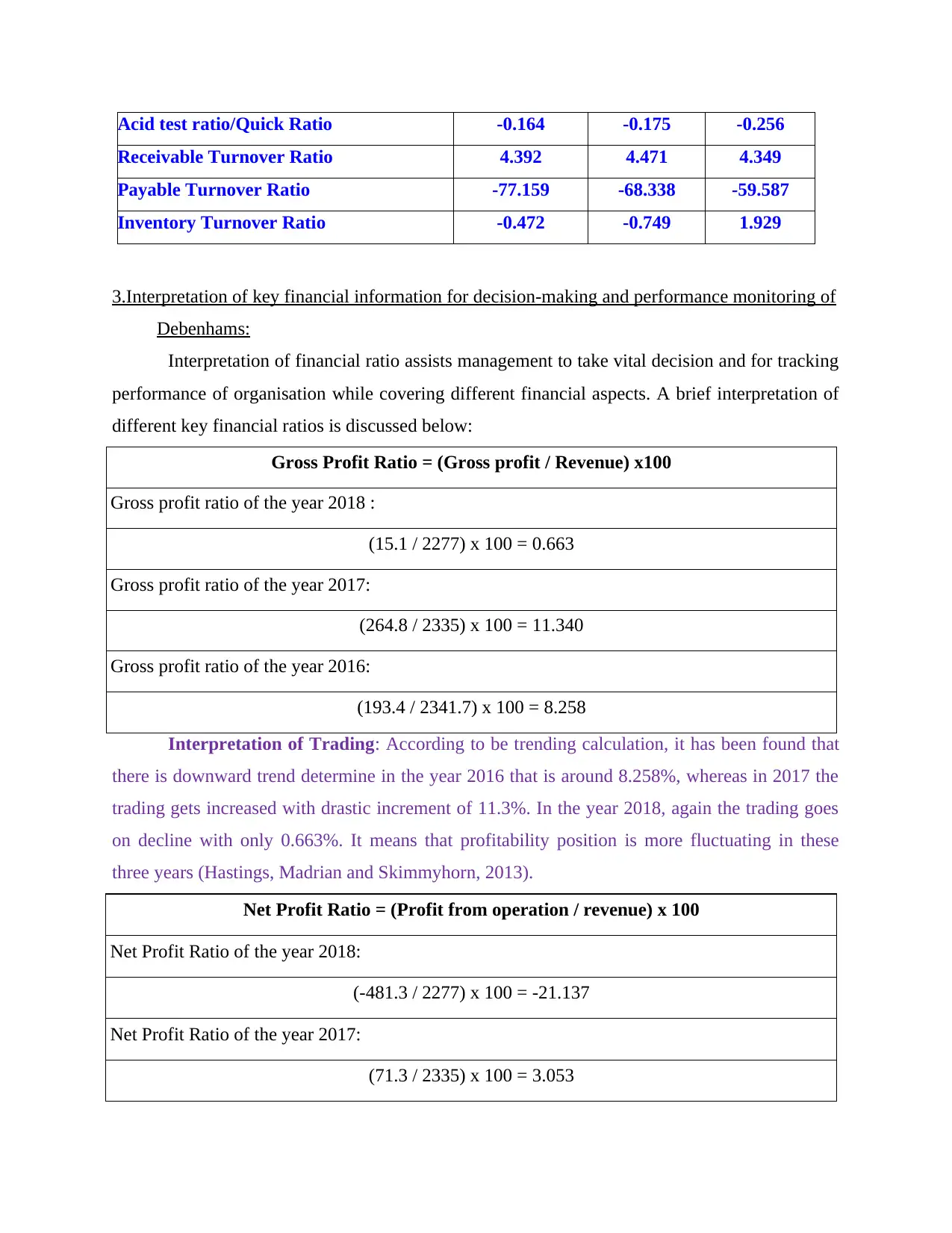

Acid test ratio/Quick Ratio -0.164 -0.175 -0.256

Receivable Turnover Ratio 4.392 4.471 4.349

Payable Turnover Ratio -77.159 -68.338 -59.587

Inventory Turnover Ratio -0.472 -0.749 1.929

3.Interpretation of key financial information for decision-making and performance monitoring of

Debenhams:

Interpretation of financial ratio assists management to take vital decision and for tracking

performance of organisation while covering different financial aspects. A brief interpretation of

different key financial ratios is discussed below:

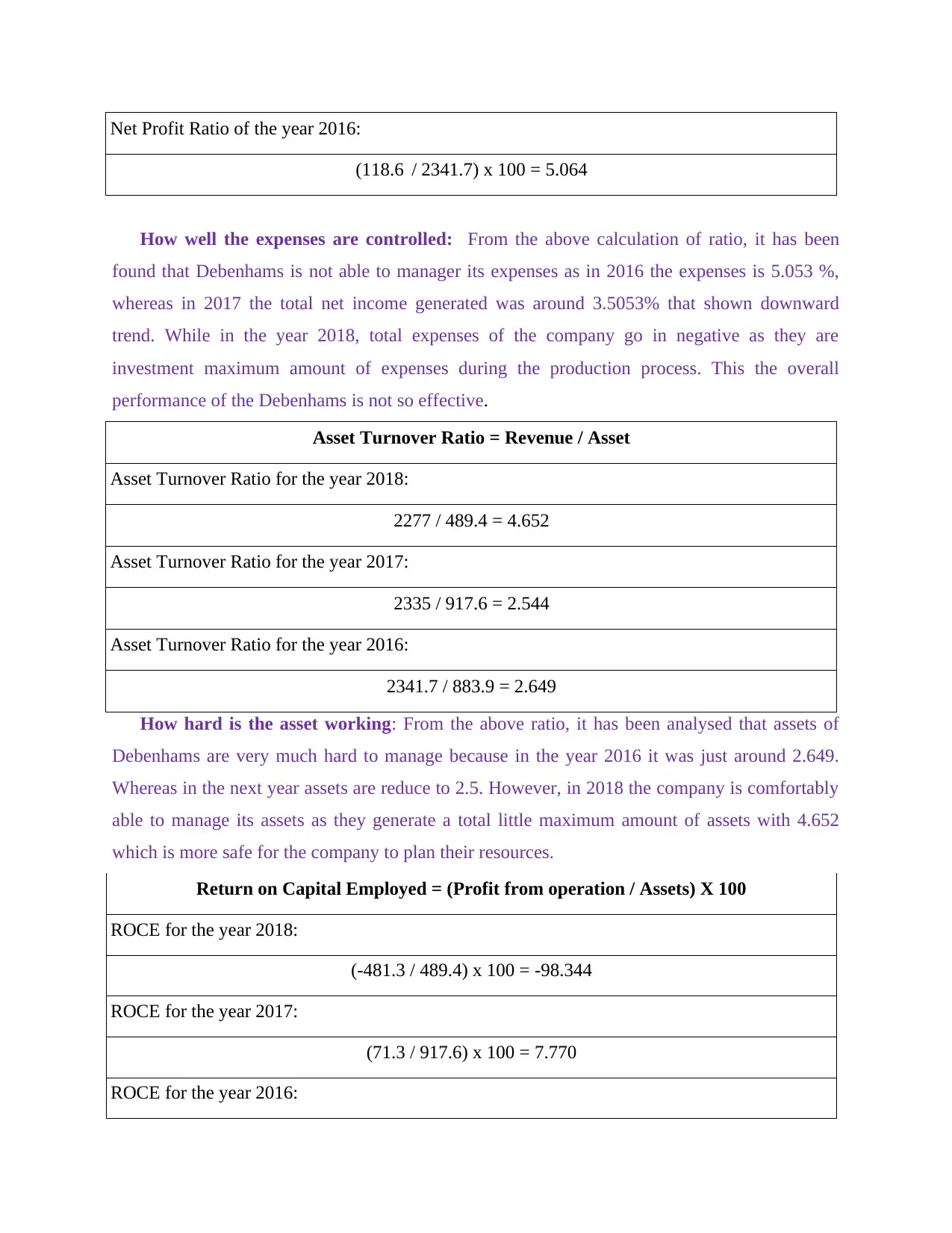

Gross Profit Ratio = (Gross profit / Revenue) x100

Gross profit ratio of the year 2018 :

(15.1 / 2277) x 100 = 0.663

Gross profit ratio of the year 2017:

(264.8 / 2335) x 100 = 11.340

Gross profit ratio of the year 2016:

(193.4 / 2341.7) x 100 = 8.258

Interpretation of Trading: According to be trending calculation, it has been found that

there is downward trend determine in the year 2016 that is around 8.258%, whereas in 2017 the

trading gets increased with drastic increment of 11.3%. In the year 2018, again the trading goes

on decline with only 0.663%. It means that profitability position is more fluctuating in these

three years (Hastings, Madrian and Skimmyhorn, 2013).

Net Profit Ratio = (Profit from operation / revenue) x 100

Net Profit Ratio of the year 2018:

(-481.3 / 2277) x 100 = -21.137

Net Profit Ratio of the year 2017:

(71.3 / 2335) x 100 = 3.053

Receivable Turnover Ratio 4.392 4.471 4.349

Payable Turnover Ratio -77.159 -68.338 -59.587

Inventory Turnover Ratio -0.472 -0.749 1.929

3.Interpretation of key financial information for decision-making and performance monitoring of

Debenhams:

Interpretation of financial ratio assists management to take vital decision and for tracking

performance of organisation while covering different financial aspects. A brief interpretation of

different key financial ratios is discussed below:

Gross Profit Ratio = (Gross profit / Revenue) x100

Gross profit ratio of the year 2018 :

(15.1 / 2277) x 100 = 0.663

Gross profit ratio of the year 2017:

(264.8 / 2335) x 100 = 11.340

Gross profit ratio of the year 2016:

(193.4 / 2341.7) x 100 = 8.258

Interpretation of Trading: According to be trending calculation, it has been found that

there is downward trend determine in the year 2016 that is around 8.258%, whereas in 2017 the

trading gets increased with drastic increment of 11.3%. In the year 2018, again the trading goes

on decline with only 0.663%. It means that profitability position is more fluctuating in these

three years (Hastings, Madrian and Skimmyhorn, 2013).

Net Profit Ratio = (Profit from operation / revenue) x 100

Net Profit Ratio of the year 2018:

(-481.3 / 2277) x 100 = -21.137

Net Profit Ratio of the year 2017:

(71.3 / 2335) x 100 = 3.053

Net Profit Ratio of the year 2016:

(118.6 / 2341.7) x 100 = 5.064

How well the expenses are controlled: From the above calculation of ratio, it has been

found that Debenhams is not able to manager its expenses as in 2016 the expenses is 5.053 %,

whereas in 2017 the total net income generated was around 3.5053% that shown downward

trend. While in the year 2018, total expenses of the company go in negative as they are

investment maximum amount of expenses during the production process. This the overall

performance of the Debenhams is not so effective.

Asset Turnover Ratio = Revenue / Asset

Asset Turnover Ratio for the year 2018:

2277 / 489.4 = 4.652

Asset Turnover Ratio for the year 2017:

2335 / 917.6 = 2.544

Asset Turnover Ratio for the year 2016:

2341.7 / 883.9 = 2.649

How hard is the asset working: From the above ratio, it has been analysed that assets of

Debenhams are very much hard to manage because in the year 2016 it was just around 2.649.

Whereas in the next year assets are reduce to 2.5. However, in 2018 the company is comfortably

able to manage its assets as they generate a total little maximum amount of assets with 4.652

which is more safe for the company to plan their resources.

Return on Capital Employed = (Profit from operation / Assets) X 100

ROCE for the year 2018:

(-481.3 / 489.4) x 100 = -98.344

ROCE for the year 2017:

(71.3 / 917.6) x 100 = 7.770

ROCE for the year 2016:

(118.6 / 2341.7) x 100 = 5.064

How well the expenses are controlled: From the above calculation of ratio, it has been

found that Debenhams is not able to manager its expenses as in 2016 the expenses is 5.053 %,

whereas in 2017 the total net income generated was around 3.5053% that shown downward

trend. While in the year 2018, total expenses of the company go in negative as they are

investment maximum amount of expenses during the production process. This the overall

performance of the Debenhams is not so effective.

Asset Turnover Ratio = Revenue / Asset

Asset Turnover Ratio for the year 2018:

2277 / 489.4 = 4.652

Asset Turnover Ratio for the year 2017:

2335 / 917.6 = 2.544

Asset Turnover Ratio for the year 2016:

2341.7 / 883.9 = 2.649

How hard is the asset working: From the above ratio, it has been analysed that assets of

Debenhams are very much hard to manage because in the year 2016 it was just around 2.649.

Whereas in the next year assets are reduce to 2.5. However, in 2018 the company is comfortably

able to manage its assets as they generate a total little maximum amount of assets with 4.652

which is more safe for the company to plan their resources.

Return on Capital Employed = (Profit from operation / Assets) X 100

ROCE for the year 2018:

(-481.3 / 489.4) x 100 = -98.344

ROCE for the year 2017:

(71.3 / 917.6) x 100 = 7.770

ROCE for the year 2016:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(118.6 / 883.9) x 100 = 13.417

The return on investment compare with the bank interest: According to the above

calculation, it has been seen that Debenhams is able to get a valuable amount or return on its

total capital investment with 13.417% in 2016, Whereas the company has to suffer with a low as

interest rate goes on little high side. In 2017, only 7.7% of return they are able to generate.

However, in 2018 Debenhams have to bear a heavy loss of about that directly made impacts on

the financial position during the same year.

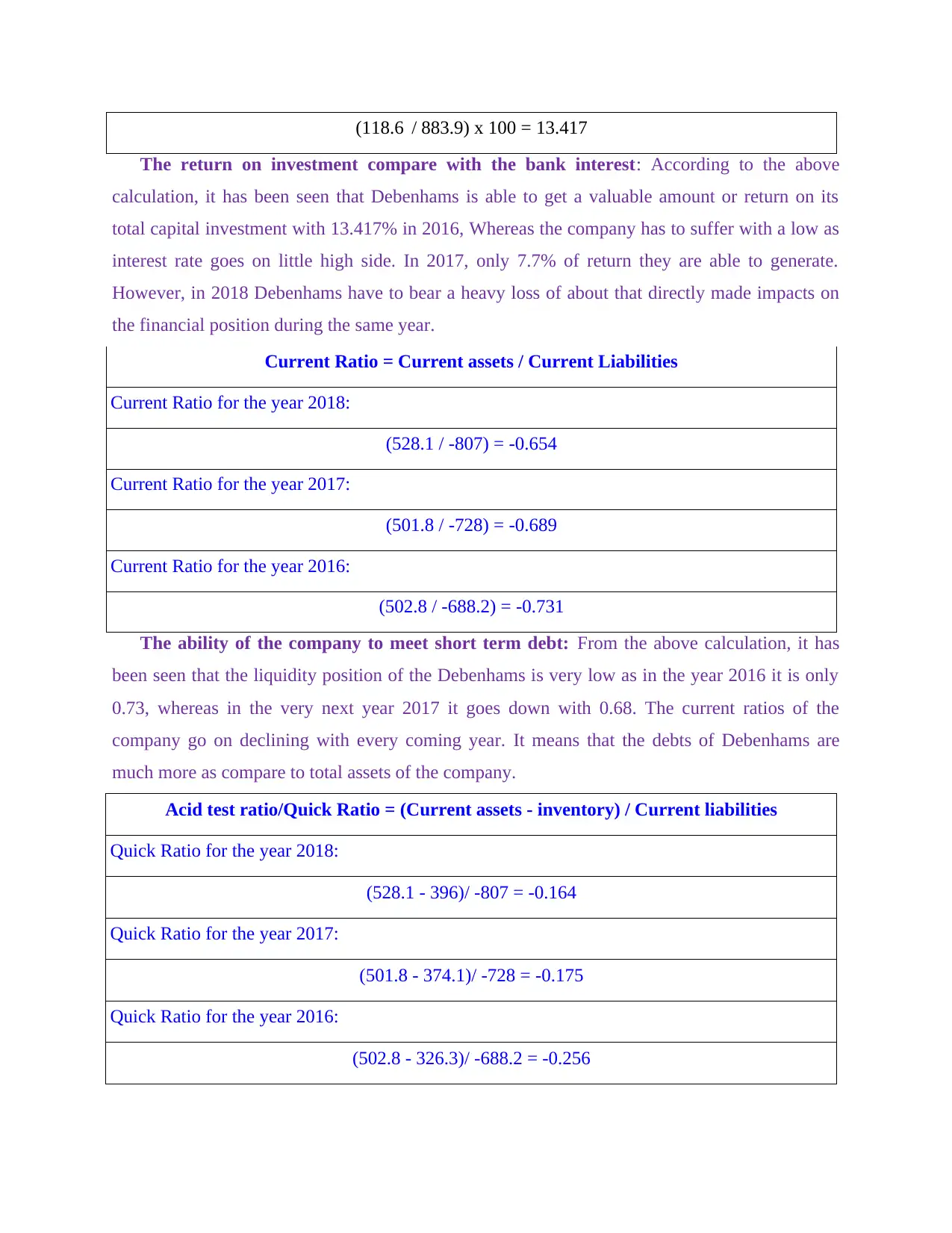

Current Ratio = Current assets / Current Liabilities

Current Ratio for the year 2018:

(528.1 / -807) = -0.654

Current Ratio for the year 2017:

(501.8 / -728) = -0.689

Current Ratio for the year 2016:

(502.8 / -688.2) = -0.731

The ability of the company to meet short term debt: From the above calculation, it has

been seen that the liquidity position of the Debenhams is very low as in the year 2016 it is only

0.73, whereas in the very next year 2017 it goes down with 0.68. The current ratios of the

company go on declining with every coming year. It means that the debts of Debenhams are

much more as compare to total assets of the company.

Acid test ratio/Quick Ratio = (Current assets - inventory) / Current liabilities

Quick Ratio for the year 2018:

(528.1 - 396)/ -807 = -0.164

Quick Ratio for the year 2017:

(501.8 - 374.1)/ -728 = -0.175

Quick Ratio for the year 2016:

(502.8 - 326.3)/ -688.2 = -0.256

The return on investment compare with the bank interest: According to the above

calculation, it has been seen that Debenhams is able to get a valuable amount or return on its

total capital investment with 13.417% in 2016, Whereas the company has to suffer with a low as

interest rate goes on little high side. In 2017, only 7.7% of return they are able to generate.

However, in 2018 Debenhams have to bear a heavy loss of about that directly made impacts on

the financial position during the same year.

Current Ratio = Current assets / Current Liabilities

Current Ratio for the year 2018:

(528.1 / -807) = -0.654

Current Ratio for the year 2017:

(501.8 / -728) = -0.689

Current Ratio for the year 2016:

(502.8 / -688.2) = -0.731

The ability of the company to meet short term debt: From the above calculation, it has

been seen that the liquidity position of the Debenhams is very low as in the year 2016 it is only

0.73, whereas in the very next year 2017 it goes down with 0.68. The current ratios of the

company go on declining with every coming year. It means that the debts of Debenhams are

much more as compare to total assets of the company.

Acid test ratio/Quick Ratio = (Current assets - inventory) / Current liabilities

Quick Ratio for the year 2018:

(528.1 - 396)/ -807 = -0.164

Quick Ratio for the year 2017:

(501.8 - 374.1)/ -728 = -0.175

Quick Ratio for the year 2016:

(502.8 - 326.3)/ -688.2 = -0.256

How quick you can pay this debt: According to the above liquid ratio calculation, it has

been seen that Debenhams company is not being able to pay its debts obligation as they are

having low amount of cash availability. In the year 2016, it is only around 0.2, whereas 0.12 has

been recorded in 2017 and in 2018 this would be more close to 0.164. The overall status of the

company is not so effective that will directly affect the profitability position.

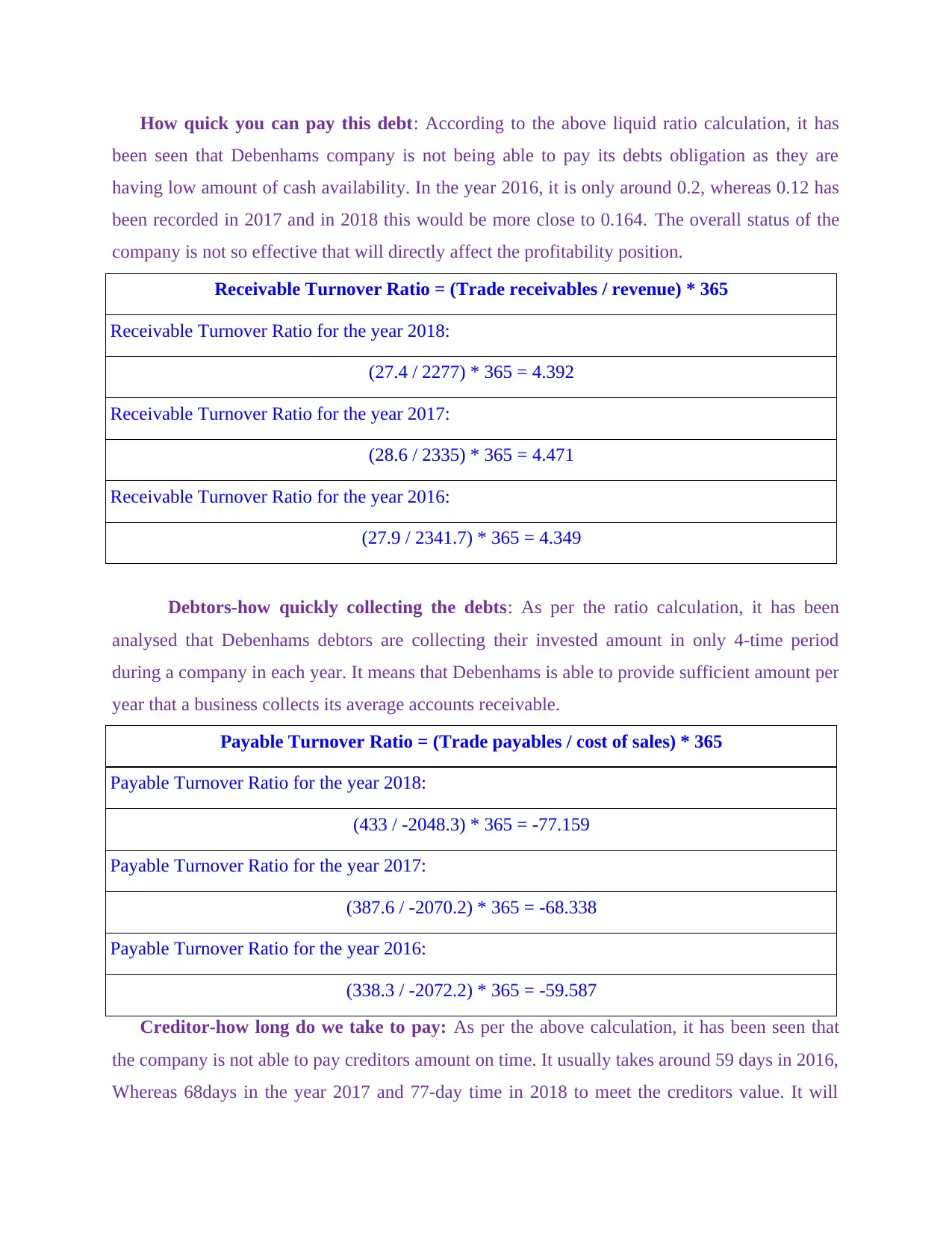

Receivable Turnover Ratio = (Trade receivables / revenue) * 365

Receivable Turnover Ratio for the year 2018:

(27.4 / 2277) * 365 = 4.392

Receivable Turnover Ratio for the year 2017:

(28.6 / 2335) * 365 = 4.471

Receivable Turnover Ratio for the year 2016:

(27.9 / 2341.7) * 365 = 4.349

Debtors-how quickly collecting the debts: As per the ratio calculation, it has been

analysed that Debenhams debtors are collecting their invested amount in only 4-time period

during a company in each year. It means that Debenhams is able to provide sufficient amount per

year that a business collects its average accounts receivable.

Payable Turnover Ratio = (Trade payables / cost of sales) * 365

Payable Turnover Ratio for the year 2018:

(433 / -2048.3) * 365 = -77.159

Payable Turnover Ratio for the year 2017:

(387.6 / -2070.2) * 365 = -68.338

Payable Turnover Ratio for the year 2016:

(338.3 / -2072.2) * 365 = -59.587

Creditor-how long do we take to pay: As per the above calculation, it has been seen that

the company is not able to pay creditors amount on time. It usually takes around 59 days in 2016,

Whereas 68days in the year 2017 and 77-day time in 2018 to meet the creditors value. It will

been seen that Debenhams company is not being able to pay its debts obligation as they are

having low amount of cash availability. In the year 2016, it is only around 0.2, whereas 0.12 has

been recorded in 2017 and in 2018 this would be more close to 0.164. The overall status of the

company is not so effective that will directly affect the profitability position.

Receivable Turnover Ratio = (Trade receivables / revenue) * 365

Receivable Turnover Ratio for the year 2018:

(27.4 / 2277) * 365 = 4.392

Receivable Turnover Ratio for the year 2017:

(28.6 / 2335) * 365 = 4.471

Receivable Turnover Ratio for the year 2016:

(27.9 / 2341.7) * 365 = 4.349

Debtors-how quickly collecting the debts: As per the ratio calculation, it has been

analysed that Debenhams debtors are collecting their invested amount in only 4-time period

during a company in each year. It means that Debenhams is able to provide sufficient amount per

year that a business collects its average accounts receivable.

Payable Turnover Ratio = (Trade payables / cost of sales) * 365

Payable Turnover Ratio for the year 2018:

(433 / -2048.3) * 365 = -77.159

Payable Turnover Ratio for the year 2017:

(387.6 / -2070.2) * 365 = -68.338

Payable Turnover Ratio for the year 2016:

(338.3 / -2072.2) * 365 = -59.587

Creditor-how long do we take to pay: As per the above calculation, it has been seen that

the company is not able to pay creditors amount on time. It usually takes around 59 days in 2016,

Whereas 68days in the year 2017 and 77-day time in 2018 to meet the creditors value. It will

directly affect the relationships amount each creditor. Henceforth, the data can lead to affect the

overall goodwill of Debenhams in relation to other competitors.

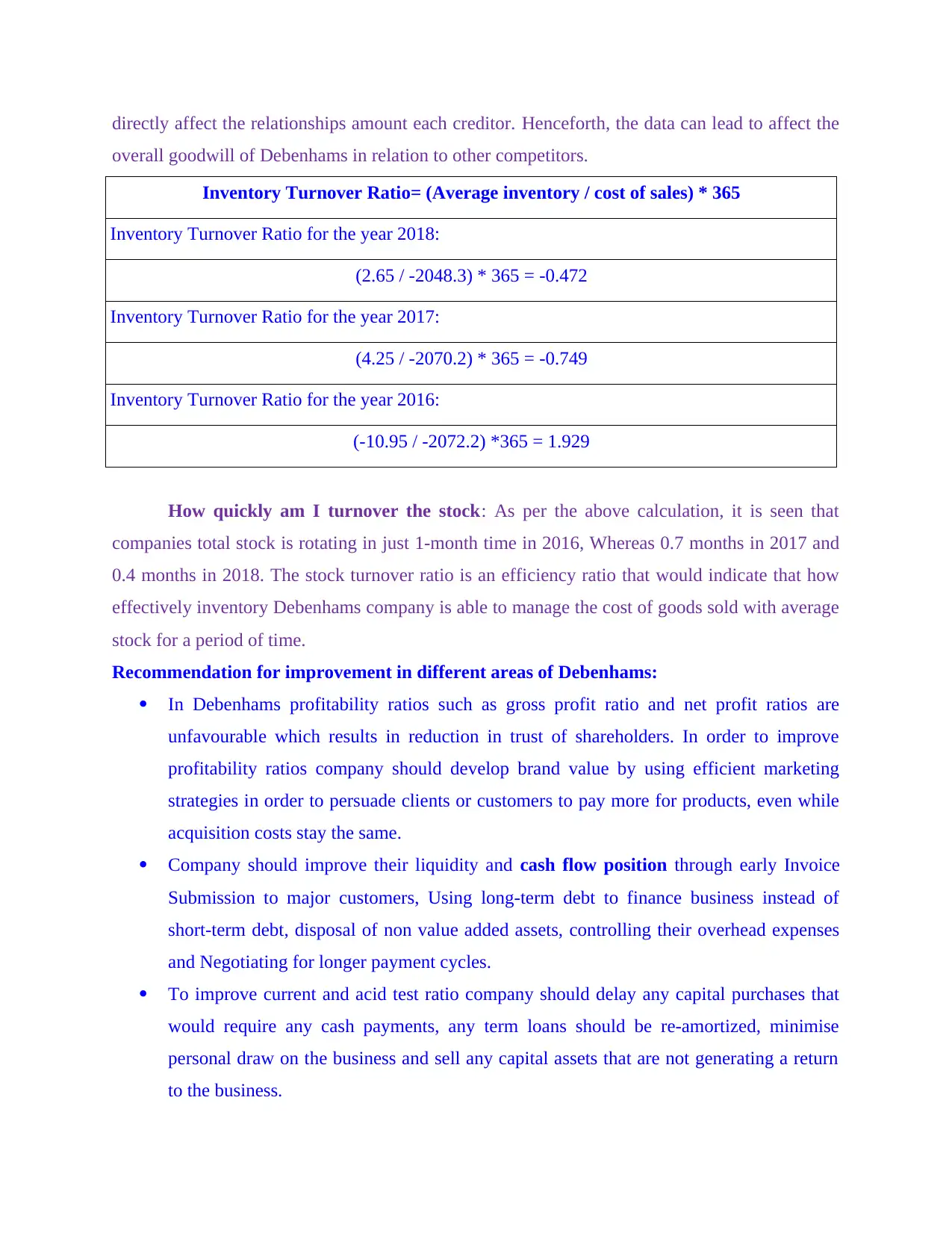

Inventory Turnover Ratio= (Average inventory / cost of sales) * 365

Inventory Turnover Ratio for the year 2018:

(2.65 / -2048.3) * 365 = -0.472

Inventory Turnover Ratio for the year 2017:

(4.25 / -2070.2) * 365 = -0.749

Inventory Turnover Ratio for the year 2016:

(-10.95 / -2072.2) *365 = 1.929

How quickly am I turnover the stock: As per the above calculation, it is seen that

companies total stock is rotating in just 1-month time in 2016, Whereas 0.7 months in 2017 and

0.4 months in 2018. The stock turnover ratio is an efficiency ratio that would indicate that how

effectively inventory Debenhams company is able to manage the cost of goods sold with average

stock for a period of time.

Recommendation for improvement in different areas of Debenhams:

In Debenhams profitability ratios such as gross profit ratio and net profit ratios are

unfavourable which results in reduction in trust of shareholders. In order to improve

profitability ratios company should develop brand value by using efficient marketing

strategies in order to persuade clients or customers to pay more for products, even while

acquisition costs stay the same.

Company should improve their liquidity and cash flow position through early Invoice

Submission to major customers, Using long-term debt to finance business instead of

short-term debt, disposal of non value added assets, controlling their overhead expenses

and Negotiating for longer payment cycles.

To improve current and acid test ratio company should delay any capital purchases that

would require any cash payments, any term loans should be re-amortized, minimise

personal draw on the business and sell any capital assets that are not generating a return

to the business.

overall goodwill of Debenhams in relation to other competitors.

Inventory Turnover Ratio= (Average inventory / cost of sales) * 365

Inventory Turnover Ratio for the year 2018:

(2.65 / -2048.3) * 365 = -0.472

Inventory Turnover Ratio for the year 2017:

(4.25 / -2070.2) * 365 = -0.749

Inventory Turnover Ratio for the year 2016:

(-10.95 / -2072.2) *365 = 1.929

How quickly am I turnover the stock: As per the above calculation, it is seen that

companies total stock is rotating in just 1-month time in 2016, Whereas 0.7 months in 2017 and

0.4 months in 2018. The stock turnover ratio is an efficiency ratio that would indicate that how

effectively inventory Debenhams company is able to manage the cost of goods sold with average

stock for a period of time.

Recommendation for improvement in different areas of Debenhams:

In Debenhams profitability ratios such as gross profit ratio and net profit ratios are

unfavourable which results in reduction in trust of shareholders. In order to improve

profitability ratios company should develop brand value by using efficient marketing

strategies in order to persuade clients or customers to pay more for products, even while

acquisition costs stay the same.

Company should improve their liquidity and cash flow position through early Invoice

Submission to major customers, Using long-term debt to finance business instead of

short-term debt, disposal of non value added assets, controlling their overhead expenses

and Negotiating for longer payment cycles.

To improve current and acid test ratio company should delay any capital purchases that

would require any cash payments, any term loans should be re-amortized, minimise

personal draw on the business and sell any capital assets that are not generating a return

to the business.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

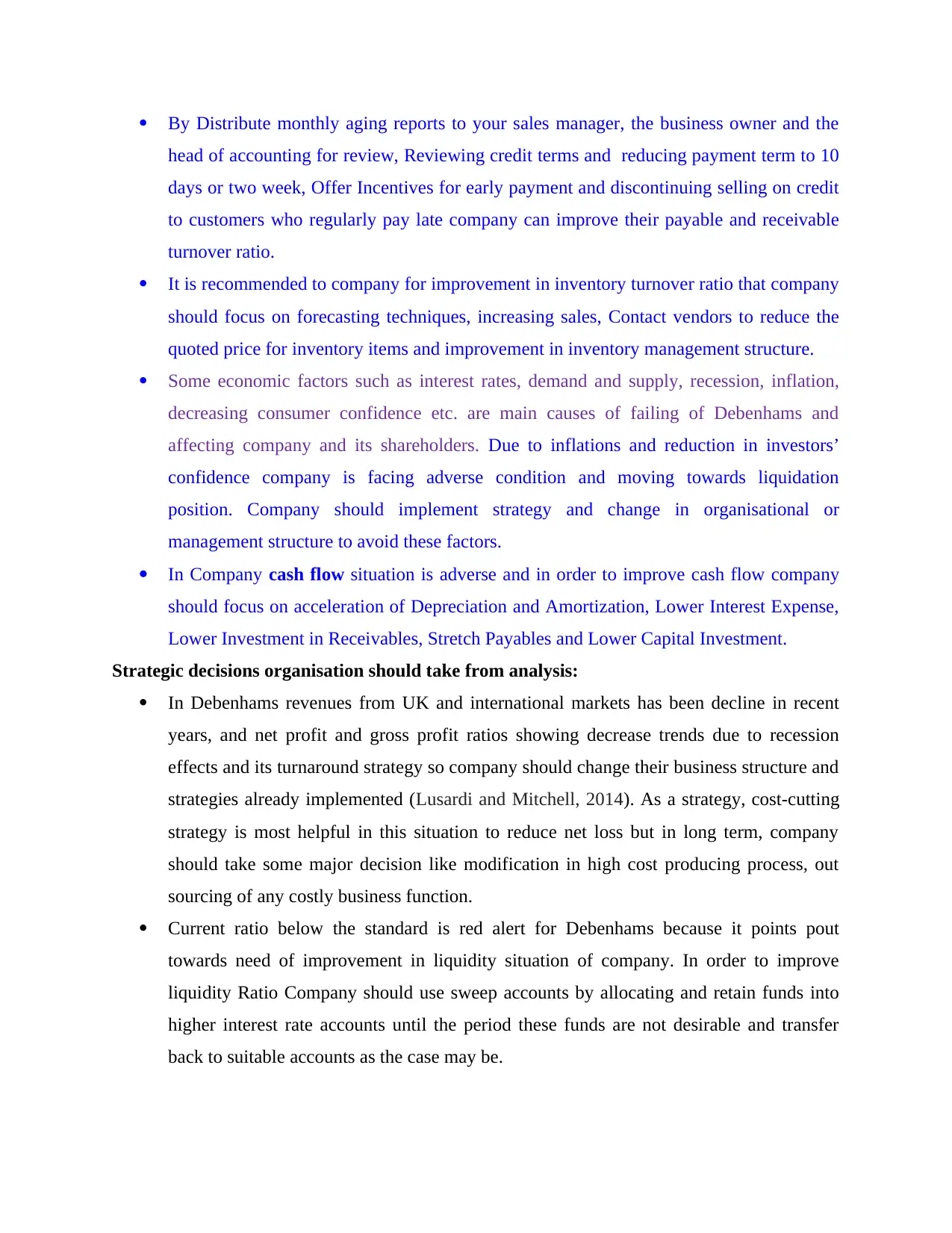

By Distribute monthly aging reports to your sales manager, the business owner and the

head of accounting for review, Reviewing credit terms and reducing payment term to 10

days or two week, Offer Incentives for early payment and discontinuing selling on credit

to customers who regularly pay late company can improve their payable and receivable

turnover ratio.

It is recommended to company for improvement in inventory turnover ratio that company

should focus on forecasting techniques, increasing sales, Contact vendors to reduce the

quoted price for inventory items and improvement in inventory management structure.

Some economic factors such as interest rates, demand and supply, recession, inflation,

decreasing consumer confidence etc. are main causes of failing of Debenhams and

affecting company and its shareholders. Due to inflations and reduction in investors’

confidence company is facing adverse condition and moving towards liquidation

position. Company should implement strategy and change in organisational or

management structure to avoid these factors.

In Company cash flow situation is adverse and in order to improve cash flow company

should focus on acceleration of Depreciation and Amortization, Lower Interest Expense,

Lower Investment in Receivables, Stretch Payables and Lower Capital Investment.

Strategic decisions organisation should take from analysis:

In Debenhams revenues from UK and international markets has been decline in recent

years, and net profit and gross profit ratios showing decrease trends due to recession

effects and its turnaround strategy so company should change their business structure and

strategies already implemented (Lusardi and Mitchell, 2014). As a strategy, cost-cutting

strategy is most helpful in this situation to reduce net loss but in long term, company

should take some major decision like modification in high cost producing process, out

sourcing of any costly business function.

Current ratio below the standard is red alert for Debenhams because it points pout

towards need of improvement in liquidity situation of company. In order to improve

liquidity Ratio Company should use sweep accounts by allocating and retain funds into

higher interest rate accounts until the period these funds are not desirable and transfer

back to suitable accounts as the case may be.

head of accounting for review, Reviewing credit terms and reducing payment term to 10

days or two week, Offer Incentives for early payment and discontinuing selling on credit

to customers who regularly pay late company can improve their payable and receivable

turnover ratio.

It is recommended to company for improvement in inventory turnover ratio that company

should focus on forecasting techniques, increasing sales, Contact vendors to reduce the

quoted price for inventory items and improvement in inventory management structure.

Some economic factors such as interest rates, demand and supply, recession, inflation,

decreasing consumer confidence etc. are main causes of failing of Debenhams and

affecting company and its shareholders. Due to inflations and reduction in investors’

confidence company is facing adverse condition and moving towards liquidation

position. Company should implement strategy and change in organisational or

management structure to avoid these factors.

In Company cash flow situation is adverse and in order to improve cash flow company

should focus on acceleration of Depreciation and Amortization, Lower Interest Expense,

Lower Investment in Receivables, Stretch Payables and Lower Capital Investment.

Strategic decisions organisation should take from analysis:

In Debenhams revenues from UK and international markets has been decline in recent

years, and net profit and gross profit ratios showing decrease trends due to recession

effects and its turnaround strategy so company should change their business structure and

strategies already implemented (Lusardi and Mitchell, 2014). As a strategy, cost-cutting

strategy is most helpful in this situation to reduce net loss but in long term, company

should take some major decision like modification in high cost producing process, out

sourcing of any costly business function.

Current ratio below the standard is red alert for Debenhams because it points pout

towards need of improvement in liquidity situation of company. In order to improve

liquidity Ratio Company should use sweep accounts by allocating and retain funds into

higher interest rate accounts until the period these funds are not desirable and transfer

back to suitable accounts as the case may be.

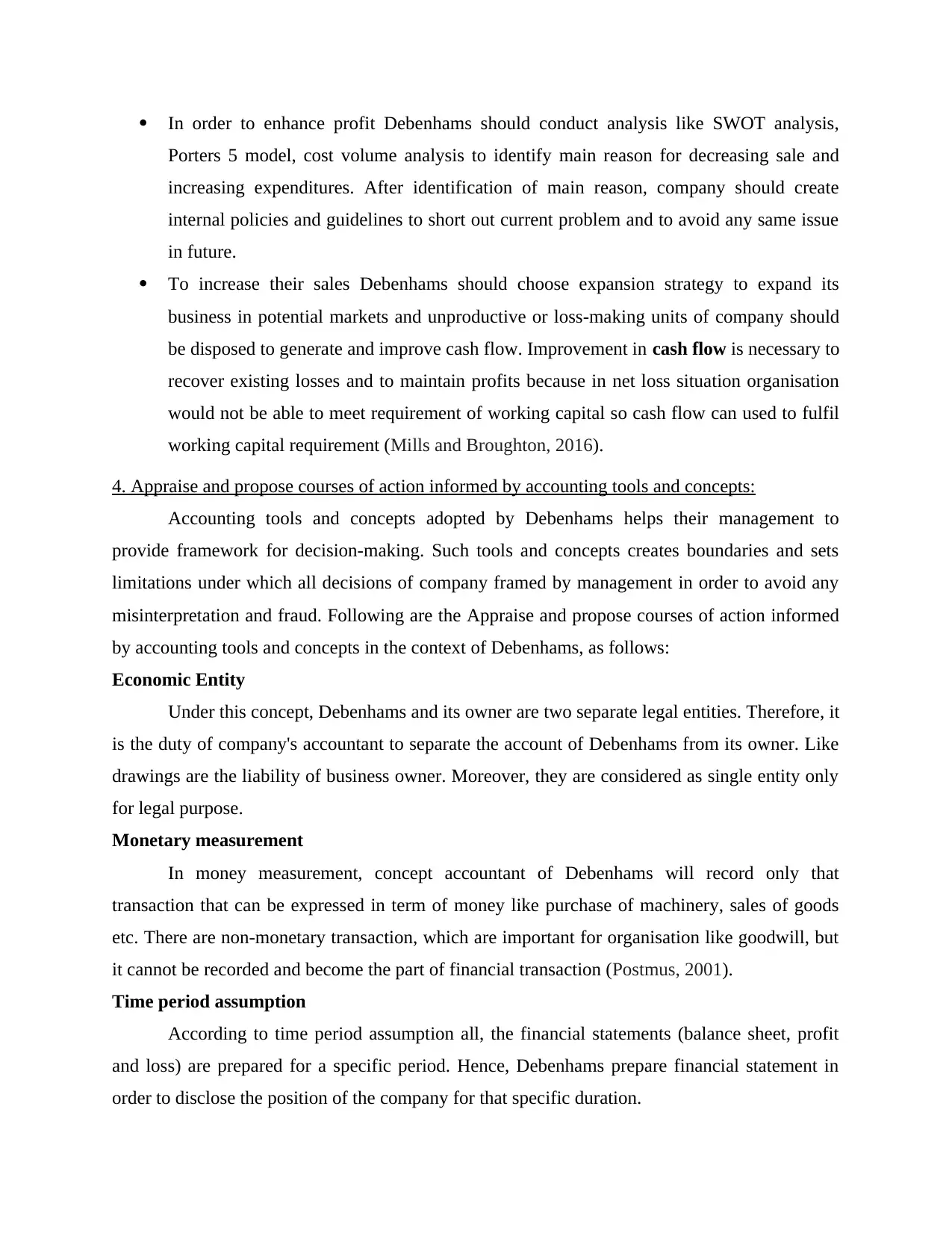

In order to enhance profit Debenhams should conduct analysis like SWOT analysis,

Porters 5 model, cost volume analysis to identify main reason for decreasing sale and

increasing expenditures. After identification of main reason, company should create

internal policies and guidelines to short out current problem and to avoid any same issue

in future.

To increase their sales Debenhams should choose expansion strategy to expand its

business in potential markets and unproductive or loss-making units of company should

be disposed to generate and improve cash flow. Improvement in cash flow is necessary to

recover existing losses and to maintain profits because in net loss situation organisation

would not be able to meet requirement of working capital so cash flow can used to fulfil

working capital requirement (Mills and Broughton, 2016).

4. Appraise and propose courses of action informed by accounting tools and concepts:

Accounting tools and concepts adopted by Debenhams helps their management to

provide framework for decision-making. Such tools and concepts creates boundaries and sets

limitations under which all decisions of company framed by management in order to avoid any

misinterpretation and fraud. Following are the Appraise and propose courses of action informed

by accounting tools and concepts in the context of Debenhams, as follows:

Economic Entity

Under this concept, Debenhams and its owner are two separate legal entities. Therefore, it

is the duty of company's accountant to separate the account of Debenhams from its owner. Like

drawings are the liability of business owner. Moreover, they are considered as single entity only

for legal purpose.

Monetary measurement

In money measurement, concept accountant of Debenhams will record only that

transaction that can be expressed in term of money like purchase of machinery, sales of goods

etc. There are non-monetary transaction, which are important for organisation like goodwill, but

it cannot be recorded and become the part of financial transaction (Postmus, 2001).

Time period assumption

According to time period assumption all, the financial statements (balance sheet, profit

and loss) are prepared for a specific period. Hence, Debenhams prepare financial statement in

order to disclose the position of the company for that specific duration.

Porters 5 model, cost volume analysis to identify main reason for decreasing sale and

increasing expenditures. After identification of main reason, company should create

internal policies and guidelines to short out current problem and to avoid any same issue

in future.

To increase their sales Debenhams should choose expansion strategy to expand its

business in potential markets and unproductive or loss-making units of company should

be disposed to generate and improve cash flow. Improvement in cash flow is necessary to

recover existing losses and to maintain profits because in net loss situation organisation

would not be able to meet requirement of working capital so cash flow can used to fulfil

working capital requirement (Mills and Broughton, 2016).

4. Appraise and propose courses of action informed by accounting tools and concepts:

Accounting tools and concepts adopted by Debenhams helps their management to

provide framework for decision-making. Such tools and concepts creates boundaries and sets

limitations under which all decisions of company framed by management in order to avoid any

misinterpretation and fraud. Following are the Appraise and propose courses of action informed

by accounting tools and concepts in the context of Debenhams, as follows:

Economic Entity

Under this concept, Debenhams and its owner are two separate legal entities. Therefore, it

is the duty of company's accountant to separate the account of Debenhams from its owner. Like

drawings are the liability of business owner. Moreover, they are considered as single entity only

for legal purpose.

Monetary measurement

In money measurement, concept accountant of Debenhams will record only that

transaction that can be expressed in term of money like purchase of machinery, sales of goods

etc. There are non-monetary transaction, which are important for organisation like goodwill, but

it cannot be recorded and become the part of financial transaction (Postmus, 2001).

Time period assumption

According to time period assumption all, the financial statements (balance sheet, profit

and loss) are prepared for a specific period. Hence, Debenhams prepare financial statement in

order to disclose the position of the company for that specific duration.

Historical cost principle

This principle state that the value of assets keeps on changing with the change in time.

Moreover, it is the duty of Debenhams accountant to update only that price on which the assets

were taken or brought into the company. Company do not have to do anything with the current

value of the asset. Their further valuation on asset takes place based on historical prices.

Full disclosure of account

Full disclosure principle states that any relevant information for the stakeholder must be

displayed in the books of account. Furthermore, Debenhams make sure any other side party or

stakeholders don't get any manipulative or misleading data as well as it ensure company don't

hide any relevant entry. In addition, it is the responsibility of Debenhams to disclose all

anticipated loss.

Going concern principles

This principle assumes that the motive of Debenhams is to operate with lifelong running

prospective. Asset of Debenhams are valued based on original cost not on market value and

assume that it will be used for indefinite purpose. In case if the accountant of company comes to

know that the company cannot continue, any more then this information must also be disclosed

in financial statement.

Matching concept

Under matching concept, the expenditures of the Debenhams must match with the

revenue of the company. All the expenses must be recorded on the day they were incurred like

advertisement expense, sales expense, bonus expense etc.

Revenue Recognition principles

Under revenue recognition all the income, revenue or profit of Debenhams must be

recorded on the date they were received. Hence, once company receives receipt then only they

will add that amount in their financial statement.

Materiality

Materiality principle means all the transaction of Debenhams should be recorded and

disclose properly. This brings transparency and attract outside party. Suppose if the liability or

expenses of company are more than asset or income it must be clearly stated in its final account.

Hence, all the petty information should not be hide from the outside party (Raudla and Kattel,

2013).

This principle state that the value of assets keeps on changing with the change in time.

Moreover, it is the duty of Debenhams accountant to update only that price on which the assets

were taken or brought into the company. Company do not have to do anything with the current

value of the asset. Their further valuation on asset takes place based on historical prices.

Full disclosure of account

Full disclosure principle states that any relevant information for the stakeholder must be

displayed in the books of account. Furthermore, Debenhams make sure any other side party or

stakeholders don't get any manipulative or misleading data as well as it ensure company don't

hide any relevant entry. In addition, it is the responsibility of Debenhams to disclose all

anticipated loss.

Going concern principles

This principle assumes that the motive of Debenhams is to operate with lifelong running

prospective. Asset of Debenhams are valued based on original cost not on market value and

assume that it will be used for indefinite purpose. In case if the accountant of company comes to

know that the company cannot continue, any more then this information must also be disclosed

in financial statement.

Matching concept

Under matching concept, the expenditures of the Debenhams must match with the

revenue of the company. All the expenses must be recorded on the day they were incurred like

advertisement expense, sales expense, bonus expense etc.

Revenue Recognition principles

Under revenue recognition all the income, revenue or profit of Debenhams must be

recorded on the date they were received. Hence, once company receives receipt then only they

will add that amount in their financial statement.

Materiality

Materiality principle means all the transaction of Debenhams should be recorded and

disclose properly. This brings transparency and attract outside party. Suppose if the liability or

expenses of company are more than asset or income it must be clearly stated in its final account.

Hence, all the petty information should not be hide from the outside party (Raudla and Kattel,

2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conservatism

Principle of conservatism state that the accountant of Debenhams must disclose all the

potential or anticipated losses but should not disclose potential or anticipate gain. Disclosing

anticipated losses makes easier for the outside party to make right choice.

CONCLUSION

From above report, it has been concluded that evaluation and monitoring of performance

of business organisation plays a major role in decision-making process. Ratio analysis is major

tool to evaluate and analyse the performance and accordingly management to improve

performance of business organisation frames strategies. Some economic issues also have direct

or indirect impact on organisation's performance but analysis of this factor using some numerical

data can avoid any financial disaster. Furthermore, actions of management and business should

be compatible with accounting tools and concepts.

Principle of conservatism state that the accountant of Debenhams must disclose all the

potential or anticipated losses but should not disclose potential or anticipate gain. Disclosing

anticipated losses makes easier for the outside party to make right choice.

CONCLUSION

From above report, it has been concluded that evaluation and monitoring of performance

of business organisation plays a major role in decision-making process. Ratio analysis is major

tool to evaluate and analyse the performance and accordingly management to improve

performance of business organisation frames strategies. Some economic issues also have direct

or indirect impact on organisation's performance but analysis of this factor using some numerical

data can avoid any financial disaster. Furthermore, actions of management and business should

be compatible with accounting tools and concepts.

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.